ASA REVIEW

Emerging Leaders discuss hot-button industry topics.

Zach Theisen (T&S Brass, left) and NIBCO’s Kayla Palmer at EMERGE2025.

Photo by Steve Woltmann/ASA

FROM THE CEO

In tightening markets, the value of a national trade association is never more important

I talk often to members, and virtually every time I do, I ask how they are doing and what do they see for the remainder of this year.

It’s clear that things are getting a little tighter with markets flattening out. When I’m in the office, I usually have one of the business shows on as background noise, which is probably a mistake since every day, they tend to change their predictions.

But clearly, things are changing.

Our markets are tightening and members are worrying that we might get the recession that has been predicted for two years. And finding reliable data to base decisions on is of upmost importance.

This is where ASA is shinning and members should get closer to us as markets tighten. Our monthly economic written reports and webinars from ASA Chief Economist Dr. Chris Kuehl are invaluable. Our annual Operating Performance Report is unequaled as a tool for members to identify how they are doing. In this issue, we report our 2024 OPR results that outline how our members are doing compared to the markets and their competitors.

Also in this issue, we have the results of our ASA Quarterly Market Survey where manufacturers take center stage, in a report all parts of the supply chain will find particularly insightful.

Graham Walker’s Part 2 to his data-driven guide for PHCP/PVF distributors walks our members through the artificial intelligence phenomenon, leaving behind the hype of the technology and focusing on some real-use cases.

Motivating and guiding your teams during tightening times is critically important. In this issue we discuss the benefits of investing in your teams in a variety of ways, whether it’s in our new, growing Master of Distributipn Management (MDM) program, engaging them in best practice events such as Emerging Leaders or helping to create a welcoming culture to attract future employees — all valuable in getting the highest performance out of your teams.

Check out in this issue some of the chatter that occurred during the ASA Emerging Leaders’ annual best practices roundtable session in Boston this spring, plus ASA Vice President of Education and Training Taylor Albano has a great overview of that exciting MDM program and how your team can benefit as markets get tighter and you need your teams to step it up.

Getting even closer to customers is also a critical endeavor as markets tighten. Scott Stockham’s article on how to implement a CRM the right way is vital in improving your team’s ability to connect with customers and will provide helpful tips even if you have a robust CRM already in place.

We are proud of this exciting quarterly publication and hope you and your teams are getting some actionable ideas from these insightful articles. Want to hear about some informative topics that we haven’t written about yet? Let us know.

Thank you for being a member and supporting our mission.

Mike Adelizzi CEO

Simplify your sales, from client mgmt to order processing.

Centralize your data, improve efficiency, & make better decisions with Distifabric.

7/9/24 9:56 AM

ASA builds strong networking programs with revamped regions

First ASA Central Summit draws rave reviews.

By Mike Miazga, Vice President Sales-Operations mmiazga@asa.net

ASA continues to gain momentum with the expansion of its regional networking summits.

The first ASA Central Summit drew a crowd of 150 attendees (including reps from 25 distributor firms) in June to the InterContinental Kansas City at the Plaza, further bolstered by the tremendous support of 33 vendor and rep sponsors.

The day-and-a-half program was jam-packed with educational, best practices and networking opportunities. Attendees heard a mid-year economic update from ASA Chief Economist Dr. Chris Kuehl, while also hearing from keynote speakers Dave Kline and Anthony Huey on leadership and sales/ communication, respectively.

A best practices roundtable session drew rave reviews, while networking opportunities included the first ASA Central Summit Open golf tournament, a night-out bash at noted Kansas City Plaza restaurant Gram & Dun, plus a well-received vendor/sponsor tabletop opening reception where attendees were able to catch up with vendor and rep partners at their display tables in a relaxed setting.

The Central Summit is a byproduct of the ASA Central region expanding to include 13 states stretching from Texas to Minnesota and Colorado to Illinois. The 2025 Central Summit takes place June 18-19 at Loews Arlington Hotel in Arlington, Texas.

A month later, the ASA Northeast Summit presented its third event since the pandemic, setting both attendance and

sponsorship records in its return to Live! Hotel and Casino in Philadelphia. The event, which also featured a night out networking gathering in the Bill Giles Suite at Citizens Bank Park for a Philadelphia Phillies-New York Yankees baseball game, was capped off by a keynote presentation from PRmarketing guru Steve Cody and standup comedian Clayton Fletcher, who provided ASA Northeast attendees with some tips for properly incorporating laughter in the workplace and sales process straight out of their new book “The ROI of LOL.”

The 2025 Northeast Summit takes place June 11-12 at The Graduate Hotel in Annapolis, Maryland where all attendees will head to the U.S. Naval Academy to participate in a special leadership course.

And to top it off, ASA’s brand-new West region, which includes 11 Western states spanning California to Washington state as well as Arizona, Utah and Nevada among others, debuts its ASA West Summit May 7-9, 2025 at Meritage Resort and Spa in Napa, California where a networking trip to the famed Inglenook winery is among many exciting events planned.

