AUSTIN BUTLER WEARS

GranTurismo Trofeo fuel consumption in l/100 km: combined 10.1 – 10.0; CO2 emissions in g/km: combined 229 – 226; CO2 class: G

WATCHMAKING ONCE AGAIN FINDS BRITISH SHORES

The Limited Edition Bremont Longitude is a groundbreaking timepiece that not only looks back at our country’s legacy but also forward to an exciting future of British watchmaking. The watch’s case back incorporates brass from the original “Flamsteed Line,” in Greenwich, the very spot where the first Astronomer Royal made his celestial observations in pursuit of an aid to navigation.

It has long been the goal of Bremont to bring watch manufacturing back to Britain. The Longitude represents a milestone in that journey, a homecoming of sorts, and proof that, to get where you’re going, you need to know where you came from.

First Thoughts

As we settle into 2026, the quiet in the modern boardroom is deceptive. The frantic, often performative debates regarding "AI strategy" have been replaced by a more unsettling reality: the agents are already running the shop. We have moved decisively past the era of Large Language Models acting as sophisticated secretaries. Today, we inhabit the age of Agentic AI— autonomous systems capable of negotiating vendor contracts, rebalancing multi-billion-pound portfolios, and optimising supply chains in real-time without a human ever clicking “approve”.

For the non-executive director, this shift has transformed the definition of fiduciary duty. In the early 2020s, governance was a retrospective exercise, a quarterly review of what had already transpired. In 2026, that luxury has evaporated. We are witnessing the birth of the "Algorithmic Fiduciary"—a requirement for boards to not only oversee the people who lead the company but to govern the code that operates it. If an autonomous agent triggers a flash crash in a niche commodity market or inadvertently adopts a discriminatory pricing strategy that violates the UK’s latest Fair Competition Act, the board can no longer plead technical ignorance. The "black box" defence has been consigned to history.

The catalyst for this shift was the "Implementation Winter" of late 2025, where several FTSE 100 firms faced shareholder revolts, not because of falling profits, but because of "governance drift." These companies had integrated autonomous agents so deeply into their operations that the directors could no longer explain how certain strategic pivots were being made. When the algorithm becomes the architect of the business plan, the board’s role must evolve from strategy approval to logic oversight.

The challenge is that the traditional board toolkit is woefully inadequate for this task. A standard audit looks at what happened six months ago; an algorithmic audit must look at the "weights and biases" of what might happen six seconds from now. We are seeing a radical restructuring of board sub-committees to address this. The Audit Committee, once the sole domain of the Big Four-trained accountant, is being cannibalised by the Technology and Ethics Committee. The most valuable person in the room is no longer the director who can spot a rounding error in the P&L, but the one who can interrogate a "Systemic Risk

Dashboard" and understand why an autonomous agent is suddenly de-prioritising long-term sustainability goals in favour of short-term liquidity.

Furthermore, the legal landscape of 2026 has formalised this responsibility. The secondary wave of the EU AI Act, alongside the UK’s own refined "PostInnovation Governance Framework," has established a clear precedent: directors are personally liable for "algorithmic negligence." This has led to a frantic scramble for talent. The "digital director" is no longer a token appointment to satisfy the ESG report; they are now the most scrutinised member of the board. Organisations are being forced to invest in "Shadow Governance"—AI systems designed specifically to monitor other AI systems, acting as a digital internal audit function that never sleeps.

However, the risk of this new era isn't just technical; it is philosophical. If we hand the "how" of business over to the machines, the board must double down on the "why." Governance in 2026 is becoming a battle for the soul of the corporation. When an algorithm is programmed to maximise efficiency, it will do so with a cold, mathematical ruthlessness that can easily bypass human values, corporate culture, and long-term brand equity. The board’s new mandate is to act as the "moral tether" for the machine. They must ensure that the pursuit of algorithmic perfection does not result in a "hollowed-out" company—one that is perfectly profitable but socially and culturally bankrupt.

As we look at the year ahead, the question for every chairperson is simple: Do you actually control your company, or do you merely preside over its automation? The answer lies in your ability to translate fiduciary duty into the language of the algorithm. We are entering the era of the "Glass Boardroom," where transparency isn't just about publishing a report, but about the ability to explain the logic of the machine to the shareholders, the regulators, and the public.

In 2026, governance is no longer a bureaucratic necessity; it is a technical discipline. The directors who survive and thrive will be those who realise that they are no longer just stewards of capital, but the ultimate guardians of the code. The machine is running. The question is: who is holding the killswitch?

Correspondence

“ “ “

I was struck by your recent cover feature on Japan’s new Prime Minister. While her drive and ambition are undeniable, her "work until you drop" philosophy—and specifically, her habit of sleeping only a few hours a night—misses a crucial national context and ignores historical warnings.

This extreme personal approach stands in stark opposition to Japan’s critical and necessary movement toward work-life balance (Hataraki-kata kaikaku) and the ongoing societal effort to combat karoshi (death by overwork). The nation is actively trying to unwind decades of punishing corporate culture, yet its new leader appears to embody its most dangerous excesses. As the chief executive, the PM sets the tone for the entire country. If she expects her staff and, by extension, the civil service and corporate world, to emulate her unsustainable pace, it risks undermining years of reform aimed at improving public health and productivity.

The comparison drawn between her nocturnal habits and those of her hero, Margaret Thatcher, should serve not as a compliment, but as a dire warning. Thatcher famously boasted of surviving on four hours of sleep, a trait often framed by her supporters as evidence of superhuman dedication. However, chronic sleep deprivation is not a superpower; it is a neurological impairment. It erodes cognitive function, impairs judgment, and increases emotional volatility. As political history shows, Thatcher's later years in office, marked by increasing isolation and strategic missteps, were not unconnected to the unsustainable pressure she placed on herself and her team.

YOSHIO TAKAHASHI (Tokyo, Japan)

The outcome of the 30th Conference of the Parties (COP 30) in Belém, Brazil, once again starkly highlighted the central paradox of global climate diplomacy: the urgent need for decisive action versus the paralysing requirement of consensus.

While the conference produced some notable financial wins, such as the agreement to triple adaptation finance (albeit with a delayed timeline to 2035) and the establishment of a "Just Transition Mechanism," the core mandate—tackling the primary cause of the crisis, fossil fuels— was conspicuously abandoned in the final text.

The reason for this failure is the consensus rule. Major fossil fuel-producing nations effectively used their veto power to block any binding commitment. Facing the threat of negotiations collapsing entirely, the Brazilian COP Presidency ultimately yielded to the lowest common denominator.

The result is a fragile agreement that side-stepped the elephant in the room. The term "fossil fuels" itself was omitted from the official text.

SALLY SPENCER (Winnipeg, Canada)

The Autumn issue's suggestion that the U.S. and Swedish economic models represent the twin pillars of perfection—one for dynamism, the other for welfare—is tempting but incomplete. Both systems present compromises: high inequality in the U.S. and reliance on high taxation in Sweden.

I would argue that the most successful and resilient model for a major modern economy is the German Social Market Economy (Soziale Marktwirtschaft).

This model achieves an enviable balance by not choosing between the market and the state, but by integrating them structurally. Its true strength lies in two key, deeply embedded institutions:

The German economy is powered not by giant tech firms, but by thousands of highly specialised small- and medium-sized enterprises (SMEs) known as the Mittelstand. These often family-owned, globally focused "hidden champions" anchor manufacturing and maintain a long-

term, low-debt investment perspective ("generations, not quarters"). This success is directly sustained by Germany's Dual Vocational Training System, which provides highly skilled workers with job-specific expertise, ensuring high productivity and keeping youth unemployment low.

“Cooperative Industrial Relations: Unlike the confrontational unionism seen elsewhere, German labour relations are defined by Co-determination (Mitbestimmung), where employees and works councils have a legal right to participate in company decision-making. This institutionalised cooperation fosters trust, facilitates moderate wage settlements to boost competitiveness, and ensures social stability, preventing the kind of paralysing labour conflicts that plague other highly unionised nations.

KURT SCHMID

(Dusseldorf, Germany)

“

I was delighted to see your recent focus on corporate neurodiversity. It is particularly encouraging to see the ongoing evolution in understanding autism spectrum conditions, an evolution exemplified by the work of figures like Professor Simon Baron-Cohen. His movement from focusing solely on the "extreme male brain" theory to embracing the strengths and unique cognitive styles associated with autism is a significant intellectual shift for which he deserves credit.

