Benefits effective from July 1, 2025 through June 30, 2026

Benefits effective from July 1, 2025 through June 30, 2026

Employees who work 30 or more hours per week, are eligible to enroll in the benefits described in this Guide on the first of the month, following 60 days of employment. In addition, the following family members are eligible for medical, dental and vision coverage:

• Spouse

• Domestic Partner

• Dependent Child(ren) (including natural, foster, step) and legally adopted child(ren) up to age 26

If you are enrolling a dependent(s) for the first time, you will need to provide proof of your dependent’s eligibility (i.e., birth certificate, marriage certificate, proof of full-time student status, etc.).

You MUST submit your elections through Employee Navigator to enroll. The benefits you elect will remain in place until June 30, 2025.

Enroll within 60 days from your date of hire. If you don’t enroll within this time period, you will not have benefits coverage, except for plans and programs that are fully paid by Perform Health, such as basic life, AD&D insurance, and the employee assistance program. After your enrollment opportunity ends, you won’t be able to change your benefits until the next Open Enrollment, unless you experience a qualifying life event, such as marriage, divorce, birth, adoption, or a change in your or your spouse’s employment status that affects your benefits eligibility.

You must notify Human Resources within 30 days of a life event to change your benefits.

If you need help enrolling: Please contact the Human Resources Benefits Department at HumanResources@performancehomemed.com

Go to www.employeenavigator.com/benefits/ Account/Login

• Returning users: Log in with the username and password you selected. Click Reset a forgotten password.

• First time users: Select “Register as a New User”’

- Enter in the Requested Information

• First Name

• Last Name

• PIN: Enter the last four digits of your SSN

• Birth Date

- Register a username and password

After you login, click “Let’s Begin” to complete your enrollment and additional required tasks if applicable.

After clicking “Start Enrollment”, you’ll need to complete some personal & dependent information before moving to your benefit elections.

TIP: Have dependent details handy. To enroll a dependent in coverage you will need their date of birth and Social Security number.

Enrolling Dependents in a Benefit

• Click the checkbox next to the dependent’s name under “Who am I enrolling?”

• Below your dependents you can view your available plans and the cost per pay. To elect a benefit, click “Select Plan” underneath the plan cost.

• Click “Save & Continue” at the bottom of each screen to save your elections.

• If you do not want a benefit, click “Don’t want this benefit?” at the bottom of the screen and select a reason from the drop-down menu.

If you have elected benefits that require a beneficiary designation, Primary Care Physician, or completion of an Evidence of Insurability form, you will be prompted to add in those details.

Review the benefits you selected on the enrollment summary page to make sure they are correct then click “Sign & Agree” to complete your enrollment. You can either print a summary of your elections for your records or login at any point during the year to view your summary online.

Perform Health offers several medical plan options through United Healthcare, all of which include prescription drug benefits. These plans follow a calendar year deductible, resetting annually on January 1st. To find participating providers in the NexusACO and Choice Plus networks, visit https://www.uhc.com/find-a-doctor

Prescription drug coverage will be included with your medical coverage. This coverage will be offered through a fullservice pharmacy benefits administrator that provides an exceptional customer service experience to employees.

Once you enroll for medical coverage you will automatically receive prescription drug coverage. For more information about the types of drugs covered under your plan, visit https://member.uhc.com/myuhc

Using the mail order program for maintenance medications will save you money. You will receive a 90-day (3 month) supply for the equivalent of two and half (2.5) retail copays. In addition to the savings, your prescriptions will be delivered right to your home.

To begin using mail order, simply complete a mail-order form and send along with your prescription(s) for a 90-day supply of medication. Mail order forms can be obtained online at www.uhc.com.

GoodRx

Stop paying too much for your prescriptions! GoodRx is a prescription drug price comparison tool which allows you to simply and easily search for retail pharmacies that offer the lowest price for specific medications.

The cost for the same medications, even when using a network retail pharmacy, varies drastically from one drug store to the next. While prescription drug plan copays may be the same no matter which pharmacy you go to, the retail cost to your employer may be greatly reduced when you get your medications from a pharmacy that charges a discounted price. Lower costs to your employer can also help keep your benefits costs down in the long run.

Use GoodRx to compare drug prices at local and mailorder pharmacies and discover free coupons and savings tips. Find huge savings on drugs not covered by your insurance plan – you may even find savings versus your typical copayment!

You can find the lowest price on prescriptions right from your phone or tablet. Download the GoodRx mobile app today for:

• Instant access to the lowest prices for prescription drugs at more than 75,000 pharmacies

• Coupons and savings tips that can cut your prescription costs by 50% or more

• Side effects, pharmacy hours and locations, pill images, and much more!

Learn more and start saving on your prescriptions today at connerstrong.goodrx.com

If you choose to enroll in the Nexus $2,500 HSA Plan, you are eligible to participate in a Health Savings Account (HSA). An HSA is a great way to save money by allowing you to set aside pre-tax dollars, via payroll deductions, to efficiently pay for qualified healthcare, dental and vision expenses. The funds in your HSA never expire; you may utilize the money you accumulate in your account for future healthcare expenses, even if you change jobs or retire.

In order to qualify for an HSA, you must be an adult who meets the following qualifications:

• You have coverage under an HSA-qualified, high deductible health plan (HDHP)

• You (or your spouse, if applicable) have no other health coverage (excluding other types of insurance, such as dental, vision, disability, or long-term care coverage)

• Are not enrolled in Medicare

• You cannot be claimed as a dependent on someone else’s tax return

For more details on eligibility requirements, visit www.irs.gov.

The maximum amount that can be contributed to the HSA in a tax year is established by the IRS and is dependent on whether you have individual or family coverage in the HDHP plan. For 2025, the contribution limits are:

• $4,300 for individual coverage

• $8,550 for family coverage

• The annual catch-up contribution for age 55 and older is $1,000

Perform Health will continue making contributions to HSA accounts for employees enrolled in the Nexus $2,500 HSA Plan at the “Employee Only” tier. For the 2025/2026 plan year, Perform Health will contribute $65.27 per month into the HSA.

You can use the funds in your HSA to pay for qualified healthcare expenses such as:

• Doctor visits

• Dental care, including extractions and braces

• Vision care, including contact lenses, prescription sunglasses and LASIK surgery

• Prescription medications

• Chiropractic services

• Acupuncture

• Hearing aids and batteries

• Over the counter (OTC) medications

• Menstrual care products

For a full list of qualified medical expenses, visit https://www.irs.gov/pub/irs-pdf/p502

Under the CARES Act, the definition of a qualifying medical expense now includes certain over-the-counter medications and products. Specifically, the act treats additional over-the-counter medications, along with menstrual care products, as qualified medical expenses that may be paid for using HSAs or other tax-advantaged accounts.

