State of the Market

Dubai in 2024

A Record-Breaking Year

Following on from a spectacular 2023, and despite predictions of a slowdown, the Dubai real estate market has achieved historic figures in 2024.

Real estate transactions alone totalled an unprecedented AED 761 billion in combined value – a rise of 20% from 2023.1 It is a figure that makes the Dubai Real Estate Sector Strategy 2033’s target of AED 1 trillion in market value an almost certain achievement.2 Happily, this also reflects in GDP terms; in 2024, real estate accounted for 8% of Dubai’s GDP.3

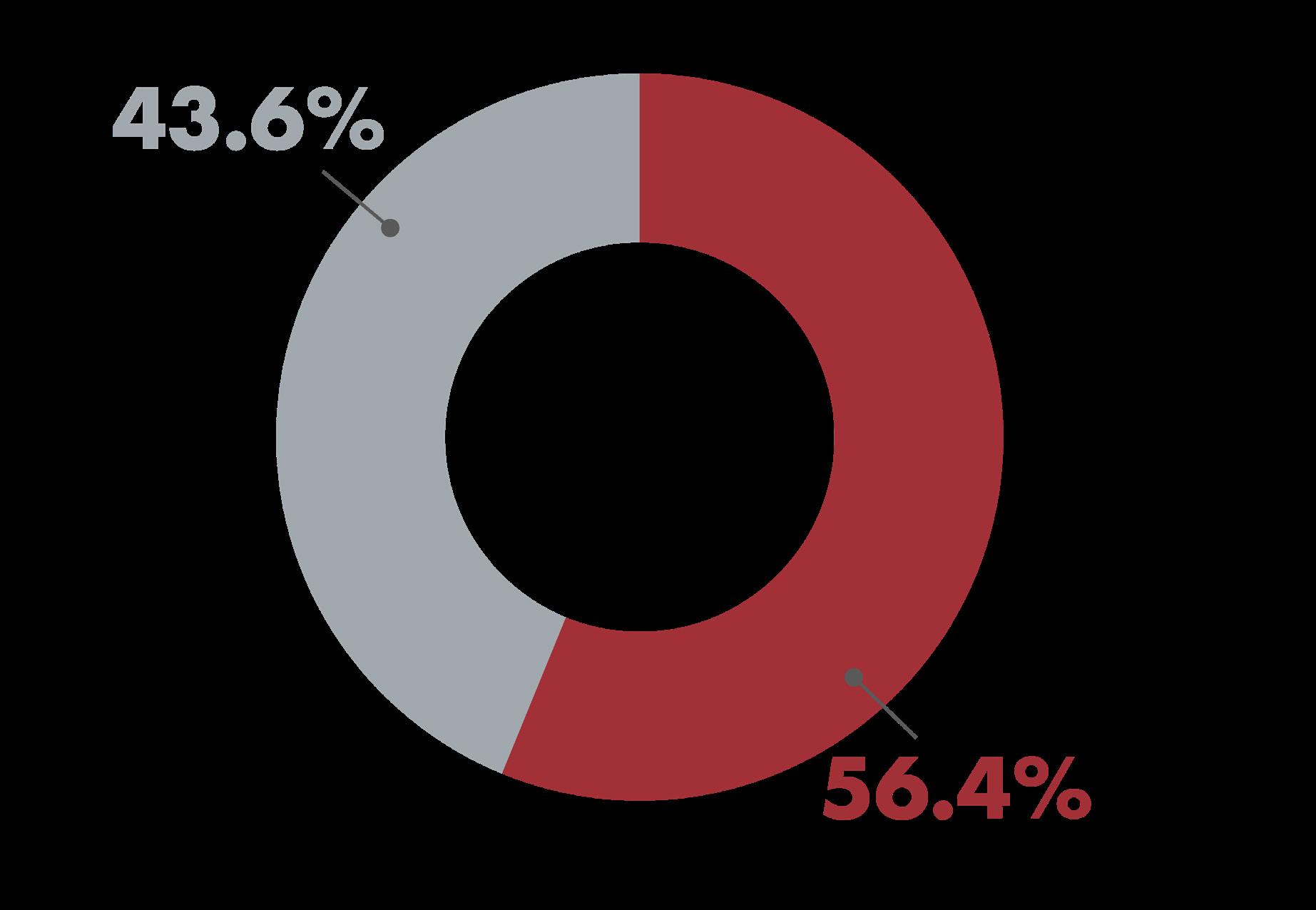

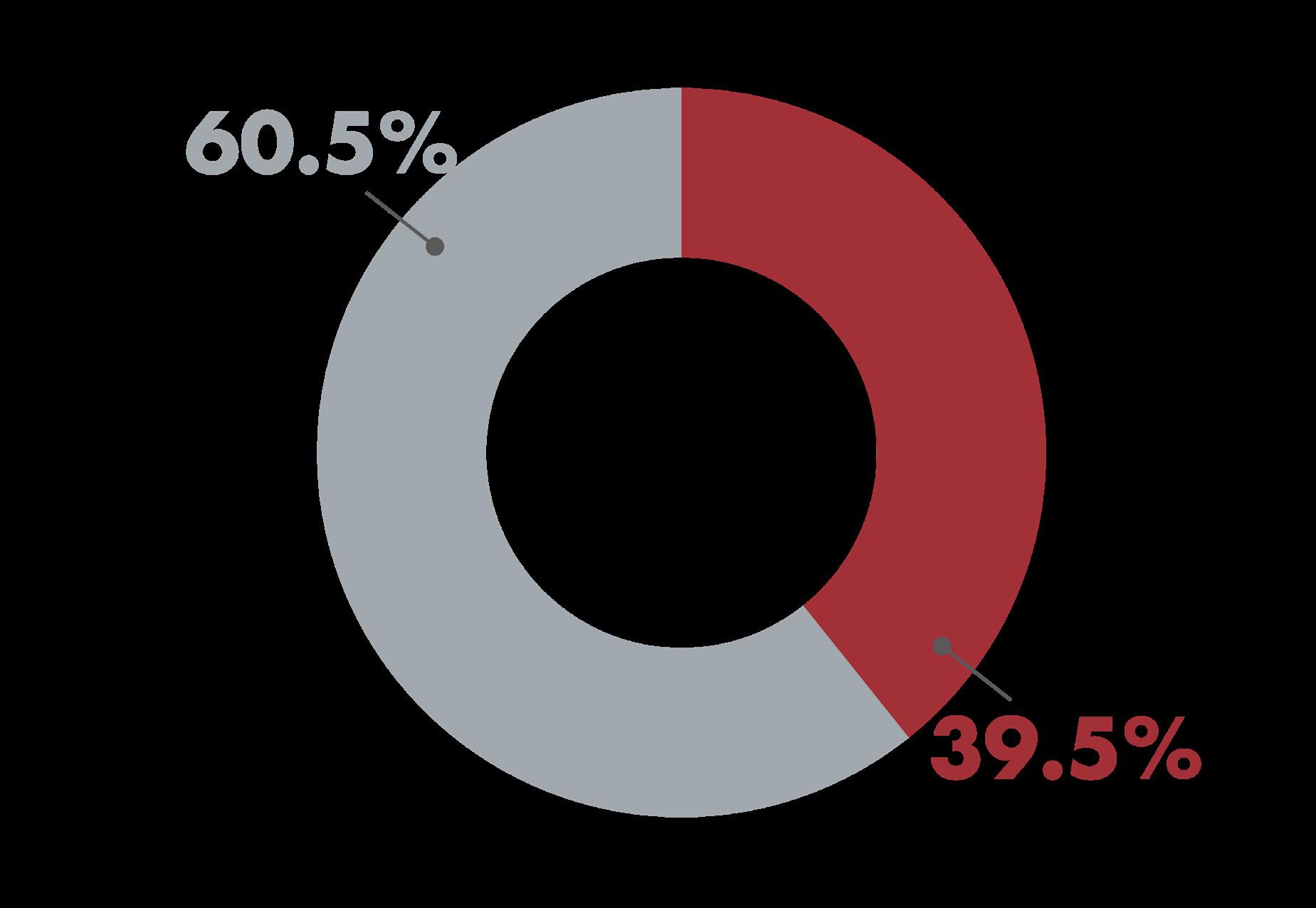

Though growth infused all market sectors, off-plan was the year’s shining star, accounting for a staggering 60.5% of all transactions by volume.4 Central to this ascent was the branded residences segment, with the likes of Bulgari, Armani, Mercedes-Benz and more taking the city by storm.

This soaring demand has been driven in large part by the veritable influx of high-net-worth individuals to the city. In 2024, the U.A.E. welcomed 6700 millionaires as new residents – the highest in the world5 and with many flocking to Dubai for reasons varying from no income tax to the lucrative Golden Visa programme. Its effects can be felt far beyond Dubai’s shores as well, with the city overtaking the likes of New York, Hong Kong and Los Angeles in terms of the value of homes sold above $10 million last year.6

State of the Market: Dubai in 2024 pays close attention to the city’s robust market, the underlying reasons for its rise, Dubai’s place in the global real estate industry and more.

1. “Dubai’s Real Estate Sector records AED 761 billion in transactions in 2024,” Emirates News Agency-WAM, 26th January 2025, https://www.wam.ae/article/bhvuhsc-dubai%E2%80%99s-real-estate-sector-records-aed761-billion

