Scottish Estates... Who is buying?

Galbraith update on the market for those looking to acquire these iconic properties.

Agricultural Holdings Act

Agri Market Update

Update on Scottish Lettings

It is vital, whether you are a landlord or tenant to take advice on AHA tenancy successions.

Galbraith team summarises the current trends in Agri Market commodity prices.

Reporting on the multiple changes to the let residential property sector in Scotland.

Spring 2024

Welcome to the Spring edition of Rural Matters 2024

As I write, farmers in the north of England have been particularly impacted by wet weather over the past few weeks and there has been an undoubted impact on sowing and grazing as well as the loss of some winter crops across the entire country.

In Scotland on the other hand, we experienced a more clement Spring and in fact one day in January a record high of 19.9 degrees was recorded in the north of Scotland! Despite this the rain has continued to fall, with some of the younger generation calling this their ‘1985’!

This just goes to show some of the perennial problems caused by our changeable weather, which has a disproportionate impact on the rural sector.

One hopes that the skies will clear and allow us all to get on with jobs that have been put on hold.

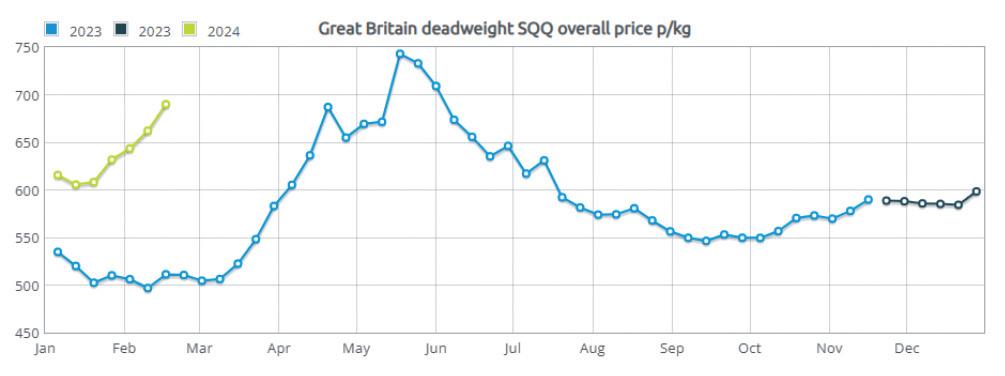

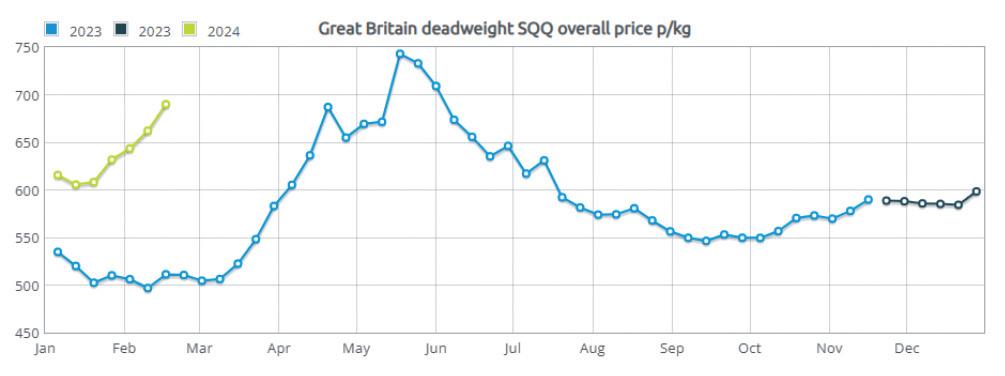

Farm businesses suffered in 2023 due to relatively high interest rates and high input costs, all with a declining gate price for our produce. The current lamb price being a notable exception.

In these pages my colleagues outline some of the opportunities and challenges faced by the rural sector.

In England there are notable developments with regard to the Sustainable Farming Incentive and we also highlight the change of use legislation for rural buildings,

In Scotland new regulations are set to be introduced for grouse moor management along with changes to the energy efficiency requirements for buildings.

Landowners across the UK will be interested in commodity prices in the agricultural sector, utilities agreements and the ever-evolving market for natural capital and woodland creation.

We hope to shed some light on these developments and offer advice and support no matter what type of rural business you manage.

I wish all our clients old and new a very happy and productive Spring/Summer. n

Ian Hope 07968 209 543 ian.hope@galbraithgroup.com

Head of our Rural Department

Galbraith is a leading independent property consultancy. Drawing on a century of experience in land and property management the firm is progressive and dynamic employing over 200 people in offices throughout Scotland and the North of England. We provide a full range of property consulting services across the commercial, residential, rural and energy sectors. Galbraith provides a personal service, listening to clients and delivering advice to suit their particular opportunities and circumstances.

| Rural Matters | Spring 2024

See us on Instagram: www.instagram.com/GalbraithGroup Join us on Linkedin: www.linkedin.com /company/galbraith Follow us on X: @Galbraith_Group Like us on Facebook: www.facebook.com/ GalbraithPropertyconsultancy See us on TikTok: https://www.tiktok.com/ @galbraithgroup Contents 4 Hot topic. 9 Benchmarking... How does your rural business measure up? 6 Nature... Ready, steady go! 8 Land use in Scotland. Striking the right balance? 18 Joined up thinking. 19 Soil health. Low-tech solutions that work. 20 Farm business Consultants network. 22 Highway hold-ups 23 Class 18B. 28 Land Reform in Scotland. 32 Carbon Credits. 36 A view from the Forest. 37 Gamebirds’ impact on biodiversity. 38 Agri market update. 42 It’s a material world. 14 Scottish Farmland Market Update. 43 Here if you need us. 44 Update on Scottish Lettings. 46 North East England Farmland Market Review. 50 Clearing a path through the thorny issue of rent reviews 51 Scottish estates in the firing line 52 The devil is in the detail. 54 The Sustainable Farming Incentive (SFI) The future of farming in England? 10 Scottish Estates... Who is buying? 24 Agricultural holdings act - Succession. 49 Plain Sailing for Turbine Agreements.

Hot Topic

Published within a recent consultation, the Scottish Government has laid out new proposals to improve the energy efficiency of properties in Scotland, working towards reducing greenhouse gas emissions and achieving its net zero target by 2045.

With buildings contributing approximately 20% of Scotland’s total emissions, initiatives set out in the Heat in Buildings Bill consultation underscore a commitment to address this issue through comprehensive energy efficiency measures, phasing out our reliance on fossil fuels to heat buildings, whilst considering the challenges faced amidst the cost-of-living crisis.

It is intended that previous proposals to mandate private rented sector (PRS) properties to attain an Energy Performance Certificate (EPC) rating of C, at change of tenancy by 2025 and subsequently requiring them to meet this standard by 2028 will now no longer be taken forward. This development comes as a surprise, with the Government having planned to introduce a minimum EPC rating in the PRS for over a decade. Within this recent proposal, private landlords will be required to meet a new energy efficiency standard by the end of 2028.

In recognition of the generally higher energy efficiency standards in owner occupied properties, homeowners will need to meet the same energy efficiency standard by 2033, unless they have phased out the

use of polluting heating systems, such as gas, oil and petroleum gas (LPG) boilers.

The Scottish Government intends this standard will be met through compliance with a list of measures that aim to have the greatest impact on homes, with minimal cost and disruption. The suggested measures include 270mm loft insulation, cavity wall insulation, draught-proofing, heating controls, 80mm hot water cylinder insulation and suspended floor insulation.

This list aims to exclude pricier and potentially more disruptive measures, such as solid wall insulation, in recognition of the ongoing cost of living crisis and potential pressure it may impose on both homeowners and landlords.

Additionally, it is understood that certain measures within this list may not be universally applicable, and compliance is expected only for those relevant to each specific property.

