TRANSPORT

2023 Issue 1

Business Sentiment Index

Diving into the surveyed statistics of the Transport industry

Recovery truck fleet expanded with Hire Purchase agreement

Close Brothers Asset Finance has provided funding for an MOT and recovery company

I’m delighted to bring you the latest business news from the Transport division. As always, it focuses on the current issues affecting Transport SMEs, whilst also showcasing how Close Brothers Asset Finance has supported businesses within the industry and will continue to do so.

We start this issue, on page 3 with a case study looking at Taxi Stop Ltd. This London based business was able to purchase three LEVC taxis using a Hire Purchase agreement provided by Close Brothers Asset Finance.

We pride ourselves on not only knowing about asset finance and being able to tailor suitable financial solutions, but our specialists have also worked within the industry themselves.

By working closely with businesses, our team of industry experts see the potential for growth and provide straightforward asset finance solutions to support this.

Asset finance is an alternative form of funding used by businesses to obtain the equipment they need to grow. In effect, it utilises the residual value in an asset to either pay for, or put down a deposit on another piece of kit. Our experts consider all aspects of a customer’s business and then recommend asset finance solutions that best suit their cash flow and long-term goals.

Common examples of the asset finance products we offer are Hire Purchase, Refinancing (Capital Release), Finance Lease and Operating Lease.

To find out more about any of the finance options we have to offer and how they could work for your business, contact the team today.

On pages 4 and 5 you’ll find our Business Sentiment Index; our confidence tracker based on business owners’ views and thoughts on the industry. This update will look at how confidence has fallen across

the Transport and Haulage sector, in part due to the rising cost of doing business.

On page 6 we feature a case study looking at ALS Autocare Ltd. This Cumbrian business was able to expand their fleet of recovery trucks using an agreement provided by Close Brothers Asset Finance.

Finally, on page 7 we have our ‘Meet the Expert’ feature. Alan Cardy is a Dealer Manager within our National Accounts & ESG team. In this edition you can find out about his work history and the favourite part of his role.

We hope you enjoy the read and as always, we look forward to working with you in the future.

John Fawcett CEO, Transport division

Sustainability and what it means for Close Brothers

Acting sustainably isn’t a choice – it’s imperative. At Close Brothers, behaving responsibly is integral to our actions and decision-making and this is reflected across sustainability objectives we set ourselves, including:

• Supporting our customers, clients and partners in the transition towards more sustainable practices

• Reducing our impact on the environment and responding to the threats and opportunities of climate change

We are committed to meeting the goals of the Paris Agreement to achieve net zero by 2050. We are conscious that the emissions impact of the assets and sectors that we finance can contribute to climate change, and as a financial services provider we recognise the role we have to play in supporting the transition to a more sustainable future. This includes supporting our customers and partners with their own transition journeys.

Our efforts to reduce the impact of our operations on the environment continue at pace, and we strive to take actions that make a positive contribution to the world around us. Careful consideration of environmental factors and potential risks now plays an integral role in the actions we take, alongside thoughtful evaluation of where opportunities may arise for us to make a meaningful difference through our business decisions.

Today, our Renewable Energy team has funded around £1.3bn of onshore wind, solar and battery storage projects. This figure doesn’t include the smaller-scale projects, which account for another significant sum, making us an important player in the renewables finance sector.

2

Case Study: Business grows its LEVC taxi fleet

Taxi Stop Ltd was formed in 2022 by company director Michael Eades. Michael has a long history of working within taxi related businesses so understands the industry well. For the past 4 years, Michael worked as Head of Driver Recruitment for a business with a large taxi rental fleet.

Opportunity

Having worked within the industry for a number of years, Michael recognised a supply and demand issue for electric black cabs within London. Spotting this gap in the market, Michael wanted to begin purchasing his own electric fleet for hire to taxi drivers within London.

To start with, Michael wanted to purchase three LEVC Taxis. Offering a total flexible range of 333 miles, these electric cabs are ideal for London taxi drivers. Michael approached Kingsley Smith, Dealer Manager with Close Brothers Asset Finance’s National Accounts & ESG team, for a funding solution.

Solution

Kingsley was able to help Michael purchase the new taxis through a Hire Purchase

agreement. By using Hire Purchase, Taxi Stop Ltd were able to acquire the three LEVC taxis whilst paying for them in instalments over time, allowing the business to spread the cost of their investment.

Result

Taxi Stop Ltd were able to purchase the new taxis thanks to a suitable agreement provided by Close Brothers Asset Finance. These LEVC black cabs are already being hired out to drivers across London, and the business now plans to keep expanding their fleet to meet demand.

