AICM

RISK REPORT 2025

Publisher: Nick Pilavidis FICM CCE Chief Executive Officer

Australian Institute of Credit Management

Editor: Claire Kasses

General Manager

Australian Institute of Credit Management

Mob: 0499 975 303

Design: Anthea Vandertouw

Ferncliff Productions

T: 0408 290 440

E: ferncliff1@bigpond.com

Australian Institute of Credit Management

Level 3, Suite 302, 1-9 Chandos Street

St Leonards NSW 2065

T: 1300 560 996

E: aicm@aicm.com.au www.aicm.com.au

Welcome

Julie McNamara FICM CCE National President, AICM

As we present the 2025 AICM Risk Outlook, we continue to navigate a dynamic and evolving credit landscape. The challenges faced by credit professionals have intensified, and as a community, we must remain proactive and adaptable.

Over the years, this report has become an essential resource, offering insights derived from industry data, our Risk Survey, and contributions from experienced professionals. It reflects not only the current risk environment but also the strategies being deployed to mitigate emerging challenges.

The past year has seen significant shifts in economic pressures, insolvency rates, and fraud activity. At the same time, technological advancements such as AI and ESG considerations are reshaping the way we assess credit risk. Through this report, we aim to equip you with the knowledge and foresight needed to make informed decisions in this evolving landscape.

A heartfelt thank you to the AICM national office, division councillors, and all contributors who have shared their expertise. Together, we continue to build a resilient and well-informed credit profession.

Let’s approach 2025 with confidence, preparedness, and a commitment to professional excellence.

Warm regards,

Julie McNamara FICM CCE National President, AICM

Welcome

Nick Pilavidis FICM CCE Chief Executive Officer, AICM

Credit professionals continue to play a pivotal role in navigating financial risk and ensuring the stability of businesses across Australia. In a rapidly evolving economic and regulatory environment, the need for strong risk management has never been greater.

The 2025 Risk Report is a reflection of the challenges and opportunities within our profession. Informed by insights from AICM members, industry experts, and our comprehensive Risk Survey, this report provides a clear picture of the current credit risk landscape and the proactive strategies being implemented to address these issues.

Over the past year, we have seen rising insolvencies, heightened fraud activity, and increasing cybersecurity threats. At the same time, the industry is embracing AI, automation, and ESG considerations as part of broader risk management strategies. These shifts highlight the importance of adaptability and continuous learning for credit professionals.

Despite the challenges, our community has shown resilience, and many credit teams are improving their performance through strategic initiatives and enhanced customer engagement.

Thank you to everyone who contributed to this report and to the AICM members who continue to share their insights and expertise. Your dedication strengthens the profession and ensures we remain at the forefront of risk management.

Looking ahead, we encourage you to leverage this report’s findings to navigate 2025 with confidence and preparedness.

Best regards,

Nick Pilavidis FICM CCE Chief Executive Officer, AICM

Our 2025 SUPPORTERS

NATIONAL PARTNERS

Our 2025 SUPPORTERS

DIVISIONAL PARTNERS

DIVISIONAL SUPPORTING SPONSORS

Overview Navigating New Realities: AICM’s Risk Outlook on Evolving Credit and Insolvency Trends

As the landscape of credit management continues to evolve under shifting economic conditions, the Australian Institute of Credit Management (AICM) provides a crucial update in its latest Risk Outlook. This comprehensive report delves into the pressing challenges and strategic responses shaping the field following the economic fluctuations of recent years.

The report is informed by industry data and the AICM’s Risk survey, which polled members on how the current conditions are impacting their operations. The detailed results of the survey were presented during the 2025 Risk seminars.

Outlook for 2025

Economic Pressures and Impact on Credit Management

The enduring pressures of inflation and the rising cost of living are beginning to impact credit operations.

In the AICM’s latest Risk Survey, 29% of respondents expect a deterioration in their credit performance, up from 19% last year. Inflation, increasing insolvencies, and economic uncertainty are the most commonly cited factors affecting performance, with businesses facing increased requests for extended payment terms and financial assistance.

Despite these pressures, engagement with creditors remains high, with 50% of respondents seeing an increase in customer requests for payment assistance. This highlights the importance of effective engagement strategies to prevent insolvency and mitigate broader financial impacts.

Corporate and Personal Insolvency Trends

Corporate insolvencies have surged, surpassing pre-pandemic levels. Australia recorded over 11,000 insolvencies in FY24. There have already been over 8,200 in the financial year to February

Source – ASIC Series 1 data (data to Feb 25).

Corporate Insolvencies

Source: AFSA.

Number of Personal Insolvencies per Financial Year

2025. If the insolvencies in March to June 2025 increase by the same rate as we have seen so far this financial year total insolvencies could reach up to 16,000.

This increase appears to be driven by postpandemic economic adjustments, rising financial pressures, and the Australian Taxation Office’s (ATO) firmer approach to debt recovery. While this presents challenges, credit teams have largely managed to anticipate these insolvencies, minimising the financial impact on their operations.

In contrast, personal insolvencies remain relatively low, though they are expected to rise in the coming years. The Australian Financial Security Authority (AFSA) forecasts an increase to around 14,750 personal insolvencies by 2025, still below historical averages.

Fraud and Cybersecurity: A Growing Challenge

Fraud remains a significant concern, with 62% of surveyed professionals reporting instances within their organisations – a slight increase from

Key Trends in Fraud

Account Takeover: Unauthorised access and control of a customer's existing account.

Identity Theft: Using stolen personal information to obtain credit.

Fake Documents: Use of forged or altered documents to obtain credit.

Application Fraud: Providing false information on a credit application.

Fraudulent Transactions: Unauthorised use of credit account for transactions.

Invoice/email interception: compromise of customer emails to alter your account details redirecting payments

Impact of Fraud

“Fraud remains a significant concern, with 62% of surveyed professionals reporting instances within their organisations...”

last year. The most common fraud types include invoice/email interception, application fraud, and identity theft.

Fortunately, the financial impact of fraud remains relatively low, members report the time cost is significant with many spending equal time on identifying potential fraud risk as they do for credit risk.

The Role of Customer Support in Credit Management

Customer support is becoming an increasingly critical component of credit risk management. Traditionally seen as a consumer credit issue, commercial credit teams are now recognising its value in sustaining healthy business relationships and improving collections performance.

