NEWS ACCOUNT

5 A Chorus of Voices: Colorado CPAs Visit Capitol Hill

In partnership with the AICPA and other state societies, COCPA members traveled to Washington, D.C., to meet with lawmakers on legislation whose passage will benefit taxpayers, tax preparers, and the profession. “The result was bipartisan teamwork and optimism for the future,” says CEO Alicia Gelinas, CPA.

6

Good news emerged from Colorado’s recent legislative session: Reform of the Retail Delivery Fee (RDF), via Senate Bill 23-143, signed by Gov. Jared Polis in May. The bill provides an exemption from the RDF for sellers with annual retail sales of tangible personal property, commodities, or services of $500,000 or less.

14 Safeguarding the Future: Unveiling the Interplay of AI and Fraud

In the age of rapidly advancing technology, the world is witnessing an unprecedented proliferation of artificial intelligence and its ubiquitous presence in our daily lives. As this technology begins to reshape industries and drive innovation, it also poses a significant challenge: the intricate interplay between AI and fraud.

20 Put in the Brainwork to Effectively Manage Burnout

Whether experienced by a farmer toiling away on the land 200 years ago or a newly minted CPA who is climbing the career ladder in 2023, burnout is a nearly universal phenomenon. Upcoming Young Professionals Conference speaker Mike Maksymiw offers strategies for identifying the symptoms and causes of burnout, and taking steps to alleviate it.

Over the course of five days in March, three small- to mid-size U.S. banks failed. News of the failures dominated media headlines and had the general public in a bit of a frenzy. While the market has settled, the failures had CFOs answering questions from their boards and CEOs. Learn more about their thought processes when it was all going down.

A publication of the Colorado Society of Certified Public Accountants Vol. 69, No. 2 July / August 2023

Officers

Diego Baca, Chair Tobias "Toby" Clary, Vice Chair

Amy E. King, Treasurer Angela Roberts, Immediate Past Chair Alicia Gelinas, Secretary

Directors

Erin N. Breit, Ronald L. Goodrich, David Loucks, Amy King, Heidi M. O'Neil, Greg C. Pfahl, Tiffany Davis

Editorial Board

Isaac Adamu, Jack Allgood, Paul Elggren, Ken Fichter, Jerald Kaiser, Lori Anne Reinwald, Laura J. Theiss, Barbara J. Tedesko, Steve Van Meter, Michael D. West, Charlie Wright

Kelli Davis, Editor Natalie G. Rooney, Contributing Writer Sarah Knight, Blue Ocean Ideas, Design

NewsAccount (ISSN #10899952) is published bimonthly by the Colorado Society of Certified Public Accountants, 7887 E. Belleview Ave., Suite 200, Englewood, CO 80111. NewsAccount is published in January, March, May, July, September, and November and reports information, news, and trends in the accounting profession. The Colorado Society of CPAs assumes no liability for readers’ business decisions in reference to advertisements or other information included in this publication.

Membership dues include a $14.00 one-year subscription to NewsAccount

Periodical postage paid in Englewood, CO, and additional mailing offices.

POSTMASTER: Send address changes to NewsAccount, Colorado Society of Certified Public Accountants 7887 E. Belleview Ave., Suite 200 Englewood, CO 80111

Net press run = 5,447 copies; sales through dealers and carriers, street vendors, and counter sales = 0; paid or requested mail subscription = 5,407; free distribution by mail = 0; free distribution outside the mail = 20; total free distribution = 20; total distribution = 5,427; office use, leftovers, spoiled = 19; returns from news agents = 0; total sum = 5,447; percent paid and/or requested circulation = 99%.

303-773-2877 • 800-523-9082 Fax: 303-773-6344

Accounting. That word conjures up so many images for each of us. But why did you choose accounting as your profession? Was it the love of numbers? Maybe it was the “this just makes so much sense in my brain” feeling from your intro to accounting class. Or maybe it was because there was a certain distinction that came with being part of a profession versus just a job.

Like many of you, I wanted to set myself up for a stable and rewarding future, so I chose accounting as my profession. I couldn’t have asked for a better start to adult life than the 13 (almost 14) years that I’ve been at EY as an external auditor. Look at all the firsts that I experienced with EY (as part of this amazing profession):

1. First airplane ride ever to Los Angeles as an intern.

2. First time in a building that was taller than three stories.

3. First time visiting New York City, a city that I used to see on Yo! MTV Raps or Seinfeld and dreamt of visiting someday.

4. First time traveling internationally to Asia in 2017. Since then, my profession has taken me to Japan, Taiwan, Hong Kong, Singapore, UK, Germany, and the Netherlands.

For many who grew up with great means, the experiences above may not have had the same impact as they had on me – or on some of my best mentors – but for me, these were all life-changing experiences that I hope may inspire other young people to pursue a similar path. It was the accounting profession

that afforded me these opportunities and changed my life.

All of us have similar stories or reflections on why this profession is so important to us. Take a moment to ponder those stories and reflections before reading on. I want that inspiration to put you in the right mindset before you read ahead.

One Sunday morning I woke up and checked my email. There was an email from Dr. Sharon Lassar to the COCPA Board of Directors regarding recent legislation introduced in Minnesota (explained in more detail below). After reading it, I stared out the window and had an epiphany. You see, for the past 10 years in my volunteer service with the COCPA, AICPA Board of Examiners, and in my role at EY as lead recruiter for the University of Colorado, I heard and talked about subjects like “the pipeline” or “the future of the profession.” Whether right or wrong, these discussions, up until this one Sunday morning, had my brain convinced that these would take place in the future. Yes, we had to prepare now, but the reality wouldn’t set in for a few years. But on that Sunday

morning, I realized a very uncomfortable truth: The future is actually the present. The future is now.

Dwindling enrollments in colleges and universities, accounting programs with record-low participation, and lagging salaries for first-year accounting grads are just some of the realities we are facing. There are also anti-regulation groups trying to eliminate or weaken licensing requirements for learned professions like accounting and architecture. Accounting firms are also dealing with the impact of big data, cybersecurity issues, and ever-changing business models every day. ChatGPT recently took the CPA exam (without studying, might I add – never a good strategy), and recent economic trends show that white collar jobs are the fastest shrinking in the employment market for the first time in several decades. Yes, that future is a reality now.

It is with all this context – both positive and negative – that I ask each of you to re-engage in the profession! If you have not been keeping track of specific issues that are currently up for debate, see below for a couple of issues that need innovative ideas and action from all of us, not just the vocal few.

• MNCPA legislation: In February, the Minnesota Society of CPAs introduced legislation that would create three paths to licensure, all of which would require passing the CPA exam plus 1) 150 credit hours and one year of work experience (the current model); 2) 120 credits and two years of work experience; or 3) 120 credits and both one year of work experience and 120 CPE credits, earned concurrently. The bill, with bipartisan support in both the Minnesota House and Senate, did not become law this year, but the MNCPA is committed to continuing discussion around this important issue.

• Firm and AICPA offerings for alternative pathways to licensure: Firms and the AICPA are developing ways to help students afford the additional 30 credit hours that are required to meet the 150-hour requirement. These programs would allow students to work, obtain more cost-effective classes, and use experience for a portion of those 30 hours.

The time for engagement in our profession is now. If we don’t hear the perspectives of the masses on issues like these, we are liable to allow only a few voices to impact the future of the profession. There are lots of opinions and perspectives on these issues and what strategies we should employ to address them. However, not enough is being done. There are many CPAs, both young

is an EY alumnus) is working with the AICPA and accounting educators to create diverse perspectives and solutions. I am asking every CPA in Colorado – regardless of where and how you practice – to think about how we can evolve our profession and get back to attracting and retaining talented, engaged professionals. I want hundreds of thousands more stories like mine to be told

and old, who have great ideas, but who are not actively engaged in the discussions on these topics.

It may feel like your opinion doesn’t matter – you’re just one voice. Or maybe you feel like you don’t have the time to get involved because of the demands of work and home life. Maybe you’ve gone inactive after moving into industry or a service line that doesn’t require a CPA. But your voice matters, and we need everyone to jump in with their innovative ideas and solutions.

