WELCOME TO THE August 2025

P u BLI s HER

Century 21 Australia Pty Ltd

CON t RIB utOR s

Chris Gray Cotality

EDI tORIAL ENQ u IRIE s

Century 21 Australia (02) 8295 0600

ADVER t I s IN g ENQ u IRIE s

Century 21 Australia (02) 8295 0600

DI s CLAIMER

We have in preparing this information used our best endeavours to ensure that the information contained therein is true and accurate, but accept no responsibility and disclaim all liability in respect of any errors, inaccuracies or misstatements contained herein. Prospective buyers and sellers should make their own enquiries to verify the information contained herein. All information contained in the CENTURY 21 Australia Pty Ltd website is provided as a convenience to clients. All links to property prices displayed on the website are current at the time of issue, but may change at any time and are subject to availability.

For more information on our Privacy Policy please refer to: www.century21.com.au/privacy

W HY MANY FINANCIAL PLANNER s st ILL

uNDERVALuE PROPERtY AND WHAt YO u CAN DO ABO ut I t

BY CHRIS GRAY, CEO, YOUR EMPIRE

When most people think about seeking financial advice, they imagine sitting down with a well-qualified, independent financial planner who can help map out their path to retirement. But if you’re a property investor – or even just curious about how real estate could help build your wealth – you might be surprised to learn that many planners still push shares as the default investment strategy. Why? Because historically, their remuneration has depended on it.

While commiss ion-based incentives have largely been phased out, the legacy of that system still lingers. Many planners built their businesses around managed funds and share portfolios – and old habits die hard. Even today, it’s not uncommon to hear of financial planners recommending clients sell property and use the proceeds to buy shares. Or they might suggest unlocking equity in your home to funnel into a managed fund, because that’s the system they’re trained in and comfortable with.

Of course, there’s nothing inherently wrong with shares. They have a role in many people’s portfolios. But the issue is when the advice is skewed – not because it’s in the client’s best interest – but because the planner doesn’t truly understand the power of property, or isn’t incentivised to recommend it.

THANKFULLY, THINgS ARE CHANgINg

We’re n ow seeing the rise of a new breed of financial planner: flat-fee, product-neutral, and genuinely independent. These planners charge based on the time, effort, and complexity involved – not on what assets you hold or where your funds end up. Whether you have a million dollars in property or a million in shares, the fee is the same. And that removes a key source of bias.

Even better, some of these planners are property investors themselves. They understand leverage. They know how real estate cycles work. And they can model future wealth projections using real-life scenarios – not just a standard 7% return assumption and a single asset cla ss.

The power of this kind of planning is huge. The best advisers we refer

our cli ents to use sophisticated forecasting tools to help you make informed decisions. You can run scenarios like:

• “What happens if I buy another $1.5M investment property this year?”

• “What if interest rates hover around 6% for the next decade?”

• “Can I retire at 50 if property prices grow at just 4% a year?”

• “Do I actually need to keep working – or am I already set?”

This modelling helps take the guesswork out of the future. And for many of our clients, it’s a massive relief. We often meet investors who’ve built a substantial portfolio, but still live like they’re broke – always saving, always scrimping – simply because they’ve never been shown what the future actually looks like.

In some cases, they could afford to relax. Maybe cut b ack on work.

Travel more. Spend more time with family. But no one’s ever given them permission to – because no one’s ever run the numbers for them.

I recently read a great book called Die With Zero by Bill Perkins. It’s not as morbid as it sounds. The central idea is that wealth has a curve – and it peaks when we still have the energy to enjoy it. There’s no point dying with millions in the bank if you didn’t take the time to live along the way.

Too often, we see the opposite: parents who worked hard, saved hard, lived frugally… and left behind a pile of assets they never enjoyed. Their kids inherit the money at 60 – when they needed it at 35. The system failed both generations.

That’s why clarity is so powerful. Knowing where you stand today and where you’re likely to end up can change how you live now. And a good financial planner – especially one who understands property – can help you get that clarity.

