West Michigan data shows alarming 43% drop

Multifamily housing starts plummeted in West Michigan last year at a rate far worse than national declines, a trend local experts attribute largely to higher borrowing costs.

Data provided to Crain’s Grand Rapids Business by Grand Rapids-based NAI Wisinski Great Lakes showed only 2,925 units of new multifamily housing under construction in West Michigan during the second half of 2023, a 43% drop from the 5,212 units during the same period a year earlier.

NAI’s reports — which are assembled using data from CoStar Group Inc., local public meeting

minutes and media reports — consider multifamily housing starts as developments of ve or more units in the Grand Rapids, Kalamazoo, Battle Creek, Lansing and Lakeshore markets. NAI denes the Lakeshore territory as the Lake Michigan shoreline from Benton Harbor to Muskegon. e local decline in housing

See

on Page 44

Chip Brander sold the 162-yearold Kutsche’s Hardware store last month, but he’s not sure he’ll ever fully adapt to leaving something he’s been involved with since he was 12. e hardware store at 307 Leonard St. NW has roots dating back to the Civil War era and has supplied most of the major West Michigan contractors and con-

struction companies for decades.

It’s the kind of shop where regular customers often stay to catch up with Brander in his o ce, where a black-and-white photo of horses and buggies outside the original downtown storefront hangs on the wall.

As Brander nears the age of 60 and other commitments take up his time, he chose to sell the hardware store and its property to East Grand Rapids resident Max Johnson. e $810,000 property sale between Brander and Johnson closed on Feb. 7, according to property records.

Michael Greengard at Wyoming-based Praxis Business

on Page 44

MANUFACTURING

Component supplier tabs Holland for North American HQ

“Operating coffee shop outposts is just not a primary initiative to support Ferris’ vision and growth trajectory moving forward.”Mark VanTongeren, CEO Ferris Coffee & Nut Co.

Ferris Coffee & Nut Co. is closing its Holland coffee shop and stepping back from operations at two in-store cafes as the family-owned business turns its attention to retail distribution.

CEO Mark VanTongeren confirmed Ferris Coffee plans to close its Holland cafe at 57 E. 8th St. on March 23 after a decade in business. The space has served as a coffee shop for the past 30 years, previously operating as JP’s Coffee.

shops to boosting retail sales in 2024.

The decision comes as the business pivots from operating coffee

“We are growing pretty significantly and with that growth, we’ve had to say ‘no’ to certain areas of our business that have been historical to us or have helped us get there,” said VanTongeren. “Operating coffee shop outposts is just not a primary initiative to support Ferris’ vision and growth trajectory moving forward.”

VanTongeren said the company “wrestled internally” with the decision not to renew its lease at the

Holland location.

“It was a difficult decision, but it was made with confidence,” he told Crain’s Grand Rapids Business. “It’s been a privilege to be part of the Holland community in this capacity for the last 10 years.”

VanTongeren, the second-generation owner who was appointed to lead the company a year ago, said the closure is part of Ferris Coffee’s plan to grow its packaged products business.

“It’s been a really nice location for Ferris, it’s been a profitable location,” he said. “It’s been a great

By Mark SanchezCorewell Health plans to transform a sprawling former General Motors manufacturing site into an $80 million service center that will support operations statewide.

The health system acquired the northern 40 acres of the vacant 75-acre site at 300 36th St. in Wyoming for $6.6 million in December, according to property records. The project is located on the south side of 36th Street at Buchanan Avenue and just east of U.S. 131.

The 295,515-square-foot service center would house supply chain offices, a courier fleet, document and mail services, and 36,000 square feet of shelled space for future use. Corewell Health will build a non-motorized trail along Buchanan Avenue and provide an easement to the city. WOOD-TV8 first reported the project on Feb. 23.

“The proposed industrial development will increase the economic strength of Wyoming’s economy with new construction jobs for the estimated $80 million development as well as new employment in the facility once constructed,” City of Wyoming planning staff wrote in a memo to planning commissioners that recommended site plan approval.

The property, known as Site 36, has been vacant since 2009 after GM ceased production at the plant, which dated back to 1936.

See COREWELL on Page 45 See COFFEE on Page 44

Michigan should continue to add jobs over the next two years and avoid an economic downturn.

That’s that latest assessment on the state’s economy in an updated outlook from the University of Michigan.

“We remain cautiously optimistic about Michigan’s economic trajectory over the next two years, judging that an ongoing decline in interest rates coupled with a growing national economy should help

Michigan to navigate through the wobbles in the auto industry,” economists from the UM Research Seminar for Quantitative Economics wrote in an updated state outlook they issued this month.

“We believe that Michigan is nearing a roughly neutral point in the economic cycle,” they wrote. “We expect economic growth to slow down from the pace we have seen recently, but we project that the state will avoid a downturn over the next two years.”

UM economists project that the

state will add 37,900 payroll jobs this year as “weak growth at the end of 2023 holds down calendar year growth in 2024,” and then add another 57,500 jobs in 2025.

The projected employment growth would increase jobs in the state to 2.2% above the pre-pandemic level by the end of 2025. Still, the “relatively upbeat forecast” leaves Michigan about 3.4% below the state’s payroll employment peak in the second quarter of 2000.

Frank Patis still can’t believe the house he grew up admiring from the sidewalk every day is now his to love and preserve in perpetuity.

Along with his wife, Melissa Patis, Frank bought the Irving Andrew and Olive Crane Kendall Dean House, better known as May ower Place, for $395,000 in 2018 from previous owners Brenda Pawl and the late Dr. Lawrence Pawl.

e Michigan State Historic Preservation O ce announced Feb. 7 that the four-bedroom home built on Grand Rapids’ west side in 1911 was one of 19 properties successfully listed on the National Register of Historic Places last year.

e designation came on July 20, after the Patises spent about a year working on the application.

Frank Patis, a nurse at Edison Christian Health Center just a few blocks from the house, said he’s been fascinated by May ower Place since his childhood in the Westside Connection neighborhood where it sits. He used to walk past it every day on his way to school, and said it’s still “hard to believe” that he owns it now.

“I (toured) the house when I was 16 in high school, and I thought, ‘Boy, this would be nice to live here.’ And then like 50 years later, here we are,” he said.

State Historic Preservation Ocer Ryan Schumaker said the home earned its spot on the Register for its unicorn status among homes built during the period.

“ e bulk of the justi cation for the nomination was based on the unique blend of the Classical Revival style and Arts and Crafts-style Foursquare,” he said. “ at was part of the consideration and part of the narrative for it being elevated to the National Register.”

e home is only the sixth single-family dwelling in Grand Rapids that’s not in a historic district to be added to the National Register.

e others are the Mathias J. Alten House and Studio listed in 2009; the President Gerald R. Ford Jr. Boyhood Home in 1995; the Augustus Paddock House that houses Mangiamo in 1985; and the Eliphalet H. Turner House and Abram W. Pike House in 1970.

An ‘unusual combination’

e home was nicknamed Mayower Place because original owner Olive Dean’s ancestors sailed to America on the Mayower in 1620. Proud of her heritage, she had architect Frank Payne Allen include a single ceramic tile in the home’s living room replace depicting the ship. e tile and red brick Craftsman

surround has survived at least a half-dozen ownership changes since 1911.

e Patises hired historians Valerie van Heest and William Lafferty, of Holland-based La erty van Heest & Associates, to gather information on the house and apply for the historic designation.

As they wrote in their application, the house presents one face to the world and another to those who step inside.

e exterior is in keeping with the Classical Revival style, “with a centered portico supported by paired Corinthian columns, symmetrical fenestration and (a) broken pediment front door surround,” they wrote.

But the interior is “ nished in simple woodwork, with panel doors and built-in cabinetry” aligning with the tenets of the Arts and Crafts movement that ourished in the U.S. and Europe between 1880 and 1920.