The COCPA (whose CEO, Alicia Gelinas,

for generations to come – stories that show just how life-changing this profession can be. Our profession and our membership are made up of so many smart people with great ideas. If you haven’t had time to get involved with the COCPA lately, please reach out, re-engage, and bring your perspective to help chart our course through some of the challenging professional issues that we’re facing.

There are many ways to get involved, including numerous committees, working groups, and boards. These groups focus on everything from conference planning work to community service projects, delving into

As accountants, we’re not always comfortable with change, but we must be willing to look at our profession and honestly assess what can be done better.

CONTINUED FROM PAGE 3

issues unique to young CPAs, and supporting accounting students in their journey, just to name a few. The array of committees offers something for everyone, and I encourage you to find an opportunity that piques your interest. We are also exploring new ways to include the voices of each of us in the COCPA’s views on some of the most important issues. Bring your voice, ideas, and enthusiasm, and join us!

Additionally, if you have CPAs in your organization who are inactive or aren’t current members, please reach out to them. Ask them to rejoin and re-engage as a member. Invite professionals from your firms and companies to be a part of the COCPA.

Our profession as we know it is facing headwinds. As accountants, we’re not always comfortable with change, but we must be willing to look at our profession and honestly assess what can be done better. How can we be a more attractive career option to students who are pursuing higher education? What are some of the ways that we can bring in the best talent? How can we be more adaptable in recruiting and mentoring? Are there ways that we can change the cultures at our organizations to attract and retain more people? How do we ensure that organizations reward the esteem of being a CPA? Finally, if you’re a non-CPA reading this (there may be a few of you), how can you engage with the CPAs within your organization?

This is an amazing profession that provides so many people with the opportunities of a lifetime. At the AICPA Fall Council meeting, I saw the phrase: “In a world that lacks trust, we [CPAs] are the world’s most trusted profession.” That resonated with me. In a world where there is so much skepticism, it feels like we’re one of the last professions to still garner the trust of the capital markets. We must remain relevant to the next generation, because the entire financial system relies on what we do. This is such a high purpose.

This career has afforded me the opportunity to be able to pursue my many passions. And one day, I want a million-dollar endowment in my name to help provide scholarships to young people, especially those from underrepresented communities. Even more importantly, I want everyone to know that I was part of the best profession in the world, by ensuring those three little letters – C-P-A – stay relevant until long past my lifetime.

Finally, you may wonder why I had the word “profession” italicized throughout. I did that to remind us that we are, indeed, professionals. Like Nikola Jokic (Go, Nuggets!) or your knee doctor, we have a skill that the general public doesn’t have. Let’s never forget that. I’m looking forward to serving you in the best way possible this year at the state and national levels. Together we can attract, inspire, and retain talented, creative, dedicated people to this profession that has given us so many incredible opportunities.

Looking for ways to engage with the COCPA? Visit cocpa.org/get-involved or contact Stacy Svendsen at stacy@cocpa.org.

Contact Diego J. Baca at Diego.baca@ey.com

The views reflected in this article are the views of the author(s) and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.

August 25, 2023

8:30 am - 5:30 pm

The annual COCPA Women’s Summit provides practical strategies for women to enhance their personal and professional development. With so many successful, professional women in one place, attendees can easily connect, engage, and gain new perspectives.

} What to Do When There’s Too Much to Do

} Leading people in the age of AI & Automation

} Bias, Ignorance, and Real Knowledge in Artificial Intelligence (2 ethics credits)

The Women to Watch Awards ceremony will take place at a special luncheon during the Women’s Summit.

Enjoy networking opportunities throughout the day.

To register for the event visit: cocpa.org/womentowatch

introduction of important bipartisan legislation that supports taxpayers, practitioners, and tax administration services.

COCPA members met with six of the eight Colorado representatives’ offices, including Joe Neguse (D-District 2), Lauren Boebert (R-District 3), Ken Buck (R-District 4), Doug Lamborn (R-District 5), Jason Crow (D-District 6), and Brittany Pettersen (D-District 7).

The COCPA delegation asked members of Congress to support:

• The Simplify Automatic Filing Extensions (SAFE) Act, which would assist the IRS with receiving extensions earlier in the year, providing taxpayers, CPAs, and the IRS with a streamlined process and reducing the need for many penalty abatement requests.

government’s financial statements. This resolution would promote greater transparency on the information included in the federal government’s financial report. “CPAs have weathered some of the most challenging times in the history of tax administration,” says AICPA President and CEO Barry Melancon, CPA, CGMA. “They have guided individuals and businesses through significant changes. We are grateful to have the partnership of many members of Congress on these important issues, and combined with the strong relationships and great advocacy work of the COCPA we hope to gain the support of many more.”

Visit cocpa.org/legislative-advocacy to learn more about the Society’s advocacy initiatives.

On May 25, 2023, six COCPA members joined members of the AICPA in Washington, D.C., to meet with lawmakers on issues of importance to the accounting profession during the AICPA Spring Meeting of Council and Annual Members Meeting.

“The day on The Hill was a harmonious demonstration of many individual CPAs devoted to pieces of legislation, sharing –through personal experience – how the proposed changes could benefit taxpayers, tax preparers, and the accounting profession overall. The result was bipartisan teamwork and optimism for the future,” recalls COCPA CEO Alicia Gelinas, CPA.

Since the onset of the COVID-19 pandemic, Congress has partnered with the accounting profession to help taxpayers and practitioners navigate IRS service issues, filing postponements, and erroneous penalties. An extension of that partnership is the

• The Freedom to Invest in Tomorrow’s Workforce Act, a bill that would expand eligible uses of 529 savings plans to include fees and expenses required to obtain or maintain recognized postsecondary credentials, including professional credentials and certifications, and provide accounting professionals with greater financial flexibility as they enter the workforce and seek to further their education.

• Legislation in both chambers to establish the accounting profession as a STEM career pathway, recognizing the value of accounting professionals, including CPAs, as technological leaders.

• The Fiscal State of the Nation resolution, which would require the Comptroller General to make a presentation to a joint session of the House and Senate Budget committees on the Government Accountability Office auditor’s report of the U.S.

If you have a personal or professional connection to one of the U.S. Colorado Congressional delegates or Colorado General Assembly legislators and would like to be a key contact for advocacy on behalf of Colorado CPAs, please contact Stephanie Bass at stephanie@cocpa.org.

I love to hear a choir. I love the humanity ... to see the faces of real people devoting themselves to a piece of music. I LIKE THE TEAMWORK. It makes me feel optimistic about the human race when I see them cooperating like that.”

– Paul McCartney

There’s good news to report out of Colorado’s recent legislative session: Reform of the Retail Delivery Fee (RDF). Specifically, Senate Bill 23-143, signed by Gov. Jared Polis on May 4, 2023, provides an exemption from the RDF for sellers with annual retail sales of tangible personal property, commodities, or services of $500,000 or less.

[Colo. Rev. Stat. (CRS) § 43-4-218(1)(e)(IV)]

The exemption is applied retroactively to July 1, 2022; however, there are no refunds of RDF already paid during that period. [CRS § 43-4-218(3)(d)(IV) and (V)]

Retailers subject to the RDF may elect to either separately state, collect, and remit the fee or, so long as the fee is not separately stated, pay the fee on behalf of the purchaser.

You may remember that in 2021, the Colorado legislature enacted Senate Bill 21-260. The bill created a delivery fee on retail sales of tangible personal property delivered by motor vehicles. The fee became effective July 1, 2022, and was part of a $5.3 billion, 10-year plan to build out Colorado’s roads and bridges, create more electric vehicle charging stations, and give a boost to mass transit. To do so, the bill created four new fee-based state enterprises and repurposed another. In fact, the RDF of 27 cents was composed of six separate fees and increased to 28 cents on July 1, 2023.

So why was this so bad (other than the fact that we all know it is really another sales tax and not a fee)?

