2024 Staffing Opportunity Report

Succeeding in the new staffing economy

The staffing boom is slowing and now the question is, which firms will consolidate the revenue growth of the last decade and emerge with strong financials and a path forward? It is easy to be brilliant when the industry is up. Now it no longer is. Staffing has grown from $25 billion to $225 billion over the last 30 years according to Staffing Industry Analysts (SIA), but as the $5 trillion in federal pandemic rescue spending and hiring incentives subside and as growth slows, we are entering a new era.

For a decade and a half, firms have only known growth, says SIA. But now the “temp penetration rate,” or the percentage of nonfarm payroll that is temporary, is down to its lowest levels since 2011. Meanwhile, AI, new technologies that help clients hire and “sidestep” staffing firms, advanced analytics, and high labor costs are all changing the traditional market dynamics.

Partner, National Professional Services Practice Leader

Citrin Cooperman

Most staffing firms felt the slowdown in the fourth quarter of 2022 and it accelerated into 2023. Travel nursing was among the hardest hit, as COVID-19 funds dried up, as was light industrial. Many IT staffing firms experienced slowdowns in the summer of 2023 along with professional services. Skilled trades and temporary healthcare (known as locum) were spared and have continued to grow. But across all sectors, all eyes are now on efficiency.

What are the top opportunities for staffing firms? We explore those in this report. It’s drawn from our recent survey of 1,000 private firms plus a variety of data providers and enriched with our experience working with hundreds of private staffing companies.

Partner, Staffing Services Practice Co-Leader

Citrin Cooperman

The primary data sources include:

2024 Private Company Performance Report

Staffing Industry Analysts (SIA)

U.S. Bureau of Labor Statistics

U.S. Chamber of Commerce

BJ Hoffman

Michael Napolitano

1

Staffing labor costs are rising faster than bill rates.

The state of the staffing industry

Rising labor costs are pinching firms that haven’t raised their bill rates enough. But clients are feeling the pressure too and are bringing more “temp” work inhouse with the help of technology. The fact that so many clients are sourcing their own talent directly is beginning to hurt staffing firm bill rates, yet it isn’t all good news for those clients — the shift does not appear to have eased their skilled worker shortage. Let’s explore seven facets of the market right now.

Demand is weakening in key client verticals.

Clients are trying to trim their staffing firm costs.

There’s a skilled worker shortage.

Staffing firms are finding uses for AI, but so are clients.

New laws affect employee designations.

Mergers and acquisitions (M&A) is recovering in staffing.

