APRIL 18, 2025

APRIL 18, 2025

The Consulate General of Jamaica, New York, in partnership with the Jamaica Stock Exchange, is proud to announce the hosting of the Investing in Jamaica & Housing Forum — a dynamic engagement platform aimed at connecting the Jamaican Diaspora with real opportunities for investment, business development, and homeownership in Jamaica.

The Forum will be staged in two cities: Philadelphia on Tuesday, May 6, 2025, at the Pyramid Club, from 3:30 PM to 8:00 PM New York City on Thursday, May 8, 2025, at Resorts World New York City, from 10:00 AM to 8:00 PM

This initiative is part of ongoing efforts to deepen partnerships with members of the diaspora and stimulate meaningful investment into Jamaica’s economic growth and development.

The Forum will focus on three key areas:

• Investing in Jamaica: Opportunities to invest through the Jamaica Stock Exchange, targeting diaspora members seeking to grow their wealth while contributing to Jamaica’s development. Brokerage houses and financial institutions from Jamaica will be present.

• Doing Business in Jamaica: Guidance on establishing and expanding businesses in Jamaica, with participation from agencies such as the Tax Administration Jamaica (TAJ), Companies Office of Jamaica, Registrar General’s Department, and legal service providers.

• Housing in Jamaica: Direct engagement with housing developers, mortgage providers, and real estate agents, showcasing opportunities for homeownership and real estate investment.

Participants will have the opportunity to interact with partners traveling from Jamaica, receive firsthand information from experts, and network with fellow diaspora members passionate about building Jamaica’s future.

Attendance is free and open to the public; however, space is limited. Interested persons are encouraged to register early:

• Philadelphia Registration: https://lp.constantcontactpages.com/ev/reg/vrv7363

• New York Registration: https://lp.constantcontactpages.com/ev/reg/a94dfgs

Consul General Alsion Roach Wilson, O.D., emphasized, “The Investing in Jamaica & Housing Forum represents an important opportunity for the diaspora to connect their passion for Jamaica with tangible action. We invite everyone to join us, learn about the diverse avenues for investment, and play a direct role in shaping Jamaica’s future.”

Senator the Hon. Aubyn Hill, Jamaica’s Minister of Industry, Investment and Commerce, is set to deliver the keynote address at the upcoming Investing in Jamaica & Housing Forum in New York City on Thursday, May 8, 2025. The event, organized by the Consulate General of Jamaica, New York, in collaboration with the Jamaica Stock Exchange, aims to connect members of the Jamaican diaspora with opportunities for investment, business development, and homeownership in Jamaica.

Minister Hill’s address will highlight Jamaica’s current investment climate, emphasizing the nation’s economic stability, strategic location, and the government’s commitment to fostering a pro-investment environment. He is expected to discuss key factors that make Jamaica an attractive destination for investors, including:

• Economic Stability: Jamaica has achieved a record low unemployment rate of 3.5%, low inflation, and a reduction in crime, signaling a stable and investable economy.

• Tax Incentives: The government offers significant tax benefits for investors, particularly within Special Economic Zones (SEZs), where corporate tax rates can be as low as 7.75% depending on employment and trade levels.

• Strategic Location: Positioned just 90 minutes from Miami and three hours from Panama, Jamaica serves as a central hub in the global logistics chain.

• Skilled Workforce: Jamaica boasts a highly skilled, English-speaking workforce, with ongoing initiatives to train and upskill citizens to meet global industry demands.

In addition to Minister Hill’s presentation, the forum will feature participation from key Jamaican agencies financial institutions and real estate developers and agencies, including:

• Jamaica Promotions Corporation (JAMPRO)

• Jamaica Special Economic Zone Authority (JSEZA)

• Tax Administration Jamaica (TAJ)

• VM Wealth Management

• Barita Investments

• JN Wealth Management

• Sun Coast Beach Club

• Keller Williams Realty

These organizations will provide insights into investment opportunities, business registration processes, tax regulations, and financial services available to diaspora members interested in contributing to Jamaica’s growth.

The Investing in Jamaica & Housing Forum is part of a broader initiative to engage the Jamaican diaspora in national development efforts. By facilitating direct interactions between potential investors and key stakeholders, the forum seeks to empower individuals to actively participate in shaping Jamaica’s economic future.

The 129th annual Penn Relays are set to take place from April 24 to 26 at Franklin Field in Philadelphia, promising a vibrant showcase of athletic prowess and cultural pride. This iconic event will feature the best Jamaican high school track and field talent competing against international rivals, drawing fans from across the U.S.

For many Jamaicans residing in the U.S., especially those who couldn’t attend the annual Boys and Girls Championships in Kingston, the Penn Relays offer a cherished opportunity to reconnect with their alma maters and relive the spirited rivalries. Expect a sea of green, gold, and black as supporters gather to cheer on their schools, rekindling the competitive spirit that defines Jamaican track and field.