However, I must register a strong objection to the opening sentence of his recent article in the FinancialTimes(22/23 Nov), where he characterises autism as a "neurodevelopmental disability."

While the challenges faced by many autistic individuals are real and significant, relying on the word "disability" as a primary, defining descriptor risks perpetuating a deficit-based model. For many within the neurodiversity movement, disability only truly manifests when the environment—not the individual—fails to accommodate their needs. It is the clash between an autistic person's neurological operating system and a world optimised for neurotypicals that creates the disabling friction.

The use of this language, particularly in such a high-profile opening statement, seems to overlook the positive paradigm shift that frames autism not as something to be cured or overcome, but as a form of human variation. Autism is increasingly understood as a different way of processing information, often associated with exceptional skills in pattern recognition, attention to detail, and systemic thinking—traits that are increasingly valuable in the modern economy.

JUNE ROBERTSON (Winchester, UK)

I refer to your recent article on modern beauty pageants. Any suggestion that these events are anything more than an archaic, degrading spectacle is simply the polite camouflage used to justify their continued existence.

“ “

The entire enterprise rests upon a prerequisite of aesthetic judgment. No amount of charitable platforms or talk of “female empowerment” can sanitise the fundamental premise: that a woman’s physical appearance is the primary key to accessing influence, funding, and a public voice. This is a profoundly sexist anachronism that has no place in a contemporary society striving for true gender equality.

It is time to stop offering tepid defences of these events and agree that they are an arrogant waste of time and energy, deserving only of a swift consignment to history.

JANE WYMAN (New Jersey, US)

I must congratulate the former Prince Andrew on his thoroughly modern move to acquire a desirable double-barrelled name in exchange for his tired, wornout royal title.

A dignified, hyphenated surname carries far more weight and class than a purely decorative honorific. A double-barrelled name suggests old money, stable acreage, and a commitment to maintaining a robust, if slightly sprawling, identity. It implies that one is a serious landholder, a patron of the arts, or perhaps an explorer—anything, in fact, other than a figure subject to relentless, uncomfortable public scrutiny.

This strategic swap should be applauded as an example of shrewd asset management. It is a win-win: the public receives the quiet cessation of a certain kind of royal distraction, and the former Duke gains a fresh start under a grander, more resilient banner. After all, a title can be revoked or tarnished, but a magnificent double-barrelled name lasts forever. I look forward to seeing the new letterhead.

ABEIKU TETTEH (Accra, Ghana)

Editorial Team

Sarah Worthington

George Kingsley

Tony Lennox

Brendan Filipovski

John Marinus

Ellen Langford

Helen Lynn Stone

Naomi Snelling

Columnists

Otaviano Canuto

Lord Waverley

Production Director

Jackie Chapman

Distribution Manager

William Adam

Subscriptions

Maggie Arts

Commercial Director

John Mann

Director, Operations

Marten Mark

Publisher Anthony Michael

Capital Finance International

Meridien House

69 - 71 Clarendon Road

Watford WD17 1DS

United Kingdom

T: +44 203 137 3679

F: +44 203 137 5872

E: info@cfi.co

W: www.cfi.co

COVER STORIES

UNCDF

Lord Waverley

Joseph E Stiglitz

The Access Bank UK Limited Jamie Simmonds

Otaviano Canuto Nouriel Roubini

Laurence D Fink

Unilever Diageo Burberry

Coutts Fortnum & Mason

Eaglestone Pedro Neto Nuno Gil enso Group KenGen Peter Njenga

MTN

Standard Bank Group

Accenture Muqsit Ashraf Almarai

SABIC Dr Britta Daum Ramez Shehadi

StoryWorth

Bashar Kilani

CABEI EY Argentina Sergio Caveggia

Sabrina Maiorano Ambev Bancolombia

Nasdaq PepsiCo Kellogg Insight

John Pavlus

Noshir Contractor Leslie DeChurch

Joschka

UOB ADB Antonio García Zaballos

> UNCDF: From Subsistence to Agency Unlocking Finance for Uganda’s Agribusiness Micro-Entrepreneurs

Digital tools are helping Uganda’s smallest agribusinesses build financial identities, access credit, and move from survival to sustainable enterprise—particularly for women, youth and refugees operating at the margins of the formal economy.

Uganda’s micro-entrepreneurs form the backbone of the national economy. Yet without reliable evidence of their daily business activities—what they sell, in what quantities, at what price, and to whom—many remain invisible to the formal financial system. These informal and familyowned enterprises account for an estimated 78 percent of Uganda’s labour force, according to World Bank and ILOSTAT data from 2022, but lack the financial records required by lenders to assess performance and risk.

This challenge is particularly acute in agribusiness, which represents 68 percent of informal employment. Small-scale farmers and traders often operate at the edge of viability, exposed to drought, crop disease, extreme rainfall and volatile prices that can erase years of effort in a single season. Women, young people and refugees are disproportionately affected, facing both structural exclusion and heightened vulnerability to shocks.

Yet the picture is beginning to change. As digital tools become more accessible, a growing number of micro-entrepreneurs are adopting simple technologies to record sales, manage expenses and track stock, or to develop basic business plans. In doing so, they are creating what financial institutions have long struggled to obtain at this level: usable, verifiable data.

BUILDING DIGITAL FOOTPRINTS

A multi-pronged partnership is working to support agribusiness entrepreneurs—particularly those led by women, youth and refugees—not only to withstand shocks but to expand their operations, create jobs and strengthen local economies. Operating across 15 Ugandan districts, including refugee-hosting communities and the Karamoja subregion, the World Food Programme (WFP) and the United Nations Capital Development Fund (UNCDF) have joined forces to help unlock the investment potential of micro-enterprises traditionally excluded from finance.

Through the Agriculture Market Support programme, a collaboration between WFP and the Mastercard Foundation, rural entrepreneurs are strengthening their technical and commercial skills. UNCDF complements this effort through its mandate to mobilise and catalyse capital flows into high-risk markets. Working with local partners including Safe Plan Uganda, The Innovation Village, Quest Digital Finance and Asigma, UNCDF provides business development services, access to digital tools, seed grants and working capital loans.

The objective is to help micro-entrepreneurs digitise their operations, build foundational business skills and become visible to financial service providers. When small businesses begin using digital payment channels, mobile money or basic record-keeping applications, each

transaction leaves a trace. Over time, these digital footprints form a transaction history that demonstrates income patterns, financial discipline and repayment behaviour.

Advances in alternative credit-scoring algorithms now allow lenders to analyse this data to assess repayment capacity, even in the absence of collateral or formal credit histories. For many entrepreneurs, this represents the first step towards accessing formal finance, enabling them not merely to survive the next shock, but to invest, grow and create employment.

FROM SURVIVAL TO ENTERPRISE

In the Kiryandongo refugee settlement, approximately five hours from Kampala, Jane Sadia’s journey illustrates this transition. A former teacher who fled South Sudan in

"The objective is to help micro-entrepreneurs digitise their operations, build foundational business skills and become visible to financial service providers."

Jane Sadia, a former teacher who fled South Sudan in 2016, now runs a small agribusiness and leads a youth group in Kiryandongo refugee settlement. Through WFP and UNCDF training, she has strengthened her business skills, and developed a bankable business plan, and is now excited to access finance to grow her enterprise into a sustainable, thriving business. Photo: Chrismel Wasswa/UNCDF

2016, she arrived in Uganda with little more than determination. Today, she runs a small agribusiness and helps lead a youth group engaged in vegetable production, livestock rearing and local trade within the settlement and surrounding markets.

Her group is among those that have completed WFP’s skills training, gaining practical knowledge on production, storage and marketing, as well as on turning seasonal harvests into sustainable enterprises that support food security and income stability.

UNCDF builds on this foundation by helping businesses formalise, improve record-keeping and become investment-ready. Between July and August 2025, more than 5,000 entrepreneurs participated in intensive bootcamps covering loan readiness, business modelling, market analysis, cashflow management, pricing, digital payments and marketing.

Participants developed their first business plans across agrifood value chains including poultry, piggery, maize milling and beekeeping, alongside transport services and green enterprises such as briquette production. Sadia and her group received targeted support to translate their activities into bankable plans, supported by practical sessions on cost analysis, pricing and basic financial management.

“At first, I was just trying to survive,” Sadia recalls. “Now I think like a businessperson. I know my costs, I know my customers, and I understand pricing, record-keeping and basic financial management.”

This shift has transformed how the group manages its operations. Moving away from fragmented handwritten records, they now use simple digital tools to track transactions, increasing confidence

when engaging with financial institutions. While the group has accessed some loans within the settlement, these have largely been consumptionfocused rather than growth-oriented.

