School district accused of ‘woke ideology’ Unvetted comments in TABOR book

BY MCKENNA HARFORD MHARFORD@COLORADOCOMMUNITYMEDIA.COMDouglas County’s superintendent is rebutting language published in the “TABOR book” that is meant to help voters weigh the pros and cons of tax issues on the ballot in the upcoming election.

“The comments are to be printed as they are, they are not fact-checked and there’s no process (for fact-checking),” Douglas County School District Superintendent Erin Kane said. “I was astounded when I learned that.”

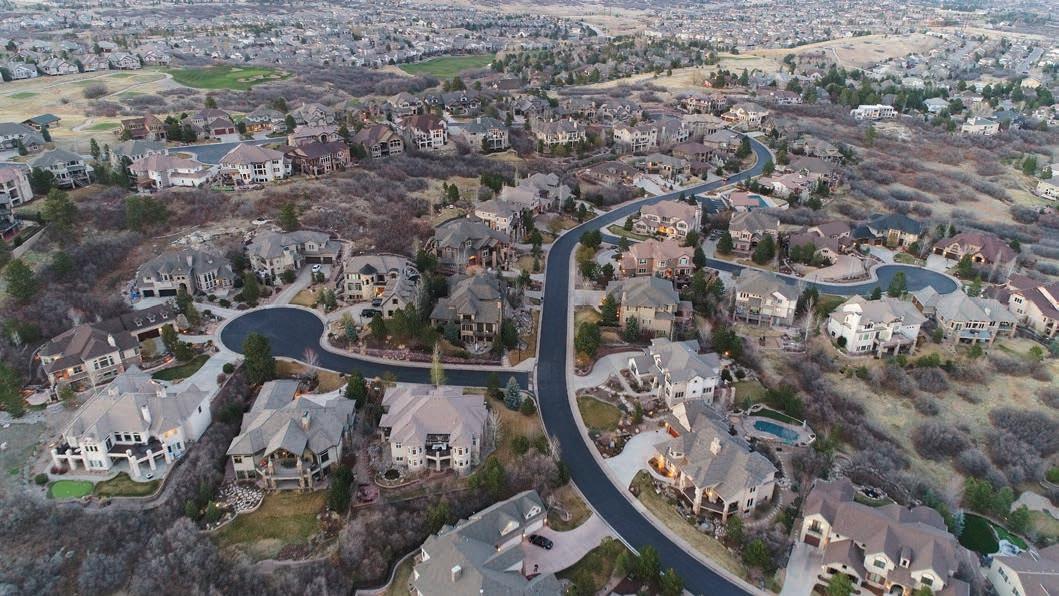

Sewage spills a problem

BY ELLIOTT WENZLER COLORADO COMMUNITY MEDIAThousands of homes dot the hills of Castle Pines, a central Douglas County community about 20 miles from the foothills of the Rocky Mountains. But underneath those houses and their hills, a problem lurks.

As residents flush their toilets, shower and rinse out their sinks, their untreated wastewater enters an aging system that’s struggling to do its job.

For years, the Castle Pines North Metro District has logged thou-

sands of gallons of sewage that has spilled from their system. Now, the state has sent them an official warning to address the problem.

As former city Mayor Tera Radloff, bluntly puts it: “Sh-t rolls downhill.”

And that’s exactly the issue for the system’s lift stations, which have the role of pumping sewage from low elevation to the nearby wastewater treatment plant.

“I think this system hasn’t been maintained for a very long time,” said Radloff, who is also one of the directors for the water district that manages the system. “Why? I’m not sure.”

The district, which serves the west side of the city, is showing

signs of many years of neglect and a significant lack of investment in infrastructure. Last year, the state required the district to issue an advisory telling customers to boil their water before drinking it. But the reason it was able to get to this point appears to be unknown. Nathan Travis, the interim district manager appointed in August, is working to get the district back on track.

“I don’t know why the treatment plant wasn’t maintained to the level it should have been maintained –why the wells weren’t taken care of on a level that they needed to be,” Travis said.

Kane made those remarks on Oct. 11 at the county school board meeting in reference to what’s called the TABOR book, which addresses county and district tax measures before voters. It contains summaries of for-andagainst positions. The guide also includes a warning that the information in it is not verified or checked for accuracy or truth.

Kane took issue with the comments in opposition to a $60 million mill levy override and $450 million bond that the district says it needs to make staff pay more competitive, to build new schools and to maintain buildings.

Opponents of the mill levy override argue that voters should kill it on the basis that the district supports “woke ideology indoctrination.”

Kane and every member of the board dismissed that claim as untrue.

“We certainly do not have an agenda-driven, formalized ‘woke’ or whatever you want to call it — social

Briefly In Douglas County

Submit comments on Transportation Improvement Program

The Denver Regional Council of Governments has received funding applications for the Transportation Improvement Program and is looking for feedback from residents before allocating a limited amount of funds. An item up for consideration is the Crystal Valley interchange project. With local support, the Town could receive up to $8 million in funding from DRCOG to construct the project.

To submit your comments today, go to the DRCOG’s project

page at https://bit.ly/3eDaQwh.

To comment, click on a project on the map or select it from the list on the right-hand side of the screen. You can then view details about all projects and provide a comment. To give your thoughts on the Crystal Valley interchange project, click on the “I-25 & Crystal Valley Pkwy. Interchange” tab.

All comments received will be presented to a project review panel which will recommend a list of projects to be funded to the DRCOG Board of Directors. The opportunity to comment will end on Oct. 26.

PRESENTS

New route opens on US 85 Residents in Northwest Douglas County – your new route to US 85 is open!

The Waterton Road Extension –from Rampart Range Road to US 85 – opened last week right after

the Board of Douglas County Commissioners gathered with members of the Sterling Ranch Community Authority Board and the Sterling Ranch Development Company to cut the ceremonial ribbon.

Sara Evans

MULTI-PLATINUM COUNTRY SINGER SARA EVANS LIVE AT PACE!

NOV 5 | PACE Center

With No. 1 hits such as “A Little Bit Stronger,” “Born to Fly,” “Perfect,” and “Suds in the Bucket,” this Academy of Country Music Award winner has charted over 20 times and become one of the most compelling vocalists of her generation.

Buy tickets at

Help in raising Christmas funds

The Douglas County Sheriff’s Offi ce (in partnership with the Community Safety Volunteer Association of Douglas County) needs help in collecting funds to support the 2022 Christmas for Kids Program. Every year deputies identify kids in need from around the county, and the community comes together to make their Christmas just a little bit brighter. Approximately 200 kids are sponsored

every year to go shopping with an offi cer with a $100 gift card. We’re hoping that the community members and businesses of Douglas County can pull it off again, making this another amazing year for these incredible kiddos. If you’re able to help, please go to https:// csvadc.org/2022-christmasfor-kids/ to spread a little joy this Christmas season. All donations are tax deductible through the CSVADC 501c3.

National Take Back Day

It’s that time of year again to properly dispose of unneeded medications. On Oct. 29, the Douglas County Sheriff’s Office will be participating in the annual program, hosting a Drug Take Back event at the Highlands Ranch substation, located at 9250 Zotos Dr. A second location will be at King Soopers, located at 4000 Red Cedar Dr. It’s that cannot be accepted during the event include needles, mercury thermometers, oxygen containers, radioactive substances, pressurized canisters and illicit drugs.

For more information, visit the website at DEATakeBack.com.

Correction:

The Castle Rock News Press errononeously put the district numbers for two candidates running for Town Council in Castle Rock. Max Brooks and Caryn Ann Harlos are part of the District 5 race against incumbent Caryn Johnson.

Fire safety is year round

It’s an alarming fact, home fires burn hotter and faster than ever. This is due to synthetics and plastics used more frequently in products found in your home. Decades ago, if a house fire started you may have had around 10 minutes to exit your

home safetly. Today, you have around two minutes to escape.

Early warning from working smoke alarms is key to quick notification in the event of a fire.

Here are some tips to help ensure your smoke alarms work in the event of a fire:

1. Check your smoke alarms monthly by pushing the test button.

2. Change your smoke alarm batteries every 6 months. Some may have a 10-year battery inside, which will not need to be replaced.

