The 2024 Manufacturers and Distributors Opportunity Report

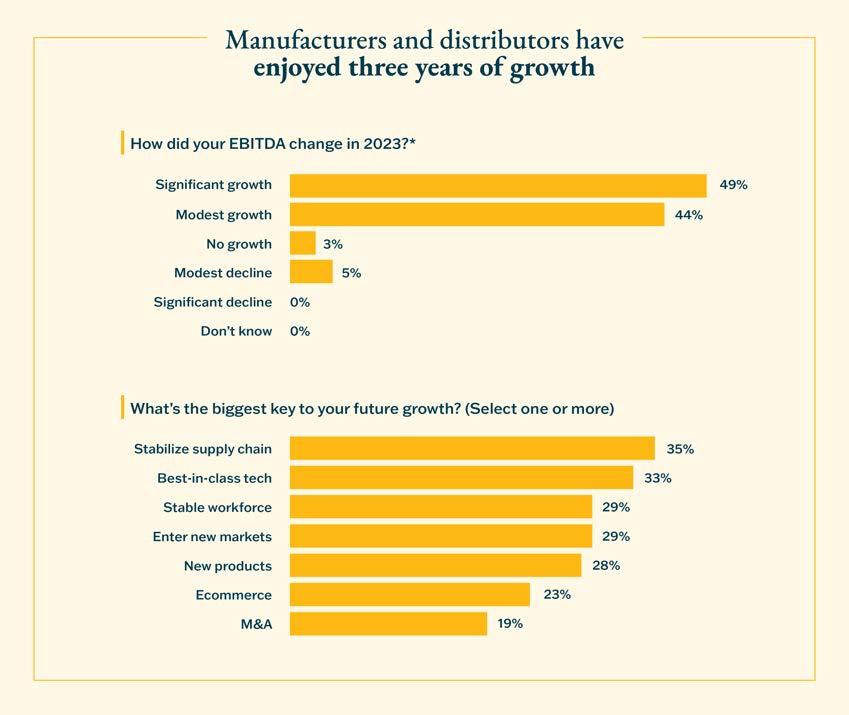

Manufacturers and distributors have generated strong revenue over the past three years and leaders are optimistic. They see increased opportunity and expect the economy to improve, and that’s despite their pessimism in some areas — they expect consumer demand to soften and global instability to rise.

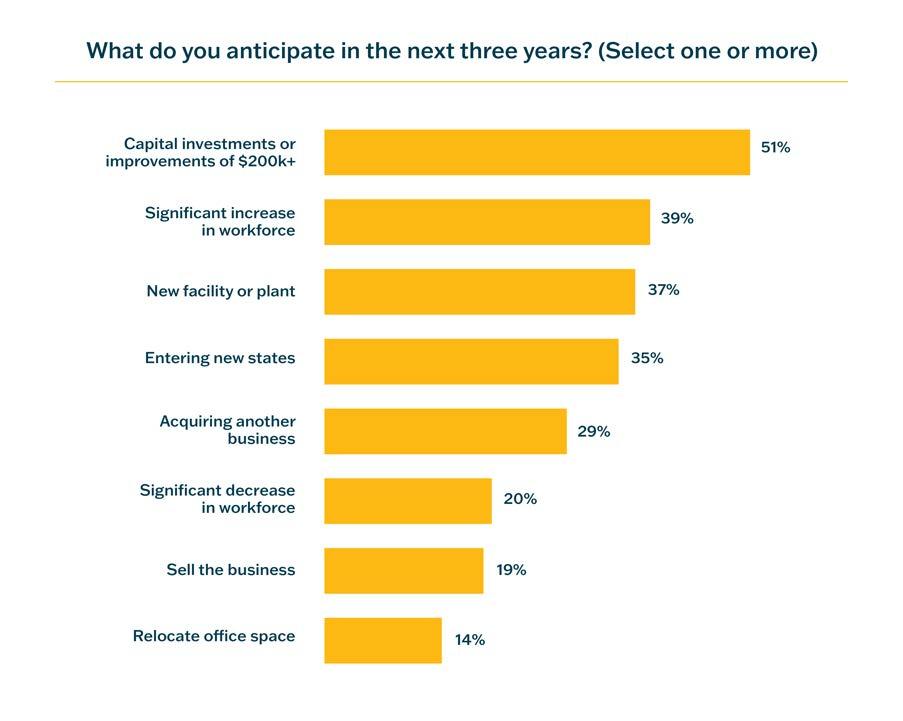

Some economic indicators are not headed in the right direction. For example, interest rate hikes typically take two years to slow an economy, and as the data indicates, they are finally taking hold. But it hasn’t halted manufacturer revenue and EBITDA growth, which are still up year-over-year. Manufacturers are busy making capital expenditures, investing in physical

locations, nearshoring, and diversifying. Whatever their misgivings, they expect business to boom. Two in five expect to hire significantly more people, even while they launch AI initiatives that will reduce jobs in other areas.

What can we make of all this data? Welcome to our first-ever opportunities report for manufacturers and distributors where we unpack our findings from two recent Citrin Cooperman surveys of hundreds of manufacturers plus broad economic data. Within, we highlight financial opportunities for your business, enriched by this team’s experience working with some of the largest private companies in this space. 75% of manufacturers expect economic conditions to improve over the next 12 months.

Manufacturers are reporting strong financial growth despite disruption. The supply chain continues to be a major focus, though it’s taken a backseat to concerns about inflation. Long-term signals of economic health like capital expenditures reveal a broad sense of optimism.

Let’s explore six facets of the market right now.

EBITDA growth suggests a strong economy

Inflation overtook supply chain as a leading concern

Product performance drove EBITDA growth

Product performance rose thanks to supply chains and demand

Manufacturing-related construction increased, as did inventory

Shipping prices remain high

2023 was another strong year for revenue and EBITDA growth. Ninetythree percent of survey respondents saw their revenues grow, many for the third consecutive year. Given all we’ve heard about supply shocks, that may surprise outsiders, but it’s evidence that these companies have successfully navigated disruption.

Of all, private equity-owned companies grew EBITDA the most — 32% percent saw significant growth compared to 26% of privately held or familyowned companies.

“This speaks to a really strong economy,” says Dr. Anirban Basu, Chairman and CEO of Sage Policy Group. “Any weakness has occurred in just the last few months. This is remarkable given continued inflationary pressure on all fronts, from labor to insurance, healthcare to products.”

This is not to say the year was without its obstacles. Inflation overtook supply chains as the largest challenge and 81% of manufacturers say inflation has impacted their spending. Consumers are likely feeling the same cost pressure and 61% of manufacturers believe consumer spending will slow as a result. There has been some slowdown in the past few months, but for the present, the economy is still running strong.

