GLOBAL MIAMI

APRIL / MAY 2024

THE TRILLION DOLLAR ASSET MANAGER PLANTS ITS FLAG PLUS THE 2024 ANNUAL TRADE REPORT

TRADE & INVESTMENT WITH CHILE

INVESTMENT, INNOVATION & TRADE

Baptist Health Miami Cardiac & Vascular Institute

APRIL / MAY 2024

THE TRILLION DOLLAR ASSET MANAGER PLANTS ITS FLAG PLUS THE 2024 ANNUAL TRADE REPORT

TRADE & INVESTMENT WITH CHILE

INVESTMENT, INNOVATION & TRADE

Baptist Health Miami Cardiac & Vascular Institute

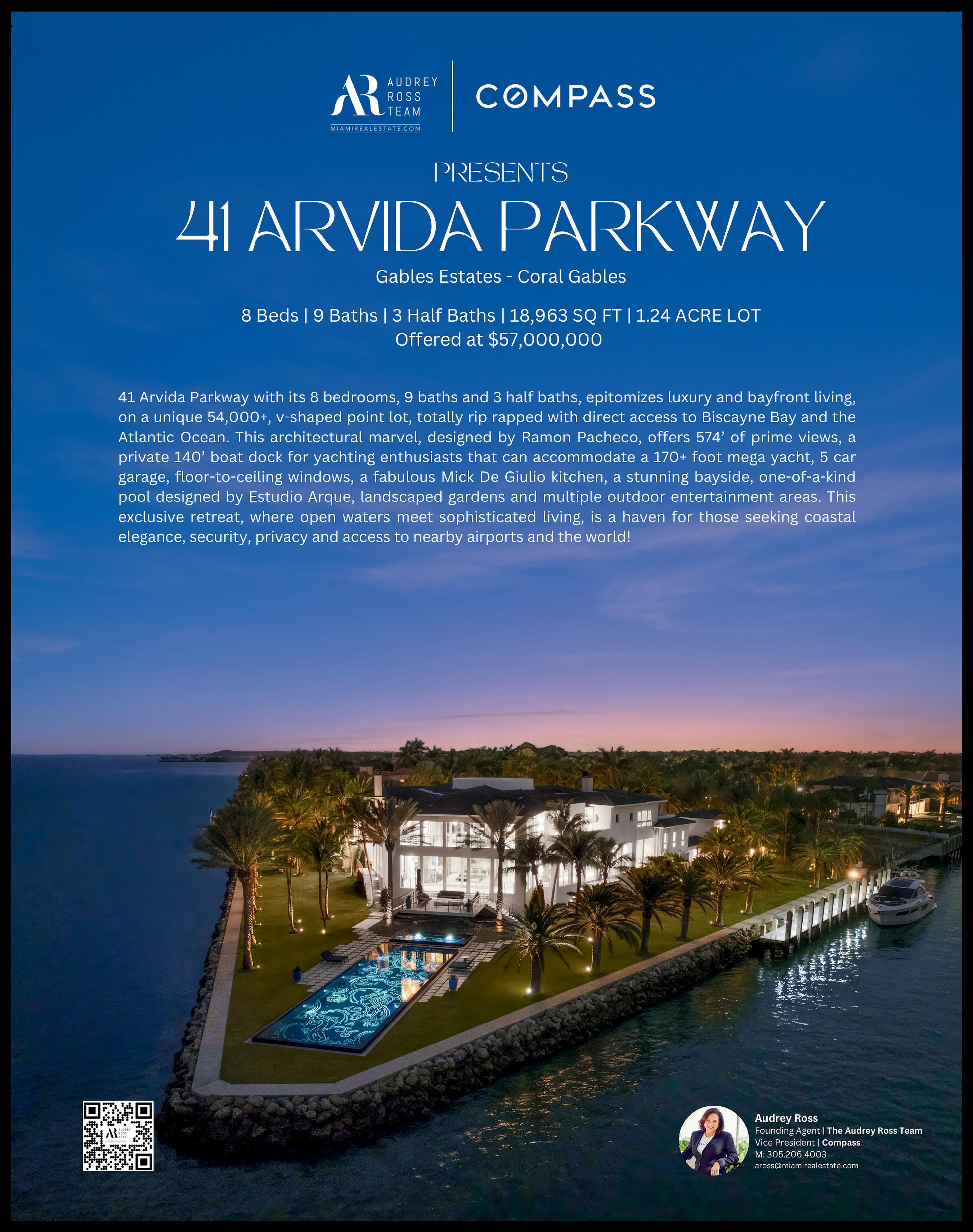

From its humble beginnings in 1987 in two small rooms tucked behind the Baptist Hospital Emergency Center to developing technologies and treatments that have changed the course of cardiovascular medicine worldwide, Baptist Health Miami Cardiac & Vascular Institute is primed for its next move to expand and elevate cardiovascular services.

Spearheading the ambitious growth initiative is the Institute’s new leader, Tom C. Nguyen, M.D., FACS, FACC. In his role as chief medical executive and Barry T. Katzen Endowed Chair of Baptist Health Miami Cardiac & Vascular Institute, where he is also the director of Minimally Invasive Valve Surgery, Dr. Nguyen plans to focus on research and innovation with patient-centered care at the Institute’s core.

Miami Cardiac & Vascular Institute, whose experts have pioneered many innovative and less invasive cardiovascular procedures, recently opened a new cardiovascular care office that includes a dedicated arrhythmia center, the first of its kind in South Florida and one of the few in the U.S. Building upon the Institute’s strong foundation, Dr. Nguyen will continue to strengthen teams that will enable the launch of other new programs such as robotic heart surgery.

“To best serve the needs of the community and make Miami Cardiac & Vascular Institute the crown jewel of South Florida and beyond, we will be exploring new services and recruiting the best cardiothoracic surgeons and other specialists from around the world,” he says.

Tom C. Nguyen, M.D., FACS, FACC

With a passion for minimally invasive surgery and for treating valvular heart disease, Dr. Nguyen has spent more than 20 years researching the mitral valve and has published more than 300 peerreviewed articles. He comes to South Florida from the University of California San Francisco (UCSF), where he was chief of cardiothoracic surgery and the Charles Schwab Distinguished Professor of Surgery. While at UCSF, he transformed the cardiothoracic surgery program as co-director of its Heart and Vascular Center.

Growing up, Dr. Nguyen never imagined he’d be an internationally recognized cardiothoracic surgeon. A political refugee whose family fled Vietnam when he was only 4, he believes life is about opportunities, second chances and paying it forward. His experience left him vowing to always fight for the underdog and the sickest of the sick, particularly when patients are told that they have no options left.

“Everyone deserves a second chance,” he says. “When my dad and older sister and I came to Houston, we spoke no English. We were very poor and lived on rice, eggs and soy sauce,” he recalls.

At a young age, Dr. Nguyen realized that their close-knit community cared deeply for each other. Neighborhood “nannies” stepped in to watch children while parents worked. Helping hands were never far away. From this, he became aware that his success was not his own doing but was the result of support systems, luck and many mentors.

Dr. Nguyen graduated from Rice University with honors in economics and then attended the Johns Hopkins University School of Medicine. He completed a general surgery residency at Stanford University, a cardiothoracic surgery fellowship at Columbia Presbyterian and a transcatheter aortic valve replacement (TAVR) fellowship at Emory University. As an innovative heart surgeon, he has performed many first-in-man operations.

“I had the chance to go back to Vietnam for the first time after I completed medical school,” he says. “One morning at the crack of dawn, I saw a young man working tirelessly on a shrimping boat. We were about the same age. I wasn’t stronger or smarter. I was just luckier.”

Because of its complexities and challenges, cardiac surgery was of particular interest to Dr. Nguyen. “I can zone out and get laser-focused,” he explains. “There are at least 100 critical steps in heart surgery with small margins of error. You need to be composed in the most

chaotic environment. Everyone has a role, and every person is vital to the team. You can’t be duplicating efforts. If we work together as a team, we are unstoppable.”

He and his wife, interventional radiologist Gina Landinez, M.D., are the parents of two young girls. As someone who is keenly aware of women’s contributions to society, he is an active advocate for diversity, equity and inclusion.

The stories of hardship and the obstacles overcome by many immigrants and marginalized people resonate with Dr. Nguyen and give him special reason to appreciate the diversity of South Florida and that of his patients and their families.

“My experience shaped me as a doctor,” he says. “It’s a privilege and an honor to care for patients who have put all of their trust in you. When a patient comes back to me and says, ‘I’ve gone fishing again,’ or ‘Here’s a picture of me hiking,’ that is amazing. Getting them back to their families is magical.”

For more information, visit BaptistHealth.net/Heart

South Florida’s premier tech event, eMerge Americas, drew 24,000 people from 50-plus countries April 18-19, made healthcare and medtech a 2024 priority.

Just before the pandemic, alternative investment giant Blackstone concluded that Miami would be a perfect fit for a second HQ. The move, led by Managing Director and Technology Officer Josh Schertzer, helped transform the city.

THE 2024 TRADE REPORT

World Trade declined last year, but the Miami Customs District did not experience a similar downtrend. Instead, the combined air and seaports of South Florida exhibited resilience and sustained growth in 2023, albeit slender.

Trade and investment between Chile and U.S. continue to grow as the Free Trade Agreement between them enters a third decade. Since the signing of the FTA, bilateral trade in goods and services between the U.S. and Chile has increased by fivefold, reaching nearly $49 billion last year.

Our cover story this month is about the arrival of Blackstone, a cutting-edge alternative investment company that is symbolic of the New Miami. Our other stories are also reflections of how the city has become the darling of high technology and global interconnectivity. It is truly astonishing what is happening in Greater Miami today. It is, however, important to step back and understand how we got here. It’s always interesting to see how individual events can eventually create major consequences.

