AUSTIN BUTLER WEARS

GranTurismo Trofeo fuel consumption in l/100 km: combined 10.1 – 10.0; CO2 emissions in g/km: combined 229 – 226; CO2 class: G

WATCHMAKING ONCE AGAIN FINDS BRITISH SHORES

The Limited Edition Bremont Longitude is a groundbreaking timepiece that not only looks back at our country’s legacy but also forward to an exciting future of British watchmaking. The watch’s case back incorporates brass from the original “Flamsteed Line,” in Greenwich, the very spot where the first Astronomer Royal made his celestial observations in pursuit of an aid to navigation.

It has long been the goal of Bremont to bring watch manufacturing back to Britain. The Longitude represents a milestone in that journey, a homecoming of sorts, and proof that, to get where you’re going, you need to know where you came from.

First Thoughts

The global shift toward remote work, catalysed by the pandemic, has evolved into one of the defining business debates of our time. What began as an emergency response has since become a long-term strategic question: should employees return to the office, continue working remotely, or adopt a hybrid approach?

The issue goes beyond logistics. At stake is a fundamental re-evaluation of productivity, culture, talent retention, and well-being.

The Case for Remote Work: Autonomy, Efficiency, and Reach

Advocates of remote work point to a host of benefits, ranging from employee satisfaction to operational efficiency.

Enhanced Well-being and Autonomy

Remote work has significantly improved worklife balance for many. The elimination of daily commutes frees up time, reduces stress, and facilitates better integration of personal and professional responsibilities. This sense of autonomy often results in higher job satisfaction and lower employee turnover. When employees are trusted to manage their schedules, engagement and loyalty tend to rise.

Productivity and Focus

Research suggests remote working can enhance productivity. While offices enable collaboration, they also introduce distractions. In contrast, home environments often allow for deeper concentration. Personalised workspaces, free from office interruptions, can support high-quality output.

Cost Efficiency

Remote work presents compelling financial advantages. Employees save on transport, meals, and professional attire. Employers reduce costs on office space, utilities, and facilities. These savings can be reinvested in technology, talent development, or innovation—improving long-term competitiveness.

Access to Global Talent

Geographic limitations fall away with remote work. Companies can access a wider, more diverse talent pool—particularly beneficial for niche or highly specialised roles. A broader talent base also fosters innovation by drawing on varied backgrounds and experiences.

Environmental Impact

With fewer people commuting, carbon emissions decline. Remote work therefore contributes to sustainability goals and aligns with the ESG commitments of forward-thinking organisations.

The Case for the Office:

Collaboration, Culture, and Development

Despite the rise of remote work, the physical office continues to play a vital role—particularly for collaboration, onboarding, and building a cohesive culture.

In-Person Collaboration Drives Innovation

Spontaneous conversations in hallways or impromptu brainstorming sessions are difficult to replicate virtually. Face-to-face interaction promotes creative problem-solving, deepens team cohesion, and builds trust—factors critical to innovation.

Cultural Immersion and Belonging Culture is cultivated through shared experiences. The office environment fosters a sense of belonging and camaraderie. For new employees, especially, in-person exposure helps them understand company values and integrate faster into the team.

Mentorship and Learning Opportunities

Younger professionals benefit significantly from being physically present. Observation, informal feedback, and proximity to experienced colleagues accelerate learning and development. Organic mentorship thrives in an office setting.

Work-Life Boundaries

Remote work, while flexible, often blurs the line between professional and personal life. The absence of physical separation can lead to longer hours and burnout. Offices restore that boundary, supporting healthier routines and allowing for true downtime.

Oversight and Operational Security

For some managers, visibility offers reassurance and enables real-time course correction. Certain roles—particularly those involving sensitive data or specialised equipment—require secure, officebased environments.

Towards a Hybrid Future: Integrating the Best of Both Worlds

The return-to-office debate need not be binary. For many organisations, a hybrid model offers the most effective path forward—balancing the flexibility of remote work with the cohesion of in-person collaboration.

Hybrid strategies may include mandated office days, flexible team-based schedules, or designated "anchor" days for key meetings and joint work. The approach should be tailored to company culture, industry specifics, and employee demographics.

Critically, leadership must remain open to feedback. Successful hybrid work depends on active listening, regular evaluation, and a willingness to adapt.

The Work Model of the Future

The pandemic triggered a dramatic rethinking of how, where, and when we work. Going forward, the goal is not to choose between remote and office work, but to integrate the strengths of both. A flexible, strategic approach—one that enhances productivity, respects employee well-being, and nurtures long-term growth—will define the most resilient and forward-looking organisations.

Correspondence

“ “

I refer to the profile of Ellen DeGeneres in your Spring issue. While the article accurately recounts her recent struggles and the public's shift in perception, I believe it's crucial to ensure that her undeniable contributions and positive impact are not totally overshadowed.

For decades, DeGeneres was a trailblazer. She normalised LGBTQ+ representation on television at a time when it was far from mainstream, courageously coming out and facing significant backlash, only to rise again as one of the most beloved talk show hosts in history. "The Ellen DeGeneres Show" was, for many years, a beacon of light, promoting kindness, generosity, and joy. She raised millions for charity.

It is undoubtedly important to acknowledge and address the criticisms that emerged regarding the workplace culture of her show. Accountability is vital, and lessons must be learned. However, in our haste to hold individuals accountable for their missteps, we risk erasing the entirety of their legacy.

Ellen DeGeneres brought smiles to millions daily. She inspired acts of kindness, and through her visibility, she undoubtedly helped to foster greater acceptance and understanding in society. Let us not forget the immense good she put into the world. A nuanced perspective allows us to acknowledge imperfections while still appreciating the significant positive contributions that defined much of her career.

SALLY GEORGE (Cape Town, RSA)

I am writing to commend your publication for drawing parallels between the shocking Lucy Letby case and the egregious Post Office scandal. It is vital that we recognise the deeply troubling common threads in these seemingly disparate events, where institutional failures, a rush to judgment, and a disregard for dissenting voices led to profound injustices.

In both instances, complex information was simplified, expert opinions were seemingly downplayed or ignored, and a narrative was pursued with relentless focus, rather than a truly open-minded investigation. The human cost of these failures is immeasurable, leaving lives shattered and public trust eroded.

To prevent such travesties from recurring, we must advocate for several crucial changes:

Firstly, foster a culture of genuine inquiry, not just advocacy. In any investigation, there must be an unwavering commitment to exploring all plausible explanations, including those that challenge prevailing theories. This means actively seeking out and respecting expert opinions, even when they contradict the initial assumptions.

Secondly, demand robust and transparent data analysis. Whether it's medical statistics or IT system outputs, the data presented must be scrutinised by independent experts, with methodologies and raw information made fully transparent. Hasty conclusions drawn from incomplete or misunderstood data are fertile ground for error.

Thirdly, empower whistleblowers and protect dissenting voices. Too often, those who raise concerns from within are silenced, marginalised, or even punished. We need clear, accessible, and protected channels for individuals to report anomalies or express doubts without fear of retribution.

Finally, cultivate humility within institutions. Acknowledging the possibility of error, being open to re-evaluating decisions, and resisting the urge to defend an initial stance at all costs are essential for justice to prevail.

ELLEN MORGAN (Windsor, UK)

I'm writing to express my amusement regarding the illustration accompanying your recent article on the Doomsday Clock. While the piece correctly notes the clock is now set to a chilling 89 seconds to midnight, the accompanying graphic still proudly displays a leisurely three minutes.

One has to wonder if your layout department is hoping to save us

all some time by fast-forwarding the apocalypse. Perhaps they're just optimists, or maybe they simply appreciate the aesthetic symmetry of the longer hand. Either way, it gave me a much-needed chuckle amidst the existential dread.

JAMIE WINTER (Chicago, IL, USA)

I was deeply moved to read the obituary for Marianne Faithfull in your Spring 2025 issue. While her later career was marked by incredible resilience and artistic depth, it was her early impact that truly resonated with me, bringing back vivid memories of a fleeting but unforgettable encounter in the 1960s.

“

I recall a gathering in some smoky London flat – where the air buzzed with the newness of the decade. And then she walked in. Even amidst the vibrant personalities of that era, Marianne Faithfull was utterly captivating. She possessed an ethereal beauty, yes, but it was more than just looks; there was a quiet intensity, a knowing glance, and an effortless charm that truly bowled one over. She spoke with a soft, melodic voice that belied the strength that would later define her. In those brief moments, one felt an immediate connection to something genuinely special, a budding star whose magnetism was palpable. Her obituary rightly traced her journey through triumphs and tribulations, but it was that initial, dazzling aura of the young Marianne Faithfull that your piece brought back so vividly. It's a testament to her enduring presence that even a brief interaction from so long ago can still evoke such a powerful sense of wonder. She truly was a unique force, and her passing marks the end of a remarkable chapter in cultural history.