In the calendar year 2024, 50% of respondents saw an increase in customer requests for payment assistance, likely driven by an increase in need and an expectation that all credit providers will offer assistance for temporary financial challenges.

Those offering customer assistance ensure customers are aware of this through a range of measures with proactive communication

“Members have reported that adopting a proactive approach to financial hardship has been shown to yield better outcomes than traditional collection

”

tactics alone.

and training of customer facing staff the most prevalent. Members have also reported that adopting a proactive approach to financial hardship has been shown to yield better outcomes than traditional collection tactics alone.

Government Response and Legislative Developments

Despite the rising number of insolvencies, comprehensive insolvency reform remains stalled. Initial discussions within the current government have not led to significant legislative changes, leaving credit professionals to navigate outdated processes.

Similarly, efforts to reform the Personal Property Securities Act (PPSA) have been halted following pushback from industry stakeholders led by the AICM.

How Do Customers Know About Assistance Offered

OVERVIEW

The AICM looks forward to engaging with the new government following the upcoming federal election to achieve reform that benefits credit professionals and the broader Australian economy.

Emerging Trends: AI & ESG Considerations

Artificial intelligence (AI) is playing an increasingly prominent role in credit risk management. While 31% of organisations have yet to integrate AI, expectations for its adoption are high. AI and predictive analytics are likely to become standard tools for credit professionals in the near future.

Environmental, Social, and Governance (ESG) factors are also gaining traction, influencing credit policies and lending decisions.

Organisations are beginning to incorporate ESG metrics into their risk assessments to ensure long-term sustainability and resilience.

Conclusion

The 2025 AICM Risk Outlook underscores the increasing complexity of the credit environment. Credit professionals are facing heightened fraud risks, cybersecurity challenges, and economic pressures, yet they continue to adapt through technological advancements and proactive customer engagement strategies.

By staying informed, leveraging AI, and refining risk management approaches, credit professionals can navigate these evolving challenges, ensuring resilience and stability in their operations.

“AI and predictive analytics are likely to become standard tools for credit professionals in the near future.”

UPDATE Economic

Commercial Credit Trends and Challenges in the Year Ahead

By Scott Mason MICM General Manager of Commercial and Property Services

As we progress into 2025, what critical challenges must credit professionals anticipate and proactively mitigate? Equifax commercial credit data signals a marginal contraction in commercial credit enquiries, a slowing rate of insolvency growth, increasing arrears within key sectors, and heightened demand for personal finance from SMEs and sole traders. Given the prevailing global and economic uncertainties, the imperative for agile and robust risk management strategies is paramount.

Commercial credit demand: a cooling trend with state-based disparities

Overall commercial credit demand saw a dip of -3.2% in Q4 2024 compared to the same period

in 2023. This decrease was largely driven by a slowdown in asset finance and trade credit volumes, stemming from lower enquiries from professional services (-16%), construction (-11%) and retail sectors (-13%).

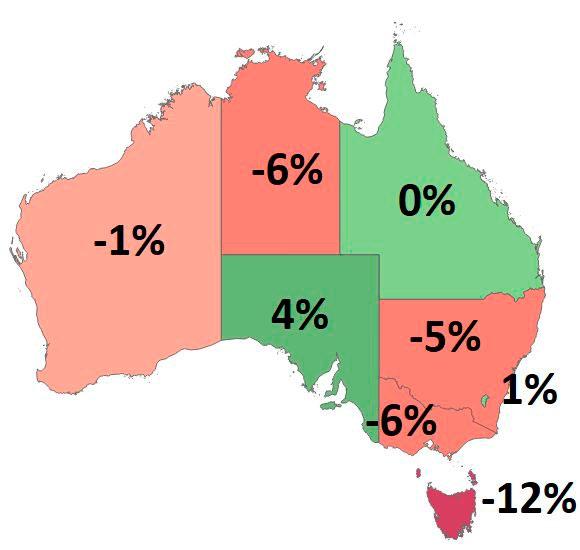

Regional Demand 2024 Q4 vs. 2023 Q4

Mixed product level performance over 24Q4 led to overall decrease in demand vs. 23Q4. Unchanged interest rates over the quarter led to lowering business confidence in the market (105.9 in Dec[1]), ultimately resulting in lower commercial enquiry volumes.

Total Market Application Demand (2020 - present)

While asset finance has previously surged off the back of Covid tax incentives, there has now been a decline in enquiries for the second and third quarters in a row, down -7.9% compared to the previous year. The majority of asset finance applications are for commercial vehicles, farm machinery and construction equipment. The Federal Chamber of Automotive Industries (FCAI) reports that vehicle sales of light commercial vehicles for November and December 2024 was down by -23% and heavy commercial vehicles down by -4.9% compared to the previous year, correlating with enquiry trends observed in the Bureau.

❖ SA was the only state in Australia that experienced growth in overall credit demand vs. last year driven by increased demand for business loans and trade credit

❖ The largest growth in SA Commercial demand came from borrowers in Financial Services (+6.3%) and Agriculture (+2.9%)

Business loan enquiries followed a different trajectory, experiencing a modest increase of +3.6%, driven by increased enquiries made towards fintech (+8.2%), finance brokers (+6.1%), Tier 2

banks (+4.3%), Big 4 & Big 4 subsidiaries (+3.2%). Business loan enquiries from SA and Queensland contributed to the nationwide improvement in demand. Interestingly, during times of higher insolvency levels, we observe a slight ‘flight to quality’, with businesses gravitating towards larger, more established institutions.

performance over 24Q4 led to overall 23Q4. Unchanged interest rates lowering business confidence in ), ultimately resulting in lower volumes.

Regional Demand

Regional Demand

2024 Q4 vs. 2023 Q4

2024 Q4 vs. 2023 Q4

insolvencies

Just as in previous quarters, the commercial credit landscape varies significantly across states. South Australia continues to be a standout performer, with robust growth in financial services (+6.3%) and agriculture (+2.9%). Queensland is also showing positive signs, while Western Australia’s growth has somewhat normalised after several quarters of strong performance. In contrast, Victoria and New South Wales continue to struggle, reflecting broader economic challenges in these regions.

These state-based disparities highlight the importance of understanding regional nuances and tailoring credit strategies accordingly.

application demand (2020-present)

of 3796 insolvencies registered across regional increases particularly in VIC volumes are softening in December, the remain higher than previous years.