3. After 10 years, your smoke alarms need to be replaced. Or sooner if the unit(s) malfunction.

If your smoke alarm is chirping, read the back of the smoke alarm for specifics on what that sound may mean.

For more information on smoke alarms, visit www.crgov. com/smokealarms.

Ballots are being sent Douglas County registered voters — be on the watch for your General Election ballot in your mailbox.

Ballots were mailed to all Douglas County registered voters beginning on Monday, Oct. 17. Learn more at https://bit.ly/3ENSyDb.

Slash mulch site closing for the season on Oct. 29

Time is running out to clean up tree limbs, shrubs and brush from your property and reduce your wildfire risk. Dispose of them at the County’s slash-mulch site, 1400 Caprice Drive in Castle Rock. Open Saturdays-only from 8 a.m.-5 p.m. through Oct. 29. For more information, visit douglas.co.us and search for Slash

Online Tax Lien Sale Nov. 3

The annual Tax Lien Sale will be held via internet auction on Nov. 3. For guidelines and to register, visit zeusauction.com The statutory interest for the 2022 Tax Lien Sale is 12%. More information is available at douglas.co.us/treasurer or by calling 303-660-7455

Drive US 85?

Construction to widen the road between Highlands Ranch Parkway and C-470 is underway. Please expect delays and watch for crews. Sign up for updates so you know what to expect. Visit douglas.co.us and search for Subscribe Now and choose US 85 construction.

What’s happening with your County government?

Our commitment to open and transparent government includes online posting of information about public meetings at which the business of government is conducted. To view public meeting agendas, participate in-person or remotely, or watch select meetings via live stream, visit douglas.co.us and search for Business Meetings / Public Hearings.

Are you looking for a mental health check-up for your child?

Check out ImatterColorado.org and take a brief assessment to find out if your child is eligible for free counseling.

For additional resources in and around Douglas County, visit: douglas.co.us and search for mental health resources

If you need immediate support, call Colorado Crisis Services at 1.844.493.TALK(8255) or text TALK to 38255. If you are experiencing a life-threatening emergency, call 911.

Visit douglas.co.us

Laydon comes out as aesthete

Commissioner says he is member of LGBTQ+ community

BY MCKENNA HARFORD MHARFORD@COLORADOCOMMUNITYMEDIA.COM

Douglas County Commissioner Abe Laydon announced he is a member of the LGBTQ+ community and released a statement on Twitter on National Coming Out Day.

Laydon’s statement, which he posted on Oct. 11 on National Coming Out Day, says he identifies as an aesthete, which he defines as appreciating and being drawn to “internal and external beauty in humans irrespective of gender.”

Speaking to Colorado Community Media, Laydon said he considers himself part of the LGBTQ+ community and released his statement after participating in the Colorado Youth Congress and hearing about the importance of representation.

Douglas County School District students visited the State Capitol on Oct. 7 to participate in the program aimed at having community leaders and elected officials hear about issues facing teenagers.

Laydon said a student at the Youth Congress encouraged the audience to be genuine, which stuck with him.

“Because I sit in a semi-public role, I think it’s important for young people and adults to see somebody that’s bold, honest and authentic,” Laydon said.

LET’S BE HONEST ABOUT PRIDE, YOUTH SUICIDE, AND MY JOURNEY

There has been a lot of conversation about Pride Fest in Castle Rock recently and I’m here to say Pride has colors because this issue isn’t black and white. pic.twitter.com/0IooZ0YAId

— Abe Laydon (@AbeLaydon) October 11, 2022

Citing statistics about LGBTQ+ youth suicide,

anxiety and depression, Laydon said he felt it was important to be open with his constituents about who he is. According to the Trevor Project, LGBTQ+ youth are four times as likely as their peers to attempt suicide.

Laydon said he doesn’t like labels, but feels aesthete is the best descriptor for himself.

“I think everybody has a right to view themselves and define themselves as they see fit,” he said. “If you want to give me any label, it’s probably just ‘human’ and I think that’s true for most people.”

He added that this announcement will not change the way he approaches his role as a commissioner and that he wants voters to know who he is, regardless of how they react to him.

Laydon is currently running for re-election to his county commissioner seat against Democrat Kari Solberg.

“I’m still the same person and I represent everybody in Douglas County and I think having a broad perspective and understanding about everyone I represent can only help me in my job,” Laydon said.

Laydon’s statement thanks his wife, children, family, friends and community, as well as Castle Rock Pride, for their support during his journey.

Responding to Laydon’s statement, Garrett Royer, a representative for One Colorado, an LGBTQ advocacy organization, said he was unfamiliar with the term aesthete , but appreciated the representation.

“This is not a term that I’m familiar with in association with the LGBTQ community specifically but I would defer to Commissioner Laydon’s self identification as an aesthete as someone that is appreciative of and drawn to the internal and external beauty of all humans, regardless of gender,” Royer said in a statement. “It’s a new perspective to learn from for me personally and as a member of the team at One Colorado, I hope we see more

House District 45 Candidates

Name: Ruby Martinez

Website: rubymartinez4hd45.com

Biography: Ruby Martinez holds a M.S. (Nursing Administration), a post M.S. certificate (Psychiatric Mental Health Nursing), and Ph.D. in Nursing from the University of Colorado. In her career, Ruby held several nursing positions at the Colorado Mental Health Institute at Fort Logan before taking a faculty position at the University of Colorado. Martinez taught psychiatric nursing, conducted research on run-away teenagers, and received several teaching awards before retiring from CU as Associate Professor Emeriti.

From 2006-2009, Martinez practiced as a manager at Denver Health on both the adolescent and adult psychiatry units. In her career, she served on a national board (Center for Mental Health Services-SAMHSA) and is a founding member of the National Latino Behavioral Health Association. Dr. Martinez is the Board Chair for the Colorado Center for Nursing Excellence and will soon join the Board of Directors at Parker Adventist Hospital.

When it comes to funding school districts and paying teachers in Colorado – How do you think we stack up on a national level? What do you think should be done at the state level to address the problems teachers and schools are facing?

With an understanding that there

can be small fluctuations in these numbers, Colorad ranks 9th in the nation in per capita income, but only 39th in the nation in per pupil revenue/operating expenses. This tells me that as a state, we have the resources to fund our schools and pay teachers but not under our current system. We must recognize that teachers are essential to the schools in Colorado. It takes an intelligent, caring person to write creative lesson plans, to make a lesson interesting, to make homework challenging, all while monitoring classroom behavior, and assessing overall growth

FROM

4

of mental health issues for adults and our youth. We are so woefully understaffed in mental health workers and facilities in this state that we should declare Colorado to be in a mental health emergency. Colorado needs more beds for youth and adults experiencing mental health crisis. Yet, year after year, our state budget disregards this issue. When elected, I will advocate for our state budget to address this cri sis because it affects so many other areas of societal health.

Inflation, gas prices and the economy continue to be an issue in 2022 – Families are paying extra for everything. What can and should be done in Colorado to help families?

Coloradans are feeling the crunch with increased gas prices and inflation at over 8%. Relief could come by passing Prop 121 - a modest reduction in the state income tax putting $400 million back in our pock ets. Energy policies have hurt working Coloradans, as many must decide to fill up their car or pay for groceries. Colorado can and should be part of the solution, and we need to repeal the legislative regulations that crushed our oil and gas indus try. Crime exacerbates afford ability issues as our citizens are seeing their insurance rates increase, and stores raise prices due to retail theft.

If elected, can you work on a bi-partisan level to pass bills and address the needs of the Colorado population as a whole and not just live along party lines? Give examples of where you could compromise.

Last year of the 657 bills in troduced, 507 were ultimately signed into law. Some of the best legislation to come out of the last two sessions were bipartisan efforts. I look forward to working with House Repub licans and Democrats alike to solve the very great challenges facing our state -specifically water issues, crime, affordabil ity, student performance and education funding.

Housing a ordability and homelessness have become a state and nationwide issue. What can be done at the state level to address the growing problem?

