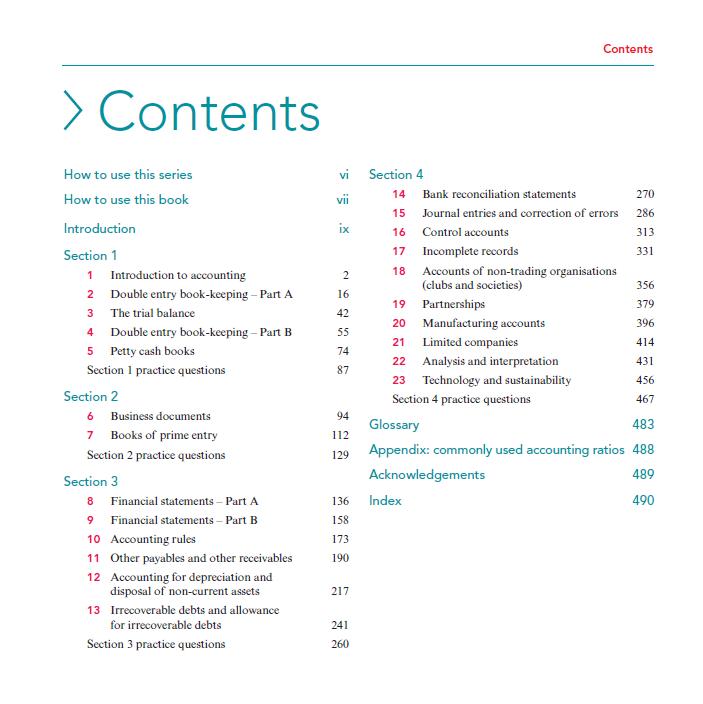

An overview of the syllabus and teaching and learning resources

Kate Brown

First assessment:

• IGCSE Accounting 0452 – March 2027

• IGCSE (9-1) Accounting 0985 – June 2027

• O Level Accounting 7707 – June 2027

Headline changes:

• Modernised subject content, including new content on ethical considerations and technology and sustainability

• Updated the accounting ratios

• Paper 1 - increased number of questions/marks to 40 and duration to 1 hour 30 minutes

Aims:

• Reworded for clarity and to inspire further study in Accounting

How it fits into the Cambridge Pathway:

• Accounting ratios, and terminology align more closely with AS & A Level Accounting

Subject content Accounting ratios Aims

An introductory explanation for each topic has been added to the content.

The accounting ratios have been amended to:

Subject content has been modernised including new topics:

7.2 Ethical considerations

7.3 Technology and sustainability

• Reflect the updated IAS standards

• Support teaching of the syllabus

• Align more closely with Cambridge International AS & A Level Accounting

The aims have been updated to better reflect the amended content.

Paper 1 Multiple-choice

For Paper 1:

• The number of marks/questions increases from 35 to 40

• The exam duration increases from 1 hour 15 minutes to 1 hour 30 minutes. Same style of questions and similar demand to past papers.

Paper 2 Structured Written Paper

The AOs have been updated to:

There are NO changes to Paper 2.

• Be clearer and more concise

• Align with Cambridge International AS & A Level Accounting

• Align more closely with Cambridge IGCSE Business and Cambridge IGCSE Economics.

The AOs are testing the same skills and knowledge as previously, so what is assessed remains the same.

Scheme of work (SOW) March 2025

Specimen Paper Answers (SPAs) May 2025

Learner Guide End of July 2025

Skills exercises End of July 2025

Example candidate responses (ECRs) 2027 (after first examination)

• All support will be available on the School Support Hub (SSH)