HSA contributions are tax deductible, you can spend the money tax-free, and any growth is tax free.

• There is no “use it or lose it” provision with an HSA. If you don’t use the money in your account by the end of the year, don’t worry! Unused funds will roll over year after year.

• You can save and invest unused HSA money for future healthcare needs

• Your HSA is portable. When you retire or leave the company, your HSA funds go with you.

Healthy teeth and gums are important to your overall wellness. That's why it’s important to have regular dental checkups and maintain good oral hygiene. You can elect to receive dental coverage even if you are waiving medical coverage.

Eligible employees and their eligible family members may enroll in the MetLife dental plan, which includes 100% coverage for preventive services such as routine dental exams, cleanings and X-rays.

Preventive & Diagnostic Services

Exams, Cleanings, Bitewing X-rays (each twice in a calendar year)

Fluoride Treatment (once in a calendar year, children to age 14)

Basic Services

Fillings, Extractions Endodontics (root canal)

* After deductible

2 Based on a percentage of the Preferred Dentist Program (PDP) Fee.

3 Based on a percentage of the Reasonable and Customary (R&C) Fee. You’ll pay your deductible plus co-insurance, and any amounts that exceed the R&C charge.

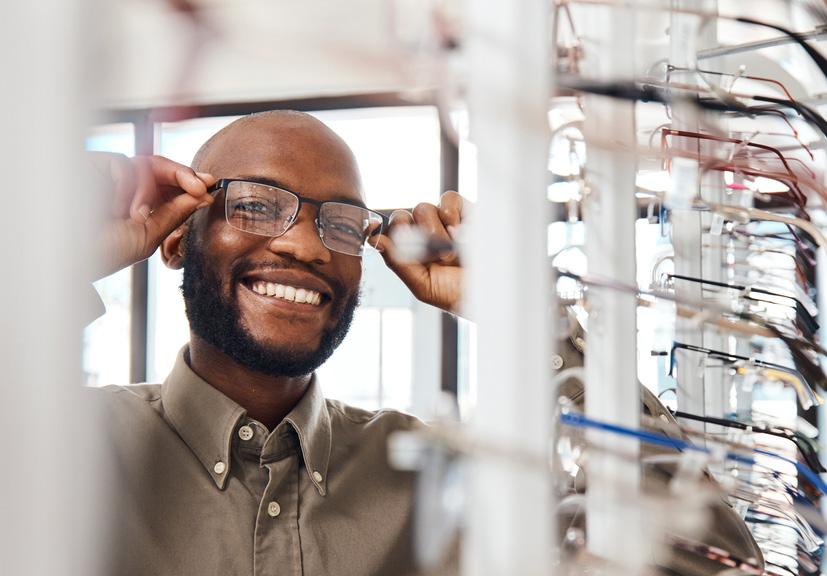

Having vision coverage allows you to save money on eligible eye care expenses, such as periodic eye exams, eyeglasses, contact lenses, and more for yourself and your covered dependents. You can elect to receive vision coverage even if you are waiving medical coverage.

Our vision plan is administered by MetLife and provides coverage for a range of vision care including exams, frames, lenses and contact lenses. The plan utilizes the VSP network, which includes a large number of participating providers, including private practice optometrists and retail center locations. To find a provider in network, visit www.vsp.com

copay

$150 allowance after $25 copay* Costco, Walmart, and Sam’s Club: $85 allowance after $25 copay

Lenses

Single Vision Lenses

Bifocal Lenses

Trifocal Lenses

Lenticular Lenses

Contact Lenses (in lieu of eyeglasses)

$25 copay

$25 copay

$25 copay

$25 copay

$150 allowance

Up to $105

It’s important to plan for your own and your family’s financial security and peace of mind. That’s why Perform Health provides a variety of benefits to help you protect yourself, your family, and assets from the unexpected.

The company provides you with basic life and accidental death and dismemberment (AD&D) insurance through MetLife so that you can protect those you love from the unexpected. This coverage comes at no cost to eligible employees.

While Perform Health offers basic life insurance, you may be interested in additional coverage based off your personal circumstances.

With voluntary life insurance, you are responsible for paying the full cost of coverage through payroll deductions. You can purchase coverage for yourself or for your spouse or your dependent child(ren) as outlined in the chart below.

Short-Term Disability (STD) is a type of disability insurance coverage that can help you remain financially stable should you become injured or ill and cannot work.

After fourteen calendar days of continuous disability, you may receive 60% of your average weekly wages to a maximum benefit of $2,000 per week. This benefit can be paid for up to 11 weeks of continuous disability.

Long-Term Disability (LTD) provides you with income continuation in the event your illness or injury lasts beyond 90 days. This helps ensure you have a continued income if you are unable to work due to a covered sickness or injury. You may receive 60% of your pre-disability earnings to a maximum benefit of $8,000 per month.

Be sure you’ve selected a beneficiary for all your life and accident insurance policies. The beneficiary will receive the benefit paid by a policy in the event of the policyholder’s death. It’s important to designate a beneficiary and keep that information up to date.

Life doesn’t always go as planned. And while you can’t always avoid the twists and turns, you can get help to keep moving forward. We can help you and your family, those living at home, get professional support and guidance to make life a little easier.

Our Employee Assistance Program (EAP) is available to you in addition to the benefits provided with your MetLife insurance coverage. This program provides you with easy-to-use services to help with the everyday challenges of life, at no additional cost to you.

The program’s experienced counselors provided through LifeWorks — one of the nation’s premier providers of Employee Assistance Program services — can talk to you about anything going on in your life, including:

• Family: Going through a divorce, caring for an elderly family member, returning to work after having a baby

• Work: Job relocation, building relationships with co-workers and managers, navigating through reorganization

• Money: Budgeting, financial guidance, retirement planning, buying or selling a home, tax issues

• Legal Services: Issues relating to civil, personal and family law, financial matters, real estate and estate planning

• Identity Theft Recovery: ID theft prevention tips and help from a financial counselor if you are victimized

• Health: Coping with anxiety or depression, getting the proper amount of sleep, how to kick a bad habit like smoking

• Everyday Life: Moving and adjusting to a new community, grieving over the loss of a loved one, military family matters, training a new pet

Your program includes up to 5 phone or video consultations with licensed counselors for you and your eligible household members, per issue, per calendar year.