The weather forecast for the event is favorable, with warm temperatures expected on Thursday and Friday. Saturday may see some cloud cover and a chance of showers, but the enthusiasm of the crowd is sure to shine through regardless of the conditions.

Adding to the excitement, several athletes who recently delivered dominant performances representing Jamaica at the CARIFTA Games in Trinidad will be competing. Their participation brings an extra layer of anticipation, as fans look forward to witnessing these young stars continue their impressive form on the track.

For those traveling from New York, convenient transportation options are available. Organizations like the Union of Jamaican Alumni Associations (UJAA) and NYPD JAMLEO are operating buses to the event. Take away the hassle of driving and parking in Philadelphia.

Tickets for the Penn Relays are still available, with general admission prices starting at $26 for Thursday and Friday, and $29 for Saturday. They can be purchased online through the Penn Athletics website or in person at various sales offices near Franklin Field.

Whether you’re attending all three days or just one, the Penn Relays offer an unforgettable experience filled with thrilling races, cultural celebrations, and the unbreakable bond of community. Don’t miss this opportunity to be part of a storied tradition that brings together the best of athletics and Jamaican pride.

For more information and updates, visit the official Penn Relays website: pennrelays.com.

The Consulate General of Jamaica in New York is proud to announce the 2025 Jamaica Independence Gala Honourees, who will be celebrated at a grand black-tie gala on Saturday, August 23, 2025, at the New York Marriott Marquis. Eight distinguished individuals have been selected to receive the prestigious Jamaica Independence Award in recognition of their remarkable contributions to Jamaican music, education, business, community development, and national advancement. This honor highlights the profound gratitude of the Jamaican community for the honourees’ impact and lifelong dedication to uplifting our culture and society.

“We are immensely proud to honor these eight distinguished individuals at this year’s Independence Gala,” said Mrs. Alsion Wilson, Consul General of Jamaica in New York. “Each honouree has made a profound impact in their field and in the lives of others, exemplifying the very best of Jamaica and the best of friends of Jamaica. Their achievements – from pioneering Jamaican music on the world stage to transforming educational institutions and empowering communities – inspire Jamaicans everywhere. It will be a privilege to recognize their contributions as we celebrate our nation’s independence.”

Mr. James Alston Award for Community Development & Philanthropy. Community leader and philanthropist, recognized for his extraordinary service and dedication to uplifting communities. Mr. Alston, a prominent businessman, has devoted decades to charitable initiatives in the Jamaican diaspora, supporting youth and families in need.

Mr. Henry “Larry” Duffus Award for Entrepreneurship. Pioneering bicycle industry entrepreneur, acknowledged for his exceptional entrepreneurial spirit and significant contributions to the community. Mr. Duffus, a Jamaican immigrant and founder of a successful New York bicycle enterprise, has used his platform to mentor youth and promote healthy lifestyles, exemplifying community leadership.

Mrs. Patricia Chin Lifetime Achievement Award. Reggae music pioneer and co-founder of VP Records, honored for her unparalleled contribution to Jamaican music. Fondly known as “Miss Pat,” Mrs. Chin has spent a lifetime championing reggae and dancehall music globally, helping to bring Jamaica’s sound and artists to international prominence.

Mr. Gregory Fisher Award for National Development. Finance expert and benefactor, recognized for his longstanding and ongoing support for Jamaica’s national development, both in the financial sector and through private charitable donations. Mr. Fisher’s advocacy for investment in Jamaica and generous philanthropy have significantly contributed to Jamaica’s economic progress and social programs.

Hon. Alfarita Constantia

“Rita” Marley OJ, OD Lifetime Achievement Award. Legendary reggae matriarch and humanitarian, honored for her unparalleled contributions to Jamaican music, culture, and community development. As a founding member of the I-Threes and matriarch of the Marley musical legacy, Mrs. Marley’s influence has helped bring Jamaican reggae and philanthropy to the global stage.

Mr. Adam Stewart Award for Business Leadership. Entrepreneur and tourism industry leader, celebrated for his exemplary contributions to entrepreneurship and economic development. As Executive Chairman of Sandals Resorts International and a driving force in Caribbean hospitality, Mr. Stewart has spurred growth and investment that benefit Jamaica’s economy.