“Across the board, we are seeing manufacturers and distributors focus on cost control in 2024. They’ve endured tremendous cost increases over the last four years, from freight to labor, products, and insurance. Now that interest rates are high and things have stabilized, they’re focusing on the value they are receiving.”

Mark Henry Partner Citrin Cooperman

What is your largest challenge? (Select one or more)

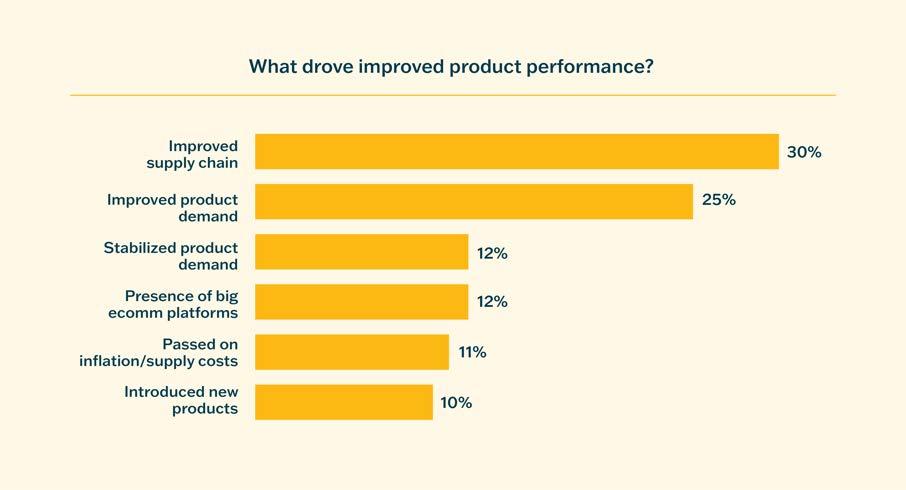

Last year, 50% of manufacturers and distributors said their products performed “much better” compared to 27% the year prior. That’s an impressive increase.

Source: 2024 Manufacturing and Distribution Pulse Survey

Supply chains improved, demand increased, and demand for additional products rose. When asked about supply chains in particular, 90% of manufacturers said theirs had stabilized. “That’s a big number,” says Dr. Basu. “And necessary for growth.” At the same time, manufacturers also listed supply chains as a top challenge. It continues to be an area of increased opportunity and risk.

As part of that stabilization, manufacturers have diversified (52%) and nearshored manufacturing operations (43%). This data suggests they’ve mostly overcome any loss of any prior supplier relationships.

90% of manufacturers said their supply chain stabilized.

Source: 2024 Manufacturing and Distribution Pulse Survey

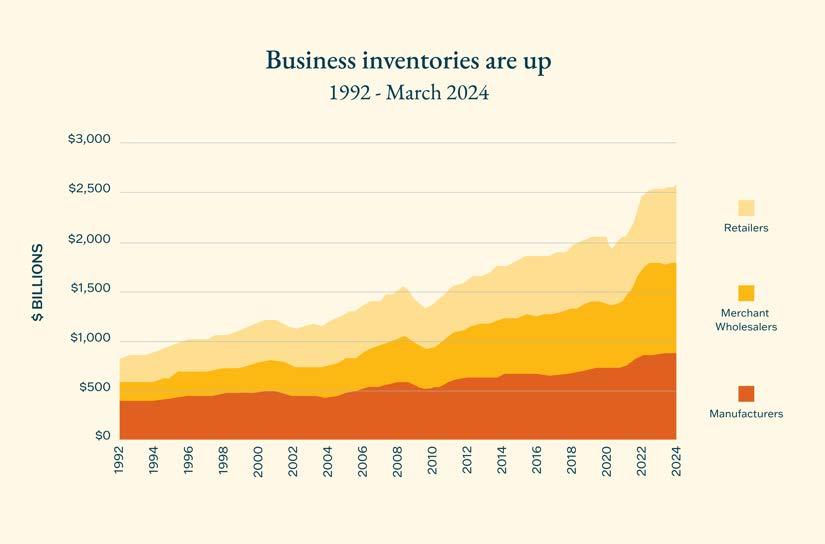

Companies are building factories across North America and inventory levels are up. This could be cause for concern, but so far it’s been offset by the increased demand. Fifty-four percent of manufacturers said they had excess inventory in the last quarter of 2023 and factory orders were down. A survey by the National Association of Manufacturers found that 45% expect inventories to fall in 2024.

“If inventory is up and the industry rapidly grows, but then consumer spending declines, manufacturers could run back into issues with inventory write-offs.”

John Giordano Partner Citrin Cooperman

of respondents expect to launch a new product or service over the next three years. 70%

At the same time, shipping prices are up according to the Baltic Dry Index. They fell from a pandemic spike, but have remained high and are rising again. “This is one of my favorite leading indicators of the economy,” says Dr. Basu. “Ships full of raw materials means eventual production.” This is promising. But the question is, will the demand still be there by the time the products are produced? If not, it could create inventory issues.

Seventy-three percent of manufacturers anticipate the cost of inventory will be higher in the next 12 months, which includes rising freight prices. One of the fastest-rising costs was insurance — global maritime insurance premiums rose 8.3% in 2022 and have continued to rise since.

“The present shipping costs reinforce the idea that the just-in-time model is no longer the norm. Red Sea attacks have quadrupled container costs and added 10 days to delivery schedules.”

Mark Fagan Partner Citrin Cooperman

of manufacturers anticipate higher cost of inventory in the next 12 months. 73%

“Understanding those scenarios and planning for what you’ll do remains critical — and will continue to challenge leaders over the next several years.”

Mark Henry Partner Citrin Cooperman

All this cost pressure and continued high interest rates will begin to erode the hottest areas of the economy. The question is, will demand remain strong enough to offset increased costs? We explore four actions manufacturing and distribution companies can take, next.

The strongest performing manufacturers and distributors in our surveys are also thorough and early adopters of technology.