You can call 1-888-319-7819 to speak with a counselor or schedule an appointment, 24/7/365. When you call, just select “Employee Assistance Program” when prompted. You’ll immediately be connected to a counselor.

If you’re simply looking for information, the program offers easy to use educational tools and resources, online and through a mobile app. There is a chat feature so you can talk with a consultant to guide you to the information you are looking for or help you schedule an appointment with a counselor.

Log on to metlifeeap.lifeworks.com,

• User Name: metlifeeap

• Password: eap

Our mobile app makes it easy for you to access and personalize educational content important to you.

Search “LifeWorks” on iTunes App Store or Google Play. Log in with the user name: metlifeeap and password: eap

When a serious illness strikes, such as a heart attack, stroke, or cancer, critical illness insurance can provide a lump-sum benefit to cover out-of-pocket expenses for your treatments that are not covered by your medical plan. You can also use the money to take care of your everyday living expenses, such as housekeeping services, special transportation services, and daycare. Plus, you can use the benefits more than once. Diagnoses must be at least 12 months apart or the conditions can’t be related to each other.

Examples of Covered Critical Illnesses include:

• Heart attack

• End-stage renal (kidney) failure

• Coronary artery bypass

• Stroke

• Coma

• Major organ failure

• Cancer

You will have two levels of coverage to choose from: $15,000 and $30,000.

The tables to the right show the per-pay cost of coverage:

Accident insurance supplements your primary medical plan by providing cash benefits in cases of accidental injuries. You can use this money to help pay for medical expenses not paid by your medical plan (such as your deductible or coinsurance) or for anything else (such as everyday living expenses). If you apply, you automatically receive the base plan — no health questions to answer. Benefits are paid directly to you (unless assigned to someone else).

You receive a cash benefit up to a specific amount for:

• Accidental death or dismemberment

• Dislocation or fracture

• Initial hospital confinement

• Intensive care

• Ambulance and other medical expenses

• Outpatient physician’s treatment

A trip to the hospital can be stressful, and so can the bills. Even with a major medical plan, you may still be responsible for copays, deductibles, and other out-ofpocket costs.

A voluntary hospital indemnity insurance plan can help by supplementing your major medical insurance coverage with cash benefits when you’re admitted to the hospital due to a covered sickness or accident. This money is paid directly to you — unless assigned to someone else — that you can use to cover expenses that your medical plan doesn’t cover.

Use this money to help cover the cost of your hospital stay and time out of work. Hospital indemnity benefits are paid in addition to any other insurance. There are no pre-existing condition exclusions with this plan, but similar to medical insurance, benefits are subject to carrier review. You can select the benefit coverage amount based on your individual needs and budget.

Don’t get lost in a sea of benefits confusion! With just one call or click, the Benefits MAC can help guide the way!

The Benefits Member Advocacy Center (“Benefits MAC”, provided by Conner Strong & Buckelew, can help you and your covered family members navigate your benefits.

Contact the Benefits MAC to:

• Find answers to your benefits questions

• Search for participating network providers

• Clarify information received from a provide or your insurance company, such as a bill, claim, or explanation of benefits (EOB)

• Guide you through the enrollment process or how you can add or delete coverage for a dependent

• Rescue you from a benefits problem you’ve been working on

• Discover all that your benefits have to offer!

You can contact Benefits MAC in any of the following ways:

• Via phone: 800.563.9929, Monday through Friday, 8:30 am to 5:00 pm EST

• Via the web: www.connerstrong.com/memberadvocacy

• Via e-mail: cssteam@connerstrong.com

• Via fax: 856.685.2253

Member Advocates are available Monday through Friday, 8:30 am to 5:00 pm (Eastern Time). After hours, you will be able to leave a message with a live representative and receive a response by phone or email during business hours within 24 to 48 hours of your inquiry.

Your Benefits Information in One Place!

At Perform Health, you have access to a full-range of valuable employee benefit programs. With BenePortal, you and your dependents can review your current employee benefit plan options online, 24 hours a day, 7 days a week! Use BenePortal to access benefit plan documents, insurance carrier contacts, forms, guides, links and other applicable benefit materials.

BenePortal is mobile-optimized, making it easy to view your benefits on-the-go. Simply bookmark the site in your phone’s browser or save it to your home screen for quick access.

Visit www.performhealthbenefits.com

With CSB Benefit Perks, members gain access to premium discounts on valuable services and items.

CSB Benefit Perks is a discount and rewards program provided by Conner Strong & Buckelew (CSB) that is available to all employees at no additional cost. The program allows employees to receive discounts and cash back for hand-selected shopping online at major retailers.

Use the Benefit Perks website to browse through categories such as: Automotive, Beauty, Computer & Electronics, Gifts & Flowers, Health & Wellness and much more! Employees can also print coupons to present at local retailers and merchants for in-person savings, including movie theatres and other services.

Start saving today by registering online at connerstrong.corestream.com

Whatever your fitness level is, HUSK has exclusive equipment and wearable technology to help support you on your wellness journey. Whether you want to monitor an everyday activity or start a new fitness routine, find the best products and deals here.

Take advantage of all the benefits of group exercise classes in the comfort of your own home. HUSK’s streaming membership options will take your wellness and workouts to the next level.

We all need help sometimes. We all go through difficulties and struggles. HUSK Mental Health connects you with licensed therapists through technology. Our therapists empower you through guidance and support using evidence-based practices.

Visit marketplace.huskwellness.com/connerstrong

Achieving optimal health and wellness doesn’t have to be complicated or expensive. Access exclusive best-inclass pricing with some of the biggest brands in fitness, nutrition, and wellness with HUSK Marketplace.

HUSK Marketplace members can access exclusive savings and flexible membership options to a variety of facilities. From national chains to specialty studios, HUSK and something for every workout.

HUSK Nutrition provides evidence-based virtual health and nutrition programs. You will meet with a Registered Dietician who will implement a complete 1-on-1 nutrition program specifically designed to answer your nutrition related questions, meet your health goals, individual needs, and busy lifestyle.

An apple a day isn’t enough…

HealthyLearn covers over a thousand health and wellness topics in a simple, straightforward manner. The data and information is laid out in an easy-to-follow format. HealthyLearn includes the following interactive features and services:

• Ask the Coach

• Rotating Health Tip-of-the-Day

• Symptom Checker

• A to Z Encyclopedia

• Health News

• Medical Self-Care Guides for Adults, Children, Adolescents and Seniors

• Women and Men Guides

• Pain Management Guide

• Mental Health Guide

• Home Safety Guide

• Wellness and Disease Management

• Tobacco Cessation

• Stress Management

• Nutrition and Weight Loss

• Health Trackers

• Monthly Wellness Newsletter Download the HealthyLife Mobile App for access on-the-go!