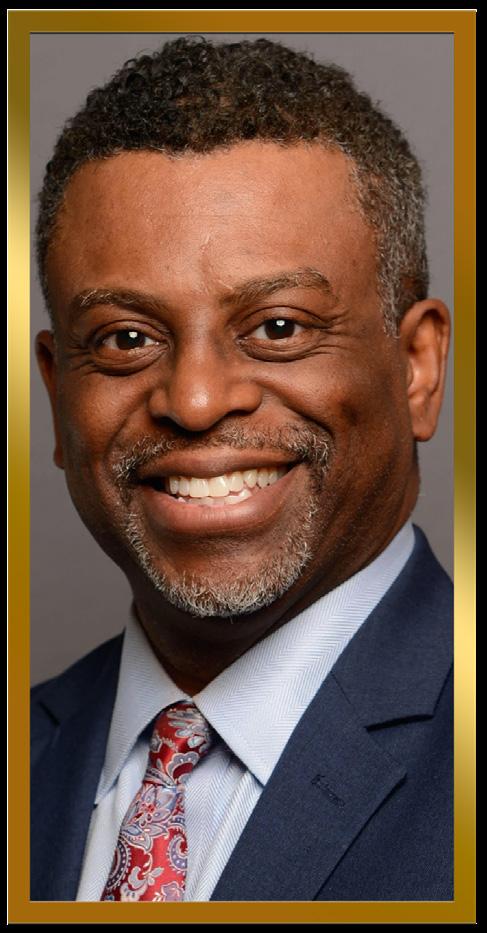

Dr. Anthony Munroe Award for Educational Leadership. Visionary educator and college president, recognized for his remarkable contributions to higher education and transformational leadership. Dr. Munroe’s commitment to academic excellence and student success has made a lasting impact in the Jamaican diaspora and beyond.

Mrs. Audrey Tugwell Henry Award for Business Leadership. Esteemed banking executive, honored for her exceptional leadership and outstanding contributions to Jamaica’s financial sector and overall economic growth. As President and CEO of Scotia Group Jamaica, Mrs. Tugwell Henry has championed innovation and inclusion in banking, fostering economic opportunities for Jamaicans.

Each of these honourees represents the pinnacle of excellence in their respective fields, and their collective achievements reflect the strength and vibrancy of Jamaica’s heritage. From the arts and business to education and community service, their dedication and success have not only brought pride to Jamaicans at home and abroad but have also positively impacted countless lives.

About the Jamaica Independence Gala

The Jamaica Independence Gala is an annual event held in New York City that celebrates Jamaica’s rich culture, heritage, and 63 years of independence. Hosted by the Consulate General of Jamaica in New York in partnership with the Jamaica’s Promise Foundation, the gala brings together Jamaicans and friends of Jamaica from across the diaspora for an evening of unity, reflection, and festivity. Guests will enjoy authentic Jamaican entertainment, fine dining, and cultural presentations, all in commemoration of the Nation’s independence. Beyond the celebration, the gala serves a meaningful purpose: supporting charitable causes in Jamaica. “The goal of the event is to bring together Jamaicans and friends of Jamaica in recognition of the nation’s independence, while giving back to our homeland through the generosity of attendees,” Consul General Wilson explained. Proceeds from the 2025 Gala will benefit important initiatives in Jamaica, focusing on areas such as education, healthcare, and community development, namely scholarships for tertiary students, the Jamaica Cancer Society and the Rita Marley Girl’s Center. This tradition of philanthropy ensures that the Independence Gala not only honors outstanding individuals but also contributes to the betterment of communities in Jamaica.

Event Details

• Event: Jamaica Independence Anniversary Gala 2025

• Date & Time: Saturday, August 23, 2025, 6:30 PM

• Location: New York Marriott Marquis, Times Square, New York City

• Attire: Black Tie/Formal

The countdown has officially begun! The most anticipated event in the Jamaican diaspora calendar is back, and it’s bigger and better than ever. The 2025 Jamaica Independence Gala will take place on Saturday, August 23, 2025, at the iconic New York Marriott Marquis, and for a limited time only, you can secure your seat at a special discounted rate.

We’re thrilled to announce that Early Bird tickets are now available exclusively on Eventbrite — and this year, we’re giving you even more reason to celebrate with a 10% discount on all individual tickets.

Whether you’ve attended before or are planning to experience it for the first time, the Jamaica Independence Gala promises an unforgettable evening of elegance, entertainment, and national pride. This year, we celebrate Jamaica’s 63rd year of independence, and we’ll be honoring eight outstanding individuals who have made extraordinary contributions to Jamaican music, education, business, community development, and philanthropy.

Set in the heart of Times Square, this black-tie affair brings together Jamaicans and friends of Jamaica from across the U.S. and beyond for a night of celebration, cultural excellence, and giving back. All proceeds from the event support charitable causes that directly benefit communities in Jamaica.

But here’s the catch: Early Bird tickets are LIMITED and only available for a LIMITED TIME. Once they’re gone, they’re gone — and regular prices will kick in.

Don’t miss your chance to be part of this milestone event at a fraction of the cost. Gather your friends, mark your calendar, and lock in your tickets now. Whether you come for the glamour, the cultural pride, or the opportunity to honor our trailblazers — this is the night that brings Jamaica to the heart of New York City.

Visit jaindependencegalanyc.eventbrite.com to purchase your Early Bird tickets today. Use the discount while it lasts — 10% off all individual tickets!

Celebrate Jamaica. Celebrate Excellence. Celebrate with Us.`Act fast — this is your moment to be part of something unforgettable.

