ABOUT THE AUTHOR

Please allow me to introduce myself.

My name is Coach Damont and I've been in the credit industry for over 20 years I started back in 2000 when credit repair was still a relatively unknown service and Lexington Law was one of the few players in the field Throughout my career I've helped tens of thousands of people achieve 700+ credit scores, enabling them to purchase homes and cars I've even helped my own mother reach an 800+ credit score However, my perspective changed when I met my billionaire mentor. He introduced me to the concept of debt deletion, showing me how it was a more effective approach than traditional credit repair. He revealed that, despite my best intentions, I was inadvertently setting people up for future challenges This realization forced me to rethink everything I knew to embrace a new way of helping others In this book, I'll share the blueprint he taught me so you can benefit from these powerful strategies I've flipped hundreds of properties, made millions of dollars, lost it all, and made it back again. I started with no money and mastered the art of OPM (Other People's Money) in real estate investing. This journey led me to become one of the largest Robotic 3D Developers, securing a $100M+ deal with a hedge fund

As the CEO of Tycoon Agency, a financial education company (www.CircleofTycoons.com), I've always had a passion for teaching. Our educational company has grown in popularity, thanks to the amazing team behind Tycoon, who support our expanding member base. As an investor, my success has been driven by my education, creative business and marketing strategies, willingness to take risks, and the power team I've built I was born in Indianapolis, IN and moved to Los Angeles, CA in my early 20's I ended up sleeping in my car This is when I met my billionaire mentor who has taught me all the things that I teach in my school and my community. This elite information has helped me to build many millionaires and literally change the trajectory of thousands of families I wrote this book for you the person seeking excellent credit who dreams of a better tomorrow Anything is possible as long as you stay focused It's still hard for me to believe that I can build houses with robots in 7 days and you can too While reaching an 800 score isn't easy, it can be incredibly rewarding Success in this business is 20% technical and 80% mental My mentor used to say, "You are more than just a moment," meaning that real estate is a long-term strategy, not a get-rich-quick scheme (although you can make a lot of money) I made my first million in real estate at the age of 24 It's essential not to get too emotional with the daily ups and downs Don't fall in love with the houses you flip or build. Fall in love with the lifestyle your profits create!

Enjoy this book. Remember that debt deletion is the fastest way to produce quick results with your credit. Luana???

Once you follow the blueprint, it will open the doors of opportunity for you to invest into positive Cash-flowing assets, like rental properties, that generate long-term wealth.

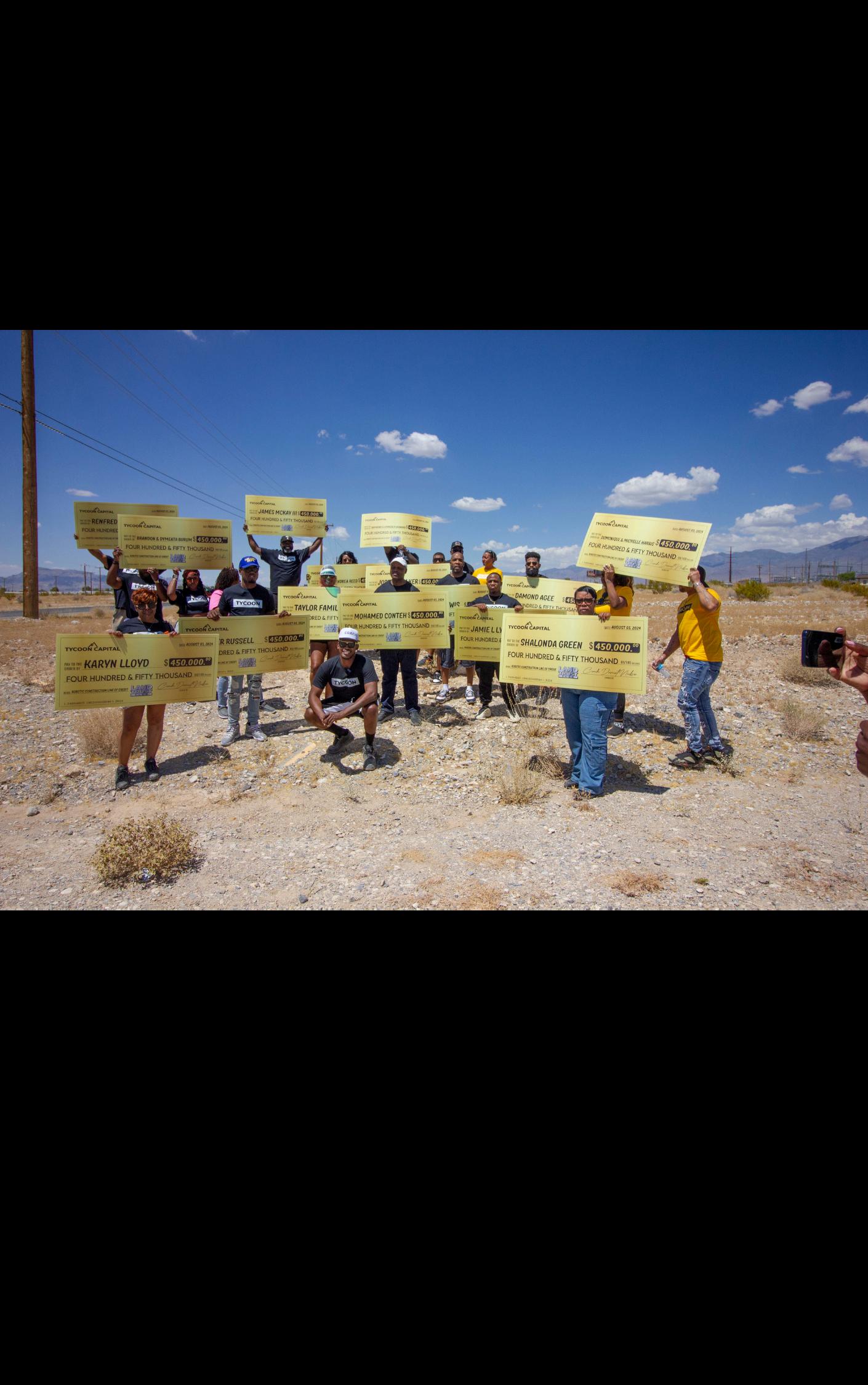

This year I’m most proud that I will award $100M in scholarships to my Tycoon School of Entrepreneurs.

The Tycoon Coach

Preface by Coach Damont

I want to start by giving you a fair warning be a bit long, but I promise it will be wort

You’re about to dive into some crucial info could change the way you think about de

Some of it might sound unbelievable at fi I assure you, it’s all true. I've been involved removal for over 20 years, and I’ve proven concepts in court for many of my trustee

What I’m going to share with you is the b for pairing any kind of debt, good or bad, Private Bulletproof Trust. This strategy can for anyone, anywhere in the world

It never ceases to amaze me how many p collection companies for debts they don’t perhaps they’re stressed out and think pa

Maybe they’ve been convinced that they truth about collections Whatever the re makes sense to me, because paying these

Let’s talk about collections This topic fire fraudulent behavior, bullying, harassm agencies. To understand the depth of this original account in question is a credit c types of collection accounts, including telecommunication accounts When you card and a credit limit. The bank or card i money when you use that card. But her from their assets or from their depositors you credit. The law is clear: “A national ba corporation” (Bowen v Needles Nat Bank the National Banking Act of 1933 set ou money or credit So, if banks can’t lend m answer is nothing When you sign a cr negotiable instrument, thanks to your signature. That signature gives the instrument value. Title 12 of the US Code instructs banks to treat negotiable instruments as cash Whose cash? Yours. In accounting terms, banks treat these instruments as “cash equivalents,” meaning that you are the one who funded the account But the banks never disclose this to you They trick you into believing they lent you something when, in reality, you are the one lending money to them.

Let’s pause here to consider contract law For a contract to be valid, it must contain four essential elements: offer, acceptance, full disclosure, and equal risk.

