l What the Labor landslide means for the Australian economy

l Exploring the potential of machine learning in credit scoring

l Protecting your supply chain: The power of retention of title

l What the Labor landslide means for the Australian economy

l Exploring the potential of machine learning in credit scoring

l Protecting your supply chain: The power of retention of title

National partners

Divisional partners

Divisional supporting sponsors

• Existing PPSR registrations analysed on sign-up

• Ongoing automated registration & grantor monitoring with alerts

• Customer-level PPSR risk scoring, always up to date

• Bulk file support for registrations & searches

• Integrated ASIC / ABR / NEVDIS data and validation

• Auto-renewals so registrations never lapse or discharge incorrectly

• Ongoing motor vehicle monitoring against NEVDIS & AFSA

• At-a-glance dashboard of all key PPSR metrics

• Modern JSON-based API for seamless system integration

• Dual-jurisdiction coverage – AFSA (AU) & MBIE (NZ)

• Quick one-off searches no account required

• White-label portal & full broker / reseller support

• Hosted on ISO 27001-certified Azure data centres in Australia

Claire Kasses, General Manager

ISSN 2207-6549

DIRECTORS

Julie McNamara FICM CCE – Australian President

Lou Caldararo LICM CCE – Victoria/Tasmania & Australian VP

Troy Mulder FICM CCE – Western Australia/Northern Territory

Rob Jackson MICM CCE – South Australia

Theresa Brown MICM CCE – New South Wales

Steven Staatz MICM CCE – Queensland

Daniel Taylor MICM – Co-opted Director

CHIEF EXECUTIVE OFFICER

Nick Pilavidis FICM CCE

Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065

PO Box 64, St Leonards NSW 1590

Tel: (02) 8317 5085, Fax: (02) 9906 5686

Email: nick@aicm.com.au

PUBLISHER

Nick Pilavidis FICM CCE | Email: nick@aicm.com.au

CONTRIBUTING EDITORS

NSW – Gary Poslinsky MICM

Qld – Emma Purcival MICM CCE

SA – Clare Venema MICM CCE, Maria Scacchitti MICM

WA/NT – Jeremy Coote MICM CCE

Vic/Tas – Alex Hawtin MICM

Tel Direct: 02 9174 5727 or Mob: 0499 975 303

Email: claire@aicm.com.au

EDITING and PRODUCTION

Anthea Vandertouw | Ferncliff Productions Tel: 0408 290 440 | Email: ferncliff1@bigpond.com

THE EDITOR reserves the right to alter or omit any article or advertisement submitted and requires idemnity from the advertisers and contributors against damages or liabilities that may arise from material published. CREDIT MANAGEMENT IN AUSTRALIA is published by the Australian Institute of Credit Management, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065. The views expressed in CREDIT MANAGEMENT IN AUSTRALIA are not necessarily those of Australian Institute of Credit Management, which does not expect or invite any person to act or rely on any statement, opinion or advice contained herein (whether in the form of an advertisement or editorial) and neither the Institute or any of its employees, agents or contributors shall be liable for any opinion contained herein. © The Australian Institute of Credit Management, 2025.

EDITORIAL CONTRIBUTIONS SHOULD BE SENT TO:

Editor, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065 or email: aicm@aicm.com.au

Julie McNamara FICM CCE National President

Welcome to the May edition of Credit Management in Australia!

Continual improvement is at the heart of credit management, and in today’s evolving financial landscape, adaptability has never been more important. AICM remains dedicated to equipping you with the knowledge, tools, and resources to thrive.

We are so proud to introduce the Credit Knowledge Hub (CKH), a transformative learning platform designed to elevate professional development with 24/7 access to worldclass training and insights. Together with this magazine, our webinars, and industry events, CKH ensures you have everything needed to grow and succeed.

I also hope, like me, you enjoy the divisional reports in this edition, showcasing the vibrant contributions to our community. A special thanks to our dedicated council representatives – Gary Poslinsky (NSW), Maria Scacchitti MICM, CCE (SA), Emma Purcival MICM, CCE (Qld), Alex Hawtin MICM (Vic/Tas), and Jeremy Coote (WA), whose invaluable reports, interviews, photos, and articles enrich each publication.

How exciting to know all the awards are coming around again for 2025!

Congratulations to our four finalists for the Credit Team of the Year Award 2025 Angle Finance, Auroraenergy, HUON and Interactive. It is an amazing achievement to reach the finals and I wish you all the very best of luck!

We also have the Young Credit Professional and Credit Professional of the year awards coming up. I would encourage all of you to give it a go! Applications close on the 31st of May GOOD LUCK! I can’t wait to celebrate with you all at The Gold Coast Marriott at this year’s Presidents Dinner at National Conference.

A huge thank you to all our contributors for sharing expertise that keeps us informed on economic shifts, technological advancements, and best practices. Your engagement strengthens our industry, and I’m proud to be on this journey with you.

I also look forward to seeing many of you at an AICM event soon. With WINC events selling out and our social and professional events buzzing in every state, it’s clear just how valuable our network and community are in shaping the future of credit management.

Warm regards,

Julie McNamara FICM CCE President, Australian Institute of Credit Management (AICM)

The credit toolbox bundle is a unique opportunity to learn or refresh on the fundamentals of credit management and is taught by credit professionals with extensive experience.

These half-day sessions focus on understanding the core requirements with real application in credit roles.

These programs cover what and why credit professionals do what they do.

Designed for:

New members of credit teams seeking an introduction

Established credit professionals seeking a refresher

Non-credit professionals seeking to better understand credit

Upon finishing all three toolbox bundle programs, attendees will receive a certificate of completion.

Course details:

Dates:

Fundamentals of credit

Thursday 10th July 2025 - 12:30 - 4:30 PM AEST

Collect with confidence

Thursday 17th July 2025 - 12:30 - 4:30 PM AEST

Understanding credit risk

Thursday 24th July 2025 - 12:30 - 4:30 PM AEST

Cost:

Member: $675 inc GST

Non-Member: $855 inc GST

Location:

Online trainer-led group session

CCE: 12 CCE points

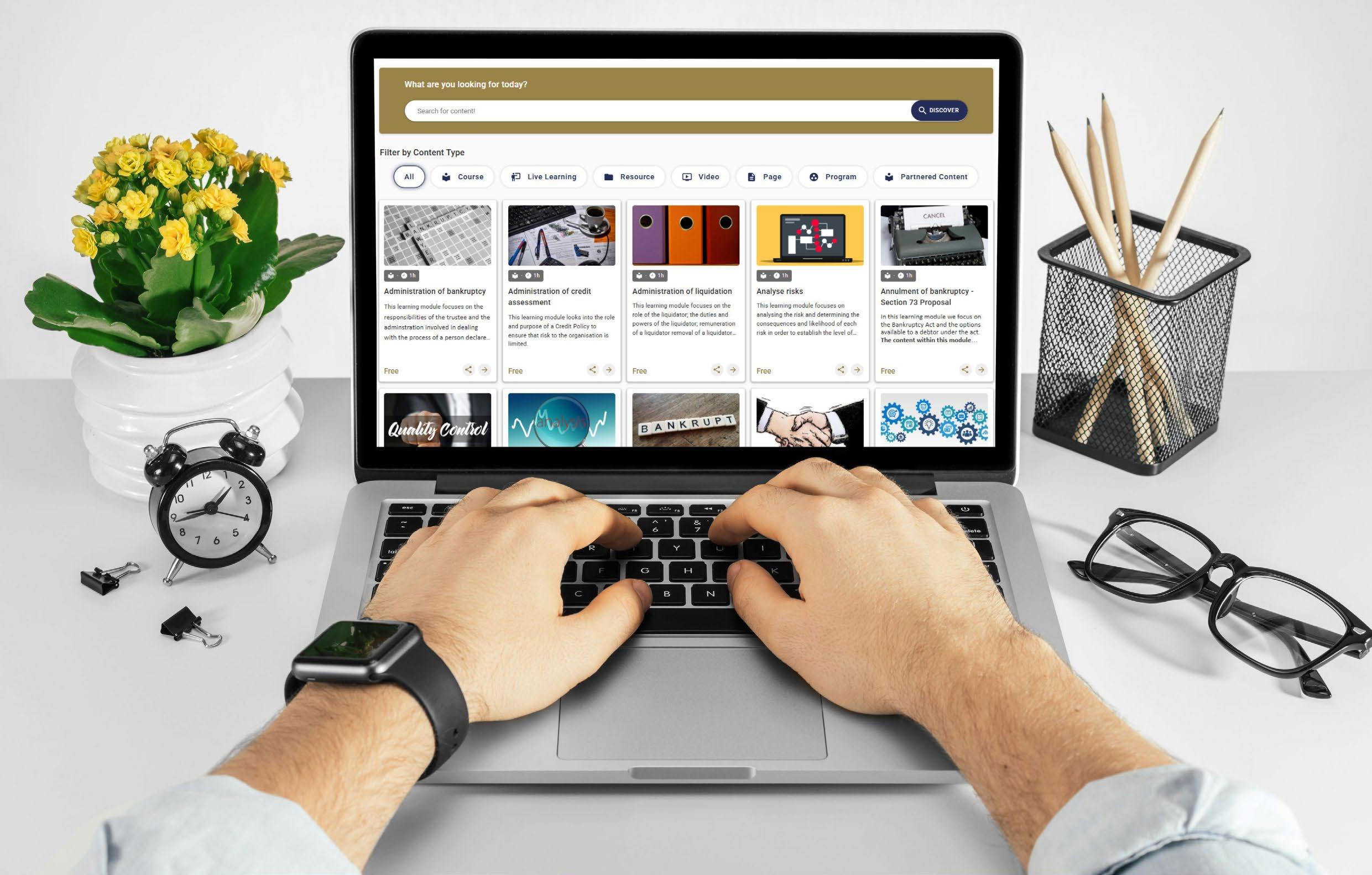

The Australian Institute of Credit Management (AICM) is thrilled to launch the Credit Knowledge Hub (CKH), a game-changing education platform designed to redefine professional development for credit professionals. With 24/7 access to world-class training and resources, the CKH sets a new standard for learning in the industry.

Drawing upon AICM’s 50+ years of expertise, the CKH is a comprehensive, subscriptionbased online platform that provides the tools and knowledge necessary to excel in credit management. It is built to support both individuals and teams in acquiring new skills, refreshing knowledge, and adapting to evolving industry demands.

Designed for maximum flexibility, CKH allows members to learn at their own pace, anywhere, anytime. With a vast library of certifications, courses, toolkits, and

masterclasses, the platform covers everything from foundational knowledge to advanced credit practices.

Courses Available on CKH:

l Cert IV in Credit Management

l Diploma of Credit Management

l Cert III in Mercantile Agents

l Toolboxes & Workshops

l Specialised Masterclasses

l And much more!

