Our in-depth look at the housing crisis

A few years ago, Aurora Warms the Night, an Aurora-based nonpro t serving people who need housing, ran into a challenge when assisting its Black clients in applying for apartments. When the applicants visited properties, landlords denied their applications. is happened over and over again.

So the team decided to take a di erent approach, sending in White volunteers to check out the apartments rst.

“I would send one of our employees or people that were White to look at the apartment — to get the pricing, get everything, to

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

At 16, his car was his rst real taste of freedom. At the age of 22, Christian Glass died in an event involving a former Clear Creek deputy on June 10, 2022 in the same Honda Pilot he drove on his 16th birthday.

e car that once symbolized freedom and joy to Glass became a place in his nal moments of life where he was trapped and terri ed at the hands of the o cers.

His parents, Sally and Simon Glass, remember when their son rst began driving.

“He absolutely loved it,” Sally said.

“I still remember thinking, ‘Gosh, why? It’s not that big a deal, we drive you everywhere anyway,’” Simon said. “But the di erence is that he could stop o and go somewhere, or change his mind or whatever I suppose, and go to the mountains. He loved driving in the mountains.”

It is memories like these that both comfort and pain the Glass family.

and

Glass remember their son who died following an event involving a former Clear Creek deputy

Some now look to build equity for future generations

If you’ve paid even just a little bit of attention to the news industry in the past decade, you know that it’s struggling. What you may not know is that community newspapers nationwide are closing at the rate of two per week. e work of our journalists continues to be so critical for our society. We’re dedicated to keeping your city councils or school boards accountable and informing you about businesses and groups that

make your community the great place where you have decided to live.

But the fact of the matter is, the materials that it takes to get a newspaper to your front door – the newsprint, the ink, the transportation fuel – have skyrocketed in cost. So while it’s not in our nature to make essential news less a ordable, we’ve come to the point where we must raise our prices. Beginning March 1, the price of a subscription to any of our paid publications and for all-access digital will be $85 per

year. (We will still o er a discount for readers over age 65.)

At less than $2 a week, we believe that’s still a reasonable priceto pay for news you often can’t nd anywhere else.

If you’re not interested in a subscription, consider a contribution to bit.ly/give2CCM, or at the QR code to the right.

Local news is a public good. Raising these prices is how we’ll do even more for our communities in 2023. I am grateful for your support.

FROM PAGE 1

Sally said she and Simon never had any conversations about the police with Christian because they didn’t think they needed to.

“And you know what, we never did. And obviously, obviously, we should have, because we didn’t know … there was something to be scared of or that because they could be dangerous,” Sally said.

“We kind of hung our heads in shame”

A typical summer for the Glass family while Christian was growing up involved lots of summer sports and art camps, visits to family in England and evenings at home with friends and family.

“ e boys would just play soccer,

they play basketball or they play frisbee or they play chase. And so that was, often I would have to say, the summer evenings,” Sally said.

ing tennis at a competitive level, so “He really really loved his sports,”

Sally said.

Summers will perhaps never be the same for the family, after former Clear Creek Sheri ’s Deputy Andrew Buen was accused of shooting Glass ve times in June 2022 after he phoned for help with his crashed vehicle in the small town of Silver Plume.

When his parents rst heard the news of their son’s death, they were led to believe he was the cause of the incident, provoking o cers and inciting violence. e two were not only overcome with grief but guilt, too.

“We kind of hung our heads in shame,” Sally remembered.

Quickly, the parents felt they were missing parts of the story.

“I started thinking about it. And I was like, but, he’s never hurt any-

Starting a Family? Growing a Family? Growing Old? Staying Young? Getting Married? Adopting?

Have any of the above been a concern of yours over the past few years? Let us at Davis Schilken, PC help put your mind at ease with our Love and Planning workshop. We can help give you a quick rundown on what type of things you need to

FRIDAY,

When: Wednesday, February

11:30am – 1:00pm

Where: Denver West Office 1658 Cole Blvd., Bldg. 6, Suite200 Lakewood, CO 80401

will be

GALA

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

No, Clear Creek County is not shutting down Charlie’s Place Animal Shelter, but the county is facing budgetary problems heading into 2023.

Social media has been buzzing with rumors about the county’s animal shelter losing sta , funding and even its building, but county o cials want to stop the gossip. “Clear Creek County is NOT planning to close Clear Creek/Gilpin Co. Animal Shelter (Charlie’s Place). However, the County is facing serious budget challenges this year and into the foreseeable future,” Clear Creek County PIO Megan Hiler stated in a Facebook post. e budget problems stem from the slated closure of Henderson Mine, the county’s largest revenue source. e mine has been slowing operations since 2016, and this is the rst year the county is seeing a large nancial repercussion.

“Our revenues are tied to how much they produce, and they’re producing a lot less,” County Commissioner George Marlin explained.

Marlin said the county cut $214,000 from the Clear Creek County Sheri ’s budget this year, with the county budget being $2.9

As a member and representative of the Clear Creek community, Marlin sees how much the animal shelter means to residents.

“We’re clearly a community that has chosen that we want to have an A+ animal shelter,” he said.

Marlin went on to explain that the property will remain an animal shelter.

“ at property was donated to us to be an animal shelter; that was the commitment we made, and it was a legally binding one,” he said.

At the Dec. 14 Board of County

Commissioners meeting, Undersheri John Stein discussed the shelter and the Sheri ’s O ce’s role in managing it.

“ e animal shelter is a necessity,” he stated.

However, he explained that there are costly repairs needed at the shelter and not much room in the budget.

ere have been early discussions of Foothills Animal Shelter stepping in to help with operations of Charlie’s Place, but Marlin wanted to assure residents they will be informed every step of the way.

“If foothills animal shelter does deliver us a formal proposal, that proposal will be discussed publicly,” he said.

one,” Sally said.

e family’s lawyers reviewed the bodycam footage and told the parents they believed Christian was not to blame for the incident, con rming the family’s suspicions.

e bodycam footage was released in September, and a vigil was held for Christian days later in Idaho Springs to call for action against police violence in Clear Creek County.

“No one said sorry”

e Clear Creek Sheri ’s O ce dubbing Christian’s death as “the June Incident” in a press release from Oct. 5 has been a painful and erasive gesture indicating failure of the system, according to the Glass family.

“ e day that Christian Glass was killed, murdered, that’s ‘the June incident.’ at’s what happened. And so that’s really important to name it, you know, and to say his name, and to remember him as a life lost,” Sally said.

Sally hailing from England and Simon from New Zealand gave them both di erent impressions of the police before coming to the United States. After this incident, they both said it would take a complete overhaul to restore a semblance of trust in law enforcement.

“I never thought the U.S. police were very nice anyway, but I didn’t realize they were totally untrustworthy,” Sally said. “So I think that on top of being deeply unpleasant and aggressive, I wouldn’t trust

them and all Christian’s friends just said, never call the police.”

Despite the international attention Christian’s murder has garnered, Simon and Sally say they still have yet to receive a real apology from o cers involved. Most of what they’ve heard has been statements from press releases expressing regret about the incident, but never taking responsibility.

“So they could, for example, come out and make a more, you know, say sorry, this is a real and full apology for what happened, which is a terrible abdication of their duty and a

crime with law enforcement, people are committing crime and then covering it up,” Simon said.

“No one said sorry,” Sally said, tearfully.

On Oct. 26 2022, the Fifth Judicial District Court announced the case would be presented to a Grand Jury.

During that time of year, Simon and Sally remember trick-or-treating with Christian and his sisters.

“ ey would take up pillowcases, and the pillowcases would be full.

And actually what they used to love doing, because he liked kind of sorting and stu – I think that was his logical brain – they loved trading,” Sally remembered.

On Nov. 23 2022, the Grand Jury brought down indictments against Buen and Gould, who were both subsequently let go from the Sheri ’s department.

In Novembers past, the Glass family had tried their hand at the American holiday of anksgiving, mainly just feasting on turkey as a family. Simon and Sally remember Christian and a girlfriend cooking dinner for them one year, but this year there was hardly an appetite with news of an impending court date.