Today we are reaping huge benefits from the decisions and hard work of a handful of individuals who had the vision, talent, political and business clout – and yes, the money – to turn South Florida from a tourist destination and retirement “village” into what has become a powerhouse of trade, finance, innovation, and investment. This metamorphosis didn’t happen overnight but rather over decades of determined efforts, combining the strengths of the public and private sectors. It started in the ’60s and the ’70s, was reinforced in the ’80s and matured in the ’90s. Years ago, yes. But we wouldn’t have the economic success we enjoy today if not for those beginning steps.

Consider this. Cuba is taken over by Fidel Castro in the 1960s. The “first wave” of Cubans migrate to Miami. Consequence? That makes us a bi-lingual city, putting us on the road to pan-hemispheric trade.

After the influx from Cuba, a brilliant mayor, Maurice Ferré, has the vision that Miami can become a global city and the gateway to the Americas. In the 1970s he creates a team: Carmen Lunetta at the seaport, Dick Judy at the airport, Roy Kenzie at the DDA, and Charlotte Gallogly at the Office for International Development (which the mayor also created). His instructions were to make it happen.

In parallel to the creation of the international “A” team, another major event occurs, which at the outset seemed perilous to the economy. Eastern Airlines, the largest private sector employer at the time with 25,000 jobs, goes bankrupt. Consequence? American Airlines buys the Eastern routes into the Americas.

American brings in a remarkable head of the Americas Division, Peter Dolara, who had the vision, tenacity, and the managerial skills to make it work at a remarkable level of success. Miami International is now the hub for American Airlines and the dominant player for Latin American connectivity. While the above is happening, another unique opportunity develops, stemming from The Edge Act of 1919. This allows national banks to engage in international banking through subsidiaries chartered by the Federal Reserve System. In short, in the 1980s there was a huge expansion in Miami of foreign banks. Consequence? It created the “Wall Street” of Miami – Brickell Avenue – which, for a period, housed more international banks than Los Angeles. We now had the capability to handle international finance at a level unpresented in the history of Miami.

So, years ago, individual events conspired to develop an economic foundation by creating the “economic engines” that make Miami and South Florida the Gateway to the Americas – as it is called today. Planning. Determination. A bit of luck. Disparate successes conflating to produce one of the most successful environments for trade, investment, and global business. One thing does lead to another, sometimes with amazing results.

RICHARD ROFFMAN PUBLISHER GLOBAL MIAMI MAGAZINE

RICHARD ROFFMAN PUBLISHER GLOBAL MIAMI MAGAZINE

PUBLISHER

Richard Roffman

EDITOR-IN-CHIEF

J.P. Faber

ASSOCIATE PUBLISHER

Gail Feldman

SENIOR VICE PRESIDENT INTERNATIONAL

Manny Mencia

DIRECTOR OF OPERATIONS

Monica Del Carpio-Raucci

SALES AND PARTNERSHIPS

Sherry Adams

Amy Donner

Andrew Kardonski Gail Scott

MANAGING EDITOR

Kylie Wang

ASSOCIATE EDITOR

Yousra Benkirane

WRITERS

Karen-Janine Cohen

Andrew Gayle

Doreen Hemlock

Joe Mann

Harriet Mays Powell

Katelin Stecz

ART DIRECTOR

Jon Braeley

PHOTOGRAPHERS

Rodolfo Benitez

Jonathan Dann Tiege Dolly

PRODUCTION DIRECTOR

Toni Kirkland

CIRCULATION & DISTRIBUTION

CircIntel

BOARD OF ADVISORS

Ivan Barrios, World Trade Center Miami

Ralph Cutié, Miami International Airport

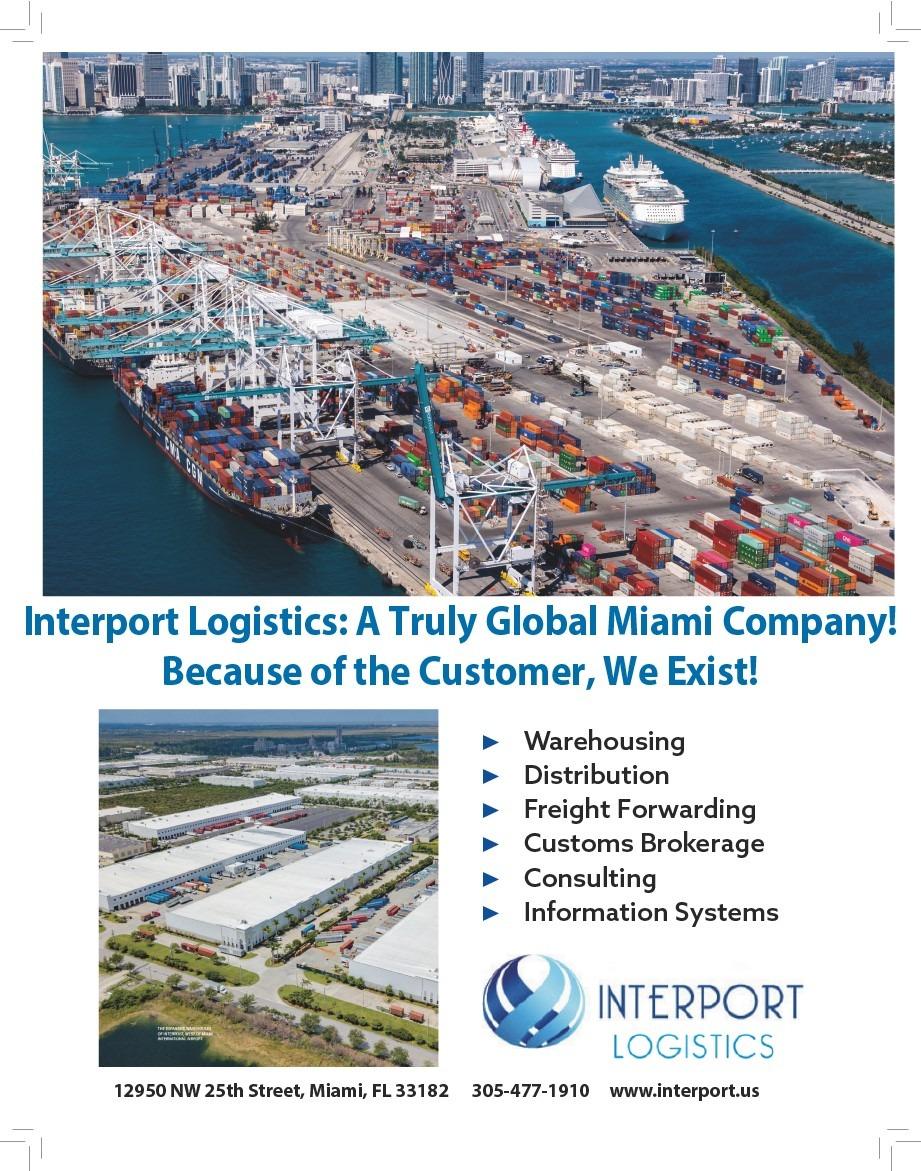

Gary Goldfarb, Interport

Bill Johnson, Strategic Economic Forum

Roberto Munoz, The Global Financial Group David Schwartz, FIBA

EDITORIAL BOARD

Alice Ancona, World Trade Center Miami

Greg Chin, Miami International Airport

Tiffany Comprés, Pierson Ferdinand Paul Griebel, Venture for America

James Kohnstamm, Miami-Dade Eco. Dev. John Price, Americas Market Intelligence

Stacy Ritter, Visit Lauderdale

TJ Villamil, Select Florida

COVER

Josh Schertzer, Blackstone

Photo by Rodolfo Benitez

Global Miami Magazine is published bi-monthly by Global Cities Media, LLC. 1200 Anastasia Ave., Suite 217, Coral Gables, FL 33134. Telephone: (305) 452-0501. Copyright 2024 by Global Cities Media. All rights reserved. Reproduction in whole or part of any text, photograph, or illustration without o\prior written permission from the publisher is strictly prohibited. Send address changes to subscriptions@ globalmiamimagazine.com. General mailbox email and letters to editor@globalmiamimagazine.com

American Airlines has debuted the first nonstop flight from Miami to Ian Fleming International Airport in Jamaica’s tourism center Ocho Rios. The flight will begin operating every Wednesday and Saturday. Previously, visitors to Ocho Rios had to land in Montego Bay and drive an hour and a half. - Condor Airlines, a German lowcost carrier, launched direct flights between Miami and Frankfurt. Originally planned for May, the airline advanced its launch date to April, betting on a vibrant summer season and a surge in travelers from Miami to Europe. - Spanish low-cost airline Level has launched flights to Barcelona from MIA, operating three times a week

EQI Investimentos, a Brazilian advisory firm, has announced the launch of an RIA (Registered Investment Advisor) in Miami, marking a strategic move in its global expansion efforts. With over $5.6 billion in assets, the group aims to attract new clients and broaden its product portfolio through the new U.S.-based operation. In related news, Spanish multinational BBVA is awaiting approval from the SEC to begin operating an RIA in Miami to provide wealth management services to ultra-high-net worth clients.

Miami-Dade County has ended Miami Seaquarium’s lease due to recurring animal welfare violations found in USDA inspections. The Seaquarium, owned by Mexican-based The Dolphin Company and leased from the county, is required to vacate its waterfront property this month. The Dolphin Company purchased the park in 2022.

CONDO BY CHINESE DEVELOPER

JDL Development obtained a $160 million construction loan for

its Caretta condo project after partnering with Chinese developer Wanxiang. Investment in Florida real estate by Chinese companies has seen a decline following Gov. Ron DeSantis’ signing of a law in 2023 that restricts companies with over 5% ownership by the government of China, a Chinese company, or a Chinese national without U.S. citizenship or permanent residency from purchasing real estate in Florida.