2. “Dubai Real Estate Sector Strategy 2033 poised to drive significant growth in transactions and international investments,” Government of Dubai Media Office, 29th October 2024, https://mediaoffice.ae/ en/news/2024/october/29-10/dubai-real-estate-sector-strategy-2033

3. “Market Watch Residential Real Estate Report,” Property Finder, https://www.propertyfinder.com/property-finder-highlights-2024-real-estate-momentum-in-dubai-and-abu-dhabi/ 4. Ibid.

5. “The UAE: A Strategic Haven for High-Net-Worth Families,” The Henley Private Wealth Migration Report 2024, Henley & Partners, https://www.henleyglobal.com/publications/henley-private-wealth-migration-report-2024/uae-strategic-haven-high-net-worth-families

6. “Dubai sets new record in $10m home sales in 2024,” The National, 3rd February 2025, https://www.thenationalnews.com/business/2025/02/03/dubai-10m-homes/

Real Estate Transactions7

761 billion

Transaction value in 2024 – a record

Rise in value from 2023

2.78 million

billion Worth of real estate investments

Total real estate procedures in 2024 –the highest in Dubai history 8% Real estate’s contribution to Dubai’s GDP in 2024

110,000

New real estate investors –a 55% increase from 2023

Real Estate Transaction Values in Dubai8

“Bolstered by the Dubai Real Estate Strategy 2033…Dubai’s real estate market remains among the world’s best, with a strong focus not only on innovation and excellence but also stability and sustainability.”

His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum

Sales Transactions

Sales Value - 2021 to 2024 Sales Value - 2021 to 2024

AED 600B

500B

400B

200B AED 300B

2024 saw Dubai record AED 522.5 billion in sales transaction value9 – the highest ever figure in the history of the city’s real estate industry and an approximately 27% rise from 2023.10

Sales Volume - 2021 to 2024

Sales Volume - 2021 to 2024

Correspondingly, the 180,987 transactions11 registered during this time amounted to a 35.94% increase from 2023 – the most the city has ever recorded.12

