C NTENT

Acquisitions & Production: The Asia Update Korea 911: Flatline or Fight Back?

Acquisitions & Production: The Asia Update Korea 911: Flatline or Fight Back?

By unignorable volume, scripted and unscripted adaptation pickups in Asia ended June 2025 a shadow of their once-upon-a-time prime. While a different narrative is unfolding, here’s what we counted in the first six months of this year.

Korean studios are cutting back at home, but powering ahead abroad, says Dhivya T, Lead Analyst & Head of Content Insights at MPA & ampd.

Global streamers have slashed Korean drama commissions by 43% over the past two years, a new report from Ampere Analysis shows. But, as the scripted market crashes and interest in unscripted originals rises, there may be a new opportunity for Korea’s producers.

For one weekend in mid-August, six Asian films made the global box office Top 10 – three Chinese films, two Indian productions and one Japanese – all part of a Summer rebound in major East Asian territories after a slack Spring. This represents both a relief for struggling cinema operators and a welcome return to conventional seasonal patterns, says Patrick Frater

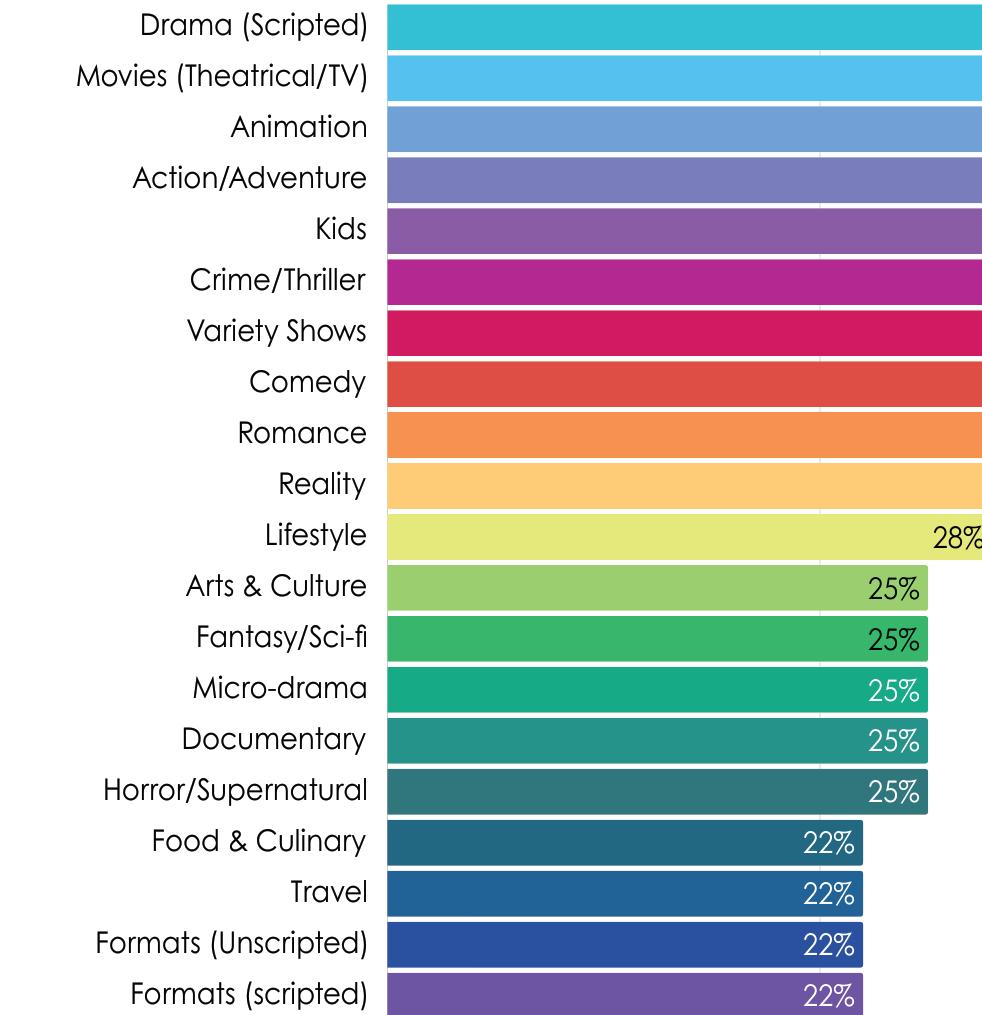

Drama, movies and animation dominate acquisitions’ wish lists in Asia for the rest of 2025 and into 2026, according to ContentAsia’s latest poll. Released in the run-up to the ContentAsia Summit in September, the survey shows drama at the top of the list (72%), followed by movies (64%) and animation (56%). Other high-interest genres include action/adventure (50%), kids (42%), variety shows (36%), crime/thriller (36%), romance (33%), and comedy (33%). Here’s what else we discovered...

For every TV woe in Vietnam at the moment, the film industry seems to have multiple wins. Martial arts star Johnny Trí Nguyễn is just one of them.

3-4 September 2025

Eslite Art House, Taipei 台北誠品電影院

Timeless Memories

3 September 2025 11:30AM-12:45PM

Zona Merah 3 September 2025

2:15PM-3:25PM

The Traitors 3 September 2025 3:55PM-5:25PM

3 September 2025 5:25PM-7:25PM Drug War: A Conspiracy of Silence 3 September 2025

7:25PM-8:55PM

A Controversial Entertainer 男公館 4 September 2025

By volume, the acquisition of format rights in Asia is a shadow of its once-upon-a-time prime. Interest is still high though, if impacted by economic circumstances, and shows like Applause Entertainment’s Tanaav (based on Yes Studios’ Fauda) have multiple seasons; Korea’s Good Doctor got rave reviews in Thailand as หมอใจ พิเศษ; and we’re waiting to see if CJ ENM’s Bad Guys will return to streaming platform Vidio in Indonesia for a second season. For unscripted, The Traitors tops our watch list, not least because it’s confirmed to be returning to India, but also because a Korean version could be in the works. Plus, original development/co-development in Asia is vibrant and bearing fruit. Meanwhile, here’s what we counted in the first six months of this year.

The first half of 2025 delivered at least 78 formats commissioned/on air across Asia, with the adaptations spotlight firmly on South and Southeast Asia, according to ContentAsia’s latest Formats Outlook research and analysis.

India led by volume with 16 titles, representing 21% of all activity, followed by Thailand with 12, the Philippines with 10, and Indonesia with nine. Together, these four markets accounted for more than 60% of all the formats commissioned/on air in the first six months of the year. Further down the league table, Sri Lanka posted six adaptations and Japan five, while Malaysia, Mongolia and Vietnam each registered three. Pakistan, Cambodia, Hong Kong and Korea contributed two

Source: Distributors/rights holders, titles/seasons either on air or commissioned in January-June 2025 by broadcasters/platforms/companies in 18 countries in Asia (including Bangladesh and Nepal, which recorded no new activity this period)

each, and single-title adaptations emerged from China, Nepal and Singapore. The spread underlines a broadening regional footprint but also a clear concentration of volume in South Asia.

