Energy Matters

Mobile networks: Rental slump threatens to bring disruption

Digital battle for rooftop space

£58bn green grid upgrade

Rethink coming for energy market

A9 route progress at last

Plastics to revive beet farming

Land access – know your rights

ISSUE28 | SUMMER 2024

By Mike Reid Head of Energy

Decarbonisation plans at risk

Welcome to Energy Matters issue 28.

Plans to decarbonise the UK look more at risk now than three years ago, before Russia’s invasion of Ukraine sent energy prices soaring.

Meanwhile, the harsh economic consequences of the covid lockdown look likely to continue for some time, and opponents of the Government’s net zero policy are as vocal as ever.

Ministers face pressure to limit any damage to the economy caused by their environmental commitments. They must ensure consumers and the wider population reap the rewards of the energy transition without suffering too much through high taxes and utility prices.

Balancing this with the need to ensure adequate supply to power industry and heat homes prompted a series of policy changes in March, as we report on page 6.

Meanwhile plans have been announced for a £58 billion upgrade to connect an extra 21GW of offshore wind to the network, combined with further low-carbon generation across Britain. Modernising the network through the 2030s will require new underground, offshore and, more controversially, overground cabling. Read about it on page 6. While customers will foot most of the bill, public support for net zero remains high and with a general election looming, it’s hard to imagine any Labour government steering us back towards fossil fuels. However, with Labour abandoning their proposed £28 billion annual investment in environmental

projects this February, due to a difficult economic outlook, the future shape of energy policies under any Labour government isn’t clear either.

The UK was the first major economy to sign net-zero into law, has reduced greenhouse gas emissions faster than any other advanced economy and is a global leader in renewable energy, especially offshore wind. We’ve been helped by nature, but that’s still quite an achievement.

Britain is also a major centre for investment, research and commercial development focused on low-carbon technologies and processes, for energy, transport and infrastructure. In wealth and job creation, the potential rewards for leadership in these areas are huge and long-lasting.

Also in this issue we return to look at the slow progress on the A9 road upgrade, the growing popularity of pumped water storage, and progress on plans to revive the sugar beet industry in Scotland, not to sweeten our cuppa but to produce ethanol for chemical manufacturing.

As with energy, things have been moving as fast in the world of telecoms. We look at the impact of installations on potential development value, how commercial returns are prompting redevelopment plans, and new planning guidance on digital communication projects to protect natural assets.

We also visit a project in northeast Scotland aimed at producing farm-scale hydrogen to power the rural economy.

CONTENTS

8

Water works: Pumped storage hydro schemes are generating renewed interest.

7

Bumpy road... but there’s progress at last on stalled A9 upgrade.

25

Fun in the sun: cutting the cost of holiday site energy.

Pag e 2 | Energy Matters | Summer 2024 | galbraithgroup.com

WELCOME

Energy Matters is produced by Allerton Communications, Marlborough, Wiltshire, and designed by George Gray Media & Design, Saint-Andeux, France.

CKD Galbraith LLP.

©

4

Rising costs: £4 billion is added to the lkely cost of upgrading the grid.

5

Faster access: New rules aim to speed up grid connections.

6

Policy change: Government tries to improve efficiency in the energy market.

22

15

10

26

16

All change: Planning guidance aimed at boosting digital telecommunications is likely to have a big impact.

20

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 3

23

Compensatory planting: When trees must make way for energy projects. 18

Size matters: As wind turbines get bigger, they’re getting trickier to move into place. 27 Renewable energy subsidies. 26 Galbraith staff news. 24

Digital report: Is Scotland’s high-speed broadband roll-out on track?

Change of use: Land traditionally devoted to food production is now seen as ideal for other purposes.

Transformation: A former coal-fired power station is being transformed into an energy and economic hub.

are

telecoms equipment.

Entry requirements: Protect yourself when companies seek to access your land and property... and get the right financial deal. 10 Sugar rush: Reviving the Scottish beet industry could boost greener plastics. 12 Rooftop rumble: Challenges

mounting for landlords hosting

14 Telecom tensions: Striking the right bargain as the rental market gets tougher.

Switching off: Some landowners are looking for other sources of revenue as telecom companies squeeze rents.

Energy farm: Putting farm-scale green hydrogen production to the test.

Cost of upgrading grid for offshore wind goes up £4bn

Grid managers put the cost of keeping the lights on while switching to green energy at £58 billion.

Ian ThorntonKemsley reports.

Scotland and the North of England are the focus of plans to upgrade Britain’s electricity grid network aimed at ensuring adequate energy supply and decarbonising power.

The £58 billion project – 7.4% higher than £54 billion estimate we reported in November – is part of a major redesign proposed by ESO, the Electricity System Operator run by National Grid. Energy will be transported from wind farms being developed off the coast of Scotland via a new electrical ‘spine’ from Peterhead to Merseyside, supplying homes and businesses across Scotland and the North of England.

The route is an early-stage option that will require further consultation, said ESO, unveiling its ‘Beyond 2030’ report on how to meet growing energy demand by 2035.

Supply would be assured by upgrading existing assets and establishing new power lines both on-

and offshore, complementing six previously recommended offshore high voltage direct current (HVDC) links from Scotland to England.

In related grid developments…

• The energy regulator Ofgem unveiled a £2 billion subsea ‘electricity superhighway’ to take 2GW from East Lothian to County Durham, connecting up to 2 million homes to clean energy. The Eastern Green Link 1 (EGL1) highvoltage subsea cable is the first of 26 energy projects, worth £20billion, under the energy regulator’s Accelerated Strategic Transmission Investment (ASTI) framework, targeting 50GW of offshore wind capacity by 2030.

• Ofgem also unveiled the £3.4 billion Eastern Green Link 2 (EGL2), a 500km electricity superhighway between Scotland and Yorkshire, with most of the 2GW high-voltage cable from Peterhead to Drax under the North Sea and the remaining 70km underground onshore.

CONCERN OVER 70-MILE PYLON ROUTE

SSEN Transmission plans to put up 70 miles of overhead lines from Kintore to Tealing in the east of Scotland as part of an ongoing grid modernisation programme.

There was much concern about this among more than 200 people I addressed at a meeting of the Angus Pylon Action Group in Forfar in March. While reparation is sometimes paid for pylon installation, I believe many affected house owners will lose out as this is limited to instances where property rights are 'taken' by the infrastructure itself or by associated facilities.

SSEN do not appear to have considered this fully in deciding on pylons as, by March 20, they had

not consulted with homeowners along the line, nor sought data on the extent of the effects on residential properties.

Those affected can submit planning objections, though even this democratic right could be threatened, as Alan Brown, the Scottish National Party energy spokesman at Westminster, sought last July to add a clause to the UK Government’s Energy Bill that would prevent councils launching a public inquiry into infrastructure works.

Government proposals to give those affected property owners up to £1,000 a year off electricity bills over 10 years will do little to address this issue.

Pag e 4 | Energy Matters | Summer 2024 | galbraithgroup.com

• SP Energy Networks announced a £3million upgrade of Dunfermline’s electricity network to host EV chargers and heat pumps. The ScottishPower subsidiary will replace 4.7km of underground cables dating from 1957 by September, supporting the ancient capital’s 2045 net-zero target.

• ScottishPower, part of Iberdrola, launched its biggest UK recruitment drive – 1,000 ‘green jobs’ over the next decade, from accountants and project managers to ecologists and engineers to help deliver a low-carbon future.

Commenting on ESO’s £58 billion Beyond 2030 plan, Fintan Slye, Executive Director, said: “Great Britain’s electricity system is the backbone of our economy and must be fit for our future. To deliver the clean, secure, decarbonised system set out by Government and Devolved Governments we must take swift, coordinated and lasting action working, collaboratively across all parts of the energy sector, government, the regulator and within our communities.”