Sales Transactions

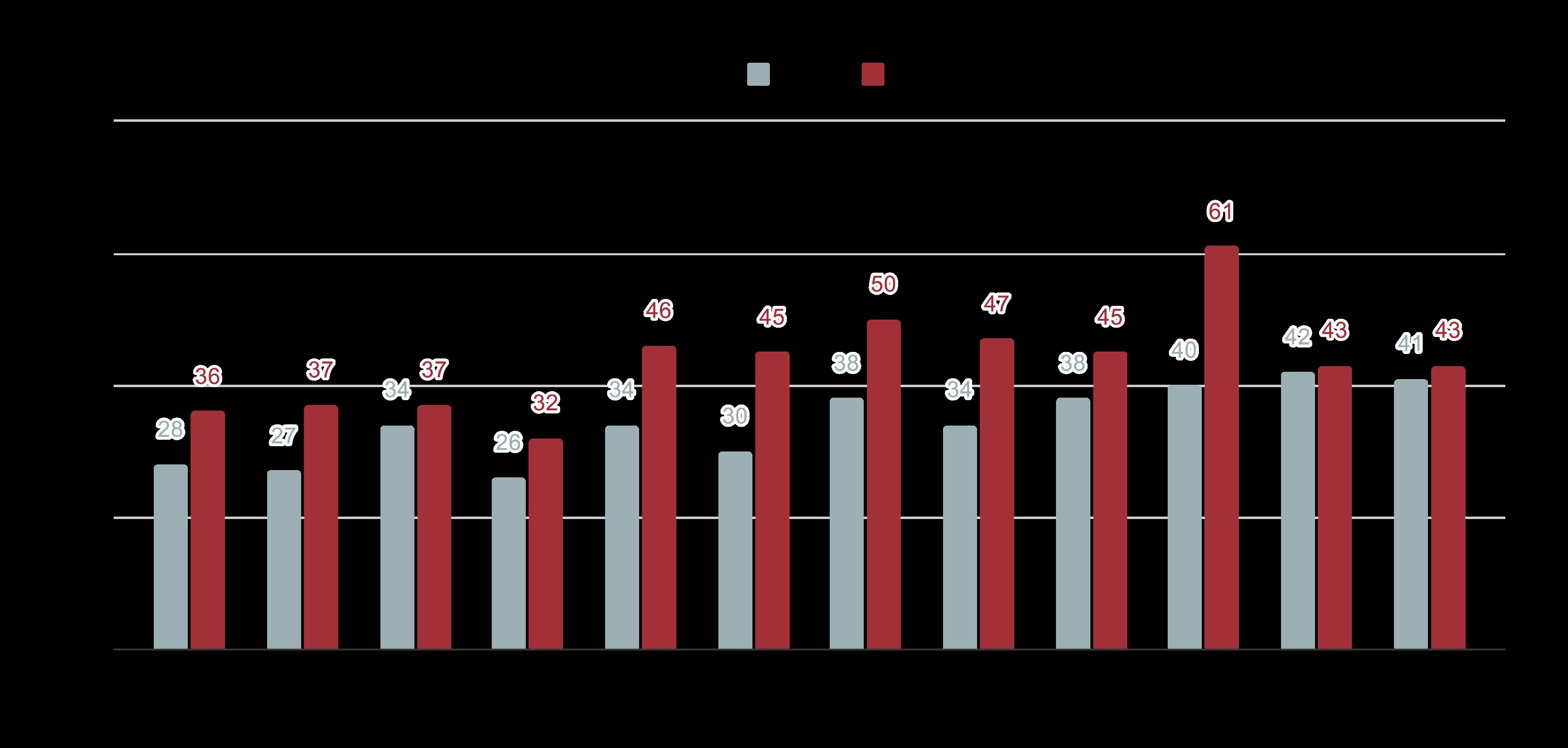

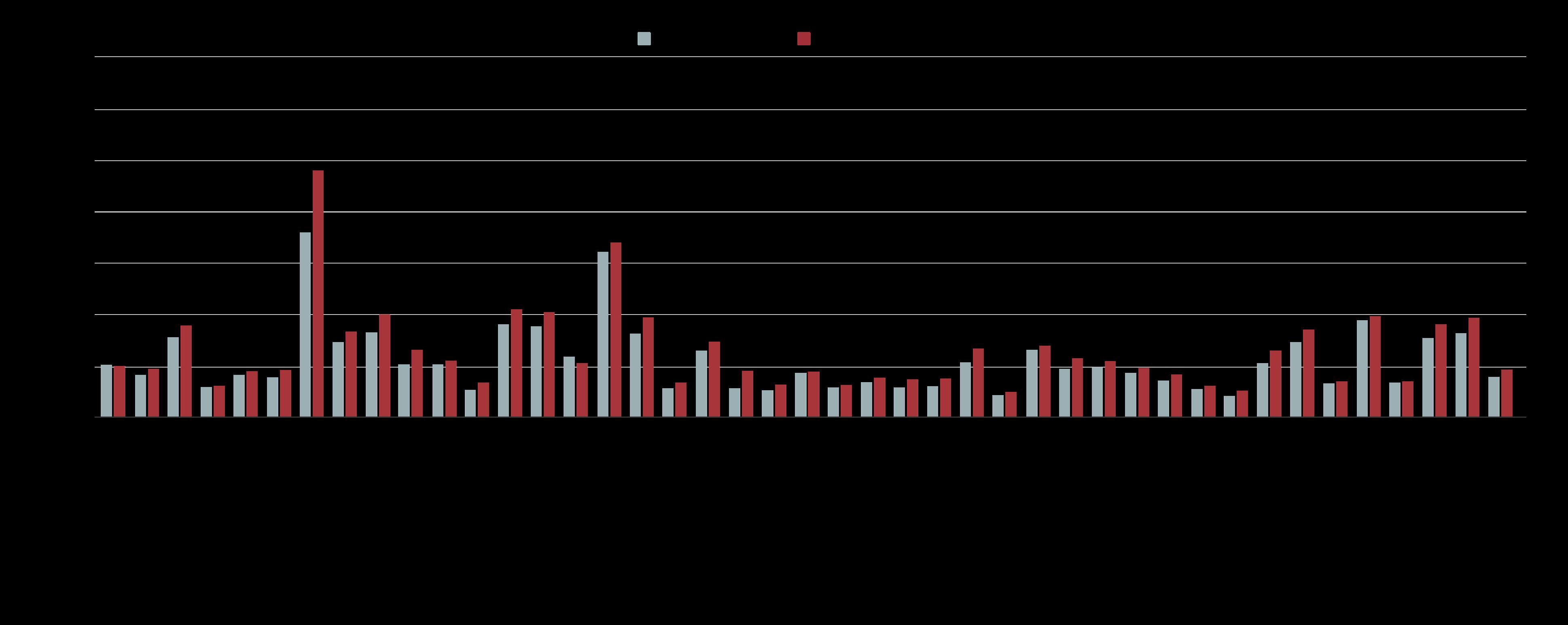

Sales Value: 2024 vs. 202313

Sales Volume: 2024 vs. 202314

Ready vs. Off-Plan Sales

Ready and Off-Plan Trends18 2024 vs. 2023

The poster child of Dubai real estate’s success in 2024 was undoubtedly the off-plan sector, which took the lion’s share of sales transactions by volume and enjoyed significant growth:

Rise in off-plan volume from 202319

Rise in off-plan value from 202320

Over 470

Projects launched in 202421

Branded Residences22

In keeping with its status as a cutting-edge and global leader in luxury, Dubai has become a bona fide hub for branded residences.

Expected growth in demand for branded residences in the Middle East in the next six years

Branded Residences

A Selection of Upcoming Branded Residences

The Rental Market24

Rental contracts signed in Dubai during 202425

Approximate rise in rental contracts signed from 202326

capital appreciation recorded for apartments in 2024

ROI recorded for apartments in 2024

The Rental Market

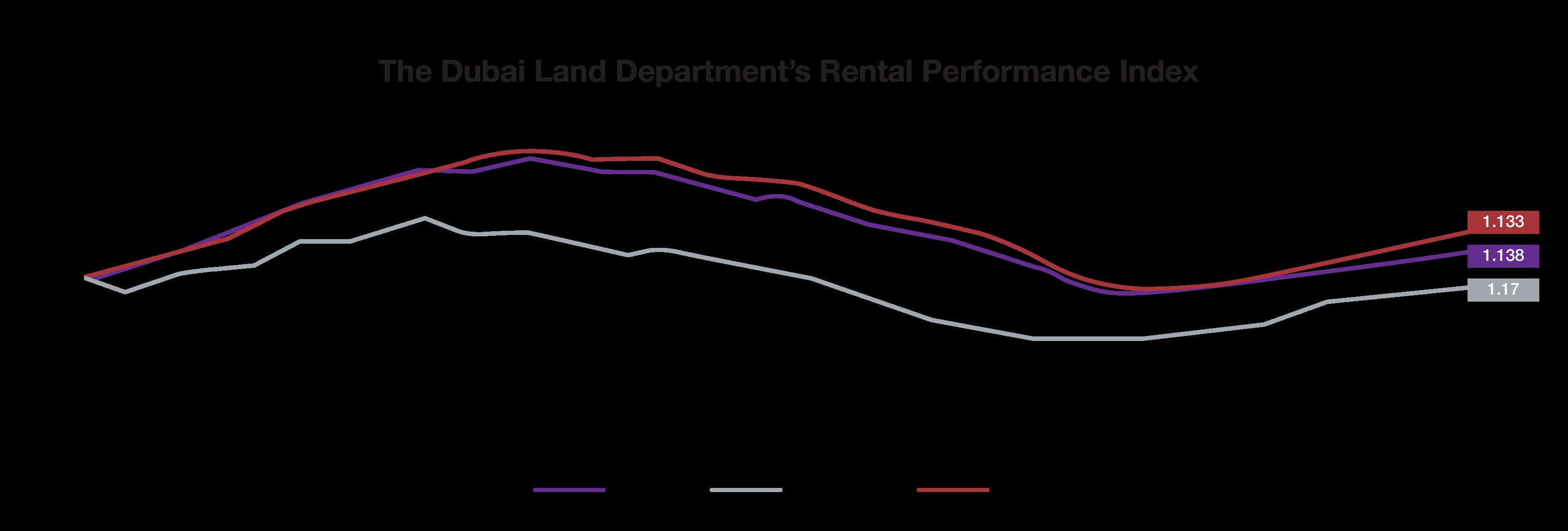

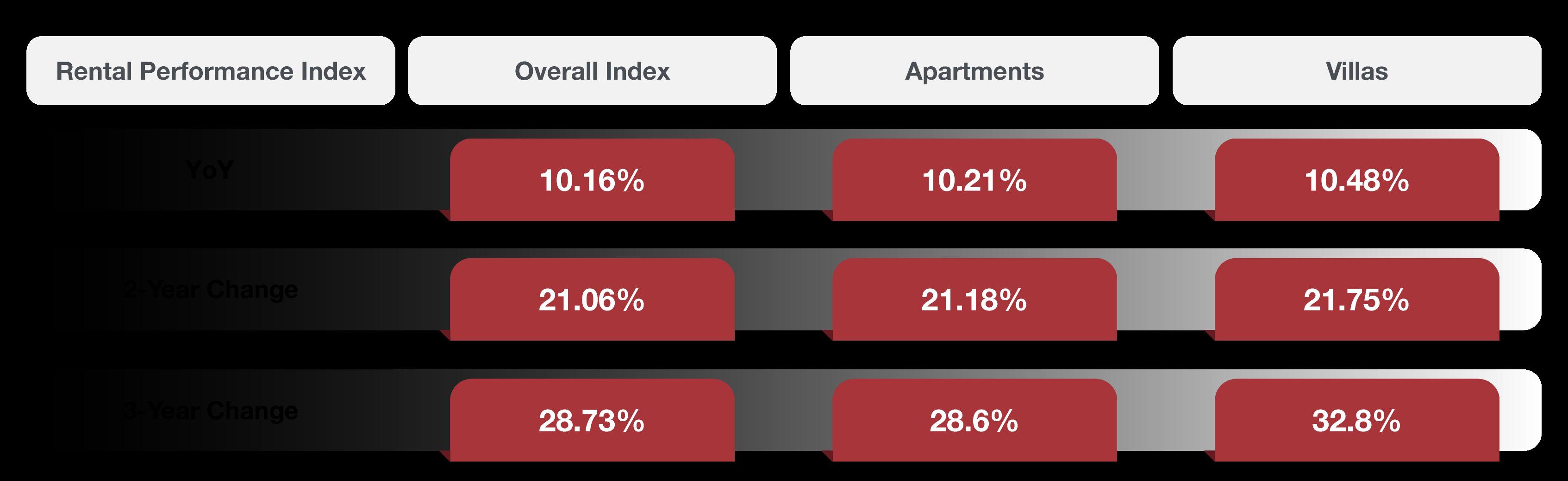

Mo’asher – The Dubai Land Department’s Rental Performance Index27

With an index price of AED 63,706 and an index rising from 1.033 in 2023 to 1.138 in 2024, the Dubai rental market enjoyed significant growth.

