Quarterly Market Update Q3 2025

Section 1:

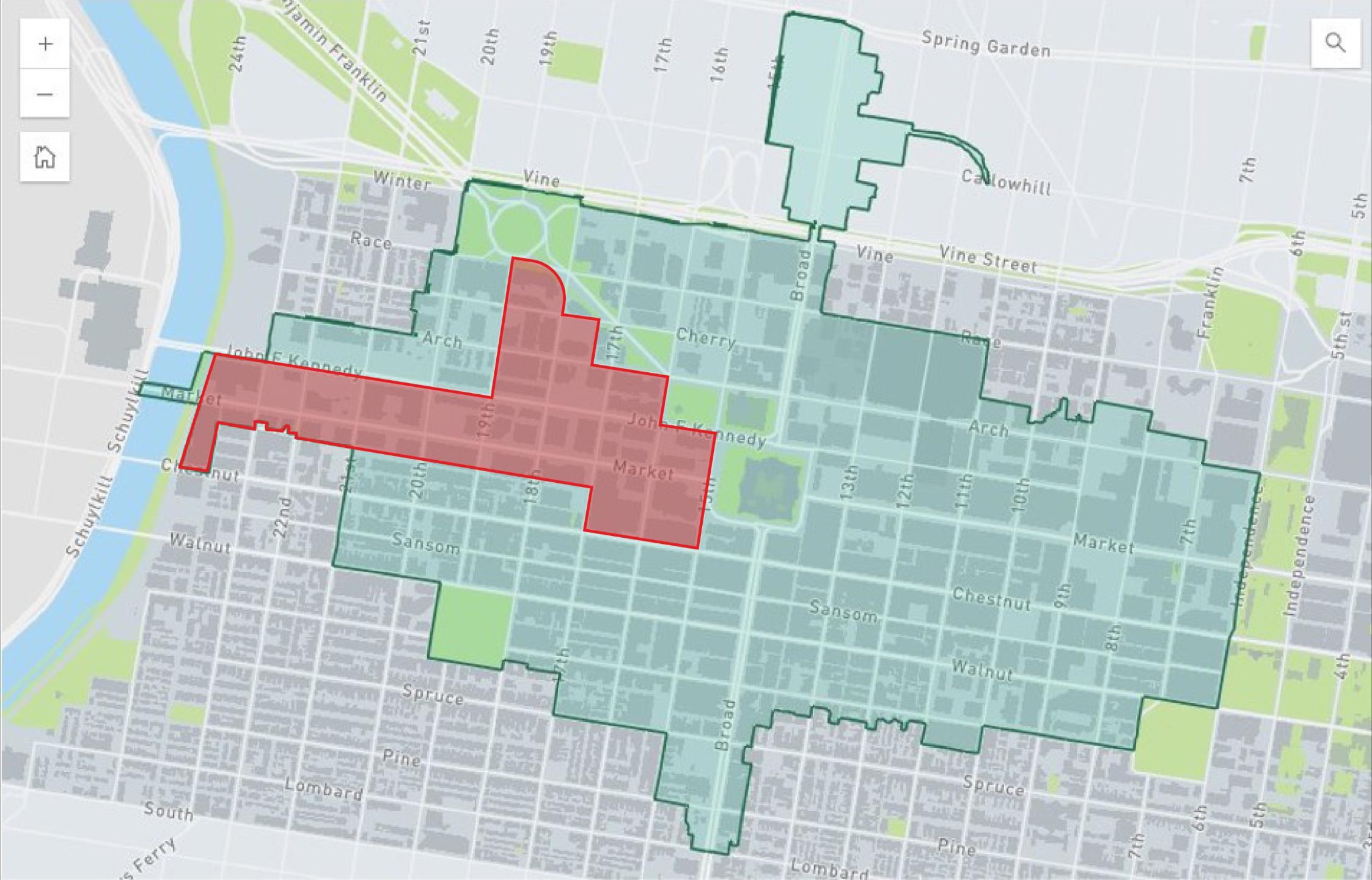

Center City District

Boundaries

Section 2: West Market Office District

Section 1:

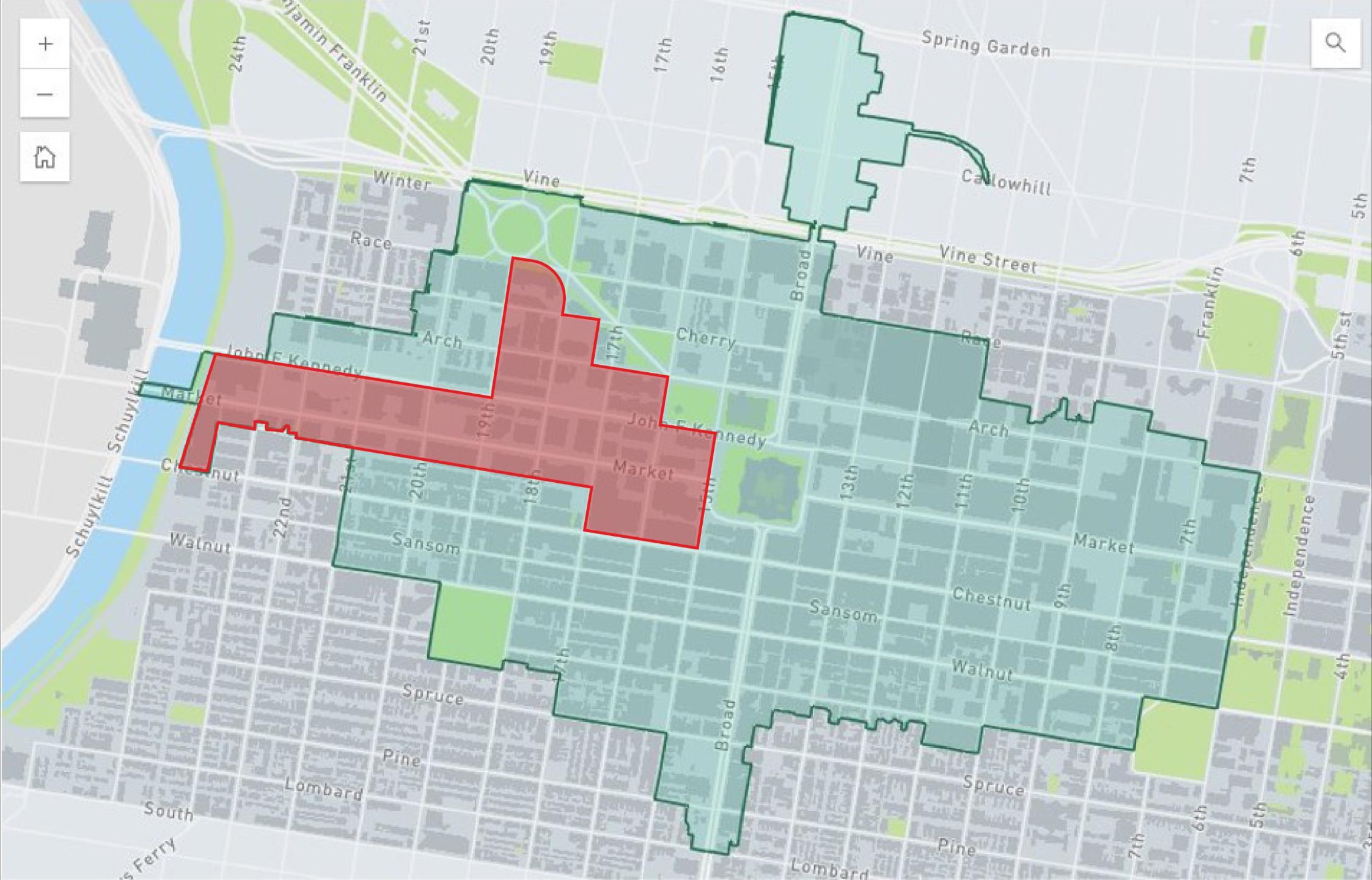

Center City District

Boundaries

Section 2: West Market Office District

84 Leases Signed Through Q3 2025 YTD

August 2025 RTO Rate: 68% Down 6% MoM Down 1% YoY Q3 2025 Office Occupancy 77.3% Down 0.1% QoQ

The number of office leases signed within the CCD boundaries through Q2 2025 decreased 48% compared to 2024, but overall leased space was only down 15%, meaning that average deal size has ticked up. Total office vacancy is hovering at 77.3%. Employee volumes within CCD boundaries during typical office hours are around 67.7% of pre-pandemic levels.

Leasing activity hit a threequarter high in Q1 2025 thanks to large renewals from Duane Morris and Faegre, Drinker, Biddle & Reath recommitting to their spaces at 30 S. 17th Street and One Logan Square, respectively.

Q2 leasing saw a return to volumes experienced at the end of last year, and a return of Trophy buildings dominating in terms of the share of total activity.

Source: CoStar

Direct deals with landlords continue to make up the overwhelming majority of leasing. Much of the market's sublease space is in older, commodity assets that are poorly positioned to compete for most of the larger tenants in the market, many of which are law firms who typically seek out high-quality fit-outs.

As of Q2 2025, Center City’s sublease availability rate stands at 4.8%, compared to 1.5% in Q4 2019. However, since 2021, an average of three sublease deals are completed per year, compared to 5 per year between 2016 – 2019.

Source: CoStar

Duane Morris reaffirmed their commitment to Center City, by renewing their lease at 30 S. 17th Street until 2039 at nearly 196,000 square feet. This represents a 19% reduction of space from their previous lease, opening up some space in their building but keeping a larger share of their footprint than other large law firms.

Following FS Investments – now known as Future Standard – in their move from the Navy Yard to Schuylkill Yards, Ben Franklin Technology Partners is relocating from the Navy Yard into 12,111 square feet on the 3rd floor of 1600 Market. The new lease is for ten years, a significant commitment to a more centrally accessible location.