Insolvency update: signs of slowing growth, key sectors affected

Overall commercial credit demand

❖ SA was the only state in Australia that experienced growth in overall credit demand vs. last year driven by increased demand for business loans and trade credit

Regional Insolvency Change

Regional insolvency change

2024 Q4 vs. 2023 Q4

24 Q4 vs. 23 Q4

❖ The largest growth in SA Commercial demand came from borrowers in Financial Services (+6.3%) and Agriculture (+2.9%)

Insolvency levels remain a key concern, with a +48% increase in Q4 2024 compared to Q4 2023. VIC increased the most among the commercial centres (+72%) due to higher insolvency registrations from businesses in construction, manufacturing and professional services sectors.

volume trend (2020-Present)

While this is a substantial rise, there are signs that the rate of increase is starting to moderate. This suggests that the ‘zombie businesses’ sustained during the pandemic are finally washing through the system, and we may be approaching a return to more normalised insolvency levels within the next 12 months – specifically, levels between those observed in 2022 and 2023.

❖ VIC increased the most amongst the commercial centers due to higher insolvency registrations from businesses in Construction, Manufacturing and Professional Services sectors

Preliminary data from January and February 2025 indicates a further deceleration in the rate of insolvency growth. Insolvencies are up +30% on a rolling 90-day basis (based on ASIC data to 23 Feb 2025) relative to the corresponding period last year.

However, notable increases persist across key industry contributors to insolvencies, including: Hospitality (Accommodation and Food Services), Professional, Scientific and Technical Services, and Transport, Postal and Warehousing. While their contribution to insolvencies is smaller, the mining sector has seen insolvency numbers halve. Conversely, Health Care and Social Assistance has experienced a doubling of insolvencies, and Education and Training businesses have seen a two-and-a-half-fold increase.

insolvencies in the hospitality sector during Q4 was likely influenced by seasonal factors, such as holiday gatherings.

Spotlight on sole traders and SMEs: increased demand for personal finance

Reduction in commercial credit demand for Asset rise in consumer product demand from self-employed

In the final quarter of 2024, construction and hospitality were the industries most severely affected by insolvencies, with increases of +49% and +40% respectively compared to the same period in 2023. In Victoria, construction insolvencies during the same period increased materially by +79%, largely driven by supply chain issues and long-term fixed contracts. In South Australia, insolvencies were +100% higher than in Q4 2023, reflecting the impact of reduced disposable income. A minor resurgence of

A notable trend is the growing reliance of sole traders and SME owners on personal credit to finance their businesses. Equifax Consumer Bureau data reveals a significant uptick in personal auto loans (+14%), residential mortgages (+14%), and credit card applications (+13%) among this cohort in Q4 2024 compared to the same period in the previous year. SME credit card application levels were +35% higher than three years prior.

❖ Auto loan demand for the SME/Sole Trader cohort is 14% higher compared to 23Q4. long term demand has also increased for this cohort, with 6% more enquiries received this quarter compared to 21Q4

Demand for auto loans increased significantly in commercial centres. In NSW, arrears grew by +21%, in WA by +29%, in Victoria by +8% and in Queensland by +6% in Q4 2024 compared to the

❖ Credit Card demand has improved vs. 23Q4, with 13% higher application volumes received from this cohort in 24Q4. Current levels of SME credit card applications are 35% higher vs. 21Q4.

Indexed SME Enquiry Demand (Q4 2021 - Q4 2024)

Indexed SME enquiry Demand (Q4 2021 - Q4 2024)

Traders grew significantly in commercial

in key sectors in these regions

Auto Loans 30+ Arrears

Note: Arrears trend excludes non-SME consumers

Note: Arrears trend excludes non-SME consumers

demand for credit cards in 24Q4; increasing industries is also observed as demand grows

❖ SME/Sole Trader arrears across all sectors were rising throughout 2024, with current levels 36% higher than

Credit Cards 30+ Arrears

Note: Arrears trend excludes non-SME consumers

Note: Arrears trend excludes non-SME consumers

same quarter the previous year. This suggests that businesses may be utilising personal financing options to fund vehicle acquisitions.

❖ Credit Card arrears in these states are also on the rise, especially for Hospitality and Construction sectors.

This trend is particularly noteworthy given the slowdown in asset finance. We’re also observing an increase in arrears on personal auto loans and

❖ Construction and Hospitality SME Arrear rates for credit card products have risen 2X vs December 2023

credit cards, indicating potential financial stress among small business owners. Auto loan arrears among SMEs and sole traders trended upward throughout the past year, reaching +36% higher in December 2024 than the previous year.

During the same comparison period, auto loan

trends and days beyond terms

arrears rates were particularly elevated for business owners in construction (+75%) and those in hospitality (+43%). Similarly, credit card arrears for this cohort have doubled since December 2023.

days beyond terms across the market on borrowings have reduced by 0.4 days in Commercial repayments are made 1 day later levels observed during COVID-19 (20Q4).

This heightened demand for personal credit and the associated increase in arrears underscore the importance of credit professionals maintaining a comprehensive view of their customers’ financial situations, encompassing both business and personal credit activity.

Days Beyond Terms by Industry (2022 - Present)

Days beyond terms by Industry (2022-Present)

Overall customer application quality

Days beyond terms

❖ Borrowers from the Electricity, Gas and water services sector have increased days beyond terms by almost 5 days since 2022 Q4

Average application quality increased marginally compared to 12 months ago, driven by more business loan applications in 24Q4 having higher scores. Short term (QoQ) improvements are also observed in the application quality of Asset Finance (+1.2%) and Trade Credit (+0.5%) applications

Customer Quality Trend (2022 - present)

❖ Days beyond terms levels for borrowers in the Hospitality, Retail and construction sectors have significantly reduced from pandemic levels Average days beyond terms trend (2022-Present)

24Q4

Average Score

Days beyond terms, a metric measuring the time commercial borrowers take to fulfill their trade credit obligations, decreased by 0.4 days in Q4 2024 compared to the same period in 2023. However, this trend does not extend to the electricity, gas and water services sectors, where days beyond terms have increased by nearly five days compared to Q4 2022.