We must begin to have serious conversations about housing affordability, crime, workforce creation, and men tal health issues. As a society, we must stop kicking the can down the road on homeless ness. It’s not compassionate to let another human being sleep on the street. Enabling homelessness only serves to dehumanize people and in creases our already escalating crime rate. We need to provide a hand up to those who will take it -provide mental health

and addiction services to those who need them and take into custody those who would prefer chronic homelessness and addiction over being law abiding members of society.

Crime is quickly becoming a major concern in Colorado. With Colorado ranking first in the nation for car thefts, and major crimes on the rise – what do state lawmakers need to do to help fix the problems?

Crime isn’t just a “major concern” in Colorado - it is the #1 concern, and I am in favor of bills that support law enforcement and put teeth back in our judicial system so that crimes are prosecuted. We are in the midst of a crime tsunami because we have reduced or eliminated bonds for violent charges, criminals are not being sent to jail, and illegal drugs are flooding into Colorado. In 2019 the legis lature reduced legal conse quences for an entire class of drugs. We simply must increase penalties for sales and possession of fentanyl and other synthetic drugs.

Public trust in government, elections and public health are at an all-time low – What should state and federal lawmakers be doing di erently to change public perception?

Government has and contin ues to encroach far too much on people’s lives, and citizens don’t feel like their voices are heard. As elected officials, we must be transparent and accessible to our constituents. I would like to work with other elected officials to hold a series of town hall meetings in House District 45 so that constituents can question and hear from those who repre sent them. I will pledge to do everything I can to let my constituents know that I am accessible, know what we are working on, and take valuable feedback on how real Colora dans think we can improve.

Water rights and water avail ability are becoming an issue for counties and local municipalities – what can the state do to create a strategic plan that works for all?

Colorado’s water issues require statewide collabora tion from all levels of govern ment. As a legislator, I would encourage broad stakeholder engagement and expertise to develop a plan that includes conservation, increased stor age, and proper utilization.

The Town of Castle Rock has demonstrated real leadership and made great decisions to limit turf in new construc tion, incentivize homeowners to replace their grass with Coloradoscape, and invest in innovative water treatment and delivery so that we not only conserve but reuse water. The state should also encour age removal of invasive, non-native species along the rivers and water systems like Tamarisk and Russian Olives.

MARTINEZ

FROM PAGE 4

of students. Schools and teachers open the doors of opportunity for our youth, which in turn, opens the possibility of a more prosper ous and civilized nation.

Mental health continues to be a problem in Colorado and nationwide – What should be done at the state level to address the youth mental health crisis and to continue increasing help for adults?

Colorado needs sufficient inpatient hospital beds and step-down beds to meet the needs of our child, adolescent and adult populations. When someone is in crisis, these are the facili ties that have the controlled environment and the qualified staff to keep people safe. Lives are saved when those in crisis get the help they need. There is also a shortage of psychiatrists, psychiatric nurse practitioners, and nurses who choose to work in this demanding field. Efforts to delay retirements of seasoned clini cians, as well as efforts to educate these health care providers is essential. We must also build in resources that are highly accessible to high risk populations, such as mental health ser vices for parents and youth in schools. Again, prevention is the most cost effective way of solving this problem. Prevention includes de-stigmatizing mental illness, understanding that how we interact with each other impacts our mental health, and learning self care (e.g., how to care for yourself to be healthy, healthy environments, healthy others).

Inflation, gas prices and the economy continue to be an issue in 2022 – Families are paying extra for everything. What can and should be done in Colorado to help families?

It’s important to recognize that our govern ment does not regulate the free market and the cause of inflation is complex with many moving parts. During times of economic downturn, we all feel the pain of higher prices, but we need to pay particular attention to the needs of our community’s most vulner able groups. Our elderly on fixed incomes or low income or single parents families living paycheck to paycheck may be faced with the choice between paying for food, rent, or gas to get to their job. For those of us that have the means, increasing our support for organiza tions such as food banks, Meals on Wheels, the energy assistance program and many others can be life altering for those in need.

If elected, can you work on a bi-partisan level to pass bills and address the needs of the Colorado popula tion as a whole and not just live along party lines? Give examples of where you could compromise. Finding common ground through compro mise has become a rare occurrencein this time of hyper-partisanism. The increased polarization between Republicans and Democrats has created legislative gridlock and distrust back and forth. Our communities and our legislators need to build civil relation ships, develop empathy for others and their views, and be able to disagree without being disrespectful. Compromise is not a failure and I think I am a good listener and a fair-minded person. I have Republicans, Unaffiliated and Democratic voters working on my campaign and I feel proud of that. We talk honestly and don’t expect to fully agree on anything. What we can agree on is that we need people in gov ernment who will solve problems and stand up for our citizens.

Housing affordability and homelessness have become a state and nationwide issue. What can be done at the state level to address the growing problem?

Homelessness must be addressed on a national level so that populations stay in place and don’t migrate to more friendly cities. My goal would be that those who want to be housed should be able to work toward that,

and those who do not, can live on the streets but we need boundaries and services so that we don’t have people toileting in public, and bathing in our creeks. Consider that the needs of the person who has just lost their home is very different from the person who has lived on the streets with no employment for years. I think shelters are necessary but the goal should be short term use with an expectation of gaining employment and eventually living independently again. States can provide cer tain services for people who are homeless such as mental health services, safe places to sleep, and personal care such as public laundry, showers, and toilets. It is really important that as a society, we help people stay in their homes. Crime is quickly becoming a major concern in Colorado. With Colorado ranking first in the nation for car thefts, and major crimes on the rise- what do state lawmakers need to do to help fix the problem?

Over the last 40 years Colorado’s population has increased well over 300% (1.35 million to 5.68 million), and, especially along the Front Range, we are increasingly experiencing issues related to other metropolitan areasincluding increased crime. There are no easy answers or comprehensive solutions to this problem. I know that people work hard to earn their belongings and we cannot allow car thefts to escalate without appropriate conse quences.

As a mental health specialist, I know that people that have a sense of belonging and are treated well by their community don’t tend to victimize it. Providing social support for strug gling families, quality education and job skills training can give people options and opportu nities that make crime a less attractive way to make a living. Prevention is more cost effec tive than punishment strategies but we need both strategies working at the same time.

Public trust in government, elections and public health are at an all-time low – What should state and federal lawmakers be doing differently to change public perception?

Distrust is a consequence of our elected officials and our media prioritizing partisan agendas and opinions over truth. The ac cepted, and it seems, expected standard of behavior for politicians has become one of contempt and open hostility toward anyone with an opposing viewpoint. I cannot think of a more pertinent or timely example of shameless deceit than the big lie. In the almost two years since the election, with over 60 court challenges and numerous investigations, absolutely no evidence of any systemic voter fraud or conspiracy has ever been uncovered. This is a good example of how lies can have bad outcomes.People were hurt, and some died on Jan. 6.

In office, I plan to build trust the way I have always done, by seeking facts, consulting with knowledgeable others who have insight into the problem wehope to solve, and offering information when I hear rumors. I treat others respectfully and I expect it back. Leaders must be as transparent as possible, willing to see all sides of an issue, and never hesitating to say “I don’t know- but I can find out!”

Water rights and water availability are becoming an issue for counties and local municipalities – what can the state do to create a strategic plan that works for all?

Record breaking increases in temperature, especially over the last 20 years, has created unprecedented drought conditions along the Colorado River system and for all who depend on it for drinking water, agriculture, indus try and recreation. Logically then, any local, state or national efforts to address the climate change crisis is essential. Historically, here in CO, agriculture uses a little over 85% of all available water supplies for the state. We must support our farmers as they transition to new methods of irrigation, use of hydroponics, making changes in types of crops and cover crops and other water saving interventions.

While he can’t explain the reasons why the system got so bad, he’s determined to simply keep moving forward, bit by bit, until it’s all operating like clockwork. In the past year, the district has invested heavily in its water treatment plant and is now beginning to look at the lift station issues.

“I just don’t have the time or energy to really worry about the why – going back 30 years into a system,” he said. “We take responsibility for the condition they were in and are absolutely dedicated to changing it.”

But getting there won’t be easy and it gets complicated quickly as the system wants to link into a larger one – the nearby Parker Water and Sanitation District. Voters overwhelmingly approved a plan to join with that district in May of 2021, but months later, the deal fell apart over financial negotiations and the issues with the metro district’s dated infrastructure.