On Dec. 4 2022, the former deputies appeared in court as defendants for the rst time. Both were out on bond, and the hearing was to approve travel over the holidays for the defendants to see their family. e Glass family explained to the judge that they too would love to spend time with their family over Christmas, but said the actions of the defendants made that impossible. e judge granted the defendants travel.

One Christmas years ago, Christian had to work on Christmas day at Starbucks. His family decided to come surprise him at work, and had Christmas dinner at the co ee shop.

“We actually went down on Christmas,” Sally said. “Because we wanted to be with him.”

Simon remembers the family ordering all sorts of seasonal drinks and treats while Christian worked behind the counter. Christian’s self-

“Because we wanted to be with him”

less spirit shined through even at his barista job, his parents said, as he worried about creating too much work for his coworkers.

“He felt bad for the people he was working with because we all came in and ordered all these drinks and stu ,” Sally said.

e family now clings to memories like these, as they will be unable to make new ones with their son.

On Jan. 4, 2023, the Douglas County Sheri ’s Department released an investigation into the body camera

footage of Christian’s murder. e department found Buen’s actions to be unjusti ed.

Seeing another agency call out the actions of the o cers involved in Christian’s murder was important to the parents.

“So it’s the rst time that another agency has come out and said this is wrong. And … it’d be nice if the Clear Creek county department came out and said…” Simon trailed o .

Jan. 30, 2023 will be the next time the Glass family sees the former deputies in court. e hearing will be held at the Clear Creek County Courthouse at 11 a.m. and is open to the public.

Georgetown.

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COMLow-income Energy Assistance Program is a federally funded program that helps eligible Colorado families, seniors and individuals pay a portion of their winter home heating costs.

e program stretches from November to April and provides assistance with heating costs, equipment repair and/or replacement of inoperable heating tools.

LEAP does not pay the entire cost of home heating, but the program aims to help alleviate some of the burdens that come with Colorado’s colder months.

e program can help support quali ed families with $250 to $1000 in credit each year on home heating bills. For the 2022-2023 season, LEAP is also paying past-due water bills for those who submit an extra form found under the “Low Income Household Water Assistance Program” tab on the website.

According to Energy Outreach Colorado, you are eligible for LEAP if…

• You pay home heating costs to an energy provider, fuel dealer, or as part of your rent

• At least one member of your household is a permanent legal resident or citizen of the U.S. and a resident of Colorado

• You can provide proof of your or your household member’s lawful presence in the U.S.

• e total monthly income of all members of your household is not larger than what is shown in the table below

A chart with income requirements can be found on the Energy Outreach Colorado website.

Clear Creek residents looking for application materials should contact 303-670-7550 to reach Stephanie McCaulley at 1969 Miner St in Idaho Springs or 303-679-2364 to reach Tracy Troia at 405 Argentine St. in

CARE Colorado’s A ordable Residential Energy Program provides free energy conservation services to eligible owner-occupied or rental properties. Both owners and renters are able to apply, as long as the renter receives permission from the owner.

Applicants must meet the income requirements and utilize Colorado Natural Gas or Xcel energy as a utility provider.

Accepted applicants may receive assistance with insulation, air-sealing, furnace repair, furnace replacement, refrigerator replacement, LED light bulbs and more.

According to Energy Outreach Colorado, you are eligible for CARE if…

• If anyone in the home participates in one of the following assistance programs, your home automatically quali es (with proof of bene t):

• Aid to the Blind (AB)

• Aid to the Needy Disabled (AND)

Supplemental Nutrition Assistance Program (SNAP)

• Old Age Pension (OAP)

• Section 8 Housing

• Women, Infants, and Children (WIC)

• Temporary Aid to Needy Families (TANF)

LEAP (Utility Bill Assistance)

Households also qualify if they fall below 80 percent of the area’s median income and live in a participating county; a list can be found on the Energy Outreach Colorado website. e maximum income a one person household can make to be considered for CARE is $58,720. More information on income limits and applications for CARE can be found on the Clear Creek County website.

Weatherization Assistance Program is a federally funded program that provides free energy conservation services to eligible households, both owner-occupied and renters.

Accepted applicants may receive assistance with insulation, air-sealing, furnace repair, furnace replacement, refrigerator replacement, LED light bulbs, storm windows and doors, and Health and Safety evaluations.

According to Clear Creek County,

you may be eligible for WAP if you or someone in your household is enrolled in any of the following programs:

• Low-Income Energy Assistance Program (LEAP)

• Supplemental Nutrition Assistance Program (SNAP)

• Supplemental Security Income (SSI)

• Temporary Assistance for Needy Families (TANF)

• Aid to the Needy and Disabled

WAP has a lower annual income requirement than CARE, with a oneperson household making $33,108 as the upper limit for eligibility.

If a home has received WAP services within 15 years, it is ineligible for weatherization services until that time period elapses.

Income requirements and applications for WAP can be found on the Clear Creek County website.

January, 2023

A local National Weather Service volunteer observer makes temperature and precipitation observations each day at about 8 a.m. at the Georgetown Weather Station. Wind observations are made at Georgetown Lake. “Max” and “Min” temperatures are from digital displays of a “MMTS” (“Maximum/Minimum Temperature System”); “Mean daily” temperature is the calculated average of the max and min. “Total Precipitation” is inches of rainfall plus melted snow. “Snowfall” is inches of snow that accumulated during the preceding 24 hours. T = Trace of precipitation. NR = Not Reported. “Peak wind gust at Georgetown Lake” is the velocity in miles per hour and the time of the maximum wind gust that occurred during the 24 hours preceding the observation time. Historic data are based on the period of record for which statistical data have been compiled (about 54 years within the period 1893-2022). Any weather records noted are based on a comparison of the observed value with the historical data set.

A local National Weather Service volunteer observer makes temperature and precipitation observations each day at about 8 a.m. at the Georgetown Weather Station. Wind observations are made at Georgetown Lake. “Max” and “Min” temperatures are from digital displays of a “MMTS” (“Maximum/Minimum Temperature System”); “Mean daily” temperature is the calculated average of the max and min. “Total Precipitation” is inches of rainfall plus melted snow. “Snowfall” is inches of snow that accumulated during the preceding 24 hours. T = Trace of precipitation. NR = Not Reported. “Peak wind gust at Georgetown Lake” is the velocity in miles per hour and the time of the maximum wind gust that occurred during the 24 hours preceding the observation time. Historic data are based on the period of record for which statistical data have been compiled (about 54 years within the period 1893-2022). Any weather records noted are based on a comparison of the observed value with the historical data set.

Day and date of observation (2023)

Temperature (T) (degrees F) Precipitation (P) (inches) Peak wind gust at Georgetown Lake Max Min Mean daily Total (TP) Snowfall (SF) Velocity (mph) Time (24 hr) During the 24 hours prior to 8 a.m.

(x) (x) (x.x) (x.xx) (x.x) (x) (xxxx)

Monday, 01/02 44 19 31.5 0.07 0.6 26 1105 Tuesday, 01/03 24 8 16.0 T 0.2 141400 Wednesday, 01/04 28 9 18.5 T T 43 0630 Thursday, 01/05 31 17 24.0 0.00 0.0 45 1040 Friday, 01/06 45 21 33.0 0.00 0.0 30 1205 Saturday, 01/07 37 24 30.5 0.00 0.0 34 1650 Sunday, 01/08 36 15 25.5 0.00 0.0 18 1215

Summary Week’s avg max, min, mean daily T; sum of TP, SF 35.0 16.1 25.6 0.07 0.8 Historic week’s avg max, min, mean daily T; avg sum of TP, SF 36.0 14.7 25.4 0.13 2.2

Colorado o ers multiple programs to assist in the cost of energy bills and weatherization e orts

Library programs are ALWAYS free! National library lovers month February is National Library Lovers Month! Celebrate with a swoon-worthy prize drawing: each time you come to the library, ll out a heart entry card with a brief note explaining why you love your Clear Creek County Libraries. We’ll draw two lucky winners at the end of the month!

Share stories, play games, and get creative with us! Storytimes are a great opportunity to connect with other Clear Creek County families with young children and make new friends.

11:15 a.m. Tuesdays at Idaho Springs Public Library

11:15 a.m. ursdays at John Tomay Memorial Library

Free COMPASS Fridays at the libraries

Let your compass guide you to fun!