DIANA WARD (Orpington, Kent, UK)

I am writing to commend the remarkable resilience and progress demonstrated by Sri Lanka in its journey toward economic recovery. After navigating an unprecedented crisis, the nation has shown impressive determination in implementing crucial reforms, stabilising its economy, and setting a course for sustainable growth.

“

The recent improvements in macroeconomic indicators –including the easing of inflation, the strengthening of the Sri Lankan Rupee, and the successful navigation of the IMF programme – signal a renewed stability that should not be overlooked by the international investment community. This hard-won stability, coupled with ongoing structural reforms aimed at improving governance and the ease of doing business, presents a compelling window of opportunity for forwardthinking investors.

Sri Lanka's strategic geographical location, at the crossroads of major shipping lanes, positions it as a vital maritime and logistics hub. Beyond this inherent advantage, several sectors are ripe for investment:

• Tourism: With its stunning natural beauty and rich cultural heritage, the tourism sector is poised for a significant rebound, offering lucrative prospects for hospitality development and related services.

• Information Technology & BPO: A skilled and English-speaking workforce, combined with lower operating costs, makes Sri Lanka an attractive destination for IT services and Business Process Outsourcing.

• Renewable Energy: The country's abundant solar and wind resources align perfectly with global sustainability goals and offer significant potential for green energy projects.

• Manufacturing & Export: Efforts to diversify the export base and create a more investor-friendly environment are opening doors in various manufacturing industries.

• Infrastructure Development: Ongoing projects and future plans in ports, logistics, and digital infrastructure offer long-term investment avenues. Now is the time for investors to look beyond past challenges and recognize the significant upside potential in Sri Lanka. The government's commitment to creating a conducive investment climate, coupled with the inherent strengths of the nation, makes this a unique moment to engage and contribute to, and benefit from, Sri Lanka's promising resurgence.

JUNE ROE (Sacramento, California, US)

Editorial Team

IBM Thought Leadership

Sarah Worthington

Transparency Makes the

George Kingsley

Tony Lennox

Brendan Filipovski

John Marinus

Ellen Langford

Helen Lynn Stone

Naomi Snelling

Columnists

Otaviano Canuto

Lord Waverley

Production Director

Jackie Chapman

Distribution Manager

William Adam

Subscriptions

Maggie Arts

Commercial Director

John Mann

Director, Operations

Marten Mark

Publisher Anthony Michael

Capital Finance International

Meridien House

69 - 71 Clarendon Road

Watford WD17 1DS

United Kingdom

T: +44 203 137 3679

F: +44 203 137 5872

E: info@cfi.co

W: www.cfi.co

STORIES

Invisible

Hand Visible Again, And Inclusive

Paolo Sironi

Otaviano Canuto & Bruno Saraiva

World

Paolo

Bruno

Bank

Jamie

XMTrading

Kim

Arup

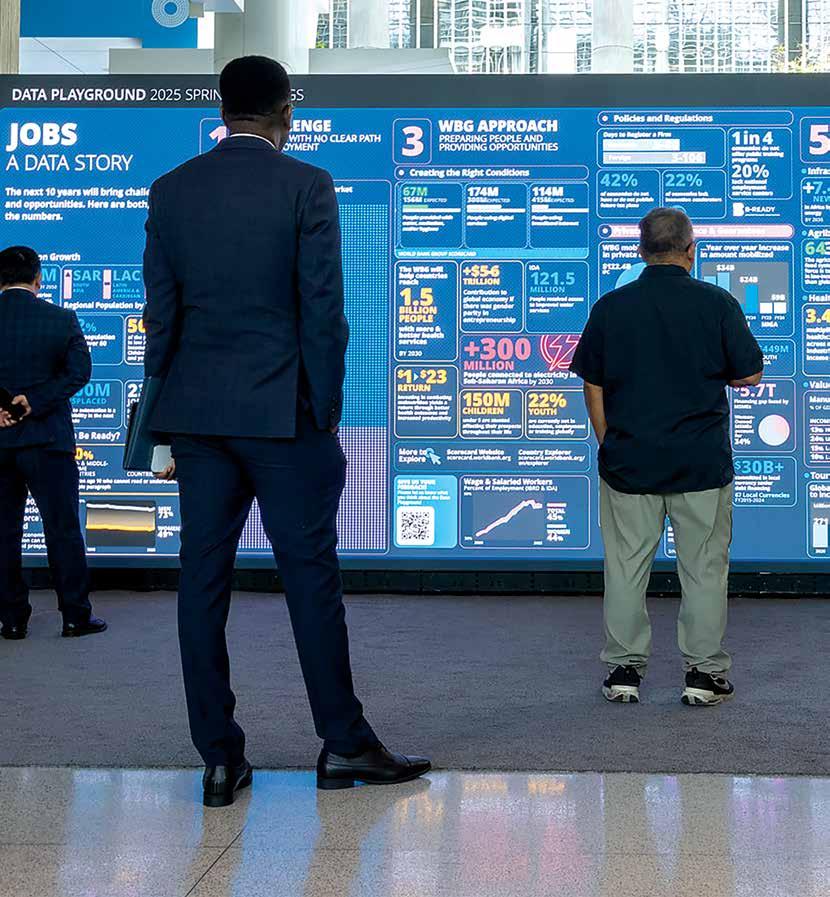

World Bank — Finding the Signal in

the Score:

How The World Bank Group is Aligning Its Scorecard and Impact Evaluations

or years, the World Bank Group’s systems for measuring results operated in parallel tracks: corporate Scorecards that monitored performance through outcome-level targets, and impact evaluations that investigated what works, for whom, and why. Both were powerful in their own right—but too often disconnected.

That is beginning to change.

Today’s context of tighter budgets, more complex challenges, and a renewed call for transformational impact has driven us to rethink how we work, how we measure success, and how we show up for our clients and each other.

We aim to be faster, simplify, operate more efficiently, and deliver greater impact. Part of this effort is to align our Scorecard and Impact Evaluation tools—by design. We are now building

By

stronger, deliberate links between the Scorecard and the growing portfolio of impact evaluations to sharpen our understanding of how to deliver meaningful outcomes at scale.

COMBINING THE WHAT AND THE WHY

The Scorecard anchors the institution’s ambition around outcome-level targets that cut across climate, jobs, gender, and inclusion. It tells us what we are achieving and where we stand.

Arianna Legovini & Lisandro Martin World Bank Group

"We aim to be faster, simplify, operate more efficiently, and deliver greater impact."

But it cannot tell us why progress is (or isn’t) happening.

That’s where impact evaluations come in. They provide the causal insight needed to explain which interventions are moving the needle— and under what conditions. They strengthen the results chain by connecting outcomes to drivers and supporting timely course correction.

Together, these systems do more than track change—they explain it. They allow us to find the signal behind the score.

INTEGRATING AGILITY AND DEPTH

Historically, Scorecards were built for speed— regular updates, short-term accountability— while impact evaluations were seen as slowmoving, academic exercises. But that divide is now narrowing.

Today’s evaluations are more agile than ever. Rapid randomised trials, adaptive designs, and embedded A/B testing can be built into project design without delaying delivery. When grounded in strong theories of change and supported by quality data systems, they can deliver early findings that inform real-time decisions.

This approach requires more than good design— it demands the operational infrastructure to act on learning. That’s why our adaptive trials embed implementation support teams directly in the field. These teams translate evidence into action through digital and AI platforms, rapid feedback cycles, and close collaboration with government partners.

The key is to start early, stay lean, and stay useful. Done right, impact evaluations are not a post-mortem—they’re a driver of accelerated learning.

FROM OPPORTUNITIES TO SYSTEMS

If the Scorecard acts as our institutional compass, then impact evaluations must shine a light on every pathway it charts. To do this, evaluations must be better aligned with the full spectrum of corporate outcomes—from emissions reduction to resilience building and quality job creation.

This shift—from scattered opportunity to strategic system—requires intentional planning, cross-sectoral collaboration, and sustained investment in learning.

FROM PROVING TO IMPROVING

We often speak of a “results culture,” but too often that culture stops at counting. A mature results culture must also value causality, curiosity, and course correction—hallmarks of a science-based adaptive learning approach that

tests, learns, and evolves continuously within the lifecycle of a project.