Staffing labor costs are rising faster than bill rates

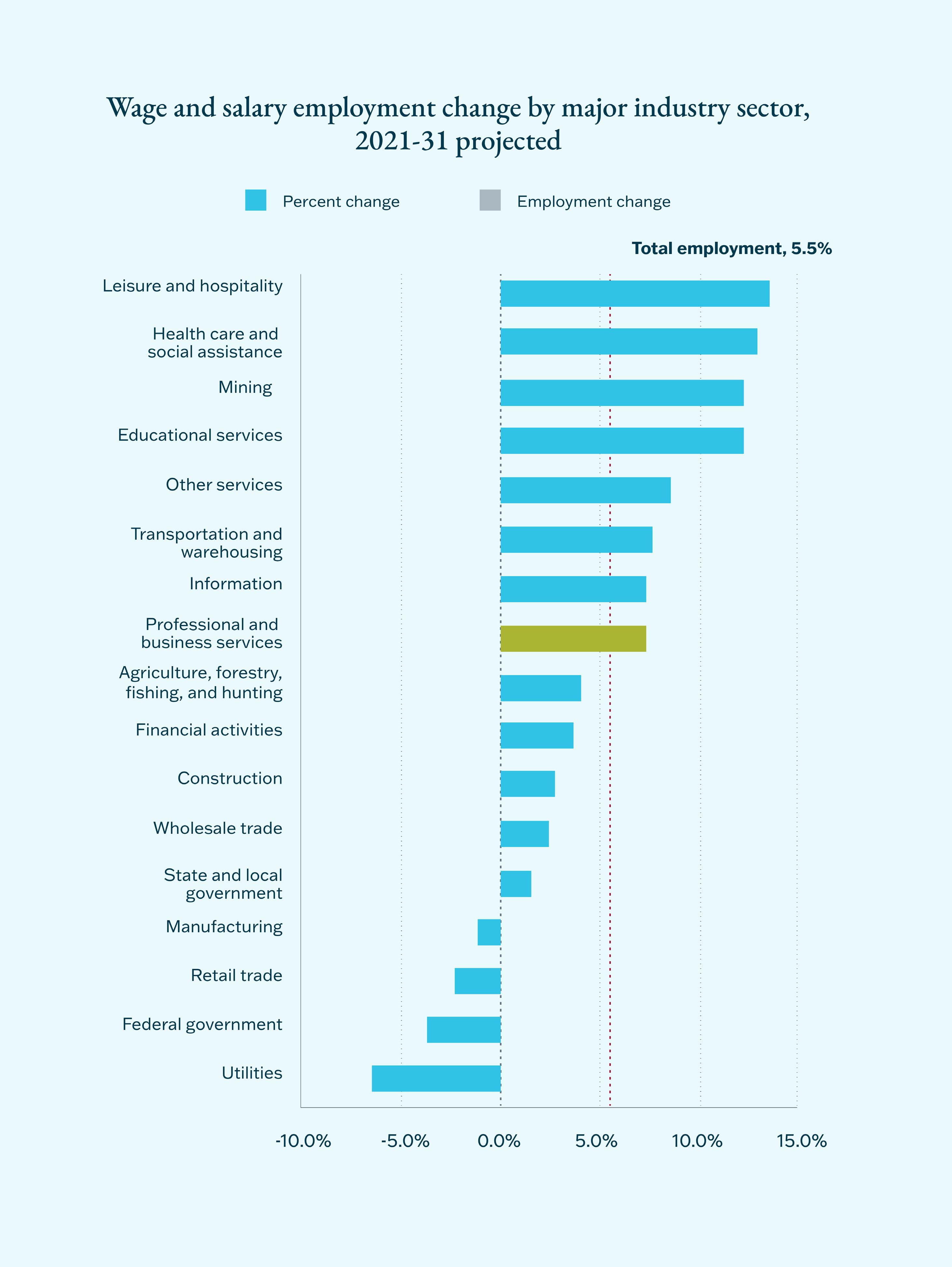

Labor has grown more expensive and costs will continue to rise. Economy-wide employment costs rose 4.4% in 2023 alone and the average U.S. wage is up $16,700 since 2021. Professional services wages are projected to grow 7.3% over this decade.

Even though staffing firm bill rates rose 30% from 2019 to 2022 according to SIA’s research, it has not been enough for staffing firms to pass along all

their rising costs to clients. Many firms have been caught between bill rate pressure and high pay rates.

“Many staffing firms did well over the last three years and haven’t needed to tend to their internal cost structures, but now it is hurting them,” says BJ Hoffman, Partner at Citrin Cooperman and Staffing Industry co-leader. “It is no longer possible to paper over inefficiencies with government stimulus funds.”

“Many staffing firms did well over the last three years and haven’t needed to tend to their internal cost structures, but now it is hurting them.”

BJ Hoffman Partner, National Professional Services Practice Leader

Citrin Cooperman

Source: U.S. Chamber of Commerce

2Demand is weakening in key client verticals

The bill rate exposure is even more dangerous in a few specific staffing industry verticals, where clients are pushing back on bill rates and trimming their profitability. For example, one travel nursing staffing firm we spoke with had the same headcount as the year prior but 25% lower revenues because hospitals were negotiating harder. It’s a similar story in some light industrial sectors, where our analysis reveals gross margins declined.

In manufacturing and distribution, we see more bifurcation. Our survey found some manufacturers are growing and hiring while others are laying workers off — 39% plan to increase staff significantly over the next three years, though 20% plan to decrease it significantly. And 31% plan to build new sites and make big capital expenditures, while an equal amount do not.

