November 10 Special Report: Resources for Small Business/Education

November 10 List: Chambers of Commerce

November 17 Special Report: Manufacturing/High-Tech/Incubators

November 17 List: Nursing Programs

November 24 Special Report: Employee Benefits/HR/Insurance

November 24 List: Commercial RealEastate Firms

December 8 Special Report: Energy/ Environment/Sustainability

December 8 List: Ski Resorts

December 15 Special Report: Construction/Design/Real Estate

December 15 List: Landscape Architects

December 22 Special Report: Nonprofit Directory

December 29 Special Report: Healthcare Quarterly/Excellence in Healthcare Spotlights NEW!

UTICA — Downtown Utica has a popular new fast food, fried chicken restaurant with the formal opening of Equis Pica Pollo.

The Dominican-style fried-chicken restaurant officially opened a new location at 1155 Mohawk St., Suite 10, with an Oct. 9 ribbon-cutting event held with the Greater Utica Chamber of Commerce. The restaurant opened to customers months earlier.

Equis Pica Pollo was founded by entrepreneur Carlos Rijo with a vision to bring

Brown & Brown, Inc. (NYSE: BRO) — the Florida–based parent of Brown & Brown of New York, Inc., which has an office in Syracuse — recently announced that its board of directors has increased its regular quarterly cash dividend by 10 percent.

The insurance-brokerage firm will pay a dividend of 16.5 cents per share on Nov. 12, to shareholders of record on Nov. 5. The dividend is up from the 15 cents a share that Brown & Brown paid last quarter. It marks its 32nd straight annual dividend increase, according to the firm’s Oct. 22 announcement.

Brown & Brown also reported that its board has authorized the purchase of up to an additional $1.25 billion of the company’s common stock outstanding. With this authorization, Brown & Brown will now have approval to repurchase up to $1.5 billion, in the

aggregate, of the company’s shares. The firm said it will buy back the stock from time to time, at the company’s discretion and subject to the availability of shares for purchase, market conditions, the trading price of the stock, and alternative uses for capital. Other factors considered include the company’s financial performance and objectives to reduce dilution from Brown & Brown’s employee equity incentive plans, decrease outstanding shares, or manage other potential factors.

Daytona Beach–headquartered Brown & Brown says it is a major insurance-brokerage firm delivering comprehensive and customized insurance products and risk-management services since 1939. It has more than 23,000 employees and over 700 offices worldwide. Brown & Brown makes frequent acquisitions of insurance agencies a major

the authentic flavor and family-centered experience of the Dominican Republic to communities across the U.S., the Greater Utica Chamber said in an Oct. 7 email announcement.

The first location of Equis Pica Pollo opened in Brooklyn, quickly gaining local popularity for its signature pica pollo, homemade sides, and welcoming atmosphere. The restaurant has now expanded to five states with Utica being its 18th location.

part of its growth strategy. Its stock price has declined about 12 percent year to date and fallen 15 over the last year, as of Oct. 24, according to Yahoo Finance data. But Brown & Brown’s stock is up more than 27 percent over the last two years and up 102 percent over the past five years.

Brown & Brown has an office at 500 Plum St. in Syracuse’s Franklin Square area.

ITHACA — Michael I. Kotlikoff was officially installed as Cornell University’s 15th president in a Friday, Oct. 24 ceremony in Barton Hall on the university’s campus.

Kotlikoff had been appointed as Cornell president back on March 21, after having served as interim president since July 2024.

The inauguration event followed a dinner for Cornell trustees, council members, and guests as part of the trustee-council annual meeting schedule, according to an Oct. 27 Cornell Chronicle article.

Anne Meinig Smalling, chair of the Cornell board of trustees, presided over the ceremony, welcoming Kotlikoff’s family members and the two former Cornell presidents in attendance — Martha E. Pollack and Jeffrey S. Lehman.

Bob Harrison, emeritus chair of the board of trustees, offered a toast, lauding Kotlikoff for his 25 years at Cornell as a professor, department chair, dean and then as the longest-serving provost in Cornell’s history (2015-24) before stepping into the role of interim president in 2024.

Provosts rarely go on to become presidents of the same

university, Harrison noted, because they typically must make many unpopular administrative decisions and balance competing academic interests and priorities, according to the Cornell Chronicle.

“Remarkably, while Mike has done all of these things, every dean with whom I have spoken during his tenure has told me how fair, straightforward and decent Mike has been as their boss,” Harrison said, thanking Kotlikoff for his “truly extraordinary leadership.”

In his own remarks at the Oct. 24 event, Kotlikoff reflected on his lengthy career at Cornell and the opportunities and challenges that lie ahead.

“It’s a different thing to be inaugurated as president of the university where you’ve spent most of your career — when you’ve been asked to help shape the future of an institution that is already your home, and to which you owe a debt of gratitude impossible ever to repay,” he said. “Cornell has given me opportunities that I could not have conceived of when I started college 56 years ago — a directionless freshman on a scholarship. And I never know quite how to respond, when people say, ‘I don’t know if I should offer you congratulations

ITHACA — The Tompkins Chamber recently announced it has chosen Rob Montana to serve as its new vice president.

Montana has 25 years of community-focused experience in communications, stakeholder engagement, and organizational leadership, including the last four years as communications manager for Visit Ithaca, a division of Tompkins Chamber. His ability to foster strong relationships with community and business leaders, as well as shaping and implementing strategic initiatives, will play a key role in helping lead the chamber as it supports Tompkins County’s economic and workforce development, and enhances the quality of life for the whole community, the chamber said in its Sept. 30 announcement.

The Tompkins Chamber says it selected Montana from among 100 applicants for the position.

“We were looking for the right person to elevate our work,” Tompkins Chamber President and CEO Peggy Coleman said in the announcement. “Rob’s passion for community building for the greater success of the Tompkins County business community is inspiring. I look forward to working with him in this new capacity and celebrating the positive impacts he makes.”

As VP, Montana will oversee the Tompkins County Employer Resource Network, manage the Live + Work in Ithaca initiative, as well as administer the Tompkins Chamber Foundation fiscal sponsorships of Tompkins Connect and Ithaca Pride Alliance. Additionally, he will collaborate with Coleman on long-term strategic planning and enhancing Tompkins County’s business climate.

“I am grateful for the opportunity to serve as Tompkins Chamber’s vice president and continue working with my dedicated colleagues to build upon the organization’s work in Tompkins County,” said Montana. “Building relationships with others in a way that strengthens the community is work I am excited to continue doing to keep Tompkins County a great place to live, work and visit.”

Montana has two decades of community journalism experience, including managing local newspapers The Ithaca Times and Tompkins Weekly and others in Maine, as well as working in development and communications roles for several nonprofit organizations and working as a grant writer. Additionally, Montana has served on several nonprofit boards and grant review committees and was a graduate of the Leadership Tompkins program in 2024.

With more than 700 members, the Tompkins Chamber says it is dedicated to making Tompkins County a great place to live, work, and do business by fostering sustainable economic growth.

on your new job, or condolences.’ ” Kotlikoff continued, “The truth is, that I could not think of a more meaningful time to serve an institution that has given me so much. And I am endlessly grateful, both for the opportunity, and for your support.”

BY ERIC REINHARDT ereinhardt@cnybj.com

MASSENA — One of the North Country’s largest employers has a new power-supply contract with the New York Power Authority (NYPA).

Alcoa Corp. (NYSE: AA) signed the deal for its Massena smelting-plant operations in St. Lawrence County.

Alcoa — an aluminum producer — is based in Pittsburgh, Pennsylvania.

The pact includes a commitment of $30 million in capital investments and supports 500 jobs at Alcoa’s Massena plant for the next 10 years, the office of Gov. Kathy Hochul announced on Oct. 22.

In addition to the contract, Alcoa is investing nearly $60 million through 2028 to rebuild and modernize a portion of the Massena facility.

This investment is made possible by the new energy contract as well as a $5.2 million capital grant and $1 million in Excelsior Jobs Program tax credits from Empire State Development (ESD). This improvement will “enable process stability and operational efficiency,” Hochul’s office said.

The Oct. 22 announcement of a signed

contract by Alcoa and NYPA follows approval of the final agreement’s terms by the Power Authority’s board of trustees and Gov. Hochul.