The ASA Central Summit attracted 25 distributor firms to Kansas City for a day-and-a-half of education, best practices sharing and networking. Photo by Mike Adelizzi/ASA.

More than 30 supplier and rep firms that sponsored the ASA Central Summit took part in a well-received tabletop opening reception. Photo by Mike Adelizzi/ASA.

EMERGING LEADERS

Emerging Leaders share thoughts on hot-button issues during record-breaking Boston conference

By Mike Miazga, Vice President Sales-Operations mmiazga@asa.net

While ASA’s two-decade-plus-old Emerging Leaders group broke new records during its EMERGE2024 event at the Westin Copley Place in Boston this spring, one thing remained the same.

The group’s pioneering best practices roundtable session again proved to be a major hit and a continued source of high value to the record 250 people in attendance in Boston (EMERGE also enjoyed record sponsor participation).

Attendees gathered in groups of eight to discuss hot-button issues, challenges and potential solutions to those challenges through best practices sharing.

Differing slightly from ASA’s regional best practices roundtable format where all parts of the supply chain are grouped together to provide a specific regional supply chain perspective, the Emerging Leaders setting separates tables by wholesalers, suppliers and independent manufacturers’ representatives.

Yet again, a main topic of discussion among the nearly 30 tables in Boston was the labor market, both in the difficulty finding good help and ways to keep folks in organizations.

“There are staffing issues, still,” noted one table captain (from a wholesaler). “There is difficulty finding people who don’t want to have their cake and eat it, too.”

On the subject of creative ideas to retain employees outside of salary-related perks, one table jotted down ideas such as set hours with no overtime, work-life balance and remote working. Another table bandied about the idea of retaining staff and expanding company knowledge by moving people around for a better fit for their skills.

EMERGE2024 in Boston at the Westin Copley Place set a new attendance record with 250 people, including more than 40 unique distributor firms in attendance. EMERGE2024 also enjoyed record sponsorship support.

The best practices roundtable session during EMERGE2024 in Boston drew a packed house where attendees shared ideas and solutions regarding subjects such as private labeling, transportation, retaining employees and combating deflation/lower margins. Photos by Steve Woltmann/ASA.

Recruitment-wise, one manufacturer at a particular table does a training program where it brings in six-to-eight students per year to show them what options are available and where they could potentially work, whether it be engineering, manufacturing, purchasing or customer service.

Private label products

Another popular topic in Boston was the increase in private label products and how to compete against them.

“Private label products are a curse and a blessing simultaneously,” noted one table captain, who wrote about long lead times for Asian shipments as being on the curse side of the ledger.

Another table captain agreed customers are getting private-label products directly from overseas — residential customers more so than commercial. “The commercial side still requires bid and spec work, which cannot be overcome by cheaper pricing.”

That same table noted phone calls and warranty claims are higher for private label items, “more issues,” the table captain explained, “causing more legwork on the back end for the manufacturer/customer. It’s only cheaper on the front end. Paying for quality typically leads to a better experience vs. lower pricing.”

Artificial intelligence

On the topic of AI, one table wrote down uses such as for job descriptions, setting pricing margins based on region and previous sales, and credit released based on thresholds.

Another table held a lengthy discussion on the AI topic with it being used to break down email. “What’s a quote vs. inventory vs. troubleshooting?”

That same table ended its AI notes entry with a line about actively looking for AI initiatives, “a solution to product differentiation or service differentiation,” wrote the captain, who followed with low awareness and hard to generate an ROI when it comes to current AI usage.

Current market conditions

One table tossed around the topic of stopping deflation, noting it’s OK to walk away from business, while also important to sell yourself and your company and not the product. That same table said at the time of the Boston meeting the election year was not affecting business, but legislation on import material will be one avenue where the industry could see issues. The table added products such as copper tubing, PVF pipe and water heaters have seen price increases. “You don’t want too much inventory when the price drops,” the table captain said.

Another table, when speaking about combating deflation and market erosion noted, “You need to speak about value because as a company you still have cost,” the table captain said. The same table also talked about having negative margins to keep jobs and also the current-day challenges related to internet pricing.

Rep wants

Another popular topic in Boston was the characteristics folks look for in a quality rep firm. One table listed attributes such as: tech savvy and knowledge, as well as connections to plumbers, wholesalers engineers and contractors, while another listed being in front of the end user, being responsive and showing up, product knowledge, willingness to change and adapt and to own up when you screw up.

Another table talked about reps and their succession plan, staying in a rep’s top-five lines, onboarding new rep agencies, “How to equip people to sell our products as best as possible,” the table captain wrote.

Other topics of discussion during the 90-minute session included transportation, specifically tracking products that go across state lines, third-party delivery options including from DC to branch, as well as various operational software options such as RebatePros, Curri and Prokeep and how to deal with difficult people.

ASA’s Emerging Leaders EMERGE event heads to Las Vegas May 13-15, 2025 at the Four Seasons on the strip.

In addition to the best practices roundtable session, EMERGE attendees took part in an educational workshop on creative thinking skills.

