This report provides an analysis of contract farming agreements (CFAs) across 14 counties, based on data from 66 agreements in 2023 and 64 in 2024. The report highlights key trends and changes in contract charges and farmers' returns, particularly in light of rising machinery and fuel costs, plus the decline of the Basic Payment Scheme.

Key findings include:

Contracting Charges: there has been a steady increase in contractors' charges per hectare, averaging £291/ha for 2024, up from £286/ha in 2023. Sugar beet, a specialised crop, saw the largest increase in rates.

Farmers' Return: Farmers' basic return has remained stable between 2023 and 2024. However, the diminishing subsidies from the Basic Payment Scheme may impact future returns.

Environmental Stewardship: Over 80% of CFAs are involved in some form of environmental stewardship, with the average area dedicated to these features increasing from 36 ha to 42 ha between 2023 and 2024.

2023-2024 Comparison: The 2023 harvest saw lower returns due to high fertiliser costs and weather conditions, but the 2024 outlook is more positive, with normalised fertiliser prices expected to improve returns despite lower yields.

The report concludes that CFAs remain a viable option for landowners, particularly in light of potential tax changes under the new Labour government. It highlights the importance of maximising government funding opportunities, although they cannot be relied upon to fully replace previous Basic Payment Scheme income.

The data collected in the 2024 Ceres Rural CFA analysis is derived from a diverse pool of clients under such agreements, across 14 counties. See figure one below for the regional distribution of agreements.

The 2023 data reviews 66 Contract Farming Agreements (CFAs), totalling 14,946 hectares (36,930 acres). The figures for harvest 2024 are estimates based on the data available at the time of writing and contain data from 64 different CFAs. All the data is in relation to arable enterprises; no livestock farming is reviewed within this analysis.

Please note that Ceres Rural defines a CFA as an agreement between a contractor and a farmer where there are fixed rates for contracting charges and farmers first charge, and then there is a share of divisible profit (where it exists) after all costs are covered.