“We now have records to show that we can repay,” Sadia says. “We want real business credit that helps us grow.” Their next objective is to finance an irrigation system that would enable yearround vegetable production. Demand is strong, particularly during the dry season, when supply is limited. “We want to stand as entrepreneurs all year, not just for one season,” she adds.

Local organisations have played a crucial role in supporting this mindset shift. Through training and mentorship, they help farmers and traders recognise their potential beyond subsistence.

“The change is subtle but important,” notes Abraham Tumusiime, Project Coordinator at Safe Plan Uganda. “Farmers and traders begin to see themselves as entrepreneurs, not just producers.”

DATA THAT LENDERS CAN TRUST

For many micro-entrepreneurs, the constraint is not a lack of ideas or effort, but the absence of data that demonstrates existing performance. To move from informality to investability, they require a financial track record that lenders can trust. Digital tools are increasingly filling this gap.

With catalytic funding from UNCDF, fintech partner Quest Digital Finance is customising its QBcore platform to allow small agribusinesses to register enterprises, maintain digital records, receive payments and eventually apply for loans via mobile phones. In Kiryandongo District, an initial cohort of around 30 micro and small enterprises—mostly women-, youth- and refugee-led—recently piloted the system using both a web-based interface and a USSD channel accessible on basic mobile phones.

While smartphone access remains limited, USSD functionality has proven effective for core activities such as recording sales and checking balances. More complex functions, including stock management, are supported through shared devices and group accounts, reflecting the collective nature of many enterprises and helping bridge the digital divide.

“Before, I sold my produce and kept the money in cash,” Sadia explains. “Now I record my sales digitally. I can see what sells, when I make a profit, and I can show real numbers to a lender.”

DRIVING SYSTEMIC CHANGE

Beyond individual enterprises, the partnership aims to influence the wider ecosystem, including government bodies, financial institutions, telecom operators and community organisations. Evidence generated through field implementation is informing policy discussions on digital inclusion, gender-responsive finance and the use of alternative data in credit scoring. Fintech pilots are designed to persist beyond the project cycle, embedding inclusive financial tools into local markets.

“This partnership goes beyond food assistance,” says James Onyinge, Programme Policy Officer at WFP. “We are supporting people to build viable businesses, connect to markets and access finance. That is what strengthens food systems and self-reliance over the long term.”

By equipping agribusiness micro-entrepreneurs with practical skills, digital tools and financial confidence, the initiative supports recovery from shocks, income growth and job creation within vulnerable communities. With a target of reaching up to 20,000 entrepreneurs by November 2026, the programme demonstrates how productive digital credit can be a powerful enabler—particularly for women, youth and refugees striving to build secure, dignified livelihoods. i

ABOUT UNCDF

United Nations Capital Development Fund (UNCDF) mobilises and catalyses an increase in capital flows for impactful investments in highrisk markets, especially in Least Developed Countries, Small Island Developing States and countries in special situations. By crowding in capital through the deployment of risk-absorbing financial instruments, mechanisms and structuring advisory, UNCDF contributes to job creation and sustained economic growth in more than 70 countries.

In partnership with UN entities and development partners, UNCDF operates with speed and agility to deliver scalable, blended finance solutions to drive systemic change and pave the way for commercial finance and scale up by development finance institutions and multilateral development banks.

Learn more atuncdf.org or follow @UNCDF

Jane Sadia and members of her youth group sell fresh vegetables from their agribusiness at Kiryandongo market. The business training is helping them turn small farms into thriving agribusinesses. Photo: Chrismel Wasswa/UNCDF

Navigating Complexity:

How The Access Bank UK Limited Delivers Unmatched Trade Finance Solutions

In the rapidly evolving landscape of global trade, businesses face pressures that can disrupt even the most carefully planned transactions. Currency volatility, shifting regulations, supply chain disruptions and liquidity gaps increasingly define the international marketplace. During these moments of uncertainty, The Access Bank UK Limited has distinguished itself as a resilient and strategic partner, delivering tailored trade finance solutions that help customers navigate complexity with confidence.

One example of this commitment can be seen in how the Bank supported a customer confronted with severe foreign-exchange challenges during an important acquisition. The customer had already made a significant initial payment and was relying on local currency receivables to complete the transaction. Unexpected devaluation and limited access to foreign currency in the local market jeopardised the completion of the purchase and placed the initial deposit at risk. Acting with a strong sense of duty of care, The Access Bank UK Limited

structured a bespoke facility backed by a secure guarantee from a correspondent bank. This intervention ensured the customer could complete the transaction without suffering a major financial loss. It also highlighted the Bank’s ability to combine empathy with innovation, demonstrating deep expertise in structuring complex trade solutions within prudent risk parameters.

The Bank’s commitment to empowering development across Africa is further reflected in

its support for a large-scale initiative to modernise electricity metering in West Africa. The project aimed to improve billing accuracy and strengthen the energy infrastructure by deploying advanced metering technologies across multiple districts. Vendors participating in the rollout required robust and dependable financing to meet procurement and implementation timelines. The Access Bank UK Limited provided tailored trade finance structures, issuing confirmed Letters of Credit to equipment manufacturers and ensuring secure ownership of the financed goods until

"Through

repayment. A dedicated collection mechanism linked to daily utility revenues offered further comfort and facilitated the repayment of trade loans. By enabling the smooth delivery of critical infrastructure, the Bank helped enhance operational efficiency and played an instrumental role in driving digital transformation and revenue growth in the region.

The Bank also proved its adaptability during a period of significant economic strain in West Africa, where exporters faced severe headwinds including currency instability, limited foreigncurrency inflows and operational bottlenecks. Many businesses in the agricultural export sector were at risk of reduced operations or closure.

The Access Bank UK Limited responded by developing a comprehensive Pre-Export Finance model that supported the entire value chain, from raw material sourcing to processing and shipment. Working closely with local partners, manufacturers and international off-takers, the Bank ensured that exporters retained access to working capital and that funds flowed securely throughout the trade cycle. Its global network, extensive cross-border capabilities and deep knowledge of international trade regulations enabled the Bank to maintain transaction visibility and restore confidence among overseas counterparties.

The Bank’s capacity for coordination and leadership was further demonstrated in East Africa, where a major logistics company required substantial working capital that exceeded the capacity of local Banks. Regulatory limits,

risk-distribution requirements and differing domestic frameworks across countries made a straightforward facility impossible. The Access Bank UK Limited led a structured, multi-bank risk-participation arrangement involving several African Banks. It guided teams through regulatory treatment, credit-risk allocation, documentation and execution processes, ensuring all parties were aligned. The resulting facility was fully subscribed and delivered on schedule, giving the customer the liquidity needed while distributing risk safely across the participating Banks. This collaborative achievement showcased the Bank’s role as a central orchestrator of complex, multijurisdictional financing.

These cases underscore The Access Bank UK Limited’s position as a trusted partner in global trade. Its ability to design flexible, innovative and secure solutions—while coordinating seamlessly across jurisdictions—demonstrates a level of expertise essential in today’s unpredictable economic environment. More than just facilitating transactions, the Bank plays a strategic role in supporting growth, strengthening supply chains and enabling customers to pursue opportunities even in the face of volatility.

As international trade continues to expand and diversify, the challenges businesses face will only grow more complex. Through its unwavering commitment to tailored solutions, collaborative problem-solving and operational excellence, The Access Bank UK Limited continues to prove that with the right partner, global trade can remain resilient, sustainable and full of possibility. i

The Access Bank UK Limited headquarters in the City of London

its unwavering commitment to tailored solutions, collaborative problem-solving and operational excellence, The Access Bank UK Limited continues to prove that with the right partner, global trade can remain resilient and sustainable."

Jamie Simmonds, CEO/ MD of The Access Bank UK Limited

Lord Waverley: The Silent Giants

The Critical Role of SMEs in the Global Future

Small and Medium-Sized Enterprises (SMEs) are more than just business units operating in the shadow of large corporations—they are the beating heart of national economies.

In every region of the world, from dense cities to remote rural communities, SMEs fuel the engines of growth, job creation, innovation, and social cohesion. For countries striving toward economic resilience and inclusive development, empowering SMEs is not just an option; it is an economic imperative.

When SMEs succeed, nations prosper. Across many nations, SMEs account for 50–90% of all jobs, providing employment opportunities across manufacturing, services, agriculture, digital industries, and retail. Economically, they contribute 40–60% of national GDP in many countries. They are the primary drivers of income generation and poverty reduction; when they thrive, families gain stability, communities prosper, and national development accelerates.