EMERGE2024 in Boston featured no shortage of networking opportunities for the 250 attendees.

MERGERS AND ACQUISITIONS

Part 2: Why independent wholesalers sell their businesses Four owners explain their reasons for selling.

By Brad Williams, Managing Director, The Beringer Group

In the Q2 2024 issue of ASA Review, we took a look at five tips for estate planning in order to effectively safeguard your company’s future.

But what if your company’s future involves selling? Deciding to keep or sell the family business is a difficult decision every business owner must face. Below are chats with four business owners who shared their personal experiences, revealing what led them to part ways with their family business. Their advice could aid you when making those difficult business decisions, and help you come to a conclusion you feel confident and comfortable with.

Between generational ownership

Adam Zima was the third-generation owner of Capitol District Supply, a family-run kitchen and bath supply company in New York, established in 1945.

Zima explains the company’s unique position between generational ownership was the driving factor behind the decision to sell Capitol District Supply. With multiple families holding ownership interests, each at different stages of their lives and careers, Zima met with an outside consultant and started exploring a variety of options.

After carefully considering multiple compelling proposals from external companies, Capitol opted for a hybrid approach. This involved selling the business operations to an external company while smoothly transitioning the real estate holdings internally within the family.

Zima recommends multi-generational business owners looking to sell bring in advisors sooner rather than later. He goes on to say, “Once we partnered with an expert, it was apparent we could have benefited from advice and planning many years before we started our process.”

Exploring your options

Roy Williams was the owner of Williams Wholesale Supply, a family-run electrical and plumbing wholesaler in Cookeville, Tennessee, established in 1939. Spanning four generations, Williams was the third generation, and his two sons represent the fourth generation.

Williams explains the decision to sell was not driven by a single factor. Williams and his sons recognized that to expand their business they needed to assess the market’s potential, which required financial resources currently unavailable to them. Consequently, Williams took the initiative to reach out to an advisor in succession planning to explore their options.

“Focus on finding a buyer who will embrace and uphold your business philosophies, ensuring the continuation of your family’s values.”

—Roy Williams, Williams Wholesale Supply

Williams was presented with the idea of going out to the market and running a competitive process, but one potential buyer stood out to him and his sons. The reasoning behind their

choice (Winsupply) was straightforward. As Williams states, “They had no negatives.” The buyer, Williams adds, ensured the welfare of the company’s employees and allowed Williams’ sons to retain a portion of the family enterprise.

Williams offers valuable advice to others looking to sell: “It’s crucial to look beyond the highest bid. Instead, focus on finding a buyer who will embrace and uphold your business philosophies, ensuring the continuation of your family’s values.”

Nearing retirement age and loss of business allure

Lee Steinhouse was the owner of Steinhouse Supply Co., a prominent wholesale plumbing distributor in Nashville, founded by his father and later handed down to Steinhouse and his two brothers.

Steinhouse explains how he and his brothers gradually lost their motivation. They grew tired of the never-ending competition with regional and national chains, transitioning from leaving by 4 or 5 in the afternoon to working late. Steinhouse openly admits, “Running the business had lost its allure.” Recognizing the need for an exit strategy, Steinhouse and his brothers reached out to a mergers and acquisitions expert.

“It’s never too early to start planning for the future.”

—Roy Williams, Williams Wholesale Supply

Steinhouse explains how finding an advisor with an extensive background in the plumbing industry played a pivotal role in attracting interested buyers, and as he explains, “surpassed the assistance that any local M&A company could offer.” This led to Steinhouse Supply Co. being acquired by Southern Pipe and Supply based out of Meridian, Mississippi.

Following the sale, Steinhouse advises business owners, “It is never too early to start planning for the future.”

Lack of future management

Robert Berman was the owner of Avon Supply Co., a plumbing and heating wholesale distributor located in Wakefield, Massachusetts, family-owned for 63 years. Berman was the second-generation owner, following in his late father’s footsteps.

Berman explains how the main factor driving his decision to sell was the lack of future management. Despite his strong performance and good health, he realized the business could not sustain itself without him, especially with aging key employees and outdated systems.

Berman considered his two daughters as successors, but neither was raised in the business, and had other interests. He wondered if rebuilding was an option but knew it would take a lot of energy. Berman concluded that a new generation of leadership was required to take the business to the next level.

Berman understands that everyone’s situation is different. He advises, “If one does sell, having an advisor on your side reduces the stress, increases the odds of success, and results in net sale proceeds at or above what you are apt to negotiate on your own.”

Zima, Williams, Steinhouse and Berman can attest that selling your business is one of the most difficult decisions a business owner has to make. They agree putting the business in the hands of someone you can trust can make the process run smoothly and enable you to find the best option for you and your family.

Brad Williams is the managing director of The Beringer Group (www.theberingergroup.com), which has worked with privately held businesses and heads of family companies since 1979.

Capitol District Supply opted for a hybrid sale that involved selling business operations to an external company while transitioning real estate holdings internally within the family. Shutterstock Photos

ASA University’s Master of Distribution Management provides strong value as the reimagined program takes hold by members Members share their MDM experiences and the value it provides their companies.

