State of the Ports 2025

UNLOCK YOUR NEXT OPPORTUNITY IN THE

JOIN THE LEADING INTERNATIONAL TRADE ORGANIZATION DEDICATED TO FOSTERING BILATERAL TRADE.

State of the Ports 2025 & Annual Trade Report

0verview

A year of infrastructure investments

Innovation Awards

MDIA sparks trade flow technology

Tunnel Vision

The importance of a highway link

0verview

Thriving despite global volatility

Flower Power

Avianca dominates floral trade

Prologis

Logistics Real Estate Leader

Top Trading Partners

The Americas Advantage

World Trade Stats

Miami’s trade with 153 countries

GLOBAL MIAMI

PUBLISHER

Richard Roffman

EDITOR-IN-CHIEF

J.P. Faber

ASSOCIATE PUBLISHER

Gail Feldman

SENIOR VICE PRESIDENT INTERNATIONAL

Manny Mencia

VICE PRESIDENT OF OPERATIONS

Monica Del Carpio-Raucci

EDITOR

MANAGING

Drew Limsky

SENIOR EDITOR

Yousra Benkirane

SALES AND PARTNERSHIPS

Sherry Adams

Amy Donner Gail Scott

ART DIRECTOR

Jon Braeley

PRODUCTION DIRECTOR

Jorge G. Gavilondo

WRITERS

Doreen Hemlock

Riley Kaminer

Joe Mann

Katelin Stecz

PHOTOGRAPHERS

Rodolfo Benitez

Alexia Fodere

CIRCULATION & DISTRIBUTION

CircIntel

BOARD OF ADVISORS

Ivan Barrios, World Trade Center Miami

Ralph Cutié, Miami International Airport

Gary Goldfarb, Interport

Bill Johnson, Strategic Economic Forum

Roberto Munoz, The Global Financial Group

Stacy Ritter, Visit Lauderdale David Schwartz, FIBA

EDITORIAL BOARD

Alice Ancona, World Trade Center Miami

Greg Chin, Miami International Airport

Tiffany Comprés, Pierson Ferdinand Paul Griebel, Venture for America

James Kohnstamm, Miami-Dade County

John Price, Americas Market Intelligence

TJ Villamil, eMerge Americas

Global Miami Magazine is published bi-monthly by Global Cities Media, LLC. 1200 Anastasia Ave., Suite 217, Coral Gables, FL 33134. Telephone: (305) 452-0501. Copyright 2025 by Global Cities Media. All rights reserved. Reproduction in whole or part of any text, photograph, or illustration without o\prior written permission from the publisher is strictly prohibited. Send address changes to subscriptions@ globalmiamimagazine.com. General mailbox email and letters to editor@globalmiamimagazine.com

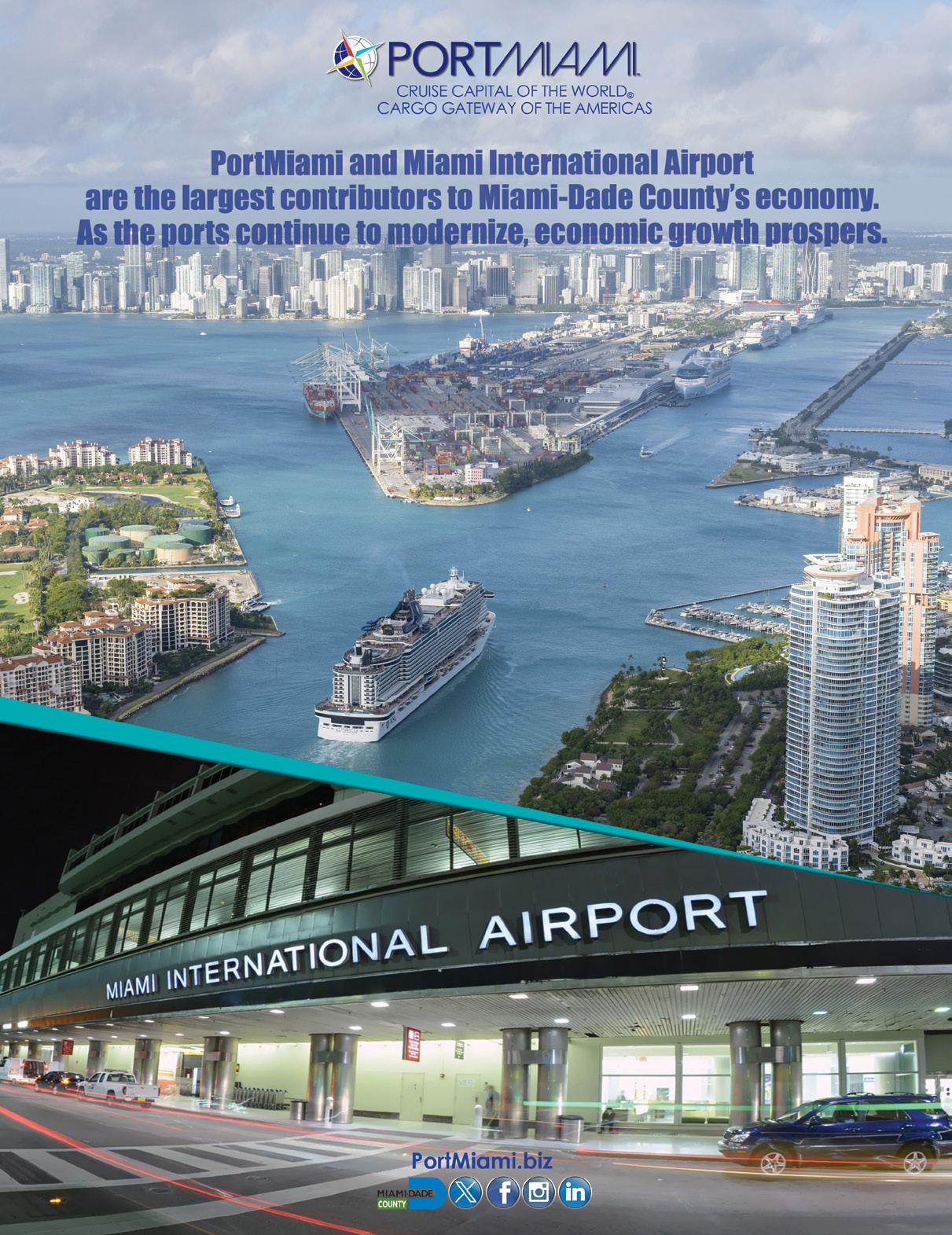

South Florida’s Air and Seaports are the Engines

That Keep it at the Forefront of Global Trade

“Our cargo operation has really exploded. We continue to be one of the premier cargo airports in the country and in the world...”

RALPH CUTIÉ, MIA’S DIRECTOR AND CEO

BY YOUSRA BENKIRANE

Together, Miami International Airport, PortMiami, and Port Everglades give the Miami Customs District – comprising South Florida’s three counties – a uniquely agile and diversified trade platform. In 2024, as global supply chains continued to adjust to new economic and political realities, these ports played an essential role in sustaining the District’s growth.

Each port contributes distinct strengths. Miami International Airport is the nation’s top gateway for perishables and a rising player in pharma and East–West e-commerce. PortMiami leads the state in containerized trade and continues to expand its reach through Europe, Asia, and the Americas. Port Everglades powers Florida’s energy flows and ranks among the top U.S. ports for perishables and luxury imports.