Kingsley commented: “We’re finding that many businesses are having to transition their fleets from combustion engine to electric and Close Brothers can help with that transition. In this case with Taxi Stop Ltd, Michael

spotted a gap in the market and we were able to help him grow the business. I look forward to working with Michael on more agreements in the future.”

“Kingsley Smith and the team at Close Brothers Asset Finance have been great from start to finish, the deal was executed quickly and we are now able to hire out our new LEVC black cabs. I would work with Close Brothers again when it comes to expanding the business further.” Michael

Director of Taxi Stop Ltd.

Eardes,

3 closeasset.co.uk

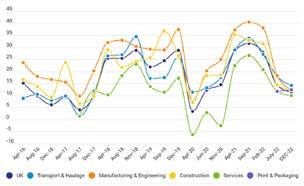

confidence continues to fall across all sectors, including Transport & Haulage

Business sentiment across all key sectors has continued to subside – although not as dramatically as was seen between March and April last year.

Our data reveals that over the past year, positivity has fallen significantly from record highs to levels not seen since the first lockdown – and what we are seeing for the first time is the sectors aligning around a smaller spread of figures than we usually see; it’s clear the pain of the rising cost of doing business, recession, interest rate rises, energy prices and inflation is being felt across all industries, not only Transport & Haulage.

According to our research, Transport & Haulage business owners’ top five concerns were:

1: Energy costs 2: Inflation 3: Interest rates 4: Cash flow 5: Lack of skilled staff

Energy costs were seen –by some distance - as the largest inhibitors of growth for the UK’s Transport & Haulage SMEs; full list:

Business sentiment index – December 2022

How the sectors have fared

After the highs of 12 months ago, the Transport & Haulage sector – as in July 2022 - again saw a fall in sentiment and an alignment with the other sectors tracked.

Sep-21 Feb-22 July-22 Dec-22 UK average 31.75 27.9 14.25 11.5 Transport & Haulage 33.86 27.1 18 14.25 Manufacturing & Engineering 40.53 38.1 18.25 12.5 Construction 32.95 31.5 14.5 12.25 Print & Packaging N/A N/A 12.75 12.5 Services 26.68 20.7 11.75 10

Transport & Haulage Energy costs 40% Driver shortages 20% Skills shortages 14% Material shortages 11% Influence of Brexit 9% None of the above 6%

4

Appetite for investment

The one positive is that, overall, well over two-thirds of Transport & Haulage firms are still looking to seek funding for investment in the next 12 months, marginally down from July’s 79%.

Q Does your business plan to seek funding for business investment in the next 12 months? Transport & Haulage Dec-22 Jul-22

Yes 72% 79%

No 28% 21%

Economic outlook

Missed opportunities

The number of Transport & Haulage companies missing business opportunities due to a lack of available finance continues to rise, with 45% admitting to having lost out.

With pressure on cash flow, most ambitious businesses rely on additional finance to enable them to invest in growth.

Q Have you missed a business opportunity in the last 12 months, due to lack of available finance?

Business owners are, unsurprisingly, more negative than positive about the macro-economic outlook and it’s this indicator that has contributed most to the decline in the BSI; for example, in November 2021 75% of Transport & Haulage respondents were positive about the economy – by December 2022 this had fallen to 35%.

Confident that the economy will grow

Concerned that the economy will slow down

I don't think there will be a significant change in the economy

Predicted business performance

Predictions about future business performance is largely unchanged, with the majority expecting their prospects to remain unchanged.

QIn general, how do you expect your business to perform over the next 12 months? UK

Score calculation

The BSI is based on the views of 900 business owners and senior members of the UK’s business community and calculated from data charting their:

• Appetite for investment in their business in the coming 12 months

• Access to finance and whether they’ve missed a business opportunity through lack of available finance

• Views about the UK’s economic outlook

• Thoughts on their likely performance in the coming 12 months

UK Average

Yes 40% 45% No 60% 55%

Transport & Haulage

UK Transport & Haulage

36% 35%

55% 51%

9% 14%

Dec-22 Jul-22 Dec-22 Jul-22 Expand 30% 31% 29% 29% Stay the same 54% 56% 61% 66% Contract 15% 12% 8% 5% Close down 1% 1% 2% 1%

Transport & Haulage

5 closeasset.co.uk

Case Study: Expanding recovery truck fleet financed through Hire Purchase agreement

ALS Autocare Ltd is an established MOT, Servicing and Vehicle Recovery provider based in Carlisle. The business offers a range of services including 24-hour vehicle recovery across the Lake District and Cumbria.