CKH removes traditional barriers to education, offering unlimited access to premium learning content at an affordable annual subscription. No more waiting for scheduled session, users can dive into over 100 continuously updated resources whenever they need.

✓ 24/7 Access: Learn anytime, anywhere, at your own pace.

✓ Unlimited Training: A single subscription

grants full access to AICM’s education resources.

✓ CCE Qualification Pathway: Advance toward obtaining a Certified Credit Executive (CCE) designation.

✓ Compliance & Best Practices: Ensure your processes align with industry standards.

✓ Trusted Content: Developed by leading experts and backed by nationally recognised qualifications.

Previously, AICM training required purchasing individual modules or attending scheduled sessions. Now, CKH transforms professional development with an affordable, all-in-one subscription model.

For an even greater value, members can bundle CKH with AICM membership, unlocking exclusive benefits, including networking, professional development, and advocacy resources.

With a vast library of certifications, courses, toolkits, and masterclasses, the platform covers everything from foundational knowledge to advanced

Traditional education models can be costly, but CKH significantly reduces expenses:

Learning Method

Self-Paced Online Courses

Trainer-Led Sessions

Qualification Pathways

Cost per Member

$330 – $435 per course

$225 – $775 per session

Previously $3,300+ (Cert IV) and $5,010+ (Diploma)

Now just $1,000 – $1,200 plus subscription

CKH removes traditional barriers to education, offering unlimited access to premium learning content at an affordable annual subscription.

Subscribing is easy, simply complete the purchase form, and within 24 hours, you’ll receive access to CKH and an invoice for your subscription.

For professionals seeking employer support, AICM provides a draft approval request letter to help secure funding for a CKH subscription.

Don’t Wait: Transform Your Credit Education Today!

Unlock unlimited learning opportunities and elevate your career with the CKH, the future of credit education.

AICM would like to congratulate its recent graduates:

FNS51522 Diploma of credit management

A special mention to Ryan Archer who has successfully completed the Diploma of Credit Management as an AICM scholarship recipient.

Ryan Archer QLD Shell Energy Australia

FNS40122 Certificate IV in credit management

Julie Aw VIC VMIA

Deepthika Kannangara QLD Nitto Australia

FNS30420 Certificate III in Mercantile Agents

Rosamil Trinos Philippines

Georgette Little VIC

Citi Bank

CCSG

PROUDLY SPONSORED BY

Congratulations to our top 4 finalists

The National Credit Team of the Year Award (CTOY) is a prestigious recognition of credit teams that excel in their work, results, culture, and commitment to learning.

Since its inception in 2008, the CTOY Award has celebrated the remarkable skills, achievements, and collaborative spirit of Australia’s leading credit teams. Past participants have described the process as one of the most rewarding and fulfilling experiences of their careers, offering a unique opportunity to reflect on their team’s accomplishments.

This year, we received an outstanding array of applications from a diverse range of brands. We extend our heartfelt gratitude to our sponsor Equifax and to our judges, Jarrod Faunt MICM from

Equifax, Rhys Buzza MICM CCE from Reece and Teena Ryan MICM from Woolworths. Their expertise and dedication have been instrumental in selecting the finalists.

We are thrilled to announce the four finalists for the 2025 Credit Team of the Year Award, each of whom has demonstrated exceptional achievements in credit management, cultural transformation, and innovation.

Each finalist has showcased excellence in credit management, process improvement, and workplace culture, making them strong contenders for the 2025 Credit Team of the Year Award.

Thank you to Equifax for supporting this award, and this amazing opportunity to celebrate the achievements of Australia’s leading credit teams.

Angle Finance’s credit team reduced broker call abandonment rates significantly and improved lender-of-choice ratings with innovations like Green ID verification and same-day settlements. They optimised AML processes, enhanced security, and fostered leadership and learning, achieving high scores in innovation and company confidence.

Aurora Energy restructured its credit team, dramatically increasing engagement and reducing occupier debt by half, with a goal to lower it further. They improved customer communication, cut bad debt write-offs substantially, and cleared COVID-era debt for vulnerable customers. Training programs and cultural rejuvenation were key drivers of their success.

Huon Aquaculture excels in values-driven operations, achieving minimal overdue debt, substantial rebate savings, and a flawless bad debt record. Their use of AI technology has streamlined processes and earned awards for efficiency. Employee growth is supported through development plans, webinars, and leadership programs.

Interactive leveraged technology to manage overdue balances effectively, reducing DSO and cutting overdue amounts significantly. They foster collaboration and recognition, implemented semi-automation for efficiency, and invested in training to empower team growth and decision-making.

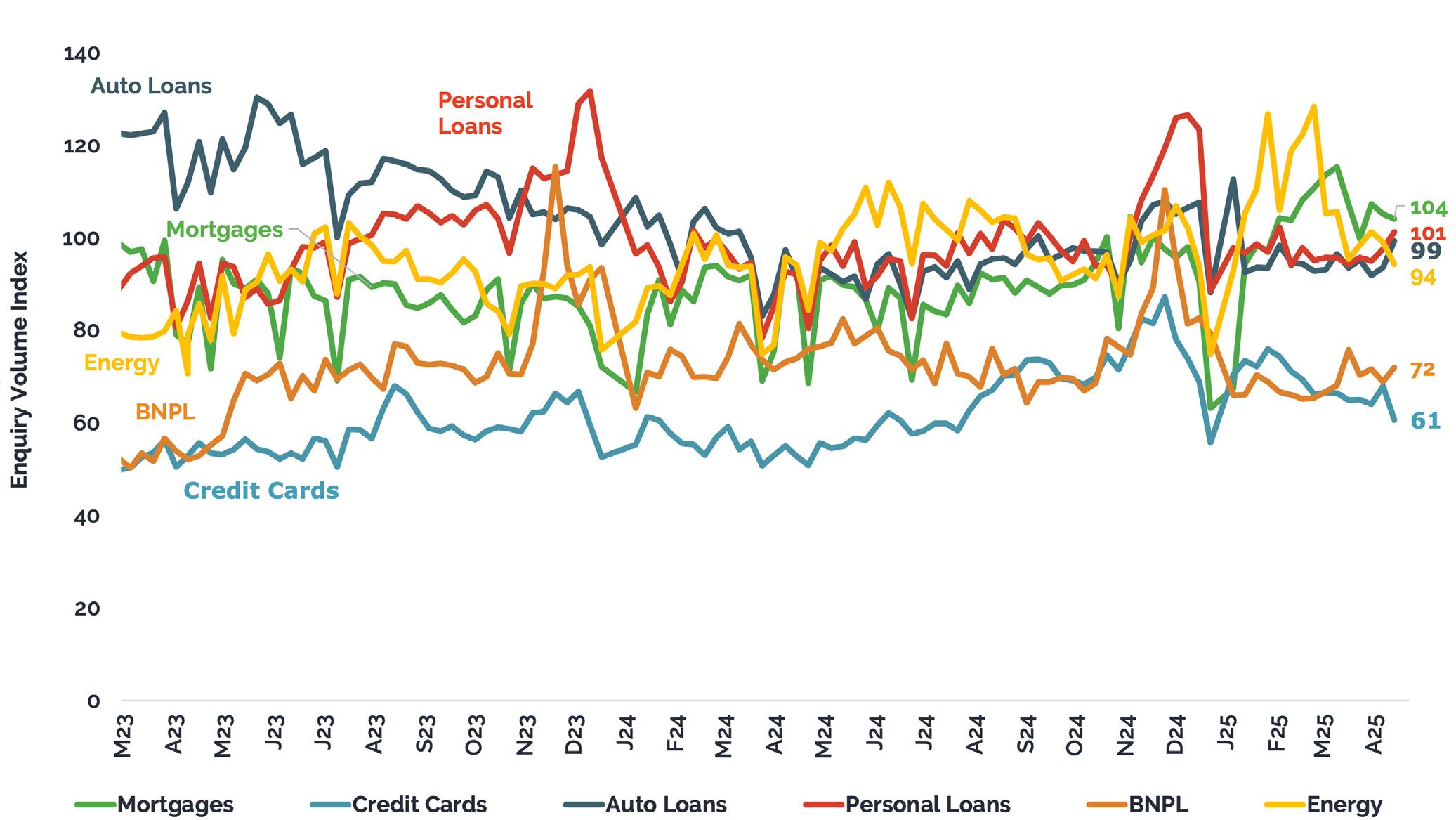

By Carrie Cheung*

The Equifax Q1 2025 Consumer Credit Report reveals growth in credit demand alongside emerging financial pressures. Unsecured credit demand, encompassing credit cards, personal loans, and BNPL, registered a second consecutive quarterly increase, up 5.5% year-onyear.

Buy Now Pay Later growth led at 17.8%, followed by a 5.7% increase in credit demand for

personal loans and a marginal 0.4% rise in credit cards.

Secured credit, encompassing mortgages and auto loans, also expanded by 4.3% in Q1 2025 year-on-year. A surge in mortgage demand was the primary driver, while auto loans saw a modest 0.3% increase.

The robust credit appetite of this year’s first quarter is contrasted by escalating arrears and financial hardship, notably within larger mortgage

Consumer Credit Demand Index Indexed to Q4 2019

Source: Equifax Australia

NB: This data has been re-indexed from 2019 to account for the recent inclusion of BNPL applications: Re-indexed data to commence in 2019 (previously 2015). Added BNPL and auto loan credit enquiries as a separate trendline (previously rolled up into personal loans)

Opened and closed accounts % of portfolio

portfolios and among consumers navigating post-holiday debt.

Key themes explored below:

Refinancing activity fuels mortgage market rebound

Mortgage demand saw a significant uplift in Q1 2025, increasing by 5.2% compared to Q1 2024. This was primarily driven by a substantial rise in external refinancing – consumers switching lenders – which grew by 11% year-on-year, marking the first positive Q1 result since 2023.

External refinancing exceeded 20% in March 2025, as consumers actively sought more competitive rates in response to market shifts. The interest rate hikes initiated in 2022 triggered a similar pattern, and this proactive consumer behaviour is evident again in anticipation of potential rate cuts.