“The market continues to evolve,” says PortMiami Director Hydi Webb. “We’re seeing new trade lanes, new partners – and we’re building the capacity to serve them.”

That spirit of constant investment is driving a wave of infrastructure upgrades across all three ports. From deeper harbors to next-generation cranes and expanded cold chain facilities, Miami’s ports are preparing not just to compete, but to lead, in the next era of global trade.

MIAMI INTERNATIONAL AIRPORT

Miami International Airport (MIA) may be best known for passengers, but it is one of the most powerful cargo airports in the world – and 2024 proved it yet again. The airport closed the year with its fifth straight record-breaking year in cargo, handling just over 3 million tons, a performance that propelled MIA to #1 in the U.S. for international freight, #3 in the U.S. for total freight, and #5 globally for international freight.

“Our cargo operation has really exploded,” says Ralph Cutié, MIA’s director and CEO. “We continue to be one of the premier

cargo airports in the country and in the world.” As of April 2025, MIA was already tracking 14% ahead of last year’s record cargo volume, defying global trade headwinds and tariff uncertainty.

Few markets depend on perishables the way MIA does, and few serve them better. Roughly 68% of all perishables entering the U.S. flow through MIA, including 91% of the nation’s imported flowers, 65% of fruits and vegetables, and 55% of seafood. Miami’s position as a hub for Latin American agriculture, combined with its unmatched cold chain infrastructure (nearly 500,000 square feet of on airport cold storage) gives it an edge few airports can match.

Perishables aren’t the only story. High-value pharmaceuticals, electronics, and industrial goods continue to move in large volumes through MIA’s air cargo network. About 50% of inbound cargo is transshipped onward by air or truck, giving MIA a central role in U.S. and hemispheric supply chains.

The airport is also investing for the future. A new $140 million phytosanitary and cold chain facility, co-developed with PortMiami and funded in part by a federal grant, will add treatment, fumigation, and expanded cold storage capacity. An 800,000-square-foot Vertically Integrated Cargo Community (VICC) is also underway. Once completed, it will expand MIA’s cargo capacity by 50%, enabling the airport to hit its 2041 cargo volume targets 10 years early.

Cutié also points to MIA’s expanding air network. The airport is in advanced talks with five Middle Eastern carriers, several Eastern European airlines, and Japan Airlines, while a new direct air cargo route from Guangzhou to MIA launched in June is accelerating cross-border e-commerce. “Our goal is to continue growing, and to stay on top,” says Cutié.

PORTMIAMI: BUILDING CAPACITY, CONNECTIVITY, SPEED

In 2024, PortMiami strengthened its role as one of the most diversified ports in the U.S. – and as one of the region’s most forward-looking. “We were flat in 2024 cargo volumes, which was a win in this environment,” says Director and CEO Hydi Webb. That stability was no accident. The port’s highly diversified trade mix – roughly 46% Latin America and Caribbean, 33% Asia, and 20% Europe and the Mediterranean – continues to insulate it from major trade shocks.

As of mid-2025, PortMiami’s cargo volume was up 3% yearover-year, outpacing national trends. The port has consistently handled more than 1 million TEUs annually for the past decade and remains Florida’s #1 container port for international trade and 11th in the U.S.

That resiliency is matched by aggressive infrastructure investments. The port recently launched Phase 2 of its yard densification project, adding 18 new electric rubber-tire gantry cranes to increase container stacking efficiency and handle growing volumes within its limited footprint. Meanwhile, a $70 million federal grant will expand PortMiami’s on-dock rail system from three to five tracks, allowing faster intermodal connections – with the ability to reach 70% of the U.S. by rail in just four days.

Looking inland, PortMiami is advancing a new inland port project in western Miami-Dade County, in partnership with Florida East Coast Railway. The inland port will give shippers additional options for container staging, customs clearance, and intermodal

PORTMIAMI AND THE CITY OF MIAMI SKYLINE

“...Our diversified trade pattern and strong relationships give us confidence that we’ll continue to grow.”

HYDI WEBB, ABOVE, PORTMIAMI DIRECTOR, ON THE TRADE TARRIFS CAUSING UNCERTAINTY IN THE MARKET

transfers, freeing up dockside capacity and helping accelerate turn times at the seaport itself.

The port’s deep dredge continues to deliver strategic value. “Without that dredge, over 2,000 vessels we’ve received wouldn’t have been able to call here,” says Webb. PortMiami remains the deepest port on the East Coast south of Virginia, giving it an edge in attracting larger vessels and new services. That includes a notable wave of new routes in the past year: three new services from Asia, four from Europe and the Med, and additional growth in Latin America connections. “Nearshoring is real,” says Webb. “We are seeing more manufacturing in Mexico and Central America, and that is directly benefiting us.”

The port is also advancing its push for greater cargo visibility and efficiency. It recently partnered with the Miami-Dade Innovation Authority on an AI-driven initiative to track truck movements and improve traffic flows through the port, a critical move as congestion and speed-to-market become competitive differentiators.

Webb remains optimistic but pragmatic. “We are tracking the tariffs closely. There is a lot of uncertainty,” she says. “But our diver-

MDIA’S NEW CHALLENGE

In May 2025, Miami-Dade County and the Miami-Dade Innovation Authority (MDIA) announced the winners of the MDIA’s third Public Innovation Challenge – this time focused on improving cargo flow at PortMiami. The initiative is part of a broader effort to modernize the port’s operations through advanced technology, with a focus on real-time tracking, efficiency, and safety. “Ports of the future will be defined not by their infrastructure, but by their intelligence,” says Leigh-Ann Buchanan, President & CEO of MDIA. “We’re helping PortMiami build muscle memory around smart port operations so it can learn, adapt, and scale new technologies in real time.”

Four startups – Argu, Conbo.ai, GenLogs, and GridMatrix – were each awarded $100,000 to deploy pilot projects for port infrastructure. The goal: test how emerging AI, computer vision, and sensor-based solutions can improve cargo flow, terminal operations, and roadway congestion. “These are not demonstration exercises – these are real pilots in a live environment,” says Buchanan. “We want to give PortMiami a faster pathway to adopt new tools that can improve its competitiveness and service.”

Argu is using AI–powered video analysis to monitor container handling and equipment safety. Conbo.ai is working with the port to track truck movements and terminal operations. GenLogs is mapping truck and trailer flows across the broader logistics network. GridMatrix is modeling truck traffic and congestion patterns around the port. “Introducing real- time cargo tracking through this pilot is a strategic step toward making PortMiami a leading trade hub for the Americas,” says Miami-Dade County Mayor Daniella Levine Cava. If the pilots succeed, PortMiami could move quickly to scale these technologies across its broader operations, part of its “smart port” innovation. MDIA worked with PortMiami leadership to design each pilot around real-world operational needs. “We’re not doing band-aid solutions,” Buchanan says. “Every pilot is about building scalable, embedded intelligence into the port’s future operations.”