Brazilian digital bank Inter&Co and Miami-based real estate developer Resia have launched a private equity fund aimed at investing in affordable housing projects. The Inter Resia Opportunity Fund I has successfully secured $30 million in capital for the development of Resia Golden Glades, an affordable housing initiative in Northern Miami.

GSO Aviation, a company specializing in aircraft maintenance, repair, and overhaul (MRO), has signed a lease agreement for a 15,090 sq ft. industrial warehouse adjacent to Miami International Airport. The company provides MRO services for commercial aircrafts manufactured by France’s Airbus, U.S.’ Boeing, Canada’s Bombardier, and Brazil’s Embraer.

Dubai’s DP World has inaugurated its Miami freight forwarding office, part of a series of over 100 global expansions aimed at aiding customers in navigating international trade. The newly opened office, now employing 1,000 staff, complements DP World’s existing workforce of 108,000 and is expected to expand further in the next year.

Guyana’s World Trade Center has signed a Memorandum of Understanding (MoU) with the World Trade Center Miami. This agreement sets the stage for networking, market access, and support

for trade missions between the two regions. The MoU was signed by Executive Director of World Trade Center Guyana, Wesley Kirton (center), and Chief Executive Officer of World Trade Center Miami, Ivan Barrios (right), during a virtual meeting held in Miami.

PortMiami welcomed the CMA CGM Bali, a large container ship boasting a capacity of 15,000 TEUs. Its arrival signifies the enduring strength of maritime trade in the area, operating on the vital Manhattan Bridge route, which serves as a pivotal connection between China and U.S. East Coast ports.

IAG Cargo, the cargo division of International Airlines Group (IAG), has announced a new service between Barcelona and Miami. The route is running three times a week to Miami International Airport, increasing to four from June to September.

Enfinity Global Inc., a Miami-based leader in renewable energy, has confirmed the completion of a minority sale within its 400 MW U.S. portfolio to Kyushu Electric Power Co. Inc., a major Japanese firm. Kyushu now holds a 40% equity stake in the portfolio, while Enfinity Global will maintain 60% ownership and management.

The innovation lab of the Inter-American Development Bank (IDB) Group, IDB Lab, and TechnoArt, a global platform for technology startups, has launched Miami LAC Gateway. The program is designed for Latin American and Caribbean companies that want to venture into the U.S. market.

Miami’s Flacks Group, led by Michael Flacks, has completed the acquisition of Paris-based Imerys’ Brazilian mining operations, with the transaction amount undisclosed. The mining operations generate about $400 million in revenue and employ over 1,000 people. The Flacks Group assets exceed $4 billion with revenue of $1 billion. Michael Flacks, originally from the UK, has an office in Brickell with 20 employees.

JetBlue is discontinuing several routes as part of cost-cutting measures following its blocked $3.8 billion acquisition bid for Spirit Airlines earlier this year. The airline will cease flights between Fort Lauderdale-Hollywood International Airport and Bogotá, Colombia; Quito, Ecuador; and Lima, Peru.

The NFL has announced that the Miami Dolphins have secured marketing rights in three additional countries – Argentina, Colombia, and Mexico – through the Global Markets Program. With this expansion, the Dolphins are one of two teams holding agreements in six global markets, which already included Brazil, Spain, and the United Kingdom. The Dolphins now dominate in Spanish-speaking regions, surpassing any other NFL team.

UK-based services specialist AerFin has opened a new facility for airframe and engine parts in Miami. The new facility, located close to Miami International Airport, will house inventory for Boeing, Airbus, and Embraer airframe products. l

When Roei Samuel was looking to expand his UK-based start-up platform Connectd to the United States, Miami seemed like the obvious place to begin. Outside of direct flights to London, nice weather, and a favorable tax climate, the city’s status as a burgeoning tech hub made it a perfect launching pad.

Samuel founded Connectd in 2020 after previously investing in several startups. That experience convinced him there was a correlation between startups that performed well and two key ingredients: Frequent interactions with investors and access to a network of experts. So, he founded Con-

nectd to “connect” the triad of players in the start-up ecosystem: founders, investors, and experts. The platform was designed with that simple mission in mind – to help founders streamline their financial reporting, meet new investors, and gain access to experts who could help jumpstart their company. Investors were also given the chance to back start-ups that regularly report.

After initial success in London’s bustling start-up community, Samuel had considered expanding into the U.S. via Silicon Valley. But that start-up community seemed too entrenched compared with Miami. “In emerging tech ecosystems like Miami, there

In emerging tech ecosystems like Miami, there are so many new entrants. There are so many new players, so many new people coming to town and being able to discover people is key for us.

ROEI SAMUEL, LEFT, FOUNDER OF CONNECTD IN THE UKare so many new entrants. There are so many new players, so many new people coming to town,” says Samuel. “And being able to discover people is key for us.”

Connectd is one of a profusion of UKbased companies that are finding success in Miami. In recent years, particularly post-Brexit, there has been an uptick in UK companies expanding to South Florida, paralleling the larger trade relationship between the UK and Florida as a whole.

From the approximately one million British tourists that visit Florida every year to British companies that employ roughly 70,000 people in the state, it’s clear that economic ties between the UK and Florida run deep. In 2022, bilateral trade between the UK and Florida totaled $5.8B, growing 119% over the preceding five years and making the UK Florida’s 8th largest trading partner. The lion’s share of that trade roared through Miami that year – some $4.89B – and though it tapered off by some $640M last year (due largely to a 43.3% decrease in packaged medication exports to the UK) it was still significant enough to prompt Governor Ron DeSantis to sign a Memorandum of Understanding (MoU) with the UK last year to further facilitate trade.

Although not a legally binding contract, the MoU serves to bolster bilateral trade by reducing barriers to entry and streamlining the process for UK companies to do business in Florida and vice versa. Outside of trade, its goals are to grow academic partnerships between institutions in the UK and Florida and promote cooperation in high-priority sectors like aerospace technology, fintech, legal services, medtech, supply chain logistics, transport, infrastructure, and agricultural biotechnology.

“The political outreach and engagement are really important,” says the UK’s Consul General in Miami, Rufus Drabble. “British FDI [Foreign Direct Investment] is still number one in Florida… and I’m delighted to say we’re [also] number two in terms of international tourists to Florida, including Miami. Sadly, the Canadiens consistently beat us, not that we have a competition. But the Brits bring a lot of money. We tend to spend more… In 2021, British tourists spent $323 million in Miami-Dade County.”

More to the point for Miami’s future as a tech hub are British companies investing in innovative niche areas. Like some of the priorities listed in the MoU, UK-Miami trade and investment mostly center around fintech, aviation and aerospace, as well as medtech. Last year, top exports to the UK through Miami included packaged medications ($1.28B) and aircraft parts ($237M), while top imports included gas turbines ($359M). That was followed by hard liquor ($238M), with growing imports of British-made alcoholic beverages (see story pg. 20).

“We’re not trying to do everything that we’re good at, but we’re trying to pick a few where we think, not only can we add value

British Foreign Direct Investment is still number one in Florida… and I’m delighted to say we’re [also] number two in terms of international tourists to Florida, including Miami.

RUFUS DRABBLE, ABOVE,CONSUL GENERAL IN MIAMI FOR THE UK

collaboratively for both UK and Florida companies, but we’re trying to get ahead of the curve – not just invest in what’s happening now but where we think things are going to go,” says Drabble.

Fintech company Floww is another example of a UK-based company that’s looking to capitalize on Miami’s emergence as a tech hub and the VC dollars it attracts. The company recently opened an office in Miami to expand its London operation. Floww’s goal is to make investing in

MIAMI CUSTOMS DISTRICT TRADE WITH UK

EXPORTS

2023: $2.09B (DOWN 30% FROM 2022)

2022 $2.99B (UP 270% FROM 2021)

2021: $808M (UP 64.9% FROM 2020)

2020: $490M

TOP EXPORTS 2023:

1. PACKAGED MEDICATIONS: 61.3% ($1.28B)

2. AIRCRAFT PARTS: 11.3% ($237M)

3. PAINTINGS: 4.2% ($88M)

4. GAS TURBINES: 2.15% ($45M)

5. OPTICAL FIBERS & BUNDLES: 1.68% ($35.3M)

Changes: Aircraft parts to the UK rose 17.2 from the previous year, medication down 43.3% IMPORTS

2023: $2.16B (UP 13.7%)

2022: $1.9B (UP 2.68%)

2021: $1.85B (UP 28.3%)

2020: $1.44B

TOP IMPORTS 2023:

1. COMMODITIES NOT SPECIFIED: 19.7% ($426M)

2. GAS TURBINES 16.6% ($359M)

3. HARD LIQUOR: 11% ($238M)

4. RECREATIONAL BOATS: 9% ($195M)

5. REFINED PETROLEUM: 7.22% ($156M)

Changes: Hard liquor grew 10.5% over the last year, boats up 27.2%, petroleum up 1.57k%, gas turbines down 31.3%

Source:

private companies as easy as publicly traded companies. By combining regulatory, legal, data, and workflow solutions, the company’s goals are to reduce the complexity of private markets and open new capitalization routes for private companies, assets, and funds. With Miami’s growing start-up ecosystem, shared language, daily direct flights, and business-friendly environment, it made sense for Floww to expand via Miami rather than New York or California.

The presences of companies like

As Miami has matured and developed more of an international business community, there’s just been an organic and natural growth of the British investment in South Florida.

