EMPLOYEE BENEFITS GUIDE

SALARIED/OFFICE HOURLY EMPLOYEES

INTRODUCTION

Phoenix Global is proud to offer a comprehensive program of benefits designed to serve the diverse needs of our unique workforce, and we are committed to continually enhancing and expanding our offerings. The information in this guide is meant to familiarize you with the benefits and programs currently in place.

WHO IS ELIGIBLE TO ELECT BENEFITS?

All full-time employees working an average of at least 30 hours per week are eligible to enroll themselves and their eligible dependents in benefits. The benefits elected will be effective on your date of hire.

Please remember that only eligible dependents can be enrolled. Eligible dependents include:

• Your legal spouse

• Your dependents

∗ Dependent child(ren) can be a natural born child(ren), stepchild(ren) (of legal spouse), adopted child(ren), and child(ren) for which you have legal guardianship

∗ Your eligible dependents can be covered until they reach age 26, regardless of student status

ENROLLING IN BENEFITS: ADP

When you are ready to enroll in benefits, you must enroll online at https://workforcenow.adp.com.

Enrolling Online

1. At the bottom of the page, select ‘Get Started’ next to where it says New User?

2. Select Find Me.

3. Next, select ‘Your Information’

• Enter your first name, last name, and date of birth, then enter your legal ID (such as SSN)

4. Hit ‘Search’

5. When results show, please select ‘Phoenix Global’.

• Note: If you used ADP at a prior employer, you may see that profile shown as an option. But again, please select the profile for Phoenix Global.

6. You will be asked to select a method for verificationeither the email address or mobile phone number on record, or you can also enter a new phone number for identity verification.

7. Enter the verification code sent to your email address or mobile.

8. Create your login credentials (username and password).

9. Once you log in, you may see a pop up display on the page. If so, please click Start Enrollment.

10. If you do not see a pop up display, follow either of the pathways below:

• From the Home Page, locate My Benefits and then click Start Enrollment

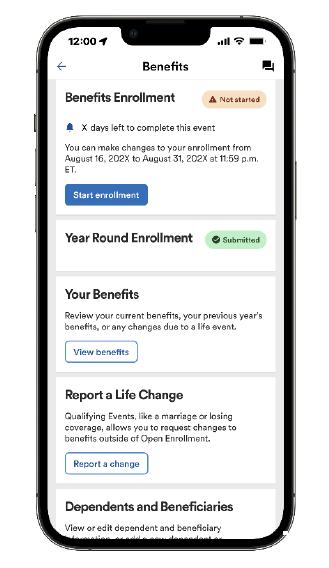

• Navigate to Myself, then click Benefits, Enrollment and Start Enrollment DOWNLOAD THE APP!

To stay connected with your information, download the ADP Mobile App and access your information on the go!

MEDICAL: INDEPENDENCE ADMINISTRATORS

Phoenix Global offers eligible employees a choice between two medical plans through Independence Administrators. Our PPO plans give you and your dependents the freedom of choice by allowing you to choose your own doctor or hospital. You can maximize your coverage by accessing your care through BlueCard PPO’s network of hospitals, doctors and specialists.

Note: The entire family deductible must be met before plan pays any benefits. If you cover any dependents under the plan, the full family deductible must be met before the plan pays any benefits. However, once any individual meets the individual out-of-pocket maximum, the plan will begin to pay benefits and that individual has no further liability for the balance of the year. Other members of the family will continue to pay toward the family deductible and out-of-pocket maximum.

PRESCRIPTION: OPTUM RX

The prescription drug benefit is administered by OptumRx. If you enroll in a Phoenix Global medical plan, you are automatically enrolled in the corresponding prescription drug plan through OptumRx.

RETAIL PRESCRIPTION (UP TO A 30 DAY SUPPLY)

MAIL ORDER (UP TO A 90 DAY SUPPLY)

PRICE EDGE

How does Optum Rx Price Edge work?

• You’re already set up. Simply show your ID card and a prescription from your doctors at any network pharmacy.

• Optum Rx Price Edge may lower copayment costs on certain covered retail and home delivery medications. If your next fill qualifies, you will automatically receive a discount.