LEIGH-ANN BUCHANAN, PRESIDENT & CEO OF MDIA

TUNNEL VISION

In Miami, not all trade infrastructure is visible above ground. Beneath Biscayne Bay, the PortMiami Tunnel has become one of the most essential conduits for South Florida’s international commerce. Since opening in 2014, it has removed more than 1.5 million trucks per year from downtown streets by connecting the MacArthur Causeway on Watson Island with the Port of Miami on Dodge Island, thereby connecting PortMiami directly to the interstate system without a single traffic light.

“The goal was to get cargo in and out quickly, safely, and freely,” says the tunnel’s founding director and current board chairman, Chris Hodgkins. “Today, no other North American port offers that kind of direct highway access.”

For a port like Miami – where high-value, time-sensitive cargo is a core strength – the tunnel’s impact is essential. It enables justin-time supply chains, supports perishable and e-commerce flows, and ensures PortMiami remains globally competitive.

Built to international safety standards, the tunnel features AI-driven traffic monitoring, advanced air and fire systems, and 110,000-pound hurricane floodgates designed to protect against sea–level rise. Operational performance remains exemplary; using dedicated tow trucks, the average response times to incidents that could slow or block tunnel traffic is just 16 minutes – well ahead of industry benchmarks. The project also stands as a model of successful public–private partnership. Delivered on time and under budget, the tunnel was built with more than 83% of its workforce drawn from Miami–Dade County.

Looking ahead, increases in traffic volume is not a concern. “We haven’t even come close to capacity yet,” Hodgkins says. “We’re ready to support PortMiami’s future growth – whatever that looks like.”

sified trade pattern and strong relationships give us confidence that we’ll continue to grow.”