While that plan appeared to be on track earlier this year, now Travis says it will take two years to get a deal with Parker done, if it goes through at all.

“I want to look at absolutely all of our options,” Travis said. “While we have this downtime I think it’s our responsibility to prove that Parker is the best option.”

Since homes started spreading here in the early 1980s, the Castle Pines North Metro District has handled water and sewer services for most of the community. The struggles have been a point of frustration in an area with a median annual income of $170,000 and home prices of about $837,000, according to the city’s data and Redfin estimates.

The problems come as the city of about 13,000 grows rapidly. By 2040, its population is predicted to nearly triple, according to the municipality.

Parker deal: dead in the water?

Castle Pines’ efforts to join Parker Water are part of a long-term plan to secure renewable water for future residents.

It also would simplify things for them.

“Everything has been so complicated,” said Michael Penny, city manager for the City of Castle Pines. “This all goes to simplifying the governance so people aren’t going ‘who the heck do I call?’”

While the west part of the community falls under Castle Pines North Metro District, the residences east of I-25 are already part of Parker Water and Sanitation and unaffected by the issues.

Soon after the ballot item to join the rest of the city with Parker was approved, Parker began taking a deeper look at the metro district’s system and announced eight things that needed to be addressed. Negotiations also began over how much the district would have to pay Parker for the repairs.

“The hinge really broke around that financial evaluation,” Travis said.

Ron Redd, district manager for Parker Water and Sanitation, said there were a few things, including the sewage spills, his team had not

known about before the vote.

“At the end of the day, they weren’t able to meet those parameters, so we exercised our right to get out of the agreement,” Redd said.

Radloff, who was mayor of the City of Castle Pines from 2018 through 2021, was elected to the Castle Pines North Metro District in May. She campaigned on reviving the agreement.

“I wanted to get that back on track,” she said. “I wanted to make sure our water was safe to drink and I wanted other people to have confidence in it as well.”

Pulling back the curtain

Redd, who has led Parker Water for the past 10 years, says that a few years ago, he would have had nothing of concern to report about Castle Pines’ water system

“They met demands and were engaged in regional discussions,” he said, “But they had a nice curtain.”

Behind that curtain is a record of 12 sewage spills caused by the Castle Pines North Metro District since 2010. Half of those occured since 2020, according to Colorado Department of Public Health and Environment data provided to Colorado Community Media. The largest spill was February 2021, when about 70,000 gallons were released into a nearby detention pond.

The most recent spill was in March, when 25,000 gallons of sewage was spilled by the district.

At the center of many problems are the district’s eight lift stations that help pump wastewater to a treatment facility. Seven of them have some level of issue that needs to be addressed, Travis said.

“They’re all past their designed lifespan,” Travis said about the seven stations.

Outside of the spills, the district has struggled with service stoppages at their treatment plant as well, such as the boil order and another incident a few months later where service was halted to more than 500

“We don’t have water districts losing service to their community,” Redd said. “You don’t hear that very often and they had it happen twice.”

As a result of the spills and other issues, many residents have said over the years they’ve lost confidence in the system as a whole, Radloff said.

“People are out and about walking their kids and their pets and … and they’re passing by lift stations and they’re seeing the discoloration of the rock and the spillway,” she said. “They’re smelling sewage.”

State issues warning

Over the summer, state officials issued what’s called a compliance advisory. The warning told the district to create a plan to fix the system or face potential enforcement actions.

“This compliance advisory is intended to advise the district of alleged violations of the Water Quality Control Act,” according to the document.

The metro district responded in August and had its plan approved. It recently hired an engineering firm to address the lift stations, with an initial design expected by the end of the year.

The next step will be in-depth engineering and a final design, which will likely take most of next year, Travis said. Then, before the work can begin, the designs will need to be approved by the state, which could take another year or more.

“It’s complicated and it takes time,” he said.

The district has estimated it would cost about $12.7 million to rehabilitate the lift stations. In the past year, the district has invested $3 million in the water treatment plant with $5.5 million more planned in the next year.

The recent compliance advisory for repeated sewer overflows is not the first from water officials. In 2011, the state’s water quality division issued a compliance advisory that

said the district’s sewage spills violated state law.

According to Castle Pines North Metro District and Parker Water, there are no records indicating whether anything was done about that previous advisory.

“CPNMD has no records that repairs, system upgrades or corrective actions were taken in response to these letters,” according to a document submitted to CDPHE.

In an email to Colorado Community Media, CDPHE said they didn’t have the historical information about any action taken against the district to ensure spills would stop.

“In the past, based on resource limitations, sanitary sewer overflows (SSOs) were typically handled with the initial response being a phone call to gather information about the release(s) as well as what the entity was doing to address them,” according to the email.

Earlier this year, the City of Castle Pines hired an attorney to write to CDPHE, raising concerns about the repeated sewage spills. They referenced the March incident that led to 25,000 gallons of sewage spilling.

“The area where this occurred is adjacent to a residential park (Coyote Ridge Park),” according to the letter. “Given the frequency and size of the (sanitary sewer overflow) events, the city is concerned about the impact of these events on public health, safety and welfare.”

They went on to ask CDPHE to complete a comprehensive investigation of the district and “take whatever actions CDPHE deems appropriate.”

A few months later, the compliance advisory was issued.

“After receiving the letter by the City of Castle Pines, the division evaluated the potential pattern of spills and determined whether additional corrective action was appropriate,” according to an email from CDPHE.

The state makes decisions on how to enforce based on their enforcement management system and the availability of resources, according to an emailed response to questions from Colorado

What’s next?

The Castle Pines district said progress is ongoing. By this time next year, all the components of their water treatment plant, which treats drinking water, will be brand new, Travis said.

Even though residents already voted to approve an inclusion into Parker Water, if the deal is to go through, another election is required.

Before that can happen, Parker Water wants to see the state grant them relief from any possible litigation related to the metro district’s sewage spills. The districts will also have to do a new financial analysis of the impact of an inclusion.

That means a vote is at least two years away.

In the meantime, the question of whether the community sees the water as safe lingers. Radloff took a tour of the water treatment facility and said her perception of the system is changing.

“I have more confidence in the water now,” she said. “The other (issues) i think they’re in progress but it’s going to take a while to get them back to where they should be.”

‘Americana’ exhibit fills former depot

Guild o ers appealing new show that runs through Nov. 6

BY SONYA ELLINGBOE SELLINGBOE@COLORADOCOMMUNITYMEDIA.COM

BY SONYA ELLINGBOE SELLINGBOE@COLORADOCOMMUNITYMEDIA.COM

The Littleton Fine Arts Guild has opened an appealing new exhibit of artworks by guild members, called “Americana,” at the Depot Art Gallery, housed in a historic Santa Fe Railroad depot at 2069 W. Powers Ave. in downtown Littleton.

“Americana” fills the inviting old red building that once served as a Santa Fe Railway depot, conveying Littleton residents to their chosen trains, with painted and photographic images of landscapes, cityscapes, happy and thoughtful people — some solo and others interacting — and various other subjects drawn from artists’ imagination.

A fence decorated with old cowboy boots is a different view of things Western. And then, my eyes focused on the tiny, red velvety, precisely-stitched “Queen of Pomegranates” in an ornate frame, near a colorful group of small purses meant to protect that ever-present phone ...

The exhibit also includes an

assortment of fine crafts — ceramics, jewelry and glass — and will run through Nov. 6.

The juror was watercolorist and teacher Dan Marshall, who is nationally recognized for his fine paintings. Visitors to the gallery should look to the left of the entry door for an example of his subtly-colored artwork. He has published several books on technique and is a highlyskilled painter, using a difficult medium.

A mixed media piece called “The Community” by member Bobbi Shupe hangs by the stairway up to the platform, with subtle colors and composition, and we will include awardwinners in a future article, since Marshall had just returned from California travel and had not yet decided on them when we visited on Oct. 11.

Of particular note: Carole Broere’s “Falling Leaves,” a sculptural ceramic work, enhanced by Raku technique, an ancient Japanese way of treating/firing clay, which adds a metallic glow that changes as one walks around it. Almost hypnotizing! Broere also exhibits a pair of ceramic masks in the back room that merit attention.