The plan connects a further 21GW of offshore wind in development off the Scottish coast to the grid, producing a total 86GW of offshore wind, ‘making Britain a global leader in offshore wind and floating offshore wind farms’.

The report was silent on finance sources – energy networks are currently funded by consumer utility bills. The plan would have to be approved by Government and the energy regulator Ofgem. The plan would bring a fully decarbonised electricity system by 2035, in line with the UK’s Sixth Carbon Budget, recommended by the Climate Change Committee, said ESO, and create and sustain more than 20,000 jobs annually, with 90% of the benefits occurring outside London and the Southeast.

The company also recommended further offshore ‘bootstraps’ along the East coast of Britain –cables linking offshore generation to onshore transmission systems, to bring about a worldleading offshore network with three times more undersea cabling than onshore.

ESO said further design and community engagement would be undertaken to balance community and wider economic and system security needs.

Much of the new network will use overhead cabling. The report says: “Pylons are typically used for the transmission network because they are around a fifth of the cost and more flexible (i.e. they can be rerouted, offer more operational choice and can be more easily upgraded) than the underground equivalent.”

New Ofgem rules aim to speed up grid access

Shake-up should free up more grid connections to boost renewable-energy transition. Cameron Main reports.

To meet the UK’s looming 2050 net-zero target, vast amounts of time and money have been expended to develop our renewable energy generating capacity.

Although ambitious, this target date was recently put into focus with the announcement that the UK has managed to halve its carbon emissions between 1990 and 2022, which is progress towards the more pressing target of a 68% reduction by 2030.

From both a foreign politics and domestic pride point of view this is encouraging news, especially when compared with other countries such as the US and France.

Pride and politics aside, with this increased focus and investment into our renewable energy provision has come a large amount of pressure on our outdated and restricted national grid capacity.

The queue of renewable energy projects waiting for access to the grid currently totals 400GW, which is much more than is required to power the entire system, and in order to bring the renewable energy generated into the national grid there needs to be enough free space to do so.

The energy regulator Ofgem introduced a new grid

management system last November. This allows any stalled or inactive schemes which were in the grid queue on a ‘first come, first served’ basis and have yet to come to fruition to be removed to create space for high-voltage transmission lines to allow quick access to the grid by generation and storage schemes.

Urgent reform has been needed for a number of years. The new rules give National Grid the power to set project-specific milestones for new connection agreements and to end projects if they do not reach these. The aim is to avoid further clogging up the grid connection queue.

Many in the industry are welcoming the change on the basis that it will help to maximise the amount of the nation’s renewable assets which are actively generating ahead of the next target on the way to 2050.

The Galbraith team has instigated a number of successful renewable energy development tenders for landowning clients and negotiated highly favourable terms for landowners who were approached directly by developers.

If you own land that may have potential for the development of renewable energy infrastructure or have been approached by a developer with a proposed scheme, please contact our team who will be delighted to discuss the opportunity.

ian.thornton-kemsley@galbraithgroup.com

01224 860710

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 5

cameron.main@galbraithgroup.com 07342 093477

Government unveils three-pronged reform of energy market

Big changes have been unveiled to secure energy supply and deliver cleaner electricity at a reasonable prices. Mike Reid reports.

A series of policy changes aimed at improving the efficiency of the energy market have been announced by the UK Government.

First, Claire Coutinho, appointed Energy Secretary in August 2023, pledged to support the building of new gas power stations ‘to maintain a safe and reliable energy source for days when the weather forecast doesn’t power up renewables’.

While ministers are sticking with their plan for net zero greenhouse gas emissions by 2050, the move recognises public concerns over energy price rises and security of supply, as well as doubts over our ability to develop effective, renewable alternatives to fossil fuels in time to achieve these targets.

The UK is the only major economy to have set a target to reduce carbon emissions by 77% by 2035 compared to 1990 levels. Emissions are now 50% lower than in 1990, according to Prime Minister Rishi Sunak, who added: “But we need to reach our 2035 goals in a sustainable way that doesn’t leave people without energy on a cloudy, windless day.”

“The reforms could save households £45 off their yearly energy bill and the government will consult on the proposals to deliver the long-term change the UK needs to make a brighter future for Britain, and improve economic and energy security for everyone,” said Ms Coutinho. However, renewable energy industry sources said the time taken to bring the necessary changes could limit investment in the sector, slowing the transition to greener electricity supply.

The third initiative is reforming the current system whereby mainly wind but also solar generators are paid by the Government to switch off at times of peak supply. Energy operators are currently paid for their actual power generation, but this encourages operating at full capacity even when grid transmission constraints mean further production can’t be used.

Now the Government will seek views on shifting to either a “deemed payment” or a capacitybased system – both aimed at compensating producers based on their potential to generate power.

The system would remain based on contracts for difference (CfDs) whereby prospective operators, incentivised by subsidy, bid to generate electricity – for 15 years for offshore wind farms. We looked at CfDs in earlier issues and in December.

Ms Coutinho said: “Without gas backing up renewables, we face the genuine prospect of blackouts. There are no easy solutions in energy, only trade-offs. If countries are forced to choose between clean energy and keeping citizens safe and warm, they’ll choose to keep the lights on ... we must be realistic.”

We need to reach our 2035 goals in a sustainable way that doesn’t leave people without energy on a cloudy, windless day. “

We consider the Government’s changes should go further and allow renewable schemes to generate power for other uses such as hydrogen production and charging battery energy storage plants even if they can’t export the power to the grid. Constraint payments would be reduced by the electricity generated that would be used elsewhere, making better use of the renewable power generated and reducing the cost of constraint payments.

Changing the current system would bring risks, though ministers are keen to boost efficiency of supply while also encouraging the use of battery energy storage systems to address the intermittency problem of wind and solar energy.

Hopes

Second, the Energy Secretary also unveiled a consultation including a proposal to shake up pricing by better matching supply and demand across the country. So-called locational pricing, which we discussed in May 2023, reflects the marginal cost of generating electricity, losses incurred in transmission and the cost of any network congestion.

It will be interesting to see how these reforms work in practice as the electricity market is already quite complicated for consumers without adding locational pricing into the mix.

Investment in these technologies and specific projects is growing, though National Grid has said the UK will need 20-25GW of energy storage capacity by 2035 to achieve electricity decarbonisation goals. That contrasts to a current 4GW in operation at the end of 2023.

It is thought any revisions to the CfD framework are unlikely to be implemented before 2028, well after the next general election so if there is a change of Government these plans may be subject to change.

mike.reid@galbraithgroup.com

Previously we’ve tracked delays to the dualling of one of Scotland’s most dangerous roads. Now, Philippa Orr reports, we’re starting to see progress.

Pag e 6 | Energy Matters | Summer 2024 | galbraithgroup.com

07909 978642

rise for progress on A9 project

Transport Scotland’s £3.7 billion A9 dualling scheme was designed to deliver economic benefits of about £210 million a year through improved road safety and reliable, quicker journey times, as well as better links to pedestrian, cycling and public transport facilities.

Construction work to convert 80 miles of single carriageway to dual between Perth and Inverness began in 2015 and in December 2021, the Scottish Ministers confirmed a commitment to update the road by 2025.

However, in February 2023 the Scottish Minister for Transport announced that the scheme had been delayed indefinitely, blaming the Covid pandemic, Brexit and the war in Ukraine. With little to no progress being made on the dualling of the A9 for several years, the Cabinet Secretary for Transport, Net Zero and Just Transition, Mairi McAllan, confirmed last December that the entire

A9 dualling programme would be completed by the end of 2035.

The delivery plan involves a rolling timescale for construction, with nearly 50% of the road being dualled by the end of 2030, increasing to 85% by the end of 2033 and completion by 2035 –10 years from the original proposed date.