821

Overall customer application quality

+0.5% Vs 23Q4

+1.0% vs 22Q4

+0.9% vs 21Q4

The quality of credit applications experienced a marginal increase (+0.5%) in Q4 2024 compared to the same period the prior year, indicating sustained application quality. Short-term enhancements are also evident in the quality of asset finance (+1.2%) and trade credit (+0.5%) applications (Q4 2024 vs Q3 2024). Significantly, borrowers seeking trade credit products in Financial Services, Hospitality, Manufacturing and Professional Services presented improved credit quality compared to the fourth quarter of 2023.

Similarly, business loan borrowers demonstrated marginally higher credit scores across all key

Customer quality trend (2022-present)

sectors during the same period. The exception is asset finance enquiries from the hospitality sector, where scores exhibited a decline since the previous year.

Leveraging data for proactive risk management

As we progress into 2025, the economic landscape remains fluid, with risks like global

trade uncertainty poised to impact growth. Consequently, procuring the optimal credit report at origination and implementing continuous portfolio management solutions are essential for navigating these challenges and bolstering business resilience.

Selecting the appropriate credit report is critical, as reports vary in detail, ranging from basic company enquiries to comprehensive trade histories and director information. Detailed reports offer a thorough assessment of potential risks, including adverse events linked to directors and related entities, enabling informed credit decisions. Each report contains an Equifax risk score utilising proprietary Bureau attributes to predict the likelihood of adverse events within the next 12 months. The score facilitates portfolio segmentation based on risk levels, thereby optimising resource allocation.

Continuous portfolio management solutions, such as health checks and alerts, are equally

indispensable for maintaining portfolio integrity. Health checks ensure data accuracy through matching, cleansing, and uplifting portfolio information, while also appending crucial data such as ACNs and ABNs, along with supplementary details like credit scores, director information, trade data and company profiles. This process effectively identifies and rectifies data discrepancies, ensuring credit decisions are based on current and accurate information.

Equifax Alerts provide daily notifications of changes within portfolios, supporting proactive risk management. These alerts offer flexibility in setup and optimisation to align with business requirements and the size of your portfolios.

Scott Mason MICM General Manager of Commercial and Property Services Equifax

Contact the Equifax team to find out more on 13 8332 or equifax.com.au/contact

“As we progress into 2025, the economic landscape remains fluid, with risks like global trade uncertainty poised to impact growth.”

Challenging conditions expected to continue, with the ‘Trump factor’ the big unknown

Ivan Colhoun Chief Economist CreditorWatch

When forecasting I often like to: 1) identify the starting point for the forecast (the factors that have combined to produce the current business conditions); and 2) consider the big forces that are likely to affect the outlook. This construct can usefully be used by any business.

The starting point

Our launching point for the 2025 outlook sees the Australian economy coming off a record year of insolvencies by number of companies, but a more moderate year for insolvencies as a share of registered corporations (though still much higher than recent years). The trend has been steeply upwards over 2024, in part rebounding from reduced enforcement during the pandemic, and has been driven by insolvencies in the Construction and Hospitality sectors. It’s possible that the trend for insolvencies may have stabilised or even improved a little towards the

“The macroeconomic and business environment remains the biggest external cause of business failure.”

end of the year, as the mid-year income tax cuts flowed more fully through the economy as a number of sectors have shown more favourable trends in recent months.

The rise in insolvencies is often attributed to the renewed collection activities of the ATO postCOVID. My view is that the ’hands off’ approach to collections by the ATO during the pandemic may have played some part in the build-up of tax debts, though the dominant issue was still the multi-faceted shocks the COVID pandemic and associated policy responses brought to many businesses. The recommencement of normal collections’ activities by the ATO has brought some of these underlying issues to the surface and this force remains important in the outlook.

The macroeconomic and business environment remains the biggest external cause of business failure. While the economy has been returning to normal since early 2022, there remain many pressures on businesses from the very complex set of circumstances and after-effects brought about by the COVID pandemic.

The rise in prices and interest rates has been particularly important. Whenever businesses

ASIC first time insolvencies Monthly, seasonally adjusted

Data sources: CreditorWatch, ASIC, Macrobond

Trimmed mean CPI - Australia Index: Q2 2008 = 100

Data sources: CreditorWatch, Macrobond

(or consumers) experience very large changes in prices (either up or down) over a short period, it tends to lead to significant challenges. The cost-of-living crisis should also be thought of as a cost of doing business crisis for many firms. Discretionary businesses such as Hospitality have had to handle not only higher wages, insurance, rent, food and other input prices but have also had their customers battling similar cost pressures.

Importantly, if the RBA is successful in returning trimmed mean inflation to 2.5% in the second half of 2026, for the most part, this does not mean

prices have fallen or the cost of living or of doing business has declined. Indeed, this measure of underlying consumer price rises will have risen about 25% in six years.

The big forces affecting the outlook

The starting point analysis highlights the cost of living as a force that is expected to be an ongoing source of pressure for many businesses. Similarly, the accumulated tax debts of companies and ongoing enforcement activities of the ATO will also be acting to keep insolvency activity elevated.

ATO tax defaults Inflow, outflow and total in effect

“The cost-of-living crisis should also be thought of as a cost of doing business crisis for many firms. Discretionary businesses such as Hospitality have had to handle not only higher wages, insurance, rent, food and other input prices but have also had their customers battling similar cost pressures.”

“Because Australia is not a significant exporter to the US, the direct impacts of US tariff policies for the economy are likely to be relatively small, though not for the industries affected.”

Insolvency given ATO default 12 months to February 2025

Data sources: Australian Taxation Office Direct Link – Currently Active ATO Defaults and Inflow and Outflow

In the two charts below, it should be noted that the counts of tax defaults are for businesses with a tax default of over $100,000.

What other big forces are out there? Looming large for businesses all over the world is the uncertainty associated with the policies of the second Trump administration. While much of the focus has rightly been on potential tariff plans, the administration has significant policy plans for trade, immigration, fiscal policy and regulation.

By virtue of the US economy’s size and close financial market links across countries, these developments will be transmitted to the rest of the world.

The proposed, but not fully clear, tariff policies due to be announced on 2 April, present a significant downside risk to US and global growth. Because Australia is not a significant exporter to the US, the direct impacts of US tariff policies for the economy are likely to be relatively small, though not for the industries affected. The indirect impacts are likely to be more significant via the impact on Australia’s major trading partners in Asia, via financial market channels including importantly the share market and via the subsidiaries of US companies operating in Australia.