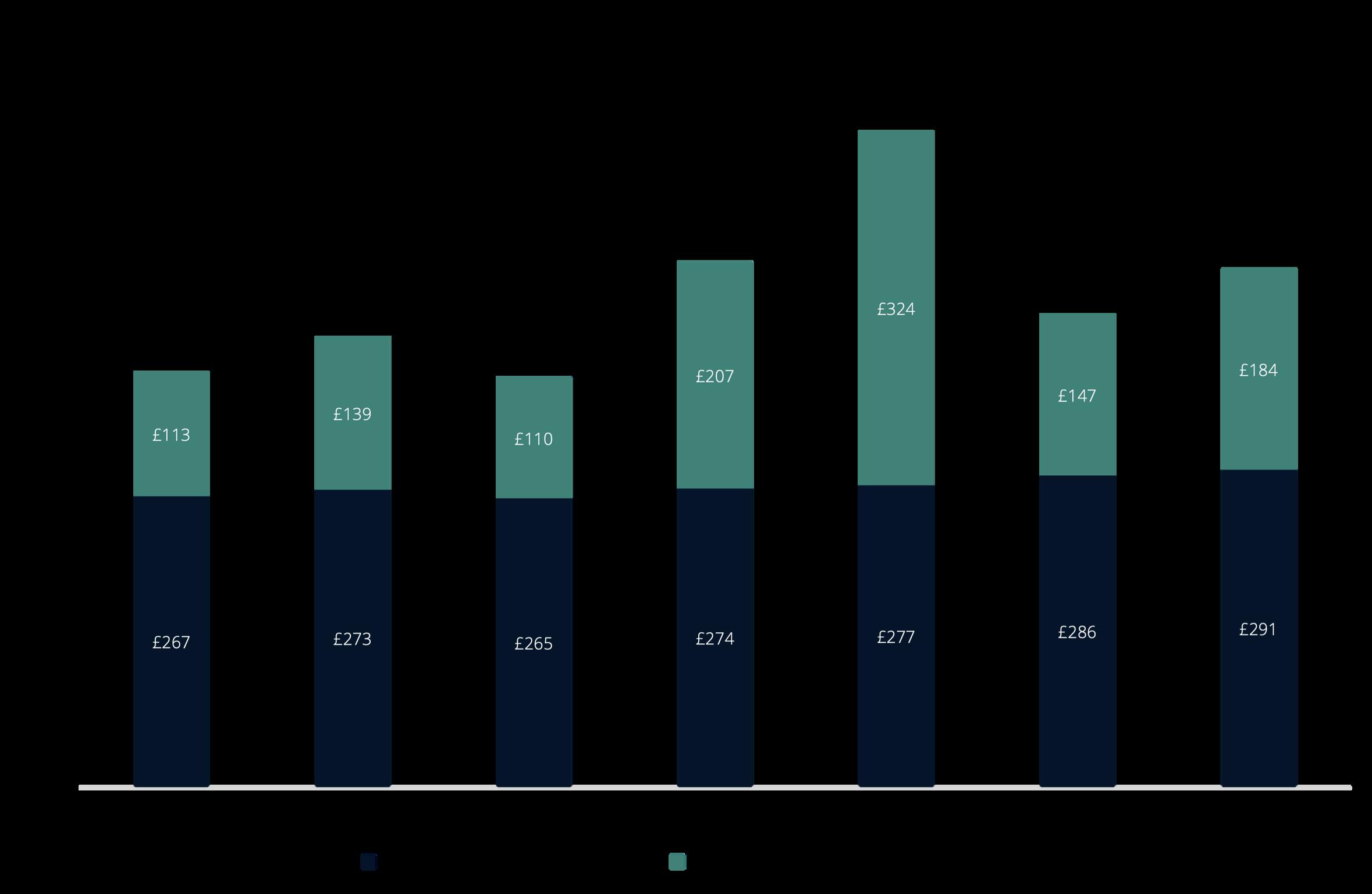

As new CFAS are born and existing ones renewed, we can observe a steady increase in the average Contractor’s Charge per hectare. The average in 2022 was £277/ha. In 2023 that rose by £9/ha, and 2024 is forecasted at an average of £291/ha, an increase of 5% from 2022. Given the rise in machinery and fuel costs this trend is unsurprising. However, with the decline of Basic Payment Scheme income, there is a higher proportion of land being placed into environmental schemes. These areas are now attracting their own contracting rates, or being excluded from agreements altogether. Either way, the average rate gets inflated.

Looking into the detail of each crop, again we can see that the average rate per hectare has increased between 2023 and 2024, but interestingly the lowest rates per hectare have remained relatively stable.

Due to its speciality in drilling and harvesting equipment, sugar beet shows a stronger upwards trajectory, with its average rate moving from £353/ha to £379/ha –7% year on year.

Table 1. Contracting rates per crop type

The Farmer’s Basic Return on average has not changed considerably between the most recent two harvest years. It will be interesting to see as more CFAs come up for renewal where the market will go. In the past, the Farmer’s Basic Return has been high due to farmers bringing the subsidy money to the table, but as that dwindles should the farmer take less as a first charge?

4. Average return to farmer vs. contractor 2023 and 2024

The 2023 harvest was difficult, with farmers experiencing historically high fertiliser prices. Adding to that, the British weather was unpredictable, with a prolonged dry period in the spring putting a strain on winter crops. Some crops did not experience rain from the day that they were drilled. This saw both the Farmer’s and Contractor’s Total Return per ha drop by 38% and 28% respectively YoY to £363/ha and £432/ha.

The 2024 harvest is looking more positive with increased returns to both parties forecasted – £475/ha return to the contractor and £400/ha return to the farmer. Both figures are close to their respective long term averages.

Early indications from our yield survey suggest decreases for the 2024 year. However, the return to largely normal fertiliser prices has helped and we are expecting this variable cost to be around £100+ per hectare lower when compared to the previous year.

With no major global political or weather-related events affecting current market trends, there are fewer peaks and troughs, but we are only a short way through the season at the point of writing.

SIMILARLY TO THE MAIZE, THE COLD, WET SPRING MEANT THAT GROWTH WAS SLOW, DELAYING THE FIR CUT OF SILAGE. SINCE THEN, WARM AND SHOWERY CONDITIONS HAVE BEEN CONDUCIVE TO GOOD GRASS GROWTH THERE WAS ALSO A REASONABLE WINDOW IN JUNE FOR HAYMAKING TO BE CARRIE OUT HOPEFULLY, ADVANTAGEOUS CONDITIONS CONTINUE TO ENSURE THAT NOT ONLY YIELD IS HIGH BUT THAT QUALITY IS RIGHT FOR FERMENTATION AND ANIMAL NUTRITION. CUTTING DATE IS KEY TO MEETING THE DEMANDS OF SILAGE FOR YOUR BUSINESS AND, THEREFORE, CLOSE ATTENTION SHOULD PAID TO EAR-EMERGENCE, PARTICULARLY WHILST CROPS ARE RACING THROUGH GROWTH STAGES

Over 80% of CFAs that Ceres Rural is involved with are in some form of environmental grant scheme.

Between the harvest years of 2023 and 2024 the average area of land being utilised for a physical environmental feature, for example seed mixtures, field corner management, or legume fallow, has increased from 36ha to 42ha. A small proportion of farms are making more drastic changes to their arable direction, with considerable areas of land being placed into environmental options or features.

From our data, we can see there is a general consensus that the payments for the management plans (integrated pest management, soil management and nutrient management) should be included in the divisible surplus calculation. How the divisible surplus is calculated for in field options is dependent on the farm and the options undertaken, with many deciding to remove them from the CFA all together.

At present, a CFA provides the optimal vehicle for landowners who are not in a position to farm the land physically, but wish to be an active party in key farming and land management decisions.

A CFA arrangement is favourable with regards to Agricultural Property Relief (APR) and the wider tax and inheritance picture. Landowners have to demonstrate that their income is subject to risk. In a CFA there is no guaranteed income for the farmer. With the new Labour government and its looming changes to tax regimes and property reliefs, the future may force the industry to re-think how land is farmed.

For now, it is important for farms to take advantage of government funding available. Whilst the income from them will not replace the Basic Scheme Payment in full, it will provide some income and help bolster margins that are becoming tighter.

RACHELBUSH

ASSOCIATEPARTNER|CHELMSFORD

rachel.bush@ceresrural.co.uk 07756 289 414

If you would like to discuss any of the topics covered in this report, please do contact a member of the Team, or speak to the project leader, Rachel Bush, via the details adjacent.