Annual Report 2017-2018

EXECUTIVE REPORT

Annual Report 2017-2018

EXECUTIVE REPORT

Welcome to the inaugural annual report of City Rail Link Limited (CRLL), which commenced operations on 1 July 2017.

When the New Zealand Government and Auckland Council agreed to jointly fund the City Rail Link (CRL) project, it signalled to all of New Zealand that building this transformational project is fundamental to meeting the demands of Auckland’s population and transport growth and moving the economy forward.

In the past year we have covered a lot of ground. As we close our first year of operations as a new organisation, we reflect on the journey that the past year has been and the successes and challenges we have faced as we strive to deliver a project that meets the needs of our sponsors and a growing Auckland.

Progress on the CRL – which started construction in 2015 –hasn’t stopped while CRLL has been in formation. Business as usual to deliver on the project has continued at the same time as we have done a great deal of work to restructure and create a single entity and identity. Following the departure of Chris Meale, CRL’s inaugural project director, we have also recruited a CEO to deliver on our Statement of Intent and our Statement of Performance Expectations.

Our programme for delivery has been challenged in the face of a dramatically changing market. Infrastructure pipelines are at an unprecedented level to cope with exponential growth both here and overseas, and capacity to deliver the work is stretched. Locally, this has been exacerbated by financial difficulties within the construction industry, which have seen the withdrawal of a preferred bidder for our largest contract package (C3 – stations and tunnels).

However, in the face of an extremely difficult market climate, CRLL has worked very hard to remain competitive and attractive to do business with, and we now have two world-class consortia with a wealth of experience shortlisted to deliver this major contract. We remain on track to have the CRL operational by 2024

Our construction programme has made significant progress in the past year. Highlights of that programme have been the start of bulk excavation and construction of the first tunnel box sections on Albert Street and completing the structural support

of and preparation for the engineering feat that is the weight transfer of the Category 1 listed Chief Post Office building. The Mt Eden C6 contract for stormwater diversion is also underway.

We are always mindful that the construction of the CRL is taking place in the middle of busy urban environments and that it is creating significant change for Auckland. We take our responsibility to be a good neighbour and keep the city thriving very seriously and we’ve been working hard to take Aucklanders and our local residents, businesses and visitors along on this journey of transformation.

During the past 12 months we’ve worked closely with contractors, Auckland Council, the business community and residents to find innovative ways to manage the impacts, keep Auckland operating as usual and, importantly, keep people safe.

Campaigns like ‘Eat Albert Street’ and ‘Wednesdays on Wellesley’ have proven successful ways to encourage people to participate in the activation of changed spaces throughout the city.

We are also proud that CRLL is leading the way in New Zealand to deliver sustainable infrastructure. The Infrastructure Sustainability Council of Australia sets the benchmark for designing, building and operating sustainable infrastructure. The CRL project is currently the only New Zealand infrastructure initiative that holds a ‘Leading’ rating under its framework for Infrastructure Sustainability, and we couldn’t be any prouder of the work we are doing to set the standard in this space.

Building this transformational project is fundamental to meeting the demands of Auckland’s population and transport growth and moving the economy forward.

We’re a world-first in integrating cultural values within that framework, we’re targeting zero waste to landfill, we’re focused on measuring and reducing our carbon footprint and we’re committed to delivering better social outcomes through our procurement models.

Our challenge in the next 12 months is to build on the work we have done in the past year and push ourselves to achieve even more in our delivery, procurement, communications and engagement and sustainability programmes. The health and safety of our workers and the public will always remain our number one priority.

By the end of the next financial year all of our contracts will have been let, including our largest contracts for constructing stations and tunnels (C3) and delivering all our underground rail systems (C7).

We’ll be part of recently formed construction alliances to deliver these significant works collaboratively and will continue to work with our other partners on the ‘design and construct’ contracts to deliver the project in full.

Construction across the city will be unprecedented as the remaining CRL contracts come on stream, and our challenge will be to continue to bring the city along with us as we get Auckland on track to a better future.

Lastly, we acknowledge that the achievements of the last year reflect the achievements of many current and former staff. In this regard, we would particularly like to acknowledge Chris Meale as both the initial project leader within Auckland Transport and the first chief executive of CRLL, who guided the project through its establishment phase prior to his retirement.

Sean Sweeney Chief Executive Officer City Rail Link Limited

Sir Brian Roche Board Chair City Rail Link Limited

Chair - Sir Brian Roche

Sir Brian is involved with a number of boards in the public and private sectors. Prior to his governance roles he was the Chief Executive of the New Zealand Post Group. He has been involved in a number of infrastructure projects.

He has a Bachelor of Commerce and Administration from Victoria University of Wellington and is a Fellow of the Chartered Accountants Australia and New Zealand.

Karen Jordan immigrated to New Zealand in 2015 from the UK, where she had been with the Ministry of Defence as Director of Contract Management, responsible for improving capability in a multi-billion-pound procurement and investment programme. Prior to that she worked with British Gas and then National Grid PLC in the commercial operations and construction of national energy infrastructure. Karen has held a number of non-executive roles for Departments of State, including Board Director and Audit Committee Chair of the British Cabinet Office. Karen is currently an Independent Member of the New Zealand Defence Force Audit and Risk Committee and the Nelson Lawyers Standards Committee.

Russell Black is a civil engineer with extensive client delivery management experience on major infrastructure projects, predominantly urban and underground railways in Hong Kong, Singapore, London, and China. He provides client governance and consultancy services to Australian urban rail projects.

Anne Urlwin is a professional director and chartered accountant with a wide range of governance experience, including in the infrastructure and construction sectors. Her current roles include directorships of Chorus Ltd, (including its subsidiary Chorus NZ Ltd), Steel & Tube Holdings Ltd, Summerset Group Holdings Ltd, and she is Deputy Chairman of Southern Response Earthquake Services Ltd. She was formerly Chairman of national commercial construction group Naylor Love and has served on a number of central and local government entity boards.

Brian Harrison has a legal background with extensive domestic and international experience advising corporates, financiers, multi-laterals and government bodies on major projects and infrastructure in a broad range of sectors, including rail, road, aviation, ports, property and public-private partnerships. His roles have included managing and executing complex projects with responsibility for overall corporate structures and governance, procurement and contract negotiation, capital and debt structuring and analysis and advice on execution and risk allocation.

Auckland is a successful and rapidly growing city.

Each year, about 45,000 extra people call Auckland home.

With a population of 1.6 million, it is projected to receive 55% of New Zealand’s total growth in the next decade, taking the city’s population to two million by 2028.

Between 2003 and 2017, public transport patronage increased by 63% –more than double the population growth.

The CRL is a priority project in a $28 billion 10-year transport improvement plan signed off by the Government, Auckland Council and Auckland Transport to cater for this projected growth and keep Auckland moving.

The region needs a resilient, sustainable and modern public transport system that provides more choices and better access to places people need to be.

The CRL, the largest transport project ever undertaken in New Zealand, is an integral part of that solution.

The growth of the rail system, including increases in train frequency, is constrained by its dead end at the Britomart Transport Centre, which limits the entire network’s capacity.

The CRL will turn Britomart Station into a two-way through station that extends the existing rail line through Auckland’s CBD to connect with the Western Line at a redeveloped Mt Eden Station via two new underground stations at Albert Street and Karangahape Road.

The CRL will enable more than double the capacity across the entire Auckland rail network and improve connections with other modes of transport, including busways, light rail and ferries, to create an integrated public transport system that keeps people moving.