Given mortgage approval timelines, this trend is likely in its early stages. Ongoing global tariff uncertainty and their potential impact on interest rates suggest consumers will

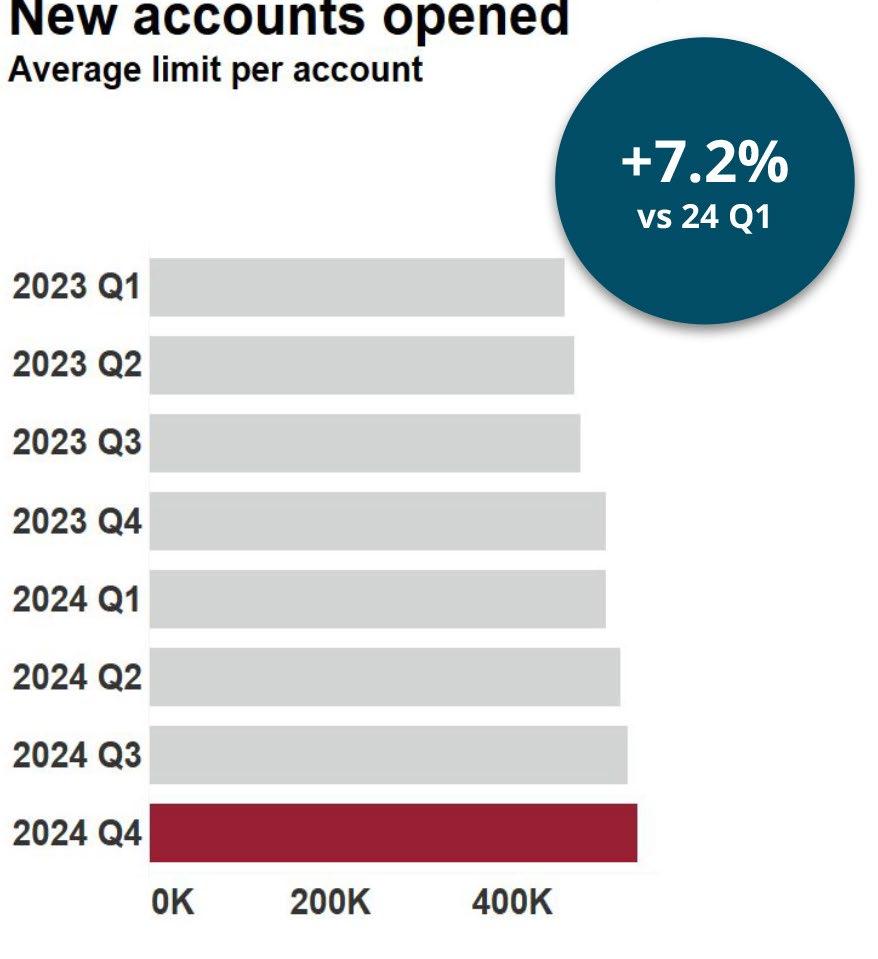

New accounts opened Average limit per account

continue to actively manage their mortgage positions.

Investors dominate mortgage refinancing

Investor activity dominated the refinance market, representing up to 80% of total inquiries in March 2025, compared to approximately 60% in March 2024. This demonstrates investors are over twice as likely to refinance compared to owneroccupiers, likely capitalising on

favourable economic conditions and anticipating further rate reductions.

Examining refinance trends in Q1 2025 reveals that over 30% stemmed from mortgages originated during the low interest rate period of 2020-2021. A notable share of this activity also involves borrowers who had previously refinanced, largely in 2022-2023, when refinance volumes peaked amidst rising rates and available offers.

Mortgage holders with large loans exhibit increasing repayment strain

While overall mortgage demand has increased, a significant rise in the dollar value of mortgages over 90 days past due signals growing repayment challenges among borrowers with larger loan amounts.

Mortgage debt has expanded due to sustained higher mortgage borrowings driven by property valuations. Larger mortgages, exceeding $1 million, are displaying unprecedented repayment stress, with arrears rates surpassing all other loan size segments for the first time on record.

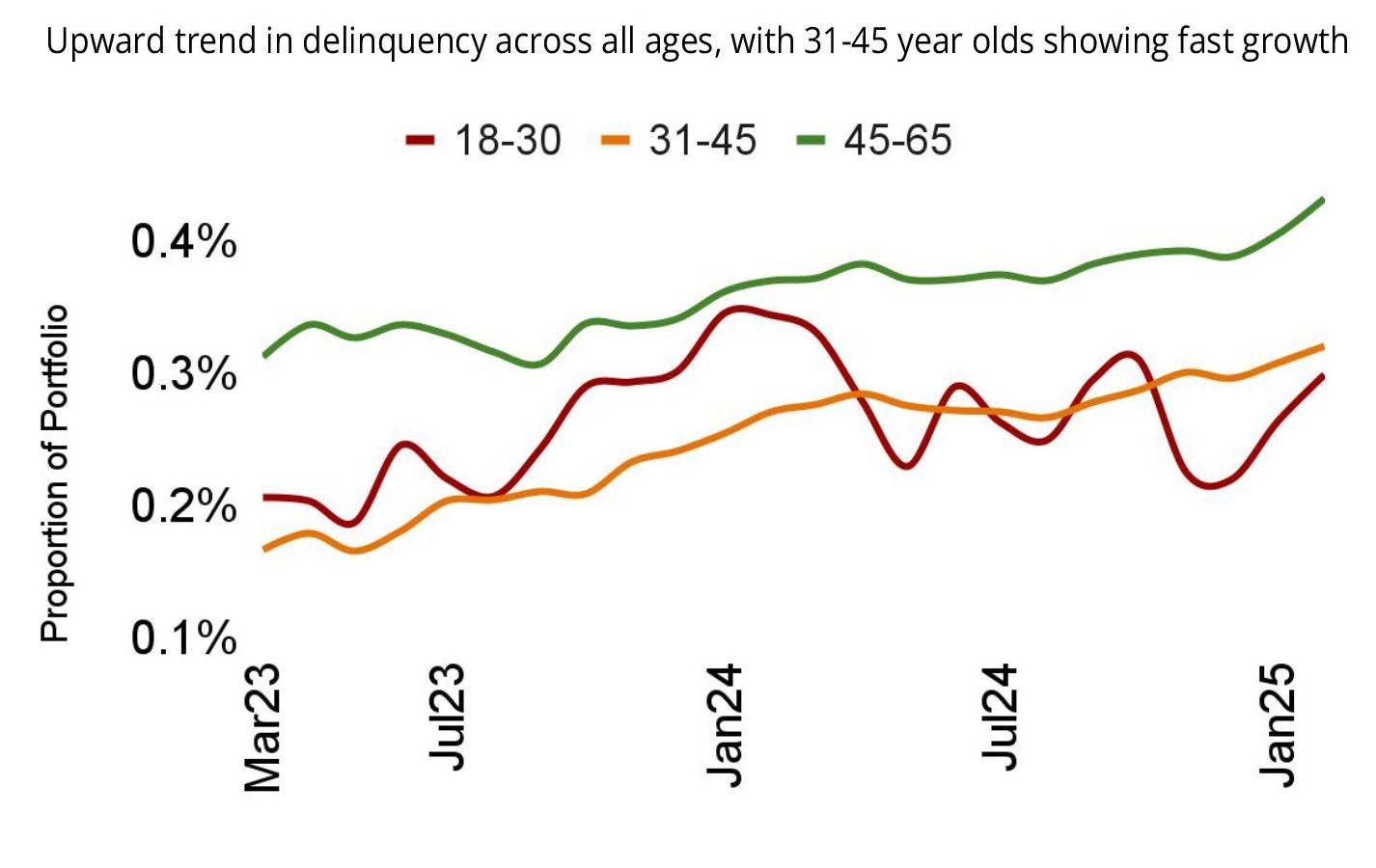

In fact, arrears on larger loans have grown four times faster than other loan sizes over the past two years. This upward trend in delinquency spans all age groups, with the 31-45 year cohort showing the fastest growth.

Despite a stable number of accounts in 90+ day mortgage arrears, total limits in arrears have increased to 9.2% in Q1 2025 compared to the same period last year. This divergence highlights that financially stressed borrowers are accumulating larger debt burdens, with limits owed per account in arrears rising persistently amid deteriorating housing affordability post the pandemic property boom.

In another sign of consumer strain, amortised limits rose in Q1 2025, up 5% year-over-year to a five-year high. Victoria’s growth trailed other states, with a growth rate of 3.7% compared to Queensland’s strong 7.8% and 4.5% in NSW.

Delinquency rate by loan size

Source: Equifax Australia

$1M+ home loans delinquency rate by age

This escalating debt burden necessitates granular risk assessment, emphasising close monitoring of highvalue mortgages for financial stress and proactive provision of support options to mitigate potential losses.

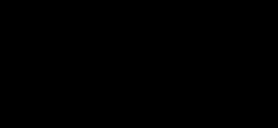

The financial aftermath of the holiday season is evident in the Q1 2025 data. Credit card arrears saw a significant

Source: Equifax Australia

year-on-year surge of 19.3%, indicating holiday-related debt is impacting consumers, with both early and late-stage delinquencies on the rise. The average limit for accounts over 90 days past due reached $7,100 in Q1 2025, up from $6,900 at the same time last year.

The total amount owing across all credit products has increased. While the proportion of personal loan accounts in arrears improved, this is attributed to nominal

account growth due to portfolio expansion. However, the total limits in personal loan arrears has also grown, up 18.7% in Q1 2025 compared to the same period the previous year, with the average delinquent loan at $12k, a 10% year-on-year increase.

Auto loan arrears growth, at 7.1% in Q1 2025, saw a slight deterioration from the previous quarter and remained stable year-on-year.

Crucially, the dollar amount owed by consumers in arrears has increased significantly across all product types, highlighting a broad trend of potential overspending during the holiday period. Credit cards and auto loans recorded the largest increases in accounts reported as experiencing financial hardship, at 5.8% and 5.1%, respectively.

As Australia’s leading consumer and commercial credit bureau, Equifax provides credit professionals with a comprehensive and consistent view of potential risk through its extensive data sources, credit reports, and alerts. Equifax’s unique ability to integrate individual and business financial data within a single credit report, leveraging AI-driven scoring models and advanced matching capabilities, enhances risk assessment and decision-making processes.

*Carrie Cheung Head of Insights

Equifax Contact the Equifax team to find out more on 13 8332 or equifax.com.au/contact.

Credit card delinquency rate

Accounts in arrears as % of portfolio

Personal loan delinquency rate

Accounts in arrears as % of portfolio

Source: Equifax Australia

Auto loan delinquency rate

Accounts in arrears as % of portfolio

Source: Equifax Australia

Source: Equifax Australia

By Monika Lacey MICM*

Uncertainty remains the name of the game for Kiwi households and businesses alike. The global economic climate coupled with the ongoing cost of living crisis is making it difficult for people to feel a sense of stability.

Recently, the Reserve Bank of New Zealand reduced the Official Cash Rate (OCR) to 3.5%, reaching the lowest it’s been since October 2022.

In response to the OCR cuts, we saw many of the major banks cut interest rates to reflect this shift in monetary policy, in some cases making it easier for people to borrow and lock in lower interest rates for their mortgages.

But the thinking behind this decision has been a point of discussion for economists,

and opinions vary about what the right course of action for the Reserve Bank should be to navigate these challenging times.

Personal loan arrears have reached double digits for the first time since February 2024, yet there’s a silver lining – yearon-year declines in vehicle, credit card, and Buy Now Pay Later arrears.

Encouragingly, financial hardship figures continue to ease after a steady climb since November 2022.