When evaluations are embedded into project lifecycles and explicitly linked to institutional targets, they move us from proving success to improving it. They allow us to tell compelling, evidence-informed stories—and more importantly, help us invest in what actually works.

This is especially critical for outcomes that unfold over time. Entrepreneurship programs may show promising outputs like increased business registrations, but only evaluation reveals which interventions—such as pairing capital with mentorship—actually generate sustainable jobs.

Similarly, skills training programs may report high certification rates, but evaluation identifies the models that truly deliver increased earnings, employment, and inclusion—especially for women and youth.

STEERING TODAY’S DELIVERY, SHAPING TOMORROW’S IMPACT

The lesson is clear: scorecards tell us whether we’re moving. Impact evaluations tell us whether we’re moving in the right direction— and why.

Take, for instance, projects that embed randomised trials into early phases of delivery— testing variations in training formats, incentive structures, or targeting mechanisms. By generating early insights and iterating in real time, these projects can adapt toward models that maximise results before full rollout. This isn’t just learning—it’s steering through experimentation.

This convergence is particularly relevant for the jobs agenda, where both speed and effectiveness are vital. By integrating performance tracking and rigorous evaluation, institutions can coursecorrect in real time and still stay focused on long-term results.

At the World Bank Group, we are no longer treating impact evaluations and the Scorecard as separate tools. We are aligning them— intentionally and strategically—to ensure that results are not just visible, but meaningful.

That is how we find the signal in the score— and how we build a science-based adaptive delivery system that delivers better outcomes, faster – central to our work to make the World Bank Group fit for purpose to address today’s development challenges with lasting, measurable impact. i

Paolo is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is thought leadership centre of IBM.

> Ask Paolo Sironi: Which Bank Will Lead the Pack with AI Innovation?

In the whirlwind of global headlines dominated by AI titans clashing over groundbreaking advances in Large Language Models (LLMs)—a relentless race to dominate in reasoning, versatility, and reliability—one truth stands out. The banks spearheading the AI revolution aren't necessarily those rushing to embrace the flashiest new models. Instead, they are the ones fundamentally reshaping their risk management mindset, embedding it deeply into platforms and architectures that deliver robust tools for validation, risk control, and strategic oversight. And this applies to any company, whatever the industry they are in.

This insight emerges from the latest research by the IBM Institute for Business Value, titled "Banking in the AI era: The risk management of AI and with AI." Drawing on a survey of 100 risk, compliance, and validation (RCV) officers from major markets worldwide, the study delves into the core hurdle of scaling AI across enterprises: effectively managing the risks posed by AI while leveraging its capabilities to enhance risk management itself. With this insight in hand, we can start thinking about how risk management uses AI to drive transformation.AI's transformative potential in risk and compliance is significant.

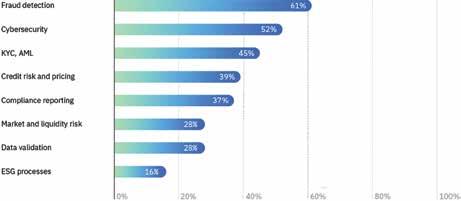

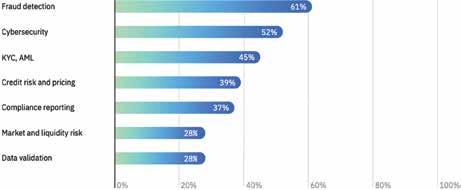

Banking executives pinpoint fraud detection and cybersecurity as top areas where AI can deliver high business value, with 61% and 52% respectively viewing them as key opportunities (see figure 1). Yet, the report reveals a cautious stance, with lower prioritisation (16%) for areas like credit risk modeling, where real market differentiation can be generated to compete through more digitalised and personalised client engagement. The biggest hurdles? The application of AI to Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, deemed the most complex by 43% of respondents. These areas involve non-standardised data, manual reviews, and escalating regulatory demands, making them resource-intensive and prone to inconsistencies. Enter agentic AI—a breakthrough featuring autonomous agents that orchestrate tasks like data collection, verification, and regulatory interpretation. The agentic AI approach can slash processing times from weeks to near-realtime, boosting efficiency, transparency, and trust. For instance, specialised agents work in parallel to authenticate documents and assess risks, minimising human error and disputes.

Figure

Figure

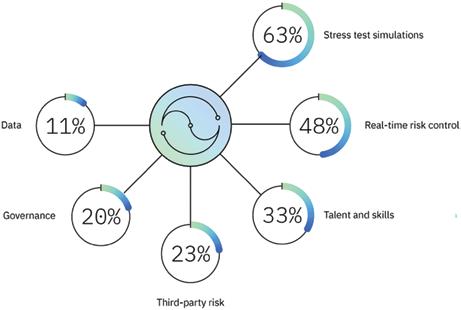

However, while AI enhances risk management practices, true innovation demands robust risk management of AI itself. The report highlights a clear gap: the need to strengthen validation capabilities to ensure models are accurate, ethical, and compliant—as identified by over 60% of respondents, who also stress the importance of investing in stress test simulations to accelerate the validation of new use cases in a timely yet thoughtful manner (see figure 2).

Additionally, 46% of RCV officers point to a significant shortfall in the capability to control risks in AI use cases, with only 25% reporting that their highest-risk scenarios are managed through real-time risk control capabilities. Greater investments are essential, alongside upskilling the workforce to foster a cohesive enterprise-wide approach—transforming every banker into an "AI risk manager" via targeted training in AI usage and ongoing learning mechanisms.

While RCVs get ready to be enablers of AI transformation by risk managing AI, they also look at AI to reshape the way they run their business thus risk manage with AI. Here the research funding are as illuminating as they are provocative: 61% of respondents zero in on fraud risk detection as the area where they could harvest the most significant boost to business value within their functions (see Figure 3). This is hardly surprising. In an era where fraudsters are as sophisticated as they are relentless, the ability to detect and prevent illicit activity in real time is nothing short of mission-critical. Close behind, 52% of respondents highlight cybersecurity, another domain where the margin for error is razor thin. Rounding out the top three, 45% of these executives point to KYC and AML processes. These areas have long been the Achilles’ heel of operation cost structures, bogged down by manual checks, outdated systems, and an ever-growing burden of regulatory requirements. But here’s where the narrative takes an intriguing twist. Despite the clear focus for using AI in these cost-intensive areas, fewer than 40% of respondents see more business-oriented processes as a major source of value. Specifically, only 39% highlight credit risk management and pricing, and a mere 28% focus on market and liquidity risk management where banks already started applying machine learning. This muted response suggests that while AI is poised to reshape certain aspects of RCV activities, traditional quantitative methods still hold the reins in others. When it comes to the core of banking risk calculus, the industry seems to be more cautious on betting the farm on AI; this might be also due to more stringent regualtory oversight about their financial modelling. Nevertheless, it is the application of machine learning to operational data, such as cash flows, that enables banks to better address lending growth on digital channels and exoand services in key client segments including small and medium enterprises.

All things consider, if you ask me which bank will lead the pack in the competitive landscape of AI transformation, the study is clear: it will be the one with the most advanced risk management of AI, embedded into a governance-enabled IT platform that facilitates a virtuous cycle of managing technology risks and unlocking business opportunities. i

Readthefullreport:

ibm.com/thought-leadership/institute-businessvalue/en-us/report/banking-in-ai-era

ABOUT THE AUTHOR

Paolo Sironi is the global research leader in banking at IBM, the Institute for Business Value, and he is author of business literature. His latest Banks and Fintech on Platform Economies has been Amazon bestseller in banking books worldwide.

Author: Paolo Sironi

Otaviano Canuto & Bruno Saraiva: Lula’s BRICS Balancing Acts in Rio

The BRICS+ group of countries met in Rio de Janeiro over the weekend of 6-7 July. The original group – Brazil, Russia, India, China and, soon after, South Africa – emerged as the materialisation of a work of fiction. Jim O’Neill, then chief economist at Goldman Sachs, produced a report in 2001 drawing attention to the rise of these countries as emerging regional powers in global economic growth.

A few years later, during the global financial crisis of 2008-2009, these countries decided to join in a common front to defend reform points in multilateral financial institutions, particularly Bretton Woods Institutions (namely, the International Monetary Fund and the World Bank). They called for increases in their voices and in shareholding and quotas, in line with the changes in the structure of global GDP that had occurred since the creation of those institutions. However, the experiences with the quota review of the International Monetary Fund (IMF) in 2010 and with the World Bank's capital increases in 2010 and 2018 made it clear that there would be limits to increasing their relative shareholding.