Congestion is costing the city $1.3 billion each year. The CRL will help to ease congestion by providing commuters with a viable alternative to driving on Auckland road. In addition, the projected journey time savings will bring twice as many people within 30 minutes of the city centre, Auckland’s biggest area of employment.

The CRL is a significant transport infrastructure project that will enhance the capacity and performance of Auckland rail services, improve public transport outcomes and add to the quality of life in the region.

The project comprises a 3.45-kilometre double-track underground rail line that will run from a redeveloped Britomart Station and under Auckland’s CBD via new stations at Albert Street and Karangahape Road to connect with the existing Western Line at a redeveloped Mt Eden Station.

It also includes other associated works to maximise the benefits of the CRL and the efficiency of the rail network.

• Improving transport access into and around Auckland’s city centre

• Improving the efficiency and resilience of the transport network of urban Auckland

• Significantly contributing to lifting and shaping Auckland’s economic growth

• Providing a sustainable transport solution that minimises environmental impacts

• Contributing positively to a liveable, vibrant and safe city

• Delivering the CRL project with a ‘best for Auckland’ approach.

Project scope

Start date XX

End date XX

Twin 3.45km rail tunnels 42m underground between Britomart and Mt Eden stations

Two new underground stations near Aotea and Karangahape Road

Redeveloped Mt Eden and Britomart Stations

New rail transport growth statistics suggest that, by 2035, CRL stations will need to cope with 54,000 passengers an hour at peak travel times, rather than the original

With trains running in both directions through Britomart Station, the CRL will remove the existing constraints on the network and enable it to more than double

Aucklanders will have new, best-in-class stations and a rail service that benefits the entire transport network for decades to come.

It will also improve travel options and journey times. The addition of two new, modern CRL stations on the network will improve connectivity and journey times for many passengers. From the redeveloped Mt Eden Station it will take only three minutes to get to the new uptown Karangahape Station, six minutes to the new mid-town Aotea Station and nine minutes to the redeveloped downtown Britomart Station.

In this way the CRL will provide a massive step-change in the rail system and close a significant gap in customer service levels, better matching public transport demand and supply.

However, the CRL is about more than improving public transport provision. It will also be a catalyst for urban development to support the future demands of our growing city. The new CRL stations will attract development opportunities that will help to shape a more vibrant and safer city with more homes and better amenities.

When the CRL is in place, up to 54,000 passengers an hour

will be able to travel by train into the CBD at peak times. That extra capacity is the equivalent of 16 extra lanes of traffic or three Auckland Harbour Bridges.

It will also help tackle Auckland’s traffic congestion issues – which cost the economy an estimated $1.3 billion in lost productivity each year – by providing a viable transport alternative to using private vehicles.

The CRL will drive growth right across the construction industry and will be employing about 1,600 people at the project’s construction peak. There will then be an ongoing demand for workers to keep the CRL underground network operational.

CRL’s extra capacity is the equivalent of 16 EXTRA LANES of traffic The

The project’s key construction activities comprise eight contracts, of which four (C1, C2, C6 and DSC) are underway. Where relevant, the expected milestones agreed in the Project Delivery Agreement (PDA) have been included in the information below and the progress up to 30 June 2018 for each contract is noted. The PDA originally contemplated Design and Construct contract models for each of the contracts. The C3 and C7 contracts were changed to Alliance contracts to reflect a review of the procurement strategy and a change in market conditions.

C1 Being delivered by Downer Soletanche Bachy Joint Venture

Creation of temporary Britomart station passenger facility and construction of tunnels from below Britomart Station to the former Downtown Shopping Centre (DSC) site. The programme of work is on track within the originally contemplated programme, with excavation about to commence, and completion scheduled for July 2020.

Milestone Commence Complete

Target Delivery Date Underway June 2020

C2 Cut and cover contract being delivered by Connectus (McConnell Dowell/Hawkins) Joint Venture

Trenching and tunnelling from the DSC site (corner Customs and Albert Streets) to the Wyndham Street intersection on Albert Street and the pipe-jack contract for the relocation of the stormwater main on Albert Street and strengthening the Ōrākei Main Sewer that intersects it. The work is running behind programme, having been affected by unforeseen technical issues in relation to the site. However, the delay is not affecting the critical path of the project. CRLL’s exposure is capped, as this is a fixed-price contract.

Milestone Commence

Complete

Target Delivery Date Underway August 2019

C3 Main stations and tunnels contract (currently out to tender, award expected April 2019)

Mining tunnels from just south of Wyndham Street to the North Auckland Line at Mt Eden, building two new CRL stations (Aotea and Karangahape) and redeveloping Mt Eden Station.

Milestone Commence Complete Contract Award February 2019 March 2019

Testing & Commissioning June 2023 March 2024

Target Delivery Date March 2024

Following the withdrawal of a tenderer, a decision was made to move to a competitive alliance process. This will see a successful bidder identified by May 2019, and the process remains on track to the revised timetable.

Connection of tunnels to existing North Auckland Line live rail corridor environment.

Milestone Commence Complete

Contract Award January 2019 March 2019

Target Delivery Date January 2024

C6 Being delivered by March Bessac Joint Venture

Stormwater line replacement in Mt Eden, prior to start of C3 and C5 works. The contract has been awarded and actual physical works are scheduled to commence quarter 1 of the 2019 financial year.

Milestone Commence Complete

Contract Award September 2017 February 2018

Target Delivery Date February 2018 February 2020

C7 Linewide systems contract (preferred alliance identified, to be awarded October 2018)

Rail systems integration, testing and commissioning from Britomart Station to Mt Eden Station.

Milestone Commence Complete

Contract Award February 2019 March 2019

Testing & Commissioning October 2023 March 2024

Target Delivery Date March 2024

Following the appointment of the CRLL Board, a review of the CRL’s procurement strategy was undertaken and a decision made to move to an alliance-based contract for C7. The Interim Project Alliance Agreement was entered into in October 2018.

C8 Wider network improvements at The Strand and Ōtāhuhu Station, delivered by KiwiRail and Auckland Transport.

Simplifying train access to The Strand stabling facility by realigning tracks and adding a track cross-over point and providing a new platform on a loop track off the main line at Ōtāhuhu Station.

DSC Being delivered by Precinct Properties

Construction of the CRL tunnels below the Commercial Bay retail and tower development site. The work is running behind programme, the schedule having been affected by the above-ground works being undertaken by Precinct. However, the delay is not affecting the critical path of the project.

Milestone Commence Complete

Target Delivery Date Underway January 2018

This section describes the 2017-2018 progress made towards achieving the identified performance measures included under CRLL’s three output areas, as outlined in the Statement of Performance Expectations.

CRLL will report on its performance against the delivery milestones to the Sponsors under the PDA.

Achieved - refer page 14 for further information

Milestone reporting as per the PDA

A revised Health and Safety Management System will be completed and approved by the Board by the end of quarter 2 of CRLL’s financial year (1 July to 30 June).

Commence negotiations on partial surface and construction occupation acquisitions by the end of quarter 4 of CRLL’s financial year.

Achieved – negotiations well advanced with actual acquisitions scheduled for 2018-2019

This section of the Statement of Performance describes the 2017-2018 results against the appropriation – Auckland City Rail Link (Non-Departmental Capital Expenditure).

* The Crown is a 51% shareholder of CRLL and funds CRLL on 50:50 basis with Auckland Council. The Crown and Auckland Council fund CRLL by subscribing to equity in the company.

** CRLL is in the first year of financial reporting, thus no comparatives are available.

* The Crown provided an amount of $93,275,122 by way of a capital contribution to CRL.