There were problems. First, the RDF had to be separately stated on a seller’s invoice, which is not a problem for a Luddite who is still writing all of his or her invoices by hand. But for the rest of us, it was difficult simply because many sales tax software vendors did not provide for such an option. (The Colorado Department of Revenue did provide some relief by not making the retail delivery fee an assessment priority.)

Second, the law required that if every item in a sale was exempt from sales tax, the delivery fee did not apply. However, if even one item in the transaction was subject to sales tax, the fee applied. For example, if a grocer delivers a bag of fruits and vegetables to your house, there is no state sales tax, and thus no retail delivery fee due. But if the purchase included a tube of toothpaste, sales tax is due on the cost of

the toothpaste and the retail delivery fee applies to the transaction.

This requirement created confusion for home service providers such as plumbers and electricians and service providers who may make only the occasional retail sale. In addition, for small sellers, the compliance and processing costs would exceed any tax due.

In light of these problems, the general assembly determined that the RDF “should only be imposed on retailers that are large enough to absorb these administrative costs without significant harm.” [CRS § 43-4218(1)(d.7)]

Bruce Nelson has nearly 40 years’ experience in federal, state, and local tax. Currently the editor in chief of the Journal of State Taxation, he is a frequent speaker for the COCPA and the AICPA. His articles have appeared in publications such as the Journal of Accountancy, Tax Executive, Journal of Multistate Taxation, and Colorado Lawyer

Join Bruce for the latest insights on sales and income tax developments in his education series, “Tax Trekking with Bruce Nelson: A Legislative Tax Update Series.” Remaining sessions, all taking place via webcast from 8:30 to 11:10 am, are August 10, 2023; November 10, 2023; and January 10, 2024.

Visit cocpa.org/NelsonLegislative to learn more or to register.

Fight Bias, by Dolly Chugh, is an inspiring and practical guide for anyone who wants to make a positive difference in the world. Chugh, a social psychologist and professor at New York University’s Stern School of Business, draws on her own research and insights from various disciplines to show how we can overcome our unconscious biases and become more inclusive and effective allies for social justice.

Chugh challenges us to rethink what it means to be a good person. She argues that instead of striving to be perfect and avoid mistakes, we should aim to be good-ish: open-minded, humble, and willing to learn from our errors. I thought that this was one of the most important concepts in this book, similar to the idea that the perfect can be the enemy of the good. None of us is perfect, but we can be good-ish; not free from bias but owning the bias when it happens. As Chugh writes, “When we commit ourselves to the good person idea, we shut ourselves off from learning, from the good-ish person idea that unlocks learning.”

Like Carol Dweck, a leading researcher on motivation and mindsets, Dolly Chugh believes in the value of having a growth mindset. If we have a fixed mindset about issues of diversity and inclusion, we may feel pressure to have all the right answers all the time and never make mistakes. Alternatively, a growth mindset allows us to be a work in progress and learn from our mistakes. Everyone stumbles, but we can “stumble upward.”

Chugh believes that if you are striving to be an ally, you are going to mess up. If you fear making mistakes, you can shut down and do nothing. If we know that we are going to make mistakes and that our knowledge is incomplete, we can use that knowledge to drive us toward being a better person.

She also helps us identify our ordinary privilege: the advantages that we have in society based on our identity, such as race, gender, sexual orientation, or education. She shows how we can use our privilege to speak up and support others who face discrimination or oppression. We all have many different dimensions to our identity. Some create tailwinds for us while others create headwinds. We don’t often (in fact rarely) think of the tailwinds, but we can have a positive impact just using the parts of our identity about which we think the least.

Chugh notes that we often confuse equality and equity. While equality refers to treating everyone the same, regardless of the headwinds and tailwinds affecting their lives, equity considers the headwinds that others face and takes them into account in order to provide them with the same access and opportunities that others receive.

The book is full of real-life examples, stories, and exercises that illustrate the psychology of good people and the barriers that prevent us from acting on our values. Chugh also offers concrete strategies and tools to help us communicate respectfully, listen empathetically, and intervene effectively in situations where bias or injustice occur. She encourages us to embrace discomfort, feedback, and accountability as ways to grow and improve ourselves and our relationships.

The Person You Mean to Be: How Good People Fight Bias is a must-read for anyone who cares about creating a more equitable and inclusive society. It is not only informative and engaging, but also empowering and hopeful. It shows us that we can all make a difference by being more aware, more compassionate, and more good-ish

Jim Brendel chairs the COCPA Diversity, Equity, and Inclusion Committee. To learn more about the committee’s activities, contact Stacy Svendsen at stacy@cocpa.org.

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles

– Cantor Forensic Accounting, PLLC

Trusted by accounting industry professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere.

22% increase in cash flow with online payments

65% of consumers prefer to pay electronically

62% of bills sent online are paid in 24 hours

BY NATALIE ROONEY

BY NATALIE ROONEY

As of May 1, the COCPA’s Peer Review Department began administering peer review for the Washington Society of CPAs (WSCPA), a move that brings benefits to both organizations. The COCPA has been administering the New Mexico Society of CPAs’ peer review program since 2016. Colorado and New Mexico combined comprised 450 firms requiring a peer review, with Washington adding approximately another 390 firms.

When a state society decides not to administer its own peer review program, it must select another entity. The WSCPA faced this decision when its peer review administrator and CPA on staff decided to retire. Thus, it began requesting proposals from other state societies.

After many months of discussion, the WSCPA chose the COCPA as its new peer review administrator, citing the COCPA’s

excellent customer service, reputation, technical support, and established backoffice practices. The AICPA then approved the transfer.

“We were excited to be chosen to administer Washington’s peer review program,” says COCPA CEO Alicia Gelinas, CPA. “It’s an acknowledgement of our commitment to the peer review process and helping members provide their clients with excellent accounting and auditing services.”

Peer review is an AICPA monitoring program that the Colorado Society administers for Colorado, New Mexico, and now Washington. Firms enrolled in the program must have a peer review of their accounting and auditing practice once every three years, which includes attest and/or compilation or review engagements.

Peer review is a back office-intensive effort. The software, PRIMA, tracks peer review

registrants and sends reminders six months prior to a firm’s peer review deadline to advise practitioners to begin preparing for their review by hiring a peer reviewer. The COCPA’s program administrators send multiple letters and emails to firm members and follow up with phone calls to help CPAs adhere to the timeline and ensure that deadlines are met.

Every peer review administrator must have a CPA on staff overseeing its program, which for the COCPA is Marilee Lau, CPA. Before retiring from KPMG as an audit partner, Lau performed peer reviews for other large CPA firms and was the quality control partner for her office when peer review started in the mid

tration of the peer review process in all three states,” she says. “We have a larger pool of professionals to draw on to help us complete the peer review process.”

In a welcome letter, Lau let Washington firms know that the COCPA team is honored and excited to work with the WSCPA to ensure a smooth transition and provide continuity and excellent customer service.

Bill Lajoie, CPA, has not only formerly served as the CPA on staff for the COCPA’s peer review program, but he has also served on the AICPA’s Peer Review Board, on its hearing panel, and as a technical reviewer. He has also been peer reviewed himself.

Lajoie thinks that peer reviews have substantially improved audit quality. “Regulators and state boards of accountancy would echo that,” he says.

In 2014, the AICPA found deficiencies in the way that a number of firms performed audits. The AICPA took steps to strengthen the peer review process, including bolstering the requirements to become a peer reviewer and enhancing the review of a firm’s quality control system. Today, approximately 80% of firms required to undergo remediation after a deficiency improve their scores by the time of their next peer review. (Source: AICPA)

“There’s a feeling of confidence now that didn’t exist 40 years ago when I first got involved with peer review,” Lajoie says. “Most firms accept the program as useful to the profession.”

The COCPA undertook the same process with New Mexico six years ago and was able to integrate the programs smoothly.

For more information on peer review, visit cocpa.org/peer-review or contact Peer Review Team members Jill Turner or Sheila Duggan at peerreview@cocpa.org.