The apartment segment jumped in the index from 1.028 in 2023 to 1.233 this year at an index price of AED 58,109 while villas and townhouses recorded an index price of AED 168,529, as well as a rise from 2023’s 1.057 to 2024’s 1.17.

Popular Areas

Apartments

Sale - Ready Properties

Dubai Marina Business Bay

Dubai Creek Harbour

Palm Jumeirah

Downtown Dubai

Dubai Hills Estate

Palm Jumeirah

DAMAC Hills

Emirates Hills

Arabian Ranches 3

Villas

Popular Areas

Apartments

Sale - Off-Plan Properties

Dubai Islands

Business Bay

Dubai Harbour

Dubailand

Jumeirah Village Circle

Meydan

DAMAC Hills 2

The Valley Dubai South Palm Jebel Ali

Villas

Business Bay Downtown Dubai

Jumeirah Beach Residence

Jumeirah Village Circle

Dubai Marina

Jumeirah

Dubai Hills Estate

Umm Suqeim

DAMAC Hills 2

Al Barsha

Villas

Buyer Nationalities

As per Christie’s International Real Estate Dubai data, countries that contributed the highest amount of buyers in 2024 included:

Russia

United Kingdom

India

China

United Arab Emirates

Market Trends and Highlights

Market Trends and Highlights

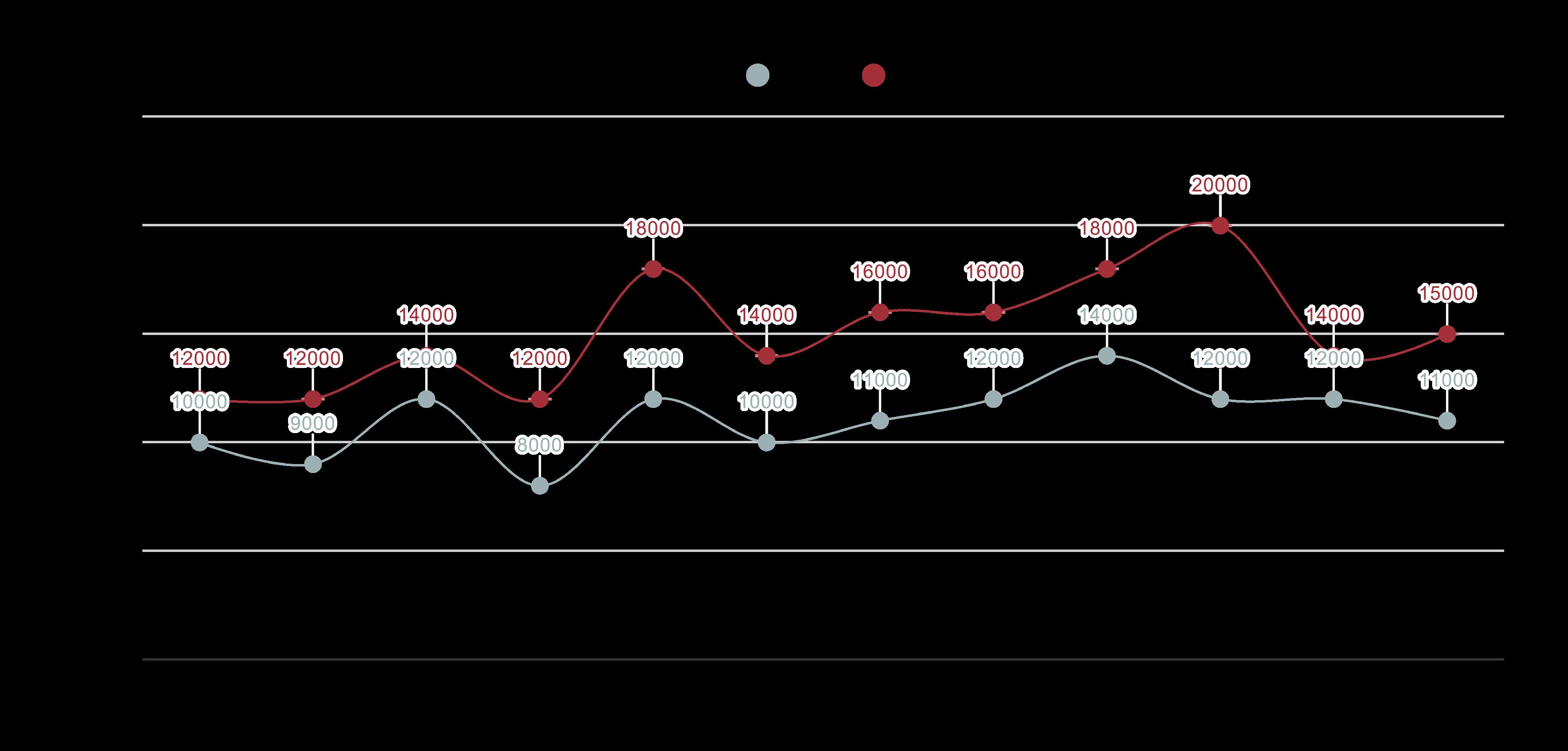

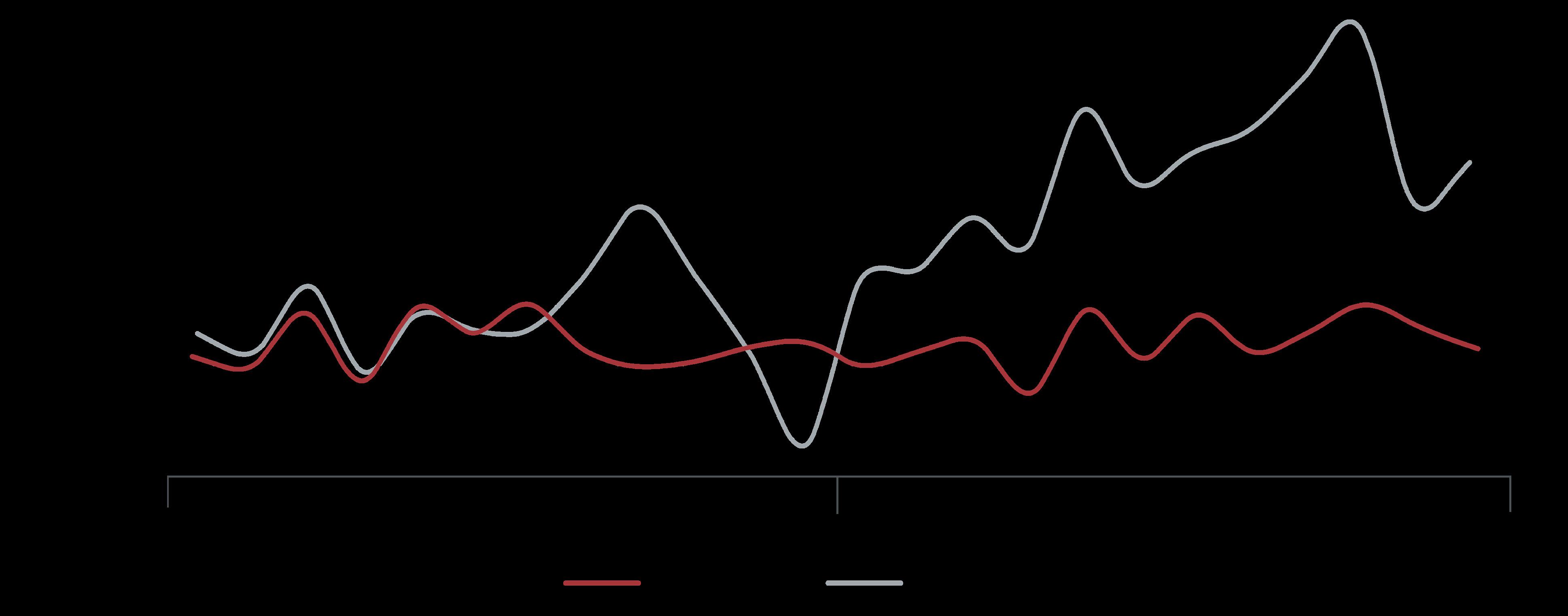

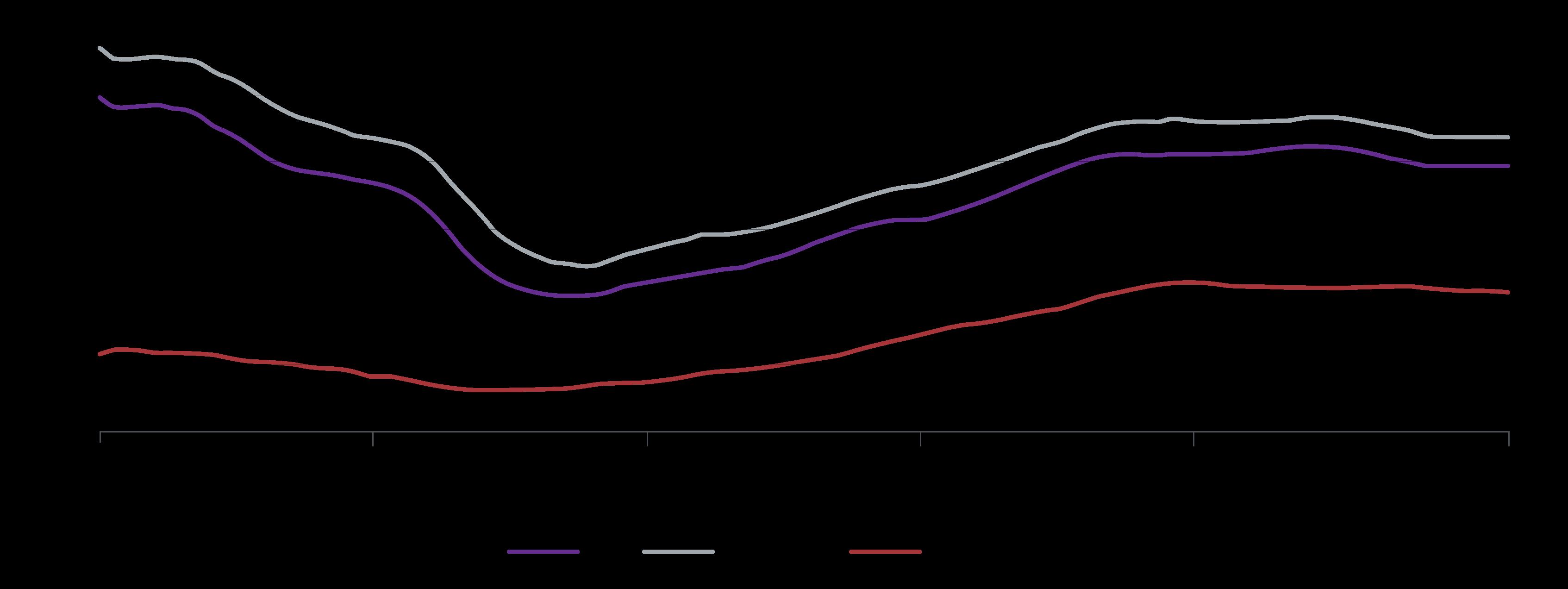

Yields in Dubai Over Time30

The value of sales transactions in Q4 2024 – AED 142.7 billion –was the highest quarterly sales in the history of Dubai real estate.31

Residential sales in the Burj Khalifa reached a staggering AED 467.1 million in 2024.32

435 homes sold for more than $10 million (AED 36.7 million) last year –the most ever – with 127 being on the iconic Palm Jumeirah.33 30.