DAVID ARCHER, PRESIDENT OF THE BRITISH AMERICAN BUSINESS COUNCIL, AND ATTORNEY FOR HINSHAW & CULBERTSON

Connectd and Floww represents a growing exchange of ideas and collaboration between the UK’s own global tech hub, London, and Florida’s Miami. “As Miami has matured and developed more of an international business community, there’s just been an organic and natural growth of the British investment in South Florida,” says British- native David Archer, President of the British American Business Council, and attorney for Hinshaw & Culbertson. “I think part of it is that Florida is pretty open for business, whereas a lot of other places have more restrictive regulations. [Consequently] we’ve seen a lot of new businesses coming into South Florida from the UK.” Connectd and Floww exemplify the fintech firms coming out of the UK and how they can benefit Miami’s tech ecosystem in particular and Florida in general.

“The UK has a strong reputation in innovation and tech companies. And we’re seeing more of that cross-pollination between the UK and South Florida,” says Tansy Jefferies, tax advisor for RSM and treasurer of the British American Business Council. “The [British] government was recently here in Florida, and one of the areas of focus in that discussion was the fintech industry. It’s something that the

UK PARENT COMPANY

AON PLC (Professional Services)

BARCLAYS BANK (Financial Services)

SOUTH FLORIDA SUBSIDIARY

AON HEWITT

BARCLAYS BANK

DELOITTE TOUCHES TOHMATSU INTL. (Professional Services) DELOITTE

DIAGEO PLC (Beverages)

DIAGEO NORTH AMERICA

EY ERNST & YOUNG GLOBAL LIMITED (Professional Services) ERNST & YOUNG

HSBC HOLDINGS PLC (Financial Services)

HSBC BANK USA, N.A.

PRINCES YACHTS INTERNATIONAL PLC (Manufacturing) PRINCESS YACHTS

governments on both sides are recognizing and aiming to find ways to help businesses collaborate and do business more easily across jurisdictions.”

And while Miami is the spigot through which most the trade between UK and Florida passes, it is also the state as a whole that intrigues British investors.

“Florida has one of the largest economies of any U.S. state, with a recipe for success that includes a low-tax/low-regulation environment, a strategically important location, and a diverse set of industries with nationally important clusters spread across the state. This is an attractive prospect for UK companies looking to break into the

U.S. market. With over $30 billion in VC investment raised in Florida since 2018, the state is among the leading states in the U.S. for tech investment,” says Harrison Lance, senior trade & investment officer at the British Consulate in Atlanta.

UK Secretary of State Kemi Badenoch echoed Lance’s remarks at the MoU signing with DeSantis. “Florida is a major economy in its own right, with a bigger GDP than most European countries,” said Badenoch. “From launching satellites to developing the latest fintech software, Florida’s leading high-tech companies offer huge opportunities to the UK’s rapidly expanding tech sector.” l

At PNB, we envision a community where every individual, regardless of their circumstances, has both hope and opportunities. We are committed to being part of the nurturing ground where compassion meets action, fostering a Miami where everyone has the chance to thrive.

That dedication stems from a core belief that we are more than just an institution serving our community; we are a team that believes in building a brighter, more inclusive future. We proudly support charities dedicated to touching lives profoundly - be it providing a haven for the unhoused, offering a guiding hand to individuals with autism, or bringing a ray of light into the lives of Alzheimer’s patients and their families.

Together with organizations that share our vision, we strive to give back to the place that has given us so much, to be one link in a network of love that resonates with the vibrant spirit of Miami.

Last month Lucky Cat, Gordon Ramsay’s new restaurant in Miami Beach, received some special visitors. Amid the velvet booths, Art Deco light fixtures, and sultry atmosphere, the couple behind the world’s first commercially available sheep’s milk vodka introduced their spirit to the U.S. market.

In 2018, Tim Spittle and his wife Tanya Spittle faced the prospect of losing their second-generation sheep farm. Tim had grown up on the farm tending sheep with his father and grandfather and couldn’t imagine the loss. Then, when couple was sipping vodka tonics on vacation in Spain, they figured out how to save the farm. “We both had a light bulb moment where we wondered, ‘Can we make vodka from sheep’s milk?’” says Tim.

The Spittles had heard about cow’s milk vodkas before but knew there was no sheep’s milk vodka on the market. So, when they got home, they began working out the logistics. The Spittles were already partnered with a local cheese maker who milked their sheep in return for the curds. When cheese is made from milk, 20 percent is separated into the curd; the other 80 percent is whey, a sugar-rich liquid that remains after the milk is curdled and strained. The Spittles thought to ferment it into vodka.

Blacklion Vodka officially launched in the U.K. and Europe in 2021, and in 2022 won Best International Vodka at the ADI International Spirits Competition. Along the way it became a favorite of celebrity chef Gordon Ramsay. The Spittles say that’s because of its sweet, creamy taste, with notes of toffee and caramel – and because of its unique origin.

The Spittles have just over 2,000 sheep on their farm in England’s Cotswolds. Many are commercial British dairy sheep and Swiss Valais Blacknose sheep. A cross between the two produced Blacklion sheep, which Tim says produce a higher quality milk.

Blacklion Vodka came to Miami first as part its nationwide “Flockstars” tour to increase U.S. brand awareness. “For us, Miami is this wonderful machine of hospitality. You have the best restaurants, the world’s best hotels, the best bars, so it’s a big thing for us to be here,” says Tim. “It’s great visibility for the brand.”

The company kicked off its tour with the Black Cat cocktail, made in collaboration with Lucky Cat, followed by a party at the

You

have the best restaurants, the world’s best hotels, the best bars, so it’s a big thing for us to be here...

TIM SPITTLE, SHOWN TOP LEFT, AT THE U.S. LAUNCH OF BLACKLION VODKA AT THE LUCKY CAT RESTAURANT

ABOVE: TIM SPITTLE AND WIFE TANYA ON THEIR U.K FARM WHERE THEY BREED BLACKLION SHEEP

Miami Beach Botanical Gardens where it showcased its vodka –along with two of the sheep.

Blacklion Vodka is currently expanding operations to the U.S. to better tap into one of the largest vodka-drinking markets in the world. And they’re bringing the sheep with them…at least the embryos. Last year, the company bought a farm and distillery in Kentucky to produce their vodka, but due to livestock importation restrictions, the Spittles couldn’t ship their sheep. Instead, they imported Swiss Valais Blacknose embryos for implantation into 40 selected Dorset Sheep.

In March, the first batch of Blacklion Sheep was born in the Kentucky farm/distillery, and it should start producing vodka next year; until then, everything will be imported. With a combined twenty employees in the UK and the U.S., the company sold several thousand cases last year – a fraction of its potential in the U.S. “We’re currently in Florida,” says Tim. “But in the next three years, when we become fully operational, I imagine we’ll be much bigger.” l

Our personal injury law firm has obtained in excess of a billion dollars in verdicts and recoveries for clients and is recognized as a leader in plaintiffs’ personal injury and wrongful death, class actions, mass torts, and other areas of litigation

Colson Hicks Eidson, one of Miami’s oldest and most accomplished law firms, is considered among the top trial firms in the United States, having won hundreds of multi-million dollar verdicts and settlements for its clients.

–Chambers USA, 2022

Our personal injury lawyers have a long history of serving individuals, groups of individuals and businesses in a wide range of lawsuits. Our trial attorneys are highly regarded for their depth of legal experience, responsiveness to client concerns and ethical tactics, both inside and outside of the courtroom. Our law firm receives respect throughout the legal community, which recognizes Colson Hicks Eidson for its various distinguished achievements.

We are or have been actively engaged in the following and many other cases:

• Takata Airbags MDL

• Champlain Plaza

• Allergan Biocell MDL

• Monat Marketing MDL

• Parkland Shootings

• Elmiron Eye Injury MDL

• 3M Combat Earplugs MDL

• BP Deepwater Horizon Oil Spill

• Ford Firestone MDL

• Toyota Sudden Acceleration MDL

• Zantac MDL

• Camp LeJeune Contamination Claims

Reggaeton blasts throughout the stadium. The smell of hotdogs and arepas followed by not-so-cheap stadium beer floats through the air as thousands of fans sit on the edge of their seats. All goes quiet when Ricardo Pinto, Venezuela’s starting pitcher, lines up at the mound to throw the first pitch of the game.

This past February, 36,677 fans crowded into the LoanDepot Park stadium to watch the Caribbean Series Championship game: Venezuela vs. the Dominican Republic. The championship game was a sellout, marking the highest turnout for a single Caribbean Series game ever recorded. The previous record occurred earlier that week when 35,972 fans attended the Dominican Republic vs. Puerto Rico game (stadium capacity: 37,000).

After nine days and 25 games featuring seven countries (the four full members of the Caribbean Professional Baseball Confederation: Dominican Republic, Mexico, Puerto Rico, and Venezuela, plus three guest countries: Curaçao, Nicaragua and Panama), the series drew just over 340,000 fans. About forty percent of them were visitors, according to Miami Marlins President of Business Operations Caroline O’Connor.

Aside from generating revenue for the stadium and greater Miami, hosting the Caribbean Series was more than just a promotional opportunity for the Miami Marlins at their home field; it was a strategic move. “It’s something we’ve had in the works for a while, but it’s part of the Marlins’ strategy really to be the home of international baseball. We want to invite people of all cultures and backgrounds in to enjoy baseball at LoanDepot park,” says O’Connor, who is one of only two women in Major League Baseball currently named as president of business operations.

The Caribbean Series is just one of the international baseball series the Marlins have hosted at LoanDepot park. Last year, they hosted the Baseball World Classic, which generated some $267 million in

It’s part of the Marlins’ strategy really to be the home of international baseball...

total economic impact, according to the Greater Miami Convention and Visitors Bureau. Final attendance for the classic was 1,306,414, also the highest in the history of the tournament.

But why should Miami best other cities to become the home of international baseball? According to O’Connor, it’s more than just the city’s baseball culture. Miami is a global destination with premium entertainment, hospitality, food, and sports, juxtaposed between some of the largest baseball leagues in the world: the MLB and various Latin American leagues.