When you become a peer reviewer, you:

→ Are seen as an expert in your field and gain increased respect from your colleagues.

→ Help firms achieve their A&A practice goals and enhance the quality of their A&A practices.

→ Identify the best practices of other firms, which can be applied to other peer review clients and to your own firm.

1980s. She currently is a subject matter expert, conducting enhanced oversight reviews for the AICPA and serving on the AICPA Practice Monitoring Task Force for Employee Benefit Plans. Now as the CPA on staff, she oversees the program administrators as well as the technical reviewers. She says that taking on Washington’s program offers more flexibility for both the COCPA and WSCPA volunteers who sit on the Peer Review Committee. “Now we have more flexibility for the adminis-

Lajoie encourages those who haven’t enrolled in the peer review program to learn about the process. He has high praise for the COCPA program administrators and says that the year and a half that the COCPA and the WSCPA spent in negotiations showed that the two organizations are a great fit and will work together well. “We found that the way we conduct peer review administration is substantially the same,” he says of the process. “We both have a lot of outstanding committee members and reviewers. If someone in Colorado wants someone in Washington to do their peer review, they can. For continuity, it’s going to be a great partnership.”

→ Gain broader practice knowledge through the peer review process, which will help sharpen your skills and reinforce your strengths.

→ Are creating an opportunity to develop an additional profit center for your firm.

→ Often receive referrals for additional consulting services as a result of performing peer reviews.

→ Enhance the effectiveness of the profession’s self-regulatory efforts and contribute to the quality of the profession.

Source: AICPA

I have coached hundreds of leaders in more than 20 countries, and regardless of career level, location, or industry, two of the top areas on which clients seek advice are executive presence and gravitas. The reasons underlying these requests usually boil down to the desire for greater influence. People want to be taken seriously, have their contributions considered essential, and be trusted and respected. Gravitas and influence enable individuals to command respect, make a lasting impact, and inspire others.

Contrary to popular belief, executive presence and gravitas are not innate qualities that you either have or don't have. They can be developed through conscious effort and practice, allowing you to build them in a way that feels authentic. In this article, we will explore effective strategies to build gravitas and executive presence, empowering you to become more influential and respected.

Building gravitas and influence begins with self-awareness. Take the time to understand your values, strengths, weaknesses, and aspirations. Reflect on your personal and professional goals and align your actions with your core principles. This self awareness will provide a solid foundation for your growth and enable you to project authenticity and confidence.

If possible, undergo a 360-degree feedback assessment. If that's not an option, schedule time with individuals who are important to your professional success, including your peers, supervisor, and direct reports. Conduct these conversations away from the office and ask specific questions, such as:

• What words would you use to describe me?

• What three things do I do well?

• What three things can I do better?

• What three things can I do differently to make my leadership more effective?

• What can I do differently to improve our working relationship?

• How can I better support you?

Listen closely to the feedback and ask follow-up questions if needed, ensuring that your responses do not sound defensive or combative. Valuing and acting upon feedback demonstrates your commitment to growth and improvement.

Demonstrate curiosity about your colleagues' lives outside of work and share something about your own life. This helps build rapport and trust, which are essential elements of influence. Genuine interest in others fosters stronger relationships and makes people more receptive to your ideas and suggestions.

Even the most influential leaders experience nerves and anxiety at times. Embrace courage and have confidence in your ability to handle whatever challenges come your way. This shift in mindset may seem subtle, but people will sense it and respect you for it.

Learn to communicate complex financial information in a way that non-financial colleagues can understand and appreciate. Work on strengthening your overall communication skills and be prepared to answer questions and clearly explain financial concepts. Additionally, practice being concise in your responses, as many executives value succinct and to-the-point communication.

Take the time to understand the priorities and concerns of other areas of the business, including human resources, IT, operations,

sales, and legal. This broader understanding will enable you to make better decisions and support other departments’ goals. By demonstrating a holistic perspective, you position yourself as a well-rounded leader who can contribute effectively to the organization’s overall success.

Arrange quarterly meetings with other business leaders to discuss their goals, priorities, challenges, and successes. These meetings establish personal connections, build trust, and demonstrate your support of their goals. Collaboration and mutual support among leaders create a powerful network that enhances your influence and impact.

Building gravitas and executive presence is a continuous journey that requires self-awareness, feedback, courage, effective communication, business acumen, and relationship-building skills. By incorporating these strategies into your professional development, you can enhance your personal power, gain influence, and become a respected leader in your organization and profession.

Remember, building gravitas and executive presence is not about exerting control over others but about positively impacting their lives and driving collective success.

Anna Conrad, CEO of Impact Leadership Solutions, is a highly sought-after executive coach, speaker, and author based in Colorado. Contact her at Anna@ILSInt.com.

Your membership with COCPA entitles you to a suite of discounts from leading providers.

Improve your work, grow your client services, and move your career forward with these savings:

Payment processing

HR solutions and outsourcing

Cost segregation studies

Merger and acquisition advisory services

“.cpa” web domains

Messaging, video, phone services

Email marketing systems

Shipping, printing, and other business services

Car rentals and travel services

Background checks

Insurance

Professional liability insurance

Long term care insurance

Disability insurance

SOFTWARE

Secure file sharing

Lease accounting software

Cloud accounting software

Tax and accounting books

CPA exam review courses

BY NATALIE ROONEY

BY NATALIE ROONEY

In the age of rapidly advancing technology, the world is witnessing an unprecedented proliferation of artificial intelligence (AI) and its ubiquitous presence in our daily lives. From powering virtual assistants to revolutionizing healthcare, AI has undoubtedly become an integral part of our interconnected global landscape. Yet, as this technology continues to reshape industries and drive innovation, it also poses a significant challenge: the intricate interplay between AI and fraud.

Artificial intelligence, with its remarkable ability to analyze vast amounts of data, learn from patterns, and make autonomous decisions, has introduced unparalleled efficiency and convenience to numerous sectors. However, as the power of AI expands, so does its potential misuse in the hands of those with malicious intent. Fraudsters and cybercriminals are increasingly leveraging AI algorithms and techniques to perpetrate sophisticated scams, manipulate systems, and exploit unsuspecting individuals and organizations.

THANKS, CHATGPT!

Here’s something that you should know right off the bat about this article: the approximately 150 words up until this point (including the title) were written entirely by ChatGPT in answer to the query, Can you write an introduction for an article about artificial intelligence and fraud?

Even if you haven’t yet experimented with ChatGPT, you’re likely already using or experiencing some type of AI every day, possibly without even realizing it:

• Personalized marketing: Have you searched something on your phone or computer and now you can’t stop seeing ads for it in your social media feeds?

• Voice assistants: Hey, Siri!

• Navigation and traveling: Hey, Siri, where is the nearest gas station?

• Facial recognition technologies: Security on your phone or at an airport.

• Smart home devices: Alexa, play The Matrix on Max.

It seems like AI is making our lives easier, but if it can be used for all of these “good” things, what “bad” things might AI also be used for?

AI’S TAKE ON ITSELF

What does ChatGPT think about the potential use of AI for fraudulent or malicious purposes? When asked, ChatGPT returned:

Yes, artificial intelligence (AI) can be used for fraud purposes. Just like any technology, AI can be misused or exploited by individuals or groups with malicious intent. Here are a few ways AI can be utilized for fraudulent activities:

• Phishing and social engineering: AI can be used to generate realistic and convincing phishing emails, messages, or phone calls.

By analyzing large amounts of data and personal information, AI algorithms can craft targeted messages to deceive individuals into providing sensitive information or performing certain actions.

• Deepfake technology: AI-powered deepfake technology can manipulate images, audio, and videos to create convincing forgeries. This can be used for various fraudulent purposes, such as impersonating individuals, creating fake identities, or generating false evidence.

• Malware and cyberattacks: AI algorithms can be used to develop sophisticated malware and cyberattack techniques. AI can analyze network patterns, identify vulnerabilities, and automate attacks, making them more effective and harder to detect.

