Clear Creek Schools Foundation grant helps teens start skate wear brand

Two Clear Creek High Schoolers are starting their own company with the help of a grant from CCSF

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

Skateboarding fashion has evolved over the years, and two local teens are working to make popular styles accessible to skaters of all income levels with help from a grant from Clear Creek Schools Foundation.

Colorado begins Mount Evans renaming process

The mountain, named after a man who contributed to the genocide of indigenous people, is getting a new name

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

The Colorado Geographic Naming Advisory Board has begun the decision-making process of changing the name of Mount Evans.

The board met on Oct. 11 for the first meeting regarding the name change of the mountain. Indigenous community members and tribal representatives gave presentations at the meeting to inform the board and the public about the significance of changing the name.

Mount Evans was named after Colorado Territorial Governor John Evans, who set the framework in 1864 to start the Sand Creek Massacre, which killed hundreds of Indigenous people who were living on “safe” land.

Dr. Andy Masich, a historian with the Heinz History Center present at the meeting, explained the harrowing details of the massacre.

“This was genocide in its most complete sense,” he said.

Tribal representatives and descendants from the Sand Creek Massacre

Voted Best Realtor Clear Creek County Josh Spinner - Broker, Owner Local Expert since 1999 303.567.1010 Cell: 303.825.2626 Zillow Premiere Agent Realtor.com Agent joshuaspinner@gmail.com 5 Acre Mtn. Retreat 13 Acres, Great Views Lux Church Loft 3 bed $350k Mtn Retreat w/VIEWS SOLDSOLD Home w/rentals WWW CLEARCREEKCOURANT COM 75 CENTSWEEKOF OCTOBER 20, 2022Serving Clear Creek County since 1973 INSIDE INSIDE Subscribe. All local, all the time. $40/year. Discounts available. Coffee with your paper PAGE 4 Visit www .clearcreek courant.com for breaking news and updates. Follow us on Facebook Visit www.facebook.com/pages/ Clear-Creek-Courant/171267532910583 VOLUME 51 ISSUE 20

Braden

Combrick (left) and William Lewis

(right)

recently got a check for their Innovation Grant project. The business partners enjoy skateboarding

together.

PHOTOS

PROVIDED BY

WILLIAM LEWIS

SEE GRANT, P2 SEE RENAMING, P6

This is the first year for the CCSF Innovation Grants. CCSF awarded more than $12,000 to teachers and students throughout the school districts to support projects that foster engaging and community connected experiences for students.

According to CCSF, “Educator grants support the development of the Clear Creek Learner Profile skills: leadership, collaboration, communication, critical thinking, adaptability, and character…. Student grants support ideas and passions and the development of Learner Profile skills.”

Laura Johnson with CCSF was excited to see applications for the inaugural year of the Innovation Grants program.

“We received applications that would affect kids of all ages,” she said.

Nine projects throughout Clear Creek School District ultimately received grant money. The projects involve teacher, student and district projects, with project ideas like flexible furniture seating for classrooms and a therapy dog for schools.

Johnson hopes that the program will help students gain the skills necessary to become valuable members of the Clear Creek community upon graduation.

“(The grant is) giving kids more choices and freedom to learn the things they’re interested in, and giving educators the ability to provide,” she said.

William Lewis, senior, and Braden Combrink, junior, of Clear Creek High School were recipients of this year’s grant. The two are working to launch their skateboarding brand, Urban Skate Co.

Lewis explained the concept of the brand is to make skate wear available to everyone. He hopes that some of the potential profit can go toward the skate park in Idaho Springs.

“(It’s) cheaper clothing that is new and that our community can afford. And hopefully, some of that money can go toward the skate park,” Lewis said.

Lewis remembers his 5th birthday when his dad took him to get his first skateboard. He’s been hooked ever since.

Combrink has fond memories of starting the sport young as well.

“I started skating when I was maybe 10. It’s really cool because of the community and all the styles,” he said.

Right now, skate fashion is all about baggy clothes and name brands. Brands like Supreme, Thrasher and Vans are wardrobe

Lewis and Combrick (pictured) plan to create their own designs for their skate wear line.

staples for skaters. Lewis and Combrink want to join the skate wear ensemble, but at a more affordable price, and even create decks and other skate essentials later on.

Currently, the duo is working on learning about entrepreneurship, finding mentors in the community and creating a roadmap for the brand. They hope to start selling products in Summer 2023.

The young business partners are planning to do everything themselves at the beginning, so they can learn about production, screen printing etc. That’s where the grant money comes in.

“A big chunk of the grant money is going toward materials, our own screen printing machine,” Lewis said.

To follow along with the progress of Urban Skate Co., check out its Instagram @urbanskate_co.

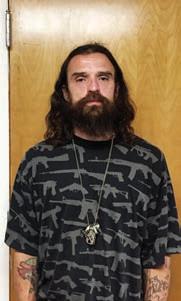

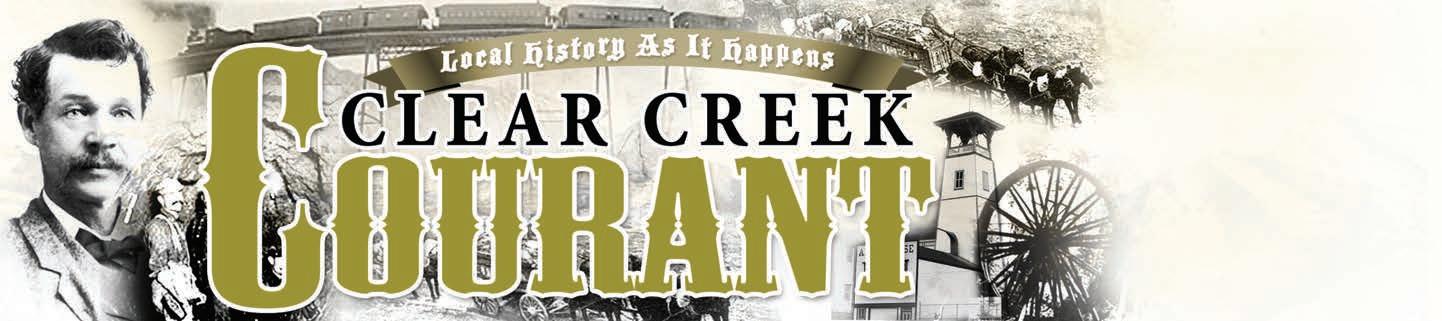

Idaho Springs Police Department seeks help in locating suspect possessing child pornography

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

Idaho Springs Police Department is seeking a suspect wanted for possession of child pornography.

Dominick Refer, a 42-year-old Idaho Springs resident, is considered a suspect after ISPD responded to a call on Sept. 28 that Refer printed child pornography from a library computer at the Idaho Springs Public Library.

ISPD and the Clear Creek County Sheriff’s Department served multiple search warrants on Oct. 6, and searched locations where Refer was known to live and frequent. The searches turned up dozens of images of child pornography at multiple

Dominick Refer

locations, according to an ISPD press release.

Refer was not located by law enforcement at the time the warrants were served, the press release stated. Clear Creek County Courts have issued a signed warrant for Refer’s arrest. Refer currently has a felony warrant for

were served, the

Sexual Exploitation of a Child, according to the press release.

ISPD is seeking assistance from the public in locating Refer, and asks the public to call 911 if he is seen.

October 20, 20222 Clear Creek Courant

Obituaries Have Moved to Page 9 To Place an Obituary Notice Please Visit www.ClearCreekCourant.com 303-566-4100 obituaries@coloradocommunitymedia.com

FROM PAGE 1 GRANT

PHOTO PROVIDED BY WILLIAM

LEWIS

Weather Observations for Georgetown, Colorado

Week of October 10, 2022

Weather Observations for Georgetown, Colorado

Week of October 10, 2022

A local National Weather Service volunteer observer makes temperature and precipitation observations each day at about 8 a.m. at the Georgetown Weather Station. Wind observations are made at Georgetown Lake. “Max” and “Min” temperatures are from digital displays of a “MMTS” (“Maximum/Minimum Temperature System”); “Mean daily” temperature is the calculated average of the max and min. “Total Precipitation” is inches of rainfall plus melted snow. “Snowfall” is inches of snow that accumulated during the preceding 24 hours. T = Trace of precipitation. NR = Not Reported. “Peak wind gust at Georgetown Lake” is the velocity in miles per hour and the time of the maximum wind gust that occurred during the calendar day preceding the date of observation. Historic data are based on the period of record for which statistical data have been compiled (about 53 years within the period 1893-2021). Any weather records noted are based on a comparison of the observed value with the historical data set.

