Cambridge IGCSE and O Level Accounting

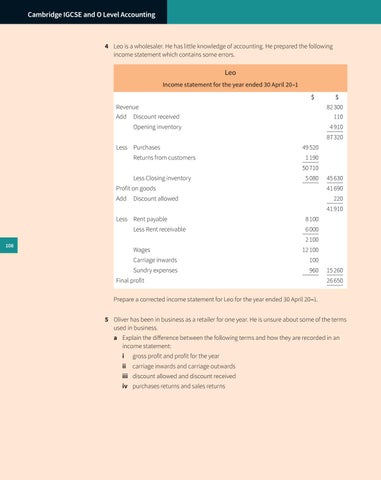

4 Leo is a wholesaler. He has little knowledge of accounting. He prepared the following income statement which contains some errors.

Leo Income statement for the year ended 30 April 20–1 $ Revenue

82 300

Add Discount received

$ 110 44 910

Opening inventory

87 320 Less Purchases

49 520

41 190

Returns from customers

50 710

Less Closing inventory

45 080

45 630

Profit on goods

41 690

Add Discount allowed

44 220 41 910

Less Rent payable

Less Rent receivable

8 100 46 000 2 100

108

Wages

12 100

Carriage inwards

100

Sundry expenses

44 960

Final profit

15 260 26 650

Prepare a corrected income statement for Leo for the year ended 30 April 20–1.

5 Oliver has been in business as a retailer for one year. He is unsure about some of the terms used in business. a Explain the difference between the following terms and how they are recorded in an income statement:

i

ii carriage inwards and carriage outwards

iii discount allowed and discount received

iv purchases returns and sales returns

gross profit and profit for the year