• Medication costs with Price Edge will count towards your maximum out of pocket.

Visit www.optumrx.com or use the Optum Rx app.

IA RESOURCES

SET UP YOUR TELADOC ACCOUNT

Members enrolled in either IA medical plan have access to telemedicine services through Teladoc.

Whether you’re on vacation or it’s the middle of the night, the care you need is just a call or click away. You and your enrolled family members have unlimited on-demand access to doctors by phone or video chat from your mobile device - 24/7/365.

REGISTER TODAY!

It’s quick and easy online. Visit Teladoc at www.teladochealth.com to video chat with a board certified doctor any time, or download the Teladoc mobile app, available for iPhone and Android users.

Why wait for the care you need? Contact Teladoc and feel better now! Call 800.835.2362 or visit www.teladochealth.com.

IA RESOURCES

Members enrolled in either IA medical plan are eligible for the following reimbursement programs.

HEALTHY LIFESTYLES PROGRAMS

Tobacco Cessation Program

You probably know many of the reasons why you should quit smoking — it can help you breathe easier, live longer, and protect the health of those around you. To help you quit for good, the Healthy Lifestyles Tobacco Cessation Program will reimburse you up to $150 for completing an approved tobacco cessation program.

Fitness Program

Get reimbursed for working out regularly! Complete 120 workouts at an approved fitness center during a 365 day period and you will be reimbursed $150.

Weight Management Program

Support from others can make weight loss feel more manageable. Enroll in Weight Watchers®, Weight Watchers® Online, or an approved weight management program at a network hospital and the Healthy Lifestyles Weight Management Program will reimburse you up to $150.

For more information about these programs, please refer to the Wellness Program brochure in the ADP document library or contact Independence Administrators at the phone number on the back of your ID card.

DENTAL: DELTA DENTAL

Phoenix Global offers eligible employees a choice between two dental plans through Delta Dental. The plan provides eligible employees 100% coverage for routine exams, cleanings, and x-rays.

& Diagnostic

Basic Services

Fillings, Space Maintainers, Simple Extractions, Posterior Composites, Root Canals, and Periodontics

Major Services Crowns, Inlays, Onlays and Cast Restorations

FINDING A DENTIST

To find an participating dentist, go to www.deltadentalins.com, click Find A Dentist and use the Delta Dental PPO network.

ID CARDS

Delta Dental does not provide physical ID cards. To access or print a copy of your digital ID card, please register at www.deltadentalins.com.

VISION: VSP

Vision benefits are available to eligible employees through VSP. With so many in-network choices, VSP makes it easy to get the most out of your benefits. You’ll have access to preferred private practice, retail, and online in-network choices. Log in to www.vsp.com to find an in-network provider.

Single Vision Lenses

Contact Lenses (in lieu of eyeglasses)

Contact Lens Fitting & Evaluation

Glasses and Sunglasses

Routine Retinal Screening

Laser Vision Correction

copay

copay

$180 allowance; 20% savings on the amount over the allowance

Covered in full after materials copay

to $70

to $45

to $65

to $85

$150 allowance (materials copay does not apply) Up to $105

Up to $60 copay Included in the contact lens reimbursement fee

Once every 12 months

Once every 24 months

Once every 12 months

Extra $20 to spend on featured frame brands. Go to www.vsp.com/offers for details 30% savings on additional glasses and sunglasses, including lens enhancements, from the same VSP provider on the same day as your Well Vision Exam. Or get 20% from any VSP provider within 12 months of your last Well Visit Exam.

No more than $39 copay on routine retinal screening as an enhancement to a Well Vision Exam

Average 15% off the regular price or 5% off the promotional price; discounts only available from contracted facilities. After surgery, use your frame allowance (if eligible) for sunglasses from any VSP doctor

FLEXIBLE SPENDING ACCOUNTS: FLEX FACTS

HEALTHCARE FSA

The Healthcare FSA is used to reimburse out-of-pocket medical expenses incurred by you and your dependents. The maximum you can contribute to the Healthcare FSA is $3,200

Eligible expenses include:

• Doctor office copays

• Non-cosmetic dental procedures

• Prescription contacts, glasses, and sunglasses

• LASIK eye surgery

DEPENDENT CARE FSA

The Dependent Care FSA is used to reimburse expenses related to the care of eligible dependents. The Dependent Care FSA allows you to use pre-tax dollars toward qualified dependent care expenses. The annual maximum amount you may contribute is $5,000 (or $2,500 if married and filing separately) per calendar year.