1. Search your app store for “healthylife mobile”

2. Download and open the app

3. Enter the Conner Strong & Buckelew special access code: CSB (all caps)

PLEASE NOTE: You must use the special access code above each time you open the app.

Learn more and get started on your path to wellness today by visiting HealthyLearn at www.healthylearn.com/connerstrong

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov.

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877-KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.

If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272).

If you live in one of the following states, you may be eligible for assistance paying your employer health plan premiums. The following list of states is current as of July 31, 2024. Contact your State for more information on eligibility –

ALABAMA – Medicaid

Website: http://myalhipp.com/

Phone: 1-855-692-5447

ALASKA – Medicaid

The AK Health Insurance Premium Payment Program

Website: http://myakhipp.com/

Phone: 1-866-251-4861

Email: CustomerService@MyAKHIPP.com

Medicaid Eligibility: https://health.alaska.gov/dpa/ Pages/default.aspx

ARKANSAS – Medicaid

Website: http://myarhipp.com/

Phone: 1-855-MyARHIPP (855-692-7447)

CALIFORNIA - MEDICAID

Health Insurance Premium Payment (HIPP) Program

http://dhcs.ca.gov/hipp

Phone: 916-445-8322

Fax: 916-440-5676

Email: hipp@dhcs.ca.gov

COLORADO - Health First Colorado (Colorado’s Medicaid Program) & Child Health Plan Plus (CHP+)

Health First Colorado Website: https://www. healthfirstcolorado.com/

Health First Colorado Member Contact Center: 1-800-221-3943/State Relay 711

CHP+: https://hcpf.colorado.gov/child-health-plan-plus CHP+ Customer Service: 1-800-359-1991/State Relay 711 Health Insurance Buy-In Program (HIBI): https://www. mycohibi.com/ HIBI Customer Service: 1-855-692-6442

FLORIDA – Medicaid

Website: https://www.flmedicaidtplrecovery.com/ flmedicaidtplrecovery.com/hipp/index.html Phone: 1-877-357-3268

GEORGIA – Medicaid

GA HIPP Website: https://medicaid.georgia.gov/healthinsurance-premium-payment-program-hipp Phone: 678-564-1162, Press 1

GA CHIPRA Website: https://medicaid.georgia.gov/ programs/third-party-liability/childrens-healthinsurance-program-reauthorization-act-2009-chipra Phone: 678-564-1162, Press 2

INDIANA – Medicaid

Health Insurance Premium Payment Program

All other Medicaid Website: https://www.in.gov/ medicaid/ http://www.in.gov/fss/dfr/

Family and Social Services Administration

Phone: 1-800-403-0864

Member Services Phone: 1-800-457-4584

IOWA – Medicaid and CHIP (Hawki)

Medicaid Website: https://dhs.iowa.gov/ime/members

Medicaid Phone: 1-800-338-8366

Hawki Website: http://dhs.iowa.gov/Hawki Hawki Phone: 1-800-257-8563

HIPP Website: https://dhs.iowa.gov/ime/members/ medicaid-a-to-z/hipp

HIPP Phone: 1-888-346-9562

KANSAS – Medicaid

Website: https://www.kancare.ks.gov/ Phone: 1-800-792-4884

HIPP Phone: 1-800-967-4660

KENTUCKY – Medicaid

Kentucky Integrated Health Insurance Premium Payment Program (KI-HIPP) Website: https://chfs. ky.gov/agencies/dms/member/Pages/kihipp.aspx Phone: 1-855-459-6328

Email: KIHIPP.PROGRAM@ky.gov

KCHIP Website: https://kynect.ky.gov

Phone: 1-877-524-4718

Kentucky Medicaid Website: https://chfs.ky.gov/ agencies/dms

LOUISIANA – Medicaid

Website: www.medicaid.la.gov or www.ldh.la.gov/lahipp Phone: 1-888-342-6207 (Medicaid hotline) or 1-855-6185488 (LaHIPP)

MAINE – Medicaid

Enrollment Website: www.mymaineconnection.gob/ benefits/s/?language=en_US Phone: 1-800-442-6003 TTY: Maine relay 711

Private Health Insurance Premium Webpage: https://www.maine.gov/dhhs/ofi/applications-forms Phone: 800-977-6740 TTY: Maine relay 711

MASSACHUSETTS – Medicaid and CHIP

Website: https://www.mass.gov/masshealth/pa Phone: 1-800-862-4840 TTY: 711

Email: masspremassistance@accenture.com

MINNESOTA – Medicaid

Website: https://mn.gov/dhs/health-care-coverage/ Phone: 1-800-657-3672

MISSOURI – Medicaid

Website: http://www.dss.mo.gov/mhd/participants/ pages/hipp.htm

Phone: 1-573-751-2005

MONTANA – Medicaid

Website: http://dphhs.mt.gov/ MontanaHealthcarePrograms/HIPP

Phone: 1-800-694-3084

Email: HHSHIPPProgram@mt.gov

NEBRASKA – Medicaid

Website: http://www.ACCESSNebraska.ne.gov

Phone: 855-632-7633

Lincoln: 402-473-7000

Omaha: 402-495-1178

NEVADA – Medicaid

Medicaid Website: http://dhcfp.nv.gov

Medicaid Phone: 1-800-992-0900

NEW HAMPSHIRE – Medicaid

Website: https://www.dhhs.nh.gov/programs-services/ medicaid/health-insurance-premium-program

Phone: 603-271-5218

Toll free number for the HIPP program: 1-800-852-3345, ext 15218

Email: DHHS.ThirdPartyLiabi@dhhs.nh.gov

NEW JERSEY – Medicaid and CHIP

Medicaid Website: http://www.state.nj.us/ humanservices/ dmahs/clients/medicaid/ Phone: 800-356-1561

CHIP Premium Assistance Phone: 609-631-2392

CHIP Website: http://www.njfamilycare.org/index.html

CHIP Phone: 1-800-701-0710 (TTY: 711)