** CRLL is in the first year of financial reporting, thus no comparatives are available. An explanation of the variances from budget can be found in note 13 of the financial statements.

Percentage of activities that are delivered to agreed standards and timeframes. Progressing as per Schedule 5 of the PDA - refer pages 14 and 15 where the activities are described.

* CRLL is in the first year of reporting and thus no comparatives are available.

Bulk excavation of the CRL’s cut-andcover rail tunnels starts under Albert Street. It will be dug to 18 metres at the deepest (southern) point, using long-reach excavators above ground and smaller machinery inside the reinforced trench.

The first concrete is poured for the CRL tunnel box in Albert Street, following the removal of 30,000 cubic metres of soil and rock and the diversion of about eight kilometres of utility pipes.

The sodium bentonite plant is set up on Lower Queen Street to produce the slurry that will be pumped into the trenches being excavated for the diaphragm walls, to keep the surrounding earth stable until steel-reinforced concrete can be added in its place.

The concrete pour for the 64th and final diaphragm wall is completed in Britomart Station’s Chief Post Office. The walls are required to support the CRL tunnel excavation under Britomart Station.

A second pedestrian bridge opens at Swanson Street, affording a great view of the CRL works happening below Albert Street.

Construction begins on the first section of the Albert Street tunnel box.

‘Sandrine’, the 90-tonne compact hydrofraise piling rig, starts work, digging the 15-to 20-metre-deep diaphragm walls that will form the structural support for the CRL tunnels under Lower Queen Street and Britomart Station’s Chief Post Office building.

The CRL’s Mt Eden stormwater realignment contract kicks off with the demolition of two CRL-owned buildings. This paves the way for construction of the 15-to 17-metredeep shafts that will launch and receive the mini tunnel boring machine that will pipe-jack the replacement 420-metre stormwater line.

The last reinforced-concrete deck slab is poured for the traffic bridge at the Customs/Albert Streets intersection. This protects utility services and allows traffic and pedestrians to continue using the intersection when the CRL tunnels are constructed underneath.

The first load transfer of a section of Britomart Station’s Chief Post Office building is completed. The weight of the heritage building is being progressively moved onto structuralsteel underpinning frames to allow CRL tunnels to be built underneath.

The Albert Street trench excavation reaches the halfway mark at the southern end.

In the Albert Street trench, the fifth wall of the CRL tunnel box is poured (bringing the total length of wall completed to 60 metres) and the formwork for the first section of the tunnel box roof is prepared.

The vision for the CRL is that it will be designed, constructed and operated to the highest sustainability standards and will set the benchmark for delivering sustainable infrastructure in New Zealand.

1. Reducing resource consumption, taking a whole-of-life-cycle approach to resource efficiency and measuring the CRL’s carbon footprint

2. Sharing Auckland Council’s aspirational goal of zero waste to landfill, with a focus on designing out waste and avoiding waste generation through construction

3. Benefiting the community of Tāmaki Makaurau through employment, workforce development, supply chain diversity and supporting our future workforce

4. Ensuring good governance, with rigorous reporting and the use of the independent Infrastructure Sustainability (IS) rating framework

5. Supporting Mana Whenua outcomes through delivering on the principles of kaitiakitanga (guardianship).

A focus on reducing resource consumption and optimising the carbon footprint during the design and construction planning for Contracts 1 and 2 resulted in a projected reduction in materials, energy and water footprints compared to business as usual. As construction progresses, both contracts are on target to reduce carbon emissions related to materials and energy use even further than projected.

Water savings have been more modest than projected, mainly due to unforeseen high use at the start of construction. Improvement in the past 12 months, along with planned initiatives to re-use water on site, means that savings are anticipated to improve.

As of 30 June, more than 132,000 tonnes of spoil, construction and demolition waste have been diverted from landfill. Current diversion figures are 98% for construction and demolition waste and 94% for spoil. Although Auckland Council’s aspirational goal of 100% diversion has not been achieved, the project has been able to divert very significant quantities of waste from landfill and still aims to exceed the demolition and spoil waste targets of 90% and 95% respectively.

CRLL has a Social Outcomes Strategy focused on training and employment outcomes for those experiencing barriers, disadvantage or discrimination in the labour market, promoting supply chain diversity and supporting our future workforce.

This past year has seen CRLL forming, developing and strengthening relationships with Mana Whenua, government agencies, community groups and education providers to address skill shortages so that its future workforce is ready when jobs become available.

There is no New Zealand sustainability standard for infrastructure, so CRLL is using the independently verified Infrastructure Sustainability Council of Australia’s Infrastructure Sustainability (IS) rating tool to measure sustainability performance. To date a ‘Leading’ IS Design rating has been achieved for Contracts 1 and 2, ahead of the ‘Excellent’ originally targeted, and both contracts are tracking well to deliver on the as-built rating at the end of construction. Sustainability has also been included in the procurement activities undertaken in the past year for the remaining contract packages, with CRLL evaluating tenderers on sustainability criteria, including social outcomes.

CRLL has continued to work closely with Mana Whenua to ensure that sustainability criteria are compatible with te Ao Māori (the Māori world view). This work, embedding cultural values across the IS framework, has led to the creation of a custom-made CRL technical manual for sustainability, titled Mahi Rauora Aratohu.

Converting Britomart Station from a dead end to a through station has provided an opportunity for CRLL to contribute to cultural sustainability by conserving the built heritage of the historic Chief Post Office building and literally digging into the area’s colonial past.

During the reclamation of the Commercial Bay area of Auckland’s waterfront in the mid-1800s, household rubbish and building debris were thrown in to the fill.

Now that CRLL has started excavating around and under the Chief Post Office, many historical artefacts are being recovered. The heritage items are documented by the project’s archaeologist and CRLL will be looking at ways to display them in the new stations.

These items, dating from mid to late 1800s, were recovered by contractors from reclamation fill beneath the CPO around 1.5 metres below ground. The torpedo-shaped bottle is considered a rare find in New Zealand. Other recovered items include a complete stoneware master ink bottle with pouring lip, two broken bottles and the remains of a wooden scrubbing brush.

As a Crown entity operating in a construction environment, CRLL aims to be a leader in health and safety and ensure compliance with the Health and Safety at Work Act 2015.

CRLL is committed to a culture that holds safety as a core part of its identity and reinforces with staff and contractors that “no task is too important or so urgent as to preclude health and safety”.

Upon its establishment, CRLL focused on the development and implementation of its first Health and Safety Management System. The system ensures that correct information flows up to the Senior Leadership Team and the Board to inform decision-making, while providing the necessary guidance to the business and its contracting partners.

As part of the ongoing refinement of CRLL’s strategic approach to health and safety, the company is looking to incorporate tikanga Māori values into its safety valuesan initiative supported by CRLL’s Mana Whenua Forum.

CRLL’s safety performance improved during the year. The Total Recordable Injury Frequency Rate (TRIFR), including all its contracted works, reduced during the year from 10.77 to 5.95 per million hours worked. This compares very favourably with the latest New Zealand industry benchmark figure for TRIFR of 10.25 per million hours worked (2016 data).

In line with industry best practice for proactive and preventive health and safety management, CRLL measures lead indicators to ensure that people are fit for work and CRL worksites are as safe as they can be. These include the differential between planned and actual site safety inspections, safety toolbox meetings and drug and alcohol testing.

Leading indicators for the year generally demonstrated positive results between planned and actual activities. Random drug and alcohol testing was below the desired level; however, CRLL is working with its contractors to agree terms for more workable testing regimes.

