GRANT PROGRAM SCHEDULE

April 10, 2023 Applications Open

June 10, 2023 Application Deadline

Aug. 10, 2023

Aug-Sept. 2023

Aug-Sept. 2023

March 1, 2024

August 1, 2024

March 1, 2024

Grant Awards Announced

Grant Agreement sent, signed, returned to CPI, project review by NPS

Project Kickoff Meeting with CPI

Grantee First Interim Report Due

Grantee Second Interim Report Due

Grantee Third Interim Report Due

Aug. 1, 2024 Covenant/Easement Drafted & Signed

Aug 1, 2025

July 1, 2025

Grantee Fourth Interim Report Due

Grantee Final Report Due - All expenses & invoices submitted w/ pics

QUICK GRANT FACTS

❑ The minimum grant award amount is $10,000

❑ The maximum grant award amount is $150,000

❑ Approximately $612,000 is expected to be awarded in grant funding in 2023

❑ This is a matching grant, recipients will be required to raise 25% match on the grant award (note the nonprofit & private property owner match is the same).

❑ In-kind match is allowed as long as invoices come from qualified contractors

❑ Recipients of grant funds awarded for the physical preservation of a historic property are required to sign an agreement placing either a five(5) year Preservation Agreement that does not need to be recorded with the deed for awards up to $50,000 or a ten (10) year easement recorded with the deed for grants over $50,000.

❑ All projects funded through this program must meet the SOIS

❑ Grants are only available in Colorado communities defined as rural (population of 50,000 or less)

❑ Eligible properties must be listed or eligible for listing on the National Register or a contributing building within a National Register Historic District. Eligible properties must be listed in the National Register by the end of the grant period in order to be eligible for grant funding.

❑ Private property owners, non-profit organizations, government entities, and educational organizations are eligible to apply

ELIGIBILITY

❑ Eligible entities for the grant program include private property owners, municipal governments, county governments, councils of government (COGs) and nonprofit organizations. We encourage these entities to partner with nonprofit Main Street communities, Downtown Development Authorities, chambers of commerce, and others to promote and possibly administer the program

❑ Eligible properties must be listed on the National Register, eligible for listing or a contributing building within a National Register Historic District. If a property is deemed eligible for listing funding would require a Determination of Eligibility for the SHPO and the property would need to be officially listed on the National Register by the end of the grant period

❑ Eligible communities must be considered rural – defined as a 2020 census population of 50,000 or less

PROJECT SIGN & PUBLIC NOTIFICATION

The Grantee must erect and maintain a project sign at the project site. This sign design will be provided by CPI but manufacturing cost can be included in the grant budget This sign must: be of reasonable and adequate design and construction to withstand weather exposure; be of a size that can be easily read from the public right-of-way; and be maintained in place throughout the project term as stipulated in the grant agreement. The sign will contain the following statement:

“Restoration/Preservation/Rehabilitation of the [name of property] is being supported in part by a grant from the Paul Bruhn Historic Revitalization Grant Program from the Historic Preservation Fund administered by the National Park Service, Department of the Interior.

This project is one of Colorado Preservation Inc’s awarded Rural Revitalization Subgrant Awards”

Images of the posted sign must be submitted for approval to CPI (who will submit it to NPS) in advance of the start of construction

ELIGIBLE PROJECTS

ELIGIBLE PROJECTS

Improvements and/or rehabilitations must comply with all state and local regulations, including obtaining any required building permits and design and/or historic preservation approvals. All project work on historic buildings shall follow the Secretary of the Interior’s Standards for Rehabilitation of Historic Structures and applicable local regulations

Eligible Projects Include

❑ Roof Repair/Replacement

❑ Structural Repairs

❑ Foundation Work

❑ Façade Restoration or Repair

❑ Window Restoration or Repair

❑ Door Restoration or Repair

Examples of Eligible Façade Improvements:

❑ Removal of non-historical false fronts

❑ Repair or replacement of windows, doors, and cornices

❑ Repair or replacement of façade materials

❑ Repair of character defining architectural features

❑ Masonry maintenance including tuck-pointing and gentle cleaning of and paint removal from brick (NOT power-washing of brick)

❑ Exterior painting

GRANT SELECTION PROCESS

CPI anticipates a highly competitive application process in the awarding of the $612,000 to historic preservation projects in rural communities across Colorado. The goal of the grant program is to create a significant impact in Colorado’s rural historic communities Applications will be reviewed by the Grant Review Committee and ranked for funding based on the following criteria.

A. Project Description – 15 Points

The project description should thoroughly describe all work elements of the project CPI will award projects with strong potential to spark economic revitalization, jobs, and preservation “how to” examples. Project descriptions should be a clear description of the project with an end use noted.