A substantial increase in US tariffs can be expected to slow global growth, raise US

prices and lower US share markets. It’s unlikely that the Australian government will respond with reciprocal tariffs, meaning Australian businesses and consumers won’t be paying more for imported goods due to tariffs, though the uncertainty over global growth and likely resultant lower prices for our export commodities may well keep the $A low.

Additionally, changes to supply chains, if tariffs are sustained, might also keep shipping costs high as trade redirects around the globe, while some of that redirected trade may find its

“The current uncertainty will also make it hard for boards and businesses to consider investment, while the new rules remain unclear.”

way into Australia’s markets at reduced prices, which would be good for consumers, but not for local businesses competing with the tariffed goods.

The current uncertainty will also make it hard for boards and businesses to consider investment, while the new rules remain unclear. Even once clarified, it’s not impossible to imagine the risk that the President may at some stage completely change his mind and reverse his policies. US economic policy changes are therefore a third large force to keep abreast of. These are likely to be a negative for growth and thus will act to raise credit and insolvency risks in general.

Slower population growth due to the government’s policy changes to immigration and foreign students are also expected to be significant.

Insolvency rate by number of payment default claimants 12 months to February 2025

Trade Payment Defaults Monthly, seasonally adjusted, Feb 2020 = 100

How best to keep across developments

With so many conflicting pressures on businesses, it might seem hard to see the wood from the trees. From a macro perspective, I continue to rely on the signals of the SEEK Job Advertisements series and the NAB Business Survey as great aggregate indicators of how the Australian economy is performing.

From a credit perspective, the CreditorWatch proprietary series on trade payment defaults is extremely useful. A trade payment default occurs when a business lodges a default notice against another business not paying an invoice. The probability of insolvency rises significantly to the extent that multiple businesses report that a counterparty is not paying its invoices.

Trade payment defaults improved a little in late 2024 and early 2025, consistent with slightly

“

With so many conflicting pressures on businesses, it might seem hard to see the wood from

”

the trees.

improved macroeconomic data as the mid-2024 income tax cuts flowed more broadly through the economy. The RBA’s February interest rate cut is likely another favourable development, though needs to be followed up with a few further cuts given the other pressures facing businesses. CreditorWatch’s overall impression is that business and credit conditions will remain challenging in 2025.

Ivan Colhoun Chief Economist CreditorWatch

E: ivan.colhoun@creditorwatch.com.au creditorwatch.com.au

MANAGING RISK

Navigating Preference Claims: Key Strategies for Credit Professionals

In the evolving landscape of corporate insolvency, preference claims pose significant challenges for credit professionals. This article shares some of the wisdom from a Corporate Insolvency Special Interest Group, where AICM members shared challenges, successes, and lessons learned from years of experience.

A preference claim arises when a liquidator seeks to recover payments made by an insolvent company to a creditor prior to its collapse, under the premise that these payments unfairly favoured one creditor over others. Minimising exposure and effectively responding to such claims requires a proactive strategy, underpinned by best practices in credit management, legal protection, and collaboration.

Minimising the Risk of Preference Claims

The first line of defence against preference claims begins with robust onboarding and credit management processes:

1. Comprehensive Credit Applications:

z Ensure credit applications are thoroughly completed and signed by relevant directors. This solidifies the terms of trade and establishes clear creditor obligations.

2. Personal Guarantees:

z Implement director’s guarantees for private companies, trusts, and sole traders. This can provide personal recourse if the company defaults.

3. Proper Security Registrations:

z Registering a Purchase Money Security Interest (PMSI) on the Personal Property Securities Register (PPSR) before supplying goods is essential. This secures rights over goods supplied and any proceeds from their sale, offering protection if the debtor becomes insolvent.

z Consider using an All Present and AfterAcquired Property (All-PAP) registration for broader security over all debtor assets, although this may result in ranking behind secured creditors like banks and employee entitlements.

z Consider placing caveats on property to secure personal guarantees from directors, though this may not be legally permissible for foreign-owned entities.

“The first line of defence against preference claims begins with robust onboarding and credit management processes.”

4. Ongoing Credit Monitoring:

z Regularly check credit reports and trade references to detect early signs of financial distress and minimise exposure.

5. Retention of Title Clauses:

z Include retention of title clauses in credit agreements to retain ownership of goods until full payment is received.

Responding to Preference Claims: A Strategic Approach

When faced with a preference claim, a swift and informed response can mitigate losses:

Consider the Nature of the Claim:

z Assess whether the claim appears to be a generic, scattergun approach often used by liquidators to target multiple creditors simultaneously. If the claim lacks supporting evidence, it may be ignored initially or responded to with a request for the liquidator to clearly outline the legal basis of their claim.

Immediate Consultation:

z Engage legal counsel experienced in insolvency matters or a registered liquidator to assess the validity of the claim and advise on potential defences.

Leverage Security Interests:

z Demonstrate valid PPSR registrations and ensure the secured assets are adequately valued at the time of liquidation. Proper documentation can often deter liquidators from pursuing claims.

Stock Verification:

z Conduct thorough stocktakes upon learning of insolvency to verify the existence and value of secured assets. This helps maintain secured creditor status and strengthens the defence against claims.

“Conduct thorough stocktakes upon learning of insolvency to verify the existence and value of secured assets.”

Proceeds of Sale Tracing:

z Implement systems to trace the proceeds of sales, especially when dealing with bespoke or unique goods, to maximise recovery under a valid PMSI.

Commercial Settlements:

z Weigh the costs of litigation versus settlement. In some cases, negotiating a reduced payment can be a practical solution to minimise financial impact.

Best Practices and Proactive Measures

Credit professionals have shared several practical strategies to fortify defences and enhance recovery potential:

Shorten Payment Terms:

z Reducing terms limits exposure by allowing earlier detection of cash flow issues. Although this approach can be unpopular, it helps identify financial distress sooner, enabling timely interventions.

Enhanced Stock Identification:

z Implement order numbers and barcodes on packaging to assist auditors in quickly locating stock and confirming unpaid inventory. This is especially useful for businesses handling perishable goods or high-turnover items.

Broader PMSI Coverage:

z Register PMSIs over all relevant assets, including goods, packaging, and associated materials, to maximise security interests.