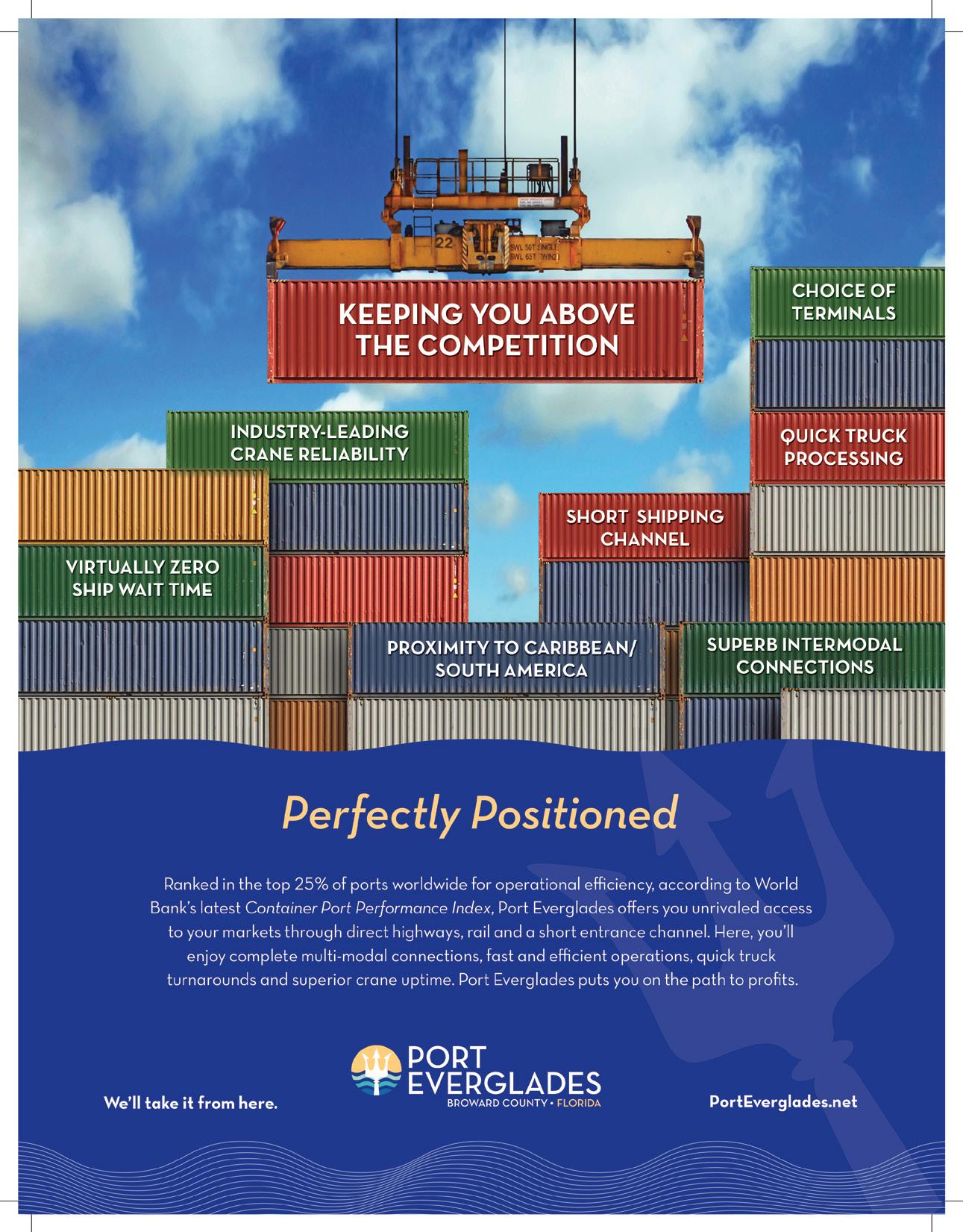

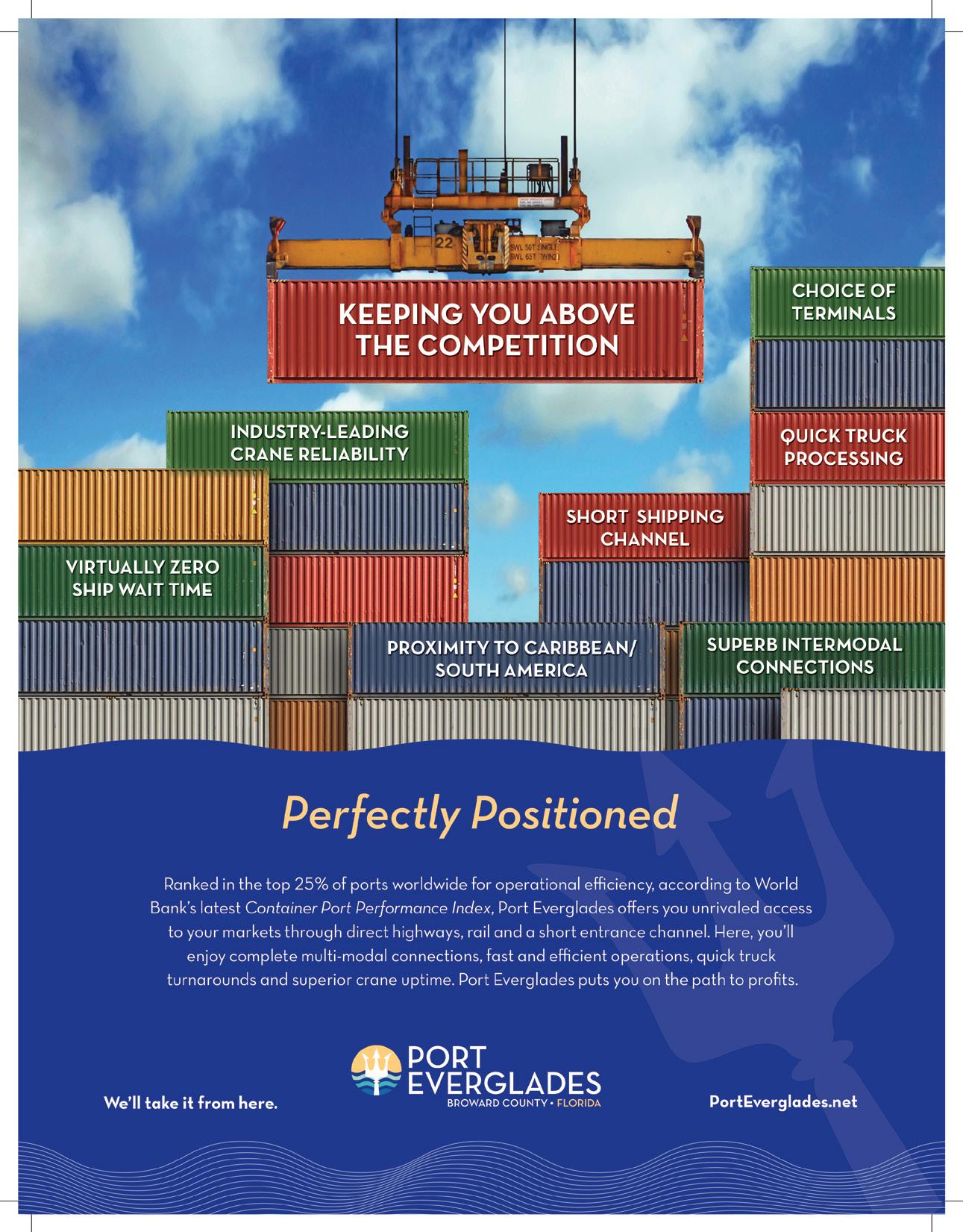

PORT EVERGLADES

At Port Everglades, trade is big business – and growing. The port generated nearly $28.1 billion in trade activity in Fiscal Year 2024, a 6% increase over the prior year, according to a report by Martin Associates. Its cargo and cruise sectors now support more than 204,000 jobs regionally, including 12,270 jobs directly tied to port operations. “The numbers demonstrate that our port’s position as a leading economic engine is well-earned and of great value to Broward County, and Florida’s residents and visitors,” says Joseph Morris, CEO and port director of Port Everglades.

Port Everglades operates as a self-supporting enterprise fund, requiring no local tax dollars for operations or capital improvements, while contributing more than $1.1 billion in state and local taxes an-

PORT EVERGLADES CARGO AND CRUISE SECTORS NOW SUPPORT MORE THAN 204,000 JOBS REGIONALLY

PRESIDENT OBAMA VISITING THE PORT OF MIAMI TUNNEL 2013

nually. That number reflects a port built for efficiency and specialization. Strategically located just two miles from I-95, Port Everglades is one of Florida’s most multimodal seaports, offering seamless integration between ocean, rail, air, and highway networks.

Nearly 90% of Port Everglades’ trade flows through Latin America and the Caribbean, and about 80% of inbound cargo remains within an 80-mile radius, feeding South Florida’s high-consumption market. The port is also a national leader in refrigerated cargo. It ranks as the #1 perishable seaport in Florida and #7 in the U.S. Its advanced cold chain infrastructure handles bananas, avocados, pineapples, seafood, and more, supported by the only on–port Chiquita ripening facility in the U.S. “We handle the product so it’s in prime condition for local retailers the moment it’s needed,” says Jorge Hernandez, director of business development.

The port is equally vital to Florida’s energy supply chain. Port Everglades delivers 100% of the jet fuel used by Fort Lauderdale–Hollywood International and Miami International Airports, as well as all the gasoline and diesel for Broward, Miami–Dade, and Palm Beach counties, making it a 24/7 energy hub for the region.

Operational flexibility is another hallmark. The port maintains a rare trade surplus, with a 52% export/48% import split, driven by containerized exports and robust roll–on/roll–off trade to Caribbean nations. It also ranks #1 nationally for yacht imports, with growing volumes of luxury yachts transported via semi-submersible vessels.

Infrastructure investments are keeping pace with demand. The recently completed $471 million Southport Turning Notch

“The numbers demonstrate that our port’s position as a leading economic engine is wellearned and of great value to Broward County ”

JOSEPH MORRIS, ABOVE, CEO AND PORT DIRECTOR OF PORT EVERGLADES

Expansion added 1,500 linear feet of new berthing and six Super Post–Panamax gantry cranes, enabling the port to handle vessels with up to 14,000 TEUs. That has already attracted new Mediterranean services, bringing in high–value cargoes such as ceramic tile, marble, and yachts.

Looking ahead, the port is preparing to launch its long awaited deepening and widening project, deepening the harbor from 42 to 48 feet and widening key channels to safely accommodate the next generation of large vessels. “It’s a critical project that ensures we can meet future demand and serve larger ships,” Morris says.

Port Everglades is also investing in terminal automation, AI–driven cargo tracking, and advanced terminal operating systems to further accelerate throughput and enhance supply chain visibility. A new 20–year Master Plan is in progress to guide long-term growth. “We have good problems – demand that continues to grow,” Morris says. l

The State of Trade 2025

PERSPECTIVES ON THE MIAMI CUSTOMS DISTRICT, TODAY AND TOMORROW

“ Trade is the ultimate barometer of resilience ”

ALICE ANCONA VICE PRESIDENT OF THE WORLD TRADE CENTER MIAMI

BY YOUSRA BENKIRANE

In a year where global trade reached a record $33 trillion, according to the UN’s latest Global Trade Update, South Florida’s trade engines – its ports, its airports, its people – once again demonstrated their ability to adapt and thrive amid persistent economic and geopolitical uncertainty.

The outlook for 2025 is already clouded by escalating tariff threats, shifting U.S. policy signals, and global supply chain recalibrations. And while global trade reached a record in 2024, the growth was driven largely by a 7% surge in services trade – with goods trade remaining uneven, growing just 2% and still below its 2022 peak. In contrast, the Miami Customs District – Miami-Dade, Broward and Palm Beach counties – surged to $144 billion, up 5% from the prior year.

Of the $144 billion in total trade for 2024 (up from $137 billion the prior year) exports totaled $78 billion, while imports rose to $66 billion. “From our vantage point, the Miami market continues to present unique opportunities – even amid uncertainty,” says Lenny Feldman, managing partner for international trade law firm Sandler,

“The Miami market continues to present unique opportunities – even amid uncertainty”

LENNY FELDMAN, ABOVE, MANAGING PARTNER, SANDLER, TRAVIS & ROSENBERG, (LAW FIRM)

Travis & Rosenberg. He points to Miami’s deep integration with the Americas as a key advantage, noting that in an era of decoupling from China, companies are increasingly looking south for new sourcing and manufacturing partnerships.

That regional strength is evident in the district’s trading relationships. Brazil remained the district’s top trading partner, with $19.38 billion in total trade, propelled by a commanding $15.3 billion in exports from Miami. Colombia followed at $10.03 billion in total trade, with the Dominican Republic, China, and Chile rounding out the top five.