During the Snowdodgers season (Jan. 20 - March 17), we will o er our COMPASS Friday activities at the Idaho Springs Public Library only.

Calling Clear Creek kids: join us for free fun on Fridays! We’ll o er scheduled afternoon activities at Idaho Springs Public Library, plus a range of activities kids can independently pursue at their own pace throughout the day (puzzles, games, computer time, quiet reading, etc).

Please visit our website at www. cccld.org for a detailed calendar.

Children under the age of eight will need adult supervision. While the Libraries provide programs for young patrons, please note that we are not a childcare provider and are not responsible for supervising children visiting our branches. If your child is feeling unwell, please bring them to visit the library at another time. If a young patron is unattended at the library and displays symptoms of illness, we will contact their parent(s) to pick them up.

12:30 p.m. - Snack

1 p.m. - Guided activity

2:30 p.m. - Snack

3 p.m. - Independent activity

Library branches close at 5 p.m. on Fridays. Please pick up your children by 4:30 p.m.

Friday virtual reality sessions

Explore new worlds at our virtual reality sessions for tweens and teens (ages 12 years and older). Registration is required. Please email heather@cccld.org to learn more and save your spot.

3-4:30 p.m. Feb. 3 at Idaho Springs Public Library

2-3:30 p.m. Feb. 10 at John Tomay Memorial Library Book groups

Connect with other Clear Creek County readers at our book groups. Light refreshments and enjoyable conversations served. Email libby@ cccld.org for information.

Idaho Springs Book Group: 4 p.m. Feb. 13

“ e Love Hypothesis” by Ali Hazelwood

John Tomay Memorial Library Book Group: 3 p.m. Feb. 16

“A Pair of Wings” by Carole Hopson

Adult crafts:

Flower arrangement workshop

Roses are red, violets are blue … nettles hint at de ance, and mint means virtue. Do you speak the secret language of owers? Discover ower symbolism and learn about oral arrangement in this special workshop. Many thanks to Marigold in Idaho Springs for partnering with us! Supplies will be provided, but space is limited. To reserve your spot, please email chris@cccld.org.

Marigold, 1620 Miner St., Idaho Springs 5:30 p.m. Feb. 21

5:30 p.m. Feb. 23

Adult snowshoe tour (ages 16+)

Snowshoe with CCCLD! Join us on a guided tour with Georgetown Outdoor Discovery. is adventure is FREE for Clear Creek County library cardholders (a $100 value)! Space is limited — please contact chris@ cccld.org to register.

1-3 p.m. Feb. 4

OMEGA (Open Minds Encouraging General Acceptance)

A collaboration between Resilience 1220 and Clear Creek County Library District.

Idaho Springs Public Library

Colorado Community Media welcomes letters to the editor. Please note the following rules:

Noon-2 p.m. Feb. 11

Join us for games, fun, and snacks the second Saturday of each month! While everyone aged 12 - 20 years is welcome, this program is designed to be a safe space for LGBTQ+ youth. Please email joe@cccld.org for more information.

Monster Mash Party

5:30 – 7 p.m. Feb. 24 at Idaho Springs Public Library Wolf down faboolous treats, play spooky games, and learn silly monster dances! Children under the age of eight years will need an adult with them in the library.

TEAM MEMBER: Holly RECOMMENDATION: “ e Family Game” by Catherine Steadman GENRE: Mystery/thriller

HOLLY SAYS: Edward, Harriet’s new ance, is handsome, rich, and a ectionate. ere’s only one catch: his powerful family can be a bit … controlling. Slightly … manipulative. Rather … secretive. As the Holbeck family draws Harriet into their strange games and history, she begins to fear that holidays with the in-laws may prove fatal.

I really enjoyed this book! Oldmoney mansions provide a glittering backdrop to intrigue and suspense — you will be tempted to nish this puzzler in one sitting.

“ e Family Game” is available to check out at your Clear Creek County Library!

FREE masks and take-home COVID tests are available for pickup at your Clear Creek County Library branches. Collection

Check out books, movies, laptops, hotspots, tablets, and more. Our Library of ings includes nontraditional items like cookware, kids’ science kits, a therapy lamp, and even an Oculus Quest!

Explore our book and movie collection at www.cccld.org View our Library of ings at https://cccld. org/library-of-things/ Or, call your Clear Creek County library to learn more and request items.

Do you have the Libby App? Download the Libby App by Overdrive to your smart device to access thousands of e-books and audiobooks, available for checkout with your library card. Visit https://cccld. org/library-resources/ and click on the Overdrive/Libby icon to get started.

All Clear Creek County Libraries will be closed Feb. 20 in observance of Presidents Day

Idaho Springs Public Library Hours

Monday: 9 a.m. – 5 p.m. Tuesday: 9 a.m. – 5 p.m. Wednesday: 9 a.m. – 6 p.m. ursday: 9 a.m. – 5 p.m. Friday: 9 a.m. – 5 p.m. Saturday: 9 a.m. – 2 p.m.

Sunday: CLOSED

John Tomay Memorial Library Hours

Monday: 9 a.m. – 5 p.m. Tuesday: 9 a.m. – 5 p.m. Wednesday: 9 a.m. – 5 p.m. ursday: 9 a.m. – 6 p.m. Friday: 9 a.m. – 5 p.m. Saturday: 9 a.m. – 2 p.m. Sunday: CLOSED

Local History Archives (in the Georgetown Heritage Center) — visitors are welcome with appointment.

Curbside pickup services — available by appointment; please contact your library branch to schedule your pickup.

Do you need library materials, but are unable to leave your home? Let us bring the library to you! Call us for details. Home delivery services are intended for homebound persons and patrons experiencing illness, and availability is determined by weather and sta ng.

Idaho Springs Public Library: 303567-2020

John Tomay Memorial Library: 303-569-2620

Local History Archives: 303-5692403

Tech access & study spaces Enjoy access to computers, WiFi,

• Email your letter to kfiore@coloradocommunitymedia.com. Do not send via postal mail. Put the words “letter to the editor” in the email subject line.

• Submit your letter by 5 p.m. on Wednesday in order to have it considered for publication in the following week’s newspaper.

• Letters must be no longer than 400 words.

• Letters should be exclusively submitted to Colorado Community Media and should not be submitted to other outlets or previously posted on websites or social media. Submitted letters become the property of CCM and should not be republished elsewhere.

LINDA

lshapley@coloradocommunitymedia.com

MICHAEL

A

Contact Us: 1630 Miner St., Idaho Springs, CO 80452 - 303-566-4100

Mailing Address: 750 W. Hampden Ave., Suite 225 Englewood, CO 80110

Phone: 303-566-4100 Web: ClearCreekCourant.com To subscribe call 303-566-4100

LINDSAY

RUTH

KRISTEN

OLIVIA

Columnists & Guest Commentaries

Columnist opinions are not necessarily those of the Courant.

We welcome letters to the editor. Please Include your full name, address and the best number to reach you by telephone.

Email letters to kfiore@coloradocommunitymedia.com

Deadline Wed. for the following week’s paper.

Clear Creek Courant (USPS 52610)

A legal newspaper of general circulation in Idaho Springs, Colorado, the Clear Creek Courant is published weekly on Thursday by Colorado Community Media, 1630 Miner St., Idaho Springs, CO 80452.

PERIODICAL POSTAGE PAID AT Idaho Springs and additional mailing o ces.

POSTMASTER: Send address change to: Clear Creek Courant, 750 W. Hampden Ave., Suite 225, Englewood, CO 80110

Some people have become so alarmed by what children might read in school or in libraries that they want books they don’t like removed — immediately. e targeted books include scenes of sexual awakening, gender identity, racism or violence.

But why aren’t these alarmists focusing on a book that’s chock-full of incest, rape and gore? I’m talking, of course, about the Bible.

In Genesis 19:30-36, Lot’s daughters get him drunk in a cave and his eldest daughter has incestuous sex with him. Judges 12 tells how an angry mob surrounds a Levite and his concubine, so he appeases them by handing over his companion. What happens next to the sacri ced woman is too gory for me to describe.

Yet the Bible hasn’t been a target of book banners; moreover, some zealots attack books they’ve never read. ey just have a list.