Hogan Lovells Hangley, Aronchick, Segal, Pudlin & Schiller

Several law firms recommitted to 1735 Market in the second quarter, an indicator of the relative stability Trophy properties are experiencing as tenants consider options during lease renewal periods. Hogan Lovells renewed two floors for a ten-year term, while Hangley, Aronchick, Segal, Pudlin & Schiller signed a twelve-year deal for one full floor.

McKinsey has extended their lease in their 2929 Arch St, location for an additional twelve years. The firm, which was more than doubled its employee headcount in Philadelphia over the last decade, credits the fact that “most McKinsey employees either live in walking distance to Cira Centre or can commute easily to nearby 30th Street Station, and clients also see the space as easy to access.”

PMC Property Group acquired Ten Penn Center (1801 Market Street) at the end of Q2 2025. The 27-story office building was bought for $30 million, less than half of its last sale price of $75 million back in 2006.

Ten Penn Center is currently 65% occupied, and upper floors may be a target for residential conversion in-line with PMC’s recent work at Three Parkway.

Once valued at more than $471 million, Centre Square has been reassessed in multiple consecutive years and is now appraised at $223.5 million per CMBS reports.

The combined occupancy rate of both towers stands at only 36%, and the property is another residential conversion candidate. Its size would make it the largest residential conversion by far in the history of the office district if it proceeds.

2000 Market was sold to New York based investors CSB Holdings and Tide Realty Capital for $45.5 million. This figure represents a 64% discount from the $126.4 million that the previous owner, Nahla Capital, acquired the property for in 2018.

1635 Market Street was reassessed at 45% of its previous value after multiple appeals to a current value of $28.3 million. When Nightingale purchased it from the Arden Group in 2014, they paid $39 million. Now owned by Intervest, the property is 70% occupied. Intervest is also an owner of 1500 Spring Garden, which has also seen substantial reductions in assessed value.

Trophy vacancy remains by far the lowest in Center City, dropping slightly from the previous quarter. Class A vacancy now sits above 25% having increased steadily every quarter for the last year.

Source: CoStar

Several large events disrupted absorption data in the second quarter. The Wanamaker showed massive negative absorption despite most tenants already having departed, and the previously announced closure of the SEC office at One Penn Center was reversed by DOGE.

Manually adjusting for these erroneous listings of new space, net absorption was very close to neutral for the second quarter.

Source: CoStar

Across CCD's boundaries, non-resident workers (across all sectors) are present during the workday at rates similar to 2024 levels. July 2025 saw a large jump compared to July 2024, but these gains are at risk due to SEPTA’s budget crisis, as evidenced by the slight drop in August’s RTO rate.

Methodology note: These data are provided by Placer.ai using anonymized samples of cell phone locations. A recent change by Placer.ai in its categorization of what constitutes a visitor and an employee have resulted in employee volumes decreasing and visitor volumes increasing as the platform more accurately determines who is traveling regularly for employment.

Source: Placer.ai

Cake and Joe

1735 Market

1,200 s.f.

Five Iron Golf

Three Logan Square

4,800 s.f.

This will be the third location for South Philadelphia-founded Cake and Joe, which operates in Pennsport and Fishtown. This brings a much-needed coffee and food offering to the primary office corridor.

Five Iron Golf is now open at Three Logan Square, bringing an experiential activity to the office district while expanding options for happy hours, corporate outings, and wellness events.

Unnamed Japanese Restaurant

1515 Market

TBD

A new concept from local restaurateur Teddy Sourias, who operates the adjacent Uptown Beer Garden, will replace the HSBC Bank with an active use that can draw activity into the evening hours. Timing is TBD.

Revolution Taco Express & Pagano’s

Comcast Concourse

TBD

As workers have returned to the Comcast Campus, the Concourse is undergoing a refresh with new dining options on the way.

300,000 s.f.

Now called 17 Market West, the building welcomed its first tenants at the beginning of May even as full build-out of amenity spaces is ongoing.

121,500 s.f.

MM Partners is undertaking this conversion, which will bring more residential density to Arch Street along the northern edge of the office district.

Parkway Complete

175,000 s.f.

The lower stack of the building, recently vacated by Drexel, will accommodate 143 apartments while the top ten floors of the building will remain as office. Several floors are finished and move-ins are underway.

Ten Penn Center Proposed

675,000 s.f.

JLL is in the market with this Penn Center office tower, the largest building to come up for sale in several years. A partial conversion to residential in the upper stack of the building is one idea being considered.

While the rate of return is not as high within the West Market office district as it is across the more diversified CCD area overall, 2025 rates of RTO have outpaced last year in every month except February and August, when SEPTA was forced to begin instituting service cuts due to the

month.

Methodology note: These data are provided by Placer.ai using anonymized samples of cell phone locations. A recent change by Placer.ai in its categorization of what constitutes a visitor and an employee have resulted in employee volumes decreasing and visitor volumes increasing as the platform more accurately determines who is traveling regularly for employment.