Sri Lanka in particular returned to the headlines this year with ITV Studios’ Catchpoint commissioned by Sirasa TV; the show premiered in mid-July as SIRASA Catchpoint. This is the first local version of the physical game show in Asia, and joins Sirasa’s renewal of The Voice (season three) and The Voice Teens (season four), both set to air this year, and builds on a consistent slate that has included big-brand commissions such as Who Wants to be a Millionaire (season 11) and The Money Drop (seasons two and three). Both were included in ContentAsia’s Formats Outlook report for 2023/2024.

Slates elsewhere reflect similar unscripted momentum. India alone aired and renewed titles including All3Media International’s The Traitors India seasons one and two for Prime Video, multiple versions of Banijay’s Bigg Boss (Big Brother) on Jio Cinema, Asianet, Star Maa, Colors Kannada and Star Vijay, and Banijay’s MasterChef India season S9/S10 for Sony SET. In Cambodia, MasterChef Cambodia returned for its fourth season on free-to-air station CTN TV, while Indonesia’s busy slate featured multiple seasons (S9/S10/S11) of game show Family Feud on MNCTV alongside MasterChef Indonesia on RCTI.

Thailand leaned heavily into both scripted and unscripted

adaptations, from the BL remake of Ossan’s Love commissioned by GMMTV and CJ ENM romcom What’s Wrong With Secretary Kim on TrueID, to MasterChef Thailand: The Professionals on BBTV Channel 7 and Netflix. In the Philippines, Fremantle’s Family Feud remained a primetime staple on GMA with two seasons (S9/S10). Nippon TV’s Mother also inspired Saving Grace across multiple broadcasters: the adaptation streamed on Prime Video from November 2024 to 9 January 2025 with 14 episodes, while an extended version, Saving Grace: The Untold Story, premiered in March on Kapamilya Channel’s Primetime Bida evening block and concluded in June 2025 with 78 episodes.

By genre, reality formats dominated the landscape, driving 42% of all activity with 33 titles.

Game shows followed with 29%, accounting for 23 adaptations, while scripted drama contributed 22% with 17 titles. These included Korea’s KBS Media period drama Hwarang: The Poet Warrior Youth, commissioned by Avex Pictures as a Japanese stage play that premiered in January 2025, and Winter Sonata, now being adapted into a webtoon in Japan by IMX Inc.

Music (3) and variety (2) played smaller roles.

Drilling down, the strongest drama drivers were romance at 35% (6) of all scripted adaptations, followed by thrillers at 29% (5) and crime at 24% (4). BL and comedy contributed smaller but distinct niches, each accounting for one title each.

On the reality side, singing competitions proved most prolific at 27% (9), closely followed by cooking at 24% (8) and social experiment shows at 21% (7).

Dating formats took 9% (3) of the share, while business and talent formats registered 6% (2) each.

Factual and fashion/beauty genres, though small at one title each, still contributed to the variety in Asia’s reality mix. The distribution picture was led by Banijay Rights and Fremantle, each claiming 23% of the region’s total with 18 titles each.

CJ ENM ranked third with 12 titles (15%), while ITV Studios ended the first half with six commissions, or 8%. Other active players included Japan’s Nippon TV (4), Korea’s KBS Media (3), All3Media International (3), NBCUniversal Formats (2), NPR Music (2), Sony Pictures Television (2) and Thailand’s Workpoint Group (2). Single-title contributions came from Philippines’ ABS-CBN, BBC Studios, Can’t Stop Media, Japan’s TV Asahi, Warner Bros International Television Production and Yes Studios.

The dominance of Banijay and Fremantle was underscored by multiple MasterChef and Family Feud commissions, while CJ ENM supplied scripted formats including romance drama format My Lovely Liar in Hong Kong (for ViuTV) and thriller Happiness in Thailand (TrueID), alongside unscripted staples like I Can See Your Voice

Korea’s most prolific production studios have maintained hit rates and delivered impactful co-productions across Asia, even as domestic drama output contracts under rising production costs, according to new research from Media Partners Asia & ampd.

Korean content remains a major engagement driver across premium VOD streaming services in Asia. In Q2 2025, Korean content accounted for 35% of total premium VOD viewership in Southeast Asia, 86% in Korea, and 5% in Japan.

SHRINKING K-DRAMA SUPPLY The Korean Drama Production Association reports that the number of domestically produced dramas peaked at 141 titles in 2022, before dropping to 107 titles in 2024. The figure is expected to moderate further in 2025 as broadcasters and studios adjust strategies amid escalating costs. The average production cost per episode now ranges from KRW1 billion-KRW3 billion/US$717,500-US$2.2 million, creating barriers to sustaining high-volume pipelines.

This contraction has already reshaped market dynamics.

CJ ENM (including subsidiary studios such as Studio Dragon) remains the most prolific player, contributing 19 of the top 100 Korean titles in Korea in Q2 2025, a decline from 26 the previous year. JTBC saw its share of the top 100 fall from 17 to just 6 titles. The downturn reflects an industrywide recalibration, where fewer titles are produced, but expectations for each to deliver global resonance are higher.

CO-PRODUCTIONS AS A GROWTH LEVER As domestic pipelines slow, Korean studios, particularly CJ, are rebalancing by seeking out lowercost, higher-impact opportunities abroad through cross-border coproductions. This strategy has delivered some of the region’s most visible July hits. These include Hatsukoi DOGs (TBS/Studio Dragon), Marry My Husband (CJ ENM, Jayuro Pictures, Shochiku), Bad Guys (Base Entertainment, CJ ENM) and Happiness Thailand (True CJ Creations).

Source: MPA, ampd

These titles and their performance illustrate how Korean companies are evolving from exporters of finished IP to active co-creators, securing upside across multiple territories while mitigating the risks of high domestic budgets.

CULTURAL IMPACT & LOOKING AHEAD Notably, one of the top titles across multiple Asian markets in July was Netflix’s Sony-produced animated feature K-pop Demon Hunters. The film is an American production, but its popularity underscores how Korean-origin cultural phenomena like K-pop now inspire global storytelling well beyond Korea’s borders.

Korea’s content and cultural prowess remain highly visible across Asia’s premium VOD ecosystem. The July data paints a picture of an industry in transition: fewer dramas at home, but a sustained ability to generate regional and global hits through smart partnerships and cultural leverage. As domestic costs rise, co-productions in Japan, Thailand, and Indonesia provide Korean studios with cost-effective avenues to sustain output, extend influence, and embed their storytelling DNA across Asia’s streaming landscape.