Strict Payment Terms Enforcement:

z Avoid accepting part payments where possible. Insist on payment by invoice under clear arrangements to reduce the risk of preference claims.

Refuse to Discharge Security Prematurely:

z Liquidators may request creditors to release their PMSI registrations. Retaining this registration until all proceeds are verified ensures creditors can claim their rightful funds.

Effective Communication:

z When insolvency issues arise, maintaining discretion and empathy is critical. Communicating professionally with the

“

Avoid accepting part payments where possible. Insist on payment by invoice under clear arrangements to reduce the risk of preference claims.”

debtor’s directors can increase the likelihood of recovering debts under personal guarantees.

Use of All-PAP Registrations Strategically:

z If suitable, especially when supplying goods not tied to specific assets, an All-PAP registration can secure broader claims. However, assess potential drawbacks, including subordination to prior-registered creditors and legal challenges.

Tracing Proceeds of Sale:

z In industries dealing with bespoke or traceable goods, creditors can pursue proceeds from subsequent sales, provided they have a valid PMSI.

An AICM Member’s Success Story

An AICM Member and CCE effectively onboarded a debtor with properly executed credit applications and personal guarantees. When the debtor faced liquidation, swift action was taken:

z A/R teams halted deliveries in transit, minimising additional exposure.

z Despite the stock on hand, fresh seafood, being of no value to the creditor, valid PPSR registration allowed the AICM Member and CCE to reclaim $18,000 through secured proceeds.

z A personal guarantee enabled recovery of the remaining debt directly from the director.

Lessons from a Real-World Case

Despite a valid PPSR, a creditor faced an unfair preference claim of $38,000. The liquidator argued that since the goods had been sold and the proceeds were no longer traceable, the

company lost its secured status. Additionally, the PMSI registration limited the effectiveness of the PPSR in this scenario, as it provided security only over specific goods rather than broader assets. An All-PAP registration could have potentially offered greater protection by securing a wider range of assets.

A commercial settlement reduced liability to $25,000, underscoring the importance of:

z Maintaining traceable and distinct asset records.

z Understanding the nuances of secured versus unsecured debt in liquidation scenarios.

z Evaluating the potential advantages of broader security registrations, such as an AllPAP.

Conclusion

For credit professionals, managing the risk of preference claims demands diligence, strategic foresight, and collaboration across teams.

Proper onboarding procedures, secured registrations, proactive monitoring, and timely legal advice are the pillars of robust credit risk management. Sharing insights, as demonstrated by AICM members, empowers professionals to mitigate losses and navigate insolvency challenges effectively.

In a volatile economic environment, being prepared isn’t just a safeguard – it’s a necessity.

RISK IDENTIFYING

What lurks beneath – unknown personal liabilities of directors

David McCrostie Partner Turks

Background

The insolvency of customers (and potential customers) are the ever-present spectres the credit professional deals with on a daily basis.

Credit professionals face the unenviable and frankly, almost impossible, task of predicting whether a candidate for credit (or for more credit) is likely to face bankruptcy or another form of insolvency administration at any time during their commercial relationship. Most often that assessment is made once, many years ago, and by a person no longer with the creditor.

Off the back of Covid, members of AICM have wrestled with the effect on their clients of skyrocketing costs of finance, labour, materials, infrastructure and logistics; natural disasters; cyber-attacks/data breaches; the rapid development and deployment of AI and other new technologies; geo-political upheaval and

Mr Tariffs himself. The combined effect of all those things is the greatest level of uncertainty Australian business has seen in decades.

Very few in business enjoy uncertainty. There are those that trade on the opportunity that uncertainty brings, but to the vast majority of SMEs in Australia, uncertainty is not welcome; it is a risk. A risk for those businesses is a risk for the credit suppliers as well.

The risk focus for AICM members

Not only do the factors described earlier apply to AICM members themselves; relevantly to this article, they apply to AICM members’ clients.

The vast majority of those clients are small and micro businesses. The factors listed above are not an exhaustive list of headwinds facing small business, but they all do have the consequence of squeezing cashflow, margins and profitability.

“Credit professionals face the unenviable and frankly, almost impossible, task of predicting whether a candidate for credit (or for more credit) is likely to face bankruptcy or another form of insolvency administration at any time during their commercial relationship.”

“The ATO is reported to have issued tens of thousands of DPNs over the last couple of years, including in relation to historical debt obligations.”

That squeeze, in turn, results in financial distress, trade payment defaults and ultimately, insolvency.

It is sometimes obvious when a creditor’s client is facing financial distress: defaults; payment arrangements, lump sum payments; communications breakdown and so on. Most of AICM’s members are attuned to these indicators of financial strife and act swiftly to ameliorate that risk.

But there is a much less obvious risk to AICM’s members lurking not too far below the surface. The details of this risk are difficult to assess in detail, but they are a clear and present danger to creditors.

In our industry, we are well aware of the focus of the Australian Taxation Office on the recovery of some AUD 50 Billion in debt; two-thirds of which is owed by small business 1

One of the most effective tools in ATO’s kitbag is the Director Penalty Notice (DPN). The ATO is reported to have issued tens of thousands of DPNs over the last couple of years, including in relation to historical debt obligations. Compliance with a DPN can be achieved by payment of the liability; appointing a Voluntary Administrator or a Small Business Restructuring Practitioner; or by commencing winding up the company by the appointment of a liquidator. As we know, the effect of a DPN that is not complied with, is to render a director personally liable for the unpaid tax liability of the company.

Naturally, the surge in the issue of DPNs has resulted in a rapid growth (but perhaps not a tsunami) of corporate insolvencies, per Alex Turner-Cohen at news.com.au.2

Where the unseen risk to trade creditors arises, there is not a corresponding observed or even predicted increase in business related personal

insolvencies. Helpfully, Worrells published this chart in November 20243 based on data harvested from ASIC’s Australian Insolvency Statistics released on 8 October 2024.

So whilst the ATO is driving an increase in corporate insolvencies, there is not a corresponding lift in business related personal insolvencies. Anecdotally, anybody attending the Bankruptcy List in the Federal Courts of Australia, will notice a comparative absence of the ATO as a petitioning creditor for bankruptcy orders compared with its activity in the winding up lists.

It is inconceivable that every DPN issued by the ATO has been complied with. It is just as inconceivable that there are not many thousands of individual taxpayers that have yet to face the ATO in the bankruptcy court.