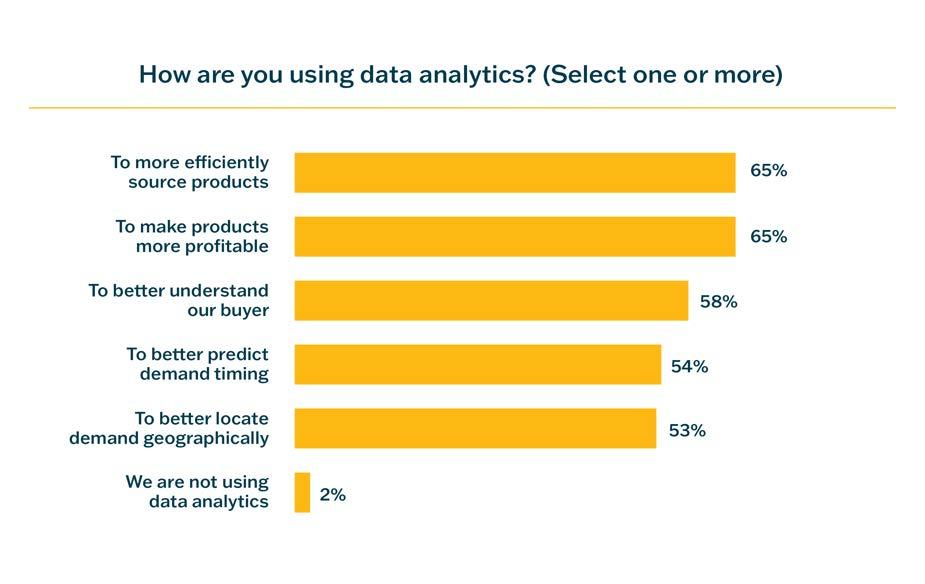

We’re in the fourth industrial revolution and businesses that aren’t yet using advanced analytics to make decisions, capitalize on the growing ecommerce opportunity, improve supply chain transparency, upgrade factories, and explore AI, appear to be behind. What can your business be doing?

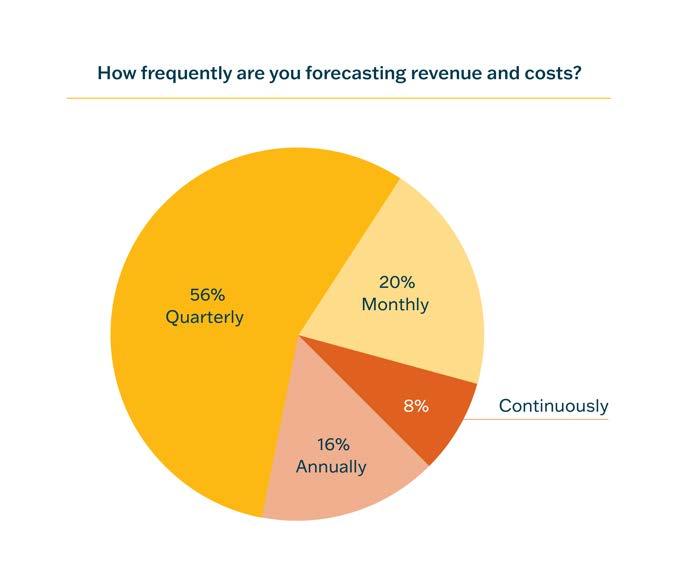

Monthly forecasting is good, but continuous is better

Ninety-eight percent of manufacturers now use data and analytics in some form. But their quality and utility vary.

A little more than one in five (27%) manufacturers say they have fully implemented data analytics. But if they have, they are able to make better and faster decisions. Those that are able to forecast continuously can spot weekly trends, do better deals, keep inventory costs low, fight shipping costs, and more intelligently diversify suppliers.

“Investing in technology can help you control, manage, and gain visibility of your supply chain in real-time. It can help you manage vendors and your purchasing process visibility to ensure you get the best price and delivery combination. Ultimately, the more transparency you have on your inventory and cost levels, the more you improve your customer experience”

John Giordano Partner Citrin Cooperman

Source: 2024 Manufacturing and Distribution Pulse Survey

“The pandemic generated a real acceleration — a new normal — where online sales have taken off. It’s the new vehicle.”

Ecommerce is dominating, in B2B as well

Ecommerce is the “new vehicle” for sales. The pandemic surge has not abated — 57% of all companies across industries say online sales account for more than 50% of their revenue. Twentythree percent of respondents say ecommerce sales have doubled in just the last 12 months. If your revenue isn’t near that level, this may be worth exploring.

Dr.

Anirban Basu Sage Policy Group

say ecommerce sales have doubled in the last 12 months.

The fourth industrial revolution, broadly defined as a rapid advance in analytics, humanmachine interaction, and robotics, relies on data. “Data quality and integrity have become crucial,” says Mark Fagan, Partner at Citrin Cooperman. “If particular metrics on a dashboard become the fulcrum around which a business model turns, they must be 100% accurate.”

In this regard, manufacturers and distributors are only slightly behind peers. Sixtythree percent have updated their ERP in the last five years compared to 66% for all industries. And 94% of manufacturers say their ERP gives them profitability information at the product level. But is the information complete and timely enough to make sound decisions? Given the complexity of manufacturing and distributing goods, any ground companies lose here can grow into a serious exposure.

Tech Opportunities: of manufacturers and distributors have updated their ERP in the last five years. Just 63%

“This sector must fortify its defenses by developing security policies and an incident response plan, revisiting compliance requirements, committing to regular hardware and software patches, and using multi-factor authentication and stronger passwords. Consider establishing a vigorous cybersecurity awareness training program complete with phishing simulations to help users avoid social engineering attacks such as spear phishing.”

Kevin Ricci Partner, Risk Advisory and

Citrin Cooperman

Compliance

Practice

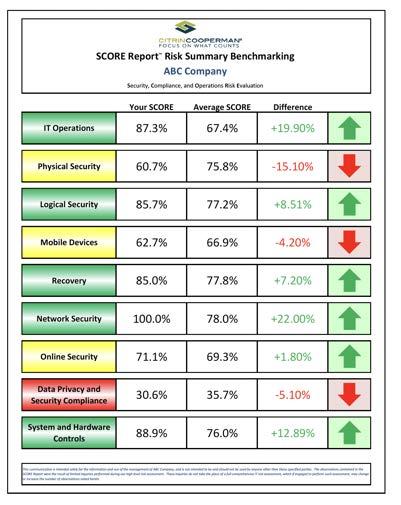

Startlingly, one in three manufacturers and distributors experienced a cyber incident or breach in the past two years. Anything online is vulnerable, and manufacturers must pair any modernization with equivalent cybersecurity measures — especially given manufacturers are increasingly caught in international trade disputes and targeted by statesupported cybercriminals.