Eligible expenses include:

• Au Pair

• Baby-sitting/dependent care to allow you to work or actively seek employment

• Day camps, preschool, or after school programs

• Adult/eldercare for adult dependents

HOW MUCH SHOULD I CONTRIBUTE?

The FSA plan year runs from September 1, 2024 through August 31, 2025. You should contribute the amount of money you expect to pay out-of-pocket for eligible expenses for the plan period. If you do not use the money you contributed, it will not be refunded to you or carried forward to a future plan year. This is the use-it-or-lose-it rule.

LIFE & DISABILITY: PRUDENTIAL

BASIC LIFE AND AD&D

All active, full-time salaried employees regularly working at least 30 hours each week are automatically enrolled in the Basic Life and Accidental Death and Dismemberment (AD&D) plan. The company pays 100% of the Basic Life and AD&D premium.

The Basic Life and AD&D benefit is 2x times annual earnings to a maximum amount of $300,000. Coverage is reduced by 35% at age 65 and 50% at age 70.

SHORT-TERM DISABILITY (STD)

All active, full-time salaried employees regularly working at least 30 hours each week are automatically enrolled in the Short-Term Disability (STD) plan. The company pays 100% of the STD premium.

After satisfying a 7-day elimination period, the STD plan pays 60% of earnings to a maximum benefit of $1,500 per week, up to a maximum duration of 12 weeks.

LONG-TERM DISABILITY (LTD)

All active, full-time salaried employees regularly working at least 30 hours each week are automatically enrolled in the Long-Term Disability (LTD) plan. The company pays 100% of the LTD premium.

After satisfying a 90-day elimination period, the LTD benefit pays 60% of earnings to a maximum benefit of $10,000 per month up until employee reaches retirement age.

VOLUNTARY LIFE AND AD&D

Eligible employees also have the option to purchase additional Life and AD&D Insurance. When you elect this coverage for yourself and/or your dependents, you pay the full cost through payroll deductions. Voluntary Life Insurance is portable.

Coverage Options

• Employees: Increments of $10,000 to a maximum of $500,000 not to exceed 5x your annual earnings.

• Spouses: Increments of $5,000 to a maximum of $100,000, not to exceed 100% of the employee’s amount. Spouse premiums are based on employees' age.

• Dependent Children (Live birth to age 26): Flat $10,000.

Guaranteed Issue Amount

• Employees: $150,000

• Spouses: $35,000

• Children: Flat $10,000

IMPORTANT REMINDERS

• Guaranteed Issue Amounts only apply to new hires. If you are currently enrolled in Voluntary Life and want to make a change or were previously eligible and waived, you must provide a health questionnaire/Evidence of Insurability (EOI).

• If you enroll in Voluntary Life coverage, you will automatically be enrolled in Voluntary AD&D for a matching amount.

• Employees must elect Voluntary Life and AD&D insurance for themselves in order to elect coverage for their spouse and/or child(ren).

EMPLOYEE ASSISTANCE PROGRAM (EAP): COMPSYCH

There are times in life when you might need a little help coping or figuring out what to do. Take advantage of the Employee Assistance Program (EAP) which includes WorkLife Services and is available to you and your family from ComPsych. It’s confidential — information will be released only with your permission or as required by law.

This program is employer paid and all Phoenix Global employees may utilize these EAP services regardless of enrollment in other benefits. You, your dependents (including children to age 26) and all household members can contact master’s-degreed clinicians 24/7 for counseling sessions by phone, online, email. There’s even a mobile EAP app. Receive referrals to support groups, a network counselor, community resources or your health plan. If necessary, you’ll be connected to emergency services.

When you call the EAP program, they will provide counseling options. You can call the counselor directly to set up your appointment, or have ComPsych call and schedule the appointment.