NEW YORK – Medicaid

Website: https://www.health.ny.gov/health_care/ medicaid/

Phone: 1-800-541-2831

NORTH CAROLINA – Medicaid

Website: https://medicaid.ncdhhs.gov/ Phone: 919-855-4100

NORTH DAKOTA – Medicaid

Website: https://www.hhs.nd.gov/healthcare Phone: 1-844-854-4825

OKLAHOMA – Medicaid and CHIP

Website: http://www.insureoklahoma.org Phone: 1-888-365-3742

OREGON – Medicaid and CHIP

Website: http://healthcare.oregon.gov/Pages/index.aspx

Phone: 1-800-699-9075

PENNSYLVANIA – Medicaid and CHIP

Website: https://www.pa.gov/en/services/dhs/applyfor-medicaid-health-insurance-premium-paymentprogram-hipp.html

Phone: 1-800-692-7462

CHIP Website: https://www.pa.gov/en/agencies/dhs/ resources/chip.html

CHIP Phone: 1-800-986-KIDS (5437)

RHODE ISLAND – Medicaid and CHIP

Website: http://www.eohhs.ri.gov/

Phone: 1-855-697-4347, or 401-462-0311 (Direct RIte Share Line)

SOUTH CAROLINA - Medicaid

Website: https://www.scdhhs.gov

Phone: 1-888-549-0820

SOUTH DAKOTA - Medicaid

Website: http://dss.sd.gov

Phone: 1-888-828-0059

TEXAS - Medicaid

Website: https://www.hhs.texas.gov/services/financial/ health-insurance-premium-payment-hipp-program

Phone: 1-800-440-0493

UTAH – Medicaid and CHIP

Utah’s Premium Partnership for Health Insurance (UPP)

Website: https://medicaid.utah.gov/upp/ Email: upp@utah.gov

Phone: 1-888-222-2542

Adult Expansion Website: https://medicaid.utah.gov/ expansion/

Utah Medicaid Buyout Program Website: https:// medicaid.utah.gov/buyout-program/

CHIP Website: https://chip.utah.gov/

VERMONT– Medicaid

Website: https://dvha.vermont.gov/members/medicaid/ hipp-program

Phone: 1-800-562-3022

VIRGINIA – Medicaid and CHIP

Website: https://coverva.dmas.virginia.gov/learn/ premium-assistance/famis-select

https://coverva.dmas.virginia.gov/learn/premiumassistance/health-insurance-premium-payment-hippprograms

Phone: 1-800-432-5924

WASHINGTON – Medicaid

Website: https://www.hca.wa.gov/ Phone: 1-800-562-3022

WEST VIRGINIA – Medicaid and CHIP Website: http://mywvhipp.com/ and https://dhhr. wv.gov/bms/

Medicaid Phone: 304-558-1700

CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699-8447)

WISCONSIN – Medicaid and CHIP Website: https://www.dhs.wisconsin.gov/ badgercareplus/p-10095.htm

Phone: 1-800-362-3002

WYOMING – Medicaid Website: https://health.wyo.gov/healthcarefin/ medicaid/programs-and-eligibility/ Phone: 800-251-1269

To see if any other states have added a premium assistance program since July 31, 2024, or for more information on special enrollment rights, contact either:

U.S. Department of Labor Employee Benefits Security Administration www.dol.gov/agencies/ebsa 1-866-444-EBSA (3272)

U.S. Department of Health and Human Services Centers for Medicare & Medicaid Services www.cms.hhs.gov 1-877-267-2323, Menu Option 4, Ext. 61565

General Notice of COBRA Rights Introduction

You’re getting this notice because you recently gained coverage under a group health plan (the Plan). This notice has important information about your right to COBRA continuation coverage, which is a temporary extension of coverage under the Plan. This notice explains COBRA continuation coverage, when it may become available to you and your family, and what you need to do to protect your right to get it. When you become eligible for COBRA, you may also become eligible for other coverage options that may cost less than COBRA continuation coverage.

The right to COBRA continuation coverage was created by a federal law, the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA). COBRA continuation coverage can become available to you and other members of your family when group health coverage would otherwise end. For more information about your rights and obligations under the Plan and under federal law, you should review the Plan’s Summary Plan

Description or contact the Plan Administrator. You may have other options available to you when you lose group health coverage. For example, you may be eligible to buy an individual plan through the Health Insurance Marketplace. By enrolling in coverage through the Marketplace, you may qualify for lower costs on your monthly premiums and lower outofpocket costs. Additionally, you may qualify for a 30day special enrollment period for another group health plan for which you are eligible (such as a spouse’s plan), even if that plan generally doesn’t accept late enrollees.

COBRA continuation coverage is a continuation of Plan coverage when it would otherwise end because of a life event. This is also called a “qualifying event.” Specific qualifying events are listed later in this notice. After a qualifying event, COBRA continuation coverage must be offered to each person who is a “qualified beneficiary.” You, your spouse, and your dependent children could become qualified beneficiaries if coverage under the Plan is lost because of the qualifying event. Under the Plan, qualified beneficiaries who elect COBRA continuation coverage must pay for COBRA continuation coverage.

If you’re an employee, you’ll become a qualified beneficiary if you lose your coverage under the Plan because of the following qualifying events:

• Your hours of employment are reduced, or

• Your employment ends for any reason other than your gross misconduct.

If you’re the spouse of an employee, you’ll become a qualified beneficiary if you lose your coverage under the Plan because of the following qualifying events:

Your spouse dies;

Your spouse’s hours of employment are reduced; Your spouse’s employment ends for any reason other than his or her gross misconduct;

• Your spouse becomes entitled to Medicare benefits (under Part A, Part B, or both); or You become divorced or legally separated from your spouse.

Your dependent children will become qualified beneficiaries if they lose coverage under the Plan because of the following qualifying events:

• The parent-employee dies;

• The parent-employee’s hours of employment are reduced;

The parent-employee’s employment ends for any reason other than his or her gross misconduct;

• The parent-employee becomes entitled to Medicare benefits (Part A, Part B, or both);

The parents become divorced or legally separated; or

• The child stops being eligible for coverage under the Plan as a “dependent child.”

When is COBRA continuation coverage available?

The Plan will offer COBRA continuation coverage to qualified beneficiaries only after the Plan Administrator has been notified that a qualifying event has occurred. The employer must notify the Plan Administrator of the following qualifying events:

• The end of employment or reduction of hours of employment; Death of the employee;

• The employee’s becoming entitled to Medicare benefits (under Part A, Part B, or both).

For all other qualifying events (divorce or legal separation of the employee and spouse or a dependent child’s losing eligibility for coverage as a dependent child), you must notify the Plan Administrator within 60 days after the qualifying event occurs. You must provide this notice to:

Human Resources Department

19625 62nd Ave S #A101 Kent, WA 98032

How is COBRA continuation coverage provided?