“By securing good paying jobs and fostering investment, this agreement ensures Alcoa will continue to be a major presence in Massena while supporting New York families and communities,” the governor said in the announcement. “The aluminum manufacturing industry has played a significant role in the nation’s economic development, and New York’s Alcoa facility has been at the forefront, driving economic growth and opportunity in the North Country.”

The contract includes a 240-megawatt (MW) allocation of low-cost power through NYPA’s Preservation Power program to Alcoa for its Massena plant. This power allocation will support Alcoa’s operations through March 31, 2036, with options for two additional five-year extensions, contingent on maintaining a minimum of 500 full-time equivalent jobs and increased capital investments.

“Alcoa has been a vital part of the North Country economy for more than 120 years. With Governor Hochul’s support, this new contract with one of the Power Authority’s oldest customers secures essential jobs and significant capital investments in the region,” Justin Driscoll, president and CEO of the New York

BY ERIC REINHARDT ereinhardt@cnybj.com

SYRACUSE — The Downtown Committee of Syracuse, Inc. used its fall progress breakfast to conclude its 50th anniversary celebration.

The event was held Thursday morning, Oct. 23, at the Marriott Syracuse Downtown and included three speakers who discussed history and storytelling.

The progress-breakfast series — held twice a year — aims to “leave attendees feeling invigorated and more connected” to downtown Syracuse. This year’s event marked the conclusion of the Downtown Committee of Syracuse’s 50th anniversary celebration.

“Reflecting on the history of Downtown has provided valuable insights into not only the current landscape of Downtown Syracuse but also how we have leveraged these elements to create a truly exceptional district,” the Downtown Committee said in its announcement.

The progress breakfast speakers included Natalie Stetson, executive director of the Erie

Canal Museum. In her remarks, Stetson discussed how the Erie Canal flowed directly through Syracuse two centuries ago (occupying what is now known as Erie Boulevard) and how it played a pivotal role in shaping downtown Syracuse.

Those gathered at the fall progress breakfast also heard from Robert Searing, curator of history at the Onondaga Historical Association (OHA), who led a virtual walking tour through downtown Syracuse, providing an understanding of the downtown district and its history.

In addition, Katrina Tulloch, editor of Syracuse.com’s life and culture department and editor-in-chief of This is CNY, discussed how she embraces storytelling to engage audiences of all ages and “create a meaningful impact” in downtown Syracuse, per the Downtown Committee announcement.

“As an organization whose mission is Downtown’s revitalization and continued vibrancy, today’s presentation was truly inspiring,” Merike Treier, executive director of the Downtown

Power Authority, said. “We are proud to continue our partnership with Alcoa and to support their growth and investment in the community.”

Alcoa has also agreed to invest a minimum of $30 million in the plant’s operation over a period of 10 years. If market conditions permit, Alcoa may extend the contract an additional 10 years, which would foster capital investments totaling $145 million over a 20-year period.

“We are proud to make aluminum in New York and the United States. Longterm, competitively priced energy enables Alcoa to proceed with this important investment that will help us meet the

demands of today while planning for tomorrow,” William Oplinger, president and CEO of Alcoa, said in a separate announcement on the company’s website. “We are extremely pleased to have worked with NYPA and ESD to achieve this outcome for our Massena Operations, which will bring economic benefits to the region and sustain American manufacturing.”

The contract provisions build on a seven-year agreement approved by NYPA in 2019. The 2019 agreement provided 240 MW of low-cost St. Lawrence-FDR hydropower in return for Alcoa’s commitment to retain 450 jobs at the aluminum company’s smelting plant in Massena. n

Committee of Syracuse, Inc. said. “It highlighted the vision and collaboration that have driven the evolution of Downtown Syracuse and will undoubtedly continue to do so.”

The Downtown Committee partners with National Grid (NYSE: NGG) in presenting the Progress Breakfast Series. Presenting sponsor National Grid is one of the largest investor-owned energy companies in the U.S., serving more than 20 million people throughout New York and Massachusetts.

“National Grid understands the value of a thriving city center, that’s why our commitment

to Downtown Syracuse remains strong. We take pride in supporting local businesses and working with partners like the Downtown Committee of Syracuse who create initiatives that support Downtown Syracuse,” Alberto Bianchetti, CNY regional director, external affairs for National Grid and a Downtown Committee board member, said in the announcement.

included community sponsor: Canandaigua National Bank, and corporate sponsors: AmeriCU, CXtec, FustCharles, and Tompkins Community Bank.

The nonprofit Downtown Committee of Syracuse describes itself as a professional downtown-management organization representing all property owners and tenants within the central business district.

The fall progress breakfast also included distribution of the “Revitalize Syracuse 2025” edition of The Central New York Business Journal, which served as a media partner for the event. Other sponsors of

breakfast

The Downtown Committee says it undertakes programs to improve downtown’s image, strengthen its economic base, increase its attractiveness, and ensure that it’s clean, safe, and accessible. n

BY ERIC REINHARDT ereinhardt@cnybj.com

ALBANY — New York State is set to spend more than $600 million on over 180 paving projects statewide that are set for completion in 2026.

That includes $25.3 million for eight projects in Central New York, $37.6 million for 15 projects in the Mohawk Valley, $59.6 million for 18 projects in the Southern Tier, $35.4 million for 28 projects in the North Country, and $46 million for 17 projects in the Finger Lakes.

The 180 projects, which total almost 2,150 lane miles, are in addition to the paving initiatives already scheduled as part of NYSDOT’s core programs and, taken together, represent the “most ambitious annual road resurfacing agen-

da ever put forward” by the New York State Department of Transportation (NYSDOT), the office of Gov. Kathy Hochul announced on Oct. 22.

The $600 million is leveraging the $800 million that the governor secured in the most recent state budget to augment the final two years of the state’s five-year, $34.3 billion capital plan.

“Investing in modern and reliable infrastructure is a central tenet of good government and something my administration has made a top priority. It also requires partnerships at all levels of government,” Onondaga County Executive Ryan McMahon said in the state’s announcement. “With today’s announcement, New York State continues its commitment to updating Route 5 - a critical thoroughfare in our community.

Thank you to the State and all our part-

ners who made this possible.”

The full list of scheduled road-paving projects across the state is available on-

BY ERIC REINHARDT ereinhardt@cnybj.com

COOPERSTOWN — The National Institutes of Health (NIH) has awarded the Bassett Research Institute’s Center for Rural Community Health a multi-year grant to study improving rural access to preventive services.

The National Institute of Nursing Research, which is part of NIH, is providing the funding.

The Rural Innovative Multi-sectoral Preventive Approaches Community Trial for Population Health Improvement (Rural IMPACT for Population Health Improvement) will consider how a community-driven model may improve population-level diabetes health out-

comes better than traditional approaches in rural areas.

“Initially this research will impact communities in Chenango, Madison, Herkimer and Delaware Counties,” Kristin Pullyblank, Ph.D., a registered nurse and the Bassett research scientist overseeing this project, said. “That’s where we’ll be conducting the study. However, if our hypothesis is supported, this could be the first step to creating a model that will serve rural areas across the country.”

The NIH has approved Rural IMPACT’s first, observational phase with a $1.2 million grant paid over two years. If phase one is successful, it will release an additional $4.19 million over five years for Pullyblank’s team and community partners to test the approach in a community-randomized trial.

The work is part of a larger national-learning collaborative run by the Penn State University College of Medicine. Bassett Research Institute is one of six orga-

BY ERIC REINHARDT ereinhardt@cnybj.com

SYRACUSE — The Energy Solutions team at NOCO is working to install energy-efficient lighting at 45 stores of Tops Friendly Markets throughout New York state.

NOCO is an energy company based in Tonawanda that has a local office at 1300 Wolf St. in Syracuse.

The installation project, which started back in February and is now more than halfway complete, includes converting all interior and exterior lighting to LED (light-emitting diode.), per the company’s Sept. 30 announcement.

Once these lighting upgrades are completed later this year, NOCO and Tops estimate annual savings of more than 16 million kilowatt hours or about $1.6 million on electricity costs.

“At Tops, we are deeply committed to sustainability and responsible energy use, and this partnership with NOCO is another step forward in reducing our environmental footprint while enhancing our in-store experience,” Ron Ferri, president of Tops Markets, said in the

NOCO announcement. “The transition to energy-efficient LED lighting not only supports our long-term operational goals but also helps us create a brighter, more welcoming environment for our customers and associates. We’re proud to lead with initiatives that deliver real impact for our communities and the planet.”