• Data manipulation and fraudulent transactions: AI can be used to manipulate large datasets, altering records, transactions, or financial information to commit fraud. AI algorithms can identify patterns in data and exploit weaknesses in systems to conduct fraudulent activities.

• Automated bots and spam: AI-powered bots can be programmed to automatically generate spam messages, comments, or reviews. These bots can be used for various fraudulent purposes, such as spreading misinformation, manipulating public opinion, or promoting fraudulent products or services.

ChatGPT added the following caveat:

It's important to note that while AI can facilitate fraudulent activities, it can also be used to detect and prevent fraud. AI-based fraud detection systems can analyze large amounts of data, detect anomalies, and identify patterns indicative of fraudulent behavior. The ethical use of AI and the development of robust security measures are crucial to minimizing the risks associated with AI-enabled fraud.

When asked specifically if AI could be malicious, ChatGPT returned, “AI itself does not possess intentions or motives, as it is a tool developed by humans. However, AI can be programmed or manipulated by humans to exhibit malicious behavior. In such cases, the AI system is designed with the intent to cause harm or engage in activities that are considered malicious.” CONTINUED ON PAGE

ARTIFICIAL INTELLIGENCE

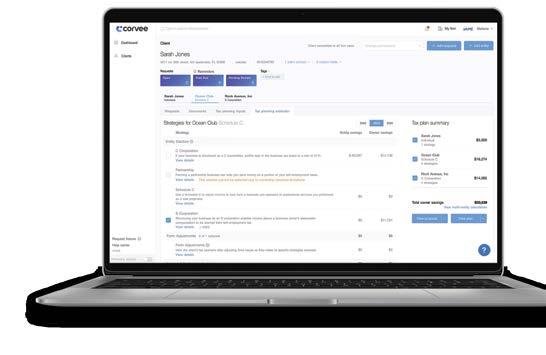

AI has had a significant impact on the accounting profession by automating numerous tasks and increasing efficiency. For example, AI can create invoices, analyze financial data, generate reports, and identify patterns and anomalies that suggest accounting fraud. However, concerns are growing about the ways in which AI can assist criminals, whether they’re hacking their way in or are already on the payroll.

Sheri Betzer, CPA, CFE, a partner at Betzer Call Lausten Schwartz, LLP, has provided services in litigation support, forensic accounting, and fraud investigations for more than 30 years. She shares her expertise with graduate students at Metropolitan State University of Denver as an instructor, educating the next generation of accounting professionals about fraud.

Betzer says while she hasn’t yet run into a situation where AI has been used to hamper a fraud investigation, she sees how it could happen, especially during the process of

interviewing a suspect. She says that detecting when someone is lying comes with experience, and when many interviews became virtual events during the pandemic, it created complications. “I can see how AI could override the success of virtual interviews,” Betzer says. “You need to see the person, look into their eyes, watch their body language, and then feed off that with questions. The threat of AI takes away anything we can rely upon during a virtual interview.”

Betzer says when it comes to financial fraud, it truly takes creativity at different levels on the part of the perpetrator, but some of them aren't yet all that savvy to cover up their actions. The hope is that companies have more internal controls to be able to catch it quickly, even with the onslaught of AI.

“We’ve been trying to train people about fraud and internal controls for decades,” she says. “But we still have the same old fraud surfacing. It requires constant training for the general public as well as the professionals. As AI changes, we have to keep up on

our training to know what we’re looking for, understand the changes, and realize that something has been manipulated. Fraudsters are always one step ahead of us, unfortunately.”

Jeff Cook, CPA, SOC Managing Principal at Fortreum, and owner of Jeff Cook CPA LLC, sees AI as a very sophisticated form of phishing that has growing implications for auditors. With a background in SOC 1 and 2 auditing and other high-level IT audits, Cook has focused on considering fraud and how a client is preventing it. Now that’s translating to fraud prevention with an AI twist. “We’re going to have to put considerations for AI fraud into our audit planning,” he says. Cook says fraudulent use of AI is in its early stages, but he’s starting to hear more about it. He has specific concerns about the write-ups of testing by auditors and the shortcuts they might take. “Instead of an auditor writing up what procedures they actually did, they could ask AI to create control test write-ups just to get the workpapers done,” he explains.

Even though Americans are using AI in their daily lives, they’re wary of its growing pervasiveness. According to a recent Reuters poll, more than twothirds of Americans are concerned about the negative effects of AI, and 61% believe it could threaten civilization. Americans also say they want companies like Microsoft, Google, and OpenAI (ChatGPT’s developer) to do something about that threat.

Another survey shows that the majority of Americans worry that people will use AI for criminal activity (84%), spreading false or misleading information (83%), radicalizing people to extremism (77%), and inciting hate and harassment (75%).

2/3 of Americans

for criminal activity

to spread false information

to radicalize people

believe

Cook says auditors need to change their evaluation process to accommodate the massive amounts of data that AI produces. “When you’re essentially sampling 100% of the population, how do you determine and report thresholds for exceptions?” he questions. “Under the old guidance, we did our statistical samples and determined the tolerable error and confidence level. The AICPA is working on it, but there’s no clear guidance yet.”

Another concern: bad data. AI and other automated tools are completely reliant on user inputs. “Bad data inputs mean bad data outputs,” Cook says. “Critical thinking has to

public and the AI has it. We need to be careful about things like this.”

With the advances in technology, Cook envisions higher-level phishing scams that go beyond criminals hacking a CEO’s email to trick someone into clicking a link and transferring money. “Now, AI might be used to make a phone call that sounds exactly like the CEO instructing someone to visit a site and transfer money,” he says. “The individuals go to the website and then it’s game over – a breach. Organizations need to consider additional safeguards – maybe a codeword that AI would never know – for added protection. Remember: trust but verify.”

Young says she has experimented with ChatGPT, including running the accounting homework assignments she develops through the chat bot. “Right now, it’s not very good at it, but it’s confident in the answers it provides.”

One alarming thing Young noticed: ChatGPT will produce wrong answers when it doesn’t know the actual answer. “I’m learning you have to be really clear on where you want the AI to pull information from,” she says. “It’s always a good idea to check every source that AI provides. The more specific you are with the model, the more specific it is about returning what you want.”

come into play to determine if the data going in is even OK.”

The lesson in all of this, says Cook, is that you can’t blindly accept any information from AI or any automated tool, even when your dashboard gives you a “green checkmark.” Has the tool been tested or audited to ensure that it’s processing correctly? Does it even point to the right data to produce the right results?

“We’ve got to make sure someone tested that machine to ensure that the data was calculated properly before the outcome is accepted, especially in cloud environments,” he explains. “This is why talent remains a top issue in fraud prevention. Auditors of the future will have to go beyond the traditional role. They’ll need some level of proficiency in understanding scripting or code so they know what the automation is doing, and they can make their determination that something is configured correctly and used properly.”

Another dangerous facet of some AI tools is the potential exposure of client information by using internet-based AI programs. “Putting client or firm information into a publicly based internet site violates the confidentiality agreement,” Cook cautions. “If staff just want to get something finished quickly and efficiently, they might not consider this. Now the information is out there for the

Higher education was already grappling with how to deal with plagiarism and cheating in a virtual world when ChatGPT exploded onto the scene. “As we started spring semester, there was very little talk about ChatGPT, and then suddenly, it became all of the talk,” says Falene Young, CPA, an accounting instructor and BSBA program coordinator for Colorado State University. “The information about generative AI is coming in quickly from a lot of different sources, including students, faculty, and textbook publishers. It’s information overload. Some educators are embracing generative AI as the new frontier while others find it incredibly threatening.”

“I’ve heard some people say AI is going to end us as educators,” Young says. “There have even been studies naming the most threatened industries, and higher education is often up there, as is accounting, so people are a little freaked out.”

Young says that technology is constantly evolving, and she encourages curiosity over fear. “When we invested in the calculator, it didn’t eliminate the need to understand how to do calculations. When we first used Google Maps, it didn’t end the need to navigate. All AI is doing is taking something that used to be a manual process and allowing us to do our jobs more efficiently. Critical thinking is still necessary.”