People on the warpath about “dangerous” books started urging libraries and schools to ban books they found objectionable in 2021. at discontent bubbled to the surface during COVID-caused school shutdowns and has now erupted into a culture war.

In Idaho, where I live, book banners have targeted the state’s three largest cities of Boise, Meridian and Nampa, all in the Treasure Valley in southwest Idaho.

So far, only Nampa has succumbed to the pressure. Oddly, the book tossing was started by just one woman, Tosha Sweeney, who emailed the Nampa school board to demand that it remove 24 “pornographic” books that sex o enders might use to “plan their attacks.”

To bolster her demand, she cited section 18-1515 of Idaho law, which says a person is guilty of “disseminating material harmful to minors”

FROM PAGE 8

and study spaces at your Clear Creek County Library.

Book our conference room at Idaho Springs Public Library for a quiet space to meet or work. Please call 303-567-2020 to make your reservation.

Technical assistance

Did you know that you can book a librarian for technical assistance? Our library sta can assist you with a variety of tasks –– using a tablet or smartphone, navigating the internet, setting up an email account, posting a resume online, accessing information, and more. Contact your Clear Creek County Library branch or email heather@cccld.org for more information.

Prints, copies, faxes Email printcccld@gmail.com or call your Clear Creek County Library branch to request prints, copies, and faxes — or, just come in and use our equipment during our hours of operation!

Notary services

Notary services are FREE! Please contact your Clear Creek County Library branch to book your appointment.

when they knowingly loan material with detailed sexual descriptions to underage children. e 24 books she cited were all “young adult” books, and parental consent was already required before they could be checked out.

In a city as big as Nampa, with over 100,000 residents, you’d think one person’s demands would at least require a hearing before action is taken, yet the school board removed all 24 books “forever.” As it turned out, only 23 books were taken o the shelves because one young adult book on the list had never been bought.

ere was no formal review, infuriating some parents who championed free speech and free choice. A month later, they joined students and teachers outside the Nampa school district o ces to protest the bans.

Laura Delaney, who owns Rediscovered Books in nearby Boise, fought back against censorship by giving away 1,500 of the banned books — donated by concerned citizens — to Nampa students and teachers.

“ ese books are written because authors are trying to gure out the world, and having them share their wisdom with people of all generations and backgrounds makes a difference,” Delaney told reporters.

en the Idaho state Legislature jumped on the controversy. Last year, House Republicans passed HB 666 to hold librarians “criminally liable” for distributing material con-

SEE WORTHY, P10

Little Free Libraries

Help yourself to free, gently-loved books from our Little Free Libraries at these Clear Creek County locations:

Idaho Springs: Clear Creek Metropolitan Recreation District

Clear Creek Health and Wellness Center

Edelweiss Pastry Shop

Georgetown: Georgetown Market

Loveland Ski Area: Loveland Valley Base Lodge Loveland Basin Base Lodge

Ptarmigan Roost Cafe

St. Mary’s Glacier: Alice Schoolhouse

Are you seeking a new home for your gently-used books? Please consider donating them to Clear Creek County Library District for use in our programs, book sales, and Little Free Libraries. Email kate@cccld.org or call 303-567-2020 for more information. Please do not drop o book donations without pre-approval.

Idaho Springs Public Library 303-567-2020

John Tomay Memorial Library (Georgetown) 303-569-2620

hello@cccld.org Visit us at www.cccld.org

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

Carlson Elementary School gained a new member of the sta for the spring semester, one with fur and four legs.

Elliott the therapy dog will be joining her handler, Jenny Pyler, every day at school to spend time with students and sta .

Pyler was awarded an Innova-

tions Grant from the school district in September 2022 so she and her faithful companion could take weekly training sessions toward becoming a certi ed therapy dog.

Elliott earned her Canine Good Citizen certi cation and her erapy Dog Certi cation on Jan. 6, 2023.

Students at Carlson listened to an instructional session on how to interact with Elliott, and they learned some of the expectations for how the pup will exist in their elementary space.

Pyler explained in a letter to the parents that precautions are being taken to make sure this is a safe experience for everyone.

She noted that there will be a “dog only” space for Elliott to separate from kids who are allergic or fearful, there will be extra cleaning and vac-

uuming at the school, Elliott will be wiped down with anti-dander wipes to help allergies, and children will be instructed to wash their hands after handling the dog.

Elliott has already settled into her rst few days of school, and Pyler said she’s tting right in at Carlson.

“She’s been awesome and the kids seem to be really excited when they rst come in the door,” she said.

Heather Aberg is a Licensed Clinical Social Worker and the founder of Resilience 1220. She said that therapy animals can make a huge di erence in the lives of children.

“ ey really bring down anxiety, perhaps anxiety kids don’t even realize they feel,” Aberg said.

Aberg went on to explain that a therapy animal, like Elliott, can be a non-judgemental, easy friend to talk

to.

“Dialoguing to an animal is so safe,” she said.

As a professional social worker, she also said there are various physical bene ts she’s seen working with kids and therapy animals, like children sitting with the animal and working to regulate breathing.

For parents looking to continue to support their children’s mental wellness outside of the classroom, Aberg suggested things like mindfulness apps, breathing exercises and using stories to identify emotions and coping mechanisms.

“Let’s take care of our emotional health the same way we take care of our physical health,” she said.

sidered “harmful to minors.”

“I would rather my 6-year-old grandson start smoking cigarettes tomorrow than get a view of this stu at the public library or anywhere else,” said Rep. Bruce Skaug, R-Nampa.

A misdemeanor conviction for disseminating harmful materials includes up to one year in jail and a $1,000 ne. Many librarians found the law terrifying; some quit their jobs or changed careers.

e “Idaho library community has lost some good people due to the con icts centered mostly around book challenges,” state librarian Stephanie Bailey-White told me. ankfully, Idaho’s Senate refused to give the anti-librarian bill a hearing. But lawmakers found another way to punish libraries: ey cut $3.8 million from this scal year’s original $11.5 million budget for the Commission for Libraries.

Idaho’s library budget cuts have now made it harder for libraries to stock new books and expand tele-

health services for seniors and rural residents. Lawmakersalso defunded a statewide e-book program managed by the Idaho Commission for Libraries.

Book banning campaigns aren’t new in America, but last year the American Library Association said that library sta faced an “unprecedented number of attempts to ban books.”

e organization said the books most targeted were those about Black or LGBTQIA people. e Bible was not on anyone’s list.

Crista V. Worthy is a contributor to Writers on the Range,writersontherange.org, an independent nonpro t dedicated to spurring lively conversation about the West. She lives in Idaho.

e rst week of Colorado Community Media’s Long Way Home series focused on what many experts say is a housing crisis across the metro area. In short, housing is increasingly una ordable and inaccessible for Coloradans. Week two of our four-week series turns to how those issues look through the lens of race and younger residents, some whose experience of the American dream is changing..

Reporters Nina Joss and Haley Lena delve into the realities faced by would-be Black homeowners and others who nd skin color can be a factor in achieving their long-term dreams. .

Joss and Lena break down how the system can sometimes work against Black applicants. ey also uncover possible solutions, including an initiative from Realtors to provide training that averts subtle biases in the buying process.

Meanwhile, reporter Ellis Arnold asks a di cult question about metro area suburbs: why are they so White? ere’s no single answer, but some neighborhood covenants from a few decades ago

FROM PAGE 1

make sure everything was available,” said Brian Arnold, who was executive director of the group at the time ve years ago. “After that, we did the application online and sent it in without them being able to see the person.”

Once the application got approved, the team at Aurora Warms the Night would let the real estate agents see the client was Black. Arnold said this process worked almost every time and became the organization’s own way of making a dent in the discrimination that people of color may face, but nd di cult to prove.

Because many of the individuals served by the group were facing homelessness and unemployment, Arnold acknowledged that these factors could have played a role in their initial application rejections. However, when they conducted the blind application process with the same nancial information, the applications were approved. For Arnold, this con rmed race was a barrier.

“ e racism is just so out there,” he said. “It was easy to realize it.”

Arnold’s group did not le any complaints because their main priority was getting their clients housed, and they found a way to do that.