The project in the impacted stores involves new lighting in customer-facing, backroom, and loading dock areas, including coolers, freezers, and deli cases.

With this current project, Tops is responsible for paying about 36 percent of the total $4.7 million project cost, offsetting the remaining balance with available energy incentives and rebates through utility-efficiency programs in the geographic areas where the stores are located.

“If you run a business, there are always factors outside of your control and rising electric prices are one of them, with no end in sight to continued rate increases,” Michael Casciano, president and COO of NOCO, said. “NOCO is committed to helping businesses optimize their energy usage while also reducing their energy costs. While Tops is

line at: https://www.governor.ny.gov/ sites/default/files/2025-10/2026_Paving_ Projects.pdf. n

nizations in the Multi-Sectoral Preventive Interventions (MSPI) Research Network, each of which has received a related NIH grant.

“One thing that stands out about this research is that it is completely community-driven,” Pullyblank said. “Decisions on how to provide resources for diabetes prevention will be made by local communities and clinics, rather than by the Department of Health or even our hospitals. This is exactly what we mean when we say Bassett ‘fosters healthy rural communities.’” n

already starting to see the cost benefits of their lighting conversion, these upgrades have also enhanced the quality of light within the stores, creating a more comfortable and appealing environment for their customers and employees.”

Since 2019, Tops has been working to retrofit stores to LED lighting in addition to converting its parking lot lights and fuel station canopies across the chain’s footprint to LED fixtures to reduce energy consumption. When the lighting conversion is completed at these 45 Tops stores, about 121 of the grocer’s stores will have been upgraded.

In recent years, Tops has reduced its electric consumption by 11.5 percent with various energy-saving initiatives involving mostly LED lighting, NOCO said. n

COMMERCIAL BANKING

PRODUCTS AND SERVICES

• Business checking and savings products

• Full range of commercial credit solutions

• Construction/real estate financing

• Treasury management solutions

• ZEscrow

• SBA loans and programs

• Business credit cards

• Credit card processing services

• Government banking & lending

INVESTMENT AND INSURANCE PRODUCTS

• Trust and investment products and services*

• Insurance and risk management*

• Retirement and benefits plans3

For 158 years, our priority has been serving the communities we live in, work in, and love. Our team supports local businesses with expert financial guidance, significant lending power, and comprehensive commercial banking services. It’s how we’ve become a trusted member of the community and how we’ll continue to grow forward: by investing in you.

BY ERIC REINHARDT ereinhardt@cnybj.com

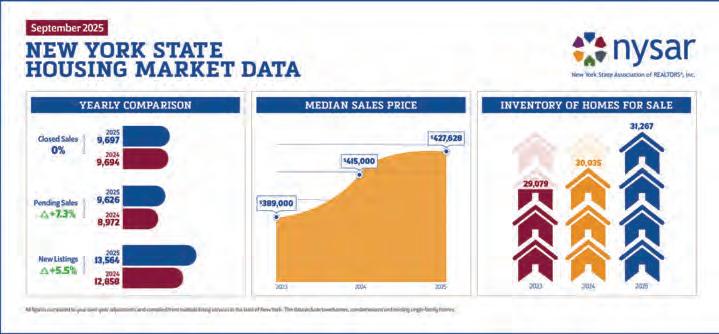

ALBANY — Realtors in New York state closed on the sale of 9,697 previously owned homes in September, virtually unchanged from the 9,694 homes they sold in the year-earlier month.

However, pending sales increased more than 7 percent in the ninth month of 2025, possibly foreshadowing a rise in closed sales in the next couple of months. That’s according to the New York State Association of Realtors’ (NYSAR) September housing report issued on Oct. 23.

“Key indicators such as new listings and pending sales increased in September while housing inventory across New York escalated for the seventh consecutive month,” NYSAR said to open the housing report.

Mortgage rates showed signs of moving lower heading into the fall. NYSAR cited Freddie Mac as indicating the average 30-year fixed rate at 6.35 percent in September 2025, down from 6.59 percent in August 2025. A year earlier, in September 2024, the average 30-year rate stood at 6.18 percent. Freddie Mac is the more common way of referring to the Virginia–based Federal Home Loan Mortgage Corporation.

New York

Statewide housing inventory reached 31,267 units in September, a 4.1 percent increase from September 2024’s total of 30,035 available homes. This marks seven straight months of increasing housing inventory statewide, NYSAR noted.

New listings of existing homes available for sale in the Empire State rose 5.5 percent to 13,564 this September from 12,858

BY ERIC REINHARDT ereinhardt@cnybj.com

NORWICH — The upcoming Principle Hotel, an $8.3 million boutique hotel in downtown Norwich, is among the projects that the community is developing as part of its funding award in the state’s Downtown Revitalization Initiative (DRI).

Officials in Norwich held an Oct. 23 groundbreaking for the hotel.

The Principle Hotel will have 61 rooms and include a rooftop lounge, restaurant, and event room, “so visitors can stay and enjoy the unique retail, dining and entertainment options in downtown Norwich,” the New York State Department of State said in an announcement.

The 12,000-square-foot property at 14-16 South Broad St., was once part of the SUNY Morrisville campus. It will soon become a boutique hotel that will include a dining area, lounge, conference room, fitness center, outdoor patio, and open courtyard with a fountain.

“This hotel represents far more than a new place to stay — it’s a cornerstone of our downtown’s rebirth,” Salvatore Testani, president and CEO of Commerce Chenango, said. “Together with the other DRI projects, it stands as a powerful sign of a healthy, growing, and optimistic Norwich.”

The Principle Hotel will have Americans with Disabilities Act (ADA)-compliant features, such as ramps, elevators, and four rooms with accessible bathrooms.

In addition to $3.3 million from the DRI, this project has received $2 million in funding from Empire State Development’s Restore New York initiative, which encourages community development and neighborhood growth through the elimination and redevelopment of blighted structures. The project was also funded through private investments.

“Norwich is building on its strengths and setting the stage for long-term success through its DRI projects, like this boutique hotel, which will allow people to stay

in September 2024.

The months’ supply of homes for sale at the end of September stood at 3.5 months’ supply, up 3 percent from 3.4 months a year prior, per NYSAR’s housing report.

A 6 month to 6.5-month supply is considered a balanced market, the association stipulates.

Pending sales totaled 9,626 in September, a jump of 7.3 percent compared to the 8,972 pending sales in the same month in 2024, according to the

NYSAR data.

Home sales prices across the Empire State continue to climb in the latest month. The median home sales price was $427,628 in September, up 3 percent from the $415,000 median price tag in September 2024.

All home-sales data is compiled from multiple-listing services in New York, and it includes townhomes and condominiums in addition to existing single-family homes, according to NYSAR. n

overnight right in downtown Norwich,” New York Secretary of State Walter Mosley said. “Here in Norwich, this investment will breathe new life into downtown, by drawing visitors, sparking new business activity and creating lasting opportunities for residents and local entrepreneurs alike.”

Besides the hotel, other DRI projects in Norwich include rehabilitating both the Unguentine Building and the Heritage Building, improving two parks, and enhancing the American Avenue streetscape.

Corning Inc. donates $185K to school food centers in Chemung and Steuben Counties

BY JOURNAL STAFF

CORNING — Corning Incorporated (NYSE: GLW) has awarded a $185,000 grant to the Food Bank of the Southern Tier to support eight school food centers in Chemung and Steuben counties.

Each school will receive $22,500 to sustain school-based food pantries, with an additional $5,000 allocated for project management, Corning Inc. said in an Oct. 15 announcement.

Part of a Food Bank initiative, school food centers serve as spaces where food and other grocery items can be distributed at no cost within a school, providing students and their families with consistent access to nutritious meals in a supportive, inclusive environment, the organization contends.

The Corning Inc. grant will support the Food Bank’s efforts to combat food insecurity in the Southern Tier,

where levels far outpace the national average. Currently, 73,070 individuals in the region — including thousands of children — are at risk of hunger annually. Chemung and Steuben counties are among the hardest-hit areas in New York state, with child food insecurity rates at 25 percent and 26.7 percent above the national average, respectively.