In 2020, there was a increase in the number of travel nurses. But now, the number of opportunities is falling swiftly. 35%

Source: The Washington Post

3Clients are trying to trim their staffing firm costs

More client companies are trying to sidestep the staffing industry and recruit contract workers via staffing software which they manage on their own. They’re finding mixed results — these platforms tend to over-promise on candidate quality and time savings. But this doesn’t prevent companies from trying, which still affects staffing firm revenues. According to SIA’s research, these talent platforms which act as intermediaries will be worth $19 billion this year.

Large enterprises are also making greater use of internal talent marketplaces which make it easier for people to move around within the organization. These human resources teams report being able to cut staffing fees.

The market:

Sidestepping

There is a skilled worker shortage

There is still a skilled worker shortage and it’s particularly acute in professional services, according to the U.S. Department of Labor. There are several reasons. A large number of 50-65 year-olds are retiring. Enterprises have been hoarding skilled labor. And in the great pandemic reshuffling, many workers left old occupations for greater work-life flexibility.

Nearly half of respondents in our survey of 1,000 midsize-to-large private companies said they must look outside their walls for at least 25% of their talent needs, and 90% said they must look outside their walls for tech skills.

The resulting gap should be a boon for staffing firms. Seventy-one percent of the U.S. temporary staffing industry are skilled workers, according to SIA’s research.

Furthermore, staffing firms may benefit from companies struggling to upskill employees. Just 38% of companies said they’d made significant progress on their training program, and 40% said retaining those newly trained employees was a challenge, according to our survey. of companies say they must look outside their walls for advanced tech skills. of companies say they must look outside their walls for 25% of their talent needs. 90% 49%

Source: 2024 Private Company Performance Report

Source: U.S. Chamber of Commerce

The skilled trades are making a comeback among Gen Z.

“These are largely positive forces for the staffing industry, particularly in skilled trades,” says BJ Hoffman, Partner at Citrin Cooperman. “Construction, HVAC, electrical, plumbing, tree cutting, every one of these skilled trades are experiencing a shortage, which means staffing can thrive, and in some cases, be highly profitable. Add on top of that all the government green initiatives, construction of large data centers, and overall construction backlogs. It’s a very positive environment for skilled trades staffing verticals.”

BJ Hoffman Partner, National Professional Services Practice Leader

Citrin Cooperman

of HR leaders say finding talent is a top 10 issue. 94% of companies consider their talent acquisition “world class.” 7%

Source: HR Research

Source: Axios

5

Staffing firms are finding uses for AI, but so are clients

Thanks to recent advances in large language models (LLMs), we’re seeing AI vendors show up in great numbers at staffing industry events. And AI is now often a feature within the software staffing firms already use, from job-matching to talent analytics. One company we work with used it to personalize talent outreach and earned 30% more responses. Software startups Interviewer.ai and First Round AI will even auto-interview candidates, though the technology is largely untested and you can be sure candidates are using AI too.

While 40% of staffing firms told us they are not yet using AI, most larger companies with more advanced recruiting departments are. Twentynine percent have replaced some temporary workers with automation. Many smaller staffing firms are staying on the sidelines for now to better understand the benefits first. But nearly all staffing associations are educating their members on AI.

6

New laws affect employee designations

In January 2024, the federal government enacted new rules to prevent employers from misclassifying workers. Those fines can range between $5,000 and $15,000 per violation or up to $25,000 if the courts find a pattern of willful misconduct. But the real issue is state and local regulation. A majority of the staffing companies we work with operate in two or more states and many struggle to keep up with new laws and regulations. As just one example, many know about California’s landmark 2019 “gig worker” law that made misclassification a form of fraud. But few know the electorate walked back portions of it with Proposition 22 the following year. Staying abreast of changes is nearly a part-time job.

States that

have

passed worker misclassification laws:

7

Mergers

and acquisitions (M&A) is recovering in staffing

The staffing industry has grown and private equity firms have taken notice; partly because the labor shortage and skilled labor shortage are blocking their portfolio companies’ plans. Acquiring firms are looking to replace lost revenue, expand their geography, or find the talent they need to enact a transition. But as M&A dropped 15% in 2023, we’re noticing changes:

• New deal structures — Terms of deals have changed from only a year ago. Most deals are being structured with less money upfront and multiyear payouts. The multiyear payouts can be earnouts based on performance, holdbacks (for example, to ensure the purchaser retains certain employees), or guaranteed payouts at a discount.

