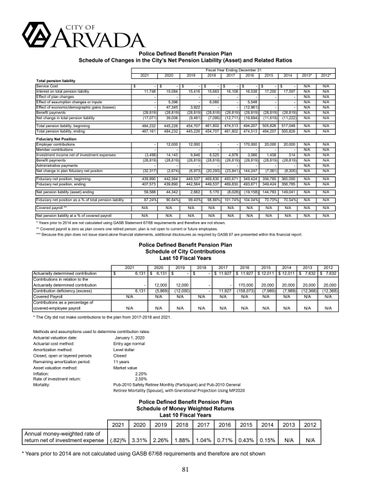

Police Defined Benefit Pension Plan Schedule of Changes in the City’s Net Pension Liability (Asset) and Related Ratios 2021 Total pension liability Service Cost Interest on total pension liability Effect of plan changes Effect of assumption changes or inputs Effect of economic/demographic gains (losses) Benefit payments Net change in total pension liability

$

2020

Fiscal Year Ending December 31 2018 2017 2016 2015

2019

2014

2013*

2012*

N/A N/A N/A N/A N/A N/A N/A

N/A N/A N/A N/A N/A N/A N/A

- $ - $ - $ - $ - $ - $ - $ 17,597 17,200 16,538 16,108 15,663 15,416 15,084 11,748 5,396 6,060 5,548 47,345 3,922 (12,961) (28,819) (28,819) (28,819) (28,818) (28,819) (28,819) (28,819) (28,819) (7,095) (12,711) (19,694) (11,619) (11,222) (9,481) 39,006 (17,071)

Total pension liability, beginning Total pension liability, ending

484,232 467,161

445,226 484,232

454,707 445,226

461,802 454,707

474,513 461,802

494,207 474,513

505,826 494,207

517,048 505,826

N/A N/A

N/A N/A

Fiduciary Net Position Employer contributions Member contributions Investment income net of investment expenses Benefit payments Administrative payments Net change in plan fiduciary net positon

(3,498) (28,819) (32,317)

12,000 14,145 (28,819) (2,674)

12,000 9,846 (28,819) (6,973)

8,525 (28,818) (20,293)

4,978 (28,819) (23,841)

170,000 3,066 (28,819) 144,247

20,000 1,458 (28,819) (7,361)

20,000 514 (28,819) (8,305)

N/A N/A N/A N/A N/A N/A

N/A N/A N/A N/A N/A N/A

Fiduciary net position, beginning Fiduciary net position, ending

439,890 407,573

442,564 439,890

449,537 442,564

469,830 449,537

493,671 469,830

349,424 493,671

356,785 349,424

365,090 356,785

N/A N/A

N/A N/A

Net pension liability (asset) ending

59,588

44,342

2,662

5,170

144,783

149,041

Fiduciary net position as a % of total pension liability

87.24%

90.84%

99.40%

98.86%

(8,028)

(19,158)

101.74%

104.04%

N/A

N/A

70.70%

70.54%

N/A

N/A

Covered payroll **

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Net pension liability at a % of covered payroll

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

* Years prior to 2014 are not calculated using GASB Statement 67/68 requirements and therefore are not shown. ** Covered payroll is zero as plan covers one retired person; plan is not open to current or future employees. *** Because this plan does not issue stand-alone financial statements, additional disclosures as required by GASB 67 are presented within this financial report.

Police Defined Benefit Pension Plan Schedule of City Contributions Last 10 Fiscal Years 2021 Actuarially determined contribution Contributions in relation to the Actuarially determined contribution Contribution deficiency (excess) Covered Payroll Contributions as a percentage of covered-employee payroll

$

6,131

$

2020 6,131

N/A

12,000 (5,869) N/A

N/A

N/A

6,131

2018

2019 $

12,000 (12,000) N/A N/A

$

-

2017 $ 11,927

N/A

11,927 N/A

N/A

N/A

2016 $ 11,927 170,000 (158,073) N/A N/A

2015 $ 12,011

2014 $ 12,011

2013 $ 7,632

20,000 (7,989) N/A

20,000 (7,989) N/A

20,000 (12,368) N/A

N/A

N/A

N/A

* The City did not make contributions to the plan from 2017-2018 and 2021. Methods and assumptions used to determine contribution rates: January 1, 2020 Actuarial valuation date: Actuarial cost method: Entry age normal Level dollar Amortization method: Closed, open or layered periods Closed Remaining amortization period: 11 years Asset valuation method: Market value Inflation: 2.20% Rate of investment return: 2.50% Pub-2010 Safety Retiree Monthly (Participant) and Pub-2010 General Mortality:

Retiree Mortality (Spouse), with Gnerational Projection Using MP2020

Police Defined Benefit Pension Plan Schedule of Money Weighted Returns Last 10 Fiscal Years Annual money-weighted rate of return net of investment expense

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

(.82)%

3.31%

2.26%

1.88%

1.04%

0.71%

0.43%

0.15%

N/A

N/A

* Years prior to 2014 are not calculated using GASB 67/68 requirements and therefore are not shown

81

2012 $ 7,632 20,000 (12,368) N/A N/A