Aircraft parts led the charge among exports, reaching $11 billion – part of a broader surge in high-value aviation, technology, and medical goods that now define Miami’s export profile. Telephones followed at $6.06 billion, buoyed by strong demand across Latin America. Computers, packaged medications, vaccines, integrated circuits, and medical instruments all saw robust movement through the district as well, underscoring Miami’s role as a conduit for both innovative products and essential goods.

Imports, meanwhile, reflect a supply chain landscape in flux. While China remains the largest source of goods, import volumes from Southeast Asia and Latin America continued to rise in 2024. Ancona describes this as part of a long-arc regionalization trend –

FLOWER POWER

At Miami International Airport (MIA), few airlines move more freight – or more flowers – than Avianca Cargo. With over 50 years of cargo operations through MIA, the Colombian carrier has made Miami a pivotal hub for its North American trade network.

In 2025, Avianca Cargo moved a record 20,100 tons of fresh flowers for Mother’s Day, a 15% increase over the prior year. Of that, an overwhelming 93% came through MIA, solidifying Miami’s position as the dominant U.S. gateway for flower imports.

“We are the number one airline for flowers from Colombia to the U.S.,” says Avianca Cargo CEO Diogo Elias. “Miami plays such a big role for us… from there, they reach not only the U.S. but also Canada.”

The supply chain is a precisely tuned operation. Flowers harvested in Colombia are rapidly packed, cooled, and flown to Miami on dedicated freighter flights. Upon landing at MIA, shipments move through specialized temperature-controlled facilities, where they are sorted and cleared for final distribution. In less than 24 to 48 hours, shipments reach floral wholesalers, grocery chains, and retailers from New York to Chicago to Toronto – a time-sensitive trade that has made MIA the unrivaled center of this $2 billion-plus industry.

Through MIA, the airline also moves large volumes of salmon from Chile, and fruit from Brazil, Central America, and the Southern Cone, while hauling pharmaceuticals, luxury goods, and e-commerce southbound to Latin America.

Avianca continues investing in MIA, growing its temperature-controlled capacity there by 83% this year, and expanding its MIA workforce by 30%. It’s also implemented 100% paperless delivery, achieving a 20% improvement in delivery times. And it's forging new partnerships to further strengthen its U.S.-Latin America connectivity. In April, Avianca launched a daily 767-300F charter service between Bogotá and Miami in collaboration with Amazon Air Cargo, enhancing capacity for cross-border e-commerce and high-value shipments between the two markets.

AVIANCA CARGO, AT THE CENTER OF MIAMI’S TRADE IN FLOWERS

“Our diversified trade pattern is our strength”

HYDI WEBB, RIGHT, DIRECTOR AND CEO, PORTMIAMI

one accelerated by both COVID-era supply shocks and preparation for the 2024 U.S. presidential elections. “We started seeing that shift into the first quarter of 2025,” she says. “That’s where the data goes a little wonky.”

Telephones remained among the district’s top imports at $4.23 billion, but sourcing shifted. Vietnam, Malaysia, and India all gained share, reflecting supply chain recalibrations away from China. “China’s been on the decline for a bit,” Ancona says. “It’s just because it’s been shifting to other parts of Asia. Everyone is trying to regionalize.”

Other import categories mirrored the complexity of this transition. Gold shipments surged to $3.73 billion, underscoring Miami’s status as a financial gateway. Fish fillets ($2.38B), largely from Chile and other South American partners, highlighted the district’s ongoing strength in perishables handling. Cut flowers ($1.88B) remained a Miami staple, and recreational boats ($1.65 billion) reflected the continued demand from South Florida’s high-end leisure sector.

Beyond individual product categories, the real story of 2024 was one of structural change. As Feldman explains, “People are now looking south of Miami.” The importance of Miami’s re-export capabilities should also not be underestimated. Roughly half of U.S. imports are not destined for domestic consumption but instead serve as inputs for manufacturing or re-export. Miami, with its deep expertise in transshipment, is positioned to support that flow. “It’s why you see such a diversity of product categories here,” he says. “From perishables to apparel to aircraft parts – it all moves through Miami because we know how to handle it.”

WHAT PORT HANDLES WHAT: NUMBERS AND NICHES

No single port defines the Miami Customs District trade story. Rather, it is the complementary roles of PortMiami, Port Everglades, and Miami International Airport that allow the region to serve as one of the world’s most versatile trade hubs.

PortMiami remains Florida’s leading container port for international trade and the 11th largest in the U.S. In 2024, the port’s trade totaled $30.4 billion and processed just over 1 million TEU containers – marking a 3% year-over-year gain in a global shipping environment where many ports saw declines. “Our diversified trade pattern is our strength,” says Hydi Webb, PortMiami director and CEO. The port’s cargo mix breaks down to roughly 46% Latin American and Caribbean, 33% Asian, and 20% European and the Mediterranean. Perishables, textiles, and apparel continue to anchor the North-South trade, while electronics from Asia and construction materials and furnishings from Europe moor East-West trade.

Port Everglades plays an equally vital role – particularly in serving Florida’s fast-growing consumer market. With trade totaling $27.9 billion, nearly 90% of Port Everglades’ commerce is with Latin America and the Caribbean, and about 80% of inbound cargo remains within an 80-mile radius of the port. “We’re the number one perishable [sea] port in Florida and seventh in the U.S.,” says

Joseph Morris, CEO and port director at Port Everglades. The port’s big three sectors – containerized cargo, energy, and cruise – each posted near-record results in fiscal 2024. In the container space, top imports include bananas, fish, and flowers; ceramic tile and marble from the Mediterranean; and high-value yachts from Europe. The port also stands out for its export strength, maintaining a rare trade surplus with a 52%/48% export-import split.

Miami International Airport rounds out the triad with dominance in total trade by value, at $82.33 billion. MIA recorded its fifth straight record-breaking year in 2024, handling more than 3 million tons of cargo. The airport remains the No. 1 U.S. airport for international freight and ranks fifth globally. “We basically own the perishables market,” MIA CEO and Director Ralph Cutié says. Nearly 70% of all U.S. perishables imports – led by flowers, fruit, and seafood – move through MIA. The airport’s deep cold chain capabilities and fast air connectivity make it indispensable for time-sensitive, high-value goods. Electronics, pharmaceuticals, and industrial equipment also flow steadily through MIA’s expanding cargo network. As of early 2025, the airport is tracking an astonishing 14% year-over-year increase in cargo tonnage – underscoring its continuing importance to Miami’s trade ecosystem.

THE SERVICES SECTOR: MIAMI’S HIDDEN TRADE GIANT

When people talk about Miami’s role in global trade, they typically speak of ships and planes, ports and warehouses. But in truth, some of Miami’s most important exports don’t move through cargo holds. They move across networks, in legal briefs, through financial transactions, and inside the ideas and expertise of its people. Services, long an underestimated force in Miami’s trade profile, are in fact

“We basically own the perishables market...”

RALPH

CUTIÉ, ABOVE, CEO OF MIA

JOSEPH MORRIS, LEFT, CEO OF PORT EVERGLADES, ALSO SAYS " WE’RE THE NUMBER ONE PERISHABLE [SEA] PORT IN FLORIDA AND SEVENTH IN THE U.S."

the U.S. ‘s leading export – and in Miami’s case, an essential and fast-growing part of the region’s global economic footprint.