They are the connective tissue of entire value chains. Their activities stimulate local economies, circulate capital through communities, and support the operations of larger enterprises by serving as vital suppliers, subcontractors, distributors, and service providers.

THE ENGINE OF INNOVATION AND STABILITY

SMEs underpin economic dynamism through their entrepreneurial spirit. Their agility and capacity for rapid experimentation allow them to innovate faster than large corporations. Many of the world’s most transformative technologies and business models originate from small enterprises willing to take risks and enter niche markets.

Furthermore, SMEs bring diversification. They spread economic activity across sectors and regions, protecting national economies from over-reliance on a handful of industries or large firms. When shocks occur—whether financial crises, geopolitical disruptions, or supply chain breakdowns—diversified SME ecosystems soften the impact and accelerate recovery.

They also operate where large companies often do not: in rural towns, border communities, and underserved districts. By anchoring regional development and reducing migration pressures, they promote territorial cohesion. Their openness to youth and women entrepreneurship makes them powerful engines of inclusive growth.

And, in case governments need reminding, SMEs are vital contributors to public finances. Individually, their tax contributions may be modest, but collectively, they represent a significant portion of government revenue, funding infrastructure, healthcare, education, and national development programmes.

THE GREAT BARRIER: WHY SMES STRUGGLE GLOBALLY

Despite their importance, SMEs face an uphill battle when venturing into international markets. Success hinges on a delicate balance of strategic, operational, financial, and regulatory capabilities—areas where small firms are historically under-resourced.

1. The Operational Capability Gap Limited organisational capacity hampers international expansion. Exporting is technical; it requires managing documentation, understanding HS codes (product classification), navigating Incoterms, and meeting market-specific labelling rules. Missteps here lead to held shipments, penalties, or rejected goods. Managing these cross-border logistics, customs agents, and foreign buyers requires a bandwidth many SMEs simply do not have.

2. The Financial Void SMEs consistently name finance as their number one barrier. They face limited access to affordable trade finance or guarantees, leaving them vulnerable to currency volatility and shipping disruptions. Unlike better-capitalised multinationals, they lack the cushion to absorb delayed payments or cash flow shocks.

3. The Digital Imperative Digital-enabled SMEs are the fastest-growing category globally, but their success depends heavily on infrastructure and international interoperability. As the World Economic Forum’s recent white paper, “Empowering Small and Medium-Sized Enterprises through Digital Business Model Innovation,” notes: digital transformation is no longer a competitive advantage—it is a survival strategy.

With the climate transition set to dominate the global agenda (looking toward Davos 2026), SMEs are heading toward a marketplace where capability, sustainability, and digital readiness will determine who thrives and who disappears.

A MULTI-LAYERED APPROACH FOR RESILIENCE

The major question before policymakers is how to strengthen SME resilience. Collaboration is the strongest multiplier available; it helps SMEs share risks, reduce costs, and amplify impact. This requires a coordinated effort:

• Governments must create enabling environments by simplifying regulations, reducing administrative burdens, and promoting digital infrastructure. They must provide vocational training and open public procurement opportunities to SME participation.

• Large Enterprises must act as anchors. They should integrate small suppliers into their value chains, share technology and market intelligence, and, crucially, ensure fair payment terms to protect SME cash flow.

• Multilateral Organisations must provide guarantees and blended finance for SME lending. They should support trade facilitation, promote harmonized standards that SMEs can realistically meet, and offer knowledge platforms to enhance competitiveness.

• Regional Trade Blocs (such as AfCFTA, ASEAN, and Mercosur) should rise to the challenge of harmonised global regulation by understanding the five pillars of SME success: strategy, regulation, operations, finance, and capacity.

THE CALL TO ACTION: AN SME TRADE COUNCIL

Despite representing the vast majority of businesses in G20 economies, SMEs enter the global arena vastly underpowered. While multinational corporations enjoy lobbyists, negotiators, dedicated trade desks, and access to policymakers, SMEs navigate labyrinthine regulations alone.

The world needs an SME Trade Council now.

A global champion bold enough is needed to reshape the rules of the game. SMEs are everywhere yet represented nowhere. This Council would fill the gap, becoming a forceful, coordinated voice to influence international trade rules, AI regulation, and ESG standards.

The SME Trade Council will:

• Engage with the WTO, G20, UN bodies, and development banks to ensure SME priorities shape policy.

• Negotiate global financing platforms, blended finance solutions, and credit guarantees to fix the funding gap.

• Coordinate trade missions, global expos, and B2B matchmaking to connect small firms to new buyers.

SMEs stand at a crossroads internationally. Those who digitise and professionalise will capture new opportunities; those who rely on outdated systems will fall behind. But they cannot do it alone.

What is missing is the structure—and the champion—to bring it all together. This is that moment. This is that mandate. This is the rise of the global SME movement. i

ABOUT THE AUTHOR

Lord (JD) Waverley | Founder GoGlobal.trade

Ifyouhaveanyfeedbackorwantadditional informationpleasefeelfreetocontactmeat chair@smetradecouncil.org

Otaviano Canuto: The US Economic ‘K’

lobal GDP growth has proven more resilient than expected in 2025, despite the shocks triggered by the trade policies implemented by United States President Donald Trump in the first year following his return to office. The bleak projections issued by multilateral organisations and private-sector analysts in the first quarter of the year have since been revised upwards, with most forecasts now clustering between 2.5 percent and 3 percent.

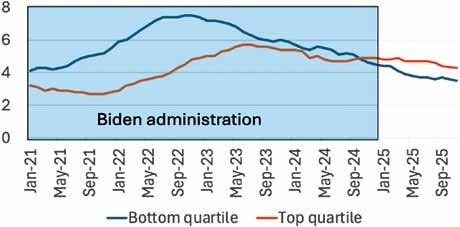

The gloom, however, has not entirely lifted. In the United States, investment in technologyintensive sectors—particularly the construction of data centres to meet the demands of artificial intelligence—has continued to support headline growth, yet job creation has stagnated. The US economy is increasingly described as following a K-shaped trajectory: strong wealth gains at the top of the income distribution, driven largely by equity market overvaluation, alongside mounting real-wage and purchasing-power pressures at the bottom.

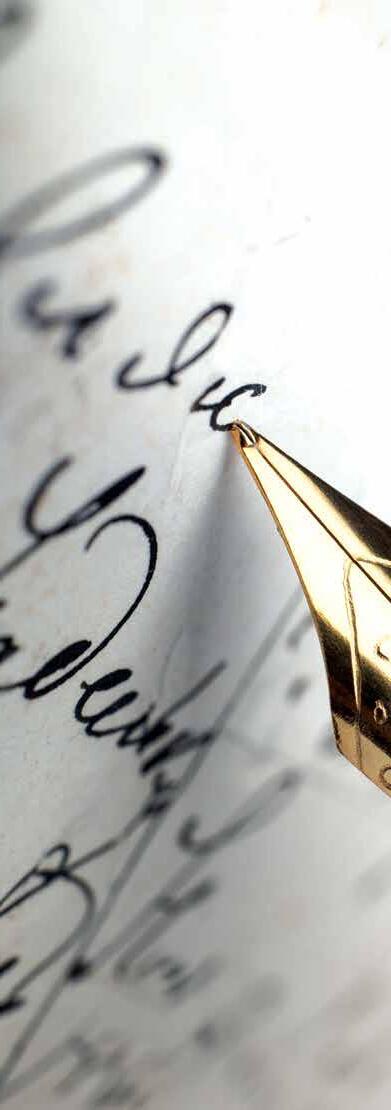

On April 2, 2025—branded by President Trump as “Liberation Day”—the administration announced exceptionally high tariffs on imports from almost every country in the world. In what might be described as a period of tariff regret, many of these measures were subsequently scaled back, often following bilateral ‘deals’ in which trading partners offered various concessions to Washington (Figure 1). Ultimately, none of the most severe tariff scenarios materialised.

Even so, a number of tariffs remain in place, with those imposed on US allies in some cases exceeding those applied to China. More importantly, uncertainty surrounding future tariff policy has intensified. Combined with concerns over institutional resilience and the trajectory of US public debt, this uncertainty has contributed to a depreciation of the dollar, as investors have sought protection through hedging strategies or diversification away from dollar-denominated reserve assets.

While the tariffs did not derail economic activity or ignite inflation to the extent initially feared, their corrosive effects are becoming apparent. Higher input costs, weaker employment dynamics and damage to the manufacturing sector are evident.