“Food insecurity remains a heartbreaking challenge in the Southern Tier, particularly for children,” said Millicent Ruffin, division VP at Corning Community Impact (CCI). “Tackling this issue requires decisive yet collaborative action. We’re proud to partner with the Food Bank to support its innovative School Food Centers, which ensure that families in our community have access to healthy food and essential resources.”

Established in December 2023, CCI centralizes Corning’s philanthropic contributions in the U.S. under a single organization to maximize impact in areas that align closely with its values and business objectives, the company says.

“School Food Centers are transforming how we sup-

The City of Norwich was named the Southern Tier Region Downtown Revitalization Initiative winner for the fifth round in 2021.

“We are very excited about this project and what it means for the revitalization of downtown Norwich,” Norwich Mayor Brian Doliver said in the state’s announcement about the hotel. “This is an important first step in bringing new life to our city center and can serve as a cornerstone for future economic vitality.” n

port families,” Mark Bordeau, president and CEO of the Food Bank of the Southern Tier, said in the Corning announcement. “By embedding food assistance into schools, we meet students and families where they are — building trust and reducing stigma. Corning’s generous support will help us expand this program and ensure no child has to wonder where their next meal is coming from.”

The school food center program also offers older students the chance to develop leadership and life skills through activities ranging from inventory management and budgeting to customer service. n

The Martin J. Whitman School of Management at Syracuse University (SU) is among the institutions collaborating on SU’s upcoming Student-Athlete Financial Empowerment Program when it launches in January.

ERIC REINHARDT / CNYBJ

BY ERIC REINHARDT ereinhardt@cnybj.com

SYRACUSE — Syracuse University (SU) is set to launch the Student-Athlete Financial Empowerment Program in January.

It’s an initiative designed to prepare Orange student-athletes for long-term financial success during and beyond their college careers. The program will also be open to all SU students, the university said in its Oct. 20 announcement.

SU’s Martin J. Whitman School of Management, Syracuse University Athletics, and Visions Federal Credit Union are all teaming up to launch the program.

The program will provide financial-literacy education to more than 550 Syracuse student-athletes across all 20 varsity sports, as well as any SU student interested in enrolling. The school describes it as

“among the first of its kind nationally in the post-NIL [name, image, and likeness] era.”

Students will take a for-credit course offered by Whitman School faculty. Through the course’s workshops, one-onone guidance, and hands-on experiences, students will learn essential skills including budgeting, credit and debt management, investing, wealth protection, and career and post-college financial planning. Student-athletes will be able to leverage what they learn in the program to help them navigate NIL opportunities and tax implications, SU said.

“This partnership reflects our deep commitment to preparing student-athletes not only for success in competition, but also for success in life,” John Wildhack, director of athletics at Syracuse University, said in the school’s announcement. “By combining the Whitman School’s academic expertise with Visions Federal Credit

Union’s industry knowledge, we’re equipping our student-athletes with the tools to make smart, confident financial decisions.”

Visions Federal Credit Union will serve as the exclusive financial education partner for the program. Its involvement ensures “consistent, personalized” support for all students, including student-athletes, while also aligning with the credit union’s mission to empower communities through financial wellness.

“At Visions, we believe financial empowerment is life empowerment,” Ty Muse, president and CEO of Visions Federal Credit Union, said. “Partnering with Syracuse Athletics and the Whitman School allows us to invest in the next generation of leaders, helping them build strong financial foundations that will serve them well beyond their playing days.”

The Martin J. Whitman School of Management will play a key role in the

program’s academic integration, providing a for-credit academic experience to ensure students are able to learn the tools needed for “financial empowerment offered by Whitman’s nationally ranked expertise in finance and business education.”

“This collaboration exemplifies the best of what Syracuse University offers — an intersection of academics, practical and relevant experience, and community partnership,” Alex McKelvie, interim dean of the Whitman School, said. “We are proud to help our student-athletes develop the skills needed to thrive in a complex business world.”

The Student-Athlete Financial Empowerment Program is part of SU’s Champion ‘Cuse campaign, which is “dedicated to providing student-athletes with the resources, support, and opportunities they need to compete — and succeed — at the highest levels,” the school said. n

BY ERIC REINHARDT ereinhardt@cnybj.com

NORTH SYRACUSE — The Beginnings Credit Union branch in the village of North Syracuse has transitioned to its new branding.

Formerly CFCU Community Credit Union, Beginnings Credit Union on Oct. 21 held a ribbon cutting at the North Syracuse branch, marking the completion of the building’s update.

Beginnings Credit Union says it is updating all of its branches throughout 2025.

The branch — located at 651 Centerville Place in North Syracuse —had been undergoing updates since the credit union first announced the anticipated rebrand from CFCU to Beginnings in April. The official name change occurred on July 1. Held in partnership with the CiceroPlank Road Chamber of Commerce and

CenterState CEO, , Beginnings Credit Union members were invited to the event to observe the branch’s updated interior and exterior signage.

“This was a wonderful way to personally introduce the Beginnings brand to our North Syracuse members and the Syracuse community,” Katie Foley, VP of marketing and sales at Beginnings Credit Union, said in the announcement.

Event speakers included Lisa Whitaker, president & CEO of Beginnings Credit Union; Gary Butterfield, mayor of the Village of North Syracuse; and Town of Cicero Supervisor Michael Aregano.

“I have been part of a credit union rebrand in the past, and I can honestly say that the level of energy and excitement from members and staff about the Beginnings rebrand is unmatched,” Michael D’Angelo, VP of member experience at Beginnings

Credit Union, contended.

Ribbon-cutting attendees enjoyed refreshments and merchandise giveaways, and Beginnings presented Credit Unions for Kids, benefitting Children’s Miracle Network Hospitals, with donations raised from bottle and can drives at Beginnings’

Waterloo and Cortland Shred Days.

Founded in 1953, Beginnings Credit Union serves nearly 77,000 members. It has $1.4 billion in assets and 15 branch offices. That includes eight offices in Tompkins County, according to its website. n

BY ERIC REINHARDT ereinhardt@cnybj.com

ROME — The New York State Department of Financial Services is expected to issue a final approval of the proposed merger between credit unions in the Mohawk Valley and the North Country by the end of the year. The members of Mountain Valley Federal Credit Union in the northeastern part of New York have voted to merge their credit union with AmeriCU Credit Union, which is headquartered in Rome.

Mountain Valley Federal Credit Union is based in Peru in Clinton County, south of

Plattsburgh. Mountain Valley members voted by mail and in-person at a special membership meeting on Sept. 18.

The proposed merger will enable the nonprofit Upstate New York credit unions to expand access to services, expertise, and branch locations for members and businesses across the Northern and Central New York regions, per AmeriCU’s Sept. 22 announcement.

federal credit unions.

AmeriCU has been serving members who live or work in Clinton and Essex counties for a number of years. The expand-

Essex counties — will become AmeriCU branches and make up AmeriCU’s Mountain Valley Region. All Mountain Valley employees have been offered the chance to continue working for the combined organization.

The merger has also been approved by the National Credit Union Administration (NCUA), the federal agency that regulates

ed AmeriCU credit union will serve more than 180,000 members across 24 counties, with 25 locations and combined assets of $2.8 billion, the Rome–based credit union said.

Mountain Valley’s four branch locations — all in Clinton and

Ron Belle, president and CEO of AmeriCU Credit Union, will continue in that role in the combined organization. Mountain Valley CEO Maggie Pope will become assistant VP for community engagement in AmeriCU’s newly developed Mountain Valley Region. Pope is a wellknown and highly regarded business leader in Clinton and Essex

Counties, AmeriCU noted in its announcement.

Mountain Valley FCU initiated the merger and its board of directors unanimously approved it earlier this year, “citing the many similarities in the organizations’ origins, foundational values, commitment to member satisfaction, and community involvement.”

“My dad would be so proud,” said Kathleen Roach, president of Mountain Valley board of directors, whose late father, John Roach, founded the credit union in 1963.

John Roach was a teacher in the Peru Central School District, per the AmeriCU announcement. n

BY JOURNAL STAFF news@cnybj.com

ROME — AmeriCU Credit Union recently announced it has hired Amber Cooleen as its new senior VP of marketing.

She recently spent four years serving as chief marketing officer for a credit union based in the Capital Region. Throughout her career, Cooleen has held

key marketing roles across various industries, from business-to-business startups to global real-estate organizations.

