Economics

THE WorLD IN BrIEF

The cost of living crisis

Currently, inflation is at 10.1%, the highest it has been in 40 years. With soaring energy and food prices, 90% of adults in the UK have reported an increase in their cost of living, with 1 in 4 people struggling financially. This staggering inflation is only going to get worse with the MPC predicting that it will reach 13% in 2023. Rising energy prices have affected many households and businesses in the UK but what is its impact on electric car owners?

In April 2022, Ofgem increased the energy cap by 54% meaning average household bills are set to rise by £700. As a result, charging costs for electric vehicle owners are up. Before the rising energy cap, the typical cost to charge an electric car at home with an annual millage of 9000 miles was between £500-£830. Now, the charging costs are going up by approximately £200. From October 1st energy prices are set to increase again by 80% meaning it will eventually cost more to run than a petrol car. However, in the recent weeks, oil prices have dropped by $5, the lowest since Russia invaded Ukraine. This, along with recession fears in the UK, is causing the price of petrol to fall.

In addition, electric cars are significantly more expensive to buy or lease than a petrol car. There is also a shortage of public charging points that may push charging costs further up in the future. With over 58% of UK drivers owning a petrol or diesel car, it is evident how much more convenient they are with a higher mileage on a full tank, their lower prices and the abundance of petrol stations. Consequently, the usage of petrol cars has a negative effect on the environment due to increased air pollution and emission of greenhouse gases that contribute to climate change. However, it is fair to say that many families across the UK won’t be concerned about this right now as they will just be concentrating on feeding their families and heating their homes. Once inflation improves, we can focus on achieving environmental sustainability.

Consumer confidence fell for the fourth consecutive quarter to its lowest level on record, even lower than when the UK entered its first COVID-19 lockdown. Consumers have become pessimistic due to increasing inflation expectations and combined with the increased base rate, and

this means that people are saving as a precaution. Hence, few consumers are willing and able to purchase ‘big-ticket items‘ like an electric car due to the current economic climate. The demand for electric cars has decreased and will stay low until inflation and confidence improves. For the time being, consumers may be using alternate transport like trains and buses or many even work from home.

However, today’s inflation is a small setback for the electric car industry. Once all petrol cars are banned in 2030 and the economic climate improves, the electric car industry will undoubtedly be booming as their PED will become inelastic due to little availability of substitutes. The replacement of petrol cars with electric creates positive externalities from no emissions and less noise pollution, while also creating thousands more jobs in construction, marketing and finance.