Your program includes up to three face-to-face assessment and counseling sessions per issue. EAP services can help with:

• Depression, grief, loss and emotional well-being

• Family, marital and other relationship issues

• Life improvement and goal-setting

• Addictions such as alcohol and drug abuse

• Stress or anxiety with work or family

• Financial and legal concerns

• Online will preparation

WORKLIFE SERVICES

WorkLife Services are included with the Employee Assistance Program. Get help with referrals for important needs like education, adoption, travel, daily living and care for your pet, child or elderly loved one.

TO CONTACT THE EAP

Call 800.272.7255 24 hours a day, seven days a week or visit www.guidanceresources.com

REGISTER ONLINE

Visit www.guidanceresources.com and click on “Register” to create your profile.

• Organization WEB ID: GRS311

• Company Name: Phoen

DOWNLOAD THE APP!

Prefer a mobile option? Access the ComPsych GuidanceResources mobile app for secure and convenient tools anytime, anywhere across any of your devices. Scan the QR code below to begin!

IDENTITY THEFT, PREPAID LEGAL AND FINANCIAL WELLNESS: COUNTRYWIDE

Employees pay 100% of the premiums for these benefits.

IDENTITY THEFT PROTECTION

The Countrywide Platinum plan delivers advanced tools and proactive monitoring that help you protect your identity and your family’s finances. Monitor your credit, financial transactions, social media, and more — all in one place. If fraud occurs, Countrywide’s up to $1 million identity theft expenses reimbursement covers many out-of-pocket expenses, lost wages, and legal fees.

LEGAL SERVICES

The Legal Services and Financial Wellness plans cover spouses and dependents up to the age of 26 at no additional cost.

Pre-Paid Legal

• Unlimited telephone advice and office consultations

• Face-to-face consultations

• Preparation of simple wills, living wills, and medical powers of attorney

• Review of contracts and legal documents

• Legal letters and phone calls on your behalf

• Advice on small claims court

• Advice on government programs

• Identity theft preventive and assistance

• DIY legal document drafter

• Warranty problems and consumer protection

• Tax and state relief advice

• Guaranteed reduced attorney fees

Financial Wellness

The coverage provides counseling services in areas such as debt management, student loans, medical debt, and housing information.

• Certified financial, credit, and debt coaching

• Student loan, personalized budget, and consumer debt counseling

• Financial education and much more!

VOLUNTARY BENEFITS:

PRUDENTIAL

The unexpected costs of an accident, illness, or hospital stay may be surprising. Even with a good medical plan, you may still have out-of-pocket expenses—from deductibles, copays, and other costs. Accident, Critical Illness, and Hospital Indemnity Insurance, issued by Prudential can help you manage these expenses so you can focus on getting well!

You can access a full schedule of benefits for each of these plans in the ADP document library.

ACCIDENT INSURANCE

Accident Insurance pays you for a wide range of injuries and medical services including:

• Injuries like: Broken Tooth, Burns (2nd and 3rd Degree), Concussion, Fractures, and Laceration

• Medical services like: Ambulance Service: Ground or Air, Emergency Room Visit, Medical Appliances (like crutches), Medical Tests, and Physical Therapy

• Benefit bundling of fracture claims: Prudential will pay your fracture claim and automatically bundle additional benefits including emergency room, physical therapy, X-rays, and physician follow-up.

Employees pay 100% of the premiums for these benefits.

CRITICAL ILLNESS INSURANCE

Critical Illness pays you for a wide range of medical conditions including:

• Alzheimer’s Disease

• Cancer: invasive or in situ

• Coma

• Coronary Artery Disease (severe)

• Heart Attack

• Major Organ Failure

• Paralysis

• Stroke

• More than 15 childhood conditions

This coverage also includes a wellness benefit of $75 for Critical Illness Insurance, which helps you stay healthy by rewarding you for routine health screenings tests such as your annual checkup, dental exam, mammogram, and more!

