GAME ON!

Y oung P rofessionals 2025

Have

Navigating

For

1

Max Gross Editor in Chief

Cathy Cunningham

Executive Editor

Tom Acitelli

Deputy Editor

Greg Cornfield

Associate Editor

Skip Card

Copy Editor

Andrew Coen, Isabelle Durso, Julia Echikson, Mark Hallum, Brian Pascus, Amanda Schiavo, Nick Trombola

Staff Writers

Josh Rozbruch

Social Media Editor

SALES

Brigitte Baron

Senior Partnerships Director

Sona Hacherian

Strategic Account Director

Mark Rossman, Olivia Cottrell Partnerships Director

MARKETING & EVENTS

Samantha Stahlman Director of Audience

Faith Akinboyewa

Senior Events Manager

DESIGN, PHOTO & PRODUCTION

Jeffrey Cuyubamba

Art Director

Rohini Chatterjee

Senior Visual Designer

Jim Sewastynowicz

Photo Editor

Eliot Pierce

SVP, Product & Operations

Francesca Johnson Director, Revenue Operations

Brianna Scottino

Account Coordinator

Ramon Encarnacion IT Manager

OBSERVER MEDIA

Joseph Meyer Chairman

HUSTLE PLAY: BKREA’s Ryan Candel, Gensler’s Tyler Winograd and Blackstone’s Aliza Herz are making it rain every single day in commercial real estate. (Photographs taken at The Dime Residences in Williamsburg, Brooklyn.)

News

Planning Commission OKs

Adams’s

Midtown South Plan

The Midtown South Mixed-Use Plan is on its way to the next stage of approval after the New York City Planning Commission gave it the green light.

The city agency led by Dan Garodnick approved the plan, which could clear the way for 9,700 new housing units across 42 blocks of Midtown South through a rezoning that allows for taller residential buildings in the area. The plan has been updated since the latest version was submitted in October 2024

The neighborhood plan aims to lift the allowable floor area ratio (FAR) — a calculation of the amount of floor space that can be built vertically in relation to the size of the lot on which the building stands

— from 12 FAR to either 15 or 18.

Up to 2,900 of the 9,700 units must be deemed affordable under Mandatory Inclusionary Housing, which requires that developers of any project over 10 units must set aside 20 to 30 percent of those homes for low-income New Yorkers.

“With commercial vacancies too high and housing vacancies at historically low levels, it’s a perfect time to seize this opportunity to create a 24/7, mixed-use neighborhood. This plan will bring forth a vibrant mix of commercial, manufacturing and residential uses, creating a truly dynamic community here,” Garodnick said in a statement.

The original draft of the plan was introduced by Garodnick, under the direction of Mayor Eric Adams, in March 2024 with the original aim of creating 4,000 new homes in the target area. That has since been expanded to the current figure.

The Midtown South Mixed-Use Plan is expected to supplement the City of Yes for Housing Opportunity, a series of zoning reforms that were formally adopted by the New York City Council in December 2024

and is similar to the citywide approach to zoning that is projected to create 80,000 new housing units over 15 years.

The Adams administration may be facing a deadline to get the new plan through the finish line in the City Council, as Adams faces intense political opposition in his bid for re-election. Adams dropped out of this month’s Democratic primary and is running as an independent in the November election.—Mark Hallum

Mayor Announces Partners to Build Housing on Coney Island

Mayor Eric Adams has announced new partners to build roughly 1,100 homes in Brooklyn’s Coney Island.

As part of Adams’s broader housing plan for the summer tourist spot, the city will partner with BFC Partners Development to complete Coney Island Phase III, which will bring 420 affordable apartments, roughly 10,700 square feet of commercial space and roughly 9,700 square feet of community facility space to the area, according to an announcement on June 17.

Coney Island Phase I was completed in 2023 and created 446 affordable housing units, as well as 15,000 square feet of retail space and 66,000 square feet of office space for the New York City Housing Resources Administration Coney Island Phase II created another 376 housing units, 20,000 square feet of retail and community space, and a 2,500-squarefoot NYC Health + Hospitals facility, the announcement said.

The Phase III development at 1709 Surf Avenue will be supported by more than $90 million in subsidy from the Adams administration, as well as a $116 million construction loan supported by the New York City Housing Development Corporation (HDC).

“At BFC Partners, we remain committed to building and preserving high-quality affordable housing,” Win Wharton, principal at BFC Partners, said in a statement. “We are especially proud of our work in Coney Island, where projects like this play a vital role in strengthening and stabilizing New York City’s neighborhoods.”

In addition, the city will partner with Settlement Housing Fund to build another 178 affordable units as

part of the nearby Coney Landing Project at 2952 West 28th Street, according to the announcement.

“With 60 percent of units dedicated to supportive housing for formerly homeless individuals and families, and additional affordable apartments ranging from 30 percent to 60 percent of the area median

“Finding a home in Coney Island should not be a roller coaster ride.”

income, this project stands as a powerful response to the strong need for more affordable housing across New York City,” Judy Herbstman, president of Settlement Housing Fund, said in a statement.

The two partnerships come after the New York City Economic Development Corporation (EDC) issued a request for proposals in February for an 80,000-square-foot, city-owned site on Surf Avenue between West 21st and West 22nd streets for a project called Coney Island West, which is set to create more than 500 mixed-income homes, 25 percent of which

will be affordable, as Commercial Observer previously reported

The EDC will select a developer for Coney Island West by the end of the year, the announcement said. Combined, all three projects will deliver roughly 1,100 new homes across Coney Island over the next three years.

“Finding a home in Coney Island should not be a roller coaster ride,” Adams said in a statement. “That’s why we’re creating 1,100 new homes in this neighborhood so that more families can live in this iconic New York City community.

“But we’re not stopping with Brooklyn — our administration is shattering affordable housing records, year after year, and advancing generational projects across all five boroughs to make New York City the best place to raise a family,” Adams added.

Adams’s plans for Coney Island also include a renovation of the Riegelmann Boardwalk, a $42 million renovation of the Abe Stark Sports Center and improvements to the neighborhood’s streets and sewers, according to the announcement.

Meanwhile, plans for a shiny new casino on Coney Island are also moving forward.

Last month, Thor Equities, Saratoga Casino Holdings, the Chickasaw Nation and Legends finalized their plans for a proposed $3 billion casino development in the neighborhood, which would include a 500-room hotel, a 2,500-seat concert venue, 70,000 square feet of retail space, and 90,000 square feet of meeting and event space, as CO previously reported.— Isabelle Durso

SOUTHERN EXPOSURE: Reforms could add 9,700 housing units to 42 blocks in Midtown South

DAN WITH THE PLAN

Invesco Real Estate Credit Solutions congratulates Andrew Kim and the class of 2025

and local insights.

Invesco Real Estate Credit Solutions — Powered by global expertise

Fulton Street

Brooklyn Developer Plans 120-Unit Residential Project at 1445

A developer has big plans for new housing in Brooklyn’s Bedford-Stuyvesant neighborhood.

Brooklyn-based developer Jacob Fulop has filed an application to build a new 12-story, 76,268-square-foot residential property at 1445 Fulton Street with a total of 120 apartment units, according to a filing last week with the New York City Department of Buildings

Fulop bought the building and its neighboring 1439 Fulton Street and 484 Tompkins Avenue in May 2024 for a combined total of roughly $5.5 million, records show. Fulop filed demolition permits in February for all three buildings, but 1445 Fulton Street is the only property he has filed a new building application for, so far, and the only one that has been demolished.

The filing submitted last week shows plans for 80 residential units, and retail space on the ground floor of 1445 Fulton Street.

However, the filing also shows that

U.S. Office Supply Set to Shrink Due to Conversions and Demolitions

For the first time in roughly 25 years, the overall supply of office space in the U.S. is set to shrink, with office-to-residential conversions playing a big part.

Over the past few decades, developers — incentivized by low interest rates and federal tax breaks — built a gluttonous amount of office towers in U.S. cities. This caused a stark oversupply of empty space, especially after the COVID-19 pandemic created an unprecedented spike in hybrid and remote work.

But an end to the oversupply is finally in sight as conversions and demolitions — as well as developer uncertainty as a result of tariffs — all finally take their toll on office inventory nationwide.

About 23.3 million square feet of office space is on track to be converted to non office uses or demolished this year, significantly outpacing the 12.7 million square feet of expected new office supply, according to a recent report from CBRE, which gathered data from the 58 markets tracked by the firm.

A spokesperson for CBRE did not immediately respond to a request for comment.

Since the pandemic, both demolition and conversion activity have accelerated, with the U.S. office conversion pipeline reaching 81 million square feet of planned projects across 44 markets as of May, up from 71 million square feet across 42 markets six months ago, the report found.