By Taylor Albano, Vice President Education and Training talbano@asa.net

ASA University’s Master of Distribution Management (MDM) program underwent a transformative overhaul last year, setting a new standard for leadership development in the distribution industry.

As the inaugural cohort sails past the midway point of its journey, we delve into their experiences, reflecting on the program’s enhancements and the impact on participants.

The MDM program, which has been growing industry leaders for more than a decade, has always focused on contextualizing leadership within the distribution sector’s unique challenges. However, recognizing the need for continuous improvement, ASA University embarked on a mission to enhance the program further.

One of the most notable additions to the program is the “Essentials of Practical Leadership in Wholesale Distribution” publication. Authored by industry experts, this book covers

core leadership skills essential for navigating the complexities of the distribution industry.

Brian Tuohey, CEO of The Collins Companies in East Windsor, Connecticut, and member of the MDM work-group responsible for the new program, shares: “Industry leaders have prepared and written the MDM curriculum based on their own personal experiences – truly invaluable information. CEOs, presidents, and business owners share insight you can’t get anywhere else.”

Flexibility has been another cornerstone of the program’s redesign. Recognizing the diverse needs of its members, ASA University now allows learners to customize their experience by electing supplemental training tailored to their specific requirements. This flexibility extends to the timeline as well, with the program now designed to be completed within a 12-month timeframe, reducing the burden on both students and their mentors.

“I was particularly intrigued by the program due to its emphasis on equipping leaders with the necessary skills to lead by example and gain a comprehensive understanding of the wholesale distribution industry,” says Chris Walther ,

ASA University’s Master of Distribution Management program underwent a transformative overhaul in 2023.

vice-president of operations at Oakland, California-based Rubenstein Supply. “We value the importance of effective leadership in driving success and fostering growth within our organization.”

The revamped MDM program also prioritizes peer-to-peer interactions, addressing the feedback from members who expressed a desire for greater community and networking opportunities. Moving away from individualized schedules, the program now operates on a cohort model, fostering collaboration and camaraderie among participants.

“Having real examples from other companies in different states facing similar challenges, despite varying in size, has been the most impactful for me,” says Bryan Morales , one MDM student from member-company CIB Corp. in Puerto Rico. “While the challenges may have different scales, the essence remains the same, which has made me more open to listening and receiving advice from colleagues whom I previously thought were unrelated to our situation.”

Monthly virtual touchpoints allow students to discuss key topics from the Essentials book, share insights, and engage with industry luminaries.

“Unlike other programs, the fact that this one emphasizes explaining and sharing what we’ve learned has made me feel much more confident in sharing my experience with my colleagues,” Morales adds.

Walther chimes in: “Collaborating with peers allows for diverse perspectives and insights to be shared. Everyone brings their own unique background, expertise, and experiences to the table, enriching the discussion and leading to more comprehensive and innovative solutions. By engaging in group discussions, I’ve been exposed to a wide range of viewpoints that have broadened my

understanding and challenged my thinking in ways that wouldn’t have been possible on my own.”

Speaking of mentors, the program has introduced a mentor orientation and revised resources to enhance their effectiveness in guiding students. One such resource, ASA’s Mentoring Handbook, is offered to mentors at no cost to ensure success with their students. Part of the role of mentor is guiding their student towards their capstone presentation, which challenges students to apply their newfound skills to real-life business problems, ensuring practical relevance.

“The MDM program from ASA provides the ideal framework for people to develop the skills necessary to be successful in our industry.”

—George Yezbak, N.H. Yates

“The greatest joy in my career has been the opportunity to mentor and coach others,” says George Yezbak , a longtime ASA volunteer from member manufacturers rep firm N.H. Yates, and mentor to Yates MDM student Todd Yates “The MDM program from ASA provides the ideal framework for people to develop the skills necessary to be successful in our industry, and it requires participants to have a mentor. It is an honor to be able to fill that role as a mentor within our organization.”

As the program approaches its culmination, ASA University is proud of the strides made in developing the next generation of distribution industry leaders. With the first class already halfway through its journey, the university looks forward to welcoming future cohorts and continuing to shape the industry’s brightest minds.

For those eager to develop their future leaders, registration for the next MDM class is now open. For more information and to register, visit ASA.net/MDM or reach out to Taylor Albano, vice-president of education and training, at talbano@asa.net.

40 20 29

Since the MDM revamp launched, 40 new students have enrolled in the program.

In 2024 alone, 29 new students have entered the MDM program.

More than 20 MDM peer-to-peer sessions have occurred since the program’s relaunch.

The revamped MDM program also prioritizes peer-to-peer interactions, addressing the feedback from members who expressed a desire for greater community and networking opportunities.

Photos by Taylor Albano./ASA.

How new sales tactics can provide critical new funding to ensure labor challenges melt away

By Randy MacLean, WayPoint Analytics

Highly profitable companies can become practically immune to the labor shortage as they fund high wages and great working environments.