The current focus is the Tomatin to Moy section, with the procurement process restarting in autumn 2023 after a turbulent period of inflated costs due to the Ukraine war, but it is expected that the contractor will be appointed in early summer and the dualling process operational by the end 2027.

The Scottish Government has said funding for the massive project has changed from traditional public finance to a new hybrid method, with some private financing accessed via a mutual investment model previously developed by the Welsh Government.

The result is that hopes of a successful delivery have risen in recent months but,

with only 11 miles newly dualled in the 16 years since we first dtarted talking about the project, there is still a lot to be done. Not only have communities in Perthshire and the Highlands and Islands had to wait to find out whether dualling of the A9 would finish, but there have been significant day-to-day travel delays and inconveniences.

Since the A9 dualling first starting, too many lives have been needlessly lost on what is considered Scotland’s deadliest road. For all the individuals impacted by the A9 road dualling, we do hope that the new timescales that have been outlined can be met.

If you think you may be impacted, either through land take or depreciation of your property, and have yet to consider your options, please do get in touch with your local Galbraith office and we will be able to provide guidance.

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 7

07917 220779 philippa.orr@galbraithgroup.com

Pumped-storage hydro could turn lochs into giant ‘batteries’

Six pumpedstorage schemes are currently under development in Scotland, but the technology has its detractors, says Calum Innes

Renewable power generation in the UK continues to grow and this trend is set to continue as we work to reduce reliance on fossil fuels.

However, producing power this way is by its nature inconsistent and consequently we have seen a growth in demand for battery storage to help balance disparity between supply and demand.

This has resulted in a rekindling of interest in pumped-storage hydro, where water is held in an upper reservoir to be released via a turbine to a lower reservoir, creating instant generation in times of peak demand. The water is then pumped back to the upper reservoir when generation outstrips demand and electricity is cheap. In effect it’s a rechargeable battery powered by water.

At present there are at least six pumped-storage hydro schemes under development in Scotland which, if they become operational, would more

than double the UK’s pumped storage capacity to around 8GW. However, none of these has reached construction phase yet.

Galbraith has been closely involved in a number of these schemes, principally providing advice to landowners upon whose land it is intended to construct these assets, regarding financial and other arrangements.

Of course, such developments are not without their detractors. There are concerns about the environmental drawbacks arising from the construction of these huge infrastructure projects in places which are generally remote and unspoiled.

Many construction scars will heal over time, but the transfer of water between one loch and another creates a ‘drawdown zone’ where areas at the edge of a body of water are frequently exposed, which may be considered unsightly. Furthermore, there are ecological concerns. For

Pag e 8 | Energy Matters | Summer 2024 | galbraithgroup.com

Loch Ness is currently the subject of three proposed developments.

example, the Ness District Fishery Board is voicing concerns regarding Loch Ness.

The loch, the UK’s largest body of water by volume, contains more water than all English and Welsh lakes combined. It is currently the subject of three proposed developments that are feared will have an impact upon salmon, wild salmon having been declared an endangered species.

Until now economics have precluded development of schemes of this type and scale since the days of the Hydro Electric Board and the post-war surge of hydro development in an effort to ‘light up the glens’.

But the demand for dynamic renewable generation at scale has rekindled interest in this particular technology resulting in a new ‘gold rush’ to develop this huge source of instant power generation.

calum.innes@galbraithgroup.com

07909 978643

Rare opportunity to acquire generating hydro-electric scheme

A rare opportunity has arisen to acquire a working hydro-electric generation scheme in Scotland with more than 10 years of UK Government subsidy still to run. Commissioned in December 2015 and located in Perthshire, the scheme operates at a high level of efficiency with generation in 2023 of 1,100 MWh, producing gross revenues of £492,053.

The assets were developed under leasehold arrangements with various landowners, with unexpired terms of over 30 years. The developer is a LLP formed for the sole purpose of developing the hydro scheme; accordingly, any transfer of ownership will be by an assignation of the leasehold rights held by the LLP.

The opportunity will appeal to family offices and institutional investors seeking quality revenues from a generating renewable-energy source, with associated ESG credentials, together with funds

specialising in renewable generating assets.

Commercial proposals are sought to acquire the assets and interests of the developer/operator. Viewing is by arrangement, with initial expressions of interest made to Galbraith as agent.

An online data room containing detailed information regarding historic accounts, lease agreements, FiT, generation data and other relevant documents will open on April 16 and is subject to a non-disclosure agreement. Commercial proposals are sought by May 7. A further process may follow to clarify matters regarding submitted offers.

Calum Innes, the Galbraith partner handling the sale, said: “Hydro assets rarely come to the market and this scheme has a proven track record, with the benefit of more than a decade of financial subsidy still to run. We look forward to discussing this opportunity with interested parties.”

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 9

Change of use: the future of Scotland’s 19 million acres

Land traditionally devoted to food production is now seen as ideal for other uses. Cameron Main reports.

Making the best use of our land while preserving nature and producing food for a growing population presents big challenges.

In October 2023 the Scottish Government released its fourth annual progress report on their land use strategy, covering the period from March 2022 to March 2023. It includes various financial support schemes from last year and examples of associated environmental, social and economic programmes.

Land use is a key part of the Holyrood government’s aim of achieving net zero greenhouse gas emissions by 2045.

The official focus on squeezing the maximum from Scotland’s 19 million acres is encouraging for landowners and managers but also presents the challenge of reconciling sometimes competing land uses while meeting other targets such as net zero.

Alongside traditional rural land uses such as crop production and livestock grazing, farmers have a significant array of other options, such as rewilding and environmental services, urban expansion and affordable housing provision, in partnership with local authorities or developers.

There is also forestry for commercial crop or to generate carbon units to sell in the emerging market, renewable energy generation, and growth of sustainable crops such as sugar beet which, through methods which are far less carbon intensive than traditional petrochemical production, can be used to make plastics, as explained in the other article on this page.

Productive arable land accounts for approximately 1.5 million acres or 8% of Scotland’s total land area, but competing uses mean a portion of this will be taken out of food production.

For example, assuming 75,000 acres of marginal arable land is used for rewilding or environmental purposes, 50,000 for urban expansion around Scotland’s major cities, a further 300,000 acres (in line with Scottish Government annual planting targets) for forestry and 85,000 acres for renewable energy development and low-carbon industrial processes, one third of the 1.5 million acres of arable land in Scotland will be dedicated to non-food use.

While this may not be a bad thing for arable land prices in Scotland, it does represent a change from accepted practice, and one which Galbraith will be keeping an eye on.

If you’re concerned about any of the issues raised in this article or would like to discuss the subject of alternative land use with one of our agents, please get in touch.

Beeting a path to greener plastics and fuel

Farmers could generate sweet returns by reviving Scotland’s sugar beet industry to produce low-carbon products.

Rachel Russell reports.

Scotland’s once-great sugar industry could be set for revival as the search scales up for new ways to curb greenhouse gas emissions.

A cross-industry steering group has been talking to farmers about planting sugar beet in the east of Scotland to produce ethanol as a feedstock for chemical manufacturing.

Beet was a sizeable industry in Scotland and a processing plant at Cupar in Fife endured recession and war before it was finally closed on economic grounds in 1971.

Most manufacturing relies heavily on carbon and energy from fossil fuels, producing the carbon dioxide emissions contributing to global warming. Using carbon sourced from plants, and renewable energy, instead reduces CO2 emissions significantly.

Sugar is converted through fermentation into ethanol, a platform

Pag e 10 | Energy Matters | Summer 2024 | galbraithgroup.com

07342 093477

cameron.main@galbraithgroup.com

molecule, which can be further converted into a range of bio-based products such as biochemicals, bioplastics and biofuels traditionally derived from fossil fuel-based petrochemicals.