Aligned with the net-zero commitment, the Scottish Government is advocating a complete phase-out of polluting heating systems, in both residential and non-domestic buildings by the end of 2045.

Building owners will have flexibility in adopting clean heating systems, such as heat networks, heat pumps and, potentially, systems based on renewable hydrogen.

Public buildings owned by Scottish public authorities are expected to transition even earlier, with a target to utilise clean heating systems by the end of 2038. It is recognised that grant funding will be essential to make low-carbon technology and installations accessible and affordable, ensuring a smooth and more widely accepted transition.

These proposals aim to enhance clarity surrounding energy efficiency standards in Scotland for homeowners, landlords and investors going forward. The consultation ended 8th March 2024 and feedback will be used to refine these proposals before implementation. n

Eadidh Monteith 01786 434 600 eadidh.monteith@galbraithgroup.com

| Rural Matters | Spring 2024

The suggested measures include 270mm loft insulation, cavity wall insulation, draught-proofing, heating controls, 80mm hot water cylinder insulation and suspended floor insulation...

NATURE... READY, STEADY GO!

In Scotland, two funding schemes are currently running for conservation and Natural Capital projects, providing multiple options for those with a vision for their land.

Rural business and landowners and community projects can benefit from a range of government funding available to support projects of all types.

Taking a traditional approach to supporting biodiversity and providing direct funding for development and implementation of projects is the Nature Restoration Fund (NRF).

The NRF is publicly funded and is currently supporting more than 65 projects across Scotland. It focuses on biodiversity projects and has received a large number of applications. Habitat connection, water quality, and habitat restoration are key areas of focus for the NRF which provides grants of between £25,000 and £250,000 in the “Helping Nature” stream and over £250,000 for larger projects in the “Transforming Nature” stream.

There are a number of opportunities to apply, through an expression of interest form, but all spending must be completed by March 2026. The next application deadline for the competitive funding is 25th April 2024 (with decisions due to be made in July).

An alternative to the more traditional NRF route for landowners, and communities looking to enhance Natural Capital and biodiversity is FIRNS (The Facility for Investment Ready Nature in Scotland).

The Scottish Government announced the first round of FIRNS funding in February 2023 as a way to encourage investment in nature.

FIRNS provides a valuable resource for nature-based projects to develop their viability, while delivering scientifically credible outcomes. It is an important first step in this very innovative, developing marketplace. Although cofunded by National Lottery Heritage Fund, FIRNS is a Scottish Governmentbacked initiative.

In the past few months, Galbraith has been working on a number of projects making use of the FIRNS funding. There is a wide breadth of projects in the pipeline, from community wealth building and engagement to developing biodiversity on farms and passion projects for individual landowners and local councils. The breadth of projects is brought together by a focus on generating value from Natural Capital and investing in communities.

Many projects have brilliant ideas, creative visions for landscape-scale development, community engagement and regenerative agricultural business, but have traditionally been reliant on public funding. FIRNS aims to take these projects and develop the governance, management and finance elements to a level where they are

prepared for private financing, or to put it another way, investment ready.

The various elements of the projects are often more complex than having the vision or determining what it is that needs to be conserved; involving in most cases, multiple landowners, creative strategies for land offerings, community and investor engagement.

There are several key factors that can boost the success of nature-based projects which have traditionally faced barriers – legal ownership of an ecosystem service, the process of the accreditation and verification of benefits offered (which in many cases are intangible or difficult to measure) and enacting a sustainable governance structure.

Galbraith’s project involvement often focuses on bringing together these complex elements with our understanding of the current land systems, operations, and economy to overcome barriers and work with landowners to develop win-win offers for corporate entities who wish to invest in natural capital.

Galbraith has been developing a level of experience through involvement in these projects and our teams are now adept at processing complexity, clarifying the options available to structure investment, and providing

| Rural Matters | Spring 2024

advice on building a sustainable project which has all the right factors to appeal to an investor.

This has also involved discussion with investors or sponsors to better understand their aims, requirements, and values. Matching these values to a project’s features or principles is often the key in linking a project with a suitable sponsor.

The FIRNS funding has now welcomed a second round of applications which will be determined in April 2024. Having worked with a number of projects both in the first phase of FIRNS, and under the NRF, Galbraith is well placed to provide advice to those who receive funding in the future rounds and provide the knowledge and skills to assist any project’s journey to investment readiness. n

Other sources of funding for rural businesses:

The Highland and Islands Environment Foundation.

The foundation supports projects in the Scottish Highlands and Islands which fit into one of the foundation's areas of interest, as follows:

• Montane.

• Fresh water.

• Marine & coastal.

• Forest & woodland.

Applications for grants will be accepted in stages in 2024.

The deadlines are 9am on:

22 April 2024 and 14 October 2024.

National Litter and Fly tipping Strategy: Private Landowners’ Grant Fund.

Zero Waste Scotland is administering the funding, on behalf of SEPA, to aid private landowners with interventions that will help prevent fly-tipping on private land. The fund aims to support innovative projects that will:

• Help prevent fly-tipping on private land.

• Engage local communities

• Facilitate the reporting of flytipping and enforcement of existing penalties.

• Have social, environmental, and economic benefits.

Georgina Weston

07909 978 645

georgina.weston@galbraithgroup.com

Richard Higgins

07717 581 741

richard.higgins@galbraithgroup.com

The maximum grant to be awarded is £10,000.

Applicants must meet the following eligibility criteria:

• Project location must be on, or connected to an area of private land.

• Proposed locations must have been fly-tipped within the last 12 months.

• Landowner based in the UK who must complete the application themselves.

Land use in Scotland... Striking the right balance?

report on its land use strategy, covering the period March 2022 to March 2023.

will be monitoring, as the legislation continues to develop as well as use of the recently introduced sustainability and environmentally focussed National Planning Framework 4 (NPF4).

Cameron Main

Within the report are all manner of financial support schemes which were offered last year and examples of where Scotland’s land has been used to provide environmental, social and economic benefits. Each example within the report represents a positive action towards achieving the Scottish Government’s bold emissions reduction target of 100% by 2045 (Section 37A of The Climate Change (Emissions Reduction Targets) (Scotland) Act 2019).

Through the lens of ambitious emissions reduction targets, the unprecedented focus on land use and ensuring we squeeze the maximum efficiency out of every acre of the 19m acres Scotland has to offer may be

with increased focus and attention comes an increase in the number of competing land uses. A balance needs to be struck between the various targets and the needs of different groups within society. Some may question whether the current policy direction will deliver the stated

objectives for land use, such as rewilding/green use, urban expansion, affordable housing, forestry, renewable energy generation, and food production.

Productive arable land accounts for approximately 1.5m acres (circa 8%) of Scotland’s total land area. Planning authorities appear in some cases to be prioritising alternative environmental, social and economic land use over and above domestic food production. On the assumption that 75,000 acres of marginal arable land is to be utilised for rewilding/green use, 50,000 acres for urban expansion around Scotland’s major cities, a further 300,000 acres (in line with Scottish Government annual planting targets) for forestry, and 85,000 acres for renewable energy development and low carbon industrial processes (such as ‘Project One’ by INEOS) roughly one third of the 1.5m acres of arable land in Scotland will be put to non-food producing use.

It is an interesting area of debate, and one which Galbraith will be monitoring, as the legislation continues to develop as well as use of the recently introduced sustainability and environmentally focussed National Planning Framework 4 (NPF4).

If you’re concerned about any of the issues raised in this article or would like to discuss the subject of alternative land use with one of our agents, please get in touch. n

Cameron Main

0131 240 6960

cameron.main@galbraithgroup.com

| Rural Matters | Spring 2024

Benchmarking... How does your rural business measure up?

Benchmarking is the practice of measuring financial and performance figures for a farming business against those of its peers.

Without an industry average to compare your farming enterprise to, it is not possible to gauge if your performance is good, bad, or average.