Young says her takeaway is that it’s important to talk about AI because it’s taking the world by storm. “Generative AI is in the disruptor phase right now, and not just in the accounting profession. There’s a lot it can do, but there’s something to be said for the human connection with professors and for higher-level thinking by CPAs. Even though generative AI is going to become more sophisticated, I still think we as a profession aren’t going to be eradicated.”

Betzer encourages CPAs to take as much training about AI as they can. “That’s how we’ll develop our own understanding about how to use our personal expertise to overcome the problems that AI might create,” she says. “It’s going to require a community sharing of ideas.”

Whether it’s AI, blockchain, or cryptocurrency, Cook says the technologies are becoming more mainstream. “An auditor must keep up with these areas to stay relevant; otherwise, how can they render an opinion on a financial statement or IT audit?” he asks. “As a profession, we pride ourselves on our reputation. We have to understand the technology so we can maintain quality and retain the trust of the people who rely on our information. It’s at the core of what we do.”

There’s something to be said for the human connection with professors and for higher-level thinking by CPAs. Even though generative AI is going to become more sophisticated, I still think we as a profession aren’t going to be eradicated.”

The COCPA welcomes the following members, who joined in April and May 2023.

Alejandro Alvarez

Colton Aplara

Luke Barber

Jayme Batchelder

Briana Beers

Christopher Bretzlauf

Jui Buch

Michael Chmelik

Alexander Ciccolo

Madison Cline

Jason Curtis

Kouassi Dapa

Melissa Dick

Nicole Dykstra

Alan Ferguson

Thomas Fraser

Colette Gagnet

Emily Gorr

Laura Greve

Jordan Borell

Shelby Brehm

Landry De Souza

Jesse Jones

Lydia Lawton

Trinity Marmy

Khadidja Meddah

Caitlyn Grimme

Cynthia Harrington

Nancy Harward

Kimberly Hastings

Beth Heiar

Kelly Heikens

Courtney Hengehold

Lauren Hiatt

Michael Joswig

John Kammlade (Retired)

Samual Kelty

Tatyana Kim

Amber King

Duane Knight

Jaime Kraak

Dillon Lionette

Trevor Lockwood

Max Lovato Yuntao Lu

Scott Mowry

Heather Russ

Michael Sell

Jana Sopkova

Marina Vega Sarzosa

Mary Jo Zuelsdorf

Steven Lynn

Leasa Magnuson

Anthony Mann

Jamie Matthews

Nicole McClintock

Katherine McCray

Maureen Meeds

Devin Meister

Eden Mickel

Catherine Mill

Wendy Neal

Paul Neiffer

Coleen O'Dell-Bergstrand

Bailey Paine

Elizabeth Payne

Timothy Pettett

Asghar Rao

Joseph Riss

Gabi Rivera

Know any of these members? Reach out and welcome them to our community!

Kristi Schleis

Heidi Schumann

Morgan Sherwood-Robinson

Jared Shmikler

Luke Short

Paulina Singer

Ian Snedden

Sidney Sotiros

Elizabeth Stahlberg

Colin Temple

Christopher Thompson

Matthew Torlone

Alec Van Wormer

Eric Varner

Mariah Ver Hoef

Cynthia Wadle

Betsey Wagner

Wiltan White

STUDENT MEMBERS

Jenna Abeyta

Nikita Cooper

Jurgita Dagiene

Mofoluwaso Emmanuel

Tianyue Gu

Margaret Kmetz

Laura Morfitt

Catherine Padilla

Cassandra Porter

Scarlett Remer

Catherine Schilling

Tala Vicknair

Aiden Wiesenmeyer

New members, are you looking for a way to get involved, meet others, and connect with your new professional community? Whether your passion is serving on a committee, participating in a special-interest group, or bettering your community, find the opportunity that speaks to you and join in!

Visit cocpa.org/get-involved

Whether experienced by a farmer toiling away on the land 200 years ago or a newly minted CPA who is climbing the career ladder in 2023, burnout is a nearly universal phenomenon. Virtually everyone has faced, or will face, burnout, and we all experience it differently. It happens as a result of circumstances in both our work and personal lives.

There’s nothing inherently wrong with burnout; remember, nearly all of us experience it at one point or another. It’s important to remember that fact, as amidst burnout we often lack the critical thinking skills required to openly evaluate why we’re feeling burned out. Instead, we fall back on a simpler concept: “There’s something wrong with me.” Nope, there isn’t. You’re good. Your brain is just so full of stress, anxiety, exhaustion, and other burdens that you’re temporarily lacking the mental capacity to evaluate the “why” behind your burnout.

Here are more details on that thought: Your brain is hardwired (read: there is nothing that you can do about it) to make very quick decisions based on the volumes of information that it receives. Your brain is also inherently lazy – it wants to do its work as quickly as possible and move onto the next thing. The quick decision that the brain makes here is, “I’m tired. I don’t want to use energy to figure

The good news is that you can actively engage your brain to dedicate the energy necessary to figure out why you're burned out, and then you can do something about it. With enough repetition, your brain realizes that it can’t take the shortcut here anymore, and it will start to proactively deal with the burnout for you. You see this in people who deal well with burnout … or don’t appear to

be burned out at all. Their secret: They’ve put in the brainwork to help themselves effectively deal with burnout.

Burnout is a combination of stressors and emotions that sap our energy, preventing us from being the best version of ourselves. This usually presents as feeling tired all the time – which you are. Your brain is tired from the constant stresses of your life, including work, people, commitments, and other factors. With the reasonable assumption that you’d prefer to be the best version of yourself, you want to avoid or escape burnout as quickly as possible.

The first step is recognizing the physical manifestations of your burnout. In addition to lethargy, signs of burnout might include losing the “brain-mouth filter” more often, feeling irritable, ceasing to enjoy the things that usually bring you happiness, or focusing more heavily on negative outcomes than positive ones. In whatever way burnout shows up for you, pay attention to it. These are the specific symptoms that you can train your brain to recognize and combat.

Let’s say you’re feeling irritable and your brain comes up with super-snarky responses to reasonable questions. I bet you’re thinking of a recent time when you did just that. How did that work out for you? My guess is that you left that conversation feeling worse than when you went into it, thereby increasing your irritability.

Here’s a fix to consider in a situation like this. When your brain comes up with the cutting, snarky response, pause. Don’t open your mouth yet, and instead, think – is this funny to me, or to the other person? Better yet,

what does this person really need and how can I help them leave this conversation better than when they joined?

Your brain will fight you. Remember, while your brain feels tired and lazy, you’re smart. Lean into that. Negotiate with your brain. Focus on something you know that it wants, such as the satisfying feeling that we get when we genuinely help someone. Your brain thinks, “Yes, we do enjoy that. I can go down that path.”

It finds some energy store, gives you information to help the person with whom you’re speaking, and you leave the conversation feeling better. Your burnout decreases a little even though you used more energy. Your brain likes that feeling, too.

Let’s talk more about the primary cause of burnout: too many things to do in too little time. I purposely phrase it this way because, as we learned earlier, burnout is not a work thing or a family thing or a life thing. Instead, it’s all of those things, in different amounts, for different people, at different times.

Here is a powerful, two-word strategy that can help: Set boundaries. While the phrase is simple, its execution is not. It can require you to say no, put yourself ahead of others, disappoint people, have uncomfortable conversations, and actively create conflict. Most people don’t like any of these things, but you can get comfortable with these uncomfortable feelings through consistent practice. What’s likely to be years of payoff will be well worth the practice time.

Here’s one method for setting boundaries. Instead of saying no – for example, when

your manager gives you a project on top of an already-full plate – say, “yes, when.”

You: “I can get to this next Thursday and have it for you by the following Tuesday.”

Your manager’s response is likely: “I need it by Friday.”

You: “Here is my current workload and the dates when the other managers expect my completed work. If you talk to the other managers to prioritize yours before theirs, I’m happy to work on yours first.”

