RIGHT

SPRING 2023

Home THE MEMBER’S CONNECTION

WHERE YOU WANT T O BE.

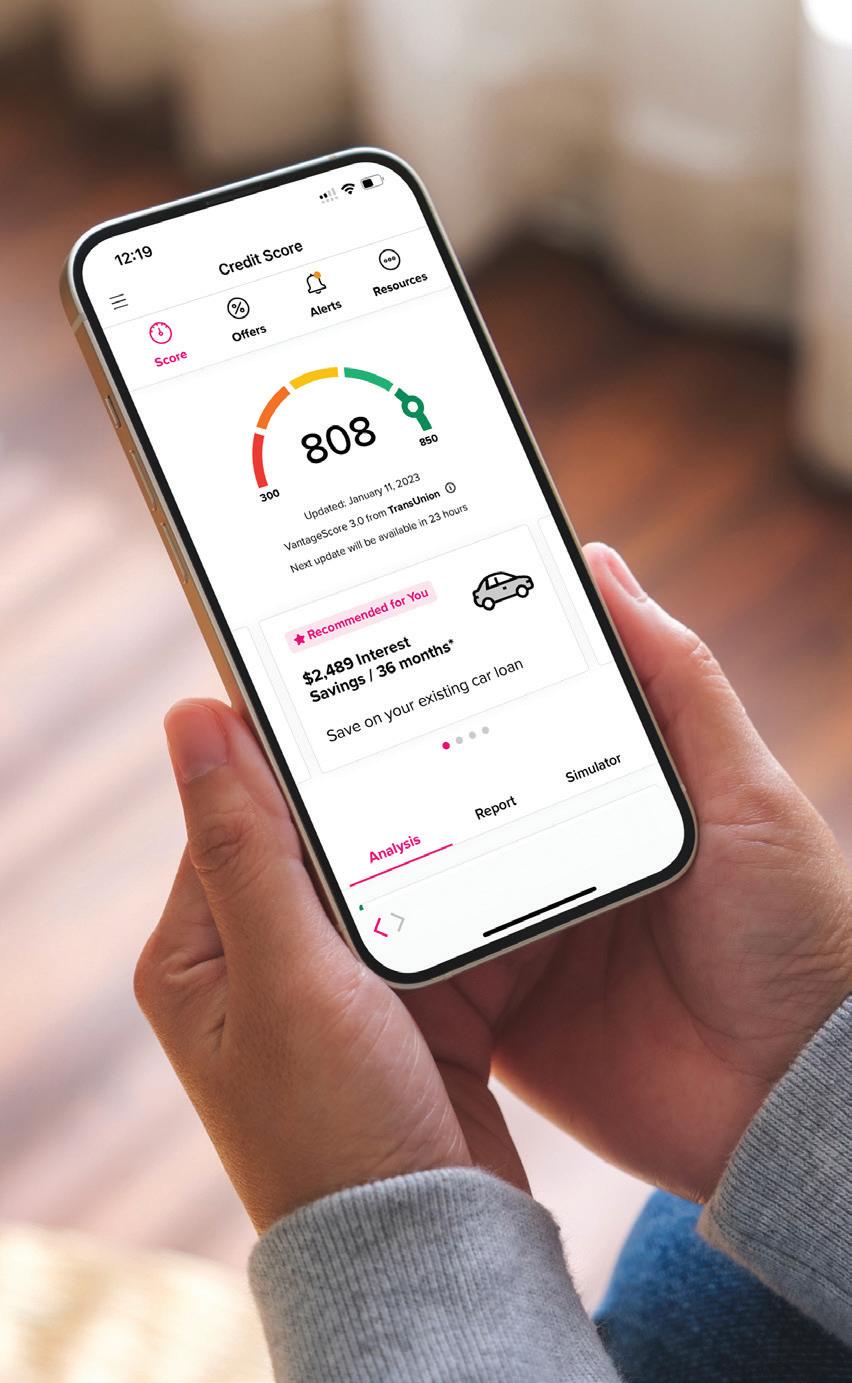

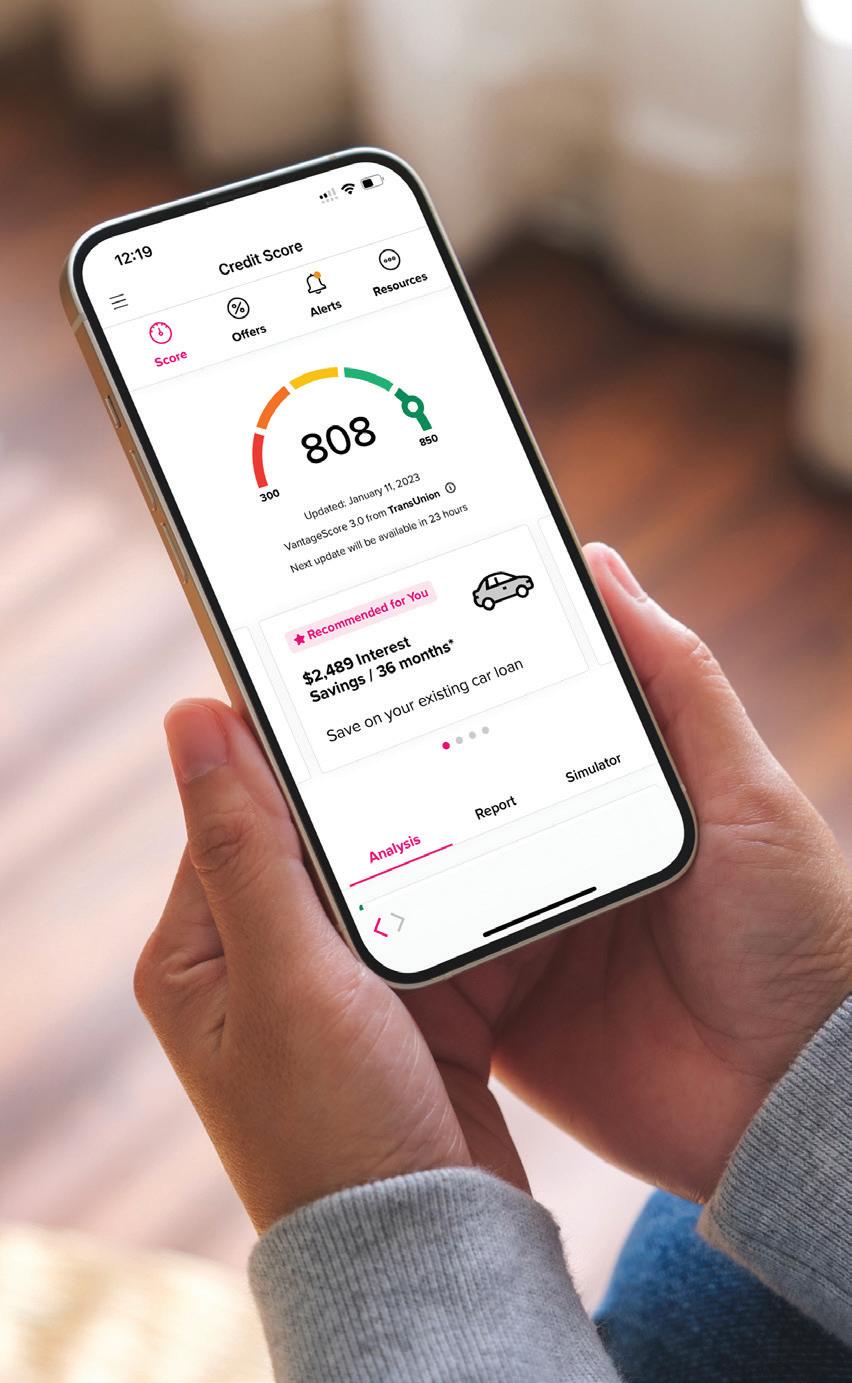

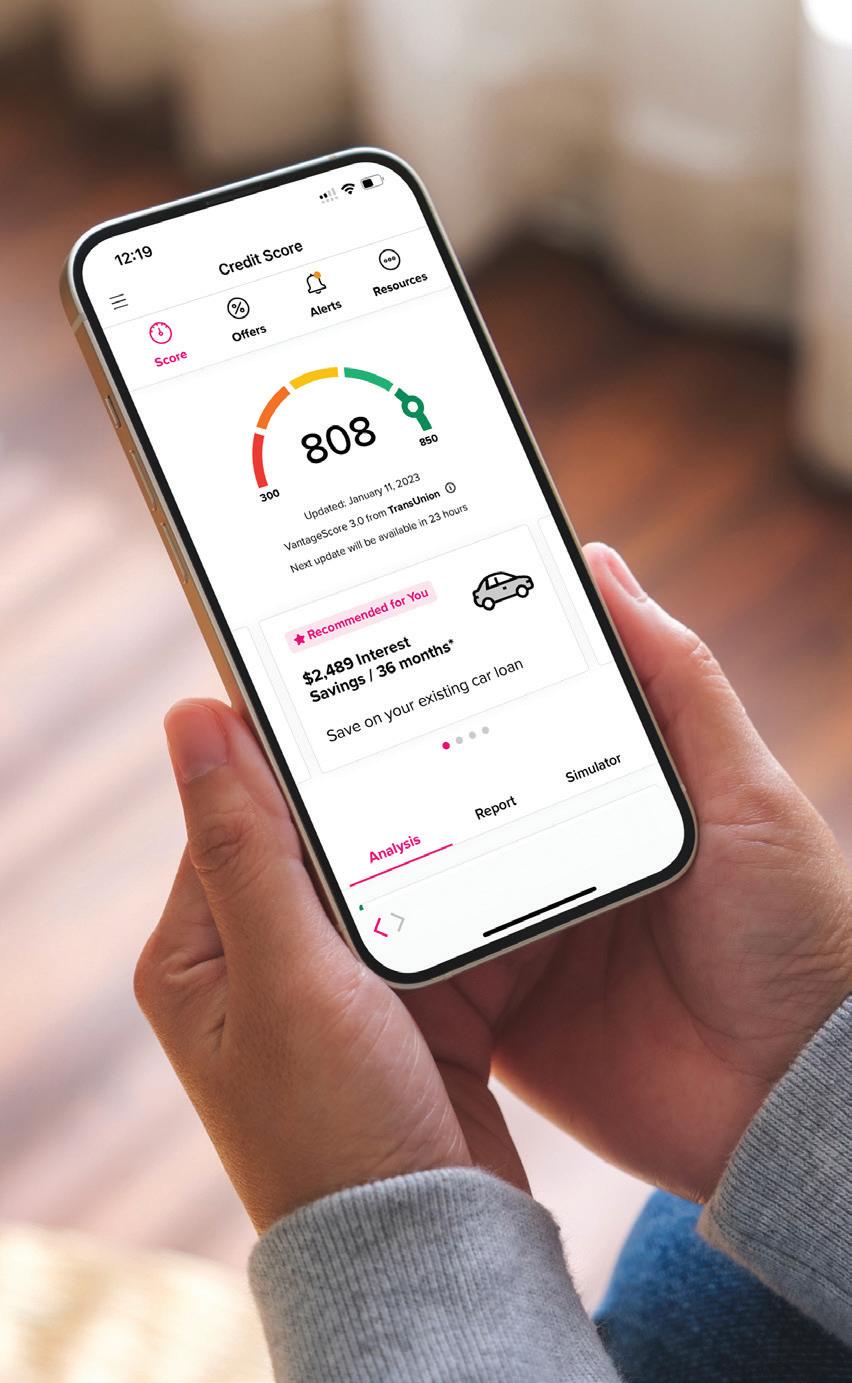

APY= Annual Percentage Yield. Rates effective as of 04/03/2023 and subject to change without notice. Minimum purchase amount is $1000. Certificates will automatically renew into a 24-month term at maturity unless otherwise directed by member. IRA certificates available. A penalty for early withdrawal may apply and may reduce earnings. Ask a CCCU representative for complete details. Insured by NCUA. Save today to plan for tomorrow. With SavvyMoney, City & County’s free credit score tool - you can access your credit score, full credit report, financial tips & so much more! Available within Online & Mobile Banking so you can stay on top of your credit anytime, anywhere. Mobile App Look for ‘My Credit Score’ in the dropdown menu. Online Banking Look for ‘My Credit Score’ from the Online Services tab. HOW TO ENROLL Introducing SavvyMoney YOUR CREDIT SCORE & MORE Home Insured by NCUA. The score displayed in digital banking is for the primary individual on the membership only. LEARN MORE AT CCCU.COM/SAVVYMONEY