JUST MAKE SURE THEY UNDERSTAND LEVERAgE

Leverage is the real game-changer in property. If you’ve got $100,000 to invest, you might be able to buy $200,000 in shares if you borrow. But many investors are wary of margin loans – because if shares drop, the bank may ask you to top up your account or sell off your position. Not great timing.

With property, that same $100,000 could allow you to buy a $1 million asset – often with as little as a 10% deposit (or even 5% in some cases). And if the market dips 5% or 10%, as long as you keep making repayments, you’re usually fine. There’s no “margin call” on your home or investment property.

That’s why banks are happy to lend 90–95% on property. It’s low-risk for them – and potentially high-reward for you. If your $1 million property goes up 10%, that’s a $100,000 gain – on a $100,000 investment. That’s a 100% return, without

counting rental income, negative gearing or tax deductions.

So imagine if your financial planner doesn’t understand that – or doesn’t believe in it. They might think they’re giving you safe, sensible advice by steering you toward a share portfolio instead. But in doing so, they could be leaving massive opportunities on the table.

That’s why we’ve built a panel of independent financial planners who understand property inside and out. They’re investors themselves. They’re unbiased. And they can help you forecast your future, make smarter decisions, and live better today – not just decades from now. And if you don’t know where to start, we’re happy to point you in the right direction. As independent buyers’ agents, we don’t take a cent in referral fees – so our recommendations are completely impartial. We just want to make sure you’ve got the right people around you.

Because the right planner can do more than just help you retire.

They can help you live.

ABOUT THE CONTRIBUTOR

Chris Gray is CEO of Your Empire, a buyers’ agency that buys homes and investments for time-poor professionals – searching, negotiating, renovating and managing property on their behalf. Chris has spent over 10 years as the host of ‘Your Property Empire’ on Sky News Business channel, where he’s interviewed various heads of property research companies and major industry figures. Chris is a qualified accountant, buyers’ agent and mortgage broker. For more information, visit www.yourempire.com.au and follow Chris on Facebook: @ChrisGraySydney