“We trade ideas and expertise as much as we trade goods,” says Ancona. “You may not see that in the same way you see a cargo plane landing or a ship docking, but it is every bit as significant. In fact, in many ways, it’s what makes the physical trade possible.”

It’s a reality that’s easy to overlook in a district known for its towering container volumes and dominant perishables market. Yet services account for roughly one-third of the Miami metropolitan area’s exports – a share that has steadily increased over the past decade. In 2024, U.S. services exports reached a record $1.1 trillion, led by sectors like finance, legal, consulting, education, and technology. In Miami, that invisible flow is everywhere.

South Florida has evolved into a hemispheric headquarters city, a place where businesses of every scale – from startups to multinationals – manage cross-border operations. Many of these firms trade in services first and foremost. Downtown Miami hosts one of the largest concentrations of international banks in the country, with institutions that annually facilitate billions of dollars in trade finance, cross-border lending, and currency transactions. Law firms advise clients on free trade agreements, tariff engineering, and complex international regulations. Marketing and media companies export creative strategies to markets across Latin America. And Miami’s fast-grow-

CONSUMER-DRIVEN TRADE

Prologis is banking not just on put-through, but on local demand

JASON TENENBAUM OF PROLOGIS

If Miami’s trade ecosystem is built on scale, few companies embody that more than Prologis. The world’s largest logistics real estate owner and developer operates in 19 countries and manages nearly 1.2 billion square feet of space across the globe. Its presence in South Florida is commanding – 30 million square feet across 225 buildings – making it the largest industrial landlord in the region.

While Miami is a global trade hub, 75% of logistics demand here is tied to local and regional consumption. Its facilities play a critical role in e-commerce fulfillment, food and beverage distribution, and retail restocking – providing supply chains that remain steady even when international trade patterns shift. “With over six million people in the Tri-County area, the logistics network here is servicing that local population,” says Jason Tenenbaum, Prologis’ South Florida market officer. “As the population continues to grow, that’s a really positive tailwind for our business.” Tenenbaum says today’s climate is driving demand for efficiency. “Our customers are looking at ways to modernize their facilities and optimize their operations,” he says. Beyond providing warehouse space, Prologis supports clients with racking, electrical connectivity, EV charging – and increasingly, Foreign Trade Zones and bonded warehouse capabilities. “We have partners and expertise to help companies establish those FTZs or bonded warehouses,” he says. Land scarcity adds another strategic challenge. “You’re really only 15 to 20 miles east to west here, sandwiched between the ocean and the Everglades,” he says. That constraint fueled one of Prologis’ most ambitious local projects, a three-story, onemillion-square-foot vertical warehouse near Miami International Airport, completed in 2024. “There’s no playbook for these things,” Tenenbaum says. “We’re designing the plane as we’re flying it.”

Prologis is also investing in Miami’s workforce

future. It launched a Trade & Logistics Academy at Miami Springs High School and a companion workforce program at Miami Dade College – helping build the next generation of logistics talent.

ing fintech, healthtech, and digital commerce sectors are expanding their international reach. “Our trade system wasn’t really designed for this level of digital integration,” Ancona explains. “But that’s where the world is headed. And Miami is right in the middle of it.”

From his vantage point at Sandler, Travis & Rosenberg, Feldman perceives the same shift. “We see an incredibly diverse portfolio of companies coming to us for guidance,” he says. “It’s not just about how to move products anymore. It’s about how to structure deals, how to navigate services trade rules, how to support clients across multiple markets.”

The district’s cultural fluency also gives it an edge. With a multilingual workforce and deep connections to Latin America, Miami offers companies an unrivaled gateway for both goods and services trade in the Americas. Many regional headquarters for Latin America operations are based here precisely for that reason. “We’ve built up an ecosystem here that’s second to none,” Ancona says. “And in an uncertain world, that kind of intellectual capital is invaluable.”

NAVIGATING THE CURRENT POLITICAL CLIMATE: TRADE STRATEGIES SHAPING MIAMI’S FUTURE

In late 2024, as the U.S. presidential election cycle unfolded, companies across South Florida began racing against the clock. The threat of new tariffs – widely expected and soon realized – triggered a wave of front-loading across the Miami Customs District.

“Once the election happened, everyone knew this is going to be a tariff moment,” recalls Ancona. By early 2025, many importers had already adjusted their strategies, moving shipments forward and holding inventory in anticipation of an unsettling year. The move was not without precedent. “It’s kind of like COVID part two –

American Airlines and the Flight Symbol logo are marks of American Airlines, Inc. ©2024 American Airlines, Inc. All rights reserved.

“When tariffs were announced, we weren’t [significantly] affected ... ”

ESTEBAN MOCTEZUMA BARRAGÁN, SHOWN RIGHT, MEXICAN AMBASSADOR TO THE U.S.

without the pandemic,” Ancona says. “It’s a continuous shift toward more regionalization, and companies are adapting again.”

The current moment reflects a broader truth about global trade, that it is an organism, constantly responding to its environment. Tariff threats and political uncertainty have accelerated the shift from just-in-time to just-in-case logistics, driving new behaviors as companies rethink fundamental aspects of their supply chains.

It is a shift that plays to Miami’s natural strengths, with its deep connectivity to the Americas, its air and sea links, and its regional expertise. All make it an ideal place for companies seeking more predictable, tariff-resilient pathways. “We’re seeing a real opportunity now,” says Feldman. “A lot of importers and exporters are looking to divest from China – not just to Southeast Asia, but to Mexico, Central America, South America, and the Caribbean.”

Mexico, in particular, is poised to play an outsized role in this evolving landscape. “When tariffs were announced, we weren’t [significantly] affected,” Mexican Ambassador to the U.S. Esteban Moctezuma Barragán told Global Miami. “A car built in Mexico might contain 40 to 70 percent American components. That part cannot be subject to a tariff. So, if a 25 percent tariff is imposed and your content is 50 percent American, it effectively drops to 12.5 percent. We’re working to clarify that. But what’s most important is

how we approach the USMCA review. That will define the future of the bilateral – and the North American – relationship. We are the most competitive region in the world, and we share similar values.”

That regional competitiveness is fueling new trade corridors. “Our relationship with Florida has been growing,” Ambassador Moctezuma said. “Florida has important comparative advantages due to its location. As Mexico develops the interoceanic corridor, the state that will benefit most is Florida – because of its position and because of the new economic trends that will emerge.”

Even for companies that cannot easily shift supply chains, Miami offers tools to weather the current volatility. “A lot of companies [will] use first sale, duty drawback, and the Foreign Trade Zones,” says Ancona. “They just didn’t use them before because trade was good.” Now, she says, it’s about cost survival: “They’re asking, ‘What tools are available to me right now to make those cost-saving decisions?’”

She explains: “First sale is a way of pricing how goods get tariffed – it’s complicated, and it requires using professionals to help navigate that. Duty drawback is like getting a refund. A lot of companies never pursued those refunds, because it felt like extra work. Now they are going back to talk to the professionals to get the duty drawback, or adjust the first sale valuation, or finally activate an FTZ because they can save on the tariff.”

Notes PortMiami Director Hydi Webb: “Right now, I think we have over 80 active Foreign Trade Zones. Some of these zones are seeing an influx of cargo to hold while the tariff situation works out.”