In addition, it must be bilateral, meaning both parties must sign it. Credit card contracts fail to meet these criteria because they lack full disclosure and equal risk. Full disclosure would require the banks to inform you that you are funding the account, that the account is insured in case of loss, and that you are paying the insurance premium for that coverage (known as a “credit default swap”) They would also have to disclose that they will most likely service the account while transferring ownership to a special-purpose vehicle, such as an asset-backed trust. They would need to disclose that this process, called securitization, voids the contract by separating the payment stream from the note.

Equal risk is another element that’s missing. What risk does the bank take? None. They don’t lend anything, they’re insured against loss, they sell the account, transfer it, and even receive tax credits. The only thing they stand to lose is the illegal profits they make, but even that’s unlikely because everything is insured. Without these essential elements, credit card contracts are not valid. Now, let’s move back to the creation of collection accounts and the fraudulent nature behind them Imagine you have a credit card and something happens that causes you to miss a payment. Fees start piling up, and eventually, you can’t keep up with the payments, leading to a default. If you ask me to intervene, I’ll call the bank and try to discuss your account They’ll ask if I’m you, and when I say no, they’ll refuse to discuss the account without your specific authorization. This is important... they cannot share any information about your account with anyone without your consent. But here’s where it gets interesting When you default, the bank charges off the account at around 180 days. But what they don’t tell you is that they have insurance for these accounts By Day 90, they’ve already filed an insurance claim for the amount of the loss. The insurance company pays the claim, and the account is now paid off in full. According to FDIC rules, creditors must charge off written contracts at Day 120 of default and revolving credit accounts at Day 180 However, they often file the insurance claim at Day 90, which is illegal, as the balance should now be zero. This is a scam, pure and simple, but it doesn’t stop there. After the charge-off, the bank claims a Profit and Loss deduction on their taxes for the charged-off account. This allows them to take a deduction or receive a credit for the asset loss Meanwhile, they’ve already made money from your payments, insurance payouts, and now tax credits. They also continue to report the account as a charge-off on your credit report, hoping to extort that balance from you. If they manage to squeeze some more money out of you, they’ll mark it as a “Paid Charge Off” on your credit report, but the balance should have been zero all along. Sometimes, banks sell off these charged-off accounts in bundles to third-party collection companies, or “debt buyers” But remember, these companies aren’t buying debt; they’re buying your information. These debt collectors purchase debts for pennies on the dollar and have no relation to the original creditor. The debt was purchased, not assigned, to them.

And here’s the crucial point: just as the bank wouldn’t talk to me about your account without your authorization, they can’t share your account information with a third-party collection agency without your consent. But they do it anyway, without your knowledge, without your authorization This is nothing short of identity theft The collection agency creates a new account in your name, sends you a bill, and claims you owe them money. But where’s the contract? Where’s the valid agreement between you and the collection agency? There isn’t one The entire process is built on fraud

These collection accounts are most likely insured as well, adding another layer to the scam. The collectors can’t validate the debt because they don’t have a valid contract with you. They have no authorization to collect, no Power of Attorney, and no standing in court. They’re not even named on the original contract with the original creditor, so they can’t legally substitute themselves into the agreement

Debt collectors love to throw around the case law from Chaudhry v. Gallerizzo, which sets a very low bar for verification. But don’t be fooled. Verification is not validation. Verification means making sure they have the right person, the original creditor’s name, account number, and amount owed. Validation, on the other hand, is the documented proof that they have a valid claim. Debt Deletion Demands validation and verification. When you demand validation, you’re asking for proof not hearsay. You want a notarized statement from the original creditor, attesting under oath that the debt is valid and that they have first-hand knowledge of the account Most of the time, they can’t provide this because they don’t have it. Plus+ the debt is no longer your debt. It’s the “trusts” debt now! Without proper validation, they have no right to collect the debt, and they certainly can’t take you to court with hearsay

This is how you beat them with debt deletion. You demand proof, you document their violations, and you build a case against them. If you ever have to go to court, you’ll have the evidence to defend yourself But most of the time, just showing them that you know your rights and that you’re prepared to fight back will make them back off. I hope this foreword has been an eye-opener for you I hope it gets you fired up and ready to take on the debt that is holding you back using debt deletion remedies. Remember, knowledge is power. The more you know, the better equipped you’ll be to protect yourself and your financial future

I dedicate this book to all of the students aka mentees aka land owners aka Tycoons who trust me to lead and guide you to the next level. To all my Tycoons who are debt-free, have an 800 credit score, own land, and serve as trustees of your own family trust I’m incredibly proud of you Your selflessness in creating a legacy and building family SOPs for those coming after you speaks volumes. You are truly transforming your family’s future, one step at a time.

COACH DAMONT CEO, TYCOON ENTERPRISES

THE EVOLUTION OF CREDIT REPAIR

In this chapter, we’ll explore the history and evolution of credit repair. When I started in the year 2000, credit repair was a relatively unknown service. But as more people became aware of the importance of credit scores, the demand for credit repair grew. We’ll discuss how credit repair works, its limitations, and why it often fails to provide a long-term solution for financial stability I created the first ever Debt Deletion Ai software that’s helping millions of people become debt free.

Overview: This chapter will explore the history and evolution of credit repair. Initially, it was a niche service, but over time it became a popular method for improving credit scores. We’ll discuss the fundamental principles behind credit repair and how it works, focusing on its temporary nature.

Can This Remove a Car Loan?

Credit repair typically cannot remove a car loan itself, especially if the vehicle is still in your possession. By doing so you would be breaking the law. Since a car loan is a secured debt, the vehicle itself serves as collateral. If the car is no longer in your possession it may be possible to remove the debt or derogatory mark from your credit report. However, this is rare and usually results in losing the vehicle.

Can This Remove a Bankruptcy? Bankruptcy is challenging but possible to remove from credit reports Credit repair methods can identify inaccuracies in how the bankruptcy is reported (such as names, dates, or amounts). By disputing these inaccuracies, one can potentially remove a bankruptcy from their credit report. Credit repair as a formal service has undergone significant changes since its early days. When I first entered the industry in 2000, the concept of credit repair was largely unfamiliar to the average consumer At that time, credit scores were not as universally recognized as they are today, and many people were unaware of their impact on financial opportunities. Over the years, as awareness of credit scores grew, so did the demand for credit repair services This chapter will trace the history and evolution of credit repair, explaining how it works, its limitations, and why it often fails to provide a long-term solution for financial stability.

My billionaire mentor taught me everything that I’m going to teach inside of this book. Most people live their entire lives and never learn this information. In this book, you will discover how just one instrument can transform your life, credit and the trajectory of your lineage.

That instrument is called a trust.

He taught me how a trust can be used for many things:

To protect assets – Shielding your wealth from creditors, lawsuits, and other potential threats.

To delete debt – Strategically moving debt out of your name to safeguard your personal finances.

To eliminate probate – Ensuring your assets transfer smoothly to your heirs without the delays and costs of probate court.

To build a legacy – Passing on wealth, knowledge, and values to future generations, allowing them to continue growing and protecting the family’s fortune.

In the late 20th century, credit reporting agencies like Equifax, TransUnion, and Experian began to gain prominence, as they introduced credit scoring models such as FICO By the mid-1990s, credit scores became a critical factor in financial decisionmaking. However, the process of disputing inaccuracies or negative items on credit reports was largely unknown and underutilized. When I started in 2000, credit repair was a niche service, mostly offered by small companies or individuals with knowledge of consumer credit laws. The Fair Credit Reporting Act (FCRA), which was enacted in 1970, provided the legal framework for disputing errors on credit reports, but it wasn't until the late 1990s and early 2000s that consumers began to harness this law to improve their credit scores. Growth in the 2000s The early 2000s saw a steady increase in consumer awareness of credit scores, fueled by the rise of online financial services and the introduction of free credit reports. A pivotal moment occurred in 2003 when the Fair and Accurate Credit Transactions Act (FACTA) was signed into law, requiring the three major credit bureaus to provide consumers with a free annual credit report. This legislation led to a surge in the number of people seeking to repair their credit, as they could now monitor their credit more closely. By 2005, the credit repair industry was growing rapidly, with more companies offering services to help consumers remove negative items from their credit reports. However, this growth also attracted scrutiny, leading to the introduction of the Credit Repair Organizations Act (CROA), which aimed to protect consumers from deceptive practices. Despite these regulations, many credit repair companies continued to operate in a legal gray area, promising results that were often temporary and unsustainable.