LEADING PERFORMANCE INDEX

CRLL expects its contractors to score above 90% in CRLL-led safety audits. Two audits on contractors’ health and safety management systems and onsite activities were carried out between July 2017 and June 2018, to ensure compliance with CRLL requirements and legislative requirements.

On the C1 (Britomart Station) contract, the first audit result was 76%. However, a new safety improvement plan resulted in a 96% follow-up score.

On the C2 (Albert Street) contract, the audit result was 95%.

CRLL’s employee-only TRIFR for the year was zero.

As part of its commitment to workplace health and safety, CRLL surveyed its employees to gauge their sense of wellbeing in the workplace. Eighty-five percent of staff responded to the survey and the results were used to develop a programme of 12 wellbeing initiatives, such as nutrition and fitness programmes and resilience training.

The successful delivery of the CRL project is reliant on the technical, commercial and financial expertise of the CRLL team.

CRLL has a defined vision, project objectives and values, in order to provide clear direction and accountability for the CRL project team.

Our policies and processes support the attraction, retention and development of skilled employees and we provide a well-equipped and welcoming place to work.

• Leadership and workplace culture – The CRLL senior leadership team is a culturally-diverse team of local and international talent. Workplace culture has been built through setting, communicating and managing expected team behaviours and acknowledging employee contribution to the project at all levels.

• Cultural diversity – CRLL follows best practice in regards to equal employment opportunities and our commitment is reflected in our varied employee groups by gender, age and ethnicity.

• Employee wellbeing and safety – CRLL has a strategic approach to employee wellbeing and safety, with monthly wellbeing initiatives and Health and Safety policies designed to engage, care for and educate our people.

• Recruitment and selection – CRLL employees are recruited through a broad range of resources, including industry networks, recommendations, recruitment advertising and use of recruitment agencies. CRLL staff have been recruited through industry best practice, using behavioural interviewing, reference checking and psychometric profiling.

• Harassment and bullying prevention – CRLL has a zero tolerance approach to all forms of harassment and bullying, with policies and processes in place to support any complaints.

Delivering quality communications and meaningful engagement is a key focus for the project.

The CRL will be the largest and most transformational transport project Auckland has seen since the Harbour Bridge was built in 1959, and will bring a great number of benefits and opportunities for the region and its people.

The project’s design and construction progress and the massive contribution it will make to life in Auckland is an exciting story to share. CRLL does this through a range of channels, from public displays, site tours, industry engagement, information sessions and face-to-face meetings to its ever-changing website, print media and social media sites, which are followed by people around the world.

Constructing a 3.45-kilometre underground railway and four stations in a busy urban environment also brings a unique set of challenges. Managing the effects of development on local residents, businesses, property owners and visitors is important to CRLL and they have been a core focus for the project through the planning and design phases.

In collaboration with Auckland Council, CRLL has arranged a number of events and activations to help mitigate construction effects and give back to the community.

The ‘Eat Albert Street’ event in August 2017 provided a food and live entertainment circuit, themed with the offerings of the participating Albert Street businesses, as part of Auckland’s Restaurant Month. The vibrant community evening event drove new and existing customers to the area, raising the profile of participating businesses.

At the end of 2017, a ‘Wednesdays on Wellesley’ street entertainment programme was run for Wellesley Street businesses affected by CRLL’s stormwater diversion works. The six-week campaign used live street performances that reflected the culture and cuisine of participating restaurants. It encouraged people to purposely visit these businesses to enjoy their food and live entertainment, and the initiative was well received by customers and businesses alike.

Public tours of Albert Street were also hosted by CRLL as part of the Auckland Heritage Festival and Auckland Walk Month.

CRLL is proud of its collaborative working relationship with the eight iwi represented in its Mana Whenua Forum.

The role of the forum is to: provide input into the design of the CRL stations and the development of the project’s many management and delivery work plans, work collaboratively around built heritage and archaeological matters, undertake kaitiakitanga responsibilities associated with the project, including monitoring and assisting with discovery procedures and providing input of Māori mātauranga (knowledge) in relevant stages of the project.

The forum meets monthly and has additional workshops on design, consents, sustainability and other matters.