“ e house, in its unusual combination of exterior and interior design approaches, outwardly re ects the reverence the Deans held for their colonial ancestors while inwardly re ects a dominant form of interior design of the period,” van Veest and La erty wrote.

e e ect is a place that awes passersby but is cozy and practical for its inhabitants.

“ is may not be surprising considering who the Deans were, an upper middle-class couple who may have considered such an interior appropriate as private and entertaining space for their station in life, especially so in Grand Rapids,” which was home to so many Arts and Crafts-style furniture designers and manufacturers, they said in the National Register application.

Olive and Irving Dean married in 1883, according to van Heest and La erty. He worked as an accountant for the Grand Rapids and Indiana Railroad until opening his own accounting rm in 1908. Like so many others in Grand Rapids, Olive Dean came from a family of furniture makers. She also was an active member of the Daughters of the American Revolution.

Olive inherited half of her brother’s estate in 1910, enabling them to hire Allen to design May ower Place. Allen was primarily a commercial architect, though he did publish a popular catalog of house plans in the 1890s, and he later designed the Felt Mansion in Laketown Township near Saugatuck, which was listed on the National Register in 1996.

e Deans never had children, and Irving died in 1927. According

to former homeowner Brenda Pawl, when Olive died in 1929, she left the home not to a relative, but to a neighbor.

“When Mrs. Dean took ill, her neighbor, Mrs. (Leonard J.) Ritzema took care of her. And it was my understanding that the house was deeded to her family because of that,” Pawl said.

Leonard Ritzema was then owner of the former Ritzema Department Store. ough further details are murky, the house appears to have changed hands a couple more times until the late Dr. Lawrence Pawl, former medical director of Hospice Grand Rapids (later absorbed by Hospice of Michigan), bought it in 1993.

He married Brenda Pawl at the house in January 1996, and they happily spent the next 22 years there.

Pawl said she felt an instant connection to the place. “ at property is so sacred, it’s so special,” she said, noting that the gated driveway opens onto 2.5 acres that feel “magical” and private, despite being located along busy Leonard Street. at’s partly because the Deans, who were globetrotters, brought home nonnative trees and plants from all over the world to create a lush, sheltered oasis surrounding the house.

During her years at May ower Place, Pawl cared for the gardens and installed a seven-circuit agstone labyrinth in the yard that she walked as part of her mindfulness practice. She also kept beehives onsite.

As her husband’s heart condition worsened, and he could no longer

climb stairs, they were forced to sell.

Enter Frank and Melissa Patis. ey were about to buy another home, but when the longtime west side residents heard May ower Place was on the market, they pivoted to buy Frank’s dream home.

Dr. Pawl, who went by Larry, was a history lover until his death in 2020, and he wanted to make sure May ower Place would go to someone who would promise to preserve the home as he and Brenda had.

“We wrote a letter when we were trying to buy the house about why we liked the house, and he picked our letter because he knew that we would care about the property as he did,” Frank Patis said.

e Patises and Brenda Pawl were grateful the Deans left behind a photo album in the house that documents their travels and sheds light on who they were. Previous owners also passed along the two framed black-and-white portraits of Irving and Olive that hang in the front stairway, and Allen’s original blueprints for the home.

Many of the original features remain, like the woodwork, hardwood oors, doors, panels, built-in cabinets, replace, and stainedglass windows.

“What makes it special is the design, the architecture outside, with the Greek Revival pillars and the stucco (sheathed exterior), and if you go inside the home, there’s a lot of Arts and Crafts woodwork,” Frank Patis said.

His favorite room is the entryway, which features the main staircase with an oak “swirl” newel and original railed banister that continues up to a landing and a second set of stairs and curves around a second- oor hallway that overlooks the lower oor.

Both the Patises and Pawl love that the main staircase is one of two.

“ e back stairs area was fun when kids and the grandkids would come over — they would run all the way up the front steps and then they’d run down through the back stairway, where there’s a dumbwaiter,” Pawl said.

Melissa Patis, who’s a graphic designer for Meijer Inc., said her favorite part of the home is the dining room, which has a built-in, nearly oor-to-ceiling canted china cabinet and a small butler’s pantry that connects the dining room to the kitchen.

“I keep my arts and crafts supplies there,” she said. “And then we also have a couple of stained glass windows that are pretty: upstairs, one in the bathroom, and then one that’s in the front of the house.”

Schumaker, at the State Historic Preservation O ce, said getting a home listed on the National Register is an “honori c designation” that does not come with any requirements for preservation of speci c elements, unlike for homes that are located in historic districts like Grand Rapids’ Heritage Hill, Cherry Hill, Fairmount Square, Wealthy eatre and Heartside.

South Korean manufacturer LT Precision Co. Ltd. plans to invest $43.2 million to establish its North American headquarters in Holland and build new manufacturing operations.

With the investment, the manufacturer specializing in producing battery cooling plates for U.S. electric vehicle makers expects to create 70 new jobs, according to a statement from Gov. Gretchen Whitmer’s office.

The company’s LT Precision Michigan subsidiary will receive a $700,000 performance-based Business Development Program grant from the Michigan Economic Development Corp., according to a statement.

The company purchased the 10acre site at 1776 Airport Court a year ago for more than $9.1 million, according to property records. The property currently includes 136,000 square feet of industrial facilities.

Established in South Korea in 1993, LT Precision produces machinery and components for both electric and internal combustion engine vehicles.

“This investment will build on our strength as the destination for growing companies in the battery and future mobility sectors,” Whitmer said in a statement.

With the move into North America, LT Precision is stepping into manufacturing and sales in the

U.S. for the first time. The Holland location will serve as the company’s hub for manufacturing and corporate offices in the U.S.

According to its website, the company is a supplier to LG Chem.

In addition to a Michigan Business Development grant, the city of Holland has offered a property tax abatement in support of the manufacturing project.

“The new facility is a great example of the economic spin-off created from existing manufacturers making business-to-business transactions,” Mark Meyers, Holland’s director of community and neighborhood services, said in a statement. “The capital investment, and more importantly job creation, is significant.”

As it enters the new market, LT Precision is seeking contracts with U.S. battery manufacturers to produce cooling plates for electric ve-

hicle batteries.

According to a statement, the company chose Michigan over potential locations in Indiana and Ohio because of the state’s proximity to its existing customer base.

LT Precision’s announcement comes amid a surge in electric vehicle manufacturing projects in Holland in recent months.

In December, metro-Detroit-based ATC Drivetrain announced it would invest $7.9 million to build a new electric vehicle-focused facility in Holland. The new, 170,000-square-foot expansion would add up to 163 jobs in Holland over the next five years as the company consolidated operations to the area. The move is supported by a $2 million Michigan Business Development Program performance-based grant.

As well, South Korea-based LG Energy Solution’s $1.7 billion ex-

pansion is currently underway in Holland. The project, first announced in 2022, adds roughly 1.7 million square feet to its existing manufacturing campus in Holland off East 48th Street, a move that will create approximately 1,000 new jobs.

In August, Roger Traboulay, project manager at LG Energy Solution Michigan, told local developers that the company was “seriously considering” making the site LG’s North American headquarters.

Soon after, the company announced that it was investing an additional $3 billion in the project

to supply Toyota Motor North America Inc. with lithium-ion battery modules for electric vehicles. LG said it will establish new production lines for battery cells and modules dedicated to Toyota, starting production at the Holland plant in 2025.

“The region’s advanced energy storage cluster continues to grow and thrive,” Jennifer Owens, president of Lakeshore Advantage Corp., said in a statement. “Having LT Precision join our ecosystem will not only create good jobs and investment, but also enhance our cluster’s innovation, productivity, and competitiveness.”

A large return on investments boosted Corewell Health’s 2023 bottom line to nearly $1 billion.

The nonprofit health system recorded $992.8 million in total net income last year, an annual result that came mostly from $822 million in investment income, according to a 2023 audited financial statement posted online.