Establishing Miami as the home of international baseball bodes well for the Marlins. Since last year’ World Classic, which preceded the Marlins MLB season,

the team saw an annual attendance growth of 28 percent to 1,162,729 fans at LoanDepot Park. While the World Classic was probably not the only reason attendance rose – the team saw a similar trend the year before – the press and coverage these international tournaments bring creates buzz before the MLB season starts, bolstering the Marlins’ visibility.

This year, the Marlins started their season on March 28, and even though O’Connor won’t put a number on how much attendance may increase, she believes the 2024 season will be promising. While the 2025 Caribbean Series will be hosted in Mexico City, she hopes to secure future Caribbean Series – while again hosting the World Baseball Classic in 2026. l

Nicklaus Children’s Hospital is the top-ranked children’s hospital in South Florida.

Hope and compassionate care fill every room and hallway at Nicklaus Children’s. Innovation and technology support our world-class medical professionals in advancing expert pediatric care to enhance clinical outcomes and the patient experience. It’s no wonder that we maintain our position as the top-ranked children’s hospital in South Florida according to U.S.News & World Report’s 2023-24 Pediatric Rankings. Leading with compassion and extraordinary care, we demonstrate every day why this is where your child matters most.

One of the biggest challenges start-ups face in their early stages is finding the right talent. Not every candidate is cut out for the fast-paced, ever-changing start-up environment, and most start-ups don’t have the budget to hire an eligible candidate with years of experience. That’s where Venture for America (VFA) comes in. The national nonprofit aims to bridge the talent gap in Miami’s start-up community by connecting entrepreneurial-minded college graduates to start-ups seeking affordable and skilled talent.

Paul Griebel, regional account director for VFA in Miami, says that VFA operates with three goals in mind: providing opportunities for college graduates, offering affordable talent for growing companies, and fostering growth in the Miami start-up ecosystem. “We view ourselves as an on-ramp to entrepreneurship for our fellows, and on the other side of that, we offer a talent pipeline solution to grow companies,” says Griebel.

Founded in 2011, the national nonprofit currently has programs in 13 cities across the United States. In 2015, Venture for America expanded to Miami with the support of the Knight Foundation, and since then has had 94 “fellows” complete their fellowships with organizations in Florida.

VFA finds its fellows through an intensive screening and application process. Approximately 140 candidates become fellows each year out of a pool of more than 1,000 applicants. The organization then partners with local and multinational corporations like Las Olas VC, ThriveDX, GoTu, and MyBundle.TV to place its fellows in a range of entry and junior-level jobs.

During their two-year fellowship, fellows gain valuable job experience in a start-up environment while attending workshops, trainings, and networking events with their cohort. The companies that hire them enjoy vetted personnel at below-market salaries (it is an internship, after all). Griebel says that cultivating a talented, highly screened pool of potential employees is tantamount to growing Miami’s start-up community.

After finishing the fellowship, fellows’ profiles are listed on VFA’s site (think of this as a very exclusive LinkedIn). Fellows may choose to continue with the corporation they worked for during their fellowship or embark on their own start-up journey.

Because VFA’s fellowship program provides its corporate partners with capable, motivated employees ready for a realistic start-up environment, VFA fellows are in high demand. Ayal Stern, CEO of ThriveDX US, says that when the Israeli-based company first began moving to Miami in 2018 it was looking for affordable staff that could handle the start-up environment.

“VFA does an amazing job of curating and filtering. We get great people that are willing to work hard, that are super smart, and it’s cost-effective. Check, check, check,” he says. Stern mentions that a former 2019 VFA fellow that ThriveDX hired is now the compa-

We view ourselves as an on-ramp to entrepreneurship for our fellows, and on the other side of that, we offer a talent pipeline solution to grow companies.

ny’s current vice president of operations. Griebel says VFA’s ideal candidate is someone who has a “passion for entrepreneurship and innovation” and has earned a four-year degree within the last three years. However, candidates need not have a business background to apply. In fact, having a diverse group of candidates with different skill sets gives Miami’s start-up community access to creative talent that can solve some of the complex challenges that start-ups face.l

Hosted by 3 time All-Star NCAA/NBA Champion and NBA Legend Glen Rice

Friday, May 17th

Normandy Shores Golf Club 2401 Biarritz Drive, Miami Beach, FL 33141 and

The Spa at St. Regis 9703 Collins Avenue, Miami Beach, FL 33154

Registration, Range Practice & Box Lunch – 11:30 AM

Shotgun – 1:00 PM

Cocktail Reception and Putting Contest – 5:30 PM

Followed by Buffet Dinner and Awards

To attend, or to learn more about sponsorship opportunities, please contact Jenny A. Ray, Executive Director of Development, at 305.898.5602 or jray@miamijewishhealth.org

When it comes to international business, air links are vital, and no carrier has contributed more to Spain-Miami ties than Spain’s Iberia. The Madrid-based airline began Miami service in 1972, and today offers more seats to Miami than to any other U.S. destination it serves. Iberia flies twice a day between Madrid and Miami on Airbus A330-300 jets with 292 passenger seats per flight, offering 420,000plus seats roundtrip last year, says Maria Jesus Lopez Solas, Iberia’s chief officer for commercial, network, and alliance development.

“Miami is our most important destination in the United States,” a country key for Iberia’s growth, says Lopez Solas. The airline already serves New York, Boston, Washington D.C., and Dallas, among other cities. In all, Iberia plans to offer 1.7 million passenger seats roundtrip between Madrid and the U.S. this year. That’s up nearly 19 percent from 2022 levels and 7 percent more than pre-COVID numbers.

Spain’s flag carrier, Iberia has a long and storied history. Founded in 1927 in Madrid, it was nationalized for much of its existence, being finally privatized in 2001. In 2011, it merged into the International Airlines Group, joining British Airways, Aer Lingus, and other European carriers, which all operate independently. It also shares codes, loyalty points, and other services as a member of the One World Alliance, which includes American Airlines.

To grow business since COVID, Iberia has been getting cre-

ative. Last summer, it opened a pop-up shop in Madrid, whose store windows looked like airplane windows with pull-down coverings. Visitors to the shop entered a space resembling a plane cabin, where they could try out seats for different classes of service. They could also order from the business class menu, which presents such treats as Galician octopus carpaccio, hake with potatoes in paprika oil and asparagus, and raspberry sorbet with fresh raspberries for dessert. The shop also offered a display of crew uniforms, plus simulators for want-to-be pilots.

Iberia now is looking to expand its portfolio by acquiring Air Europa, which also serves Miami. Air Europa started up in 1986 as Air España, with headquarters on the Spanish island of Mallorca, specializing in holiday charters. It now has some 40 Boeing jets and is Spain’s third largest carrier, after Iberia and Vueling, a low-cost carrier based in Barcelona.

“The purchase of Air Europa is still being evaluated by authorities in the European Union, and until there’s a decision [expected in June 2024], both companies will continue to compete strongly,” says Lopez Solas. The acquisition aims to “offer a better product to our clients, with more connectivity and more travel options, with a focus on the United States and Latin America.” Of its Miami routes, Iberia says about half the passengers come from the U.S. and half from Europe, a third of those from Spain. The jets also carry cargo to and from Miami.

Iberia aims to expand its Miami and U.S. service as needed. This winter it boosted its portfolio to 90 flights a week from Madrid to eight U.S. cities. That is up 24 percent from pre-COVID levels in 2019. “We’re making an important bet on the U.S market,” says Lopez Solas, “with Miami undoubtedly our main focus.” l

OVER 40 SHOPPING, DINING, AND ENTERTAINMENT DESTINATIONS

CMX CinéBistro • Kings Miami • Marina Kids • Miami Improv • Martini Bar

Chico Malo • Cooper’s Hawk Winery • Copper Blues Miami • Kuba Cabana

Novecento • Tap42 • Suviche

BurgerFi • Carrot Express • Juan Valdez Café • Sloan’s Ice Cream • The Fresh Market

Anatomy Fitness • BÜNDA • 4Ever Young • Mancave • Semper Laser

The Lash Lounge • Venetian Nail Spa

OPENING SOON: Escapalogy • Italianni’s

Jamaica’s largest fast-food chain is expanding into the United States, with plans for an initial 26 stores in Florida over the next five years, starting in Greater Miami.

Juici Patties, which already has 63 locations in its Caribbean homeland, is growing through franchises, which also account for most of its stores in Jamaica. Its first U.S. store opened last month in Hollywood, the touristy coastal enclave just south of Fort Lauderdale. The U.S. outlets will offer the chain’s flaky turnovers, which come stuffed with beef, chicken curry, vegetables and other fillings. They will focus on combo platters, with a patty, sliced avocado, fried plantains, and a drink, making it easy for customers to say, “Give me a No. 1, or give me a No. 2,” says Daniel Chin, CEO for the U.S. and COO worldwide. Combos likely will run about $10 and a single patty about $3.50 in Florida this year, says Chin.

The expansion caps six years of preparation, with Juici Patties working with U.S.-based consultants with executive experience at such fast-food chains as McDonald’s and Dunkin Donuts. Those consultants helped the Jamaican company develop an operations manual, streamline the process for opening stores, and adopt software for tracking franchisees, scheduling construction and expanding by U.S. zip-code, says Chin.

“Even before we started recruiting franchisees in the United States, we’ve been adopting these best practices and applying these procedures in Jamaica,” says Chin. The effort led to more stores on the island and a 2023 award for the best customer service at Jamaica’s fast-food chains.