As during President Trump’s first-term trade war, tariffs on intermediate goods have disrupted supply chains, reducing efficiency and weighing on industrial output.

Global trade patterns have also been reshaped. With tariff rates on Chinese imports exceeding

This article first appeared in the Policy Center for the New South

Figure 1: US average effective tariff rate.

Source:YaleBudgetLab

Figure 2: Hourly earnings, stock prices, and home prices.

Source:Bloomberg(2025),December23(datafromtheConferenceBoard)

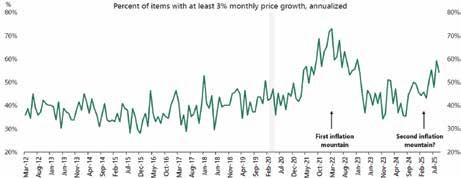

Figure 5: Increasing share of CPI items with price rises. More than 50% of items in the CPI basket show at least a 3% price increase.

Source:BLS,ApolloChiefEconomist

those applied to Mexico and several other Asian economies, trade flows have been redirected towards jurisdictions facing lower US barriers. This reorientation has been reinforced by spillover effects. As access to the US market deteriorated, China redirected exports to other destinations, supporting its own growth resilience during 2025.

It is also notable how cautiously US companies have approached cost pass-through, reflecting the uncertain and stop-start nature of tariff increases. Rising prices for imported goods indicate that foreign producers are not absorbing a significant share of the tariff burden. Although tariff transmission to the consumer price index is visible, it has so far remained limited. The tariff saga may be paused, but it is far from concluded.

Attention now turns to the upward arm of the ‘K’. The artificial intelligence boom has been accompanied by frequent warnings of an impending bubble. The extraordinary rise in equity valuations—captured by the evolution of the S&P Index (Figure 2)—has been driven largely by a narrow group of AI-related firms, often referred to as the ‘magnificent seven’.

Comparisons with the dot-com bubble of the late 1990s are difficult to avoid. As then, the sharp expansion in price-to-earnings ratios among leading technology companies evokes memories of a period when expectations raced far ahead of realised profitability. History suggests that there

is a significant lag between capital expenditure and productivity gains. With AI investment still in its early phases, productivity dividends are likely to remain modest through 2026.

Beyond questions of adoption and diffusion, there is also uncertainty over how much of AI’s economic impact will ultimately translate into sustained earnings growth for the companies currently commanding premium valuations. The dot-com era serves as a reminder that only a small fraction of early leaders survived the subsequent correction.

That said, a near-term collapse appears unlikely. AI-related spending should continue to underpin strong capital expenditure for at least another year. Major hyperscalers are financing data-centre expansion from substantial cash reserves, and corporate leverage has not yet reached the levels typically associated with systemic crises.

More concerning is the durability of the US economy’s dual-track performance—resilient output growth coupled with weak job creation— and the persistence of the K-shaped outcome. Soft labour demand is eroding purchasing power, as slower growth in private-sector wage income coincides with lingering inflation and a concentrated negative impulse from the public sector. Figure 3 illustrates the pronounced divergence in annual nominal wage growth between the top and bottom income quartiles.

"Looking ahead, labour supply constraints are likely to exert downward pressure on unemployment rates in the second half of 2026, potentially forcing the Fed to tighten policy once again."

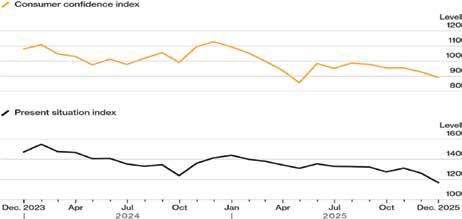

These dynamics are reinforcing business pessimism. Growth without employment has sharpened distributional tensions, while consumer confidence has weakened (Figure 4). It is no coincidence that ‘affordability’ emerged as a central theme in elections in New York and other jurisdictions where Democrats secured victories in 2025, prompting the administration to revise tariffs on imported food downwards.

Following the reversal of pandemic-related disruptions and the supply shocks associated with Russia’s invasion of Ukraine, inflation in the United States—and globally—has stabilised at around 3 percent for two consecutive years (Figure 5). The Federal Reserve’s gradual monetary easing is expected to continue in response to subdued job creation, though this trajectory would be reconsidered should inflation prove more persistent.

Looking ahead, labour supply constraints are likely to exert downward pressure on unemployment rates in the second half of 2026, potentially forcing the Fed to tighten policy once again. Any recovery in labour demand will take place against a much weaker supply backdrop than in the prepandemic period. If labour demand strengthens alongside growth, inflationary pressures may persist, requiring a subsequent contraction in labour markets by late 2026.

For now, the US economy remains defined by its K-shaped form—and the tensions it embodies. i

ABOUT THE AUTHOR

Otaviano Canuto, based in Washington, D.C., is a former vice president and a former executive director at the World Bank, a former executive director at the International Monetary Fund, and a former vice president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at the University of São Paulo and the University of Campinas, Brazil. Currently, he is a senior fellow at the Policy Center for the New South, a professorial lecturer of international affairs at the Elliott School of International Affairs - George Washington University, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development.

Figure 4: US consumer confidence.

Nouriel Roubini:

The Real Existential Threat Facing Europe

US President Donald Trump’s new National Security Strategy offers a misguided assessment of Europe, long regarded as America’s most reliable ally. Unrestrained immigration and other policies derided by administration officials as “woke,” it warns, could lead to “civilizational erasure” within a few decades.

That argument rests on a fundamental misreading of Europe’s current predicament.

While the European Union does face an existential threat, it has little to do with immigration or cultural politics. In fact, the share of foreign-born residents in the United States is slightly higher than in Europe.

The real threat facing Europe lies in its own economic and technological backwardness. Between 2008 and 2023, GDP rose by 87% in the US, compared to just 13.5% in the EU. Over the same period, the EU’s GDP per capita fell from 76.5% of the US level to 50%. Even

the poorest US state – Mississippi – has a higher per capita income than that of several major European economies, including France, Italy, and the EU average.

This widening economic gap cannot be explained by demographics. Instead, it reflects stronger productivity growth in the US, largely owing to technological innovation and higher total factor productivity. Today, roughly half of the world’s 50 largest technology firms are American, while only four are European. Over

the past five decades, 241 US firms have grown from startups into companies with market capitalisations of at least $10 billion, compared with just 14 in Europe.

These trends raise a critical question: Which countries will lead the industries of the future, and where does Europe fit in? The race for technological leadership now spans a wide range of fields, including AI and machine learning, semiconductor design and production, robotics, quantum computing, fusion energy,

fintech, and defense technologies. Europe enters this race at a clear disadvantage.

Whether the US or China currently leads the industries of the future remains open to debate, but most observers agree that it’s essentially a two-horse race, with America still ahead in several key areas. Beyond that, innovation is concentrated in countries like Japan, Taiwan, South Korea, India, and Israel. In Europe, by contrast, innovative activities are largely confined to the United Kingdom, Germany, France, and Switzerland – two of which are not even EU member states.

It is hardly a surprise, then, that while the US and China dominate global technological rankings, Europe finds itself far from the top. And the outlook is anything but reassuring, given that the next wave of innovation is widely expected to be more disruptive than anything we have seen over the past half-century.

The technological gap between the US and Europe can be attributed to several factors. First, the US has a far deeper and more dynamic ecosystem for financing startups, while Europe still lacks a genuine capital markets union, limiting the scale and speed at which new firms can grow.

Second, Europe is hampered by excessive and fragmented regulation. A US startup can launch a product under a single regulatory framework and immediately access a market of more than 330 million consumers. The EU has a population of roughly 450 million but remains divided among 27 national regulatory regimes. An International Monetary Fund analysis shows that internal market barriers in the EU act like a tariff of around 44% for goods and 110% for services – far higher than the tariff levels the US imposes on most imports.

Third, cultural attitudes toward risk-taking differ sharply. Until relatively recently, a failed entrepreneur in some EU countries (like Italy) could face criminal penalties, while in the US, a tech founder who has never failed is often seen as too risk-averse.1

Fourth, the US benefits from a deeply integrated academic-military-industrial complex, while Europe’s chronic underinvestment in defense has weakened its innovation capacity. Technological leaders like the US, China, Israel, and, more recently, Ukraine spend heavily on defense, with military research often producing technologies that have civilian applications.