Outside of investments, Corewell Health recorded an improved $190.7 million in net operating income, an amount that included $18.5 million in state and federal pandemic-relief funding. The operating income came on $15.15 billion in total operating revenue.

The operating result equated to a 1.3% operating margin last year, a slight improvement over the 1.1% operating margin in 2022. The 2023 margin percentage came from the $157.8 million in net operating income that Corewell Health generated on $13.8 billion in total operating revenues across all business units, as well as $106 million in state and federal assistance.

The 2023 results point to improved financial performance for

Corewell Health coming out of the pandemic. Higher costs for labor and supplies led to slim or negative operating margins for many hospitals and health systems. As 2023 went on, operating margins began to stabilize and improve nationally.

“I’m happy that we were able to achieve a 1.3% operating margin in an environment where many other organizations did not end the year positively. This measure is slightly above where we ended in 2022. I’m also very pleased with our investment returns, essentially making up for losses in 2022” that totaled $815 million, Corewell

ability and value will be critical to success in 2024 and beyond.”

In 2023, the care delivery side of Corewell Health generated $8.27

“Corewell Health is proud of its results for 2023 but recognizes that continued focus on operational excellence, affordability and value will be critical to success in 2024 and beyond.”

Matt Cox, Corewell Health CFO

Health CFO Matt Cox wrote in an email to Crain’s Grand Rapids Business. “Corewell Health is proud of its results for 2023 but recognizes that continued focus on operational excellence, afford-

billion in patient revenue. Premium revenue from insurance company Priority Health generated $6.48 billion. Another $398.9 million came from other income that put the health system’s total oper-

ating revenue at $15.15 billion last year, a 9.7% increase over 2022.

Care delivery generated $88.1 million in operating income and Priority Health had operating income of $17.9 million. Another $66.2 million in operating income came from Corewell Health’s corporate shared services unit that supports administrative functions.

Cox attributes the improved operating results and revenue growth in 2023 to higher patient volumes and membership growth at the 1.3-million-member Priority Health. The improved performance came despite higher cost pressures for labor, supplies, equipment and medications that “continue to grow at rates higher than our revenues” and persist in

2024, Cox said. Higher utilization rates at Priority Health also drove medical claims higher.

“We have a plan to improve again in 2024. The headwinds are continuing, with higher prices from suppliers and drug manufacturers and continued wage pressure,” he said. “We are focused on investing in our amazing team members, nurses and physicians, and our facilities to provide access to care and our technology to ensure we offer convenient access to health and information. We are also investing in our community to be even more proactive and helpful in enabling people to be healthy.”

Corewell Health invests earnings back into the business, mainly for what Cox called “facility and technology enhancements” that include more neighborhood outpatient physician practices, inhome care and digital health connectivity.

Crain’s Grand Rapids Business reported in February how the largest in-state health system in Michigan has been investing to buildout a wider outpatient care footprint in the Grand Rapids area. The health system also is pursuing the development of an $80 million service center at the site of a former General Motors manufacturing plant in Wyoming.

County land banks across West and Southwest Michigan plan to use millions of dollars in recent state funding to prepare blighted properties for redevelopment, including former schools that could be converted into housing.

e Michigan Department of Labor and Economic Opportunity (LEO) last month awarded more than $30 million in grants from the State Land Bank Authority to 13 counties and the city of Detroit to rehabilitate blighted properties. Nearly half of the funds are supporting housing-related projects.

is was the fourth and nal round of grants in the state- and federally-funded Blight Elimination Program, which LEO designed to help “disproportionately impacted communities” prepare vacant properties for redevelopment.

Land banks in Muskegon, Manistee, Calhoun and Van Buren counties were among the latest grant recipients.

“Given the need in (our) county and statewide, we want to make sure that we’re addressing (residential properties), especially given the age of our housing in Muskegon,” said Tim Burgess, Muskegon County Land Bank Authority coordinator.

e program has so far injected more than $100 million into projects across the state, according to LEO data.

e rst two rounds committed state budget funding to the e ort between fall 2022 and summer 2023. Rounds three and four,

awarded in September 2023 then in February, were funded with American Rescue Plan Act dollars that must be committed by the end of 2024 and spent by 2026.

Eligible activities for the funding include demolition or stabilization of publicly or privately owned structures, as well as environmental remediation or rehabilitation.

ough the grant program guidelines do not require the funds be spent on housing-related projects, according to the state, about $14 million is being used for that purpose in round four.

Susan Corbin, director of LEO and chair of the State Land Bank board of directors, said in a statement that the funding represents “the culmination of a historic contribution to land banking and blight elimination that will make a real di erence” in revitalizing communities.

Muskegon County efforts

e Muskegon County Land Bank Authority holds about 327 properties countywide that it typically acquired through foreclosure, and many of the properties are blighted, Burgess said.

e land bank was awarded about $1.83 million across two grants in round four of the Blight Elimination Program, in addition to $200,000 from round one and $2.5 million from round three.

Burgess said the funds from round one were dedicated mostly to demolition and stabilization for a couple of land bank properties in the county, while round three will

be spent “almost exclusively” on rehabilitation of residential properties, primarily in the cities of Muskegon and Muskegon Heights, to get those land bank-owned parcels back onto the market.

e rehab process will include lead and asbestos remediation as well as steps to improve the energy e ciency of the homes, he said.

“We don’t want to put lipstick on a pig,” he said. “We want to make sure these homes are generationally safe.”

For round four, the Muskegon County Land Bank is serving as the conduit for funds that will go toward two projects not led by the land bank.

e rst is $1.4 million toward the rehabilitation of the 94-yearold Froebel School at 417 Jackson Ave. in Muskegon into 46 low-income apartments by Samaritas, a project the nonpro t developer proposed last summer. e Mus-

the former Kennedy School, located at 610 E. Parkdale Ave. in Manistee Township, which closed in 2011. East Lansing-based RT Group III LLC plans about 280 market-rate apartments at the old school, Nelson said.

“ at’s a super exciting project,” she said. “ ey would have done the project, but it would have impacted those rent costs in the long run. Being able to fund something like this, and take that cost right o the top, just helps keep that rent down and helps with more a ordable housing in our community.”

kegon City Commission approved the sale of the school, which has been vacant for 20 years, to Samaritas for $1,000 last October, pending receipt of Low-Income Housing Tax Credits that have not yet been awarded.

“Froebel is a neat project because it’s got so many cool old architectural features to it, it’s an old Spanish-mission style school, and we’re hoping that can be preserved as best as it can,” Burgess said.

e second grant from round four is $440,000 that will go toward demolishing a 60,000-square-foot former factory and warehouse at 1367 W. Sherman Blvd. that’s owned by the city of Roosevelt Park. e industrial facility sits on 7 acres at Sherman and Glenside boulevards. Burgess said that’s a large chunk of unused land for the 1-square-mile municipality.

e property went up for sale last year, and the city issued a request for proposals to develop it, but was stymied by the cost of demolishing the building. Burgess said now that the cost of taking down the building is covered, it puts all options on the table, whether for housing, commercial or mixed-use.

e Manistee County Land Bank Authority has now received a little more than $3 million in blight program funding, including about $1.85 million in the most recent round.

e county land bank holds relatively few properties but is able to pass the funding on to private property owners for their blight elimination projects, said county treasurer and land bank authority board chair Rachel Nelson.

e latest funding round will support two projects in Manistee County.

Property owner Josh Compeau will demolish an old storage building at 518 First St. in Manistee’s central business district to build housing. Kevin Schae er, founder of Clover Real Estate Investments LLC, will stabilize a long-vacant commercial building he owns at 141 Washington St., north of the Manistee River. Pending receipt of state tax incentives, Schae er plans to convert 141 Washington into a mixed-use project with 15 apartments, according to media reports last fall.

Meanwhile, a previous funding round will pay for demolition of

Round two grants also will support demolition of the former Disabled American Veterans building at 305 First St. in Manistee.