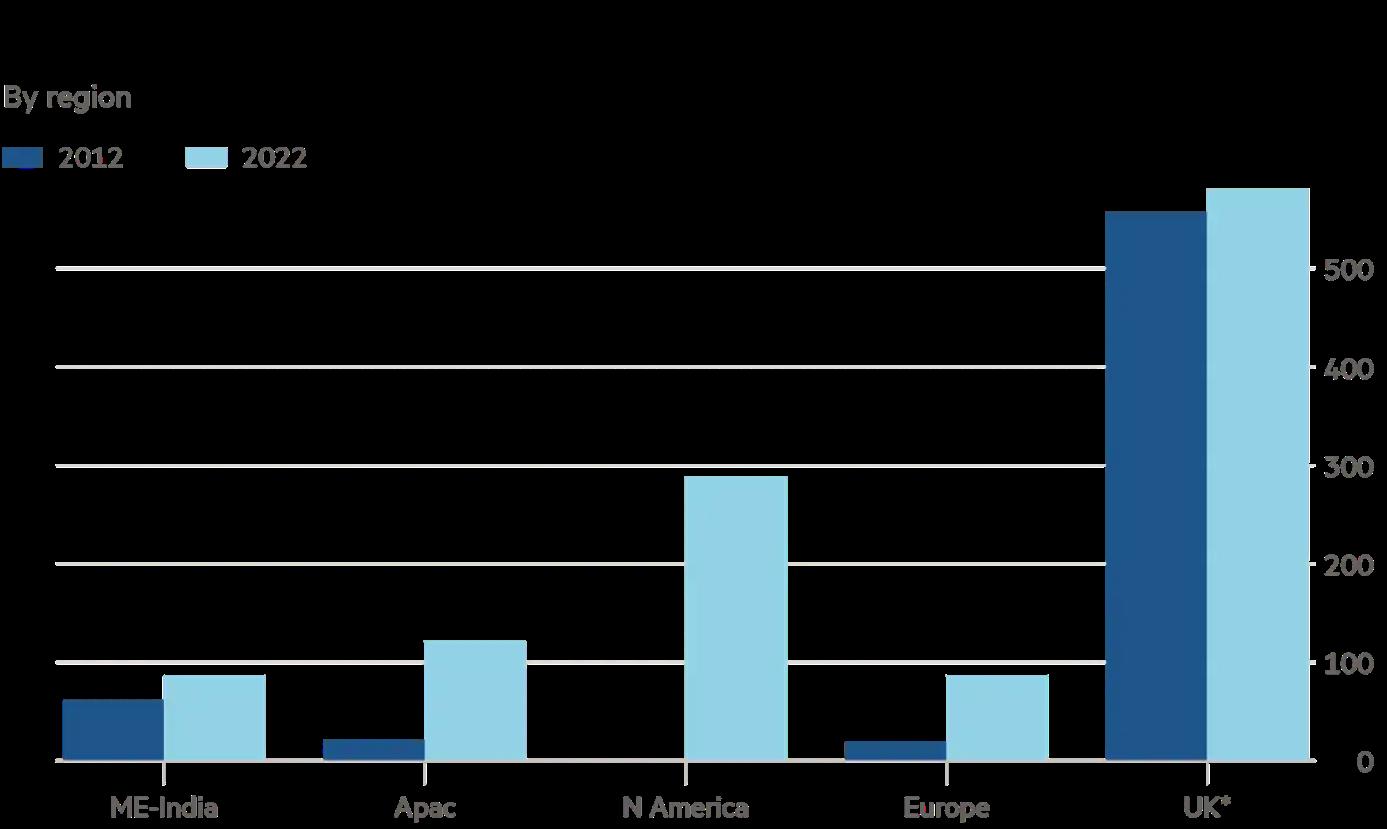

WHSmith was once a prominent feature of high streets across the UK but in the past two decades as online shopping and out of town retail took over, the chain has entered an era of change. Although many see the company as a retailer in decline and it has regularly been voted Britain’s ‘worst’ High Street shop, the chain’s shift to outlets in airports, railway stations and hospitals has dramatically changed the company’s fortunes with earnings from its travel division exceeding the revenue earned from its 537 high street stores for the past 12 years. WHSmith’s best-selling products now include goods such as Bose Headphones as opposed to novels, magazines and stationery. Airport based retail has been especially successful for the company due to an increased

to buy from them. This is increased by the restrictions that are placed on passengers as they are unable to bring their own drinks into the terminal due to airport security rules. Consumers at airports are also driven by impulse purchases and immediate needs and as they see purchases at airports as more infrequent, they are less price sensitive and more focused on convenience. This means that with high sales and high margins, profits from the travel sector are high.

The chain is now making a bold move with large expansion into the $3.2 billion US travel market and expanding in Europe. Acquiring both InMotion, the largest airport-based technology retailer in North America, and the Marshalls retail group in 2018 and 2019 respectively, has

31 stores in major Spanish airports such as Barcelona and Madrid.

However, due to the COVID-19 pandemic which led to a decline in international travel, revenues fell significantly leading to losses for the firm. The cost of living crisis has led to decreased travel and consumer spending, and issues at airports in the past couple of months has led to flight cancellations. This has meant that passenger numbers are still 20 per cent below 2019 levels which could threaten the company’s success. However, travel stores are still performing well with sales in Q1 of 2022 123% of sales in the same period in 2019 before the pandemic. Whereas revenue from WHSmith’s high street shops has not returned to pre-pandemic levels with sales only in Q3 of 2022 only 79% compared to 2019.

WHSmith reported their positive outlook in a statement in June 2022. “While the broader global economy remains uncertain, the group is well positioned to capitalise on the ongoing recovery in our key markets and take advantage of the many opportunities ahead, including the 125 new stores won and yet to open, and our new store formats and category development across multiple geographies.”

likelihood of purchase from travelers, with the group’s Chief Executive, Carl Cowling, suggesting that 30 per cent of travelers at Heathrow airport will make a purchase at a WHSmith outlet, compared to only around 1 per cent of those passing through London’s Euston rail terminus. This is due to the lack of other options and thus WHSmith acts as a monopoly with consumers having no choice but

helped the chain gain market share in the US after an initial struggle to gain tenders. WHSmith now has 273 US outlets and has plans to open another 63 in coming months. However, the retailer’s US market share is still significantly lower than rival company Hudson which controls 70 per cent of the US market. Earlier this year WHSmith also won a tender from Spanish operator Aena to open

The company’s travel division may even benefit from this period when many consumers have less disposable income as their food and drinks are inferior goods, as less consumers will purchase inflight food and drink instead opting for more affordable snacks at WHSmith’s before their flight, as well as having inelastic demand.