Media Partners Asia (MPA), established in 2001, is a leading independent provider of advisory, consulting and research services, focusing on media and telecoms in Asia Pacific. MPA also operates ampd, launched in 2019, which measures digital activity across 12 markets using proprietary software, with detailed insights to drive planning and business outcomes. Across the 12 markets in which we operate, ampd leverages passively measured panel members with two SaaS-based products – ampd Vision and ampd Pulse – while providing customized research to clients across streaming VOD, content, advertising, telecoms, and more. Our clients include leading global internet and technology brands, Hollywood and Asian content studios, advertising agencies, telcos, and pay-TV operators. ampd won the Best International Video Media Research Award at the 2023 UK Mediatel Media Research Awards, which recognises organ

isations driving innovation in research.

Blending action, family, and secrets, Ejen Ali has grown from a Malaysian hit into an internationally acclaimed spy saga.

Global streamers have slashed Korean drama commissions by 43% over the past two years, a new report from Ampere Analysis shows. But, as the scripted market crashes and interest in unscripted originals rises, there may be a new opportunity for Korea’s producers.

Global streamers have slashed Korean commissions by 43% and local production – crippled by rising production costs – fell by 20% in the two years between the first half of 2023 and the first half of 2025, a new report from Ampere Analysis shows.

Scripted commissions have been hit hardest; the number of scripted announcements dropped 39% between the first half of 2023 and the first half of 2025.

Netflix has bucked the trend, maintaining volume while would-be global rivals cut Korean commissions. Ampere says Netflix accounts for 88% of South Korea’s H1 2025 global SVoD announcements, but has reduced its proportion of scripted content as it shifts its focus to unscripted.

The August 2025 report said global demand was expanding even as commissions were shrinking.

“Local companies have struggled with rising production costs and the broader macroeconomic challenges, while international SVoD [platforms] are shifting their content strategy towards acquisitions and original unscripted K-content,” Ampere says.

The share of viewers outside Korea who say they watch South Korean TV series or films “sometimes” or “very often” rose from 22% in Q1 2020 to 35% in Q1 2025 – a 13 percentage point increase.

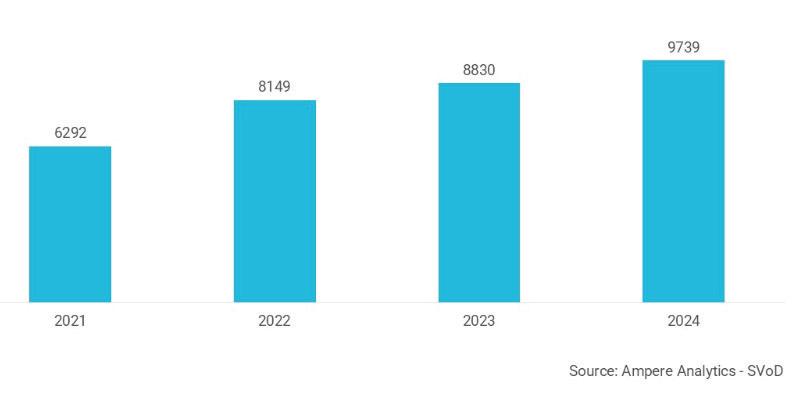

Ampere said the availability of South Korean content on international streaming services increased by 55% between 2021 and 2024.

Ampere Analysis analyst, Mariana Enriquez Denton Bustinza, said

moves like Netflix’s cap on actors’ fees could lead to a “more accessible and reinvigorated local production landscape” – and particularly the proportion of content being produced for local platforms and channels.

“As large international players moved into the Korean market, they found success with Korean content among a worldwide audience, which has seen them invest heavily in original Korean content,” says Fred Black, Ampere’s research director.

“This has pumped investment into the Korean production landscape and electrified the demand for Korean content globally. But it has also caused significant inflation to production costs in Korea. This has then had the effect of pricing out local platforms and channels from being able to produce the same quantities of their own local content, as production capacity is taken up by more expensive projects for international players,” Black says.

Now, global streaming services are beginning to revise down their commitment to original content in Korea – a function of cost-cutting initiatives.

“However, there is ongoing demand for that content from a large global audience. This should encourage local platforms and channels to commission more, and take risks on more expensive content, with the certainty there is an international audience out there for it.”

If there are fewer originals than before, global players may well drive an invigorated syndication/distribution market.

For one weekend in mid-August, six Asian films made the global box office Top 10 – three Chinese films, two Indian productions and one Japanese – all part of a Summer rebound in major East Asian territories after a slack Spring. This represents both a relief for struggling cinema operators and a welcome return to conventional seasonal patterns, says Patrick Frater.

Cinema business activity over the Summer has rebounded after a slack Spring in several major East Asian territories. That represents both a relief for struggling cinema operators and a welcome return to conventional seasonal patterns.

In South Korea, the 4 July to 10 August period threw up six consecutive weekends with nationwide cinema revenues in excess of US$10 million. In the first six months of 2025 there had only been one.

The mini-boom was powered by a healthy mix of Korean-produced and imported titles, which have delivered the top results seen so far this year.

Local feature My Daughter is a Zombie is this year’s most watched film with 4.31 million tickets sold since release on 30 July. Apple’s F1: The Movie claims the crown for highest gross to date in 2025 at US$31.8 million.

Daughter reverses the usual zombie horror narrative and instead its story sees a father who embarks on a life-or-death mission to train his daughter, the last remaining zombie.

F1 ’s performance is a particular triumph for Imax, which helped turn the car-racing thriller into a must-see event. After opening in late June, it achieved the rare feat of returning to the top of the Korean charts in its fourth week of release. This in a country without much of a Formula One track record; Korea is not host to a F1 race and the country has not yet produced a top-flight driver. Other summer highlights have included big-budget Korean fantasy Omniscient Reader (US$7.19 million) and imported adventure franchise instalment Jurassic World: Rebirth, which has a US$15.3 million total. Before Covid, Summer seasons were often marked by a mix of

F1’s performance in Korea is a particular triumph for Imax screens and technology... in a country without much of a Formula One track record.

Korean-produced horror-comedy films and Hollywood tentpoles, and had become a key boost for Korean cinema. One explanation for this annual mid-year bump is that the oppressive heat and humidity, which drives people into air-conditioned cinemas. Horror films are a summer staple in Korea and are said to create (welcome) cold sweats. A more prosaic explanation could be the effects of academic holidays and a wide

But Korean movies and Korean exhibitors have both struggled to recover post-Covid and this summer’s modest rebound cannot be

A similar pattern could be observed in mainland China. This year

the industry enjoyed a spectacular Lunar New Year season, but from February to June activity was mostly weak. Summer, which commentators define differently, has been notably firmer.