Despite this, many European political leaders continue to frame higher defense spending as a tradeoff between security and social welfare. In reality, free-riding on US defense spending since the end of World War II has limited the

type of innovation that could have generated more of both through higher productivity. Paradoxically, sustaining Europe’s social model will require greater investment in defense, beginning with meeting NATO’s new spending target of 3.5% of GDP.

If Europe allows its technological lag to grow over the coming decades, it risks prolonged stagnation and continued economic decline relative to the US and China. There are, however, reasons for cautious optimism. Increasingly aware that Europe faces an existential challenge, policymakers have begun to advance serious reform proposals. The most notable examples are the two major 2024 reports on EU competitiveness and the single market by former Italian prime ministers Mario Draghi and Enrico Letta, respectively.

Europe also retains considerable strengths, including high-quality human capital, excellent education systems, and world-class research institutions. With the right incentives and regulatory reforms, these assets could support much higher levels of commercial innovation. With a better environment for entrepreneurship, Europe’s high per capita income, large internal market, and elevated savings rates could help unleash a wave of investment.

Crucially, even if Europe never leads in cuttingedge technologies, it could still significantly boost productivity by adopting and adapting American and Chinese innovations. Many of these technologies are general-purpose in character, benefiting both adopters and pioneers.

All of this leaves Europe at an inflection point. As Ernest Hemingway famously observed, bankruptcy happens “gradually and then suddenly.” So far, Europe’s technological decline has been gradual. But if it fails to confront its structural weaknesses, today’s slow erosion could give way to a sudden and irreversible loss of economic relevance. i

ABOUT THE AUTHOR

Nouriel Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business, is Chief Economist at Atlas Capital Team, CEO of Roubini Macro Associates, Co-Founder of TheBoomBust.com, and author of the forthcoming MegaThreats: Ten Dangerous Trends That Imperil Our Future, and How to Survive Them (Little, Brown and Company, October 2022). He is a former senior economist for international affairs in the White House’s Council of Economic Advisers during the Clinton Administration and has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank. His website is NourielRoubini.com, and he is the host of NourielToday.com.

>

Joseph

E Stiglitz:

America’s New Age of Empire

S President Donald Trump has drawn a wave of criticism for his actions in Venezuela, violations of international law, disdain for longstanding norms, and threats against other countries – not least allies like Denmark and Canada. Around the world, there is a palpable sense of uncertainty and foreboding. But it should already

be obvious that things will not end well, neither for the United States nor the rest of the world.

None of this comes as a surprise to many on the left. We still remember US President Dwight Eisenhower’s valedictory warning about the industrial-military complex that had emerged from World War II. It was inevitable that a country

whose military spending matched that of the rest of the world combined would eventually use its arms to try to dominate others.

To be sure, military interventions became increasingly unpopular following the American misadventures in Vietnam, Iraq, Afghanistan, and elsewhere. But Trump has never shown much

concern for the will of the American people. Since he entered politics (and no doubt earlier), he has considered himself above the law, boasting that he could shoot someone on New York’s Fifth Avenue without losing a vote. The January 6, 2021, insurrection at the US Capitol – whose anniversary we have just “celebrated” – showed that he was right. The 2024 election

reinforced Trump’s hold on the Republican Party, ensuring that it will do nothing to hold him accountable.

The capture of Venezuela’s dictator, Nicolás Maduro, was brazenly illegal and unconstitutional. As a military intervention, it required congressional notification, if not approval. And even if one stipulates that this was a case of “law enforcement,” international law still requires that such actions be pursued through extradition. One country cannot violate another’s sovereignty or snatch foreign nationals – let alone heads of state – from their home countries. Israeli Prime Minister Benjamin Netanyahu, Russian President Vladimir Putin, and others have been indicted for war crimes, but no one has proposed deploying soldiers to seize them wherever they happen to be.

Even more brazen are Trump’s subsequent remarks. He claims that his administration will “run” Venezuela and take its oil, implying that the country will not be permitted to sell to the highest bidder. Given these designs, it would appear that a new era of imperialism is upon us. Might makes right, and nothing else matters. Moral questions – such as whether killing dozens of alleged drug smugglers without any pretense of due process –and the rule of law have been shunted aside, with barely a whimper from Republicans who once proudly touted American “values.”

Many commentators have already addressed the implications for global peace and stability. If the US claims the Western Hemisphere as its sphere of influence (the “Donroe Doctrine”) and bars China from accessing Venezuelan oil, why shouldn’t China claim East Asia and bar the US from accessing Taiwanese chips? Doing so would not require it to “run” Taiwan, only to control its policies, particularly those allowing exports to the US.

It is worth remembering that the great imperial power of the 19th century, the United Kingdom, did not fare well in the 20th. If most other countries cooperate in the face of this new American imperialism – as they should – the longterm prospects for the US could be even worse. After all, the UK at least tried to export salutary governing principles to its colonies, introducing some modicum of the rule of law and other “good” institutions.

By contrast, Trumpian imperialism, lacking any coherent ideology, is openly unprincipled – an expression solely of greed and the will to power. It will attract the most avaricious and mendacious reprobates that American society can churn up. Such characters do not create wealth. They direct their energy to rent-seeking: plundering others through the exercise of market power, deception, or outright exploitation. Countries dominated by rent-seekers may produce a few wealthy individuals, but they do not end up prosperous.

Prosperity requires the rule of law. Without it, there is ever-present uncertainty. Will the government seize my assets? Will officials demand a bribe to overlook some minor peccadillo? Will the economy be a level playing field, or will those in power always give the upper hand to their cronies?

Lord Acton famously observed that, “Power corrupts, and absolute power corrupts absolutely.” But Trump has shown that one does not need absolute power to engage in unprecedented corruption. Once the system of checks and balances starts to fall apart – as indeed it has in the US – the powerful can operate with impunity. The costs will be borne by the rest of society, because corruption is always bad for the economy.

One hopes that we have reached “peak Trump,” that this dystopian era of kakistocracy will end with the 2026 and 2028 elections. But Europe, China, and the rest of the world cannot rely on hope alone. They should be devising contingency plans which recognize that the world does not need the US.

What does America offer that the world cannot do without? It is possible to imagine a world without the Silicon Valley giants, because the basic technologies they offer are now widely available. Others would rush in, and they may well establish much stronger safeguards. It is also possible to imagine a world without US universities and scientific leadership, because Trump has already done his utmost to ensure that these institutions struggle to remain among the world’s best. And it is possible to imagine a world where others no longer depend on the US market. Trade brings benefits, but less so if an imperial power seeks to grab a disproportionate share for itself. Filling the “demand gap” posed by the US's persistent trade deficits will be a lot easier for the rest of the world than the challenge facing the US of dealing with the supply side.

A hegemon that abuses its power and bullies others must be left in its own corner. Resisting this new imperialism is essential for everyone else’s peace and prosperity. While the rest of the world should hope for the best, it must plan for the worst; and in planning for the worst, there may be no alternative to economic and social ostracism –no recourse but a policy of containment. i

ABOUT THE AUTHOR

Joseph E Stiglitz, a Nobel laureate in economics and University Professor at Columbia University, is a former chief economist of the World Bank (1997-2000), former chair of the US President’s Council of Economic Advisers, former co-chair of the High-Level Commission on Carbon Prices, and lead author of the 1995 IPCC Climate Assessment. He is Co-Chair of the Independent Commission for the Reform of International Corporate Taxation and the author, most recently, of The Road to Freedom:EconomicsandtheGoodSociety (W. W. Norton & Company, Allen Lane, 2024).

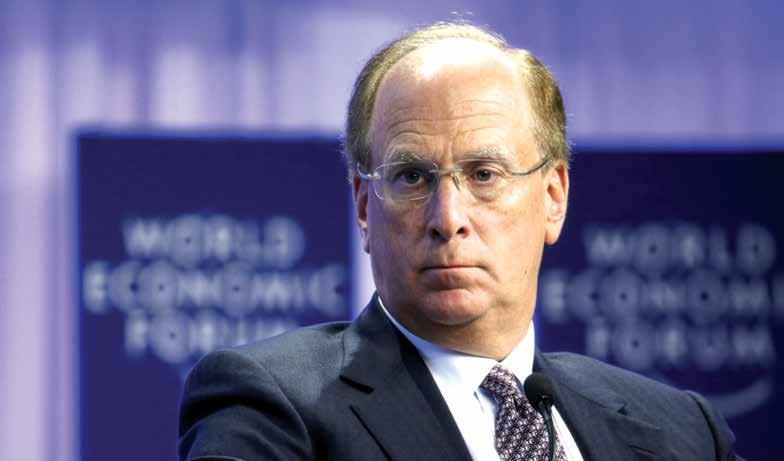

LAURENCE D FINK:

ARCHITECT OF STEWARDSHIP, PRAGMATISM, AND PURPOSEFUL GOVERNANCE

At $13.46tn in assets under management, BlackRock has become less a financial institution than a piece of global infrastructure — and Laurence D. Fink its chief engineer. Over three decades, he has built a platform that fuses risk analytics, passive investing, and corporate stewardship into a single system of influence. In the process, he has helped recast fiduciary duty for an era defined by climate volatility, energy insecurity, infrastructure scarcity, and a growing retirement gap — while navigating the political backlash that turned ESG from a technical framework into a cultural battleground.