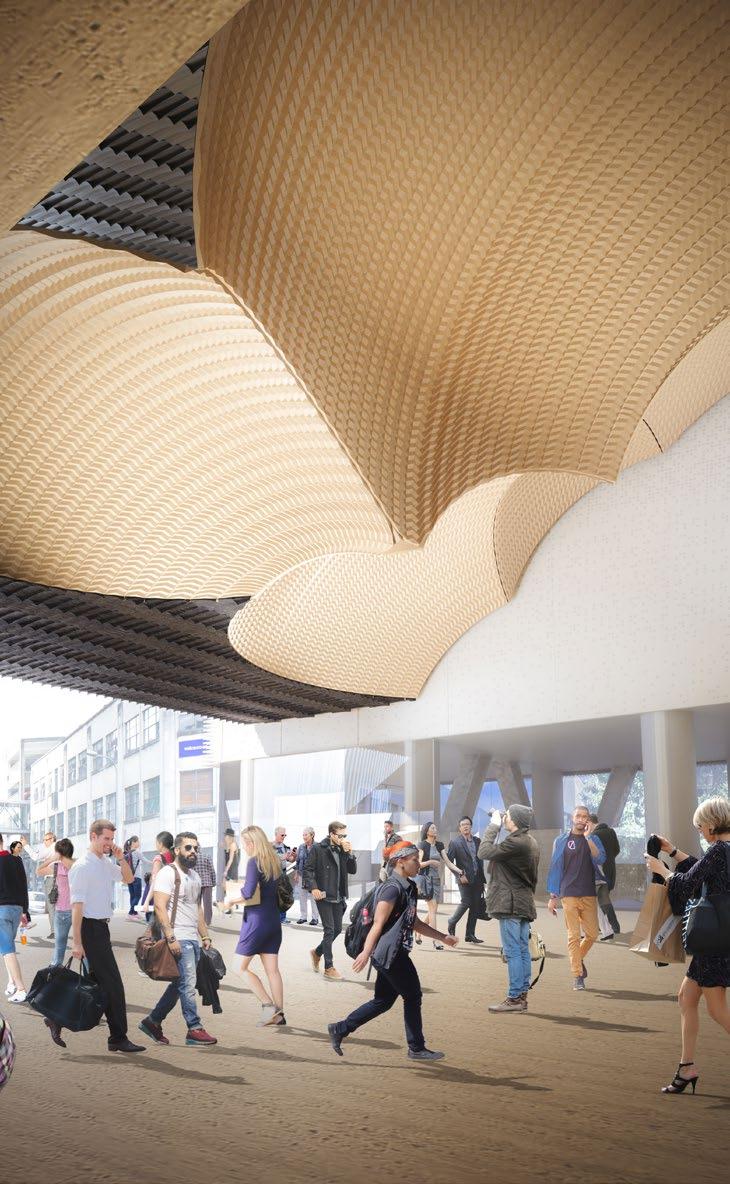

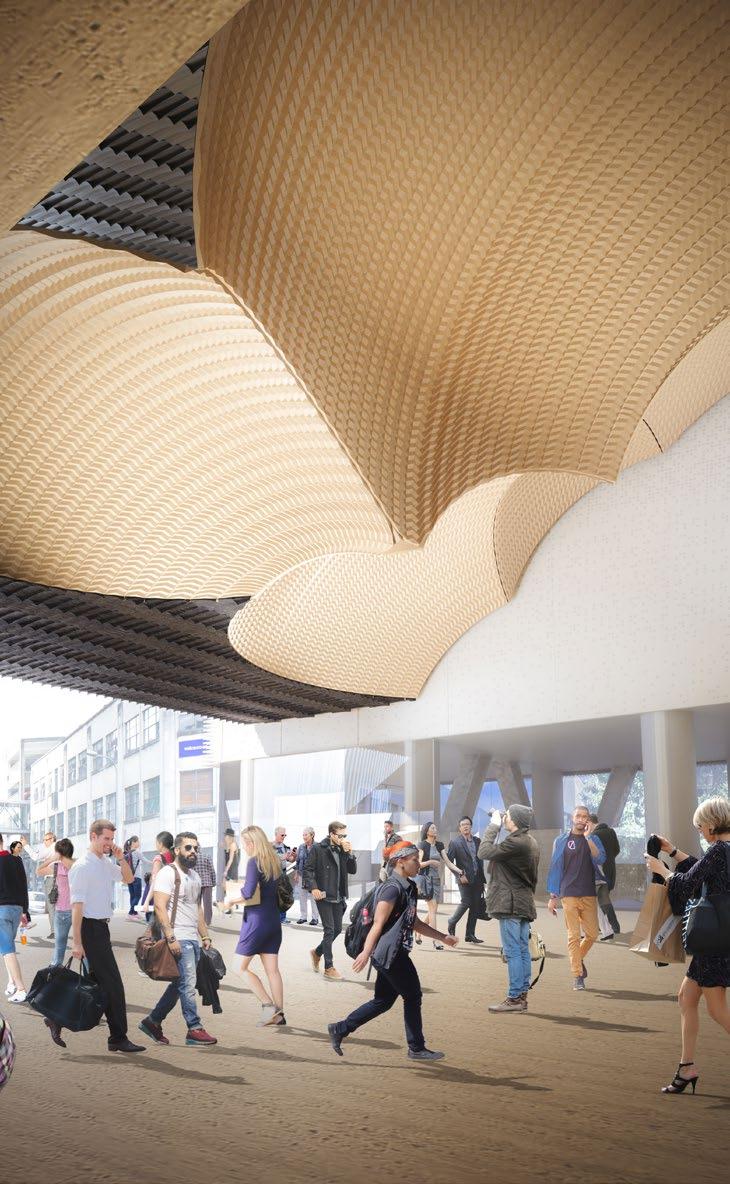

Iwi narratives have directly influenced the station designsboth the internal structure and the external appearance.

CRLL has four Community Liaison Groups that are representative of the residents, property owners and businesses directly affected by its construction works.

The groups meet regularly through the construction period to receive updates on project progress, monitor and give feedback on the effects of construction on the community, provide feedback on the development of a wide variety of construction management and delivery plans, and propose potential joint initiatives regarding the interim use of properties, including vacant land acquired for construction.

Community Liaison Group members have made a time commitment to the groups, who will meet regularly in several years of construction to allow for the accumulation of knowledge about the project.

The forum has always been an integral part [of the project] that has been developed by CRLL. Over the term of the project, our views have been listened to and acted on where they can.

We’re sure the outcomes that are going to be achieved are positive and they are going to be unique to Auckland.

- Geoff Cook, Ngāti Maru

CRLL connects with a wide variety of people via its digital platforms, operating four social media channels in addition to its project website and e-newsletter.

The launch of the CRL website cityraillink.govt.nz was timed to coincide with the establishment of CRLL. The website is a regularly updated platform that provides information for a variety of audiences. Visitors range from people wanting to keep up to date with project progress to those interested in working on the project.

The website attracts an average of 40,000 page views per month. Our social media platforms now include Facebook, LinkedIn, YouTube and Instagram.

HAS ESTABLISHED THREE KEY COMMUNICATION PRINCIPLES FOR ITS INTERACTION WITH ITS STAKEHOLDERS

CRLL will inform people affected by the project in such a way that they hear from the project before they hear about it from any third party. Information will demonstrate that CRLL is being upfront and transparent about what is proposed and provide as much certainty and detail as possible.

Communications will be straightforward, fact-based, clear, engaging and interesting. Jargon and bureaucratic language will be avoided.

Responses will be timely, full, helpful, frank and as detailed as possible. They should demonstrate that CRLL is listening, even if agreement cannot be reached. There will be investment in face-to-face communication and personal attention.

BOARD

SENIOR MANAGEMENT

Sir Brian Roche (Chairman)

Russell Black

Brian Harrison

Karen Jordan

Anne Urlwin

Sean Sweeney (CE)

Caroline Beaumont

Steve Brunell

Rhys Clark

Sumi Eratne

Victoria Jessop

Rob Mair

Moira Manning

Russell McMullan

John Williamson

BANKERS

AUDITOR

REGISTERED OFFICE

SOLICITOR

Bank of New Zealand

Queen Street

Auckland ANZ

Albert Street

Auckland

Audit New Zealand on behalf of the Auditor-General

Level 17, AMP Building

29 Customs Street West

Auckland Central

Auckland 1010

Simpson Grierson

We are responsible for the preparation of City Rail Link Limited’s (the Company’s) financial statements and statement of performance, and for the judgements made in them. We are responsible for any end-of-year performance information provided by the Company under section 19A of the Public Finance Act 1989.

We have the responsibility for establishing and maintaining a system of internal control designed to provide reasonable assurance as to the integrity and reliability of financial reporting. In our opinion, these financial statements and statement of performance fairly reflect the financial position and operations of the Company for the year ended 30 June 2018.

Signed on behalf of the Board

Sir Brian Roche Chairman

Dated: 31 October 2018

Anne Urlwin Director

Dated: 31 October 2018

for the year ended 30 June 2018 in New Zealand ‘000 Dollars

Surplus/(Deficit) for the year (33,283)

Total comprehensive revenue and expense for the year (33,283)

This statement is to be read in conjunction with the notes to the financial statements. City Rail Link Limited commenced operations with effect from 1 July 2017. As a result, there are no prior period comparatives. Refer to note 16 on page 49 for comparatives to budget.

589,000

for the year ended 30 June 2018 in New Zealand ‘000 Dollars

for the year ended 30 June 2018 in New Zealand ‘000 Dollars

Cash

1. Statement of accounting policies

1.1 Reporting entity

City Rail Link Limited (the ‘Company’) is a Crown Entity, registered under schedule 4A of the Public Finance Act, and is domiciled in New Zealand. The Company was incorporated on 13 April 2017. The Company is jointly owned by the Crown and Auckland Council.

The Company’s purpose is to govern and manage the delivery of Auckland’s City Rail Link project.

City Rail Link Limited commenced operations with effect from 1 July 2017. As a result, there are no prior period comparatives.

The financial statements of the Company are for the year ended 30 June 2018. These financial statements were authorised by the City Rail Link Limited Board on the date specified on page 33.

1.2 Basis of preparation

The financial statements have been prepared on a going-concern basis and the accounting policies have been applied consistently throughout the year.

The financial statements of the Company have been prepared in accordance with the requirements of the Crown Entities Act 2004, which includes a requirement to comply with generally accepted accounting practice in New Zealand (NZ GAAP) and the Companies Act 1993.

The Company has elected to report under Tier 1 Public Benefit Entity (PBE) standards and as such the financial statements have been prepared on that basis.

The financial statements are presented in New Zealand ‘000 Dollars ($), which is the Company’s functional currency, and have been prepared on an accrual and historical cost basis.

1.3 New and amended standards and interpretations

The new standards and interpretations that are effective from 1 July 2017 have no impact on the Company’s financial position, performance and/or disclosures due to this being the first year of operations.

1.4 Cash and cash equivalents

Cash comprises cash at bank and short-term deposits with a maturity of three months or less.