TIP A CD locks in a higher earnings rate than your savings so you earn a boost for the money you’re already saving. TIP Simply accept the one-time opt in and begin using your new credit score tool! CALL US AT (651) 225-2700 OR VISIT A BRANCH TO GET STARTED! $1,000 MINIMUM 4.32%APY 15-MONTH CD SPECIAL NEW OR EXISTING DEPOSITS ELIGIBLE

Equal Housing Opportunity. Mortgages not available in all states. Closing cost credit is applied as a lender credit towards eligible closing costs. Closing cost offer subject to change. Eligible loans under $100,000 will receive a $250 lender credit, all others $500. Offer not available for home equity or commercial loans. 3% down payment for first purchase or new purchase, 30, 20 & 15 year fixed rate mortgage. Payment example: On a $300,000 home loan at a rate of 5.875% for 30 years, the monthly payment would be $1,774.61 resulting in a 6.065% APR. Payment does not include applicable taxes and insurance and may result in a higher payment. Other restrictions may apply. Rate effective 4/5/2023. APR = Annual Percentage Rate. Contact us for more information. Exclusive Offers Home Right where you want to be. TIP Learn more about the Home Buying process by downloading our Free Home Buyer’s Guide. Scan the code to get started! At City & County Credit Union, we know fluctuations in the housing market can make it difficult to know when it’s time to buy. And while we can’t predict the future - we do know that when a new home is calling, we’ll be right by your side to ensure you feel confident with your decision by helping you lock in the best option for your family. From pre-approval to closing, our local mortgage team will be with you every step of the way so all that’s left for you to do is celebrate! APPLY ONLINE AT CCCU.COM | (651) 225-2729 | MORTGAGETEAM@CCCU.COM $5OO OFF CLOSING COSTS UP TO DOWN PAYMENTS AS LOW AS 3%

Always Moving Forward.

When you bank with City & County Credit Union, there is no limit to what you can achieve. We’re here to help keep life moving forward –just like Theresa, member since 1983.

“I love how City & County continues to improve their processes. The purchasing of my 2023 car was so simple. The online application was easy & the staff putting together the documents were incredibly pleasant and efficient. Signing the loan agreement didn’t require an appointment, we could do it all online. Thank you City & County!”

Ready to hit the road in your new ride? Enjoy auto loan rates as low as 3.99% APR. Apply online at CCCU.COM.

unexpected expenses, home improvement projects, college tuition & more

a CITY & COUNTY HOME EQUITY LOAN

Cover

with

.

APR=Annual Percentage Rate. APR ranges from 6.24% to 18.00%. Actual rate based on applicant’s credit qualifications, collateral, and loan term. Maximum term available is 240 months. Minimum loan amount is $25,000. No closing costs. Member is responsible for cost of appraisal regardless of completion of the loan. Appraisal fees may range from $102 - $1,000 depending upon location. Payment per $10,000, 80% Loan-To-Value is approximately $112.56 at 6.24% APR for 120 months, $77.53 at 7.00% APR for 240 months, and 90% Loan-To-Value is approximately $80.85 at 7.50% APR for 240 months. Rates subject to change at any time. Other restrictions may apply. Equal Housing Opportunity. Most loans close within 30 days from receipt of required information. Processing times may vary. APPLY ONLINE AT CCCU.COM TO GET STARTED! APR = Annual Percentage Rate. Actual rate based on applicants credit qualifications, collateral and loan terms. Rate effective 04/03/2023 and subject to change.