Cambridge University Press & Assessment

Julia Fusi

resources

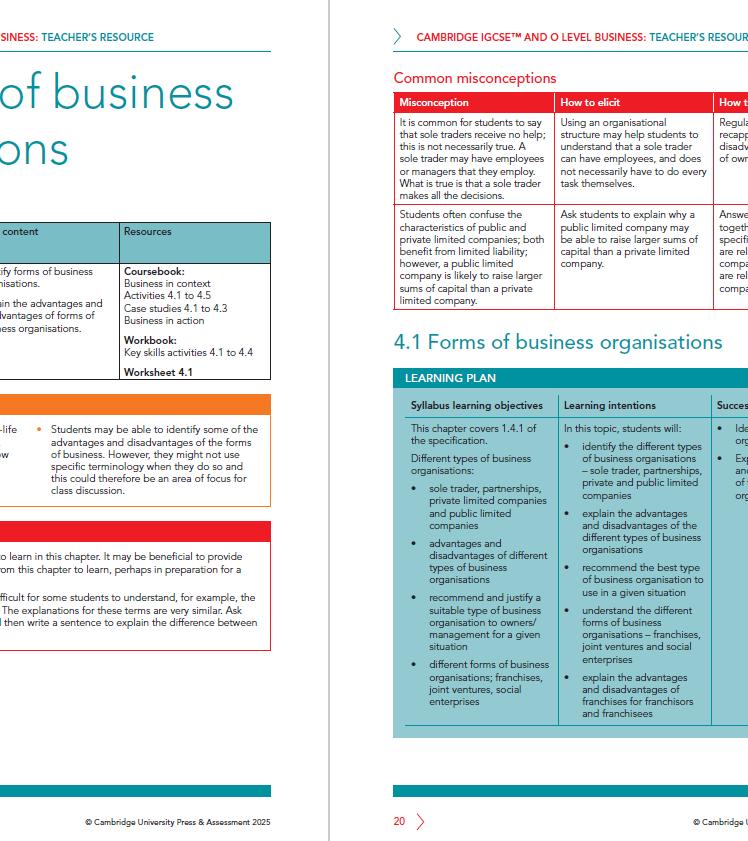

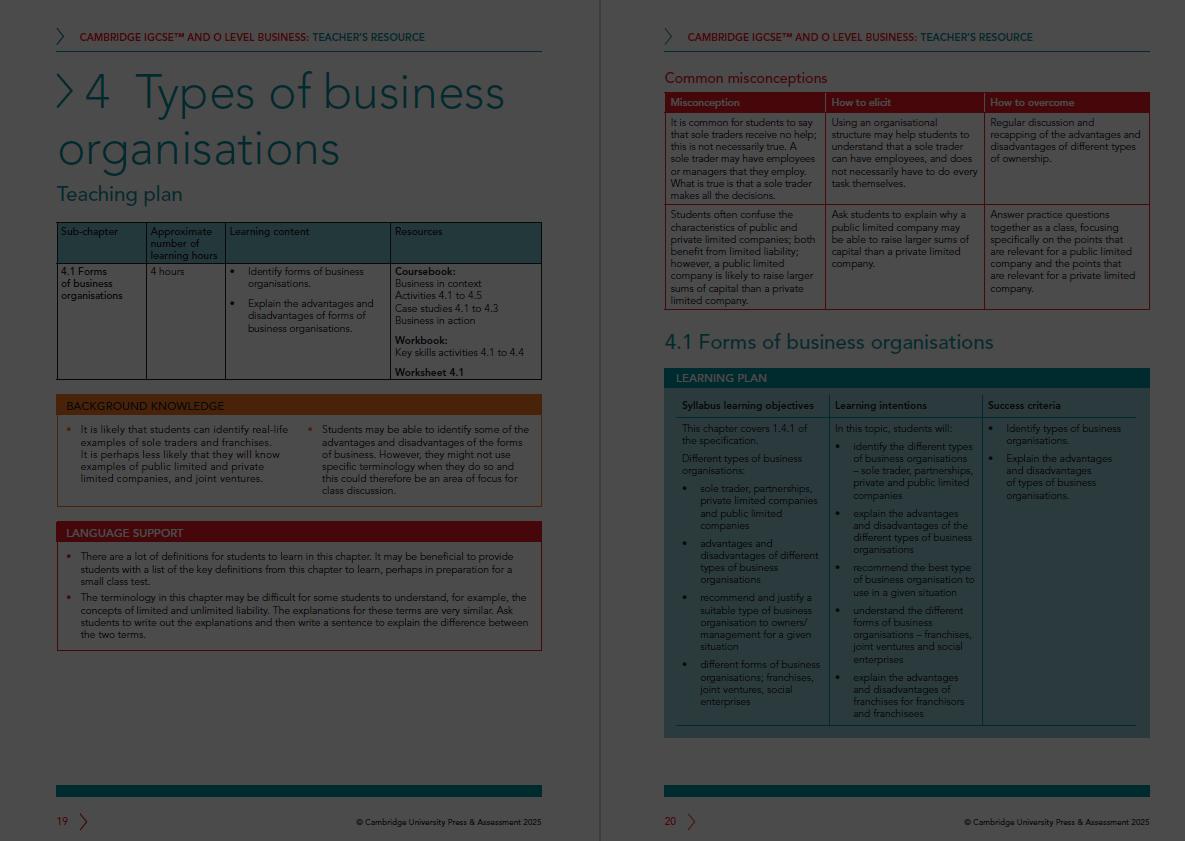

Scheme

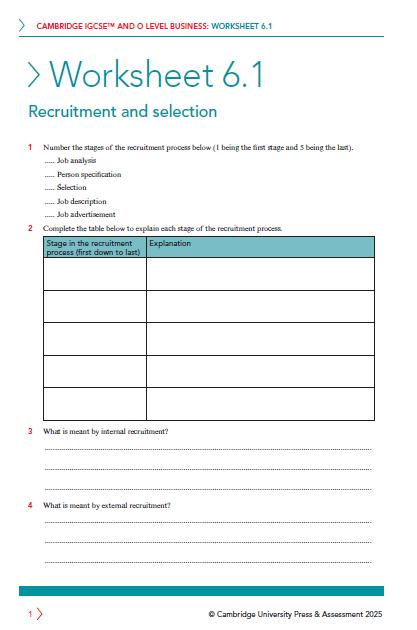

Lesson planning

Skills Exercises

Learner guides

Teaching tools

Specimen Paper Answers

Example Candidate Responses

Pub date: 17th April 2025

Pub date: 16th June 2025

Pub date: 21st January 2026

Sharon Elan-Puttick

Fully updated to align to the updated syllabus

Fully endorsed

Accounting in Context

Introduce students to the content in the chapter

Contains questions to allow for group discussion

They place some of the key ideas from the chapter into a real-world business setting