HOSPITAL INDEMNITY INSURANCE

Hospital Indemnity Insurance pays you for a wide range of services including:

• Hospital: Hospital Admissions, Daily In-Hospital Stays, Intensive Care Unit Admission, Daily Hospital Intensive Care Unit Stays, Rehabilitation Confinement

• Premature infant and NICU benefit

• High-risk pregnancy benefit

• Quarantine and pandemic benefits

• Other: Physical Therapy

This coverage also includes a wellness benefit of $75 for Hospital Indemnity Insurance, which helps you stay healthy by rewarding you for routine health screenings tests such as your annual checkup, dental exam, mammogram, and more!

BENEFITS MAC: CONNER STRONG & BUCKELEW

Don’t get lost in a sea of benefits confusion! With just one call or click the Benefits MAC can help guide the way!

The Benefits Member Advocacy Center (Benefits MAC), provided by Conner Strong & Buckelew, can help you and your covered family members navigate your benefits. Contact the Benefits MAC to:

• Find answers to your benefits questions

• Search for participating network providers

• Clarify information received from a provider or your insurance company, such as a bill, claim, or explanation of benefits (EOB)

• Rescue you from a benefits problem you’ve been working on

• Discover all that your benefit plans have to offer

Member Advocates are available Monday through Friday, 8:30 am to 5:00 pm ET. After hours, you will be able to leave a message with a live representative and receive a response by phone or email during business hours within 24 to 48 hours of your inquiry.

CONTACT THE BENEFITS MAC

You may contact the Benefits Member Advocacy Center in any of the following ways:

• Via phone: 800.563.9929

• Via the web: www.connerstrong.com/memberadvocacy

• Via email: cssteam@connerstrong.com

VALUE-ADDED SERVICES

The following programs offer you support for living a healthy life and preventing illness. These programs are available at no cost to all employees.

HUSK MARKETPLACE

Achieving optimal health and wellness doesn’t have to complicated or expensive. Access exclusive best-in-class pricing with some of the biggest brands in fitness, nutrition, and wellness the HUSK Marketplace.

Learn more at: marketplace.huskwellness.com/connerstrong

HEALTHYLEARN

This resource covers over a thousand health and wellness topics in a simple, straight-forward manner. The HealthyLearn On-Demand Library features all the health information you need to be well and stay well.

Learn more at: www.healthylearn.com/connerstrong

BENEFIT PERKS

This feature provides a broad array of services, discounts and special deals on consumer services, travel services, recreational services and much more. Simply access the site and register and you can begin using it now.

Learn more at: https://connerstrong.corestream.com

GOODRX

GoodRx is a prescription drug price comparison tool which allows you to simply and easily search for retail pharmacies that offer the lowest price for specific medications. Use GoodRx to compare drug prices at local and mail-order pharmacies and discover free coupons and savings tips. Find huge savings on drugs not covered by your insurance plan - you may even find savings versus your typical copayment.

Learn more at: www.connerstrong.goodrx.com

CARRIER CONTACTS

LEGAL NOTICES

Availability of Summary Health Information

As an employee, the health benefits available to you represent a significant component of your compensation package. They also provide important protection for you and your family in the case of illness or injury.

Your plan offers a series of health coverage options. Choosing a health coverage option is an important decision. To help you make an informed choice, your plan makes available a Summary of Benefits and Coverage (SBC), which summarizes important information about any health coverage option in a standard format, to help you compare across options. A paper copy is also available, free of charge, by calling Human Resources.

Newborns’ and Mothers’ Health Protection Act Notice

Group health plans and health insurance issuers generally may not, under federal law, restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal delivery, or less than 96 hours following a cesarean section. However, federal law generally does not prohibit the mother's or newborn's attending provider, after consulting with the mother, from discharging the mother or her newborn earlier than 48 hours (or 96 hours as applicable). In any case, plans and issuers may not, under federal law, require that a provider obtain authorization from the plan or the issuer for prescribing a length of stay not in excess of 48 hours (or 96 hours).

Women’s Health and Cancer Rights Act Notice

If you have had or are going to have a mastectomy, you may be entitled to certain benefits under the Women’s Health and Cancer Rights Act of 1998 (WHCRA). For individuals receiving mastectomy-related benefits, coverage will be provided in a manner determined in consultation with the attending physician and the patient, for:

• all stages of reconstruction of the breast on which the mastectomy was performed;

• surgery and reconstruction of the other breast to produce a symmetrical appearance; prostheses; and treatment of physical complications of the mastectomy, including lymphedema.