Gary Goldfarb, chief strategy officer for Interport Logistics, and chair of the World Trade Center Miami, has seen demand explode. “I’ve been doing tens of Foreign Trade Zones every week,” he says. “I think I’m now close to 900 FTZ activations either done or in

process.” For companies using FTZs correctly, the benefits are clear: “You can receive products, not pay duties while they’re in the FTZ, and only pay duties if they enter U.S. commerce. If you export, you never pay the duty.”

This resurgence of interest in trade tools also reflects a structural shift. “Tariffs are really a return to businesses requiring professionals to help them move their merchandise,” Goldfarb explains. “It’s not as simple as it used to be. Now you need compliance experts, and tools like FTZs are at the forefront.”

The broader reality is that uncertainty will continue, and trade volatility will be passed through the entire economy. “We’re paying for it,” says Ancona. “Walmart’s going to have to raise prices, and other retailers will follow. The consumer is going to feel it.”

In that environment, South Florida’s logistics and compliance ecosystem will matter more than ever. As Goldfarb puts it: “Our community of somewhere around 1,900 [commercial and professional] entities is probably the most experienced, most knowledge-based anywhere in the country – potentially anywhere in the world.”

2025 OUTLOOK

As Miami Customs District enters 2025, trade leaders across the district are bracing for a year where political risk, evolving trade policies, and shifting consumer demand will require constant adjustment, not static strategy. The United Nations Center for Trade and Development [UNCTAD] outlook highlights key risks: escalating trade wars, potential U.S. policy shifts, and ripple effects across supply chains. “You can’t look at the trade data by itself,” Ancona says. “Consumer confidence, employment trends, and political decisions are now direct drivers of what moves through Miami.”

Companies will likely continue pursuing regionalization and supply chain agility – but with greater urgency. The Miami market

“You can receive products, not pay duties while they’re in the Foreign Trade Zone, and only pay duties if they enter U.S. commerce... ”

GARY

GOLDFARB, LEFT, CHIEF STRATEGY OFFICER FOR INTERPORT LOGISTICS

LEFT: AVIANCA CARGO AT MIA

is already seeing an uptick in Mexican and Latin American trade volumes, and new East-West air cargo links are building a more diversified network. A new Guangzhou-Miami route, for example, coupled with pending talks for Middle Eastern and Eastern European service, points to Miami’s growing role as a global transshipment and e-commerce center.

At the same time, services trade will continue to act as a stabilizer in an otherwise volatile goods environment. Certainly risks remain. U.S. tariff policy under the new administration could trigger rapid shifts in sourcing patterns and consumer prices. Retailers are already signaling potential price increases, which may dampen discretionary demand – a critical issue for Miami, given its exposure to tourism, luxury goods, and consumer-driven trade.

2025 will likely be a year of fragmented but high-value opportunities, where agility will trump volume. Companies that can move fast, hedge risk, and tap Miami’s deep multi-modal and services ecosystem will gain an edge. As MIA’s Ralph Cutié put it: “Miami always adapts.” l

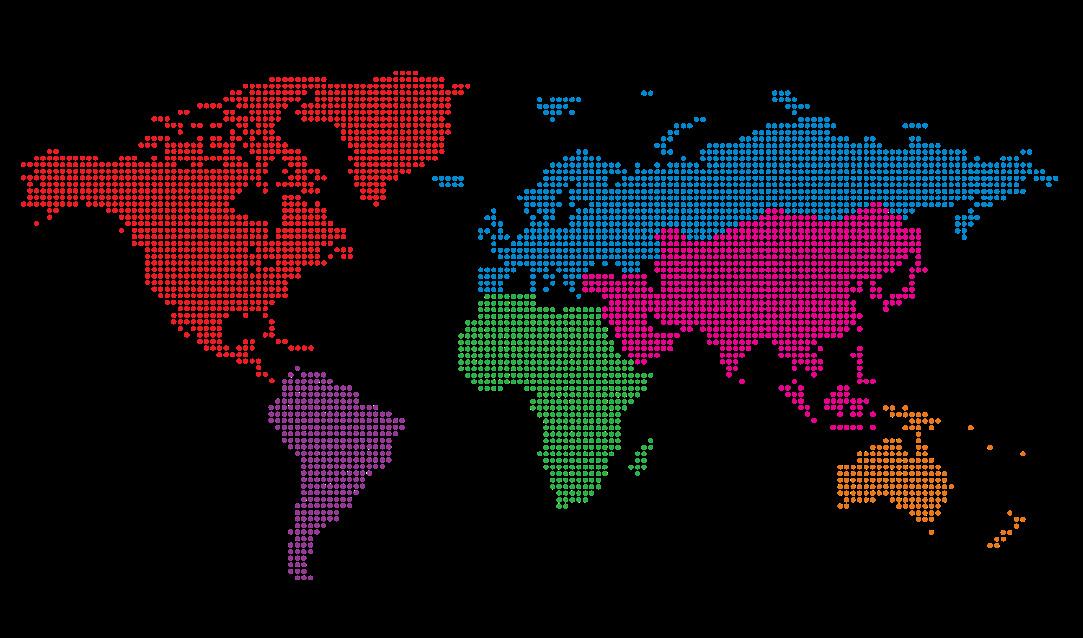

South Florida’s Trade with the World

NORTH AMERICA & THE CARIBBEAN $44.85 BILLION (32 COUNTRIES)

& THE

$54.42 BILLION (12 COUNTRIES)

$1.66 BILLION (48 COUNTRIES)

$27.86 BILLION (44 COUNTRIES) OCEANIA: $1.38 BILLION (11 COUNTRIES) EUROPE: $29.49 BILLION (133 COUNTRIES)

Top 10 Miami Customs District Trading Partners 2024

THE AMERICAS ADVANTAGE: MIAMI’S INVIABLE TRADE POSITION

Even though Canada and Mexico are the top trading partners of the U.S., their combined trade with the Miami Custom District (Miami-Dade, Broward, and Palm Beach counties) – even with Central America and the Caribbean included – still falls $10 billion short of the trade with South America. Of the top 10 trading partners, the four from South America amount to $40 billion in trade, twice the four from Central America and the Caribbean, and more than five times the trade with China.

These strong trade ties with South America, Central America and the Caribbean mean that Miami is well positioned to survive the current turbulence in tariffs, since these areas are facing far lower increases than Asia or Europe. While particular commodities and products – such as steel and building supplies – face high tariffs regardless of origin, as a region the Americas (excluding Mexico and Canada) are facing the less stringent trade winds of 10% tariffs. The rest of the world faces far higher jumps.

In the general de-coupling from China and other Asian sources of production,

the Americas offer an attractive alternative for offshoring of low-cost manufacturing. Already, Central American nations such as El Salvador and Guatemala are seeing new factories geared in particular to the production of clothing; in the Caribbean, the Dominican Republic is making a concerted push to become a manufacturing center.

For offshore production as well as for perishable imports, the shorter shipping distances to the Americas (versus Asia or Europe) further reduce costs, and result in shorter lead times for “just-in-time” manufacturing. Miami also enjoys a pivotal position as a distribution hub for the Americas, where, for example, European goods can be transshipped from Free Zone warehouses in Miami for distribution points across the hemisphere.