The progressive nature of the activities will build students’ confidence as they work through the chapters.

Encourages student engagement – activities require thought and discussion

A range of open-ended questions which enables students to gain a better understanding of accounting in the real world

Allows

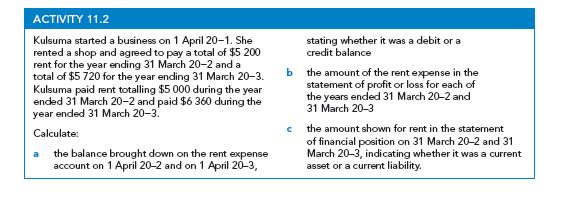

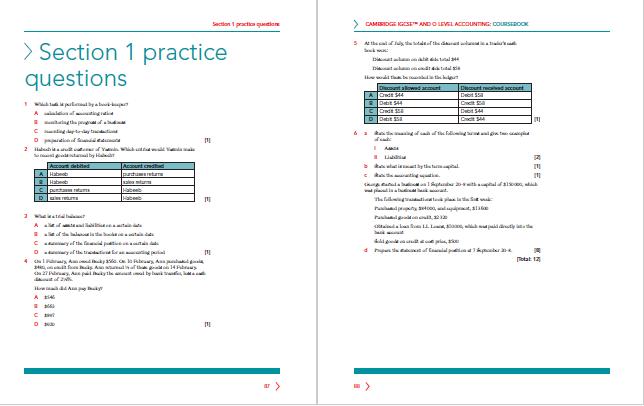

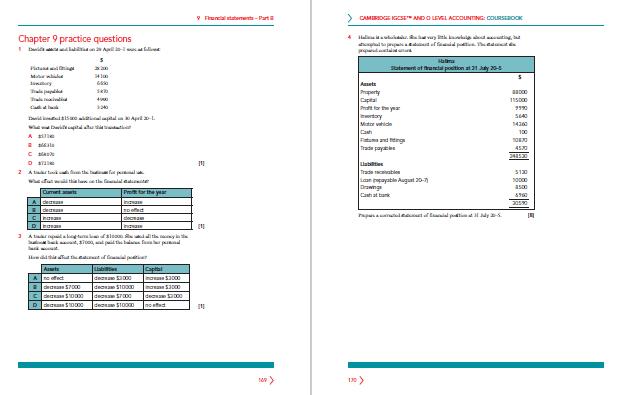

Practice questions become more complex as students progress with knowledge required from earlier sections in the book included

Opportunity for students to practice their knowledge, skills and understanding in a range of practice questions