Dubai and the World34

6700

Millionaires moved to the U.A.E. in 2024 – the highest globally and with many to Dubai. For context, the U.K. suffered a net loss of 9500 millionaires, and China 15,200.

Over $4 billion (~ AED 14.69 billion)

Global private capital targeting Dubai’s residential market

$7 billion

Value of homes sold above $10 million in Dubai during 2024. By the end of Q3 2024, Dubai had overtaken New York, Hong Kong and L.A. in this market segment.

Growth in the millionaire population over the last decade

Dubai and the World

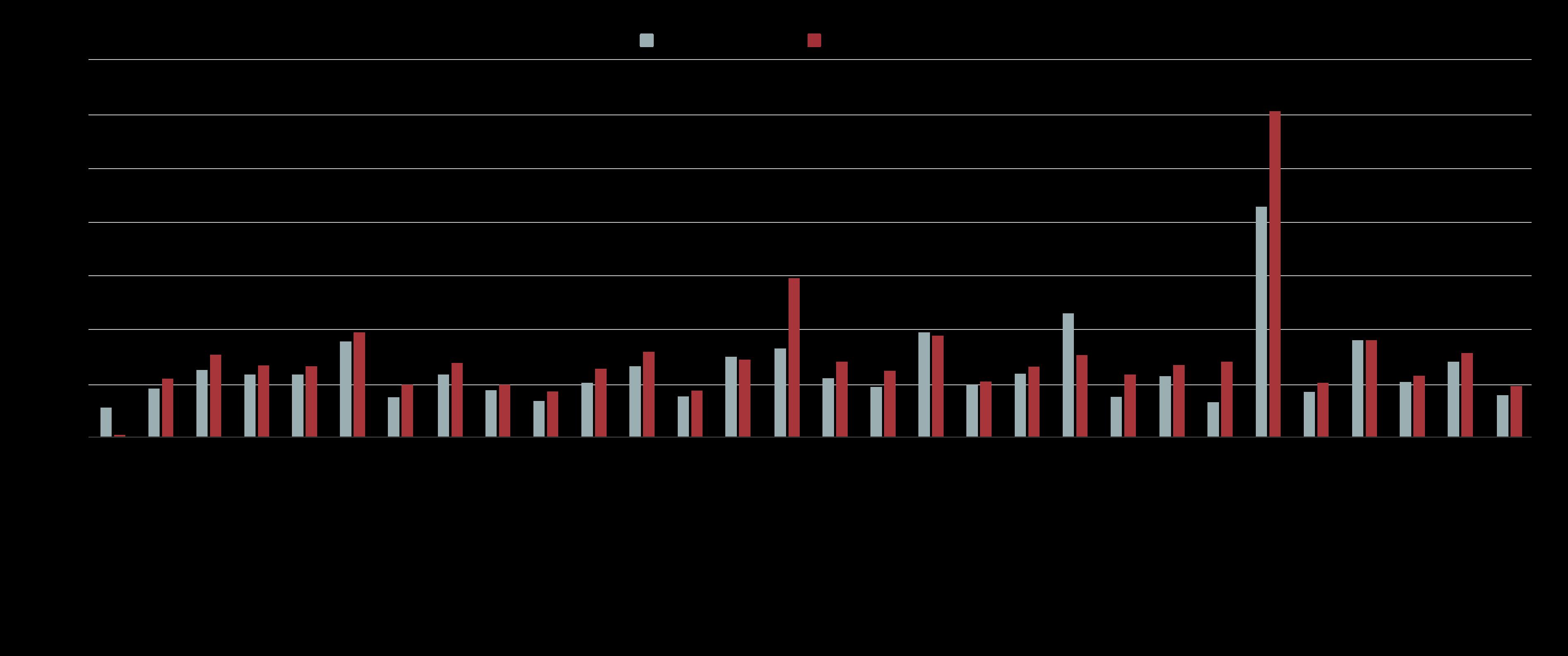

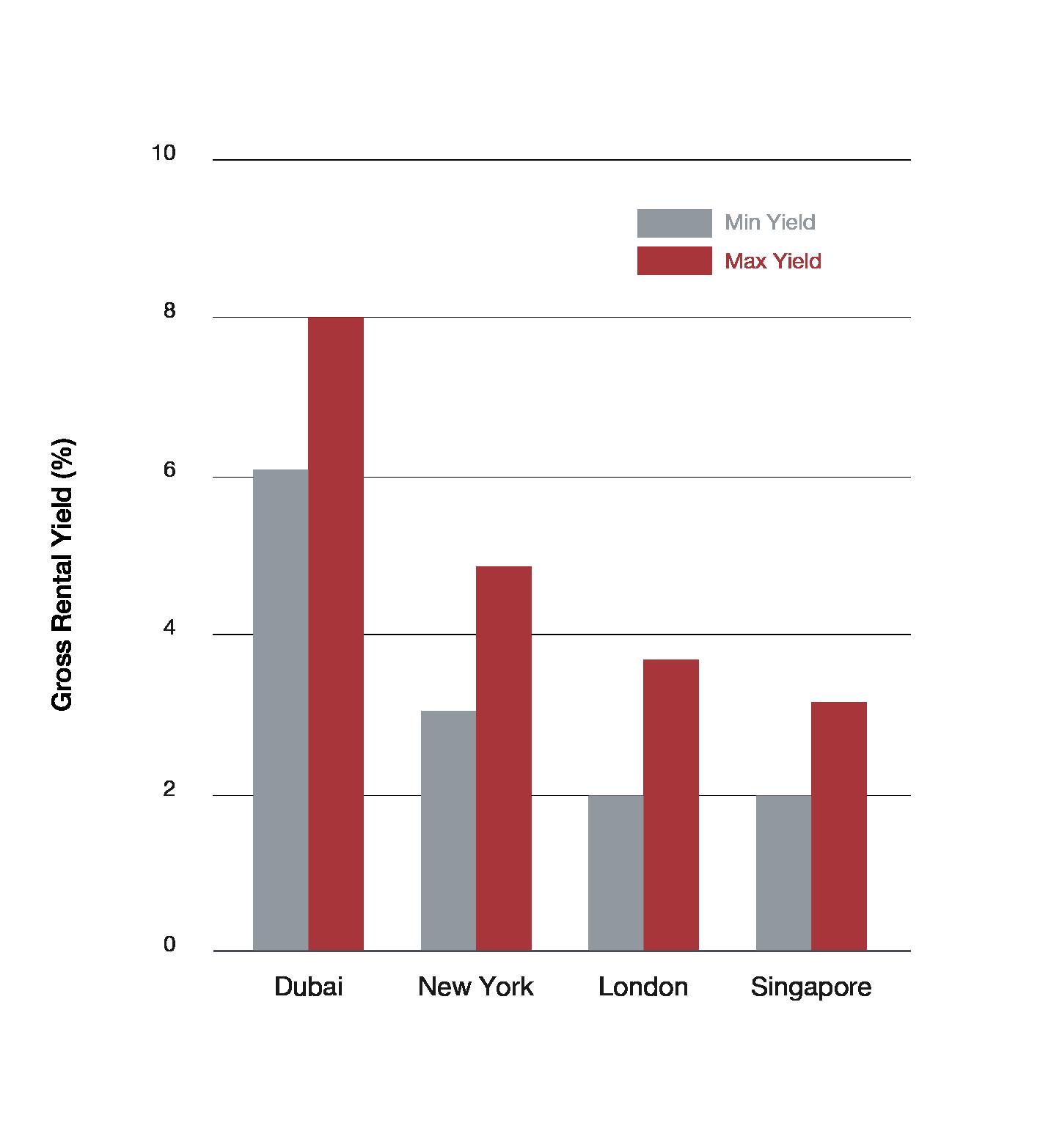

Gross Rental Yields by City35

Factors Attracting HNWIs

Longer-term infrastructure plans like the Al Maktoum International Airport

Looking Ahead: 2025

Large parts of the Middle East will continue to face geopolitical churn in 2025 but Dubai will continue to remain one of the safest and most lucrative real estate markets in the world.

What will change will be the opportunities within the market. The government’s decision to allow freehold ownership on Sheikh Zayed Road and in Al Jaddaf could trigger a jump in property values there of between 30% and 50%.36 This reflects the city-wide increase in prices that is expected to continue this year. The general consensus of a 5-10% average increase holds within it the luxury market segment, which should see an 8-10% average price rise.37

This will coincide with Dubai’s new Smart Rental Index, which will concentrate on building classifications and cover residential properties in both freehold and non-freehold areas. Powered by AI, the system is expected to have an accuracy level in excess of 90% and cut rental conflicts by 20%.38 Coupled with a bright 2025 outlook, this makes for a real estate market that is not only among the fastest-growing in the world but also more transparent than ever before.

The number of units delivered in 2025 will play a crucial role in confirming or dampening these projections. Despite the recent supply shortage in the face of soaring demand, some estimates peg Dubai handovers at over 50,000 units this year – a sharp and welcome uptick.39

January 2025 enjoyed a spectacular showing of AED 44.4 billion in sales value and approximately 14,238 transactions, which is a reported 24% increase from January 2024.40 It makes clear that Dubai real estate is and will continue to be a magnet for all types of buyers and investors, particularly high-net-worth ones.

The takeaway? If 2024 set the record, 2025 could well break it.

