Following a modest 0.5% expansion of the national economy in 2024, GDP growth for 2025 is projected to range between 1.5% and 1.9%. Inflation reached 4.7% in March, driven largely by rising food prices and a weakening exchange rate. As of mid-April, the EUR/HUF exchange rate exceeded 408, influenced primarily by external factors such as uncertainty around U.S. trade tariffs and Hungary’s economic outlook. Despite these headwinds, the labour market remains relatively tight. However, due to weakerthan-expected economic performance, the unemployment rate rose slightly to 4.5% by the end of February. In contrast, Budapest maintains a lower unemployment rate of around 2.5%.

Market summary

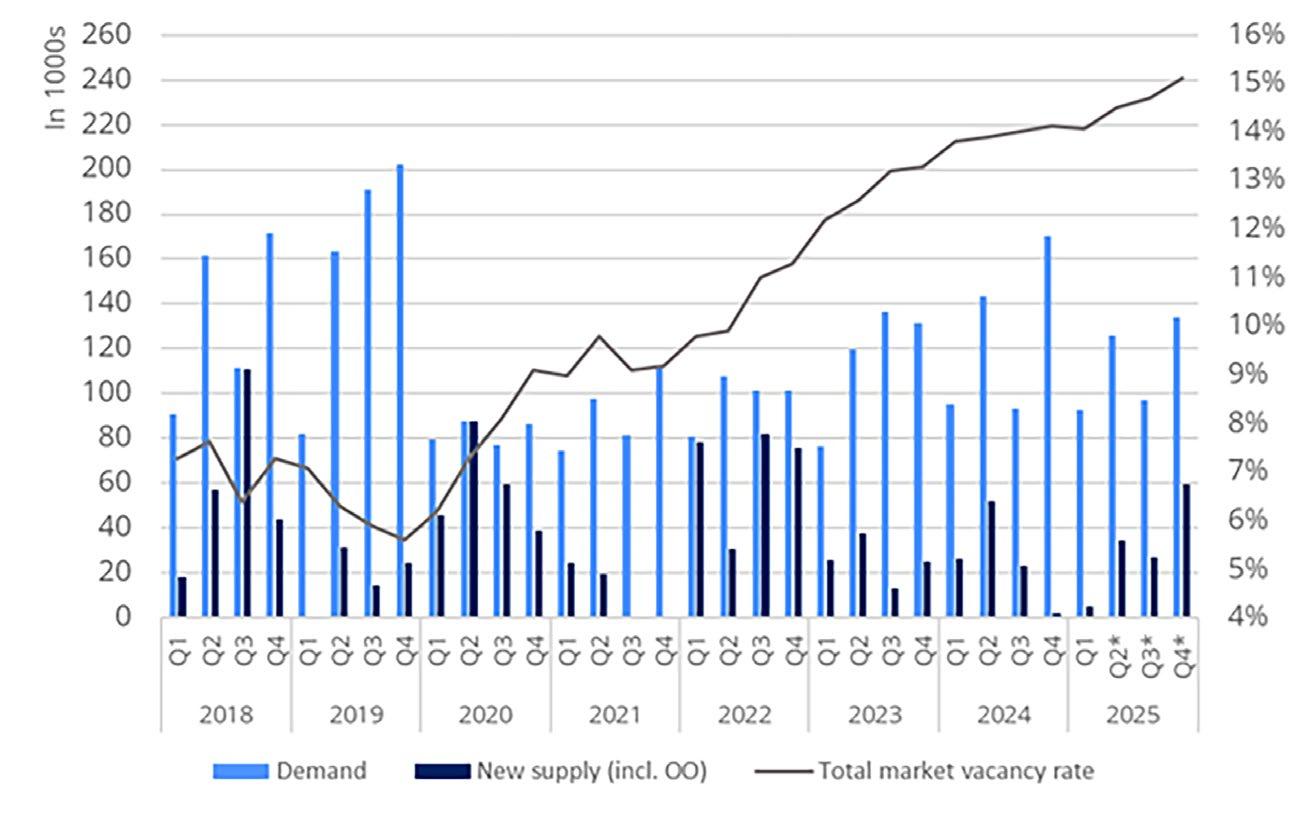

Overall tenant activity decreased on an annual basis, with a 2.1% year-on-year drop in Q1 2025 (92,967 sqm compared to 94,976 sqm in Q1 2024). Throughout the first quarter, net take-up—which measures the level of new demand—increased by 20.6% year-onyear (50,969 sqm vs. 40,270 sqm), accounting for 55% of total tenant demand. This growth in net take-up was primarily driven by a 33% year-on-year increase in new transactions (44,432 sqm compared to 33,488 sqm). In terms of deal structure, renewals accounted for only 45%, which is 8 percentage points lower than in Q1 2024.