The Limitations of Credit Repair

Credit repair operates on the principle of disputing inaccurate or outdated information on a credit report This can include late payments, charge-offs, collections, and even bankruptcies. However, the process is often limited in its effectiveness Credit repair can temporarily boost a credit score, but it does not address the underlying financial behaviors that led to the negative items in the first place. For example, removing a car loan from a credit report is particularly challenging. Car loans are secured debts, meaning the vehicle serves as collateral Unless the car is no longer in the borrower’s possession, it is unlikely that a car loan can be removed through credit repair. Even if the vehicle is repossessed, the negative mark on and if it is removed it could still pop back up at any time once it’s sold to another debt collector

This temporary result impacts the borrower's ability to secure new loans because it’s still in the internal banking system. Similarly, while it is possible to remove a bankruptcy from a credit report by disputing inaccuracies, this is a rare occurrence Bankruptcies are public records, and unless there is a legitimate error in how the bankruptcy is reported, it typically remains on the credit report for seven to ten years. Statistics and Trends To illustrate the impact of credit repair, consider the following statistics:

2000-2010: The number of consumers seeking credit repair services increased by approximately 50% during this decade, as awareness of credit scores became more widespread

2012: A study by the Federal Trade Commission (FTC) found that 20% of consumers had errors on their credit reports, highlighting the potential need for credit repair

2018: The credit repair industry was valued at over $3 billion, with thousands of companies offering services across the United States

Despite the growth of the industry, studies have shown that credit repair often provides only temporary relief. According to a 2017 report by the Consumer Financial Protection Bureau (CFPB), many consumers who utilized credit repair services saw their credit scores drop again within six months. Conclusion The evolution of credit repair reflects a growing awareness of the importance of credit scores in financial life. However, while credit repair can be a useful tool for addressing inaccuracies, it is not a solution for financial problems. The limitations of credit repair highlight the need for more sustainable solutions, such as debt deletion, which will be explored in later chapters. By understanding the history and limitations of credit repair, readers can make informed decisions about their financial future

CREDIT REPAIR COMPANIES EXPOSED

Credit Repair Abuse refers to the misuse or deceptive practices within the credit repair industry, often resulting in harm to consumers. Here are some key points about Credit Repair Abuse: False Promises: Many credit repair companies promise to remove negative items from credit reports, even when these items are accurate and valid. This creates false hope for consumers and often leads to disappointment

1. Temporary Fixes: Credit repair often provides short-term improvements to credit scores, but the underlying debt or issues may resurface if not handled properly. This gives the illusion of progress while leaving consumers vulnerable in the long term.

2. Excessive Fees: Some credit repair companies charge high fees for services that consumers could perform themselves for free, such as disputing inaccurate items on their credit reports.

3. Illegal Practices: Certain credit repair companies engage in fraudulent practices like advising consumers to create a new identity (through a process known as "file segregation") or disputing legitimate debts, which can lead to legal trouble.

4. Exploiting Vulnerable Consumers: Those with poor credit often turn to credit repair out of desperation Credit repair abuse targets these individuals, exploiting their financial struggles and exacerbating their problems.

5. Revolving Debt: Credit repair may improve a consumer’s credit score temporarily, but since the underlying debts are not deleted, creditors can still sell the debts to collection agencies, leading to future financial challenges.

6 Risk of Garnishment or Lawsuits: Since credit repair does not invalidate debts, consumers are still at risk of being sued or having their wages garnished by creditors, despite any temporary score improvements.

8

7 Misleading Consumers About Credit Laws: Credit repair services may misrepresent consumer rights under the Fair Credit Reporting Act (FCRA) and other consumer protection laws, leaving consumers unaware of what can legally be done regarding their credit issues.

Credit repair abuse underscores the importance of understanding the difference between ethical, legal debt deletion methods and manipulative credit repair tactics that often harm consumers in the long run.

Lawsuits against Lexington Law and Progrexion (2020): The Consumer Financial Protection Bureau (CFPB) filed a lawsuit against these major credit repair firms, alleging they violated the CROA by misrepresenting their services and charging upfront fees before providing any credit repair help. The CFPB claimed the companies used deceptive marketing and led consumers to believe they would quickly improve credit scores.

FTC v. American Credit Crunchers (2012): The Federal Trade Commission (FTC) brought action against this company for claiming they could remove negative information from credit reports for a fee. The company was found to have falsely guaranteed results and failed to deliver on its promises The case resulted in the FTC shutting down the operation and freezing assets.

United States v. Prime Credit Consultants (2014): The CFPB filed a complaint against this credit repair company for charging illegal advance fees They required consumers to pay before performing any services, which is a direct violation of the CROA The lawsuit resulted in restitution payments for affected consumers and a ban

deceptive practices.

FTC v. RMCN Credit Services (2011): The FTC sued RMCN Credit Services for submitting false dispute letters to credit reporting agencies, claiming that negative credit items were incorrect even when they knew the information was accurate. This violated both CROA and the Fair Credit Reporting Act (FCRA). The court issued a significant monetary judgment against the company.

Credit Repair Cloud Lawsuit (2022): The CFPB filed a lawsuit against Credit Repair Cloud for enabling telemarketers to charge consumers upfront fees through illegal credit repair schemes. The company was accused of assisting these telemarketers in violating the Telemarketing Sales Rule (TSR) by charging fees before rendering services.

FTC v. National Credit Repair Co. (2008): The FTC targeted National Credit Repair Co. for deceptive claims about credit score improvements and debt settlement services The company falsely advertised that they could remove all negative items from credit reports and settle debts for pennies on the dollar. The court ordered the company to cease operations and pay significant fines

Class Action v Ovation Credit Services (2009): A class action lawsuit was filed against Ovation Credit Services, alleging the company engaged in fraudulent billing practices and misrepresented their ability to remove accurate but negative information from credit reports. The company settled the case, agreeing to stop deceptive practices and provide refunds to consumers

Credit Repair Debt Deletion

THE DEBT DELETION METHOD

Overview: Debt deletion is a revolutionary approach to eliminating debt by invalidating it at its core Unlike credit repair, which addresses only the symptoms, debt deletion deals with the root cause, leading to permanent solutions.

Can This Remove a Collection? Debt deletion can remove a collection As a unsecured debt, the debt debt is invalidated after being transferred over to the proper type of trust.

Can This Remove a Repo? Debt deletion can effectively remove repossessions from your credit report by challenging the accuracy of the information reported by credit bureaus and having the debt invalidated If the automobile is no long a secured debt then it will qualify for debt deletion.

LIST OF ITEMS DEBT DELETION CAN DELETE LEGALLY

Debt deletion can legally remove certain items from a credit report, but the process involves leveraging consumer protection laws, such as the Fair Credit Reporting Act (FCRA) AND Equity law and other related statutes. Here are items that can be legally deleted from a credit report under specific circumstances:

1. Inaccurate or Erroneous Information

Incorrect personal information: Wrong names, addresses, or phone numbers.

Incorrect account details: Wrong account numbers, balances, or credit limits.

Accounts that don’t belong to you: Fraudulent or misreported accounts from identity theft or clerical errors.

Duplicate accounts: When the same debt is listed multiple times by mistake.

2. Unverified Debts

Unverified negative items: Credit bureaus are required by law to remove any negative item that a creditor cannot verify within 30-45 days after a dispute is filed. This includes:

Late payments

Charge-offs

Collections

Bankruptcies (if not properly verified)

3. Outdated Information

Accounts past the reporting period: Negative information must be removed from your credit report after a certain period:

Late payments: 7 years from the date of the delinquency.

Charge-offs: 7 years from the date of the charge-off.

Collections: 7 years from the original delinquency date

Bankruptcies: Chapter 7 remains for 10 years, while Chapter 13 can be removed after 7 years.