1.5 Financial instruments

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Financial assets

Financial assets are classified as loans and receivables. Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market.

After initial measurement, such financial assets are subsequently measured at amortised cost using the effective interest rate method, less impairment. Amortised cost is calculated by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the effective interest rate.

Financial liabilities

Financial liabilities are classified as payables. The Company’s financial liabilities include trade and other payables.

Trade and other payables are unsecured and are usually paid within 30 days of recognition. Due to their short-term nature they are not discounted.

A financial liability is derecognised when the obligation under the liability is discharged or cancelled, or expires.

1.6 Property, plant and equipment

Property, plant and equipment consist of land, building, subterranean land, furniture and fittings, computer hardware, computer software and office equipment.

Recognition and measurement

Property, plant and equipment are measured initially at cost. Cost includes expenditure that is directly attributable to the acquisition of the items. The cost of an item of property, plant and equipment is recognised only when it is probable that the future economic benefits or service potential associated with the item will flow to the Company, and if the item’s cost can be measured reliably. The majority of capital expenditure will remain as work in progress for the duration of the project.

Subsequent expenditure

Subsequent expenditure is capitalised only if it is probable that the future economic benefits associated with the expenditure will flow to the entity.

Repairs and maintenance costs are recognised as expenditure as incurred.

Depreciation

Land, Buildings and Subterranean Land are held for the development of rail tunnels and stations and are not depreciated. All other assets are depreciated on a straight-line basis over the useful lives of the asset. Depreciation is charged at a rate calculated to allocate the cost or valuation of an asset less any estimated residual value over its remaining useful life.

The estimated useful lives of property, plant and equipment are as follows:

Land and buildings Not depreciated

Subterranean land Not depreciated

Furniture and fittings 5 years

Office equipment 5 years

Computer hardware 5 years

The assets’ residual values, useful lives and amortisation methods are reviewed, and adjusted if appropriate, at each financial year end.

Derecognition

An item of property, plant and equipment is derecognised upon disposal or when no further future economic benefits or service potential are expected from its use or disposal.

Gains and losses on disposals are determined by comparing proceeds with the carrying amount. These are included in surplus or deficit.

Impairment of non-cash generating assets

For non-financial non-cash-generating assets, CRLL assesses at each reporting date whether there is an indication that a non-cash-generating asset may be impaired. If any indication exists, or when annual impairment testing for an asset is required, CRLL estimates the asset’s recoverable service amount. An asset’s recoverable service amount is the higher of the non-cash-generating asset’s fair value less costs to sell and its value in use.

Where the carrying amount of an asset exceeds its recoverable service amount, the asset is considered impaired and is written down to its recoverable service amount.

In assessing value in use, CRLL has adopted the depreciation replacement cost approach. Under this approach, the present value of the remaining service potential of an asset is determined as the depreciated replacement cost of the asset. The depreciated replacement cost is measured as the reproduction or replacement cost of the asset, whichever is lower, less accumulated depreciation calculated on the basis of such cost, to reflect the already consumed or expired service potential of the asset.

In determining fair value less costs to sell, the price of the asset in a binding agreement in an arm’s length transaction, adjusted for incremental costs that would be directly attributed to the disposal of the asset, is used. If there is no binding agreement, but the asset is traded on an active market, fair value less cost to sell is the asset’s market price less cost of disposal. If there is no binding sale agreement or active market for an asset, CRLL determines fair value less cost to sell based on the best available information.

Impairment losses are recognised immediately in surplus or deficit.

For each asset, an assessment is made at each reporting date as to whether there is any indication that previously recognised impairment losses may no longer exist or may have decreased. If such indication exists, CRLL estimates the asset’s recoverable service amount. A previously recognised impairment loss is reversed only if there has been a change in the estimates used to determine the asset’s recoverable service amount since the last impairment loss was recognised. The reversal is limited so that the carrying amount of the asset does not exceed its recoverable service amount, nor exceed the carrying amount that would have been determined, net of depreciation, had no impairment loss been recognised for the asset in prior years. Such a reversal is recognised in surplus or deficit..

Intangible assets acquired separately are measured on initial recognition at cost.

Following initial recognition, intangible assets are carried at cost less any accumulated amortisation and accumulated impairment losses. The Company has no internally generated intangible assets.

The useful lives of intangible assets are assessed as finite.

Intangible assets with finite lives are amortised over their useful economic lives and assessed for impairment whenever there is an indication that the intangible assets may be impaired.

The amortisation period and the amortisation method for an intangible asset with a finite useful life are reviewed at least at the end of each reporting period. Changes in the expected useful life or the expected pattern of consumption of future economic benefits or service potential embodied in the asset are considered to modify the amortisation period or method, as appropriate, and are treated as changes in accounting estimates.

The amortisation expense on intangible assets with finite lives is recognised in surplus or deficit as the expense category that is consistent with the function of the intangible assets.

Gains or losses arising from derecognition of an intangible asset are measured as the difference between the net disposal proceeds and the carrying amount of the asset and are recognised in surplus or deficit when the asset is derecognised.

1.7 Intangible assets (continued)

Software

The Company holds several computer software packages for internal use, including purchased software. Purchased software is recognised and measured at the cost incurred to acquire the software.

A summary of the policies applied to the Company’s intangible assets is as follows:

Intangible asset Useful life

Software 5 years

1.8 Leases

Amortisation method

Straight-line basis

The determination of whether an arrangement is or contains a lease is based on the substance of the arrangement at inception date. The substance of the arrangement depends on whether the fulfilment of the arrangement is dependent on the use of a specific asset or assets or the arrangement conveys a right to use the asset, even if that right is not explicitly specified in an arrangement.

Company as a lessee

Operating leases are leases that do not transfer substantially all the risks and benefits incidental to ownership of the leased items to the Company. Operating lease payments are recognised as an operating expense in surplus or deficit on a straight-line basis over the lease term.

Company as a lessor

Rent received from an operating lease is recognised as income on a straight-line basis over the lease term. Contingent rents are recognised as revenue in the periods in which they are earned.

1.9

Liabilities for wages and salaries (including non-monetary benefits) and annual leave are recognised in surplus or deficit during the periods in which the employees rendered the related services, and are generally expected to be settled within 12 months of the reporting date. The liabilities for these shortterm benefits are measured at the amounts expected to be paid when the liabilities are settled. Expenses for sick leave are recognised when the leave is taken and are measured at the rates paid.

1.10

Equity is made up of accumulated comprehensive revenue and expense and contributed capital.

Accumulated comprehensive revenue and expense is the Company’s accumulated surplus or deficit since the formation of the Company.

Contributed capital represents the transfer of project costs based on a settlement agreement between the Crown and Auckland Council as well as shares issued to the shareholders, the Crown and the Auckland Council for funding of the project. 1000 Ordinary shares were issued for the contributed capital with B class shares being issued for funding. Each funding share represents one New Zealand dollar.

Revenue is recognised to the extent that it is probable that the economic benefit will flow to the Company and revenue can be reliably measured. Revenue is measured at the fair value of the consideration received. The following specific recognition criteria must be met before revenue is recognised.

Rental revenue arising from operating leases on investment properties is accounted for on a straight-line basis over the lease terms and is included in revenue in the statement of financial performance due to its operating nature.

Outstanding customer receivables are monitored monthly and balances >30 days are followed up for recovery. As at 30 June 2018, there were 27 property debtors with outstanding balances. The balance of each debtor was assessed individually as to collectability and a provision for doubtful debt has been accounted for as a result.