Colorado Community Media reached out to Aurora Warms the Night to see if this is still a strategy but did not get a response.

But once a Black client successfully got on a lease, Arnold said even more challenges ensued if they were looking to someday own a home.

“How do we get them from renting into homeownership?” he said. “ ose barriers seem to be some of the biggest.”

prove, in writing, that race was sometimes a factor in creating our communities.

Accessibility to housing isn’t only an issue of race. It’s an issue of income, as well. Many Coloradans simply can’t a ord to apply for a home, and some of them are rede ning their idea of the American dream as a result. Reporter Christy Steadman digs into this issue. When affordability, accessibility and fairness play a role, families are shifting away from the old dream in which people started a family and bought a home.

When rising home prices and in ation makes that next to impossible for many Coloradans, the American dream may shift from the idea that owning a home is the true measure of success. Still, across generations, many hold out hopes for homeownership.

Statistics, data and experts may have great information on how the market works, but it’s the people living through the crisis who matter the most.

To read all the parts of our Long Way Home series, visit https://coloradocommunitymedia. com/longwayhome/index.html.

For decades, homeownership rates for Black people have lagged far behind those for White people. Census data released last month shows just how wide that gap is. More than seven in 10 White Coloradans and a little more than half of Latino residents own their homes, according to the 2021 ve-year American Community Survey. Only 42% of Black Coloradans own their homes.

Although Latino homebuyers in Colorado face many of the same barriers as Black homebuyers, their rates of homeownership have grown in recent years. For Black Coloradans, on the other hand, the numbers have remained stubbornly low.

ese trends hold across the metro area, with Adams, Je erson, Arapahoe and Douglas counties all showing higher rates of homeownership in White communities than in those of color.

e reasons for this gap are myriad, but over time, Black Coloradans have generally had less opportunity to build home equity and wealth to pass from one generation to the next. ese barriers mean many metro Denver communities lack racial and ethnic diversity. rough training and other measures, many are now trying to reverse this situation and improve access to housing for all.

In 2021, eo E.J. Wilson and his wife started looking to buy a home in Aurora. Wilson is a Black college lecturer and non ction television host.

Like many Coloradans regardless of color, Wilson and his wife did not have enough money for a down payment in today’s expensive housing market, even though they both make a good living. In Arapahoe County, the median sale price of a single-family home increased by $180,000 over the past ve years, according to the Colo-

rado Association of Realtors. In other metro Denver areas, the numbers have skyrocketed even more drastically.

While many White Americans may have bene ted from the e orts of their ancestors, particularly through inheritances, Wilson says many Black people, including him, were denied that possibility. In his eyes, that’s part of why homeownership has been so elusive.

“In what some of my elders have called the ‘illusion of inclusion,’ income is used as a metric to say that things are getting better for Black people,” Wilson said.

But, he pointed out, income is di erent from wealth. For generations, “White America was building wealth, assets and the skill set and personnel to manage that wealth,” he said.

Wilson’s older family members, on the other hand, were not o ered the same opportunities, he said.

Wilson’s grandfather was in the Army Air Forces during World War II, a Tuskegee airman, one of a pioneering group of Black military aviators. When he returned to New York City after the war, he did not receive federally backed home loans like his White counterparts did.

“ ey basically shoveled these White vets from World War II into programs that gave them college money and programs that gave them homes in the suburbs,” Wilson said. “Imagine if my grandpa would have got the property that he would have got had he been White in New York City. How much would that be worth today?”

Many Black veterans faced issues using the programs o ered by the GI Bill. ey often could not access banks for home loans, were excluded from certain neighborhoods and faced segregationist policies. Instead of a home in the suburbs, and despite his service to his country, Wilson’s grandfather wound up in low-income housing. ere, he raised Wilson’s father, who was not able to attend college.

“ e only physical thing that I have from (my grandfather) besides his DNA is a collection of hats … that shouldn’t have been the case,” Wilson said. “I should have more from him than his name, his genes and some hats.”

In that era, federal authorities also made color-coded maps that reected the practice of restricting access to home loans in certain areas, partly based on race. is practice is known as “redlining.” People of color were also excluded from obtaining housing through “racially restrictive covenants,” or text written into property records that was used to prevent people of certain races from purchasing certain homes.

Some exclusionary policies, which have been documented in the Denver area, left a toll that’s evident in communities of color today.

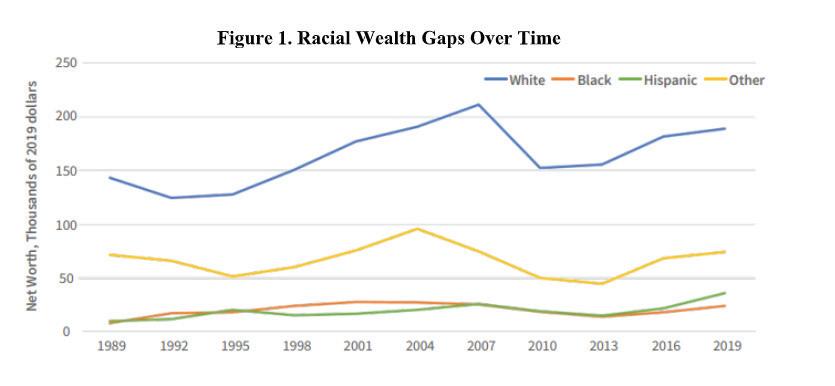

Family wealth is a good measure of that. In 2019, the median White family in the country had about $184,000 in wealth compared to just $38,000 and $23,000 for the median Hispanic and Black families, respectively. at’s according to data from the Federal Reserve Survey of Consumer Finances.

ese numbers speak to the notion of generational wealth. Generational wealth is anything of nancial value that is passed from one generation to another — including money, property, investments, valuable heirlooms or businesses.

“ ink about the wealth that was created during (the ‘40s and ‘50s) that White families have been able to leverage generation after generation, either to send their kids to college, to be able to start a business, to writing a check for their loved ones to be able to have money for (a) down payment in order to buy their own home and continue that generation-

al wealth transfer,” said Aisha Weeks, managing director at the Dear eld Fund for Black Wealth, a Denver area group that emphasizes homeownership. “ at wasn’t available in mass for Black and African American families.”

A family’s primary residence is typically their most valuable asset, according to the National Association of Realtors.

It’s not just the monetary value of a house and property that adds to wealth. ere are tax bene ts for homeowners and people can borrow against a home’s equity to start a business or to help with unexpected bills. Homeownership also provides stable housing, which has been shown to positively impact health and educational achievement. ese factors can, in turn, improve a person’s economic prosperity.

Trying to change the equation

e Dear eld Fund for Black Wealth o ers down-payment assistance loans with no interest and no monthly payments up to $40,000 or 15% of the purchase price for Black homebuyers.

“We acknowledge that there’s a generational wealth gap, and so Dear eld Fund is walking alongside our clients and borrowers to say, ‘We will provide that down-payment assistance,’’’ Weeks said. is program helped Wilson and his wife buy their home in Aurora.

In addition, the fund also o ers advice and education on how to build wealth.

“We know that there are so many pitfalls and just things that, as a community, we have not learned at the dinner table like our counterparts,” Weeks said. “ ere’s a lot of power in the knowledge information transfer that happens within other communities that we need to make sure that families are understanding.”

at issue of being at the proverbial dinner table comes up a lot for communities of color. Without an example to follow, some rst-time homebuyers don’t know where to begin. According to Alma Vigil, a local loan o cer assistant, families who do not own homes often do not pass along information about how to own and maintain a home.

To address this challenge, the Colorado Housing and Finance Authority o ers homebuyer education programs to teach Coloradans nancial skills and the steps to homeownership. ese classes are o ered in English and Spanish in an e ort to remedy language barriers, which can add challenges for potential homebuyers who do not speak English.

“ ere’s very (few) Spanish speaking loan o cers,” said Vigil, who is Hispanic and speaks Spanish herself. “ ere are some that claim to speak Spanish, but they’re not very uent. So it becomes a huge problem, especially with lack of understanding.”