Judgments and tax liens: Usually 7 years, but tax liens that are paid can sometimes be removed sooner.

4. Settled or Paid Collections

Settled debt accounts: When a debt is settled or paid, you can negotiate with creditors or collection agencies to remove the account from your report as part of the settlement agreement (often called "pay-for-delete")

Paid collections: Some collection agencies will remove paid debts from your credit report upon request.

5. Medical Debts (with Consumer Protection)

Unpaid medical debt: As of 2022, medical debts that have been paid or are under $500 are often removed from credit reports due to updates in credit reporting policies by the three major bureaus (Equifax, Experian, and TransUnion).

Debts covered by insurance: If an insurance company eventually covers a medical debt that was previously reported, it should be removed.

6. Debts Involving Identity Theft

Fraudulent accounts: Accounts opened or debts incurred through identity theft can be removed after proving the fraudulent activity.

Incorrect collections due to fraud: Any collections related to identity theft can be disputed and removed

7. Accounts in Dispute

Disputed items: If a debt is being disputed under FCRA, the item can be temporarily or permanently removed from the credit report, especially if the creditor fails to provide evidence of its validity within the allowed time frame. 8.

Bank Errors

Incorrect reporting by banks or lenders: If the lender made a reporting error, such as misreporting payment history or loan amounts, this can be removed once corrected.

9. Hard Inquiries

Unauthorized hard inquiries: If a credit inquiry was made without your permission or knowledge, it can be disputed and deleted from your report.

Expired hard inquiries: Hard inquiries automatically fall off your credit report after 2 years.

10. Accounts Closed by Consumer Request

Closed accounts with negative marks: Sometimes closed accounts can have their negative items removed, especially if they were closed by you and the account was in good standing

11. Debt That Was Discharged in Bankruptcy

Bankruptcies that were discharged: After the bankruptcy is resolved and debts are discharged, related negative items (e g , accounts, collections) may be removed or updated to show a zero balance.

The Debt Deletion Method

Overview: Debt deletion is not just another method for managing debt; it's a transformative approach that has been used by the wealthy for centuries to eliminate debt by invalidating it at its core. Unlike credit repair, which often only masks the symptoms of financial distress, or debt consolidation, which merely reorganizes existing debt without reducing the overall burden, debt deletion addresses the root cause. This leads to a permanent resolution of financial liabilities, creating a path to true financial freedom.

The Legacy of Debt Deletion Among the Wealthy

For centuries, powerful families such as the Forbes, Rockefellers, and Trumps have utilized strategies akin to debt deletion to preserve and expand their wealth. These families have long understood that the key to maintaining financial stability lies not in managing debt, but in eliminating it using a trust By leveraging legal and financial strategies, they have been able to challenge the validity of debts, often erasing them entirely. This approach has been instrumental in building and preserving their vast fortunes.

Debt deletion, by contrast, challenges the very existence of the debt. By questioning the validity of the debt or the accuracy of the information reported by credit bureaus, debt deletion can lead to the complete removal of the debt from the consumer's record. This method doesn’t just improve a credit score it erases the liability, freeing the consumer from the financial burden entirely It’s a strategy that has been used by the wealthy for generations, and when executed correctly, it offers a permanent solution to debt. For example, in cases of bankruptcy, debt deletion can be particularly effective While credit repair might focus on removing the bankruptcy from the credit report, debt deletion challenges the legal standing of the bankruptcy itself, potentially leading to its complete removal. This approach not only cleans up the credit report but also eradicates the debt, offering a fresh financial start CREDIT REPAIR:

Credit repair primarily focuses on disputing inaccuracies on credit reports While it can be effective in the short term, it often only addresses the symptoms of financial distress. For instance, removing a negative item from a credit report might improve a credit score temporarily, but it doesn’t eliminate the underlying debt. Moreover, if the dispute is unsuccessful, the negative item remains, and the consumer is back where they started Credit repair can also be time-consuming, with no guarantee of success, making it an unreliable long-term strategy.

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. While this can simplify repayment and reduce monthly payments, it doesn’t reduce the overall debt. In many cases, debt consolidation can lead to a longer repayment period, meaning consumers pay more in interest over time Additionally, if new debts are incurred after consolidation, the consumer can end up in a worse financial situation than before This approach is more about managing debt than eliminating it, which can prolong financial distress.

Conclusion: Debt deletion is a powerful, though often overlooked, strategy for achieving financial freedom. Unlike credit repair or debt consolidation, which offer temporary or superficial relief, debt deletion addresses the root of the problem, offering a permanent solution. By understanding and employing the strategies that have been used by wealthy families for generations, anyone can take control of their financial future, erasing debt and building a legacy of wealth

UNDERSTANDING CONSUMER LAW

Consumer law is a critical component of the debt deletion process. This chapter will cover the key laws that protect consumers from unfair debt collection practices, including the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA). We’ll also discuss how these laws can be leveraged to delete debt permanently

Overview:

Consumer law is vital in the debt deletion process. This chapter will cover essential laws like the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA), explaining how they protect consumers from unfair debt collection practices.

How Does One Stop a Collection Agency From Harassing Calls? To stop a collection agency from harassing you with calls, request proof of debt validation. The agency must cease all contact until they provide this validation. If they continue calling, you may be entitled to $1,000 per violation, so record every call as evidence.

Is It True That a Debt Collector Must Respond in 30 Days? The 30-day rule applies to consumers, not debt collectors. Consumers must request validation within 30 days of the first collection letter Debt collectors can take as long as they wish to respond but cannot collect until they validate the debt.

1. The Fair Credit Reporting Act (FCRA)

Purpose: The FCRA, enacted in 1970, is designed to promote the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. It regulates how credit information is collected, shared, and used, giving consumers the right to access and dispute information in their credit reports

Key Provisions:

Right to Access: Consumers are entitled to one free credit report per year from each of the three major credit bureaus (Equifax, Experian, TransUnion).

Right to Dispute: If there is inaccurate or incomplete information in a credit report, consumers can dispute it. The credit bureau must investigate and correct any errors within 30 days.

Limitations on Reporting: The FCRA limits how long negative information can remain on a credit report typically seven years for most negative items and ten years for bankruptcies.

Example: A consumer finds an error in their credit report a loan they never applied for. By using their rights under the FCRA, they file a dispute with the credit bureau. The bureau investigates and removes the incorrect information, preventing potential damage to the consumer's credit score

Key Provisions:

2. The Fair Debt Collection Practices Act (FDCPA)

Purpose: The FDCPA, enacted in 1977, regulates the behavior of debt collectors, prohibiting abusive, unfair, and deceptive practices It ensures that consumers are treated fairly and with respect during the debt collection process.

No Harassment: Debt collectors cannot use threats, profanity, or repeatedly call to annoy or harass the debtor.

Written Validation: Within five days of the initial contact, the debt collector must send a written notice detailing the amount owed, the name of the creditor, and how to dispute the debt.

Dispute and Validation: Consumers have the right to dispute the debt within 30 days. The collector must cease collection efforts until the debt is verified.

Example: A consumer receives harassing phone calls from a debt collector at odd hours.

Under the FDCPA, they can demand that the collector stop contacting them at those times and request a written validation of the debt If the collector continues the harassment, the consumer can file a complaint with the Consumer Financial Protection Bureau (CFPB) or take legal action.

3. The Truth in Lending Act (TILA)

Purpose: Enacted in 1968, TILA ensures that consumers are provided with clear and accurate information about the costs of credit, including the annual percentage rate (APR), terms of the loan, and any fees involved It aims to promote informed use of credit by requiring disclosures about its terms and costs

Key Provisions:

Disclosure of Terms: Lenders must provide clear information about the terms of the loan, including the APR, total payments, and payment schedule.

Right of Rescission: In some cases, such as with home equity loans, consumers have three days to cancel the transaction without penalty.