Once the Plan Administrator receives notice that a qualifying event has occurred, COBRA continuation coverage will be offered to each of the qualified beneficiaries. Each qualified beneficiary will have an independent right to elect COBRA continuation coverage. Covered employees may elect COBRA continuation coverage on behalf of their spouses, and parents may elect COBRA continuation coverage on behalf of their children.

COBRA continuation coverage is a temporary continuation of coverage that generally lasts for 18 months due to employment termination or reduction of hours of work. Certain qualifying events, or a second qualifying event during the initial period of coverage, may permit a beneficiary to receive a maximum of 36 months of coverage.

There are also ways in which this 18-month period of COBRA continuation coverage can be extended:

Disability extension of 18-month period of COBRA continuation coverage

If you or anyone in your family covered under the Plan is determined by Social Security to be disabled and you notify the Plan Administrator in a timely fashion, you and your entire family may be entitled to get up to an additional 11 months of COBRA continuation coverage, for a maximum of 29 months. The disability would have to have started at some time before the 60th day of COBRA continuation coverage and must last at least until the end of the 18-month period of COBRA continuation coverage.

Second qualifying event extension of 18-month period of continuation coverage

If your family experiences another qualifying event during the 18 months of COBRA continuation coverage, the spouse and dependent children in your family can get up to 18 additional months of COBRA continuation

coverage, for a maximum of 36 months, if the Plan is properly notified about the second qualifying event.

This extension may be available to the spouse and any dependent children getting COBRA continuation coverage if the employee or former employee dies; becomes entitled to Medicare benefits (under Part A,

Part B, or both); gets divorced or legally separated; or if the dependent child stops being eligible under the Plan as a dependent child. This extension is only available if the second qualifying event would have caused the spouse or dependent child to lose coverage under the Plan had the first qualifying event not occurred.

Are there other coverage options besides COBRA Continuation Coverage?

Yes. Instead of enrolling in COBRA continuation coverage, there may be other coverage options for you and your family through the Health Insurance Marketplace, Medicaid, Children’s Health Insurance Program (CHIP), or other group health plan coverage options (such as a spouse’s plan) through what is called a “special enrollment period.” Some of these options may cost less than COBRA continuation coverage. You can learn more about many of these options at www. healthcare.gov.

Can I enroll in Medicare instead of COBRA continuation coverage after my group health plan coverage ends?

In general, if you don’t enroll in Medicare Part A or B when you are first eligible because you are still employed, after the Medicare initial enrollment period, you have an 8-month special enrollment period to sign up for Medicare Part A or B, beginning on the earlier of

• The month after your employment ends; or

• The month after group health plan coverage based on current employment ends.

If you don’t enroll in Medicare and elect COBRA continuation coverage instead, you may have to pay a Part B late enrollment penalty and you may have a gap in coverage if you decide you want Part B later. If you elect COBRA continuation coverage and later enroll in Medicare Part A or B before the COBRA continuation coverage ends, the Plan may terminate your continuation coverage. However, if Medicare Part A or B is effective on or before the date of the COBRA election, COBRA coverage may not be discontinued on

account of Medicare entitlement, even if you enroll in the other part of Medicare after the date of the election of COBRA coverage.

If you are enrolled in both COBRA continuation coverage and Medicare, Medicare will generally pay first (primary payer) and COBRA continuation coverage will pay second. Certain plans may pay as if secondary to Medicare, even if you are not enrolled in Medicare.

For more information visit https://www.medicare.gov/ medicare-and-you.

If you have questions

Questions concerning your Plan or your COBRA continuation coverage rights should be addressed to the contact or contacts identified below. For more information about your rights under the Employee Retirement Income Security Act (ERISA), including COBRA, the Patient Protection and Affordable Care Act, and other laws affecting group health plans, contact the nearest Regional or District Office of the U.S.

Department of Labor’s Employee Benefits Security Administration (EBSA) in your area or visit www.dol. gov/ebsa. (Addresses and phone numbers of Regional and District EBSA Offices are available through EBSA’s website.) For more information about the Marketplace, visit www.healthcare.gov.

Keep your Plan informed of address changes

To protect your family’s rights, let the Plan Administrator know about any changes in the addresses of family members. You should also keep a copy, for your records, of any notices you send to the Plan Administrator.

Plan contact information

Human Resources Department 19625 62nd Ave S #A101 Kent, WA 98032

General FMLA Notice

The United States Department of Labor Wage and Hour Division Leave Entitlements

Eligible employees who work for a covered employer can take up to 12 weeks of unpaid, job-protected leave in a 12-month period for the following reasons:

The birth of a child or placement of a child for adoption or foster care;

• To bond with a child (leave must be taken within 1 year of the child’s birth or placement);

To care for the employee’s spouse, child, or parent who

has a qualifying serious health condition;

• For the employee’s own qualifying serious health condition that makes the employee unable to perform the employee’s job;

For qualifying exigencies related to the foreign deployment of a military member who is the employee’s spouse, child, or parent.

An eligible employee who is a covered servicemember’s spouse, child, parent, or next of kin may also take up to 26 weeks of FMLA leave in a single 12-month period to care for the servicemember with a serious injury or illness. An employee does not need to use leave in one block. When it is medically necessary or otherwise permitted, employees may take leave intermittently or on a reduced schedule.

Employees may choose, or an employer may require, use of accrued paid leave while taking FMLA leave. If an employee substitutes accrued paid leave for FMLA leave, the employee must comply with the employer’s normal paid leave policies.

While employees are on FMLA leave, employers must continue health insurance coverage as if the employees were not on leave.

Upon return from FMLA leave, most employees must be restored to the same job or one nearly identical to it with equivalent pay, benefits, and other employment terms and conditions.

An employer may not interfere with an individual’s FMLA rights or retaliate against someone for using or trying to use FMLA leave, opposing any practice made unlawful by the FMLA, or being involved in any proceeding under or related to the FMLA.

An employee who works for a covered employer must meet three criteria in order to be eligible for FMLA leave. The employee must:

• Have worked for the employer for at least 12 months; Have at least 1,250 hours of service in the 12 months before taking leave;* and

• Work at a location where the employer has at least 50 employees within 75 miles of the employee’s worksite.

*Special “hours of service” requirements apply to airline flight crew employees.

Generally, employees must give 30-days’ advance notice of the need for FMLA leave. If it is not possible to give 30-days’ notice, an employee must notify the employer as soon as possible and, generally, follow the employer’s usual procedures.