The 2025 Jamaica Independence Gala is more than a celebration—it’s a showcase of culture, excellence, and community impact. Taking place on August 23, 2025, at the prestigious New York Marriott Marquis, this black-tie affair will bring together leaders in business, government, entertainment, and the Jamaican Diaspora for a night of purpose and prestige.

We’re inviting brands, businesses, and changemakers to join us as official sponsors of this landmark event. Sponsorship offers a powerful platform to connect with an influential audience, build brand awareness, and demonstrate commitment to cultural and philanthropic advancement. Opportunities include logo placement, media recognition, VIP access, product placement, and engagement with distinguished honorees and high-level guests.

Whether you’re a global brand or a community enterprise, this is your chance to align with one of the most anticipated cultural events of the year.

Let your brand stand where excellence meets legacy.

To explore sponsorship packages and benefits, email us at info@jamaicaindependencegalany.com. We’d love to craft a partnership that elevates your brand while helping us uplift Jamaica’s story of pride, resilience, and progress.

Secure your place in this unforgettable celebration.

Empowering Jamaica’s Future Through Education, Health, and Opportunity

The 2025 Jamaica Independence Gala is more than a celebration—it’s a commitment to uplifting lives across Jamaica. Proceeds from this year’s gala will support three transformative initiatives focused on education, health, and the empowerment of young women.

In our last cycle, 17 final-year students from institutions such as UWI, UTECH, Sam Sharpe Teachers’ College, and CASE received full tuition scholarships. These scholarships enabled students facing financial hardships to complete their degrees and pursue careers that contribute to Jamaica’s development. This initiative not only alleviates financial burdens but also fosters a generation of educated leaders ready to make a difference.

Breast cancer remains the leading cause of cancer-related deaths among Jamaican women, with many cases diagnosed at advanced stages due to limited access to screening. The Jamaica Cancer Society (JCS), operating the country’s largest mammography clinic, performs approximately 9,000 mammograms annually, including services via a mobile unit reaching underserved areas . Gala proceeds will enhance JCS’s screening programs, providing subsidized mammograms and educational outreach, aiming to increase early detection and save lives.

Located in Trench Town, the Rita Marley Girls’ Center is a sanctuary for young women aged 17–25. This center offers mentorship, life skills training, professional development, and mental health support, reflecting Rita Marley’s enduring commitment to community upliftment . By creating a safe and nurturing environment, the center empowers young women to lead lives of purpose and resilience.

Our goal is ambitious: raise $500,000 to $1 million to fund these vital programs. Every ticket purchased and donation made brings us closer to this target. Together, we can:

• Educate future leaders through scholarships.

• Save lives by enhancing breast cancer screening.

• Empower young women to achieve their full potential. We can do it - together.

Jamaica’s Promise is a registered 501(c)(3) nonprofit organization. All donations are taxdeductible. Join us in building a brighter future for Jamaica.

For more information on the beneficiaries and how you can play your part email info@jamaicaindependencegalany.com or info@japromise.org.

Donating from abroad? If you’re part of the Jamaican diaspora, a church group, or any well-meaning individual looking to send school supplies or medical items to Jamaica, careful planning is crucial. Jamaica has specific laws for charitable imports, and getting clearance and approval before shipping will save you from costly delays. This guide explains how to partner with local registered charities – like the National Education Trust (NET) for school items and the National Healthcare Enhancement Foundation (NHEF) for health-related items – to smoothly import and distribute your donations. We’ll cover why these partnerships matter, step-by-step shipping advice, a documentation checklist, key contacts, and available tax exemptions to ensure your generosity reaches those in need hassle-free.

Jamaica’s Charities Act (2014) created a streamlined process for importing donated goods. To take advantage of duty waivers and fast-track customs clearance, donations must be channeled through certified charitable organizations. When done correctly, charitable imports enjoy significant tax breaks:

• No Import Duties or GCT: Registered charities pay no import duty and no General Consumption Tax (GCT) on donated items. This is a huge cost savings for your shipment.

• Reduced Customs Fees: Even the standard Customs Administration Fee (CAF) is cut in half (only 50% CAF is charged instead of 100%), and other fees like environment levy are minimal.

• Avoiding Red Tape: By partnering with an authorized Jamaican charity, you ensure your goods are recognized as charitable donations. This avoids “red tape” so gifts reach schools and clinics without bureaucratic holdups.

Without these approvals, shipments sent independently may be treated as commercial imports – incurring full duties, taxes, and potential clearance problems. In worst cases, items can be held by customs or delayed for months. The takeaway: Always secure clearance before you ship by linking with a local registered charity. It’s the legal and smart way to donate.

Partnering with Local Registered Charities

To import educational or medical supplies into Jamaica, it’s highly recommended to work with official

charities that are registered under Jamaica’s Charities Act. Two key organizations facilitate donations in education and health:

National Education Trust (NET)Education Donations

For back-to-school drives and educational supplies, the National Education Trust (NET) is the goto partner. NET is a Government of Jamaica agency dedicated to mobilizing resources for schools. The Education Ministry specifically requires school donations to go through NET to receive duty concessions.