Interest revenue

Interest is received on the cash held at bank and short-term deposits maturing within less than three months. Interest income is included in finance income in the statement of financial performance.

City Rail Link Limited is a Public Authority in accordance with the Income Tax Act 2007 and consequently is exempt from the payment of income tax. Accordingly, no provision has been made for income tax. All amounts are shown exclusive of GST, except for receivables and payables that are stated inclusive of GST.

and assumptions

The preparation of the Company’s financial statements requires management to make judgements, estimates and assumptions that affect the reported amounts of revenue, expenses, assets and liabilities, and the accompanying disclosures, and the disclosure of contingent liabilities. Uncertainty about these assumptions and estimates could result in outcomes that require a material adjustment to the carrying amounts of assets or liabilities affected in future periods.

Judgements

In the process of applying the Company’s accounting policies, management has made the following judgements, which have the most significant effect on the amounts recognised in the financial statements:

Operating lease commitments – Company as lessor

The Company has entered into commercial and rental property leases on its property portfolio. The Company has determined, based on an evaluation of the terms and conditions of the arrangements, such as a lease term not constituting a substantial portion of the economic life of a property, that it retains all the significant risks and rewards of ownership of these properties and accounts for the contracts as operating leases.

The bulk of these properties (both residential and commercial) will, at some stage during the project, need to be demolished, with new stations constructed on these sites.

Estimates and assumptions

The key assumptions concerning the future and other key sources of estimation uncertainty at the reporting date, which have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year, are described below. The Company based its assumptions and estimates on parameters available when the financial statements were prepared. Existing circumstances and assumptions about future developments, however, may change due to market changes or circumstances arising beyond the control of the Company. Such changes are reflected in the assumptions when they occur.

Useful lives and residual values

The useful lives and residual values of assets are assessed using the following indicators to inform potential future use and value from disposal:

• The condition of the asset based on the assessment of experts employed by the Company

• The nature of the asset and its susceptibility and adaptability to changes in technology and processes

• Changes in the market in relation to the asset.

The estimated useful lives of the asset classes held by the Company are listed in notes 1.6 and 1.7.

2. Employment expenses

Breakdown of personnel costs and further information 30 June 2018 Salaries and wages

Defined contribution plan employer contributions (KiwiSaver) 226 Increase/(Decrease) in employee entitlements

The number of employees, contractors and former employees and contractors who received remuneration and other benefits exceeding $100,000 during the year to 30 June 2018 are specified in the following table. Remuneration includes salary, any performance incentive payments, redundancy payments, employer contributions to superannuation, health and insurance plans, motor vehicle and other sundry benefits received in their capacity as employees or former employees of the Company and payments to contractors at their agreed rates in their capacity of filling roles that would otherwise have been filled by employees.

30 June 2018

Number of employees

$100,000 - $109,999

$110,000 - $119,999

$120,000 - $129,999

$130,000 - $139,999

$140,000 - $149,999

$150,000 - $159,999

$160,000 - $169,999

$170,000 - $179,999

$180,000 - $189,999

$190,000 - $199,999

$200,000 - $209,999

$210,000 - $219,999

$220,000 - $229,999

$230,000 - $239,999

$240,000 - $249,999

$260,000 - $269,999

$270,000 - $279,999

$280,000 - $289,999

$530,000 - $539,999

Severance payments

Termination benefits relate to severance amounts paid to three employees as a result of the reorganisation of the Company. The total termination amounts paid by the Company to these employees was $108k.

Redundancy payments

Termination benefits relate to redundancy amounts paid to eight employees as a result of the reorganisation of the Company. The total redundancy amounts paid by the Company to these employees was $286k.

Board Member Remuneration

30 June 2018

3. Property, plant and equipment

June 2018

There are no items of PPE where title has been restricted or that have been used for security against liabilities.

4. Intangibles

5. Capital work in progress

Capital work in progress is measured at the lower of cost or net realisable value. 30 June 2018

City Rail Link Limited capitalises those costs directly attributable to the construction of the City Rail Link. These are captured under the description ‘Capital work in progress’. Examples of these costs include payments to contractors for the actual construction works, resource consents and compliance expenses and costs incurred in the design, procurement and supervision of the works. The Company also capitalises a portion of the overhead costs that it deems is required to support the construction of the actual physical works. Examples of these overhead costs include staff costs for corporate functions, and operating costs such those for as rent and utilities. For 2018, the total value of overhead costs capitalised is $11.3m. This allocation of costs is reviewed regularly to ensure that the method adopted remains appropriate for the stage of the project.

On completion of the transfer of assets from the Crown and Auckland Council (note 12), CRLL undertook a detailed review of their values. The review examined all of the cost components in relation to specific assets and classes of assets. A total of $434m of expenditure, dating back to 2012, was reviewed. CRLL reviews its work in progress, at least annually, to identify any impairment of the carrying value of its assets.

The review identified certain transactions which did not meet the definition of capex or CRLL’s accounting policy for ‘Capital Work in Progress’ as adopted by CRLL on the 1st of July 2017. An impairment of $24m has therefore been recognised to reflect this in the year ended 30 June 2018.

6. Cash and cash equivalents

Cash comprises cash at bank and short-term deposits with a maturity of three months or less.

Cash at bank earns interest at floating rates based on daily bank deposit rates. Short-term deposits are made for varying periods of between one day and three months, depending on the immediate cash requirements of the Company, and earn interest at the respective short-term deposit rates.

Reconciliation of operating surplus with net cash from operating activities

Surplus/(Deficit) for the year

7. Trade and other receivables

Accounts receivable are recognised and carried at the original invoice amounts less any allowance for any doubtful debts. Receivables are deemed to be doubtful when there is evidence that the amounts will not be fully collectable. The uncollectable amount is the difference between the carrying amount due and the present value of the amount expected to be collected. Accounts receivable are financial assets classified as trade and other receivables. All receivables are from exchange transactions (for cost or a nominal cost).

As at 30 June, the aging analysis of trade receivables was:

8. Trade and other payables

Accounts payable and accruals represent liabilities of goods and services provided to the entity that have not been paid at the end of the financial year.

Accounts payable and accruals are classified as other liabilities, and are measured at amortised cost.

Terms and conditions of the above financial liabilities:

• Trade payables are non-interest bearing and are normally settled on 60-day terms

• Related party payables mainly relate to accruals for NoR applications not yet invoiced by Auckland Council

• Sundry payables and accruals are non-interest bearing and have an average term of three months.

9. Employee entitlements

June 2018 $(000)

10. Commitments and contingencies

Operating lease commitments – Company as a lessee

The Company has entered into commercial leases. These leases have an average life of between three and five years, with renewal options included in the contracts. There are no restrictions placed upon the Company by entering into these leases.

Future minimum rentals payable under non-cancellable operating leases as at 30 June 2018 are, as follows:

June

Operating lease commitments – Company as a lessor

The Company has entered into commercial and rental property leases on its property portfolio consisting of the Company’s buildings. These noncancellable leases have remaining terms of between one and three years. Each lease include a clause to enable upward revision of the rental charge on an annual basis according to prevailing market conditions.

Future minimum rentals receivable under non-cancellable operating leases as at 30 June 2018 are as follows:

At 30 June 2018, the Company had commitments of $211.714m relating to the project (in relation to capital work in progress). In addition to this, as at balance date, CRLL continued to finalise outstanding matters relating to the initial transfers from Auckland Council Group.

Contingencies

As at 30 June 2018 CRLL is a party to various claims and sundry disputes. Where it has been assessed that the likelihood of having to make a payment meets the recognition criteria for a provision, this has been included in the financial statements.