The day will come (perhaps once the dust has

settled after the next election), where individuals who owe money to the ATO will face their day of reckoning over that debt. Those individuals may now be directors of new corporate customers with whom AICM members have credit accounts and may be guarantors of those new corporate customers.

What is unknown, is that camoflagued beneath a healthy and solidly performing corporate customer, is a human with every digit crossed, hoping the ATO does not shift gears in the personal insolvency space.

What can be done?

It is entirely appropriate in assessing the credit worthiness of a potential customer to ask detailed questions about the tax affairs, not only of the customer itself, but also of those standing behind it and those guaranteeing its performance.

Australian Insolvency Statistics

Released: 24 March 2025 © Australian Securities & Investments Commission

Figures after the dotted line are provisional, refer to INFORMATION SHEET 80: How to interpret ASIC insolvency statistics. Published to the most recently completed month.

Chart 1.1.1: The first time a company enters external administration or has a controller appointed–Appointment type, MONTHLY (All)

To protect themselves, AICM members should look to their credit account terms and conditions and decide if it is prudent to become more “banky” and seek routine covenant reviews that include the tax affairs of the customer and its directors and guarantors.

There will always be things that are unknowable in a commercial relationship; often the expense of seeking to ameliorate a risk outweighs the benefit, having regard to the dollar value of the risk. Indeed, there will also be a surprising number of directors and guarantors that may not even know they have this corporate debt liability.

Forewarned is forearmed and it remains a decision for each business as to how deep they wish to probe into their customers’ financial history and affairs, however when all of the risk is on the supplier providing credit, it feels not unreasonable to ask.

David McCrostie Partner Turks www.turkslegal.com.au

FOOTNOTES:

1 ABC News Online ATO moves to claw back $50 billion in debt, but during a cost-of-living crisis it’s causing turmoil Posted Fri 19 Jul 2024 at 4:50am Friday 19 Jul 2024 at 4:50am, updated Fri 19 Jul 2024 at 12:17pm: https://www.abc.net.au/news/2024-07-19/ato-goodcop-to-bad-cop-to-claw-back-50-billion-in-tax-andsuper/104114212

2 news.com.au Insolvency number spells disaster for Aussies March 28, 2024 – 12:47PM: https://www.news. com.au/finance/business/other-industries/insolvencynumber-spells-disaster-for-aussies/news-story/81ffd69 7b3ce70ab298c5eb5c4fe2b72

3 Worrells On the Pulse Insolvency update: The growth industry nobody asked for 1 November 2024 https:// worrells.net.au/resources/news/insolvency-updategrowth-industry-nobody-asked-for

Credit reporting (Part IIIA) Final review: Here’s everything you need to know

Richard McMahon General Manager – Government & Regulatory Arca

The long-awaited final report of the Review of Australia’s Credit Reporting Framework –commissioned by the government last February – has arrived. The government has indicated it will consult on the review’s recommendations before any future reform agenda is set.

Nonetheless, it’s helpful to understand what the review recommended and how it could disrupt the operation of the credit reporting system. Here, we outline what you need to know, why it matters for your organisation, and the steps you can take to be ready for the next stage of consultation.

Understanding the final review

Part IIIA of the Privacy Act (which covers credit reporting) has been in force since 2014, with the CR Code providing more detailed operational guidance for the industry.

However, this framework has never been comprehensively examined until now. The review, conducted over a compressed sixmonth period, looked at whether the rules governing credit reporting adequately protect consumers and effectively support lenders.

Arca raised concerns that the short timeline limited the depth of analysis and the extent of public consultation. We welcome the government’s intention to consult again. The credit reporting system is vital for Australia’s economic stability, and any changes should be carefully considered.

What could change for credit providers?

The report’s 37 recommendations touch on every corner of Australia’s credit reporting system. While many details remain open for

“The review, conducted over a compressed six-month period, looked at whether the rules governing credit reporting adequately protect consumers and effectively support lenders.”

“The review hints at bringing more data into Australia’s credit reporting system, such as consumer account balances or even government debts.”

further deliberation, here are some proposed shifts that credit providers should watch out for:

Potential replacement of the CR Code

One recommendation calls for scrapping the existing CR Code in favour of more regulation set by the government. History has shown the CR Code is quite flexible – it has been updated eight times since 2014 and has been shaped by industry expertise while overseen by the Office of the Australian Information Commissioner.

By contrast, the government-set regulations have not received regular updates. Therefore,

this proposal could reduce operational flexibility and make it harder for the legal rules to adapt to a changing credit market.

Expansion of available data

The review hints at bringing more data into Australia’s credit reporting system, such as consumer account balances or even government debts. If implemented, this could give lenders a more holistic view of a consumer’s credit profile, leading to better credit decisions and credit management. However, the transition will be important, as changes of this nature involve cost and need a clear understanding of exactly how any new data elements are defined.

Data minimisation principles

The review also sets out some principles that could govern what data gets added to, or removed from, the credit reporting system over time. One principle proposed was data minimisation – which would mean that certain data should not appear on credit reports or should be removed once available elsewhere. Such a principle, while intended to protect consumer privacy, could have wide-ranging consequences for credit managers who consistently rely on credit reporting data to aid decisions and credit management.

Shortening retention periods

The review includes proposals to shorten the time that credit enquiries remain on a consumer’s file (e.g., from five years to two) or adjust the default thresholds. This may affect lenders’ credit assessment strategies and risk models – especially for those only participating at the negative level.

Licensing regimes for credit reporting bodies

Another recommendation is introducing a new licensing regime for credit reporting bodies (CRBs). CRBs are already subject to a myriad of obligations to protect data – including through their contractual relationships with lenders – so further work would be needed to determine the costs and benefits of any new obligations.

“The review also sets out some principles that could govern what data gets added to, or removed from, the credit reporting system over time.”

“There are challenges ahead. Scrapping the existing CR Code and introducing new or revised regulations may result in inflexibility, and require extensive system rewrites and staff retraining.”

Why it matters

Arca welcomes work to modernise Australia’s credit reporting system. However, careful consideration is needed to make sure that any changes are beneficial and support both industry and consumers. And, of course, credit providers must be prepared, as any change would involve substantial compliance and operational adjustments.