A local National Weather Service volunteer observer makes temperature and precipitation observations each day at about 8 a.m. at the Georgetown Weather Station. Wind observations are made at Georgetown Lake. “Max” and “Min” temperatures are from digital displays of a “MMTS” (“Maximum/Minimum Temperature System”); “Mean daily” temperature is the calculated average of the max and min. “Total Precipitation” is inches of rainfall plus melted snow. “Snowfall” is inches of snow that accumulated during the preceding 24 hours. T = Trace of precipitation. NR = Not Reported. “Peak wind gust at Georgetown Lake” is the velocity in miles per hour and the time of the maximum wind gust that occurred during the calendar day preceding the date of observation. Historic data are based on the period of record for which statistical data have been compiled (about 53 years within the period 1893 2021). Any weather records noted are based on a comparison of the observed value with the historical data set.

Day and date of observation (2022)

Monday, 10/10

Tuesday, 10/11

Wednesday, 10/12

Thursday, 10/13

Friday, 10/14

Saturday, 10/15

Sunday, 10/16

Week’s avg max, min, mean daily T; sum of TP, SF

Temperature (T) (degrees F)

Precipitation (P) (inches)

Peak wind gust at Georgetown Lake Max Min Mean daily Total (TP) Snowfall (SF) Velocity (mph) Time (24 hr)

During the 24 hours prior to 8 a.m.

47.5

50.0

47.5

During the previous calendar day

Historic week’s avg max, min, mean daily T; avg sum of TP, SF 59.732.446.10.251.6

Clear Creek Courant 3October 20, 2022 26731 Main Street • Conifer Drive A Little...Save A Lot! WOOD • GAS • PELLET / FIREPLACES • STOVES • INSERTS • LINEARS / GRILLS • FIREPITSMILITARY & EMS DISCOUNTS • RETIRED VETERAN-OWNED CALL US FOR A FREE QUOTE! 303-838-3612 inglenookfireplaces.com PREMI E R D EALER WE SELL & SERVICE THE HIGHEST Q U A L I T Y PRODUCTS C O L O R A D O S O N LY * 26% of total purchase and installation charges of select biomass-burning models quali es for federal tax credit.26%* FEDERAL TAX CREDIT $ave ON PURCHASE & INSTALLATION! % Financing Please ask for details. FOR 12 MONTHS $ave $15000 $ave $10000 $ave $10000 $ave $10000 $ave $10000 $ave $10000 $ave $10000 $ave $15000 Classic Bay 1200 Pellet Stove up to 2,700 sq ft P35i Pellet Stove Insert up to 2,100 sq ft Discovery II Wood Stove up to 2,600 sq ft Out tter II Pellet Stove up to 2,300 sq ft Castile Pellet Stove up to 1,800 sq ft Radiance Gas Stove up to 2,500 sq ft QFI 30 FB Gas Insert up to 2,500 sq ft Excursion III Gas Insert up to 2,500 sq ft WHILE SUPPLIES LAST ON NOW $ AVE TODAY! Oct. 14-Nov. 7Inventory Sale TrickTreat!or PaidforbyDylanRobertsforColorado.RegisteredAgent:DylanRoberts. StandsUpForSmallBusinesses AffordableHealthcareandHousing SaferCommunities ProtectsOurWater&Environment LearnMoreatdylanroberts.org

62 33

0.00 0.0 NR N

62 38

0.00 0.0 21 2330

61 34

T 0.0 37 1130

61 38 49.5 0.04 0.0 31 1950

60 33 46.5 0.00 0.0 19 0400

63 32 47.5 0.00 0.0 19 1600

64 31 47.5 0.00 0.0 17 1245

61.934.148.00.040.0

Co ee with your paper: The Frothy Cup

The Frothy Cup in Idaho Springs is a decades-old shop welcoming locals and travelers

BY OLIVIA JEWELL LOVE OLOVE@COLORADOCOMMUNITYMEDIA.COM

When you walk into the Frothy Cup in Idaho Springs, you’ll likely be greeted by a table of locals, a wall of compliments and a smiling barista ready to help kickstart your day.

The Frothy Cup in Idaho Springs

Mount Evans means hope

sees a mix of travelers passing through town, as well as locals enjoying their daily cup of joe. With fresh coffee roasted in-house and pastries baked fresh daily, the shop is a favorite for slowing down or taking a cup to go.

Amanda Moeller and her fiance have owned the Frothy Cup for one year as of Oct. 20. Moeller said the

mix of customers is a big part of the shop’s charm.

“We meet people from all over,” she said. “It’s also our sleepy little mountain town.”

Mornings at the Frothy Cup usually consist of the round table full of locals, armed with their own coffee

COFFEE, P5

October 20, 20224 Clear Creek Courant IN THE HANGARIN THE HANGAR SATURDAY, OCTOBER 22ND 10:00 AM – 2:00 PM Have a Spooky Good Time at Wings Over the Rockies! WingsMuseum.org/Hauntings Wings Over the Rockies Air & Space Museum 7711 East Academy Blvd, Denver, CO 80230 When you’re living with a chronic or progressive illness, Mount Evans will be there to help you manage your symptoms and stress. 303-674-6400 MountEvans.org

The pastry case is full of mu ns, cookies, danishes and other sweet treats made in house. PHOTOS BY OLIVIA JEWELL LOVE The walls of “love notes” are full of positive messages all around the store.

SEE

COFFEE

FROM PAGE 4

cups that hang on the wall waiting for them.

The shop has an aesthetic Moeller likens to “grandma’s house.” An old piano, topiaries and fabric-lined tables can make anyone feel nostalgic. The mountain rustic design aims

to pay homage to Idaho Springs, Moeller explained.

The Frothy Cup roasts all its beans in-house. When packaging the beans, the roaster lists their name and what music they are listening to, just to add a more personal touch when you pick up a bag.

The shop utilizes a roasting machine they’ve lovingly dubbed, “the snowflake,” because it’s one of a kind. The machine was built by the

Diedrich brothers, in their garage, and has been in the backroom for decades.

With coffee at the forefront of the menu, the shop has a wall full of unique espresso drinks to try, as well as options to craft your own creation. People come from all over for blueberry muffins, cookies and other pastries made with love on the daily.

The walls of the Frothy Cup are

lined with “love notes” singing praises of the shop and sharing good news, uplifting quotes and fun doodles. Moeller says these pops of happiness create the friendly environment she hopes customers see when they walk in.

Moeller advises taking a gander at the wall “if you ever need a little sunshine in your day.”

Estate Planning Awareness Month

October is upon us! Which means pumpkin spice lattes, apple cider, skeletons, ghosts, and Estate Planning! That’s right, its Estate Planning Awareness Month. Each year during the month of October we remind our community how important it is to ensure that your Estate Planning Goals are met.

One of the most common things amongst all client worries is centered around Probate. So, what is Probate?

Probate is the judicial process in which your Will is “proven” in court, and the court gives its stamp of approval. These are known as the Letters Testamentary. Probate typically occurs in the County of the State in which you reside. The Executor is the person that is then appointed by your Will to wrap or up administer the Will. This sounds well and good, but Probate can be a disaster for many. Below are a few things to remember.

1) To start off, a Probate in the State of Colorado must be open for a minimum of 6 months and a maximum of 36 months.

2) Creditors to the Estate must be notified of someone’s passing.

3) Everything in the decedent’s name at the time of their death must go through probate.

4) Only the elected or appointed Personal Representative/Fiduciary has the legal authority to begin administering the Estate.

These things can be extremely difficult to remember, and even more difficult for your fiduciary to handle. Not only is the fiduciary dealing with the stress of the court, but they are likely grieving from the loss of a loved one as well.

Contact the Davis Schilken, PC team to learn more about what you can do to ensure that your estate plan is set up to help avoid the probate process and that all your wishes are being carried out the way that you would like them to be (303)670-9855. We offer no obligation in person or virtual meetings. We make estate planning simple!

Visit our comprehensive website for more tools www.dslawcolorado.com

Clear Creek Courant 5October 20, 2022 Take advantage of one-to-one help at an Enrollment Center. Licensed sales agents are available to answer your questions in person. Stop by any time during the times listed. Annual Open Enrollment starts Oct. 15th and ends Dec. 7th It’s time to take advantage. Call today to schedule an appointment or visit us at your local Evergreen Enrollment Center in Evergreen 27945 Meadow Drive Evergreen, CO 303-880-7473 Ed Regalado Licensed Sales Agent 303 674-1945, TTY 771 edregalado46@gmail.com United Healthcare For accommodation of persons with special needs at meetings, call 303-674-1945, TTY 711. Events will follow applicable public health safety guidelines. Plans are insured through United Healthcare Insurance Company or one of its affiliated companies, an Medicare Advantage organization with a Medicare contract. Enrollment in the plan depends on the plan’s contract renewal with Medicare. © 2021 UnitedHealthcare Services, Inc. All rights reserved. Y0066_22SPRJ55537_C 22SPRJ55537 004F885B

Davis Schilken, PC – Let our deep experience meet your heartfelt goals!