How NET helps with your donation:

• Pre-Approval of Items: NET asks donors to email a list of the items they plan to send before shipping. They will review your list (e.g. ensure electronics meet local specifications or that items are appropriate for the schools).

• Consigning Shipments: Donors are instructed to consign the shipment to “National Education Trust (NET)” c/o the intended school. This means on your shipping documents, NET will appear as the receiver, which flags the cargo as an official donation.

• Hassle-Free Customs Clearance: When the items arrive in Jamaica, Customs notifies NET, and NET provides an authorization letter to Customs so the goods are cleared without hassle. Essentially, NET’s involvement fast-tracks the clearance.

• Minimal Fees: Using NET’s channel, the donor typically only pays 50% of the standard admin fees plus the environment levy, with all other import fees waived. You won’t be charged duties or GCT on these items.

• Guidance and Support: NET can advise on any permits (for example, if you’re donating certain technical equipment) and ensure the school gets the items. They are experienced in handling large school donations every summer.

How to contact NET: Before shipping, reach out to NET for guidance. You can email info@net.org.jm with details of your planned donation. NET’s office can also be reached by phone at (876) 922-3134 or 967-9007. Early communication ensures your backto-school barrels or boxes meet the requirements and have the green light to ship.

National Healthcare Enhancement Foundation (NHEF) – Healthcare Donations

For medical supplies, equipment, or items for health fairs, the National Healthcare Enhancement Foundation (NHEF) (sometimes called the Health for Life and Wellness Foundation) is the official channel under the Ministry of Health. NHEF coordinates healthcare donations and medical missions on behalf of the Ministry. Partnering with NHEF is crucial for anything from first-aid supplies for a community health fair to hospital equipment donations.

How NHEF assists with your healthrelated donation:

• Initial Offer & Approval: Donors should first contact NHEF to discuss the items they wish to donate. NHEF will likely ask for a detailed list or have you complete a donation offer form/checklist (covering item descriptions, quantities, etc.). This helps them ensure the items meet Jamaica’s health standards (e.g. medical

equipment meets specifications, pharmaceuticals are not expired and are registered if required.

• Coordination with Health Ministry: The NHEF team will review your offer in collaboration with health officials. They assess if the items are appropriate, economical, and needed. Once vetted, they will provide an acceptance and approval letter for the donation.

• Shipping Consignment: As with NET, you will be instructed to consign the shipment to NHEF or the Ministry of Health (with perhaps the specific hospital/ clinic as a secondary consignee if applicable). This marks the shipment for charitable use in healthcare.

• Customs Clearance: NHEF, acting as the registered charity, will handle the critical paperwork with Jamaica Customs. They liaise with the Jamaica Customs Agency to ensure your medical donations are cleared duty-free. In fact, the Health Ministry’s policy is that NHEF will consult with Customs for clearing any gifts from overseas. Once your shipment arrives, NHEF will use their documentation to get it released without you having to pay import taxes.

• Distribution to Facilities: NHEF also coordinates the distribution of donated items to the intended health facilities or community health fair. They make sure the right hospital, clinic, or event receives your contribution, matching resources to needs in the public health system.

How to contact NHEF: It’s best to connect with NHEF via the Ministry of Health well before shipping. You can reach the NHEF at (876) 676-6418 or email info@nhef.gov.jm (their main contact) to get started. Provide details on what you plan to send and ask for guidance on the approval process. Early coordination with NHEF will iron out any regulatory requirements (for example, import permits for medical devices or pharmaceuticals) before your goods are shipped.

While NET and NHEF are the primary government-affiliated channels for education and health donations, you could also partner with other

Jamaican registered charities if they are involved in your project. For example, organizations like Food For The Poor or local service clubs often handle charitable imports. The key is that any charity must be registered with the Department of Cooperatives and Friendly Societies (DCFS) to get Charities Act benefits. If you partner with a different local NGO, verify they have a charity registration and Tax Compliance in Jamaica. They would then follow similar steps: getting preapproval for your donation, consigning the shipment to themselves, and providing the customs clearance documents. NET and NHEF are highlighted here because of their specific focus on schools and health facilities, which aligns with back-toschool and health fair initiatives.

To ensure a smooth process, follow these steps when organizing your back-to-school or health fair donations to Jamaica:

1. Plan Your Donation and Identify Recipients: Decide exactly what items you will donate and who they will benefit. For example, you might collect textbooks, tablets, and backpacks for a specific primary school, or medical supplies for a rural health clinic. Having a clear list of items and intended recipients (school name, clinic, etc.) will make discussions with local charities easier.

2. Contact a Local Registered Charity (NET for Schools, NHEF for Health): Before packing or shipping anything, reach out to the appropriate charity partner (see contact info above). Provide them with:

• A detailed list of items you wish to send (including quantities, and descriptions like new/used, model numbers for electronics or medical equipment, etc.).