The table below summarises the maturity profile of the Company’s financial liabilities which show the timing of the cash outflows and the maturity profiles of financial assets held by the Company which are readily saleable or expected to generate cash inflows to meet the cash outflows of the financial liabilities. The amounts disclosed are undiscounted contractual cashflow.

The Company’s risk management policies identify and analyse the risks faced by the Company and set appropriate risk levels and controls to monitor those risks.

(i) Market risk

Market risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk comprises three types of risk: currency risk, interest rate risk and other price risk. The Company has significant exposure to fluctuations in currency risk.

(ii) Credit risk

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party, by failing to discharge an obligation.

The entity is mainly exposed to credit risk from its financial assets, and the maximum exposure to credit risk at balance date is represented by the total amount of financial assets in the statement of financial position:

• Cash and cash equivalents

• Trade receivables

The Company manages credit risk by analysing the credit worthiness of its customers, including with external ratings if available.

(iii) Liquidity risk

Liquidity risk is the risk that the Company will have difficulty meeting the obligations associated with its financial liabilities. The entity’s approach to managing liquidity is to ensure that it has sufficient liquidity to meet its liabilities when they are due. Funding will be made available upon request in a prescribed format from the shareholders of the Company and therefore the Company has no significant exposure to liquidity risk. In addition, the Company has a letter of credit with the BNZ to the value of $450k in favour of Datacom.

12. Related parties

a) Key management personnel

Key management personnel include the senior management and the Board of Directors.

and

Key management personnel did not receive any remuneration or compensation other than in their capacity as key management personnel. If the number of personnel were reported as FTEs the number of senior managers would have been 8.68 FTEs.

The Company did not provide any compensation at non-arm’s-length terms to close family members of key management personnel during the year.

The Company did not provide any loans to key management personnel or their close family members.

During the first year of operations, the Board members’ fees included a 50% loading to recognise the additional responsibilities required by the Board members in the company’s first year of operations.

Indemnities and insurance

In accordance with section 162 of the Companies Act 1993 and City Rail Link Limited’s Constitution, the Company has arranged Directors’ and Officers’ Liability Insurance covering directors and senior employees of the Company, for liability arising from their acts or omissions in their capacity as directors or employees. The insurance policy does not cover dishonest, fraudulent, malicious or wilful acts or omissions.

The Company has also entered into a Deed of Indemnity with each director, under which the Company indemnifies the director for liabilities incurred in their capacity as a director, and that permits directors after they cease to hold office to access, subject to certain conditions, Company records relating to the period in which they were directors.

Information used by directors

There were no notices from directors requesting to disclose or use Company information received in their capacity as directors that would not otherwise have been available to them.

b) Related party transactions and balances

Related party transactions other than remuneration of key management personnel

All related party transactions that the Company entered into during the year occurred within normal client/supplier relationships and under terms equivalent to those that prevail in arm’s-length transactions in similar circumstances. City Rail Link Limited entered into a ‘transitional business agreement’ during its establishment phase with Auckland Transport. The terms of this agreement were on an arm’s-length commercial basis. Balances at year end

c) Transferred assets

The Crown and Auckland Council transferred the following assets to City Rail Link Limited on 1 July 2017 in accordance with the ‘Asset Transfer Agreement’.

13. External auditors’ remuneration

C7

14. Capital management

City Rail Link Limited’s capital is its equity, which comprises capital and accumulated surplus/(deficit). Equity is represented by net assets.

City Rail Link Limited is subject to the financial management and accountability provisions of the Crown Entities Act 2004, which impose restrictions in relation to borrowings, acquisition of securities, issuing guarantees and indemnities, and the use of derivatives.

City Rail Link Limited manages its equity by prudently managing revenues, expenses, assets, liabilities, investments and general financial dealings to ensure the company effectively achieves its objectives and purpose.

15. Subsequent events

There have been no events subsequent to balance date which would materially affect the financial statements.

16. Explanation of major variances against budget

Major variations from the Company’s budget figures are explained below:

Statement of financial performance and statement of other comprehensive revenue and expense

The Company’s net deficit was $30.8m higher than budgeted. The net effect of the following items contributed to this variation.

Expenses were higher than budgeted by $33.3m. This is mainly due to the impairment expense, general expenses, professional fees and employee costs being higher than budgeted by $24.6, $1.9m, $3m and $3.1m respectively. This is due to CRLL becoming an independent Company and budgets being set based on figures used within the ‘Project Delivery Agreement’ which focused on the cost of the project build without including normal operating costs of a company.

Statement of financial position:

The Company’s net assets were $15.2m higher than budgeted.

This was mainly caused by a delay in acquiring properties whilst awaiting ‘Acquiring Authority’ status to be granted to City Rail Link Limited. This caused a higher-than-expected closing cash balance as well as a reduction in the anticipated value of assets.

17. Standards and interpretations issued but not yet effective

The standards and interpretations that are issued, but not yet effective, up to the date of issuance of the Company’s financial statements are unlikely to have an impact on the Company’s financial position, performance and/or disclosures.

Directors made the following entries in the Director’s Interest Register pursuant to section 140 of the Companies Act 1993 during the year end of 30 June 2018.

DIRECTOR POSITION

Sir Brian Roche Chairman

BOARD/COMMITTEE MEMBERSHIPS ENTITY

Wellington Gateway General Partner No 1 Ltd

Special Purpose Vehicle (Chairman)

Chairman

Chairman

Wellington Gateway General Partner No 2 Ltd

Antarctica New Zealand

Chairman Tait New Zealand Limited

Chairman Hugh Green Industries Limited

Russell Black Independent Chairman, Project Steering Group

Peer Review Group Advisor

Board Member

Brian Harrison Director

High Capacity Metro Train PPP

Melbourne Metro Rail Authority

Sydney Metro Assurance Board

Secure Future Wiri Holdings Ltd

Director Secure Future Wiri Ltd

Director Infrared Infrastructure NZ (WGP) Ltd

Director

Director

Wellington Gateway General Partner No.1 Ltd

Wellington Gateway General Partner No.2 Ltd

Director Crown Irrigation Investments Ltd

Karen Jordan Lay Canon

Lay Member

Anne Urlwin

Director & Chairman (ceased 30/10/17)

Christ Church Cathedral, Nelson, Anglican Diocese of Nelson

Lawyers Standards Committee, Nelson

Naylor Love Enterprises Ltd (and subsidiary companies: Naylor Love Construction Ltd, Naylor Love Properties Ltd, Naylor Love Ltd)

Director & Deputy Chairman Southern Response Earthquake Services Ltd

Director Chorus Ltd

Director Chorus New Zealand Ltd

Director

Summerset Group Holdings Ltd

Director Steel & Tube Holdings Ltd

Director

OnePath Life (NZ) Ltd

Special Purpose Vehicle

Crown Entity

Technology Company

Property Ownership and Development including farming operations

Victoria State Government

Victoria State Government

New South Wales State Government

Limited Company

Limited Company

Limited Company

Limited Company

Limited Company

Crown Entity – Limited Company

Anglican Church of New Zealand

The Law Society

Private company

Company – Crown-owned company (Schedule 4A, Public Finance Act)

Publicly listed company

Subsidiary of publicly-listed Chorus Ltd

Publicly listed company

Publicly listed company

Company – subsidiary of ANZ Bank group

Independent Chairman Te Rūnanga O Ng āi Tahu Audit & Risk Committee Committee of Te Rūnanga O Ng āi Tahu

Board member

Hockey New Zealand

Director Tilt Renewables Ltd

Incorporated society

Publicly listed company