South Fork Market Summary

The first quarter of 2025 delivered a stronger performance for the Hamptons real estate market, marking a notable shift in momentum as buyers returned with renewed confidence despite ongoing macroeconomic pressures. Total single-family home transactions rose 26.4% year-overyear to 349 units, while sales volume increased 35.4% to $1,203,628,613, reflecting greater engagement at higher price points. Among the major submarkets, Bridgehampton stood out with a 71.4% increase in transactions (24 sales) and an 84.1% surge in sales volume to over $144 million.

In Amagansett, transactions more than tripled compared to Q1 2024.

Both average and median prices rose, with the average price up 7.1% to $3,448,793 and the median climbing 11.7% to $2,200,000. This upward trend signaled a more balanced market one where value remains important but no longer dominates. Sub-$1 million properties continued to draw strong demand west of the canal, representing 13% of all transactions, while strength in higher price brackets elevated overall pricing metrics. East Hampton’s median price rose 20% to $2,550,000, while Bridgehampton’s median climbed 63.3% to $5,062,500, underscoring both areas ' continued desirability.

The ultra-luxury segment properties priced above $10 million also maintained strong momentum, with sales rising 40% year-over-year. Amagansett led the category with six transactions, including the quarter’s most notable sale: 370–372 Further Lane, which closed for $70 million.

The first quarter wasn’t without challenges. Economic uncertainty and tariff concerns temporarily slowed activity and introduced greater buyer caution, but confidence is gradually returning That said, it’s still too early to declare a sustained trend. Real estate continues to stand out as a reliable investment, reaffirming its role as a safe haven amid broader market volatility. With opportunity still present and long-term value intact, we’ll be watching the second quarter closely as the Hamptons market moves forward with measured optimism.

–Joe Fuer Managing Director

FORK MARKET REPORT

$1,203,628,613

$3,448,793

$2,200,000

Pictured on the cover page: 105 & 111 Lily Pond Lane East Hampton

Submarket

East Quogue, Hampton Bays, Quiogue, Quogue, Remsemburg, Speonk, Westhampton, Westhampton Beach, and Westhampton Dunes

Bridgehampton and Sagaponack

Amagansett, East Hampton, East Hampton Village, Montauk, Northwest Woods, Springs, and Wainscott

Southampton, Southampton Village, and Water Mill

North Haven, Noyac, Sag Harbor and, Sag Harbor Village

South Fork - Single Family

TOTALS

South Fork - Single Family

112 GEORGICA CLOSE ROAD

EAST HAMPTON

West of the Canal - Single Family

West of Canal - Single Family

PRICE POINTS

1052, 988 & 986 NOYAC PATH WATER MILL

East of the Canal - Single Family

TOTALS

East of the Canal - Single Family

East of Canal - Single Family

PRICE POINTS

Your home. Your choice.

OWN THE NARRATIVE

THE 3-PHASED MARKETING STRATEGY INTRODUCING

DEVELOP YOUR STRATEGY WITH COMPASS

CANOE PLACE BOATHOUSES HAMPTON BAYS

Submarket

53 SOUTH ROAD

WESTHAMPTON BEACH

South Fork - Single Family

TOTALS

Westhampton - Single Family

East Quogue

Hampton Bays

Quiogue

Quogue

Westhampton - Single Family

TOWN

$2,239,749

$2,100,000

Westhampton Beach

Westhampton

Speonk

Remsenburg

Westhampton Dunes

115 HEADY CREEK LANE SOUTHAMPTON

Southampton - Single Family

North Sea

$18,385,000

$2,626,429

$3,500,000

Southampton Village Southampton

Water Mill

$5,793,636 $5,825,000

Bridgehampton - Single Family

$39,800,000

$4,975,000

$2,675,000

Bridgehampton

Sagaponack

Sag Harbor - Single Family

2528 NOYACK ROAD, SAG HARBOR

North Haven

Noyac

Sag Harbor

Sag Harbor Village

Shelter Island - Single Family

TOWN

Shelter Island

40 DINAH ROCK ROAD SHELTER ISLAND

East Hampton - Single Family

$4,957,857

$4,950,000

Montauk

North Fork Market Summary

The first quarter of 2025 marked a period of adjustment for the North Fork real estate market, with activity slowing compared to a strong finish in 2024. A total of 75 single-family home transactions were sold, representing a 6.3% decline year-over-year and a 27% drop from the fourth quarter of 2024. Sales volume followed a similar trend, falling 15.6% year-over-year to $89,473,300.

Average and median prices both edged lower The average sale price dipped 3.4% year-overyear to $1,192,977, while the median price declined 9.9% to $930,000. Compared to the previous quarter, the average price fell from $1,364,360 and the median price from $975,000, suggesting growing sensitivity to pricing and a preference for value-driven opportunities across the region.

Southold led the region in overall sales, recording 18 transactions totaling $23,268,500, supported by a median price of $1,135,000. Cutchogue remained strong as well, with nine transactions and an average price of $1,412,778. In contrast, Greenport saw a significant pullback, with total sales volume dropping by more than 50% year-over-year to $10,222,800, even as transaction counts remained steady, highlighting downward pressure on pricing.

