7 minute read

2. An overview performance of the South African economy

2. An overview performance of the South

African economy

Advertisement

The global economic recovery has seen a divergence in prospects, with economic growth forecasts for emerging markets and developing economies lowered, while those for advanced economies have been revised up. Nearly 40% of the population in advanced economies has been fully vaccinated, with less than half that number in emerging market economies. South Africa is lagging behind its emerging market peers: by the end of July, the country had fully vaccinated only 4.8% of the population (2.8 million adults). The drive towards more vaccinations is imperative for further opening up of the domestic economy and industrial activity.

2.1 Gross Domestic Product growth rates to first quarter of 2021

Gross Domestic Product (GDP) data released by Stats SA for the second quarter affirmed an uptick in economic growth in the second quarter of 2021. According to Stats SA, real gross domestic product (measured by production) increased by 1.2% in the second quarter of 2021, following an increase of 1.0% in the first quarter of 2021. Second-quarter growth was mainly attributed to six sectors recording positive growth between the first quarter and second quarter of 2021.

Figure 3: Trends in South African GDP growth rate to 2021 Q1

Source: Stats SA

The uptick in GDP is certainly a welcome development, especially given the current economic environment against the backdrop of rising unemployment level, rising input costs, increasing energy costs and the COVID-19 pandemic. Encouragingly, the agriculture sector and mining sector showed the best growth rates at 6.2% and 1.9% respectively.

Gross Fixed Capital Formation (GFCF) data released along-side the GDP figures is also supportive of the positive trend in GDP and production figures, as GFCF increased by a marginal 0.9% in the second quarter of 2021.

Another positive element in the latest Stats SA data released along-side GDP figures is the increase in exports of goods and services of 4.0% in the second quarter of 2021, mainly attributed to increases in mineral products, precious and semi-precious stone and sand vehicles.

June 2021

The PMI has averaged 55.5 index level for the first six months of 2021 to June, thus indicating that the country industrial activity has been in expansionary territory. PMI for South Africa improved from 50.9 index level in January 2021 to reach 57.4 in June 2021, as depicted in figure 4. This demonstrates the greenshoots in the economy from the industrial activity point.

Figure 4: Manufacturing PMI Trends in South Africa to June 2021

Source: BER

2.3 Gross Fixed Capital Formation in South Africa

Gross Fixed Capital Formation (GFCF) includes land improvements (fences, ditches, drains, and so on); plant, machinery, and equipment purchases; and the construction of roads, railways, and the like, including schools, offices, hospitals, private residential buildings.

South Africa needs to increase its share fixed investment to GDP from current levels if the country is to deal with the challenges of poverty and inequality as identified in 1994. In 2020, GFCF share to GDP was 17% and this is below other emerging economies such as China (42.6%).

Gross Fixed Capital Formation recent data released along-side the rebased quarter 2 GDP figures, is also supportive of the positive trends in GDP figures, as GFCF increased by a marginal 0.9%. The main contributors of this increase were machinery and equipment, other assets and transport equipment. In the second quarter of 2021, GFCF share to GDP was 13.5% with total value of 152 billion, a decline of 1.3% from the first quarter of 2021 in real terms. This decline in GFCF was driven by a decrease in residential buildings, non-residential buildings, and construction works, demonstrating the strain being felt by the construction sector. Thus, Infrastructure spending into the economy is key in driving the increase in fixed investment ratio to GDP.

Figure 5: Gross Fixed Capital Formation trends in South Africa

Source: Stats SA

2.4 South Africa’s public infrastructure spending

The Government has continued to offer a stimulus package in the form of infrastructure spend to boost fixed investment into the local economy, across sectors. A total of R959.3 billion was spent on infrastructure-related investment by the Government in the last four fiscal years to 2020/21. In the next three fiscal years, R791.2 billion is allocated for key public infrastructure projects, according to National Treasury Department.