Despite that, only half of our survey respondents have:

• Performed a cyber assessment during the last 12 months

• Considered penetration testing to assess their strength

• Invested in cyber insurance

• Hired internal or external personnel to actively monitor cybersecurity

• Enacted an incident response plan

• Provided ongoing cybersecurity awareness training

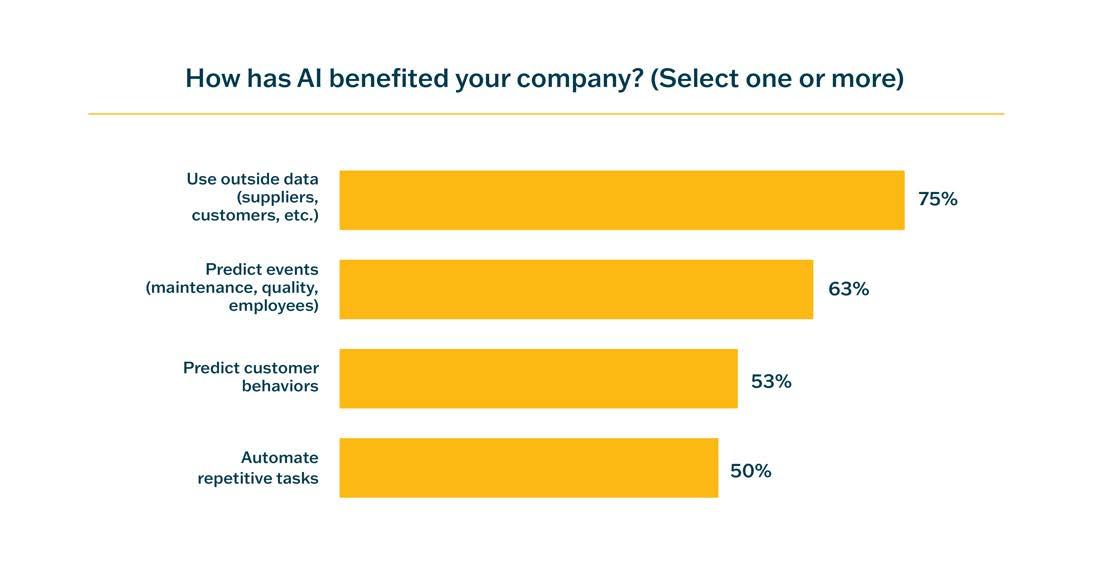

Thirty-two percent of manufacturers say AI and machine learning have allowed them to reduce headcount. Thirty-four percent say it’s altered people’s job descriptions and allowed managers to shuffle staff. Half seem to be finding that workers’ jobs are not quite as homogeneous or automatable as previously thought. Despite the fact that 20% of manufacturers plan to significantly decrease their workforce, twice as many — 39% — expect to significantly increase it.

“The ‘manufacturing skill set’ is changing. We’re long past the days of manually monitoring assembly lines. Now, even the oversight is being automated, and those systems are predicting downtime and defects.”

John Giordano Partner

Citrin Cooperman

as many companies expect to significantly increase headcount versus decrease it over the next three years. 2x

The skill gap persists

50%

38%

of companies say that to meet the demands of advanced tech, they’ll have to outsource at least one quarter of their talent needs. say “talent” is their greatest barrier to implementing AI.

More change is coming. The best thing a business can be right now is adaptable. Manufacturers have diversified suppliers and reduced risk by nearshoring, but anywhere you can give yourself the additional foresight of faster forecasting and new data insights, you gain an advantage.

“The cost of education is rising, as is debt. But there are great opportunities in manufacturing through apprenticeships. Will we see this attract more talent?”

John Giordano Partner

Citrin Cooperman

We’re seeing companies get more creative about attracting the talent needed to deploy more advanced technology with flexible work arrangements, better search tools, and strong relationships with universities and alumni programs. But as skill needs continue to change, the hire-versus-outsource equation may tip. Upskilling employees on new technologies from smart factory cobots to predictive LLMs when you don’t already have those expertises in-house will likely be slower and less effective than hiring outside experts. These individuals can then train your staff through doing the work.

Also important is informational agility. Manufacturers need to move material and products, but so too ideas, designs, and plans. We are helping some clients explore the stillearly concept of the industrial metaverse. Might it help your business collaborate, codesign, stress test, and train workers, all remotely?

“We are seeing the larger ERP software publishers offering AI features but it will be a year or two before the more complex supply chain use cases are ready for mass adoption. When they are, companies that haven’t upgraded their ERP recently will find themselves behind.”

Smija Simon Director, Digital Transformation Practice

Citrin Cooperman

Opportunities:

Revisit your ERP, CRM, manufacturing execution system (MES), and product lifecycle management (PLM) implementations to ensure you’re able to use data on everything from components to service tickets.

• Measure and share cost variant data (i.e. with revenues)

• Get the data into the right hands quickly

• Visualize data for real-time operational insights

If your ERP doesn’t allow you to forecast monthly or continuously, it’s worth revisiting. To remain competitive, we believe companies must:

• Track activities in real-time (no manual uploads)

• Factor in time, project schedules, and costs

• Track performance metrics trends

• Allow workers convenient mobile access

Learn how to implement a new ERP

Invest in a best-in-class point of sale website

To take advantage of the ecommerce opportunity, you must have an effective digital experience. That means intuitive navigation, pleasing design, lowfriction interactions, quick load times, short click paths, and simple, secure checkouts.

Cyberattacks are not a matter of “if” but when. Recall, nearly one-third of manufacturers and distributors suffered an attack in the last two years. It’s also difficult to evaluate “unknown unknowns” or threats your team isn’t yet aware of. Outside experts can apply the knowledge of hundreds of incidents and recommend better policies, programs, and software. For example, does your company properly evaluate all new tools, including AI? Require SOC compliance? Require uniform SLAs?

Learn how we help with cybersecurity

A sample cybersecurity benchmark report

Invest in warehouse automation

Automation has the potential to reduce human error and eliminate labor overhead. But before you invest, consider the return — can you calculate the upside by analyzing similar rollouts? Will it allow you to reduce headcount or will it create new roles in other areas? What are the tax implications of these capital expenditures?

Learn about warehouse automation

By streamlining categorization, companies can improve the efficiency of their warehouses, reduce inventory holding costs, and fulfill orders faster. For example, they can better sort packages by size, weight, seasonality, and new factors not previously considered.

As labor costs rise, manufacturers and distributors are reacting the same way they reacted to supply disruption: They’re diversifying.

Manufacturers are considering a wider variety of ways to address their talent needs, from relaxing outdated job requirements to outsourcing to tech.