In addition, an annual record of 94 conversion projects totaling 13.1 million square feet were completed in the U.S. in 2024, compared to the average 58 annual office conversions completed from 2018 to 2023, according to CBRE. In 2025, the country is expected to see approximately 68 conversions totaling 12.8 million square feet.

More than 70 percent of the planned and ongoing conversion projects are set to become multifamily properties, with 28,500 housing units already delivered since 2018 and another 43,500 planned, CBRE said. Most conversion activity is taking place in major U.S. cities, including New York City, Los Angeles and Washington, D.C.

New York City is leading the conversion push with 8,310 new housing units in the pipeline as of February, a large chunk of which will come from major projects such as Apollo Global Management, SL Green Realty and RXR’s conversion of the 1.1 million-squarefoot office building at 5 Times Square into as many as 1,250 housing

units, and Metro Loft Management and David Werner Real Estate Investments’ plan to turn the former Pfizer headquarters at 235 East 42nd Street into a total of 1,600 units. Meanwhile, D.C. is planning 6,533 new housing units and L.A. is expected to see 4,388, as Commercial Observer previously reported In D.C., private equity firm Henderson Park and L.A.-based real estate investment and development company Lowe are converting the 536,000-square-foot office building at 1250 Maryland Avenue SW into an 11-story, 658,000-square-foot apartment complex with 428 units and 53,000 square feet of retail and commercial space, as CO reported

And in L.A., multifamily developer Jamison Properties leads the way with a growing slate of office-to resi projects, including its plan to turn the former Pierce National Life Building at 3807 Wilshire Boulevard into 210 apartments, CO reported.—I.D.

Fulop intends to ultimately build a total of 120 apartment units on the lot. It’s unclear whether all 120 units will be included in one building or within multiple buildings on the site.

Fulop and a spokesperson for Kao Hwa Lee Architects, which is listed as the architect on the project, did not immediately respond to requests for comment.

News of the project comes after Fulop bought the office building at 545 Broadway in Williamsburg in June 2022 for $23 million, according to Crain’s New York Business

His project is also one of many new residential developments planned in Brooklyn, with a total of 3,080 new apartments proposed in the borough during the first quarter of 2025, Crain’s reported. Those developments include Goose Property Management’s 163-unit project at 570 Fulton Street in Downtown Brooklyn and Thorobird’s 213-unit affordable apartment building at 581 Grant Avenue in Cypress Hills.—I.D.

Skyline Developers’ Orin Wilf has sold off the office portion of his family’s properties at 9-11 West 54th Street, according to property records.

Greenwich, Conn.-based Interlaken Capital purchased 9-11 West 54th Street from the Wilf family for $38 million. The family had bought two Gilded Age buildings — the office building at 9-11 West 54th Street, and a residential property at 10 West 55th Street — for $75 million in 2019, with $20 million of that going toward the 54th Street property. The family had no particular plans for the investment, Wilf told The Real Deal at the time.

Skyline backed the acquisitions with a $91 million loan from Goldman Sachs

Interlaken Capital was founded in 1979 by William Robert Berkley and the deed is co-signed with the William R. Berkley Foundation, according to property records. Interlaken Capital could not be reached for comment. Skyline Developers did not immediately respond to a request for comment.

McKim, Mead & White, the architecture firm that designed the original Pennsylvania Station, which was famously demolished in the 1960s, was the outfit behind the look of 9-11 West 54th Street. It was built sometime between 1896 and 1898 for New York City businessman James Junius Goodwin, and is known to the New York City Landmarks Preservation Commission as the James J. Goodwin Residence — M.H.

IN THE MIX: Plans for 1445 Fulton Street include housing and retail.

TURNING OFFICE OFF: Office supply is shrinking in the U.S. as conversions gain in popularity.

THE MOST BRILLIANT IDEAS ONLY MATTER WHEN YOU CAN BRING THEM TO LIFE.

Congratulations to Benjamin Bouganim, Cecelia Galligan, Sam Hoffman and Patrick O’Rourke for being recognized on Commercial Observer’s 2025 Top Young Professionals List.

Benjamin Bouganim

Cecelia Galligan

Sam Hoffman

Patrick O’Rourke

Lease Deals of the Week

A New York City public school is staying at The Factory in Long Island City, Queens, awhile longer, Commercial Observer has learned.

The New York City School Construction Authority (NYCSCA) has signed a 15-year renewal on behalf of New York City Public Schools for the 75,000-square-foot Robert F. Wagner Jr. Secondary School for Arts and Technology on part of the ground and second floors of Atlas Capital Group’s 30-30 47th Avenue, according to a source with knowledge of the deal. Asking rent was $45 per square foot.

The NYCSCA is responsible for building new public schools and managing the design and construction of existing schools in the city, according to its website

Robert F. Wagner has been a tenant of the building between 30th Place and 31st Street since 1995, the SCA said.

Newmark’s Brian Waterman, Jordan Gosin and Alex Rosenblum brokered the deal for the landlord, while the NYCSCA represented itself.

Newmark declined to comment, while a spokesperson for Atlas did not respond to a request for comment.

Other tenants of the 10-story, 1.2 million-square-foot building on 47th Avenue include toy company Cardinal Industries, contracting firm TEI Group, promotional products distributor Halo Branded Solutions and apparel brand Ralph Lauren, which expanded its photo studio at The Factory to 54,602 square feet in March 2023. — I.D.

It’s 11:30 (somewhere) and the club is jumpin’, jumpin’.

Trampoline park Sky Zone is setting up its first New York City location at 2350 East 69th Street in Brooklyn’s Mill Basin neighborhood, having signed a 52,100-square-foot, long-term lease at the property, Crain’s New York Business first reported.

Landlord Turnbridge Equities represented itself in the deal. Turnbridge did not respond to Commercial Observer’s request for comment. Josh Gosin and Jordan Gosin from Newmark represented Sky Zone in the deal. Newmark didn’t respond to a request for comment.

Asking rent was not available, but the average asking rent for industrial space in Brooklyn runs between $15 and $40 per square foot, according to Cushman & Wakefield data.

Turnbridge Equities acquired the one-story warehouse for $8.9 million in January of last year. The space is currently occupied by the fitness club MatchPoint.

“Expanding in Brooklyn is an exciting step forward in our mission to make active play more accessible to families nationwide,” Mike Revak, chief operating officer of Sky Zone, told CO via email. “Brooklyn, and the greater New York City area, remains a key focus as we continue to grow the Sky Zone brand on our path to 500 parks.”

The Mill Basin location is scheduled to open during the fourth quarter, a source close to the deal told CO via email. — Amanda Schiavo

Gymnastics studio NYC Elite, which provides gymnastics programs and coaching instruction for people of all ages, signed a 20-year renewal for its 20,908-square-foot studio at 40 Worth Street, a Tribeca building owned by Jeffrey Gural’s GFP Real Estate

The gymnastics company moved into the 16-story building between Church Street and West Broadway — also known as the Merchants Square Building — in January 2015, as Commercial Observer previously reported NYC Elite’s space at the property comprises 10,987 square feet of ground-level space, 2,761 square feet of mezzanine space, and 7,160 square feet of lower-level space, according to GFP.

“We are beyond excited to renew our lease and not only continue to work alongside the Gural family, but also to have the opportunity to continue bringing joy and confidence to the kids in our community through gymnastics,” Tina Ferriola, founder and president of NYC Elite, said in a statement.

The asking rent was not provided, but when NYC Elite signed its lease at 40 Worth in 2015, asking rents for the space were $95 per square foot on the ground floor and $45 per square foot on the sublower level, CO reported. GFP’s Roy Lapidus brokered the deal for both the tenant and the landlord.

NYC Elite’s Tribeca spot is its third location in Manhattan, joining 421 East 91st Street on the Upper East Side and 200 Riverside Boulevard on the Upper West Side, according to its website. — I.D.

What would you find in “a playground for the intellectually adventurous?”

Darwin’s monkey bars? A slide into relativity? The see-saw between Stoicism and hedonism?

Because that is the slogan for a new social club from Lightning Society, a 20-year-old social organization that just signed a 19,000-square-foot lease for a members-only club at Chetrit Organization’s cast-iron 45 Howard Street (also known as 427 Broadway) in SoHo, at the corner of Broadway and Howard Street. 45 Howard Street will host the club’s entrance, while 427 Broadway is the building’s retail entrance.

The new club, backed by executives from WeWork, Soho House and Burning Man, will be Lightning Society’s first permanent home.

Lightning Society founder and CEO Timothy Phillips wouldn’t disclose the exact terms of the lease, but said it was “a very, very long lease,” and called the rent “substantial, but below market.”

Aaron Ellison at Newmark represented Lightning Society. The Chetrit Organization was repped by Newmark’s Howard Kesseler Jr., according to Phillips.