Manager: “Just do mine and talk to the other managers.”

You: “I don’t have any authority to reprioritize other people’s projects. That puts me in the middle and takes time away from me completing my work, which will further delay delivering on everyone’s projects, including yours.”

Manager: “Just work more and make it happen.”

You: “I don’t have the capacity to work any more hours. I told you when I can do it, and that I will do it. If the timeline doesn’t work,

please talk with the other managers about reprioritizing my projects.”

You may be thinking, “Wow, that’s a bold conversation to have with my boss.” And you’re right, it is. But consider this: The current talent shortage within the accounting profession offers you significant leverage to engage in these types of bold but respectful conversations as needed.

The worst outcome is that you are no longer employed. The problem is that we’ve been conditioned to think that being fired is a bad thing. But logically, that difficult manager is not someone with whom you want to work. So why do you feel compelled to keep that job when you can relatively easily find a new one in the current hiring environment? Your career is yours, not your employer’s.

It’s important to remember that actions have consequences, and if the outcome of you protecting your wellbeing is that the name on the top of your paycheck changes, so be it. You don’t need to work there, and fearbased management techniques don’t work.

You are empowered to own your career, what you do, and where you do it. And to bring this full circle, when your brain knows that it will be safe after the decision, it is more likely to make that decision.

Mike Maksymiw, CPA, CGMA, MSA, is the Executive Director of Aprio Firm Alliance, where future-oriented firms convene to discuss challenges and solutions to running their firms. He is a tireless advocate for value vs. time, family initiatives, inclusion and belonging, work/life harmony, and challenging the historical norms to which the accounting profession clings. He lives in Connecticut with his wife and two teenage daughters. Reach Mike at Mike.Max@Aprio.com.

Hear more from Mike at his interactive session, “Burnout – How to Prevent it and Combat it,” featured at the 2023 COCPA Young Professionals Conference, July 28, 10 am to 6 pm at the Curtis Hotel, Denver. To learn more or to register for the conference, visit cocpa.org/young-pros.

Many thanks to Tyler Linnebur and Caitlyn O’Neil, who joined COCPA staff member Abbey Aguirre at the COCPA booth at the State FBLA Conference in April.

MEMBER CONNECTIONS COMMITTEE

COCPA members came together at the Member Connections Committee-sponsored wine tasting – part of the Summer of Fun Series – and Thirsty Third Thursday. For more information on upcoming events, visit cocpa.org. All COCPA members and their guests are welcome.

Each year, AMP the Cause connects more than 800 volunteers with local nonprofit organizations. On May 20, 16 volunteers represented the COCPA Nonprofit Working Group, in partnership with AMP the Cause, spending the day sorting roughly 55,000 pounds of donated food at the Action Center. The Action Center offers resources and services to those experiencing hardship, and seeks to stabilize lives and promote pathways to lasting change.

Many thanks to these Team COCPA volunteers: Kellen Aden, Serenity Ann Clark, Brooke Greve, Rebecca Jacobs, Lesley Johnson, Bridget Kalicki, Tyler Linnebur, Barb Ogg, Tom Ogg, Luke Morales, Chloe Reindl, Lori Anne Reinwald, Rebecca Shreck, Cynthia Wadle, Tiffany Carson, Stacy Svendsen, and Action Center Manager of Volunteer Programs and Special Events Monica Wilde.

We’re pleased to recognize Nonprofit Working Group members Bridget Kalicki, Nathan Oberle, and Lori Anne Reinwald, who volunteered their time presenting and answering questions at the Colorado Nonprofit Association’s May 4 ask-an-expert virtual lunch-and-learn program.

Our thanks to the following members, who worked tirelessly to plan the COCPA 2023 Not-for-Profit Conference. The conference was a great success, and we couldn’t do it without you.

Ron Goodrich

Jill Korenek

Lisa Meacham

Ksenia Popke

Lori Anne Reinwald

Steve Sauer

The COCPA Technology Users Group was well represented at the recent AICPA Engage Conference in Las Vegas, with chair Jim Gilbert, along with members Casey Barlow and Dan Schmidt, each presenting sessions to fellow Engage attendees.

Mark your calendar for August 24, when Kristine Brands, DM, will present “What CPAs Need to Know about Ransomware Attacks,” virtually from noon to 1 pm. The event offers one hour of CPE and is free to COCPA members. To register, visit cocpa.org/RansomwareAttacks

Looking to share your time, talent, and expertise on a COCPA committee, working group, or board while connecting with other members? Visit cocpa.org/get-involved or contact Stacy Svendsen at stacy@cocpa.org to learn more about volunteer opportunities.

BY NATALIE ROONEY

BY NATALIE ROONEY

The bank failures during spring 2023 dominated media headlines and had the general public in a bit of a frenzy. While the market has settled, the failures had CFOs answering questions from their boards and CEOs. Here’s some insight into their thought processes when it was all going down.

Over the course of five days in March, three small- to mid-size U.S. banks failed. Silicon Valley Bank (SVB) failed when a bank run was triggered after it sold its Treasury bond portfolio at a large loss, causing depositor concerns about the bank's liquidity. Silvergate Bank and Signature Bank, both with significant exposure to cryptocurrency, failed during the resulting turbulent market.

Despite the media hype, the general public actually had little to worry about during the failures: the FDIC insures accounts up to $250,000. But for companies and organizations with multiple accounts of more than $250,000 in one bank, there was more at stake, says Charlie Wright, MBA, CPA, CMA, CFO of the Denver Zoo. “For your average larger company, and even nonprofit organizations, $250,000 is a drop in the bucket for your bank operating balance,” he says. “Larger companies might have millions in an operating account that they need in order to transact daily business for things like payroll and vendor payments.”

Board members can get nervous, especially if an organization is using a smaller bank as opposed to a giant “too big to fail” institution. “A board might issue a strong suggestion to get an organization’s money into one of these larger banks, even if the risk is small,” Wright says.

A bank run today is a far cry from the bank runs of old, when people panicked and lined up outside a bank to physically

withdraw their money. Today, a rumor starts and almost instantaneously, customers can simply open their bank’s app and move their money, which is what happened to SVB. Then rumors begin circulating about what bank could be next to fail. “When the media publishes articles about ‘the next 10 regionals that will be in trouble,’ that gets the whole world of businesspeople, many of whom serve on boards and audit committees, asking, ‘Why are we taking this risk?’” Wright explains.

In a Gartner survey just a week after the failures, about 85% of CFOs responded that they were concerned about the impact of the bank failures on their business, while 18% noted that they had “some level of direct exposure to one of the failing banks.” The same survey revealed that 39% of CFOs said they were focusing on educating their board on exposure and risk, and 38% said they were assessing risk and viability of their existing funding sources. More than one-quarter (28%) of CFOs said they planned to diversify their deposits across more banks.

Marc Hendrikson, CPA, CCIFP, CGMA, SVP – Contractor and Commercial Banking, Sunflower Bank, N.A., says the key to understanding the situation and the subsequent bank failures is wrapped up in how the media told the stories. “Everyone was using the word ‘crisis.’ Three banks failed. That’s scary and certainly disconcerting, but these were isolated, odd events. The Fed already

has many tools in place to ensure ongoing confidence in the banking system and to stem the panic-driven behavior.”

Hendrikson says that in fairness though, it is distressing for the public. He emphasizes that banks are required to produce quarterly financial information for public access, referred to as the Statement of Condition or Call Report, and that information is out there for anyone to access on the FDIC’s website. Customers can also request this financial information directly from their bank institutions. “There is so much information out there to help calm fears,” he says. “But of course, that’s not the story that sells in the media.”

In particular, what was different about these recent bank failures was the speed at which they happened. For the first time in history, people were able to issue wires on their mobile phones totaling $40 billion in withdrawals within just a few hours, causing an unprecedented and lightning bank run. “That’s a really new dynamic,” Hendrikson explains. “The first failure caught everyone by surprise and almost overwhelmed the Fed’s withdrawal system. That’s clearly not ideal and was a situation never before encountered, and it caught banking regulators and the general public off guard.”