Imported titles Jurassic World: Rebirth and Japanese animation Detective Conan The Movie: One-Eyed Flashback both enjoyed US$25 million opening weekends.

But their exploits have been overtaken by a strong succession of Chinese-made pictures. Chief among these have been The Lychee Road (with a US$94 million haul) and the patriotic-historical Dead to Rights, which has earned US$357 million in its first four weeks on release.

In August, Dead to Rights was displaced from the top spot by Nobody , the second Chinese-produced animated film to head the box office charts this year. It follows all-time record breaker Ne Zha 2 , which dominated proceedings in January and February and earned an astonishing US$2 billion.

Based on stories about four minor characters from the traditional Journey to the West tale, Nobody is reported to also be the highestgrossing Chinese film ever made using the traditional 2D animation process, rather than CGI or 3D animation. In 16 days of release, No -

Box Office Estimates for the weekend of 15-17 August 2025

Source: Comscore, Global/International Box Office Estimates for the weekend of 15-17 August 2025 Chart recreated by ContentAsia

On e explanation for this annual mid-year bump is [Korea’s] oppressive heat and humidity, which drives people into air-conditioned cinemas. ..

But Korean movies and exhibitors have both struggled to recover post-Covid and this summer’s modest rebound cannot be taken for granted.

body has accumulated US$139 million of gross revenues. In Japan, the world’s third-richest cinema market after North America and China, there have also been Summer fireworks. Demon Slayer: Kimetsu no Yaiba – The Movie: Infinity Castle has become the highest grossing film of the year and the fifth biggest film of all time at the Nippon box office. Kimetsu no Yaiba is both a continuation of a franchise that straddles film and TV and the first of a trilogy of feature films. After 30 days on release, it achieved ¥25.32 billion (approx. US$170 million). It overtook the iconic Your Name and is on course to surpass

Frozen and Titanic , though it is currently short of overall record-holder Kimetsu no Yaiba – The Movie: Mugen Train , which amassed ¥40.43 billion in 2021.

The success of the Asian films this Summer has also impacted global box office. Over the 15-17 August weekend, Nobody was the world’s second-best performing movie, while Kimetsu no Yaiba was third. And the weekend top 10 included three Chinese films, two Indian productions and one Japanese – alongside four Hollywood titles.

Drama, movies and animation dominate buyers’ wish lists in Asia for the remainder of 2025 and into 2026, according to ContentAsia’s latest Buyer Survey. Released in the run-up to the ContentAsia Summit in September, the survey shows drama at the top of the list (72%), followed by movies (64%) and animation (56%). Other highinterest genres include action/adventure (50%), kids (42%), variety shows (36%), crime/thriller (36%), romance (33%), and comedy (33%). Here’s what else we discovered...

NOTES: The information was gathered from 36 acquisition executives from 33 companies, operating across a wide range of genres in 10 countries (Brunei, Cambodia, Indonesia, Japan, Malaysia, Philippines, Singapore, Taiwan, Thailand, and Turkey), as well as regional programmers and operators across video broadcast and streaming platforms in Asia. 12 free-TV broadcasters participated, along with 11 programming/distributor companies, six streaming/online/on-demand services, four pay-TV platforms and three pay-TV channels. The survey was conducted between 15 July and 5 August 2025.

Scripted television series continue to lead acquisition priorities in Asia, with 72% of surveyed buyers identifying a genre broadly as a top strategic focus. Movies – including both theatrical and TV titles – follow at 64%, alongside animation at 56% and kids’ programming (42%). Drilling down into scripted, action/adventure led with 50% of buyers, followed by crime/thriller (36%). In the mid-tier, comedy (scripted and unscripted) and romance are each acquired by one in three buyers, with reality and lifestyle also holding steady.

Segments such as arts & culture, fantasy/sci-fi, documentary (general/investigative/biographical), and horror/supernatural attract one in four buyers, while food/culinary, sports, music/entertainment and historical titles capture smaller but steady interest.

Respondents highlight evolving strategic priorities as audience behaviours shift – though brand loyalty continues in some cases to outweigh short-term viewing spikes. In Japan, for example, the enduring success of long-running fan-favourite anime property, Detective ranks among this year’s strongest performers on one of the country’s major platforms.

KOREAN ORIGINALS Asian audiences’ sustained appetite for Korean content continues to drive acquisition strategies across the region. However, escalating licensing costs – reaching up to asks of US$900,000 per episode – driven by stratospheric production budgets are prompting buyers to reassess portfolio priorities. Platforms are increasingly diversifying with lower-cost acquisitions and alternative formats that deliver stronger cost-to-value efficiencies while sustaining competitive audience engagement. Despite pricing pressures, selective investment continues to deliver results. In Taiwan, Bill Sung, EVP of Cai Chang International, highlights Korean fantasy epic Along with the Gods: The Two Worlds (Parts 1 & 2) as a standout performer, demonstrating the ongoing ability of premium Korean titles to drive significant viewership impact when carefully acquired, integrated into line-ups, and marketed.

Sport continues to dominate audience loyalty metrics. According to Kou Serey Ratha, content and acquisition manager at Bayon Media High System (Cambodia), local sports – particularly Kun Khmer and soccer – consistently rank among the network’s highest-rated programmes, underscoring their sustained ability to drive engagement. Zooming out (and despite steep drops in some markets), there seems to be nothing like a high-value international sports property to break open corporate purse-strings. In Indonesia, the latest three-year cycle of multi-platform Premier League rights are rumoured to have sold for US$60 million. In Thailand, domestic club football rights went to Jasmine International (JAS) and domestic telco Advanced Info Service (AIS) in a four-season deal worth a total THB 2 billion/US$54 million.