With more than 20 years of experience, Cooleen “brings innovation, creativity, and a proven record of leadership to help support AmeriCU’s growth,” the credit union contended in its Aug. 25 announcement.

Cooleen indicated that her focus will be on strengthening the credit union’s connection with its members, reinforcing that members can count on AmeriCU.

“Our members are at the center of everything we do, and it’s critical that we connect with them in a meaningful, impactful manner,” Cooleen said in the announcement. “Our members have many choices for where they open a checking account, get a car loan, or apply for a mortgage. What sets us apart is the relationships we have with them — we aren’t just a credit union, we are a trusted financial partner.”

Cooleen holds a bachelor’s degree in English with a concentration in writing, along

with a master’s degree in corporate and organizational communications from Fairleigh Dickinson University in New Jersey

Beyond her professional accomplishments, Cooleen has volunteered with organizations such as Catherine’s Center for Children and the Red Cross of Northeastern NY, where she served three years on the board of directors. She has also volunteered as a judge for the America’s Credit Unions’ Diamond Awards, an annual credit union marketing competition.

The nonprofit AmeriCU Credit Union is a member-owned, financial institution with total assets of $2.8 billion and more than 170,000 members in New York state and beyond. n

BY ERIC REINHARDT ereinhardt@cnybj.com

ENDWELL — Visions Federal Credit Union (FCU) has a new VP/chief human resources officer (CHRO), who started her new duties back in the summer.

For Aoife Quinn, the priority early on has been to listen and learn.

“After getting a sense of who we are, where we are, and where we want to be, my focus will be translating those insights into clear priorities that strengthen our culture, deepen employee engagement, and reinforce the trust our employees and members place in us,” Quinn said. “We’re

building alignment and momentum for the future — ensuring that our people strategy is a lever for growth, impact, and long-term value.”

Quinn comes to Visions FCU with 30 years of experience in human resources (HR), per the Sept. 9 announcement. She also has experience in change management, workplace culture transformation, and executive leadership coaching with corporate clients, and global, multicultural SaaS (software as a service) enterprises for more than a decade.

Prior to joining Visions FCU, Quinn worked as VP/people & culture, head of global human resources at Utopus Insights, which is based in Valhalla in Westchester County. In that role, she led all HR activity for the renewable-energy

analytics organization across 10 countries.

In three years, Quinn implemented HR strategies that drove engagement and recruitment, reduced turnover, and supported a positive workplace culture. During that time, she also provided her leadership in change management as Utopus Insights was acquired by and integrated into Vestas Wind Technologies, Visions FCU said.

“I’ve consistently been drawn to organizations, like Visions, that prioritize the employee experience,” Quinn said. “I’m driven by the opportunity to shape an inclusive workplace culture where everyone has a chance to thrive.”

Visions FCU’s workforce includes more than 900 full-time employees across its three-state footprint in New York, New Jersey, and Pennsylvania. In addition to pro-

viding financial services, the credit union emphasizes “people helping people” and includes service and community as two of its corporate values, the credit union noted.

Visions FCU went on to say that Quinn has already noticed how these values “resonate among the workforce.”

“I’ve already met so many individuals who are not only deeply passionate about their work but also kind, intellectually curious, and engaged in the world beyond their day-to-day roles,” she said.

Established in 1966, the nonprofit Visions Federal Credit Union serves more than 250,000 members in communities throughout New York, New Jersey, and Pennsylvania. Services include banking as well as auto, home, personal, and business loans. n

BY ADAM ROMBEL arombel@cnybj.com

SYRACUSE — Even as stock markets continue to make all-time highs, there has been a lot of chatter about national economic uncertainty this year with slowing job growth and concern about the potential impact of tariffs, continued inflation, and most recently the federal-government shutdown.

But current conditions and the outlook for the Central New York economy and business climate are not really showing those problems, says one local banking expert.

“I’ll be honest there hasn’t been much shift. We’re not really seeing much negativity,” says Lindsay Weichert, Community Bank, N.A.’s regional president for the Central New York market. “Margins are really holding up. Revenues and sales

are holding up well, pretty much across our book of clients.”

Weichert spoke with CNYBJ on Oct. 16. In her position, she is responsible for leading Community Bank’s business development and community-engagement activities while ensuring effective communication across all bank and non-bank lines of business in the Central New York region.

Weichert says tariffs have not yet created many impacts for her bank’s clients, inflation has steadied some, and interest rates have ticked down in recent months.

“We’re still seeing kind of just the normal business cycle. It’s end of year; folks are evaluating equipment purchases. [Clients] still seem kind of unphased by the economy. So we’re not really seeing any pullbacks, anything like that,” she says.

One indicator Weichert looks at to gauge how businesses are doing, is their

credit-line usage.

“You expect that if there is broad concern with the economy, they may borrow, throw some cash into an account, and sort of sit tight,” she explains. The bank is not seeing that. Credit-line usage is “totally within a normal range. It’s actually down a little bit from a couple months back,” Weichert notes.

The Micron effect

“It’s really kind of business as usual. And I think we do have a pretty significant advantage here in Syracuse relative to some of the rest of the country with Micron,” Weichert says, referring to Micron Technology’s (NASDAQ: MU) project to build a massive semiconductor campus at the White Pines Commerce Park in the town of Clay. “That provides some pretty good certainty… it’s pretty nice to know that by the end of next year we’ll have 5,000 construction workers on site.”

Even before that, the stage is being set within the community.

“We’re really starting to build out a tal-

It’s never been easy to navigate the ever-shifting tax rules around charitable giving, and now it’s even trickier.

Major changes under the One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, are creating complexity, opportunity, and, for some, urgency. The OBBBA reshapes both how much you can deduct for charitable contributions and who can ben-

efit from these deductions in the first place.

Whether you are working with clients as a professional advisor, or planning your own year-end giving, these rules are worth understanding. At the Community Foundation, we often serve as a sounding board when charitable giving comes up. We have tools that can help, and if we can’t help directly, we’ll point you in the right direction.

Here are three key changes to keep in mind as 2025 winds down.

1. Consider “bunching” charitable contributions in 2025

The OBBBA expands the standard de-

duction to $15,750 for single filers and $31,500 for married couples in 2025, with even higher levels for taxpayers aged 65 and older. This will make it harder for many households to itemize deductions. A strategy known as “bunching” charitable donations can help. For example, instead of giving $12,000 each year, a donor could contribute $36,000 (three years’ worth of gifts) to a donor-advised fund in 2025. This pushes total deductions high enough to itemize for one year, while future gifts can be distributed to charities from the fund while taking the standard deduction.

ent pipeline …you can see it in the higher education space between OCC, Syracuse University, CenterState CEO, all these different folks, MACNY, kind of gearing up to really focus on the apprenticeship program and build on the talent pipeline,” says Weichert. “That sort of feeds on itself and attracts more folks into our market. And then just the multiplier effect. You get 5,000 people as an influx into the community, there is no way they’re not spending a couple bucks while they’re here.”

Micron says it expects to create 9,000 jobs directly over the next 20 years or so.

“But then that multiplier effect is like 5 or 6 [times that] for all the ancillary businesses. So, all those folks are renting and purchasing homes. And going out and patronizing the restaurants, and so on and so forth,” says Weichert.

That helps provide a foundation that there is going to be a certain amount of economic growth going forward in our area and helps allay some concerns about the variability of the broader national and global economy. n

Beginning in 2026, only charitable donations exceeding 0.5 percent of adjusted gross income will be deductible. That means a couple with $225,000 in adjusted gross income (AGI) would see their deductible charitable amount reduced by $1,125 annually. In addition, the maximum tax benefit from charitable deductions for high-income taxpayers will be calculated at a 35 percent rate instead of 37 percent. For many households, 2025 will be a pivotal year to consider accelerating charitable gifts using bunching strategies to maximize current tax strategies before these tighter rules take effect.

Also starting in 2026, taxpayers who take the standard deduction will be able to claim up to $1,000 (single filers) or $2,000 (married filing jointly) in direct charitable deductions. This is good news for the roughly 100 million Americans who don’t itemize. But note the fine print: this deduction only applies to cash gifts made directly to charities — it excludes gifts of stock or contributions to donor-advised funds, which are tax-effective and convenient charitable-giving vehicles.