• Smaller deal sizes — Organic growth has slowed into the single digits and many staffing firms are adapting by adding M&A as part of their growth strategy. Some are locating firms in a high-growth geography, adding a new vertical, or aqui-hiring a team for the management.

• Intensified due diligence — Acquirers are looking more carefully at the seller’s markets, customers, and what their sales and marketing efforts have done to reverse any downward trends. Headcount by customer has become a key metric, along with credible projections.

What can we make of all this?

While staffing firms are facing cost pressure and clients are trying to sidestep with in-house talent software, the skilled worker shortage remains. It puts many firms in a position to command higher rates and take advantage of four opportunities which we discuss next.

OPPORTUNITY 1 / MARGINS

Get margins under control with accounting and create more value with your expertise

It’s

time to consider your value beyond the talent you provide.

If talent platforms further infiltrate the market, and companies can reliably find cheaper and cheaper contractors, what value will you offer? The best advice we can provide here is twofold: Run a sound financial operation with a strong profit margin so you can afford to transform, and build a moat using your expertise. Let’s explore both.

Run a sound financial operation

Build a moat around your expertise

As staffing grows more commoditized, it will continue to hurt bill rates. What expertise has your firm accumulated that no software can replace? How can you be a problem solver, not an order taker? Perhaps it’s your firm’s relationships, depth of understanding about what attracts candidates, or an uncanny process for exceeding expectations. Explore your answer now and consider formalizing what you find into intellectual property (IP). You might even build new products and revenue streams around it.

Nothing will provide you flexibility like free cash flow. If your financial foundation isn’t yet sound, if you don’t have a serviceor job-level understanding of where your profit comes from or the ability to forecast demand, you’ll want to find the financial talent who can help you with such assessments. Have them benchmark your firm against peers so you can understand the lowest-effort, highest-value ways to generate more cash now.

“I have two clients that reframed their business around selling expertise, not just taking orders, and it dramatically increased their revenue,” says Michael Napolitano, Partner and Staffing Services Practice Co-Leader at Citrin Cooperman. “But beware trying to develop software or launch products that are far from your core expertise. We have onboarded several staffing firms that were investing in their own software, and they were essentially competing with much stronger software in the tech industry which led to a total loss of that investment. It can work for some, but it is not the norm. One light industrial firm did it successfully. Their technology allows them to acquire similar companies and gain a few percentage points of profit because of that efficiency.”

Michael Napolitano

Partner, Staffing Services Practice Co-Leader

Citrin Cooperman

Action:

Conduct a bill rate analysis

Analyze the trends in your bill and pay rates and craft a model to ensure you never fall beneath a comfortable threshold, with breakpoints where you act to preserve that margin. Examine this down to an individual employee level. One company we worked with discovered that nine of its recruiters were not even covering their own salaries, but could be, with adjustments.

Consider finding a partner who can help you answer questions like:

• Are you billing enough?

• Are you selling the right services?

• Are you paying too much?

• Does your firm have too many internal staff?

• Are your office spaces affordable?

Learn how we can help with bill rates

Action: Benchmark against peers

Benchmark your performance against other staffing firms in your vertical and other staffing firms in general. This can help you spot anomalies and point you to areas where you can increase your profit margin. In order to properly benchmark, ensure your financial statements are organized according to industry standards. For example, cost of goods sold should include all direct employee costs.

Action:

Consider a phantom stock plan to secure and retain key talent

Firm owners can give employees a greater sense of buy-in through what’s known as a “phantom stock plan.” This operates like equity or profit share, so they have a stake in the firm’s success without actual legal ownership. It can vest on certain milestones, which motivates employees to think about how they can contribute to the firm’s longterm success. This is a great way to incentivize key personnel without complicating their current tax reporting.

Action: Outsource your finance and back office

Unless your firm specializes in finance and accounting, it’s sometimes easier to outsource those functions to focus on what you’re best at. (This is probably a similar story to what you advise clients.) Outside financial advisors can help you with month-end close and build you a dashboard for running your business, which clarify the levers you can pull for greater performance.