Employees do not have to share a medical diagnosis, but must provide enough information to the employer so it can determine if the leave qualifies for FMLA protection. Sufficient information could include informing an employer that the employee is or will be unable to perform his or her job functions, that a family member cannot perform daily activities, or that hospitalization or continuing medical treatment is necessary.

Employees must inform the employer if the need for leave is for a reason for which FMLA leave was previously taken or certified.

Employers can require a certification or periodic recertification supporting the need for leave. If the employer determines that the certification is incomplete, it must provide a written notice indicating what additional information is required.

Once an employer becomes aware that an employee’s need for leave is for a reason that may qualify under the FMLA, the employer must notify the employee if he or she is eligible for FMLA leave and, if eligible, must also provide a notice of rights and responsibilities under the FMLA. If the employee is not eligible, the employer must provide a reason for ineligibility.

Employers must notify its employees if leave will be designated as FMLA leave, and if so, how much leave will be designated as FMLA leave.

Employees may file a complaint with the U.S. Department of Labor, Wage and Hour Division, or may bring a private lawsuit against an employer.

The FMLA does not affect any federal or state law prohibiting discrimination or supersede any state or local law or collective bargaining agreement that provides greater family or medical leave rights.

Genetic Information Nondiscrimination Act (GINA)

The Genetic Information Nondiscrimination Act of 2008 (“GINA”) protects employees against discrimination based on their genetic information. Unless otherwise

permitted, your Employer may not request or require any genetic information from you or your family members.

The Genetic Information Nondiscrimination Act of 2008 (GINA) prohibits employers and other entities covered by GINA Title II from requesting or requiring genetic information of an individual or family member of the individual, except as specifically allowed by this law. To comply with this law, we are asking that you not provide any genetic information when responding to this request for medical information. “Genetic information,” as defined by GINA, includes an individual’s family medical history, the results of an individual’s or family member’s genetic tests, the fact that an individual or an individual’s family member sought or received genetic services, and genetic information of a fetus carried by an individual or an individual’s family member or an embryo lawfully held by an individual or family member receiving assistive reproductive services

Health Insurance Exchange Notice

New Health Insurance Marketplace Coverage Options and Your Health Coverage

When key parts of the health care law take effect in 2014, there will be a new way to buy health insurance: The Health Insurance Marketplace. To assist you as you evaluate options for you and your family, this notice provides some basic information about the new Marketplace and employment-based health coverage offered by your employer.

The Marketplace is designed to help you find health insurance that meets your needs and fits your budget. The Marketplace offers “one-stop shopping” to find and compare private health insurance options. You may also be eligible for a new kind of tax credit that lowers your monthly premium right away. Open enrollment for health insurance coverage through the Marketplace begins in October 2013 for coverage starting as early as January 1, 2014.

Can I Save Money on my Health Insurance Premiums in the Marketplace?

You may qualify to save money and lower your monthly premium, but only if your employer does not offer coverage, or offers coverage that doesn’t meet certain standards. The savings on your premium that you’re eligible for depends on your household income.

Does Employer Health Coverage Affect Eligibility for Premium Savings through the Marketplace?

Yes. If you have an offer of health coverage from your employer that meets certain standards, you will not be eligible for a tax credit through the Marketplace and may wish to enroll in your employer’s health plan. However, you may be eligible for a tax credit that lowers your monthly premium, or a reduction in certain costsharing if your employer does not offer coverage to you at all or does not offer coverage that meets

certain standards. If the cost of a plan from your employer that would cover you (and not any other members of your family) is more than 9.5% of your household income for the year, or if the coverage your employer provides does not meet the “minimum value” standard set by the Affordable Care Act, you may be eligible for a tax credit.†

Note: If you purchase a health plan through the Marketplace instead of accepting health coverage offered by your employer, then you may lose the employer contribution (if any) to the employer-offered coverage. Also, this employer contribution -as well as your employee contribution to employer-offered coverage- is often excluded from income for Federal and State income tax purposes. Your payments for coverage through the Marketplace are made on an after-tax basis.

How Can I Get More Information?

For more information about your coverage offered by your employer, please check your summary plan description or contact:

Human Resources Department

19625 62nd Ave S #A101 Kent, WA 98032

The Marketplace can help you evaluate your coverage options, including your eligibility for coverage through the Marketplace and its cost. Please visit HealthCare.gov for more information, including an online application for health insurance coverage and contact information for a Health Insurance Marketplace in your area.

This section contains information about any health coverage offered by your employer. If you decide to complete an application for coverage in the Marketplace, you will be asked to provide this information. This information is numbered to correspond to the Marketplace application.

Here is some basic information about health coverage offered by this employer:

• As your employer, we offer a health plan to:

☑ Some employees. Eligible employees are: Full time employees working 30 hours per week

• With respect to dependents:

☑ We do offer coverage. Eligible dependents are: Spouse, Domestic Partner and Children of Employee, Spouse or Domestic Partner

☑ If checked, this coverage meets the minimum value standard, and the cost of this coverage to you is intended to be affordable, based on employee wages.

Note: Even if your employer intends your coverage to be affordable, you may still be eligible for a premium discount through the Marketplace. The Marketplace will use your household income, along with other factors, to determine whether you may be eligible for a premium discount. If, for example, your wages vary from week to week (perhaps you are an hourly employee or you work on a commission basis), if you are newly employed mid-year, or if you have other income losses, you may still qualify for a premium discount.

Medicare Part D Creditable Coverage Notice

Important Notice from Performance Modalities, Inc. dba Perform Health About Your Prescription Drug Coverage and Medicare .

Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with Performance Modalities, Inc. dba Perform Health and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to join a Medicare drug plan. If you are considering joining, you should compare your current coverage, including which drugs are covered at what cost, with the coverage and costs of the plans offering Medicare prescription drug coverage in your area. Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice.

There are two important things you need to know about your current coverage and Medicare’s prescription drug coverage:

• Medicare prescription drug coverage became available in 2006 to everyone with Medicare. You can get this coverage if you join a Medicare Prescription Drug Plan or join a Medicare Advantage Plan (like an HMO or PPO) that offers prescription drug coverage. All Medicare drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium.

• Performance Modalities, Inc. dba Perform Health has determined that the prescription drug coverage offered by the 2022 - 2023 Plan Year is, on average for all plan participants, expected to pay out as much as standard Medicare prescription drug coverage pays and is therefore considered Creditable Coverage. Because your existing coverage is Creditable Coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to join a Medicare drug plan.