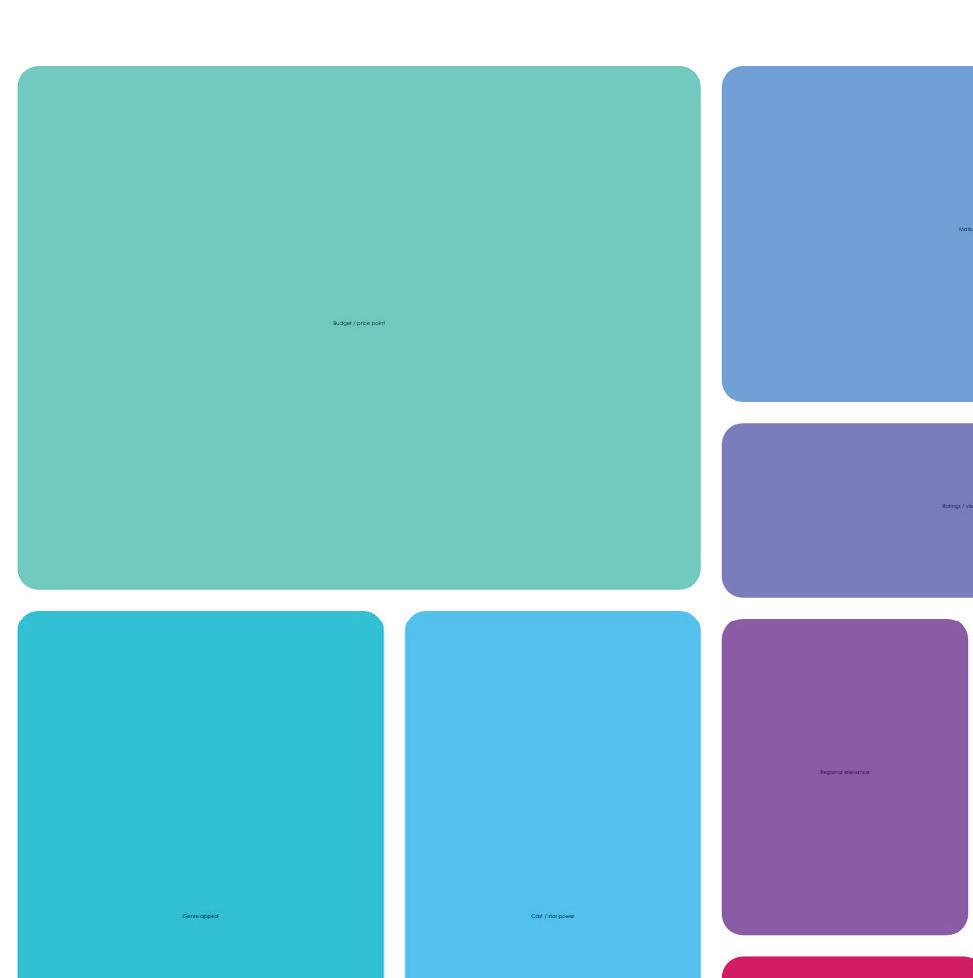

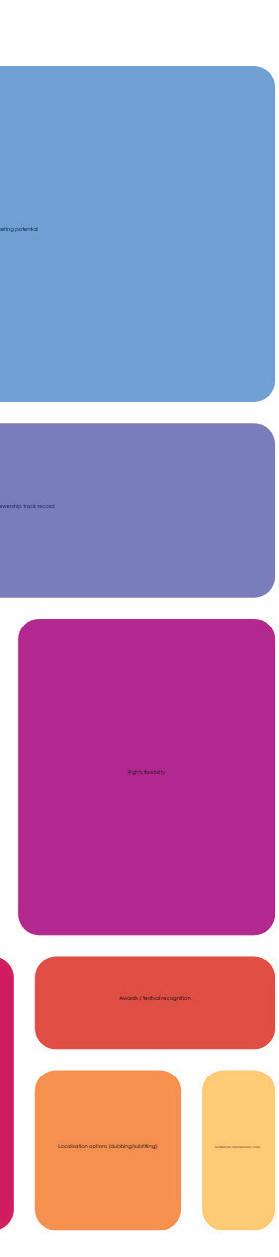

What are the most important factors in acquisition decisions?

Will buyers acquire more or less non-Asian content for the rest of 2025 and 2026 than they did in previous years?

We’re hoping for more cross-region collaborative opportunities to strengthen the industry.”

Kevin Foo, Chief Operating Officer, Media Prima (Malaysia)

That’s after JAS paid US$560 million/THB19.2 billion for six Premier League seasons from 2025/26 to 2030/31 for Thailand, Cambodia and Laos, including live broadcasts, reruns and highlights.

FAMILY DRAMA Family dramas are gaining prominence in acquisition strategies. According to Mariani Abdullah, head of acquisition and distribution at Brunei’s DM Don Square Entertainment, the strong focus on this genre reflects audience demand for stories that resonate with real-life experiences and everyday realities.

BOYS’ LOVE (BL) For buyers and platforms, the message is clear: niche genres are no longer peripheral. As competition intensifies, integrating Boys’ Love (BL) and other passion-driven formats into acquisition portfolios offers a path to audience diversification, brand differentiation, and incremental monetisation beyond traditional content verticals. Thailand remains the regional leader in BL production, though some industry players caution that the segment may be approaching market saturation at home and has limited appeal in more conservative markets.

Even so, the success of Thai BL content highlights the growth potential of niche genres.

As Mediaplex International CEO Joe Suteestarpon observes, “Thai BL dramas have been standout performers for us this year,” underscoring both their domestic dominance and increasing international appeal.

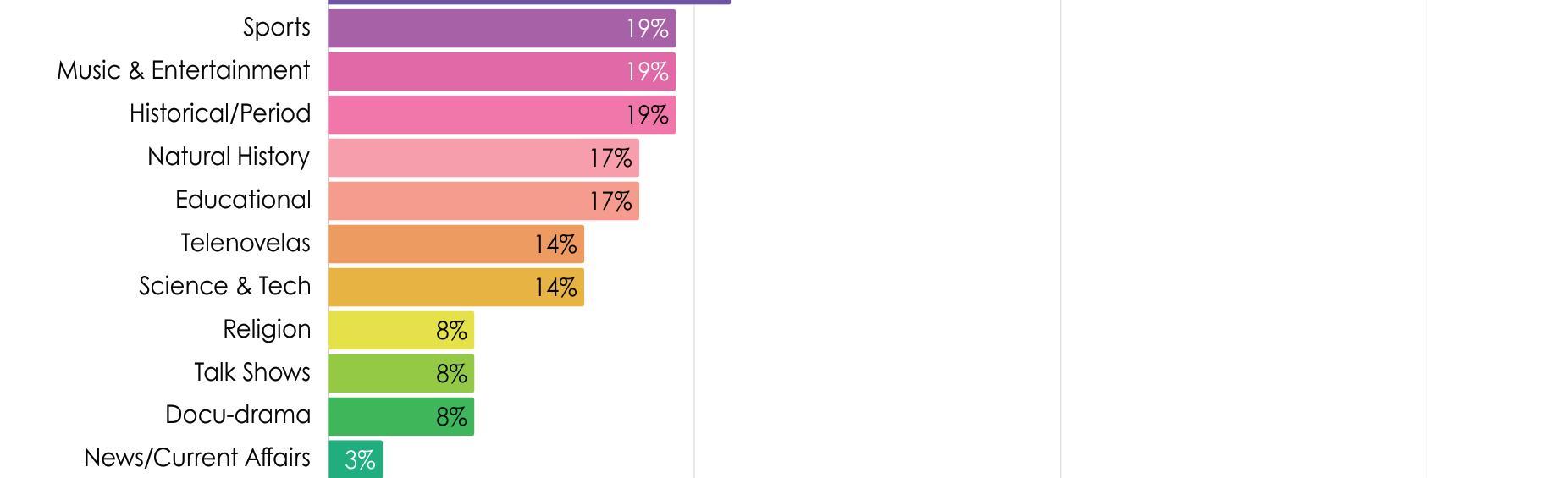

RELIGION In Malaysia, Broken Heaven (Bidaah), a drama produced by Rumah Karya Citra, has emerged as a top-performing title. Centered on a young woman’s infiltration of a religious sect to save her devout mother, the series reflects audience engagement with religion-driven narratives and highlights the genre’s relevance in regional content strategies. Religious practices also underpin a rising slate of original family dramas.