Hendrikson says that when he receives calls from clients, prospects, business owners, or other professionals who have concerns about where their money is, and particularly if they are contemplating moving their money,

he encourages them to have confidence in the nation’s very healthy banking system and get the information they need to make an informed decision.

Curtis Woitte, CPA, Deputy Director and CFO at the Denver Art Museum, says as a prudent fiduciary, he firmly believes that when a risk profile changes, CFOs should look at and assess it. “There’s a heightened burden when you’re holding money from donors,” he says. “When you think about a bank’s failure and couple that with the long memory of 2008, I think every fiduciary went and looked at their banking partners.”

The museum’s board of directors didn’t express concerns to Woitte, but part of the museum’s process is to include the chair of the finance committee in the review and the steps taken.

Woitte’s first action was to shift funds out of the museum’s operating accounts and into Treasuries. “That was really just an extension of our investment strategy of purchasing 30-, 60-, and 90-day T bills laddered to mature frequently,” he says. “You can never eliminate risk, but you can reduce it to the lowest possible level. That provided us with time to review each of our financial institution partners.”

Woitte says the close working relationships that he has established with each of the museum’s banking partners paid off. “We were able to hold candid conversations with them to understand their exposures and the steps they were taking, and we reviewed their financial information.”

Jim Altman, CPA, is the CFO of the Denver-based Welch Equipment Company, which also operates in Utah and New Mexico. He says the company’s deposits vary day to day but are consistently over the $250,000 FDIC-insured threshold. The company’s CEO asked for Altman’s thoughts when the SVB story began making headlines.

Altman had been monitoring the situation. “I’ve been around since the tech bubble burst in the early 2000s,” he reflects. “I thought about these things happening in Northern California, and my first reaction was, ‘Are we on the verge of another tech industry issue?’” He had also been considering the impact of the Fed’s continued raising of interest rates. “We kept seeing the Fed raise rates, and we knew banks that had loaned out money at

lower rates were going to have trouble covering their margins. If they don’t have that flexibility and capitalization, we saw there could be a problem,” he says. “Then the Fed raised rates two more times.”

As Altman monitored what was happening with SVB – which he’d never heard of prior to the run and subsequent collapse – and

Sometimes, the best thing you can do as a CFO is to slow down, take a breath, and not panic. Take the time to evaluate your options and be an active participant in banking relationships. Know your banks, what they’re invested in, and what backstops their deposits.

other banks, his overriding sense was confidence in his banking relationship at PNC. “I didn’t have any concerns that we were personally on the brink as a company,” he says. “PNC isn’t as big as a Chase or Wells Fargo, but they have a substantial presence.” Ultimately, Altman took a wait-and-see approach. “I don’t even think it crossed my mind to call my banker,” he says. “Would there be some smaller banks collected in this? Possibly, but I wasn’t overly concerned, even after the second failure. I looked at the diversity of industry in Colorado and the markets that we serve and didn’t have any big concerns.”

Altman also felt that the media was putting a dramatic spin on the news story, so he focused on what was happening behind the scenes. “Bank failures have happened for decades,” he says. “There are specific issues impacting Silicon Valley, and it’s a pendulum. CFOs need to be smart and strategic in the way they go about things.”

Woitte says that understanding your banking relationships and what you can and can’t do at any given time will drive any conversation with your banker. “Banking relationships are complicated, but over 20 years of working with banking institutions, I can pick up the phone and have the necessary conversations.”

On the other side of that equation, Hendrikson agrees. “Talk to your banks and your banker. Ask your bank about your options so the majority of your balance is fully insured even if you keep that balance at the same institution. There are programs that exist for that option now.”

The COCPA Members in Business and Industry Group meets to network, discuss trends, share best practices, and grow as a community. For more information on its upcoming events, visit cocpa.org/ business-and-industry or contact Lindsay Moore at lindsay@cocpa.org.

“When the media publishes articles about ‘the next 10 regionals that will be in trouble,’ that gets the whole world of businesspeople, many of whom serve on boards and audit committees, asking, ‘Why are we taking this risk?’"

Each year, the Educational Foundation of the COCPA recognizes, with its Gold Key Award, top graduating accounting students as chosen by faculty at each Colorado college or university.

Since 1958, the Foundation has used scholarship dollars to assist Colorado students who are on the path to a CPA career. Made possible through COCPA members’ financial support, scholarships are awarded primarily on merit and the student’s commitment to pursuing an accounting career. New to the Educational Foundation’s scholarship offerings this year is the Community College Accounting Scholarship.

Congratulations to these outstanding recipients and future CPAs:

To contribute to the Educational Foundation and continue its important work, visit coloradogives.org/EFColoradoSocietyCPAs/overview.

For more information on the Educational Foundation, contact Executive Director Paul Greiving at paul@cocpa.org.

November 9, 2023

Westin Denver Downtown

Nomination Deadline:

September 15, 2023

Each and every day, away from the headlines, in businesses large and small across Colorado, and in others’ lives, CPAs make a difference. We will honor those contributions with the 2023 Everyday Heroes and Heroines Awards.

If you know a CPA who should be considered, send a narrative, not to exceed three pages, explaining why you believe the candidate should be recognized and detailing his or her accomplishments.

Nominees must hold a CPA certificate and be a COCPA member. They should be “everyday” heroes and heroines who haven’t been recognized widely for their contributions. Nominees should demonstrate significant service in one or more areas:

The AICPA joined a coalition of organizations that have come together to make taxpayers and practitioners aware of the new Beneficial Ownership Information (BOI) reporting requirement.

BOI is an anti-money laundering initiative enacted through the Corporate Transparency Act (CTA) in 2021 that mandates that BOI information is reported to the Financial Crimes Enforcement Network (FinCEN). It is estimated that there will be 32.6 million filings in 2024, and 5-6 million filings each year thereafter, with the potential for steep penalties for the taxpayer.

“There is concern that many business owners are unaware of this filing requirement,” says COCPA CEO Alicia Gelinas, CPA. “Many small businesses will be subject to this requirement, and the goal is to inform them prior to the regulation start date of Jan. 1, 2024.”

The coalition includes the AICPA, Latino Tax Pros, National Association of Black

Accountants, Inc., National Association of Enrolled Agents, National Association of Tax Professionals, National Conference of CPA Practitioners, National Society of Accountants, National Society of Black Certified Public Accountants, Inc., National Society of Tax Professionals, Padgett Business Services, the Diverse Organization of Firms, H&R Block, Paychex, and Prosperity Now.

As FinCEN releases more information on this reporting requirement, the COCPA and the AICPA will update members on the issue. In the meantime, the coalition will continue to raise awareness and educate taxpayers of their filing obligations.

For more information, visit cocpa.org/boi-reporting

INVOLVEMENT: Describe the nominee’s level(s) of involvement, length of involvement, and time devoted to nonprofit organizations and community activities.

LEADERSHIP: Describe the nominee’s position(s) held and substantial accomplishments achieved in one or more community organizations, including taking the lead in identifying and solving a problem, founding or rescuing an organization, or developing an innovative program.

IMPACT: Describe how the nominee’s actions benefited the community, improved the overall quality of life, helped others overcome adversity, or served as a role model for CPAs exemplifying the profession’s core values of integrity, competency, and objectivity.

For more information and to submit your nomination electronically, contact Stephanie Bass, stephanie@cocpa.org, 303-741-8627.

Social media has become an everyday part of life, and accordingly, an everyday part of business. There are countless examples of businesses and organizations that have successfully used Facebook, Twitter, LinkedIn, blogs, and other social media outlets to promote their products, services, and agendas. But one oftenoverlooked consideration for employers is how they control employees’ use of social media.

There may be unwritten rules and management pronouncements regarding the use of social media during the workday. However, if an issue arises, having an unwritten policy can spell trouble for an employer. You must also consider the effect outside of business hours. Like so many other things that must be included in an employee handbook, employers must consider what policy to establish regarding the use of social media in the workplace.