In order to close the gaps, some lenders across the metro Denver area provide services in Spanish. A list of Spanish-speaking lenders can be found on the Colorado Housing and Finance Authority’s website. e issue isn’t just one faced by Hispanic and Latino communities. A report by the National Coalition for Asian Paci c American Community Development found language barriers are also often a challenge for members of the Asian American community when pursuing homeownership. In addition to conversations with lenders, real estate paperwork and documents rarely come in languages other than English.

Over the last couple of years, Brandon Stepter, a community consultant, has been working in Broomeld. In an e ort to bring more people of color into the community, Stepter looks at housing infrastructure, housing practices and community practices.

Stepter and his wife, Gabrielle, both of whom are Black, have been renting in Aurora but have recently been looking to purchase a home.

“We thought we would be pretty solid in that regard and we both make a decent amount of money,” Stepter said. “We thought we would be able to start looking, even in this market, to try and nd an equitable home that ts our budget.”

Stepter, who also works as a healthcare administrator, and his wife, who works for a technology company, said they are trying to gure out how to pay o their student debt so they can get a home loan within the next couple of years.

“I think right now what we’re seeing is a lot of younger African Americans who are in copious amounts of student debt and that has been preventing them from owning a home,” Stepter said.

Debt-to-income ratio is often a signi cant barrier for Black people who are looking to buy a home because that number is assessed when underwriters are deciding whether or not to give a mortgage, according to Jice Johnson, founder of the Black Business Initiative.

e Black Business Initiative is a Denver-based organization that focuses on economic equity in the Black community.

“In America, you are encouraged

to graduate high school and go to college,” Johnson said. “Typically speaking, because you don’t have access, when you go to college you’re not going to pay for college outright. Instead, you’re going to get a student loan … So it increases the debt side of your ratio by a lot, oftentimes preventing you from purchasing a home.”

Black college graduates tend to owe thousands of dollars more in student debt, on average, than their White peers. According to a 2016 report from the Brookings Institution, the amount can exceed $7,000 at the date of graduation.

Black and Hispanic workers also tend to be paid less than their White counterparts, according to many studies on the subject. In 2020, Black workers in Colorado earned 74% and Latino workers in Colorado earned 71% of the hourly earnings of White workers, according to numbers from the 2020 ve-year American Community Survey.

“So you go to school, you get the degree, which is what you’re supposed to do to get the high-paying job,” Johnson said. “Now you come out and you have debt and also your income isn’t as high as it should be. So, your entire debt-to-income ratio doesn’t allow for you to purchase a home.”

In a national statistical analysis of more than 2 million conventional mortgage applications for home purchases, a data-based news publication called e Markup found that lenders were 40% more likely to turn down Latino applicants for loans, 50% more likely to deny Asian/Paci c Islander applicants, 70% more likely to deny Native American applicants and 80% more likely to reject Black applicants compared with similar White applicants.

Even for families of color that may not struggle immediately with wealth and knowledge disparities, discrimination persists in the housing market. People of color are often treated di erently in appraisals, lending practices and neighborhood options.

Stories about what that looks like in the Denver area abound. Johnson of the Black Business Initiative lived in Westminster before moving to Aurora. When she was staging her home to sell, her real estate agent gave her some advice.

“It was encouraged for me to make sure I had no family photos up,” she said.

Meanwhile, she visited homes for sale that had photos of White families.

Johnson said it was good business advice. Her Black Realtor, Delroy Gill, understood the landscape and was looking out for her.

“ at’s my Realtor trying to get me top dollar,” she said. “ e question is, why would (leaving) my photos prevent me from getting top dollar?”

Gill said the practice of taking down photos removes potential hurdles that could occur for his clients.

For Black clients, race is sadly one of those hurdles that could a ect how appraisers, inspectors and potential homebuyers view the home, he said.

“We do know racism is a real thing,” he said. “And it exists in every facet of life. So therefore, when you

In 1967, Black Americans were mired in “the long, hot summer.” Frustrations over poverty, unemployment, discrimination and myriad other issues spilled into the streets, leading to clashes with police and arrests in many places, including Denver. e widespread tensions over race left President Lyndon B. Johnson searching for answers.

So, he issued an executive order for a report that would detail what caused the chaos. He wanted it to answer a crucial question: How can the country prevent more unrest in the future?

When the report arrived seven months later, it laid out hundreds of pages of analysis and recommendations for improving race relations in America.

But its message was best summed up in a sentence:

“To continue present policies is to make permanent the division of our country into two societies: one, largely Negro and poor, located in the central cities: the other, predominantly White and a uent, located in the suburbs and in outlying areas.”

In other words, the issue of where people can live was at the heart of the report. It all ties into the American dream, the idea of a family owning a home, building wealth as that home increases in value over time and being able to live in whatever neighborhood a family can a ord without fear of discrimination.

Yet more than half a century later, that divide between Black and White residents continues to complicate the dream in many parts of America, including the suburban towns and cities that surround Denver. e divide is less stark and less known than it was in 1967, but its legacy is still alive in the metro area, where the Black population tends to live in Denver or Aurora, numbering in the tens of thousands.

Elsewhere, Black residents number in the hundreds or just a few thousand while White residents make up strong majorities. White residents are 78% of the population in Arvada and 1% are Black. White residents are 80% of the population in Littleton and 2% are Black. White residents are 82% of the population in Castle Rock and less than 1% are Black.

So, why do the metro area’s communities look the way they do? e answer isn’t completely clear, but two map experts have delved into local property records, uncovering data that could help start to answer that question.

ey’re trying to discover what many have either forgotten or swept under the rug about parts of the metro area — or simply never knew. ey’re digging in at the neighborhood level, looking for words in property documents — called “ra-

cially restrictive covenants” — that excluded people from housing by race. ey’re looking to discern the legacies that still echo in communities today.

Christopher iry, a map librarian at Colorado School of Mines in Golden, is one of the diggers. Discovering the covenants in Je erson County shocked him.

“ at blew me away that this rural county at the time would have them,” iry said. “As I tell people, ‘Yeah, the suburbs of Birmingham, Alabama, sure. But Je erson County? Come on.’”

‘Only persons of the Caucasian race’ iry, a longtime resident of Golden, took inspiration from the “Mapping Prejudice” project, an effort at the University of Minnesota to identify and map racial covenants.

He jumped into his work after the killing of George Floyd by a Minneapolis police o cer. e mapping is a tedious task of sifting through mostly mundane, uncontroversial rules, like how many feet a house must sit away from the road or bans on billboards in front of homes.

iry has examined about 1,000 Je erson County documents and found nearly 200 had some kind of race-based stipulation. He looked at documents from the 1860s to 1950, though most of them were from the 1910s to 1950.

Speci cally, he has pored over “plats,” or plans for new neighborhoods. e plat for one neighborhood — Cole Village, located along Colfax Avenue near Kipling Street in what’s now Lakewood — had this to say:

“Only persons of the Caucasian race shall use or occupy any building or any lot. is covenant shall not prevent use or occupancy by domes-

tic servants of a di erent race.” e document was registered with the county in 1945. at type of racebased language is now unenforceable but remains on o cial plats, property deeds and other documents, according to iry.

It wasn’t just developers who pushed such language, iry said.

Local elected and appointed ofcials of the government of Je erson County signed the documents, iry added.

He singled out some other examples:

• “Ownership in this subdivision shall be restricted to members of the Caucasian race,” says a planning document for Sunshine Park in Golden at Sunshine and High parkways, dated 1944.

• “Stipulate that no lot at any time shall be occupied or owned by any person or persons not of the Caucasian races. However, this provision shall not prohibit the employment of persons of other races by the occupants,” says the plan for Green Acres along 6th Avenue in what’s now Lakewood, dated 1939.

• “No (area) shall at any time be occupied or owned by any person or persons of other than the Caucasian race, however, this shall not prohibit the employment of persons of other races on the premises by the occupants,” says the plan for Happy Valley Acres in the Golden area at South Golden Road and Orion Street, dated 1939.

• “ e said (land) shall (be) used for no other purpose than for the building and maintaining thereon and the occupancy thereof of private residences by Caucasians, and the erection of necessary outbuildings,” says a planning document for part of the Indian Hills area, dated 1923. iry has used his ndings to

make a map of the parts of Je erson County where race-based rules were baked into the original plans of the housing developments.