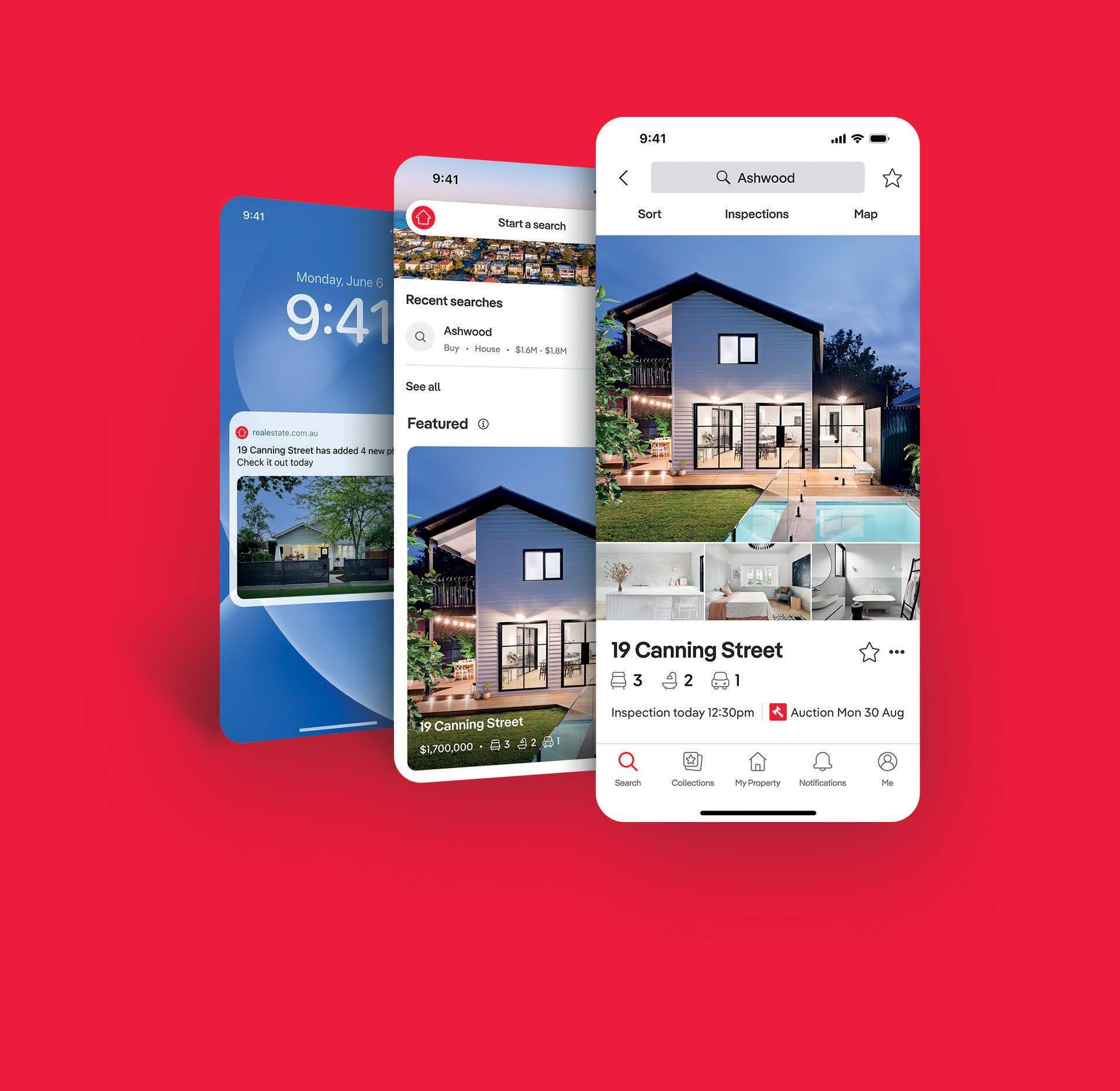

VAL u E s RI s E ACRO ss EVERY CAPI tAL As g ROW t H CYCLE WARM s u P BY COTALITY

National dwelling values rose by 0.6% in July, with the rate of growth holding firm relative to the prior two months, according to Cotality’s latest Home Value Index.

That marks the sixth straight month of gains, with the positive inflection aligning with the first rate cut in February.

“At the national level, the pace of growth in housing values is no longer accelerating,” said Cotality’s research director, Tim Lawless.

“Rather, we have seen growth rates holding a little above half a percent from month to month since May as the opposing influence of low supply, falling interest rates and rising confidence run up against affordability constraints and lingering uncertainty.”

Every capital city recorded a rise in dwelling values through the month, led by Darwin with a solid 2.2% rise, followed by Perth, up 0.9%. At the softer end of the growth tables are Hobart (+0.1%), Melbourne (+0.4%) and the ACT (+0.5%).

“While the Darwin trend doesn’t have much influence on the headline numbers, the Top End capital has moved into a solid upswing, posting

a 9.7% gain through the first seven months of the year,” Mr Lawless said.

“The mid-sized capitals are also once again standing out, especially Perth, where the monthly pace of gains has accelerated to the fastest rate of growth since September last year.”

The positive trend in housing values is supported by persistently low inventory levels, with national listings tracking -19% below the previous five-year average for this time of the year. At the same time, Cotality’s estimate of annual sales is tracking about 1.9% above the previous five-year average.

The imbalance between available supply and demonstrated demand has supported auction clearance rates, which have been tracking slightly above the decade average since mid-May.

Although the monthly growth trend looks to have found a sweet spot around 0.6%, the rolling quarterly change shows a clear upswing. The 1.8% rise in the national index

over the three months ending July was the strongest outcome since the three months ending June last year (+2.0%).

The rate of growth in house values is once again outpacing gains across the unit sector. The past three months have seen national house values rise by 1.9%, adding approximately $16,700 to the median value. In comparison, unit values are up a smaller 1.4% or roughly $9,700 on the median value. This may be because more expensive markets tend to have higher interest rate sensitivity, with higher-income households seeing a bigger boost to borrowing capacity. This usually leads to house values outperforming units during housing market upswings.