Facts and figures are needed to make informed business decisions. Business benchmarking provides you with a better understanding of your farm and enterprises rather than making assumptions. Having this information at your disposal will allow you to build strategies to improve business performance. This technique may be used to discover inefficiencies, which in return helps to strengthen and stabilize agricultural financial structures. Benchmarking allows farmers and landowners to investigate their strengths and shortcomings, which helps with decision-making to increase earnings

while discovering areas for costcutting and adding value to your bottom line.

Understanding your business and being able to benchmark its performance are critical tools for your farm’s long-term success. Benchmarking can reveal the production and management strategies and procedures that drive enterprise production costs and profitability. The main performance goals of one agricultural company may differ significantly from those of another. Farmers may currently look for information about their businesses from open days and farm walks, group networks, and consulting services. Benchmarking in agriculture will add more objective business comparison information. It can be helpful to know benchmarks for basic

performance such as crop yields, stocking rates, and lambing percentages.

Agricultural benchmarking will assist you to achieve better profit margins over time. It allows you to gain a more accurate picture of how much room there is for improvement by seeing what the best producers are achieving from similar farms.

Benchmarking analyses business performance and provides the foundation for good decision-making in order to increase profits. n

Calum Smith 01292 268 181 calum.smith@galbraithgroup.com

Scottish Estates... Who is buying?

Over the last five or so years, we have seen the market for those looking to acquire these iconic properties expand beyond what was traditionally mainly restricted to those with sporting and occasionally agricultural interests.

| Rural Matters | Spring 2024

Back when I started my career as a rural surveyor over 20 years ago, your typical Scottish estate (if there can be such a thing) would be of principal interest to those looking to stalk, shoot, fish or farm. The desire to own and enjoy a piece of rural Scotland was then highly sought after, as is still very much the case.

However, over the intervening years and especially more recently, the market has expanded to include those with a far more diverse range of interests. The traditional sporting market still thrives however, the range of interested buyers also now includes those to whom the peace and solitude of owning a part of ‘wild’ Scotland is the principal driver and where having access to remote and undisturbed spaces is the primary objective.

Similarly, there are many who relish the opportunity an estate may offer to create and establish a rural business such as holiday lets, a hospitality venue or as a site for the creation of bespoke products such as a micro-brewery or gin distillery!

Undoubtedly, interest peaked during the pandemic years, but it was also the time when a whole “new” buyer profile arrived –the Natural Capital focussed purchaser.

As a firm, we at Galbraith have witnessed this changing market first hand. A prime example coming in 2019 when we brought to the market Auchavan Estate; an idyllic estate lying within the iconic Angus Glens and offering traditional field sports together with

a number of houses, hill farming opportunities and forestry. Those interested in buying were principally traditionally based with one or two conservation/re-wilding orientated buyers also coming forward and ultimately, it was a ‘traditional’ buyer who acquired the property. Moving forward to 2020, Kinrara Estate in Inverness-shire was brought to the open market and by this point the market had significantly expanded and was being driven by private buyers, institutions and investment vehicles seeking to invest in woodland creation and explore the phenomenon now widely referred to as ‘natural capital’. We also arranged the sale of an extensive stock hill farm and without exception, all the interest was in the potential to manage the ‘natural capital’.

The press coverage for the following two years, up to the second half of 2022, indicated that land in Scotland was principally being sold for forestry planting and/or conservation and biodiversity interests. There was very much a gold rush during this time

Undoubtedly, interest peaked during the pandemic years, but it was also the time when a whole “new” buyer profile arrived –the Natural Capital focussed purchaser...

Emma Chalmers

| Rural Matters | Spring 2024

with estates and hill farms generating high demand and achieving strong sale prices thus the value of this more marginal quality land did rise accordingly. However, the buyers, based both in the UK and internationally, also included traditional buyers and they were not all buyers securing land for forestry planting, conservation and biodiversity projects. Examples being Pluscarden Estate in Moray and Finegand Estate in Perthshire, both being sold to traditional estate buyers.

We have now entered 2024 and the high demand for Scottish estates remains. There continues to be keen interest from buyers not only based in Scotland and the UK, but also internationally where the perennial appreciation of our scenery, amenity, culture and history, not to mention traditional sporting interests are still core. The natural capital gold rush may have slowed somewhat but there are still many with a more than strong interest in natural capital. National aspirations towards a net zero carbon

footprint grows stronger and Scottish estates and their effective management have proven to be exceptional vehicles to help achieve this aim.

The difference today, compared to say two years ago, is that there is a more considered and measured approach to any estate purchase with buyers taking time to undertake their own due diligence. Rather than rush in headfirst, asking questions later, a buyer (and their professional advisors) will undertake extensive research and analysis in advance of offering and amongst other investigations may well look to instruct soil surveys, peatland assessments, bird surveys and woodland creation assessments. The list can be extensive and bespoke depending on the particular interests of the buyer.

From the seller’s perspective, a successful sales outcome relies on generating interest and competition and is achieved by having a tailored and professional marketing campaign, complimented with careful pricing.

Given the now far broader spectrum of buyers with their diverse range of interests and key criteria, making an accurate valuation of an estate is now more specialised and intricate than ever before.

Detailed knowledge and evidence of previous sales is key to making an accurate assessment, setting a realistic and achievable guide price and ultimately achieving the best possible sale. That said, as has always been the case and will always be “it is only worth what someone is prepared to pay” and this is really only ever established by generating interest and competition to fully test the market.

Going forward this year there will certainly be further Scottish estates coming to the market. Demand continues from this new broader range of buyers and we certainly do not anticipate this to diminish. n

Emma Chalmers

01738 451 111

emma.chalmers@galbraithgroup.com

Scottish Farmland Market Update

Galbraith marketed over 15,000 acres (6,000 hectares) of land during 2023, which was more than the preceding 12-month period, but overall the prime farmland market remained fairly restricted during 2023.

The impact of rising interest rates has been twofold for both buyer and seller in terms of servicing of debt. The rise in interest rates from December 22 to August 23 encouraged the sale of some farming holdings which had already been struggling to achieve a viable profit margin, along with farm businesses that had existing high levels of debt exposed to variable interest rates and the resulting need to service higher repayment costs.

The preceding increases in input costs, including fertiliser, feed and fuel, have also played a significant part. From a buyer’s perspective, some buyers who were already overstretched in terms of being able to service a purchase, were not in a position to offer for some very desirable holdings. Going forward however, we expect input costs to represent less of an issue for rural businesses –fertiliser prices have now fallen by about 50 per cent compared with their peak in September 2022, and energy and fuel prices have also eased. In the final quarter of 2023, following the pause in interest rate rises, buyers appeared much more positive. Equally, lenders have become more willing to lend, providing suitable security is offered, and, more importantly, that the purchaser is in a position to service the debt at the prevailing rate and subject to more stringent stress tests.

| Rural Matters | Spring 2024

SOLD DURING 2023

GARBLIES FARM, AULDEARN, NAIRN OFFERS OVER £1,090,000

A delightful small farm in a stunning ▪ and accessible rural setting.

▪

About 47 hectares / 117 acres.

Attractive extended traditional ▪ farmhouse.

Useful traditional ‘C’ shaped steading. ▪

▪

Excellent quality grazing / arable land.

Ideal for those with equestrian,

▪ small holder and agricultural interests.

Update

There still remains however a shortage of land on the market, and the more productive areas of arable land in Scotland are in demand, along with less productive and marginal land, providing it is suitable for afforestation or other natural capital purposes.

Although we expect supply of more productive arable land to improve this year, the expected supply will fall way short in meeting current levels of demand, and we expect the more productive areas to hold their value

going forward, with the best arable land in the country still achieving in excess of £15,000/acre.