Market pace also shifted across submarkets. East Marion recorded the longest average days on market (DOM) at 158 days, reflecting a more measured approach among buyers in that area. Overall, homes across the North Fork averaged 92 days on the market in Q1 2025, compared to 86 days in the prior quarter and 93 days a year ago.

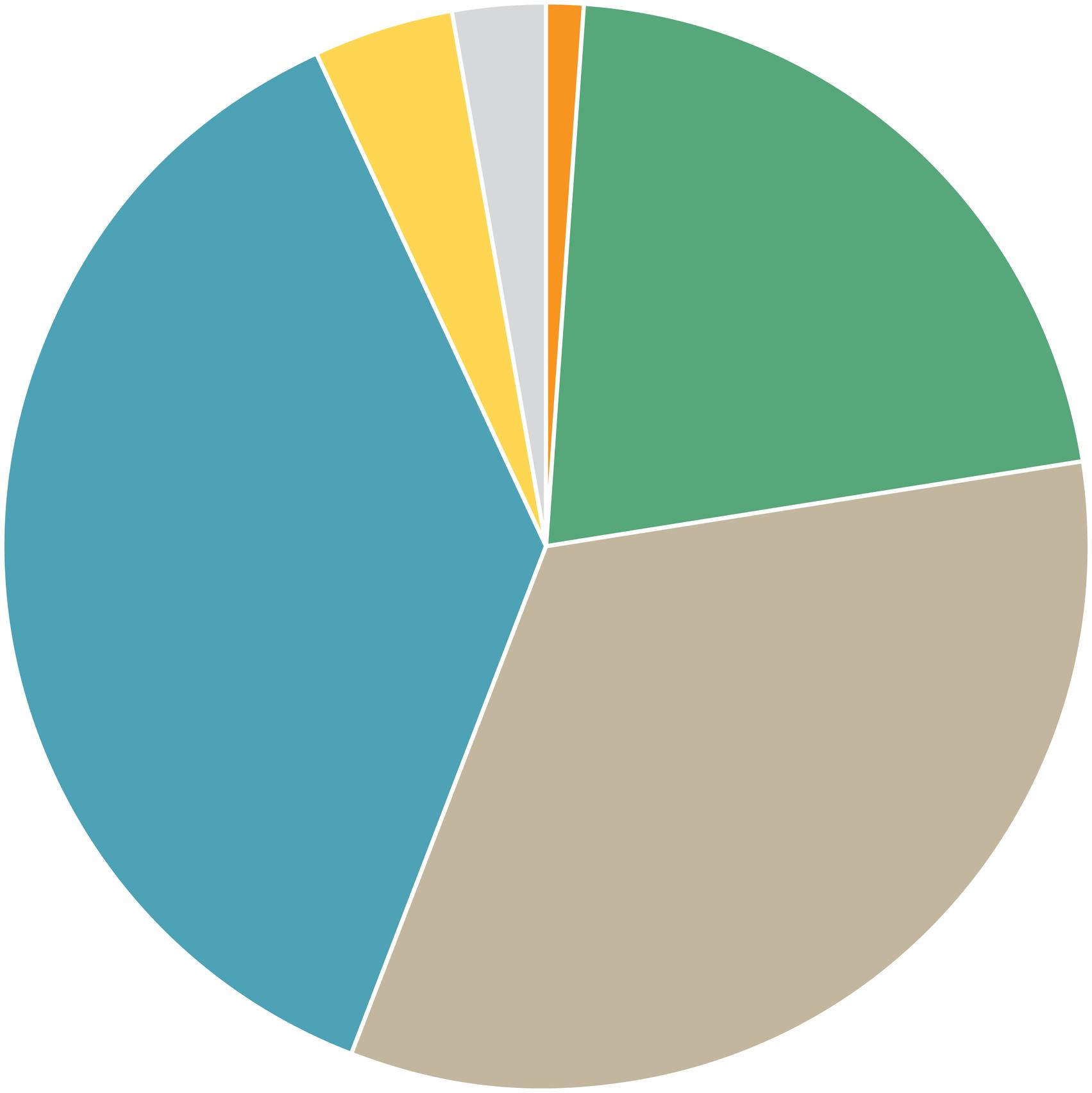

Entry-level properties under $1 million accounted for 56% of all single-famly transactions, while the $1 million–$2 million segment represented 37% of sales, reinforcing the North Fork’s ability to attract a broad range of buyers seeking both value and lifestyle.

– Joe Fuer

Managing Director

North Fork - Single Family

TOTALS

ONE PLACE FOR HOME

The only platform designed to connect you and your agent through every phase of your real estate journey.

STEP INSIDE COMPASS ONE

North Fork

Baiting Hollow Aquebogue

Cutchogue

East Marion

North Fork

Jamesport & South Jamesport

Mattituck

Laurel

Greenport