• The name of the school or health facility/event that you intend to benefit.

• Your tentative timeline (e.g. you hope to ship by a certain date for an August back-toschool fair).

Why this step matters: The charity

will review your plan and advise on any guidelines. For instance, NET might flag if some electronics need specific power adapters or if certain supplies are already abundant, while NHEF might need to verify that any medical items (like medications or devices) comply with local regulations. Getting their “OK” and guidance is critical. NET explicitly advises donors to send the item list in advance so they can “advise of the procedures” and ensure items are appropriate.

3. Obtain Necessary Approvals or Letters: Work with the charity to secure any approval letters or permits required:

• NET may provide a letter confirming they are expecting your donation and that it’s destined for a particular school.

• NHEF/Ministry of Health may issue an official acceptance letter for your donation (after you might fill out their forms) and guide on any import permits needed (for example, pharmaceuticals usually need permits, and medical devices might need Bureau of Standards clearance – the foundation will help with this)

• If any item needs special permission (e.g. radios that need spectrum clearance, or large generators, etc.), address it now with the relevant authority as guided by your charity partner.

4. Prepare Your Shipment and Documentation: Once you have the green light, start packing and preparing for shipping. Maintain detailed documentation, as this will be needed for customs:

• Create a Packing List – an itemized list of everything in the shipment (e.g. 10 cartons of notebooks, 5 laptops, 200 pencils). This helps customs verify contents.

• Obtain or create an Invoice or donation valuation – even if goods are donated, customs needs a value declaration. You can list the estimated value of items (if new, use purchase price; if used, a reasonable fair

value). Mark it as a donation. This acts as the “invoice” for customs purposes.

• Ensure you have the Bill of Lading or Airway Bill from your shipping company. This document proves shipment details and consignment. It should list the consignee as instructed by the charity (e.g. “National Education Trust on behalf of [School Name]” or “National Healthcare Enhancement Foundation for Ministry of Health”). Doublecheck the consignee info with your charity partner so it’s 100% correct – this is crucial for customs to recognize the shipment as a charitable one.

• Label Boxes Clearly: Label all boxes or barrels with the consignee name and destination. For example: “Charitable Donation to Jamaica – Consigned to National Education Trust for XYZ Primary School.” This is not an official requirement, but it helps everyone in the chain quickly spot that it’s a donation shipment.

5. Arrange Shipping or Freight: Decide how you’ll send the items:

• Barrel or Box Shipping: Many diaspora donors ship barrels or large boxes via sea freight (as it’s cheaper for bulk). Choose a reputable shipping agent and provide them the consignee details provided by the charity. Make sure the shipping schedule aligns with your event (sea freight to Jamaica can take several weeks)

• Air Freight: If the items are needed quickly or are smaller in volume, air freight (or even extra baggage on a flight, if a team is traveling) could be used. Remember Jamaica allows up to US$500 equivalent of goods duty-free for passengers, but that’s for personal travel – shipping larger donations should still go through the formal charity process.

• Note on Shipment Value: If the value of the shipment exceeds US$5,000 (CIF) –

cost, insurance, and freight – Jamaican regulations require a licensed customs broker to clear it. In practice, many charities or shipping agents will have brokers to handle this. Discuss with your charity partner; they might arrange a broker if needed. Be prepared for a broker’s fee if applicable (this is separate from taxes; it’s a service fee

6. Confirm Arrival and Clearance Plans: Stay in touch with your charity partner as the shipment is en route. Provide them with the final shipping documents (copies of the Bill of Lading, packing list, etc.) so they can be ready for customs.

• NET or NHEF will typically prepare the Special Declaration and have their Tax Compliance Certificate (TCC) and charity registration on hand for customs – those are things you as the donor don’t have to provide, but the charity does. Ensure they have what they need; usually they do this routinely.

• Upon the shipment’s arrival, the charity’s representative (or their broker) will go to the port with all documents to clear the items. They will likely invite you or inform you, but they handle the formalities. If you are in Jamaica and plan to help deliver the items personally, coordinate with them so you can be present at pickup.

7. Distribution and Handover: Once cleared from customs, the goods can be delivered to the intended school or health fair location. Often, the charity may arrange transportation to the site, or you might do that, depending on your prior arrangement. At this stage, you might have a small handover ceremony or acknowledgement – for example, schools often like to acknowledge donors. NET and NHEF often provide a certificate of appreciation for your records, and it’s a nice way to document the successful donation.

Throughout this process, maintain communication with your local partner charity. They are your lifeline for navigating local requirements. Start

the process months in advance of summer initiatives – if you want goods ready for an August back-to-school, initiate contact in the spring. This lead time allows for any paperwork and shipping transit times.