Southwest Michigan

e land banks in Van Buren County, which borders Kalamazoo County to the west, and Calhoun County, which abuts it to the east, also received grant funding through the Blight Elimination Program.

For Calhoun County, where Ford Motor Co. is planning an electric vehicle battery plant in Marshall that’s expected to add 1,700 jobs, local o cials say the funding will provide crucial predevelopment support for several projects that could add housing.

Calhoun County received three separate grants totaling nearly $3 million in round four, which comes on top of $2.7 million awarded in previous funding rounds.

Krista Trout-Edwards, executive director of the Calhoun County Land Bank Authority, said that the grants will fund six rehabilitation projects, primarily single-family homes and one duplex, as well as three stabilization projects for mixed-use properties in Battle Creek and Albion. e remaining dollars will be used for demolition and preparing properties for future development in Albion, Battle Creek and the village of Tekonsha.

ose three municipalities are all within a 20-minute commute of the planned Marshall battery plant.

Trout-Edwards added that all of the projects, which could total a couple dozen housing units between single-family, duplex and mixed-use multifamily projects, will be targeted to residents making 80% to 120% of the area median income for Calhoun County. at was $61,040 to $91,560 for a four-person household in 2023, according to the U.S. Department of Housing and Urban Development.

e largest number of units could be built at the former Austin School in Albion, which has been vacant since 1979 and will be stabilized with a blight grant. Trout-Edwards said the building could potentially contain at least 15 residential units.

e Calhoun County Land Bank owns about 700 properties, “pretty much all” of which are blighted, Trout-Edwards said. at number is nearly half what it was in recent years, as the county has gradually sold o the land to developers, and fewer properties are entering the land bank because of fewer foreclosures.

Wolverine World Wide Inc. is permanently laying off 150 workers as it closes its Kentucky distribution center this spring, the latest move in a months-long turnaround plan to boost the company’s profitability.

Wolverine had completed the sale of the Kentucky warehouse on Dec. 28, 2023, company executives disclosed during a company update.

Hufnagel

The Rockford-based marketer and licenser of footwear and apparel disclosed the layoffs at its warehouse at 6001 Cane Run Road in Louisville through a recent Worker Adjustment and Retraining Notification (WARN) Act filing with the state of Kentucky.

According to the notice, the en-

The property sale generated $23 million in cash during the fourth quarter of 2023, part of a total of $250 million in cash the company generated during the full fiscal year through a series of transactions.

The company at the time said it would continue operations for Saucony and Sperry at the Kentucky distribution center under a lease agreement. Weeks later, Wolverine sold the Sperry brand to Authentic Brands Group Inc. for roughly $130 million.

“Wolverine World Wide is a much different company now than it was just six months ago.”

Chris Hufnagel, Wolverine World Wide CEO

tire operation will close permanently with employee separations expected to start around May 3. A company spokesperson could not be reached for comment.

Wolverine currently operates other U.S. distribution centers in Howard City, Mich., and Beaumont, Calif.

The news of the Kentucky closure came less than a week after Wolverine reported its fourth-quarter and fullyear earnings for 2023.

Company executives in a call with analysts highlighted efforts made over the past year as part of a company “turnaround,” which has included a series of divestitures, layoffs, office consoli-

dations and leadership changes in 2023.

“Wolverine World Wide is a much different company now than it was just six months ago,” CEO Chris Hufnagel said during the call. “As we begin 2024, our portfolio is more focused than it has been in over a decade. … Our business is poised to be much more profitable.”

Executives are aiming for an anticipated 44.5% adjusted gross margin in 2024, which would be a record-high for the company.

“We’re in the late innings of the

stabilization phase of the company’s turnaround,” CFO Mike Stornant said during the call, noting $140 million in anticipated profit improvement in 2024.

Wolverine’s total 2023 revenue dipped to $2.24 billion, a 16.5% drop from $2.68 billion a year earlier. Following the series of divestitures, the company is projecting $1.7 billion to $1.75 billion in revenue for 2024, a 13.4% decline.

Wolverine’s ongoing transformation plan has involved other recent layoffs. In November, Wolverine announced that a “global

workforce restructuring” was underway, though it was unclear how many employees or which areas of the business were affected.

Other recent actions aimed at turning around the company include the sale of Keds to Designer Brands Inc. in February 2023; the sale of the U.S. Wolverine Leathers business to New Balance in August 2023; and the exit from a joint venture for Merrell and Saucony in China along with the Asiabased leathers business sale in December 2023.

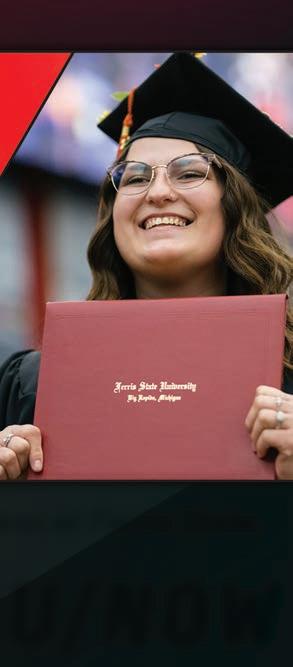

A new Grand Valley State University initiative aims to make post-secondary education more accessible for adults in Michigan.

The university’s new Omni learning model is designed to enhance flexibility for adult learners by combining online learning with in-person instruction available at regional GVSU campuses or locations in Holland, Traverse City, Jackson, Battle Creek and Detroit.

The idea is to boost the career potential for the 2.5 million Michigan adults who don’t have a post-secondary degree or credential, according to GVSU officials. Enrollment is scheduled to begin this spring.

GVSU President Philomena Mantella told Crain’s Grand Rapids Business that the idea behind the program surfaced around the time she joined GVSU in 2019. The university has been working to put the pieces in place over the last few years.

“Understanding our program assets, understanding our structures, getting through the pandemic — all of that got us to a place of launching GVSU Omni, which in fact takes our good work that’s done right now today with adult learners and expands and extends that to thousands more,” Mantella said.

Kara Van Dam, who joined the university’s leadership team in 2021 and previously served as GVSU’s vice provost for graduate and lifetime learning, will lead the new Omni initiative.

Van Dam has more than two decades of experience in adult post-secondary education from

the University of Maryland Global Campus and Kaplan University (now Purdue Global).

“We know that post-secondary education is the surest path out of poverty … and we know that 71 out of our 83 counties (in Michigan) don’t have a four-year public institution,” Van Dam said. “Part of what we’re trying to do is close that gap and bring the education to those learners across the state.”

The Omni model allows learners to choose how they pursue their education with options for fully online, hybrid or in-person from various regional campuses or partner locations across the state.

Van Dam said GVSU is intentionally seeking partners and community leaders in each region

dent and CEO of the W.K. Kellogg Foundation, said in a statement. “Opportunities like these are crucial to move our communities toward becoming more equitable places of opportunity, and also help parents better support their children so they can thrive.”

Going forward, GVSU will explore ways to expand the regional network across Michigan “and maybe beyond,” Van Dam said. The university also is looking for additional investors as well as more state support to help move toward more competency-based education based on adult learners’ capabilities.

GVSU already has started recruiting for noncredit programs with Omni and will expand to more degree programs this fall.

“When we look at our work of helping our community members get to the careers that are most successful for them, training and education is one of the key factors in helping them be successful.”

Angie Barksdale, COO at West Michigan Works!

to help understand the unique demographics and labor market needs and tailor Omni offerings accordingly.

One such regional partner is the W.K. Kellogg Foundation, which is supporting the Omni initiative at GVSU’s Battle Creek campus.

“The needs of Michigan’s workforce demand bold solutions,” La June Montgomery Tabron, presi-

Van Dam noted that Omni is not meant to compete with the university’s more traditional residential model but is intentional about removing barriers of access for students who aren’t completing a degree directly after high school.

“This is really going to serve students who haven’t been able to take advantage of a Grand Valley education because of some of their other life circumstances that have nothing to do with their capability to learn,” she said.