B. Location – 10 Points

The goal of this grant program is to support preservation projects in rural communities statewide. Priority will be given to rural communities with limited ongoing preservation projects. Final awards will reflect geographic diversity.

C. Community Impact – 20 Points

The grant will award catalytic projects in rural communities across Colorado. Projects that demonstrate a strong impact to the community will score high. Scoring should consider how the project will enhance the value of the building and increase value to the community. Scoring considers overall public benefit

D. Urgency of Funding – 10 Points

This category considers how urgent the project is and how critical the grant funds are for the project. Urgency should be demonstrated but also demonstrate additional funding identified.

E. Effect on Historic Preservation Ethic – 15 Points

The grant program hopes to affect the historic preservation ethic in rural communities by giving additional incentives for National Register listing. Scoring will consider the community’s existing preservation ethic and the project’s ability to increase awareness of the benefits of historic preservation among other things

F. Ability of Applicant to Complete Project on Schedule – 30 Points

Considers risk assessment of the applicant to complete the project as described and projected This should also look at the administrative capability of the individual managing the grant funds as well as the overall budget to ensure it is accurate. Project demonstrates strong project team with a clear timeline and understanding of the Secretary of the Interior’s Standards.

GRANT SELECTION PROCESS – BONUS POINTS

Property Ownership – 25 BONUS Points

Limited funds are available to support private property owners with historic buildings. Bonus points will be awarded to projects privately owned

BIPOC – 20 BONUS Points

Projects tied to traditionally marginalized and underrepresented individuals/communities will receive bonus points This includes projects that reflect Black, Indigenous, People of Color (BIPOC) resources whether this be through a building’s history, current ownership, current use, or anticipated future use

Preservation Partners & Incentives – 10 BONUS Points

Applications supported by overlap of other statewide partner programs such as the Department of Local Affairs (DOLA)’s Colorado’s Main Street Program (CMS) and Certified Local Government (CLG) communities, as well as communities with CPI’s Endangered Places Program (EPP) listings, will also receive priority.

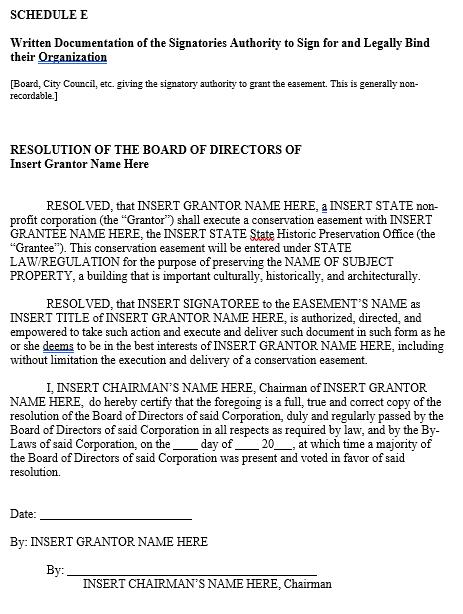

PRESERVATION AGREEMENT & COVENANT/EASEMENT REQUIREMENT

According to the Historic Preservation Fund Easement Requirement (Section 54 USC 302902 (b)(1)(c), use of Federal funds requires a Preservation Agreement or Covenant/Easement.

❑ Grant awards less than $50,000 require a 5-year Preservation Agreement and awards over $50,001 require a 10-year preservation covenant/easement.

❑ If the property is currently protected by a perpetual or other preservation covenant/easement that meets or exceeds the requirements of this grant program as determined by the NPS, no additional duration or restrictions are necessary

❑ If the property is currently subject to a preservation covenant/easement that meets the minimum federal preservation requirements, an extension must be executed for an additional duration to meet the requirements of the new funding award For example, if a property had 10 years remaining on a previous 20-year easement and it received over $50,000 in funding, an amendment to add 10 years would be required.

❑ If a covenant/easement is required, CPI must submit it to the NPS for review within one calendar year after the signed grant agreement . Following the completion of all grant-assisted work, the preservation covenant/easement must document the grant-assisted condition of the site and the character defining features. The covenant/easement must then be executed by registering it with the deed of the property

IN-KIND MATCH

In-Kind Donations are approved for use towards the 25% match requirement on the awarded grant amount, but must meet the following definition:

❑ Contractor time/labor is allowable as well as architect/engineer services, however the architect/contractor./engineer would need to report their in-kind in their invoices and the subgrantee will need to include these invoices in their grant reports when applying for reimbursement.

❑ In-Kind does not include services performed by full-time staff of the grantee, project volunteers, donated materials or equipment.

❑ All In-Kind amounts must be submitted for approval before officially counting towards match.