When it’s time to clear the shipment through Jamaican Customs, having all paperwork in order is vital. Here’s a checklist of documents and steps to ensure a smooth customs clearance for charitable donations:

• Charity Registration Certificate: (Provided by your partner charity) – A copy of the charity’s official registration under the Charities Act. (The charity will have this document from the Department of Cooperatives & Friendly Societies.)

• Tax Compliance Certificate (TCC): (Provided by charity) – Proof that the charity is tax-compliant in Jamaica. Customs requires this to grant the concessions. Your partner will have a valid TCC ready.

• Special Declaration Letter: A signed declaration from the charity stating that the goods are for free distribution and eligible for duty-free entry under the law. The charity will draft and sign this. It usually includes a statement that the items won’t be sold and are for charitable use as approved by the Commissioner of Customs.

• Bill of Lading / Airway Bill: The shipping document from your freight company, naming the charity as consignee. Ensure you have at least a copy. The original may be needed for sea shipments.

• Packing List: Detailed list of contents (you prepare this). It should match what’s actually in the shipment and helps customs inspect efficiently.

• Invoice or Donation Value Letter: A document stating the value of the goods. Even if it’s a donation, customs needs to assign value for their forms. You can prepare a simple invoice listing each category of item with a notional value (or actual cost if you purchased them). Mark it as donation with no charge to the recipient. This goes a long way in avoiding any confusion at the port.

• Import Permits or Licenses (if applicable): If your items include things like medical equipment, pharmaceuticals, or other regulated goods, you may need permits:

• Medications might require a permit from the Ministry of Health/Pharmacy Council.

• Certain electronics or communication devices might need approval from the relevant authority.

Your charity partner and possibly your shipping broker can advise on this before you ship. If required, have the permit document ready for customs

• Identification & Authorization: The person clearing the goods (likely the charity’s representative or broker) should have a valid ID. If you as the donor or a third party will be involved in collecting the goods on behalf of the charity, the charity should provide a Letter of Authorization naming you. This letter must be on the charity’s letterhead and signed by a director, allowing you to act on their behalf at customs.

• Customs Broker (if required): If your shipment’s CIF value is over US$5,000, ensure a licensed customs broker is engaged. Provide them with all the above documents in advance. They will prepare the customs entry paperwork and coordinate with the port.

• Post-Clearance Plan: Have a plan for how the items will be transported after clearance (e.g. a truck to the school). While not a “document,” knowing this ahead prevents warehousing delays. Sometimes shipments can be cleared in Kingston but need to go to a rural area – coordinate logistics so once customs releases the items, they move quickly to their destination.

Before the shipment arrives, doublecheck this checklist with your charity partner to ensure nothing is missing. Jamaican Customs has indicated that when all these documents are in hand, clearing charitable shipments is straightforward. In summary, the charity covers the proof of charitable status (registration, TCC, special letter),

and you as donor cover the shipment specifics (packing list, invoice, etc.), then together you satisfy any additional requirements.

Embedding a few additional tips and best practices can further help avoid hiccups:

Timing: Aim to ship well ahead of your distribution event. If doing a backto-school drive for September, send goods by early summer. This accounts for shipping time and any unforeseen delays in customs or logistics.

• Use Reputable Shippers: Work with shipping companies experienced in Jamaica freight. Some shippers even specialize in barrels or charity shipments and can advise you on paperwork. They might offer consolidated shipping which can be costeffective.

• Insurance: Consider insuring valuable items during transit. While rare, barrels can get lost or damaged. Insurance provides peace of mind since these items are precious to the cause.

• Stay Organized: Keep both physical and digital copies of all documents. Send scanned copies to your charity partner and broker before arrival, so everyone is on the same page.

• Keep Receipts: If you bought new items (like tablets or medical devices) for donation, keep those purchase receipts. In case customs questions the value, receipts back it up. They usually won’t charge duties due to the charity status, but it’s good documentation to have.

• Be Present if Possible: If you can be in Jamaica when the goods arrive, it can be helpful (though not mandatory). Being on the ground means you can assist with any last-mile issues, help verify the items at customs if needed, and directly participate in the handover to the school or health fair. It’s also a rewarding experience to see the items delivered!

• Post-Clearance Audit Awareness: Note that Jamaican authorities (Customs or Tax Administration) may conduct post-clearance audits

on charitable organizations. This mainly concerns the charity, but it means they must account for the items properly (proving they were indeed distributed freely). As a donor, just ensure you delivered the items to them/ the school as planned. In rare cases, the charity might ask you for confirmation or help if any questions arise later. This is just part of maintaining the system’s integrity and nothing to worry about if everything was done above board.

By following these tips and the guidance of your local partners, you greatly reduce the chance of any customs issues. Many diaspora groups successfully send shipments to Jamaica every year using these processes –preparation and partnership are the secrets to success.

When in doubt or in need of assistance, here are some useful contacts and resources to help you navigate donations to Jamaica:

• National Education Trust (NET) –Education Donations

Email: info@net.org.jm

Phone: (876) 922-3134 or (876) 967-9007

Website: net.org.jm

Note: NET is your primary liaison for anything school-related – from books and stationery to computers and furniture for schools.