The difference between the national median house and unit value is at a record high, with a 32.3% difference between the two broad housing

Continued over page

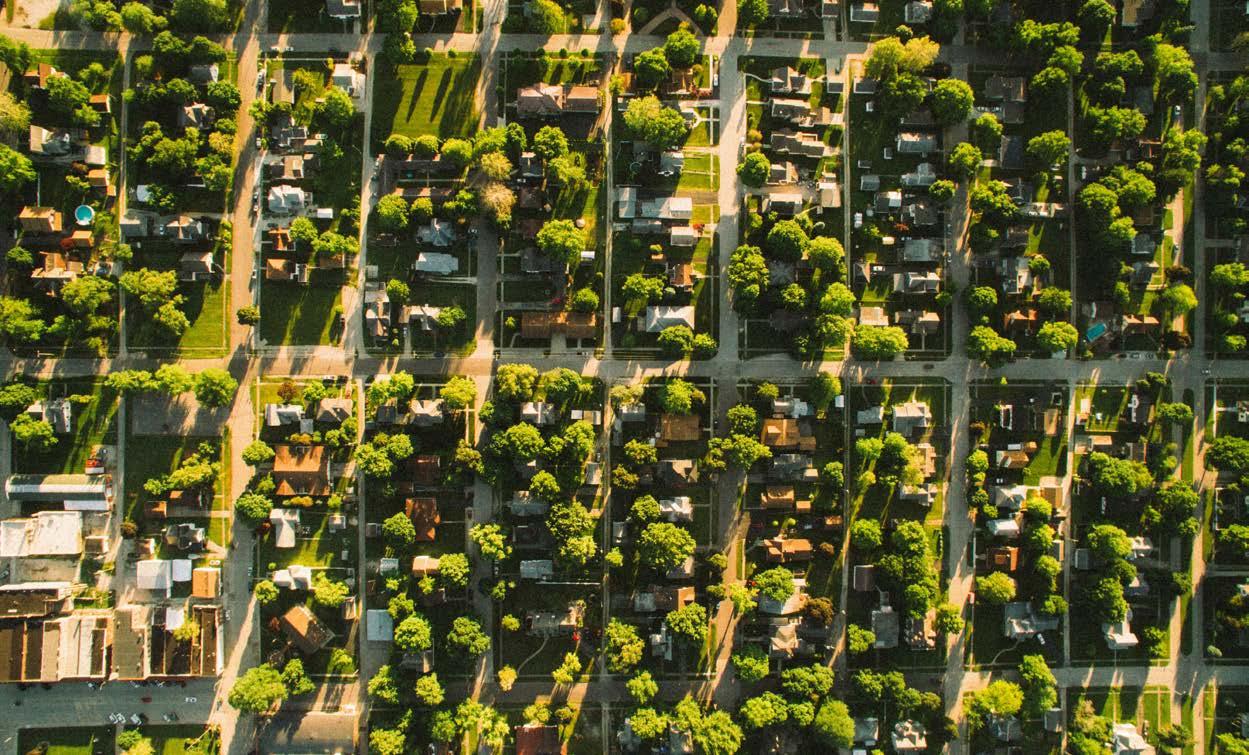

Image: Levi Arnold on Unsplash

Continued from previous

types, or approximately $223,000 in dollar terms

Mr Lawl ess noted: “Such a wide difference comes amid ongoing affordability constraints and a lack of newly built multi-unit housing supply, which seems counter-intuitive. Clearly, demand

preferences are still weighted towards detached housing options despite the substantially lower price points available across the unit sector.”

The combined regional markets (1.7%) are no longer outperforming, with the rolling quarterly gain once again favouring the combined capitals (1.8%). The stronger capital

city trend comes after nine months where the quarterly trend rate of growth has been stronger across regional Australia.

The stronger capital city trend isn’t evident everywhere, with regional markets in Vic (1.4%), Qld (2.5%) and SA (2.0%) continuing to outperform their capital city counterparts (1.2%, 2.3% and 1.5% respectively).

s u B u RB s ON t HE

RI s E: WHERE LIFE st YLE MEE ts

OPPOR tu NI t Y IN

2025

As the Australian property market continues to evolve, more buyers are looking beyond the obvious hotspots and turning their attention to emerging suburbs that blend lifestyle and long-term value. In 2025, lifestyle-led migration, flexible work, and shifting buyer priorities mean new growth pockets are popping up across the country.