The bottom line is that 2025 is shaping up to be a pivotal year for charitable-giving decisions. Nonprofits across our community are in urgent need of donor support, and beyond the tax implications, philanthropy addresses critical local needs that transcend any deduction. Whether you’re advising clients or planning your own giving, now is the time to consider how to maximize both the tax benefits and the community impact of your charitable contributions. n

Pragya Murphy serves as director of development & impact investing at the Central New York Community Foundation, where she leads charitable planning for individuals, families, and companies and provides outreach to the local professional advisor community and nonprofit organizations. She also supports the Community Foundation’s impact investment program and is available to nonprofits interested in learning more about or applying for impact investments.

COMMERCIAL BANKING

PRODUCTS AND SERVICES

• Business checking and savings products

• Full range of commercial credit solutions

• Construction/real estate financing

• Treasury management solutions

• ZEscrow

• SBA loans and programs

• Business credit cards

• Credit card processing services

• Government banking & lending

INVESTMENT AND INSURANCE PRODUCTS

• Trust and investment products and services*

• Insurance and risk management*

• Retirement and benefits plans3

For 158 years, our priority has been serving the communities we live in, work in, and love. Our team supports local businesses with expert financial guidance, significant lending power, and comprehensive commercial banking services. It’s how we’ve become a trusted member of the community and how we’ll continue to grow forward: by investing in you.

BY ADAM ROMBEL arombel@cnybj.com

WARSAW, N.Y. — Financial Institutions, Inc. (NASDAQ: FISI), parent company of Five Star Bank, recently reported net income of nearly $20.5 million in the third quarter of this year, up 52 percent from almost $13.5 million in the third quarter of 2024.

The company, in its Oct. 23 earnings report, cited strong performance in each of its commercial banking, consumer banking, and wealth management lines of business.

After preferred dividends, net income

available to common shareholders of Financial Institutions totaled $20.1 million, or 99 cents per share, in the third quarter of 2025, compared to $13.1 million, or 84 cents, in the year-earlier earnings period.

Net interest margin expanded 76 basis points from the banking company’s yearago quarter, to 3.65 percent this past quarter. Financial Institutions’ net interest income of $51.8 million in the third quarter was an all-time quarterly high and was up by $11.1 million, or 27 percent, from the third quarter of 2024.

Noninterest income at Financial

YJOANNE GRITTER Viewpoint

ou’re launching campaigns, hitting deadlines, and filling the pipeline. On paper, things look great. But something’s off. Internal-messaging debates keep resurfacing. Campaigns feel shallow and reactive instead of resonant and on-point. Ask people what the brand stands for, and you get different answers from each. These are classic signs your marketing is outpacing your brand strategy. The body is in motion, but the soul is missing. Without a clear brand soul, marketing actions lose direction and authenticity; without active marketing, even a strong soul never makes an impact. Brand is the why and the identity. Marketing is the how and the action. When they fall out of sync, trouble follows.

Too often, brand strategy gets mistaken for a logo, a color palette, or a mood board. In reality, it’s the organization’s inner compass (purpose, values, identity, and promise) guiding every decision over the long term.

It answers the big questions: Who are we? What do we believe in? How are we different, and why should anyone care? Brand strategy is the North Star, aligning the organization around a meaningful identity that resonates with customers, informs product decisions, and shapes culture.

Brand strategy is a long-term discipline. Strong brands reinforce the same core narrative and values over years, building equity: trust, loyalty, and a price premium. Inconsistent brands have to work harder and spend more to be heard. It’s not mere theory: studies show brands with consistent messaging earn more, seeing a 10 percent to 20 percent revenue boost compared to fragmented brands, and that brand-aligned companies are two times more profitable as inconsistent ones.

If brand is the soul, marketing is the body in motion — the campaigns, channels, and content that bring the brand to life. Marketing is how you reach people, drive action, and achieve near-term objectives.

When marketing is aligned with a strong brand foundation, it acts as a powerful amplifier, reinforcing identity and values across every channel. Without that foundation, marketing risks becoming movement without purpose. Teams chase trends, fragment messaging, and change their story to grab quick attention. Short-term wins can mask long-term erosion of trust.

A marketing plan without brand strategy is like a GPS without a destination: lots of directions, no clear end point.

Not every downturn in campaign performance or internal struggle is due to tactics or budget. Often, the root cause lies upstream in the brand clarity and cohesion. How can you tell if you have a brand-strategy problem, instead of a marketing problem? Look for these red flags:

• Inconsistent positioning and messaging. Your value proposition shifts from campaign to campaign. Different teams or partners describe the brand differently. Customers can’t tell what you stand for, and their trust erodes.

• Internal misalignment. Ask five employees to describe your brand promise. If you get more than two or three different answers, your brand isn’t clear internally. And if your own team isn’t sure how to describe your voice or promise, it’s a sign of a soul-and-action gap.

• Reactive, disconnected campaigns. Without brand guardrails, campaigns chase the moment instead of reinforcing the mission. Clever ideas might land in isolation but fail to build a coherent brand story. In higher education, for example, 61 percent of institutions report inconsistent marketing efforts leading to off-brand campaigns. The result is

often competing funnels rather than one cohesive strategy.

Brand equity is the cumulative value of how people think and feel about you — trust, reputation, loyalty, and differentiation. Strong brand equity makes customers less price-sensitive, more loyal, and more open to new offerings. It reduces acquisition costs and increases lifetime value.

When brand clarity is missing, these advantages fade. Inconsistent brands have to spend about 1.75 times more on advertising to achieve the same growth as consistent ones.

rooted in service and loyalty. Every employee (whether in insurance, banking, or IT) is inculcated with the mission of “We know what it means to serve” and putting members first. In fact, many employees are veterans, bringing true authenticity to every interaction. Their marketing is essentially word-of-mouth from members whose experiences match the promise. Closing the gap between soul and action

1. Revisit your brand foundation. Document your identity, purpose, positioning, values, personality, voice, and promise. Make sure it’s still true, relevant, and bold enough to matter. Socialize it internally so everyone can articulate it.

Every USAA employee (whether in insurance, banking, or IT) is inculcated with the mission of “We know what it means to serve” and putting members first.

Conversely, investing in brand is investing in resilience. Each aligned marketing action builds on the last, strengthening recognition and trust. Notably, an analysis by System1 of 56 brands found that those with consistent branding grew market share faster and were twice as profitable as those constantly switching their messaging. Decisions get easier because teams have a shared filter: Does this fit our brand? The result: sharper execution, faster consensus, and a more confident presence in the market.

• Patagonia has built decades of loyalty on a mission to “Build the best product, cause no unnecessary harm, and use business to inspire and implement solutions to the environmental crisis.” Every employee can articulate it. Every campaign reflects it.

• Cleveland Clinic lives its “Patients First” promise across the entire patient experience. That clarity shows up in consistent, patient-centered marketing and one of the strongest reputations in health care.

• USAA is a financial-services firm that serves military families with a brand

2. Audit marketing through a brand lens. Map your campaigns to brand pillars. Cut or adjust what doesn’t fit. Align media spend with your core story.

3. Make brand checkpoints routine. Bake brand reviews into campaign planning and creative briefs. Keep guidelines updated and accessible.

Your marketing team can be creative, data-driven, and fast. But without a clear, differentiated brand soul as the foundation, you’re building on sand. Brands that live their purpose consistently earn trust, loyalty, and profitability. Marketing that runs ahead of brand eventually burns out, wastes budget, and muddles identity. Before your next campaign, ask: Do we know who we are? Does everyone here know it? Is our marketing expressing it? If the answer is no or unsure, slow down and realign. When brand and marketing move together, the inside matches the outside, and your message rings true. That’s the kind of alignment customers notice — and stick with. n

JoAnne Gritter is the chief operations officer at ddm marketing + communications, a B2B digital-marketing agency for highly complex and highly regulated industries. She is responsible for overseeing and facilitating collaboration between all major functional areas at ddm, including finance, human resources, IT, operations, sales, and marketing.

BY ERIC REINHARDT ereinhardt@cnybj.com

SOLVAY — Solvay Bank says it has awarded 10 local nonprofit organizations a $5,000 grant each, as part of the Federal Home Loan Bank of New York’s (FHLBNY) Small Business Recovery Grant (SBGR) program.

