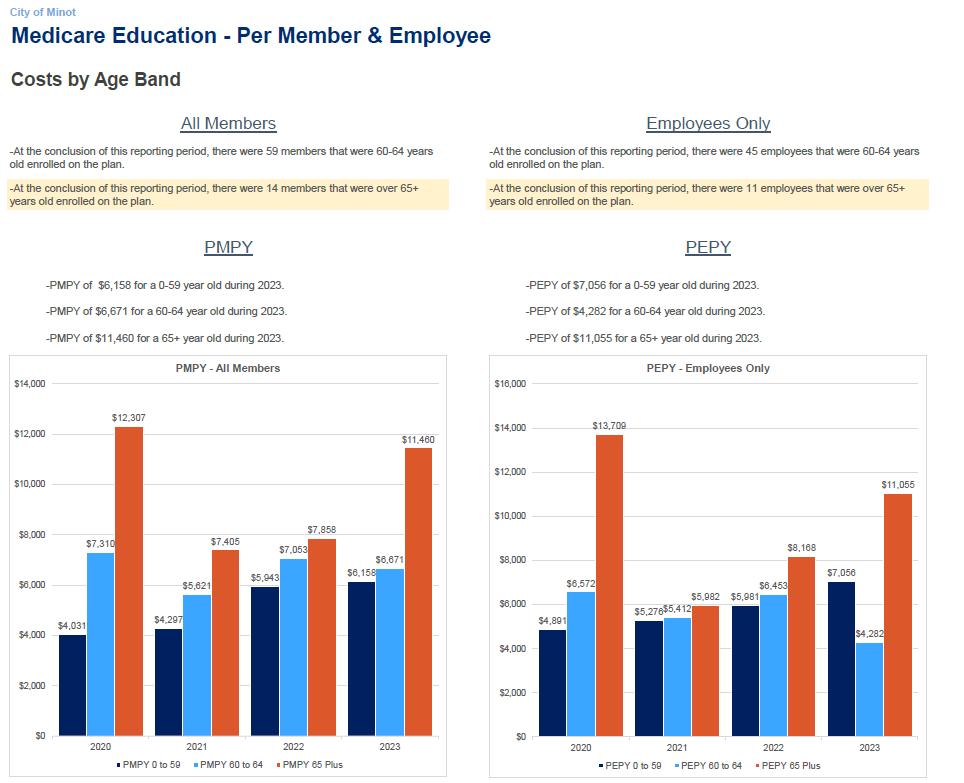

City of Minot

Self-Funded Benefit Renewals 2025

Agenda

2025 Medical Renewal

2025 Medical Plan Considerations

2025 Dental Renewal

2025 Vision Renewal

Stewardship and Appendix

Self-Funded Benefit Renewals 2025

Agenda

2025 Medical Renewal

2025 Medical Plan Considerations

2025 Dental Renewal

2025 Vision Renewal

Stewardship and Appendix

• The percentage of total average costs for covered benefits that a plan will cover.

» For example, if a plan has an actuarial value of 90%, on average, you would be responsible for 10% of the costs of all covered benefits.

• City of Minot’s current plan’s actuarial value is 90.55% making it a Platinum plan

����

(1) 2022 claims projections developed by Brown & Brown

• Plan Designs

» Increase out of pocket maximum (OOPM)

o Current

– $2,250 | $3,375 | $4,500

o Option 1

– $5,000 | $7, 500 | $10,000

o Option 2

– $7500 | $11,250 | $15,000

» Coinsurance

o Current

– 90%/10%

o Recommendation

– 80%/20%

» Emergency Room (mental health parity requirement)

o Current

– Copay + coinsurance

o Recommendation

– Deductible + coinsurance

» GLP-1 Drug Coverage

o Remove coverage for weight-loss diagnosis

• Stop Loss Threshold ($100,000 current)

» $125,000

» $150,000

• The percentage of total average costs for covered benefits that a plan will cover.

» For example, if a plan has an actuarial value of 90%, on average, you would be responsible for 10% of the costs of all covered benefits.