Nearly every company can do the same, and in this article, I’ll share how it’s being done.

Labor shortage

Declining birth rates and increasing college education rates have coalesced into a significant labor issue in western countries. The cohort of non-college-educated 20-35-yearolds has declined from 31M in 2000 to 25M in 2022. This diminishing labor pool is not only the source of our warehouse, delivery and clerical employees, but also shared with construction, manufacturing, hospitality and the military.

This has driven wages in wholesale/distribution from $22.04 in 2006 to $33.84 in 2023. We’re competing with a host of other employers for a smaller number of people. Turnover is reaching frightening levels.

The outlook is bleak — birthrates dropped below replacement levels more than a decade ago, and this is not going to get better. If this reversed right now, it will be two decades before the newborns enter the workforce.

The solution (big picture)

Simply put, there are three focus areas companies need to adopt — and quickly:

Companies MUST adapt to much-higher, competitive wage rates;

As far as possible, labor must be utilized ONLY where it’s absolutely necessary and contributes to profits, not losses; and

Higher wages must be funded by gains in customer profit generation.

To amplify the first of the three points, your company will have to be capable of offering industry-leading (not just industrymatching) wages. You’ll need to obtain and retain the labor needed to serve customers. Turnover needs to be avoided — it reduces your customer-centric focus and absolutely destroys customer service levels.

For the second point, labor will have to be deployed more sparingly, directed to customers and products that drive sufficient profit levels to fund it. Productivity and efficiency measures, combined with detailed cost analysis, is needed to know (for sure) if this is being done.

And for the third, detailed customer profitability analysis drives the funding for more competitive wages, and also the deployment of labor to both customer accounts and product categories that provide the new profits needed for funding wage increases.

Finding balance

It’s no surprise that customers have differing values to your financial results. The startling realization is the shockingly high proportion of sales are actively destroying already-made profits. Industry-wide, more than 60% of sales are unprofitable by any measure.

Higher wages must be funded by gains in customer profit generation. Shutterstock Photo.

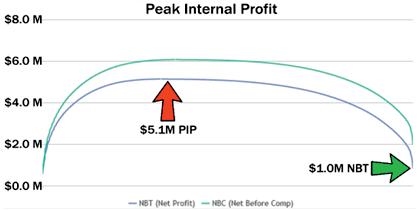

The company made over $5M (PIP) on money-making sales, but retained only $1M (NBT) after accounting for money-losers. Reducing labor on money-losing activities is key.

The reason for the difference between PIP (Peak Internal Profit) and NBT (Net Before Taxes, or bottom line) is because most sales are money losers. Let that sink in more than half of what you write destroys more than half the profits you’ve already made!

In fact, if you get that 60% down to under 50%, you can have industry-leading profit rates. Shifting the balance to more highconversion, money-making accounts and fewer profit-draining accounts is the only way to drive up cash-flow and profits, and is the key to funding more competitive wages.

What really drives customer profitability?

Operating profitability is driven by OpCash (“operating cash” or gross profit dollars), driven by volume and margin which represents the ceiling on available profit, less Cost-to-Serve (expenses incurred to service the account).

Most companies have pretty good customer-level information on OpCash (gross profit) and have nothing at measuring customer-level Cost-to-Serve. Without the whole picture, profit management is practically impossible, and initiative effectiveness ranges from disappointing to outright destructive.

Companies cannot excel without accurate and detailed cost analytics.

Customer profitability analysis

Most sales lose money, thus cancelling profits already made on profitable ones. This sets the stage for effective action. Shifting the balance between profitable and unprofitable sales is what propels market leaders to the top.

The predominant factor in customer profit generation is individual customer cost-to-serve (or expense) rate. It’s useless to apply a generalized expense rate to known customer margins. Statistically, the average rate will not match over 96% of sales and will be off by a mile on those where it really counts. (Check the extreme variability in customer expense rates in the example below.)

This is why detailed customer cost analysis has been a priority for the market leaders. Knowing where profits come

from (and where they’re lost) is necessary for effective profit management. Let’s take a look…

Gross margin rates are not correlated in any useful way to customer profitability or customer value, yet it’s the

Customers ranked by NBC profit and revenue-to-profit conversion rate (red). Customer profit value DOES NOT correlate to volume (green) or gross margin rate (blue), so neither are reliable indicators of customer profit value. It’s the spread between margin and expense rate that deliver profits.

predominant (and highly dysfunctional) metric most distributors still use to evaluate sales value. In the profit ranking above, neither sales volume nor gross margin rate will identify the top five accounts.

No operating company would have accounting that didn’t include expenses, but almost all distributors run their sales strategy and activities with gross margin alone, not accounting for expenses at all.

New metrics

With detailed analytics, strategy and decision-making are driven by NBC (operating profit) and NBC conversion rate (conversion rate of revenue to profit). These are the two columns in the red block in the illustration.