So, where should you keep an eye if you’re searching for a place that feels like home and holds strong investment potential? Here’s a look at why certain suburbs are on the rise and how to spot your next opportunity.

WHY BUYERS ARE LOOKINg BEYOND THE CITY CENTRE

The pandemic reshaped how we live and work. Fo r many Australians,

the daily commute is no longer a dealbreaker, and buyers now value bigger blocks, outdoor space and a stronger sense of community. Suburbs with good schools, parks, cafes and transport links continue to attract families, first-home buyers and investors alike.

Affordability is another factor driving demand. With inner-city prices remaining high, buyers are happy

to trade a few extra kilometres for more space and a better lifestyle.

KEY FEATURES OF UP-AND-COMINg SUBURBS

If you’re on the hunt for an area with strong growth prospects, look out for suburbs that share these signs:

• Planned infrastructure improvements, like new train lines or upgraded highways.

• Population growth and new developments bringing fresh amenities.

• Revitalised town centres with cafes, small businesses and vibrant community spaces.

• Access to schools, healthcare and local services that support families and retirees.

• A healthy balance of owneroccupiers and rental demand.

ONES TO WATCH IN 2025

While every market is unique, here are some growth trends worth watching this year:

Image: Lisa Anna on

Image: Lisa Anna on Unsplash

Outer-Metro Suburbs: Many outer-ring areas around major cities like Brisbane, Perth and Adelaide are seeing steady growth as buyers search for more affordable houses with larger blocks.

Regional Lifestyle Towns: Regional towns with strong employment hubs, good schools and natural attractions continue to attract city escapees looking for a tree change or sea change.

Infill Suburbs: Older inner suburbs with new zoning or redevelopment plans often experience revitalisation, bringing young professionals and investors keen to

add value through renovations or new builds.

HOW TO MAKE THE MOST OF A gROWINg SUBURB

Buying in an emerging suburb can be a smart move if you do your research. Look at recent sales data, future development plans and local council investments. Visit the area at different times of day to get a feel for traffic, amenities and the community vibe.

Speak to a trusted local agent who knows the area well. They can help you identify hidden gems, avoid overpaying and secure a home that matches yo ur lifestyle goals.

KEY TAKEAWAY

In 2025, suburbs that offer a healthy mix of liveability and opportunity will continue to attract buyers and investors. Whether you’re planning to upsize, downsize or expand your portfolio, exploring emerging pockets could set you up for both comfort and growth in the years ahead.

Curious about which suburbs are on the rise near you?

Contact your local Century 21 agent today for local insights and advice you can trust.

Image: Alex Tyson on

Unsplash

H OW g OOD LAND s CAPIN g CAN BOO st YO u R HOME’ s

st REE t APPEAL

When it comes to selling your home or simply making it more inviting, first impressions count. The good news is, you don’t need a huge renovation budget to create a warm welcome. Smart landscaping is one of the most cost-effective ways to lift your property’s street appeal and make it stand out in any season.

Whether you’re preparing to sell or want to enjoy your outdoor space more, here’s why investing in good landscaping pays off and how to get it right.

WHY STREET APPEAL MATTERS

Buyers often decide whether they like a home before they even step inside. A tidy, well-maintained front yard signals that a property is cared for and creates a positive feeling

from the start. It sets the tone for what’s inside and can even add thousands to the final sale price.

Good landscaping can also make a home look larger, highlight its best features and help it feel connected to its surroundings.

EASY LANDSCAPINg IDEAS THAT MAKE A BIg DIFFERENCE

You don’t have to overhaul your entire garden to see results.

Small, well-planned updates can dramatically boost street appeal.

Start with the Lawn:

Keep it neat, healthy and edged. If your lawn is patchy, reseed or consider fresh turf for an instant lift.

Add Native Plants:

Choose hardy Australian natives that thrive in your local climate. They’re low-maintenance, water-wise and add year-round colour and texture.

Frame the Entrance:

Use garden beds, potted plants or hedges to draw the eye to your front door. A clear, welcoming path makes the entry feel more inviting.