However, following changes to the additionality framework with respect to carbon credits, and difficulties encountered by some buyers in relation to proposed woodland creation models, some investors are now far more selective and have placed greater focus on examining any wider environmental and wildlife restrictions connected to a purchase, before a deal is agreed. There still

remains a significant element of uncertainty as to how this market will continue to develop in 2024.

We have also experienced a shift towards some more collaborative and partnership arrangements with regard to the purchase of marginal land, between funds or investors and landowners. This trend is one that we expect to continue for the foreseeable future.

The various land holdings that were launched to the market in 2023 are now in the process of completing

| Rural Matters | Spring 2024

SOLD DURING 2023

missives, or are settled. Transactions took considerably longer as lenders and purchasers were more cautious with regard to due diligence and partly influenced by the interest in natural capital which has proved to be an evolving market sector.

So far this year we have been instructed for a number of new landholdings, which will appear on the market in the next few months.

We anticipate that the fairly limited supply of land will continue this year, which will be met by a good level of

EASTER KINNEAR FARM, NEWPORT-ON-TAY, FIFE OFFERS OVER £4,200,000

A traditional farmhouse with 3 ▪ reception rooms, 5 bedrooms, set within a walled garden, orchard and paddocks.

Practical range of farm buildings and ▪ livestock handling facilities.

617 acres in all, with 347 acres of arable ▪ land and 259 acres of permanent pasture.

Potential for private or commercial ▪ equestrian use.

Highly sought after and commutable ▪ location.

demand from existing farmers encouraged by the levelling off of interest rates.

There remain a number of different types of buyer in the market, from existing farmers looking to diversify or expand their landholdings to those who have recently sold and are looking to reinvest their capital, as well as investors from outside the agricultural sector. This range of buyers chasing available land and farms continues to support a very active market.

Galbraith has the largest network of AMC agents in the country, and we also work with a number of other financial providers, so if you are looking to discuss financing options or assessing the viability of a farm expansion, please give us a call. n

Update

Barrie

434 600 duncan.barrie@galbraithgroup.com

Duncan

01786

Joined up thinking

opportunities as part of existing rural businesses.

Successful rural businesses and property owners understand the importance of strategic planning to ensure they are resilient to the increasing number of financial and operational opportunities and challenges that are emerging in the face of constant regulatory change.

This principle of strategic awareness is once again essential for those with an interest in land that are considering the opportunities that are unfolding in the complex and developing space of Natural Capital.

Our clients are increasingly keen to understand what natural capital opportunities are available to them and how they can get one step ahead and maximize future revenue from these emerging markets – but it is essential that the answer to this is framed in the bigger picture of the business that considers appropriate ownership structures, business models, succession planning, capital taxation and a plethora of other professional matters. As ever, making significant land use decisions without considering all of the pertinent aspects of a land-based business could have unintended consequences.

The opportunities are relatively well known. Some are now quite developed such as carbon payments, whilst others are still germinating (Scotland’s proposed Natural Environment Bill will propose legal targets for nature restoration), however the combination of net zero ambitions and the growing importance of Environmental, Social

and Governance (ESG) criteria in the business world is a perfect storm that has attracted corporate attention and so incentivized the creation of natural capital markets.

The key for our clients is that in order to establish a product that can be attractive to investors, the natural capital markets require measurable improvements to the condition of natural assets and it is the farmers and landowners who are on the ground managing those natural assets who are exposed to the opportunities and so have the springboard to engage in the new natural capital markets for financial and environmental gain. In the context of the reduction in direct support payments to farmers, this couldn’t be more timely for many businesses, however it would be a mistake to view this as a like for like replacement of historic subsidies. These natural capital opportunities may fill a BPS-shaped hole but eligibility for BPS was based on the land being used for agriculture. Legislation and taxation make special provisions for farming which are conditional on positive husbandry of animals and the land – if agricultural activity ceases, then it stands to reason that so do the special provisions.

This is where strategic awareness of the wider business interests is so important because there is the potential for significant unintended consequences associated with changing how land is used which need to be factored in. This doesn’t mean

that the natural capital opportunities are not exciting, but it does mean that a joined-up approach is necessary. If a hypothetical farmer or landowner enters into a long term, large scale natural capital project, have they ensured that the scheme is compatible with their wider business? Have they thought about how the new revenues will be treated within the business? Is the income from farming and agriculture? Does this alter the dynamic of a previously devised business structure? Does it affect eligibility for inheritance tax relief? Does this therefore trigger a discussion with regard to succession planning with the next generation?

Natural capital markets offer our clients a golden opportunity to open up new income streams for their businesses and we are confident that they will be a critical part of the agricultural industry going forward. But whereas a lack of planning can create unintended consequences, Galbraith’s breadth of knowledge and experience in representing the best interests of farmers and landowners makes us very well placed to offer insightful and informed advice on how to incorporate natural capital income streams into existing rural businesses. n

| Rural Matters | Spring 2024

Nick Ainscough 07795 336 070 nick.ainscough@galbraithgroup.com

Soil health... Low-tech solutions that work

Assessing and maintaining a healthy soil is critical for farmers to ensure productivity, whilst also looking towards greater sustainability. Although advanced equipment and laboratory testing provides precise analysis, many farmers lack access to such resources and testing can be costly.

However, there are simple yet effective in-field techniques that farmers can employ to assess soil health, providing instant and informative results.

Furthermore, observing the presence of soil organisms can offer clues about soil health. Earthworms, for instance, are indicative of well-aerated and fertile soil. Their presence indicates a thriving soil ecosystem capable of nutrient recycling and soil structure improvement. Similarly, the presence of beneficial insects, such as ground beetles, suggests a balanced ecosystem that can naturally regulate pests.

Our clients are increasingly keen to understand what natural capital opportunities are available to them and how they can get one step ahead and maximize future revenue from these emerging markets.

A key method is the Visual Evaluation of Soil Structure (VESS) test, a spade test which requires no specialised equipment. The VESS test grades soil on a scale from Sq1 to Sq6, with Sq1 the most friable and Sq6 the most compacted. By digging a small hole in the soil and observing its structure, farmers can gain valuable insights. A healthy soil should exhibit a crumbly texture, indicating good aggregation when broken up by hand. This structure allows for adequate water infiltration and root penetration. By contrast, compacted soil may appear dense and lack visible pore spaces, hindering plant growth. Additionally, farmers can assess soil colour, with darker hues tending to indicate higher organic matter content, essential for nutrient retention and microbial activity.

Another valuable tool available to farmers is their sense of smell. Soil that emits a sweet, earthy aroma is typically indicative of good microbial activity and organic matter decomposition. This pleasant scent is a sign of healthy soil biology, fostering nutrient cycling and plant nutrient uptake. Conversely, foul odours, such as those resembling sulphur or ammonia, may signal anaerobic conditions or excessive nutrient build-up, necessitating various corrective measures.

Additionally, farmers can perform simple infiltration tests to assess soil permeability. Pouring water onto the soil surface and observing its rate of absorption can indicate soil compaction or crusting issues. Rapid infiltration suggests good soil structure and porosity, while slow absorption may indicate compaction or poor aggregate stability. To enhance the effectiveness of this method, a farmer could hammer a cylinder into the ground and time how long it takes for a set volume of water to infiltrate into the soil, which allows for greater comparability both over their holding and over time, when repeated. While these techniques provide valuable insights into soil health, it's important to note that they are qualitative and may not offer the precise quantitative measurements of laboratory testing. However, for farmers without easy access to sophisticated equipment, these simple in field assessments serve as valuable tools for gauging soil health and informing decisions that promote soil fertility, productivity, and sustainability in agriculture. n Laura

Hunter

693 693

01434

laura.hunter@galbraithgroup.com

FARM BUSINESS

CONSULTANTS NETWORK

The UK farming sector is currently facing challenge after challenge with ongoing subsidy uncertainty causing great worry and debate within the sector. Further to the subsidy unease, commodity prices continue to cause concern with fluctuating input costs and ongoing uncertainty as to sale prices and their volatility.