Protection Against Fraud: TILA provides certain protections against fraudulent lending practices and allows consumers to sue lenders who violate the Act

Example: A consumer takes out a home equity loan but later realizes the terms were not fully explained Within three days, they decide to cancel the loan TILA allows them to rescind the agreement without losing money, protecting them from potentially predatory lending practices

4. The Equal Credit Opportunity Act (ECOA)

Purpose: The ECOA, enacted in 1974, prohibits discrimination in the credit application process based on race, color, religion, national origin, sex, marital status, age, or because one receive public assistance. It ensures that all consumers have an equal opportunity to obtain credit.

Key Provisions:

Prohibition of Discrimination: Lenders cannot discriminate against applicants based on the factors mentioned above

Notification of Denial: If a credit application is denied, the lender must provide a reason for the denial or inform the applicant of their right to request this information

Right to Information: Consumers have the right to know why they were denied credit and can challenge incorrect or unfair decisions

Example: A consumer applies for a credit card but is denied They suspect the denial was due to their age. The ECOA requires the lender to provide a specific reason for the denial, which allows the consumer to challenge the decision if they believe it was discriminatory

5. The Credit Repair Organizations Act (CROA)

Purpose: Enacted in 1996, the CROA governs the behavior of credit repair organizations, ensuring they operate with transparency and honesty. It protects consumers from deceptive and abusive practices in the credit repair industry Key Provisions:

Full Disclosure: Credit repair organizations must provide a written contract detailing the services they will perform, the time frame, and the total cost Right to Cancel: Consumers have three days to cancel a contract with a credit repair organization without incurring any fees Prohibition of False Claims: Credit repair organizations cannot make false claims about their ability to remove negative information from credit reports or charge fees before performing services

Example: A consumer hires a credit repair company that promises to remove all negative items from their credit report. However, after signing the contract, they discover that the company’s claims were exaggerated The CROA allows them to cancel the contract within three days without any penalties, and they can report the company for making false claims.

Conclusion: Understanding consumer credit laws empowers individuals to take control of their financial lives, ensuring they are treated fairly by creditors, lenders, and debt collectors. These laws provide a framework for challenging inaccuracies, preventing discrimination, and protecting against abusive practices, ultimately leading to better credit health and financial stability

EQUITY LAW AND TRUSTS

Trusts have been used by wealthy families for generations to protect and grow their assets In this chapter, we’ll delve into the principles of equity law and how trusts can be used to transfer and protect assets, including debt. We’ll also explore the different types of trusts and how they can be used to build and maintain wealth

Overview: Equity law and trusts are crucial tools for protecting and growing assets. This chapter will explain how trusts can be used to transfer assets, protect wealth, and even manage debts

State Statute Says Banks "Exempt" as Collection Agency - What Now?

In some states, banks are exempt from state collection agency statutes. In such cases, federal statutes like the FDCPA are still applicable and can be used to protect your rights.

Can One Remove a Criminal or Civil Penalty from IRS/Gov?

Debt deletion can work in scenarios similar to bankruptcy Whether a government fine or penalty can be discharged depends on the intent behind it. If the fine is punitive, it likely cannot be discharged, but if it's compensatory, there may be options

Equity Law and Trusts Overview: Equity law and trusts are pivotal in asset protection, wealth management, and the strategic transfer of both assets and liabilities. This chapter explores how equity law underpins the creation and function of trusts, the different types of trusts available, and how they can be employed to manage and protect assets, including debt.

1. Understanding Equity Law

Definition: Equity law is a branch of law that focuses on fairness and justice, complementing common law. It emerged to address situations where the rigid application of common law might lead to unfair outcomes. Equity provides remedies and principles designed to achieve fair results.

Key Principles:

Equitable Remedies: Unlike common law remedies, which typically involve monetary compensation, equitable remedies may include injunctions (orders to do or not do something), specific performance (compelling a party to fulfill their contractual obligations), and declaratory relief (a declaration of rights or obligations).

Equitable Maxims: Principles like "He who comes into equity must come with clean hands" and "Equity will not suffer a wrong without a remedy" guide decisions to ensure fairness.

Trusts as an Equitable Tool: Trusts are fundamentally rooted in equity, allowing for the management and distribution of assets in a manner that aligns with equitable principles.

Example: A trust is established to ensure that a family’s wealth is managed according to their wishes If a trustee fails to act in the best interest of the beneficiaries, equitable principles allow the beneficiaries to seek remedies, such as the removal of the trustee or a change in the management of the trust.

2. Types of Trusts and Their Uses

A. Revocable Trusts Purpose: Revocable trusts, also known as living trusts, can be altered or revoked by the grantor (the person who creates the trust) during their lifetime They are primarily used for estate planning and avoiding probate

Key Features:

Flexibility: The grantor can modify the terms of the trust or dissolve it entirely. Avoidance of Probate: Assets in a revocable trust pass directly to beneficiaries upon the grantor’s death, avoiding the probate process. Example: A wealthy individual creates a revocable trust to manage their assets during their lifetime and ensures that their estate is distributed according to their wishes after their death, without the need for probate.

B. Irrevocable Trusts Purpose: Irrevocable trusts cannot be changed or revoked once established. They are often used for asset protection, reducing estate taxes, and providing for beneficiaries. Key Features:

Asset Protection: Assets transferred to an irrevocable trust are generally protected from creditors and legal judgments.

Tax Benefits: These trusts can help reduce estate taxes by removing assets from the grantor’s taxable estate.

Example: A person transfers ownership of their home to an irrevocable trust to protect it from potential creditors and reduce their estate tax liability. The home is now managed by the trustee and not considered part of the grantor’s estate

C. Special Needs Trusts

Purpose: Special needs trusts are designed to provide for individuals with disabilities without disqualifying them from government benefits.

Key Features:

Preservation of Benefits: Funds in the trust do not count as assets for meanstested benefits programs like Medicaid or Supplemental Security Income (SSI). Personalized Care: The trust provides funds for additional care and quality of life improvements for the beneficiary

Example: A family establishes a special needs trust to provide for their child with a disability, ensuring that the child continues to receive government benefits while also having access to additional resources for their care and well-being.

3. Using Trusts to Manage and Protect Debt

A.

Transferring Debt to a Trust

Mechanism: While trusts are primarily used for managing and protecting assets, they can also play a role in managing debt By transferring assets into a trust, the debt associated with those assets may be managed or reduced, as the trust becomes the legal owner of the assets.

Key Points:

Asset Protection: Transferring assets into a trust can protect them from creditors if done in a way that complies with relevant laws and regulations.

Debt Management: In some cases, a trust can assume responsibility for certain debts,especially if it holds significant assets and has the capacity to service the debt.

Example: A business owner transfers company assets into a trust The trust then becomes responsible for servicing the business's debts. This can help in negotiating debt terms or protecting the business’s assets from personal creditors

B. Exemptions and Protections

State Statute Says Banks "Exempt" as Collection Agency: In states where banks are exempt from state collection agency statutes, federal laws such as the Fair Debt Collection Practices Act (FDCPA) still apply This ensures that consumers are protected from unfair practices by debt collectors, including banks. Example: If a bank is exempt from state collection regulations, a consumer facing unfair collection practices can still seek protection under the FDCPA. They can file a complaint with the CFPB or take legal action against the bank.

4. Removing Government Fines or Penalties

Mechanism: Debt deletion and asset protection strategies can be applied to certain government fines or penalties, depending on their nature While punitive fines are generally not dischargeable, compensatory penalties may have options for reduction or removal. Key Points:

Nature of the Fine: Determining whether a fine is punitive or compensatory affects the approach to removal or reduction.

Legal Remedies: Some fines or penalties may be subject to negotiation or reduction based on legal arguments or hardship.

Example: A business fined by the IRS for non-compliance may seek to challenge the penalty if it can demonstrate that the fine was compensatory rather than punitive. Legal strategies might include negotiation or applying for penalty relief based on circumstances.

Conclusion: Equity law and trusts are powerful tools for managing and protecting assets By understanding the principles of equity and the various types of trusts, individuals and families can strategically transfer, protect, and grow their wealth while also addressing and managing debts. Whether through irrevocable trusts for asset protection or special needs trusts for providing for loved ones, these legal instruments offer flexibility and security in financial planning.