Juici Patties chose Florida to begin its overseas expansion partly because of the large Jamaica community in the Sunshine State. Many non-Jamaicans in Florida are already familiar with Jamaican patties and cuisine, making the nearby state “a logical first step,” says Chin. Its U.S. stores will run about 1,400 square feet, with 15 to 20 seats each, he estimates. After Florida, Juice Patties aims to grow in New York, Texas, and Georgia, which also host large Jamaican and Caribbean communities.

U.S. expansion wasn’t top of mind when Chin’s dad Jukie started the business in 1978. Back then, at age 16, Jukie cooked up

Even before we started recruiting franchisees in the United States, we’ve been adopting these best practices and applying these procedures in Jamaica

batches of patties in his mom’s kitchen and sold them in a shop at the front of his Chinese-Jamaican family’s home. In 1980, Jukie opened his first store as Juici Beef Patties. Franchising came in the 1990s. Today, the renamed chain keeps a 20-acre headquarters with offices, a manufacturing plant, recreation area, restaurant, and other features. In all, it employs about 1,800 people in Jamaica, most fulltime, making 48 million patties a year, says Chin.

Of course, success at home doesn’t guarantee success overseas, especially in the competitive U.S. market. Entrants must contend with such issues as differences in the taste of ingredients, higher labor costs, and limited name recognition in a larger market. Social media often plays a greater role in U.S. marketing too, says Peter Ricci, director of the hospitality and tourism program at Florida Atlantic University in Boca Raton. What’s more, Ricci says, South Florida has “a multitude of Caribbean and Jamaican food offerings already.”

Chin embraces the US challenge, bolstered by Juici Patties’ success in selling to supermarkets in 11 Caribbean nations and the United Kingdom. He’s already excited to offer a new combo: curry-chicken patty with sliced avocado, thanks to year-round availability of avocados in the U.S. l

Earlier this year, more than 200 local officials and foreign delegates converged at one of the busiest cruise terminals in PortMiami for the 26th annual Inter-American Conference of Mayors and Local Authorities. Organized by the Miami-Dade Board of County Commissioners, the twoday February conference brought together policymakers and officials from 27 cities and 16 countries across Latin America and the Caribbean to discuss topics ranging from eco-tourism and disaster planning. One panel was especially relevant to Miami’s recent growing pains: sustainable infrastructure.

In recent years, as Miami’s risk for climate-related challenges has increased, Miami-Dade County has focused on resiliency and sustainable infrastructure. In 2023, the county was designated as a hub for climate technology by the U.S. Economic Development Administration, making it eligible for federal grants to promote solution-oriented climate research like shoreline protection systems and hybridized coral reefs.

Moderated by Wendy Conforme, CEO of the PortMiami Tunnel, the panel featured some of Miami’s leading voices in infrastructure, including Ralph Cutie, director and CEO of the Miami-Dade Aviation Department, and Richard de Villiers, PortMiami’s chief of staff. As the panel made clear, sustainable infrastructure is an international problem rather than just a local one.

According to a recent study funded by the University of Miami Laboratory for Integrative Knowledge (U-LINK), the long-term strength of PortMiami is contingent on the resilience of its trade partners. This includes ports such as Puerto Cortés (Honduras), Veracruz (Mexico), Puerto Plata (Dominican Republic), and St. Thomas, which, due to their low resilience levels could impact PortMiami’s performance. By improving their resiliency, these ports can help make PortMiami’s maritime supply chain less vulnerable to future climate-related disasters.

One organization that is strengthening the ports network is the Inter-American Development Bank (IDB). Tatiana Gallego-Lizon, the Chief of Housing and Urban Development for IDB, spoke on the importance of increasing sustainable infrastructure in Latin America and the Caribbean. “Climate is truly transforming the way in which we approach infrastructure. Latin America and the Caribbean have 81 percent of people living in cities, and cities in these regions are highly vulnerable,” said Gallego-Lizon. Because human resources are so concentrated, the effects of climate-related natural disasters

MIAMI’S COVETED POSITION AS A GLOBAL HUB MAY DEPEND ON SURVIVING CLIMATE CHANGE

BY KATELIN STECZwould be especially detrimental.

The IDB is currently the largest multilateral development bank working in the region, with 26 borrowing members in Latin America. According to Gallego-Lizon, sustainable infrastructure now represents more than 50 percent of the $15 billion annual lending that the bank does. Dr. Rafael Echevarne, director general of Airports Council International-Latin American and the Caribbean, said that sometimes investments in sustainable infrastructure are also the most cost-effective, especially when it comes to smaller scale airports. “I always say as a half-joke that, even if you don’t believe in climate change, it makes sense to use solar power, because it reduces tremendously the cost of powering these airports,” he said.

De Villers and Cutie described how PortMiami and the airport are investing in energy-efficient solutions that will have long-term compounding effects. De Villiers said PortMiami is reducing emissions with its shore power program for docked vessels and its utilization of new technology to process trucks faster and thereby reduce the time they sit idle. Cutie gave examples

Climate is truly transforming the way in which we approach infrastructure. Latin America and the Caribbean have 81 percent of people living in cities, and cities in these regions are highly vulnerable...

TATIANA GALLEGO-LIZON, THE CHIEF OF HOUSING AND URBAN DEVELOPMENT FOR INTER-AMERICAN DEVELOPMENT BANK (IDB)

ABOVE LEFT TO RIGHT: WENDY CONFORME, WELLINGTON ANDRADE, TATIANA GALLEGO-LIZON, DR. ARMANDO MARTÍNEZ MANRÍQUEZ, RALPH CUTIE, RICHARD DE VILLIERS, DR. RAFAEL ECHEVARNE

ALTAMIRA CONFERENCE, TOP LEFT TO RIGHT: WELLINGTON ANDRADE, WENDY CONFORME, TATIANA GALLEGO-LIZON, DR. ARMANDO MARTÍNEZ MANRÍQUEZ, RALPH CUTIE, RICHARD DE VILLIERS, DR. RAFAEL ECHEVARNE.

CENTER: HYBRID REEF STRUCTURES ON A BARGE, READY TO BE LOWERED INTO THE OCEAN OFF MIAMI BEACH TO ALLOW COASTAL RESILIENCE.

BOTTOM: PLACING THE CONCRETE HYBRID REEF STRUCTURES AGAINST THE SEAWALL.

of how the airport has cut down on energy consumption. In 2020, MIA completed a contract with Florida Power & Light Company (FPL) that installed $45 million worth of energy-efficient LED lighting, HVAC units, and water and heating systems that will yield more than $60 million in savings over 15 years.

Even though sustainable infrastructure seems like an obvious priority for governments across the region, many lack adequate funding resources. To fill the gap, some are turning to private investment and non-profit organizations for long term investments. Dr. Armando Martínez Manríquez, mayor of Altamira, Mexico, offered his city as a case study for encourage private companies to complete sustainable infrastructure projects. Altamira is working on a wastewater treatment plant that Mexico’s National Water Commission was unable to fund. Local business leaders invested in the project in exchange for private ownership and longterm returns.

On the non-profit side, Wellington Andrade, CEO of the Mato Grosso Soybean & Corn Growers Association, Brazil (Aprosoja-MT), spoke about how his association influences farmers to grow more sustainably, thus reducing deforestation. Because the state of Mato Grosso grows 10 percent of the world’s soybeans and 3.5 percent of the world’s corn, Aprosoja-MT can make a significant impact by by educating its 8,000 members.

For Miami, investment in sustainable infrastructure has huge economic impact. By ensuring its adaptability to the worsening climate crisis, and to potential climate-induced catastrophes, the city becomes a safer bet for foreign companies.

“[Sustainable infrastructure] can drive foreign investment,” says Galen Treuer, climate tech and economic innovation manager for Miami-Dade County. “This makes our region more competitive with China because we’re enhancing the trade in our region – and maintaining it – the same technologies we’re developing here are going to be relevant throughout the Gulf and Latin America.” l

I

t might be safe to say that the gap between popular past images of Miami and the political and economic realities of the city today is closing. “We’re more than our [traditional] image in the media. Miami now, being the amazing global city that it is, has transformed,” says Dr. Athena Passera, President and CEO of Global Ties Miami.

Global Ties Miami, an affiliate of the Global Ties U.S. network, is a non-profit long dedicated to closing that gap by promoting citizen diplomacy and connecting international visitors with the people of Miami. The organization implements the U.S. Department of State’s International Visitor Leadership Program (IVLP), which brings delegations from around the world to engage on different topics the State Department is prioritizing. “The subject areas and the visitors that come through this program very much align with U.S. foreign policy objectives. It’s very specific and deliberate,” says Dr. Passera, who was born in Florida but spent most of her life in Trinidad, Barbados, and Canada as the daughter of a Trinidadian Ambassador.

For some visitors, the State Department wants introductions to federal entities like SouthCom or the Coast Guard, which Global Ties arranges. If the topic is combatting climate change, Global Ties will set up meetings with entrepreneurs or university professors who have created innovative solutions for visitors seeking impactful takeaways. “A lot of Miami’s transformation has to do with subject areas [of current interest], and whether Miami has the right resources for it,” says Dr. Passera. “The difference from decades ago till now is that Miami can do anything now. There really aren’t many subject areas that Miami can’t set up quality experiences for.”

The IVLP has been around for 80 years, with over 100 organizations throughout the U.S. and 20 countries to help coordinate the programs. The Miami chapter, serving the entire Miami Customs District, was introduced to the city 64 years ago when a group of volunteers wanted a way of introducing international students studying in Miami to the local community, believing that faceto-face interactions would contribute to building a more interconnected world. Since then, Global Ties has hosted over 12,000 international visitors, with delegations coming two to three times a month – everything from African entrepreneurs to engineers and environmentalists from Latin America to bankers and financiers from Turkmenistan

and Guinea-Bissau. The State Department provides Global Ties with 50 percent of their operational funding; the rest comes from fundraising.