We recognise the uncertainty facing the sector and we have therefore expanded our agricultural consultancy team to support, develop and strengthen existing and potential new clients within the sector.

Mike Halliday has joined the Castle Douglas office and will undertake a range of subsidy and businessrelated support in this area and throughout the South-West of Scotland.

Further strengthening the West of Scotland, Calum Smith has joined the Ayr office to support our offering but also to carry out carbon audit analysis for many farming clients throughout Scotland.

David Hurst covers the North of England and the Scottish Borders from the Morpeth office. David is carrying out and looking into exciting new Natural Capital opportunities alongside his ongoing subsidy and farm business support.

Finally, from the Perth office, Jack Marshall, Ian Hope and I continue to provide subsidy advice and support alongside farm business consultancy support to our existing and new clients throughout Scotland, with a particular focus on strengthening business development.

As noted, there continues to be uncertainty but there is also opportunity via Natural Capital, continued subsidy grant opportunities and diversification which has proven to be a strong pillar for some developing and new businesses.

The main element of difference we see between farming businesses is the awareness of technical performance and the ability to adapt and mitigate against any short-term challenges or changes. n

Martin Rennie 07899 923 138

martin.rennie@galbraithgroup.com

...There continues to be uncertainty but there is also opportunity via Natural Capital, continued subsidy grant opportunities and diversification... Martin Rennie

| Rural Matters | Spring 2024

Biography – David Hurst

David lives in rural North Northumberland overlooking the ancient Ingram valley and Cheviot Hills with his wife and 3-year-old daughter, their cocker Spaniel and five chickens.

Prior to starting work as an agricultural consultant, he spent over 12 years as a farm manager after completing his degree in agriculture at the SAC in Edinburgh. His first job was managing a fleet of 50 combine harvesters in Ukraine on a 250,000-acre farm before taking on a role managing a mixed unit on the Carse of Gowrie in Perthshire. He latterly managed a 6,000-acre mixed farming business in East Anglia and Nottinghamshire

specialising in seed crop production and growing 37,500 tonnes of sugar beet for British Sugar. They also ran 2,500 ewes and 100 suckler cows.

Beyond heading the Galbraith Morpeth office, his day job sees him travel far and wide covering an area including Dumfries and Galloway, Northumberland and the Scottish Borders and the Lothians. He looks after the farming interests of a wide range of clients particularly focusing on contract farming agreements and biodiversity opportunities.

David Hurst

07587 572 006

david.hurst@galbraithgroup.com

Biography – Mike Halliday

Mike joined the Galbraith Castle Douglas office having been a rural consultant for nearly a decade. He is an agricultural valuer (Fellow of the CAAV) and is FBAASS (Farm Business Advisor Accreditation Scheme for Scotland) accredited. His background is in livestock farming, having been born and brought up on a family farm with dairy, beef and sheep enterprises.

After studying Agriculture at Aberdeen University, Mike ran the dairy enterprise at home for 15 years, doubling milk production during that time, before deciding to have a change of direction into consultancy.

Mike has significant experience working in the area of agricultural tenancies, grants and subsidies, land sales and utility / compensation claims. He still farms at home running a grassbased store cattle enterprise based on a low input rotational grazing system. Additionally, he is the current Chair of the Dumfries NFUS branch and represents Dumfries & Galloway on the national NFUS Environment & Land Use Committee.

Mike Halliday 01556 505 346

mike.halliday@galbraithgroup.com

Biography – Calum Smith

Calum comes from South Ayrshire where he currently lives. He joined Galbraith having previously been with another firm as an agricultural consultant. Before this he worked in the livestock feed industry for seven years. At home he runs his own pedigree cattle and commercial sheep business that he took over from his father. Outside of work and farming he plays rugby, golf, and has a keen interest in physical and mental health.

He is based in the Galbraith Ayr office but regularly travels all over Scotland. He enjoys all parts of the job working with existing and new clients, but his main areas of work currently are carbon audits with data collection and mitigations. These have proved to work well

utilising the Preparing for Sustainable Farming (PSF) grant available. He also works with clients to build applications for land tenancy or contract farming opportunities. Farm business reviews allow him to dig into a business with the client and look for areas where profits could be improved or for business growth. Some other fields he is currently involved in are Agri-Environment Climate Scheme (AECS) applications. AECS Organic Conversions, Basic Payment Scheme (BPS) Entitlement trading, budgeting, and estate consultancy.

Calum Smith

01292 268 181

calum.smith@galbraithgroup.com

Biography – Jack Marshall

Jack hails from a dairy farm in Castle Douglas in the South-West of Scotland and is based in the Galbraith Perth Office. Once he completed his degree in Rural Business Management, Jack initially joined Galbraith as a Graduate Surveyor in 2018. Since then, he has qualified as a Chartered Surveyor, and covers a wide range of professional work, with a strong focus on agricultural consultancy.

He is involved with the management of farm businesses, including Contract Farming

Agreements (CFA’s) and agricultural tenancies. He also deals with the trading of BPS Entitlements, management and implementation of AECS contracts, subsidy applications including Single Application Forms (SAF); Scottish Suckler Beef Support Scheme (SSBSS); Scottish Upland Sheep Support Scheme (SUSSS).

Jack Marshall

07899 980 246

jack.marshall@galbraithgroup.com

Highway Hold-ups

Is the A9 dualling now on track?

Transport Scotland’s £3.7 billion A9 dualling scheme was launched with a pledge to deliver economic benefits of about £210 million a year, through improved road safety and shorter journey times. The project also promised improved links to public transport services and to cycle paths and footpaths.

Construction work to dual 80 miles of single carriageway between Perth and Inverness began in 2015. In December 2021, Scottish Ministers confirmed a commitment to upgrade the road by 2025.

However in February 2023 the Scottish Minister for Transport announced that the scheme had been delayed indefinitely due to the pandemic, Brexit and the war in Ukraine.

With little to no progress being made for a number of years, the Cabinet

Secretary for Transport, Net Zero and Just Transition, Mairi McAllan, announced on 20th December 2023 that the entire A9 dualling programme will be completed by the end of 2035.

The delivery plan involves a rolling construction timescale with nearly 50% of the road intended to be dual carriageway by the end of 2030, increasing to 85% by the end of 2033 and the whole road dualled by 2035. If this deadline is met, it will be ten years after the original proposed completion date.

The current focus is on the Tomatin to Moy section, with the procurement process recommencing in Autumn 2023 after a turbulent period of inflated costs and cancellation of the previous procurement round, due to only one firm bidding for the contract. Each of the 11 sections of

the

scheme have been subject to a separate procurement process.

It is expected that the contract will be awarded in the summer of this year and that this section (Tomatin to Moy) should be in operation by the end of 2027.

Transport Scotland and Scottish Ministers have advised that the funding for the project is to change to an amended version of the NEC4 model, which Transport Scotland described as ‘preferred by the industry and used widely across the UK’. This has been welcomed by the Civil Engineering Contractor’s Association, Scotland.

Many in the construction sector are now more confident that the A9 dualling programme will be delivered in full. However, with only 11 miles of the 80-mile road completed in 16 years, a great deal of work remains to be done.

Communities in Perthshire and the Highlands and Islands have been left in limbo regarding upgrading of the A9 in their area, along with significant day-to-day travel delays and inconvenience. Since the project first began, 72 individuals have lost their lives on what is considered Scotland’s deadliest road, with 13 of these deaths occurring in 2022.

We very much hope that the new timescales will be met. If you think you will be impacted by the project, either through compulsory purchase of land or depreciation of your property, please do get in touch with your local Galbraith office to discuss your options. n

Philippa Orr 07917 220 779 philippa.orr@galbraithgroup.com

CLASS 18B

A simpler and easier way to maximise the potential of under-used farm buildings

Class 18B is a provision with the Town and Country Planning regulations for Scotland.