The grant initiative focuses on supporting small businesses and nonprofit organizations that have faced economic challenges due to inflation, supply-chain constraints, and/or rising energy costs.

Recipients can use the money for “reasonable and necessary” expenses, the bank said in its online announcement. Solvay Bank awarded grant checks to the 10 local nonprofits in October.

The recipients this year included Solvay-Geddes Community Youth Center, Victory for Vets, Onondaga Fire Company, Taunton Fire Department,

Continued from page 12

Solvay Fire Department, Lakeside Fire Department, NAMI Syracuse, Onondaga Free Library, Solvay Public Library, and Tigris Shriners.

“As a community bank, we believe in the power of small businesses and non-profit organizations to drive economic growth and positively impact our local neighborhoods,” Michele Fernandez, VP, enterprise risk manager & CRA officer at Solvay Bank, said in an announcement. “It is our mission to invest back, ensuring a brighter future for all. We thank the small businesses and local organizations for their commitment to our community.”

Founded in 1917, Solvay Bank is the oldest community bank established in Onondaga County. Solvay Bank has nine branch locations in Solvay, Baldwinsville, Camillus, Cicero, DeWitt, Liverpool, North Syracuse, Westvale, and downtown Syracuse in the State Tower Building. The bank also has a commercial-lending pres-

ence in the Mohawk Valley.

The FHLBNY helps community lenders advance housing and community growth in New Jersey, New York, Puerto Rico and the U.S. Virgin Islands. The FHLBNY is part of the congressionally chartered, nationwide Federal Home Loan Bank

System and increases the availability of mortgages and home finance to families of all income levels by assisting members in “more effectively” serving their neighborhoods and meeting their Community Reinvestment Act responsibilities, per the Solvay Bank announcement. n

The banking company’s total loans increased by $187.4 million, or 4.3 percent, from Sept. 30, 2024 levels, to reach $4.59 billion as of Sept. 30, 2025, driven by solid commercial-loan growth, it stated.

Institutions totaled $12.1 million in the latest quarter, up $2.6 million, or almost 28 percent, from the third quarter of 2024. Higher investment advisory income and swap fees boosted results, per the earnings report.

Financial Institutions is a financial holding company, based in Warsaw in New York’s Wyoming County, with about $6.3 billion in assets, offering banking and wealth-management products and services. Its Five Star Bank subsidiary provides consumer and commercial banking and lending services to individuals, municipalities, and businesses through banking locations spanning Western and Central New York and a commercial-loan production office serving the Mid-Atlantic region. Five Star Bank’s Central New York offices include a commercial-loan production office in Syracuse and retail branches in Auburn, Waterloo, and Geneva. n

DEAR RUSTY: I was born in April 1958, and my plan has been to take my Social Security (SS) at age 70. However, my sister-in-law says that it is smarter to take it now while I am still working. I will be 70 in 2.5 years. Her husband collects his SS and has kept working. She believes their strategy will net more money than mine due to the fact he has continued to pay into the system, and she believes it has super boosted his monthly benefit. What say you? BTW, Lord willing and the creek don’t rise, I plan on living at least till age 87.?

Signed:QuestioningMyPlan

Dear Questioning: You have already reached your SS full retirement age (FRA), so you can earn as much as possible without your SS benefit being negatively affected by Social Security’s Annual Earnings Test. In fact, if your current earnings are among the highest over your lifetime, your SS benefit amount will continue to increase because of your higher current earnings. You are now also earning Delayed Retirement Credits (DRCs), which will improve your monthly amount by 0.67 percent for each month (8 percent for each full year) you delay. That means that if you wait and claim at age 70, you will receive about 127 percent of what you would have gotten had you claimed at your FRA of 66 years and 8 months (plus you’ll also receive all cost-ofliving adjustment, or COLA, increases that occur between now and then). So your life expectancy is key. It usually takes about 12 years to breakeven moneywise by claiming at age 70 versus at FRA. In other words, if you claim at 70 instead of FRA, you will have received the same amount of SS money after you are age 82. Thus, if your life expectancy is greater than 82, you’ll receive more in cumulative lifetime benefits by waiting until 70 to claim. Of course, no one really knows how long they will live, so it is a judgement you need to make. “Average” life expectancy for a man your current age is

about age 84, but if you’d like to get a more personalized longevity estimate you can use this tool we use here at the AMAC Foundation: https://socialsecurityreport. org/tools/life-expectancy-calculator/ Another thing to keep in mind is whether your wife will receive a widow’s benefit if you die first. A widow will get the higher of either her own SS retirement benefit, or the husband’s benefit amount when he died. So, if you claim at age 70, your surviving spouse will benefit (if her own SS is smaller) because you waited until 70 for your higher SS amount. Just something else to keep in mind. Yet another is whether your wife will be entitled to a higher benefit as your spouse while you are both living. (FYI, a spouse will get a “spousal boost” if her own SS retirement benefit at FRA is less than 50 percent of her spouse’s FRA entitlement). If so, your wife cannot claim her spousal benefit until you take your own SS retirement benefit. If your wife will be entitled to more as your spouse while you are both living, then delaying until age 70 means your wife cannot collect her higher spousal amount until you claim. Depending on your financial needs as a couple, that may affect your decision as well. When to claim is always a judgement call, which should consider your life expectancy, your financial needs, and

your marital status. If you don’t need the SS money now (while you are working) and believe you will, indeed, live “at least till 87,” then waiting would likely be your best long-term decision. If you have doubts about your life expectancy, and/or if your wife will substantially benefit from a “spousal boost” if you claim earlier, then claiming now would also be a wise choice. Finally, it’s also important to understand that your SS benefits may be taxable by the IRS and, if you are still working, your IRS tax rate will likely be higher now than it would be after you retire from working. (Note: The so-called “One Big Beautiful Bill Act” provides only temporary tax relief (thru 2028) on SS benefits — the IRS will still tax SS benefits, but also allow a separate tax deduction to offset those SS taxes you pay). n

Russell Gloor is a national Social Security advisor at the AMAC Foundation, the nonprofit arm of the Association of Mature American Citizens (AMAC). The 2.4-million-member AMAC says it is a senior advocacy organization. Send your questions to: ssadvisor@amacfoundation.org.

Author’s note: This article is intended for information purposes only and does not represent legal or financial guidance. It presents the opinions and interpretations of the AMAC Foundation’s staff, trained, and accredited by the National Social Security Association (NSSA). The NSSA and the AMAC Foundation and its staff are not affiliated with or endorsed by the Social Security Administration (SSA) or any other governmental entity.

The journey to becoming a small-business owner is challenging yet rewarding. Each stage of this endeavor has opportunities and obstacles — from planning and development to launch and expansion. Fortunately, there are valuable resources available to support and empower entrepreneurs along the way.

When you’re ready to scale your busi-

ness, a loan with support from the U.S. Small Business Administration (SBA) could be the key to unlocking your next phase of growth.

At times, a bank wants to approve a loan that falls outside traditional credit requirements. For instance, a founder looking to buy a business may lack the necessary col-

lateral to secure funding. This is where the SBA and its loan programs come into play. SBA loans can be used to finance a waste management company whose only available collateral is garbage bins, or a tech company where employees work from home and their assets are not physical.

SBA loans, backed by the federal government, provide financing options for various business needs, including acquiring a company, expanding operations or launching a startup. Since these loans are supported by an agency specifically focused on helping entrepreneurs and small businesses, they offer significant advantages for borrowers and lenders compared to traditional business loans.

If you have dedicated your time and money to building your business, registered it as a legal, for-profit entity, and are operating within the United States or in a U.S. territory, you’re likely eligible for an SBA loan.

SBA loans’ eligibility requirements and terms and conditions are broader and more favorable than traditional loans because this funding is backed by the federal government and often include an SBA loan guarantee. This guarantee reduces the risk for lenders, allowing financial institutions to offer longer repayment terms — an advantage that makes these loans especially appealing to small-business owners.

For small-business owners, this translates to lower monthly payments, more manageable debt, and extra cash flow to reinvest in your business. The flexibility of SBA loans can be a game-changer, helping you navigate the early stages of your venture, sustain growth and maintain financial stability — especially during periods of expansion or economic uncertainty.