When a diplomat from Vanuatu participated, Dr. Passera says the diplomat was pleasantly surprised to learn that Americans cared about rising sea levels. “She had never been to the U.S. before and works specifically on sea levels rising and the fact that they [in the South Pacific] are on the verge of disappearing.” In previous meetings overseas, “she ended up having a very negative

view of Americans.” However, after visiting Miami through the IVLP, her perspective changed. “We had her meet with some local nonprofit organizations that were working on climate change and rising sea levels. She was shocked because she was convinced that Americans did not care about this issue,” says Dr. Passera. Since then, the diplomat –with her newfound knowledge and perspective – said negotiating with Americans has gone much smoother.

This is not a unique scenario. Nine out of ten IVLP alumni say they can understand

The difference from decades ago till now is that Miami can do anything now. There really aren’t many subject areas that Miami can’t set up quality experiences for.

DR. ATHENA PASSERA, OPPOSITE PRESIDENT AND CEO OF GLOBAL TIES MIAMI

ABOVE: THE GLOBAL TIES OFFICES AND MAP PINNED WITH VISITOR HOME COUNTRIES

and communicate more accurately about the U.S. after coming to Miami. The South Florida community also benefits from these global exchanges. For example, a group combating wildlife trafficking was touring the Everglades with a visitor from Namibia who explained how they monitor animals in the wild – by using AI and global tracking devices – thus inspiring the South Florida locals to implement similar systems.

“That happens often, when we get that moment of realizing that this is not a one-way communication,” says Dr Passera. “We’re learning a lot from the problems of others and the innovative ways they’re figuring out how to handle similar challenges.”

Alex Moreno, Clinical Program Manager at the University of Miami’s Miller School of Medicine, agrees. “It’s always good to meet with professionals I’d probably never get to meet without this program,” he says. Depending on the topic, Global Ties will facilitate exchanges between interna-

tional visitors and city commissioners, local nonprofits, South Florida universities, and people in the private sector. “We want to make sure that the international visitors see how an issue is managed at all different levels,” explains Dr. Passera. “I’d like folks to see us as a way for them to turn their frustrations with what’s happening around the world into action. Every single person can come and meet with our visitors and tell their Miami story – and allow folks to know that you do have a place for building bridges in South Florida. “ l

In 1968, Dr. Michael Gordon unveiled Harvey®, a 700-pound mannequin that would revolutionize medical education. For one of the first times in history, medical students could study the sounds associated with heart diseases in a reproducible classroom setting at the University of Miami’s “Simulation Center.” When a student listened to a certain part of Harvey’s chest, they would hear the sound associated with a particular heart disease.

By today’s standards, the first Harvey seems archaic. At the time, however, it was cutting-edge technology that would inspire one of Gordan’s interns to expand the field of medical simulation technology. Today, the modern models of Harvey can simulate 50 patient scenarios ranging from pulmonary stenosis to heart failure, and it’s just one of the simulators at what is now called the Gordon Center for Simulation and

Innovation in Medical Education. Among them are full-body simulators that can mimic childbirth and advanced trauma.

Much of the credit for the center goes – besides to Dr. Gordon – to Miami native Dr. Barry Issenberg. In 1982, when he was in just 8th grade, Issenberg began an internship under the direction of Gordon. He got to work firsthand with some of the latest medical simulation technology, and on weekends would go to the “Simulation Center” and record Harvey’s heartbeats on four-track cassette tapes for Gordan.

Fast forward 42 years. Gordon’s former high school intern, now a medical doctor, is the Gordon Center’s director. Each year, the center, and the simulators it exports to more than 60 countries, trains more than 20,000 first responders and front-line clinical providers. The mission is straightforward: to save more lives.

According to a study by Johns Hopkins, medical errors occurring in a healthcare setting are the third leading cause of death in the United States. That’s right. Just after heart disease and cancer, medical mistakes are a leading cause of death. Issenberg says the medical simulation community can reduce those errors by better preparing future healthcare providers with more comprehensive training.

The Gordon Center uses two strategies. It develops, promotes, and exports advanced simulation technology like Harvey, and it creates a curriculum to use in conjunction with that technology. Part research institution, part publishing house, the Gordon Center is responsible for some of the latest medical instruction on emerging technologies. Issenberg says it’s not enough to just pioneer new teaching technologies like Harvey; there must also be a guide on how

There’s no substitute for working with a real patient and learning about illness and how to manage that illness. However, it was recognized that there were certain things that we do to patients – procedures, interventions – where you would not want to be that patient if the learner is doing that procedure for the first time.

DR. BARRY ISSENBERG, DIRECTOR OF THE GORDON CENTER FOR SIMULATION AND INNOVATION IN MEDICAL EDUCATION, AT THE UNIVERSITY OF MIAMI

ABOVE: DR. ISSENBERG TRAINING MEDICAL STUDENTS WITH SIMULATION TECHNOLOGY COMBINED WITH A CURRICULUM.

to use that technology.

“Without a curriculum, a piece of equipment will just be there installed in a room and won’t be used,” says Issenberg. “I mean, the curriculum is the common language for educators, both in medicine and in nursing, and it’s through that curriculum that we disseminate the technology.”

Issenberg says the traditional model of medical education follows students from the classroom to the observation of experienced practitioners, and finally to caring for patients. Simulation, he says, adds more low stakes learning opportunities where medical students are allowed to make mistakes; future providers can experience more repetitions of a replicable situation before being thrown into patient care.

By combining its curriculum with simulation technology, the Gordon Center is impacting healthcare on a global scale. Harvey is now used in 56 countries, from Peru to the Philippines, and the Gordon Center’s partnership with multiple international universities has cemented its presence around the world. For example, through its Advanced Stroke Life Support® (ASLS)

program and partnership with the American Heart Association (AHA), the Gordon Center has been able to use the AHA’s existing infrastructure to disseminate its stroke care curriculum. The international launch of its ASLS program recently took place in Dubai, and according to Dr. Ivette Motola, assistant director of the Gordon Center, representatives from more than 20 countries have since expressed interest in the center’s ASLS program.

Issenberg also hopes that his upcoming role as the president of the Society for Simulation in Healthcare will magnify the center’s global influence. According to Issenberg, it’s the largest international organization devoted to healthcare simulation, with members in approximately 80 countries.

“There’s no substitute for working with a real patient and learning about illness and how to manage that illness,” says Issenberg. “However, it was recognized that there were certain things that we do to patients – procedures, interventions – where you would not want to be that patient if the learner is doing that procedure for the first time.” l

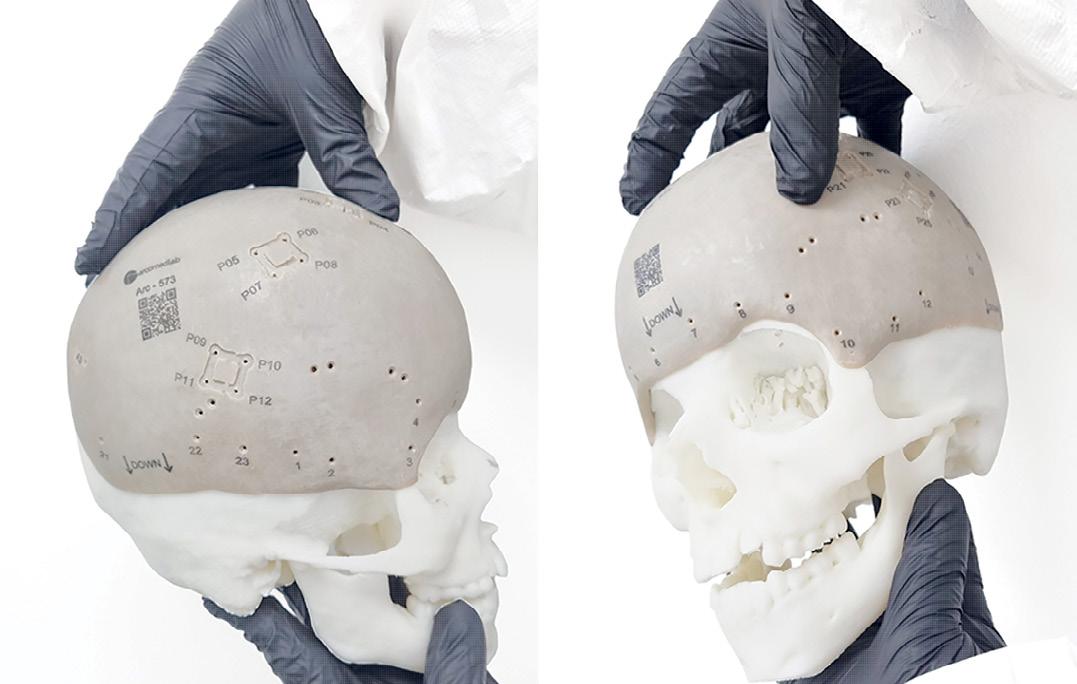

The medtech/healthtech sector is experiencing unprecedented growth and innovation, fueled by technological advancements and rising demand for healthcare solutions. By highlighting the sector at our conference, we can show how technology can continue to improve patient care and healthcare delivery.

MELISSA MEDINA, CEO EMERGE AMERICAS

BY DOREEN HEMLOCKRobotic surgery. New medicines for rare diseases. Predictive diagnostics. The world of healthcare is brimming with new technologies, and this year’s eMerge Americas tech conference raised the profile of medical innovation to encourage business in the fast-growing sector.

South Florida’s premier tech event, which drew 24,000 people from 50-plus countries in April, made healthcare a priority, building on partnerships with the Jackson Health System and the University of Miami Health System (called UHealth); Baptist Health and Florida International University (FIU); and Nicklaus Children’s Health System, among others. The cooperation featured large pavilions for each on the exhibit floor, plus panel discussions on such topics as high-tech trauma centers and organ transplants.