NBC dollars show the exact value of the account — what does the customer relationship deliver to the bottom line, and NBC % rate indicates the efficiency of the account in converting revenue to profit. Clearly, a customer with more than 20% of the revenue getting to the profit line represents a much greater opportunity than a typical one at 3.5%. The former generates more than five times the profit for each new dollar in sales!

Each account has its own cost envelope, with particular costs depending on order size, ticket lines, direct/warehouse sales type, delivery cost, commission rate, rebates and myriad other factors. This is reflected in the Exp % column, which indicates the percentage of revenue that is consumed in servicing the account. Knowing expense rate is essential to managing profits, to delivering funding for higher wages, and is a key output of robust profit analytics.

Clearly, a customer that requires only 10% of revenue to handle their product represents a greater opportunity than one where 30% of revenue is consumed.

continued on page 20...

How does your company measure

against the market

and your competition?

New ASA 2024 Operating Performance Report provides more than 70 critical financial benchmarks.

By Mike Miazga, Vice President Sales-Operations mmiazga@asa.net

Brian Tuohey, CEO of East Windsor, Connecticut-based The Collins Companies and a former ASA president, places a high value on the PHCP-PVF trade association’s annual Operating Performance Report — regarded by many as the financial benchmarking gold standard for PHCP-PVF distribution firms.

“We utilize this report for comparison with the ‘high profit PVF firms,’” he explains. “We look at their results and compare them to every line item on our income statements and balance sheets, and then we identify any discrepancies for further review.”

Tuohey and Collins take that OPR data one step further.

“Depending on our findings, we will assign them to the appropriate manager as a business improvement initiative with a ‘cash bonus,’ which is paid to them and their team once the desired results are achieved,” he says. “The benefits are twofold. Our company improves our overall performance and the managers and their teams get excited to analyze and succeed in reaching their specific short-term goal — and, of course, the bonus doesn’t hurt. It’s a nice win-win for all parties.”

Birmingham, Alabama-based American Pipe and Supply uses the OPR in its future planning/forecasting efforts. “American Pipe always appreciates the comparative data and scope of work ASA puts together for us,” American Pipe and Supply Chief Financial Officer Brant Watts says. “We are able to compare from several different perspectives and set our internal goals and metrics based on the findings in the OPR. Thank-you for continuing to provide this data.”

Now in its 41st year of publication in partnership with ASA longtime business intelligence partner Industry Insights, ASA’s OPR provides PHCP-PVF wholesalers with vital financial and

Each year’s OPR includes a special analysis showing industry profitability based on “return on net worth” (before tax). This single measure essentially summarizes all key components of profitability:

Margin management

Asset management

Financial policy (debt) management

ASA’s Operating Performance Report, in its 41st year of publication, is regarded as the gold standard in PHCP-PVF wholesaler financial benchmarking. Shutterstock Photos.

operating performance benchmarks for gauging company strengths, weaknesses and improvement opportunities. Such information is nowhere else available.

Sales growth

After sustained double-digit sales growth in 2021 and 2022 across all industry segments, sales growth in 2023 declined sharply, Industry Insights points out. Plumbing supply firms reported a 0.3% sales decline vs. a 15.3% sales gain in 2022. PVF wholesalers showed a 7% increase in 2023, following an increase of 29.9% in 2022. Blended branches (plumbing and PVF) reported a 1% gain in 2023 vs. a 15.3% increase in 2022. HAVC and other firms also experienced a 1.9% sales increase in 2023 vs. a 15.8% increase in 2022.

Following double-digit growth in 2022, U.S. wholesale sales decreased by 1.7% in nominal dollars in 2023.Participants in the ASA OPR saw a 1.4% increase in sales (also in nominal dollars) during the same period. It is important to note that all figures presented are before adjusting for inflation. Industry Insights notes. When accounting for inflation, wholesale sales grew by 1.1% in 2023.

“Monitoring sales change is important since it often drives a company’s performance and the company’s ability to achieve profits,” says Greg Manns, senior vice president at Industry Insights and the author of the OPR. “Keep in mind, sales-related measures could be impacted by the inflationary surge, which reached heights far above target levels set by the Federal Reserve. In such an environment, it is important to remember revenue performance could be somewhat misleading. As prices rise, the reported sales figures may appear to be increasing, but, in reality, they may only reflect the effect of higher prices rather than an actual increase in the quantity of goods or services sold.”

Manns adds it becomes crucial for businesses to separate the effects of inflation from genuine sales growth to gain an accurate understanding of their performance.

“Businesses should conduct thorough analyses that account for the impact of inflation on their sales growth in order to make more informed decisions and develop strategies that are resilient in the face of inflationary pressures,” he notes.

Interpreting OPR data

The ASA Operating Report presents benchmarking data in more than 70 key financial categories throughout the 60page summary.

“When evaluating the report and its data, distributors should always look at the median score, which is a better benchmark of ‘company’ performance, whereas the composite is a better indicator of overall ‘industry’ performance.” Manns says. “These are two years of very significant increases, albeit somewhat ‘artificial’ growth due to the inflationary environment

in which we have been operating in. Over the last 10 years prior to 2021, annual sales growth typically fell in the 2%-7% range for all respondents.”