Beyond immediate funding, SBA loans can also lead to future financing opportunities. The security of an SBA guarantee means that even those with limited credit history or collateral can access capital. Successfully obtaining and repaying an SBA loan can also help to build your credit profile, improve your financial standing and make it easier to secure additional funding.

In addition to financial support, SBA loans come with access to valuable resources designed to help entrepreneurs succeed. From career counseling and training programs to marketing strategies and operational guidance, organizations like the Small Business Development Centers (SBDC), SCORE, and local chambers of commerce offer expert assistance. If you’re unsure whether an SBA loan is the right fit for you, these resources can provide guidance and even assist with the application process.

From $500 to $5 million, borrowers can acquire funding for various expenses — whether it be a small or large need. Most community banks offer the following types of SBA loans:

• 7(a) Loans: SBA 7(a) Loans are the most common SBA loans and provide up to $5 million for working-capital expenses. This loan is a flexible-financing solution for business owners looking to grow their businesses, purchase new equipment, invest in real estate, or cover payroll expenses.

• SBA Express Loans: SBA Express Loans offer up to $500,000 and have an expedited review process for quicker access to funds — these loans are typically approved within 36 hours.

• 504 Loans: SBA 504 Loans support small-business expansions and modernization through long-term fixed-rate financing, providing up to $5.5 million in funding. These loans can be used for constructing or purchasing buildings, land, or large equipment or machinery.

From starting your career to growing your startup or expanding your business, SBA loans provide the right mix of flexibility and support to help you achieve your goals. n

Paula Valencia is assistant VP and SBA lending manager at Tompkins Community Bank, Central New York.

Research by Vance Marriner vmarriner@cnybj.com (315) 579-3911 @cnybjresearch

November 10 Chambers of Commerce

November 17 Nursing Programs

1 CNY Market Share is calculated based on deposits in the 16-county Central New York region, as reported in the June 30, 2025 FDIC Deposit Market Share Report.

Data for this list came from the June 30, 2025 FDIC Deposit Market Share Report, previously reported data from other lists, and the institutions’ individual websites. While The Business Journal strives to print accurate information, it is not possible to independently verify all data submitted. We reserve the right to edit entries or delete categories for space considerations.

Central New York includes Broome, Cayuga, Chemung, Chenango, Cortland, Herkimer, Jefferson, Lewis, Madison, Oneida, Onondaga, Oswego, St. Lawrence, Seneca, Tioga, and Tompkins counties.

If your company would like to be considered for next year’s list, or another list, please email: vmarriner@cnybj.com

1.

S. Clinton St. Syracuse, NY 13202 (315) 424-4582/mtb.com

2. NBT Bank 52 S. Broad St. Norwich, NY 13815 (607) 337-2265/nbtbank.com

3. KeyBank 201 S. Warren St. Syracuse, NY 13202 (315) 470-5394/key.com

4. Community Bank 5790 Widewaters Parkway DeWitt, NY 13214 (315) 445-2282/cbna.com

5. Tompkins Financial Corp. 110 N. Tioga St. Ithaca, NY 14850 (607) 273-3210/TompkinsTrust.com

6. JPMorgan Chase 110 W. Fayette St. Syracuse, NY 13202 (315) 424-2731/chase.com

7. Chemung Canal Trust Company 1 Chemung Canal Plaza Elmira, NY 14901 (607) 737-3711/chemungcanal.com

8. Pathfinder Bank 214 W. First St. Oswego, NY 13126 (315) 343-0057/pathfinderbank.com

9. Bank of America 268 Genesee St. Utica, NY 13502 (315) 798-2452/bankofamerica.com

10. Solvay Bank 1537 Milton Ave. Solvay, NY 13209 (315) 468-1661/solvaybank.com

11. Bank of Utica 222 Genesee St. Utica, NY 13502 (315) 797-2700/bankofutica.com

12. Adirondack Bank 185 Genesee St. Utica, NY 13501 (315) 798-4039/adirondackbank.com

13. Citizens Bank 6770 East Genesee St. Fayetteville, NY 13066 (315) 449-3019/citizensbank.com

14. Watertown Savings Bank 111 Clinton St. Watertown, NY 13601 (315) 788-7100/ watertownsavingsbank.com

15. Berkshire Bank, a Division of Beacon Bank & Trust 6319 Fly Road, Suite 3A East Syracuse, NY 13057 berkshirebank.com

16. Five Star Bank 150 Lake St. Elmira, NY 14901 (607) 737-2165/five-starbank.com

17. Tioga State Bank 725 5th Ave. Spencer, NY 14883 (607) 589-7000/tiogabank.com

18. Geddes Federal Savings and Loan Association 2208 W. Genesee St. Syracuse, NY 13219 (315) 468-6281/geddesfederal.com

19. Lyons National Bank 2 N. Main St. Jordan, NY 13080 (315) 689-9530/bankwithlnb.com

20. Fulton Savings Bank 75 S. First St. Fulton, NY 13069 (315) 592-4201/fultonsavings.com

21. North Country Savings Bank 127 Main St. Canton, NY 13617 (315) 386-4533/ northcountrysavings.com

22. Carthage Federal Savings and Loan 313 State St. Carthage, NY 13619 (315) 493-3480/carthagesavings.com

23. Cayuga Lake National Bank 3 Cayuga St. Union Springs, NY 13160 (315) 889-7358/ cayugalakenationalbank.com

24. Seneca Savings 35 Oswego St. Baldwinsville, NY 13027 (315) 638-0233/senecasavings.com

25. First National Bank of Dryden 7 W. Main St. Dryden, NY 13053 (607) 844-8141/drydenbank.com

26. Generations Bank 19 Cayuga St. Seneca Falls, NY 13148 (315) 568-5855/mygenbank.com

Main St. Massena, NY 13662 (315) 764-0541/ massenasavingsloan.com

30. Savannah Bank 563 Main St. Fair Haven, NY 13064 (315) 947-5600/ savannahbankny.com

31. WSB Municipal Bank 111 Clinton St. Watertown, NY 13601 (315) 788-7100/ watertownsavingsbank.com

32. Peoples Security Bank 1235 Upper Front St. Binghamton, NY 13905 (607) 721-8830/psbt.com

33. Upstate National Bank 729 Proctor Ave. Ogdensburg, NY 13669 (315) 393-3332/upstatebank.com

34.

19 Main St. Hammond, NY 13646 (315) 324-5961

42 Church St. Gouverneur, NY 13642 (315) 287-2600/gouverneurbank.com

Research by Vance Marriner vmarriner@cnybj.com (315) 579-3911 @cnybjresearch

1 CNY Market Share is calculated based on deposits in the 16-county Central New York region, as reported in the June 30, 2025 FDIC Deposit Market Share Report.

Data for this list came from the June 30, 2025 FDIC Deposit Market Share Report, previously reported data from other lists, and the institutions’ individual websites. While The Business Journal strives to print accurate information, it is not possible to independently verify all data submitted. We reserve the right to edit entries or delete categories for space considerations.

Central New York includes Broome, Cayuga, Chemung, Chenango, Cortland, Herkimer, Jefferson, Lewis, Madison, Oneida, Onondaga, Oswego, St. Lawrence, Seneca, Tioga, and Tompkins counties.

If your company would like to be considered for next year’s list, or another list, please email: vmarriner@cnybj.com

As Washington, D.C. skirmishes over the future of enhanced tax credits under the Affordable Care Act (ACA), New York State (NYS) has relatively little to gain or lose.

The number of New Yorkers using any ACA credits, enhanced or not, stands at about 119,000 or 0.6 percent of the population, the lowest proportion of any state other than the District of Columbia, according to the latest federal enrollment report.

That compares to utilization rates as high as 19 percent in Florida and 13 percent in Georgia, and an average of 6 percent nationwide.

The driver of this disparity is New York State’s Essential Plan, which offers zero-premium, government-funded coverage to residents up to 250 percent of the poverty level. That program has absorbed the bulk of the NYS population that would otherwise be using ACA tax credits to offset their costs.

The Essential Plan also reaps the federal money that would otherwise have been spent on credits for its enrollees, covering all its $14 billion budget.

Although the enhanced credits enacted in 2021 have nominally boosted that revenue by about $1 billion per year, it’s not clear NYS is actually collecting that amount — because the program was unable to spend all its available funding even before the enhancements took effect.

Still, New York Gov. Kathy Hochul and her administration have joined a national