The focus comes amid strong investment in ventures that produce hardware, software, and tech services for healthcare. Last year, the medtech/healthtech sector ranked second for venture capital funding in South Florida, trailing only after financial tech. The sector received $362 million, or 16 percent of the $2.4 billion invested in South Florida ventures in 2023, says eMerge Americas CEO Melissa Medina.

“The medtech/healthtech sector is experiencing unprecedented growth and innovation, fueled by technological advancements and rising demand for healthcare solutions,” Medina told Global Miami Magazine. “By highlighting the sector at our conference, we can show how technology can continue to improve patient care and healthcare delivery.”

To be sure, health is not a new focus for eMerge, which launched its conference a decade ago to help make South Florida a tech hub. The first company to win the eMerge conference’s Startup Competition was Modernizing Medicine, which makes cloud-based software to run medical practices. That Boca Raton venture, now called ModMed, today employs more than 1,000 people and has raised at least $380 million to finance growth, reports show.

Last year’s eMerge conference also hosted a bustling University of Miami booth showcasing innovations by students, faculty, and researchers. Attendees gawked at the latest iteration of Harvey, a patient-mannequin that simulates some 50 heart and lung conditions. (see story pg. 34). This year’s eMerge hosted additional pavilions, including a return by UM in partnership with Formula 1 race cars, with an emphasis on advanced sports medicine. “The technology used in Formula 1 eventually comes out to the public. For instance, they have gloves the drivers use that measure their vital signs,” says Carlos Migoya, President and CEO for Jackson, which spans hospitals, urgent care, long-term care, and graduate medical education in its network.

The pavilion by FIU and Baptist Health featured interactive displays that allowed users to experience the handicaps of people with different neurologic disorders. On one display, participants first drew spirals on a touch screen under “normal” circumstances. Then a vibrating plate underneath gave them the experience of Parkinson’s with their next attempted spiral. Another memory kiosk simulated the confusion experienced by patients with Alzheimer’s.

One new pavilion was that of Nicklaus Children’s Health Systems, which offers world-class pediatric care at Nicklaus Children’s Hospital. Their pavilion allowed participants to experience the latest in Virtual Reality headsets, which the hospital uses to calm and relax children undergoing procedures.

“We have been leveraging VR as it pertains to the patient

experience, using it as a distraction for pre-surgery, to reduce anxiety and perceived pain,” says Dr. Christina Potter, a psychologist and behavioral researcher who leads their VR program. “We have seen amazing results… [the children] wear it until they put on the [anesthesia] mask and go to sleep.” Nicklaus is also a leader in the use of digital innovation and Ai to process and analyze health data.

“Overall, Miami is increasingly a health tech hub.”

In addition to the technology itself, what was different at this year’s eMerge was the attention to bringing together diverse players in health – entrepreneurs, investors, tech users, and others – to spur business in the sector. The push extended even into sports, with

the Jackson/UHealth pavilion display of its Formula 1 race car; Jackson’s Ryder Trauma Center acts the medical team for Formula 1 racing at Hard Rock Stadium, deploying such innovations as a telemedicine robot that can work with drivers or others in case of medical emergencies.

South Florida has a strong base to develop technologies for health. The area offers ample medical services and hospitals because of its rising population, including retirees. Baptist Health and other systems market services to patients in Latin America and the Caribbean, deploying new tech that may not be available in their homelands. Some universities – notably UMiami and FIU– have medical schools with active research arms. More generally, The Beacon Council, Miami Dade’s development group, targets the life-science and health sector for growth, recognizing the many jobs it creates, from technicians and doctors to administrators and cleaners, says Greg Horowitz, who leads the Council’s life-sciences push.

One weakness for health tech has been local funding, but an influx of finance and tech companies since COVID hit in 2020 has closed part of that gap. New entrants are keen on health and investing, especially in such digital health solutions as remote monitoring of patients, Horowitz says. Indeed, there’s so much buzz around South Florida health now that overseas groups are visiting more frequently to explore opportunities, some recently arrived from Spain and the United Kingdom, he says.

“In February, we had an Austrian delegation from senior-care companies and technologies,” says Horowitz, a Beacon Council vice president. “We see health tech as a definite growth area.”

Israel, dubbed “Startup Nation” for its innovative companies,

Total invested in South Florida ventures: $2.41 billion in 393 deals. That ranked the Miami-Fort Lauderdale metro area seventh nationwide by number of deals and 11th for deal value.

VC investment by sector in South Florida: Fintech: $577 million. Healthtech/medtech: $362 million. Climatetech/cleantech: $263 million.

Source: eMerge Americas 2023 Annual Insights Report.

stands out among early players in South Florida med tech. Perhaps the best known of its Miami ventures is Insightec, led by Dr. Maurice R. Ferre, son of Miami’s former mayor. The venture treats essential tremors and Parkinson’s disease without surgery, using focused ultrasound. In 2023, Insightec was recognized by BioFlorida, the state’s largest life-sciences network, as the BioFlorida company of the year. Based in Israel’s Haifa and in Miami, it has offices in Dallas, Shanghai and Tokyo and just received $200 million in new credit to expand.

Ferre also chairs Israeli med tech Momentis Surgical, formerly Memic Innovative Surgery, a robotic surgery company based in Tel Aviv, with a unit in Fort Lauderdale. Momentis has raised more than $100 million since its founding a decade ago to finance growth, according to news reports.

HEALTHSNAP: Founded in 2015 as an outgrowth of University of Miami, Miami-based Healthsnap specializes in monitoring patients with chronic diseases, working with 150-plus medical groups and healthcare systems. It announced a $25 million funding round in February led by Sands Capital and including Comcast Ventures and Florida Opportunity Fund, among others. It has raised more than $48 million.

CYRANO THERAPEUTICS: Founded in 2014, the Delray Beachbased company is pioneering treatments for the loss of smell. In January, it raised $9 million led by Florida Opportunity Fund and including Deepwork Capital, among others. It has raised more than $21 million.

NEOCIS: The Miami company created and sells a system that uses robots to plan dental implant surgery, a system cleared by the U.S. Food and Drug Administration. So far, it’s been used for more than 40,000 surgeries. In January, it announced $20 million in funding from NVentures, Nvidias’s venture capital arm, as well as Mirae Asset Capital/Mirae Asset Venture Investment. It has raised about $180 million to date. The company employs more than 140 people, most based in Miami. It is led by a UM grad who formerly worked at Mako Surgical, together with another former colleague from Mako.

CLAYFUL: The Davie-based startup offers text-based coaching on-demand for students to support their mental wellness, partnering with K-12 schools and school districts. In November, it announced $7 million in funding led by Reach Capital. It employs more than 100 people nationwide, including vetted coaches.

FORWARD THERAPEUTICS: Founded in 2022, this Palm Beach Gardens-based startup is developing molecule therapies for chronic inflammation and immune system disorders. In November, it announced a $50 million funding round led by BVF Partners and including RA Capital Management, among others.

DELOREAN AI: Founded in 2019, this Palm Beach-based startup uses artificial intelligence in varied ways, including helping hospital systems apply algorithms to patients’ medical records to forecast the course of diseases and speed treatment. In September, it announced $7.5 million in funding led by Sopris Venture Capital and including Pinta Capital Partners, among others

Sources: Company announcements, tech website refreshmiami.com

I’m very excited about what eMerge is doing in health. They’re bringing together people from different partnerships to think about ways to create medical innovation

DOCTOR PHILLIP LIU, ABOVE, VENTURE- STUDIO FIRM, ATOMIC

Venture capitalists divide opportunities in the sector into three areas based on their complexity and timeline for returns. Most complex is biotech, which includes drugs and other “small molecule” products regulated by the U.S. Food and Drug Administration. Biotech takes the longest to bring to market, regularly involving clinical trials. It includes such South Florida ventures as Coral Gables-based Catalyst Pharmaceuticals, which makes medicines for rare diseases and was BioFlorida’s 2022 winner.

Next comes medtech, which refers mainly to medical devices and hardware regulated by the FDA, such as surgical implants. Medtech also may refer to algorithms that offer predictive diagnostics to help doctors make medical decisions. Last and least complex comes healthtech, which is not FDA regulated, and encompasses such ventures as online platforms to hire health coaches.

Short-term, healthtech offers the greatest potential for growth in South Florida – but with a caveat, says Phillip Liu, a medical doctor who runs the healthcare practice for venture-studi firm Atomic and chairs the Beacon Council’s committee on healthcare and life sciences. New products and services need to be high-quality and able to scale, not just variations on existing wares or small-scale ventures, says Liu.

“Biotech can take decades to develop,” Liu says. “But when you think about the diversity of the Miami patient population, the size and connectivity of the South Florida market up to Orlando, the business friendliness of Florida’s public sector – all those are hidden gems that don’t exist everywhere. So, if you can prove high-quality healthtech works here, you show it can work in other places.”

Historically, South Florida has racked up few biotech or medtech successes on the scale of the almost $2 billion sale of Ferre-led Mako Surgical in 2013. Gains from that sale rippled into financing for Insightec, Momentis, and angel investments locally to spur the sector and jobs, says Liu.

“That’s why I’m very excited about what eMerge is doing in health,” says Liu. “They’re bringing together people from different partnerships to think about ways to create medical innovation.” l

PART OF THE NEW MIAMI:

JOSH SCHERTZER, CHIEF TECHNOLOGY OFFICER FOR BLACKSTONE’S ENTERPRISE SYSTEMS AND CO-MANAGER OF ITS MIAMI OFFICE. IN THE BACKGROUND: MIAMI’S NETWORK ACCESS POINT (DOMES) AND ITS $6 BILLION WORLDCENTER, STILL UNDER CONSTRUCTION.