These benefits will be provided subject to the same deductibles and coinsurance applicable to other medical and surgical benefits provided under this plan. Therefore, the following deductibles and coinsurance apply: Low Plan: In Network Deductible of $500/person and $1,000 family and Coinsurance of 20%. High Plan: In Network Deductible of $0/ person and $0 family and Coinsurance of 100%. If you would like more information on WHCRA benefits, call Human Resources.

Special Enrollment Notice

Loss of other coverage (excluding Medicaid or a State Children’s Health Insurance Program). If you decline enrollment for yourself or for an eligible dependent (including your spouse) while other health insurance or group health plan coverage (including COBRA coverage) is in effect, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the Company stops contributing toward your or your dependents’ other coverage). However, you must request enrollment within [30 days or any longer period that applies

under the plan] after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage). If you request a change within the applicable timeframe, coverage will be effective the first of the month following your request for enrollment. When the loss of other coverage is COBRA coverage, then the entire COBRA period must be exhausted in order for the individual to have another special enrollment right under the Plan. Generally, exhaustion means that COBRA coverage ends for a reason other than the failure to pay COBRA premiums or for cause (that is, submission of a fraudulent claim). This means that the entire 18-, 29-, or 36-month COBRA period usually must be completed in order to trigger a special enrollment for loss of other coverage.

Loss of eligibility for Medicaid or a State Children’s Health Insurance Program. If you decline enrollment for yourself or for an eligible dependent (including your spouse) while Medicaid coverage or coverage under a state children’s health insurance program (CHIP) is in effect, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage. However, you must request enrollment within 60 days after your or your dependents’ coverage ends under Medicaid or CHIP. If you request a change within the applicable timeframe, coverage will be effective the first of the month following your request for enrollment.

New dependent by marriage, birth, adoption, or placement for adoption. If you have a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your new dependents. However, you must request enrollment within [30 days or any longer period that applies under the plan] after the marriage, birth, adoption, or placement for adoption. If you request a change within the applicable timeframe, coverage will be effective the date of birth, adoption or placement for adoption. For a new dependent as a result of marriage, coverage will be effective the first of the month following your request for enrollment.

Eligibility for Medicaid or a State Children’s Health Insurance Program. If you or your dependents (including your spouse) become eligible for a state premium assistance subsidy from Medicaid or through a state children’s health insurance program (CHIP) with respect to coverage under this plan, you may be able to enroll yourself and your dependents in this plan. However, you must request enrollment within 60 days after your or your dependents’ determination of eligibility for such assistance. If you request a change within the applicable timeframe, coverage will be effective the first of the month following your request for enrollment.

To request special enrollment or obtain more information, contact Human Resources.

Premium

Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www.healthcare.gov.

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877-KIDS NOW or www.insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.

If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www.askebsa.dol.gov or call 1-866-444-EBSA (3272).

If you live in one of the following states, you may be eligible for assistance paying your employer health plan premiums. The following list of states is current as of January 31, 2023. Contact your State for more information on eligibility –

ALABAMA – Medicaid

Website: http://myalhipp.com/ Phone: 1-855-692-5447

ALASKA – Medicaid

The AK Health Insurance Premium Payment Program Website: http://myakhipp.com/ Phone: 1-866-251-4861

Email: CustomerService@MyAKHIPP.com

Medicaid Eligibility: http://dhss.alaska.gov/dpa/Pages/ medicaid/default.aspx

ARKANSAS – Medicaid Website: http://myarhipp.com/ Phone: 1-855-MyARHIPP (855-692-7447)

CALIFORNIA - MEDICAID

Health Insurance Premium Payment (HIPP) Program http://dhcs.ca.gov/hipp

Phone: 916-445-8322

Fax: 916-440-5676

Email: hipp@dhcs.ca.gov

COLORADO - Health First Colorado (Colorado’s Medicaid Program) & Child Health Plan Plus (CHP+)