The need for flexible adult education pathways is widespread, including in West Michigan.

Regional workforce development agency West Michigan Works! recently released its 2024 Hot Jobs report outlining in-demand careers in Kent, Ottawa, Allegan, Muskegon, Montcalm, Ionia and Barry counties.

Angie Barksdale, COO at West Michigan Works!, noted that most of the 100-plus occupations outlined in the report require some form of post-secondary education, often a credential or certificate but sometimes a bachelor’s degree or higher.

“When we look at our work of helping our community members get to the careers that are most successful for them, training and education is one of the key factors in helping them be successful,” Barksdale said.

With adult learners who aren’t completing a degree immediately after high school, Barksdale noted that common barriers tend to involve work-life balance with juggling school and a full-time job in order to pay for rent or mortgages, as well as managing child care and family life.

For Barksdale, programs like Omni are often most successful when intentional flexibility is offered.

“Not every individual is adept at

doing things fully online — some need that in-person (learning),” she said. “I think the most successful programs are offering options for individuals based on their learning needs and the situation they’re in.”

Both Mantella and Barksdale pointed to Gov. Gretchen Whitmer’s Sixty by 30 goal, which was announced in 2019, of increasing the percentage of Michigan adults with postsecondary degrees or certificates to 60% by 2030.

Key elements of that initiative include closing the skills gap as more jobs and sectors demand increased training and providing greater access to the education for that training.

“We have big aspirations. We really want to see (Omni) serve the full stay in a way that meaningfully moves us forward in our Sixty by 30 goals,” Mantella said.

For Barksdale, programs like Omni are important not only for the adult learners but also for communities.

“Any opportunity to innovate and provide opportunities for individuals and a non-traditional way is important, and we as a community need to continue to look into those things to provide those opportunities,” Barksdale said.

An online degree program that Davenport University will launch in the fall aims to raise the talent pool of people who are bilingual and help more Latino students earn a college education.

The Casa Latina program will offer a dozen undergraduate and graduate degrees online that are taught in English one week and in Spanish the next week.

Latinos represent the fastest-growing demographic in the U.S. “but the least represented in higher education, and you know who’s at fault? Higher education.

Because we haven’t responded,” Davenport President Richard Pappas said.

“It is us changing for their needs,” Pappas said. “Often, universities say, ‘Well, come and adapt to our culture, to what we do.’ And what we said is, ‘What is the culture that would be most successful for you?’ That’s what we’ve been changing.”

Through Casa Latina, Davenport

University wants to erase a gap in college attainment rates between Hispanics and Latinos and their white counterparts, Pappas said. He cites data that shows 37% of white/non-Hispanic adults aged 25 and older hold an undergraduate degree or higher. That compares to 18% of Hispanics and Latinos.

In creating the program, Davenport University found that research shows that Latinos generally face three main barriers to a college education: finances, a feeling “that their English was not good enough,” and that “higher ed was not for them,” said Executive Director Carlos Sanchez.

“They didn’t see themselves in higher ed,” Sanchez said. “Out of that, we set out to develop Casa Latina.”

Casa Latina will offer scholarships of $9,200 for full-time undergraduate students and $5,000 for graduate students. Part-time students can receive pro-rated scholarships.

Davenport University also will offer all student-support services bilingually, Sanchez said. “So, the students can actually choose the way they want to be served,” he said. “Rather than us inviting Latinos to come to Davenport University and adapt to the way we teach, we are adapting to the way the Latino community speaks.”

The university has so far secured $2.7 million in contributions to

support the program financially.

That includes contributions from the Community Foundation for Southeast Michigan, the M.E. Davenport Foundation, Daniel and Pamella DeVos Foundation, Frey Foundation, Steelcase Foundation, and Steve and Tana Wessell.

Davenport University prepares to launch Casa Latina as the nation’s Latino population grows rapidly. The U.S. Census Bureau in 2021 reported that the nation had a

Hispanic or Latino population of 62.1 million people in 2020, a 23% increase from 2010.

“As we think of the future of talent, as we think of a regional economy, as we think of getting the next generation of Latino business owners and Latino entrepreneurs prepared, this program that Davenport University has put together is going to be a gamechanger, not just to this region but to our state and, hopefully, we’ll show what can be done at the national level,” said Guillermo Cisneros, president and CEO of the West Michigan Hispanic Chamber of Commerce. “As we continue to see our economic growth, we need to make sure that we continue to invest in organizations and schools and institutions like Davenport University that are setting that standard and are setting the foundation for the future in this region.”

Davenport University has about 5,000 students enrolled online and at campuses near Grand Rapids, Kalamazoo, Lansing and Detroit.

• For the mid-career, experienced leader

• Elevate your thinking to a strategic mindset

• Every other weekend classroom commitment

• Ideal for the early career, emerging leader

• Gain advanced business thinking

• Weekly evening classes

www.gvsu.edu/seidmangrad

Ten Grand Rapids Public Schools buildings are expected to close in the next five years, presenting potential housing redevelopment opportunities on nearly 132 acres across the city.

The Grand Rapids Public Schools Board of Education voted in late 2023 to shutter the 10 schools over the next five years.

The first two schools, East Leonard Elementary and Stocking Elementary, are set to come offline at the end of the current 2023-2024 school year.

Closing nearly a quarter of the district’s schools is part of consolidation, restructuring and improvements under the Reimagine GRPS plan, which is supported by a $305 million school bond that voters passed in November 2023.

The school district is holding community meetings for feedback on the closures and to let families affected by the closures know what schools their children will attend in the future.

District officials also are in the early stages of envisioning how these properties could be repurposed. GRPS currently operates 67 buildings, which includes 47 schools, that total roughly 4 mil-

them, Hendrix said.

“It’s a bit of a tight rope we’re walking here,” he said.

The next phase will involve gathering input from neighbors of East Leonard Elementary and Stocking Elementary schools on what they want the properties to look like, said Luke Stier, project manager for the Reimagine GRPS plan.

“Right now we’ve been focused on taking care of the scholars,” Stier said. “That’s the focus, but as we move into the spring we’ll be engaging the neighborhood more on the properties and what they want to see there.”

While the targeted feedback sessions on the properties haven’t started, neighbors are already discussing what they want to see happen.

Gregg Hampshire, executive director of the Creston Neighborhood Association on the city’s north side, said while it’s sad to see some of the schools close, the consolidation paves the way for more efficient uses of GRPS property.

“Most of the feedback (in the Creston Neighborhood) is about the sadness of the closure of Palmer (Elementary),” Hampshire said. “It’s one of our (English as a Second Language) schools that works really closely with our refugee population.

“We’ve certainly heard from people who know about the housing crisis in our city and know if there is a way to make more affordable housing in these buildings, that could be a huge addition to our community.”Luke Stier, project manager for the Reimagine GRPS plan

lion square feet of facility space.

Part of the decision-making behind closing schools — and which locations should be shuttered — was based on enrollment declines as well as the age and condition of buildings, said Leon Hendrix, executive director of communications and external affairs for GRPS.

“There is a lot of interest in the property,” Hendrix said. “GRPS is the second-largest landowner in the city, only second to the city itself. It’s been the position of (district) leadership and the school board to really want to take time and make decisions with a longterm lens and make sure we’re making decisions in the best interest of our community and the GRPS district.”

However, district leaders also feel a “sense of urgency” to determine the future of the properties based on the cost of maintaining

Grand Rapids to stabilize the housing market. However, GRPS enrollment is declining for a variety of reasons, Hendrix said. The proliferation of charter schools and declining birth rates are also among contributing factors, he said.

As for the closing schools, district leadership has stated a preference for maintaining ownership of the properties in case of future expansion needs, though redevelopment of the properties is an option as well.

“I think everything is on the table,” Hendrix said.