A report funded by Scottish Enterprise and produced by Industrial Biotechnology Innovation Centre (IBioIC) concluded in November 2021 that growing sugar beet as a net-zero feedstock would create jobs, drive opportunities for agriculture, boost industrial biotechnology and ‘secure a biobased alternative to fossil carbon for Scotland’s manufacturing sector’.

Experts involved in producing the report, Sugar Beet: A Just Transition for the Chemicals Sector and a Net Zero Solution for Manufacturing, have been talking to farmers in Angus and Fife about reviving the crop to help bring about a low-carbon economic transition.

Sugar beet is grown as a break crop,

providing a rest from cereal crops that dominate most arable rotations. This provides diversity to help reduce disease, pest and weed levels and to improve soil health.

Trials are being conducted this year to test quality, yield volumes and the effects of harvesting on soil condition in what has been an unusually wet season. Farmers will want to be satisfied that growing the winter crop (a) is consistent with good soil stewardship and (b) would generate sufficient revenue to warrant their involvement.

Farmer feedback has suggested the sugar beet crop margin would need to be higher than alternative break crops to justify the risk of switching to sugar beet that is harvested throughout the winter. The price per tonne of £35 mentioned in the report is likely to be higher now, considering rising costs and expected returns more than two years on.

Industry representatives have also been consulted about the possibility of establishing a bioethanol plant to produce nature-based chemicals for the production of plastics.

Developing a new sustainable feedstock would help safeguard some of the thousands of chemical industry jobs, said the report, adding that Grangemouth’s petrochemicals site is home to most of Scotland’s chemical manufacturers.

Petroineos, which owns an oil refinery at the site, is to cease operations there as early as 2025, though the company, a joint venture between the Chinese state-owned oil firm and Ineos, has said it would also explore low-carbon options including refining biofuels there. Ineos was contacted for comment. rachel.russell@galbraithgroup.com

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 11

657219

07884

Rents, access, safety: the battle of the rooftops is hotting up

Challenges are mounting for landlords hosting telecoms equipment, as technology advances require more from buildings, says

Ian

ThontonKemsley

Rental returns for hosting electronic communications have fallen dramatically –despite rising demand from phone network operators.

An Edinburgh rooftop site could have commanded an annual rent of £20,000, but property owners are now offered between £3,000 and £5,000. More worryingly, since the introduction of the 2017 Electronic Communications Code, there has been a major shift in the way that main network operators (MNOs) are treating landlords.

Litigation to obtain sites is the norm, with some 150 applications a year from operators to the Lands Tribunal for Scotland (LTS) Operators now seek wide rights over the whole property and are reluctant to shift from their standard agreements. In one case currently before the LTS, a company is seeking rights of access and rights to install electronic communications apparatus anywhere in or over

the whole of a building despite the existing lease and the access being restricted to a small part. In another case, an operator sought rights which could have restricted development within line of sight of the mast anywhere over 19,000 acres owned by the landlord.

Tribunals have tended to support unrestricted equipment rights, despite the fact that the Code omits any specific right to “add” to the electronic communications apparatus.

This is likely to cause problems merely due to the physical demands on property presented by the latest communication technologies.

Whereas a 4G configuration would usually require antennae weighing some 400 to 600kg, a 5G configuration comes in at about 2,000kg.

Windloading – the amount of wind a surface must resist to stay intact – is also significantly greater. Clearly a landowner needs to consider the effect of this on his property.

In some instances, wide rights to install

Pag e 12 | Energy Matters | Summer 2024 | galbraithgroup.com

equipment have severely impacted property, rendering maintenance almost impossible.

Paragraph 17 of the Code gives a limited right to upgrade or share a site. The public benefit of wider rights – an improved communications infrastructure that benefits the wider population – must be balanced with the need to ensure the least possible loss and damage to the site provider in accordance with the Code.

The upgrading and addition of equipment more generally involves physical change that may have structural and visual implications. Sharing occupation, while it provides improved revenue generating opportunities for an operator, may have adverse implications for a site provider.

Sharing occupation introduces another Code operator to the landlord-tenant relationship, which might require a separate action for removal in order to get vacant possession.

Sites should be designed, installed and operated in adherence with Construction Design and

Management Regulations, CEMFAW rules for electromagnetic fields, Management of Health and Safety at Work Regulations and other health and safety regulations. Risk should be designed out, we are told, but this is not always the case with new sites. Often antennae are installed without consideration of drop zones – an area at ground level in which items might land if they were dropped.

It is important that the landowners, who have duties under the Health and Safety at Work Act and allied legislation, retain a measure of control over access.

As the recognised authority on the subject, the International Commission on Non-Ionizing Radiation Protection (ICNIRP) sets out guidance for exposure limits for electromagnetic fields. The ICNIRP exclusion zones resulting from the presence of telecoms apparatus now extend well beyond the antennae due to changes in technology.

Whereas the impact of a single antennae may extend out about 19.6 metres for 4G equipment, it may impact as far as 55.5m for 5G and, crucially, has a very different profile.

While some operators consider that a worker can act safely in areas that are off-limits to the public, the ICNIRP consider that the public exclusion zone applies to “individuals of all ages and of differing health statuses, which may include particularly vulnerable groups or individuals, and who may have no knowledge of or control over their exposure to EMF”.

ICNIRP stresses the importance of any worker entering a public zone being trained and wearing monitoring equipment. These provisions could have the effect of substantially increasing a landlord’s liability should something go wrong. An upgrade to 5G network equipment may also result in a 70% increase in power demands. Amid high and rising utility costs, this is likely to cause economic difficulties for site providers where their electricity supply is used by operators.

Faced with difficulty in obtaining alternative sites, operators resist any attempt to remove their increased powers.

“

In some instances, wide rights to install equipment have severely impacted property, rendering maintenance almost impossible.

In a recent case an operator, Cellnex, indicated it was prepared to move antennae on a residential building to allow re-felting to prevent water ingress into the flats below. The landlord, a local council, paid for scaffolding around the whole building for the refurbishment work to proceed safely. The operator then demanded substantial costs which the council simply could not pay. The council is now locked in contested legal proceedings to remove the operator from the roof in order to renew the roof surface.

Meanwhile, redevelopment of a building in Falkirk has been put on hold due to an operator’s refusal to remove. Where operators share occupation, landowners have to raise separate actions against each one.

Such conflicts are likely to become more of an issue as property owners face increased energy performance targets for commercial buildings. In many instances the rooftop is the only possible location for measures to address these requirements. 01224

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 13

860710

ian.thornton-kemsley@galbraithgroup.com

Striking the right bargain as the rental market gets tougher

New rules make lease and renewal terms tougher for landowners, reports

Mathew Austin

Since the implementation of the Electronic Communications Code in 2017, landowners have seen a significant fall in rental income from having communications equipment on their land.

The Product Security and Telecommunications Infrastructure Bill in 2023, which comes into force fully on April 29, will give even more powers to the operators to renew leases. They already have significant powers under the Digital Economy Act 2017, which introduced the ECC.

The operators can now apply for an interim rent order to fix any new site payment from the date of their application rather than when any new lease is agreed. These measures have been put in place to reduce procrastination by landowners in agreeing renewal terms, and will probably have that effect.

Landowners, who may include social and sports club, churches and charities, often receive lease renewal approaches from the operators with heads of terms offering derisory site payment sums.

These approaches become increasingly difficult for landowners to assess due to the different approaches taken by each of the major network operators (MNOs) as well as other operators. The telecoms landscape is even more confusing for landowners when operators make approaches for new sites, offering higher site payments and incentive premiums than they offer for a lease renewal. MNOs are willing to offer higher site payments and one-off incentives for new Shared

Rural Network sites as they can face substantial fines – up to 10% of their annual turnover, if they fail to meet their coverage obligations.

