5 minute read

9. Price and cost dynamics in the Metals and Engineering Sector

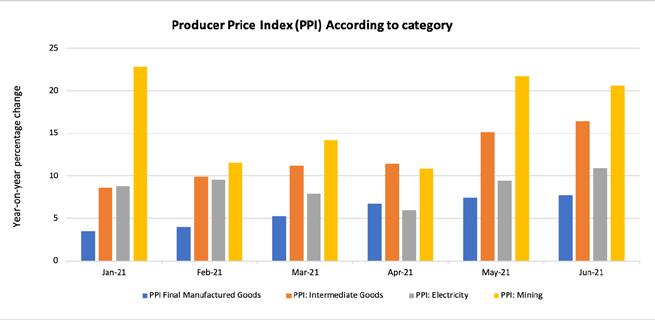

Prices are a key component of the decision-making process in business to guide how revenue will be generated, either taking the approach of increasing price or volume. Within the manufacturing sector, historical patterns show that since January 2013 to June 2021, average prices increase of final manufactured goods was 5.2% while that of intermediate manufactured goods was 5% year on year, as depicted in figure 67.

Figure 67: PPI for Final and Intermediate manufactured goods

Advertisement

Source: Quantec

In the year 2020, PPI data suggests that electricity prices increased at a much faster pace than those of prices for intermediate manufactured goods. However, prices of mining products increased more than those of both electricity and intermediate manufactured goods during the period of January 2020 to December 2020. This reflects the prevailing difficulty in the operating environment, characterised by rising intermediate inputs costs from the mining sector.

Since 2016, there is a prevailing discouraging trend of generally decreasing price patterns in both the intermediate and final manufactured goods PPI. It is important to keep electricity price increases under control in order to ensure businesses’ sustainability since their negative effect on turnover can lead to the shutting down of businesses and more job losses in the short to medium term. The massive surge in prices of mining input products to 32.5% in 2020, which is above price increases of intermediate manufactured goods, is of great concern when it comes to the survival of the M&E sector. The high electricity prices have compounded the existing gap between the selling prices for M&E intermediate goods and production.

In the first six months of 2021 to June, PPI showed a rise from 7.4% in May 2021 to 7.7% in the month of June 2021 for final manufactured goods, with metals products, food products and computing equipment being among the largest contributors to the increase. This rise in PPI is concerning for the overall domestic inflation outlook; as producers pass on costs increases to consumers in a retail market.

Prices for intermediate manufactured goods increased to a highest level of 16.4% in the year in June 2021. This is the category within which most products within the M&E sector fall in. In a depressed market, this may have negative implications in terms of affordability from the customer base, thus affecting sales volumes.

The mining sector remains the key raw material supplier to the M&E sector and mining PPI data highlights some the input cost pressures faced by the M&E sector. Mining PPI increases remain above the 20% level from the May 2021 movement, averaging 17% in the first six months of 2021 to June.

Currently, the global economy is also taking a similar trend, with global producer price inflation picking up to levels averaging above 5%, for the Euro area, China and the US, amid resurgent global demand and supply constraints.

Source: Quantec

9.1 Producer Price Index growth rates trend by sub-sector

Figure 69 presents a similar picture of products prices within the M&E sector. Year-on-year monthly prices for rubber, plastic and other fabricated metal products between January 2013 and June 2021 were 6.8%, 4.3% and 6.3% respectively. This put pressure on revenue for the sub-sectors under increasing input costs, such as mining products and electricity prices. In the last six-months to June 2021, PPI for rubber, plastic and other fabricated metal products increased by an average of 9.5%, 16.5% and 21% respectively, showing some green-shots in prices.

Figure 69: Monthly PPI for Rubber, Plastic and Other Fabricated metal products

Source: Quantec

Figure 70 presents a similar picture of products prices within the M&E sector. Year-on-year monthly price increases for basic iron and steel, non-ferrous metal and structural metal products between January 2013 and June 2021 were 6.5%, 6.7% and 4.6% respectively. This put pressure on revenue for the subsectors under increasing input costs, such as mining products and electricity prices. In the last six-months to June 2021, PPI for basic iron and steel, non-ferrous metal and structural metal products increased by an average of 29.5%, 11.3% and 11.8% respectively, once again improvements coming in prices for 2021.

Figure 70: Monthly PPI for Basic Iron and Steel, Non-ferrous metal and Structural metal products

Source: Quantec

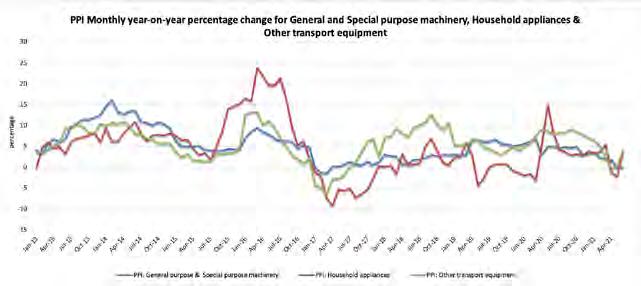

Year-on-year monthly price increases for general and special purpose machinery, household appliances and other transport equipment products between January 2013 and June 2021 were 5.3%, 4.5% and 5.8% respectively, as depicted in figure 71. This put pressure on revenue for the sub-sectors under increasing input costs, such as mining products and electricity prices. In the last six-months to June 2021, PPI for general and special purpose machinery, household appliances and other transport equipment products increased by an average of 1.6%, 2.1% and 3.1%, thus demonstrating the pressures in these three sub-sectors for producers on the revenue side.

Figure 71: Monthly PPI for General & Special purpose machinery, Household appliances & Other transport equipment

Source: Quantec

Note: PPI Data for Motor vehicle parts and accessories, Electrical machinery and Bodies for motor vehicles, trailers and semi-trailers is not available

9.2 Conclusion

Since 2016, there is a prevailing discouraging trend of generally decreasing price patterns of intermediate manufactured goods PPI. High electricity prices have compounded the existing gap between the selling prices for M&E intermediate goods and production. The massive surge in prices of mining input products to 32.5% in 2020, which is above intermediate manufactured goods’ price increases, is a concern when it comes to the survival of the M&E sector. Across sub-sectors, in the first six months of 2021 to June there was a pick in monthly year-on-year percentage changes in prices for plastic, rubber and other fabricated metal products. There was an increase in prices of structural metal products, non-ferrous and basic iron and steel products, while prices for general and special purpose machinery, household appliances and other transport equipment sub-sectors experienced lowest prices increases in 2021 to June.