While enjoying the back-room space, note paintings on the wall by Bonella Hererra and jewelry by Christine Johnson. Both are named “Artist of the Month”

by fellow guild members. (In past years, there was only one “Artist of the Month,” but LFAG members have decided to name two, offering extra recognition to different skills.)

On the baggage platform in the front room and on the floor of the rear room, there are large round racks, filled with beautifully designed colored notecards by guild members. These are a real pleasure to use for all sorts of greetings and are a small gift to the recipient in each case. Pick out a handful for family and friends and bypass the drugstore and grocery racks.

Dan Marshall said his “work is greatly influenced by living in the American West.” He is currently based in Denver, although he grew up on the East Coast and has lived in California. He teaches for art groups across the country and has been featured in Southwest Art, Watercolor Artist, American Art Collector and Plein Air Magazine.

IF YOU GO

The Depot Art Gallery is located at 2069 W. Powers Ave., northwest of the old courthouse on Littleton Boulevard. It is open from 11 a.m. to 4 p.m. Tuesday through Sunday. Admission is free and exhibits change every month to six weeks.

Honey-loving bear coming to stage

Newman Center Presents is a varied program of entertainment through the season at the University of Denver, and will include a new musical about Winniethe-Pooh on Nov. 11-13 in the Gates Concert Hall. The notice I have says “Various Times” so I think a call to the box office is in order for potential attendees: 303-871-7720. It is by the Sherman Brothers and is a Broadway musical based on the Disney version of this beloved story, with “spectacular puppets.” 2344 E. Iliff Ave., newmancenterpresents.com.

Stories on Stage Stories on Stage — professional actors reading stories for an audience of grown-ups — will next offer “Modern Times” with Buntport Theater performers at 2 p.m. Nov. 6 at Su Teatro, 721 Santa Fe Drive, Denver. storiesonstage.org, 303-494-0523.

Tesoro lecture

Tesoro Historic Lecture Series’ next presentation is “The Night the Stars Fell” with Ron Hranac discussing “What is a Meteor” in connection with a meteor shower seen at Bent’s Fort on Nov. 12, 1833, as the Plains Indians thought it might be the end of the world. Dinner lecture at the Fort, 19192 Morrison Road, Morrison. $80 non-members, $70 Tesoro members. 303-839-1671, tesoroculturalcenter.org.

Own An Original

The 57th annual “Own an Original’ thematic fine art competition will

SONYA’S SAMPLERrun from Nov. 4 through Dec. 31 at the Littleton Museum, with a theme of “Labyrinth.” Juror is Molly Casey. More on this soon.

DMNS New at the Denver Museum of Nature & Science, 2001 Colorado Blvd. — “Apollo: When We Went to the Moon” with more than 100 artifacts from the U.S. Space and Rocket Center’s archives. Make footprints on a virtual moon, climb aboard a lunar rover model in a multi-sensory exhibit. See dmns. org.

Oil painting techniques

Cliff Austin teaches oil painters special techniques on how to paint from photographs. Heritage Fine Arts guild hosts this class at the First Presbyterian Church of Littleton, 1509 W. Littleton Blvd. Cost: $35 Heritage Guild members, $50 for non-members. Limited to 20 students. For details, see heritageguild.com and select Current Workshops. Oil painters only.

Miners Alley

Miners Alley Playhouse, 1224 Washington, Golden, announced its 2023 season: Jan. 27-March 5, “The Great American Musical.”; March 31-April 23: “I Hate Hamlet”; May

19-June 11: “The Oldest Boy: A Play in Three Ceremonies”; Aug. 11-Sept. 17: “Avenue Q: the Musical”; Oct. 13Nov. 5: “The Cherry Orchard”; Nov. 24-Dec. 31: “A Christmas Story.”

Littleton musical

“Newsies” is the next musical to appear at Littleton Town Hall Arts Center, opening Nov. 17 and playing through Dec. 29. Special benefit for the Denver Actors Fund will be Dec. 12 at 7:30 p.m. See townhallartscenter.org.

Christmas show

Also in the Newman Center Presents series at the University of Denver: “Damien Sneed’s Joy to the World: A Christmas Musical Journey” on Dec. 1 at 7:30 p.m. See newmancenterpresents.com.

Camp Christmas

Coming to Lakewood: “Camp Christmas” at Heritage Lakewood Belmar Park. From Nov. 17 to Dec. 24, concocted by the clever Lonnie Hanzon. Tickets: denvercenter.org, 303-893-6030.

Estate Planning Awareness Month

October is upon us! Which means pumpkin spice lattes, apple cider, skeletons, ghosts, and Estate Planning! That’s right, its Estate Planning Awareness Month. Each year during the month of October we remind our community how important it is to ensure that your Estate Planning Goals are met.

One of the most common things amongst all client worries is centered around Probate. So, what is Probate?

Probate is the judicial process in which your Will is “proven” in court, and the court gives its stamp of approval. These are known as the Letters Testamentary. Probate typically occurs in the County of the State in which you reside. The Executor is the person that is then appointed by your Will to wrap or up administer the Will. This sounds well and good, but Probate can be a disaster for many. Below are a few things to remember.

LEADERSHIP MATTERS

As your County Commissioner, Abe has worked hard with you to make a positive impact in our community.

A few of his achievements include:

Balanced budget - zero debt

Approved the largest tax cut in the history of Douglas County returning millions back to citizens

Kept Douglas County free and open during COVID

Advocated for the economy, public safety, mental health, and your constitutional rights

Protected natural resources - introduced wildfire initiative and support preservation of open spaces, parks, trails, and historic resources

Paid for by the Committee to Elect Abe Laydon. Registered agent Marge Klein.

1) To start off, a Probate in the State of Colorado must be open for a minimum of 6 months and a maximum of 36 months.

2) Creditors to the Estate must be notified of someone’s passing.

3) Everything in the decedent’s name at the time of their death must go through probate.

4) Only the elected or appointed Personal Representative/Fiduciary has the legal authority to begin administering the Estate.

These things can be extremely difficult to remember, and even more difficult for your fiduciary to handle. Not only is the fiduciary dealing with the stress of the court, but they are likely grieving from the loss of a loved one as well.

Contact the Davis Schilken, PC team to learn more about what you can do to ensure that your estate plan is set up to help avoid the probate process and that all your wishes are being carried out the way that you would like them to be (303)670-9855.

We offer no obligation in person or virtual meetings. We make estate planning simple!

Visit our comprehensive website for more tools www.dslawcolorado.com

Castle Rock candidates discuss development, homelessness, public safety

Four hopefuls take part in Chamber of Commerce event

BY MCKENNA HARFORD MHARFORD@COLORADOCOMMUNITYMEDIA.COM

A debate between candidates for Castle Rock Town Council focused on how the town should handle future development and the impacts of its growth, including homelessness and expanding services.

The Castle Rock Chamber of Commerce hosted four of the five town council candidates for a moderated debate on Oct. 6 at the Sturm Collaboration Campus.

Running in District 5 is incumbent Caryn Johnson and candidates Caryn Ann Harlos and Max Brooks. In District 3, incumbent Kevin Bracken and candidate Dean Legatski are running.

Legatski told Colorado Community Media he was unable to attend the Chamber’s debate because he was traveling.

Multiple questions at the debate asked candidates how they think the town should handle

continuing growth, whether that be already entitled properties or future development.

Bracken and Johnson, both incumbents, gave details about how the council has approached recent projects, such as requir-

ing impact fees and working with developers to downsize projects.

Johnson said she is interested in finding a stable source of revenue for town services, such as police and fire, which are currently mostly funded by sales tax.

“While (impact fees) pay for capital improvement projects, they do not fund the additional increase in operations needed for our town services,” she said,

DISCUSSION

FROM

noting that she doesn’t have a specific tax or fee in mind.

Brooks also said he would work with builders to make future growth align with the town, while noting that property rights limit how town council can respond.

Harlos said government should have a small role in development, but did note growth should pay for the additional burden on services.

“I can tell you that I’m a free market person. I do not believe in a great deal of central planning and I believe in government

empowering people and getting out of their way.”