43% saw significantly higher employee costs

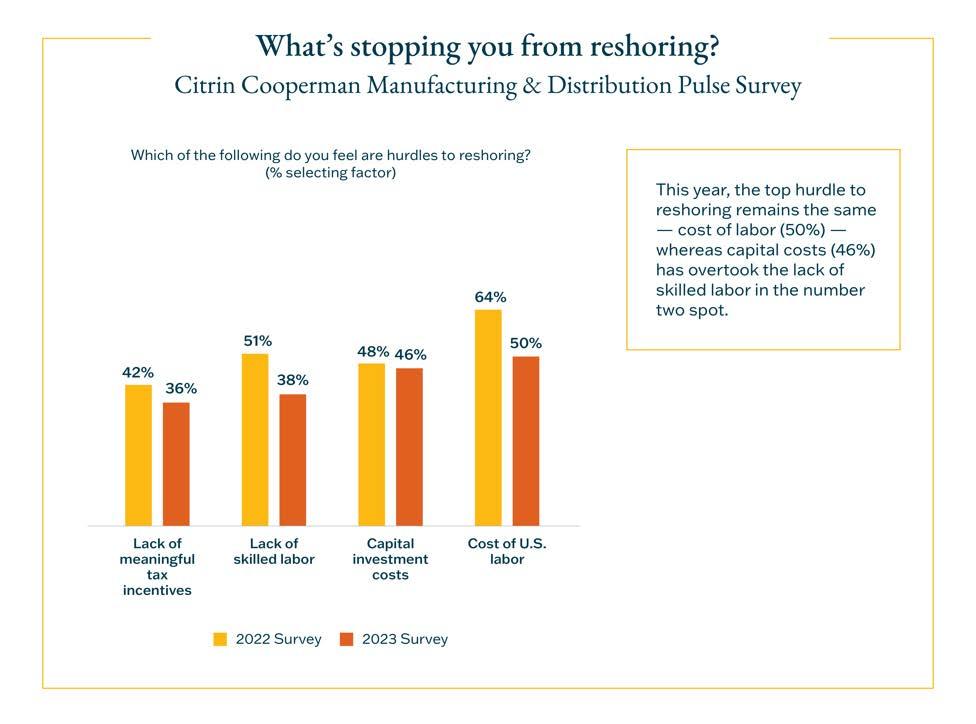

Labor grew more expensive last year and 50% of manufacturers say this was one of their top hurdles to reshoring operations. Employee costs are unlikely to decrease because U.S.

living costs continue to rise — rents have quickly outgrown income in several major metros, and national real wage growth was negative for several years and has only just recovered. If it’s any indicator, the UPS and Teamsters Union negotiated a five-year contract where at the end, UPS drivers will make an alleged $170k per year.

“If labor costs continue to rise, is there any way they won’t lead to increased consumer prices? Businesses asked their customers to pay higher costs to offset shipping delays. Higher inflation and interest rates will result in even greater costs to consumers.”

John Giordano Partner Citrin Cooperman

Labor shortages have shown up evenly across all areas of operations. The U.S. Chamber of Commerce reported that 622,000 manufacturing job openings were yet to be filled as of January 2024, and the Bureau of Labor Statistics projects assemblers and fabricators to have the most unfilled openings through 2032.

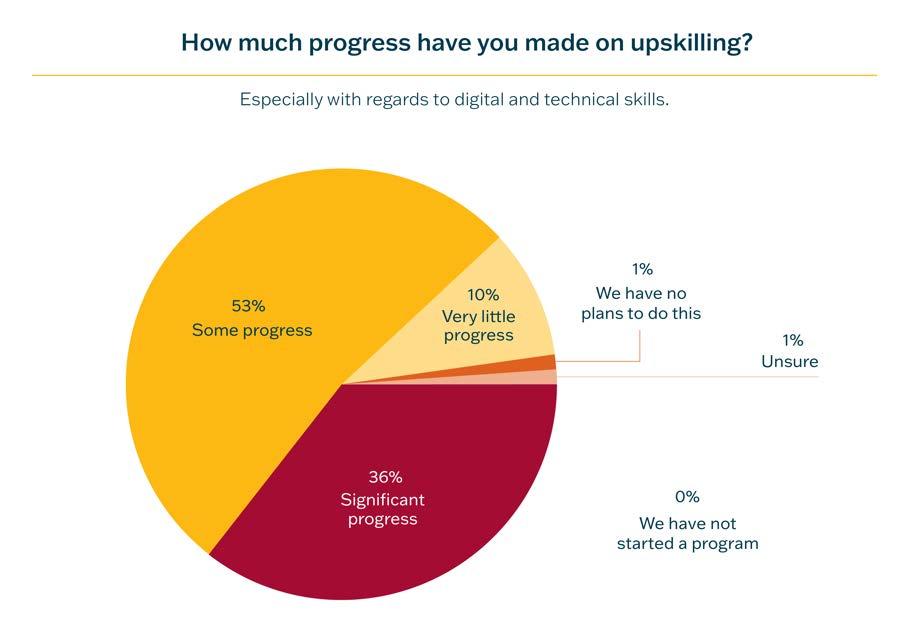

Training Opportunities:

This figure puts manufacturers and distributors only somewhat behind other industries (38%). Part of the reason may be that upskilled manufacturing workers are somewhat more difficult to retain. From the warehouse to skilled trades, it’s an employee’s market, and 42% of manufacturers say retaining newly upskilled workers is a top challenge.

Source: 2024 Manufacturing and Distribution Pulse Survey

“Retaining upskilled employees has become a top challenge for manufacturers, especially in the digital realm.”

Mark Fagan Partner Citrin Cooperman

Upskilling will, in effect, decide whether companies successfully adopt new technology and seize new opportunities. As labor shortages and costs worsen, we’re seeing many companies outskill — outsourcing the skilled part of a job to experts on contract. Those experts augment and can even teach existing employees. Outskilling can be cheaper and more assured than launching an internal training program — there’s no certainty a training program will work, nor prove its value quickly. Whereas outskilling is a more direct and immediate answer.

This is a large part of why 90% of companies in our survey said they need to look outside their organization to help with advanced technological readiness. When companies invest in outskilling and outsourcing, it also allows them to train their existing workforce and sometimes, transition them to more meaningful roles.

say they must look outside their organization for advanced tech skills. 90%

Then, of course, there’s the question of AI, and whether you should expect it to reduce headcount. Given twice as many manufacturers envision having significantly more headcount rather than significantly less over the next three years, take actions that keep your options open — outskill, outsource, and run reversible experiments. Where you can, use AI to automate repetitive tasks that may have been the past cause of turnover, and retrain those employees in operating and program engineering, quality control, purchasing, management, or back-office roles in their current department.

If you invest in training programs, invest in programs that make employees more adaptable and ready for even more disruption. There is no reason to believe the present rate of change will slow. Think about the present wave of new skills, but also beyond, to what’s next.

Turnover is tax. Even if you must shuffle workers, you should strive to retain their various talents because it may be 6-12 months before a replacement is productive. The more knowledge you retain, the smoother the transition.

• Invest in clearer career paths

• Invest in manager training (just 18% receive formal training)

• Reevaluate requirements (e.g. certifications, degrees)

• Diversify your hiring pipeline (revisit job descriptions, find new sources)

• Reevaluate and update benefits

The build-versus-buy equation is tipping toward “rent.” The key ingredient to outsourcing work is understanding how it is done, and few companies have their work documented well enough to productively incorporate outsiders. Outside consultants can help you with this and prepare your teams.