There have been several cases which have set benchmarks for the procedure to determine lease renewal site payments under the Code, most of which the operators will quote within their offer letters.

Consensual lease renewals are being agreed above these site payment levels, so being offered the same site payment as might be imposed by a tribunal gives no incentive for consensual agreements to be reached.

Table 1 shows the site payments imposed in various tribunal cases and the equivalent site payment values once increased by inflation from the date of the relevant decision to January 2024.

The MNOs are generally still quoting rental figures as determined by the tribunal cases for lease renewals and haven’t adjusted these for inflation so the amounts offered are inadequate and now below the equivalent level that is likely to be awarded by the tribunal.

Site payments for a lease renewal should reflect a consensual agreement rather than one imposed at tribunal. The table below outlines typical site payments being offered to landowners by operator’s agents.

Lease renewal site type

Greenfield

Rooftop

TABLE 1

Typical operator initial offer

£750 - £1,200

£1,500

However, landowners have rarely been willing to agree deals at these initial low levels. Operators have tried to incentivise landowners by offering a one-off capital payment or a series of payments, reducing the site payment over several years.

These payments are time sensitive, are not guaranteed and differ from operator to operator. Most consensual deals are being negotiated in excess of the operator’s initial offers, with payments being agreed within the following ranges:

Lease renewal Consensually Incentive site type

The tables highlight a large difference in what a variety of operators are initially offering and what can be achieved when a land agent is able to negotiate a consensual deal. Whereas the level of site payment is important part of any agreement care needs to be taken to agree the best overall terms for a lease renewal to future proof any agreement for the longer term.

The role of the land agent is crucial in achieving the best lease terms and higher site payments in a new code world where landowners have seen their rental incomes drastically fall. The operators should also cover any reasonable professional fees incurred for progressing a consensual lease agreement.

Pag e 14 | Energy Matters | Summer 2024 | galbraithgroup.com

- £4,000

agreed levels payments Greenfield £1,500 - £5,000 £2,000 - £7,500+ Rooftop £3,500 - £15,000 £4,000 - £15,000+

01334 659980

TELECOMS MARKET COMMENTARY

mathew.austin@galbraithgroup.com

Decision Type of Annual site Increase for property payment inflation to January 2024 EE Limited v William Ian Service Rural, no £950.00 £1,056.18 (Lands Tribunal for Scotland) housing CTIL v Fothringham Rural, no £600.00 £773.27 (£1,500 in (Lands Tribunal for Scotland) housing year of installation) Stephenson (Pendown Farm) Rural, £750.00 £826.05 no housing On Tower v Green (Dale Park) Rural, adjacent £1,200.00 £1,541.28 to housing On Tower v AP Wireless (Port Talbot) Industrial area / £2,020.00 £2,245.76 storage yard On Tower v AP Wireless (Huntingdon) £2,100.00 £2,334.71 Affinity Water Suburban £3,000.00 £3,608.02 residential, water tower CTIL v Marks & Spencer City, department £3,850.00 £4,734.22 store / offices CTIL v London & Quadrant City, residential £5,000.00 £6,422.02 rooftop

Rental slump threatens to disrupt mobile networks

Tensions between landowners and the telecom companies are causing some owners to look for other revenues, says

Mike Reid

Growing pressure by phone companies on the landlords hosting their masts is threatening disruption to UK mobile networks.

A rift over the reduced rental payments for the hosting of communications infrastructure is prompting landlords to consider redevelopment and an end to their agreements with the mobile phone companies.

Meanwhile, mobile charges remain high for business and individual customers despite progressively lower rental charges incurred by phone companies for siting their equipment.

Mobile connectivity in the UK has improved, although not as quickly as the Government anticipated when it introduced the 2017 Electronic Communications Code (ECC). In recent years, as firms invest in widening their networks and filling in geographical and system gaps, many landlords believe improvements have been made at their expense, as mobile phone companies significantly reduce rental payments but not charges for sharing sites to each other by the same degree.

Mobile phone companies are using the provisions of the ECC – aimed at digitising the UK economy – to reduce payments to landlords for the siting of mobile masts and associated equipment on their properties.

Landlords looking at their overall property portfolio now see the land occupied by telecommunications equipment as giving the lowest rental return. Combined with health and safety concerns and disruption caused by the mobile companies requesting 24-hour access to equipment, this makes redeveloping land for other purposes an attractive option to some landlords.

Whereas development, particularly in the urban fringe, used to work around the mobile mast

infrastructure, reduced rental returns have encouraged landlords to look at redevelopment options ignoring the presence of these sites as there should be the ability to terminate agreements should the site or land adjacent to the site be redeveloped.

Other factors prompting owners to consider moving their property away from mobile use include:

• The hassle of dealing with some mobile phone companies who consider the use of their site should take priority over adjacent uses of the land;

• Access to mobile sites being required 24/7 and the disruption that causes to adjacent occupiers, particularly when access protocols aren’t adhered to;

• Commercial investors are getting a nasty surprise on finding newly acquired property is host to telecom equipment as these rights don’t need to be registered against the title of the property;

• Landlords risk ‘falling between two stools’ –facing financial penalties because they’re unable to fulfil their legal obligations to make roof space available for both transmission apparatus and then fulfil their EPC requirements as space has been taken up restricting deployment of renewable-energy equipment, such as solar panels and batteries. With the expectation of receiving low rental returns from mobile phone masts, landlords are now looking to redevelop these sites where they can, one of the few reasons they’re allowed to terminate these agreements under the Code. I’ve seen a number of these cases in Scotland recently, and I believe that pattern is being repeated across the UK. Terminating sites which disrupts mobile networks signals bad news for the economy but looks to be an unintended consequence of the new Code. If rental levels weren’t reduced by such significant levels this issue could have been avoided.

mike.reid@galbraithgroup.com

07909 978642

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 15

Only connect ...but with minimal environmental impact

Planning guidance aimed at boosting digital telecommunications in both rural and urban areas is likely to have a big impact.

Cameron

Finnie

reports.

New rules have been unveiled to boost broadband and mobile connectivity across Scotland while protecting wildlife, heritage and the environment.

Planning Guidance on Digital Communications aims to safeguard populations and natural assets, at the same time encouraging investment in infrastructure such as phone masts and street cabinets.

Officials believe the planning system has a big role to play in filling connectivity gaps and removing barriers to digital access by easing delivery of services and technology improvements.

The long list of challenges faced by phone operators in this includes terrain affecting radio transmission, protecting nature and history, serving high-demand urban areas, dealing with landowners, and accessing sites and power connections. They must also navigate natural obstructions that weaken signals and obey radiation rules.

“Modern telecommunications and digital connectivity have a central role in unlocking the potential of our places across all of Scotland.. [allowing] people to be connected for business and social purposes at work, home or remotely, with greater demands on fixed and wireless communications,” according to the guidance, published on December 20.

Site location

The guide urges operators to ‘future-proof’ digital infrastructure, focusing on areas with no or low

connectivity and where there are benefits to communities, local economies and in reducing travel. They should:

• Share information with planners on other infrastructure in the local area.

• Minimise landscape, visual and amenity impacts, where possible using existing buildings, structures, sites and masts and taking into account heritage assets and landscape, safeguarded sites or environmental designations.

• Observe biodiversity principles to safeguard nature and nature recovery.

• Engage with planners, site owners and communities in pre-application discussions.

• Observe local development plans (LDPs) and the National Planning Framework for Scotland (NPF4).

• Demonstrate measures to minimise impacts, producing plans, design statements and visualisations and, where relevant, a declaration under ICNIRP, the international radiation body, and..

• Remove redundant apparatus.