So, Britain’s ‘worst’ retailer looks in a good place to weather the current economic crisis and beyond.

With inflation soaring from 9.4% to 10.1%, it is safe to say that the UK is in the midst of a cost of living crisis. With many homes struggling to make ends meet with the rising prices of everyday essentials like food, which the latest report by the Office of National Statistics suggests have risen by 2%, and energy bills, with the latest announcements from Ofgem suggesting that the energy price cap would rise by 80%, to an average of £3,549 per year, UK consumers are being forced to make impossible decisions; put food on the table or keep their home heated.

There have been many accumulating factors that have contributed to this cost of living crisis over the last few years. Undoubtedly, COVID-19 and the pandemic have had a significant impact, as the national and international lockdowns brought about economic, financial and wage uncertainty, hitting those in sectors like transport and hospitality the hardest, forcing many people to resort to living off savings or unemployment benefits, and causing their personal disposable income to tighten. The war between Russia and Ukraine also had a huge effect on energy prices, with Russia supplying the EU with a quarter of its crude oil and a fifth of its natural gas, the import restrictions on Russian commodities have forced the prices of home energy, petrol and diesel to sky rocket; the average cost of a litre of unleaded petrol as of 29th August costing 170.05p.

Supply chain issues cross Europe and the world have also contributed to the drastic increase in the cost of living. With both fuel and lorry drivers being in short supply, caused by the ongoing impacts of Brexit, the transportation costs of goods from supplier to shelf have naturally risen. For example, to ship a container from Asia to the UK used to cost £3,000 but the same transportation would now cost £15,000.

Apart from energy bills, with analysts from Cornwall Insight predicting the energy cap may rise again to £5,300 in January 2023, and groceries being the main causes of the cost of living crisis, there are also other price hikes that are occurring. For example, the Bank of England interest rate rose from 1.25% to 1.75% in August, putting the base rate at its highest level since 2008. The two million households with variable mortgages will feel this effect the most, as well as first time buyers. In addition, luxury goods and services like home entertainment streaming service Netflix have rolled out price hikes; with their most basic service increasing from £5.99 to £6.99 per month, in order to ‘sustain its content output’ and ‘compete with rivals’.

Delivery service Amazon Prime also recently announced that from 15th September, the cost of its next-day prime services will rise, with their yearly subscription increasing from £79 to £95. Despite these seemingly small price hikes, all the little increases quickly add up, contributing to the surge in inflation that the nation is currently experiencing, forcing households to re-evaluate their spending patterns and in most cases cut down on nonessential items.

But what is being done to tackle this cost of living crisis? Back in May, then-chancellor Rishi Sunak confirmed a payment of £400 will be given to every household in Great Britain to help cover the cost of energy bills. The money will be automatically added to the balance of household’s energy bill accounts over a six month period and will not need to be repaid. In addition, £650 will be given to qualifying households

between 14th and 31st July to help cover the rising cost of living. For example, to be eligible, you had to be receiving a form of benefits like the Jobseeker’s Allowance as of 25th May. Furthermore, new prime minister Liz Truss has been rumoured to be implementing a price freeze on the rising energy prices, freezing the bills around the current price of £1,971.

Other schemes to help ease the rapidly rising cost of living include a rise in benefit payments, £150 cash payment to those receiving disability benefits and a rise in the threshold for National Insurance contributions of up to £12,570 per annum. Despite the aid, it is predicted that most households will still struggle in some way amidst the cost of living crisis. But how can you best survive this impossible situation? A few tips, as suggested by Forbes Advisor state the following: search for cheaper insurance, try to fix mortgages and energy bills, make the most of supermarket discounts/deals and find out if you are entitled to any benefits (for example, if you are working and have a child between the ages of 3-4, you are eligible for 30 hours of free government childcare).