Household financial strain remains most pronounced in mortgage repayments, followed by credit card debt and personal loan obligations.

This trend suggests that, despite ongoing economic uncertainty, many individuals are

“The global economic climate coupled with the ongoing cost of living crisis is making it difficult for people to feel a sense of stability.”

taking proactive steps to manage financial challenges by working with lenders.

Meanwhile, Kiwi businesses persist in showing resilience despite persistent pressures.

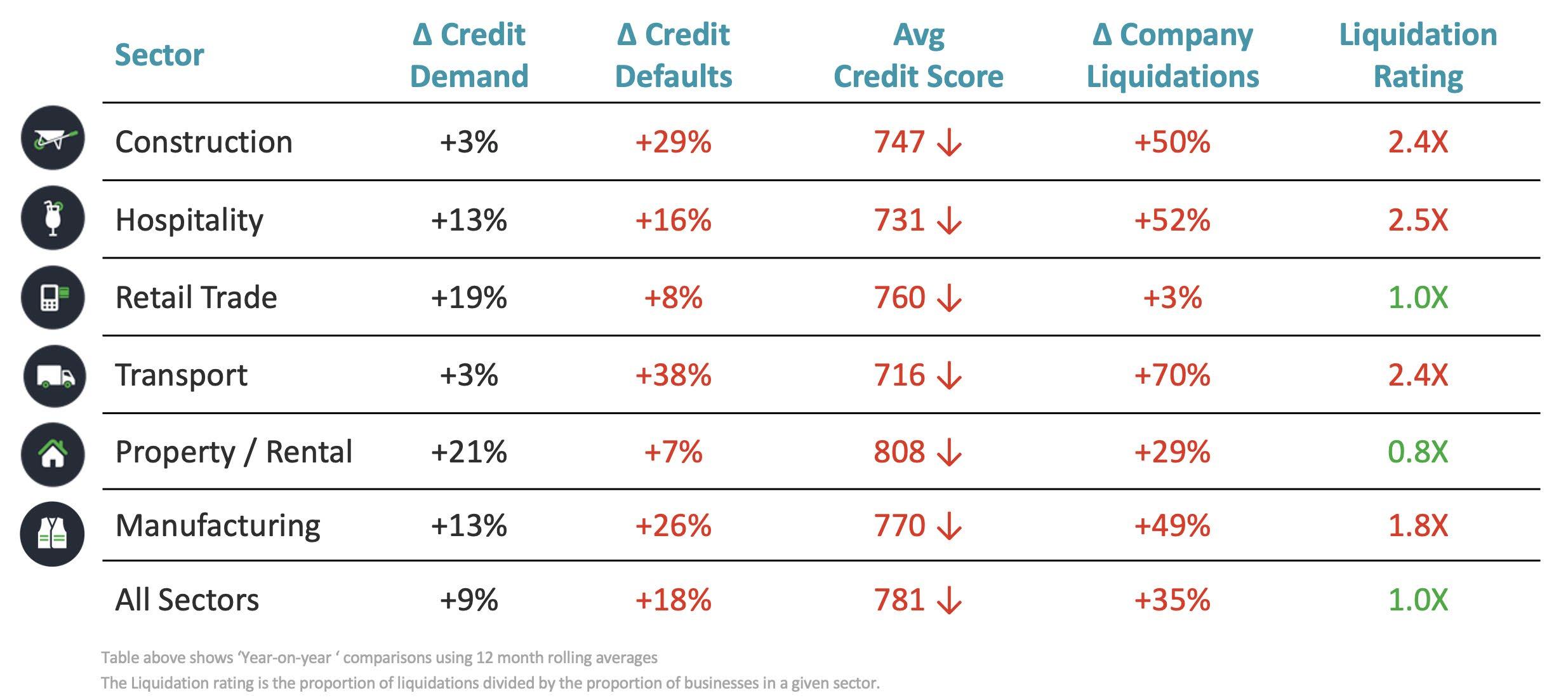

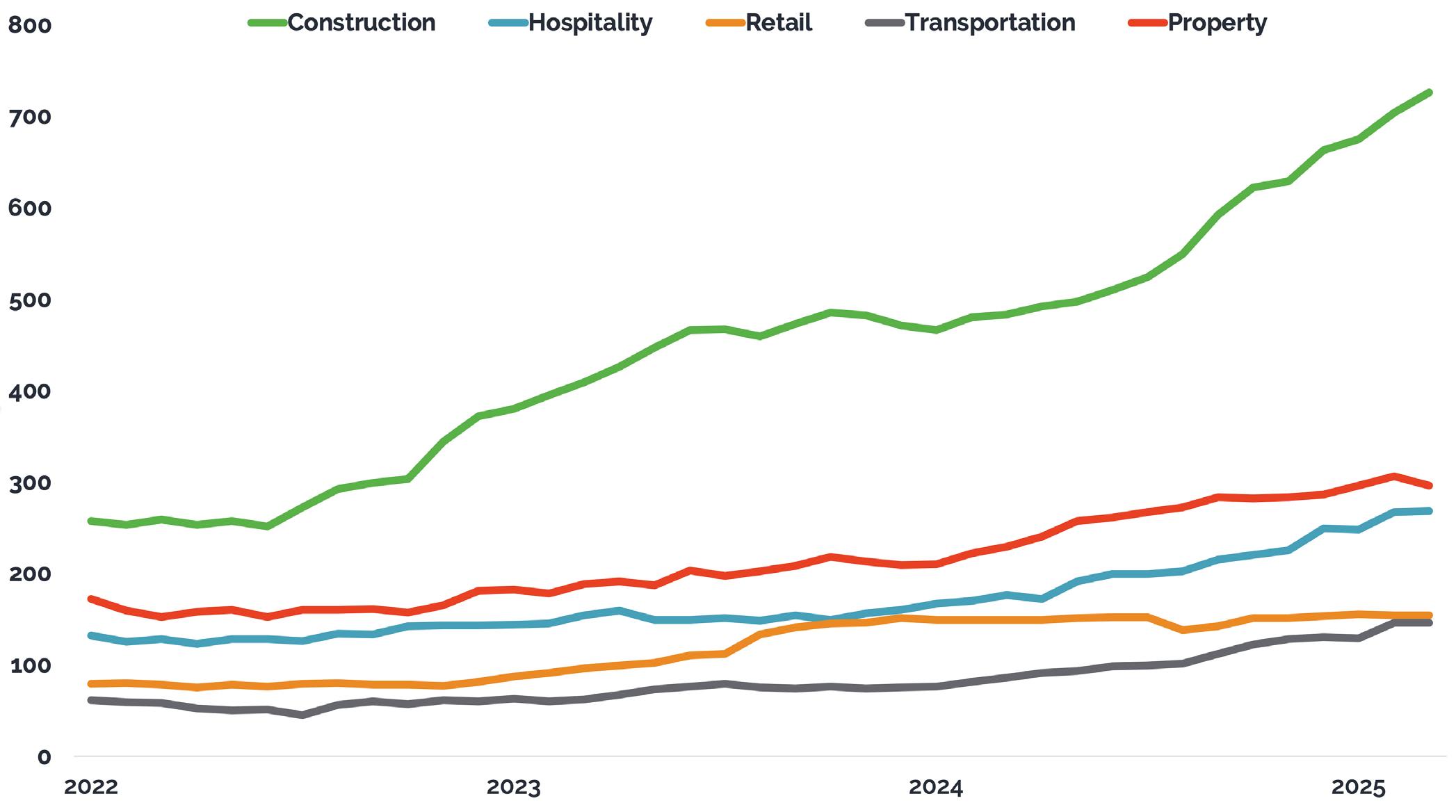

Company liquidations have surged by 35% over the past

year, with transportation and construction firms particularly vulnerable to financial strain.

The manufacturing sector is also feeling the impact, grappling with reduced demand and uncertainty in global trade policies.

Looking at recent arrear trends, we saw the number of consumers in arrears in March 2025 climb to 489,000 – an increase of 9,000 from the previous month – accounting

for 12.61% of the credit-active population.

This uptick follows the typical seasonal trend, as household finances often experience strain after summer.

Despite the month-on-month rise, the current arrears rate remains 0.7% lower than the same period last year, hinting at potential recovery in the credit cycle. Of those in arrears, 174,000 consumers are over 30 days past due, with 74,000 exceeding 90 days.

Furthermore, March saw personal loan arrears surpass 10% for the first time since February of the previous year, reflecting a notable 4% year-on-year increase.

Meanwhile, vehicle loan arrears edged up slightly to 5.8% from 5.7% in February but remained below last year’s figures. Credit card arrears also saw a minor increase to 4.7%, though they were 3% lower compared to the same time last year.

Buy Now, Pay Later (BNPL) arrears continued their downward trend, falling to 8.4% in March – a 7% year-on-year decrease.

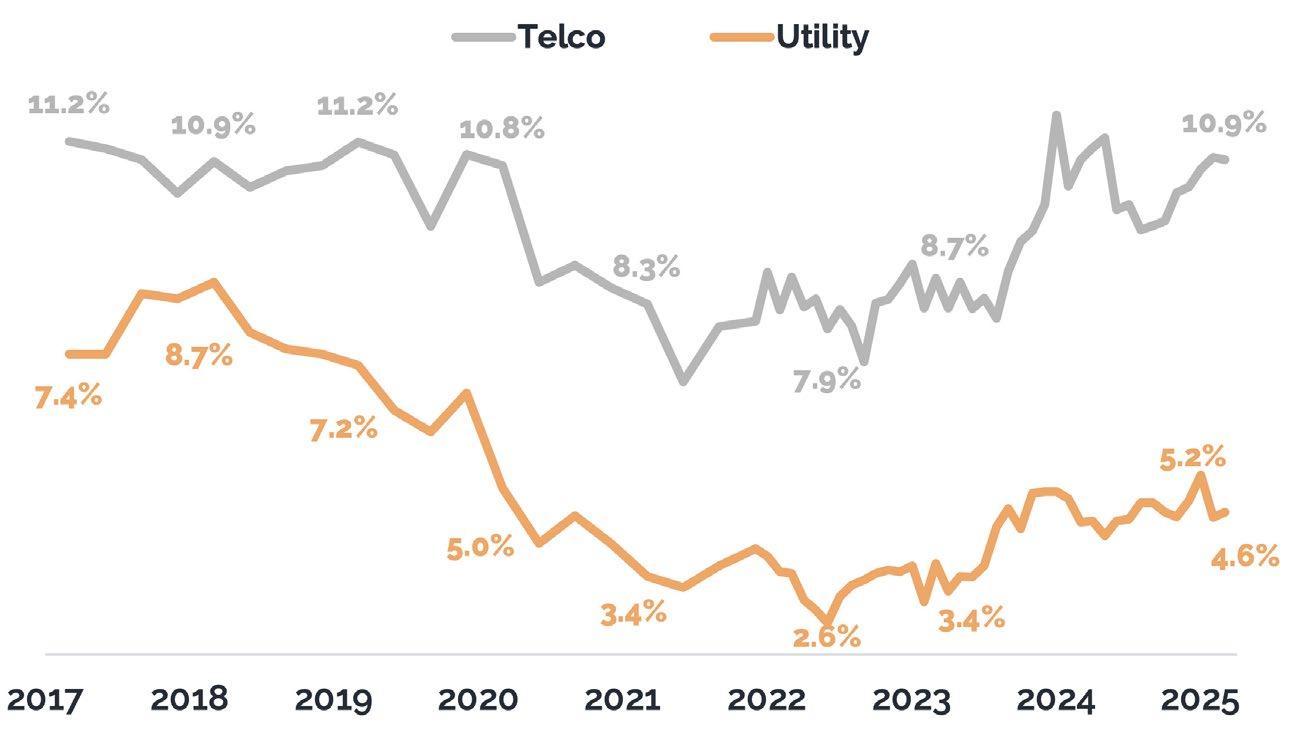

Retail energy arrears ticked up to 4.6%, marking a 4% annual increase, while telco arrears for mobile and broadband services remained steady at 10.9%, consistent with the previous year.