In the first half of the decade, the BRICS countries decided to create two institutions of their own that became part of the network of multilateral/ regional development banks and the global financial protection network, respectively: the BRICS Bank or New Development Bank (NDB) and the Contingent Reserve Arrangement (CRA). It is worth noting that these new institutions were created more as a complement than as substitutes or competitors to existing ones. The evolution has been more like one “from Bretton Woods to a bridled path”.

The now expanded membership of countries, (Egypt, Ethiopia, Indonesia, Iran, the United Arab Emirates joined the original 5 countries, while Saudi Arabia has been invited to become a member) represent about 40% of global GDP in purchasing power parity (PPP) terms and almost a quarter of global trade and investment flows. They comprise the most significant source of global economic growth in this century. Although most trade flows in BRICS countries are with countries outside the group, intra-BRICS trade has doubled since 2020, showing that there may be a potential for further increase in complementarities.

However, this coming of age of the BRICS takes place in a context different from the one of its inception. The first fifteen years of the century were marked by what seemed then as a virtuous circle between the US as a world consumer of last resort, China and other Asian countries as main

"President Lula and Brazil were obliged to exercise diplomatic skills to perform three balancing acts in Rio."

goods providers and consumers of raw materials, while many emerging markets and developing economies were providers of commodities.

This situation changed in the mid-2010s, with Russia being increasingly the target of G7 sanctions after the invasion of Crimea, the end of the commodities super-cycle, and China becoming the focus of escalating trade tensions with the US. Now, while the BRICS economies are already larger than the G7, measured in PPP terms, the group is in a much more complex and delicate relationship with the advanced economies.

It should not be forgotten that the group's agenda is, above all, economic and financial. After all, this is a group in which China and India inevitably have a rivalry, including territorially; the desire to counter the United States as a threat on the part of Russia and Iran – and, to some extent, China – is not shared by the others; there are disputes between Egypt and Ethiopia over the use of the Nile River, as well as disagreements between Middle Eastern members of the group. It is far from being a group with homogeneous views and geopolitical stances in relation to the G7 countries.

In this context, President Lula and Brazil were obliged to exercise diplomatic skills to perform three balancing acts in Rio.

First balancing act: reinforcing the leadership of the BRICS among emerging market and developing economies without antagonising the G7. With the increasing polarisation between US and China and the hostile relationship between Europe and Russia, the BRICS became a sensitive ground to coalesce developing economies. Moreover, from the standpoint of most members, deepening integration and cooperation among BRICS should proceed without contaminating other important economic relationships.

Second balancing act: expanding the BRICS membership without losing its identity and capacity to position itself in critical economic issues. While an expanded membership potentially brings more clout, the increased diversity of members may weaken the stance of the group in global economic issues where the interest and perspectives of members may have widened significantly with respect to the original group.

Third balancing act: fostering BRICS own institutions, namely the NDB and the CRA, without diverting from the effort to reform the Bretton Woods Institutions (BWIs).

With all those balls to juggle, President Lula tried to move ahead with a work plan. In this respect, on the year Brazil is hosting COP30, climate finance was a critical issue on the BRICS economic agenda and the subject of a specific declaration by the leaders.

There are other promising themes that still need to be developed to garner consensus within the group, such as initiatives to promote long-term investment. The discussions to establish a BRICS Multilateral Guarantees initiative, which will initially be hosted as a pilot in the NDB, has taken off, with a view to de-risk strategic investment and improve creditworthiness in BRICS countries, fostering private infrastructure and climate investment. Brazil also created a task force to continue a discussion on possible practical ways of enhancing BRICS countries’ reinsurance capacity, which is currently concentrated in advanced economies. Discussions on mechanisms to mitigate exchange rate risk have continued and the possibility of creating an infrastructure hub to share information on investment projects has been entertained.

Work has also continued to identify possible ways to improve the interoperability of payment systems, and facilitate fast, low-cost, more accessible, efficient, transparent, and safe cross-border payments among BRICS countries. Settlement of bilateral payment flows in local currencies has also been at the top of the BRICS agenda. It should be highlighted that the NDB has pursued efforts to use more local currencies, which now respond to almost a third of its finance projects, reducing its reliance on the US dollar. Furthermore, the CRA is at the last stage of a review of its main documents which will likely open space for the use of other eligible payment currencies.

In sum, Lula took the opportunity of Brazil’s BRICS presidency to send a strong message against protectionism and in favor a renewed multilateralism, trying to further BRICs-specific initiatives without burning the bridges with the advanced economies, which remain key historical partners of Brazil and other BRICS countries.

However, despite the exercise of BRICS balancing act, President Donald Trump threatened "extra 10% tariff over ‘anti-American’ BRICS policies". And, last week, he threatened to impose a 50% tariff on Brazil, making references to the legal

This article first appeared in the Policy Center for the New South

process against former President Jair Bolsonaro for a planned coup plot, as well as to measures taken by Brazil’s Supreme Court against U.S .social media platforms.

Presumably, from Trump’s perspective, pursuing lower reliance on the US dollar was enough to push Lula and the BRICS off their balancing act. i

, based in Washington, D.C, is a former vice president and a former executive director at the World Bank, a former executive director at the International Monetary Fund, and a former vice president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at the University of São Paulo and the University of Campinas, Brazil. Currently, he is a senior fellow at the Policy Center for the New South, a professorial lecturer of international affairs at the Elliott School of International Affairs - George Washington University, a nonresident senior fellow at Brookings Institution, and a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development.

is a civil servant at the Central Bank of Brazil), having worked at the Ministry of Finance (2004-06), the World Bank (2006-07) and the Inter-American Development Bank (IDB) (2007-11). He was head of the Department of International Affairs at the Central Bank of Brazil (2011-16) and alternate executive director for Brazil at the International Monetary Fund (IMF) (2016-24). The opinions here expressed by Bruno Saraiva are personal and do not reflect the position of the Central Bank of Brazil or the

The US Economy Will Thrive In Spite of Trumponomics

ince Donald Trump’s “Liberation Day” on April 2, when he announced sweeping trade tariffs on friend and foe alike, the conventional wisdom about the US economy’s short-term and medium- to long-term prospects has been pessimistic. Higher tariffs will cause a US and global recession; US exceptionalism is over; America’s fiscal and current-account deficits will become unsustainable; the US dollar’s status as the main global reserve currency will soon end; and the dollar will sharply weaken over time.

Certainly, some of the policies that Trump has announced warrant such pessimism. Tariffs, protectionism, and trade wars are likely to be stagflationary (causing higher inflation and lower growth), as are draconian restrictions on migration, mass deportations of undocumented workers, large unfunded fiscal deficits, and efforts to interfere with the US Federal Reserve’s independence. Equally, the US economy would not be well served by a Mar-a-Lago Accord to weaken the dollar, further damage to the rule of law at home and abroad, or tighter restrictions on

foreign talent – scientists and students – coming to the United States.

Nonetheless, I have maintained (since last winter) that the US economy will be fine – not because of Trump’s policies, but in spite of them. For starters, I expected a combination of market discipline, Trump’s more sensible advisers, and Fed independence to prevail, and that is what has happened. Trump has consistently chickened out and pursued trade deals, rather than following through with his Liberation Day tariffs. S

Nouriel Roubini:

Trump’s default may be “TALO” (Trump Always Lashes Out), but bond vigilantes and financial markets have pushed him into TACO (Trump Always Chickens Out) mode. As his most damaging economic policies take a milder form, the US economy will still endure some pain, but the likely end-of-year scenario is a growth recession (meaning below-potential growth), not an outright recession (typically defined as two consecutive quarters of negative growth).

Second, because the positive effects of technology will always trump the negative

effects of tariffs, the era of US economic exceptionalism is not over. The US is ahead of everyone – including China – in most of the revolutionary innovations that will define the future. Accordingly, its potential annual growth is likely to increase from 2% to 4% by the end of the decade, before rising much higher in the 2030s. Suppose that new technologies increase its potential growth by 200 basis points while trade and other bad policies reduce it by 50 bps; America would remain exceptional. It is America’s uniquely dynamic private sector, not

Trump’s policies, that will determine the future growth outlook.

Third, if potential growth does accelerate toward 4% over time, US public and external debts as a share of GDP will prove sustainable, stabilising and then falling over time (unless there is even greater fiscal recklessness). While the Congressional Budget Office projects a rising public debt-to-GDP ratio, that is because it assumes that US potential growth will peak at 1.8%.