It permits a change of use for agricultural buildings offering the opportunity to create a residential dwelling. The clause was introduced on 1st April 2021 in Scotland. In order for any application to be successful, certain criteria must be met, including:

The proposed works to the building may only be to the extent which they are reasonably necessary to convert the building to use as a dwelling. For example this can include the installation of windows, doors, roofs, exterior walls, drainage and electricity and partial demolition to the extent necessary to carry out the installations.

The building must have been used solely for agricultural use on or prior to 4th November 2019.

There is a five dwelling limit and the floorspace of each dwelling cannot exceed 150 square metres.

The building cannot be listed, on a site of archaeological interest, a safety hazard area, a military explosives storage area or located on croft land.

The class allows provision of access to the dwelling and hard surface of parking incidental to the enjoyment of the dwelling.

The change of use includes the land within the curtilage of the building.

The determination period is 28 days for the prior notification, considerably quicker than a full planning application.

Once the change of use has been established, it allows you to upgrade the planning status to a full planning permission to enable a more innovative design for the building and additional curtilage.

This creates a great opportunity for landowners and farmers to add value to agricultural buildings that are surplus to requirements to generate an additional income stream though the creation of a residential property to be brought to the rental market or perhaps as a holiday let. Equally the change of use will increase the capital value of the farm, which may be particularly significant where previously planning policy did not support any development of agricultural buildings. n Kitty

| Rural Matters | Spring 2024

Campbell 07385 930 697

kitty.campbell@galbraithgroup.com

Agricultural Holdings Act

Succession

In England, many holdings are still occupied under an Agricultural Holdings Act 1986 (AHA) tenancy. Some of these tenancies carry succession rights, meaning that potentially a further two generations could be eligible to apply for a tenancy of the holding. However, a succession tenancy will not automatically be granted on death or retirement of the predecessor, certain eligibility and suitability criteria must be satisfied, and there is a strict application procedure to follow.

24

| Rural Matters | Spring 2024

Generally, the rule is that a tenancy protected by the AHA 1986 will benefit from succession rights if the tenancy commenced before 12th July 1984.

There are exceptions to this rule, including where the AHA tenancy was granted after 12th July 1984 but before 1st September 1995 and the tenancy agreement expressly states that succession rules (Part IV of the AHA) apply; or where the tenancy itself is a first succession.

On death of a tenant

The key procedure is as follows:

1. Written Notice to the Landlord

The personal representatives of the deceased tenant must serve a written notice on the landlord to inform them of the tenant’s death. This step is necessary even if the landlord is already aware of the situation. The landlord then has three months to serve a valid Case G notice to quit.

2. Application to the Tribunal

The proposed successor must submit an application to the First Tier Tribunal (FTT) in England (or the Agricultural Lands Tribunal in Wales). The application must be made within three months of the tenant’s death, using the correct form. These timings are critical; if the correct procedure is not followed, the application will be invalid and will not be accepted by the tribunal.

3. Notice to the Landlord

Simultaneously to the application to the tribunal, the successor must provide a notice in the correct form to the landlord to inform them of their application to the tribunal. The landlord must respond within one month from receipt of this notice if they wish to dispute the application.

4. Tribunal Hearing

The landlord and proposed successor can seek to negotiate terms for a succession or new tenancy by agreement before a tribunal hearing. However, if no agreement has been reached between the parties before the hearing date, the case will be decided by the tribunal. They will decide to agree to the proposed succession, or to give consent to operation of the landlord’s notice to quit.

25

Succession on retirement

Previously, a tenant had to be aged 65 or older before an application could be made for succession on retirement. This is no longer the case. The Agriculture Act 2020 repealed the minimum retirement age so that an application for succession on retirement can be made when the current tenant is of any age.

The key procedure is:

1. Retirement notice to be served on landlord

The sitting tenant must serve a written notice on the landlord not less than 12 months and not more than 24 months before the proposed term date for succession.

2. Written notification to landlord

The proposed successor must notify the landlord in writing of their intention to apply to the FTT for a succession tenancy before the application is submitted. If the landlord opposes the application, they must respond within one month of the retirement notice being served on them.

3. Application to the Tribunal

Within one month from serving the retirement notice on the landlord, the proposed successor must submit their application to the tribunal. The application must be signed by the retiring tenant and the successor, and include a copy of the retirement notice.

4. Tribunal Hearing

The landlord and proposed successor can seek to negotiate terms for a succession or new tenancy by agreement before a tribunal hearing. However, if no agreement has been reached between the parties before the hearing date, the case will be decided by the tribunal.

| Rural Matters | Spring 2024

If you are a tenant, strategic planning could ensure that future generations are in a good position when the time comes to apply for a succession tenancy...

Sarah Hall

Eligibility Criteria

For an applicant to be considered suitable and eligible to apply for a succession tenancy (on death or retirement), they must satisfy the following statutory tests. However, it should be noted that in the case of application on death, a proposed successor can apply to be treated as eligible. The Agriculture Act 2020 brought in phased changes to the eligibility criteria with the aim of simplifying the requirements.

At present, the tests are:

1. The close relationship test

The applicant must be a close relative of the retiring or deceased tenant

2. The principal source of livelihood test

The applicant’s principal source of income in five of the previous seven years must be derived from the holding (or another unit of which the holding forms part).

3. The commercial unit occupation test

The applicant must not separately occupy another commercial unit of agricultural land.

4. Suitability test

The applicant must be deemed suitable to take on the tenancy from the retired or deceased tenant i.e. the successor tenant must demonstrate they have sufficient training and experience to take on the tenancy and run the farm as well as demonstrate they are of suitable health and financial standing to take on the tenancy and run the farm.

The changes which take effect from 1st September 2024 are:

1. Commercial unit test

This test will no longer be a requirement.

2. Suitability test

This test has been revised, and with effect from 1st September 2024, the tribunal must disregard the age of the applicant and rent offered for the holding. The tribunal must consider a person’s suitability based on:

i. their experience, training and skills in agriculture and business management

ii. their financial standing and character

iii. the character, situation and condition of the holding

iv. the terms of the tenancy

Having regard to the above, the proposed successor needs to demonstrate to the tribunal that if the tenancy was available on the open market, they are of a standard that a prudent landlord would be willing to shortlist them for the tenancy.

This test might now be considered more onerous on an applicant than previously, as they will need to supply detailed information of their farm business plan to support the application, including cashflows, budgets, and references from their bank and personal references.

Conclusion

It is vital, whether you are a landlord or tenant to take advice on AHA tenancy successions.

If you are a tenant, strategic planning could ensure that future generations are in a good position when the time comes to apply for a succession tenancy. Especially since the repeal of the minimum retirement age, the younger generations may now be able to take on and develop the farming business at an earlier stage.

For landlords, AHA tenancies can limit the value of the asset. Ensuring that the correct procedure is followed, in a timely manner upon the death of / proposed retirement of the sitting tenants is of utmost importance.

There are also important tax matters to consider on both sides, particularly for a landlord when considering inheritance tax planning. n

Sarah Hall

07718 523 048

sarah.hall@galbraithgroup.com

Land Reform in Scotland

| Rural Matters | Spring 2024

The Scottish Government’s new Land Reform Bill published on 14 March this year signals a major change to the way in which land in Scotland is owned, managed, bought and sold The proposals within the Bill are radical with stakeholders expressing serious concerns.

It is the third round of land reform legislation introduced in Scotland in 20 years.

The Land Reform (Scotland) Bill includes measures that will apply to all landholdings over 1,000 hectares, prohibiting sales in certain cases to allow Ministers time to consider the impact on the local community.

The Bill covers two parts. Part 1 deals with Large Land Holdings, their management and transfer of ownership. Part 2 of the Bill deals with agricultural tenancy reform:

Part 1, Section 1 defines a ‘large landholding’ as being >3,000ha in extent or land of at least 1,000ha that accounts for >25% of a permanently inhabited island. Any such large landholding will be obliged to produce a Land Management Plan (LMP) and to engage with local communities in line with the Land Rights and Responsibilities Statement (LRRS).