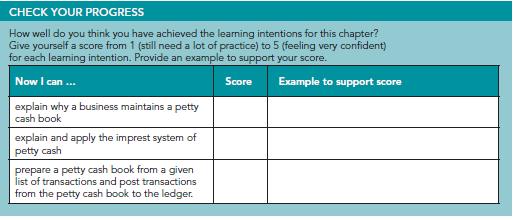

Learning Intentions help students to navigate through the coursebook

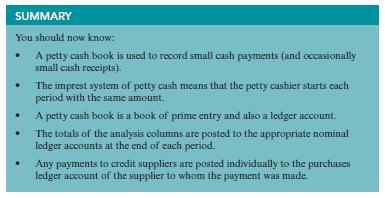

Summary brings together the key information students have learnt – can be used as a revision aid

Check your Progress, can support students to reflect on their own learning, and links back to the Learning Intentions

students’ metacognitive skills

Supports students with English as an Additional Language

Walks through the steps involved in completing an activity and Helps students to understand what a successful answer looks like.

Provides support in developing the key skills that are needed for Accounting

Fully updated to align to the updated syllabus

Digital access

Practice Questions

Scaffolded skills support

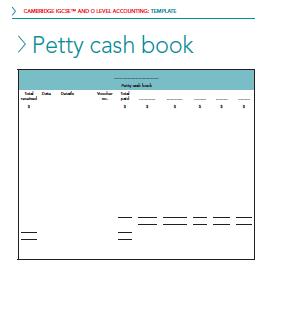

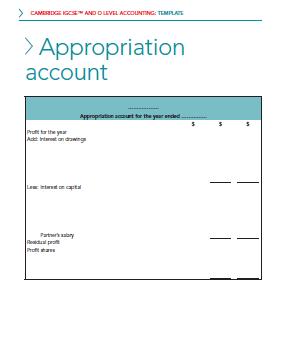

Downloadable templates

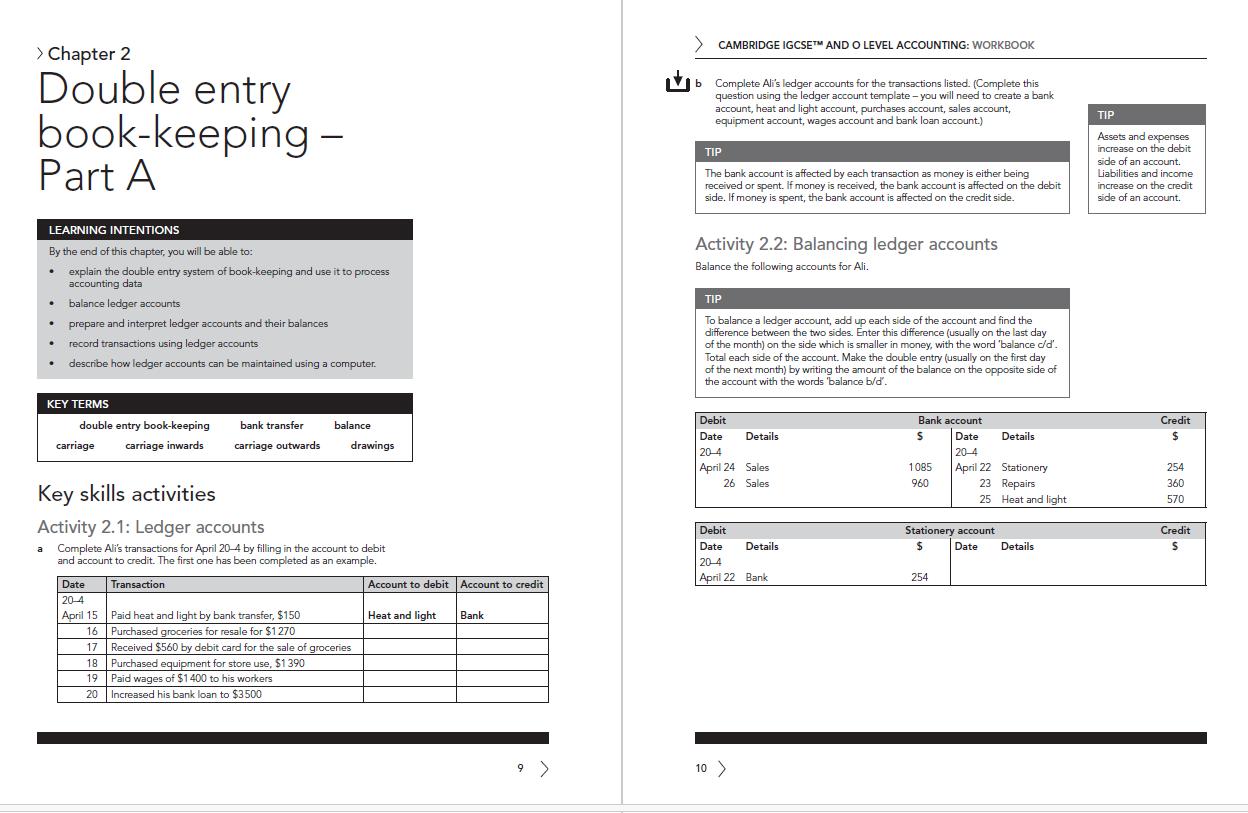

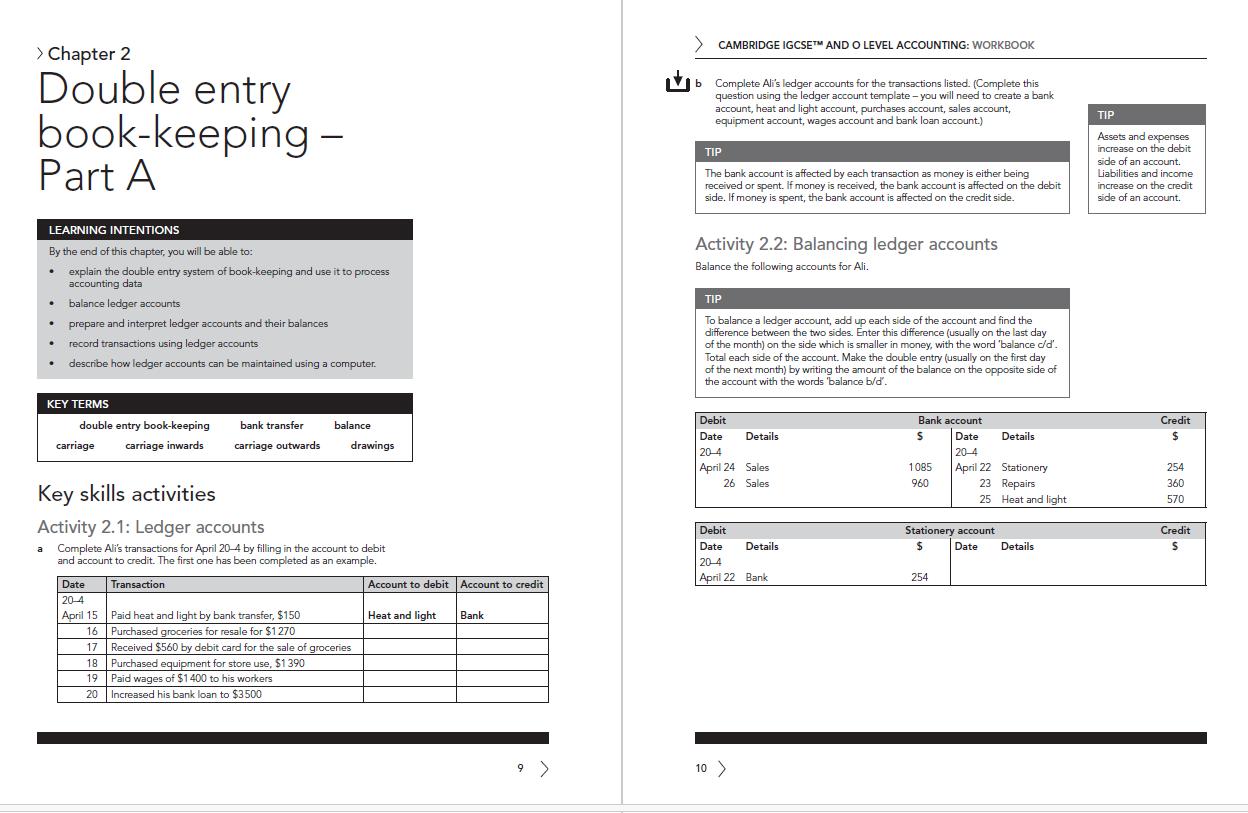

Learning Intentions help students to navigate through the workbook

Tips offer additional guidance and advice.

Key Terms provide a reminder of the key terms that you need to recall for each chapter topic.