New fleet additions

ALS Autocare recently signed new contracts with leading national recovery companies, meaning they are on hand to recover their customers if they break down in the Lake District and Cumbria. As well as this, the business has customers they need to be on standby for in case of vehicle breakdowns.

As a result of this growth in business, ALS Autocare Ltd needed to expand their fleet by purchasing two new vehicles; MAN TGL 12.250 tilt and slide recovery trucks. These heavy-duty recovery trucks were just what the business needed to help fulfil their new contracts.

To fund the purchase of the two new recovery trucks, the Director of ALS Autocare Ltd, Barrie Thomson approached Alan Gibson,

Area Sales Manager, Close Brothers Asset Finance for a funding solution.

A suitable agreement

Alan worked with Barrie to understand the business and its requirements and put together a comprehensive agreement which utilised a Hire Purchase agreement. By using Hire Purchase, ALS Autocare Ltd could spread the cost of the new recovery trucks into manageable instalments to suit their cash flow.

As a result of the new finance agreement, ALS Autocare Ltd has been able to acquire the two new recovery trucks to fulfil their leading national recovery companies contracts.

Alan commented: “Helping our customers achieve their expansion goals is one of the great pleasures I have within my role. In this case I got the chance to work with Barrie and his team at ALS Autocare Ltd to fund the new recovery trucks through an affordable Hire Purchase agreement. I look forward to working with Barrie again in the future.”

“I’ve never been a fan of finance or finance companies but Alan and the team at Close Brothers Asset Finance are different; they provide a friendly service and take a real interest in my business and its development. This agreement for the new recovery trucks was a great success and it has meant we can now fulfil our new contracts. I wouldn’t look to go to another provider if I required finance in the future.”

Barrie Thomson, Director of ALS Autocare Ltd

6

Meet the Expert:

Alan Cardy Dealer

Manager, National Accounts & ESG team

Alan Cardy is a Dealer Manager and industry specialist within our National Accounts & ESG team. Here he shares his journey to Close Brothers and the favourite part of his role.

Tell us about your role and your current responsibilities…

My role consists of working with our dealer partners, providing them with a recognised and trusted secondary finance provider. This means we only assist as and when their primary finance provider, namely the manufacturers finance house, is unable to support.

What was your journey to Close Brothers?

I spent 17 years working for a MercedesBenz commercial dealer in East Anglia, I enjoyed selling finance with nearly all my sales, working with the customer to make the deal fit their budget. I joined Close Brothers as a Dealer Manager in 2019. In January 2020 my role was expanded to include the National Accounts team, working with Andrew New.

What is it about working for Close Brothers that is different?

I’ve found that Close Brothers really value their people, it’s nice to work for an

organisation that is primarily concerned about your welfare, it makes you feel valued within the company and your team. I like that we are also given the opportunity to grow and develop products that could add value to your role. One such example is an RV based product for HGVs which we are now able to provide, which has enhanced our dealer relationships.

What’s your favourite part of your role?

I enjoy working in partnership with the salesperson at each of our Commercial dealer groups. My role is to enhance this working relationship by offering the most suitable finance product. It is extremely rewarding when the dealer and customer offer repeat business because you know they were satisfied with the outcome the first time. Give us

an example of how you’ve helped a customer…

I had a customer who was an owner driver of a haulage company, they had a dream of

owning their own business and being their own boss. At this point they had a contract in place but needed to purchase a truck to get their business going. A lot of lenders wouldn’t touch such a new business, they would want to see their trading history before committing to a loan. At Close Brothers we understand the risk of a new business through our years of experience, giving us the ability to help. We often find that a start-up business will grow year on year with our tailored support.

Tell

us one thing people may not know about you…

I once participated in a tandem skydive in Northern Australia jumping out of a plane at 14,000 feet. Fantastic experience!

Our teams are specialists in their fields and experts in asset finance. Contact Alan and the team today:

North – 01283 808 731 South – 020 3393 9963

7 closeasset.co.uk

Close Brothers Asset Finance is a trading style of Close Brothers Limited. Close Brothers Limited is registered in England and Wales (Company Number 00195626) and its registered office is 10 Crown Place, London, EC2A 4FT. Our team of experts can help you defeat the mounting cost of doing business. We offer a range of flexible options that can allow you to: • Unlock the value of existing assets • Invest in new equipment • Create positive cash flow Our quick lending decisions and industry knowledge, enable our customers to unleash the value in their business. Contact us today to find your superpower. closeasset.co.uk/transport Combat rising costs