And, as far as balance of trade goes, Miami holds the advantage, at least among its top 10 trading partners, with $42 billion in exports versus $30 billion in imports. And this does not include the city’s vast surplus in service exports, in everything from professional talent to entertainment and tourism.

World Trade Statistics

16. TURKS & CAICOS (TOTAL TRADE: $418.8M) EXPORT VALUE: $412.0M IMPORT VALUE: $6.8M

1.

2. COSTA RICA (TOTAL TRADE: $4.37B)

3. HONDURAS (TOTAL

$1.78B

4.

5.

6. NICARAGUA (TOTAL

7.

9. EL SALVADOR (TOTAL TRADE: $2.29B) EXPORT VALUE: $1.30B IMPORT VALUE: $995.0M

10.

15.

17. ARUBA (TOTAL TRADE: $386.5M) EXPORT VALUE: $383.0M IMPORT VALUE: $3.5M

18. SAINT MAARTEN (TOTAL TRADE: $339.5M) EXPORT VALUE: $324.0M IMPORT VALUE: $15.5M

19. CUBA (TOTAL TRADE: $305.0M) EXPORT VALUE: $304.0M IMPORT VALUE: $1.0M

20. BELIZE (TOTAL TRADE: $303.6M) EXPORT VALUE: $279.0M IMPORT VALUE: $24.6M

21. CURAÇAO (TOTAL TRADE: $229.8M) EXPORT VALUE: $225.0M IMPORT VALUE: $4.8M

22. ANTIGUA & BARBUDA (TOTAL TRADE: $212.3M) EXPORT VALUE: $210.0M IMPORT VALUE: $2.3M

23. BRITISH VIRGIN ISLANDS (TOTAL TRADE: $163.5M) EXPORT VALUE: $157.0M IMPORT VALUE: $6.5M

24. SAINT LUCIA (TOTAL TRADE: $159.9M) EXPORT VALUE: $157.0M IMPORT VALUE: $2.9M

25.ST KITTS & NEVIS (TOTAL TRADE: $107.8M) EXPORT VALUE: $99.2M IMPORT VALUE: $8.6M

26. GRENADA (TOTAL TRADE: $92.5M) EXPORT VALUE: $81.2M IMPORT VALUE: $11.3M

27. ST VINCENT & THE GRENADINES (TRADE: $85.1M) EXPORT VALUE: $82.4M IMPORT VALUE: $2.7M

28. ANGUILLA (TOTAL TRADE: $40.6M) EXPORT VALUE: $40.4M IMPORT VALUE: $214.0K

29. DOMINICA (TOTAL TRADE: $39.2M) EXPORT VALUE: $38.4M IMPORT VALUE: $778.0K

30. MARTINIQUE (TOTAL TRADE: $23.8M) EXPORT VALUE:

1. UNITED KINGDOM (TOTAL TRADE: $4.9B)

2. ITALY (TOTAL TRADE: $3.76B)

17. CZECHIA (TOTAL TRADE: $120.6M)

34. MALTA (TOTAL TRADE: $6M)

5. NETHERLANDS (TOTAL TRADE: $1.6B)

6. SPAIN (TOTAL

$1.57B)

18. FINLAND (TOTAL TRADE: $112.0M) EXPORT VALUE: $36.9M IMPORT VALUE: $75.1M

19. UKRAINE (TOTAL TRADE: $102.1M) EXPORT VALUE: $72.1M IMPORT VALUE: $30.0M

20. GREECE (TOTAL TRADE: $94.3M) EXPORT VALUE: $48.6M IMPORT VALUE: $45.7M

21. LITHUANIA (TOTAL TRADE: $90.8M) EXPORT VALUE: $60.9M IMPORT VALUE: $29.9M

22. BULGARIA (TOTAL TRADE: $46.3M) EXPORT VALUE: $14.9M IMPORT VALUE: $31.4M

23. ROMANIA (TOTAL TRADE: $44.3M) EXPORT VALUE: $23.2M IMPORT VALUE: $21.1M

24. LUXEMBOURG (TOTAL TRADE: $42.2M) EXPORT VALUE: $17.8M IMPORT VALUE: $24.4M

25. SERBIA (TOTAL TRADE: $38.4M) EXPORT VALUE: $5.2M IMPORT VALUE: $33.2M

26. SLOVENIA (TOTAL TRADE: $34.8M) EXPORT VALUE: $15.5M IMPORT VALUE: $19.3M

27. LATVIA (TOTAL TRADE: $32.7M) EXPORT VALUE: $8.0M IMPORT VALUE: $24.7M

28. SLOVAKIA (TOTAL TRADE: $25.4M) EXPORT VALUE: $4.3M IMPORT VALUE: $21.1M

29. ESTONIA (TOTAL TRADE: $23.5M) EXPORT VALUE: $12.4MIMPORT VALUE: $11.1M

30. CROATIA (TOTAL TRADE: $14.7M) EXPORT VALUE: $2.9M IMPORT VALUE: $11.8M

31. RUSSIA (TOTAL TRADE: $10M) EXPORT

32. CYPRUS (TOTAL TRADE: $9.7M)

33. BOSNIA & HERZEGOVINA (TOTAL TRADE: $6.6M)

YOU

In today’s fast-paced market, the only way to close the gap with your trading partners is to improve the supply chain. To do this, you will need a group of dedicated, hardworking professionals with over 40 years of experience in logistics and ocean transportation. You will need more than just excellent customer service. You will want to work with a company striving to be better and more innovative. At Seaboard Marine, your customers are closer because our customers are at the center of everything we do.

20. CAMBODIA (TOTAL TRADE: $82.4M)

25. OMAN (TOTAL TRADE: $41M) Export Value: $16.3M Import Value: $24.7M

26. KAZAKHSTAN (TOTAL TRADE: $31.2M)

Export Value: $25.8M Import Value: $5.4M

27. MALDIVES (TOTAL TRADE: $30.4M)

Export Value: $18.0M Import Value: $12.4M

28. SRI LANKA (TOTAL TRADE: $22.3M)

Export Value: $2.8M Import Value: $19.5M

29. BAHRAIN (TOTAL TRADE: $20.1M)

Export Value: $15.6M Import Value: $4.5M

30. LEBANON (TOTAL TRADE: $19.8M)

Export Value: $15.6M Import Value: $4.2M

31. AZERBAIJAN (TOTAL TRADE: $19.1M)

Export Value: $15.9M Import Value: $3.2M

32. IRAQ (TOTAL TRADE: $17M)

Export Value: $14.2M Import Value: $2.8M

33. FAROE ISLANDS (TOTAL TRADE: $11M)

Export Value: $4.5K Import Value: $11.0M

34. ARMENIA (TOTAL TRADE: $9M)

Export Value: $8.7M Import Value: $230.0K

35. NEPAL (TOTAL TRADE: $6.5M)

Export Value: $4.2M Import Value: $2.3M

36. UZBEKISTAN (TOTAL TRADE: $5.4M) Export Value: $4.7M Import Value: $716.0K

37. YEMEN (TOTAL TRADE: $5.2M)

Export Value: $5.1M Import Value: $43.8K

38. KYRGYZSTAN (TOTAL TRADE: $4.7M)

39. BRUNEI (TOTAL TRADE: $3.6M)

40. IRAN (TOTAL TRADE: $3.1M)

42.

44.

KUWAIT (TOTAL TRADE: $44.4M)