Over this period, home loan arrears surpassed seasonal expectations, with 24,000 residential mortgage accounts reported as past due – an increase of 700 from the previous month and a 7% rise compared to the same period last year.

The arrears rate edged up

to 1.58%, slightly higher than February’s 1.55%. However, loans overdue by more than 90 days have remained stable, indicating some consistency in longer-term delinquencies.

Approved lending and credit demand continues to climb

Consumer credit demand experienced moderate growth, rising 2.4% year-on-year. Credit card applications remained a strong driver of this increase, surging by 23.8%. However, auto loan demand saw a slight decline of 4%, while Buy Now Pay Later (BNPL) transactions dropped 6.5%.

The property market showed heightened activity, with mortgage applications jumping 17.8% as borrowers sought

“Consumer credit demand experienced moderate growth, rising 2.4% year-onyear. Credit card applications remained a strong driver of this increase, surging by 23.8%.”

Credit Demand by Product Type

more competitive interest rates. New mortgage lending reflected this trend, climbing 23.3% compared to the previous year. Despite this growth, volumes remain 18% below the peak reached during the 2021 property boom.

Non-mortgage lending – including credit cards,

vehicle loans, personal loans, BNPL, and overdrafts – rose 7.1% year-on-year, with vehicle loans playing a key role in this increase. In total, new household lending expanded by 21.7%, indicating increased borrowing across multiple financial products.

One interesting trend is around the rate of financial hardships recorded in March 2025.

There were 14,400 accounts reported in financial hardship in March, a decline of 200 from the previous month but remain up 11.5% year-on-year.

Although financial hardship cases have been rising since November 2022, this has shown a slowdown in recent months.

“The property market showed heightened activity, with mortgage applications jumping 17.8% as borrowers sought more competitive interest rates.”

Financial

Mortgage payment difficulties account for 45% of these cases, followed by credit card debt at 30% and personal loan repayments at 17%. The highest rate of financial hardships is observed among individuals aged 35 to 49.

High company liquidation figures highlight economic squeeze

New Zealand businesses continue to grapple with economic uncertainty, facing persistent financial pressures. Business credit demand has

risen 9% year-on-year, with the arts and recreation services sector seeing the strongest growth at 23%, followed by property (21%) and financial/ insurance services (20%).

However, rising credit demand has coincided with

Business Credit Demand: 2020 – 2025

“Company liquidations have surged by 35% over the past year. Construction firms, in particular, remain heavily impacted, with more than 720 building companies entering liquidation in the last 12 months.”

increased defaults across all sectors. Transport recorded the highest jump at 38%, followed by construction (29%) and manufacturing (26%), underscoring the ongoing financial strain affecting these industries.

Company liquidations have surged by 35% over the past year. Construction firms, in particular, remain heavily impacted, with more than 720 building companies entering liquidation in the last 12 months.

Insolvency figures for March 2025 showed a slight decline,

totalling 268, compared to 284 in March 2024.

However, company liquidations rose to 257 – up from 239 in the same period last year. Among the hardesthit businesses are residential new home builders, cafés and takeaway food outlets, and property developers, which have recorded the highest number of company failures.

It’s clear 2025 isn’t proving to be the return to fiscal abundance

many had hoped for. The lagging economic recovery coupled with the ongoing global uncertainty is causing caution across the board.

With the New Zealand Government’s annual budget coming up this month, all eyes will be on the Finance Minister to see where fiscal tightening will occur to deliver a surplus to New Zealand’s economy.

*Monika Lacey MICM Chief Operating Officer Centrix Credit Bureau of New Zealand www.centrix.co.nz

By Ivan Colhoun*

While the opinion polls were generally indicating a win for the incumbent Labor government, the result was a landslide win that no pollster predicted. Adding salt to the wounds, the Leader of the Opposition, Mr Dutton, became the first Leader of the Opposition in history to lose his seat, meaning the Coalition must now elect a new leader. Such was the scale of the rout, that a number of other senior Liberal shadow ministers also lost their seats.

At the current time, the ALP has 90 seats, well above that required for a majority, with a real possibility it may end up with several more. The scale of the ALP win sees the Liberal Party dramatically reduced as a Coalition partner, with very few

seats in inner-city Melbourne, Sydney, Adelaide and Hobart. “Teal” Independents generally improved their positions in the wealthier inner city electorates previously the domain of traditional Liberal voters.

The main reasons advanced for the disastrous result for the Opposition included:

l A lack of real policy options, with only the divisive and not well understood nuclear energy policy completely different from the government

l A very poor election campaign that saw considerable policy mis-steps including promising to reverse a small income tax cut introduced by the government in the budget, a promise to force public servants back to full-time

“The scale of the ALP win sees the Liberal Party dramatically reduced as a Coalition partner, with very few seats in inner-city Melbourne, Sydney, Adelaide and Hobart.”

“The Labor Party did better in terms of providing support for those impacted by the cost of living, the key issue for most voters.”

work in the office, 41,000 public service jobs to be cut, expressing the view that the welcome to country should be less frequent. Some of these missteps and/or policies allowed comparison to Mr Trump

l The Trump tariff shock likely caused voters to stick with the safety of a known entity. Indeed, the strength of the swing against the Liberals right across the country, suggests a common factor such as Trump, though this paragraph suggests the Liberals made many mistakes.

l Unpopularity of the

Opposition Leader, Mr Dutton, though until very recently he was preferred PM in polls.

l The Labor Party did better in terms of providing support for those impacted by the cost of living, the key issue for most voters. While the Opposition did provide cost of living options, this was a relatively new conversion as they had continually argued against previous Labor cost of living support.

l It’s also possible that the voting population decided that a majority government was a better outcome than a minority government.

Strategists note that the Coalition’s main constituency is older, white voters (the Baby Boomers – which are a declining proportion of the population).

The Australian Financial Review’s Andrew Tillett, noted that Labor targeted renters, mortgagees, younger voters, those with a university education, middle income voters and those with a migrant background. Many of the seats picked up from the Liberal or Greens had either higher than average numbers of voters with mortgages or renting, especially the five big surprises (two Green seats in Brisbane and the seats of Dickson, Hughes and Moore.

So what does all this mean for the economy?

The key economic and societal challenges facing the re-elected government are not impacted by the election result. First, the government will have to negotiate/deal with President Trump’s trade and tariff policies. Other challenges include the megatrends I have written about before: AI/technology; the ageing population; geopolitics; climate change and rising inequality. The election results suggest the ALP is perceived as better placed to manage these pressures – or perhaps more correctly to look after those affected by these trends.

Treasurer Chalmers confirmed the Government did not have a mandate for broader tax reform as this was not taken to the people at the election. That’s a shame as Australia desperately needs tax reform – lower income taxes and higher indirect taxes (GST), though neither side of politics seems brave enough to address this issue.

Beginning to address budget repair would be worthwhile, though measures to redress inequality work in the other direction given the failure to address tax reform. A good first step would be to reintroduce a cap on spending as a percent of GDP.

The Treasurer highlighted a focus on improving productivity.

“The key economic and societal challenges facing the re-elected government are not impacted by the election result.”

My investigations suggest that the best approach in this regard would be to address productivity on a sector by sector basis rather than in aggregate. Aggregate productivity will be restrained by the ageing population, and the increase in jobs in lower productivity areas such as health and aged care. Focus should be on improving productivity in these large, low productivity areas, while also addressing the drop in productivity in other large sectors such as Finance, Construction, Education and Training and Mining. Regulation is likely to be a big factor in each of the latter sectors.

The election result is unlikely to affect the RBA’s deliberations on May 19/20. The continued progress in reducing inflation towards target justifies a further reduction in the degree of restriction imposed by current interest rate settings, while the ongoing low unemployment rate argues against the need for a large cut, in spite of global uncertainties, which may quickly be reversed or lessened.

*Ivan Colhoun Chief Economist CreditorWatch

E: ivan.colhoun@creditorwatch.com.au www.creditorwatch.com.au

“... Australia desperately needs tax reform – lower income taxes and higher indirect taxes (GST), though neither side of politics seems brave enough to address this issue.”

Corporate Insolvency: 10 June 2025 – Share scenarios, discuss legislative proposals, and drivers of insolvency trends. Register Now

eInvoicing: 17 June 2025 – Dive into the latest in electronic invoicing through the Peppol Framework. Register Now

Personal Insolvency: 8 July 2025 – Explore trends, scenarios, and legislative changes. Register Now Complaints and Disputes: 15 July 2025 – Share best practice insights, legislative updates, and industry trends. Register Now

Personal and Team Development: 12 August 2025 – Focus on recent trends challenges and achievements. Register Now

l Share and Learn: Exchange insights on what strategies work and what don’t, gaining valuable knowledge from peers.

l Answer Known and Unknown Questions: Find answers to your questions and discover new ones through engaging discussions.

l Deep Dive into Practical Aspects: Explore the practical, day-to-day aspects of our work in greater detail.

l Explore Complex Issues: Understand how others approach areas where there are no clear blackand-white answers so you can implement the best solution for your scenario.

l Tap Community Knowledge: Access the collective wisdom of the community and understand the credit profession’s day-to-day realities.

l Understand Best Practices: Learn and implement industry best practices shared by fellow professionals.

l Professional Growth: Gain new ideas for improvement and stay ahead of trends.

l Contribute to Advocacy: Play a role in AICM advocacy efforts and shape the future of our profession.

l Membership Benefits: Enhance your membership experience and build valuable professional relationships.

We are excited to announce the launch of our new member only Special Interest Groups (SIGs), designed to enhance your professional development and foster stronger connections within our community. These groups will offer a unique platform to dive deep into niche topics, share best practices, and discuss the day-to-day challenges and triumphs of our profession.