Many are concentrated in what are now the Wheat Ridge and Lakewood areas, with a handful dotting the Golden and Arvada region. Others sit in the Evergreen and Indian Hills areas.

It’s not yet a complete picture.

iry is wary that he may have missed pieces. ough the map is a work in progress, it already has him wondering how the covenants still in uence lives today.

Beyond that, what can be done to right past wrongs.

His work has made one measurable impact. It has inspired the work of another mapper, Craig Haggit, a map librarian at Denver Public Library.

Haggit, who is looking into where racist restrictions lurked in the paperwork for housing in Denver, also wants to shed light on “the way forward” for communities.

“I feel like we can’t know where we’re going until we know where we’ve been and how we got there,” Haggit said. “Otherwise, you’re just (in) the dark.”

It could take years to look through all the documents. But so far, Haggit’s work has revealed racial restrictions in Denver that targeted people in “a mix” of ways.

“Sometimes, it’s excluding ‘Negro’ or ‘Asian’ or ‘Mongoloid’ or whatever terms they used. And sometimes it just says only White people” can live in a certain house, Haggit said.

His team at rst zeroed in on the 1930s because the Ku Klux Klan was so active in the 1920s in the metro area. Since he’s in the early stages of the research, Haggit is unsure which neighborhoods were home to large concentrations of racially restricted housing.

One clue could be redlining, a term that refers to marking areas red on color-coded federal maps in the 1930s, re ecting the practice of restricting access to home loans in certain areas, partly based on race. at disparity stood in the way of homeownership for majority-Black areas and other groups in urban cities.

ough he doesn’t know yet, Haggit expects that the neighborhoods that were not redlined — the ones deemed higher class — would have the restrictive deeds because they were trying to keep certain people out.

In Denver, redlining zeroed in on predominantly Black neighborhoods, but it also covered neighborhoods where other ethnic or religious groups were present, according to the Denver redline map as displayed by the “Mapping Inequality” project from the University of Richmond and other university teams.

Denver’s redlined areas at the time included some western parts of the city and areas that surrounded downtown. But the map also redlined a small part of Aurora along Colfax Avenue — and parts of west and central Englewood. (A sliver of Je erson County in the Edgewater

Amber Carlson is a Colorado native. She loves the Denver area for all its amenities — from outdoor recreation to the arts-and-culture scene. But with so many other people moving to the region because they also love those things, Carlson would consider moving away.

“I don’t blame people for wanting to live here,” she said. “It’s got a lot going on.”

Carlson doesn’t want to uproot from Colorado, but if she did, it would be because of the region’s skyrocketing cost of living.

“It’s di cult when you’ve lived here your whole life and it has become hard to stay,” she said.

Carlson is in her 30s. She went to Denver’s George Washington High School and is currently in graduate school at the University of ColoradoBoulder. She lives with her partner in a house in Wheat Ridge that he owns, a situation she feels fortunate to have. Otherwise, Carlson said, she is not sure if she would be able to a ord a rental on her own.

Her experience leaves her with questions about the idea of the American dream — owning a home. It is, for many, a dream of a singlefamily home on a private plot of land in the suburbs, maybe with a picket fence and tire swing hanging from a lofty tree.

But younger people are changing their perceptions about what the American dream should be. Driving that change is the increasingly una ordable nature of housing, according to a few surveys, including one by Bankrate last year. It found that two-thirds of respondents cite a ordability as a major hurdle to homeownership. eir pinch points included everything from salaries that didn’t keep up to a lack of ability to save for down payments to high mortgage rates.

‘The American dream has decreased in relevance’

James Truslow Adams, a writer and historian, is credited with coining the term “the American dream” in 1931 — early in the Great Depression — in his book, “ e Epic of America.”

“ e American Dream is that dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement,” Adams wrote. “It is not a dream of motor cars and high wages merely, but a dream of social order in which each man and each woman shall be able to attain to the fullest stature of which they are innately capable, and be recognized by others for what they are, regardless of the fortuitous circumstances of birth or position.”

Carlson re ects on all of that. She said that people began to conceptualize how to get their American dream — go to college, get a good job and buy a home — in the postWorld War II era.

“ ere was this idea that you could have all of this,” Carlson said.

More Americans these days, she said, are de ning success on their own terms. More folks might see homeownership as a relic, even something that holds them back in life, rather than necessary for all of their needs and desires.

“Buying a home is probably something that some people want,” Carlson said. “But I don’t think everybody wants or needs to buy a home.”

Others are holding onto the old idea. Bankrate found that homeownership remains a persistent part of the American dream. Homeownership is the “most-mentioned milestone” for Americans 26 and older, but younger Americans see it as less important. Gen Z, aged 18-25, doesn’t rank it as the top accomplishment like older Americans tend to.

Gen Z member Caitlyn Aldersea, a student at the University of Denver, is representative of the changing attitude.

She remembers as a young child how the Great Recession that began in 2007 a ected her family.

“ e American dream today is much di erent than how my parents thought of it,” Aldersea said. “Today, it’s more based on what can be accomplished. It’s not shooting for the stars anymore.”

Aldersea’s personal de nition of the American dream includes a ful lling career, opportunities to be part of a community that one is able to give back to and the freedom to pursue personal interests. She believes housing should be attainable for everyone, but doesn’t think it de nes success or happiness.

Aldersea doesn’t envision ever becoming a homeowner. One reason is that she wants to be able to relocate as she pursues her career goals. Another is that she wants to travel and pay o student loans.

“I don’t think my wage or salary will ever help me a ord a house or mortgage,” Aldersea said. “A house would not be the only thing I’d have to focus on nancially.”

Time will tell whether homeownership will eventually become more important to younger Americans. According to Bankrate, the pull to own a home remains strong. Fiftynine percent of Gen Z members want to own a home as a life goal, second only to having a successful career (60%).

For other generations, homeownership remains the top life goal and the likelihood of that increases with age. Eighty-seven percent of older adults, aged 68 and up, cite homeownership as integral to the American dream.

e advice Gill gave Johnson was not unique. Paige Omohundro, business development manager at the Colorado Housing and Finance Authority said her team heard similar stories in recent focus groups with real estate agents, nonpro ts, lenders, housing advocates and people trying to achieve homeownership in Black and African American communities. She said these stories were shared by members of Hispanic and Latino communities as well.

Gill said that because of his precautions, discrimination rarely impacts his clients’ sales. One time, however, the preparation was not enough.

A couple of years ago, Gill was working with an interracial couple to sell their home in Parker. When the appraiser arrived, the Black husband was leaving the property.

“I own investment properties in the area, so I know the area very well,” Gill said. “And I used to live in the neighborhood. So the value that we gave to the house was very appropriate — and the appraisal came in $100,000 less (than our value).”

According to Gill, the buyers, who were White, decided to pay the extra $100,000 out of pocket because they knew the original asking price was fair.

“ e agent and the buyers thought that the price was reasonable and that the appraiser made a big mistake,” Gill said. “We tried to dispute the appraisal and failed. He said he’s not going to change it.”

Gill said the homebuyers noted that the low appraisal was probably due to racial discrimination.

According to a 2021 study by Freddie Mac, a government-sponsored mortgage-buying company, this experience was not rare. Black and Latino mortgage applicants get lower appraisal values than the contract price more often than White applicants, according to the study.

e study found that, based on over 12 million appraisals from Jan. 1, 2016 to Dec. 31, 2020, 8.6% of Black applicants receive an appraisal value lower than contract price, compared to 6.5% of White applicants. In the study, Freddie Mac said it would be valuable to conduct further research to understand why this gap exists.

In a report by the National Fair Housing Alliance, however, personal stories like that of Gill’s clients make the case that the appraisal gap comes from racial or ethnic discrimination.

One of these stories, originally reported by the Washington Post, was about a mixed-race couple in Denver. An appraiser greeted by the White wife valued the house at $550,000, whereas one greeted by the Black husband valued it at $405,000. e lower value appraisal report explicitly compared the home to others in a nearby predominantly Black neighborhood, even though that’s not where the house was located.

Since 1968, housing discrimination based on race has been illegal under the Fair Housing Act. Nine years before that federal law was signed, Colorado was the rst state to pass its own fair housing laws, according to the Colorado Housing and Finance Authority.