KIDS By many accounts, the TV kids’ content sector is in serious decline, with production pipelines thinning and local output under pressure.

Buyers are increasingly selective, placing the greatest emphasis on story quality, casting and market buzz as differentiators. With key exceptions, established international brands continue to dominate acquisition decisions, reinforcing the challenges faced by original and locally produced kids’ programming.

WHAT FACTORS MOST INFLUENCE YOUR DECISIONS? Asked about the factors that most influence acquisition decisions, respondents consistently cited budget and price points, underscoring the continued importance of cost-efficiency in content strategies.

Accurate assessment of market relevance and audience demand

How is streaming/OTT landscape influencing acquisition strategies going into 2026?

How

has streaming impacted overall release and scheduling strategies?

are also identified as critical acquisition drivers. Content must align with local viewer preferences, notes Artine S. Utomo, CEO of Indonesia’s free-TV network RTV, echoing a broader industry consensus.

Buyers – including Redian Tandiana, acquisition manager of ANTV Indonesia, and Taiwan’s Bill Sung of Cai Chang International Taiwan – emphasise flexibility in managing rights and strong marketing potential.

Gary Tsai, Taiwan’s Far EasTone Telecom COO, Digital Entertainment Service, and Gala Television’s manager Wenchia Shih, highlight the role of cast and star power. Ratings performance and localisation opportunities are emphasised by Shakuntala Chandra, APAC lead of Indian content creator, aggregator and distributor Shemaroo Entertainment, and Andri Detulong, head of acquisition of Jakarta-based distributor PT

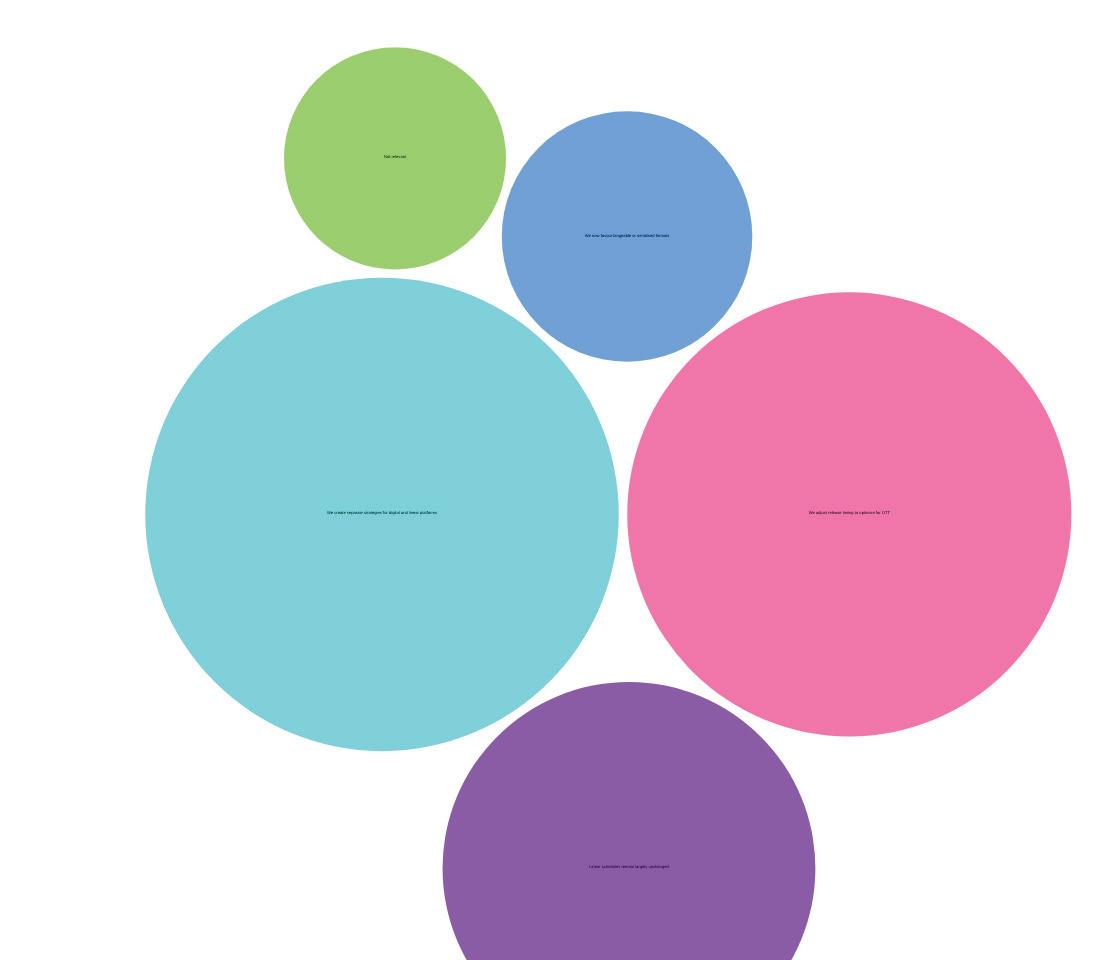

Not relevant 11%

Prioritising on-demand, binge-friendly formats 14%

Create separate strategies for digital and linear platforms 50%

Adjust release timing to optimise for OTT 44%

Linear schedules remain largely unchanged 31%

Indonesia’s biggest challenges are the digital content era and economic pressures...coproductions and flexible deals with distributors help us continue delivering high-quality content.”

Artine S. Utomo, CEO, RTV Indonesia

Satuvisi Abadi, which focuses on family-friendly programming for free-toair and digital platforms in Indonesia.

In summary, while cost remains the primary filter, acquisition decisions are increasingly shaped by a balanced evaluation of audience alignment, rights flexibility, and proven market performance.