Customer Engagement and Support: 19 August 2025 –Discuss recent trends, hardship, vulnerability, and resolving payment disputes. Register Now

Corporate Insolvency: 9 September 2025 – Share scenarios, discuss legislative proposals, and drivers of insolvency trends. Register Now

eInvoicing: 16 September 2025 – Dive into the latest in electronic invoicing through the Peppol Framework. Register Now

Personal Insolvency: 11 November 2025 – Explore trends, scenarios, and legislative changes. Register Now

Click here and login to see more dates for 2025

l Quarterly Zoom Meetings: Join interactive sessions with audio and video.

l Pre-Meeting Surveys: Share your initial views, questions and comments before the meeting to help shape the discussion.

l Facilitated Discussions: Engage in open forums led by experienced chairs.

l Ongoing Engagement: Continue the conversation post-meeting via the AICM LinkedIn Group.

l There will be at least two SIGs each month, with each session lasting one hour.

l Topics will initially be held quarterly which may increase or decrease based on developments in the area.

l Registration is open now for the upcoming sessions.

l SIGs are a member only benefit.

We look forward to your active participation in these groups. Together, let’s shape the future of our profession and strengthen our community.

In 2025, Good360 Australia proudly celebrates 10 years of creating real impact-delivering over 43 million new items to over 4 million people doing it tough across the country. This milestone is made even more meaningful through our partnership with the Australian Institute of Credit Management (AICM), as we also mark the 10-year anniversary of the Women in Credit (WINC) initiative.

We’re inviting AICM members to join us

in celebrating this shared milestone at the upcoming WINC luncheons across the country, where Good360 Founder and MD, Alison Covington AM will share her inspiring journey of turning corporate experience into national impact.

Fighting Material Deprivation: More Than Just Missing Items

Material deprivation isn’t just about lacking

“Our mission is simple but powerful: ensure that no usable new product goes to waste when it could support someone in crisis.”

furniture, clothing, or whitegoods – it’s about missing the chance for stability, dignity, and wellbeing. It means families sleeping without bedding, children attending school in ill-fitting uniforms, or adults unable to cook meals due to broken or missing appliances.

In Good360’s newest report, we explore the continued impacts the cost-of-living crisis is

Alison Covington AM, Good360 Australia Founder & MD.

having on everyday Australians and their ability to afford basic home essentials. The facts:

l 9.1 million Australians say the cost-of-living crisis is worse for them than it was a year ago.

l 17% have delayed replacing broken or worn-out household items due to financial strain.

l 2.9 million Australians can’t afford the basic essentials to live comfortably at home.

Read Good360’s full report on material deprivation

How Good360 Makes a Difference

Good360 Australia is a not-for-profit that connects businesses with surplus new goods – everything from bedding and toiletries to toys and technology – and redistributes them to people in need via a network of over 4,700 charities and disadvantaged schools Australia-wide.

Our mission is simple but powerful: ensure that no usable new product goes to waste when it could support someone in crisis. By working in four key impact areas – Education, Home, Hygiene, and Play – we restore dignity and comfort to people around Australia.

In a country where $2.5 billion in household goods go to waste each year, and 1 in 8 Australians live in poverty, Good360’s model is both practical and transformative.

Join Us at the WINC Luncheons

At the luncheons, Alison Covington AM will share how she built Good360 from the ground up and why product philanthropy is changing lives across Australia. Her message is one of innovation, action, and hope – perfectly aligned with AICM’s mission to empower and uplift.

Be Part of the Circle of Good

You can help extend Good360’s impact in three powerful ways:

1. Attend a WINC luncheon near you and hear firsthand how your support makes a difference. Register today

2. Make a donation – every $1 enables Good360 to deliver $20 worth of goods to people in need. Donate here

3. Spread the word within your networks and help grow the Good360 Circle of Good. Perhaps

you have a client who has surplus goods they can donate to help their local community. Learn more here

Together, we can help fill homes not just with goods, but with dignity, stability, and care.

Learn more at the Good360 Australia website

Because everyone deserves more than four walls – they deserve a home filled with comfort and hope.

By Andrew Spring MICM CCE and Nash Chance*

In uncertain times, even longstanding customer relationships can end in financial loss. But there is a way for suppliers to reduce risk. A well-structured Retention of Title clause can mean the difference between recovering goods or writing off the debt entirely.

When a customer enters formal insolvency, suppliers often find themselves out of pocket, waiting in line as unsecured creditors – hoping (often in vain) for a dividend. But one powerful protection that credit managers can leverage is the Retention of Title (RoT) clause. A well-drafted and properly implemented RoT clause can make the difference between recovering your goods or writing off a bad debt. In essence, an RoT clause ensures that legal ownership of goods remains

with the supplier until payment is made in full. It’s a strategy that shifts the supplier’s position from unsecured creditor to secured party – a that is, if the right steps are followed.

In an insolvency scenario, unsecured creditors are usually left with little or nothing once priority creditors are paid. However, suppliers with a valid and enforceable RoT clause may be entitled to recover their goods

“A well-drafted and properly implemented RoT clause can make the difference between recovering your goods or writing off a bad debt.”

“The RoT clause must be explicitly included in the trade supply agreement and on any invoices issued under that agreement. This creates clear contractual grounds for reclaiming the goods in the event of default.”

before they’re sold or otherwise dealt with by the administrator or liquidator.

Take, for example, a recent case involving a national stationary supplier. Thanks to an RoT clause that was not only correctly drafted but also properly registered on the Personal Property Securities Register (PPSR), the supplier was able to recover more than $20,000 worth of inventory. Without the protection of RoT, they would have participated as an unsecured creditor in a liquidation where no dividend was paid, resulting in a total write-off of the debt.

This outcome is not uncommon. For credit managers, it highlights how proactive risk management and a strong understanding of RoT provisions can safeguard a business’s bottom line.

The essentials of an effective RoT arrangement

Despite its potential, an RoT clause is only as strong as its implementation. Credit managers should ensure that the following three key elements are in place:

1. Contractual clarity

The RoT clause must be explicitly included in the

trade supply agreement and on any invoices issued under that agreement. This creates clear contractual grounds for reclaiming the goods in the event of default.

2. Timely PPSR registration

Suppliers must register their security interest on the PPSR immediately after the goods are supplied or a contract is entered into. A failure to do so risks the interest being ‘unperfected’, meaning the goods will likely vest in the insolvent company under Section 267 of the Personal Property Securities Act 2009

3. Clear identification of goods

Goods must be marked in a way that links them directly to the relevant invoice. While serial numbers are ideal, they aren’t always practical –particularly for high-volume inventory. In those cases, some other clear, traceable identifier must be used.

Common pitfalls – and costly consequences

Unfortunately, credit managers frequently encounter issues that undermine their RoT rights. These include:

1. Late or no PPSR registration

Waiting until a customer is clearly in trouble to register an interest can backfire. Under Section 588FL of the Corporations Act 2001, a security interest granted within six months of administration or liquidation must be registered within 20 business days. Otherwise, it’s voidable.

2. Unidentifiable goods

A national paper supplier recently lost out on a $4,000 recovery because the goods couldn’t be matched to the invoices that were subject to the RoT clause. Similarly, a local mechanic lost over $45,000 in equipment installations because the registration didn’t comply with the Corporations Act timeline.

3. Assuming best intentions are enough

Goodwill and verbal assurances offer no protection in insolvency. Without proper documentation and registration, suppliers have no enforceable rights.

In another example, a local plumber lost the opportunity to reclaim over $8,000 in water pumps installed on a rural property – simply because the interest wasn’t registered. These cases underline the importance of having robust systems in place and being proactive, not reactive.

Under Australia’s Small Business Restructuring (SBR) process, secured creditors (including those with RoT claims) typically don’t have to compromise on their debt, provided their interest is valid and enforceable. Since goods subject to RoT are often used in the day-to-day running of a business, credit managers with compliant RoT clauses can often avoid participating in the compromise altogether.

Protect now, recover later Insolvency scenarios can be complex and unpredictable, but an effective RoT strategy is one of the best tools at a credit manager’s disposal. By ensuring contractual clarity, timely registration, and identifiable goods, suppliers can improve their chances of recovery –and avoid being caught in the unsecured creditor queue. It’s a small investment in time and due diligence, but one that can pay substantial dividends when things go wrong.

*Andrew Spring MICM CCE Partner Jirsch Sutherland

*Nash Chance Manager Jirsch Sutherland www.jirschsutherland.com.au

“By ensuring contractual clarity, timely registration, and identifiable goods, suppliers can improve their chances of recovery – and avoid being caught in the unsecured creditor queue.”

By Sam Rodda*

Tariff volatility is a constant reality and it’s not going away anytime soon. Tariffs can change rapidly and without warning, creating ongoing uncertainty for trade creditors. The introduction, adjustment, or removal of tariffs can have a profound and immediate effect on supply chains, margins, and customers’ financial stability. For credit professionals, staying ahead of tariff-related risk isn’t just a best practice – it’s business critical.

While tariffs are typically government-imposed taxes on imported goods, their implications extend far beyond the border. From delayed shipments and cost hikes to buyer insolvency and payment defaults, tariff shocks can pressure a trade creditor’s exposure.

So, how can credit professionals navigate this landscape and protect their organisations?

According to ASIC, insolvencies surged by 43% in the first quarter of the 2024–25 financial year compared to the previous year. Construction, retail, and food sectors have been especially hard hit, driven by rising costs, tightening credit conditions, and ongoing global uncertainty. In this landscape, even reliable customers can become sudden risks – making proactive credit risk management more important than ever.

What short-term risk management actions can you take?

1. Assess exposure in the supply chain

Before you can manage the risk, you need to understand it. For

“The introduction, adjustment, or removal of tariffs can have a profound and immediate effect on supply chains, margins, and customers’ financial stability.”

“Before you can manage the risk, you need to understand it. For trade creditors and executives managing global supply chains this means identifying customers whose operations depend on tariff-sensitive goods or services.”

trade creditors and executives managing global supply chains this means identifying customers whose operations depend on tariff-sensitive goods or services. The following questions are a starting point to help you assess potential disruptions due to tariffs: Are they importing raw materials or finished goods recently becoming more expensive? Are their end customers scaling back due to tariff-related price increases? These upstream and downstream considerations must be embedded into your credit assessment process. Ask the hard questions: Which

of our customers operate in tariff-vulnerable sectors? How dependent are they on specific regions or trade relationships? What contingency plans do they have in place?

2. Understand how tariffs can impact payment risk

Tariff volatility does not impact profitability, but it destabilises cash flow and increases the likelihood of delayed payments or defaults. Creditors need to anticipate how rising input costs, reduced customer demand, or disrupted supply chains could impair their buyers’ ability to meet payment terms.