The total market vacancy rate slightly decreased on a quarterly basis in Q1 2025 (by 0.07 percentage points), reaching 14.06%, mainly due to stock correction and the repurposing of some Category B buildings. However, this still represents a 0.3 percentage point increase year-on-year. The speculative vacancy rate stood at 17.4% at the end of the quarter—down 0.1 percentage points from the previous quarter, but up 0.5 percentage points year-on-year. This was mainly driven by the fact that 33% of speculative office stock delivered between 2023 and 2025 remains vacant.

The stock correction in Q1 resulted in negative net absorption, with total occupied stock decreased by 11,475 sqm.

Tenants continued to show a strong preference for sustainable, energy-efficient buildings that comply with ESG standards. In certified buildings, the speculative vacancy rate was 1.8 percentage points lower than the overall market average at the end of Q1 2025.

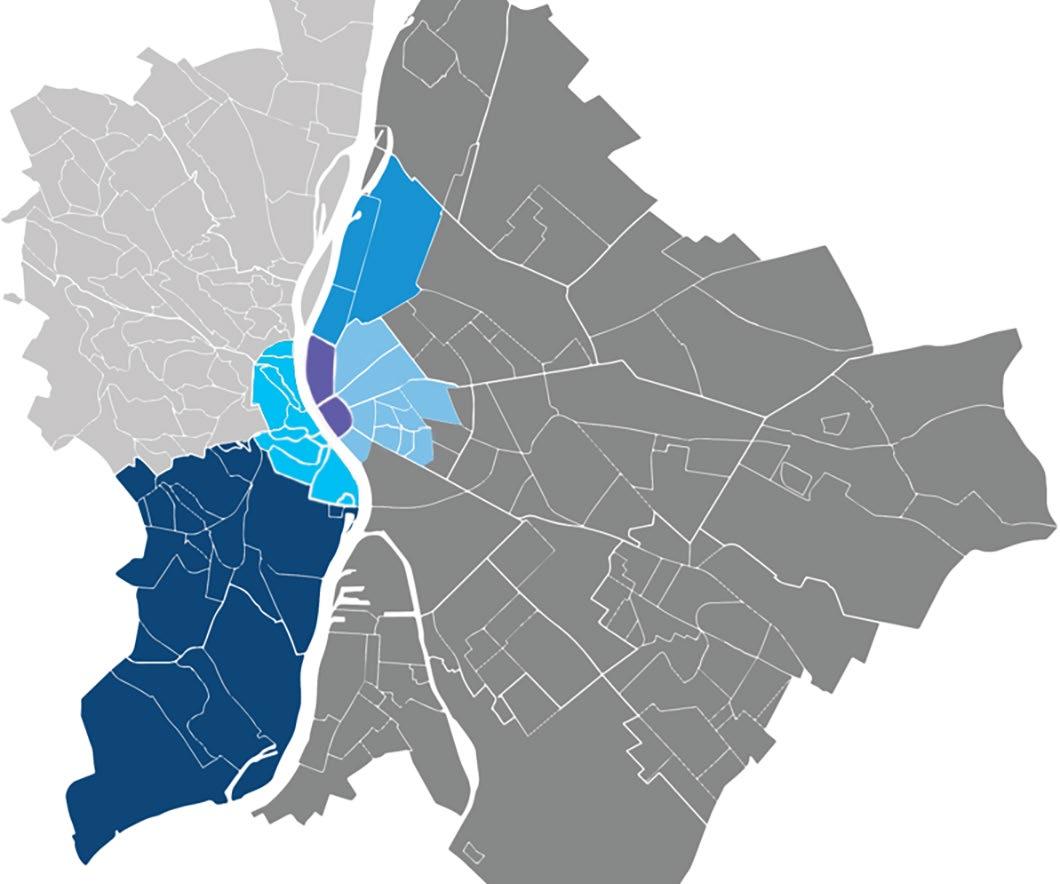

Looking ahead, the total speculative office pipeline—excluding onhold projects—through the end of 2027 amounts to 84,108 sqm, with the Váci Corridor (including H2O Phase 2 and Centerpoint III) accounting for the largest share, at 59,208 sqm; the remaining projects are relatively small in scale and scattered across the city.

During the first quarter of 2025, two speculative office buildings were completed: Rhodium Office Building (2,807 sqm, 90% vacant) and Wagner Palace (2,253 sqm, fully let).

Rents remained stable or experienced slight increases across various categories. Prime headline rent stands at €25.5/sqm/ month, while new headline rents ranged between €19–21/sqm/ month at the end of the quarter. Average rents for Category “A” buildings were €17.1/sqm/month, and Category “B” buildings averaged €12.9/sqm/month.