BUILDING WEALTH WITH TRUSTS

Families that use trusts are often able to maintain and grow their wealth over generations This chapter will provide real-life examples of families who have used trusts to build and preserve wealth. We’ll discuss the strategies they use and how you can apply these same principles to your own financial situation.

Overview: Trusts are powerful tools for building and preserving wealth across generations. This chapter will explore how families use trusts to maintain financial stability and pass on assets without the burden of debt.

How Long Until an Account Goes into Collections?

Accounts typically go into collections after 91 days of missed payments. At this point, the original creditor sells the debt note to a third-party collection agency

The Basics of Trusts

How Trusts Can Protect Assets

Trusts are a tried-and-true method used by some of the wealthiest families in the world to protect their assets, manage debts, and ensure financial stability for future generations. Here are examples of elite families who have leveraged trusts for these purposes:

The Rockefeller Family

Overview: The Rockefeller family, one of the wealthiest families in American history, is known for its extensive use of trusts to manage and protect its vast fortune. The Rockefeller Trust, established by John D. Rockefeller, has been crucial in preserving the family’s wealth for over six generations.

Trust Strategy: The family used trusts to control their assets, minimize taxes, and protect their wealth from creditors. By placing assets in trusts, they were able to shield them from potential liabilities and ensure that the wealth was passed down through generations without being depleted.

Debt Management: The trust structure also allowed the family to manage debts strategically, using income from trust-held assets to pay off obligations, thereby protecting the principal wealth.

Overview: The Kennedy family, known for its political legacy, also utilized trusts extensively to manage their wealth Joseph P Kennedy, the patriarch, set up several trusts that helped protect the family’s assets and reduce their tax liabilities.

Trust Strategy: Trusts were used to transfer wealth to future generations while minimizing estate taxes. The Kennedy trusts were designed to keep the family’s wealth intact and ensure that it could be used to support the family and their political ambitions.

Debt Management: The trusts were structured in a way that allowed the family to pay off debts efficiently, using the income generated from trust investments, thus preventing the accumulation of burdensome debt.

The Kennedy Family

The Walton Family

Overview: The Walton family, heirs to the Walmart fortune, have used trusts to manage their wealth, making them one of the richest families in the world. The family’s use of trusts has been instrumental in minimizing tax liabilities and protecting their assets

Trust Strategy: The Walton family has set up a series of trusts to hold their Walmart shares and other investments. These trusts have allowed the family to maintain control over the company while reducing their tax burden and protecting their wealth from creditors.

Debt Management: The family’s trust structure has enabled them to manage any debts associated with their business and personal investments effectively, ensuring that their wealth remains secure.

Nipsey Hussle's Legacy Blueprint: Building a Lasting Legacy

Nipsey Hussle was not just an influential artist; he was a visionary who understood the power of wealth-building and legacy preservation In his song, he laid out the framework for building a true legacy:

“Open trust accounts, deposit racks, Million dollar life insurance on my flesh, Beamer's, Benz, Bentley's, or a Lex, Ferrari's and them Lambo's that's what's next.”

This verse highlights the steps necessary to secure generational wealth. Below is the blueprint Nipsey Hussle left for us, a step-by-step guide to b

When set up properly, it shields your assets from probate—a lengthy and expensive legal process that can drag on for years, diminishing your wealth.

In the entertainment industry, many celebrities failed to establish trusts, and as a result, their estates went through probate, leaving their families to deal with the legal complexities.

Michael Jackson: Although Michael Jackson had a will, it took years for his estate to clear probate. With assets tied up in court, the legacy he built faced threats from creditors and legal fees.

James Brown: The legendary singer died without a proper trust in place, leaving his estate in probate for more than 15 years.

Bob Marley: Despite his vast wealth, Marley died intestate (without a will or trust), leaving his family to fight over his estate in probate.

Pablo Picasso: The famous painter’s family spent six years and millions in legal fees battling over his estate.

Jimi Hendrix: Hendrix’s estate also went through a long probate process, with disputes continuing for decades after his death.

Aretha Franklin: Known as the Queen of Soul, Franklin passed away without a will or trust, leaving her estate to be contested in probate court.

Takeoff (from Migos): The rapper's untimely death led to his estate facing potential probate disputes, impacting his legacy

Prince: Prince died without a will or trust, and his estate spent years in probate with multiple legal battles that diluted his legacy.

These examples highlight the importance of estate planning. Without a trust, these celebrities’ families lost significant portions of their inheritance to legal fees, and their legacies were often altered by drawn-out court processes.

How Nipsey's Trust Is Different: Puma Pays into His Children's Trust

Nipsey was forward-thinking. One of the key aspects of his legacy preservation was the trust he set up for his children. Puma, a brand he collaborated with, ensures that a portion of their sales from Nipsey Hussle’s collection is paid into the trust for his children This shows how his business dealings were structured to ensure long-term financial support for his family, even after his passing.

His decision to establish a trust meant his assets were protected from probate, and his children’s futures were financially secure. This strategy created a smooth transition of wealth, ensuring his family would be well taken care of

How to Build a Lasting Legacy Like Nipsey Hussle

Nipsey’s legacy blueprint isn’t reserved for celebrities; anyone can follow his steps to protect their wealth and build a lasting legacy for future generations Here’s a breakdown of how to do it:

Step 1: Open a Trust

Before you accumulate significant wealth, open a trust This trust will protect your assets from legal disputes, ensure privacy, and avoid the costly and timeconsuming probate process. Nipsey emphasized that protecting your assets should be the first priority.

Step 2: Deposit Money into the Trust

Ensure you deposit your wealth whether it’s income from your job, investments, or businesses into the trust. This step ensures that the assets are protected, and you can even create non-taxable events, allowing wealth to grow without being eroded by taxes.

Step 3: Put Your Life Insurance into the Trust

A critical element Nipsey mentioned was the importance of life insurance. By placing your life insurance policy into the trust, the payout becomes part of the trust's assets, bypassing probate entirely. This ensures that your loved ones will be financially supported without delays

Step 4: Use the Trust Fund for Purchases & Compensation

Once the trust is established, it can be used to purchase liabilities like cars, properties, and other luxury items Additionally, if you serve as the trustee of your own trust, you can compensate yourself for managing the assets. This keeps wealth within the family while also providing a stream of income for you and your descendants.

Final Thoughts: Protecting the Legacy

Nipsey Hussle’s vision for building wealth wasn’t just about the short-term it was about creating a structure that would last for generations.

By leveraging trusts, he ensured his children and future descendants would benefit from his hard work.

In contrast, many iconic entertainers failed to follow these steps, resulting in lengthy probate battles that chipped away at their legacies. Nipsey’s foresight, business acumen, and commitment to generational wealth serve as a blueprint for anyone who wants to protect and build a lasting legacy.

By following his steps opening a trust, depositing funds, securing life insurance within the trust, and using it to buy assets you can secure your family’s financial future and prevent your estate from falling into probate

The Pitfalls of Credit Repair

Credit repair may offer a quick fix, but it often comes with significant drawbacks In this chapter, we’ll explore the pitfalls of credit repair, including why it’s often a temporary solution and how it can leave you vulnerable to further financial issues

Overview: Credit repair offers a quick fix but often comes with significant drawbacks. This chapter will delve into why credit repair is often a temporary solution that can leave you vulnerable to further financial issues

ThePitfallsofCreditRepair

Overview: Credit repair is often marketed as a quick fix for improving credit scores and financial health. However, it has significant limitations and potential pitfalls that can undermine long-term financial stability. This chapter will delve into the shortcomings of credit repair, highlighting its temporary nature and the risks associatedwithrelyingonitasasolutiontodebtandfinancialissues.

1. The Temporary Nature of Credit Repair

Definition: Credit repair involves disputing inaccuracies on a credit report to improve one's credit score While this process can temporarily boost a credit score, it does not address the underlying issues that led to the poor credit score in the first place

Limitations:

Short-Term Fix: Credit repair often results in a temporary increase in credit scores by removing or correcting errors However, if the underlying financial habits or issues are not addressed, credit scores can quickly drop again.

