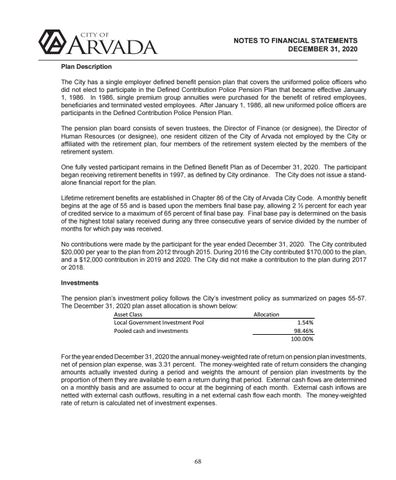

NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2020 Plan Description The City has a single employer defined benefit pension plan that covers the uniformed police officers who did not elect to participate in the Defined Contribution Police Pension Plan that became effective January 1, 1986. In 1986, single premium group annuities were purchased for the benefit of retired employees, beneficiaries and terminated vested employees. After January 1, 1986, all new uniformed police officers are participants in the Defined Contribution Police Pension Plan. The pension plan board consists of seven trustees, the Director of Finance (or designee), the Director of Human Resources (or designee), one resident citizen of the City of Arvada not employed by the City or affiliated with the retirement plan, four members of the retirement system elected by the members of the retirement system. One fully vested participant remains in the Defined Benefit Plan as of December 31, 2020. The participant began receiving retirement benefits in 1997, as defined by City ordinance. The City does not issue a standalone financial report for the plan. Lifetime retirement benefits are established in Chapter 86 of the City of Arvada City Code. A monthly benefit begins at the age of 55 and is based upon the members final base pay, allowing 2 ½ percent for each year of credited service to a maximum of 65 percent of final base pay. Final base pay is determined on the basis of the highest total salary received during any three consecutive years of service divided by the number of months for which pay was received. No contributions were made by the participant for the year ended December 31, 2020. The City contributed $20,000 per year to the plan from 2012 through 2015. During 2016 the City contributed $170,000 to the plan, and a $12,000 contribution in 2019 and 2020. The City did not make a contribution to the plan during 2017 or 2018. Investments The pension plan’s investment policy follows the City’s investment policy as summarized on pages 55-57. The December 31, 2020 plan asset allocation is shown below: Asset Class Allocation Local Government Investment Pool 1.54% Pooled cash and investments 98.46% 100.00% For the year ended December 31, 2020 the annual money-weighted rate of return on pension plan investments, net of pension plan expense, was 3.31 percent. The money-weighted rate of return considers the changing amounts actually invested during a period and weights the amount of pension plan investments by the proportion of them they are available to earn a return during that period. External cash flows are determined on a monthly basis and are assumed to occur at the beginning of each month. External cash inflows are netted with external cash outflows, resulting in a net external cash flow each month. The money-weighted rate of return is calculated net of investment expenses.

68