BPO can offer a strategic way to:

• Control costs

• Accelerate timelines

• Standardize processes

• Create consistency

• Minimize errors

• Increase transparency

Training Opportunities:

Enlist an expert to audit your BPO readiness

They can evaluate and advise on the:

• Quality of your documented procedures

• Systems you are using

• Maturity of your financial reporting

• Level of current support from accounting

Learn how we help with outsourcing

Manufacturers face a number of headwinds. Inflation looms large, followed by supply chains and cost of capital. Manufacturers are addressing it in many ways.

Inflation has overtaken supply chain as their primary challenge according to 41% of respondents across all industries. Over 81% of manufacturing and business leaders say inflation has altered their business spending habits and they expect consumer spending to slow in 2024.

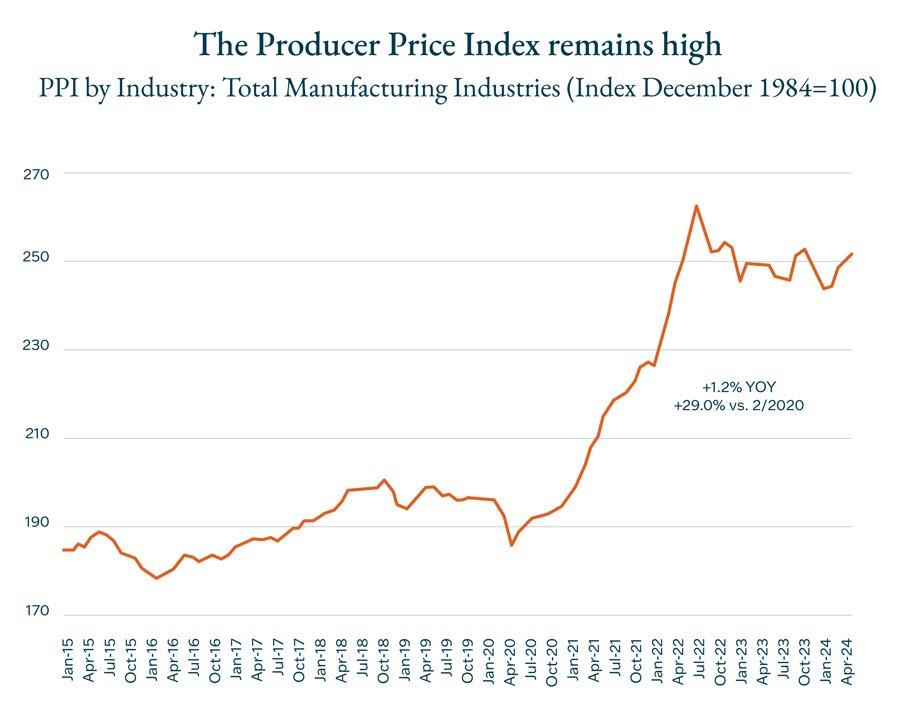

Last year, 80% of manufacturers saw inventory costs increase more than 11%, and 73% expect inventory costs to increase over the next 12 months. In addition to increased costs of product, the costs of holding inventory, and businesses’ increased need for working capital amid a slowing cash conversion cycle, are driving down profitability. Sixty-two percent say they have seen an increase in the cost to carry inventory. have seen inventory costs rise more than 11%. expect inventory costs to rise in the next 12 months. 80% 73%

Source: U.S. Bureau of Labor Statistics

What’s astounding about the positive revenue story last year is that EBITDA continued to grow despite many numbers like inflation, inventory costs, and capital costs moving in the wrong direction. But now, the costs of capital are beginning to bite — manufacturers feel cost of capital is the biggest challenge facing the economy (25%), ahead of (but of course, related to) interest rates (23%).

Perhaps they are extrapolating from personal experience. Fortysix percent of manufacturers say the cost of capital is a major impediment to reshoring. And that rising cost to buy and carry inventory increases the working capital they need to operate.

Economy-wide, the producer price index (PPI), which is a measure of wholesale inflation, remains at a historic high (up 1.2%), but appears to be “softening,” according to Dr. Basu. Meanwhile, the Consumer Price Index (CPI) remains “stubbornly high” at 3.4%. These may be a sign interest rates are having their intended effect, and the economy weakening.