The 132 acres of school properties present as many redevelopment opportunities as they do challenges, several Grand Rapids developers and multifamily investment experts told Crain’s Grand Rapids Business. Despite the hurdles, the development community will certainly be interested in the properties’ potential based on the low inventory of developable land in the city.

Palmer is also a very popular school because of its walkability, so that is a loss.”

Recurring comments so far have included desires to convert some of the closed schools into affordable housing, and retaining some of the playgrounds and greenspace for continued community use, Stier said.

“We’ve certainly heard from people who know about the housing crisis in our city and know if there is a way to make more affordable housing in these buildings, that could be a huge addition to our community,” Stier said.

In fact, Grand Rapids’ lack of affordable housing options has driven some families out of the city and into the suburbs, Hendrix said.

“Finding an affordable place to live in Grand Rapids for young families has been an issue for some time,” Hendrix said. “That has driven the boom of the suburbs, and people who may have traditionally chosen to live in the city are living outside of the city. That’s drawing scholars away.”

A Kent County Housing Needs assessment shows 34,699 more housing units will be needed in the county by 2027, and 14,106 units will be needed in the city of

Housing developments are especially hard to pencil out right now, unless they are Class A projects rented out at a high price point, according to multifamily housing experts at NAI Wisinski of West Michigan. Even if it isn’t affordable housing that goes on the school properties, communities might be accepting of the projects if the alternative is demolishing the buildings.

“The real struggle with most of those buildings is the interior block wall,” said Scott Nurski, senior director of multifamily investment for NAI Wisinski of West Michigan. “You run into structural issues, and the cost and time to remove them. There is a certain point where it’s no longer cost effective to try to use the shell.”

Still, former school properties are attractive because of their location, Nurski said.

“It’s hard to get good infill locations, and some of these schools do have a good amount of acreage,” Nurski said. “There is an efficiency of gaining a site with bulk on the land side when you’re trying to do infill neighborhood redevelopment.”

Leaders at Dwelling Place and ICCF Community Homes both expressed interest in redeveloping the properties. Both nonprofit housing developers have taken on school-to-housing conversions before and are uniquely qualified to take on these types of developments, said Ryan VerWys, CEO of ICCF Community Homes.

“There is nothing wrong with for-profit developers that worry about the bottom line,” VerWys said. “But the reason we say ‘yes’ sometimes when some other developers might say ‘no’ is because there is more here than just the bottom line. Going the extra mile

with community buildings like old schools, sometimes it’s the right thing to do and that is not cost-effective.”

With projects like redeveloping school buildings, many neighbors feel a sense of ownership of the building, VerWys added.

“Change, even good change that we know we need like more housing, can be scary,” VerWys said. “We really need our community to be open to a future for these buildings that still serves the community. It just serves it differently.”

Other challenges with redeveloping historic school buildings include the need for abatements and extra measures to preserve historic elements. As well, extra-wide hallways are harder to keep warm or cool depending on the season, VerWys said.

In general, schools are well-adapted for housing conversions, said Dwelling Place CEO Jeremy DeRoo, who echoed VerWys on the importance of involving the community in projects.

“Schools have been major parts of social infrastructure as well as physical assets in neighborhoods, so it’s important to recognize the park space and open space they provide and potential for neighbors to get to know each other many times in the buildings,” DeRoo said. “The city has a high need for housing developments across the economic spectrum and limited opportunities for redeveloping large-scale housing projects. This really is a unique opportunity for the school district to achieve social impact through long-term assets.”

Kettering equipped me to succeed faster than my peers at other schools. It tested me academically and pushed me to turn aspirations into tangible achievements.

VARUN RALLABANDI ‘25

MAJOR: Computer Science

CO-OP: Lab2Fab, Fremont, CA

ORGANIZATIONS: Vice President Student Government, Phi Delta Theta Fraternity, Robot Honor Society

ACHIEVEMENTS: Two provisional patents

Not everyone splits their time between cutting-edge research in Michigan and high-level strategy sessions in California. Not everyone patents robotic solutions for household brands and pitches their ideas to CEOs — before they graduate. But Bulldogs do — because their Kettering experience is like no other.

A federal judge’s ruling against a law that requires businesses to report their ownership to the government has limited application for now.

The March 1 ruling by Judge Liles Burke of the U.S. District Court of the Northern District of Alabama that the Corporate Transparency Act was unconstitutional applies only to the roughly 65,000 members of the National Small Business Association that brought the case challenging the law.

That means businesses that are not members of the trade association should proceed as they already would have and file forms disclosing their ownerships to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network, or FinCEN. The U.S. Small Business Administration reports nearly 33.2 million small businesses in the country.

“How does this (ruling) impact your business? In short, not much. The court issued a permanent injunction barring enforcement of the CTA only for the parties named in the lawsuit,” Honigman LLP attorneys wrote in a legal briefing to clients. “The injunction does not prohibit the federal government from enforcing the law against other parties, including the ongoing collection of beneficial ownership information from entities that are subject to reporting requirements under the CTA.”

Judge Burke gave the federal government 60 days to appeal his

ruling, which remains in effect unless an appellate court issues a stay.

Seth Ashby, a partner at Varnum LLP in Grand Rapids who leads the law firm’s task force on the Corporate Transparency Act, expects an appeal and for the case ultimately go get decided by the U.S. Supreme Court.

Until then, “everyone should probably take a deep breath because there’s a long road ahead,” said Ashby, who previously said the Corporate Transparency Act ushered in a “sea change” by requiring most businesses to disclose their ownership.

“And we’re waiting for Treasury or the Department of Justice to, hopefully, come out with some sort of guidance as to their view of this decision and its strategy going forward,” Ashby said. “We

wouldn’t advise companies that are bumping up against their deadline not to file based on this ruling because it only applies to a limited set of businesses.”

For now, and unless they are a member of the National Small Business Association, businesses that were required to file disclosure documents with FinCEN “should proceed and still file,” Ashby said. “The CTA still applies to you.”

The bipartisan Corporate Transparency Act that Congress enacted in 2021 and took effect Jan. 1 targets illegal activities such as using shell companies for money laundering, terrorist financing and tax fraud. The law requires legal business entities registered with a state to report their beneficial owners to FinCEN.

The law defines beneficial ownership as anyone who has an ownership interest of 25% or more in a business, a majority of voting ownership, or someone who exerts “substantial control” over the entity, such as executives, senior officers and board directors — even if they do not hold an ownership stake in the company.

FinCEN, in a notice posted online March 4, said it was not enforcing the law against the plaintiffs who brought the case and the National Small Business Association members, and “will comply with the court’s order for as long as it remains in effect.”

“Those individuals and entities are not required to report beneficial ownership information to FinCEN at this time,” the agency said.

In a 53-page ruling issued March 1 that declared the law as exceeding the Constitution’s limits on the ability of Congress to regulate commerce, Judge Burke cited the late Supreme Court Justice Antonin Scalia, who once remarked that “federal judges should have a rubber stamp that says, ‘Stupid But Constitutional.’”

“The Constitution, in other words, does not allow judges to strike down a law merely because it is burdensome, foolish, or offensive. Yet the inverse is also true — the wisdom of a policy is no guarantee of its constitutionality. Indeed, even in the pursuit of sensible and praiseworthy ends, Congress sometimes enacts smart laws that violate the Con-

stitution. This case, which concerns the constitutionality of the Corporate Transparency Act, illustrates that principle,” Judge Burke wrote in his ruling. “The Corporate Transparency Act is unconstitutional because it cannot be justified as an exercise of Congress’ enumerated powers.”

Under the law, a company created or registered to do business prior to Jan. 1, 2024, has until Dec. 31 to file an initial beneficial ownership information report with FinCEN through an online portal.

A company created or registered on or after Jan. 1, 2024, and before Jan. 1, 2025, has 90 days to file from the date when it receives notice from the state that its registration is effective. Companies formed or registered on or after Jan. 1, 2025, will have 30 days to file an initial report to FinCEN.