The new club will occupy the building’s top four floors and the rooftop terrace, which constitutes the entire building except the lowerlevel retail. The new endeavor replaces a museum called The House of Cannabis. News of the lease was first reported by The Real Deal. — Larry Getlen

Retail real estate owner, operator and developer Macerich is moving its New York City office to a new location.

The firm has inked a 13-year, 12,000-square-foot lease at 825 Third Avenue, landlord The Durst Organization announced. Asking rent was $96 per squarefoot for the Midtown East space. Macerich’s website lists its current New York City office at 500 Fifth Avenue

It is unclear when the firm will make the move to Third Avenue. Macerich did not respond to a request for comment.

The Durst Organization was represented in house by Tom Bow, Ashlea Aaron, Bailey Caliban and Sayo Kamara. Macerich was represented by Gordon Ogden and James Hart of Bradford Allen

“Macerich joins an esteemed and growing roster of firms who have moved to 825 Third Avenue looking for a modern, sustainable workplace and convenient amenities, including our retailers and indoor-outdoor [amenity space called] Well& by Durst that acts as an extension of their office,” Jody Durst, president of The Durst Organization, said in a statement. Bow, Aaron, Caliban and Kamara were unavailable to provide a comment.

“Macerich is pleased with their move to 825 Third Avenue and the building’s recent upgrades which suits their growing business,” Ogden told Commercial Observer via email. The company will occupy an entire floor of the Third Avenue building. — A.S.

Lease Deals of the Week

An arts and crafts goods retailer is sticking to its knitting in Brooklyn after taking space in Industry City

Artist & Craftsman Supply signed a 10-year, 10,101-squarefoot lease in the complex owned in a joint venture by Jamestown, Belvedere Capital, Cammeby’s International, FBE Limited, and TPG Angelo Gordon, according to the landlords.

The tenant will relocate from 307 Second Street in Park Slope, Brooklyn, to Building 4 of the converted industrial complex in Sunset Park.

Representatives for the landlord did not disclose the asking rent in the deal, but industrial space in Industry City ranged from low- to mid-$20s per square foot as recently as March

“Industry City’s expansive and renowned hub of artists and creatives makes for the perfect home for Artist & Craftsman Supply,” Industry City Senior Vice President of Leasing Jeff Fein said. “Adding a leading art supply store like Artist & Craftsman Supply reflects our mission to build an ecosystem where creative businesses can both make and sell, prototype and scale — all on the same campus.”

Nick Shears, vice president of leasing at Industry City, represented the landlord in-house.

Other tenants in the complex include biotechnology company Cresilon, cycling organization Bike New York, and design studio Staged To Sell Home

— Mark Hallum

Crypto firm Artemis is taking over some office space in SoHo, Commercial Observer has learned.

Artemis, which provides data and analytics for digital assets, has signed a five-year sublease for 5,539 square feet on the ninth floor of Northwood Investors’ 520 Broadway, according to broker Current Real Estate Advisors Asking rent was $110 per square foot.

Artemis subleased the space from crypto investment firm Paradigm, said Current. It’s unclear whether this is a new location or a relocation for Artemis, which has a current address at 141 East Houston Street

“These deals underscore the sustained strong demand for crypto and Web3 spaces, particularly here in SoHo,” Current’s Adam Henick, who brokered the deal for the tenant along with Rob Kluge, said in a statement to CO.

“We’re proud to continue facilitating the majority of transactions in this vibrant sector.”

It’s unclear who represented the landlord in the deal.

Spokespeople for Artemis, Northwood and Cushman & Wakefield, which is listed as the leasing contact for the property, did not immediately respond to requests for comment.

News of the deal comes after a few other new leases at the 11-story 520 Broadway, including crypto firm MoonPay’s deal in April to lease more than 5,000 square feet on the eighth floor, and a health care company’s recent lease on the seventh floor, Current said.— I.D.

Department store chain Nordstrom will open its third retail service hub in New York City, this one in Williamsburg, Brooklyn.

Nordstrom Local, Nordstrom’s sister brand, has signed a lease for 3,000 square feet at 154 North Seventh Street, according to a Monday announcement from the company.

Nordstrom’s store at the base of the four-story building between Bedford Avenue and Berry Street, which is owned by Williamsburgh Square LLC, will open June 26, the announcement said.

“New York is one of our largest markets, and we’re looking forward to opening Nordstrom Local Williamsburg to offer Brooklyn customers even more opportunities to engage with our services closer to where they live and work,” Fanya Chandler, president of Nordstrom stores, said in a statement.

The length of the lease and asking rent were unclear, but a report from the Real Estate Board of New York found retail rents in Williamsburg averaged $250 per square foot in 2024 (the most recent data available).

It’s also unclear who brokered the deal. A spokesperson for Nordstrom did not respond to a request for further comment, while the landlord could not be reached for comment.

The brand’s new Williamsburg store represents its third Nordstrom Local outpost in the city, following openings at 13 Seventh Avenue in the West Village and 1273 Third Avenue on the Upper East Side, according to its website. — I.D.

It’s not stretching the truth to say this flexibility service is catching on.

StretchLab, a mobility-improving studio known for its musclestretching treatments, has taken 1,300 square feet of retail space at the 499-unit residential building the Jasper, located at 2-33 50th Avenue in Long Island City, Queens, landlord representative Igloo announced.

Retail space at the Jasper — owned by residential developer The Domain Companies — is now 100 percent occupied, and spans 35,000 square feet across the building’s ground floor. The space also houses 10 other businesses including grocers, restaurants, and wellness service providers.

“The lease-up at Jasper is a great example of the value-proposition of the Igloo platform,” Adam Joly, principal at Igloo, said in a statement. “The project will benefit from a wide range of retail activations which will enhance the resident experience and deliver impactful business offerings to the LIC area.”

StretchLab was represented by Ripco’s Peter Yoon. Ripco did not immediately respond to a request for comment.

Asking rent and the length of the lease were not disclosed, but average asking rent for retail space in Queens is $49.04 per square foot, according to PropertyShark

Other retailers occupying ground-floor space at the Jasper include children’s clothing store Peanut and Honey, and restaurant Frankie’s Brooklyn Pizza. — A.S.

Studio Pilates International is extending its presence in New York City.

The 23-year-old Australianborn fitness services brand inked a five-year, 1,126-square-foot lease at 301 West 110th Street in Harlem. The lease deal includes a five-year renewal option.

The Harlem outpost be the brand’s first Manhattan location, tenant broker Norma Ashkenazi of KSR told Commercial Observer. Ashkenazi brokered the deal alongside Eli Yadid. It is not clear who brokered the deal for landlord Argo, which did not respond to CO’s request for comment.

The New York Business Journal first reported this lease. Asking rent for the space was not available, but previous Commercial Observer reporting noted asking rent of $85 per square foot for retail space in Harlem.

“It was a pleasure representing Studio Pilates in their first Manhattan lease,” Ashkenazi said via email. “Their upscale, boutique concept will add real value to the neighborhood.”

The building at 301 West 110th Street is a 47,533-square-foot condominium building with 599 residential units, according to Property Shark.

Studio Pilates International was founded in 2002 by husband and wife Jade and Tanya Winter. This latest Studio Pilates International location is set to open on July 12, while the company’s first New York City location opened in Brooklyn in 2021. — A.S.

ANAGRAM TURTLE BAY

RUBY

Congratulations to on being named one of Commercial Observer’s 2025 Top Young Professionals. Here's to what you've built and what's still to come. Adam Freindlich

MABEL

FINANCE

Debt Deals of the Week

Wells Fargo Provides $460M Refi for Hell’s Kitchen Multifamily Development

Gotham Organization has sealed a $460 million debt package to refinance a 1,238unit multifamily development in Manhattan’s Hell’s Kitchen neighborhood.

Wells Fargo’s multifamily capital group, led by Peter Cannava, closed the direct bond purchase facility for the developer’s Gotham West property that consists of 555 market-rate apartments along with 683 units designated as affordable or middle income, according to the lender.

The deal comprises $260 million of fixed-rate debt and $200 million of floating-rate debt, with Wells Fargo also obtaining a credit enhancement for the deal from Fannie Mae. It refinances an existing 10-year direct purchase that Wells Fargo has held since 2011 when it co-led a construction facility for the project.

Located at 550 West 45th Street, the 2013-built Gotham West was financed with 100 percent taxexempt bonds issued by the New York State Housing Finance Agency in exchange for setting aside roughly half of the apartments as affordable or middle income. Its amenities include two fitness centers, an outdoor courtyard, a roof deck, coworking space and two children’s playrooms.

Officials at Gotham Organization did not return a request for comment. —A.C.