Fourth, as long as American economic exceptionalism obtains, the “exorbitant privilege” conferred by the dollar’s global primacy is unlikely to erode. Despite higher tariffs, US external deficits will probably remain high, since investment as a share of GDP will rise on the back of a secular tech-driven boom, while the savings rate remains relatively stable. The resulting increase in the current-account deficit will be financed by equity inflows (both portfolio investment and foreign direct investment).

In this context, the dollar’s role as global reserve currency is unlikely to be significantly challenged, even if there is some modest diversification out of dollar-denominated assets. Likewise, these structural inflows will limit downside exchangerate risks, and they could even strengthen the dollar over the medium term.

In short, the US is likely to do well over the rest of this decade, not thanks to Trump but in spite of him. There is no question that many of his policies are potentially stagflationary. But the US happens to be at the center of some of the most important technological innovations in human history. These will deliver a large positive aggregate supply shock that will increase growth and reduce inflation over time. This effect should be an order of magnitude larger than the damage that stagflationary policies can induce.

Of course, one should not be complacent about damaging policies; their negative impact could be serious. But as long as markets and bond vigilantes do their job, Trump’s worst impulses will be constrained. i

ABOUT THE AUTHOR

Nouriel Roubini, Professor Emeritus of Economics at New York University’s Stern School of Business, is Chief Economist at Atlas Capital Team, CEO of Roubini Macro Associates, Co-Founder of TheBoomBust.com, and author of the forthcoming MegaThreats: Ten Dangerous Trends That Imperil Our Future, and How to Survive Them (Little, Brown and Company, October 2022). He is a former senior economist for international affairs in the White House’s Council of Economic Advisers during the Clinton Administration and has worked for the International Monetary Fund, the US Federal Reserve, and the World Bank. His website is NourielRoubini.com, and he is the host of NourielToday.com.

Stable Outlooks, Sustainable Finance Trends & Impact of US Policy Measures

ith nearly 30 years of experience in Latin America, Moody’s Ratings continues to evolve, reflecting a constant commitment to understanding customer needs and providing world-class service.

Moody’s Ratings is at the forefront of credit risk and sustainable finance analysis in Latin America, striving to help customers make more informed and strategic decisions. The region is essential to Moody's Ratings' global presence,

serving as a key component of its Emerging Markets strategy.

There are the three key dynamics Moody’s Ratings sees shaping Latin America’s economies and credit markets as the region faces a complex and evolving landscape in 2025: the credit outlook for sovereign and nonfinancial companies; the prospects for the sustainable finance industry; and the impact on the region of policy measures adopted by the United States.

By

STABLE OUTLOOK FOR SOVEREIGN & NONFINANCIAL COMPANIES

The region remains resilient thanks to adaptable economies, despite external challenges: Upside: Declining borrowing costs and governments' efforts to shore up fiscal health are delivering benefits.

Downside: Modest growth prospects and uncertainty related to shifts in US trade policy.

Nonfinancial companies must balance growth opportunities with inherent risks influencing

Moody’s Ratings

corporate credit quality worldwide:

• Finding macro normal, geopolitical tensions, global transitions, and digitalization and disruption.

• Adapting to these dynamics will be crucial to credit quality and sustainable growth.

SUSTAINABLE FINANCE TRENDS

Global sustainable bond issuance is expected to total $1 trillion in 2025, steady from 2024.

• Europe will lead it, as it has done since 2017, although issuance may once again be flat given

the maturity of the market.

• Asia-Pacific will remain an important driver of sustainable bond volumes.

• North America issuance will remain muted amid a retrenchment of environmental policies under a new US administration.

• Emerging market volumes, especially in Latin America and the Caribbean, should rise as COP30 in Brazil approaches.

The design and implementation of government policies to reduce greenhouse gas emissions will be a slow undertaking in Latin America.

National oil companies in the region face intensifying demands to reduce emissions, but weak legislation, limited finances, and the need to focus on energy security to replace imported fossil fuels pose significant challenges.

Data centers are expanding in areas with the most demand for cloud computing and 5G networks, including Brazil, Mexico, Chile, and Colombia. Upside: Low-cost, renewable power is widely available.

Downside: Economic volatility, policy uncertainties, water management risks and transmission bottlenecks threaten long-term returns on investment for new data center developments.

What we’re tracking: Challenges and opportunities for Chilean renewable energy; Mexico’s power sector and Brazil’s high interest rates.

Chile’s massive copper and lithium industries bode well for its long-term energy transition, but the short-term is less certain.

Snapshot: Mining companies will need to balance the need to expand production of future-facing commodities with the need to reduce carbon emissions from production processes with mandated decommissioning of carbon power plants. Network developments lagging the rapid expansion of renewables add further volatility to the power sector, increasing the risk of curtailment. Deployment of battery projects will play an important role in energy transition.

Mexico’s need substantial clean-energy investment to reach its ambitious energy transition goals. The new participation schemes offer private generators clear guidelines and options to grow, but the country’s weaking rule of law hurdles for investors.

Snapshot: New investment schemes will allow private companies to supply power, partnering with the state-owned utility CFE, or continue participating in the wholesale electricity market,

with substantial government oversight and control.

Brazil’s contractionary monetary policy will reduce banks' credit growth and margins.

Snapshot: Brazil's increasing interest rates, persistent inflation and further currency depreciation will strain corporate cash flow and reduce profitability in 2025, limiting the financial room for companies to meet their financial obligations.

UNITED STATES POLICY MEASURES

Latin America and the Caribbean are exposed to changes in the United States’ trade policies which drive both the resulting geopolitical dynamics between the United States and China, and financial market volatility.

Announced US tariffs would hit Mexico economy hardest given the amount of trade between the two countries. But goods that comply with the USMCA – about half of Mexico's exports, according to media reports – are not subject to tariffs.

Other countries in the region do not depend heavily on trade with the US for economic growth, but the US and China are the largest trading partners for many Latin American countries. While South America is less linked to the US than it once was, its trade and investment ties to China represent channels that indirectly expose them to policy changes in the US.

• Nearly a third of Brazil’s exports and more than a third of Chile’s and Peru's total exports go to China, for example.

• And Brazil and Argentina export steel and aluminum, which are subject to 25% tariffs, to the US.

Snapshot: Recently, China has played an expanded role as investor in some of those countries with its foreign direct investment increasingly going into infrastructure in addition to primary activities, i.e., mining.

An emblematic example is Peru's Chancay megaport that was built by Chinese companies and that will likely channel an important part of trade between Latin America and Asia.

US policies to counter Chinese influence in the region could entail increased investments by US companies or strategies targeted via multilateral development banks, which could result in opportunities for Latin American countries. i

TolearnmoreabouthowMoody’sRatingscanhelp decision-makersnavigaterisk,visit: moodys.com/web/en/us/solutions/ratings.html

Strengthening the Custody Chain:

Bank One Supports Africa’s

Private Capital Evolution

By Khalid Mahamodally

Adecade ago, fewer than one in ten African pension funds reported exposure to private capital. In 2024, Preqin’s Institutional Allocation Study shows that more than one-third expect to increase allocations to private debt and infrastructure over the next three years. Appetite is growing, but the means of entry remain uneven. Complex fund structures span jurisdictions, and settlement windows rarely align with the tight capital-call schedules imposed by alternative asset managers.

In April this year, a Mauritian pension fund faced that reality. A modest investment into a pan-African renewable energy fund required subscription before a Friday deadline. The fund’s depositary was in Luxembourg, the general partner in Nairobi, and investors were spread across three time zones. The difference between participation and exclusion came down to a custodian capable of moving cash, verifying documentation, and reconciling records across multiple regulatory domains in a matter of hours—not days.

That is the service gap Bank One set out to close. From our base in Mauritius, we provide asset safekeeping, trade settlement, income collection, corporate-action processing, and regulatory reporting for a diversified client base. Real-time integration with Bloomberg ensures full trade-cycle visibility, while secure file-transfer protocols maintain data integrity. Yet our greatest strength is not technology—it is continuity. With low staff turnover, our clients deal with the same specialists year after year, an increasingly rare consistency in a consolidating industry.

Head of Securities Services and Deputy Head, Private Banking, Bank One

A PLATFORM WITHOUT CONFLICTS

Independence is the second pillar of our offering. Bank One does not manufacture investment products or channel clients toward proprietary platforms. We operate on an open-architecture basis, working with third-party managers selected on merit. Whether the portfolio includes listed equities, sovereign bonds, ETFs, or illiquid private equity funds, clients benefit from reporting designed for decision-making— concise, timely, and stripped of promotional gloss.