All credit providers, including banks, non-bank lenders, and fintechs, are obliged to abide by Part IIIA and the CR Code. Any overhaul of these requirements can have ripple effects on compliance strategies, lending practices, IT systems, and customer engagement.

There are challenges ahead. Scrapping the existing CR Code and introducing new or revised regulations may result in inflexibility, and require extensive system rewrites and staff retraining. Greater governmental oversight could potentially lead to higher fees or levies. There’s a risk that in making the rules more principles-based, inconsistency might flourish, undermining the integrity of the credit system and confusing both lenders and consumers.

Despite these challenges, there are also opportunities. A more comprehensive and modernised framework can promote innovation, streamline data-sharing arrangements, and

“This is the perfect time to consider what a good credit reporting system would look like for your organisation and its customers.”

improve consumer protection, ultimately benefiting lenders who proactively adapt to the evolving landscape.

Take action now

This is the perfect time to consider what a good credit reporting system would look like for your organisation and its customers. That way, when the government consults again, you’ll be ready to put forward information about current pain points, the opportunities for future improvements and the benefits that credit reporting provides.

Don’t wait until you’re facing urgent deadlines or rushed consultations. If you have questions or concerns about the Review of Australia’s Credit Reporting Framework, contact Arca. We’re here

to support you in advocating for, understanding and implementing any forthcoming reforms –helping ensure compliance and the long-term success of your lending operations.

Richard McMahon General Manager – Government & Regulatory Arca E:

info@arca.asn.au

Richard McMahon is the General Manager, Government & Regulatory for Arca. In this role, Richard is responsible for developing industry codes of practice that reflect Arca’s mission to make credit work for all Australians as well as managing relationships with Government stakeholders. Prior to joining Arca, Richard spent over ten years at the Australian Securities and Investments Commission, leading teams working on technical legal and policy issues relating to consumer credit and banking. Richard has also worked at the Commonwealth Treasury on superannuation law reforms and at a boutique funds management company. Richard holds a Bachelor of Laws (with Honours).

NCI insights: Credit risk and stagnation. What NCI’s data is telling us

Kirk Cheesman MICM Group Managing Director NCI

We have been observing for some time two key forces that are simultaneously shaping the outlook for Australian companies: rising insolvencies and slowing sales growth. NCI’s latest internal data, drawn from thousands of clients presents a clear and concerning picture.

The convergence of these two trends is increasing the pressure on businesses to actively manage credit risk and take a cautious approach when it comes to customer assessments.

As claims rise and growth flattens, now is the time for businesses to re-evaluate their credit management practices and protection strategies.

Insolvencies Exceeding Pre-COVID Levels

The first chart below compares ASIC external administration data with NCI’s gross claims from

January 2018 through to January 2025. While insolvency numbers understandably declined through the height of government protections, the rebound has been steady.

By late 2024, the number of companies entering external administration was regularly exceeding 1,200 per month. This trend is not isolated or seasonal.

NCI’s claim volumes have followed suit, confirming a strong and consistent correlation between formal insolvency activity and Trade Credit Insurance (TCI) claims. In 2024 alone, $66.5 million was paid to NCI clients, highlighting the cashflow benefit ensuring Trade Credit Insurance is in place.

While not all company failures are foreseeable, many recent insolvencies have been preceded by signs of stress: slowing payments, lower sales

“As claims rise and growth flattens, now is the time for businesses to re-evaluate their credit management practices and protection strategies.”

“By late 2024, the number of companies entering external administration was regularly exceeding 1,200 per month. This trend is not isolated or seasonal.”

ASIC External Administrations and NCI Claims (2018 - 2024)

Insolvencies trending higher than pre-C19

Strong correlation with TCI claims

$66.5m in TCI claims paid in 2024

and opting to restructure to avoid credit risk. For credit teams, this reinforces the value of early warning systems and the importance of acting decisively when risks emerge.

Sales Growth Slowing Across the Board

NCI’s direct client data shows clear evidence that business turnover is losing momentum. Our second chart, drawn from NCI’s base of approximately 3,500 clients, tracks average estimated turnover growth from Q1 FY23 through to Q2 FY25.

In early FY23, businesses reported sales growth as high as 18% in a single quarter. But by Q2 FY25, average sales growth had dropped to 0% (or more precisely -0.4%). This reflects a broader economic cooling, with softening demand and tighter business conditions all contributing to reduced business activity.

For businesses that rely on trade credit to stimulate sales, this flattening trajectory presents a major challenge. While some industries are more resilient than others, the overall sentiment points to caution, especially when growth and profit margins are no longer providing a buffer against bad debts.

“The rise in insolvencies and claims activity suggests a heightened risk environment, while the concurrent slowdown in turnover growth reduces the capacity of businesses to absorb financial shocks.”

Average Estimated Turnover Growth

Data from NCI’s base of ~3,500 clients from Q1 FY23 to Q2 FY25.

A Critical Juncture for Risk Management

These charts point to a critical juncture for businesses across Australia. The rise in insolvencies and claims activity suggests a heightened risk environment, while the concurrent slowdown in turnover growth reduces the capacity of businesses to absorb financial shocks.

This is where Trade Credit Insurance plays a vital role, not just as a safety net, but as a strategic tool for credit managers and CFOs navigating

uncertain terrain. NCI’s data-backed insights allow businesses to better understand customer behaviour, adjust terms appropriately, and ensure that major exposures are protected.

In addition, businesses should:

z Regularly review and adjust credit limits based on updated financial and trading data along with industry sentiment

z Monitor payment trends closely, especially for long-standing customers

z Leverage credit intelligence to anticipate and respond to stress signals early.

Looking Ahead

As 2025 unfolds, the combination of increasing insolvency activity and stagnant growth will continue to shape the credit landscape. NCI remains committed to providing Australian businesses with the insights, tools and protection they need to trade confidently and protect their cash flow.

Kirk Cheesman MICM Group Managing Director

National Credit Insurance (Brokers) Pty Ltd

E: kirk.cheesman@nci.com.au

T: 1300 654 500 www.nci.com.au

“NCI’s data-backed insights allow businesses to better understand customer behaviour, adjust terms appropriately, and ensure that major exposures are protected.”

Our PEOPLE

Board Members South Australia

Western Australia/ Northern Territory

Queensland New South Wales

Our PEOPLE

Victoria/Tasmania