No Structural Changes: Credit repair does not involve any structural changes to how debts are managed or repaid It focuses on cosmetic changes to the credit report rather than solving the root causes of poor credit.

Example: A credit repair company successfully disputes late payment marks on a credit report, leading to a temporary increase in the credit score. However, if the individual continues to make late payments, their credit score may decline again, rendering the credit repair efforts ineffective in the long term

Explanation:

2. Risk of Legal Action Despite Credit Repair A. Lawsuits:

Issue: Even with credit repair, individuals can still face lawsuits from creditors and debt collectors Credit repair does not eliminate the legal obligations or prevent creditors from pursuing legal action to recover debts

Debt Validation: Credit repair involves disputing inaccuracies on the credit report, not validating or settling the underlying debt If a creditor or debt collector sues, it is because the debt is still legally owed.

Judgments: Creditors can obtain judgments against individuals for unpaid debts, which can lead to wage garnishment, bank account seizures, or liens against property, regardless of the credit repair efforts.

Example: A person undergoing credit repair is sued by a credit card company for an unpaid balance. The lawsuit and potential judgment are not affected by the credit repair process, which only addresses the credit report, not the debt itself.

B. Debt Sales:

Issue: Credit repair does not prevent creditors from selling debts to collection agencies. Once a debt is sold, the new creditor can pursue collection efforts, including legal action.

Explanation:

Debt Ownership: When a debt is sold, the new creditor has the right to pursue collection efforts, including lawsuits The credit repair process does not impact the ownership of the debt or the ability of the new creditor to seek repayment.

Example: An individual’s credit card debt is sold to a collection agency while they are engaged in credit repair The collection agency can continue collection efforts, including legal action, despite the credit repair activities.

Issue: Credit repair does not prevent wage garnishment, which can occur if a creditor obtains a judgment for unpaid debt Wage garnishment is a legal process where a portion of an individual’s wages is withheld to satisfy a debt.

Explanation:

Legal Proceedings: If a creditor obtains a judgment through legal proceedings, they can seek a court order for wage garnishment. Credit repair does not provide protection against this legal outcome.

Debt Repayment: Wage garnishment is a separate legal issue that credit repair does not address. It focuses on improving credit scores rather than managing or settling debts

Example: An individual’s unpaid debt results in a court judgment allowing for wage garnishment. Even if the individual has undergone credit repair, their wages can still be garnished to repay the debt

4. Credit Repair vs. Debt Management

Comparison:

Credit Repair:

Focus: Disputing inaccuracies and improving credit scores

Scope: Limited to cosmetic changes on the credit report.

Outcome: Temporary improvement in credit scores; does not address underlying financial issues

Debt Management:

Focus: Managing and repaying debts through structured plans or negotiations.

Scope: Directly addresses debt repayment and financial health.

Outcome: Potential for long-term improvement in financial stability and credit scores through active debt management.

Example: While credit repair may fix inaccuracies on a credit report, debt management involves creating a plan to repay debts and improve financial habits, leading to more sustainable improvements in financial health.

Conclusion: Credit repair, while useful for addressing inaccuracies on a credit report, has significant limitations and potential pitfalls. It provides a temporary solution that does not address underlying financial issues, legal risks, or the sale of debts For a more comprehensive approach to financial stability, individuals should consider debt management strategies that address the root causes of credit problems and provide long-term solutions.

TheCreditRepairIndustryandItsPitfalls

The credit repair industry has grown into a multi-billion-dollar business over thepastfewdecades,withcountlesscompaniesofferingservicesthatclaimto improve credit scores quickly and effectively Today, there are thousands of creditrepaircompaniesacrosstheU.S.,fromlarge,well-knowncorporationsto small, local operations. These companies advertise solutions to clean up bad credit, but many people who use their services don’t fully understand how the process works or worse, the temporary nature of the results they receive.

TheScaleoftheCreditRepairIndustry

In the United States alone, there are over 50,000 credit repair companies, ranging from major players like Lexington Law and CreditRepair.com to smaller, independent businesses. This industry thrives on marketing to individuals with low credit scores who are seeking a quick fix to their financial problems. With nearly one-third of Americans having a credit score below 670, thetargetaudienceisvast.

The appeal of credit repair services is rooted in the emotional distress and urgency that comes with a low credit score. People with poor credit often feel desperate to qualify for housing, car loans, and better interest rates. Credit repair companies prey on this desperation, making bold claims about being able to erase negative items from credit reports, often without fully explaining thelimitationsoftheirservices.

The Lack of Consumer Law Knowledge

One of the major issues with the credit repair industry is that many of the people who offer these services do not have a deep understanding of consumer protection laws. In fact, most credit repair companies focus on disputing negative items with credit bureaus without addressing the legal standing of those debts. This means that while they may be successful in temporarily removing certain negative marks, they aren’t truly resolving the underlying debt

Credit repair typically relies on automated disputes that challenge the accuracy of items on credit reports. This process is allowed under the Fair Credit Reporting Act (FCRA), which gives consumers the right to dispute incorrect or unverifiable information on their credit reports. However, simply disputing an item doesn’t mean that the debt is invalid If the creditor can verify the debt’s legitimacy, it will reappear on the report often within a few months.

People who work in credit repair often don’t understand the intricacies of consumer law beyond the basics of the FCRA. They rarely educate their clients on other important laws such as the Fair Debt Collection Practices Act (FDCPA), which governs how debts are collected, or how to invalidate debts through legal means. Instead, their primary goal is to clean up the credit report quickly without addressing whether the consumer actually owes the debt.

This lack of knowledge is problematic because it gives consumers a false sense of security Many believe that once an item is removed from their credit report, it’s gone for good, but that’s rarely the case. The debts remain unpaid, and creditors can continue pursuing collection efforts, often leading to lawsuits, wage garnishments, or the debt being resold to another collection agency.

Credit Repair Sets People Up for Failure

The biggest issue with credit repair is that it’s not a permanent solution. Credit repair sets people up for failure by giving them short-term results that don’t last. The temporary removal of negative items from a credit report can make a person feel like they’re making progress, but in reality, the underlying debt is still there, lurking in the background, ready to reappear

For example, if someone has a valid medical debt in collections and the credit repair company disputes it, the debt may temporarily be removed from their credit report. However, if the hospital or collection agency verifies that the debt is valid, it will show back up on their credit report within months The consumer is then back in the same position they started in, but now they’ve wasted time and money on a service that did nothing to actually resolve the debt. What’s more, the temporary nature of these fixes can lead to even worse financial outcomes. Many consumers feel emboldened after their credit score improves only to have it crash down again when the negative it g th by d ey st

Emotional Manipulation and the Desperation Market

Credit repair companies make a lot of money off people who are in emotional distress over their financial situation. The idea of “cleaning” one’s credit score is immensely appealing to someone who has made a few financial mistakes and is looking for a way out. These companies market their services aggressively, emphasizing how a bad credit score can prevent someone from buying a house, getting a car, or even landing a job.

The emotional and psychological impact of having a low credit score is significant. It can cause anxiety, depression, and even relationship issues. Credit repair companies capitalize on this emotional vulnerability, offering what appears to be a fast and easy solution to a complex problem. They create an illusion that all it takes is a simple dispute, and one’s financial troubles will be over. But these claims are misleading, and the temporary nature of the results often leaves consumers feeling cheated.

Many consumers spend hundreds, if not thousands, of dollars on credit repair services without understanding that they are not solving the core issue: the debt itself. The end result is a consumer who is still drowning in debt, still subject to lawsuits and wage garnishments, and now also frustrated that the credit repair services didn’t work as promised.

The Financial Exploitation of the Vulnerable

Credit repair has, in many ways, become a predatory industry. Companies exploit the desperate emotional need of people who are seeking a fresh financial start. Rather than offering real, lasting solutions like educating consumers on how to legally delete debts or manage their finances better credit repair companies focus on making money from those who feel like they have no other option. These companies make a substantial profit from individuals who may not fully understand the limitations of credit repair. They charge monthly fees, setup costs, and other hidden charges, often dragging out the process as long as possible. The longer they can keep a consumer on their books, the more money they can make, even if the consumer is seeing little to no real progress.