You might also explore business process outsourcing (BPO). Several companies we’ve worked with have used offshore service centers to support domestic teams. They now have 24/7 support and less downtime between when they receive orders, process them, start work, and bill at a lower cost structure than before.

Benefits to outsourcing include:

• Immediate access to key financial skills

• Immediate access to key tax insights

• The team size flexes to meet your need

• No employment overhead (+20%)

• No added management overhead

• Strategic advice from rotating experts

Learn how we can help outsource your finance

Reevaluate your approach to accounting and taxes, particularly state and local tax (SALT) compliance

State and local taxes present an outsized opportunity and risk for staffing firms.

Firms that operate across many municipalities have more options to save on taxes. But they also accrue compounding risk if they don’t consider how they classify workers in all those regions, or fail to comply with incredibly complex tax requirements. We estimate that a majority of staffing firms are out of compliance and are exposed to greater risk than they realize.

This can be particularly disruptive if those firms want to engage in M&A. These issues tend to crop up during due diligence. When an acquiring firm learns its target must refile taxes in 10 states and pay back years of uncollected tax, it can affect the purchase price, delay sale proceeds, or kill the deal entirely.

“We estimate that a majority of staffing firms are out of compliance with state and local tax codes.”

Michael Napolitano Partner, Staffing Services

Practice Co-Leader

Citrin Cooperman

“We have a completely Byzantine taxation system in the U.S. Our job at Citrin Cooperman is to identify and quantify those exposures so management can make informed decisions.”

BJ Hoffman Partner, National Professional Services Practice Leader

Citrin Cooperman

Further, the penalties for noncompliance can be severe and often compound. States can go back many years to levy assessments and taxes, and these are difficult to negotiate. Sometimes, penalties and interest exceed the tax itself. New Jersey, for example, assesses a 20% penalty to start, which compounds.

When we work with staffing companies, we help them visualize these risks in a “threat matrix” that provides owners a complete view of their compliance risks and quantifies the implications. It might show those businesses weren’t paying the Washington state occupancy tax, which is unlike normal income tax, or not abiding by Pennsylvania or Ohio’s notoriously complex codes.

compounding penalty assessed in New Jersey for state and local non-compliance. 20%

Action: Assess current tax compliance methodologies to reduce tax burdens and mitigate risk

If your team has not conducted an in-depth analysis of its income tax strategies recently, consider doing so. There is a litany of potential opportunities and pitfalls, including with pass-through entity regimes and remote worker classifications.

Consider:

• Whether remote worker revenue can be counted in different regions (e.g. in New York)

• Multistate and local jurisdiction tax planning to increase compliance and reduce burdens

• Using pass-through entity regimes (IRS Sec 199A) to exclude 20% of net income from federal taxation

• Analyzing remote and contract worker classification (W2 versus 1099)

• Accrual versus cash accounting basis elections to increase cash flow and defer taxes

• Analyze officer compensation for tax efficiency

• Election into state pass-through entity (“PTE”) regimes to convert otherwise non-deductible personal state income tax burdens into tax-deductible business expenses

• Maximize your use of federal tax credits, like the Work Opportunity Tax Credit (WOTC)

Learn how we can help with tax strategies

Action:

Standardize your reporting

Your business should be conforming to staffing industry norms when presenting financial statements, so as to be comparable with other firms. For instance, in the P&L, drug screening costs, temporary worker’s compensation insurance expenses, and background search costs should be part of “cost of revenues” and not “selling, general, and administrative expenses.” Leases should be capitalized on your balance sheet. You should adequately provide disclosures regarding captive / offshore worker’s compensation insurance and associated liabilities. If your financial reports aren’t standardized, it invites greater scrutiny from lenders or buyers in the M&A process.

Action: Identify state and local tax credits

Many states and localities offer hiring incentives but many staffing firms don’t have the internal financial bandwidth to investigate, which can leave money on the table. Consider finding a partner that can help identify and apply to hiring incentives — or if you are building products around your expertise, research and development (R&D) tax credits.

OPPORTUNITY 3 / COMPLIANCE

Revaluate worker compliance

As more states regulate worker classification, staffing firms are among their first targets.