36. “Revealed: Freehold ownership move could trigger 30-50% jump in property values on Dubai’s Sheikh Zayed Road, Al Jaddaf, say experts,” Arabian Business, 27th January 2025, https://www.arabianbusiness. com/industries/real-estate/revealed-freehold-ownership-move-could-trigger-30-50-jump-in-property-values-on-dubais-sheikh-zayed-road-al-jaddaf-say-experts

37. “Dubai Real Estate Market 2025: A Promising Horizon,” Global Banking and Finance Review, 30th January 2025, https://www.globalbankingandfinance.com/dubai-real-estate-market-2025-a-promising-horizon

38. “Dubai’s new Rental Index is live; ‘star’ rating to decide what tenants pay,” Gulf News, 2nd January 2025, https://gulfnews.com/business/property/dubais-all-new-digital-rental-index-to-go-live-with-new-buildingclassification-1.500009834

39. “Dubai rent hikes to slow down in 2025 as property market set for record supply,” Khaleej Times, 28th January 2025, https://www.khaleejtimes.com/business/realty/dubai-rent-hikes-to-slow-down-in-2025-asproperty-market-set-for-record-supply

40. “Dubai realty market records 24% surge in value,” Khaleej Times, 6th February 2025, https://www.khaleejtimes.com/business/dubai-realty-market-records-24-surge-in-value

Christie’s International Real Estate Dubai is the leading authority in luxury U.A.E. real estate.

As the first Middle Eastern affiliate of Christie’s International Real Estate, it is part of a storied brand that shares the same heritage of service excellence at the highest echelons of luxury as the over 250-yearold auction house, Christie’s.

Part of an invite-only network that spans over 50 countries, its comprehensive professional services deliver exceptional value. These include residential, commercial and off-plan sales, property investment guidance, project development consultancy and more.

The information in Christie’s International Real Estate Dubai’s State of the Market: Dubai in 2024 is intended for general use only. Where data has been collected, compiled or quoted from an external source, due credit has been provided. Christie’s International Real Estate Dubai has made every effort to ensure the accuracy of the information but will not be held responsible for any errors in this report. If you wish to use or copy any of the text, data, images, charts, graphs or other material in this report, kindly contact Christie’s International Real Estate Dubai beforehand.

State of the Market: Dubai in 2024 is published by Christie’s International Real Estate Dubai, P03, Building 2, Bay Square, Business Bay, Dubai, United Arab Emirates.