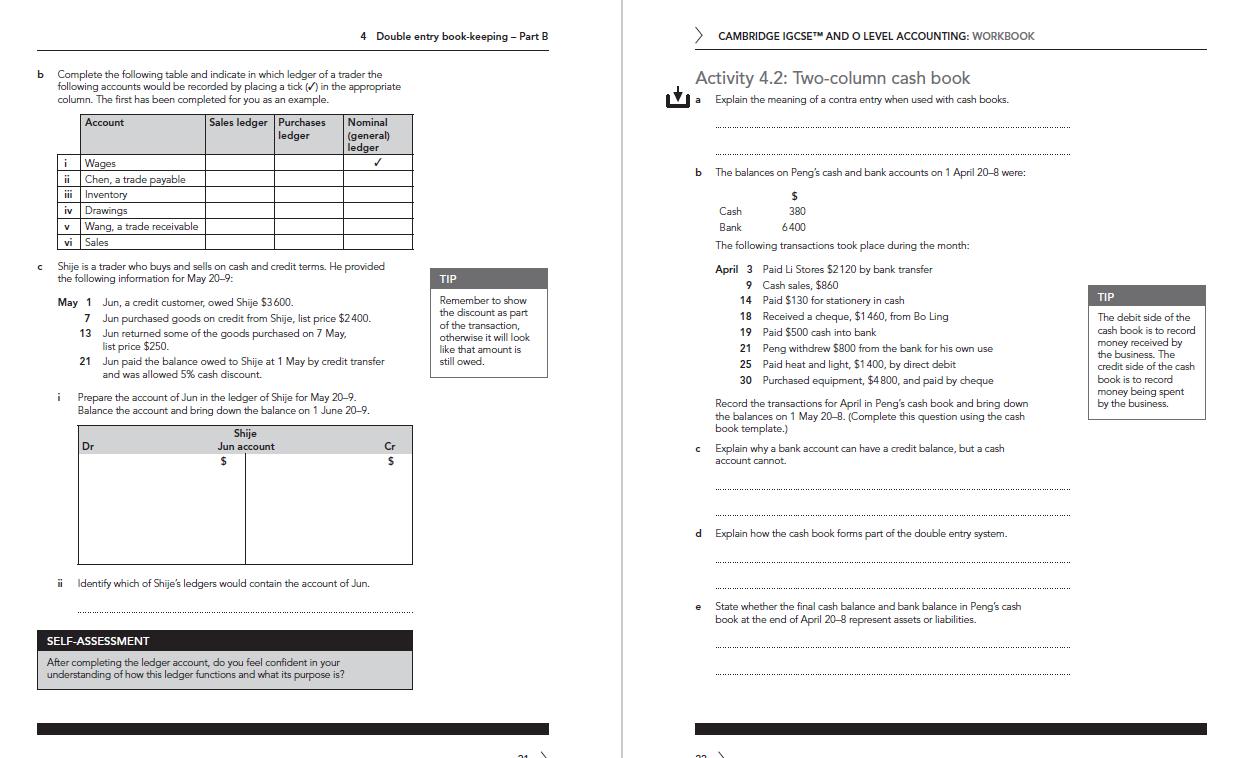

Scaffolded to support progression through the course

A range of tasks to help students consolidate, practice and reinforce their knowledge and understanding of accounting practice.

Provide students with a sample answers to help understand how to respond to questions using key skills. Advice and guidance are provided to help you assess the answer.

An opportunity to evaluate a sample answer to a question.

More demanding practice questions provide students with an opportunity to try out further questions on what you have learnt in each section