The 65,000-member National Small Business Association, which brought the case on behalf of a small business owner in Huntsville, Ala., praised the ruling as a “victory for law-abiding small-business owners across the U.S. who would have been forced to disclose their sensitive personal information to a government database.”

“The CTA has from the very beginning been poor policy that unfairly targets America’s small businesses,” association President and CEO Todd McCraken said in a statement. “This ruling justifies the concerns of millions of American businesses about how the CTA is not only a bureaucratic overreach, but a Constitutional infringement.”

A long-dormant lakeshore beer brand is coming back to life thanks to a new production agreement with Muskegon’s Pigeon Hill Brewing Co.

The yet-to-open Muskegon Brewing Co. will occupy space at the $250 million mixed-use Adelaide Pointe project that broke ground last spring on 32 acres fronting Muskegon Lake.

Ibex Hospitality Group, founded by Adelaide Pointe developer Dr. Emily Leestma, is spearheading the revival of Muskegon Brewing Co., which previously closed in 1957 after 80 years in business.

Grand Rapids Business. “It was such an integral part (of the community). It was a big source of commerce here and it was also a stopover for people and really brought a lot of hospitality to Muskegon.”

While no one owned the rights to the Muskegon Brewing name, Leestma contacted the grandsons of the company founders before launching her project. She said they “gave their blessing” and expressed excitement for her plans to bring the brewery back to life after more than 60 years.

The company announced it has inked a deal with Pigeon Hill to contract brew beers for the Muskegon Brewing restaurant and bar, which Leestma expects to open sometime in June. The site is adjacent to the former Muskegon Brewing facility and will celebrate the brand’s history, she said.

“We thought it’d be very cool to pay homage to the site and to the history of Muskegon and bring back the Muskegon Brewing Company name,” Leestma told Crain’s

Although Ibex Hospitality wanted to revive the brewery name, the company realized early on that it wanted to partner with another producer to brew the beer, which led to conversations with the owners of Pigeon Hill.

“They’re really the best in town,” Leestma said.

Michael Brower, co-owner of Pigeon Hill and a self-proclaimed “history nut,” said he has been intrigued by the legacy of Muskegon Brewing Co., having collected many historic items from the brewery’s heyday. At one time,

Brower even planned to open a business under the brand, going so far as to register the name.

When Leestma approached him about the project, Brower realized it “presented a real opportunity for the revival of the name,” and agreed that Pigeon Hill would take on the role of brewer for the gastropub.

Pigeon Hill will produce a range of classic and modern styles, including a lager, blonde ale, west coast IPA, hazy IPA, saison, fruit beer and wheat beer, all of which will be packaged under the Muskegon Brewing Co. brand.

While Brower owns an old brewing log from the original

Muskegon Brewing Co., he has no plans to resurrect any of the recipes from the old brewery since ingredient types and processes have changed significantly since the company was originally brewing.

“The main guiding principle won’t be ‘historic accuracy’ because just as the recipes brewed by the historic breweries in Muskegon changed to match people’s taste preferences, we have to focus on making good beer that people will be excited to drink,” he said. “Our focus will be brewing up beers that are approachable and drinkable.”

When the restaurant and bar

opens, Muskegon Brewing Co. will seat 250 people and offer a view of Muskegon Lake. The focal point of the restaurant will be its 42-seat curved bar that extends between the 5,500-square-foot restaurant and the 2,700-square-foot patio.

Leestma, who also owns local-favorite Bear Lake Tavern in North Muskegon, is developing a gastropub-style menu that she hopes will “elevate the local dining scene,” bringing in new food vendors and dishes while remaining approachable. She said the food will be “to-go friendly” to cater to boaters during the summer months.

Adelaide Pointe also includes a 55-unit condo building, retail and event space, a 125-room hotel, public fishing pier and marina. The development aims to contribute to waterfront commerce in Muskegon, a focal point for Leestma.

“Muskegon has some of the most beautiful waterfront in the entire state with three lakes that are all interconnected,” she said. “If you’re a boater, there’s tons of lakes to boat around, but there’s no place in Muskegon to really stop. Boaters like to have destinations, so I saw an opportunity there.”

At Calvin University, you can dream bigger. Think deeper. Aim higher. Our world-class faculty push students to keep asking hard questions and never settle for the status quo. Become part of a university that challenges students to go beyond – as Christ’s agents of renewal in the world.

Gotion Inc.’s plan for a $2.4 billion battery manufacturing project near Big Rapids has taken another step forward.

The company formally submitted a site plan to Mecosta County planners for the project that includes plans for four large buildings, reduced estimates for water withdrawals and attempts to limit onsite traffic congestion. The proposed plan also includes 60 protected acres for wildlife habitat preservation.

The sprawling project would be built in two phases and calls for four 800,000-square-foot buildings, parking lots, an electric substation, a nitrogen and equipment storage area, and stormwater ponds, per a site plan drawing. The proposal also indicates that discussions are ongoing with DTE Energy and Consumers Energy for utility services.

Paul Bullock, Mecosta County’s administrator and controller, said the site plan is expected to go before the planning commission during a special meeting on May 1.

Bullock told Crain’s Grand Rapids that the project will be “handled like any other application” with review by building and zoning department staff before it’s forwarded to the planning commission for review.

“It’ll be normal course of business — it’s just the scope that’s unusual,” Bullock said.

Annette Coles, Mecosta County’s building and zoning director, confirmed the site plan was received. She said the application “is looking very promising” in terms of the necessary information provided by Gotion.

The planning commission’s decision will likely take place at the May 1 meeting, she said.

Among recent changes to the proposal is a reduction in the anticipated amount of water usage expected at the factory, which had been estimated at 700,000 gallons per day. The new amount now will be “significantly decreased,” according to a news release.

“We’re building a state-of-theart facility in Mecosta County that will nestle into the existing landscape and protect the environment for generations to come,” Chuck Thelen, Gotion’s vice president for North American operations, said in a statement.

Thelen was not immediately available for an interview.

Gotion also aims to limit traffic congestion near the plant by creating an onsite truck and trailer staging area to accommodate at least 50% of anticipated daily traffic.

Other key elements of the site plan include a “dark sky design” to limit light from the factory and plans to recycle raw materials and by-product from manufacturing the cathode and anode materials for electric vehicle and energy storage battery cells.

The site plan application comes after Gotion last month began cutting trees on the 120-acre plot in Green Township where the battery plant would be built.

Thelen also told Crain’s last month that the company was preparing “very comprehensive permit requests for the project involving construction as well as environmental reviews.

He said local permits are still needed from Mecosta County and the county drain commissioner related to construction on the buildings. Additionally, air and water quality permits will be needed from state and federal regulators, including the Michigan Department of Environment, Great Lakes, and Energy (EGLE) and the U.S. Environmental Protection Agency.

The project’s potential environmental effects have been a lingering concern among local opponents, in addition to criticism about Gotion’s parent company’s ties to the Chinese Communist party.

In 2023, a local opposition group threatened to sue the company over concerns involving the plant’s potential effect on endangered species as well as groundwater, given the project’s proximity to the Muskegon River.

While Mecosta County’s consideration of the plans will involve opportunity for public comment, Coles noted that the plant is “an allowable use by right” based on the property’s industrial zoning. Any opposition to the project presented to the board must pertain to the

New Holland Brewing Co. is further expanding along the lakeshore with plans for a new spirits tasting room in downtown Grand Haven.

zoning ordinance or any local, federal or state laws.

“It has to be something valid for an individual to advise the board that (Gotion is) not meeting those requirements,” Coles said. “Otherwise it is a use by right and they will be able to build their plant.”

Thelen previously said Gotion had been working with EGLE for about 16 months and completed site surveys. A report on the environmental condition of the site will be submitted along with the permit requests, he said.

“Gotion’s environmental and safety record is unmatched, and our mission to protect and preserve the environment is woven into every aspect of the design process,” Thelen said in the statement. “As a lifelong conservationist myself, this is not only a key company requirement but a personal requirement.”