Historical performance

This year’s ASA OPR is loaded with historical performance data, in measurements such as real wholesale sales and unemployment rates.

Manns points out another useful employment measure is the labor force participation rate, which tracks the percentage of the population that is either employed or actively seeking employment. From 2002-2008, the labor force participation rate was around 66%. From 2014-2019, that rate fell to a range between 62-63%, the lowest since the 1970s. In the peak of the pandemic (April and May 2020), participation rates were below 61%. The rate climbed to 62.7% in April 2024 but is still well below pre-pandemic levels of more than 63% in February 2020.

This year’s report also shows10-year historical data for return on assets and return on next worth (after tax) for plumbing, PVF, blended branches and HVAC/other firms.

“Comparing 2023 performance results to those of previous years can help identify trends,” Manns notes. “This analysis is useful for understanding past industry developments and anticipating the future direction of the PHCP-PVF wholesale industry.”

The ASA OPR represents the most complete, accurate and upto-date comparative financial performance data and 20-year trends published anywhere.

““I use the information as a report card for our employees in various departments such as sales, purchasing and inventory management,” says Chris Sunde, CEO of Briggs Inc. of Omaha. “I find comparing our company results in the OPR with our peers in the industry very beneficial.”

How do I get a copy?

If you submitted data into the OPR study and paid your participation fee, you already have a copy of the 2024 report. If you are a distributor that did not participate in the survey, the report is available for purchase by contacting Bri Baresel at bbaresel@asa.net.

QUARTERLY MARKET SURVEY

ASA member manufacturers speak out in new survey

Topics

discussed include wholesaler private labeling, sales growth, rebate programs and more.

By Mike Miazga, Vice President Sales-Operations mmiazga@asa.net

ASA member manufacturers reported a mixed bag of sales results thus far in 2024, that coming from the latest ASA Quarterly Market Survey.

While the Q1 survey delved into all things manufacturers reps, the latest survey focused on ASA member suppliers. As is the case with all ASA Quarterly Market Surveys — a free ASA member benefit delivered to your email inbox — survey questions were generated by ASA member suppliers, wanting to query fellow suppliers on a variety of important/current industry-related topics.

In terms of 2024 sales, 47% of respondents report sales increases thus far this year, while 42% say sales have been flat. Only 11% note a decrease in sales.

“Q1 was flat, but in the last two months we have seen a sizable bump in sales,” one supplier noted.

“PVF distribution sales cutting back on inventor due to decline in projects,” another supplier wrote. “MRO is growing, plumbing is growing and international sales to Europe and Asia are growing.”

Taking out the proverbial crystal ball, 47% of respondents to the survey predict sales will be up the remainder of 2024, while 47% say flat and only 6% predict a decrease.

“Residential construction is beginning to pick up,” one supplier said. “The reshoring of industrial manufacturing continues.”

“High interest rates are keeping opportunities at a very conservative level,” another supplier pointed out, “and there is extremely aggressive competition.”

While there was a mixed bag of sales responses, 62.9% of supplier respondents say they are looking to expand in 2024 through acquisition or organic growth.

Suppliers also were asked their view on attempts by some wholesalers to introduce private labeling/creating wholesaler house brands, which elicited a large swath of responses.

“Some manufacturers see it as being a good partner,” one supplier wrote. “Others see it as competing with themselves. We look at what makes sense for the business and the long-term.”

Looking at the remainder of the year, 47% of survey respondents say they expect to see an increase in sales.

“It’s a growing trend,” another wrote. “Success varies and it still seems to be focused on the basics.”

Other topics broached in the survey:

What have manufacturers done to increase brand loyalty with distributors and sell-through to contractors?

Investment in training to ensure contractors are welltrained and educated on the latest product innovations and products for the future.

Best practices around launching new products to reps and other rep-related operational questions.

What does a typical rebate program look like?

Current trends with pricing and inventory

Effective training methods for wholesale showroom and outside sales personnel?

Hiring and retention trends

How can I get a copy of the survey?

If you are not on the mailing list to receive ASA Quarterly Market Survey results, contact ASA’s Bri Baresel at bbaresel@asa.net

Forty-two percent of supplier respondents to ASA’s Quarterly Market Survey report increased sales thus far in 2024, while 47% say sales have been flat. Shutterstock Photo.

ASA World Plumbing Day Poster Contest

Highlights member childrens’ creativity.

Earlier this year, ASA, in partnership with the International Water, Sanitation and Hygiene Foundation, celebrated World Plumbing Day by once again conducting a World Plumbing Day poster contest for children in the first through sixth grades.

This is the third year ASA has offered the poster competition. This year’s contest received entry posters from across the country representing a broad spectrum of ASA member companies and age groups.

ASA holds the contest for all ASA member company employees’ children and children of ASA member company customers.

All posters submitted to ASA are also forwarded on to IWSH for participation in the international competition. The ASA Poster Contest is sponsored by the ASA Plumbing Division Advisory Group and managed through the volunteer help of the World Plumbing Day Task Group.