• City of Minot’s actuarial value would be

» 1: $5000 OOPM 86.57 < GOLD

» 2: $75000 OOPM 84.71 < GOLD

• GLP-1 Drug Utilization is quickly increasing across the nation

• The FDA is likely to approve several other conditions for use.

• Average cost of GLP-1 drugs is $1,000-$1,5000 per month.

• City of Minot Utilization for weight-loss diagnosis

» ~$42,000 annually.

• Options:

» Continue to cover like other formulary drugs

» Remove coverage for weightloss (full savings)

» Remove coverage for weightloss but offer at a discount through a compound pharmacy (some savings)

• Cigna recently did a study that stated the average ROI for a GLP-1 drug takes about 24-30 months of utilization

• One year ago, GLP-1s made up approximately 1% of all RX spend nationally, it is currently tracking at 3%

• 60% of GLP-1 utilizations stop taking it after 6 months

» no long-term ROI)

• There are currently 54 additional uses being reviewed by the FDA

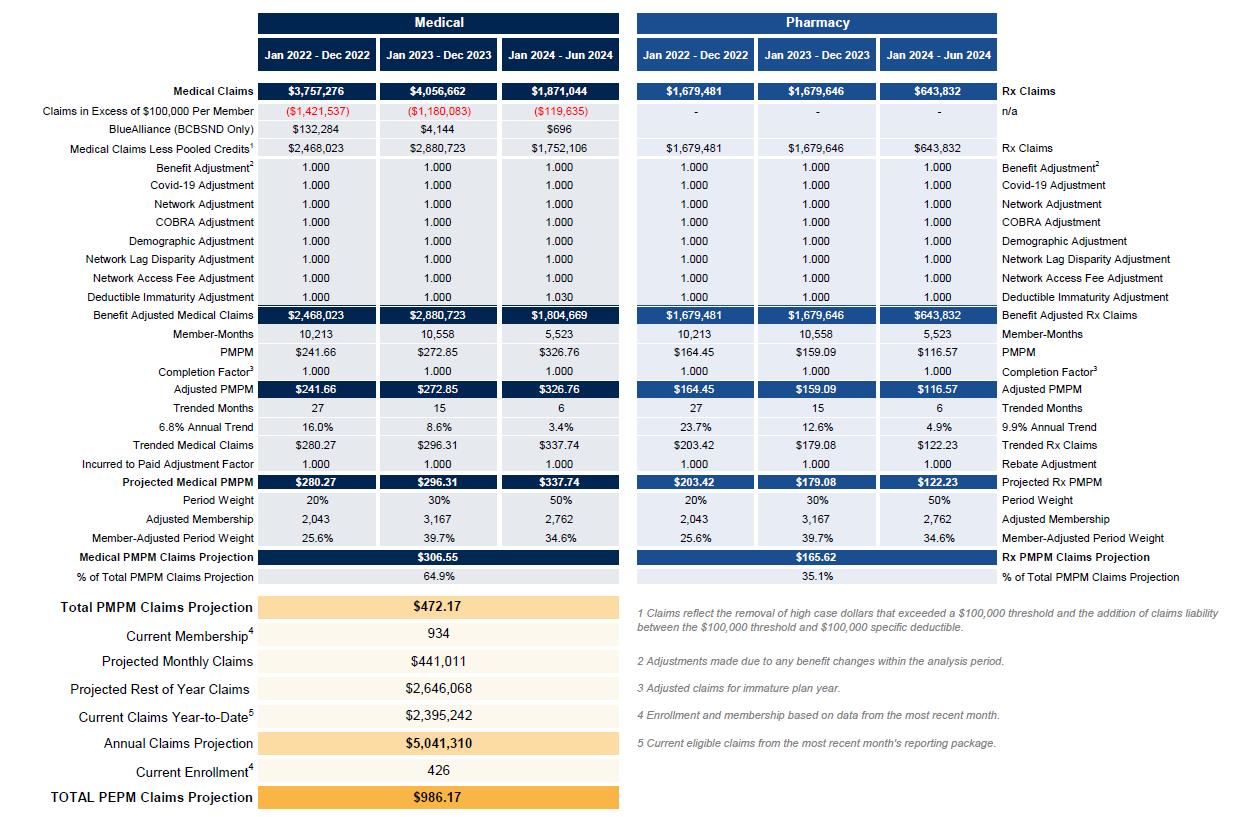

Through June

Large Claim Analysis - Claims > $50,000 (Current Year)

• The Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA) is a federal law that generally prevents group health plans and health insurance issuers that provide mental health or substance use disorder (MH/SUD) benefits from imposing less favorable benefit limitations on those benefits than on medical/surgical benefits.