Refresh Mulch and Garden Borders:

Fresh mulch tidies up garden beds and helps keep weeds down. Clean, defined borders make your landscaping look intentional and cared for.

Update Outdoor Lighting:

Soft path lights, uplighting for trees or a feature light by the door can transform your garden after dark and add extra security.

Image: Digital Marketing Agency on Unsplash

Image: Mathias Reding on Unsplash

COMMON LANDSCAPINg MISTAKES TO AVOID

When planning your landscaping, think long-term. Avoid overcrowding plants, which can make the space feel smaller and create extra maintenance work. Choose plants that suit the local soil and sunlight so you don’t spend more time and money replacing them later.

If you’re unsure, keep it simple and neat. A clean lawn and a few well-placed plants often look better than an overcomplicated garden.

WHEN TO CALL IN THE PROS

While plenty of landscaping tasks can be tackled as weekend projects, larger jobs like installing irrigation, building retaining walls or planting mature trees are generally best left to professionals. An experienced landscaper can help design a layout that complements your home’s style and maximises your block.

KEY TAKEAWAY

First impressions matter, and great landscap ing is one of the easiest

ways to boost your home’s street appeal and add real value. Whether you’re getting ready to sell or simply want your home to look its best, a well-kept garden makes all the difference.

Thinking about selling and want to know which updates will pay off?

Contact your local Century 21 agent for trusted advice on how to present your home at its best.

Image: Mitchell Luo on Unsplash

W HAt tO EXPEC t At AN HOME OPEN:

B

u YER E t IQ u E tt E AND IN s IDER t IP s

Attending a home open is an exciting step in the property search, but it can feel a bit daunting if you’re not sure what to expect. Whether you’re a first-home buyer or a seasoned investor, knowing how to approach an inspection can help you make a smart decision and leave the right impression if you’re serious about making an offer.

Here’s what you need to know before stepping through the front door of your next open home.

DO YOUR HOMEWORK FIRST

Before you head out, spend some time researching the property. Check the listing details, look at recent sales in the area and plan your route so you arrive on time. Bring a notepad or use your phone to jot down any questions you might have for the agent.

It’s also a good idea to read the contract of sale if it’s available. This can help you understand what’s included and if there are any conditions attached.

ARRIVE ON TIME AND BE RESPECTFUL

Home opens are usually scheduled for a set window, often 30 minutes. Arriving on time ensures you have enough opportunity to look around and chat to the agent without feeling rushed.

Be courteous to the homeowner’s space. Wipe your feet, avoid

touching personal items and keep children close by if they’re with you.

KNOW WHAT TO LOOK FOR

It’s easy to get distracted by fresh paint and styling, but make sure you look deeper. Pay attention to things like:

• Storage space and cupboard sizes

• Signs of damp or water damage

• Natural light and airflow

• Noise levels, both inside and outside

• The condition of fixtures and fittings

Don’t be afraid to open cupboards or windows if it helps you get a better feel for the property’s condition.

ASK THE RIgHT QUESTIONS

An open home is your chance to gather as much information as you can. Ask the agent about the property’s history, any recent renovations, average utility costs and why the owners are selling.

If you like the property, find out if there’s a lot of interest and how soon offers need to be submitted.

BE HONEST WITH THE AgENT

Agents appreciate genuine feedback. If you’re keen, let them know so they can keep you updated about offers or upcoming inspections. If you’re not interested, it’s fine to say so politely.

Leaving your details with the agent is a good way to stay in the loop if you’re still deciding.

CONSIDER THE NEIgHBOURHOOD

An open home isn’t just about the house itself. Take a walk around the neighbourhood before or after the inspection. Check for nearby parks, cafes, shops, public transport and the general vibe of the street.

If possible, visit at different times of day so you know what parking, traffic and noise levels are really like.

KEY TAKEAWAY

A home open is your chance to get a clear picture of whether a property is the right fit. With a little preparation, good questions and respectful etiquette, you’ll make the most of every inspection and feel confident about your next step.

Image: Brad Chapman on Unsplash

READY TO FIND YOUR DREAM HOME?

Contact your local Century 21 agent today for expert advice and access to the latest properties in your area.

Image: Valeriia Miller on Unsplash