Health First Colorado Website: https:// www.healthfirstcolorado.com/

Health First Colorado Member Contact Center: 1-800-221-3943/ State Relay 711

CHP+: https://www.colorado.gov/pacific/hcpf/child-healthplan-plus

CHP+ Customer Service: 1-800-359-1991/ State Relay 711

Health Insurance Buy-In Program (HIBI): www.mycohibi.com

HIBI Customer Service: 1-855-692-6442

LEGAL NOTICES

FLORIDA – Medicaid

Website: https://www.flmedicaidtplrecovery.com/ flmedicaidtplrecovery.com/hipp/index.html Phone: 1-877-357-3268

GEORGIA – Medicaid

GA HIPP Website: https://medicaid.georgia.gov/healthinsurance-premium-payment-program-hipp Phone: 678-564-1162 Press 1

GA CHIPRA Website: https://medicaid.georgia.gov/programs/ third-party- liability/childrens-health-insurance-programreauthorization- act-2009-chipra Phone: 678-561-1162 Press 2

INDIANA – Medicaid

Healthy Indiana Plan for low-income adults 19-64

Website: http://www.in.gov/fssa/hip/ Phone: 1-877-438-4479

All other Medicaid

Website: https://www.in.gov/medicaid/ Phone 1-800-457-4584

IOWA – Medicaid and CHIP (Hawki)

Medicaid Website: https://dhs.iowa.gov/ime/members Medicaid Phone: 1-800-338-8366

Hawki Website: http://dhs.iowa.gov/Hawki Hawki Phone: 1-800-257-8563

HIPP Website: https://dhs.iowa.gov/ime/members/medicaida-to-z/hipp

HIPP Phone: 1-888-346-9562

KANSAS – Medicaid

Website: https://www.kancare.ks.gov/ Phone: 1-800-792-4884

HIPP Phone: 1-800-766-9012

KENTUCKY – Medicaid

Kentucky Integrated Health Insurance Premium Payment Program (KI-HIPP) Website: https://chfs.ky.gov/agencies/ dms/member/Pages/kihipp.aspx

Phone: 1-855-459-6328

Email: KIHIPP.PROGRAM@ky.gov

KCHIP Website: https://kidshealth.ky.gov/Pages/index.aspx Phone: 1-877-524-4718

Kentucky Medicaid Website: https://chfs.ky.gov

LOUISIANA – Medicaid

Website: www.medicaid.la.gov or www.ldh.la.gov/lahipp Phone: 1-888-342-6207 (Medicaid hotline) or 1-855-618-5488 (LaHIPP)

MAINE – Medicaid

Enrollment Website: www.mymaineconnection.gob/benefits/ s/?language=en_US

Phone: 1-800-442-6003 TTY: Maine relay 711

Private Health Insurance Premium Webpage: https://www.maine.gov/dhhs/ofi/applications-forms Phone: -800-977-6740 TTY: Maine relay 711

MASSACHUSETTS – Medicaid and CHIP

Website: https://www.mass.gov/masshealth/pa

Phone: 1-800-862-4840

TTY: 617-886-8102

MINNESOTA – Medicaid

Website: https://mn.gov/dhs/people-we-serve/children-andfamilies/health-care/health-care-programs/programs-andservices/other-insurance.jsp

Phone: 1-800-657-3739

MISSOURI – Medicaid

Website: http://www.dss.mo.gov/mhd/participants/pages/ hipp.htm

Phone: 1-573-751-2005

MONTANA – Medicaid

Website: http://dphhs.mt.gov/MontanaHealthcarePrograms/ HIPP

Phone: 1-800-694-3084

Email: HHSHIPPProgram@mt.gov

NEBRASKA – Medicaid

Website: http://www.ACCESSNebraska.ne.gov

Phone: (855) 632-7633

Lincoln: (402) 473-7000

Omaha: (402) 595-1178

NEVADA – Medicaid

Medicaid Website: http://dhcfp.nv.gov

Medicaid Phone: 1-800-992-0900

NEW HAMPSHIRE – Medicaid

Website: https://www.dhhs.nh.gov/programs-services/ medicaid/health-insurance-premium-program

