1 minute read

8. Gross fixed capital formation in the Metals and Engineering Sector

The broader definition of Gross Fixed Capital Formation (GFCF) includes spending on land improvements (fences, ditches, drains, and so on); plant, machinery, and equipment purchases; the construction of roads, railways, private residential dwellings, and commercial and industrial buildings. This also applies to the M&E sector with regards to fixed investment made.

The deep-dive in GFCF in the M&E sector is only covered in the full year State of the Metals and Engineering sector report released in February, as quarterly data is not available, hence reference should be made to the report of February 2021 for this section.

Advertisement

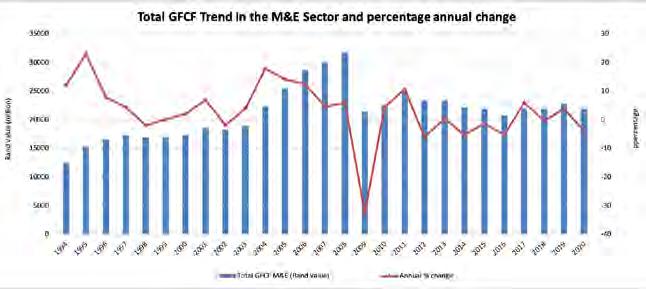

However just for a snap-view reminder, total GFCF by value for the M&E sector increased from 1994 to 2008, from R1.3 billion to R3.2 billion, as the country embarked on a rebuilding of the economy, with massive infrastructure projects, which also supported investment into the sector under overall favourable market conditions. Massive infrastructure projects implemented between 2003 and 2009, which included the 2010 Soccer World Cup, provided a huge boost for the sector. However, as the economy started experiencing a subdued construction activity, there was a dip in GFCF in the M&E sector. Since then, the level of GFCF in the sector has remained lower than during the 2008 peak, reaching R2.2 billion in 2020, as depicted in figure 66.

Between 2008 and 2020, the average annual percentage change in GFCF for the M&E sector was -2.5%, a clear reflection of reduced investment into the sector in the last 12 years. In 2020 alone, investment into the sector declined by 3.8% as COVID-19 lockdown measures were in effect.

Figure 66: Total GFCF of M&E for South Africa and annual percentage change

Source: Quantec

The GFCF across the entire M&E sector followed similar patterns into third quarter of 2020, with all sub-sectors experiencing massive drops in investment levels in 2009. The investment levels achieved in 2008 have not been experienced, demonstrating a lack of attractiveness to invest into the sector due to challenging market conditions.