To broaden choice without compromising rigour, we partnered with Euroclear, one of the world’s most trusted post-trade market infrastructure providers. Euroclear’s global settlement and fund-servicing network extends our custody reach well beyond domestic markets while keeping client assets off our balance sheet—a structure that materially reduces counterparty risk.

Returning to the April example: the Mauritian pension fund submitted its subscription through Euroclear’s platform. By mid-afternoon, confirmation of receipt had been issued, and the allocation secured. No manual reconciliations. No cross-border lag. Just clear visibility and ontime execution.

MOMENTUM BEHIND PRIVATE MARKETS

The appeal of private capital is structural. Sovereign bonds no longer offer the income they once did, equity valuations remain elevated in many markets, and long-dated investments linked to energy transition and digital infrastructure demand capital that public markets cannot adequately supply.

Preqin forecasts global private capital assets under management will reach $18.3tn by 2027, with private debt and infrastructure absorbing much of that growth. Africa is increasingly a part of this narrative. According to the African Private Equity and Venture Capital Association (AVCA), the continent recorded $6.5bn in private capital deal value in 2023—its second-highest total ever. Early data from 2024 point to an even greater focus on climate-linked strategies and digital connectivity.

Yet these headline numbers conceal structural barriers. Investors across Sub-Saharan Africa and the Indian Ocean face fragmented regulatory frameworks, foreign-exchange restrictions, and a shortage of custodians that can accommodate both listed and unlisted assets under one roof. That is why we have embedded private-market services—capital call processing, distribution reconciliation, bespoke reporting—directly within our custody platform. Clients can now monitor all holdings holistically, avoiding the operational sprawl that typically accompanies alternative assets.

MAURITIUS: A STRATEGIC JURISDICTION

Mauritius strengthens this proposition. Its hybrid legal framework—rooted in English common law but adapted for international finance—is backed by robust regulatory oversight. Its time zone enables smooth trading across Africa, Europe, and Asia. Our affiliation with East Africa’s I&M Group provides deeper insights into multicurrency flows, tax structures, and cross-border transaction logistics.

Our clients include sovereign entities, pension funds, family offices, and investment intermediaries. Some are African institutions diversifying outward; others are global allocators seeking exposure to African growth. All benefit

from a custodian that understands local nuance while maintaining global standards.

EXECUTION OVER INNOVATION

The success of that April transaction rested not on groundbreaking technology but on operational clarity. Roles had been rehearsed, processes agreed, and escalation routes defined. This procedural discipline is fundamental. Internally, we track service-level performance and share metrics with clients. Any deviation from standards prompts root-cause analysis—not a cosmetic fix.

In the custody business, predictability trumps novelty. Clients rely on us to deliver consistent execution, not constant reinvention. Our roadmap is therefore guided by practical needs:

• First, automating onboarding and KYC procedures so new limited partners in private funds can clear compliance in hours, not weeks.

• Second, expanding our analytics dashboard to include ESG metrics requested by global allocators.

• Third, deepening ties with regional securities depositories to accelerate cross-listed settlements.

Success will not be measured by product launches, but by how reliably we protect assets, deliver clarity, and enable capital to flow where it is needed most.

LOOKING AHEAD

The future of custody lies in convergence. As digital asset classes gain regulatory recognition, we intend to offer secure custody solutions that bridge traditional and tokenised securities. When that day comes, whether a pension fund facing a subscription deadline or an investor allocating to Africa’s climate future, they should find a custody path that is not only open—but fully operational and well lit. i

Author: Khalid Mahamodally

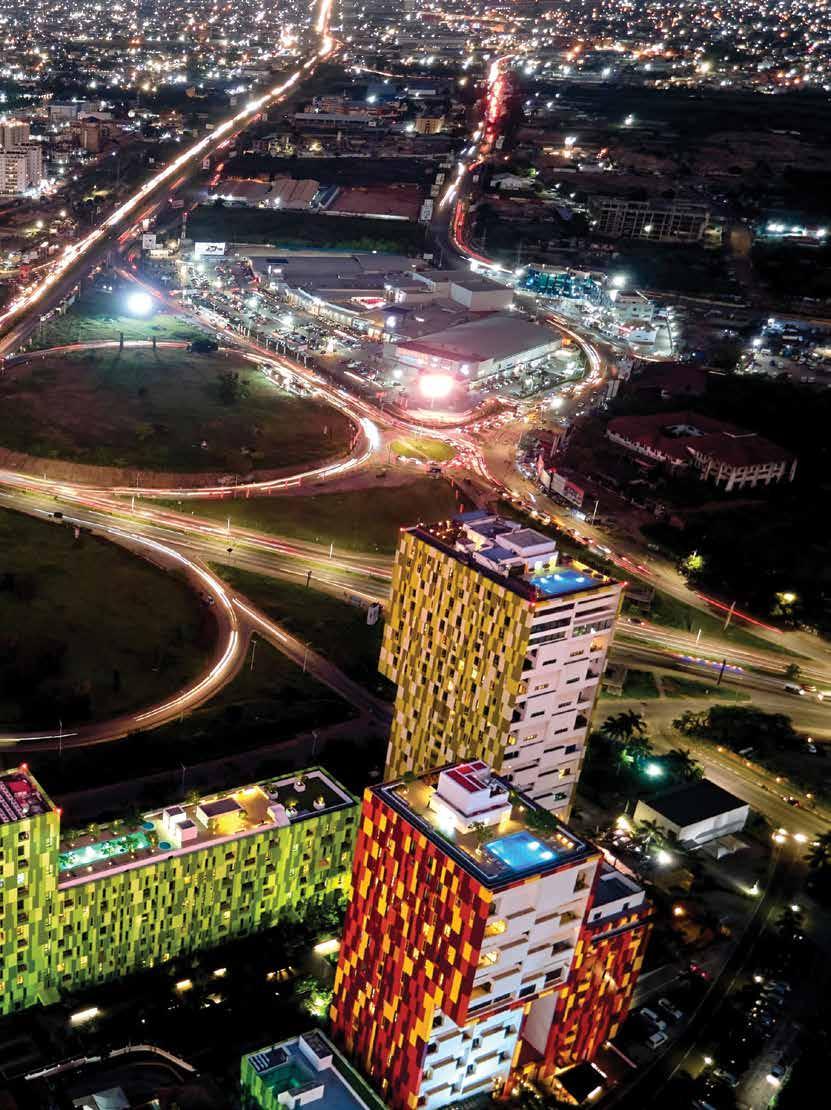

Mauritius: Port Louis

Bridging Continents

> The founder of The Access Bank UK Limited reveals how a dedication to relationships, controlled strategic expansion, and a commitment to people have propelled the Bank to the forefront of international trade, bridging continents and redefining African finance.

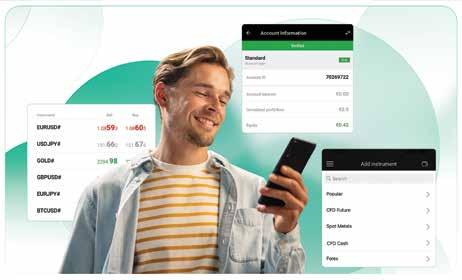

Jamie Simmonds, visionary CEO and Managing Director of The Access Bank UK Limited, in conversation with CFI. co, outlines the institution's pivotal role within the broader Access Bank Group. As he explains, "Within Access Bank Group, our role is clearly defined. Anything that happens outside of the continent of Africa falls under The Access Bank UK Ltd’s responsibility." This positions the Bank as a crucial global arm, leveraging its presence in OECD markets to offer unique solutions that bolster the Group's strategic objectives, particularly in global trade and fostering African economic growth.

This positioning allows the Bank to "bring an added element in meeting customer solutions that would not be possible with solely African continent exposure." The Bank's core role, he emphasises, is to ensure the creation of "a global network whereby we can primarily address trade finance solutions and, increasingly over time, wealth management solutions for a customer base that has expanded rapidly from Nigeria, and across Africa." This approach aims for the completion of "a number of key building blocks so that we can provide global coverage" within the current five-year strategic plan.

A GLOBAL WEB OF INFLUENCE AND FIRSTS

The strategic blueprint for this global reach is evident in the Bank's growing international footprint. "If you look at what we're doing in Dubai, we have had a presence there for ten years," Simmonds shares. He highlights its active role in supporting trade finance transactions "between the MENA region and what was historically Nigeria but is now much more broadly across Africa." The expansion into Hong Kong marks another significant milestone: "We were the first West African bank to be authorised in Hong Kong." This presence is vital for facilitating the "significant and increasing" interaction between China and Africa. Over time, it also enables us to pick up broader trade flows in Asia," including working with customers in Singapore.