Meridian Arranges $173M Loan for UES Apartments in First Agency Deal Since 2023 Freddie Mac Ban

Meridian Capital Group is officially back in the agency financing game.

The brokerage giant closed a $173.1 million Freddie Mac-backed loan originated by NewPoint Real Estate Capital on behalf of investor Rubin Schron to refinance the Monterey luxury apartment building on Manhattan’s Upper East Side in a deal that closed Monday, Commercial Observer can first report.

The 10-year loan, which was arranged by Meridian’s Matt Texler, carries a 5.07 percent interest rate with eight years of interest-only payments and a 35-year amortization schedule.

The deal marked the first agency deal for the firm since Freddie Mac and Fannie Mae placed restrictions on Meridian-brokered loans in November 2023 when a loan it negotiated was called into question.

“It shows to the market that we’re not just technically back in the agency market, we are really back in a big way, “ Meridian CEO Brian Brooks told CO in an interview last week. “It’s not just that somebody said we can do it, we are executing on it.”

Brooks said it took about three months to “find the right deal,” and a sponsor who would be an ideal fit to announce a relaunch of Meridian’s agency-lending business. He said there were unknowns about whether agency debt would even be the right fit for the loan given the volatile market conditions early this year, but more recent market conditions allowed Meridian to lock in an attractive interest rate for the financing.

NewPoint and Schron did not immediately return requests for comment.

The transaction closed on the heels of Freddie

Invesco

Mac lifting its ban late last year and Fannie Mae easing restrictions in April. Meridian also implemented new underwriting procedures with a screening process for all brokeraged transactions to ensure compliance, and also formed a management credit approval committee to review large loans as part of its enhanced procedures to end the bans.

The improved processes for GSE loans was spearheaded by Brooks, a former acting controller of the currency and general counsel at

“It shows to the market that we’re not just technically back in the agency market, we are really back in a big way.”

Fannie Mae, who replaced founding Meridian CEO Ralph Herzka as CEO in March 2024. Brooks credited Melissa Martinez, who he hired in June 2024 from CoreLogic as the company’s first chief risk officer, with paving the way for the company’s agency brokering relaunch.

“I brought her on because I’ve worked with her and known her for almost 20 years at this point. and she and I have done turnarounds together,” Brooks said of Martinez. The two

worked on OneWest Bank Group’s takeover of IndyMac 2009 when Brooks was vice chairman of the bank.

“She was a huge chief player in this and is very respected by the agencies since she used to have the senior multifamily risk role at Fannie Mae years ago,” Brooks said.

Brooks said Meridian will soon be arranging its first Fannie Mae deal since its suspension was lifted, and that the brokerage has several other agency transactions in the pipeline for 2025. He projects that by the end of the year Meridian will have executed around $500 million of agency loans.

Meridian was greenlighted to work again with Freddie Mac and Fannie Mae amid uncertainty about privatization of both GSEs after President Donald Trump’s appointment of private equity veteran Bill Pulte as chair of the Federal Housing Finance Agency.

Ending the conservatorship of Fannie and Freddie for the first time since the 2008 Global Financial Crisis has the potential to open up more deal flow, according to Brooks, with the addition of private capital and without the restrictions of annual caps.

While Meridian’s half-billion dollars of projected agency volume this year pales in comparison to the roughly $10 billion the brokerage achieved in 2021, Brooks said it represents a strong signal of a return to a crucial part of its capital markets business.

“There’s a line in startup land where they talk about how zero to one is a lot harder than one to 10,” Brooks said. “This is our zero to one loan. We took a year in the penalty box, and now we’re out. This is our first goal, and once you’re scoring you’re scoring.”—Andrew Coen

Real Estate Closes $355M Refi for 24-Asset Industrial Portfolio

A Bridge Investment Group subsidiary has secured a $354.6 million loan to refinance a portfolio of 24 industrial assets, spanning more than 2.4 million square feet across six states, Commercial Observer can first report.

Invesco Commercial Real Estate Finance Trust (INCREF), the private credit real estate investment trust owned by Invesco Real Estate, provided the financing to Bridge Logistics Properties, a real estate investment manager under the umbrella of its $49 billion alternative asset management parent firm.

The loan carries a loan-to-value ratio of less than 70 percent, while the entire infill industrial portfolio is currently “well-leased, cash-flowing,” according to Charlie Rose, global head of credit for Invesco Real Estate.

“This loan is complementary to our existing

portfolio of moderate leverage loans made to the highest quality institutional sponsors in the industry,” Rose added.

Matt Berger, chief financial officer at Bridge Logistics Properties, said in a statement that the new capital from Invesco strengthens his firm’s ability to execute a core logistics investment strategy across U.S. markets.

“We are proud to partner with Invesco in supporting long-term performance for this high-quality portfolio,” he added.

The 24-property portfolio spans a total of 2.45 million square feet across California, Washington, Texas, New Jersey, New York and Florida, according to Invesco.

Yorick Starr, managing director for Invesco Real Estate, noted in a statement that the $354.6

million loan goes hand in hand with INCREF’s strategy to originate income-generating loans secured by the best possible assets in what his firm considers to be “the most liquid markets” across the U.S. and Europe.

“Bridge Logistics Properties are exceptional investors and operators in these key logistics markets,” Starr added.

Rose, who also serves as the lead portfolio manager of INCREF, emphasized that the firm’s private credit real estate investment trust now carries a portfolio of 61 loans totaling $3.6 billion in commitments.

“Each loan we have closed this year has been representative of our consistent focus on the highest-quality segment of the floating-rate real estate credit market,” he said.

Brian Pascus

Wells Fargo’s Peter Cannava.

FINANCE

Miami Design District Owners

Land $125M to Build Multifamily Rental Tower

The owners of the Miami Design District are adding rental housing as part of an expansion of the 30-acre luxury shopping mall.

Amerant Bank and Bank Hapoalim provided $125 million to finance the construction of Cassi, a 107-unit multifamily tower at 91 Northeast 36th Street, just south of the Miami Design District and Interstate 195. Besides the housing component, the 20-story development will include 23,000 square feet of retail space on a half-acre site. Units will average 1,509 square feet.

The outdoor mall is also set to further expand. In 2022, Craig Robins’s Dacra, alongside partners, bought a collection of retail buildings along Northeast 39th Street for $166 million, with plans to add more retail, a hotel and possibly condos, which architect David Chipperfield will master design. Chipperfield won the prestigious Pritzker Architecture Prize in 2023.

The development team for Cassi consists of the Miami Design District Associates, Michigan-based Hunter Pasteur, and Palm Beach Gardens-based The Forbes Company. Miami Design District Associates — a partnership between Dacra and LVMH-backed L Catterton — developed most of the Miami Design District, which today is home to Chanel, Dior and Hermes boutiques.

Walker & Dunlop’s Sean Reimer, Aaron Appel, Keith Kurland, Jonathan Schwartz, Adam Schwartz, Jordan Casella and Michael Stepniewski represented the developers in securing the loan package.

Representatives for Dacra did not respond to requests for comment.

—Julia Echikson

Madison Realty Capital Lends $57M on 195-Unit Binghamton University Student

An Aptitude Development affiliate has landed a $57 million debt package for the purchase and construction of a student housing project serving Binghamton University, Commercial Observer has learned.

Madison Realty Capital (MRC) originated a senior mortgage and mezzanine loan for the 195-unit project that will sit 500 feet from the main entrance to Binghamton University’s main campus in Vestal, N.Y. where a Quality Inn & Suites now sits. Aptitude is slated to commence construction of the 516-bed The Marshall building in the third quarter and complete the complex ahead of the 2027-2028 academic year.

“Aptitude Development is an experienced developer of high-quality, pedestrian-to-campus student housing, and we look forward to delivering a highly amenitized and geographically desirable accommodation that will serve Binghamton University students for

Housing Project

years to come, Josh Zegen, principal and co-founder of MRC, said in a statement.

Binghamton currently enrolls 18,332 students with around half living on campus where supply is constrained, according to MRC.

The Broome County IDA approved a 20-year payment in lieu of taxes (PILOT) agreement for the student housing project in March, despite objections from the Vestal Town Board which claimed that the PILOT would cost it more than $10 million of lost tax revenue over the next two decades, The Press & Sun-Bulletin previously reported

The five-story development will consist of studio, one-, two- and four-bedroom apartments. Community amenities will include a fitness center, a sauna, a hot tub, a yoga studio, a meditation room, tanning beds, study rooms and a community clubhouse lounge.

Officials at Aptitude Development did not return a request for comment.—A.C.

Urban Standard Capital Provides $60M Loan for East Hartford Apartments

A joint venture between Jasko Development and Zelman Real Estate has nabbed $60 million of construction financing to repurpose of a former movie theater in East Hartford, Conn., into a multifamily property, Commercial Observer has learned.