We often find there is a lack of co-operation and co-ordination between mobile operators who propose new sites in close proximity to each other without properly investigating the opportunities to share sites. The 2017 Electronic Communications Code has granted the mobile operators significant powers to impose sites on landowners that it is often easier for them to progress a new site than share with each other. Operators are reminded not to obstruct airports

Pag e 16 | Energy Matters | Summer 2024 | galbraithgroup.com

and aviation, technical sites, or transmitter/ receiver facilities, observing minimum antenna heights. They must also provide protection against the adverse effects of non-ionising radiation.

The guidance further urges operators to:

• Share sites with others where practicable, as required by the Electronic Communications Code, minimising the number of sites required

• Install the smallest suitable equipment.

• Consider, for example, a slimline pole with antennas packed in a shroud for a new mast on a public road, instead of the usual lattice design with exposed antennas.

• Use ‘small-cell technologies’ such as microcells and picocells to improve capacity in urban areas or in using 5G technology.

• Hide or disguise equipment, unless existing equipment brings a slimmer design requiring less support equipment.

• Conceal antennas in flagpoles, telegraph poles or behind louvres in church towers.

Sometimes a new mast is the only practical option – to avoid unsightly clutter, a big height increase or radio interference, or where an existing mast is poorly sited or too short for good coverage or cannot cope with extra equipment.

Mitigation hierarchy

“

Operators should bear in mind the height, scale and style of equipment installed, especially where it may affect historic environment assets.

Cabinets housing support equipment should be located close to antennas, coloured to blend in and where appropriate, screened with landscaping or planting. The specification and colour for any compound fencing should be appropriate for the local environment, as should any security measures.

Operators should reduce the impact of access tracks for building and maintenance by ensuring they fit with field and vegetation boundaries and contours, address drainage issues, redress cuttings and banks with any vegetation stripped along the route. They should avoid harm to historic environment assets and use appropriate materials and greening of tracks.

There’s also a ‘mitigation hierarchy’, avoiding or minimising soil disturbance, avoiding deep peat, and using bog matting, low-pressure vehicles, floating tracks and cut batters to abate disturbance, while ensuring verges are quickly re-vegetated.

Impact minimisation

Operators should bear in mind the height, scale and style of equipment installed, especially where it may affect historic environment assets.

Consents in addition to planning permission and permitted development rights may also be needed, such as listed building consent.

Equipment installed on buildings or structures should be retain proportion, respect architectural style, minimise impact on roofline, important views and skylines, avoid clutter, use clean lines, maintain symmetry and be coloured to

Ways to lessen the impact of a new, groundbased mast include placing it near similar structures or adjacent trees, using a slimline, light-permeable lattice mast or colouring the structure to suit the sky or backdrop. s

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 17

correspond with the background or reduce contrast.

Demand is growing for infrastructure in urban areas due to increased call and data volumes and to facilitate the rollout of the 5G radio network, requiring significantly taller apparatus with greater visual and radio frequency impact. Here, operators are encouraged to site equipment in industrial areas and business parks, on commercial buildings, at traffic junctions, near main roads and on pylons and telephone exchanges.

In residential areas, operators should locate new equipment away from areas where the exclusion zones for radio frequencies impact residential properties and this is becoming more difficult as exclusion zones are larger for the 5G rollout.

Boosting mobile

A historic focus on population centres has left large areas and dispersed communities with little in the way of mobile coverage, while some large underpopulated areas host visitors and people travelling through on road or rail.

Both the Scottish and UK governments aim to boost mobile broadband in these areas through

“

Providing power to a remote location by installing new overhead and underground powerlines will usually impact the landscape.

the Shared Rural Network (SRN), to link computing devices embedded in everyday objects to the web. This will serve agriculture, tourism and emergency services, help monitor protected species and air quality, and enable drones. Inevitably, some projects are controversial and the overall geographical coverage targets don’t require the mobile operators to cover the full extent of any specific area but just a proportion of the overall UK landmass.

Therefore, even with new SRN sites deployed there are often large areas with no coverage so people in these areas won’t be able to rely on receiving mobile reception and will still need to deploy alternative measures for connectivity.

Scotland’s often rugged topography and lack of fibre infrastructure and masts can make line-of-sight between antennae difficult to achieve, while installing a power connection can be complex and costly.

This is heralding the use of taller masts and sites powered by renewable sources such as solar panels or wind turbines, potentially reducing the number of sites required in some sensitive landscapes.

However, these sites can have a significant environmental and visual impacts on the natural beauty which is often what attracts visitors to these areas.

Providing power to a remote location by installing new overhead and underground powerlines will usually impact the landscape, sometimes more than the mast sites themselves.

In forested areas powerlines require trees to be cleared and will sterilise wide corridors from forestry crops at a time where Scotland is looking to increase the percentage of tree cover across the country to help mitigate the effects of climate change.

The effects of overhead or underground cabling should be understood and mitigated if possible.

Any generator used to power a mast should be sited where it can be refuelled from a road or track and connected by cable to the base station. However, this won’t always be possible and some proposed SRN are so remote they are only accessible by helicopter.

Solar arrays can also be used, usually with a long-life battery and back-up generator. Renewable solar reduces carbon footprint and can negate landscape impact as it will need neither power lines nor underground trenching but this requires the mast sites to take up a larger land area potentially causing greater visual amenity impacts. Potential impacts on historic assets and places need to be balanced against the benefits that increased coverage brings. Any detrimental effects should be minimised, if possible, but some proposed sites just aren’t suitable and shouldn’t be granted planning consent.

Having been involved in over 150 potential new sites for the SRN alone Galbraith have a wealth of experience in advising landowners on mobile phone mast site locations and design.

cameron.finnie@galbraithgroup.com

07824 591262

Bigger blades raise oversail issues

As wind turbines get bigger, they’re getting trickier to move into place. Rose Nash says landowners should know their rights.

It’s something of an understatement to say that wind turbines are getting bigger. Larger turbines are more efficient as the larger rotor diameters sweep more area, capture more wind and produce more electricity.

The race is on to build a 20MW turbine although it may be some time before we see this size in the UK.

The largest operational wind turbine is the GWH252-16MW model at the Zhangpu Liuao Phase 2 offshore wind farm in the southeastern Fujian Province in China, and came online in July 2023. This 16MW installation has a rotor diameter of 252 metres and a swept area of around 50,000 square metres – the equivalent of seven football pitches. The hub is 146 metres high – as tall as a 50-storey building.

Whereas planned onshore wind turbines in the UK are around 6MW, the Chinese manufacturer Goldwind has developed a 12MW onshore turbine, so the scale of turbines is likely to increase further.

Pag e 18 | Energy Matters | Summer 2024 | galbraithgroup.com

s

While size brings obvious advantages in power generation and efficiency, transporting the structures to their installation site requires intricate planning by wind farm developers. The route often requires wind turbines to either ‘oversail’ or overrun third party land. Oversail happens when a turbine swings across the air space of land owned by third parties, while overrun is where the delivery vehicle’s wheels run over land owned by a third party outwith the boundary of the adopted public highway.

It is imperative that these rights are secured by the developer before access is taken, to enable the project to progress.

Landowners affected by these transport considerations are normally paid for the rights across the land to facilitate the development but they need to be sure to receive an appropriate payment, and avoid giving away rights unnecessarily, so they retain the ability to agree terms with another developer who may need to access the same area.

Developers may offer to either purchase the land outright, take a servitude (agreement in perpetuity) or lease over areas of land required for this purpose.

agreement. If the land is to be leased, any contract should properly reflect the specifics of the wind farm development.

A few key points to consider when evaluating such an option are:

• The extent of the rights to be granted and where those access rights should benefit;

• The term of the lease and appropriate break rights;

• What area should be leased and what rights should be granted by ancillary rights of access;

• The value of the access rights should be linked to the benefit of the project facilitated by the rights of access not the value of the land crossed for the overrun or oversail;

• The lease should reserve rights for the landowner to grant access rights to other developers without requiring consent from the current developer.