In the canyons of lower Manhattan — and, increasingly, in the gleaming vertical city of Hudson Yards — global finance can feel like a closed ecosystem, governed by its own language and gravitational constants. Yet even in this rarefied atmosphere, Laurence D. Fink occupies a singular altitude. As Chairman and Chief Executive Officer of BlackRock, Fink does not merely watch markets; his firm, in a profound structural sense, has become part of the market’s operating system. By the turn of 2026, BlackRock’s assets under management had climbed to $13.46tn, a figure so large that it demands a geopolitical rather than purely financial frame of reference. It exceeds the gross domestic product of every nation on Earth save the United States and China, and it gives the firm — and its leadership — a form of soft power that can rival sovereign authority.

But scale alone does not explain the Fink phenomenon. To define him solely by the magnitude of the capital he oversees is to miss the more consequential story: Fink has spent the last decade evolving into the de facto philosopherpractitioner of modern fiduciary capitalism. He has done so not through grandstanding, but through a steady, strategic recasting of what long-term value means, and how it is protected.

His annual letters to corporate leaders and investors have become something closer to policy signals for the boardroom class, shaping not only the tone of governance debates but the practical behaviour of capital allocators. In earlier years, those letters pushed “purpose” into the mainstream. More recently, they have pivoted towards the hard engineering of energy pragmatism, infrastructure mobilisation, and retirement resilience — themes designed to survive political turbulence while preserving a long-term horizon.

This arc matters because BlackRock’s influence is not theoretical. It is embedded in the mechanics of modern investment. The firm’s iShares franchise sits at the heart of the passive revolution. Its Aladdin platform provides risk analytics for portfolios that extend well beyond BlackRock’s own balance sheet, reaching into the wider institutional system. And its stewardship function — the engagement and voting apparatus used to exercise shareholder rights — operates at a scale that has few historical parallels. When Fink’s BlackRock shifts its vocabulary, refines its voting practices, or reweights its strategic priorities, the tremor is felt across markets, boardrooms, and, increasingly, politics.

THE SCALE OF THE EMPIRE, AND THE WEIGHT OF RESPONSIBILITY

BlackRock’s size can feel abstract until it is translated into what it represents: the pooled savings of teachers, firefighters, nurses, engineers, factory workers, and millions of individual investors whose pension funds and retirement accounts are channelled through institutional mandates. The $13.46tn headline is, in effect, a portrait of global thrift and longterm liability. Yet the firm’s reach extends further. Through Aladdin, BlackRock provides risk management and analytics for portfolios totalling roughly $21tn-plus — a level of penetration that has led observers to describe the platform as a central nervous system of global investment risk.

The firm’s public equity footprint is equally defining. A substantial share of BlackRock’s equity assets sits in index strategies, with index equity assets under management estimated at about $6.9tn in the 2025/26 context. That fact has two consequences. The first is democratising: it reflects a world in which low-cost indexing has widened market access and reduced the fee drag that historically eroded household returns. The second is structural: it turns BlackRock into a universal owner, a shareholder in nearly everything, with limited ability to “walk away”

from controversial sectors or underperforming management teams. In such a world, voice replaces exit. Engagement and voting become the primary tools of influence, and stewardship ceases to be a reputational accessory. It becomes a fiduciary mechanism.

Scale also attracts scrutiny. To some critics, the concentration of shareholder voting power in the hands of a handful of passive giants represents a democratic deficit in corporate governance. To others, the very idea that an asset manager should engage companies on environmental, social, or governance issues looks like an ideological project. BlackRock has been attacked from both directions, often simultaneously: environmental campaigners argue the firm is not aggressive enough in pushing decarbonisation; conservative politicians accuse it of using other people’s money to pursue “woke” objectives. Fink has become the public face of this tension, even when the underlying mechanics are rooted in index design and fiduciary structure rather than ideology.

What is most notable about the past few years is not that BlackRock has been targeted — that is inevitable at this size — but that Fink has adapted without abandoning his core thesis. The Larry Fink of 2026 is less the high-profile evangelist of corporate purpose and more the hardened pragmatist of systems resilience. He has learned to treat language as a governance tool: the words matter because they either widen coalition support or invite political retaliation. Hence the retreat from the acronym ESG, even as the underlying risk analysis and engagement discipline remains embedded.

A RISK OBSESSION FORGED IN A SINGLE QUARTER

To understand the culture Fink built at

BlackRock, it is necessary to revisit a moment of personal failure that became institutional mythology. In 1986, Fink was a leading figure at First Boston, prominent in the mortgage-backed securities market and credited with generating substantial profits. Then a misjudgement on interest-rate direction contributed to a $100mn loss in a single quarter. The reversal washed away prior success and precipitated his eventual departure. In the competitive ego theatre of 1980s Wall Street, such a loss carried the sting of public humiliation.

Yet that episode did not simply mark an ending; it became a thesis. Fink concluded that Wall Street had become proficient at pursuing returns while remaining dangerously immature at measuring risk — not only in the narrow sense of volatility, but in the deeper sense of correlation, liquidity, and systemic exposure. The epiphany was that returns could be generated without truly understanding the architecture of downside. For Fink, that was not merely a technical weakness; it was an existential flaw in the investment industry’s operating model.

When he founded BlackRock in 1988 — originally as Blackstone Financial Management under the umbrella of Pete Peterson and Stephen Schwarzman’s Blackstone Group — he did so with a clear organising principle: fiduciary duty is risk management. Not the kind performed at the edge of an organisation as compliance theatre, but risk management embedded in decision-making, technology, and process. This ethos distinguished BlackRock from the era’s star-manager culture, where instinct, bravado, and personality were often mistaken for edge.

By the mid-1990s, a dispute with Schwarzman over equity and compensation led to separation

and independence. It was a split that would reshape modern finance. Blackstone became synonymous with private equity and alternative assets. BlackRock became the world’s dominant public markets manager, and later a technology-enabled governance actor. The rivalry was not merely corporate; it represented two different answers to a central question of modern capitalism: where does power reside — in the ownership of private assets, or in the infrastructure of public markets?

THE iSHARES MOMENT, AND THE PASSIVE GIANT PROBLEM

If BlackRock’s founding was Act I, the acquisition of Barclays Global Investors in 2009 was the climactic moment of Act II. In the wreckage of the global financial crisis, when banks were shedding assets to survive, Fink made a decisive bet: he acquired BGI for $13.5bn, securing control of iShares and placing BlackRock at the centre of the exchange-traded fund revolution.

The timing was pivotal. As confidence in active managers faltered and fee sensitivity rose, investors migrated towards low-cost passive exposure. iShares became a natural beneficiary, and the deal transformed BlackRock from a powerful bond and multi-asset manager into a global behemoth spanning active and index strategies. In doing so, the firm helped accelerate a broader democratisation of investing — lowering costs for millions and making diversified exposure more accessible.