Urban Standard Capital supplied the loan for the co-developer’s entity, Jasko Zelman 1, to facilitate the planned transformation of a vacant site that previously housed a Showcase Cinemas theater into a 300-unit apartment community called Concourse Park

“We are excited to support this transformative project that will bring much-needed housing to East Hartford,” Seth Weissman, founder and managing partner of Urban Standard Capital, said in a statement.

Paradigm CRE’s Adrian Edery arranged the transaction.

“The joint venture between Jasko Development and Zelman Real Estate brought together experienced, well-capitalized developers with a proven track record in multifamily,” Edery said in a statement. “That gave us confidence in their ability to execute at scale.”

The Town of East Hartford sold the long-vacant 25.6-acre parcel to Jasko Zelman in 2019 for $3.3 million. The sale was finalized this month after Zelman agreed to $10 million in public infrastructure funding for the project, according to Connecticut Insider.

Avner Krohn, chairman and CEO of Jasko Development, said public support for the project will enable rents to be “highly competitive”

and is hoping it can fill a housing need for an area with many large employers.

“We think it will help retain and attract some of the many workers in the area,” Krohn told CO. “This area hasn’t seen a new market-rate Class A product in decades.”

Krohn said the project is slated to break ground in a few months, with an estimated completion date in late 2027. The building will have community amenities that include an outdoor pool, a cabana area, grill stations and a fitness center.

Brian Zelman, principal of Zelman Real

Estate, said Concourse Park will mark the first market-rate apartment project for East Hartford in nearly 50 years. He credited local lawmakers with allocating necessary funding to enable the project to get off the ground.

“The development would not be possible without a public-private partnership with the Town of East Hartford, State of Connecticut and the Capital Region Development Authority,” Zelman said. “The location with significant frontage on I-84 and a few miles from the I-91/ I-84 junction is arguably the best situated site in the region.”—A.C.

The Marshall building at Binghamton University.

A rendering of Concourse Park at the former Showcase Cinemas location.

Dacra’s Craig Robins.

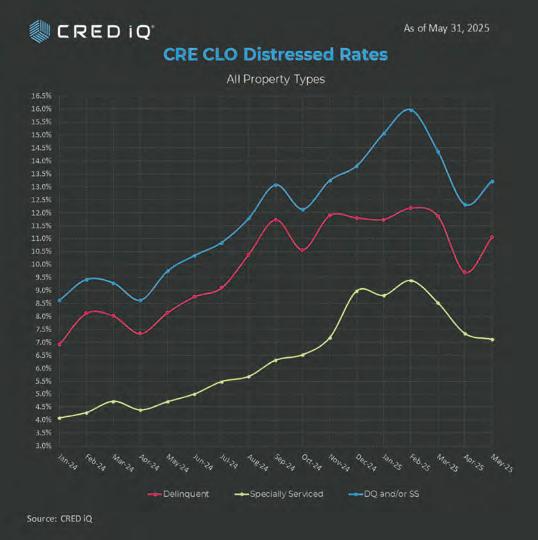

Chart Finance

CRE CLO Distress Rates Seesaw Back Above 13%

By Mike Haas

Following a dramatic reduction, the commercial real estate collateralized loan obligation (CRE CLO) market saw its distress rate rise by 80 basis points (bps) to 13.2 percent in May, according to CRED iQ’s latest data. Originations in the sector continue to be robust, so the picture is murky at best.

Investors hoping for a third consecutive reduction in the CRE CLO distress rate were left a bit disappointed as the benchmark added 80 bps to close at 13.2 percent in the May report. The underlying metrics were mixed, with the special serving rate shaving off 30 bps to 7.1 percent while the all-important delinquency rate added 130 bps, bringing

it to 11 percent.

Similar to last month’s data, our research team widened the aperture a bit to examine the velocity of the CRE CLO sector over the past year.

Total year-to-date CRE CLO issuance totals $10.5 billion across 11 deals. As a comparison, during the first four months in 2024, CRE CLO volume totaled only $2.2 billion (across three deals), meaning CRE CLO issuance velocities have increased 377 percent compared to last year. (Indeed, as we approach summer, it could be argued that CRE CLO issuance is already hot.)

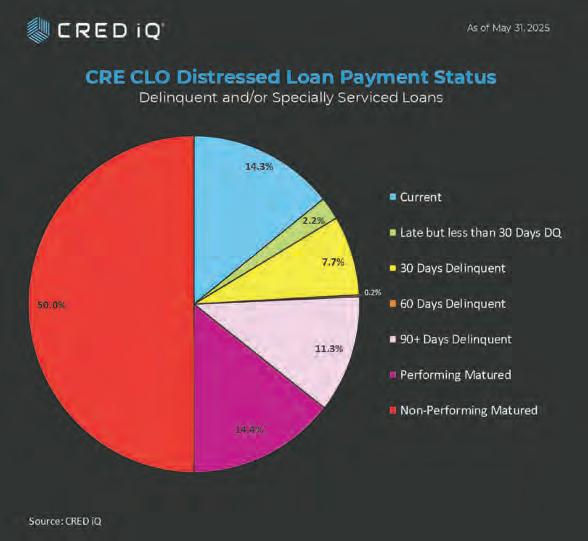

Looking across a wider analysis of payment status reveals ongoing challenges. 64.4 percent of CRE CLO loans have surpassed their maturity date (up from 63.1 percent last month). More than a third (36.6 percent) are classified as “performing

matured” — down from 37.3 percent. This suggests that many borrowers are exercising extension options or negotiating month-to-month arrangements to avoid default.

Precisely half (50 percent) of CRE CLO loans have surpassed their maturity date and are not performing, which is a record. This metric was 25.6 percent in our January print. May’s data showed that 14.3 percent of CRE CLO loans are current — down from 16.8 percent last month. Delinquent Loans (pre-maturity) account for 21.3 percent, which is the third consecutive monthover-month increase.

These figures reflect a market grappling with the aftermath of loans originated in 2021 and 2022, when cap rates were compressed, valuations were elevated, and interest rates were historically low. Many

of these loans, structured with floating rates and three-year terms, are now hitting maturity walls in a dramatically different economic environment.

Case study: Norterra Canyon Apartments

A real-world example illustrates the pressures facing CRE CLO borrowers. The $58.6 million Norterra Canyon Apartments loan, backed by a 426-unit multifamily property in Las Vegas, highlights maturity-related challenges. The loan was added to the servicer’s watchlist in November 2024 due to pending loan maturity. Set to mature in May 2025, the loan transitioned to non- performing mature status in May 2025.

Mike Haas is the founder and CEO of CRED iQ

2025 EVENTS

t’s a big roster, but each of these young pros have come to play.

For instance, consider L&L’s Giannina Brancato, who, at 29, has been doing leasing for 425 Park Avenue, one of the hottest (and most highly priced) office properties in all of Manhattan.

Then there’s Marc D. Smouha, who founded his own firm earlier this year and has already personally completed $165 million in industrial transaction volume. (Did we mention that Smouha is all of 22 years old?)

Tom Bentsen is hardly long in the tooth at 29, yet he’s currently directing the engineering work on one of the most anticipated adaptive reuse projects in New York City: SL Green’s One Madison Avenue.

Then there’s Erkan Kilic, 30, a principal at Blackstone, whose signature can be found on the, well, Signature deal that dominated headlines in December 2023 — the $17 billion loan portfolio that Blackstone, CPPIB, Rialto and the FDIC picked up from the failed bank of the same name.

Oh, and don’t forget Amir Abdu, 34, who is leading BGO’s Core Plus Fund, which in addition to being BGO’s top-performing multifamily asset class also saw a 50 percent uptick in its rental income in three short years.

One can feel the excitement of a scout on a trip to a Davidson College basketball game, and encountering Stephen Curry effortlessly hitting three-pointers from well beyond the arc.

Commercial Observer looks for Young Professionals who are smart, patient, quick to learn — and who want the ball right now, and know what to do with it. While we received a record number of submissions this year (hurrah!) we were disappointed when we received only four submissions for women (out of 80) in the finance category. We hope to see far more in 2026.

But that doesn’t change the fact that our class of 2025 — made up of people who were dropped into real estate’s existential crisis of COVID when some of them were still in school — had little choice but to play hard, right from the start.

Sit back. Enjoy. Because these brokers, architects, lenders, designers and engineers have got game. —M.G.

By Tom Acitelli, Isabelle Durso, Max Gross, Larry Getlen, Mark Hallum, Aaron Short, Patrick Sisson, Nicholas Trombola and Celia Young | Photograph by Chris Sorensen

Ryan Candel.