The LMP is to include:

• structured.

How the ownership of the land is

The long-term vision and

• objectives for managing the land, including any potential sale.

• with the Scottish Outdoor Access Code & Code of Practice on Deer Management.

Details of how the owner complies

• the land in a way that contributes towards achieving the Scottish Government’s net zero emissions targets, adapting to climate change and increasing or sustaining biodiversity.

Details of how the owner manages

Owners must:

Engage with communities in the

• development of the content of and any changes to the LMP.

• Review and where appropriate

Make the LMP publicly available.

• revise the plan every 5 years.

It is difficult to ignore what can only be assumed as unintended consequences of the negative impact this would have on local stakeholders...

Landowners must also give consideration to a reasonable request from a community body to lease land or any part of it (including any building on it).

Composite holdings are included and defined as contiguous areas of land that are not owned by the same person but by persons who are connected through companies in the same group, or who have similar controlling interests in the land.

Section 2 details that for any holding >1,000ha, the introduction of obligations on landowners to give prior notification to community bodies of an intention to sell or transfer any land in order to provide them with an opportunity to purchase all or part of the land in question. The notification would be valid for 2 years.

Section 4 prohibits the transfer of land (large holdings >1,000ha) without a ‘lotting decision’. The Bill introduces powers for Ministers, that means that for large landholdings (or in some cases for land transfers of >50ha of a large landholding), an owner must ask the Scottish Ministers for a lotting decision prior to a transfer commencing.

The Minister must decide whether or not the land should be transferred in lots. If the land is to be transferred in lots, this cannot result in the same or connected parties owning more than one lot. Any lotting decision is valid for 5 years although a landowner can apply for a lotting decision review after one year. Ministers must seek professional advice from a person who is suitably qualified, independent and has knowledge or experience of transfers of land when it comes to a review of a lotting decision and landowners can also make a request that Ministers offer to buy any unsold lots.

It is difficult to ignore what can only be assumed as unintended consequences of the negative impact this would have on local stakeholders. This prohibition on the sale of land would limit estates from selling a strip of garden ground to a neighbour without going through a drawn out very public declaration of intent.

Lotting decisions currently are a key part of a sale where clients and agents discuss the most practical and optimum split which will maximise the sale price and protect future interests. The Bill would not allow for this, lotting decisions would be removed entirely from the seller and agents.

The creation of a new Land and Communities Commissioner within the Scottish Land Commission is also significant change. Whereas in the past the Scottish Land Commission operated in an advisory capacity, engaging with stakeholders, it will now have a regulatory role.

With regard to agricultural holdings, the principle underpinning ‘right to buy’ for certain tenants has been extended and strengthened, with more weight given to the Land Court. There are also changes proposed to resumption rights, rent reviews, a new Part 4 Schedule for tenants improvements focusing on sustainable and regenerative agriculture, diversification, game damage, and waygo.

For small landholdings, the Bill introduces a pre-emptive right to buy for tenants, which is similar to the right available to 1991 Act tenants.

There is concern that the legislation has huge implications for landowners, farmers and rural businesses and may discourage investment in Scotland. When looking at the impact on sales of large land holdings, it would mark the end of private sales, as all intent would need to be publicly declared.

| Rural Matters | Spring 2024

Katie Marr

The Scottish government’s press release on the subject refers repeatedly to ‘empowering communities’ but does not explain how the measures will help achieve the government’s stated aims of sustainable land management for food production, biodiversity and carbon capture.

‘Landscape-scale’ conservation has been a key tenet of policy in both Scotland and England in recent years, for the benefit of nature and climate. Dividing landholdings into smaller parcels of land creates barriers between competing interests and impedes the successful implementation of nature restoration programmes, such as peatland restoration, set-aside, or hedgerow creation.

The Net Zero, Energy and Transport Committee will be accepting written submissions from stakeholders ahead of Stage 1.

We will work with our partners including Scottish Land & Estates, NFU Scotland and others to represent the views of landowners and rural businesses as the Bill is scrutinised in the Scottish Parliament.

Katie Marr

07824 435 087

katie.marr@galbraithgroup.com

Carbon Credits...

Factors to consider and recent changes to carbon standards

The Woodland Carbon Code (WCC) and Peatland Code (PC) provide significant opportunities for landowners to generate high integrity carbon credits from woodland creation and peatland projects. The carbon credits generated by such schemes can help landowners achieve multiple objectives, such as funding the development of nature restoration projects, creating an additional revenue stream and boosting their business’s environmental credentials. With these benefits in mind, what are some of the key factors that need to be considered when appraising a potential carbon scheme on your land?

| Rural Matters | Spring 2024

What is my land best suited to?

The primary influence on the type of project that can be undertaken is the nature of the land itself. Decision making will be constrained to a large extent by physical factors such as soil type and topography, however there are a number of variables that are within a landowner’s control.

For woodland creation, the requirement for land that is planted to remain as woodland in perpetuity under the Woodland Carbon Code means that tree planting must be carefully considered, as it cannot be reverted to another land use once planting is completed. If alternative land uses are being considered, it is important to fully consider the implications of each scenario to ensure your key objectives will be met.

Furthermore, the type of woodland to be created needs to be appraised for its eligibility with the WCC. Whilst some commercial woodlands will meet the ‘additionality’ criteria of the WCC, consideration may need to be given to adjusting the species mix to include a higher proportion of non-productive and native species. If generating income from timber production is a primary objective, this will significantly affect the potential for generating carbon credits under the WCC. However, carbon credits may unlock potential for less productive woodlands that would be more financially challenging owing to their long-term structure and less productive species mix.

For peatland restoration, physical constraints play a significantly greater role in decision making than woodland creation, owing to the requirement for eligible peatland to meet minimum depth and condition criteria. Furthermore, areas suitable for peatland restoration are typically more constrained from an alternative land-use perspective than areas suitable for woodland creation.

Despite this, the impact of restoration on current and future alternative land uses needs to be considered. For example, many areas of blanket bog are currently managed for sporting objectives as grouse moors and deer forests, or as summer grazing. If grazing densities are high, or muirburn is currently undertaken, the effects of these management practices on carbon ‘leakage’ will need to be reviewed and appropriate steps taken to address this.

However, carrying out peatland restoration does not mean current land uses need to cease. Instead, current management practices may need to be adjusted to meet the new objectives for the land, such as reducing deer and sheep densities to a level where trampling and grazing effects are minimized.

What timescales are best suited to me?

Under the WCC and PC, projects must have a minimum duration of 30 years and typically have a maximum duration of 100 years. The long timescales associated with the codes

have benefits and constraints for landowners, and the decision over project length should be considered thoroughly.

For woodland creation, longer timescales are typically advantageous as many non-commercial species require a significant period of time to reach maturity. Additionally, if the woodland will be managed for permanent cover with no felling and limited to no thinning, a long timescale will have a limited impact on its management. However, for woodlands with a higher proportion of commercial species the landowner will need to carefully consider whether the project length is suited to the scheduled rotation.

For peatland restoration, longer timescales typically have fewer advantages than is the case with woodland. Crucially, as peatland projects involve restoring a degraded site (according to defined classifications) and maintaining it in its improved condition, it can be viewed as a higher-risk activity in the longer term than woodland creation, as the risks are currently less

understood and insurance coverage is consequently limited.

When should I sell my carbon credits?