Closer to home, the focus shifts to Europe. "Our presence in France is very important and allows us to assist with trade flows between France and

the Francophone countries in Africa." The team in Paris is equipped to deliver a "relationshipbased model," and the Bank is "very active on the ground in those countries." Post-Brexit, Malta has become strategically important, as "it means that we can operate across Europe" and, due to its location, "Malta opens up North Africa." The experienced team in Malta is adept at handling trade flows and meeting customer needs in this region. Meanwhile, the UK office, "where we've built the muscle that is the anchor point for international at the moment," will continue to "very much focus on sub-Saharan Africa". Ultimately, it's about "creating that integrated network" to meet the increasing needs of a more diverse customer base.

BUILDING ON A FOUNDATION OF TRUST AND EXCELLENCE

Simmonds' journey with Access Bank began in 2007, a time when he observed "many misplaced perceptions about Nigerian banks, especially in a supposed lack of governance, and lack of attention to AML and KYC." What he discovered upon being approached by Access Bank Plc, was a different reality. "Actually, the systems and controls, were comparable to any international bank. In many senses they were stronger because of that unfortunate perception." This conviction, coupled with "the opportunity to build something from scratch in the UK," and given the confidence of "a parent that was operating to the highest standards" and "clarity that we were going to operate independently within the Access Bank Group," was persuasive. It was, he concludes, "the ability to build an endto-end bank with a clear view of what we were setting out to achieve."

As for Group's international achievements through the UK operation, Simmonds asserts, "The numbers speak for themselves." But beyond this, two factors stand out as most important to him. Firstly, "The numbers are being achieved in the right manner: working on a relationshipbased model." This dedication to bespoke customer solutions is paramount, going beyond an "unbroken increase in revenue for more than a decade." Secondly, he highlights The Access Bank UK Limited’s commitment to its people: "We were very clear from the outset that people

joining the Bank would have diverse and fulfilling careers. Our key competitive strength would always be our people." He notes that "most of our present senior managers joined us in the early days." We are proud of our Platinum rating from Investors In People, an "external body that evaluates and marks our scorecard," serving as validation as to how we're doing in supporting our staff to reach their potential." The fact that we have "grown our own when it comes to the quality and the depth of the people within the Bank" is a source of immense pride.

MILESTONES OF GROUNDBREAKING PROGRESS

Simmonds also proudly notes the Bank’s ascent to become "by significant measure, the largest Nigerian bank operating in the UK. This objective seemed challenging at the outset but was achieved "a good few years ago."

The Access Bank UK Limited has consistently broken new ground. Simmonds lists a series of significant "firsts". "Ours was the first bank of ultimately Western African ownership to be granted approval in Malta; the first bank in ten years to open in Malta; and the first West African bank to be granted approval in Hong Kong."

The Access Bank UK Ltd was also "the first African bank to be granted a banking license in Dubai." These developments represent "a number of firsts that we've achieved as we set out to be where we currently are." The current challenge, Simmonds explains, is "twofold: to remain humble and show humility in our achievements, because if you don't do that, the danger is that you won't continue to progress."

The focus now is on ensuring that "the sum of the parts of an international viewpoint end up being greater than the whole," by providing

CEO and Managing Director of The Access Bank UK Limited: Jamie Simmonds

"customer solutions in all the markets that we've opened up."

POWERING AFRICAN ECONOMIC GROWTH AND RESILIENCE

The Access Bank UK Limited’s strategic vision for global trade is inextricably linked to fostering economic growth in Africa. "Well, we are already doing that," Simmonds affirms, pointing out that "the majority of the customers we serve are outside of Access Bank Group." While remaining a "proud member of Access Bank Group" and providing solutions across it, the Bank "operates much more across Africa than it would seem from the outside.” And this has "certainly been the case for the past decade." He reveals that the Bank is, "in many senses, the largest correspondent bank in Nigeria for Tier 2 and Tier 3 banks." An increasing capability across a range of African countries ensures that "trade transactions both in and out of Africa are handled seamlessly."

The Bank is willing to step in when other international banks retreat. "When there are challenges within Africa, when there are global disturbances that are outside of their control, the tendency for international banks is to step back. What we do is step forward." This proactive stance, which aims to "fill some of the gaps," ensures that vital "trade flows that are the lifeblood of much of what's required in Africa" are maintained. Simmonds highlights its growing involvement in transactions "for the importation of materials and machinery, which is creating industrial capability within Africa." He recalls The Access Bank UK Limited’s pioneering role in Nigeria's electricity generation, where it was "the first Nigerian bank in the UK to be recognised as a trade finance bank by the Central Bank of Nigeria." Now, the Bank is working with companies focused on "creating infrastructure within Africa" and slowly changing the dynamic where " many goods, finished products, are imported into Africa rather than being manufactured in-country." The Bank has "great pride in taking a proactive role in the trade finance transactions necessary to import to achieve that."

NAVIGATING REGULATION

When it comes to the complexities of regulatory environments, Simmonds offers a refreshingly straightforward philosophy: "Regulatory environments are only complex if your goal is to operate at the minimum level that regulators are seeking." His belief is that "a banking license is a privilege that should never be taken for granted." By aiming for a higher standard than the minimum requirements and fostering "an open and transparent relationship with the regulators wherever you operate," complexity is mitigated. He acknowledges that since the 2008 financial crisis, there have been "many more prescriptive requirements when it comes to capital and liquidity." However, he reiterates,

"As long as you're aware what those requirements are, you make sure that you're operating to the right standards, and that shapes what you can do to support customers. That's the philosophy we've always maintained."

THE FUTURE OF TRADE FINANCE: AFRICA'S ASCENDANCY

Simmonds is bullish on the future of trade finance, especially in Africa. "Africa is rich in potential, and especially in terms of the increasing young population." This "demographic" advantage is complemented by "the emergence of a middleclass sector in many African countries." While this journey may be "bumpy," the "momentum is there," indicating an "increasing need for trade finance in what is going to be a huge trading block for the foreseeable future." Furthermore, considering "the global demand for raw materials and commodities, and the richness of what's available in Africa when it comes to rare earth minerals through to more core requirements," Simmonds believes "Africa will become even more relevant on the global stage." Trade finance, he asserts, "is the bedrock of the way that the world operates when moving commodities and finished products." He is confident that "trade finance will be an increasing area of importance to Africa." Therefore, what the Bank is building "enables us to play a proactive and positive role, and one that is based around relationship management."

COLLEGIATE LEADERSHIP AND CORE DISTINCTIONS

Simmonds prefers not to focus on his individual leadership style, instead emphasising the strength of his team. "We have a very well-established senior leadership team within The Access Bank UK Limited, and we operate collegially when it comes to that senior team. Everybody shares the passion to deliver what is being asked of us."

This collaborative approach extends to the entire organisation, where his role is "to be part of a broader leadership grouping, both at the parent level and within the UK." He stresses, "it's not about an individual or personalities. It's about an experienced group of individuals bringing their best to the workplace every day, where everybody feels open to challenge constructively. So, we end up with decisions that are more robust, more broadly based and much more inclusive. It’s important that everyone feels part of what we're seeking to build."

The Access Bank UK Limited distinguishes itself through its operation in OECD markets. Simmonds points out that this allows the Bank to "bring a dimension to the Access Bank Group that is not available when you are solely looking at the countries within Africa." Therefore, "when it comes to confirming of letters of credit and ensuring that there is the smoothness of goods and commodities moving around, we're able to deliver that and we're uniquely placed to do so."

Within the broader banking industry, the Bank’s deep understanding of customers allows it to

provide "solutions for customers, not products for customers." The Access Bank UK Limited "works with customers in terms of what their objectives are." Crucially, the Bank offers "a consistent presence," even when "global headwinds that sometimes have adverse effects in the African markets that we operate in arise”. Because of its "local intelligence and long-term commitment, the Bank is able to give consistency of support that is not common with some of our competitors."

ADAPTING TO GLOBAL SHIFTS AND EMBRACING INNOVATION

The Bank's strategy for adapting its trade finance methodologies to meet new challenges and opportunities is inherently tied to customer needs. Simmonds groups these into a "broad basket" because "it comes down to what our

customers are seeking to achieve. And for each customer, they're seeking to achieve something different." The customers that naturally gravitate to the Bank are those "that are proactive when it comes to trade finance" and "ambitious in terms of what they want to achieve." The Bank's role is "about understanding that ambition. It's about making sure we can provide the right support." For many, this includes helping their planning by "providing insights and knowledge," not just on their current operating country but also on broader African expansion possibilities. Therefore, when it comes to challenges and opportunities, "it's about the intelligence we're gathering. It's about understanding where the customer ambitions are and being clear that we can support them. That's the Bank’s role." This also extends to working with correspondent banks, where they are clear

about their ambitions and "calibrating that back into what we can deliver and the timeframe to deliver that then shapes our strategic planning."