• Key changes made by MHPAEA, which is generally effective for plan years beginning after October 3, 2009, include the following:

» If a group health plan or health insurance coverage includes medical/surgical benefits and MH/SUD benefits, the financial requirements (e.g., deductibles and co-payments) and treatment limitations (e.g., number of visits or days of coverage) that apply to MH/SUD benefits must be no more restrictive than the predominant financial requirements or treatment limitations that apply to substantially all medical/surgical benefits (this is referred to as the “substantially all/predominant test”).This test is discussed in greater detail in the MHPAEA regulation (linked below) and the summary of the MHPAEA regulation found below.

» MH/SUD benefits may not be subject to any separate cost-sharing requirements or treatment limitations that only apply to such benefits;

» If a group health plan or health insurance coverage includes medical/surgical benefits and MH/SUD benefits, and the plan or coverage provides for out-of-network medical/surgical benefits, it must provide for out-of-network MH/SUD benefits; and

» Standards for medical necessity determinations and reasons for any denial of benefits relating to MH/SUD benefits must be disclosed upon request.

• Individual Stop Loss: is the form of excess risk coverage that provides protection for the employer against a high claim on any one individual

» City of Minot $100,000

• Aggregate Stop Loss: provides a ceiling on the dollar amount of eligible expenses that an employer would pay, in total, during a contract period » 120% of expected claims

• Know Your Risk

• Health & Welfare Plan Analytics

• Workforce Demographic Analysis

• Benchmarking / Gap Analysis

• Risk Pool Management Assessment

• Plan Design Strategy

• Tiering & Contribution Strategy

• Traditional vs. Alternative Funding

• Network Efficiency

• Total Rewards Strategy

• Vendor & Product Mix

• Perpetual & Predictive Analytics

• Care Delivery & Quality

• Population Health and Well-being Strategies

• Communications, Engagement & Advocacy

• Incentive Optimization

Industry focuses on:

• Health Reimbursement Accounts (HRA)

• Health Savings Accounts (HSA)

• Case Management

• Population Health Management

• Wellness Programs

While important, must start with:

• Administration Fees

• Stop-Loss Premiums

• Pooling Charges

• Network Access Fees Settlement Costs

• Rx Rebates

• Reserves

• Taxes

The factors can increase health plan cost

Rate Tier Factors are generally not set correctly according to enrolled risk of those tiers Misaligned Employer Contributions by plans and tiers can understate required revenue

Offering misaligned Multiple Plans Creates Adverse Selection… healthy members select lower cost plans

Plan design is immaterial to driving healthcare costs increases... High Cost Claimants Drive Cost

Behavior Economics and Member Choices are most often misaligned and not considered… Cost vs. Value

John (45)

Hemophiliac

Cost: $750,000

Your Plan’s MOOP: $5,000

Spouse’s Plan MOOP: $3,000

Choice: Spouse’s plan

John Saves: $2,000

Company Saves: $750,000

Sarah (58)

Transplant

Cost: $410,000

Your Plan’s MOOP: $5,000

Spouse’s Plan MOOP: $7,000

Choice: Your plan

Sarah Pays: $5,000

Company Pays: $405,000

Stephen (27)

No Claims

Monthly Premium: $160

Your Deductible: $3,000

Spouse’s Deductible: n/a

Choice: Waive

Result: Company looses premiums of young healthy male w/ no claims Your Risk Pool

Lower employee contributions invites “good risk” to participate in your health plan

Unfavorable plan design (higher MOOP) encourages “bad risk” to go elsewhere

Large claims drive costs, NOT general utilization