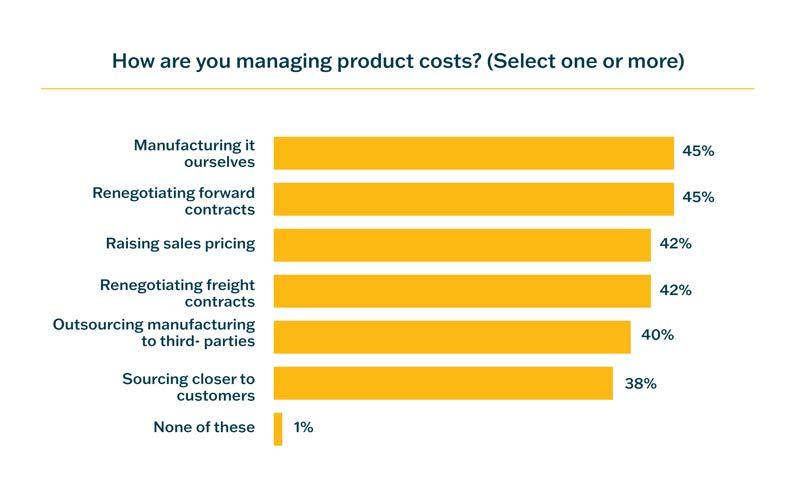

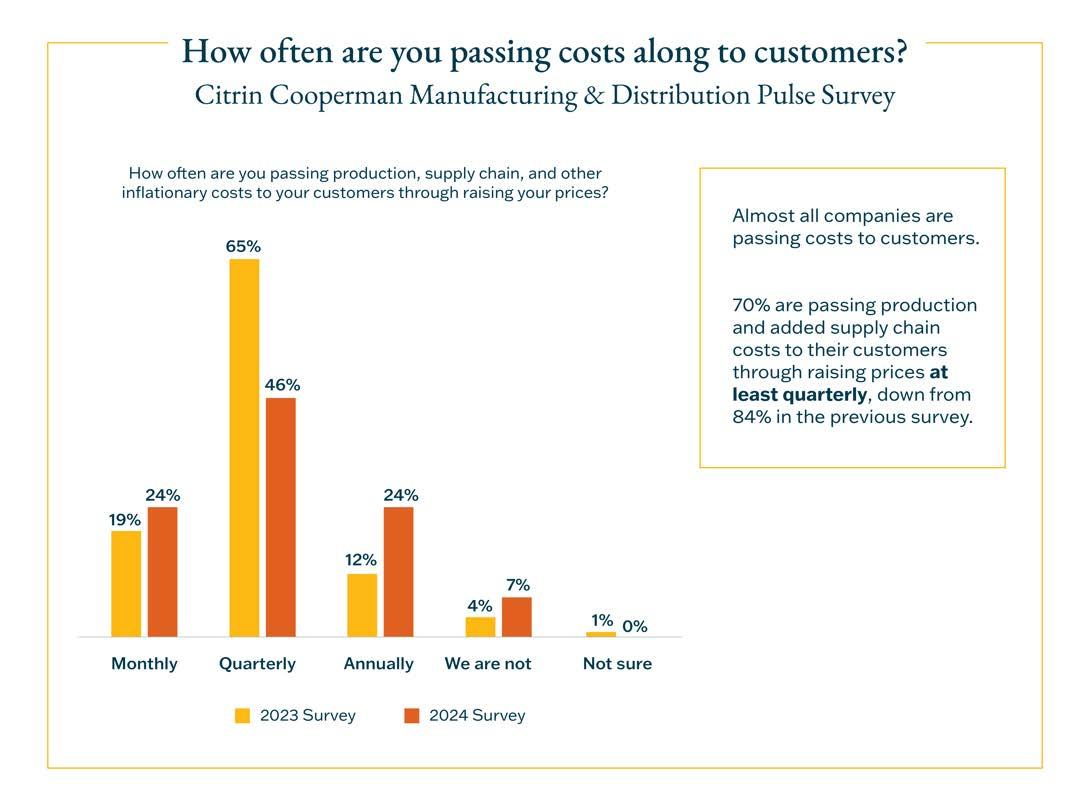

Forty-two percent of manufacturers are passing rising costs along to customers by raising prices, applying administrative or service fees, and using third-party logistics providers and warehouses. Manufacturers and distributors are very focused on managing these costs going forward — especially as customers are less willing to pay higher prices than they were last year.

Manufacturers are passing rising costs along to customers.

Source:

To keep their EBITDA high, manufacturers must get creative about managing costs. We’re seeing our customers more diligently reviewing all their expenses and evaluating how to remain as operationally lean as possible. They’re devoting more resources to identifying and minimizing financial risk (market risk, credit risk, liquidity risk — there are 15 factors in total) and reevaluating existing supplier contracts.

A great majority are passing along product costs up to the point of disrupting demand permanently, but no further. Many are raising these costs on a product-byproduct basis. Recall nearly all have an ERP that allows for this product-level segmentation, though even with

a world-class ERP, it is a non-trivial task. And one that requires continuous attention.

We recommend manufacturers pass those increased costs into projects and product pricing as often as their systems and customers can tolerate. (Building that process is half the challenge.) This year, 26% more companies are passing costs along monthly than did last year, and 70% pass along costs at least quarterly.

Of course, the economy will have to remain strong to absorb these price increases. Should it falter, the EBITDA story will change rapidly.

You may be able to write off more than you think. Recent tax laws have changed the U.S. manufacturing and distribution landscape repeatedly, and this could continue with a new administration with new policies. It will be critical for companies to understand what’s under discussion so they can plan and develop effective strategies to minimize tax.

aspects of this change, including cost allocation and amortization start dates.

Planning for potential changes to the tax law can create significant cash flow benefits for manufacturers and distributors. These tax changes are things your finance team can forecast and plan for as tax rates continue to fluctuate.

As just one example, as of 2022, to comply with Internal Revenue Code (IRC) section 174, businesses must capitalize and amortize R&D expenditures over five years domestically and 15 years for foreign research. This replaces the previous immediate deduction or amortization options. The IRS Notice 2023-63 clarifies

Also investigate IRS code sections:

• 41: Research and Experimental Tax Credit

• 168(k): Bonus Depreciation

• 45X: Advanced Manufacturing and Production Credit

• 48D: Advanced Manufacturing Investment Credit

Though the Senate did not pass the Tax Relief for American Families and Workers Act of 2024, we may see future bills like it, which would allow companies to claim additional depreciation, expense more domestic R&D, and more.

In the past few years, tax legislation has changed the landscape for many manufacturing businesses. For example, laws like IIJA, CHIPS, and IRA help fund clean energy initiatives, build the U.S. semiconductor industry, and rebuild U.S. infrastructure. Private semiconductor-related companies (clean energy, electric vehicles, batteries, components) may find significant grants and tax incentives.

At the time of writing, the U.S. government is also funding manufacturers for national defense, such as the Navy’s Supplier Development Fund. Staying current on government programs and grants can help you stay ahead of the competition.

Short for “domestic international sales corporations,” the DISC framework aims to encourage U.S. exports by offering tax incentives for companies that export goods. It is, we feel, an underutilized tax saving strategy. A DISC maintains its own records and bank accounts, but can distribute profits back into the parent company.

In addition, if your company sells into foreign markets, you may find significant tax savings via the foreign-derived intangible income (FDII) provision of the Tax Cuts and Jobs Act. It’s effective for tax years beginning after December 31, 2017 and can reduce the U.S. corporate tax rate to 13.125% for certain qualified businesses.

Sometimes the best advice is also the oldest: Manage your costs and cash flow. Talk to your bank, create a 13week cash flow forecast, re-forecast your production and backlog, review margins, and more.

Learn more about how to factor costs in

Learn more about cash management

Manufacturers may be able to at least partially offset increasing inventory and holding costs with better management techniques. For example, just-in-time (JIT), ABC analysis, minimums, and improving supplier relationships. One Citrin Cooperman customer began purchasing bulk products from China but finishing them in their U.S. factory, which is a joint venture with the Chinese manufacturer.

Learn more about inventory management

When costs rise, manufacturers buy inventory at higher prices, sell inventory at lower costs, and recognize more income. To combat this, consider switching from “first in, first out” to “last in, first out” accounting, so you can expense higher cost items during periods of inflation. (To execute this, you must maintain books and tax on the LIFO method.)

Learn more about LIFO

OPPORTUNITY / TEAM

More manufacturers are expanding into new markets and states.

They are reshoring, nearshoring, smartening up factories, and experimenting with new production processes. All of this adds complexity. To manage that complexity, companies need a team of experienced advisors.