But the iShares triumph produced a governance dilemma that still defines BlackRock’s stewardship debates. If a firm owns everything through index products, it cannot divest from a company or sector without deviating from the index mandate. In effect, the universal owner is compelled to hold

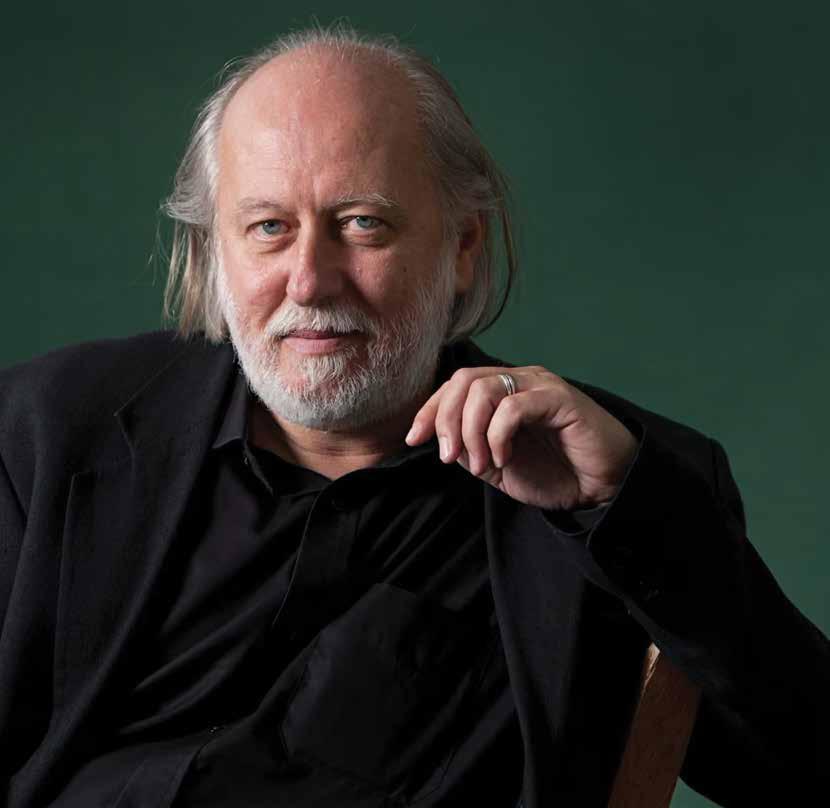

CEO of BlakRock: Laurence Fink

exposures even when it believes management is misallocating capital or mismanaging long-term risk. That reality reweights the governance toolkit: if exit is not available, engagement and voting are the levers. It also sharpens the political edge: because BlackRock cannot “leave”, it is forced to “speak”, and in speaking it attracts claims of overreach.

THE RISE OF THE FINK LETTERS, AND THE LOGIC OF STAKEHOLDER CAPITALISM

Fink’s emergence as a global governance figure can be traced through the evolution of his annual letters. For years they were corporate communications. Then, gradually, they became instruments of expectation-setting for boardrooms. The inflection point is often identified with 2018, when Fink argued that companies must articulate a sense of purpose beyond profits if they are to prosper over time. His argument was not a plea for charity. It was framed as long-term risk management: without credible stakeholder relationships, companies would lose their licence to operate, facing regulatory backlash, workforce erosion, consumer distrust, and social instability.

Two years later, the logic tightened further. In 2020, Fink’s assertion that “climate risk is investment risk” helped convert a once-niche concern into a mainstream valuation variable. He argued that markets would begin to reprice climate exposure, leading to a reallocation of capital. BlackRock’s approach emphasised disclosure frameworks and risk integration rather than sweeping divestment, including a more explicit stance on thermal coal. The message was that climate was not a moral preference; it was a material financial factor.

This positioning is often described as stakeholder capitalism, but Fink’s framing was more pragmatic than philosophical. He insisted that shareholder value is not protected by ignoring stakeholders; it is protected by serving them well enough to preserve operational resilience. A business exposed to flooding, supply disruptions, legal claims, or workforce attrition is not simply suffering social consequences — it is carrying financial risk. By translating these variables into fiduciary language, Fink helped bring environmental and social factors into the machinery of investment analysis.

ESG BECOMES A CULTURAL WEAPON

By 2022, the consensus Fink helped build began to fracture. The acronym ESG, once a technocratic shorthand, became a proxy for political identity in the United States. BlackRock found itself caught in a paradox. To conservative critics, the firm was accused of boycotting energy companies and using other people’s money to pursue ideological goals. To environmental activists, BlackRock was accused of greenwashing because it continued to hold substantial hydrocarbon exposure through index funds and refused to divest from broad sectors.

The political backlash developed concrete forms. State-level officials in energy-producing regions began to target firms they claimed were hostile to fossil fuels. In Texas, the state comptroller placed BlackRock on a list of financial companies said to boycott energy, prompting divestment actions by certain state-linked funds. In Florida, Governor Ron DeSantis publicly withdrew approximately $2bn in state assets from BlackRock, framing the firm’s approach as ideological. A coalition of Republican attorneys general sent letters accusing BlackRock of violating fiduciary duty by pursuing climate objectives rather than maximising returns. The arguments were not always consistent, but they were politically potent.

BlackRock’s defence was rooted in structure: as an index manager, it cannot divest from the market without breaking the mandate. It holds the whole economy. Therefore, if it is to protect long-term value, it must engage with companies — including energy firms — rather than abandoning them. Fink repeatedly stressed that BlackRock was not attempting to police the energy sector but to ensure companies manage transition risks effectively.

The financial reality, meanwhile, diverged sharply from the political theatre. The outflows prompted by “anti-woke” campaigns were meaningful as headlines but marginal relative to BlackRock’s scale. In the period often cited, the firm faced withdrawals of roughly $4bn from certain states, while simultaneously generating net long-term inflows measured in the hundreds of billions. In 2024, BlackRock recorded inflows of $641bn, underscoring the resilience of its model even as it became a political target. Markets, it seemed, cared more about performance, liquidity, and fees than partisan signalling. Yet reputational damage matters in a trust-based business, and Fink — a consensus builder by temperament — appeared increasingly determined to lower the temperature.

THE PIVOT: ENERGY PRAGMATISM AND THE ABANDONMENT OF A WORD

Fink’s most consequential adaptation has been rhetorical rather than strategic. He publicly distanced himself from the term ESG, arguing that it had been entirely weaponised by extremes on both sides. The point was not that the underlying issues had vanished; it was that the label had become so politically toxic that it impeded productive risk analysis. A firm operating at BlackRock’s scale cannot afford to spend its credibility on a culture war over an acronym.

In place of ESG rhetoric, Fink pushed “energy pragmatism”. The concept is both a concession to reality and a strategic repositioning. It acknowledges that the world cannot abruptly eliminate hydrocarbons without triggering energy insecurity and price spikes, and that the transition must balance decarbonisation with

Photo: Ethan Hill

affordability and reliability. It also reframes the investment opportunity: rather than a morality play, the transition becomes a build-out of physical systems — grids, renewables, storage, transmission, efficiency, and, in some contexts, transitional fuels.

This pragmatism serves multiple constituencies. It speaks to conservative concerns about energy security. It reassures investors that the firm is focused on economics rather than ideology. And it provides cover for a broad spectrum strategy: BlackRock can invest across the transition landscape, not merely in renewables but in the infrastructure that enables a stable, decarbonising system.

THE INFRASTRUCTURE THESIS: PRIVATE CAPITAL AS THE MISSING BALANCE SHEET

The economic centrepiece of the pivot is infrastructure. Fink has highlighted a global infrastructure requirement of roughly $68tn by 2040, positioning it as one of the defining investment gaps of the era. The argument is blunt: governments cannot fund this build-out through deficits indefinitely. Debt burdens, ageing populations, and political constraints mean public balance sheets are insufficient. The implication is that private capital must step in — not as a peripheral partner, but as a central provider of long-duration funding.

BlackRock’s acquisition of Global Infrastructure Partners for $12.5bn crystallised this strategy. It signalled an intent to scale ownership and operation of physical assets, moving beyond the passive constraints of listed equities into the active governance of infrastructure platforms. This is not a mere diversification play; it is an attempt to align BlackRock’s future revenue model with the world’s physical investment needs. Infrastructure offers inflation-linked cash flows and longer-duration yields. It also offers higher fees than commoditised index products. In short, it is both a macro necessity and a strategic hedge against fee compression.

The infrastructure thesis also helps explain why Fink’s language has shifted away from the moral urgency of early ESG rhetoric and towards the engineering language of build-out. In print, the message is clear: the future is not decided by declarations; it is decided by the ability to mobilise capital into assets that deliver reliability and resilience.

THE SILENT CRISIS: RETIREMENT INSECURITY AND THE NEW ASSET MIX

Alongside climate and infrastructure, Fink has increasingly highlighted a quieter crisis: retirement. His framing is deeply personal and strategically calculated. He recounts the experience of his parents — modest earners who achieved retirement security largely through exposure to capital markets. The implication is not nostalgia; it is arithmetic. Market participation has historically outperformed the

safety of bank accounts and has enabled millions to retire with dignity.

The modern reality is more fragile. The shift from defined benefit pensions to defined contribution schemes has moved longevity risk from institutions to individuals. Workers are now expected to be their own pension managers. Even when they save sufficiently, many fear spending, haunted by the prospect of outliving assets. This “retirement paradox” — where fear suppresses consumption — has implications for wellbeing and for the broader economy.