Africa

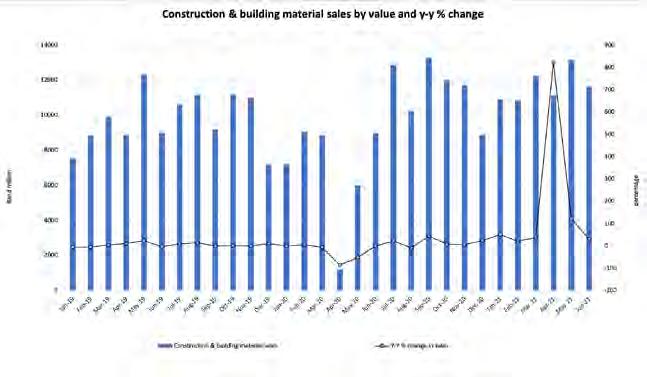

As can be seen in Figure 6, after a dip in construction and building materials products sales in April 2020 to R1.2 billion due to COVID-19 lockdown restrictions, monthly sales started to improve into December 2020, reaching a total of R109 billion in 2020.

From March 2020, sales for construction and building materials products were lower than those recorded in 2019, with the exception of July, September, October, November, December 2020, during which yearon-year growth rates were positive, thus indicating improvements in business activity under eased lockdown levels. StatsSA data shows that the yearon-year growth rate of construction and building materials sales since September 2019 into February 2020 averaged 2.5%. The impact of the COVID-19 lockdown was the massive year-on-year decline in sales of -86.4% and -54.3% in April and May 2020 respectively. Total construction and building sales for 2020 were R110.3 billion, a decline of -3.7 from 2019.

In the first six-months of 2021 to June, total Construction and Building material sales were R69.9 billion, growing by 69.2% when compared to the first six-months of 2020.

Figure 6: Construction and building material sales to June 2021

Source: Stats SA

2.6 Business Confidence in South Africa

The RMB/BER business confidence index in South Africa rose to 50 in the second quarter of 2021 from 35 in the previous period and well above pre-pandemic levels, amid the gradual relaxation of some COVID-19 restrictions. It was the highest reading since the last quarter of 2014, as confidence rebounded especially sharply in the manufacturing, retail trade and motor trade sectors. By contrast, sentiment among building contractors and the wholesale trade sector improved only marginally. Still, it was noted that the economy faced risks from a fast-spreading third wave of coronavirus infections, additional lockdowns and Eskom’s unstable electricity grid.

Figure 7: South African Business Confidence Index to Second quarter of 2021

Source: BER

2.7 South African Monetary policy environment

The Monetary Policy Committee of the South African Reserve Bank (SARB) unanimously decided to leave the repurchase rate on hold at 3.5%, which was in line with market expectations. The headline Consumer Price Index growth rate has been within the Reserve Bank target range of 3% to 6% since as far back as May 2020, with the Repo rate remaining unchanged since August 2020 at 3.5%.

The decision to hold the Repo rate at 3.5% in the latest Monetary Policy Committee of July 2021 was largely on the back of uncertain growth prospects and a relatively contained inflation outlook. While the economic performance surprised on the upside in the first quarter, the recent protests in KwaZulu-Natal and Gauteng are set to weigh on activity in the short term, particularly by hampering investor sentiment and employment. Moreover, the recovery remains uneven across sectors, while the road back to pre-crisis levels is long amid a slow vaccine rollout, renewed restrictions due to a rise in new COVID-19 cases, policy uncertainty and electricity shortages. Turning to inflation, although higher prices for food, electricity and oil could exert upward pressure on prices in the coming months, price pressures are seen remaining contained overall in 2021 and 2022 as the SARB projects easing core inflation, before increasing to around the midpoint of the Bank’s 3.0%–6.0% target range in 2023.

The SARB projects a 25 basis-point hike in fourth quarter of 2021 and each quarter of next year, its stance will remain highly accommodative as it continues to support the economic recovery.

Figure 8: South African Headline CPI and Repo rate to June 2021

Source: SARB