Opportunity to apply advice for student’s own answer

Fully updated to align to the updated syllabus

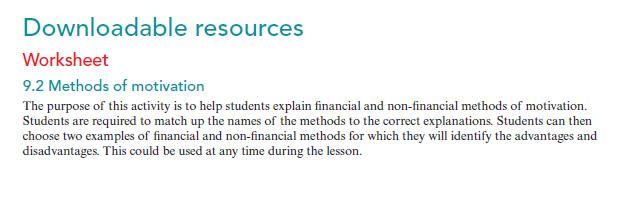

Downloadable worksheets

Access to the digital coursebook and digital workbook

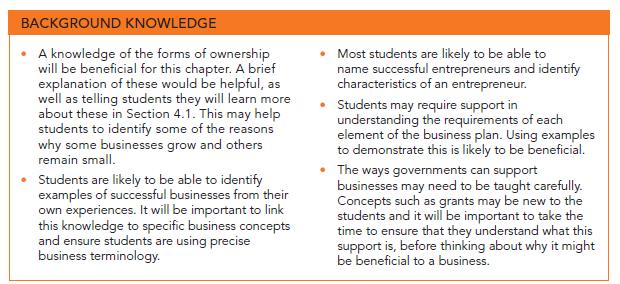

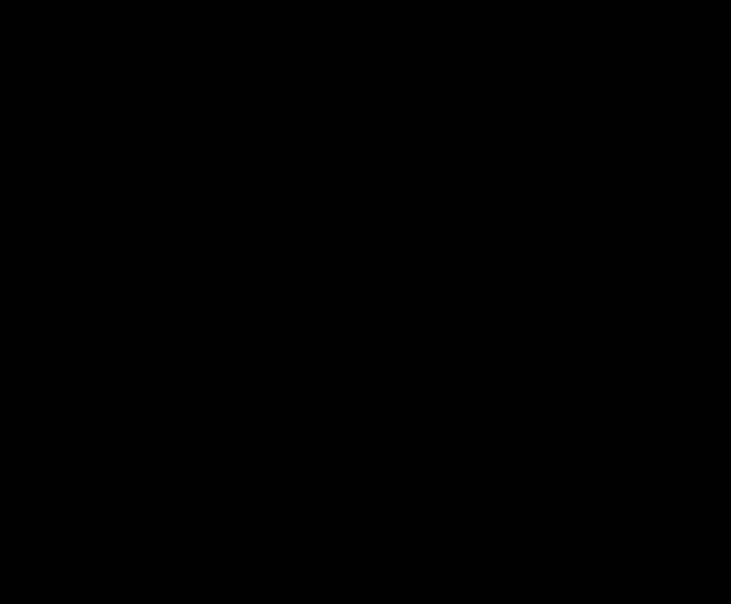

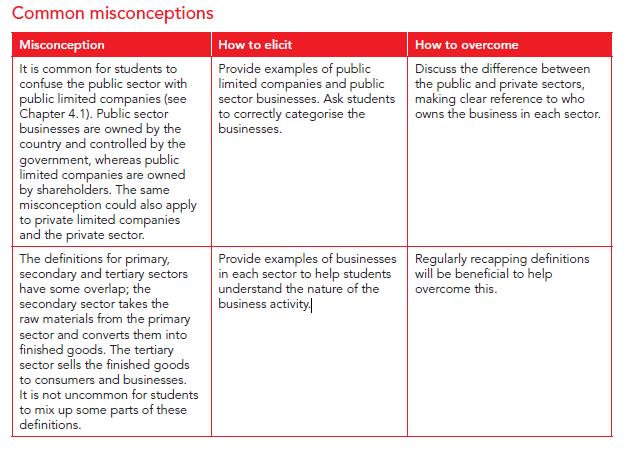

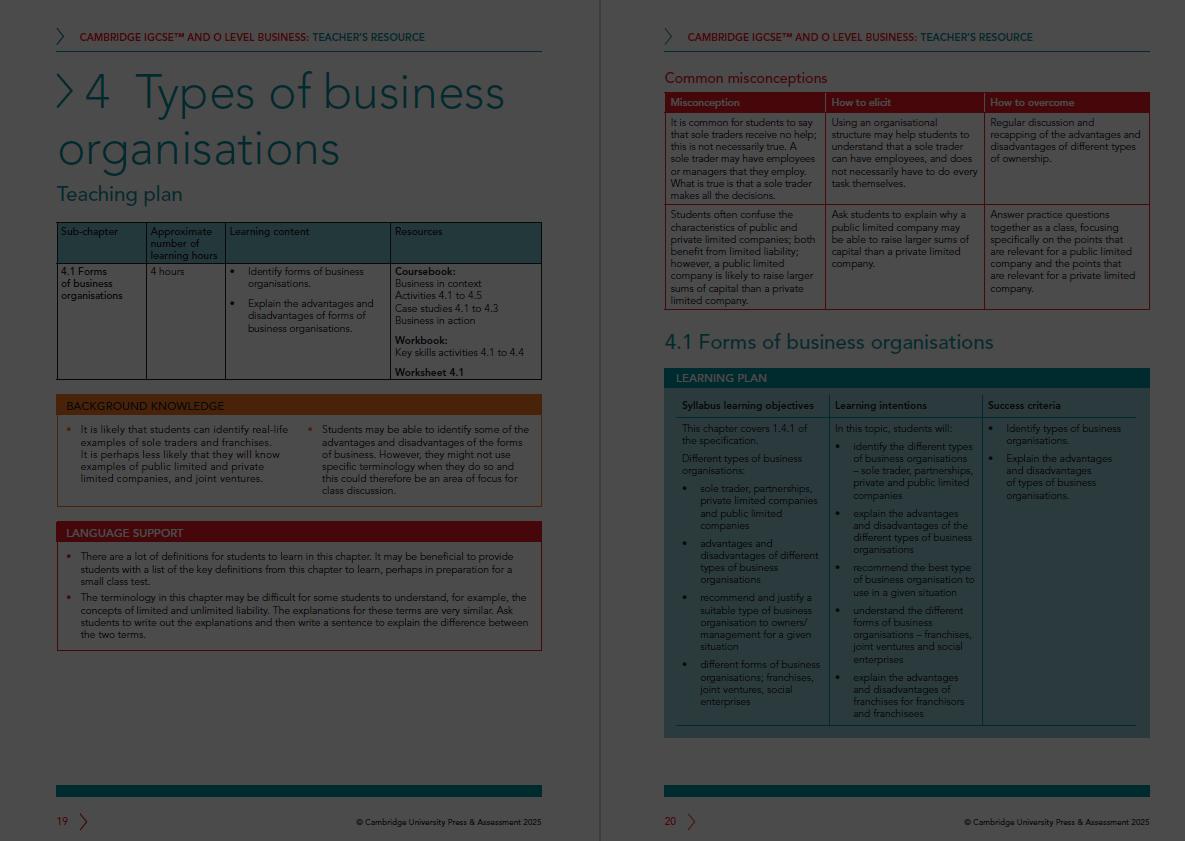

Explains the prior knowledge required to access the chapter and gives suggestions for addressing any gaps in students’ knowledge

Provides suggestions for eliciting evidence of misconceptions

Provides suggestions on how to overcome them

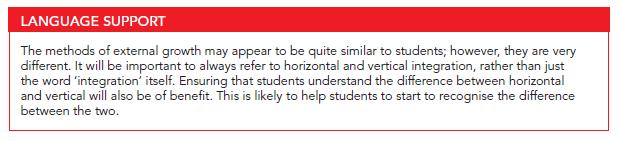

Contains suggestions on how to support students, especially those with English as an Additional Language.