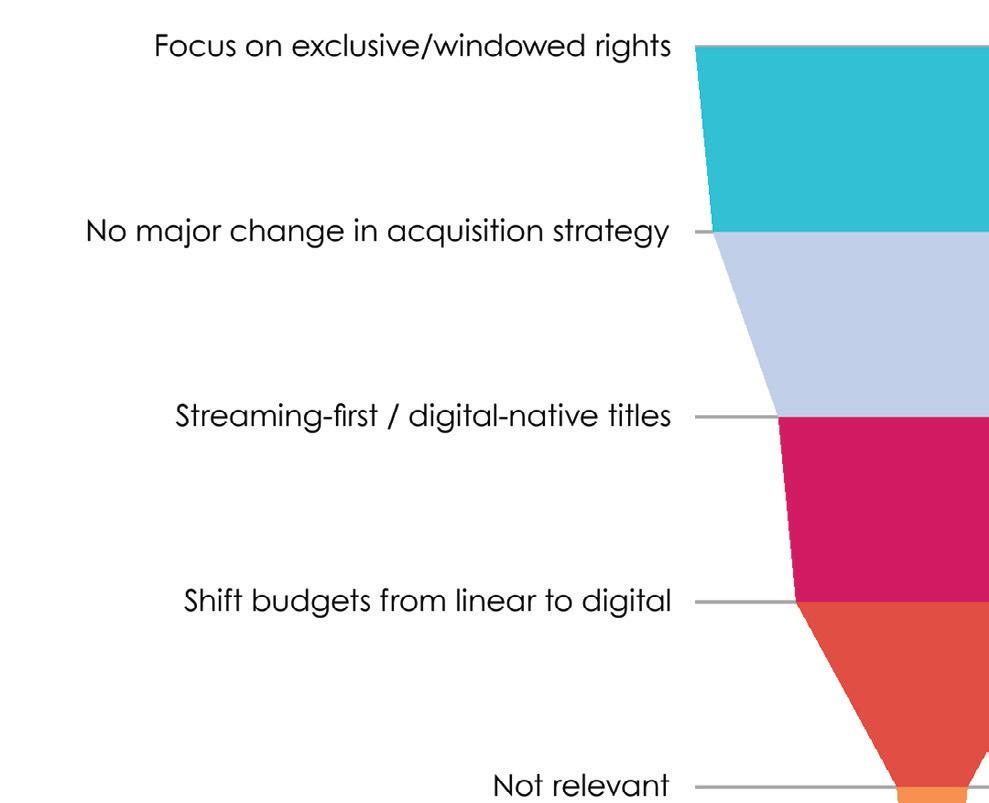

STREAMING’S IMPACT IS... The 2026 outlook shows streaming continuing to reshape acquisition and scheduling strategies. Fourteen respondents say they are prioritising exclusive or early release windows, while nine are leaning toward digital-first titles, and eight report shifting budgets from linear to digital. Although 13 buyers say their approach remains unchanged, the overall trend points to a steady tilt toward digital-driven acquisitions.

Original Content Output: 2026 vs 2025: Are platforms producing more or less?

The shift from FTA to OTT for viewers is a defining structural change.”

Joe Suteestarpon, CEO, Mediaplex International (Thailand)

Spending on original content: 2026 vs 2025: Will budgets rise, fall or stay steady?

audiences choose to watch online”.

Joe Suteestarpon, Mediaplex International

In scheduling, streaming’s influence is being felt across the board – whether or not companies operate their own OTT platforms.

Media Prima, which operates the country’s largest free-TV services (58% audience share in Jan-March 2025) along with digital platform Tonton, now treats OTT as a strategic pillar, with distinct planning from its free-toair channels.

Shemaroo Entertainment’s Chandra pointed to streaming service ShemarooMe, which has grown into a multi-genre, multilingual offering. She notes that release schedules are now “closely aligned to when and how

In Indonesia, ANTV’s Tandiana adds that audiences increasingly expect content in bingeable formats, a view echoed by Gary Tsai of Far EasTone, whose friDay Video platform integrates streaming with telecom data to refine programming strategies. Touch Bopha, director of Global PNN Holdings in Cambodia, says her team is also reshaping its approach, noting that OTT platforms have become an increasingly important space for testing new content and reaching younger viewers.

Not all feel the impact equally: DM Don Square Entertainment’s Abdullah says the OTT shift remains “not relevant” to current operations.

ORIGINAL CONTENT OUTLOOK Most content execs anticipate near-term stability in original production and spending. Close to 60% expect the same level of original content in 2026 as in 2025, while 17% say there will be increases and 14% foresee a decline.

Growth is expected from companies such as Bayon Media High System, ANTV and Mediaplex, while Cai Chang International and Thailand Kylo30 Project’s advisor/media specialist, Krissada Trishnananda, forecasts a scale back. Global PNN’s Bopha cites the challenges of sustain-

NOTES: The information was gathered from 36 acquisition executives from 33 companies, operating across a wide range of genres in 10 countries (Brunei, Cambodia, Indonesia, Japan, Malaysia, Philippines, Singapore, Taiwan, Thailand, and Turkey), as well as regional programmers and operators across video broadcast and streaming platforms in Asia. 12 free-TV broadcasters participated, along with 11 programming/distributor companies, six streaming/online/on-demand services, four pay-TV platforms and three pay-TV channels. The survey was conducted between 15 July and 5 August 2025.

13th-16th October

Palais des Festivals, Cannes.

WHERE DEALS ARE DONE, PARTNERSHIPS ARE BORN AND STORIES FIND THEIR STAGE

In the past 12 months, particularly in the freeto-air landscape, we’ve experienced a noticeable decline in advertising revenue… This has pushed us to be more selective in curating content.”

Redian Tandiana, Acquisition Manager, ANTV (Indonesia)

ing original production in a highly competitive environment.

Most expect budgets to remain flat, with optimism at ANTV and Mediaplex, which plan to raise investments, and cau tion at Media Prima, which expects to reduce spending despite steady output. Far EasTone Tele com’s director Hanes Chin also points to a conservative stance, citing the need to balance production ambitions with market realities.

CHALLENGES AND OPPORTUNITIES Content execs flag challenges ranging from rising rights costs and the “battle for rights” to platform disruption.

The different preferences of TV and online viewers remain an ongoing challenge.”

Mediaplex International’s Suteestarpon describes the ongoing “shift from FTA (free-to-air) to OTT” as a defining change, while PT Satuvisi Abadi’s Detulong notes his team is “now into OTT” when making acquisitions.

Cai Chang International’s Bill Sung points to the broader economic climate, while RTV’s Utomo cites digital disruption and economic pressures as the biggest challenges.

“Indonesia’s biggest challenges are the digital content era and economic pressures. As viewing habits shift, RTV adapts by investing in unique digital content and being more selective in acquisitions and productions. Co-productions and flexible deals with distributors help us continue delivering high-quality content,” Utomo says.