Theresa MEMBER SINCE 1983

Submit an online application and get access to your cash within 30 days. Lock in a fixed rate as low as 6.24% APR for affordable financing. APR

Where you bank matters.

BY Patrick Pierce | CCCU President

For the past 95 years, City & County Credit Union has been a financially safe, sound & secure financial institution – and we plan to be that way for the next 95 years & beyond. It’s our commitment to our not-for-profit founding principles that sets us apart from big banks and most recently, the institutions who have made news headlines.

This is why City & County Credit Union is proud to be different. We believe in the cooperative mindset and put purpose over profit. We listen to the needs of our community and ensure we are doing what’s right not for a group of shareholders, but for our member-owners. You can see this difference in action when you visit our branch locations to make a deposit, use our mobile app to check your account balance and even in the principles that guide our everyday business practices.

Board of Directors

City & County Credit Union is governed by a volunteer Board of Directors that is comprised of member-owners. They are the voice of the membership and act in your best interest. In addition, the Board helps set the direction of credit union policies and ensures we are operating with sound business practices that best protects funds & assets.

Meet members of your Board of Directors and learn more about the impact City & County Credit Union made in 2022 by attending our Virtual Annual Meeting on Thursday, April 27.Keep an eye on your inbox for an invite coming soon.

Financial Strength

As a cooperative financial institution, we thrive when our members thrive. We’re right by your side to celebrate big financial successes and face challenges with affordable financial solutions to keep you moving forward. With the strength of our membership – 62,600+ members - City & County Credit Union’s net worth remains well above our peers and measures financially strong and secure as set by guidelines from both state & federal governing agencies.

NCUA & ESI Insurance

Most importantly, your deposits at City & County Credit Union are insured by the National Credit Union Administration (NCUA) up to $250,000 and Excess Share Insurance (ESI) up to $250,000 - totaling $500,000 per individual account holder. Your insured deposit amount can increase based on additional factors like joint owners & beneficiaries, but if you’re like most City & County members you’re more than likely already 100% insured.

We’re proud to be your not-for-profit financial cooperative and promise to always keep you at the forefront. Your trust is our greatest asset and we will continue to maintain it with transparency in what we do & why we do it. Simply put –where you bank matters now more than ever before and we know, and can promise, City & County Credit Union is the best place to be.

STATE OF THE CREDIT UNION

Stay In the Know WITH OUR VIDEO LIBRARY Subscribe to City & County’s YouTube Channel to stay in the know on important topics. You’ll find playlists focused on youth money lessons, digital technology how-to videos & a short series explaining what happened

to Silicon Valley Bank.

Home 144 11TH STREET EAST ST. PAUL, MN 55101-2380 CHANGE SERVICE REQUESTED (651)225-2700 (800)223-2801 8 CONVENIENT LOCATIONS Brooklyn Park | Eagan | Lake Elmo | Maplewood Minnetonka | Saint Paul | Shoreview | Woodbury SAVINGS & CHECKING Savings Checking Money Market Certificates IRAs & HSAs Business Accounts Youth Accounts Financial Planning LOANS Auto Loans RV & Boat Loans First Mortgages Home Equity Loans & Lines of Credit Credit Cards Personal Loans Private Student Loans CONVENIENT ACCESS Mobile Banking Mobile Deposit Online Banking Bill Pay eStatements ATM/Debit Cards Direct Deposit ATLIS by Phone SERVICES CONTACT INFORMATION PRESORT STD U.S. POSTAGE PAID PERMIT 7524 TWIN CITIES, MN CCCU.COM CO-OP SHARED BRANCHING Access to over 5,000+ locations nationwide: cccu.com/branch-atm Spring Shred Day EVENT SATURDAY, MAY 20 9:30 - 11:30 AM Minnetonka & Maplewood Branch Donate a non-perishable food item & we’ll shred your documents for free! INVESTING IN YOU