On the technology front, Simmonds acknowledges the transformative power of AI and automation, recognising them as "significant game-changers as we move forward over the next decade." The Bank is "making good use of the automation that's available." He foresees that "blockchain will start to simplify and assist when it comes to trade finance," particularly for "the current documentation required as goods are shipped around the world." While "the exact form and shape of that is still evolving," his "firm belief is that blockchain will simplify matters and the ledger approach to blockchain will make it easier in terms of some of the documentation."

Crucially, technology must always serve as an enabler: "it must be used in a way that makes your business more effective, more efficient, but it should never be at the expense of relationshipbased service." Simmonds is firm in his belief that technology will "free-up our people to add more value to the services we offer. It’s an enabler – not a replacement." He does "not believe that technology will replace human interactions, the trust that is built around that, and the responsiveness that will come from a relationshipbased service." While "we will become more efficient in handling documentation, postdelivery, and more – the core principles of the Bank will not change. They’ll only benefit," he concludes, painting a clear picture of a bank that embraces the future while remaining steadfast in its foundational values. i

The Access Bank UK Limited - Paris Branch, located between Place de l’Opéra and the Bourse, was launched in 2023

DRIVING GLOBAL GROWTH THROUGH SUSTAINABLE BANKING THE ACCESS BANK UK LIMITED:

The Access Bank UK Limited, a wholly owned subsidiary of Access Bank Plc—listed on the Nigerian Stock Exchange—continues to strengthen its presence in key global markets while remaining committed to sustainable and relationship-led banking.

The Bank provides a comprehensive suite of Trade Finance, Commercial Banking, Private Banking, and Asset Management services, supporting customers in their dealings with Organisation for Economic Co-operation and Development (OECD) markets and assisting companies seeking to invest in or trade with Africa, the MENA region, Asia and other international markets.

Authorised by the Prudential Regulation Authority (PRA) and regulated by both the Financial Conduct Authority (FCA) and the PRA in the UK, The Access Bank UK Limited has built an international footprint that reflects its strategic ambitions. Its Dubai branch, located in the iconic Gate Building of Dubai International Financial Centre (DIFC), is regulated by the Dubai Financial Services Authority (DFSA). The Paris branch is authorised and regulated by the French Prudential Supervision and Resolution Authority (ACPR), while its Hong Kong branch, situated in the Central District of Hong Kong Island, is regulated by the Hong Kong Monetary Authority (HKMA). The Bank’s most recent addition, The Access Bank Malta Limited—its first fully owned European subsidiary—is based in Sliema and is licensed and regulated by the Malta Financial Services Authority (MFSA) and the European Central Bank.

Aligned with the ethos of its parent company, The Access Bank UK Limited is focused on developing a sustainable business model underpinned by prudent risk management, a strong customer service culture, and long-term customer relationships. Rather than pursuing unsustainable yields, the Bank prioritises stable, quality growth through strong customer connections, in line with the group’s broader vision to become “the world’s most respected African bank.”

The Access Bank UK Limited plays a critical role in facilitating trade between Africa and the rest of the world. It holds confirming bank status under the International Finance Corporation’s Global Trade Finance Programme, enhancing its capabilities in this space. It was also the first Nigerian bank in the UK to be appointed as a correspondent bank to the Central Bank of Nigeria, undertaking infrastructure work on behalf of the Nigerian government and issuing Letters of Credit for both the government and the Nigerian National Petroleum Corporation (NNPC).

The Commercial Banking division offers a wide range of relationship-driven services to corporate and individual customers, supported by competitive pricing, modern technology, and high

service standards. Meanwhile, Access Private Bank delivers bespoke investment solutions shaped by trust, integrity, and performance. A highly experienced private banking team provides customers with a proactive service and tailored investment strategies.

In Dubai, the Bank serves customers across the MENA region, facilitating trade and investment with Nigeria and broader markets. The DIFC branch continues to emulate the successful relationship-based approach that has proven effective in the UK and elsewhere.

The Access Bank UK Limited is led by an experienced management team with deep expertise in African, MENA, and international markets. Employees benefit from ongoing professional development, fostering a culture of commitment and professionalism. This dedication was reaffirmed when Investors in People (IIP) re-accredited the Bank with platinum status in 2023, recognising excellence in people management.

The year 2024 marked a period of strategic advancement, particularly in expanding The Access Bank UK Limited’s global operations. Following regulatory approval from the Hong Kong Monetary Authority in December 2023,

the Bank launched its Hong Kong Restricted Licence Branch, becoming the first West African bank to establish a presence in the region. This milestone strengthens The Access Bank UK Limited’s ability to capitalise on trade flows between China, other major Asian markets, and Africa, complementing its already successful models in Dubai and France.

In a further milestone, The Access Bank Malta Limited was approved in late 2024. Malta, a globally recognised financial hub and gateway between the two continents, offers a strategic location for fostering economic partnerships. With the establishment of its Malta subsidiary, The Access Bank UK Limited aims to capitalise on growing trade opportunities and strengthen its role in facilitating Europe-Africa commerce.

According to the recently published 2024 Annual Report and Financial Statements, the Bank exceeded its strategic objectives, highlighting robust execution and long-term vision. Titled "Africa’s International Gateway," the report outlines strong performances across all Strategic Business Units (SBUs), with continued momentum in Europe and Asia. Total income grew by 18 percent year-on-year to $244.3m, marking the second consecutive year the Bank exceeded the $200m income threshold.

Trade Finance remained the largest SBU, posting a 0.85 percent increase to $107m (2023: $106.1m). Commercial Banking experienced significant growth, with income rising 34.3 percent year-on-year to $106m (2023: $78.9m),

and customer deposits climbing to $1.55 billion, a 6.8 percent increase.

Asset Management division recorded its strongest performance to date, with Assets Under Management (AUM) rising to $565m (2023: $440m), a 23.37 percent increase, while income increased by 35.58 percent to $14.1m (2023: $10.4m).

Commenting on the results, CEO and MD of The Access Bank UK Limited, Jamie Simmonds said, "The year was marked by an acceleration of the Bank’s efforts to deliver on its mandate from the Group to create and expand a strong international capability to capitalise on global trade flows into and out of Africa. The year’s solid performance has left us well-placed to build on the consistent progress of recent years and to start generating income from our expanded international network."

David Charters, Chairman and Independent NonExecutive Director, added, “The launch of The Access Bank Malta Limited, our first fully owned subsidiary, and our status as the first West African bank to establish a presence in Hong Kong, were the undoubted highlights of a year which saw the continuation of our international expansion plans. We enter the year ahead with cautious optimism, and in expectation of further measured growth, as our international operations move from the investment and start-up phase to start generating trade flows and income, whilst our core strategic business units continue to build on their successful financial and operational track records."

RELATIONSHIP BANKING IN A DIGITAL WORLD: WHY HUMANCONNECTIONISIMPORTANTFORUS

In an increasingly digitised world, where efficiency and speed dominate customer expectations, relationship banking remains a vital cornerstone of customer trust and long-term engagement. At The Access Bank UK Limited, Relationship Managers continue to demonstrate that human connection, far from being obsolete, is now more essential than ever.

Relationship banking is not merely a service model—it is a philosophy grounded in empathy, reliability, and deep customer understanding. Staff across the Bank see their role not just as facilitators of transactions, but as long-term partners in the financial journeys of their customers. One manager describes it as “being consistently present and empathetic demonstrating that our customers are not merely account holders, but valued individuals with unique aspirations and challenges.”

This commitment begins with the onboarding process, which staff strive to make seamless and reassuring. It continues through every stage of the customer relationship, with regular touchpoints, proactive service, and the delivery of tailored solutions. Trust, they emphasise, is built over time through reliability, responsiveness, and a genuine interest in the customers’ goals.

Customers value this approach. Many have remained with the Bank for numerous years, citing the quality of personal service and the sense of being known and understood. One

The Access Bank UK Limited - DIFC/ Dubai Branch situated in the iconic Gate Building of Dubai International Financial Centre

Relationship Manager recalled how a customer initially joined for business banking in 2022 and subsequently entrusted the Bank with his personal banking needs—a move that reflected both satisfaction and a deepening relationship. In another case, a longstanding customer referred several individuals and businesses to the Bank, further illustrating how strong relationships naturally generate new opportunities.