Keaton Baum, 29

Associate in acquisition and asset management at Time Equities

Growing up in Pittsburgh, Keaton Baum saw firsthand the way real estate can combine theoretical and practical business realities. While interning with a friend’s father at a development firm, he observed the way business plans became tangible when he toured tenant spaces, got out in the field, and saw how market predictions met market realities.

Years later, after graduating from New York University and working at Time Equities, he’s replicating that experience as part of a team that buys and manages assets across the globe. His team sources and underwrites new acquisition opportunities, crafts detailed business plans, and conducts market- and property-level due diligence — and then oversees management and operations. Since joining Time Equities seven years ago, he’s been involved in $1 billion in acquisitions.

From his first big deal in 2022, repositioning a nearly 270,000-square-foot office building in Phoenix next to the Paradise Valley Mall after buying it for $43 million, to recent work on a $40 million multifamily deal in Ohio, Baum has become familiar with redeveloping and reimagining office space, cementing partnerships across the firm’s wide portfolio. A deal for a 40,000-squarefoot apartment in Seattle’s North Lake Union area, for instance, positioned the firm to benefit from the city’s continued tech industry expansion.

He’s currently working on overseas projects in Scotland, after closing a series of deals for Time Equities in the Netherlands as part of a 35-plus property portfolio worth 100 million euros.

“I’ve gotten that analytical knowledge over the last six years working here, and the ability to fly across the country — or fly to Europe — and sit and have meetings with people who have been in the business for 30 years and feel super comfortable,” Baum said, “I think that’s a strength that I have.” —P.S.

Benjamin Bouganim, 27

Senior associate at Cushman & Wakefield

Growing up in Sunny Island Beach, Fla., just north of Miami, Benjamin Bouganim found himself drawn to real estate, interning and working for both residential and commercial shops during his time at the University of Florida. But the pull of Manhattan was undeniable. When rumors of a gig in New York reached him in 2019, he coldcalled brokers at Cushman & Wakefield, sold himself, and has been working up North ever since.

Focused on office leasing, Bouganim was drawn to the analytical side of the work. There’s emotion in commercial leasing, like in any area of real estate — but, for him, it comes down to advising clients and thinking five or six steps ahead to fashion a long-term strategy.

He’s recently signed a number of deals in the Financial District and for law firms and coworking companies. That includes working with colleagues to close a number of deals for flex provider Industrious, landing them new boutique space post-CBRE acquisition, including 20,000 square feet at 560 Lexington Avenue in March, 27,630 square feet at 860 Broadway in April, and a 24,000-square-foot deal at Trinity Church in May,

Bouganim has taken to negotiating like some of the lawyers he’s found offices for. He said during one negotiation for the firm Cole Schotz, which led to a 32,128-squarefoot lease at 1325 Sixth Avenue, he played hardball to

convince the landlord to come to the table and make a deal — one that eventually included concessions and tenant improvement packages.

While Bouganim has started to advance in his career, he remembers starting out in June of 2020, when he was traversing the eerie, empty, pandemic-cleared streets. He feels like he’s still in the trenches today.

“Even as I progress, I relate to the guys starting out who are bright-eyed and bushy-tailed, and eager and excited,” he said. “And I think that’s a beautiful thing.” —P.S.

Giannina Brancato, 29

Assistant vice president of leasing at L&L Holding

Growing up as an architect’s daughter, Giannina Brancato was fascinated with real estate from a young age. Brancato attended the University of Maryland for a business degree, but ultimately returned to her home turf in New York City to chase her real estate dreams. She landed a rotational internship with SL Green Realty in 2016.

After doing a surprise “Shark Tank”-style pitch at the

Benjamin Bouganim.

Keaton Baum.

end of the internship and being the only intern chosen for a full-time job, Brancato started at SL Green in 2018, working on the operations side for office buildings that included 11 Madison Avenue and One Vanderbilt.

“The experience gave me a deep understanding of how buildings actually function, not just from the top floor, but from the boiler room up,” Brancato said. “I saw firsthand what it takes to deliver a best-in-class experience to tenants, which gave me a unique lens on what drives retention value and long-term performance.”

In 2021, Brancato started at L&L Holding as an assistant property manager and began her current position of assistant vice president of leasing in March 2024. In this role, she handles lease negotiations and develops marketing strategies for L&L’s 5 million-square-foot New York City portfolio.

At L&L’s 425 Park Avenue, Brancato helped complete the leasing, and leased the remaining retail portion to Ferrari, which took 7,629 square feet in April. But her biggest deal to date was at L&L’s 114 Fifth Avenue, where Brancato and her team negotiated a lease with Capital One in February to expand its footprint at the building by 96,606 square feet.

As for her most complex deal so far, Brancato helped to secure a multiparty lease restructuring at 195 Broadway, transitioning out a legacy tenant while simultaneously securing a 41,854-square-foot deal with new tenant Orchestra.

And after finishing a master’s degree in real estate development at New York University this year, Brancato is ready for plenty more complex deals.

“I want to continue to do deals with new developments and stay curious, stay driven, and help shape a more resilient, beautiful New York,” Brancato said. —I.D.

Sofia Bruno, 26

Vice president at JLL

Some people might say that beginning one’s career in the midst of a society-altering pandemic is unfortunate

timing. But Sofia Bruno found opportunity. Bruno joined JLL’s New York leasing division after graduating from the University of Georgia in 2021. COVID had injected so much disruption into the commercial real estate industry by that point — the meteoric rise of remote work, for starters — the viability of a career in the space wasn’t necessarily a given.

“When I was first looking into getting into it, I had a lot of people say, ‘You’re kind of nuts,’ ” Bruno said. “Like, ‘Are you sure that that’s really what you want to do?’ ”

Yet Bruno quickly realized, with the help of her mentors, that she was entering an industry that was reorienting itself in the wake of massive societal change. An exciting dynamic formed between her and those mentors, Bruno said, because they would sometimes need to find fresh solutions to certain challenges together in real time.

“Most of it was a typical mentorship relationship, but there was maybe 10 to 15 percent of the time where it was like, ‘All right, we’re in COVID — what are our clients interested in hearing? What can we tell them? How do we find solutions?’ ” she said.

“So that allowed me to be a part of that thought process. … You’re picking up on all of their habits and what they’re teaching you. But, at the same time, really kind of allowing you to think for yourself in a scheme where they’re not so comfortable either.”

Highlights from Bruno’s career thus far — which have helped earn her recognition as a JLL Brokerage Top Achiever in 2022 and 2023, and as a Gold Achiever in 2024 — demonstrate that dynamism.

In early 2024, Bruno’s team represented State Street Bank’s relocation to 30,000 square feet at BXP’s Citigroup Center tower in Midtown, in a move that coincided with the bank’s brand relaunch and to “meet the post-pandemic needs of its workforce,” per JLL. A few months later, Bruno’s team reconfigured a roughly 42,400-square-foot lease for Faegre Drinker Biddle & Reath at Silverstein’s 1177 Avenue of the Americas, to provide the law firm a more collaborative space. —N.T.

Nora Caliban, 27 Commercial leasing associate at Durst Organization

Nora Caliban is right at home with the Durst Organization, where she handles leasing for the firm’s office and retail portfolio on Manhattan’s West Side.

The native New Yorker began her career at Durst as an intern, leasing apartments and then going to work for Tishman Speyer for three years before Durst called her back to help lease up its Class A office buildings on Sixth Avenue such as 1155 Avenue of the Americas.

But getting into real estate when she did was hardly an easy path — though it tempered her in a unique way.

“Leasing apartments was scary at the peak of the pandemic. And then coming to Durst and seeing real estate shift in all these different directions, it’s been really interesting,” Caliban said. “I feel lucky to be able to experience all these different sides of it at a young age.”

One of the deals that stands out over the last two and a half years at Durst was insurance firm Everest taking 66,444 square feet across the seventh through ninth floors of 1155 Avenue of the Americas in April 2024.

“Being the youngest person on the team and being trusted with the leasing efforts at 1155 was really exciting,” Caliban said. “That deal started the momentum for us, and now 1155 is almost 94 percent leased.”

Another memorable deal for Caliban involved the company responsible for the concept of sushi restaurant Momoya, which signed a 5,000-square-foot lease at the ground level of One Bryant Park in February for an as-yet unnamed venture.

“I remember when the Momoya team came through to look at [the space],” Caliban said. “We were like, ‘This is totally the right fit, these are the right operators, they have vision.’ ”

Caliban isn’t the first in her family to work at Durst, nor is she the first on Commercial Observer’s Young Professionals list: Her older brother Bailey, who made the list in 2023, handles leasing for the company’s portfolio on the East Side. —M.H.

Sofia Bruno.

Nora Caliban.

Giannina Brancato.