Harlos also pledged to never vote to raise taxes, saying Castle Rock’s tax burden is already too high.

Brooks said he agreed that the tax burden in Castle Rock is high and he’d be hesitant to increase it, but noted the importance of maintaining public safety at the same time.

“We need to make sure we have enough law enforcement on the streets and enough fire responders to take care of our growing community,” he said. “However, you’ve got to stay out of our pockets to do that. These things have always historically been paid by sales tax, so we cannot being going to the residents of

Castle Rock and saying ‘hey, give us more money.’”

Johnson reiterated her view that public safety services need a more reliable revenue source than sales tax.

“As we know, sales tax revenue gets effected by economic downturns, economic downturns mean other projects in town get hit,” she said. “So finding a longterm solution to a stable revenue source for our police and firefighters is very important for our long-term security in town.”

Responding to questions about homelessness, Bracken, Brooks and Johnson were adamant that they didn’t support a shelter in town and said Castle Rock lacked the resources to support homelessness services.

VOTE YES on

TO PROTECT DOUGLAS COUNTY PARKS, TRAILS, HISTORIC RESOURCES, AND OPEN SPACE

on

in

County for the

space, historic

RAISING

and

Only Harlos said she would consider a shelter, particularly if a local religious organization or nonprofit wanted to develop and manage it. She also said she would support services for the homeless in town.

“In proportion to our size, we should have services for people in need,” she said. “I think we need to enable charities and private organizations to step in because the cold face of government is not the best answer for people in need.”

Candidates also answered questions about securing water for Castle Rock, changing the town ordinance on lewdness, and their thoughts on the redevelopment of downtown, as well as giving opening and closing statements.

Two arrested in Centennial shooting

occurred Sept. 18

Two adult males have been taken into custody with charges related to shots being fired into multiple homes in Centennial on Sept. 18, the Arapahoe County Sheriff’s Office announced in a news release on Oct. 12.

Investigators previously asked for help finding the person, or people, who fired gunshots into multiple homes near East Progress Circle and South Flanders Court in Centennial around 8:30 p.m. on Sept. 18.

According to the news release,

Arrests have been made in a Centennial gunfire incident.

At one time, great taste. Now over-filling.

Whenever you are outside and you notice a piece of trash, please stop and dispose of it properly. What isn’t collected today is picked up in the next rainstorm and sent directly to the nearest creek. From the moment this small piece of trash enters our waterways, it is responsible for a tremendous amount of damage. By developing habits such as securing loads in open vehicles and keeping lids closed on trash bins, you help minimize litter scattered by wind and rain.

Local stormwater agencies are teaming together to bring you this message. We take this so seriously that we posted this ad rather than send you more garbage in the mail. One thing is clear: our creeks, rivers and lakes depend on you.

clogs up storm drains and poses a threat to

and wildlife. Pick up one piece of litter

when you can.

TABOR

FROM

justice, activist — curriculum here in the schools,” board member Mike Peterson said.

He added that the district’s curriculum follows state standards.

Another claim from opponents that raised concern among board members involved characterizations of the mill levy override.

A claim in the TABOR book said the mill levy override cost would be added on top of any future assessed home values. Kane said that is not true. The cost is expected to be roughly $52 per year for each $100,000 of current assessed home value.

Another opposition comment claims the district will use some of the $450 million in bond money, should voters pass the measure, for operating costs or current expenses. Kane called that a misrepresentation

of the district’s budget and emphasized that the expenses outlined in the bond are future capital investments.

“Those capital investments are not within our current capacity or our current plans,” Kane said. “(The capital investments) are covered if the bond passes and only if the bond passes.”

It’s unclear who wrote or submitted the comments. Per the county’s regulations, only registered voters within the district are allowed to submit comments for the TABOR book to a designated election official. From there, the clerk’s office compiles and publishes the guide.

Colorado Community Media has filed a request under the Colorado Open Records Act with the county clerk for the for-and-against information about the school district issues used in TABOR book.

The school district did not write any comments either for or against the ballot measures, Kane said.

withtax

Knowsomeone withtax

potential?

potential?

A lot oftax experience?

New totax prep?

VOICES

Painfully watching, waiting

EDITOR’S COLUMN

October is Domestic Violence Awareness Month and I have seen plenty of social media posts and PSAs circulating with phone numbers and websites about how the victims can get help. In seeing them – I am always glad they are there. However, there is also this twinge of pain. There are strong moments of sadness for me and I’m sure others in the same boat. You see, many of us have a family member or friend who may be victims of domestic violence, but the phone numbers and websites mean nothing because they do not use them.

Thelma GrimesI am talking about the men and women who may be in an abusive situation but they continually decide to stay, take it and suffer.

For family members and friends watching this happen we too suffer. We all know we would step in and help at the drop of a hat. We all hold our breath as we know that one day we will get the call saying things went too far and the person we love is hurt or dead.

Sound harsh? It is harsh. It sounds that way because it is reality. We know that all the efforts to talk sense are falling to the wayside and we often lose the small battles to the abuser who, for reasons we cannot figure, continues to win the war.

Statistics provided by the National Coalition Against Domestic Violence say this about victims:

On average, nearly 20 people per minute are physically abused by an intimate partner in the U.S. During one year, this equates to more than 10 million women and men. One in four women and one in nine men experience severe intimate partner physical violence, intimate partner contact sexual violence, and/or intimate partner stalking with impacts such as injury, fearfulness, posttraumatic stress disorder, use of victim services, contraction of sexually transmitted diseases, etc. On a typical day, there are more than 20,000 phone calls placed to domestic violence hotlines nationwide. Women between the ages of 18-24 are most commonly abused by an intimate partner. Only 34% of people who are injured by intimate partners receive medical care for their injuries.

According to SafeLives, an organization aimed at ending domestic violence, it can take years for a victim to even seek help. And when they do seek help for that first time, it likely ends with a phone call but could take another year or more for the victim to be serious.

On average, SafeLives estimates that a victim can be hurt physically 50 times or more before thinking about getting help.

Domestic violence has a far-reaching affect on so many lives and our communities. For those who have to stand on the sidelines because legally there is nothing you can do – I feel for all of you. I say be strong and never lose hope.

We all have to believe that a good outcome is possible.

Thelma Grimes is the south metro editor for Colorado Community Media.

LINDA SHAPLEY Publisher

Call first: 9233 Park Meadows Dr., Lone Tree, CO 80124 Mailing Address: 750 W. Hampden Ave., Suite 225 Englewood, CO 80110

303-566-4100

DouglasCountyNewsPress.net CastlePinesNewsPress.net CastleRockNewsPress.net

To subscribe call 303-566-4100

WINNING WORDS

Can we handle the truth?

She vacillated for months. Her boss was micromanaging everything that she and her team were doing. Never satisfied with anything that was produced by anyone on the team, her boss felt compelled to change even the smallest of details. It was a blind spot for the leader for sure, and unfortunately demoralizing to the entire team.

When she found what she thought was the right opportunity to discuss this blind spot with her boss, hoping it would make a change, she unfortunately found herself on the receiving end of even tighter scrutiny and micromanagement, eventually ending in her termination.

He was experiencing some erosion of trust with his friend. The friend began acting and behaving in a way that was outside their normal behavior. As the behavior became increasingly amplified, he began wondering what the truth was and what were lies any time that his friend shared a story. He invited his friend to meet for breakfast one morning to talk about it.

Defensiveness was their shield. His friend took offense at what was being shared, so much so that they got up and left. As he sat their wondering if he had made the right call to bring this change in behavior to his friend of more than 20 years, his first feeling was regret. That feeling quickly gave way to relief as he knew the conversation had to happen. To this day they have not spoken, and the hopes are that his friend has made some changes in their life, wherever they may be today.