Conclusion: A Need for Real Solutions

The rise of the credit repair industry reflects a larger problem in our financial system: the lack of education and understanding around consumer laws and debt management. Many people don’t know that there are legal ways to delete debt permanently, and instead, they fall victim to the temporary fixes offered by credit repair companies. What consumers truly need is education on debt deletion, consumer law, and financial management solutions that offer permanent, ethical relief from debt.

Credit repair may appear to be a quick solution, but it often leads to more harm than good. The results are not permanent, the debt remains, and consumers are left feeling exploited. It’s time for a shift toward solutions that genuinely empower consumers and free them from the cycle of financial desperation.

The Role of Debt Validation and Verification

Validation and verification are key components of the debt deletion process. This chapter will explain the difference between the two and why both are necessary to invalidate a debt. We’ll also discuss the legal requirements for creditors to provide a wet ink signature and how this can be used to your advantage

Overview: Validation and verification are crucial steps in the debt deletion process. This chapter will explain how to use these tools to challenge the validity of your debt and how they can lead to its removal

How Often Are Debts Invalidated Without Going to Court?

According to a study by the FTC, approximately 48.7% of disputed debts are invalidated without any reply from the debt collector. This shows the power of proper validation requests.

The Debt Deletion Method

Validation vs. Verification: Understanding the Difference When dealing with debt, particularly in the context of Debt Deletion, it's essential to understand the concepts of validation and verification These terms are often used in legal and financial contexts, but they have distinct meanings and implications.

Verification

What It Is: Verification is the process of confirming the accuracy or truth of specific details related to a debt This might involve checking that the debt amount is correct, that the interest rate is as agreed upon, or that the payment history matches what was reported.

How It Works: When you request verification, you are asking the creditor or debt collector to provide evidence that supports the details of the debt. This could include copies of statements, payment records, or a breakdown of how the debt was calculated.

Purpose: The purpose of verification is to ensure that the debt information is accurate and has been properly reported It is a way to double-check the facts before accepting them as true.

Example: Suppose you receive a notice from a debt collector claiming you owe $5,000 on a credit card. You request verification, and they provide you with copies of your credit card statements, showing that the balance was indeed $5,000. Verification confirms that the debt amount is accurate

Validation

What It Is: Validation, in the context of debt, refers to the legal process of establishing that a debt is legitimate, enforceable, and that the creditor has the right to collect it. Validation is broader and more comprehensive than verification.

How It Works: Under the Fair Debt Collection Practices Act (FDCPA), you have the right to request that a debt collector validate the debt. This requires the collector to provide proof that they have the legal right to collect the debt, that the debt is legitimate, and that it hasn't been paid or settled already.

Purpose: The purpose of validation is to ensure that the debt is legally enforceable and that all legal requirements have been met by the creditor or collector. It challenges the very existence and legitimacy of the debt.

Example: Using the same $5,000 credit card debt scenario, you request validation. The debt collector must then provide documentation such as the original signed contract with the credit card company, proof that they have the legal right to collect the debt (eg, a transfer of ownership of the debt), and evidence that the debt has not already been settled or invalidated. If they fail to provide this, the debt may be deemed invalid and unenforceable.

Key Differences

Scope: Verification is about confirming specific details of the debt, while validation is about confirming the entire debt’s legitimacy and enforceability.

Step 2: Opt out of bureaus & wait 10 days.

THIS METHOD HAS GIVEN ME MILLIONS OF RESULTS....

Opt out of Secondary Credit Reporting Companies to remove their services and suppress their report so they will not report to companies on your behalf.

o You do not want them reporting behind the scenes information while you are disputing negative accounts. o You do not want TransUnion, Equifax, and Experian to have information to verify your accounts

When it comes to opting out of the Secondary Reporting Companies, you can use the following agencies:

LexisNexis–Usetheonlineoptoutchoice*LexisNexisisthemain reportingagencythatholdsinformationforbankruptcies,judgments, andtaxliens.

Web-https://optout.lexisnexis.com

Address–P.O.Box933,Dayton,OH,45401

Email–privacy.information.mgr@lexisnexis.com

Phone–866-490-1920

Innovis–Usetheonlineoptoutchoice

Web-https://wwwinnoviscom/securityFreeze/index Address–P.O.Box26,Pittsburgh,PA15230

Phone–800-540-2505

CoreLogic–Usetheonlineoptoutchoice

Web-https://credcofreeze.corelogic.com/ Address–P.O.Box105281,Atlanta,GA30348-5281

Phone=1-877-532-8778

SageStream–Callorfaxtooptout

Web-https://wwwsagestreamllccom/security-freeze/ Address–SageStream,LLCConsumerOffice,P.O.Box503793, SanDiego,CA92150

Fax–(858)451-2847

Phone-1-888-395-0277

ARS-Callormail

Web-https://wwwars-consumerofficecom/securityfreezefaces Address-AdvancedResolutionServices,Inc.5005RocksideRoad Suite600,Independence,OH44131

Fax-216-615-7642

Phone-1-800-392-8911

In this "cheat code" you should also include the following elements:

Understanding Consumer Law: Knowing the laws that protect consumers, such as the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA), can help you challenge the validity of certain debts. 1.

2.

Utilizing Trusts: Transferring debt to a trust can protect assets and reduce personal liability. Wealthy families have used this strategy for generations to safeguard their wealth.

3.

Equity Law: Equity laws can be used to argue that certain debts are unjust or should be voided due to improper practices by creditors.

4. Negotiation Tactics: Understanding how to negotiate settlements with creditors, sometimes for pennies on the dollar, can be part of the cheat code.

Debt Validation: Requesting creditors to validate the debt can sometimes reveal that they lack the necessary documentation or legal standing to collect the debt, leading to its deletion.

5 These methods, when used together, create a powerful approach to eliminating debt, rather than just managing it, offering a more sustainable path to financial freedom.

First Steps to Structure Your Credit

Your payment history needs to be 100%

Your credit accounts should be at least 4 years old.

Your derogatory marks should be 0.

The system credit bureaus use is automated. It processes dispute letters when they are scanned

How do they verify the information in the dispute letters about negative collection accounts?

There is a computer system and database which houses the information. Credit bureaus use secondary reporting agencies such as LexisNexis, SageStream, CoreLogic, and Innovis on the backend.

These companies house our information on the back end which verify the information the creditors send to credit bureaus.

You can only remove items from your credit report if they are unverified or inaccurate.

How Debt Deletion AI Works

Debt Deletion AI is a groundbreaking tool that automates the process of deleting debt. In this chapter, we’ll explain how the software works, its benefits, and how it has helped thousands of people achieve financial freedom. We’ll also provide a stepby-step guide on how to use the software to delete your own debts

Overview: Debt Deletion AI automates the process of deleting debt, making it accessible to a wider audience This chapter will provide a step-by-step guide on how to use this software to eliminate your debts.

What Debts Are Covered with Debt Deletion?

Debt Deletion covers personal, family, and household debts, including medical bills, charge accounts, credit cards, and car loans. However, business debts are not covered by the FDCPA

Debt Deletion AI refers to the use of artificial intelligence to automate, optimize, and streamline the process of debt deletion. This technology leverages AI algorithms to analyze, identify, and apply legal and financial strategies that can lead to the reduction or elimination of debt Here's how it typically works:

1. Data Analysis and Collection

AI systems can analyze a user's financial data, including credit reports, debt accounts, payment histories, and legal documentation The AI gathers data from various sources, such as credit bureaus, financial institutions, and legal databases.

2. Debt Validation and Verification

The AI can automatically generate and send debt validation requests to creditors It checks whether the creditor has the proper documentation to prove the debt is valid and legally collectible. If the creditor cannot provide the necessary documentation, the AI flags the debt for potential deletion

3. Legal Strategy Application

AI can identify opportunities to apply consumer protection laws, such as the Fair Debt Collection Practices Act (FDCPA) or the Fair Credit Reporting Act (FCRA), to challenge the validity of a debt. The AI can generate legal arguments, draft letters, and file disputes on behalf of the user.

4. Negotiation and Settlement