According to our reading of recent case law, staffing firms should default to treating their contingent workforces as W2 employees rather than independent contractors. There are exceptions, such as in IT staffing or medical, but it serves as a useful rule.

The “game” of creatively reclassifying workers as contractors to save on payroll tax is fraught with peril. The penalties are severe. The business may owe all those employment benefits taxes plus interest for the entire time of employment. It’s enough to put some companies out of business.

Action: Run a worker compliance audit

Engage a credible independent firm to audit your worker classifications. A third party that specializes in this will have a greater awareness of the applicable case law in states you operate in and can help you assess your risk.

Learn how we can help with compliance

Reevaluate your tech and conduct an AI audit

AI seems to have great potential in recruiting and staffing, particularly with its ability to match candidates with roles, automate rote processes, and reduce back-office expenses.

However AI is only as good as the data available, which is why it’s essential to have a modern, upto-date enterprise resource planning (ERP) and applicant tracking system. Every staffing firm that plans to use more technology should be investing in pushing timely and accurate staffing, project, and cost data here.

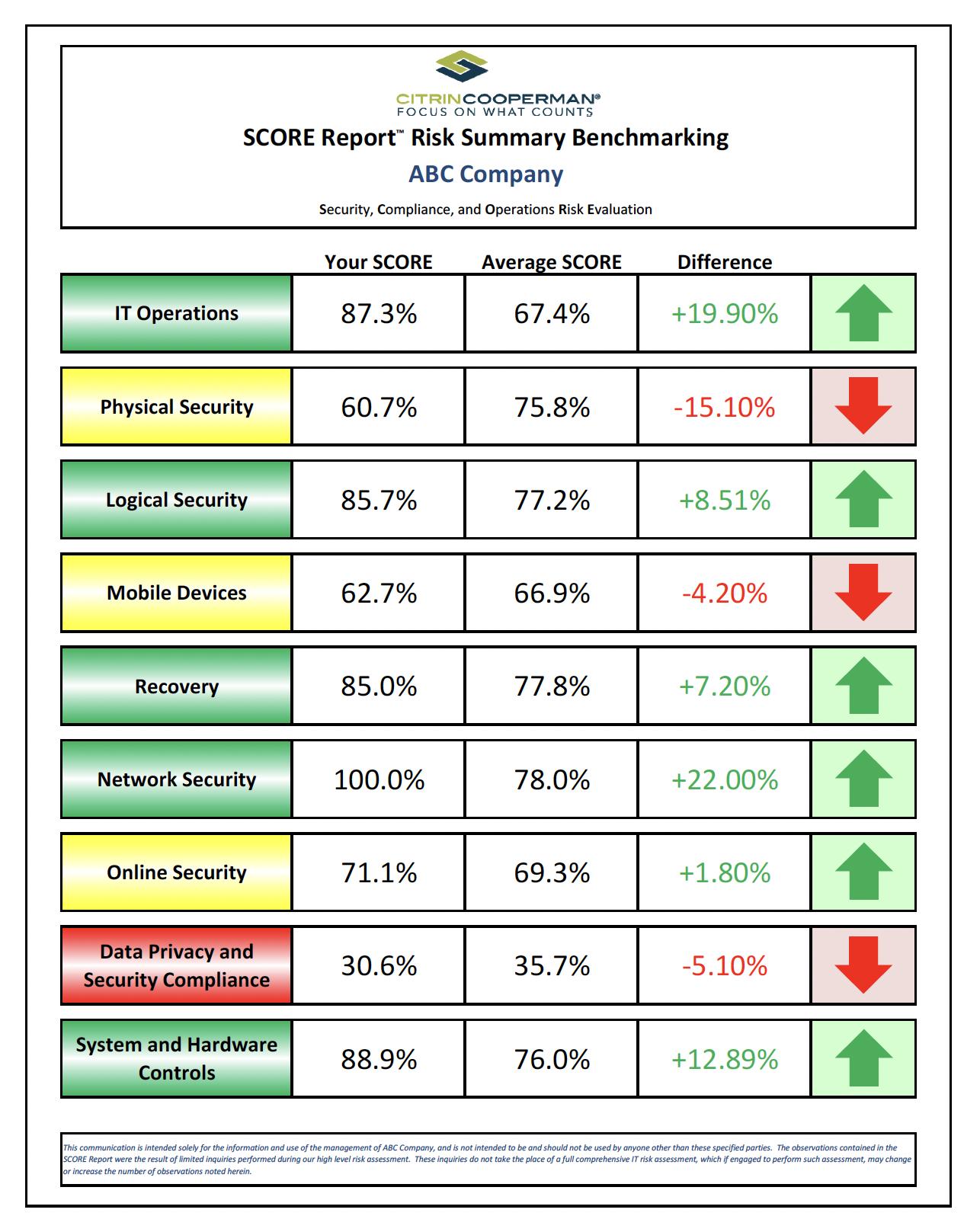

In tandem, staffing firms should be investing an equal amount into cybersecurity. Thirty-two

percent of companies faced a cyberattack in the past two years according to our survey and given the amount of communication staffing firms send and receive, and volume of sensitive data they hold, they are prime targets. If you aren’t training all employees on phishing and deep fakes, that’s an easy place to start.

of companies faced a cybersecurity attack in the past two years.

Source: 2024 Private Company Performance Report

Opportunities:

Action:

Explore advanced talent analytics

If you have an ERP system in place, you may gain the ability to run advanced analytics that can help you create that “expertise moat.” According to HR Research, of teams that invest in talent analytics:

• 36% are automating their interview scheduling

• 33% are automating their onboarding

• 29% are automating their skills and pre-employment testing

So-called “talent leader” firms are twice as likely to use an applicant tracking system, LinkedIn recruiting tools, and internal or external talent referral systems.

Action:

Conduct a cybersecurity audit

With staffing firms holding so much sensitive data, they are uniquely exposed to cybersecurity risks. Cyber protection is a very different skill set than IT, and we believe all firms should consider engaging a third party that can help audit vulnerabilities and implement protections.