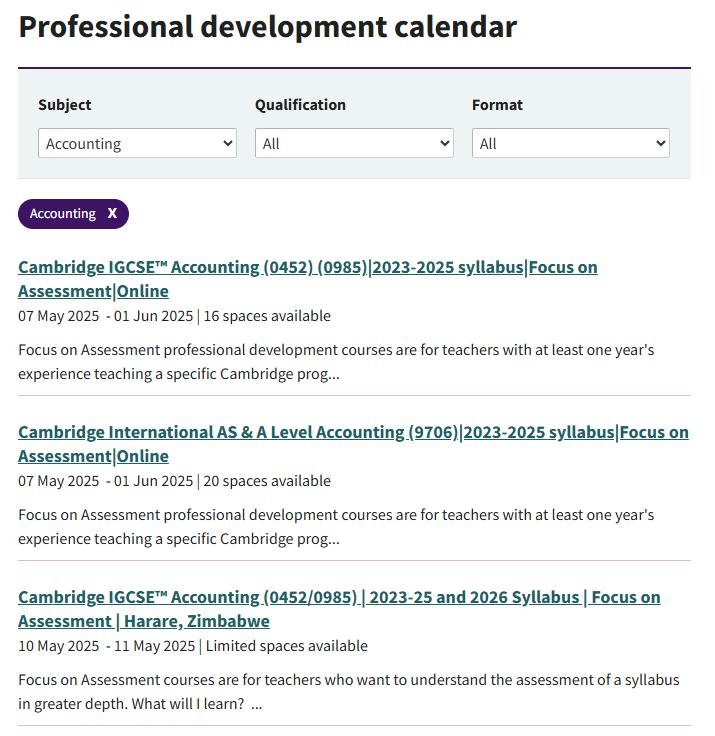

Introduction courses – Introduce teachers to Cambridge programmes. Recommended for teachers who are new to Cambridge or to a specific qualification.

Marking workshops – Engage with recent candidate responses to build confidence in their understanding of the assessment criteria. Recommended for teachers with at least one year's experience teaching Cambridge programmes.

Focus on Assessment – Engage with our syllabuses in greater depth and build confidence in your delivery.

Recommended for teachers with at least one year's experience teaching Cambridge programmes.

Focus on Teaching – For teachers who want to explore a specific area of teaching and learning within the syllabus.

cambridge.org/internationaleducation