Phone: 603-271-5218

Toll free number for the HIPP program: 1-800-852-3345, ext 5218

NEW JERSEY – Medicaid and CHIP

Medicaid Website: http://www.state.nj.us/humanservices/ dmahs/clients/medicaid/

Medicaid Phone: 609-631-2392

CHIP Website: http://www.njfamilycare.org/index.html

CHIP Phone: 1-800-701-0710

NEW YORK – Medicaid

Website: https://www.health.ny.gov/health_care/medicaid/ Phone: 1-800-541-2831

NORTH CAROLINA – Medicaid

Website: https://medicaid.ncdhhs.gov/ Phone: 919-855-4100

NORTH DAKOTA – Medicaid

Website: http://www.nd.gov/dhs/services/medicalserv/ medicaid/ Phone: 1-844-854-4825

OKLAHOMA – Medicaid and CHIP

Website: http://www.insureoklahoma.org Phone: 1-888-365-3742

OREGON – Medicaid

Website: http://healthcare.oregon.gov/Pages/index.aspx http://www.oregonhealthcare.gov/index-es.html Phone: 1-800-699-9075

PENNSYLVANIA – Medicaid and CHIP

Website: https://www.dhs.pa.gov/Services/Assistance/Pages/ HIPP-Program.aspx

Phone: 1-800-692-7462

CHIP Website: https://www.dhs.pa.gov/CHIP/Pages/CHIP.aspx

CHIP Phone: 1-800-986-KIDS (5437)

RHODE ISLAND – Medicaid and CHIP Website: http://www.eohhs.ri.gov/ Phone: 1-855-697-4347, or 401-462-0311 (Direct RIte Share Line)

SOUTH CAROLINA - Medicaid Website: https://www.scdhhs.gov Phone: 1-888-549-0820

SOUTH DAKOTA - Medicaid Website: http://dss.sd.gov Phone: 1-888-828-0059

TEXAS - Medicaid Website: http://gethipptexas.com/ Phone: 1-800-440-0493

UTAH – Medicaid and CHIP Medicaid Website: https://medicaid.utah.gov/ CHIP Website: http://health.utah.gov/chip Phone: 1-877-543-7669

VERMONT– Medicaid Website: https://dvha.vermont.gov/members/medicaid/hippprogram Phone: 1-800-250-8427

VIRGINIA – Medicaid and CHIP Website: https://www.coverva.org/hipp/ https://www.coverva.org/en/famis-select Phone: 1-800-432-5924

WASHINGTON – Medicaid Website: https://www.hca.wa.gov/ Phone: 1-800-562-3022

WEST VIRGINIA – Medicaid and CHIP Website: http://mywvhipp.com/ https://dhhr.wv.gov/bms/ Medicaid Phone: 304-558-1700 CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699-8447)

WISCONSIN – Medicaid and CHIP Website: https://www.dhs.wisconsin.gov/badgercareplus/p10095.htm Phone: 1-800-362-3002

WYOMING – Medicaid

Website: https://health.wyo.gov/healthcarefin/medicaid/ programs-and-eligibility/ Phone: 800-251-1269

To see if any other states have added a premium assistance program since January 31, 2023, or for more information on special enrollment rights, contact either:

U.S. Department of Labor Employee Benefits Security Administration www.dol.gov/agencies/ebsa 1-866-444-EBSA (3272)

U.S. Department of Health and Human Services Centers for Medicare & Medicaid Services www.cms.hhs.gov 1-877-267-2323, Menu Option 4, Ext. 61565

This benefit summary provides selected highlights of the employee benefits program at Phoenix Global. It is not a legal document and shall not be construed as a guarantee of benefits nor of continued employment at the Phoenix Global. All benefit plans are governed by master policies, contracts and plan documents. Any discrepancies between any information provided through this summary and the actual terms of such policies, contracts and plan documents shall be governed by the terms of such policies, contracts and plan documents. Phoenix Global reserves the right to amend, suspend or terminate any benefit plan, in whole or in part, at any time. The authority to make such changes rests with the Plan Administrator.