The first noteworthy point is that this book was published in October 2020, so the predictions made about the effects of the pandemic can now be replaced with the realities of the last two years. Secondly, the title is slightly deceiving as the pandemic is an insignificant part of the book and much of it covers pre-existing affairs which makes the content slightly less authentic.

One criticism is that some facts were merely implemented but not explained, such as “today, the British economy is more dependent upon the services sector than any other G7 economy”, ended a paragraph which covered Thatcher’s anti trade union stance, deindustrialisation, oil prices and the value of the sterling, the manufacturing sector of the UK and exploitation of people low down on the global value chain. This paragraph could be seen as a microcosm of the whole book: a lot of interesting topics which are disconnected and often underdeveloped.

On the other hand, Blakeley provides a deep insight into some of the overlooked effects of recent crises, particularly in terms of inequality. She highlighted the effects of the financial crash of 2008 on income and wealth inequality. She reflects on how the use of loose monetary policy disproportionately disadvantaged lower income consumers with fewer assets. This was a result of it being relatively more difficult to gain access to credit (under low interest rates) for these types of earners compared to high income earners with many existing assets.

A more political take on inequality was demonstrated in her argument on the role of the state. Despite greater state intervention generally seen as favourable by left-wing individuals, Blakeley asserts that the greater government involvement in the pandemic was implemented “not to help the most vulnerable through the crisis, but to save capitalism from itself’. However, the innumerable statements promoting left-wing ideology may be uninviting and unconvincing for readers with different political affiliations and damaging to those who are in a socialist echo-chamber.

As current affairs become increasingly significant, insights into their causes and effects should be embraced. Any book which highlights the dangers of the pandemic, and its effects is guaranteed to be interesting and as a result of this I believe this book is worth the read.

Due to the rising cost of living many families across the country are struggling with the rise in food prices. This has meant that many are changing their spending and eating habits in order to save money. Mrs. Carr’s recipe for an aubergine and potato curry proves that eating on a budget can still be healthy and delicious with cheap staple ingredients such as potatoes (only 19p each) and chopped tomatoes (only 28p per can).

1 large aubergine, chopped into cubes

5 medium potatoes, chopped into cubes

5-6 ripe tomatoes or a can of chopped tomatoes

4 garlic cloves, crushed

2 inches ginger or 3 frozen ginger cubes

1 green chilli, chopped or 1 frozen green chilli cube

2-3 tbsp sunflower oil

1 tsp cumin seeds -

1 tsp mustard seeds

½ tsp Kashmiri chilli powder

½ tsp asafoetida

½ tsp turmeric powder

2 tsp ground cumin powder

2tsp ground coriander

1 tbsp sugar

2tbsp garam masala

500-600ml boiling water Salt

Chopped coriander Juice of one lemon

1. Heat oil in wide based pan. When hot, add your mustard seeds, cumin seeds, Kashmiri chilli powder. Once sizzling, add the asafoetida. Let this cook for 15-20 seconds

2. Add the chopped aubergine, garlic, ginger and green chilli, turmeric powder, ground cumin and coriander and mix well and cook for 30 seconds

3. Now add the chopped tomatoes and potatoes and mix well

4. Once all the veggies are coated, add the water, salt and sugar and stir well. Bring to the boil and once boiling, reduce heat to a simmer and cover and cook for 20 minutes, stirring halfway.

5. After 20 minutes, uncover and add the garam masala. Let it cook uncovered for 10 minutes or longer if sauce still needs thickening. The gravy should be thick and luscious, and all the veggies should be super soft. Add the lemon juice and fresh coriander and serve!