Gotion also is seeking a soil erosion and sedimentation control permit through the Mecosta County drain commission.

Meanwhile, the company recently acquired office space in downtown Big Rapids at a former JCPenney department store, where executives hope to have 55 employees working by the end of this year.

Thelen said he also hopes construction on the factory will break ground this year.

“Based on the result of the permit process, as soon as that is done, we will break ground,” Thelen said last month. “I’m hoping, optimistically, that will be the end of summer, but it could be early fall.”

The new 1,300-square-foot bar will be located in the lobby of the former Grand Theatre that was built in 1928 and now includes apartments. The project would join other New Holland lakeshore locations in Saugatuck and South Haven, as well as its flagship bar in downtown Holland.

The historic former theater located at 24 S. Washington Ave. was an enticing location for New Holland CEO and founder Brett VanderKamp.

“The community holds (the Grand Theatre) dear, and we’re just thrilled to be able to continue the legacy that that place has for being a place for community and gathering,” VanderKamp said.

The Grand Haven spirits tasting room will seat roughly 40 guests and will employ 10 people. In addition to a range of cocktails and tasting flights, the location also will offer small charcuterie plates. Only the company’s line of spirits will be available at the location.

The space also will include a retail area with bottled spirits and New Holland merchandise, and additional plans call for an outdoor seating area in warmer months.

New Holland will make some additions to the street-facing space beneath the marquee, including a walk-up window to offer grab-and-go beverages as part of Grand Haven’s social district.

However, VanderKamp plans “minimal modifications” to help preserve the historic nature of the property.

“The physical bar space has al-

ready been carved out there, and so there were a lot of things that we wanted to be really careful to preserve,” he said.

The building plans were “a little bit different than our other tasting room locations where we could kind of create a space from scratch,” VanderKamp said, adding that “it’s just really cool (to have) built-in features already that have been working for years.”

In addition to preserving the decades-old bar, the brewery also plans to resurrect an old aquarium behind the bar.

“Our plan is to maintain as much of the character and charm of the space while still introducing the New Holland Brewing Company’s brand to the community,” Dave White, New Holland’s vice president of development and facilities, said in a statement.

The new location follows the opening of the New Holland Spirits’ South Haven tasting room in 2022. The company also added a full taproom in Battle Creek a year ago.

VanderKamp said the Grand Haven location is part of New Holland’s strategy to build out tasting rooms on the Michigan lakeshore, where communities with a solid tourism base and an engaged downtown draw in customers.

“We’re just getting better at building (taprooms) out and kind of have the framework now. We know how to do everything from the decor to the feel,” he said, adding that he anticipates building more tasting rooms in the coming years.

The Grand Haven project will be built-out by New Holland’s internal team, with architecture by Holland-based J. Andrew Baer. VanderKamp anticipates the tasting room will be open by Memorial Day.

You’re an individual who is truly unique. We celebrate the passions that drive you and the possibilities that inspire you. Here, a degree is a pursuit of purpose where learning empowers you, well-being strengthens you and an experience-driven education leads to a meaningful career.

Western is the place to become your best self.

A real estate investment and property management firm is partnering with a local nonprofit on an “innovative” idea to move chronically unhoused individuals off the streets of downtown Grand Rapids and into a new temporary shelter on the city’s east side.

An entity tied to Grand Rapids-based Eenhoorn LLC bought the vacant Van Andel Pavilion at the former Fulton Manor campus, located at 1450 E. Fulton St. in the city’s Eastown neighborhood, from an affiliate of Hope Network on Feb. 16 for just under $1 million, according to Eenhoorn CEO Paulus Heule.

Eenhoorn then donated the property and the funds to renovate the building to the Grand Rapids-based nonprofit Community Rebuilders.

When completed, the rehabilitated building will house the Nexus Initiative, a housing and social service facility run by Community Rebuilders that will be able to house 42 individuals at a time who are emerging from homelessness, Heule said. The project also has received an undisclosed amount of

funding support from the DeVos family for ongoing operating costs.

The renovations are scheduled to begin this month and take six months to complete, with plans to populate the building by late fall. The project received administrative approval from the city late last year.

Heule said the partners’ “innovative” idea is meant to help reduce the number of chronically unhoused people in downtown.

“In downtown Grand Rapids, there are a lot of homeless people, but really only (about) 100 chronically,” he said. “So if we are able to house 40 of them, hopefully that will have a somewhat material impact on the problem, at least for the time being.”

Eenhoorn’s plan for the building includes 42 fully furnished “micro apartments” to house one person each.

Each apartment will include a kitchenette, bathroom, and living and sleeping quarters, situated around two central courtyards. The design of the building is expected to minimize disturbance to the community and to be more energy efficient and sustainable.

Grand Rapids-based TRU Build-

ing is the contractor for the renovations, and Keith Carey Design, also of Grand Rapids, is handling exterior design.

The housing will be provided rent-free to residents, although those with an income may be asked to contribute a nominal sum if they plan to stay long term.

Eenhoorn and Community Rebuilders said they are working collectively to secure funding for the annual operating budget for the facility from local foundations and government agencies. So far, they have a commitment of an undisclosed sum from the DeVos Family Foundation through its Facing Home Initiative, as well as funding from an anonymous corporation.

A DeVos family spokesperson could not immediately be reached for comment.

Ryan Kilpatrick, a contractor for the DeVos Family Foundation through his consulting firm Flywheel Community Development, told Crain’s Grand Rapids Business in January that the foundation was working on a partnership with Community Rebuilders to address homelessness through the DeVoses’ Facing Home Initiative that involved rehousing of chronically

homeless individuals.

“In exploring this issue with some of the (Grand Rapids Coalition to End Homelessness) service providers, what we found was, as of last spring, there were 113 individuals who were categorized as chronically homeless, and from the Family Foundation perspective, that felt like a number that we could make a serious dent in, if not eliminate in a very short period of time with targeted investments,” he said at the time.

Vera Beech, executive director of Community Rebuilders, said the goal will be for each individual to exit the facility with stable housing.

“We will work with individuals to create a housing plan for their

long-term housing stability and have a really individualized approach,” she said.

During tenants’ stays, Community Rebuilders will provide a range of services, from access to health care, employment services, transportation and food security, depending on each person’s needs, Beech said.

Hope Network bought the former Fulton Manor property from Holland Home in September 2021 for $4.1 million and is currently building 118 low-income apartments there in a project called Eastpointe Commons. Holland Home, a nonprofit providing endof-life care and housing, had owned the property since 1912.

Perrigo Co. plc expects to introduce the first oral contraceptive available in the U.S. without a physician’s prescription by mid-March, even as it prepares to reduce its workforce by 6% under a restructuring initiative.

The company has “activation plans” in place to promote and drive consumer awareness of Opill at retail stores and for online sales when it goes to market, said President and CEO Patrick Lockwood-Taylor.

“We expect Opill to be available to consumers in-store and online within a few weeks,” Lockwood-Taylor said during a Feb. 27 conference call to discuss Perrigo’s latest quarterly results. “You’ll find it in every store, and you’ll find it everywhere online.”

The U.S. Food and Drug Administration last July approved Opill’s conversion for over-the-counter sale. When introduced in early 2024, Opill will become the first birth control pill available in the U.S without a prescription.

In preparing for one of the largest product launches in the company’s history, the maker of over-thecounter medications envisions Opill becoming a core product in its women’s health division.

“We view Opill as a key pillar to

our growing women’s health care business. Perrigo intends to be a global leader in women’s health, and believe we have the core portfolio and personnel to implement this strategy,” Lockwood-Taylor said. “This is by far the most revolutionary and holistic product launch in the history of Perrigo and will be a benchmark for future branded launches.”

Perrigo (NYSE: PRGO), which is domiciled in Dublin, Ireland, and operated from Grand Rapids, expects consumers switching from a prescription birth control to account for half of Opill’s initial sales.