The baristas quickly whip up all types of espresso drinks.

PHOTO BY OLIVIA JEWELL LOVE

RENAMING

FROM PAGE 1

told accounts of the massacre that claimed the lives of over 230 men, women and children. One participant, Otto Braided Hair Jr., was only able to be present for the meeting because his great-grandmother escaped the massacre on horseback. This first meeting of the Naming Advisory Board was not open to public comment, but supporters sounded off in the comments with messages of support for a name change. The next meeting of the board will be on Nov. 17, where board members will hear proposals for several different names.

October 20, 20226 Clear Creek Courant

Mount Evans, seen here in December 2020 from Fire Tower Trail along Highway 103, was named for John Evans, Colorado’s second territorial governor. Evans is believed to have authorized the Sand Creek Massacre.

FILE PHOTO BY CORINNE WESTEMAN

75 foothills Girl Scouts participate in their own Cupcake Wars

BY DEB HURLEY BROBST DBROBST@COLORADOCOMMUNITYMEDIA.COM

BY DEB HURLEY BROBST DBROBST@COLORADOCOMMUNITYMEDIA.COM

More than 1,000 cupcakes graced The Lodge at Ascent Church on Oct. 14 as Girl Scouts from 10 troops participated in the first Cupcake Wars.

Based loosely on the baking competition show, the event brought together more than 75 Scouts from all over the foothills. Each girl brought 13 cupcakes — one for judging and 12 to swap with other Scouts.

Guest judges tested each cupcake for presentation, creativity and taste, and they agreed they had their work cut out for them to pick one winner in each of four divisions: Daisies, Brownies, Juniors and the combined Cadettes, Seniors and Ambassadors.

While the judges worked hard, the Scouts made a craft and played a trivia game while waiting for the results.

It was obvious the Scouts put a lot of work into their cupcakes and decorations. Some judges were delighted to find surprises in the cupcakes — one even had a thin mint cookie hiding inside — and changed creativity scores to reflect the extra something.

Many cupcakes were decorated for Halloween, with candy corn, decorated ghosts, witches and more.

Many were splashed with bright colors. They definitely were creative.

of Murphy’s Mountain Grill, the Muddy Buck and more, explained that she and judge Audrey VanWestrienen were judging the presentation and creativity of the cupcakes created by the Brownies before diving in for the taste test.

they were trying to create,” Packer said.

Briar Oesterle, 8, a member of Troop 1104 at Parmalee Elementary School, made her cupcakes from scratch with only mom Lauren helping by putting the cupcakes in the oven.

“This is our first Girl Scout event,” Lauren said. “I would never have encouraged (Briar) to bake if not for this event.”

Briar explained that she combined chocolate and fun-fetti cake flavors and used marshmallow fluff for the frosting. She decorated with candy corn, marshmallows and Twix candies.

Fifth grader Bitsy Altrich with Troop 67430 created witches as decorations for her cupcakes. She called it a long process to decorate the cupcakes, especially finding choco-

Holiday Treasures

Clear Creek Courant 7October 20, 2022 FDI-1867K-A © 2022 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED. > edwardjones.com | Member SIPC Call or visit your local financial advisor today. Compare our CD Rates Bank-issued, FDIC-insured Minimum deposit % APY* Minimum deposit % APY* Minimum deposit % APY* * Annual Percentage Yield (APY) effective 10/12/2022. CDs offered by Edward Jones are bank-issued and FDIC-insured up to $250,000 (principal and interest accrued but not yet paid) per depositor, per insured depository institution, for each account ownership category. Please visit www.fdic.gov or contact your financial advisor for additional information. Subject to availability and price change. CD values are subject to interest rate risk such that when interest rates rise, the prices of CDs can decrease. If CDs are sold prior to maturity, the investor can lose principal value. FDIC insurance does not cover losses in market value. Early withdrawal may not be permitted. Yields quoted are net of all commissions. CDs require the distribution of interest and do not allow interest to compound. CDs offered through Edward Jones are issued by banks and thrifts nationwide. All CDs sold by Edward Jones are registered with the Depository Trust Corp. (DTC). Zach Pitman Financial Advisor 1800 Colorado Blvd Ste 5 Idaho Springs, CO 80452 303-567-9200 $5000 $5000 $5000 4.053.7 1-year 3.3 3-month6-month

at Shadow Mountain Gallery Find something for everyone on your holiday list at Shadow Mountain Gallery. Gifts priced for every budget. Located in downtown Evergreen between Java Groove and Beau Jo’s Open Daily 10 - 5 303-670- 3488

Members of Girl Scout troop 5557 take a vote on the best looking cupcake to bring up for judging.

Three Halloween themed cupcakes are brought in for judging for the Girl Scouts Cupcake War event at Ascent Church in Evergreen.

THE ICING ON THE CUPCAKE SEE CUPCAKES, P13

GREG ROMBERG

VOICES

On Colorado’s liquor laws

Based upon a combination of policies to protect existing businesses and puritanical beliefs about the use of alcohol, Colorado’s liquor laws were designed to have a variety of provisions that limited a market-based approach to many elements about how the product was sold in our state.

There have been limits of what kind of stores could sell what kinds of products, where they could sell them, how many licenses any person or company could have and when sales could occur.

While these limitations have impacted consumers, most discussions about the policy implications, and virtually all the money for lobbying and campaign activities to change or maintain them, have been about how changes would impact the businesses that sell alcoholic beverages.

Businesses whose operations have been protected from competition say they have built their businesses and made long-term investments based upon a regulatory structure that limited who could compete against them and how they could operate. Businesses who have been prohibited from

business activities argue that the government should not be in the business of choosing winners and losers.

Over time, some limits have been relaxed and the market has become freer, but legislative changes have been tortured exercises with bizarre, negotiated agreements that stretch into the future and have resulted in phased-in changes that didn’t satisfy any of the parties.

Colorado voters are being asked to weigh in on three specific ballot initiatives on these topics in the November elections. Proposition 124 increases the number of liquor stores any person or company can own. Proposition 125 allows grocery and convenience stores that sell beer to also sell wine. Proposition 126 allows third-party vendors to deliver alcohol from licensed liquor establishments. If they pass, we’ll have a much more market-based regulatory structure than has ever been the case for the sale of alcohol in Colorado.

While I have a certain amount of empathy for people who opened and operated their businesses based on a regulatory model that carved out a specific market for

them, it makes more sense for us to allow a free-market system where consumers vote with their feet and dollars to determine where, when and how people purchase alcoholic beverages than through an outdated and byzantine system that was designed to carve out a specific market solely for people with specific government licenses.

I will vote for Propositions 124, 125 and 126. If they pass, we will move forward toward a more rational and market-based environment for how alcohol is sold and purchased in Colorado. I further believe that if that happens, the ingenuity of current and future liquor store owners will lead to a market that will benefit Colorado consumers with a variety of different operators who will provide the products desired by their customers.

Greg Romberg had a long career in state and local government and in government relations. He represented corporate, government and trade association clients before federal, state and local governments. He lives in Evergreen with his wife, Laurie.

What other dirty linen in our geographic drawer needs cleansing?

BIG PIVOTS

Evans will almost certainly be replaced as the name for Colorado’s 14th-highest mountain. But what about other names associated with an ugly massacre?

Our heartburn about the name Evans appears to be nearing resolution. The Colorado Geographic Naming Advisory Board this week heard testimony about the role of John Evans, then the territorial governor, in the Sand Creek Massacre of 1864.

The evidence presented by representatives of Cheyenne and Arapahoe tribes, the primary victims of the massacre, was not new, but it was damning. Can there be any doubt that Colorado’s 14th highest mountain, dominant on Denver’s western skyline, should have a different name? Blue Sky and Cheyenne-Arapaho are among the names formally proposed.

The board will likely adopt a recommendation to Gov. Jared Polis in January or February. Polis will in turn report to the U.S. Board of Geographic Names, the final arbiter.

Other names assigned our mountains, streets and schools may cause indigestion if you examine the historical footnotes. Just how much more geographic cleansing do we need to address those wrongs?

Take William Byers, a frontier newspaperman who encouraged and then defended the bloodletting. That most lovely triangle of a 12,804-foot peak overlooking Fraser bears his name as does an orangehued canyon of the Colorado River.

LINDA

MICHAEL

LINDSAY

Then there’s Irving Howbert, whose name adorns an elementary school. Then 18, Howbert was among the 3rd Regiment soldiers nearing the end of their 100-day volunteer enlistments. They methodically killed between 150 and 230 people, mostly women and older men but also children and babies. Victims also included several Anglo-Indian “half breeds.” In camping peacefully along Sand Creek, they believed they had been afforded protection from the attack by the U.S. Army. They held up their end of the deal. Howbert, later a founder of Colorado Springs, never apologized.