Securing the correct agreement can provide a good income if your land is situated at a pinch point on a transport route. We recommend that early advice is taken from your land agent and other advisers to ensure the best possible return.

Any landowner approached by a developer should seek advice before entering into any rose.nash@galbraithgroup.com

Operators should bear in mind the height, scale and style of equipment installed, especially where it may affect historic environment assets. “

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 19

07342 053317

How to handle requests for access to your land

They say your home is your castle, but, asks Larry Irwin, how do you protect yourself from those seeking to access your land and property?

A significant increase in infrastructure and development projects across Scotland and the UK means the demands and obligations being placed on landowners are expanding.

More and more developers seek access to land and property to undertake surveys and plan for future project construction.

At Galbraith, we are approached regularly by landowners concerned about what to do when faced with such approaches and what they can do to protect themselves.

Here is a quick guide to the circumstances a landowner may face and how to handle such requests.

The most common approach made to landowners is for access by infrastructure and utility providers, such as water, electricity or telecoms operators. Each of these has statutory rights which they seek to rely on to gain access for the purposes of maintaining existing installations or seeking surveys for new installations.

It is important to know the differences and whether access for an existing site is already governed by a lease or wayleave and the terms contained therein. If seeking a new site, there are different requirements to follow; these companies cannot simply turn up unexpectedly and expect to be granted access.

A good example can be seen following the Scottish Government announcement of proposals for the construction of significant new transmission lines across large parts of Scotland by SSE and Scottish Power.

These companies have authority under the legislation to delivery nationally important infrastructure; but they must still approach affected landowners in advance of proposals to set out what they may require and, most importantly, what provisions they will put in place to protect the landowner from damage. This should also address how any damage they may cause as a consequence will also be compensated.

Unfortunately, things can and do go wrong. The terms of any access agreed become important since the consequences may not affect only the party seeking access but the landowner too. For example, vicarious liability for wildlife or environmental liability under the Scottish Environment Protection Agency.

Before any access is undertaken, there should

therefore be sufficient opportunity for negotiations to agree an access protocol. This should address all practical and foreseeable issues resulting from the access being proposed. Talks should also consider the nature of the land use already in place, the physical impact on the access tracks and the timing and duration of access. They should also seek to cover key security aspects, especially where agriculture is concerned.

Bio-security remains a hot topic. With challenges faced by all farmers, the livestock sector faces the most immediate threat of disease transfer. The last outbreaks of bird flu were in December 2023, and concerns remain over possible outbreaks of swine flu in Europe. The last foot and mouth outbreak, in 2003, resulted in devastation across UK farms.

Arable operators also need to remain extra vigilant, given the potential ease of spreading diseases such as PCN and clubroot from transfer of soils, which have long-lasting impacts to future cropping.

As demands for access continue to become more challenging, competition for occupation means landowners may not be willing to voluntarily provide access. This is where utility companies can rely upon statutory rights under their respective legislation, such as the Electricity Act 1989 or Water (Scotland) Act 1980. These contain processes for such companies seeking entry even whne an owner is reluctant to grant it. It is therefore vital to address requests for access as early as possible and in as much detail as possible, to protect your land and property against unwanted consequences.

CASE STUDY

An incident occurred earlier this year with a telecoms contractor taking access to a remote mast site with an inappropriate vehicle for the condition of the access route. The vehicle was damaged while taking access and the resulting oil leak nearly caused environmental contamination into a nearby watercourse.

Concerningly this event wasn’t notified to the landowner who came across the abandoned vehicle by chance and was able to help mitigate the impact with their own oil spill kit.

Steps are now being taken to clean up the contamination from the access track.

Pag e 20 | Energy Matters | Summer 2024 | galbraithgroup.com

532146

07795

larry.irwin@galbraithgroup.com

Make sure the price of access is right

Approached about a development on your land? Seeking expert advice can increase financial payback, say Philippa Orr and Mike

Reid

What unites utility providers, renewable developers and telecommunication operators?

They all need to access other people’s property to carry out their work –whether it’s to install pipes, cables, solar, turbines, batteries and other equipment. There are a number of ways this can be done – through wayleaves and servitudes, statutory notices, option and lease agreements or land sales.

It is important that all landowners know that they can seek a land agent’s advice before agreeing to one of the aforementioned options.

If we look at an approach by a renewable energy developer, the initial rental figures being offered will likely be appealing, probably more so than growing cereals or grazing livestock. However, more often than not, the originally offered headline figures will be lower than the market numbers.

At Galbraith we have experts in all aspects of possible land approaches and we know where the market is at for renewable projects, utility approaches and temporary compounds, to name a few. Our recommendation, should you be approached, is that you speak to us, especially before signing any agreement.

A landowner may focus on a headline figure, be it the renewable rent or the

acquisition price, but there are a lot of other commercial figures that should also be taken into consideration when looking at these agreements. If we take renewable heads of terms (HoTs), there are other commercial payment figures that also need to be taken into

We were able to agree the oversail at more than five times the original offer.

consideration, which include but are not limited to, option payment, extension payment, exercise payment, planning success fee and acquisition fee. We expect to see these commercial figures in all HoTs but they are not always in the first version that a developer would want a landowner to sign up to.

The commercial terms offered should be at the market level, but it is also important to think about how one project may impact another, and the requirement to keep back certain rights and restrictions on what a developer, operator or utility company is allowed to do.

in recent cases we have been able to

increase commercial figures significantly.

Some years ago, we assisted a landowner with agreeing initial HoTs for a battery energy storage system (BESS). The landowner was approached by the developers to extend the scheme but did not involve us in renegotiations for the expanded site as he had the figures from the last time. However, in only two years, BESS rents had significantly increased as the technology became more popular with renewable developers.

Hearing me speak at Galbraith’s Annual Farming Seminar, where we discussed current renewable rents, the client realised his rental was lower than the market rate due to the time passed. Galbraith were then instructed to renegotiate the HoTs for the extended site and we were able to double the rent.

We also have a significant database providing comparable evidence and this has added value for clients. One owner was happy to accept a nominal offer by wind developer for an area of oversail, then, on seeking our advice, realised the offer was significantly less than what Galbraith have agreed elsewhere. We were able to agree the oversail at more than five times the original offer. At Galbraith we have the knowledge and resources to advise on different approaches to make sure landowners get what is due to them, whilst allowing protection and future proofing agreements. In most cases, the developers, operators or utility companies would pay for landowners and legal fees so it would be prudent for landowners to seek advice before agreeing to grant access, and we would be more than delighted to assist.

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 21

07917 220779 philippa.orr@galbraithgroup.com

07909 978642

“

mike.reid@galbraithgroup.com

Putting green hydrogen to the test at farm scale

Hydrogen is emerging as a key factor in decarbonising UK energy supply, but you don’t yet hear much of how this gas could be produced commercially on farms. Larry Irwin reports.

Could hydrogen become a viable alternative to fossil fuel use in agriculture? A recent workshop helped to answer the question.

It was organised by the James Hutton Institute, which is conducting research on its hydrogen project at Glensaugh Farm, Fettercairn.

The session, which I attended, brought together different stakeholders in the energy sector and the wider community to understand how how farm-scale hydrogen could be more widely produced.