Although it is illegal, discrimination in housing based on race or color still happens, according to the Department of Justice. e department has led cases related to lending discrimination, including a 2012 Wells Fargo case in which the bank was forced to pay a settlement for its pattern of discrimination against quali ed Black and African American and Hispanic and Latino borrowers.

ere are e orts to change the process. According to the Urban Institute, a nonpro t research organization, 89% of all property appraisers and assessors are White while only 2 percent are Black and 5 percent are Hispanic. Addressing the lack of diversity in the profession could improve outcomes for Black and Hispanic communities, the organization said.

e Appraiser Diversity Initiative, a program led by mortgage-buying companies Fannie Mae and Freddie Mac and civil rights organization the National Urban League, is teaching new potential appraisers with a diversity of identities in an e ort to close this gap.

Approaching inclusion in real estate from a wider perspective, a program through the Urban Land Institute Colorado works to train women and people of color in development. is program, called the Real Estate Diversity Initiative,

aims to create urban landscapes that serve diverse communities.

“I think trust in community-building is key,” Executive Director Rodney Milton said. “When developers build projects, they need community support because they’re shaping the community. And who better to be equipped to strengthen a community, to build it out, to revitalize it, then the folks who are from that community?”

Welcome to Fairhaven

Housing is a source of discrimination complaints. e Colorado Civil Rights Commission Annual report found that 14% of complaints were claims about housing issues.

Chantal Sundberg, a Black Realtor who works in the metro Denver area, said she has not witnessed or experienced discrimination in her work with her clients, most of whom are Black.

“Everyone is treated equal, whether it’s borrowing or buying homes,” she said.

Sundberg witnessed the 1994 Rwandan genocide, when hundreds of thousands of members of a minority ethnic group called the Tutsi were murdered by members of the Hutu ethnic majority. In her eyes, although it might be important to talk about topics of racial discrimination, focusing on them too much can have unintended consequences.

“When we emphasize them so much, it creates more division rather than unity,” she said.

Still, discrimination is an ongoing concern for the National Association of Realtors and Brokers. Sundberg

FROM

said Realtors are trained to address discrimination issues.

And to Gill, the Realtor who helped Johnson sell her home, the association’s training is not enough to help all real estate agents.

“Race is a part of it, but it’s not the in-depth, you know, ‘how to understand if you’re being a racist or not,’” he said.

To address such concerns, the association released an immersive online simulation in 2020 that aims to train agents to recognize and avoid acting on their own biases.

e program is part of the association’s Fair Housing Act Plan, which leaders created to emphasize accountability and culture change. e training is meant to make housing more accessible and a ordable to people of color.

A White Colorado Community Media reporter went through the online simulation, which takes place in a ctional town called Fairhaven. e simulation puts a person in the shoes of potential homebuyers who are experiencing discrimination.

One scenario is based on a federal court case, Clinton-Brown v. Hardick. In 2020, Todd Brown and Ebony Clinton-Brown led a suit against

Helene L. and John Hardick alleging violations of the Fair Housing Act and Rhode Island law.

e case claims the Hardicks noticed Clinton-Brown’s rst name and asked their real estate agent if Ebony was Black. When they learned she was, the Hardicks refused to sell their property and the agent withdrew the listing upon the Hardicks’ request, ceasing communication.

roughout the simulation, agents attempt to theoretically sell four homes within six months while coming across day-to-day happenings including the views of colleagues and encounter issues like language

barriers. e simulator provides for moments of re ection in the sales process. At the end of the training, agents are given feedback.

According to Alexia Smokler of the National Association of Realtors, the organization decided to pursue the simulator after a Newsday investigation revealed alleged housing discrimination on Long Island, New York.

“We wanted to show how discrimination plays out in real life scenarios and so we drew on real fair housing cases and frequently asked questions from our members to create these simulated scenarios so they

could see how discrimination looks,” Smokler said.

Scenarios in the simulation are based on true stories. ey include testimonials to show discrimination from the perspective of race, disability and LGBTQ+ identities.

“We’ve had people tell us watching these videos — they’re very emotional videos — that they are in tears, that they’re angry, that they’re going to stand up for their clients and also we’ve had folks say ‘I wasn’t aware of these sorts of things are going on’ and ‘this has really opened my eyes,’” Smokler said.

Brian Arnold, who used to work with clients at Aurora Warms the Night, said training like Fairhaven could help combat discrimination. But he noted that since the Fairhaven simulation is not a mandatory step in real estate agent licensing, it is challenging to ensure people who need the training actually do it.

“For your … real estate agents that are doing well, that are maybe using discriminatory practices, how are you going to get those people to use it?” Arnold said. “Unless it’s a mandatory (program) ... then it’s just a nice program that’s out there that could help.”

Ellis Arnold contributed to this story.

7.

8.

98.8% of their DNA? 10. MOVIES: Which movie features the famous line, “I see dead people”?

Answers 1. e Rembrandts (“I’ll Be ere for You”). 2. e hyoid bone. 3. Prince Edward Island. 4. Ted Danson. 5. Rome, Italy. 6. 108 minutes. 7. Subway Restaurants. 8. Light. 9. Chimpanzee. 10. “ e Sixth Sense” (1999). (c) 2023 King Features Synd., Inc.

* Toothpaste works well as a silver polish. Wet your silver, plop a little non-gel toothpaste on it and rub gently to clean. Rinse well and let it shine.

* A great hint from Mary R. of Duluth, Georgia: If the kids are drawing with felt markers and their hands get covered with ink, don’t worry. Just spray their hands down with hairspray, then wipe o the ink with a paper towel. Don’t forget to wash their hands afterward!

* Dip your toothbrush in baking soda before you add toothpaste when brushing your teeth. You get used to the taste, but the extra scrub really gets your teeth clean, and it’s very inexpensive to use. -- R.E. in Arizona

* Have clumped-up sugar in the canister? No worries. To keep sugar from hardening, add a slice of bread to

the container from time to time, and leave it there a day before removing.

* Use this quick x for oily hair. Rub a small amount of cornstarch into the oily areas of your hair. e cornstarch will soak up the dirt and oil; you just brush it out.

* A reader from Michigan wonders: How can I keep from having static head, especially when using a hat? e answer: You probably already have a tube of lip balm in your pocket or purse. Rub some on your palms, then run your palms over your hair. Send your tips to Now Here’s a Tip, 628 Virginia Drive, Orlando, FL 32803.

(c) 2023 King Features Synd., Inc.

Become a published author. We want to read your book! Dorrance Publishing trusted since 1920. Consultation, production, promotion & distribution. Call for free author`s guide 1-877-729-4998 or visit dorranceinfo.com/ads

Safe Step. North America’s #1 Walk-in tub. Comprehensive lifetime warranty. Top-of-the-line installation and service.

Now featuring our free shower package & $1600 off - limited time! Financing available. 1-855-4171306

BATH & SHOWER UPDATES in as little as ONE DAY! Affordable prices - No payments for 18 months!

Lifetime warranty & professional installs. Senior & Military Discounts available. Call: 855-761-1725

The Generac PWRcell solar plus battery storage system. Save money, reduce reliance on grid, prepare for outages & power your home. Full installation services. $0 down financing option. Request free no obligation quote. 1-877-539-0299

Caring for an aging loved one? Wondering about options like seniorliving communities and in-home care? Caring.com’s Family Advisors help take the guesswork out of senior care for your family. Free, noobligation consult: 1-855-759-1407

Free high speed internet if qualified. Govt. pgm for recipients of select pgms incl. Medicaid, SNAP, Housing Assistance, WIC, Veterans Pension, Survivor Benefits, Lifeline, Tribal. 15 GB internet. Android tablet free w/one-time $20 copay. Free shipping. Call Maxsip Telecom! 1-833-758-3892

Eliminate gutter cleaning forever! LeafFilter, the most advanced debrisblocking gutter protection. Schedule free LeafFilter estimate today. 20% off Entire Purchase. 10% Senior & Military Discounts. Call 1-833-6101936

DRIVER

Class B CDL propane delivery truck driver for Spring Valley Gas, Elizabeth.

P/T & F/T positions; responsible for propane delivery and customer service.