• National Healthcare Enhancement Foundation (NHEF) – Health/Medical Donations

Email: info@nhef.gov.jm

Phone: (876) 676-6418

Address: 72B Hope Road, Kingston 6 (Ministry of Health compound)

Note: The NHEF works under the Ministry of Health & Wellness. They coordinate all health sector donations and medical missions. Reaching out to them will plug you into the Health Ministry’s process for accepting equipment, supplies, or organizing health fairs.

• Jamaica Customs Agency Imports and Customs Queries Website: jca.gov.jm – See the “Donations/Charities” section for official guidelines

Hotline: 876-922-5140 (Head Office) – You can call for general

inquiries. However, note that clearing charitable donations is usually handled by the charity’s broker, so customs will often communicate with them directly. If you have trouble or need clarity on a rule, Customs can explain requirements like the need for a broker over $5,000, etc. Their website’s FAQ might also address common donation questions.

• Department of Cooperatives & Friendly Societies (DCFS) –Charity Registration Info Website: dcfsjamaica.org – This is more for organizations, but if you ever consider forming your own charity or verifying one, DCFS handles registrations. They ensure an entity is legally a charity to get Charities Act benefits

Note: Not needed if you’re teaming with NET/NHEF, since those are already registered. But useful knowledge if you plan longterm charitable work.

• Ministry of Foreign Affairs & Foreign Trade (MFAFT) –Diaspora Affairs Website: mfaft.gov.jm –“Procedures for Charitable Donations” page – Summarizes the required channels (essentially what we’ve covered: go through NET for education, Health Ministry for health). This is a good reference to validate that you’re following official recommended procedures. It also links to guidelines and forms.

Diaspora Engagement Hub: jadiasporaengage.mfaft.gov. jm – Offers tips on giving back, including medical missions and how to create a charity

• Local Jamaican Embassy/ Consulate (Overseas) – If you’re unsure whom to contact, your local Jamaican consulate or High Commission (in the US, Canada, UK, etc.) often has a Community Relations Officer or Diaspora officer. They can usually point you in the right direction for charitable donations and might have literature on it. They work closely with MFAFT and can connect you with NET or the Health Ministry as needed

One of the biggest advantages of going through registered charities

is the generous customs incentives for charitable goods. It’s helpful to understand what fees are exempted and which still apply, so you can budget accordingly (and not be surprised by any charges):

• Import Duty – 0% (Waived): Normally, imported goods can carry hefty import duties. Charitable items consigned to a registered charity are exempt from import duty. You won’t pay the usual tariff that commercial imports would incur.

• General Consumption Tax (GCT) –0% (Waived): Jamaica’s GCT (similar to VAT) is not applied to approved charity imports. This is typically 15% on goods, so it’s a significant saving for your donation.

• Customs Administration Fee (CAF) – 50% Discount: The customs processing fee (CAF) is cut by half for charitable imports. For example, if the standard CAF would be J$10,000 for your shipment, a registered charity only pays J$5,000. This is one cost you or the charity will need to cover, but it’s discounted.

• Special Consumption Tax (SCT) –Waived (if applicable): SCT is mainly for specific goods (like alcohol, tobacco, or certain vehicles). Most typical donation items won’t have SCT, but if they did (say a vehicle donation), registered charities also get SCT waived and 50% off the CAF on vehicles.

• Standard User Fees – Applicable: Any other standard port fees or charges (like wharfage, warehouse storage, handling fees) might still apply. These are not taxes, but service fees. However, if your paperwork is in order and clearance is quick, these

fees are usually minimal. The key is to avoid delays (which can incur storage fees).

• Environment Levy: Jamaica has an environment levy on imports (usually a small percentage or fixed fee). The JIS info from NET indicates the donor is responsible for the environmental levy. It’s generally a small amount (e.g., 0.5% of CIF or so). NET mentioned donors pay this, so expect a nominal charge here.

In practice, when NET or NHEF assists in clearing your items, they will inform you of any remaining fees to be paid (mostly that half CAF and the enviro levy, maybe a small handling fee). All the “big” taxes – duty and GCT – are zero, which is why partnering with a charity is indispensable. For example, if you shipped $1,000 worth of school supplies, normally duty+GCT could be $300+, but with NET it becomes negligible, maybe just a few dollars of fees.

Important: These concessions are given with the understanding that the items truly go to charity. As noted, authorities may audit charities to ensure compliance. This just means the charity must not divert the items elsewhere. As a donor, ensure you deliver the goods to the intended beneficiaries for free (no strings attached, no payments by recipients). That keeps everything above board and in the spirit of the law. If a charity misuses the concessions (for example, selling donated items), they can face penalties – but that’s an issue between them and the law. Your role is simply to follow the proper channels and genuinely help the community, which you are doing by following this guide.