Eighty-two percent of respondents have a presence in multiple states and 40% have a presence in multiple countries and many are

thinking of expanding. Thirty-five percent plan to enter one more additional state over the next three years. Every additional state and country means additional reporting, regulation, cash management, and potentially, currency exposure. of manufacturers operate in multiple states. of manufacturers operate in multiple countries. 82% 40%

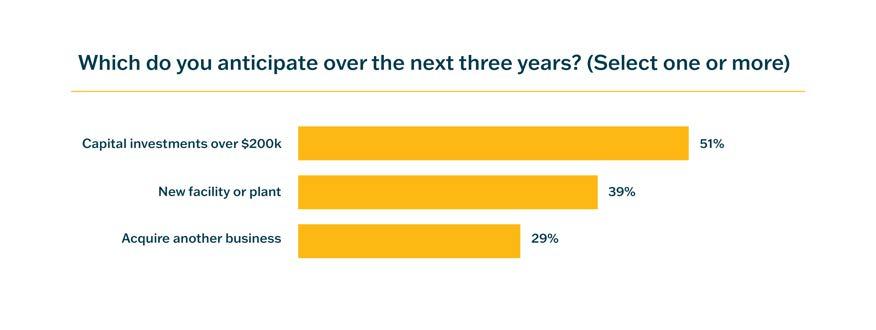

Fifty-one percent of manufacturers plan on making capital improvements, adding buildings, and purchasing equipment exceeding $200,000 over the next three years. Thirty-seven percent plan to expand into a new plant or facility. These dispersed and larger operations add complexity openings through 2032.

Source: 2024 Manufacturing and Distribution Pulse Survey

Opportunities:

In our survey, 35% of companies are private equityowned. That means, generally, more rigorous oversight, financial reporting, and more structured (and often, higher) growth goals. The pressure to perform may be especially acute because private equity firms are recovering from a difficult year where deal volume and values are down across industries, reports Bain & Company. The value of “unexited” assets is growing and private equity firms will be pushing to tell a stronger story and find that exit. Especially since private equity investors are facing the same cost of capital issues their manufacturing investments face.

Companies are adding complexity to their manufacturing and distribution process

Some 38-45% of companies are relocating their sourcing, manufacturing in-house, or outsourcing more. Recall that one of the top supply chain challenges was successfully diversifying suppliers. Many are also exploring reshoring, with all its attendant challenges like labor negotiations and costs.

Opportunities:

State and federal regulators are growing more active

States and the federal government are increasingly looking to harvest profits from private business. On one hand, the IRS and states like California and New York are adding agents to find and collect underpaid sales tax, and going after companies trying to pull revenue across borders. On the other hand, the federal government is trying to entice manufacturers to reshore, and states and localities are trying to “up their game” and attract industry with better tax benefits. This complicates the decision of where to locate your business and warehouse sites.

Learn how we can help with entering new states

Smart manufacturing, onshoring, nearshoring, and predictive analytics add to a company’s decision-making burden. More sprawl means more difficulty knowing whether they’ll have reliable access to raw materials and components, how to protect IP, and how to ensure they don’t compromise their cybersecurity in the transition.

Manufacturing, already complex, is only growing more so. Manufacturers and distributors who want to run a competitive national or global organization should aim to have what we call a “team of talent”— advisors with deep enough experience in all the regions and domains the company operates in to help leadership make sound decisions.

Organizations also need strong talent who can work through the complexities of expanding internationally or implementing an ERP system or recovering from a cyberattack. Without this, companies expose themselves to unknown risks. Federal, state, and international tax penalties are

often draconian and non-negotiable — for example, failure to comply with foreign bank and financial account reporting (FBAR) can result in fines of 50% of the account value.

In addition, more countries means more currency conversions, and your expansion strategy is subject to Metcalfe’s Law: The more points in a network, the exponentially greater the number of interconnections. A company that diversifies some manufacturing away from China to, say, Vietnam and Brazil, opens you up to currency conversions in six directions.

Every multi-state, international company should have advisors who specialize in tax and legal matters, including:

• International taxation and information compliance

• Cross-border entity restructuring

• FIRPTA compliance

• Transfer pricing

• Foreign tax credit planning and utilization

• Intellectual property and digital asset structuring

• State nexus laws

• State requirements for assessment of income, franchise, sales, and use taxes

• Audit representation and controversy

• Federal and state credits and incentives

• Import and export tariffs and laws, including anti-dumping

Businesses in the middle market tend to have it worst. They often lack sufficient internal specialists. And though they might play in the same markets at a competitor twice their size, they carry the same requirements to deal with the complexities of their business. It’s a major consideration in expanding, and one to weigh carefully.

For companies that do assemble a team of talent, they achieve greater stability. They have a better professional team of attorneys, CPAs, and board members, as well as a strong leadership team which provides them insight into and predictability around their supply chain, more predictable transaction and sale volume, and better control over their taxes. Source: Citrincooperman.com

Opportunities:

Analytics allow manufacturers to consider more variables and make better decisions. For example, model moving into a new state or country. The key to making use of those analytics is a team of talent — the CEO surrounding themselves with a community of board directors, outsourced and internal tax advisors, HR specialists, and more.

Small- and medium-sized manufacturers can use the (IAC) Implementation Grants Program. It’s part of the passage of the 2021 Bipartisan Infrastructure Law and means the government has invested $550 million to help manufacturers grow while reducing industrial emissions and encouraging a net-zero environment.

Many companies spent 2023 trying to reduce their inventory. Had they engaged third-party logistics providers, they could have potentially avoided that costly inventory surplus.

Opportunities:

States are forcing more retailers selling over $100,000 into a state to collect sales tax and file an income tax return in that state (known as “nexus”). One of a manufacturer’s best protections is public law 68-272, which can save manufacturers from filing for income tax purposes.

Learn more about SALT

EBITDA is a powerful drug and owners are optimistic about the future — 71% believe economic conditions will improve further over the next 12 months, and are investing capital accordingly. That future growth is of course dependent upon their ability to improve their distribution channels and expand customer options, and we believe ecommerce will be key to that. As will advanced analytics and a best-in-class ERP, carefully considering all the financial and tax implications of capital expenditures, and meeting increased complexity with a team of talent.

An upgraded ERP can unlock continuous forecasting. A stronger website can unlock more ecommerce sales. And a cybersecurity audit can help you avoid being one of the one in three manufacturers to face an attack.

Outsourcing offers a double advantage: If you outsource like 90% of companies are, you get that key talent fast, and they train your people. This is especially important with advanced tech skills, like operating smart factories or deploying LLMs, which are unlikely to come from your existing team.

Advanced manufacturers and distributors are doing this on a monthly basis. This requires an ERP and clean data, but it’s the key to maintaining EBITDA growth.

The sheer complexity in operations, technology, tax and the workforce create an unforgiving environment. Having a team of experienced advisors is critical to seizing opportunities. All of these are manageable with a combination of thirdparty and internal teams.

Our dedicated team leverages our deep industry expertise to provide a full range of professional services to help our clients achieve their goals. We help leaders like yourself make informed decisions to increase efficiency, reduce cost, and improve the bottom line.

Subsectors we serve:

• Consumer products and retail

• Distribution and logistics

• Food and beverage

• Industrial products

• Manufacturing