countrysingapore

Dare devils No. of pay-TV subscribers (000s)

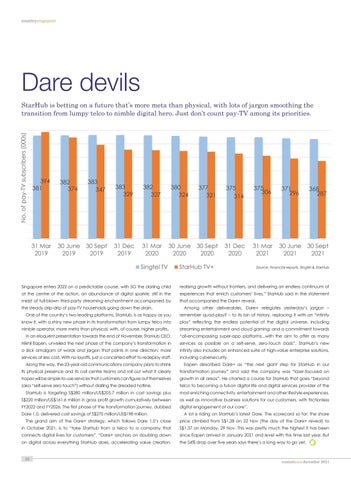

StarHub is betting on a future that’s more meta than physical, with lots of jargon smoothing the transition from lumpy telco to nimble digital hero. Just don’t count pay-TV among its priorities.

394 381

31 Mar 2019

382 374

383 347

30 June 30 Sept 2019 2019

383 329

382 327

31 Dec 2019

31 Mar 2020

380 324

377 321

375 314

375 306

30 June 30 Sept 2020 2020

31 Dec 2020

31 Mar 2021

Singtel TV

StarHub TV+

371 296

368 287

30 June 30 Sept 2021 2021

Source: Financial reports, Singtel & StarHub

Singapore enters 2022 on a predictable course, with 5G the darling child

realising growth without frontiers, and delivering an endless continuum of

at the centre of the action, an abundance of digital sparkle, still in the

experiences that enrich customers’ lives,” StarHub said in the statement

midst of full-blown third-party streaming enchantment accompanied by

that accompanied the Dare+ reveal.

the steady drip-drip of pay-TV households going down the drain.

Among other deliverables, Dare+ relegates yesterday’s jargon –

One of the country’s two leading platforms, StarHub, is as happy as you

remember quad-play? – to its bin of history, replacing it with an “infinity

know it, with a shiny new phase in its transformation from lumpy telco into

play” reflecting the endless potential of the digital universe, including

nimble operator, more meta than physical, with, of course, higher profits.

streaming entertainment and cloud gaming; and a commitment towards

In an eloquent presentation towards the end of November, StarHub CEO,

“all-encompassing super-app platforms...with the aim to offer as many

Nikhil Eapen, unveiled the next phase of the company’s transformation in

services as possible on a self-serve, zero-touch basis”. StarHub’s new

a slick amalgam of words and jargon that points in one direction: more

infinity also includes an enhanced suite of high-value enterprise solutions,

services at less cost. With no layoffs, just a concerted effort to redeploy staff.

including cybersecurity.

Along the way, the 23-year-old communications company plans to shrink

Eapen described Dare+ as “the next giant step for StarHub in our

its physical presence and its call centre teams and roll out what it clearly

transformation journey” and said the company was “laser-focused on

hopes will be simple-to-use services that customers can figure out themselves

growth in all areas”. He charted a course for StarHub that goes “beyond

(aka “self-serve zero touch”) without dialling the dreaded hotline.

telco to becoming a full-on digital life and digital services provider of the

StarHub is targeting S$280 million/US$205.7 million in cost savings plus

most enriching connectivity, entertainment and other lifestyle experiences,

S$220 million/US$161.6 million in gross profit growth cumulatively between

as well as innovative business solutions for our customers, with frictionless

FY2022 and FY2026. The first phase of the transformation journey, dubbed

digital engagement at our core”.

Dare 1.0, delivered cost savings of S$270 million/US$198 million.

A lot is riding on StarHub’s latest Dare. The scorecard so far: the share

The grand aim of the Dare+ strategy, which follows Dare 1.0’s close

price climbed from S$1.28 on 22 Nov (the day of the Dare+ reveal) to

in October 2021, is to “take StarHub from a telco to a company that

S$1.37 on Monday, 29 Nov. This was pretty much the highest it has been

connects digital lives for customers”. “Dare+ anchors on doubling down

since Eapen arrived in January 2021 and level with this time last year. But

on digital across everything StarHub does, accelerating value creation,

the 54% drop over five years says there’s a long way to go yet.

32

contentasia december 2021