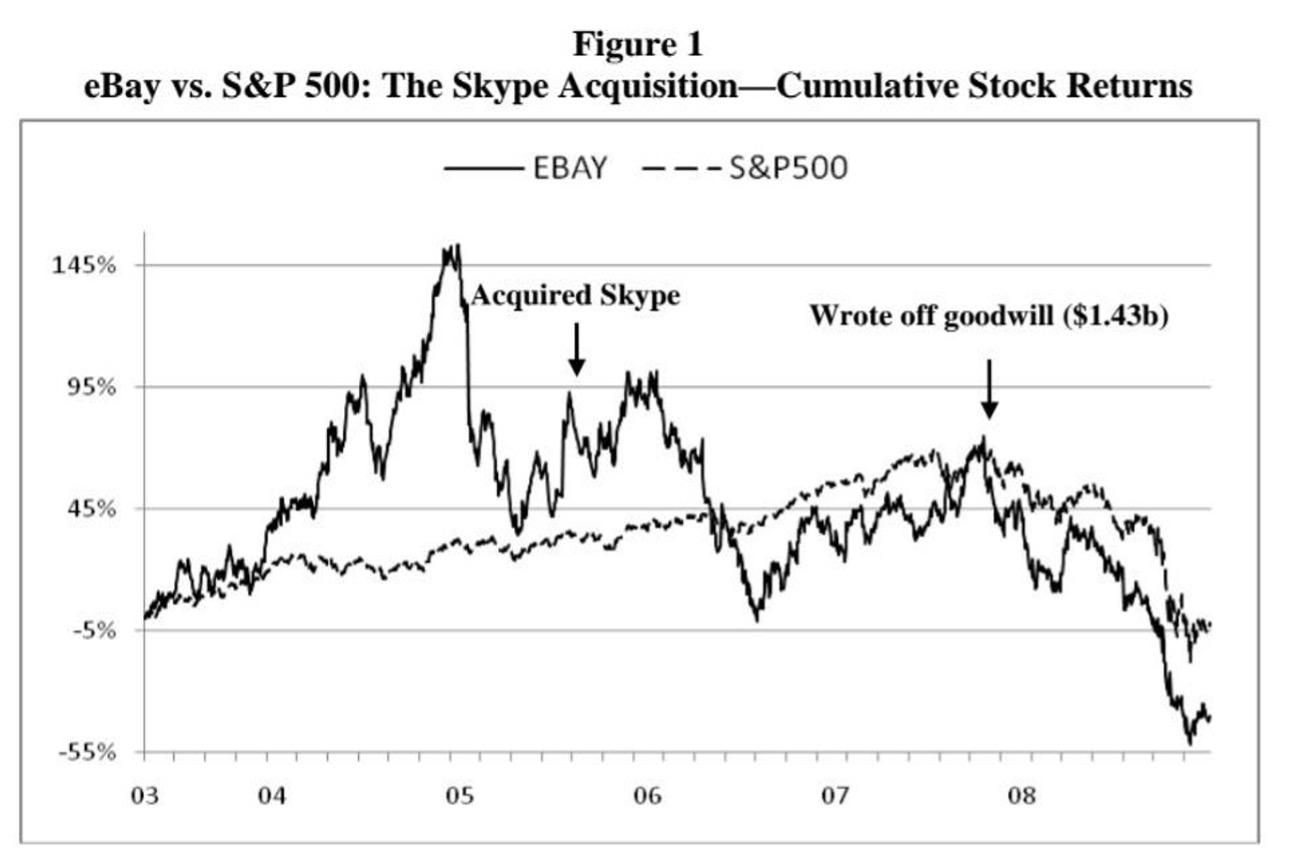

1998 - eBay is founded in California

2002 – eBay acquires PayPal for $1.5bn

2004 – eBay successful implements PayPal into their business model

2005 – eBay acquires Skype for $2.6bn

eBay Enterprise’s annual net revenue in 2005: $440m

Skype’s annual net revenue in 2005: $71.8m

• eBay believed that they could increase their number of users by incorporating Skype into their business model as Skype was very successful at the time with tens of millions of active users.

• eBay believed the use of voice and video calling would aid in building client loyalty and thus increase the velocity of purchases made.

• Skype would allow buyers and sellers to communicate more efficiently and would be a more robust way to connect them.

After acquiring Skype, eBay never informed their users on how to utilise Skype, which left many eBay and Skype users unaware that the two companies were connected.

In theory, the availability of voice calling instead of emailing should

have helped to reduce the amount of fraud in eBay’s actions, helping to reduce costs and attract more buyers. However, in practice, users simply preferred emails to calls.

Furthermore, the use of voice calling compromised the anonymity of bidding, which was one of the unique things about eBay’s business model.

Throughout the 4 years that eBay owned Skype, sales began to fall, and the business began to stumble – then came the crisis. During the global recession of 2008/9, it was believed that consumers would turn to flee markets and eBay to find bargains, but in practice, this just deteriorated eBay’s business even more.

Although theoretically the merger should have been beneficial for both companies which were successful at the time, in retrospect, I would not have gone ahead with the deal.