There was a deep family secret. Something that was held onto for a very long time. So many opportunities to get the skeleton out of the closet, yet too many excuses about why it was never the right time. Then one day the truth was shared, the skeleton set free from its chains. Thinking that finally the air would be cleared, knowing it might take time for the family and friends to understand, they believed all would eventually be OK and the sins of

lshapley@coloradocommunitymedia.com

MICHAEL DE YOANNA Editor-in-Chief michael@coloradocommunitymedia.com

THELMA GRIMES South Metro Editor tgrimes@coloradocommunitymedia.com

ELLIOTT WENZLER Community Editor ewenzler@coloradocommunitymedia.com

ERIN ADDENBROOKE Marketing Consultant eaddenbrooke@coloradocommunitymedia.com

AUDREY BROOKS Business Manager abrooks@coloradocommunitymedia.com

ERIN FRANKS Production Manager efranks@coloradocommunitymedia.com

LINDSAY NICOLETTI Operations/ Circulation Manager lnicoletti@coloradocommunitymedia.com

the past forgiven. It was not to be, not yet anyway. The truth and pain were too much. Those secrets hidden for so long brought too much current-day pain.

The truth will set us free. For those of us hearing the truth, I guess sometimes it depends on if we are ready to handle the truth. For those delivering the truth, it truly is freedom.

How often have we wished we could say exactly what is on our mind? Probably more than we can count on our fingers and toes. We remain quiet, but why? Political correctness? Maybe we don’t want to hurt a family member, friend, peer or employer. The issue could be so white-hot that anything we say will possibly be misconstrued and the tables turned on us. We might stay quiet because we fear being canceled, shut out, unfriended or blocked on social media.

Here’s the real question, as the examples above were about real people who shared their stories and experienced negative repercussions. The question is, the title of this column, can we handle the truth? We live in a world of chaos, corruption, and lies. Chaos, corruption, and lies that companies, politicians, television, social media and people will justify because they believe it is for our greater good. Is it? Is it really? We cannot manage what we do not know. Maybe it’s not our place to manage it anyway. But we all want the truth. Can we handle it?

Who is the arbiter of truth? For me, I find it through my faith, as it is the way, the truth, and the life. Even for my many, many sins of the past, by the way probably the record holder of sins, I know that the truth comes from one source, our God. I would love to hear your story of handling the truth at gotonorton@gmail.com, and when we can get to a place where we can handle the truth, no matter how hard it is, it really will be a better than good life.

Michael Norton is an author, a personal and professional coach, consultant, trainer, encourager and motivator of individuals and businesses, working with organizations and associations across multiple industries.

Columnists & Guest Commentaries

Columnist opinions are not necessarily those of the News Press. We welcome letters to the editor. Please include your full name, address and the best number to reach you by telephone.

Email letters to letters@coloradocommunitymedia.com

Deadline

Wed. for the following week’s paper.

To opt in or out of delivery please email us at circulation@ coloradocommunitymedia.com

Douglas County News-Press (ISSN 1067-425X)(USPS 567-060)

A legal newspaper of general circulation in Douglas County, Colorado, the NewsPress is published weekly on Thursday by Colorado Community Media, 9233 Park Meadows Dr., Lone Tree, CO 80124.

PERIODICALS POSTAGE PAID AT LONE TREE, COLORADO and additional mailing o ces.

POSTMASTER: Send address change to: Douglas County News Press, 750 W. Hampden Ave., Suite 225, Englewood, CO 80110

FINANCIAL STRATEGIES

Business exit planning crucial

The way we conduct business after COVID has changed forever. Business owners continue to struggle to find good employees and customers in this new “flex” work world.

One of the biggest challenges continues to be consolidation and business closures. However, few are prepared for these changes.

Maybe you were a fan of Banana Republic downtown, or Echo Lake Gift Shop and Lodge Restaurant.

Perhaps you purchased a car from Rocky’s Autos or furniture from Larrabee’s over the last 40 years.

There are hundreds of well-known, longstanding businesses shuttering. It could be a COVID hangover, or higher rents and a labor shortage.

Or you could be part of the mass of baby boomers wanting to retire and transition their business.

This is why the State of Colorado Office of Economic Development and International Trade, and the

LETTERS TO THE EDITOR

Thanks for symposium

I just finished reading your story about the Senior Safety Symposium in Englewood on Sept. 21. It was a very well written article partially explaining why the Rocky Mountain Railroad Heritage Society joined with the City of Englewood, Parks, Recreation and Library to create the symposium.

Our railroad society feels we need to be involved with any community we are in, regardless if it is railroadoriented or not. The symposium has proved popular in Englewood as the attendance has increased and we have had a lot of positive feedback. It is our hope that this event will be a continuous occurrence for many years to come. We also hope to see this expand to other towns in Colorado.

I would like to give credit to those whose help ensured the success of the program. First, Cheryl Adamson who worked tirelessly for both of the years of the symposiums. She was the guiding influence for the quality of the speakers and the topics presented. Sadly she moved on to another job a week prior to the symposium. We wish her the very best in the future and know she will be a great success.

Shelly Fitz-Pelley did a yeoman’s job of filling the void left with Cheryl’s departure. If it wasn’t for Shelly the way the presentations were presented would not have been half as interesting as they were. Filling in for the vacancy created by Cheryl’s departure would have been a difficult task at best for anyone, but Shelly did a credible and noteworthy job of overseeing the presentations.

The volunteers who helped answer questions and assist the patrons made the symposium a friendly and welcoming event. Allison Boyd, Michelle Smith, Sheri Crabtree, Ida May Nicholl and Bonnie Gehringer deserve a lot of the credit for the casual and relaxed atmosphere.

Allison Boyd is to be thanked for allowing the city’s participation for these last few years. Without her assistance

Exit Planning Institute launched a Business Owner Readiness Survey to help business owners determine how to exit from their business. This survey indicated that 70% of respondents would like to sell in 10 years, referred to as the “Silver Tsunami.”

It is always better to plan and be prepared then find out in a lurch that your lease is not being renewed or your talent pool has gone off to find themselves. Entrepreneurs are a different breed. They eat, sleep, and breathe their business 24/7. It is a life choice but also a life cycle that eventually comes to an end.

“Having a plan to transition prior to an exit enables the owner to unlock the wealth of the business and create the future and legacy a business owner envisioned,” Robert Lee, CFP explained. Lee is involved with the Exit Planning Institute where they help businesses prepare an exit strategy. The recent survey results from the Business Owner Readiness Survey state that:

Seventy percent of companies put on the market today fail. Six in 10 respondents indicated that they had no exit planning advice or educa-

the Senior Safety Symposium might not have happened.

A thank you to all the merchants who supported the symposium with door prizes. Hopefully there will be another one next year. For senior safety is the main reason for these symposiums.

Jim Jordan. President, Rocky Mountain Railroad Heritage Society Englewood Don’t stand with Democrats

In response to the “Stand with Democrats” letter that ran Oct. 6:

Biden is the worst president we’ve ever had. I guess people that vote for Democrats don’t like $2 gas, low inflation, low unemployment, telling the truth or secure borders. Biden walked into low inflation, low gas prices, energy independence and open schools, but he and his party had to screw everything up.

Over 2.5 million migrants have illegally entered through our southern border with nearly 1 million “got aways.” They travel hundreds of miles with a plastic bag and most are single, military age males. Where are they all going? We know it’s not Martha’s Vineyard because the migrants who were sent there were bused out quickly. New York and D.C. have done but complain about the migrants, yet they are “sanctuary cities.” Speaking of New York and other big blue cities, violent crime has risen nearly 40%, yet the Democrats want to “defund,” vote radical Soros DAs into office and take away U.S. citizens’ guns.

Inflation and high gas prices are not worldwide problems, they are now but since day 1 in office gas prices and inflation have risen. We went from a country that was energy independent with hundreds of years in reserve, to a country that now begs Saudi Arabia and Venezuela for barrels of gas. I could go on and on about the wrongs of the current administration, and as long as people vote for lies they’ll stay in office.

John Couf Highlands Ranch

tion. And 68% were either unsure or didn’t know of the transition options available to them. Lee further stated, “When business owners connect the concept that an exit strategy is a business strategy, they are more likely to embrace their decision to transition.”

Business owners find it challenging to be personally ready to transition. Owners often struggle to envision life after the business while focusing on growing their business. When asked in the survey “how ready the owner considered themselves personally for a major transition of their company,” 84% of the respondents said they were below average, or they were not ready at all for their personal transition from their company.