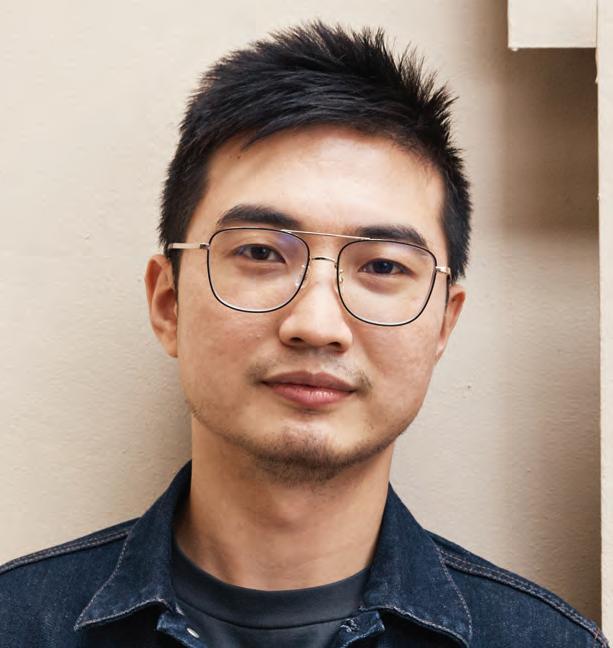

Ryan Candel, 26

Senior vice president at BKREA

Ask Ryan Candel about an aspect of the New York commercial real estate market, and get ready for some numbers.

Candel has a senior role in land development deals at BKREA, the firm that veteran investment sales broker Bob Knakal started in early 2024. Knakal and company are known within the industry for decades’ worth of deep stats on the New York market.

“It’s data that I’m able to share with my sellers — because that’s, at the end of the day, who I want to speak with on a daily basis — but also speaking to developers and getting them comfortable with certain sites based on data,” Candel said. “It just helps us to our advantage.”

A multisport athlete in high school who played lacrosse for a time in college, Candel originally envisioned himself as a sports agent in the mold of the fictional Ari Gold. The Upper East Side native who grew up in Nassau County found himself making deep inroads into commercial real estate after graduating the University of Wisconsin at Madison (and after a brief detour working in e-commerce). Part of that was having family in the business, and the other part was from conscious networking, including via a sports training business he started in the Hamptons during the COVID lockdowns.

Through that networking, Candel landed an informational meet-and-greet with Knakal and then-business partner Jonathan Hageman while they were at JLL. That led to a job there. Candel then followed Knakal to BKREA in spring 2024, after what he described as an impactful experience at the brokerage. That included helping broker the $87.4 million sale of 540 West 21st Street in April 2024 for a high-end condo.

“I decided it was an opportunity I couldn’t pass up on, and it really has been an awesome experience thus far,” Candel said of the move.

In addition to parsing which land development deals work for BKREA at large, Candel works on his own trades. The most prominent recent one involves an assemblage in Manhattan’s coveted NoMad enclave that provides 157,000 buildable square feet to a buyer. It’s coming to market this summer. —T.A.

William Demuth, 25

Assistant director in integrated consulting strategies at Savills

William Demuth was the sole analyst on one of the largest office lease transactions in New York City in 2024, the relocation of American Eagle Outfitters’ 338,085-squarefoot headquarters.

“We advised American Eagle on consolidating all of their different brands in New York and putting them under one roof,” said Demuth, a graduate of Franklin & Marshall College who is currently the youngest member of Savills’ Integrated Consulting Strategies Group.

“All these different brands were spread across multiple buildings, and they had been in their previous headquarters for over 20 years,” he said. “We led them through a strategic relocation process to 63 Madison Avenue. It was the biggest office deal in New York year-to-date at the time.”

Demuth studied business in college but also honed an appreciation for fine art, ultimately marrying the two through the pursuit of architecture. He quickly came to embrace the more financial and analytical aspects of his studies, leading to a shift toward brokerage consulting.

Two key internships helped him along that path. Demuth worked on office leasing at Cushman &

Wakefield in 2020, and then spent time as a summer analyst at Beatty Development Group in Baltimore in 2021. At Beatty, he played a key role in supporting the underwriting for a 27-acre, mixed-use development in Baltimore’s Harbor Point neighborhood, and created a comprehensive pro forma for a proposed multifamily development which he then, as an intern, pitched to potential investors.

When asked about his ambition for the future with Savills, Demuth said he anticipates working on more impactful projects, particularly in New York.

“I’d like to continue working in our integrated consulting strategies practice, hopefully as a partner,” said Demuth, “and continue to help this city thrive and maintain its identity as the greatest city on earth — not only for professionals, but for people to work, play and live in.”

L.G.

Edward DeSimone, 28

Vice president and associate director at Matthews Real Estate Investment Services

Edward DeSimone scored the perfect Wall Street finance job after graduating from the University of Colorado at Boulder in 2019, but he soon switched gears to real estate to chase a more personal connection to his work.

Now, he’s working to expand Matthews Real Estate Investment Services’ presence in the Northeast.

The New Jersey native started working at the Nashvillebased investment firm’s Los Angeles office in 2019, but when Matthews opened its first New York office at 575 Fifth Avenue in May 2023, he returned to his old home. And, while DeSimone specializes in retail investment advisory nationally in his current role at Matthews, he’s focused specifically on expanding retail in the Northeast — and he’s doing it one deal at a time.

“I primarily focus on single-tenant lease sales around the U.S., but I’m back out here trying to focus more on Northeast retail as a whole, including shopping centers and multi-tenant strips,” DeSimone said. “I’m not someone that hits home runs or even triples. I hit a lot of singles and doubles. I do a lot of deals a year.”

Over the course of his career, DeSimone has closed on more than 145 individual properties. The list includes the nearly $5 million sale of an Applebee’s restaurant in Orlando, Fla.; the sale of seven vacant dollar stores across the U.S.; and the $37.1 million portfolio sale of 14 Jiffy Lube properties spread across the nation.

Moving forward, DeSimone emphasizes his focus on the Northeast as Matthews expands into markets such as New York City, Boston and Philadelphia, while still keeping its Southern and Western roots.

“I think there’s a massive opportunity for us to gain more market share in the Northeast market, across all retail products,” DeSimone said. “So, within the next five years, I’m hoping to really ramp that up and become a much more dominant player up here.” —I.D.

William Demuth.

Edward DeSimone.

Ryan Candel.

Ana Erickson, 24 Associate at Savills

Unlike many of her peers, Ana Erickson has no family background in real estate. Her path into the industry evolved not from familial ties, but from a love of eyelash extensions.

“I’ve always loved lash extensions, so I started my own lash extension business,” said Erickson, who graduated from Barnard College with a bachelor’s degree in political science. “I loved taking that love and sharing it with the world, and building relationships with my clients.”

Erickson decided to blend her interest in developing deeper client relationships with her interest in New York City. She joined Savills in September 2022, after being chosen for the firm’s Junior Broker Development Program.

Erickson works on the brokerage team of Savills TriState Brokerage CEO Mitti Liebersohn, which has been an all- encompassing learning experience.

“A lot of my position is working on transactions for our various office clients,” said Erickson. “My position is unique in that Mitti is also in leadership, so I get a taste for his different responsibilities when it comes to supporting Savills Tri-State and creating a lot of great culture here in New York.”

Erickson worked on the March 2025 lease renewal for Santander Bank’s 192,000-square-foot U.S. headquarters at 437 Madison Avenue, and also on the April 2024 American Eagle Outfitters’ relocation to 338,085 square feet of space at 63 Madison Avenue.

This is the kind of work she hopes to continue on a deeper level moving forward.

“I will always think of the American Eagle transaction as the deal that launched my career, because it was the first deal I really saw from ‘I’m pitching this client’ to ‘The deal has closed,’ ” said Erickson. “It was a very complicated deal during COVID, and dealt with different kinds of financing. But what made it special was seeing over the two-year period it took to do the deal how close you got with those clients. Those are people I still interact with.” — L.G.

Matthew Fogel, 28 Director at KSR

Despite the shadow of the pandemic, Matthew Fogel hit the gas on his career during his senior year at the University of South Carolina and earned his real estate license so he could jump into the market right away.

Taking that early interest in the then up-and-coming KSR would serve him well. It put him in touch with brands making a big splash in the New York City retail market, such as Unapologetic Foods, Crumbl Cookies and Pura Vida.

“It’s been a tremendous six years now for me,” Fogel said. “I went to KSR right after college, and I’ve had the opportunity to grow with the company alongside it. I started six months before the pandemic, and I navigated my way through it, and I saw the retail landscape change. A lot of headlines had gloom written all over them, but things are just changing, and that’s the way business works. Everyone has to adapt.”