Also in Indonesia, ANTV’s Tandiana highlights the financial squeeze facing free-to-air channels. “In the past 12 months, particularly in the freeto-air landscape, we’ve experienced a noticeable decline in advertising revenue. This trend has affected almost all FTA broadcasters in Indonesia. As a result, the key challenge has been acquiring high-quality content with more limited budgets. This has pushed us to be more selective in

Kou Serey Ratha, Content & Acquisition Manager, Bayon Media High System (Cambodia)

There is now a stronger emphasis on family dramas, as they better reflect real-life experiences and everyday realities.”

Mariani Abdullah, Head of Acquisition & Distribution, DM Don Square Entertainment (Brunei)

curating content, while also requiring greater flexibility in terms and rights

Some see opportunity in programming shifts. DM Don Square Entertainment’s Abdullah highlights the rise of family dramas, while Kou Serey Ratha of Bayon says balancing TV and online preferences is an ongoing challenge.

WHAT’S THE OUTLOOK? Cross-border collaboration and co-operation is a key theme that continues into the year ahead. Media Prima’s Foo stresses the importance of cross-border collaboration: “We’re hoping for more cross-region collaborative opportunities to strengthen the industry.”

Similarly, ANTV’s Tandiana emphasises the need to deepen cooperation between rights owners and broadcasters.

Most buyers expect their acquisitions of non-Asian content to remain steady for the next 12 months. Two-thirds (66.7%) say they will acquire about the same amount in 2025 and 2026 as in previous years, while 14% expect to increase non-Asian acquisitions.

Another 14% anticipate acquiring less non-Asian content, citing stronger emphasis on regional programming and local audience demand. As one buyer says: “We’re only choosing non-Asian titles with fresh stories and strong differentiation from local offerings”.

For every TV woe in Vietnam at the moment, the film industry seems to have multiple wins.

Since early 2023, Vietnam’s Decree 71 has pretty much decimated the international/regional TV industry’s interest in the country. Higher operating costs, driven by tighter regulation and oversight, coupled with low yields... you get the picture. Players scaled back, paused expansion plans, or slammed their laptops shut and exited the market entirely. Even French giant, Canal+, which has doggedly soldiered on in Vietnam since what seems like the beginning of pay-TV time, is now reconsidering its presence. “The Vietnam business is being closely assessed as its performance has been meaningfully affected by the market environment,” the company said in July.

The domestic film industry, on the other hand...

Not least of the bright and shiny signals coming out of this sector is new, young-ish leadership in key government positions. At the end of February this year, the 48-year-old Lê Hải Bình was appointed Deputy Minister of Culture, Sports and Tourism. He assumes the role after years in various diplomatic and foreign affairs positions.

About three months after his appointment was announced, Lê hosted a delegation from the Motion Picture Association of America (MPAA). According to post-meeting notes distributed by the Ministry, Lê said Vietnam’s current legal framework for the film industry was “very open, creating favourable conditions for content producers”.

In the same session, he said there was still a “small amount of content that is not suitable for the conditions and culture of Vietnam, so some content still needs to be strictly managed”. But he emphasised the end of an era that was characterised by the viewpoint that “if you can’t manage, then ban”.

That was all part of a vibrant six months for Vietnamese filmmakers. And that’s official, according to Viet Nam News, the state-run news organisation. The English-language daily reports a record-breaking first half 2025, with eight local films breaking the VND100 billion/US$3.9 million revenue mark. As a result, local filmmakers “are entering the latter half of the year

with renewed confidence and high hopes for another leap forward,” the news platform says.

The next spark of life is Korea-Vietnam joint project – Saigon Oppa – scheduled to shoot in Vietnam and Korea in 2026. The film was showcased in Seoul in August as part of the “Vietnam–Korea Cultural Industry Cooperation Forum”, and billed as “a deepening of cultural and creative industry ties between the two countries”. The parties involved include Korea’s Film Line and Vietnam’s BHD.

Written and directed by Korea’s Park Gyu-tae (6/45: Lottery Couple), Saigon Oppa is about two Vietnamese husbands who reluctantly travel to Seoul in search of their wives, who go to Seoul to a K-pop concert and to chase after their favourite Korean idols. Their misadventures gradually unfold into a tale about love, kindness and mutual understanding.

BHD describes Saigon Oppa as a “touching exploration of cultural connection and emotional discovery, offering audiences in both Vietnam and Korea a fresh, heartfelt perspective on relationships, identity, and shared humanity”.

Vietnam’s other Korean collaborations this year are Mang Mẹ Đi Bộ (Leaving Mom), Điều Ước Cuối Cùng (The Final Wish) and Cải Mả (Reburial). BHD vice chair, Ngô Bích Hạnh, says the success of Mang Mẹ Đi Bộ reflects a “new level of cooperation between Vietnam and South Korea, characterised by closer collaboration, greater equality, and a shared commitment to showcasing the cultures of both nations”.

Another 2026 highlight is epic martial arts feature, The Last Secret of the First Emperor (Hộ Linh Tráng Sĩ - Bí Ẩn Mộ Vua Đinh), directed by Nguyen Phan Quang Binh (Song of The Stork) and produced/distributed by BHD – Vietnam Media. The film, starring heartthrob Johnny Trí Nguyễn (who is also the film’s martial arts director), follows seven warriors on a mission to mislead hostile forces. Their true objective: to protect the spirit of the country and ensure that the tomb of Vietnam’s first Emperor remains an eternal mystery.

Connecting your brand and products with more than 12,200 verified executives in the Asia-Pacific content space, across all platforms in 22 APAC markets. ContentAsia’s clear editorial focus on Asia delivers all the latest trends, market developments, influences, information & analysis that make a difference.

Contact

Leah@contentasia.tv (Americas/Europe)

Malena@contentasia.tv (Asia Pacific/Middle East)

CJ@contentasia.tv (China/Taiwan)

New iWant rolls out as ABS-CBN’s iconic tower falls Global streamer boosts streaming line-up, picks up int’l rights to GMA titles Philippines’ celebrities, creators and industry execs turned out in force to bid farewell to the iconic Millennium Transmitter, which is being demolished as part of ABS-CBN’s US$110-million sale to Ayala :and. But the once-mighty ABS-CBN didn’t wait for the tears to dry on its past before it turned its eyes to the future… and the relaunch of global

streaming platform iWant.

full story is on page 5

under way Cassie Yoo’s the Soul Creative x All3Media Int’l adaptation follows with a Scalpel success The Korean script for Scandi thriller is about to be turned in, with pro duction set to begin in Q2 2026. is by Shinho Lee (The Chaser) adaptation of the All3Media format is by the Soul Creative, set up a year ago by