Not only was the introduction of voice calling into eBay’s business model excessive and unnecessary, it also degraded an important aspect of what made it so unique too –anonymous bidding.

As well as eBay’s misevaluation of their consumers’ wants and needs, there was a culture clash in the firms’ values, which made making the merger work difficult. eBay overestimated the synergies between the two companies.

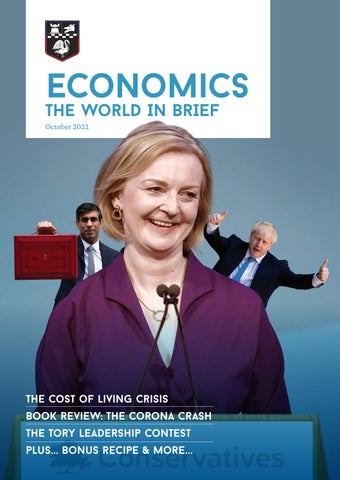

A series of scandals in June and July 2022 severely damaged Boris Johnson’s reputation. This led to over 60 government ministers, parliamentary private secretaries, trade envoys and party chairmen resigning between the 5th and the 7th of July, the largest mass resignation in British history. This brought about a government crisis, culminating in the resignation of Johnson as party leader and prime minister on the 7th of July.

After a series of MP ballots, the list of candidates competing for the job was narrowed down to Liz Truss, the Foreign Secretary and the minister for women and equalities under Johnson’s leadership, and Rishi Sunak, who served as the chancellor of the exchequer until the 5th of July.

The economy is the area in which the differences between Mr. Sunak and Ms. Truss remain the greatest with the two having very different opinions on how to deal with the cost of living crisis, soaring energy costs, rampant inflation and how to drag the country out of its lack of growth.

Much of the debate focused on tax cuts. Ms. Truss argued that cancelling the rise in corporation tax

and cuts in national insurance along with other supply-side reforms would generate growth and thus pay for themselves. This expansionary fiscal policy aims to shift out both long run aggregate supply and boost aggregate demand leading to long run economic growth. However, many economists believe these policies are likely to push inflation even higher leading to severe economic damage and will do little to alleviate the immediate impacts of the cost of living crisis on lower income families. Instead, those on the highest incomes will benefit. However, the UK’s inflation is mostly global and driven by supply side factors, a mix of high energy prices and post-pandemic supply chains issues, which feed into the prices for all goods. This is exacerbated by a very tight labour market, a consequence of the pandemic and Brexit. There is very little evidence that UK inflation is demand pull and thus increases in aggregate demand will not lead to further inflation, some economists argue.

Whereas, Mr. Sunak initially pledged no tax cuts until inflation was under control. However, after pressure from Tory party members he agreed to temporarily scrap the 5% valueadded tax on domestic energy bills

and suggested that in the future cuts to the basic rate of income tax from 19% in 2024 to 16% in 2029 may be implemented. He also pledged to spend between £3 and £5 billion on assistance for the lowest income groups to help them to pay for soaring energy costs. He would fund the help through temporary borrowing and by squeezing savings from departments. He would enact a planned increase in corporation tax, from 19% to 25% in April 2023, and concentrate on strengthening incentives for investment.

As expected, Liz Truss won the election with 57% of the votes from Conservative Party members. However, many world leaders such as Joe Biden and economists have criticised her policies suggesting that they will lead to inflation and do nothing to benefit the poorest and most vulnerable in society, with Truss even acknowledging that her plans will disproportionately benefit the rich. Proposed tax cuts will undoubtedly boost many fortunes in the short term, but we won’t know for some whether the nation’s longerterm prospects or have been severely damaged.

Adam – year

Adam – year

Amid wages plateauing and massive inflation driven by the RussiaUkraine war it comes as no surprise that energy bills are surging. Russia, who is the most significant supplier of gas globally, is engaged in an immoral war, so admirably countries in the EU have engaged in economic warfare. The nature of this is that they place sanctions on high ranking and rich Russian individuals like oligarchs, Putin etc. to stop them from travelling and pulling money out of their bank accounts to support the Russian regime. This is called “asset freezing”, limiting Putin’s ability to fund his war. In response, Russia has been pressuring European countries into lifting these same sanctions by cutting off major gas pipelines under the guise of refurbishment, reducing the supply of gas with which we run our factories and heat our homes. There is an increase in the scarcity of energy, so prices increase due to rationing, simple as that, right?