You can join a Medicare drug plan when you first become eligible for Medicare and each year from October 15th to December 7th.

However, if you lose your current creditable prescription drug coverage, through no fault of your own, you will also be eligible for a two (2) month Special Enrollment Period (SEP) to join a Medicare drug plan.

If you decide to join a Medicare drug plan, your current Performance Modalities, Inc. dba Perform Health coverage will not be affected. Enrollment in Part D Medicare will not affect benefits under this plan.

If you do decide to join a Medicare drug plan and drop your current Performance Modalities, Inc. dba Perform Health coverage, be aware that you and your dependents will be able to get this coverage back.

Will You Pay a Higher Premium (Penalty) to Join a Medicare Drug Plan?

You should also know that if you drop or lose your current coverage with Performance Modalities, Inc. dba Perform Health and don’t join a Medicare drug plan within 63 continuous days after your current coverage ends, you may pay a higher premium (a penalty) to join a Medicare drug plan later.

If you go 63 continuous days or longer without creditable prescription drug coverage, your monthly premium may go up by at least 1% of the Medicare base beneficiary premium per month for every month that you did not have that coverage. For example, if you go nineteen months without creditable coverage, your premium may consistently be at least 19% higher than the Medicare base beneficiary premium. You may have to pay this higher premium (a penalty) as long as you have Medicare prescription drug coverage. In addition, you may have to wait until the following October to join.

For More Information About This Notice or Your Current Prescription Drug Coverage Contact the person listed below for further information call Sara Hall at 253-2363145. NOTE: You’ll get this notice each year. You will also get it before the next period you can join a Medicare drug plan, and if this coverage through Performance Modalities, Inc. dba Perform Health changes. You also may request a copy of this notice at any time

For More Information About Your Options Under Medicare Prescription Drug Coverage

More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook. You’ll get a copy of the handbook in the mail every year from Medicare. You may also be contacted directly by Medicare drug plans.

For more information about Medicare prescription drug coverage:

• Visit www.medicare.gov

• Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You” handbook for their telephone number) for personalized help

• Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available. For information about this extra help, visit Social Security on the web at www.socialsecurity.gov, or call them at 1-800-772-1213 (TTY 1-800-325-0778).

Remember: Keep this Creditable Coverage notice. If you decide to join one of the Medicare drug plans, you may be required to provide a copy of this notice when you join to show whether or not you have maintained creditable coverage and, therefore, whether or not you are required to pay a higher premium (a penalty).

Date: 07/01/2024

Name of Entity/Sender: Performance Modalities, Inc. dba Perform Health

Contact: Position/Office: Human Resources Department

Address: 119625 62nd Ave S #A101 Kent, WA 98032

Phone Number: 253-236-3145

Newborns’ and Mothers’ Health Protection Act Notice

Group health plans and health insurance issuers generally may not, under Federal law, restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal delivery, or less than 96 hours following a cesarean section. However, Federal law generally does not prohibit the mother’s or newborn’s attending provider, after consulting with the mother, from discharging the mother or her newborn earlier than 48 hours (or 96 hours as applicable). In any case, plans and issuers may not, under Federal law, require that a provider obtain authorization from the plan or the insurance issuer for prescribing a length of stay not in excess of 48 hours (or 96 hours).

Your Rights and Protections Against Surprise Medical Bills

When you get emergency care or are treated by an out-of-network provider at an in-network hospital or ambulatory surgical center, you are protected from balance billing. In these cases, you shouldn’t be charged more than your plan’s copayments, coinsurance and/or deductible

What is “balance billing” (sometimes called “surprise billing”)?

When you see a doctor or other health care provider, you may owe certain out-ofpocket costs, like a copayment, coinsurance, or deductible. You may have additional costs or have to pay the entire bill if you see a provider or visit a health care facility that isn’t in your health plan’s network.

“Out-of-network” means providers and facilities that haven’t signed a contract with your health plan to provide services. Out-of-network providers may be allowed to bill you for the difference between what your plan pays and the full amount charged for a service. This is called “balance billing.” This amount is likely more than in-network costs for the same service and might not count toward your plan’s deductible or annual out-of-pocket limit.

“Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in- network facility but are unexpectedly treated by an out-ofnetwork provider.

Surprise medical bills could cost thousands of dollars depending on the procedure or service. You’re protected from balance billing for:

If you have an emergency medical condition and get emergency services from an out-ofnetwork provider or facility, the most they can bill you is your plan’s in-network costsharing amount (such as copayments, coinsurance, and deductibles). You can’t be balance billed for these emergency services. This includes services you may get after you’re in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

What consumers need to know about surprise or balance billing

Certain services at an in-network hospital or ambulatory surgical center When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers can bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers can’t balance bill you and may not ask you to give up your protections not to be balance billed.

If you get other types of services at these in-network facilities, out-of-network providers can’t balance bill you, unless you give written consent and give up your protections.

You’re never required to give up your protections from balance billing. You also aren’t required to get out-of-network care. You can choose a provider or facility in your plan’s network.

https://www.insurance.wa.gov/what-consumers-need-know-about-surprise-orbalancebilling

When balance billing isn’t allowed, you also have these protections:

• You’re only responsible for paying your share of the cost (like the copayments, coinsurance, and deductible that you would pay if the provider or facility was innetwork). Your health plan will pay any additional costs to out-of-network providers and facilities directly.

• Generally, your health plan must:

• Cover emergency services without requiring you to get approval for services in advance (also known as “prior authorization”).

Cover emergency services by out-of-network providers.

• Base what you owe the provider or facility (cost-sharing) on what it would pay an in-network provider or facility and show that amount in your explanation of benefits.

Count any amount you pay for emergency services or out-of-network services toward your in-network deductible and out-of-pocket limit.

If you think you’ve been wrongly billed, contact the No Surprises Help Desk, operated by the U.S. Department of Health and Human Services, at 1-800-985-3059.

Visit www.cms.gov/nosurprises/consumers for more information about your rights under federal law.

Perform Health reserves the right to modify, amend, suspend or terminate any plan, in whole or in part, at any time. The information in this Enrollment Guide is presented for illustrative purposes and is based on information provided by the employer. The text contained in this Guide was taken from various summary plan descriptions and benefit information. While every effort was taken to accurately report your benefits, discrepancies, or errors are always possible. In case of discrepancy between the Guide and the actual plan documents, the actual plan documents will prevail. If you have any questions about your Guide, contact Human Resources.