This is where trade credit insurance can play a crucial role. A well-structured policy can help mitigate non-payment risk from economic hardship, geopolitical instability, or other tariff-driven disruptions. Regular policy reviews are essential to ensure you’re covered for emerging risks and industry-specific exposures. Beyond traditional protection, modern policies now serve as strategic tools. Insurers actively monitor customer creditworthiness, provide early warning signals, and support debt recovery. This transforms trade credit insurance into a dynamic enabler of secure growth.

Scenario modelling is a useful but underused tool in credit management. Building tariffbased scenarios into your credit risk analysis allows you to anticipate what might happen if tariffs were imposed (or lifted) on specific goods.

For example, If steel or aluminium tariffs were introduced on a key customer’s input materials, how would that affect their margins? Could they absorb the cost or pass it on? How would this affect their ability to pay on time?

Proactively modelling these stress scenarios can help you

set more appropriate credit limits, identify at-risk accounts, and flag potential supply chain bottlenecks before they happen.

While political risk insurance won’t typically respond to tariff changes, trade credit insurance might – especially where tariffdriven financial instability leads to missed payments. Equally important is ensuring your business interruption insurance and contingent business interruption (CBI) cover reflect today’s realities.

Tariff-induced disruptions – such as sharp cost increases,

shipping delays, or abrupt changes in customer behaviour – can affect revenue and cash flow. Your declared values and policy limits must reflect the actual impact of these shifts, particularly in industries where replacement costs or inventory values are rising due to international trade issues.

5. Maintain strong communication with your customers

Don’t underestimate the value of open, proactive dialogue in tariff uncertainty. Trade creditors should maintain regular contact with customers to understand how tariffs affect their operations,

“Don’t underestimate the value of open, proactive dialogue in tariff uncertainty. Trade creditors should maintain regular contact with customers to understand how tariffs affect their operations, pricing, and sales outlook.”

pricing, and sales outlook. Use these insights to adapt your credit terms, flag early warning signs, and offer support where appropriate.

When trade partners know you’re paying attention – and are willing to collaborate – it can help preserve trust, improve payment performance, and reduce default risk even in harsh trading conditions.

Case in Point: One Lockton client specialising in custom plastic containers faced a significant loss when a key customer went insolvent before the invoice date. By working with Lockton, the

client secured pre-shipment cover, including production costs. When the insolvency occurred, the policy paid out 90% of the loss – turning a near-disaster into a manageable event.

Tariff volatility is now a permanent feature of global trade. For trade creditors, the challenge is twofold: protecting your organisation from unexpected losses while helping your customers remain resilient.

This requires a thoughtful blend of traditional credit assessment, insurance risk management, and strategic forecasting. At Lockton, we work with credit managers to identify vulnerabilities and

build protection strategies that withstand today’s unpredictable trade environment.

Consider a professional review if you’re unsure whether your current insurance program adequately reflects the risks posed by tariffs. The right strategy could make all the difference when the next disruption hits.

For insights or a complimentary insurance program review, contact the Lockton team

*Sam Rodda Client Manager, Credit Solutions Lockton Companies Australia

E: sam.rodda@lockton.com

T: +61 478 976 648

By Barrett Hasseldine MICM*

Machine learning (ML) techniques can enhance the development of credit scoring models by uncovering subtle patterns in consumer behaviour that may otherwise be missed. In this article, we examine how ML models compare to logistic regression models in credit scoring, focusing on their potential to improve credit inclusiveness, reduce borrowing costs, and enhance credit risk management for both lenders and borrowers.

Barrett Hasseldine MICM

Research objective and terms of reference

In a recent report, Incorporating machine learning techniques in banking transaction scores, released by illion, an Experian

company, we analysed the value of a Machine Learning approach to credit scoring compared to that of logistic regression.

Our research was carried out by comparing models that were built from bank statement data – i.e. Transaction Risk Scores – as this data offered a far richer and nuanced insight into consumer behaviour than traditional credit bureau data.

The benefits quoted in the report are couched in both commercial and societal terms. For example, it considers the value to consumers from greater credit inclusiveness, less subjective discrimination, cheaper borrowing costs, and lower indebtedness. Similarly, the benefit to lenders is considered

“Machine learning (ML) techniques can enhance the development of credit scoring models by uncovering subtle patterns in consumer behaviour that may otherwise be missed.”

in terms of higher profit, revenue, revenue margin, and lower credit risk. Additional benefits that are not quantified, but may also arise from improvements in modelling technique, include higher revenues from lower application withdrawal rates and cost savings from greater automation of decisions (e.g. fewer referrals and less decision overriding).

The benefits were assessed from two case studies that used data from two mainstream lenders – 1) a personal loan provider and 2) a credit card issuer. Both lenders offered credit to prime and near-prime borrowers. The performance of both scores was measured against the lenders’ credit decisions, the consumers’ payment performance, their application withdrawals, and their subsequent credit performance across all holdings.

The ML transaction score increased the personal loan provider’s loan funding by 4% over the traditional score and by 10% over the existing underwriting process, without increasing credit risk. Similarly, the credit card issuer could have increased their limits funded by 3%.

The ML transaction score could have reduced the personal loan provider’s credit risk by 15% compared to the traditional model, lowering bad debt reserves by $29 per $10,000 lent and increasing profit by $41 per $10,000 lent. Using the ML

transaction score, the provider could have earned an additional $4.3 million in portfolio profit annually, based on 50,000 underwritten loans at an average size of $21,000.

Alternatively, if these benefits had been passed onto the borrowers, their average interest rate could have been reduced by an average 12 basis points, without the lenders needing to underwrite any additional risk.

Without underwriting any additional credit risk, the ML transaction score could have led to an increase in the approval

“The analysis verified that machine learning can offer superior performance compared to traditional credit scoring methods.”

strategy that achieved the ‘same credit risk’ from either lender would have realised the following bene ts from model over the Traditional model:

Applying a strategy that achieved the ‘same approval rate from either alternative, the lender would have realised the following bene ts:

Further validating our findings, we found that a credit card issuer could achieve broadly similar benefits to those of the personal loan provider.

rate of young consumers by identifying highly creditworthy, but less experienced, borrowers. To illustrate, the approval rate of consumers with less than two years’ credit experience rose by 19%, while their credit default risk was 40% lower than those approved by the traditional score. Borrowers living in higher-risk areas saw 24% more approvals, but with a 30% lower credit default risk (compared to that approved by the traditional model).

The analysis verified that machine learning can offer superior performance compared to traditional credit scoring methods. By leveraging rich data sources such as those obtained from bank statements

While their personal risk was low, people living in higher-risk geographic neighbourhoods stood to benefit from greater credit inclusion if the ML model was used.

and extracting the insight from its many nuances, ML models can help to enhance the credit experience of both lenders and consumers.

As highlighted in our key findings and case studies –from increased loan profits to empowering underserved customers – these benefits could pave the way for more equitable and profitable lending practices.

For a deeper understanding of how ML can be applied to credit scoring, we invite you to explore our full report, which offers further insights. You can find out more by visiting our website.

*Barrett Hasseldine MICM Head of Modelling illion

www.illion.com.au

Disclaimer

This Article (“Article”) is provided by illion Australia Pty Limited, an Experian Company as general information, and it is not (and does not contain any form of) professional, legal or financial advice. This Article is based on Australian data. illion makes no representations, warranties or guarantees that this Articleis error-free, accurate or complete. You are solely responsible and liable for any decision made (or not made) by you in connection with information contained in this Article. illion (and its related bodies corporate) exclude all liability for any and all loss, cost, expense, damage or claim incurred by any individual or entity as a result of or in connection with (whether directly or indirectly), this Article or any reliance on the information contained within it. illion owns (or has appropriate licences for) all intellectual property rights in this Article and the Articlemust not be edited, copied, updated or republished (whether in whole or in part) in any way without illion’s prior written consent.

About illion

illion, an Experian company, is a leading provider of data and analytics products and services in Australia and New Zealand. illion is now owned by Experian, one of the world’s leading global data and technology companies.

About Experian

Experian is a global data and technology company, powering opportunities for people and businesses around the world. We help to redefine lending practices, uncover and prevent fraud, simplify healthcare, deliver digital marketing solutions, and gain deeper insights into the automotive market, all using our unique combination of data, analytics and software. We also assist millions of people to realise their financial goals and help them to save time and money. We operate across a range of markets, from financial services to healthcare, automotive, agribusiness, insurance, and many more industry segments.

By Michael Rosen*

Michael Rosen

Automation is a buzzword in many industries – and for good reason. Its impact has been undeniable across various sectors, driving productivity and efficiency gains by minimising human intervention in tasks and processes.

Whether it’s robotic precision in healthcare, onsite and offsite design in construction, or warehousing pick, pack and delivery, automation streamlines operations for speed, accuracy, and consistency. Three out of four (74%) organisations have seen investments in automation meet or exceed expectations, with 63% planning to increase their efforts and further strengthen these capabilities by 2026.

The credit management industry is no exception. For businesses with trade accounts, automation offers a pathway to optimising strategic growth whilst reducing costs and allocating resources more effectively.

Automating accounts receivable (AR) goes beyond minimising manual effort –it empowers businesses to strengthen their customer

relationships, boost team morale, connect their data and streamline processes for seamless collaboration.

What you need to know about automating accounts receivable processes

What is accounts receivable automation?

Accounts receivable (AR) automation leverages technology to transform manual processes and business rules operating credit management tasks into standardised and streamlined workflows. Manual methods of receiving, storing, and processing data are replaced with digital data capture, housing information securely in the cloud. Credit management teams access real-time, centralised data for convenience, enabling faster, more precise, and data-driven decision-making.

Beyond simplifying daily operations, AR automation provides a comprehensive view of the customer lifecycle, enabling businesses to gain insights and identify trends

and patterns to better forecast revenue, supply chain needs, and operational requirements, delivering greater overall efficiency.

By removing repetitive tasks, automation unlocks valuable time and team resources, which can be effectively redeployed toward areas of revenue generation and customer growth. When it comes to AR, the business case for automation is clear and compelling.

Areas of AR that can be automated

If a manual AR process involves human intervention, it is a strong candidate for automation. Here are some key AR functions that can be automated to elevate B2B credit management processes:

1. Account application

Traditional paper or PDF application forms can be

digitised for a fast and easy customer experience. The captured data is instantly used to assess a customer’s creditworthiness. Data is securely and centrally stored in the cloud for realtime access to current and historical application information.

2. Credit assessment

Existing business rules can be transformed into automated workflows. Credit reports, identity verification, and fraud checks are handled seamlessly in the background. Data-driven decision-making allows for fast, efficient credit assessments – applications are instantly approved or flagged for review and approval.

3. Invoicing

Manual invoicing is often rigid and time-consuming. Automation enables

“For businesses with trade accounts, automation offers a pathway to optimising strategic growth whilst reducing costs and allocating resources more effectively.”

businesses to generate and send invoices based on a preset schedule, ensuring timely and accurate billing. Gone are the days of end-ofmonth cycles.