GRANT AWARD PAYMENT

❑ All grant funds are paid on a reimbursement basis only. Documentation of all expenditures (grant and local matching share) must be submitted to and be audited by CPI.

❑ All expenses must be documented with copies of bills and photocopies of both sides of canceled checks.

❑ All matching funds must also be documented

❑ Reimbursement may be made in installments once 25%, 50%, 75% and 100% of the project is complete 10% of total grant award will be withheld for final payment pending approval of the project products by CPI. Grantees must fill out the budget sheet to track what has been currently invoiced to the grant and submit these at the set intervals to receive payment. This schedule will be outlined in the official grant agreement.

PROJECT SELECTION & COMPLIANCE

All grant applications will be reviewed and voted on by a committee made up of CPI Board and staff, consultants as well as partner organizations such as Colorado’s Main Street Program, History Colorado, the Office of Archaeology and Historic Preservation as well as appropriate preservation nonprofit organization representatives.

All applications will be reviewed for compliance with Federal regulations including:

1. Department of the Interior’s Standard Terms and Conditions

2. Competitive Selection of Contractors

NPS requirements requires that CPI’s subgrantees competitively select their contractors requiring at least three bids to be gathered/solicited for awarded funds. Consultants and contractors must have the requisite experience and training in historic preservation to oversee and complete the project work. Documentation of the competitive selection must be maintained by the subaward grantee and submitted to CPI as part of the required materials.

3. Federal Review: Section 106

Grant applications will be sent to the Commission and NPS for compliance with Section 106 of the National Historic Preservation Act (54 U.S.C.306108) which requires Federal agencies to consider effects to historic properties. Projects that are determined to have an “adverse effect” will not be considered for grant funding The consultation process stipulated in the regulations issued by the Advisory Council for Historic Preservation in 36 CFR 800 must be completed prior to the commencement of all grant-assisted construction or ground disturbance on a property.

4. Federal Review Section 110(f)

Grant applications for projects involving a National Historic Landmark (NHL) will be sent to the Commission and NPS for compliance with Section 110(f) of the National Historic Preservation Act (54 U.S.C.30Pri6107) which requires Federal agencies to protect NHLs from harm. Projects that are determined to have an “adverse effect” will not be considered for grant funding. The consultation process stipulated in the regulations issued by the Advisory Council for Historic Preservation in 36 CFR 800 must be completed prior to the commencement of all grant-assisted construction or ground disturbance on a property.

5. Build America/Buy America

Provisions of the Build America/Buy America 2022 Bipartisan Infrastructure Law enhanced domestic sourcing requirements for materials. This law requires all Federally funded projects to use iron and steel produced in the U.S as well as manufactured goods and construction materials. Since the funds for CPI’s Rural Revitalization subgrant program are Federal funds, this is a requirement of all grant recipients

Waivers may be requested and granted if:

❑ The types of iron, steel, manufactured products or construction materials are not producing in the U S in sufficient and reasonably available quantities or of a satisfactory quality

❑ The use of iron, steel, manufactured projects or construction materials produced in the U.S. will increase cost of overall project by >25%

Colorado’s Historic Preservation Tax Credit Program

What is the "Adjusted basis"? How do I determine that?

Twenty-five percent of the adjusted basis of a building for the State Tax Credit is determined by the following formula:

Purchase price of the buildings - Value of the land x 25%

You may want to consult an accountant or a real estate agent to help you calculate the adjusted basis for your property.

What costs would qualify towards the credit?

The costs which do count towards the credit are known as qualified rehabilitation expenditures. In general, the following items are considered qualified expenditures:

❑ "Hard costs" associated with the physical preservation of the property-demolition, carpentry, plaster and/or sheetrock, painting, ceiling/floor repair, doors and windows, roofing and flashing, cleaning, brick and mortar repair, wiring, light fixtures, stairs, elevators, heating systems, etc.

❑ "Soft costs", such as architect, engineer, and developer fees, would not count towards the State Tax Credit.

❑ Appliances which are permanently installed (a built-in stove, for example) count towards the State Tax Credit.

❑ State Tax Credits for residential properties allow only for repair of kitchens and bathrooms. Replacement items of any type (appliances, fixtures, flooring) do not.

Are there any other requirements I should know about?

The projects are reviewed according to the Secretary of the Interior's Standards for Rehabilitation. These were designed by the National Park Service to help people to renovate their homes and buildings in a historically sensitive manner. You do not need to "restore" your building in order to claim the tax credit, but you must preserve existing historic features whenever possible.

What must I do to claim these credits?

This depends on the type of credit being claimed. Each involves an application, which is reviewed and certified (approved). Contact CPI and/or History Colorado for more information on applying for tax credits.