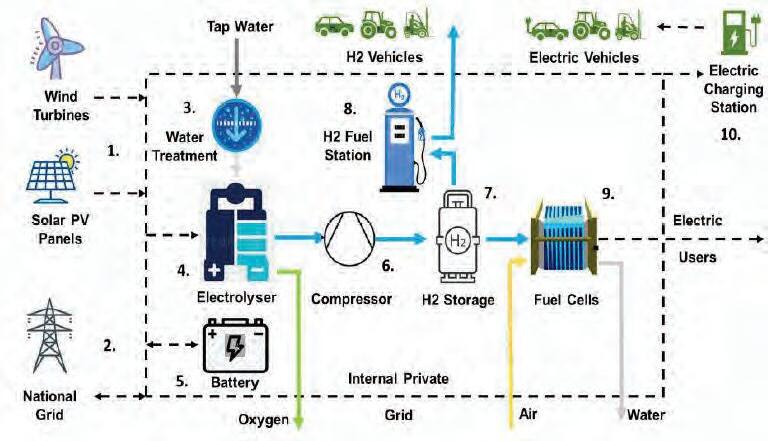

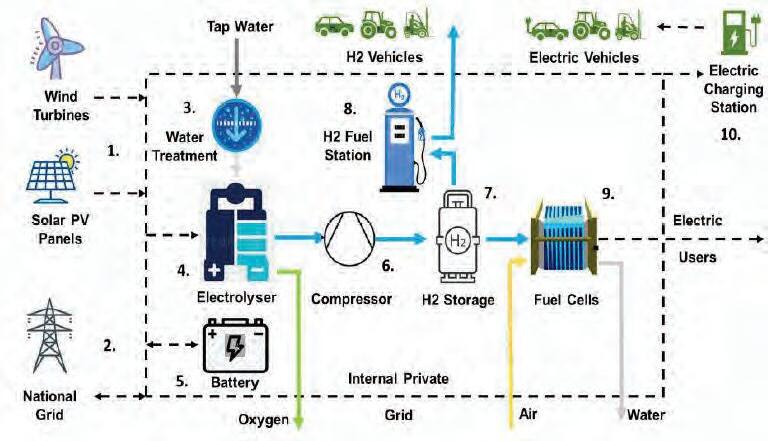

The Glensaugh Farm project –dubbed Hydroglen –aims to harness renewable energy generated by wind turbines and solar panels to create hydrogen.

A major issue is how hydrogen generation can be made commercially attractive to users of fossil fuels to help the transition to green energy. While there are many challenges to overcome for hydrogen to become mainstream, I was encouraged by the ambition of the HydroGlen project to develop a hydrogen model that will enable others to learn from their development process and use collective experiences. The viability of mainstream hydrogen production is likely to be determined by economies of scale. Mass development of the supply chain and technology is necessary to allow farms and estates to convert the generated electricity into hydrogen for onward use, to power vehicles and equipment or for transmission into a pipe network.

Such economies of scale will only be achieved with a combination of Government support and policy and a willingness to take a chance in the early stages to adopt the technology, to promote the sustainability and energy security we need. However, at farm scale, if the technology was available and affordable, it could provide a solution which enables farms and businesses to

KEY COMPONENTS OF THE HYDROGLEN SYSTEM

Pag e 22 | Energy Matters | Summer 2024 | galbraithgroup.com

Glensaugh Farm, Fettercairn, where the James Hutton Institute is conducting research on farm-scale hydrogen production.

insulate against fluctuating global energy prices – a key metric for maintaining sustainable cropping and food production.

At the moment the competition between electric and hydrogen power seems to be a bit like that between Beta-Max and VHS in the days of video tape. Only with hindsight we will be able to tell which technology will win through.

Currently the mainstream is on EVs and electrification of the grid. But chemical batteries have their own challenges to overcome and rely on energy from the grid, which highlights the additional options for hydrogen which can support the energy storage sector as it also offers flexible solutions.

larry.irwin@galbraithgroup.com

532146

07795

At farm scale, the technology could enable farms and businesses to insulate against fluctuating global energy prices.

When trees must make way for energy projects

Compensatory planting limits the environmental impact of renewable-energy developments. Cameron Main reports.

The subject of compensatory planting hit the headlines when it emerged some 16 million trees had been felled to make way for wind farms in Scotland.

The Scottish Government came in for criticism over how the policy worked in action.

However, there is a trade-off to be had between the public’s attachment to long-standing woodland cover in traditional areas and the requirement for updated facilities and renewable energy-generating assets that will aid our transition to a net-zero economy. When permanently removing woodland to make way for infrastructure, developers are obliged under strict planning conditions to plant an equal area of trees in either a single or multiple suitable locations, so the net loss of overall woodland cover is negligible. This is called compensatory planting as the new area of trees compensates for the trees lost as a result of the development. The suitable area search has recently been extended Scotland-wide and not just locally, allowing greater flexibility to find a site that is wholly suitable.

Technology has also played a part as, instead of clearing an entire forest for a new wind farm, turbines can often now be ‘keyholed’ into the woodland due to their larger size and clearance from the tree canopy, creating an open area around the tower and reducing the need for compensatory planting. However, there still needs to be a suitable clearance between the trees and the turbines to maximise the efficiency of electricity production and for bat foraging areas and other requirements.

Designing new telecom sites for the Shared Rural Network is challenging with sites often being in remote locations where obtaining a mains power connection isn’t cost effective. Alternative power sources are required and these can include solar panels. When considering the development of a solar array the telecom operator will want to keep a large semi-circular area cleared of all vegetation, including trees, to allow the solar panels full access to sunlight from the east, south and west, maximising their efficiency. If trees need to be removed this also can trigger a compensatory planting requirement.

The question of how we determine the suitability of an alternative site for woodland planting is an interesting and complex topic. Tree planting for a compensatory planting obligation won’t be eligible for grant aid and premium payments are offered to secure these planting sites.

Galbraith is at the forefront in negotiating for landowners who have been approached by developers looking for compensatory planting sites. If you have been approached, please feel free to contact one of our specialists to discuss your options.

cameron.main@galbraithgroup.com

07342 093477

galbraithgroup.com | Energy Matters | Summer 2024 | Pag e 23

“

Is Scotland’s high-speed broadband roll-out on track?

Digital connectivity has become one of the most crucial pieces of national infrastructure. Edward Fletcher reports on progress.

Service industries are extremely important to the UK economy, and increasingly much of this work is undertaken away from the office, so this sector is very reliant on quality, reliable electronic communications.

Sectors such as accountancy, law, marketing and consulting account for 81% of total UK economic output, while 40% of working adults carry out their duties from home at some point during an average week.

Therefore, delivering superfast broadband to premises across the UK is a strategic priority for both the Westminster and Scottish governments.

The Scottish Government’s flagship digital connectivity initiative, the Reaching 100 programme (R100), initially aimed to deliver fast broadband (speeds of at least 30Mbs) to every home and business in Scotland by 2021. Currently about 96% of premises have access to a 30Mbs+-

capable network, while 74% are within reach of much higher-gigabit speeds.

The second phase of the project is to deliver access to a gigabit-capable network to a further 114,000 premises by 2028. Work on this is currently taking place across three areas – North Scotland and the Highlands, Central Scotland and Southern Scotland.

That is the objective, but how effectively is it being met?

The First Minister’s most recent update, on January 18, claimed that an extension to R100 had so far connected ‘more than 36,100 premises’ with the remainder being planned between now and 2028.

So at first glance, the project appears to be making good progress towards the 2028 goal. However, it is notable that Scotland remains behind the rest of UK in terms of new fibre connections.

According to a ‘State of Fibre’ report by the telecoms research firm Intelligens Consulting, full fibre coverage has recently increased from 29% to 36% as of January 2023. In contrast, the UK average for the same period rose from 33% to 41%.

It remains important to critically evaluate the progress figures being issued by the Holyrood Government. “

Pag e 24 | Energy Matters | Summer 2024 | galbraithgroup.com

Further, some confusion arises when the First Minister’s latest comments are checked against the Scottish Government’s Digital Scotland website, which says more than 42,000 premises have now been connected.

The discrepancy is because the figure reported for the total R100 build also accounts for the impact from contracted build, overspill and vouchers. The voucher scheme provides funding up to £5,000 for households and businesses not covered by R100 contracts or planned commercial investment.