4. Task management

Manual tasks like reviewing credit limits and blocking overdue accounts can be automated using predefined rules. This allows for fast, accurate responses and mitigates financial risk, particularly in instances where overdue accounts might otherwise go unnoticed.

5. Payment reminders

Proactive and consistent communications elevate the customer experience. Automated payment reminders can be sent on a set schedule using templated emails, providing visibility into the status of an account.

Matching payments to invoices can be tedious and time-consuming. Automation simplifies this process with sophisticated data-matching methods, enabling fast and accurate reconciliation that positively impacts cashflow.

7. Reporting

Reports can be generated in real time with automation, eliminating delays caused by manual consolidation. Centralised data makes it easy to create timely reports for better decision-making and planning.

By shifting AR functions to a consolidated credit management solution, all processes can be streamlined into a single workflow. Integrating a CRM or an ERP takes this a step further, facilitating seamless data flow between systems, ensuring updates and changes are automatically reconciled.

PwC describes this as the unified platform – a central nervous system for integrating initiatives that helps reduce costs, minimise technical debt and unlock opportunities for real-world business process transformation. It eliminates countless disconnected and isolated steps and processes.

What is the value of automation?

Automating credit management processes brings substantial value to organisations, delivering benefits across three key pillars:

l Process efficiencies

y Eliminate manual tasks and processes

y Centralised, real-time data

y Standardised and consistent workflows

y Faster, more informed decision-making

l Cost savings

y Redeploy resources to growth areas

y Reduce errors and rework

y Accelerate payment allocations

y Mitigate business risks

l Improved customer experience

y Strengthen customer relationships

y Simplify customer onboarding

y Boost team morale

y Ensure faster response times

Who benefits from accounts receivable automation?

Credit and finance teams

Credit and finance teams are the primary beneficiaries of accounts receivable automation. By replacing manual tasks with automation,

leading retailer Woolworths Group experienced a significant boost in team morale. Credit teams can strengthen financial controls, gain real-time data visibility for effective decisionmaking, and reduce risk through automated checks, verifications and ongoing account monitoring.

Sales and customer service teams

Sales and customer service teams experience significant advantages, including a controlled increase in credit limits for growth, a centralised view of trade account information, and account status visibility. Response times are improved with the right information always at hand.

The future of automation in credit management

Artificial Intelligence (AI) automation is advancing at an unprecedented pace. By leveraging machine learning and advanced algorithms, AI systems

can analyse and learn from large volumes of data, identify patterns, match payments and optimise processes –without manual intervention. By continuously analysing and incorporating real-time data, AI enhances the accuracy of predictions. Cashflow forecasts can be updated regularly, providing early warnings for businesses to proactively adjust their strategies.

A practical application of AI is in fraud detection. AI can analyse transactions in real time, swiftly identifying anomalies to mitigate potential risks before they impact operations.

A study by McKinsey highlighted that AI use cases

in credit risk are extensive, with potential applications spanning the entire credit life cycle, from client engagement to customer assistance processes.

Automation equips organisations with a powerful tool to optimise credit management processes, streamline operations, reduce costs and improve customer engagement.

As you explore optimisation opportunities within your organisation, consider how much time your accounts receivable team currently spends on manual tasks that could otherwise be automated. A cost-benefit analysis will likely

uncover substantial potential for improvement. In today’s fastpaced business world, harnessing the power of automation enables your organisation to scale efficiently, meet increasing performance and productivity demands, and significantly reduce operating costs.

*Michael Rosen is Head of Product at Opypro, a cloud-based credit management platform that simplifies and automates accounts receivable processes. With end-to-end automation, Opypro streamlines operations, reduces costs and drives growth.

Sources: Reinventing Enterprise Operations, Accenture (2024). The benefits of strategic systems integration, PwC (2024). Woolworths Group Customer Story, Opypro (2024).

By Nick Pilavidis FICM CCE*

In the spirit of this month’s theme – embracing innovation and staying ahead, I thought I’d highlight the Government’s initiative of driving eInvoicing by default for Business to Government (B2G).

With many business functions becoming digitalised, it’s a good time to touch base with your Government buyers and ask about eInvoicing and how it can streamline your processes, enhance security, and help you get paid on time, if not faster.

What is the B2G Mandate for eInvoicing?

A B2G mandate would mean that businesses supplying goods or services to the government must use eInvoicing to submit invoices

through standardised and secure Peppol network.

In March Hon. Stephen Jones MP, Assistant Treasurer and Minister for Financial Services to ministers, stated the Government’s commitment to eInvoicing. Expanding on the 2024-25 Budget announcement, the Government is mandating an ‘eInvoicing by default’ policy for all non-corporate Commonwealth Entities (NCEs).

Why Should Businesses Pay Attention?

Government agencies are ramping up efforts to upgrade systems, onboard more suppliers and internal targets are being established. This means your business may be required to send

“A B2G mandate would mean that businesses supplying goods or services to the government must use eInvoicing to submit invoices through standardised and secure Peppol network.”

“eInvoicing can help streamline processes, disrupt email scams, enhance data security, improve payment efficiency, and help with Payment Times Reporting.”

eInvoices in the near future. This is a great opportunity to embrace innovation and stay ahead of the game by adopting eInvoicing.

The B2G mandate is the interim step towards B2B eInvoicing, most countries in Europe have followed a pattern of implementing B2B policies following their B2G mandate.

eInvoicing can help streamline processes, disrupt email scams, enhance data security, improve payment efficiency, and help with Payment Times Reporting. B2G mandate will encourage widespread adoption of eInvoicing by creating a structured and

efficient method for businesses of all sizes to interact with Government agencies.

A good place to start is by assessing your readiness for implementation, choosing an appropriate service provider or system for integration and training teams and upgrading internal processes.

Embracing eInvoicing and preparing for the B2G mandate is a positive step forward and I encourage you to see this change as an opportunity for

growth. I also want to invite you to join AICM’s eInvoicing Special Interest Group forums which are held quarterly.

If your business needs assistance please contact The Australian Peppol Authority, they provide support to guide your business through the transition.

Please contact the APA at eInvoicing@ato.gov.au or visit ato.gov.au/eInvoicing for more information.

*Nick Pilavidis FICM CCE CEO Australian Institute of Credit Management

www.aicm.com.au

We recognise those members who achieved membership anniversaries between January, February and March 2025. Congratulations to these members on achieving such important milestones.

Opypro is excited to share our commitment to extending our partnership with the AICM for the 2025 Member in Spotlight series!

This initiative has become a welcomed and powerful platform to recognise AICM members who are driving progress and prosperity within the credit management industry.

It’s been especially rewarding to hear how the interviews have inspired members to connect, share insights, and explore each other’s transformation journeys, particularly in areas like technology and automation.

In 2025, we’ll continue to shine a spotlight on members who are leading the way, sharing practical knowledge and

real-world strategies for implementing and managing transformation initiatives. These stories will continue to highlight how innovation is helping shape and optimise operations, boost team engagement, and elevate the customer experience.

Together, we’ll celebrate the impact of AICM members and showcase their positive contributions to both our industry and the wider community throughout 2025 and beyond.

Join us as we dive into inspiring member conversations, honour excellence, and promote collaboration across the credit management landscape.

–

Dion Appel MICM and the Opypro Team

What a year we are having! Our Economic and Risk Seminar on 13th March was well attended and our Guest Speaker from the Reserve Bank of Australia was James Holloway (Deputy Head, Economic Analysis Department) who provided us with the most interesting and innovative updates happening in Australia at the moment.

Our CEO Nick Pilavidis gave us an update on Risk with input from Malcolm Field from SV Partners, David English from Bunnings, Thomas Banfield from Turks, Cameron Miller from Equifax, and Troy Mulder from Horizon Power. Subjects covered were Fraud and Cybersecurity, AI & Technology, Bankruptcy, and Insolvency and Preparing for the 2025 Challenges ahead. For Credit Professionals,

this seminar was invaluable for information sharing.

Last Friday, 9th May, we had our Annual Golf Day at Collier Park and it was just fabulous, great weather, even better company and loads of fun playing an Ambrose Game! Everyone is already looking forward to next year! A huge thank you to NCI for sponsorship of the event and to Equifax for providing prizes for the winners. Thanks to Auxillium, AMPAC, SV Partners, Equifax and NCI for putting in teams. Onwards and upwards next year for double the amount of teams!

We have our Young Credit Professional of the Year and Credit Professional of the Year awards in August and the applications close off 31st

May 2025! Please have a think about applying for one of our WA Awards, it is a wonderful addition to your resume and the prize for first place is a trip to Conference in October to represent WA!!!

WA is having our Women in Credit Luncheon on Friday 6th June at 12pm at the Doubletree by Hilton Waterfront and it’s sure to be an unforgettable event with the Honourable Simone McGurk MLA as our guest speaker. We invite you all to come along for this special luncheon celebrating WINC for 10 years!

Take care out there everyone and have a good time at the upcoming AICM Events.

– Cheri Bowater FICM CCE WA Division Council President.

South Perth’s Collier Park Golf Course played host to another unforgettable AICM Golf Day recently, bringing together players of all skill levels for a day of friendly competition, stunning scenery, and perfect weather. The event, held at the picturesque 27-hole championship course just 10 minutes from Perth’s CBD, was a great success with clear skies and warm sunshine setting the stage for a memorable outing.

We played the Lake and Island 9-hole courses this year, which offered participants a diverse and challenging experience. The well-maintained fairways, manicured greens, and scenic surroundings, complete with pine trees and local wildlife, created an ideal backdrop for the day. The course’s reputation as one of Perth’s premier public golf facilities was on full display, with players enjoying the blend of accessibility and quality that Collier Park is known for.

The weather couldn’t have been better, with bright, sunny conditions and a gentle breeze ensuring comfortable play throughout the day. NCI reprised their role as sponsor of the drinks cart

which kept our golfers hydrated throughout the day. This support is greatly appreciated!

The event wasn’t just about golf; it was about bringing our credit community together. Players mingled afterwards at the fully licensed venue offering light refreshments, a sausage sizzle dinner and open bar facilities. It was the perfect spot to relax, share stories, and celebrate the day’s highlights.

Equifax generously provided the prizes for the winning teams with Summit Fertilizers supplying all teams with gift packs for attending. This year in an upset, the AMPAC team stormed home to come first overall, playing a stunning round of golf to pip

the perennial favourites, NCI & Auxilium Partners to the post. This will no doubt increase their hunger to come back next year to snatch the title.

For those who missed out, keep an eye on the AICM website for updates on upcoming events, including next year’s golf event, and further AICM seminars and networking outings. A big thank you to all the participants, staff, and volunteers who made the Golf Day a hole-in-one success!

Nirav Shah SV Partners

Can you tell us a little about your background and how you got into the insolvency profession?