Fogel helped Unapologetic Foods, the famed Indian food brand, secure a 3,600-square-foot lease at 107 First Avenue in July 2024, where it would channel the success of its other New York City restaurants such as Dhamaka and the Michelin-starred Semma (which was named the No. 1 restaurant in Gotham recently by The New York Times).

Another brand Fogel helped in its expansion on a nonexclusive basis is Playa Bowls, which greatly expanded its store count as retail made a comeback from the pandemic.

Originally pursuing a psychology degree to enter the same field as his father, Fogel instead chose real estate after deciding that there’s more than one way to help people — namely through philanthropy and sharing business knowledge with the less fortunate. “I figured I could do a lot greater things in the world from a charitable philanthropy aspect,” Fogel said.

Most recently, Fogel worked with a charter school program in the Bronx giving students the opportunity to learn how the commercial real estate industry works and what kind of options they have for career opportunities. —M.H.

Sam Hoffman, 28 Director at Cushman & Wakefield

The pandemic taught important lessons to many up-and-coming brokers. In the case of Sam Hoffman, who became a director at Cushman & Wakefield last year, he used the downtime to methodically study New York’s commercial real estate market: who owns what, the advantages of niche submarkets, and how large firms built their portfolios.

Hoffman has always been attracted to the personalities and business plans — he was intrigued seeing nascent tech startups pitch their plans during his C&W internships in 2019 and 2018 while attending Trinity College — and he feels it’s translated to having a better handle on business development and valuing assets as he’s become more experienced with office leasing.

“New York specifically has such a deep talent pool,” said Hoffman. “From a relationship standpoint, I’ve seen certain senior brokers stand out, and have really tried to emulate their approach to winning business, and that’s what really gets me going.”

After hitting the ground running after graduating in 2019, Hoffman has risen through the ranks to become an office leader and an international broker, with about 15 percent of his work taking place in European markets.

Currently, his role is strictly business development and client retention, so in the last 18 months he’s been more involved with getting deals over the finish line. These included a deal last year at 1410 Broadway for tech firm Grata’s new office, or the renewal of the Writers Guild of America East headquarters lease at 250 Hudson Street.

At the end of last year, Hoffman helped close a deal for 40,000 square feet across two buildings in London’s prestigious St. James Square for global hedge fund Point72.

“Because of the demand, there just wasn’t much wiggle room on the lease, and it was tough to keep competitors away,” he said, “because it was such a highly sought-after tenant.” —P.S.

Ana Erickson.

Matthew Fogel.

Sam Hoffman.

Courtney Hughson, 28 Vice president at CBRE

Courtney Hughson caught the real estate bug after attending college in the South.

She grew up in Westchester County with her father and older sister, who both worked in real estate finance. Hughson chose Vanderbilt University because she was drawn to Nashville’s food and country music scenes and its balmy weather, but her family led her to major in economics.

“I knew I wanted to go down the finance path,” she said. “My dad has been in real estate for my whole life, and I was exposed to real estate at a young age.”

Hughson got an internship in college at Wells Fargo’s large loans group, where she learned about real estate lending, market research, and how deals were structured. Her first job after graduating in 2019 was with CBRE’s consulting group on the tenant rep side, where she modeled and analyzed different transaction structures to help her clients. Six months later, she was working from home after New York City shut down.

“It was definitely a transition, especially being new to the job and having to learn everything remotely,” she said. “There was a big lull in activity, so we were doing what we could to stay relevant with our clients by providing market updates.”

Hughson has since worked with auction house Christie’s, which contemplated relocating its New York office but chose to renew its 373,000-square-foot lease at 20 Rockefeller Center for 20 years. “They wanted to relocate to make a splash, but upon further due diligence and diving deeper we decided a renewal would be the best way forward,” she said. “Given how their operations worked, we weren’t able to find a solution that made financial sense for them.”

Hughson now lives in Williamsburg, where she enjoys hot yoga classes, baking and doing puzzles, which she picked up during the pandemic. Her current neighborhood has some of the best views of the city’s skyline.

“I live not too far from Domino Park and I walk there often,” she said. “The amount of people out here on any given day is surprising. It’s a whole new neighborhood.” —A. Short

Eddie Keda, 25

Managing director at Tri State Commercial Real Estate

Growing up around his father’s shoe stores in Brooklyn, Eddie Keda was exposed to an unrelenting work ethic at a young age — never mind in a business that hinged on moving merchandise.

“There was no such thing as days off,” Keda said. “I was brought up with the mindset of ‘Do it all yourself, get out in the field, don’t slack.’ ”

When Avi Akiva, a partner at Tri State Commercial Real Estate, approached an 18-year-old Keda with an offer to mentor him through the process of entering the world of CRE, the younger man was hesitant.

But that was in 2018, and he’s still in commercial leasing in Brooklyn.

Some of the more notable deals Keda has worked on include K9 Resorts Luxury Pet Hotel, which took a 16,187-square-foot lease at Eliezer Breco’s 295 Front Street in May 2024, as well as a 26,000-square-foot deal with Ember Charter School and a 12,000-square-foot deal with Tarlow Events in the same building.

Ember Charter School was facing a deadline, “so from the time that they saw the space they had around four weeks to sign a lease before the next school,” Keda said. “Anybody in commercial real estate will tell you it’s impossible. You can’t get approvals for a charter school on the upper floor in a four-week span. … Just to get the deal done, we had to get super creative.”

In reality, that deal should have taken about six to eight months to gel, according to Keda.

Keda also worked on a deal on the landlord side that involved famed chef Enrique Olvera when he was establishing a new location for Tacos Atla in Williamsburg, Brooklyn, one of the city’s trendiest neighborhoods. Olvera signed for 2,800 square feet at 142 North Fifth Street in June 2023. —M.H.

Leo Koné, 28

Associate director at Newmark

Leo Koné has always been head and shoulders above the competition. The Washington Heights native loved baseball but utterly dominated opponents’ offensive lines while at Dalton, becoming one of the rare prep school athletes to play for a Division 1 football team.

“If you look up my highlights, I’m 6-foot-4 and 300 pounds playing against the Upper East Side guys who I work with now at Newmark,” he said. “They’re my best friends now.”

At Wake Forest, the defensive tackle played with future Atlanta Falcons safety Jessie Bates III and roomed with future Jacksonville Jaguars backup quarterback John Wolford. Alas, the NFL wasn’t in the cards. A football injury in college prompted Koné to consider alternatives for his future, and he zeroed in on real estate.

“All of the parents at Dalton were in real estate, and I always loved architecture,” he said.

Koné got an internship at RAL Development while in school and joined Lee & Associates after college. He moved back home when the pandemic happened and was contemplating grad school until a family friend suggested he meet Newmark executive David Falk for a change of scenery. Now Koné works with 10 people, and appreciates the camaraderie of being on a big team again.

“COVID happened and that was a big knockdown, but you have to brush yourself off, line up again, and try to go sack the quarterback,” he said. “The lows are low, the highs are high, but you have to stay even-keeled.”

Over the past year, Koné’s team worked with the Olnick Organization to lease 120,000 square feet at 130 Fifth Avenue in the Flatiron District. This spring, Koné also repped Radar Labs, which moved into 20,000 square feet at 111 Fifth Avenue, the biggest tenant rep deal of his career.

Koné doesn’t tackle anyone anymore. Instead, he attends as many Yankees games as he can and plays softball on a team that just won its league championship. “It was a 10-0 blowout, and I actually pulled my hamstring,” he said. “I hit a home run and pulled it running around the bases.” —A. Short

Courtney Hughson.

Leo Koné

Eddie Keda.

Nick Martin, 26

Director of real estate at Friend of Chef

An upbringing in the restaurant industry preheated Nick Martin for his current role as the real estate director for Friend of Chef, an outfit that offers brokerage services as part of its larger restaurant advisory practice.

The Rhode Island-born Martin was brought up by chefs and eventually ended up studying business at the University of Colorado at Boulder before heading to New York City, where he initially worked for the New

York Yankees before going into residential brokerage at Platinum Properties.

“I think what I’ve found over the last two years of working at Friend of Chef is that I love the people I work with,” Martin said. “Not only my co-workers but all the chefs, hospitality group owners, restaurateurs — the people I’ve been around my entire life. It’s just a very easy connection for me to be on the same level as these people. I’ve done almost anything you can at a restaurant, so I think that sets me up for what we do at Friend of Chef.”

One deal Martin has worked on that forced some creativity was arranging a deal for Las Vegas staple the Golden Steer Steakhouse, which was looking to expand away from its well-known spot on Sahara Avenue just north of the Strip.

The proprietors for the eatery wanted to establish its second location in New York City, eventually settling on 6,000 square feet at 1 Fifth Avenue, also known as One Fifth.