Well maybe not, there is a second reason why energy prices are rising due to the self-interest of energy firms, which have a lot of pricing power due to their sheer size, companies like Saudi Aramco, Exxon Mobil and Shell. At the end of the day, energy companies are businesses and

they are motivated by profit, and this creates an incentive for exploitation of prices. They are using the war as a scapegoat for rising oil prices, all the while recording record profits and revenues.

Though what relevance does this have to own-label products? The relationship is that consumers have limited disposable income and therefore have to make hard choices in everyday life. When the price of gas rises, this squeezes household budgets resulting in cost cuts such as switching from branded products to the cheaper alternative of ownlabel products. To give perspective to this, over 87% of consumers are now opting to buy own-brand items or switch to shopping at different stores, particularly to save money. Furthermore, due to the recent COVID pandemic, consumers have been forced to switch before and are now getting more accustomed to using own-label brands such as IKEA, Tesco Everyday, Lidl and Aldi perhaps due to default bias (consumers preferring to behave as they always have done) as well as an increasing acceptability in today’s society for buying ownlabel products. According to recent research conducted by Nielsen, 48%

of 2,000 consumers said if their weekly shopping bills rose by just 3%, they would switch to own-label products. Over 60% of shoppers think that own-label products are just as good as named brands and better in price - nearly double the proportion of consumers who thought that 4 years ago.

So to summarise, consumers have switched to own-label products for a variety of reasons. Primarily, people’s incomes are being squeezed by massive inflation with little to no wage inflation to follow. This has come after a recession caused by COVID and a cost of living crisis in part driven by Putin’s war, causing a realisation that own-label products are after all not so bad. This is seconded by the rise of now trusted supermarkets like Aldi and Lidl, which provide a convenient and cheap alternative as well as a real increase in the quality of own-label products.

The second Elizabethan era is now over. The Queen died on the 8th of September at the age of 96 after having served for 70 years. This makes her Britain’s oldest and longest reigning Monarch. Therefore, the UK entered the 12-day mourning period, resulting in closure of businesses temporarily out of respect. Her funeral took place on Monday the 19th of September at Westminster Abbey to commemorate her life.

Over her time the Queen visited over 100 countries across the globe including China, Australia and Canada. The Queen also welcomed the last 14 US presidents, from Truman to Joe Biden. As well as the last 15 British prime ministers, the most recent being Liz Truss and starting with Winston Churchill. As a result, she has had an impact on many lives both in the UK and globally. She also featured on more currencies than any other living figure, that being 33 different currencies.

Economic impacts of our late Queen The Queen has consistently brought tourism to the UK since the beginning of her reign; in the

fiscal year 2019-2020 the monarchy generated £49.9 million in tourism revenue, this was an increase of £1.1 million from the year prior. This is a significant factor in creating demand, specifically London hospitality and retail businesses. Similarly, the royal family was valued at £67.5 billion, this signifies their importance, specifically the Queen, in aiding the economy to reach objectives. Furthermore, the Queens’ properties such as Windsor Castle, Frogmore House and Buckingham Palace too, help earn hundreds of millions in revenue, due to exhibitions targeted at tourists.

In stark contrast, many citizens argue that the royal family waste money that the government could spend on the public sector to benefit citizens, especially in recent years due to the evident cost of living crisis and strain on the NHS. For instance, the Platinum Jubilee cost £28 million which was believed to be an excessive unnecessary cost, which didn’t benefit any citizens in the long term and the event was mainly appreciated by royalists. Similarly, the Queen’s funeral is estimated to cost £6 billion,

which risks putting the economy into a recession due to the significant cost. Although, overall the Royal Family bring in more revenue to the UK than the cost of their upkeep due to the global attraction towards them.

On top of this you may be unaware of how many times the Queen visited our local area. She first visited High Wycombe as Monarch in 1952 to see the stamp factory that was producing the stamps that would be released around the time of her coronation in 1953. In Aylesbury she also had a meal with around 200 residents in the area in 1962. However, her very first visit to the county was for her 8th birthday in April of 1934 when she visited Bekonscot model village in Beaconsfield.

From these few facts I think you can see the breadth and depth of Her Majesty’s role and importance in the world. She will be sadly missed by many. Long Live the King!