Learn how we can help with cybersecurity

Acting on opportunities in the present market

Staffing firms’ greatest financial opportunity in the present market is fourfold: They must get margins under control to free cash flow. They must evaluate their taxation and worker classification. And they must reevaluate their technology and invest in an ERP that supports them with AI. Finally, they must focus on sales and recruiting and continue to provide their recruiters tools to succeed. If they do this, they position themselves to take advantage of the continued skilled staffing shortage among companies.

Though things have grown increasingly difficult over the last two years, many firms are now in a position to run a sounder business with the healthy margins they need to continue to grow.

About Citrin Cooperman

With over 40 years of experience advising staffing firms, and with numerous clients in this industry, Citrin Cooperman’s Staffing Industry Practice understands the common financial challenges that business owners face. Through careful examinations of business structures, costs, and tax strategies, our professionals are able to help organizations save thousands of dollars annually and reach new levels of financial success. At Citrin Cooperman, our clients always have immediate access to experienced professionals who can answer their questions. That’s our promise.

Citrin Cooperman is the nation’s largest provider of accounting, tax, and business advisory services to the staffing industry.

Our Staffing Industry Practice currently serves over 200 clients who offer:

• Contingent staffing

• Direct placement

• Executive search/retained search

• Professional employer organization services (PEOs)

• Outsource solutions

About Citrin Cooperman

Citrin Cooperman is one of the nation’s largest professional services firms, helping companies and high net worth individuals find smart solutions. Whether your operations and assets are located around the corner or across the globe, we can provide new perspectives on strategies that will help you achieve your short- and long-term goals.

Citrin Cooperman” is the brand under which Citrin Cooperman & Company, LLP, a licensed independent CPA firm, and Citrin Cooperman Advisors LLC serve clients’ business needs. The two firms operate as separate legal entities in an alternative practice structure. The entities of Citrin Cooperman & Company, LLP and Citrin Cooperman Advisors LLC are independent member firms of the Moore North America, Inc. (MNA) Association, which is itself a regional member of Moore Global Network Limited (MGNL). All the firms associated with MNA are independently owned and managed entities. Their membership in, or association with, MNA should not be construed as constituting or implying any partnership between them.