And what to do with Downing, one of Denver’s most prominent streets, named after Jacob Downing, who participated in the massacre. Later, he helped create Denver’s City Park. Like many others, including Evans, who also did much good, his story is not a simple one.

Blame comes easily in the case of John Chivington, the commander of the volunteers. He was blatantly driven by aspirations for glory, likely aspiring to elevated military rank and ultimately high political office.

Evans has been a more difficult case. Abraham Lincoln had also appointed him as Indian agent, giving him responsibility for looking after the best interests of the tribes. He did not, as a report issued in 2014 by a Northwestern University panel made clear. A University of Denver report the same year, the 150th anniversary, delivered

RUTH

KRISTEN

OLIVIA

Columnists

a more stinging conclusion, putting Evans on the same high shelf of culpability as Chivington. The report found that Evans, through his actions, “did the equivalent of giving Colonel Chivington a loaded gun.”

Both institutions were founded by Evans.

George “Tink” Tinker, an American Indian scholar-activist who contributed to that DU report, told advisory board members that discussions were “much more radical than the final report was.”

Said Ryan Ortiz, a descendant of White Antelope, an Arapaho chief killed and mutilated at Sand Creek: “The most prominent peak in Colorado should not be named after a man who (was) comfortable with the massacre of other human beings.”

As for Byers, no proposal has been filed for shedding his name from Grand County, the site of the peak and the canyon. As editor of the Rocky Mountain News, the mining camp’s first newspaper, Byers had habitually inflamed local fears with “stories that focused on Indian war, atrocities, and depredations, greatly exaggerating the actual threat locally,” says the Northwestern University report. “This press campaign made already apprehensive settlers think that Indians might set upon them at any moment.”

Like Evans, Byers refused to condemn the massacre even decades later. Instead, he argued that it had “saved Colorado and

Clear

A

PERIODICAL

POSTMASTER:

October 20, 20228 Clear Creek Courant 8 - Opinion

& Guest Commentaries Columnist opinions are not necessarily those of the Courant. We welcome letters to the editor. Please Include your full name, address and the best number to reach you by telephone. Email letters to kfiore@coloradocommunitymedia.com Deadline Wed. for the following week’s paper. Contact Us: 1630 Miner St., Idaho Springs, CO 80452 - 303-566-4100 Mailing Address: 750 W. Hampden Ave., Suite 225 Englewood, CO 80110 Phone: 303-566-4100 Web: ClearCreekCourant.com To subscribe call 303-566-4100

SHAPLEY Publisher lshapley@coloradocommunitymedia.com

DE YOANNA Editor-in-Chief michael@coloradocommunitymedia.com

NICOLETTI Operations/ Circulation Manager lnicoletti@coloradocommunitymedia.com

DANIELS Advertising & Sales rdaniels@coloradocommunitymedia.com

FIORE West Metro Editor kfiore@coloradocommunitymedia.com

JEWELL LOVE Community Editor olove@coloradocommunitymedia.com A publication of

Creek Courant (USPS 52610)

legal newspaper of general circulation in Idaho Springs, Colorado, the Clear Creek Courant is published weekly on Thursday by Colorado Community Media, 1630 Miner St., Idaho Springs, CO 80452.

POSTAGE PAID AT Idaho Springs and additional mailing o ces.

Send address change to: Clear Creek Courant, 750 W. Hampden Ave., Suite 225, Englewood, CO 80110

LOCAL

Columnist

Allen Best

SEE BEST, P9

Icall my essays Higher Living Reflections. What, though, does living higher entail? It includes elevating oneself and rising above base proclivities, a challenging endeavor often fraught with obstacles.

The concept is ancient. Buddhists call those base proclivities desires, which cause suffering. Christians call them the Seven Deadly Sins, which bring about eternal suffering in the world beyond our ken.

Rising above is not just a spiritual quest. It is also an earthly one that involves becoming a better human by doing any number of basic things: checking passions; being kinder and more gracious; saying please and thank you; covering coughs or sneezes; respecting others’ spaces and sacred places; and not slurping soup (unless culturally acceptable) or eating with unwashed hands.

It entails showing compassion toward all others, practicing the kind of love the Greeks called agape, offering gratitude for being alive and conscious of the world around us, walking in another’s shoes to see life from their point of view, and realizing that we are not owners of the earth but, instead, temporary caretakers who are charged with preserving it for generations to come.

For me, it also includes articulating clearly when I speak, reading challenging works to sharpen my critical thinking skills and my ability to comprehend and convey complex thoughts, entertaining ambiguity, appreciating nuance and irony, divining symbolism and fostering my innate curiosity.

All those beliefs and practices enrich life experiences and help dignify the human experience by demonstrating that we Homo sapiens are intrinsically above the rest of the animal kingdom. We are spiritual beings having a human experience. Yet too often, we witness fevered animalistic groupthink taking hold among ostensibly psychologically and emotionally mature adults. Scenes from “Lord of the Flies” come to mind: the hunt, the chilling chant, the sound of the fury.

In the novel, the boys are developmentally immature adolescents. After butchering a sow, which symbolizes the beast within the human psyche, the boys place its head atop a spike. Later, the boys hunt down

Ralph, who represents civilization, the rule of law and courage. They intend to behead him and place his head on a pike.

It is telling that William Golding named the character who represents rational intelligence “Piggy.” He is pudgy, has asthma and is nearsighted, which make him vulnerable. Piggy’s nearsightedness also suggests that his intellect, though strong, is limited. He is incapable of seeing what is beneath or beyond that which he can discern — and that is intellect lacking insight or wisdom. Piggy shows us that evil cannot be defeated by reason alone.

Simon personifies wisdom and innate goodness. Like Samuel in Bless Me, Ultima, Simon is a Christ figure, destined to be scorned, mutilated and sacrificed. He is unafraid of the dark forest, for he innately understands he is as much a part of nature as every other creature. As things begin to fall apart, Simon wonders if there really is a beast.

For him, the beast is not a physical being. It is, rather, something that lurks within the human unconscious. In a vision, the Lord of the Flies confirms it and says it cannot be easily dismissed.

Golding did not write “Lord of the Flies” in a vacuum. It is not an abstract, creative, philosophical tale drawn from his imagination. Rather, it arose from his utter revulsion of the horrors he witnessed during World War II committed by nations that were among the most advanced in terms of education and sophistication. Based on what he witnessed, he concluded that we are oblivious to the depth of evil humans are capable of perpetrating.

By ripping the façade from human nature, Golding forces the reader to come to grips with an essential truth: Intelligent and “good” people can swoon before and fall under the spell of charismatic, psychopathic leaders who tap into and exploit fears that lie submerged in their followers’ psyches. Feeling then a sense of validation and empowerment from those leaders, mobs go on todesecrate public buildingsand commit unimaginable atrocities.

Golding’s work deserves to be

blocks away in History Colorado, where museum visitors are asked: “Do we need monuments?”

read periodically to remind us how easy it is for people to descend to the depths instead of striving for higher living. In hindsight, I understand that I previously appreciated the profundity of “Lord of the Flies” merely intellectually and academically. Now I see it haunt-

ingly playing out not in some far-off or imaginary land but in real time right here at home.

Jerry Fabyanic is the author of “Sisyphus Wins” and “Food for Thought: Essays on Mind and Spirit.” He lives in Georgetown.

FROM PAGE 8

taught the Indians the most salutary lesson they had ever learned,” according to Ari Kelman’s “A Misplaced Massacre,” one of several dozen books about Sand Creek.

Oddly, while two congressional committees and a military commission that investigated Sand Creek pronounced it an unprovoked massacre, Colorado did not. Until it was toppled by protesters in 2020, a statue honoring veterans located at the Colorado Capitol referred to the “Sand Creek Battle.”

That statue now stands several

Museums, yes, but not monuments, one person answered. But here we are, stuck in 21st century Colorado with a lot of names of 19th century men on our maps. Some seem not to offend, but those associated with the massacre assuredly do.

An Evans-Byers house stands near the Denver Art Museum. The names have been scrubbed from the sign, though. I suspect in time we’ll do the same with our mountains.

Allen Best writes about energy, water and sometimes other transitions at BigPivots.com.

Clear Creek Courant 9October 20, 2022

BEST

The beast within

JERRY FABYANIC Columnist In Loving Place an Obituary for Your Loved One. Memory 303-566-4100 obituaries@coloradocommunitymedia.com Self placement available online at ClearCreekCourant.com

Choosing right weather words for an ‘alerta’

BY MICHAEL BOOTH THE COLORADO SUN

For all of us who have ever weighed a tornado “watch” versus a tornado “warning,” it’s no surprise that a growing number of researchers say distinguishing between Spanish words like “aviso” and “alerta” in weather bulletins can be a life or death choice.

If a twister sprouts east of Pueblo, or a climate-driven wildfire threatens Jefferson County, or more hurricanes pummel Florida, Spanish-speaking communities need weather warnings to meet the moment. More and more meteorological and social science research shows they’re failing.

As Hurricane Ian bore down on the west coast of Florida, weather service parent agency the National Oceanic and Atmospheric Administration was talking about its new research suggesting Spanish translations need to bump up in urgency.

NOAA and the weather service — as well as FEMA — mean to say “warning” when it comes to tornadoes and hurricanes and other hazards, but the Spanish word they have been using, “aviso,” is not taken as seriously by Spanish speakers.

Researchers asked more than 1,000 Spanish speakers to rank advisory words. The researchers were told

that the words they’d been using as strong, “aviso” and “vigilancia,” were not heard as forcefully as the more urgent Spanish words “emergencia,” “amenaza” and “alerta.”

The author of NOAA’s study, which was published in the Bulletin of the American Meteorological Society, said the study backs up other recent work comparing signals from

English words versus signals from Spanish.

“Aviso” is a literal translation of

Phone and Internet Discounts

Available to CenturyLink Customers

The Colorado Public Utilities Commission designated CenturyLink as an Eligible Telecommunications Carrier within its service area for universal service purposes. CenturyLink’s basic local service rates for residential voice lines are $28.50 per month and business services are $41.00 per month. Speci c rates will be provided upon request.

CenturyLink participates in the Lifeline program, which makes residential telephone or qualifying broadband service more affordable to eligible lowincome individuals and families. Eligible customers may qualify for Lifeline discounts of $5.25/month for voice or bundled voice service or $9.25/month for qualifying broadband or broadband bundles. Residents who live on federally recognized Tribal Lands may qualify for additional Tribal bene ts if they participate in certain additional federal eligibility programs. The Lifeline discount is available for only one telephone or qualifying broadband service per household, which can be either a wireline or wireless service. Broadband speeds must be at least 25 Mbps download and 3 Mbps upload to qualify.

CenturyLink also participates in the Affordable Connectivity Program (ACP), which provides eligible households with a discount on broadband service. The ACP provides a discount of up to $30 per month toward broadband service for eligible households and up to $75 per month for households on qualifying Tribal lands.

For both programs, a household is de ned as any individual or group of individuals who live together at the same address and share income and expenses. Services are not transferable, and only eligible consumers may enroll in these programs. Consumers who willfully make false statements to obtain these discounts can be punished by ne or imprisonment and can be barred from these programs.

If you live in a CenturyLink service area, visit https://www.centurylink.com/ aboutus/community/community-development/lifeline.html for additional information about applying for these programs or call 1-800-201-4099 with questions.

October 20, 202210 Clear Creek Courant Visit hrblock.com/offers/tax-pro-referral/ to refer your friends. You’ll need to know their first and last name, street address, phone number and email address for each referral. RecommendtheH&RBlockTax Knowledge Assessment and Income Tax Courseat hrblock.com/BeAPro Whentheysuccessfullypass and are hired byH&RBlock–youareeligiblefor a reward! apply.ThereisnotuitionfeefortheH&RBlockIncomeTaxCourse.However,youmayberequiredtopurchasecourse materials,whichmaybenonrefundableStaterestrictionsmay apply.Validatparticipatinglocationsonly.Voidwhereprohibited.AdditionaltrainingortestingmayberequiredinCA,ORandotherstates.Thiscourseisnotintendedfor,noropentoany personswhoareeithercurrentlyemployedbyor seekingemploymentwithanyprofessionaltaxpreparationcompanyororganizationother thanH&RBlock.Duringthecourse,should H&RBlocklearnofanystudent’semploymentorintendedemploymentwithacompetingprofessionaltaxpreparationcompanyorservice,H&RBlockreservestherighttoimmediately cancel thestudent’s enrollment.The student wil be requiredtoreturnall course materials 104 0-QE-2662 ©202 2 HRB Ta x Group Inc. Here’s how it works: 1. 2. 3. Earn $150 when someone you refer successfully completesour Income Tax Course andishired.* Earn $250 when yourefer an experienced tax professional whopassesourTax Knowledge Assessmentandishired.* Knowsomeone withtax pro potential? *Program rules: Limit of 5 paid referrals per Experienced Tax Pros and First Year Tax Pros and 4 paid referrals for Receptionists. All referrals must be submitted between 4/1/22 – 3/31/23 using hrblock.com/offers/tax-pro-referral/. Tax Pro referrals must be submitted prior to a candidate’s enrollment in ITC or starting the TKA and the candidate must successfully pass the appropriate course/test with a minimum grade (70% for ITC and 80% for TKA). Receptionist referrals must be submitted prior to hire date. Referred candidates must become active by March 31, 2023 in order for the referral to be paid. Rewards will be paid April 2023. A lot oftax experience? New totax prep? Visit hrblock.com/offers/tax-pro-referral/ to refer your friends. You’ll need to know their first and last name, street address, phone number and email address for each referral. RecommendtheH&RBlockTax Knowledge Assessment and Income Tax Courseat hrblock.com/BeAPro Whentheysuccessfullypass and are hired byH&RBlock–youareeligiblefor a reward! apply.ThereisnotuitionfeefortheH&RBlockIncomeTaxCourse.However,youmayberequiredtopurchasecourse materials,whichmaybenonrefundableStaterestrictionsmay apply.Validatparticipatinglocationsonly.Voidwhereprohibited.AdditionaltrainingortestingmayberequiredinCA,ORandotherstates.Thiscourseisnotintendedfor,noropentoany personswhoareeithercurrentlyemployedbyor seekingemploymentwithanyprofessionaltaxpreparationcompanyororganizationother hanH&RBlock.Duringthecourse,should H&RBlocklearnofanystudent’semploymentorintendedemploymentwithacompetingprofessionaltaxpreparationcompanyorservice,H&RBlockreservestherighttoimmediately cance thestudent’s enrollment.The student will be requiredtoreturnal course materials 104 0-QE-2662 ©202 2 HRB Ta x Group Inc. Here’s how it works: 1. 2. 3. Earn $150 when someone you refer successfully completesour Income Tax Course andishired. Earn $250 when yourefer an experienced tax professional whopassesourTax Knowledge Assessmentandishired.* Knowsomeone withtax pro potential? *Program rules Limit of 5 paid referrals per Experienced Tax Pros and First Year Tax Pros and 4 paid referrals for Receptionists. All referrals must be submitted between 4/1/22 – 3/31/23 using hrblock.com/offers/tax-pro-referral/. Tax Pro referrals must be submitted prior to a candidate’s enrollment in ITC or starting the TKA and the candidate must successfully pass the appropriate course/test with a minimum grade (70% for ITC and 80% for TKA). Receptionist referrals must be submitted prior to hire date. Referred candidates must become active by March 31, 2023 in order for the referral to be paid. Rewards will be paid April 2023. A lot oftax experience? New totax prep?

SHUTTERSTOCK

IMAGE Weather warnings run into language challenge SEE WEATHER, P11

“warning,” but aviso is “more like advice you might get from a parent,” and doesn’t come across as an urgent official warning to act, said Joseph Trujillo-Falcón, lead author from NOAA’s Cooperative Institute for Severe and High-Impact Weather Research and Operations in Oklahoma.

The difference can literally mean life and death, as Florida officials struggled to convey the dangers of Ian’s intense ocean surge to evacuation stragglers around Tampa. How Spanish speakers accept the words is also key in tornado-prone spots with large Hispanic populations, from Colorado to Texas. As climate change makes emergency weather events more frequent, language and communication matter all the more, researchers say.

“It’s just so important to get people the right information at the right level of urgency,” said Ben Hatchett, assistant research professor for atmospheric science at Reno’s Desert Research Institute.

In tornado advisories, for example, the word “watch” means conditions are ripe for a tornado and residents should be alert. “Warning” means a tornado has been spotted or is imminent and residents should take shelter. The study notes that “66% of the English speakers correctly identified the meaning of a tornado watch as an early notice of possible severe weather,” but “only 38% of the Spanish speakers chose this definition.”

“Our data supports using the Spanish word ‘vigilancia’ for a tornado watch and the Spanish word ‘alerta’ for a tornado warning,” Trujillo-Falcón said.

9News meteorologist Chris Bianchi, who often handles the regular Spanish-language weather casts for the station, agrees with the research and is writing about it at 9News. com. He commented on the studies just before leaving for Florida, where he joined the hurricane coverage.

“This is absolutely critical,” Bianchi wrote from DIA, as he waited for his Tampa flight. “There has long been a huge, discernible gap between English and Spanish forecasting and terminology.”

Hatchett also does research from his base in Santa Rosa, California, on whether English-speaking communities are hearing bad-weather warnings with the urgency forecasters and safety officials intend. It’s crucial, he said, to study local dialect and geography, and which communicators are the trusted sources of information.

In Reno, Hatchett said, weather listeners don’t pay enough attention to warnings of “up to 6 inches of snow in the area.” They assume that means up on the mountains in the Tahoe area, not so much in the lower-lying Truckee Meadows.

“But if you say, ‘It’s going to snow 6 inches down here,’ everyone’s like, ‘Oh, it’s gonna snow down here in the valley in downtown Reno. OK, got it. Got to think about how I’m going to get to work tomorrow,’” Hatchett said.

Climate and weather researchers are also trying to use high temperature ranges rather than one number when expressing growing

dangers from urban heat waves, Hatchett said. Instead of saying just, “It’s likely to hit 106 degrees tomorrow,” they use probability forecasting: “It’s very likely going to be above 95 and could hit 100.”

How then, Hatchett said, to best present that range visually or verbally, to enclaves of different speakers and listeners, from San Diego to the San Luis Valley? Will they be concerned enough to think about staying home from an outdoors job, or keeping kids out of an unairconditioned school?

It’s “super important,” he said, to use translation from native speakers familiar with a community to find the words “through the lens of the local person who you’re trying to convince to make a decision.”

Meteorologists appear to welcome the flurry of social scientists researching how to sharpen communication in their field.

“We often forget how young meteorology is,” Bianchi said, adding that 100 years ago weather warnings were coming primarily from priests on the hurricane frontlines in Cuba. He’s worked on some of the NOAA research panels, and he sees the impact of words while talking with the 9News audience.

“Translating and accounting for regional dialects and slang can be very difficult,” he said.

This story is from The Colorado Sun, a journalist-owned news outlet based in Denver and covering the state. For more, and to support The Colorado Sun, visit coloradosun.com. The Colorado Sun is a partner in the Colorado News Conservancy, owner of Colorado Community Media.

HolidayContest

What is your favorite Holiday recipe?

us online at ColoradoCommunityMedia.com

submit your recipe to be included in our upcoming Hometown Holidays special section!

Clear Creek Courant 11October 20, 2022

and

Visit

FROM PAGE 10 WEATHER

DYLAN ROBERTS FOR STATE SENATE RURAL COLORADO’S BIPARTISAN CHAMPION

ROOTS THAT RUN DEEP

A third-generation Coloradan who grew up in Routt County and now calls Eagle County home, Dylan’s committed to serving our community as Eagle County’s former Deputy District Attorney and now as State Representative.

RESULTS THAT DELIVER

Dylan picks solutions over politics to get things done. He’s cut taxes for everyday Coloradans, invested in rural small businesses and housing for our workforce, and delivered solutions for rural transportation.

October 20, 202212 Clear Creek Courant

Paid for by Raising Colorado Independent Expenditure Committee — Jennifer Walmer, Registered Agent. Not authorized by coordinated with, or controlled by any candidate. VOTE DYLAN ROBERTS FOR STATE SENATE BY NOV 8

CUPCAKES

late ice cream cones for the hats.

The chocolate cake was frosted with what Bitsy called an “obnoxious green” vanilla frosting.

She noted it was fun to meet Girl Scouts from other troops.

Cupcake Wars was the brainchild of Juniors Troop 67431, which is based out of Bergen Valley, and the Scouts spent a month planning the evening’s activities.

Judge Rebecca Kelty, co-owner of Alpine Pastries in Evergreen and a former Girl Scout, told the bakers how proud she was of them for stepping out of their comfort zone, and they will never regret doing their

best.

Judge Kappy Kling, owner of HearthFire Books & Treat and also a former Girl Scout, said the cupcakes looked amazing, and she advised the Scouts to find something they love to do and put everything they can into doing it.

Judge Kristin Ledgerwood, owner of Vivian’s Gourmet, advised the Scouts to be true to themselves,

while Packer told the Scouts that each one of them is a gift to the world, and each must unwrap themselves so others can see who they really are.

“I’ve judged other competitions,” she told them, “but this might be the coolest thing I’ve ever judged.”

Clear Creek Courant 13October 20, 2022 FALL SAVINGS EXPIRES 10/30/22 50% OFF INSTALLATION all shower & bath projects 24 MONTHSNo Payments & No Interest for INSTALLED IN JUST 1 DAY! OVER 125,000 HOMEOWNERS HAVE CHOSEN US, BECAUSE THEY: • Wanted to Say Goodbye to Mold and Constant Cleaning • Needed a Safe & Low Step-in Shower • Wanted to Customize the Style to Match Their Bathroom • Needed the Job Done and Ready for Use in Less Than a Day • Needed Removal and Installation Completed by Trained Experts • Needed an Affordable Option to Meet Their Budget 4.8 4.8 SERVICING 33 LOCATIONS ACROSS 15 STATES OVER 125,000 SATISFIED CUSTOMERS IF YOU WANT YOUR SHOWER REMODELED BEFORE THE HOLIDAYS, CALL TODAY! 720 -734 - 5066 *Plan 1247. Subject to credit approval. 0.00% interest rate during 24 month promotional period followed by fixed interest rate of 17.99% for 84 months. Payment example: for $10,000 purchase on approval date (APR 10.72%), 24 payments of $0.00 followed by 84 amortized payments of $210.11. Financing for GreenSky® consumer loan programs is provided by federally insured, equal opportunity lender banks. NMLS #1416362. Minimum purchase $9,999 required. New orders only. Cannot be combined with other offers. See design consultant for details. Other restrictions may apply. **50% off install is equal to 10% off the total project price. Offer expires 10/30/22. OL-23-05747 www.BestBathDenver.com

Briar Oesterle, 8, carries a snowman cupcake she baked herself up to the judges table for the Girl Scouts Cupcake War event Oct. 14.

PHOTOS

BY SARA HERTWIG

Kristin Ledgerwood, owner of Vivian’s Gourmet, judges entries made in the Girl Scouts Cupcake Wars event Oct. 14.

FROM PAGE 7

Job app maker sees no restaurant labor shortage

The way Diego Montemayor talks about Chamba, his Denver startup, makes one wonder why it didn’t exist before. Chamba is another job app, but, as with most startups, there’s a twist.

Chamba launched a bilingual app in April 2020 that connects Spanishspeaking workers with the employers who need them. In late July, Chamba narrowed its focus to the restaurant industry. That seems like good timing if you’ve been paying attention to the restaurant staffing woes and how hard it’s been to find people, especially for jobs busing tables, in the kitchen and other nontipped “back-of-the-house” work.

But Montemayor has a different perspective.

“There’s not a labor shortage. There’s a connectivity problem,” said Montemayor, Chamba’s cofounder and CEO. “And that’s what we’re solving here. We’re connecting restaurants to the talent that wants these kinds of jobs.”

Employers, he said, are “looking for talent in the same talent pool. They have not diversified where they search for talent and are looking in the same, common places.”

A number of companies are already promoting Chamba’s service on the app’s site, including Brothers BBQ. Within two days of using the app, the Aaron Nelsen, the general manager for two of the Denverbased chain’s locations, arranged three interviews and made a hire. “We picked the best candidate out of those three interviews,” he said in a video testimony on Chamba’s site. The Spanish-speaking employee started work the next day.

Chamba service really just helps employers look in a place they probably weren’t looking before. In a few short months, it’s helped 187 clients connect to workers in Denver and New York City, the only two cities covered so far. The app’s been downloaded more than 172,000 times from the Apple App store and 50,000 jobs have been posted, said Corina Hierro, Chamba’s community manager and a founding member. Co-founder and Chief Technology Officer David Ruiz oversaw the development of the app and led the team of developers in Colombia.

Chamba looks beyond the audience that typically relies on Indeed, LinkedIn and other English-heavy job sites. The app, available in Spanish and English, is marketed to the

Latino community and helps job seekers create online resumes.

It also vets the employers by checking online reviews first. If the company passes muster, Chamba will talk to the owners or hiring managers to see how much investment they’re putting into workers. Employers that don’t seem to care can cause job seekers to feel lost, like they don’t matter, Montemayor said.

“If they’re spending a little bit of time with the talent, then that’s a good fit for Chamba,” he said.

Chamba is offering Denver restaurants free access to the app to advertise their job openings.

Chamba, which employs about 15 people, has big plans for growth. It’s a venture-backed startup with more than $1.1 million in seed funding so far, with some of it coming from local accelerator program Techstars last year. “Techstars became our megaphone,” he said. “It put us in front of people who were actually going to listen (to) the social impact

TURN TO THE COLORADO SUN FOR NEWS ACROSS THE STATE

that we were having on the community.”

To kick off the company’s Denver Startup Week presence, Montemayor was one of five newer founders getting a place on stage to grill — and be grilled — by a Colorado unicorn, or a company that has raised so much investment, its valuation tops $1 billion.

Mark Frank, cofounder of SonderMind, which helps people with mental health issues connect to therapists, was that unicorn founder. And the founders’ conversation focused on community, which is important to both companies. SonderMind, which employs 300 people, has raised more than $180 million, according to equity-tracking site Crunchbase.

“So, how did you get to 300 employees,” Montemayor asked Frank.

“Well, it wasn’t that long ago that we were a team of 15. Actually, it was three years ago at this time, we were a team of 18,” Frank said. “For us, what the bigger challenge

has been how do we maintain our culture, which has been a real driver of our success. … I would encourage everyone to find ways to get together in person and do things virtually as well that can really home in on that community aspect.”

Montemayor said he considers Chamba a synonym for community.

“Everything we do is around community,” he said. “We build community by building trust and that’s by showing who is behind the product. We get people that look like the people that we are helping and people who are going through the same experience as us.”

This story is from The Colorado Sun, a journalist-owned news outlet based in Denver and covering the state. For more, and to support The Colorado Sun, visit coloradosun.com. The Colorado Sun is a partner in the Colorado News Conservancy, owner of Colorado Community Media.

The Colorado Sun is a journalist-owned, award-winning news outlet that strives to cover all of Colorado so that our state — our community — can better understand itself.

In this way, The Sun contributes to a more vibrant, informed and whole Colorado.

The Sun, launched in 2018, is committed to fact-based, in-depth and non-partisan journalism. It covers everything from politics and culture to the outdoor industry and education.

Now, The Colorado Sun co-owns this and other Colorado Community Media newspapers as a partner in the Colorado News Conservancy. The Sun is CCM’s partner for statewide news.

For Colorado Sun stories, opinions and more, and to support

The Sun’s misssion as a member or subscriber, visit coloradosun.com.

October 20, 202214 Clear Creek Courant

Employees at the new Slim Chickens restaurant in Parker prepare meals during their first day open.

PHOTO BY ELLIOTT WENZLER

Back-of-the-house jobs a tough fill

Counties have no mental health team for crisis calls

Funding is available

BY OLIVIA PRENTZEL AND JENNIFER BROWN THE COLORADO SUN

More than half of Colorado counties lack a “co-responder” program in which a mental health professional joins law enforcement on police calls, including Clear Creek County where local officers shot and killed a 22-year-old man as he sat in his car.

The death of Christian Glass in the small mountain town of Silver Plume, about 45 miles west of Denver, is once again raising questions about law enforcement response to 911 calls involving someone who is having a mental health crisis. Glass’ parents and their attorney revealed details of the man’s June 11 death last week.

The Clear Creek County Sheriff’s office said Glass became “argumentative and uncooperative” and tried to stab an officer. But video from the arrest shows that Glass, who made a heart with his hands toward the officers and said he was terrified, never even got out of his vehicle. The officers busted out the window, shot him six times with bean bag rounds, multiple times with a Taser and then shot him five times, according to the family’s attorney.

Co-responder programs are meant to de-escalate encounters with police and reduce the number of people who need mental health treatment but are instead sent to jail. Colorado has ramped up efforts in the past few years and provided state funding to local law enforcement agencies and mental health centers to expand programs across the state. Yet wide swaths of rural and mountain communities still do not have co-responder teams.

Since 2017, the state Behavioral Health Administration has offered funding to communities to start the programs, which also require local financial contributions. Today, 24 out of the state’s 64 counties have a co-responder program funded through the administration.

The state Behavioral Health Administration funds co-responder programs in 24 of 64 counties, including 70 law enforcement agencies statewide. Eleven communities have programs that don’t receive BHA funding.

None have been added to the state program in the past year. The Alamosa Police Department, however, hired a co-responder last month and the Steamboat Springs Police Department now coordinates with the local community mental health center.

The Behavioral Health Administration program, with a $7.3 million budget, is funded through taxes on marijuana sales as well as federal mental health aid. State laws passed in 2017 and 2019 provided dedicated state funding for the program.

Co-responder teams funded by the Behavioral Health Administration responded to 25,900 calls from July 2020 to June 2021, and 98% of the time, there was no arrest, accord-

ing to state data. And 86% of the time, the mental health professional who responded to the call ended up providing help, often with a behavioral health assessment or a link to treatment.

Most of the calls are resolved on site, though some result in transport to a hospital or mental health center. The model helps police respond more effectively to behavioral health calls, “which are often timeconsuming, difficult to resolve, and, on relatively rare occasions, result in tragic injuries or deaths,” said Stefany Busch, spokeswoman for the Behavioral Health Administration.

Glass called 911 after he drove off a dirt road and said his car was stuck. Officers who responded, lights flashing in the dark, asked him repeatedly to get out of the car.

“You don’t need to be terrified,” one says, an exchange captured on body camera footage. “We’re out here to try and help you and have a conversation.”

Over the radio, Colorado State Patrol asks what the deputies’ plan is, before saying that if Glass is not suicidal, homicidal or posing danger there is no reason to contact him.

“My sergeant says there’s no point contacting him if he’s not a harm to himself or anyone else, then no crime,” an officer says.

But the interaction escalated as Glass refused to get out of the car or roll down the window. Officers threatened to break the window and Glass, who had a knife, threatened to kill them if they didn’t leave him alone. One officer got on the hood of the vehicle, pointing a gun and bright light at Glass. After about an hour, officers broke the window and Glass grabbed a knife. Officers shot him with bean bags and a stun gun, and Glass screamed as he was being pelted and hit with a Taser.

The video shows Glass, still in the driver’s seat, thrusting a knife toward an officer. He’s shot five times, and Glass stabbed himself before he died.

O cers were trained in mental health response

Although Clear Creek has no coresponder program, both sheriff’s deputies who responded to Glass’ 911 call were trained to identify signs of mental health distress, Undersheriff Bruce Snelling said. The annual training is required for all of its deputies, along with peer support training that includes recognizing signs of medical and mental distress.

Upon being hired, every deputy is required to take a two-hour training on de-escalation and must repeat the course every two years, according to the Clear Creek County Sheriff’s Office policies and procedures manual.

“Law enforcement is heaped upon to solve a lot of problems, whether it be drug abuse, alcoholism, mental health issues, domestic violence.

People expect that we’re capable and well-trained to handle each and every one of those things that might

Air Duct Cleaning Fall Specials

Breathe Easy & Relax!

SINUS PROBLEMS? ALLERGIES?

DUST PROBLEM? HEADACHES? HIGH POWER BILLS?

IF IT’S IN YOUR DUCTS, IT’S IN YOUR LUNGS

Our mission is to lower energy costs and provide the healthiest quality air possible. For anyone, business or residential, we will increase e ciency of your system by using the very latest techniques, the latest technologies and top of the line products. We will provide the highest quality of work possible. Our professional sta will assure a high level of professionalism that cannot be matched in our industry. We guarantee our products and services.

OUT SPECIAL

Clear Creek Courant 15October 20, 2022

ASTHMA?

$49 CLEAN

10 Vents, 1 Return, & 1 Main. FREE system analysis/inspection. Call for details. Additional vents priced separately. We service all areas. Offer expires 11/19/22. FREE DRYER VENT CLEANING WITH ANY COMPLETE AIR DUCT SYSTEM CLEANING. Call for details. Offer expires 11/19/22. 50% OFF HOSPITAL GRADE SANITIZER HELPS WITH GERMS & BACTERIA With purchase of complete ductwork cleaning. Offer expires 11/19/22. Call or visit us online today to schedule an appointment! (303) 747-6781 theapexcleanair.com We Will Beat Any Price With Superior Quality 100% Guarantee

SEE MENTAL HEALTH, P18

BY BELEN WARD BWARD@COLORADOCOMMUNITYMEDIA.COM

Painter and muralist Eli Pillaert, a New Orleans native, spent a part of her formative years working as a Colorado ski instructor, teaching kids at Eldora Mountain Ski Resort.

But it was the summers spent hiking around the area that left her inspired.

“This one plant, the mountain mahogany, kept popping up. It’s so beautiful. It has spiraling pieces with little fluffy bits on them,” Pillaert said.

So, when she was selected by Adams County’s Cultural Arts Division to help bring some color to county open spaces, that’s where she looked.

“It’s local flora and fauna. It’s something that people see and could connect with. It’s exactly why I went with this design,” she said.

Pillaert is one of 15 national artists who are having their designs unveiled across Adams County this fall.

But it’s not a gallery show and you don’t need tickets to see any of them. All you need is a little time and some decent walking shoes.

Pillaert’s design, featuring long swooping branches and colorful fluff, is now a part of the county’s Clear Creek Trail at Twin Lakes Park, along 70th Avenue just west of Broadway.