It is crucial for business owners to integrate business planning with personal and financial planning to increase the likelihood that their exit will be successful.

The Exit Planning Institute encourages business owners to take a holistic and focused approach to align the critical elements necessary to prepare for transition. Steps can include:

• Learn about the options on how to transition a business.

• Obtain a business valuation.

• Envision the next phase of your life.

• Establish an advisory team with your CPA, attorney, and financial advisor.

There is usually a better success rate and smooth succession when you have time to plan, choose your advisors and develop your successors. No one likes an emergency exit. Planning ahead will help in your day-to-day operations as well as give you a roadmap to guide you through the next steps.

There are resources to help you improve your readiness and advisors to help with financial reviews and valuations. Now is the time to prepare for your own future, even if it is many years away. You don’t want to be caught off-guard, and not be able to protect your legacy, family, and employees.

Patricia Kummer has been a Certified Financial Planner professional and a fiduciary for over 35 years and is Managing Director for Mariner Wealth Advisors.

Self placement available online at DouglasCountyNewsPress.net

Designs from 15 creators being unveiled this fall

BY BELEN WARD BWARD@COLORADOCOMMUNITYMEDIA.COM

Painter and muralist Eli Pillaert, a New Orleans native, spent a part of her formative years working as a Colorado ski instructor, teaching kids at Eldora Mountain Ski Resort.

But it was the summers spent hiking around the area that left her inspired.

“This one plant, the mountain mahogany, kept popping up. It’s so beautiful. It has spiraling pieces with little fluffy bits on them,” Pillaert said.

So, when she was selected by Adams County’s Cultural Arts Division to help bring some color to county open spaces, that’s where she looked.

“It’s local flora and fauna. It’s something that people see and could connect with. It’s exactly why I went with this design,” she said.

Pillaert is one of 15 national artists who are having their designs unveiled across Adams County this fall.

But it’s not a gallery show and you don’t need tickets to see any of them. All you need is a little time and some decent walking shoes.

Pillaert’s design, featuring long swooping branches and colorful fluff, is now a part of the county’s Clear Creek Trail at Twin Lakes Park, along 70th Avenue just west of Broadway.

Other designs featuring other artists and their inspirations are spread across the county’s trail system — not on the walls or entrances to tunnels but on the trails themselves.

It’s part of the county’s “Love Your Trails” series. Adams County is about halfway through the series, bringing colorful murals and designs highlighting the county’s natural resources and environment to those walking paths.

“Adams County has been dedicated to the arts for quite a while now,” said Adams County Cultural Arts Liaison Zoe Ocampo.

Adams County started its parks and open space Cultural Arts Division within the Arts and Cultural Department in 2019. Ocampo said arts and culture are part of a vision for Adams County to expand public art in its communities that

calls for increased spending on displays everyone can enjoy.

“It won’t just be new buildings, it will be parks, trails and also all different kinds of projects throughout the county that are deemed eligible,” she said.

Choosing 15

Ocampo said that 50 artists from around the country applied to be part of the Love Your Trails project. The county’s Visual Arts Commission, a nine-member board of community volunteers, selected the final 15.

Pillaert said the artists were given the opportunity to include the community in the project. Hers is the only one of the eight completed so far that did that.

“The community element is part of organizing the mural so that it can be painted by the community,” Pillaert said. “It’s something that’s really near and dear to my heart. It’s something that’s really cool to see people connect through art.”

South Florida’s Stephanie Leyden made her mural theme of the four seasons. It’s also located on the Clear Creek Trail along Tennyson Street and north of 54th Avenue.

She painted summer elements transitioning into fall, winter, and spring and added designs she associated with the state — butterflies flying, animal tracks, wildflowers and changing colors of leaves as they have blown off the trees.

“It’s something we don’t have in South Florida. The seasons are here, they’re just not as obvious,” Leyden said. “With each season, I painted four butterflies, four leaves, four types of animal tracks and four wildflowers. It was fun.”

Leah Nguyen is from Seattle and her mural was more specific.

Called “Community Vision: Bennett, CO,” it’s located in Bennett’s Civic Center Park off of South Street.

Nguyen’s patterns depict small-town life, farmers growing corn, sunflowers, hay and wheat in the surrounding areas. The patterns connect generations of families to preserve the town’s history.

“I created the Community Vision pattern to provide support for communities that are doing the difficult work of excavating their histories, having dialogues and taking actions toward reconciliation, healing old wounds, and visioning new ways to come together and collaboratively thrive,” Nguyen said. “The pattern makes sense there at Bennett City Hall, which holds space for visionary civic work and community building conversations.”

Di erent perspectives

Northampton, Massachusetts artist Kim Carlino calls her mural “Portals

FROM

for Looking Inward.” It’s located in Strasburg Community Park. Her mural is an illusion of depth and volume occupying space in a two-dimensional surface with color that is expressive.

“I had this idea for a path coming across these portals or ovals reflecting the night sky with colorful Candy Land-like pathways that flow in and out of the portals as if they were going underneath the path and coming up the other side to give a sense of playfulness and movement,” Carlino said. “I love this idea of moving through space and coming across something that makes you take pause, and in that pause you can reflect.”

Traveling artist Kerry Cesen went small with his work. He said he lives in several places, including Maryland, Oregon and Washington state. His mural continues along the Clear Creek trail and is located just west of Lowell Boulevard along West 55th Place.

Cesen dives into the roots of the smallest species as though you are looking through a microscope. He illustrates the natural world beneath our feet.

“It emphasizes the interactions between plants, animals, aquatic life, and fungal growth,” Cesen said. “Several magnified areas within the design allow us a deeper glimpse into the micro-world, where scientific research and design techniques help inform viewers about some of the smaller parts that make up the whole.”

Clearwater, Florida artist Beth Warmath’s mural is inspired by the Colorado landscape and two notable flowers: Sunflowers in the fields and the Colorado columbine.

“I love nature and its perfect beauty, so I challenge myself to recreate it larger

than life. I draw from actual objects so I used the surrounding landscape for my inspiration,” Warmath said. “I was happy to see wildlife in its natural habitat such as fox, elk, chipmunks and bison.”

Paz de la Calzada is originally from Spain but has lived in the San Francisco Bay area for 18 years. Calzada’s mural is located at Riverdale Regional Park in Brighton near the South Platte River. It’s an abstract design that keeps flowing, intertwining with the landscape and river.

“The landscape inspired me with the color of green flowing with nature and the color of blue metaphor flowing with the river both intersecting together, and both need each other water needs nature and nature needs water,” Calzada said.

Milwaukee artist Theresa Sahar researched the Adams County area and learned that trout fishing is a popular sport in Colorado. That became the centerpiece of her mural, which is located along the South Platte Trail just east of Riverdale Dunes Golf Course and the county’s Fishing is Fun Pond. It features a realistically rendered fish leaping off of the trail.

“I’ve done some anamorphic (3D) chalk art pieces in downtown Milwaukee and decided it would be a fun and interesting addition to the Love Your Trails project,” Sahar said.

Adams County’s Ocampo said the remaining murals should be finished this fall, at least before the snow falls. The additional artists selected to work on their mural scheduled for painting are Toni Ardizzone, Sofi Ramiez, Wes Abarca, Keeley Hertzel, Eye Cough, Angela Beloian and Julio Juls Mendoza.

For more information about the artist and mapping location to see the artist’s trail mural, visit: adcogov.org/ cultural-arts-current-projects.

To learn about more projects and its process, visit the call-for-entry website at adcogov.org/call-for-entry.

ARRESTED

investigators received several tips through the sheriff’s offi ce tip line that “led to the possible identity of the shooters.” Authorities did not provide the identities of the two subjects at this time.

After further investigation, investigators found probable cause for arrest warrants for “two of the males involved,” the sheriff’s offi ce said in the release.

On Oct. 11, investigators conducted surveillance on one of the suspect’s homes and “saw the two individuals enter the suspected vehicle used in the original shooting and drive away,” the sheriff’s offi ce said in the release.

Investigators and patrol deputies conducted a “high-risk stop on the car” and took the two males into custody, according to the news release.

The suspects were transported to the Arapahoe County Detention Center and booked on the following charges: