Brighton council fine with sharing victim services

Fort Lupton, Lochbuie could combine e orts with Brighton after New Year

BY SCOTT TAYLOR STAYLOR@COLORADOCOMMUNITYMEDIA.COMBrighton leaders are fine expanding their current Victim Services program — which provides counseling and other services for crime victims — to include Fort Lupton and Lochbuie.

The Greater Brighton Chamber of Commerce celebrated a ribboncutting ceremony of its own Oct. 13, officially opening a new location at Brighton’s Historic Train Depot at 269 E. Bridge St.

and so excited to be back here in Brighton,” said Robin Martinez, Brighton’s economic development president and CEO. “This is a beautiful space that Natalie built out here, and we are excited to partner with them. They’re right across the street from our office. I have a

passion for small business so I can’t wait to see what we can develop together.”

The train depot was built in 1908 as a cabbage loading dock on Second Avenue on the west side of the tracks.

Election 2022: How Secure is the Vote?

BY VIGNESH RAMACHANDRAN COLORADO NEWS COLLABORTIVE

BY VIGNESH RAMACHANDRAN COLORADO NEWS COLLABORTIVE

Colorado is known for its mailin-ballot system that some election experts have called the “gold standard” in the nation. But with unfounded claims of massive voter fraud rampant, some state residents remain concerned about whether their vote will get counted.

The Colorado News Collaborative is speaking with nonpartisan election experts to help the public understand more about the integrity of the vote. One of them, M.V. (Trey) Hood III, is a professor of Political Science at the University of Georgia. His state has been the epicenter

of high-profile claims of voter fraud in the 2020 election, which have been found false.

This Q&A has been edited for clarity and length.

How easy is it for someone to mess with the vote?

Certainly every state has a lot of things that have been put in place to prevent voter fraud, so a lot of safeguards are in place. It’s not necessarily easy to commit voter fraud. It does happen — it’s pretty episodic and rare, though. But, the fact that it does happen some – that’s what gets into the news and that’s sort of what reinforces the belief that it’s just completely rampant.

[Editor’s note: In Colorado, the conservative-leaning Heritage Foundation has documented 16 cases of voter fraud in the entire state since 2005.]

Georgia has been in the news in the last few years because of Trump supporters and allies claiming fraud in the 2020 Election. What are your thoughts about these claims, which have been found baseless?

In Georgia, all kinds of claims were made, and there has just been no evidence at all.

Outside of a handful of cases, there’s no evidence at all that there was voter fraud anywhere at the

“Well, that’s a great idea,” Brighton Councilor Mary Ellen Pollack said during the City Council’s Oct. 11 study session meeting. “They are our neighbors and I think that the way times are now — we all know that it’s not pretty out there — and we can help them and they can help us. You never do know when we are going to have a real big emergency and it will take more than one department to deal with it.”

Colorado municipalities are required to provide some level of victim rights services. Brighton and Commerce City have combined their efforts since 2014 and Fort Lupton, Lochbuie and other communities relied upon the Weld County Sheriff’s Department to provide those services. Weld County announced earlier this year that it would stop providing those services after Dec. 31 of this year.

“Brighton and Commerce City Victim Services have established a reputation that far exceeds the normal services that victims receive,” Kim Messina, Brighton victim services manager, said. “We have been recognized locally, nationally and across the state. I don’t tell you that so you’ll say what a great job we do. We have built a program that is successful and based upon best practices that truly work.”

DA Brian Mason sounds the dangers of fentanyl

BY STEVE SMITH

THORNTON – Brian Mason, the district attorney for the 17th Judicial District, spent some of his Oct. 13 town hall meeting at the Thornton Active Adult Center talking about his office’s duties, functions, divisions, who sets bail for defendants (it’s the judge assigned to the case) and even a “jury duty 101” presentation.

But the thing that was most on his mind was the drug fentanyl, which he said was synthetic, manufactured in China, shipped to Central America and is widely available in North America and around the world.

Methamphetamine used to be the drug of worry and concern in law enforcement, but not now, he said.

Mason said one reason for the drug’s popularity is that it’s cheaper to make.

“They are literally putting fentanyl in every drug on the market,” Mason said. “We’ve found it in what

appears to be oxycodone pills. We’re finding that people who take the drug think it’s one thing

Five people in Commerce City died earlier this year of a fentanyl overdose. So far, the DA’s office hasn’t been able to charge anyone for lack of evidence. Mason said the victims thought they were taking cocaine instead. In a separate case, the district attorney said a grand jury recently indicted two people on drug trafficking charges in connection with the death of a 2-year-old who died of fentanyl poisoning.

Mason said methamphetamine “continues to be a huge problem.” But he said his office is seeing more cases of fentanyl abuse and poisonings.

“Fentanyl can give a bigger high,” Mason said. “I’m proud of how we are attacking the problem. I didn’t have the tool to charge someone with fentanyl poisoning resulting in death. Sometimes, we can be real creative and charge first-degree murder. But one of the requirements

we have is to prove the suspect’s intent.”

Mason said the reaction to fentanyl is quick and fast.

“Parents? Talk to your kids about fentanyl. Fentanyl is the most dangerous drug on the streets,” he said. “We have to get people to understand how dangerous this drug is. If you have a drug that didn’t come from a pharmacy, don’t take it.”

Motor vehicle theft

Mason said he and other district attorneys in the state want to change the state’s motor vehicle theft law.

As of now, Mason can file charges based on the worth of the stolen car. He and the other attorneys plan to lobby the Legislature for a change.

“That is quite unjust,” Mason said. “It discriminates against people who have cars that aren’t valuable. Many people who have cars that aren’t valuable are poor. Many people can’t buy another car, so they can’t get to work or school or take their kids to daycare.”

Brighton considers hiring park security

Private security could help tamp down on gra ti, drug use in city parks

Brighton could hire outside security staff to keep track of 22 parks and city properties overnight, City Councilors heard Oct. 11.

Parks and Recreation Director Travis Haines said Brighton’s city parks have seen a rise in crime.

“As you all know, the amount of undesirable activity is skyrocketing in our parks — graffiti, vandalism, overnight guests, drug activity, violent attacks and crimes and things are just continuing to climb every year,” Haines said. “I think we are pretty much at an all-time

SERVICES

FROM PAGE 1

Lochbuie and the Fort Lupton police contacted Brighton to see if the program could be expanded. Messina said it could.

“One thing we thought about, though, is we will have to increase staff, but we can talk about that later in the budget,” Messina said.

Each department would provide space for the victim services staff to work and to meet confidentially with crime victims. Victim advocates themselves would work in all the cities and train with all departments and Messina would work directly with each department’s chief of police.

She said it would call for hiring at least one full-time victim advocate for the program.

high right now for what we have ever seen.”

He said he talked with neighboring communities, and many are hiring outside staff. His staff checked with four private companies to provide special patrols seven days each week from 10 p.m. to 6 a.m. Prices came in from 96,000 to $132,000, he said.

The companies would provide staff to monitor 22 city properties.

The security consultants would visit all areas two times each night.

They would have keys to go in and inspect restrooms and buildings looking for overnight camping, drug use or vandalism and would speak with people in the parks, making sure they adhere to closing times and curfews. They’ll contact police, if necessary.

Armed security would be an option, but Haines said he does not think Brighton needs that.

“I don’t think that’s the direction we want to go,” Haines said. “We don’t need somebody that is a contract employee for the city going crazy and causing issues with a firearm.”

Most companies provide TASERS and pepper spray for their consultants.

“Which is a lot more of what we are more looking for, you know, less lethal,” he said.

The security team would be required to keep reports of all interactions and the city would have access to all records, including body cameras and vehicle GPS data. They would not arrest people but would contact sworn police

Increasing paid staff would allow for better coverage across the four municipalities.

She said that they will have to adapt what they do to work with each new police department.

“Currently Lochbuie and Fort Lupton have not had a robust victims services program,” she said.

“We have about 75% call-out rate and we meet victims on the scene. That’s not something they have had or have been doing, so that could be a challenge for them and for our staff.”

It will also take those departments some work to get used to having victims services staff regularly involved on a regular basis, she said.

According to Messina, the expanded program will cost about $655,000 to operate annually and that would be shared by each community based on population, the

TURN TO THE COLORADO SUN FOR NEWS ACROSS THE STATE

The Colorado Sun is a journalistowned, award-winning news outlet that strives to cover all of Colorado so that our state — our community — can better understand itself. In this way, The Sun contributes to a more vibrant, informed and

whole Colorado.

The Sun, launched in 2018, is committed to fact-based, in-depth and non-partisan journalism. It covers everything from politics and culture to the outdoor industry and education.

number of victim rights calls for service in 2021 and the number of unattended deaths in each city. Under that formula, Commerce City would pay about $353,000, Brighton would pay about $213,000, Fort Lupton $52,000 and Lochbuie $36,000.

Councilor Clint Blackhurst wondered if Brighton volunteers would be asked to respond to the new communities. Messina said they would.

“Currently the way we have it, our volunteers come from both Brighton and Commerce City and they respond to whichever city calls,” she said.

He said he did see a concern with matching work cultures across the four departments.

“You have spent a good portion of your lifetime with the city training our officers on victim services and why it’s important and when they should be called,” Blackhurst said. “I venture to say those two agen-

if there is an issue, Deputy Chief Matt Domenico said.

“It really does feel like a dedicated solution to get people out checking on these parks on an ongoing basis in a way the PD staff just cannot do,” Domenico said. “But it allows us to target those areas and if something occurs, they will be able to get in contact with us.”

Domenico said the department would have to work out the details, if a private company is hired.

Councilor Clint Blackhurst said he was on board.

“I wish we had a dozen park rangers, and maybe someday it will have to be that way,” he said. “But I don’t think that’s what we need today. I just want to congratulate you on well thought out way to address a problem.”

cies will not have the same culture going in, which could create conflicts.”

Deputy Brighton Police Chief Matt Domenico said that’s a valid concern.

“They are certainly getting a different level of service than what we provide in our community,” he said.

“That being said, Kim and her staff have experience managing culture changes among organizations.

There was a significant culture change in Commerce City and the victim advocate program was viewed very differently.”

That’s changed, he said, and now victim services is an accepted part of the Commerce City Police Department’s culture.

“I feel very good that we will be able to recognize some significant benefits while helping out our neighboring communities as well,” he said.

Breathe

PROBLEMS?

PROBLEM?

POWER BILLS?

IF IT’S IN YOUR DUCTS, IT’S IN YOUR LUNGS

Our mission is to lower energy costs and provide the healthiest quality air possible. For anyone, business or residential, we will increase e ciency of your system by using the very latest techniques, the latest technologies and top of the line products. We will provide the highest quality of work possible. Our professional sta will assure a high level of professionalism that cannot be matched in our industry. We guarantee our products and services.

CUTTING

Union Pacific transferred owner

to a

owner in 1980.

According to Brighton’s Historic Preservation Staff, Howard Eyerly moved it to 269 E. Bridge St. in 1981 on the east side of the tracks.

The historic depot has been through several transitions since then. Soon after it was moved, it opened as a rail-themed restau rant and its owners added a train car on the right of the depot. They also added a model train with tracks that runs along the top of the ceiling into the bathroom.

“I have people come in all the time and tell me, ‘When I was a little kid, we would come on my birthday,’ and the prime rib was supposed to be the best item on the menu,” said Natalie Cummings, president, and CEO.

The lower part of the depot also held a popular bar and Cummings said she knows plenty of people that enjoyed having drinks there. It was also a place where the dis trict attorneys would come over and wait while their cases were being decided in District Court.

“There are lots of stories that went on at the depot and stories people won’t talk about because names could be mentioned. It’s pretty funny,” Cummings said.

Cummings said she believes the restaurant was sold, and a second restaurant tried to make it hap pen, but it wasn’t successful.

“Somewhere in 2000, it became a bicycle shop called Treads. They

did an excellent job restoring the building and got the model train running again. They did a lot of work, and then it was closed down. There are lots of gaps in the story,” Cumming said.

The Chamber tried to work with the city to get into the building for years.

“Then last fall, we started talk ing to the city again and we were able to make the deal and moved in this March and we are very excited,” Cumming said.

Cummings said they have plans to use the space on the back patio between the Chamber, the library, and the Armory for functions.

“Today its grandeur, we can add outdoor lighting, get permanent furniture back in the patio,” Cum mings said. “So we’re working with the Brighton Urban Renewal Authority to work on some ideas where we can partner and get those things done.”

They would like to use the back space of the Chamber for a coffee shop and restaurant.

“The opportunities that exist are so fantastic, the partnerships we have here in this community between economic development for the city, city council, the Chamber,” Cummings said. “And of course, with everything that’s happening with the library, I think that we’re going to find a solution that blesses the city but is also generates business. I’m looking forward to that.”

Cumming said the tourism cen ter is slowly developing to create something usable.

“It will help generate more visi tors. It’s our goal.”

Latino groups host CD8 forum Oct. 20

STAFF REPORT

Candidates in Colorado’s newest Congressional District are expected Oct. 20 at a Greeley Latino issues forum.

Several groups – CIRC Action, the Latino Coalition of Weld County, LULAC Greeley Chapter, CLLARO, COLOR, Working Families Party, Mi Familia Vota, The Latino Action Council, League of Women Voters and UNC Dept. of Equity, Diversity

Holly

and Inclusion organization – are hosting the forum from 6-8 p.m. Oct. 20 at the UNC University Center Longs Peak Ballroom, 2101 10th Ave. Greeley.

Residents will get to interact oneon-one with the candidates from 6- 6:30 p.m. The forum kicks off at 6:30 p.m. with candidates for the U.S. Congress, the State Board of Educa tion, the CU Regents and several house districts squaring off in a forum focused on Latino community issues.

Candidates expected to attend include Dr. Yadira Caraveo(D) and Barbara Kirkmeyer (R), candidates for the U.S. Congressional District 8. Other candidates expected are Col orado Board of Education candidate Rhonda Solis; CU Regent candidates Yolanda Ortega and Mark VanDriel; Jennifer Parenti, candidate State House District 19, : Mary Young and Ryan Gonzalez, candidates for State House District 50; Ryan Armagost and Richard Webster, candidates for State House District 64; Lisa Chollet and Michael Lynch, candidates for State House District 65; and Spring Erickson, candidate for State House District 48.

The forum is free to the public, and refreshments will be included. There is also free parking available around the University Center.

Fifth Sunday sing

Brighton United Methodist Church will host its Fifth Sunday Sing at 6 p.m. Sunday, Oct. 30, at 625 S. Eighth Ave. Call 303-659-2022.

Dia de los Muertos art sought for The Armory

The Art at The Armory annual Dia de los Muertos exhibit seeks local artists to join a show that runs through Nov. 16 at The Armory Performing Arts Center, 300 Strong St. This exhibit is a collaboration with the Chicano Humanities & Arts Council with support from the Brighton Cultural Arts Commission. The Armory will host a reception Friday, Oct. 28, featuring entertainment and refreshments. If you have questions, contact Armory House Coordinator Marcus Garcia at 303-655-2140.

Get inspired at Eagle View’s Annual Craft Fair

See the work of dozens of local artisans at Eagle View Adult Center’s Annual Craft Fair on Saturday, November 5 from 8 a.m. to 3 p.m. at 1150 Prairie Center Parkway.

Forty-nine vendors will be present to sell homemade crafts to event attendees. The annual craft fair has been a community favorite event, featuring local artisans and bringing Brighton citizens together to appreciate creative talent and get an early start on holiday shopping. Bake sale goods, breakfast burritos and lunch items will be available for purchase.

For the fourth year, Brightonbased United Power donated $1,000 to help with event expenses. All proceeds will go toward Eagle View Adult Center’s operating costs.For more information, contact the Eagle View at 303-655-2075.

Dive into Splashing Pumpkins on October 23

Swim into the spooky season at the Brighton Recreation Center’s Splashing Pumpkins on Oct. 23 from 12:30 - 4 p.m. at 555 N. 11th Avenue. Participants will get to dive into a floating pumpkin patch to retrieve a pumpkin of their choice.

The entry fee is $6, which includes a pumpkin to take home. The chaperone entry fee is $3. Please note that chaperone tickets do not include a pumpkin. Chaperones must be at least 16 years old.

Participants are encouraged to pre-register at Brighton’s activity registration page, at https://tinyurl. com/yzv7az7w on the internet. Walk-ins will be allowed if there is space available. You can also register by calling 303-655-2200.

If you have questions about the event, please call the Recreation Center at 303-655-2200.

Armory Performing Arts concerts

Brighton’s lineup for concerts at

BUY FOUR SELECT

the Armory Performing Arts Center, 300 Strong St. continues through November.

Oct. 29: Yesterday, The Beatles

Tribute, at 7 p.m.

Nov. 18: The Long Run, performs its “Alter Eagles” set at 8 p.m.

Nov. 19: The Long Run, Colorado’s tribute to the Eagles, at 8 p.m.

Tickets are available at brightonarmory.org. Contact Gary Montoya, events and downtown initiative manager, at gmontoya@ brightonco.gov.

Car registration now open for Car-nival Palooza 2022

In preparation for the annual trunk-or-treat event Car-nival Palooza, the Brighton Recreation Center has opened registration for cars to participate in the event. Car-nival Palooza is scheduled for 4:30 to 7:30 p.m. Saturday, Oct. 29, at the Brighton Recreation Center parking lot (555 N. 11th Ave.).

HAVE YOUR BATTERY TESTED AT NO CHARGE*

E AGLE VIEW A DULT C ENTER

Eagle View Adult Center Update –Oct 19 - 26 , 2022 Eagle View Adult Center is open Monday – Friday, 8:00 a.m. - 4:00 p.m. Call 303-655-2075 for more information. e September & October Newsletter is available.

Cards, Games and Pool

If you like to play games like bridge, pinochle, dominos, scrabble and pool… Eagle View is the place to get connected. Check out the newsletter for playing times.

VOA Lunch

A hot, nutritious lunch is provided by Volunteers of America, Mondays and ursdays at 11:30 a.m. Please reserve your VOA meal in advance: For Mondays reserve the ursday before, for ursdays reserve the Monday before.! Call Eleanor at 303-655-2271 between 10:00 a.m. - 2:00 p.m., Mon. & urs. Daily meal donations are appreciated. $2.50 Donation per meal if age 60+ $8.50 Mandatory charge if under 60

Monsters & Legends

From the vampires of Eastern Europe to the stories of werewolves, zombies, and more, we will explore the origins and history of familiar (and not so familiar) tales and how they have evolved and grown over time. 1:30 p.m. Wed. Oct 19 $5 Deadline: Tues. Oct 18

Age of Reform: 1820 - 1850

Starting with the extraordinary concept of giving all adult males the right to vote, Americans believed they could improve the culture. Consequently, a series of reform movements began such as temperance, abolition of slavery, public education, and women’s rights. Presenter: Paul Flanders. 1:30 p.m. urs. Oct 20 $4 Deadline: Wed. Oct 19

Medicare 101

Whether you are turning 65 in the next few months or are already enrolled in Medicare, you’ll learn about all the Medicare alphabet – A, B, C, D, etc. Bring your questions! Our Medicare information series will continue in November. 1:30 p.m. Tues. Oct 25 Free Deadline: Mon. Oct 24

Colorado Ghost Stories Ghosts, goblins, witches galore. Jack-o-Lantern light the door. Come sit a spell and hear the lore of ghastly apparitions, witches and more. Time Traveling with Jackie Smith will make you scream with delight; only if you’re there, you’ll be in for a fright! 1:30 p.m. urs. Oct 27 $4 Deadline: Tues.

VOICES

What other dirty linen in our geographic drawer needs cleansing?

Our heartburn about the name Evans appears to be nearing resolution. The Colorado Geographic Naming Advisory Board this week heard testimony about the role of John Evans, then the territorial governor, in the Sand Creek Massacre of 1864.

The evidence presented by representatives of Cheyenne and Arapahoe tribes, the primary victims of the massacre, was not new, but it was damning. Can there be any doubt that Colorado’s 14th highest mountain, dominant on Denver’s western skyline, should have a different name? Blue Sky and Cheyenne-Arapaho are among the names formally proposed.

The board will likely adopt a recommendation to Gov. Jared Polis in January or February. Polis will in turn report to the U.S. Board of Geographic Names, the fi nal arbiter.

Other names assigned to our mountains, streets and schools may cause indigestion if you examine the historical footnotes. Just how much more geographic cleansing do we need to address

between

tary school. Then 18, Howbert was among the 3rd Regiment soldiers nearing the end of their 100-day volunteer enlistments. They methodically killed between 150 and 230 people, mostly women and older men but also children and babies.

Victims also included several Anglo-Indian “half breeds.” In camping peacefully along Sand Creek, they believed they had been afforded protection from the attack by the U.S. Army. They held up their end of the deal. Howbert, later a founder of Colorado Springs, never apologized.

And what to do with Downing, one of Denver’s most prominent streets, named after Jacob Downing, who participated in the massacre. Later, he helped create Denver’s City Park. Like many others, including Evans, who also did much good, his story is not a simple one.

looking after the best interests of the tribes. He did not, as a report issued in 2014 by a Northwestern University panel made clear. A University of Denver report the same year, the 150th anniversary, delivered a more stinging conclusion, putting Evans on the same high shelf of culpability as Chivington. The report found that Evans, through his actions, “did the equivalent of giving Colonel Chivington a loaded gun.”

Both institutions were founded by Evans.

George “Tink” Tinker, an American Indian scholar-activist who contributed to that DU report, told advisory board members that discussions were “much more radical than the fi nal report was.”

Said Ryan Ortiz, a descendant of White Antelope, an Arapaho chief killed and mutilated at Sand Creek: “The most prominent peak in Colorado should not be named after a man who (was) comfortable with the massacre of other human beings.”

As for Byers, no proposal has been fi led for shedding his name from Grand County, the site of the

tlers think that Indians might set upon them at any moment.”

Like Evans, Byers refused to condemn the massacre even decades later. Instead, he argued that it had “saved Colorado and taught the Indians the most salutary lesson they had ever learned,” according to Ari Kelman’s “A Misplaced Massacre,” one of several dozen books about Sand Creek.

Oddly, while two congressional committees and a military commission that investigated Sand Creek pronounced it an unprovoked massacre, Colorado did not. Until it was toppled by protesters in 2020, a statue honoring veterans located at the Colorado Capitol referred to the “Sand Creek Battle.”

That statue now stands several blocks away in History Colorado, where museum visitors are asked: “Do we need monuments?”

Museums, yes, but not monuments, one person answered. But here we are, stuck in 21st-century Colorado with a lot of names of 19th-century men on our maps. Some seem not to offend, but those associated with the massacre assuredly do.

An Evans-Byers house stands near the Denver Art Museum. The names have been scrubbed from the sign, though. I suspect in time we’ll do the same with our moun-

Allen Best writes about energy, water and sometimes other transitions at BigPivots.com.

Weld urges yes on Home Rule Charter Question 1A

compensation plans. The system created under the Weld County Home Rule Charter provides for a competitive and well-liked salary and benefits package, including unemployment insurance, healthcare, dental, life, disability insurance, worker’s compensation, and a generous retirement package. On average, the county annually spends an additional $28,000 per employee on a benefits package more generous than many in the private sector. The county provides a safe work environment, thoroughly investigates all disciplinary accusations, and proactively protects employees’

legal

general

Brighton, Colorado, Brighton Standard

Colorado

Brighton

PERIODICAL POSTAGE PAID

Brighton and

POSTMASTER: Send address change to: Brighton Standard

W.

JAMES

And the county has done all of that without a collective bargaining law.

Injecting collective bargaining as an additional bureaucratic layer is as unnecessary as it is expensive. If Weld County is required to en-

LETTER TO THE EDITOR

Family first, rivalry second

During the PVHS vs Brighton Varsity game we raised funds for a Brighton football player who is fighting Leukemia with our 50/50 raffle. We raised $900 total. $450 of the boosters earning were going to go to Parker and his family! Well, our winner (a 27j employee) didn’t skip a beat and wanted to donate her winnings to the family also!!

On Sunday (Oct. 9), a couple of booster members and players went to meet Parker Rose and his family. Y’all, this

gage in collective bargaining with Weld County employees, the estimated additional annual cost to the county would be $42,943,426.00 to $60,120,796.00, as analyzed by Donald Warden, Weld County Director of Finance and Administration.

Collective bargaining will force the county to reallocate funds from necessary projects to a program that largely duplicates protections already in place. And it will be at

the expense of services citizens rely upon to keep them safe and provide for a high quality of life.

Fortunately, as a home-rule county, the voters can amend the home-rule charter to ensure the Weld County Commissioners are under no obligation to recognize or negotiate with, for the purpose of collective bargaining, any collective bargaining unit of county employees.

ABOUT LETTERS TO THE EDITOR

family is truly amazing. They are a ray of sunlight during this tough time. Parker’s smile is enough to melt your heart. He couldn’t believe some of the players from Prairie View would take time on a Sunday to visit him.

Parker was having a pretty good day on Sunday and was even able to stand with the players for a photo.

Yes, PV and Brighton is a rivalry; however, we are all part of the football family.

Tim Cardenas, Prairie View High School football coach

Colorado Community Media welcomes letters to the editor. Please note the following rules:

• Email your letter to letters@coloradocommunitymedia.com. Do not send via postal mail. Put the words “letter to the editor” in the email subject line.

• Submit your letter by 5 p.m. on Wednesday in order to have it considered for publication in the following week’s newspaper.

• Letters must be no longer than 400 words.

• Letters should be exclusively submitted to Colorado Community Media and should not submitted to other outlets or previously posted on websites or social media. Submitted letters become the property of CCM and should not be republished elsewhere.

• Letters advocating for a political candidate should focus on that candidate’s qualifica-

And, fortunately, as a home-rule county, the voters can have a direct say as to how their tax dollars are used in this case.

Therefore, Weld County voters are encouraged to vote ‘YES” on Weld County Home Rule Charter Question 1A.

Submitted by Commissioner Chair Scott James on behalf of the Board of Weld County Commissioners

Submitted by Commissioner Chair Scott James on behalf of the Board of Weld County Commissioners

tions for o ce. We cannot publish letters that contain unverified negative information about a candidate’s opponent. Letters advocating for or against a political candidate or ballot issue will not be published within 30 days of an election.

• Publication of any given letter is at our discretion. Letters are published as space is available.

• We will edit letters for clarity, grammar, punctuation and length and write headlines (titles) for letters at our discretion.

• Please don’t send us more than one letter per month. First priority for publication will be given to writers who have not submitted letters to us recently.

• Submit your letter in a Word document or in the body of an email. No PDFs or Google Docs, please.

Eugene “Gene” A. Cvancara

As a family we want to express what an amazing life our husband and father Eugene “Gene” Cvancara lived. He was born on September 1, 1935 and started his life living in a tar paper shack on the family homestead in Ross, North Dakota. After his grandparents passed away, the family moved into the main farmhouse. Gene recalled how they lived an hour outside of town. e kids would put stones on the pot belly stove and wrap them in blankets that they placed at their feet in the open sleigh for the ride into town.

Gene quit school after 6th grade and helped on the farm. At 16 years old, Gene lied to get a job as a roughneck and drove to Texas to work. is not only gave him an excellent job, but he came back to his hometown and was able to help put the crop in with his family. He had been so proud and excited to help his family as an “adult”.

He returned to Texas to nish his job and at 18 years old, he signed up for the Army. He nished boot camp and was stationed in Fort Belvoir in Virginia. He was trained in the Army Corp of Engineers and upon completion of his training, he shipped out to Germany to rebuild buildings and roads. He took advantage of being in Europe enjoying sites in Amsterdam, France and Italy. Even though he loved remembering the areas he saw, he remembered how thankful the German people were to see their war-torn country being repaired and rebuilt. He said they all welcomed the soldiers and took care of them while they were there.

He started a life with his wife Sharon on June 15, 1958 and quickly moved from North Dakota to South Dakota and landed in Brighton, Colorado by spring of 1960.

ey raised their 3 children: Scott, Lezli and Shawn who all live in the area to this day. He not only built a life but worked on building the city. He was a superintendent for Asphalt Paving and his most notable

projects were all of I-225, 6th Avenue and I-25 through the “mousetrap”.

He worked for Cox Construction working with telephone conduit, but his true passion came to fruition when he started Vancara Builders with his son Scott. ey built custom homes throughout Brighton. Most people today can still recognize the style, quality and craftsmanship that went into each and every house.

After working in California for a while, Gene returned to Colorado and retired from Concrete Express. He and Sharon enjoyed his retirement years while living part-time between Colorado and Arizona. ey extensively travelled throughout the country in an RV and always enjoyed meeting new people and visiting with friends and family along the way. ey took cruises to Alaska, the Panama Canal and were truly blessed when they ful lled their lifelong dream of travelling through the Holy Lands of Israel.

Gene passed away on September 23, 2022 with his family by his side. He is survived by his wife Sharon, brother Larry (Edith) Cvancara, son Scott (Gretchen) Cvancara, daughters Lezli (John) Belohrad and Shawn (Tom) Weaver. His grandchildren: Lynette (Rob)Laursen, Lori (Jered) Maupin, Seth (Kenzie) Cvancara, Shannon ( omas) Quayle, Mykol Sostarich, Tyler (Danielle) Weaver, Travis Belohrad, Alyssa (Devin) DeRocher, Ralphie Martinez, Auston Belohrad and Braden Weaver. Greatgrandchildren Alyanna Hale, Providence Quayle, Titus Quayle, Aspen Cvancara and Melody Sostarich.

He is preceded in death by his parents Louis and Cora Cvancara, brothers Leo and Donnie, sisters Ida and MaryAnne and daughter Tammy.

We celebrate a truly blessed life and look forward to seeing him again with our Lord and Savior in heaven.

Thu 10/20

5A Region 3 Championships

@ 2pm / Free-Free

Northwest Open Space, 2100 W 112th Ave, Northglenn

3A Region 3 Championships

@ 3:30pm / Free-Free

2100 W 112th Ave, Northwest Open Space, Northglenn

Diabetes Self-Empowerment Series

@ 4pm

Oct 20th - Nov 10th

Bison Ridge Recreation Center, 13905 E. 112th Avenue, Commerce City. 303-2893760

Fri 10/21

Breakfast Burrito Bingo 10/21

@ 3pm

Bison Ridge Recreation Center, 13905 E. 112th Avenue, Commerce City. 303-2893760

Willy Wonka Jr.

@ 5pm / $10-$15

The LoCol Theatre, 800 South Hover Road, Longmont

Clay Creations

@ 11pm

Eagle Pointe Recreation Center, 6060 E. Parkway Dr., Commerce City. 303-2893760

Sat 10/22

Colorado Avalanche vs. Seattle Kraken

@ 7pm / $75-$999

Ball Arena, 1000 Chopper Circle, Denver

Westminster Harvest Festival

@ 12pm

Downtown Westminster, 5453 West 88th Avenue, Westminster. prl@cityofwestminster.us, 303658-2192

Sun 10/23

Intro to the Outdoors

@ 10:30pm

Offsite, 6060 E Parkway Drive, Commerce City. 303-289-3760

Wed 10/26

Apple Days

@ 5:30pm

Fort Lupton Recreation & Parks De‐partment, 203 S Harrison, Fort Lupton. 303-857-4200

Lost World of Egypt (10/26)

@ 7pm

Splashing Pumpkins

@ 12:30pm

Brighton Recreation Center, 555 North 11th Avenue, Brighton. ksulli van@brightonco.gov, 303-6552000

Eagle Pointe Recreation Center, 6060 E. Parkway Dr., Commerce City. 303-2893760

Hocus Pocus w/ Colorado Symphony Orchestra

@ 7:30pm

Boettcher Hall, 1000 14th Street, Denver

Anavrin's Day: Friday Night @ Hoffbrau

@ 9pm

Hoffbrau, 9110 Wadsworth Pkwy, West‐minster

Lifeguard Class (October 2022)

@ 11pm

Oct 21st - Oct 30th

Fort Lupton Recreation & Parks De‐partment, 203 S Harrison, Fort Lupton. 303-857-4200

Thornton Trunk or Treat @ 4pm

Carpenter Park Fields, 11000 Col‐orado Boulevard, Thornton. Re nee.Dodson@ThorntonCO.gov, (303) 720-977-5917

Denver Broncos vs. New York Jets

@ 2:05pm / $119-$475

Empower Field At Mile High, 1701 Bryant St., Denver

Mon 10/24

Denver Nuggets vs. Los Angeles Lakers

@ 8pm / $45-$6705

Ball Arena, 1000 Chopper Circle, Denver

Adventure & Experiential Learning

@ 10:30pm

Oct 26th - Oct 29th

Eagle Pointe Recreation Center, 6060 E. Parkway Dr., Commerce City. 303-2893760

Thu 10/27

Pumpkin Painting (10/27)

@ 5pm

Eagle Pointe Recreation Center, 6060 E. Parkway Dr., Commerce City. 303-2893760

Northglenn Safe Street

Halloween @ 4pm

Elanor M. Wyatt Centennial Park, 305 Kennedy Drive, Northglenn. jlund@northglenn.org, 303-4508850

Longmont Farmer's Market (10/22) @ 4pm

Eagle Pointe Recreation Center, 6060 E. Parkway Dr., Commerce City. 303-2893760

Denver Nuggets vs. Oklahoma City Thunder @ 7pm / $19-$3410

Ball Arena, 1000 Chopper Circle, Denver Gloria Trevi Isla Divina Tour @ 8pm Bellco Theatre, 700 14th Street, Denver

Anavrin's Day: Saturday Night Show @ Hoffbrau @ 9pm Hoffbrau, 9110 Wadsworth Pkwy, West‐minster

Victorian Halloween with the Molly Brown House Museum @ 5:30pm

Anythink Brighton, 327 East Bridge Street, Brighton. rbowman @anythinklibraries.org, 303-4053230

DnD Adventures- The Tumble Sprite Rally @ 8pm

Bison Ridge Recreation Center, 13905 E. 112th Avenue, Commerce City. 303-2893760

Tue 10/25

Tuesday Movie Matinee 10/25 @ 7am

Eagle Pointe Recreation Center, 6060 E. Parkway Dr., Commerce City. 303-2893760

Ryan Hutchens at ALOFT Broom�eld @ 6pm

Aloft Broom�eld Denver, 8300 Arista Pl, Broom�eld

Dayglow

@ 8pm

Ogden Theatre, 935 E. Colfax Ave., Denver

Natural Endings: Green options for the end of life

@ 5:30pm

Anythink Wright Farms, 5877 East 120th Avenue, Thornton. mhibben @anythinklibraries.org, 303-4053200

Tejon Street Corner Thieves

@ 7pm

The Barn, Boulder

Nature Photography @ 10:30pm

Oct 27th - Nov 10th

Eagle Pointe Recreation Center, 6060 E. Parkway Dr., Commerce City. 303-2893760

VOICES

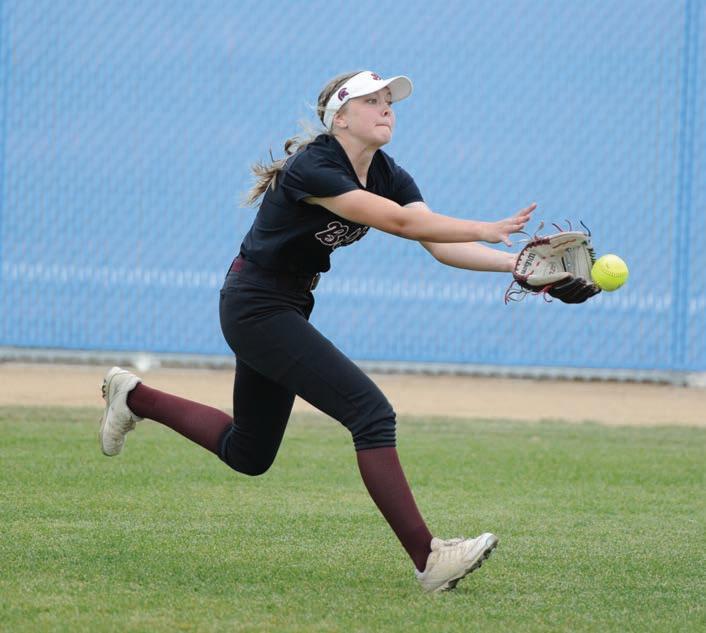

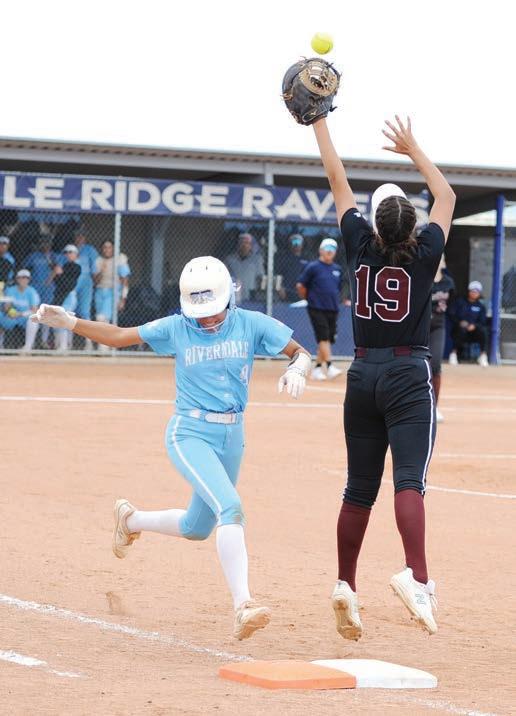

Riverdale Ridge cruises to state 4A tournament

BY JONATHAN MANESS SPECIAL TO COLORADO COMMUNITY MEDIA

THORNTON – The Riverdale Ravens’ softball team is fl ying on to the state tournament, and the Ravens are doing it with swagger.

Fourth-rated Riverdale Ridge cruised through the class 4A Region 4 District tournament Oct. 15. The Ravens rolled by No. 29 Evergreen 14-4 and then fl ew by No. 13 Berthoud 10-0.

“I am so proud of this team,” Ravens’ coach Ray Garza said. “They work so hard in the offseason, and I’m just blessed to be a part of this group.”

Riverdale Ridge (22-3 overall) will have its work cut out next week at the class 4A state tournament with a tough slew of competition up and down.

Amongst the top of the competition is No. 1-rated Lutheran, which defeated Riverdale Ridge in a tough 1-0 defeat earlier this year, and Holy Family, the team that knocked Riverdale out of the playoffs last season.

“(Class) 4A has a lot of competition,” Garza said. “It’s going to be tough. Any of the 16 teams can win, it is entirely possible. We are just going to ride it out and bring our ‘A’ game.”

The Ravens brought their game Saturday. They got off to a slow start against Evergreen, allowing the Cougars to score three runs in the fi rst inning. But Riverdale started to pull away in the third with a seven-run inning to go up 11-4. The Ravens sealed the win in the fi fth with a pair of runs.

Sophomore Jazmyn Sandoval led the way with three hits and four RBIs. Zoie Linville and Madyson Ortiz also had a pair of RBIs and scored two runs. Neila Lucero added a pair of runs too.

The Ravens carried the momentum into their contest against Berthoud and put the Spartans in a big hole early.

Aubree Davis and Ganessa Duran each hit a pair of three-run home runs in the fi rst inning, and Linville scored on a passed ball to give the Ravens a 7-0 advantage after the fi rst.

With the big lead behind her, Riverdale’s outstanding sophomore pitcher, Brynn Trujillo, was cooking on the mound. She struck out 12 batters in the contest and shut down 11 batters in the row. Only two Spartans got in scoring position in the contest, but Trujillo and the Ravens stout defense left the runners stranded.

Junior Tegan Medina sealed the victory with a solo shot in the fi fth.

“The strong start was very important. It gave us a big confi dence boost and got us going,” Davis said. “I have complete confi dence in our team, and we are just going to play our game (next week).”

SPORTS

Prairie View High School

Football

AURORA -- Rangeview stopped Prairie View 29-15 at Hinkley High School Oct. 12. No stats were available for either team.

Soccer

Rocky Mountain scored four times in the second half en route to a 5-0, home-pitch win over Prairie View Oct. 11.

Miles Monner scored four of the Lobos’ goals. Benito MacEachran scored the other. No stats were available for PVHS.

Volleyball

Loveland beat the ThunderHawks 25-14, 25-16, 25-14 in Loveland Oct. 11. Elena Gonzales had five kills to pace PVHS. Paige Walker and Kira Ulibarri added two.

Olivia Williams had 11 kills for Loveland. Layne Elder added eight, and Avaree Stalker served up four aces.

Brighton High School

Softball

PARKER -- Loveland downed Brighton 16-6 in the class 5A, Region 6 tournament at Ponderosa High School. Ava Araujo, Kasey Dean and Rachael Dean had two hits and an RBI. Emily Moreno had Anna Headley also contributed base hits.

Loveland ‘s Laynee Case had three hits and three RBIs. Jordan Hodges added two hits and three RBIs, while Ava Gintoli had a base hit and three RBIs.

The host Mustangs beat the Bulldogs 12-2 in the tournament’s first game. No stats were available for Ponderosa. Brylyn Haddick had a base hit and got credit for BHS’ only RBI. Jordyn Martinez had two hits for BHS.

The losses bring an end to Brighton’s season. The Bulldogs had a record of 11-14, 7-7 in the Front Range League.

Football Horizon topped Brighton 26-20 in Brighton Oct. 14. It was the Hawks’ second straight win.

No stats were available for either team.

Volleyball

Brighton tripped up Erie 26-24, 25-14, 13-25, 25-11 in Brighton Oct. 13. Andi Jackson led Brighton’s offense with 16 kills. Evelyn Udezue was next with nine. No stats were

available for the Tigers.

Fort Collins held off Brighton 25-21, 25-22, 23-25, 15-25, 16-14 in Fort Collins Oct. 11. Jackson had a dozen kills for the Bulldogs. Meghan Scruggs and Evynn Jacobson added five.

Claire Wagstaff (15 kills) and Jordyn Romano (12 more) led the Lambkins’ offense. Sydney Stokes served five aces.

Soccer

Fossil Ridge stopped Brighton 6-1 in Brighton Oct. 11, thanks to the Sabercats’ five-goal second half.

Adrian Morjon Martinez scored three times for Fossil Ridge. Sterling Bellendir added a pair, and Antonios Katopodis chipped in with one score. No stats were available for BHS.

Eagle Ridge Academy

Soccer

Faith Christian Academy downed Eagle Ridge Academy 4-0 in Arvada Oct. 11.

Davey Bunavi scored twice for the Eagles. Caleb Cassell and Charlie McDonough also added goals, and goalie Zach Cohoon had four saves. No stats were available for the Warriors.

Volleyball

Faith Christian Academy downed Eagle Ridge 25-19, 25-12, 25-21 in Arvada Oct. 14. Ellie King had 11 kills to pace FCA’s offense. Avery Davis added nine. No stats were available for the Warriors.

Colorado Springs Christian beat Eagle Ridge 25-23, 25-17, 25-21 in Colorado Springs Oct. 11. Jordyn Rollins had 1-0 kills for the Lions. Lauren Handy and Taylor Boals added eight. No stats were available for ERA.

Eagle Ridge downed Denver School of Science/TechnologyGreen Valley Ranch in straight sets Oct. 10. No stats were available for either team.

Riverdale Ridge High School Cross country

FORT MORGAN -- Here are Riverdale Ridge’s results from the Longs Peak League meet at Riverside Park Oct. 12.

Girls

10. Payton Meineke, 19:13.3 (season best). 27. Johanna Pataluna, 21:25.4 (season best). 34. Savannah Mommens, 22:09.5. 37. Cayley Hansen, 22;21.7. 62, Usla Ruiz, 24:29.1 (season best).

HARVEST

Thomas III

2022 Statewide Ballot Issues

The Colorado Constitution (Article V, Section 1(7.3)) requires the Colorado Legislative Council to publish the ballot title and legal text of each statewide ballot measure.

A “YES/FOR” vote on any ballot issue is a vote in favor of changing current law or existing circumstances, and a “NO/AGAINST” vote on any ballot issue is a vote against changing current law or existing circumstances.

Amendment D

New 23rd Judicial District Judges

The ballot title below is a summary drafted by the professional legal staff for the general assembly for ballot pur poses only. The ballot title will not appear in the Colorado constitution. The text of the measure that will appear in the Colorado constitution below was referred to the voters because it passed by a two-thirds majority vote of the state senate and the state house of representatives.

Ballot Title:

Shall there be an amendment to the Colorado constitution concerning judges of the newly created twenty-third judicial district, and, in connection therewith, directing the governor to designate judges from the eighteenth judicial district to serve the remainder of their terms in the twenty-third judicial district and requiring a judge so designated to establish residency within the twenty-third judicial district?

Text of Measure:

Be It Resolved by the House of Representatives of the Seventy-third General Assembly of the State of Colorado, the Senate concurring herein:

SECTION1. At the election held on November 8, 2022, the secretary of state shall submit to the registered electors of the state the ballot title set forth in section 2 for the following amendment to the state constitution:

In the constitution of the state of Colorado, section 10 of article VI, add (5) as follows:

Section 10. Judicial districts - district judges - repeal. (5) Pursuant to the creation of the twenty-third judicial district, no later than November 30, 2024, the governor shall designate district judges from the eighteenth judicial district to serve as district judges in the twenty-third judicial district. No later than January 7, 2025, each district judge designated pursuant to this section shall establish residence in the twenty-third judicial district. Each district judge designated pursuant to this section, at the completion of the last term for which the judge was last elected or appointed, is eligible to seek retention in the twenty-third judicial district. A vacancy in any judicial office in the twenty-third judicial district occurring after January 7, 2025, shall be filled as provided in section 20 (1) of this article VI.

SECTION2. Each elector voting at the election may cast a vote either “Yes/For” or “No/Against” on the following ballot title: “Shall there be an amendment to the Colorado constitution concerning judges of the newly created twentythird judicial district, and, in connection therewith, directing the governor to designate judges from the eighteenth judicial district to serve the remainder of their terms in the twenty-third judicial district and requiring a judge so designated to establish residency within the twenty-third judicial district?”

SECTION3. Except as otherwise provided in section 1-40123, Colorado Revised Statutes, if at least fifty-five percent of the electors voting on the ballot title vote “Yes/For”, then the amendment will become part of the state constitution.

Amendment E Extend Homestead Exemption to Gold Star Spouses

The ballot title below is a summary drafted by the professional legal staff for the general assembly for ballot pur poses only. The ballot title will not appear in the Colorado constitution. The text of the measure that will appear in the Colorado constitution below was referred to the voters because it passed by a two-thirds majority vote of the state senate and the state house of representatives.

Ballot Title:

Shall there be an amendment to the Colorado constitution concerning the extension of the property tax exemption for qualifying seniors and disabled veterans to the surviving spouse of a United States armed forces service member who died in the line of duty or veteran whose death resulted from a service-related injury or disease?

Text of Measure:

Be It Resolved by the House of Representatives of the Seventy-third General Assembly of the State of Colorado, the Senate concurring herein:

SECTION1. At the election held on November 8, 2022, the secretary of state shall submit to the registered electors of the state the ballot title set forth in section 2 for the following amendment to the state constitution:

In the constitution of the state of Colorado, section 3.5 of article X, add (1)(d) and (1.7) as follows:

Section 3.5. Homestead exemption for qualifying senior citizens, disabled veterans, and surviving spouses receiving dependency indemnity compensationdefinition. (1) For property tax years commencing on or after January 1, 2002, fifty percent of the first two hundred thousand dollars of actual value of residential real property, as defined by law, that, as of the assessment date, is owner-occupied and is used as the primary residence of the owner-occupier shall be exempt from property taxation if: (d) For property tax years commencing on or after January 1, 2023, only, the owner-occupier, as of the assessment date, is an eligible spouse.

(1.7) As used in this section, “eligible spouse” means either a surviving spouse of a United States armed forces service member who died in the line of duty and received a death gratuity from the department of defense pursuant to 10 U.S.C. sec. 1475 et seq. or a surviving spouse of a veteran whose death resulted from a service-related injury or disease as determined by the United States department of veterans affairs if the surviving spouse is receiving dependency indemnity compensation awarded by the United States department of veterans affairs pursuant to chapter 13 of part II of title 38 of the United States Code, chapter 5 of part I of title 38 of the United States Code, and any other applicable provision of federal law.

SECTION2. Each elector voting at the election may cast a vote either “Yes/For” or “No/Against” on the following ballot title: “Shall there be an amendment to the Colorado constitution concerning the extension of the property tax exemption for qualifying seniors and disabled veterans to the surviving spouse of a United States armed forces service member who died in the line of duty or veteran whose death resulted from a service-related injury or disease?”

SECTION3. Except as otherwise provided in section 1-40123, Colorado Revised Statutes, if at least fifty-five percent of the electors voting on the ballot title vote “Yes/For”, then the amendment will become part of the state constitution.

Amendment F Changes to Charitable Gaming Operations

The ballot title below is a summary drafted by the professional legal staff for the general assembly for ballot pur poses only. The ballot title will not appear in the Colorado constitution. The text of the measure that will appear in the Colorado constitution below was referred to the voters because it passed by a two-thirds majority vote of the state senate and the state house of representatives.

Ballot Title:

Shall there be an amendment to the Colorado constitution concerning the conduct of charitable gaming activities, and, in connection therewith, allowing managers and operators to be paid and repealing the required period of a charitable organization’s continuous existence before obtaining a charitable gaming license?

Text of Measure:

Be It Resolved by the House of Representatives of the Seventy-third General Assembly of the State of Colorado, the Senate concurring herein:

SECTION1. At the election held on November 8, 2022, the secretary of state shall submit to the registered electors of the state the ballot title set forth in section 2 for the following amendment to the state constitution:

In the constitution of the state of Colorado, section 2 of article XVIII, amend (2), (4)(c), and (6) as follows:

Section2. Lotteries prohibited - exceptions - repeal.

(2) No game of chance pursuant to this subsection (2) and subsections (3) and (4) of this section shall be conducted by any person, firm, or organization, unless a license as provided for in this subsection (2) has been issued to the firm or organization conducting such games of chance.

The secretary of state shall, upon application therefor for a license on such forms as shall be prescribed by the secretary of state and upon the payment of an annual fee as determined by the general assembly, issue a license for the conducting of such games of chance to any bona fide chartered branch or lodge or chapter of a national or state organization or to any bona fide religious, charitable, labor, fraternal, educational, voluntary firemen’s, or veterans’ organization which that operates without profit to its members and which that is registered with the secretary of state and has been in existence continuously for a period of five three years immediately prior to the making of said its application for such the license or, on and after January 1, 2025, for such period as the general assembly may establish under subsection (5) of this section, and has had during the entire five-year period of its existence a dues-paying membership engaged in carrying out the objects of said corporation or organization, such license to expire at the end of each calendar year in which it was issued.

(4) Such games of chance shall be subject to the following restrictions:

(c)(I) No person may receive any remuneration or profit in excess of the applicable minimum wage for participating in the management or operation of any such game.

(II) This subsection (4)(c) is repealed, effective July 1, 2024.

(6)(a) The enforcement of this section shall be under such official or department of government of the state of Colorado as the general assembly shall provide.

(b) This section does not require or authorize the secretary of state to receive or review claims concerning employee wages or compensation, including tax claims, or other associated labor, employment, or contractual matters.

2022 Statewide Ballot Issues

SECTION2. Each elector voting at the election may cast a vote either “Yes/For” or “No/Against” on the following ballot title: “Shall there be an amendment to the Colorado constitution concerning the conduct of charitable gaming activities, and, in connection therewith, allowing managers and operators to be paid and repealing the required period of a charitable organization’s continuous existence before obtaining a charitable gaming license?”

SECTION3. Except as otherwise provided in section 1-40123, Colorado Revised Statutes, if at least fifty-five percent of the electors voting on the ballot title vote “Yes/For”, then the amendment will become part of the state constitution.

Proposition FF Healthy School Meals for All The ballot title below is a summary drafted by the professional legal staff for the general assembly for ballot pur poses only. The ballot title will not appear in the Colorado Revised Statutes. The text of the measure that will appear in the Colorado Revised Statutes below was referred to the voters because it passed by a majority vote of the state senate and the state house of representatives.

Ballot Title:

SHALL STATE TAXES BE INCREASED $100,727,820 ANNUALLY BY A CHANGE TO THE COLORADO REVISED STATUTES THAT, TO SUPPORT HEALTHY MEALS FOR PUBLIC SCHOOL STUDENTS, INCREAS ES STATE TAXABLE INCOME ONLY FOR INDIVID UALS WHO HAVE FEDERAL TAXABLE INCOME OF $300,000 OR MORE BY LIMITING ITEMIZED OR STAN DARD STATE INCOME TAX DEDUCTIONS TO $12,000 FOR SINGLE TAX RETURN FILERS AND $16,000 FOR JOINT TAX RETURN FILERS, AND, IN CON NECTION THEREWITH, CREATING THE HEALTHY SCHOOL MEALS FOR ALL PROGRAM TO PROVIDE FREE SCHOOL MEALS TO STUDENTS IN PUBLIC SCHOOLS; PROVIDING GRANTS FOR PARTICIPAT ING SCHOOLS TO PURCHASE COLORADO GROWN, RAISED, OR PROCESSED PRODUCTS, TO INCREASE WAGES OR PROVIDE STIPENDS FOR EMPLOYEES WHO PREPARE AND SERVE SCHOOL MEALS, AND TO CREATE PARENT AND STUDENT ADVISORY COM MITTEES TO PROVIDE ADVICE TO ENSURE SCHOOL MEALS ARE HEALTHY AND APPEALING TO ALL STUDENTS; AND CREATING A PROGRAM TO ASSIST IN PROMOTING COLORADO FOOD PRODUCTS AND PREPARING SCHOOL MEALS USING BASIC NUTRI TIOUS INGREDIENTS WITH MINIMAL RELIANCE ON PROCESSED PRODUCTS?

Text of Measure:

Be it enacted by the General Assembly of the State of Colorado:

SECTION1. In Colorado Revised Statutes, add part 2 to article 82.9 of title 22 as follows:

PART 2

HEALTHY SCHOOL MEALS FOR ALL PROGRAM 22-82.9-201. Short title. The short title of this part 2 is the “Healthy School Meals for All Act”. 22-82.9-202. Legislative declaration. (1) The general assembly finds and declares that:

(a) No Colorado child should experience hunger, and every public school student should benefit from access to healthy, locally procured, and freshly prepared meals during the school day;

(b) Healthy school meals are necessary for all students for effective learning, and Colorado’s investment in education should include healthy school meals for all students to support the

nourishment students need to achieve academic success;

(c) Access to healthy school meals should not cause stigma or stress for any student seeking an education;

(d) Colorado’s healthy school meals program should support Colorado’s food systems, including local farmers and ranchers;

(e) Colorado’s healthy school meals program must support students’ nutrition and provide quality meals to boost the health and well-being of Colorado students;

(f) During the COVID-19 pandemic, the United States department of agriculture eased program restrictions to allow free meals to continue to be available to all students universally, ensuring that all students facing hunger had access to food while in school; and

(g) Now that strategies exist to prevent hunger for all students during the school day, it is imperative that the state embrace these strategies to move toward the goal of ending child hunger.

(2) The general assembly finds, therefore, that it is in the best interests of the students of Colorado and their families to enact the healthy school meals for all program to provide free meals in public schools for all students. 22-82.9-203. Definitions. As used in this part 2, unless the context otherwise requires:

(1) “Colorado grown, raised, or processed products” means all fruits, vegetables, grains, meats, and dairy products, except liquid milk, grown, raised, or produced in Colorado and minimally processed products or value-added processed products that meet the standards for the Colorado proud designation, as established by the Colorado department of agriculture, even if the product does not have the Colorado proud designation.

(2) “Community eligibility provision” means the federal program created in 42 U.S.C. sec. 1759a (a)(1) (F) that allows school districts to choose to receive federal special assistance payments for school meals in exchange for providing free school meals to all students enrolled in all or selected schools of the school district.

(3) “Department” means the department of education created in section 24-1-115.

(4) “Eligible meal” means a lunch or breakfast that meets the nutritional requirements specified in 7 CFR 210.10, or successor regulations, for the national school lunch program or the national school breakfast program.

(5) “Federal free reimbursement rate” means the free reimbursement rate set by the United States department of agriculture for meals that qualify for reimbursement under the national school breakfast program and the national school lunch program.

(6) “Identified student percentage” means the percentage of a public school’s or school district’s student enrollment who are certified as eligible for free meals based on documentation of benefit receipt or categorical eligibility as described in 7 CFR 245.6, or successor regulations.

(7) “Minimally processed products” means raw or frozen fabricated products; products that retain their inherent character, such as shredded carrots

or diced onions; and dried products, such as beans, but does not include any products that are heated, cooked, or canned.

(8) “National school breakfast program” means the federal school breakfast program created in 42 U.S.C. sec. 1773.

(9) “National school lunch program” means the federal school lunch program created in the “Richard B. Russell National School Lunch Act”, 42 U.S.C. sec. 1751 et seq.

(10) “Participating school food authority” means a school food authority that chooses to participate in the healthy school meals for all program.

(11) “Program” means the healthy school meals for all program created in section 22-82.9-204.

(12) “School food authority” has the same meaning as provided in section 22-32-120 (8).

(13) “State board” means the state board of education created and existing pursuant to section 1 of article IX of the state constitution.

(14) “Value-added processed products” means products that are altered from their unprocessed or minimally processed state through preservation techniques, including cooking, baking, or canning. 22-82.9-204. Healthy school meals for all program - created - rules. (1)(a) There is created in the department the healthy school meals for all program through which each school food authority that chooses to participate in the program:

(I) Offers eligible meals, without charge, to all students enrolled in the public schools served by the participating school food authority that participate in the national school lunch program or national school breakfast program;

(II) Receives reimbursement for the meals as described in subsection (1)(b) of this section;

(III) Is eligible to receive a local food purchasing grant pursuant to section 22-82.9-205, subject to subsection (4)(b) of this section;

(IV) Is eligible to receive funding pursuant to section 22-82.9-206 to increase wages or provide stipends for individuals whom the participating school food authority employs to directly prepare and serve food for school meals, subject to subsection (4)(b) of this section; and

(V) Is eligible to receive assistance through the local school food purchasing technical assistance and education grant program pursuant to section 2282.9-207, subject to subsection (4)(b) of this section.

(b) The amount of the reimbursement provided through the program to each participating school food authority for each budget year is equal to the federal free reimbursement rate multiplied by the total number of eligible meals that the participating school food authority serves during the applicable budget year minus the total amount of reimbursement for eligible meals served during the applicable budget year that the participating school food authority receives pursuant to the national school breakfast program, the national school lunch program, sections 22-54-123 and 22-54-123.5, article 82.7 of this title 22, and part 1 of this article 82.9.

(c) The department shall develop procedures to allocate and disburse, beginning in the 202324 budget year, the money appropriated as

2022 Statewide Ballot Issues

reimbursements pursuant to this section among participating school food authorities each budget year in an equitable manner and in compliance with the requirements of the national school breakfast program and the national school lunch program.

(2) A school food authority that chooses to participate in the program must annually give notice of participation to the department as provided by rule of the state board. At a minimum, the notice must include evidence that the school food authority is participating in the community eligibility provision as required in subsection (3) of this section.

(3) If the United States department of agriculture creates the option for the state, as a whole, to participate in the community eligibility provision, the department shall participate in the option and shall work with school food authorities and the necessary state and local departments to collect data and implement the community eligibility provision statewide. Until such time as Colorado participates in the community eligibility provision as a state, each participating school food authority, as a condition of participating in the program, must maximize the amount of federal reimbursement by participating in the community eligibility provision for all schools that qualify for the community eligibility provision and that the participating school food authority serves.

(4)(a) As soon as practicable after the effective date of this part 2, the department shall apply to the federal secretary of agriculture to participate in the demonstration project operated pursuant to 42 U.S.C. sec. 1758 (b)(15) for direct certification for children receiving medicaid benefits, with the intent that the demonstration project is implemented statewide to the extent allowable under federal law. If the state is selected to participate in the demonstration project, the department shall comply with all of the requirements of the demonstration project, including entering into an agreement with the department of health care policy and financing to establish procedures by which a student may be certified, without further application, as meeting the eligibility requirements for free or reduced-price meals pursuant to the national school breakfast program and the national school lunch program based on information collected by the department of health care policy and financing in implementing the medicaid program.

(b) Implementation of sections 22-82.9-205 to 22-82.9207 is conditional upon the state of Colorado being certified to participate in the demonstration project for direct certification for children receiving medicaid benefits that is operated pursuant to 42 U.S.C. sec. 1758 (b)(15).

(5) The state board shall promulgate rules as necessary to implement the program, including rules to maximize the amount of federal funding available to implement the program.

22-82.9-205. Local food purchasing grant - amount -advisorycommittee-verificationofinvoices.

(1)(a) Subject to subsection (5) of this section, each participating school food authority that creates an advisory committee as described in subsection (3) of this section is eligible to receive a local food purchasing grant pursuant to this section to purchase Colorado grown, raised, or processed products.

(b) On or before August 1 of the first full budget

year in which this section is effective as provided in subsection (5) of this section and on or before August 1 of each budget year thereafter, each participating school food authority shall track and report to the department for the preceding budget year:

(I) The total amount spent in purchasing all products used in preparing meals and how much of that total was attributable to the local food purchasing grant the participating school food authority received;

(II) The total amount spent to purchase Colorado grown, raised, or processed products and how much of that total was attributable to the local food purchasing grant the participating school food authority received;

(III) The total amount spent to purchase value-added processed products and how much of that total was attributable to the local food purchasing grant the participating school food authority received; and

(IV) The total number of eligible meals the participating school food authority provided to students.

(2)(a) Subject to the provisions of subsection (2)(b) of this section, at the beginning of each budget year the department, subject to available appropriations, shall distribute to each participating school food authority that is eligible to receive a grant pursuant to this section the greater of five thousand dollars or an amount equal to twenty-five cents multiplied by the number of lunches that qualified as an eligible meal that the participating school food authority served to students in the preceding school year. The participating school food authority shall use the money received pursuant to this section to purchase only Colorado grown, raised, or processed products and as provided in subsection (3)(b) of this section and shall not use more than twenty-five percent of the amount received to purchase valueadded processed products. In addition, a school food authority may use up to ten percent of the money received pursuant to this section to pay allowable costs, as identified by rules of the state board, incurred in complying with this section.

(b) At the beginning of each budget year, each participating school food authority shall submit to the department an estimate of the amount it expects to spend to purchase Colorado grown, raised, or processed products for the budget year; a description of the items and amounts it expects to purchase; and a list of the suppliers from which it expects to purchase the items. If, based on the information provided, the department determines that a participating school food authority is unlikely to spend the full amount of the grant described in subsection (2)(a) of this section, the department shall reduce the amount of the grant accordingly. The department shall distribute to other participating school food authorities that are eligible to receive grants pursuant to this section any amount that is retained pursuant to this subsection (2)(b). The department shall distribute the additional amounts to the participating school food authorities for which the grant amount calculated pursuant to subsection (2)(a) of this section is less than twenty-five thousand dollars, prioritized based on the highest identified student percentages and greatest financial need.

(3)(a) To receive a local food purchasing grant pursuant to this section, a participating school food

authority must establish an advisory committee made up of students and parents of students enrolled in the public schools served by the participating school food authority. In selecting students and parents to serve on the advisory committee, the participating school food authority shall ensure that the membership of the advisory committee reflects the racial, ethnic, and socioeconomic demographics of the student population enrolled by the participating school food authority. The advisory committee shall advise the participating school food authority concerning the selection of foods to ensure that meals are culturally relevant, healthy, and appealing to all ages of the student population.

(b) A participating school food authority may use up to twelve percent of the amount received pursuant to subsection (2) of this section to support implementation of the advisory committee required in subsection (3)(a) of this section.

(4) The department shall annually require a selected group of participating school food authorities that received a grant pursuant to this section in the preceding budget year to submit to the department a representative sample of the invoices for the products purchased using the grant money. No later than September 1 of the second budget year in which this section is effective as provided in subsection (5) of this section, and no later than September 1 of each year thereafter, the department shall review the invoices to verify that the products purchased met the requirements specified in this section. If the department finds that a participating school food authority used a significant portion of the grant money, as determined by rule of the state board, to purchase products that did not meet the requirements of this section, the participating school food authority is ineligible to receive a grant pursuant to this section for the next budget year following the budget year in which the department completes the review.

(5) This section is effective beginning in the first full budget year after the state of Colorado is certified to participate in the federal demonstration project for direct certification for children receiving medicaid benefits as provided in section 22-82.9-204 (4) and begins including medicaid direct certification in determining school districts’ identified student percentages.

22-82.9-206. School meals food preparation and service employees - wage increase or stipend. (1) Subject to subsection (2) of this section, in addition to the amounts received pursuant to sections 22-82.9-204 and 22-82.9-205, a participating school food authority may receive the greater of three thousand dollars or an amount equal to twelve cents multiplied by the number of school lunches that qualify as eligible meals that the participating school food authority provided in the previous budget year, so long as the participating school food authority uses one hundred percent of the amount received pursuant to this section to increase wages or provide stipends for individuals whom the participating school food authority employs to directly prepare and serve food for school meals. To receive the amount described in this section, a participating school food authority must submit documentation to the department as required by rules of the state board to demonstrate that the increase in wages or provision of stipends using the amount received pursuant to this section is implemented for the

2022 Statewide Ballot Issues

budget year in which the amount is received.

(2) This section is effective beginning in the first full budget year after the state of Colorado is certified to participate in the federal demonstration project for direct certification for children receiving medicaid benefits as provided in section 22-82.9-204 (4) and begins including medicaid direct certification in determining school districts’ identified student percentages.

22-82.9-207. Local school food purchasing technical assistance and education grant program - createdreport. (1) Subject to subsection (4) of this section, there is created in the department the local school food purchasing technical assistance and education grant program to issue a grant to a statewide nonprofit organization to develop and manage a grant program to assist with the promotion of Colorado grown, raised, or processed products to participating school food authorities and to assist participating school food authorities in preparing meals using basic ingredients, with minimal reliance on processed products.

(2) Subject to available appropriations, the nonprofit organization may award grants for:

(a) Training, technical assistance, and physical infrastructure, awarded to participating school food authorities, grower associations, or other organizations that aggregate products from producers for:

(I) Professional contracting services to support the development and sustainability of local and regional food systems;

(II) Chef training on food handling, meal preparation using basic ingredients, and procurement practices, and for kitchen equipment purchases;

(III) Good agricultural practices certification costs and good handling practices certification costs and training on selling to schools; and

(IV) Capacity building for local value-added processed products; and

(b) Education, outreach, and promotion for:

(I) Schools to engage families and communities on the benefits of farm-to-school and ways to support farm-to-school; and

(II) Grower associations and growers to communicate to schools and school communities about the multiple benefits of purchasing local products.

(3) The nonprofit organization shall annually report to the department on implementation of the technical assistance and education grant program, including: (a) The number and types of entities receiving grants;

(b) The number, types, and purposes of the grants awarded pursuant to subsection (2)(a) of this section; and (c) The types of education, outreach, and promotion conducted by participating school food authorities and others pursuant to subsection (2)(b) of this section.

(4) This section is effective beginning in the first full budget year after the state of Colorado is certified to participate in the federal demonstration project for direct certification for children receiving medicaid benefits as provided in section 22-82.9-204 (4) and begins including medicaid direct certification