Arguably the most crucial decision that a landowner needs to make when undertaking a carbon scheme is deciding when, and if, to sell their carbon credits. Carbon credits under the WCC and PC take two forms, namely Pending Issuance Units (PIUs) and Woodland/Peatland Carbon Units (WCUs/PCUs) that have been verified. PIUs for the entire project length are issued once validation is achieved, whilst WCUs/PCUs are issued in tranches at regular intervals (known as vintages) at each verification. When PIUs are sold, a contract is entered with the buyer to deliver the number of verified units once these are realized. Whilst this generates capital at the start of the project, it also creates risks associated with delivering the verified units to the buyer in the future. Alternatively, when WCUs/PIUs are sold, there is reduced risk since the units can be instantly reported and there is no future obligation on the seller.

| Rural Matters | Spring 2024

However, recent changes to ISO 14068 by the International Organisation for Standardisation (ISO) will have important implications for the sale of WCUs/PCUs that landowners need to consider carefully.

ISO 14068

The International Organisation for Standardisation (ISO) is a global federation of national standards bodies. ISO’s are reviewed, added to and evolve, based on the recommendations of technical committees. These new ISO publications are often quickly adopted by organisations to maintain credibility. ISO also carries weight for national standardisation programmes such as the British Standardisation Institute (BSI). The Woodland Carbon Code meets BSI PAS 2060:2014 requirements, the national standard that the ISO 14060 family of standards is based on to provide a robust platform for carbon accounting and trading. It is important for those that have a stake in carbon offsetting, whether that be landowners or buyers, to keep up to date with changes to regulatory standards because they may influence how and when carbon offsets can be used, which in turn, will affect their end value.

A new standard Environmental, Social and Corporate Governance (ESG) has rapidly evolved over the last decade, with increased pressure placed on both the private and public sector by consumers, stakeholders and taxpayers to take actions that address social and environmental issues. However, increased pressure on companies to expand their ESG goals have, in some cases, generated

For woodland creation, longer timescales are typically advantageous as many non-commercial species require a significant period of time to reach maturity...

Edward Fletcher

accusations of greenwashing, unsubstantiated emissions statements and incomplete scoping. ISO 14068 is a comprehensive standard for companies which dictates when carbon neutrality can credibly be claimed to have been reached and maintained. Many of the provisions of the ISO follow the existing good practice of the woodland carbon and peatland codes, for example by demonstrating additionality. However, there are important new provisions in the ISO which may affect how those generating carbon units are able to sell them. According to ISO 14068, Carbon credits must be issued with a start date no earlier than 2020 and no more than 5 years before GHG emissions offset period. Offsets used to achieve carbon neutrality must be retired no later than 12 months after the end of the reporting period. The implication of this addition is that carbon scheme owners will not be able to sell Woodland Carbon Units (WCUs) with old vintage dates to buyers conforming to the standard.

The effect of the new standard

The new standard nullifies the value of carbon credits older than five years to entities using the ISO standard as the basis of their carbon neutral claims. The effect of this new ISO will benefit consumers, stakeholders and taxpayers as entities making claims to be net zero and carbon neutral are held accountable. For landowners holding verified carbon units from projects such as the Woodland Carbon Code and Peatland Code, it is possible that the codes will be updated from their current BSI standard to reflect the new ISO with a stipulation that credits must be

‘retired’ or cancelled five years after they have been verified. This change would not only discourage speculators who purchase large volumes of carbon credits and held on to them in the hope that their value will increase over time, but it would also have direct impact on landowners who seek to hold onto the WCU’s as an investment.

Future of natural capital markets

As carbon reporting standards become increasingly rigorous, a rise to the standard of high integrity carbon credits follows. We have seen a growing increase in the value of high integrity carbon units which are used by organisations to make claims of net-zero whilst they strive to make active long-term cuts to their carbon emissions.

If you have an existing Woodland Carbon Code it is important to keep on top of your verification dates, as they require a survey.

Another opportunity that has been steadily developing is funding for biodiversity restoration. In both England & Scotland, there are opportunities to monetise appropriate biodiversity measures. n

Edward Fletcher 07990 130 753

edward.fletcher@galbraithgroup.com

James Lighton 07342 093 469

james.Lighton@galbraithgroup.com

A View from the Forest

If you are keen on working towards creating a sustainable environment, forestry is a great way of getting involved in tackling some of the elements of climate change, with the benefit of creating sustainable building materials whilst removing CO2 from the atmosphere.

Forestry is also an important way of aiding natural restoration through native woodland creation or natural regeneration projects, connecting fragmented habitats through woodland corridors and restoring the landscape to its former glory.

If you enjoy being outside in all elements, managing projects to create a more diverse landscape whilst creating habitats for wildlife and producing sustainable UK forest products, then think about the forestry industry.

Part of our role here at Galbraith within the Forestry team involves advising clients of ways we can aid the diversification of their assets; from creating management plans, large scale native woodland creation, restructuring of woodlands and restoration projects looking at long term income from carbon sequestration. The emphasis has moved away from traditional estate management techniques towards more intrinsic forestry and

environmental values, for example restructuring woodlands away from plantation planting and towards a more sustainable woodland that can work with the local environment whilst creating a sustainable timber resource for local needs. We are engaged in a wide range of projects for clients in the north of England and across Scotland. If you would like to join our forestry team, please do not hesitate to get in touch. n

| Rural Matters | Spring 2024

448

Alex Flinn 07584 383

alex.flinn@galbraithgroup.com

Gamebirds’ impact on biodiversity questioned by the Cairngorm

National Park

It is widely understood that traditional sporting activities are coming under increasing pressure in terms of financial visibility and the public’s ethical viewpoint. However, under the Cairngorm National Park Partnership Plan 2022-2027, landowners within the Park are facing a new challenge over biodiversity.

The National Park Partnership Plan was drafted to assist in achieving the aims of the National Park which include the conservation of its natural and cultural heritage as well as promoting sustainable use of natural resources. The Partnership Plan includes Nature Objectives to achieve these aims, with one area under scrutiny being gamebird management.

Here, the Park have addressed their interest in low ground releases of non-native gamebirds. The crucial target that has concerned landowners is that “Gamebird releases [should have] no negative impact on native biodiversity”.

This has sparked questions such as - how will biodiversity be measured and what measures could landowners be facing to achieve this target? When considering a traditional low ground release of thousands of birds, there is a concern that significant compensation could be required to mitigate any perceived effect on biodiversity.

If shoots have a significant effect on biodiversity (according to the Cairngorm National Park), they could be expected to reduce the density of birds to help balance any perceived pressure on other wildlife. Or perhaps there could be compensatory measures where shoots could be expected to create habitat elsewhere.

This threat comes as many low ground shoots are experiencing challenging financial conditions. The rates being charged to the guns have increased due to significant increases in bird rearing costs. Like many pursuits that can be classified as a luxury - in times of recession, this increase in cost is not

always accepted by customers, leading to fewer bookings.

However, The Game and Wildlife Conservation Trust (GWCT) has suggested that there should not be an assumption that shoots are detrimental to biodiversity. They are conducting research which shows that larger shoots can actually have a less significant effect on biodiversity than smaller shoots. This is because larger shoots are better staffed and therefore more likely to control predators, which will offer significant protection to native wildlife, in particular rare ground-nesting birds. GWCT also suggests that larger shoots tend to have a presence all year round and feed gamebirds through the winter which also benefits overall biodiversity. GWCT has advised that a way of combating this threat is to reduce the mortality of gamebirds prior to the shooting season. This would reduce the number of birds being put down for the season, while maintaining shoot numbers. Fewer birds being put down, but the same overall shoot bag would assist in achieving the Park’s targets, as well as benefiting the efficiency of the shoot.

The Park has set out the action by 2027 to “Establish a baseline for the number of gamebirds released in the National Park and assess their impact on native biodiversity.” Essentially the Park are gathering evidence to understand the extent of the effect of gamebirds on biodiversity, allowing shoots to continue as normal until at least 2027. The action beyond 2027 depends on their findings. If a biodiversity deficit is found, it is encouraging to understand that there are multiple ways of mitigating negative biodiversity, not all of which are detrimental for the future of the sport. n