Other designs featuring other artists and their inspirations are spread across the county’s trail system — not on the walls or entrances to tunnels but on the trails themselves.

It’s part of the county’s “Love Your Trails” series. Adams County is about halfway through the series, bringing colorful murals and designs highlighting the county’s natural resources and environment to those walking paths.

“Adams County has been dedicated to the arts for quite a while now,” said Adams County Cultural Arts Liaison Zoe Ocampo.

Adams County started its parks and open space Cultural Arts Division within the Arts and Cultural Department in 2019. Ocampo said arts and culture are part of a vision for Adams County to expand public art in its communities that

calls for increased spending on displays everyone can enjoy.

“It won’t just be new buildings, it will be parks, trails and also all different kinds of projects throughout the county that are deemed eligible,” she said.

with art and nature

Choosing 15

Ocampo said that 50 artists from around the country applied to be part of the Love Your Trails project. The county’s Visual Arts Commission, a nine-member board of community volunteers, selected the final 15.

Pillaert said the artists were given the opportunity to include the community in the project. Hers is the only one of the eight completed so far that did that.

“The community element is part of organizing the mural so that it can be painted by the community,” Pillaert said. “It’s something that’s really near and dear to my heart. It’s something that’s really cool to see people connect through art.”

South Florida’s Stephanie Leyden made her mural theme of the four seasons. It’s also located on the Clear Creek Trail along Tennyson Street and north of 54th Avenue.

She painted summer elements transitioning into fall, winter, and spring and added designs she associated with the state — butterflies flying, animal tracks, wildflowers and changing colors of leaves as they have blown off the trees.

“It’s something we don’t have in South Florida. The seasons are here, they’re just not as obvious,” Leyden said. “With each season, I painted four butterflies, four leaves, four types of animal tracks and four wildflowers. It was fun.”

Leah Nguyen is from Seattle and her mural was more specific. Called “Community Vision: Bennett, CO,” it’s located in Bennett’s Civic Center Park off of South Street. Nguyen’s patterns depict small-town life, farmers growing corn, sunflowers, hay and wheat in the surrounding areas. The patterns connect generations of families to preserve the town’s history.

“I created the Community Vision pattern to provide support for communities that are doing the difficult work of excavating their histories, having dialogues and taking actions toward reconciliation, healing old wounds, and visioning new ways to come together and collaboratively thrive,” Nguyen said. “The pattern makes sense there at Bennett City Hall, which holds space for visionary civic work and community building conversations.”

Di

erent perspectives

Northampton, Massachusetts artist Kim Carlino calls her mural “Portals

October 20, 202216 Clear Creek Courant

Leah Nguyen’s mural is called “Community Vision: Bennett, CO.”

COURTESY PHOTOS

Designs from 15 creators being unveiled this fall Kerry Cesen illustrating the smallest species.

SEE POP, P17 LIFE LOCAL LIFE

for Looking Inward.” It’s located in Strasburg Community Park. Her mural is an illusion of depth and volume occupying space in a two-dimensional surface with color that is expressive.

“I had this idea for a path coming across these portals or ovals reflecting the night sky with colorful Candy Land-like pathways that flow in and out of the portals as if they were going underneath the path and coming up the other side to give a sense of playfulness and movement,” Carlino said. “I love this idea of moving through space and coming across something that makes you take pause, and in that pause you can reflect.”

Traveling artist Kerry Cesen went small with his work. He said he lives in several places, including Maryland, Oregon and Washington state. His mural continues along the Clear Creek trail and is located just west of Lowell Boulevard along W. 55th Place.

Cesen dives into the roots of the smallest species as though you are looking through a microscope. He illustrates the natural world beneath our feet.

“It emphasizes the interactions between plants, animals, aquatic life, and fungal growth,” Cesen said. “Several magnified areas within the design allow us a deeper glimpse into the micro-world, where scientific research and design techniques help inform viewers about some of the smaller parts that make up the whole.”

Clearwater, Florida artist Beth Warmath’s mural is inspired by the Colorado landscape and two notable flowers: Sunflowers in the fields and the Colorado columbine.

“I love nature and its perfect beauty, so I challenge myself to recreate it larger than life. I draw from actual objects so I used the surrounding landscape for my inspiration,” Warmath said. “I was happy to see wildlife in its natural habitat such as fox, elk, chipmunks and bison.”

Paz de la Calzada is originally from Spain but has lived in the San Francisco Bay area for 18 years. Calzada’s mural is located at Riverdale Regional Park in Brighton near the South Platte River. It’s an abstract design that keeps flowing, intertwining with the landscape and river.

“The landscape inspired me with the color of green flowing with nature and the color of blue metaphor flowing with the river both intersecting together, and both need each other water needs nature and nature needs water,” Calzada said.

Milwaukee artist Theresa Sahar researched the Adams County area and learned that trout fishing is a popular sport in Colorado. That became the centerpiece of her mural, which is located along the South Platte Trail just east of Riverdale Dunes Golf Course and the county’s Fishing is Fun Pond. It features a realistically rendered fish leaping off of the trail.

“I’ve done some anamorphic (3D) chalk art pieces in downtown Milwaukee and decided it would be a fun and interesting addition to the Love Your Trails project,” Sahar said.

Adams County’s Ocampo said the remaining murals should be finished this fall, at least before the snow falls. The additional artists selected to work on their mural scheduled for painting are Toni Ardizzone, Sofi Ramiez, Wes Abarca, Keeley Hertzel, Eye Cough, Angela Beloian and Julio Juls Mendoza.

For more information about the artist and mapping location to see the artist’s trail mural, visit: adcogov.org/cultural-arts-currentprojects.

To learn about more projects and its process, visit the call-for-entry website at adcogov.org/call-for-entry.

Clear Creek Courant 17October 20, 2022

Stephanie Leyden’s mural has a theme of four seasons.

PHOTO BY BELEN WARD

Theresa Sahar learned that trout fishing is a popular sport in Colorado.

PHOTO BY BELEN WARD

Eli Pillaert, with help from community members

Nathan and Jaquelin Valencia, painted a mountain mahogany.

PHOTO BY BELEN WARD

Kim Carlino calls her mural “Portals for Looking Inward.” COURTESY PHOTO

FROM PAGE 16 POP

pop up,” Snelling said. “So we’re always looking to try to expand what our knowledge and training capabilities are and we work hard at that each and every day.”

But the sheriff’s office is not currently looking at specific ways to improve the department’s mental health training, he said, and a low number of mental health calls the sheriff’s office receives wouldn’t justify implementing a co-responder model.

“We’re a small place, you know. It’s not like we run into a mental health issue every day. We can, but sometimes you might not run into it for a couple of weeks,” Snelling said.

“I think if we had a greater call volume of mental health issues, we might be able to justify having a coresponder program.”

Snelling declined to comment specifically on the shooting, citing the ongoing investigation.

The Colorado Bureau of Investigation is reviewing the case, alongside the Fifth Judicial District that includes Clear Creek County, District Attorney Heidi McCollum said last week. Her office plans to release a report on the shooting or present the case to a grand jury, which would decide if the deputies violated the law, McCollum said.

Jurors in previous Clear Creek case wanted mental health resources

Glass’ death isn’t the first time Clear Creek deputies have come under scrutiny for shooting a person having a mental health crisis.

In June 2020, a grand jury was convened by then District Attorney Bruce Brown, McCollum’s predecessor, to review the actions of two Clear Creek County sheriff’s deputies after they shot and killed an Idaho Springs man experiencing what appeared to be a mental health episode. Darrin Patterson, 57, was well-known to local police for his frequent, paranoid 911 calls.

After a high-speed chase, during which Patterson lit a gasolinedoused blanket in his backseat on fire, Patterson held a gun to his head while inside his car before pointing it toward one of the deputies, according to a grand jury report. A deputy shot Patterson fearing for the other deputy’s life.

Grand jurors did not find that either deputy violated the law, but

said they were “troubled” by the repeated responses by the Idaho Springs Police Department before Patterson’s death and “their failure to take any affirmative steps to facilitate assistance to Darrin Patterson, a person obviously experiencing profound mental illness.”

In the year before he died, Patterson had several encounters with the Idaho Springs police, many of them initiated by him, when he explained to officers his paranoid delusions of people spying on him, voices that

he heard and his belief that people were following him. He was never aggressive or showed violent tendencies, according to a grand jury report. Hours before his encounter with Clear Creek County deputies on the night of his death, Patterson called Idaho Springs police saying he was afraid people were following him and that he felt unsafe.

The jurors recommended that more mental health resources be made available across Clear Creek County and that its municipalities

contribute more funding to address mental health issues. They encouraged the local governments within the county to identify mental health resources “that do not currently exist” for law enforcement officers to help those in mental health crisis

“in hopes of preventing another tragedy like this from occurring,”

October 20, 202218 Clear Creek Courant