World Plumbing Day is an opportunity to recognize all ASA members and all those employed in the plumbing supply chain. This recognition is centered on the theme that all involved in the manufacturing, distribution and installation of plumbing products play a valuable and critical role in the protection of public health and safety while also having a huge and positive impact on the economy through workforce development and economic growth.

Jaxson Otradovec (First Supply) won the first-through-third-grade division competition, while Palmer Elkin (Pittman Supply) took second and Harrison Viviani (First Supply) ended up in third place. Viviani is a repeat winner. He also took third last year in the firstthrough-third division.

In the fourth-through-sixth-grade division, Leah Harris (Consolidated Supply) took first for her drawing, while Isla Morgan (A. O. Smith) was second and Sadie Rogge (Prier Products) finished in third place.

The ASA World Plumbing Day Poster Contest winners received a certificate honoring their achievement, plus they and their schools both received a prize: First-place winners received $300; Secondplace winners received $150; and third-place winners received $75.

In the IWSH 15th annual World Plumbing Day Poster Contest international competition, Jack Lutes (Billco Corp.) finished in second place, while Morgan took third. Lutes is a sixth-grader at Lincoln Elementary School in St. Charles, Illinois, while Morgan is a sixth-grader at Salem Public School in Elora, Ontario, Canada. Lutes and his school received $50 and $500, respectively, while Morgan and her school received $25 and $250, respectively.

All winners along with the other posters submitted for the contest will be enlarged and displayed at NETWORK2023 Nov. 13-15 at the Fairmont Chicago Millennium Park.

Isla Morgan (A. O. Smith) finished third in the IWSH contest.

Leah Harris (Consolidated Supply) won the fourth-through-sixth-grade competition.

Jaxson

Otradovec (First Supply) finished first in the first-through-third-grade division.

Jack Lutes (Billco) was the runner-up in the IWSH international portion of the poster contest.

How to implement a CRM system the right way

Being able to distinguish between self-directed and management-directed sales teams is important in this process.

By Scott Stockham Repfabric

When it comes to sales teams, no two are exactly alike.

Some teams are as free-spirited as jazz musicians, playing their own tunes (let’s call these “self-directed teams”), while others follow the conductor’s baton to a tee, aligning with a more symphonic approach (“management-directed teams”).

In this colorful world of sales dynamics, implementing customer relationship management (CRM) tools can sometimes feel like trying to harmonize guitars with cellos — challenging but not impossible, and often leading to a beautiful symphony.

Let’s dive into the two types of sales teams and the implementation techniques that work best on each one. Whether you have a self-directed squad that thrives on autonomy or a management-directed tactical team that operates with military precision, your team will respond differently based on your approach.

For the mavericks: Self-directed sales teams

Imagine a team of seasoned sales veterans, each with their own set of tricks and techniques. They’re the mavericks of the

sales world, operating with a level of independence that would make a lone wolf nod in approval. Now, how do you introduce a CRM tool to a group that prides itself on being free-spirited?

First, focus on the value. Show these self-starters how a CRM can be their personal assistant, one that keeps track of their

A seasoned team of sales veterans may have their own set of tricks and techniques. How do you introduce a CRM tool to a group that prides itself on being free-spirited? Shutterstock Photos.

conquests and automates menial work without stepping on their toes. A good CRM tool for a self-directed team should offer flexibility and customization, allowing sales reps to tweak the system to fit their personal sales style.

Highlight the CRM’s ability to spot trends and patterns that even the most intuitive salesperson might miss. It’s not about putting a leash on the sales team; it’s about providing them with a GPS that helps them navigate their sales journey more efficiently and close more business.

For the strategists: Managementdirected sales teams

On the other end of the spectrum are the managementdirected teams. These teams operate in a world where strategy maps are as crucial as the air they breathe. In these settings, CRM tools are the linchpins that hold the sales strategy together.

In such environments, implementation should emphasize the CRM’s role in streamlining processes and enhancing communication. The tool becomes the central repository of sales data and insights that align with the business’s broader goals.

Training for these teams should focus on the procedural aspects of the CRM — how to enter data, how to generate reports, and how to use these insights to drive sales strategy. The CRM should be positioned as the ultimate playbook for a team that values structure and strategic direction.

Hybrid havens: Balancing the two

Many companies exist somewhere in the middle of this spectrum, and here, the CRM implementation can truly shine by bridging the gap between independence and guidance. For these hybrid teams, the CRM tool can be customized to provide enough structure to maintain alignment with business objectives while still offering the flexibility that self-directed salespeople crave.

The key here is choice and customization. Allowing team members to choose how they interact with the CRM — what information they see first, how they report their sales, which notifications they receive — can make a significant difference in how well the tool is adopted.

Overcoming resistance with a smile

Resistance to new tools is as natural as a toddler’s aversion to broccoli. It’s here that an upbeat, jovial approach can work wonders. Who says training has to be dull? Gamify the experience. Create competitions: Who can enter their data the fastest? Who can generate the most insightful report?

Remember, humor is a great icebreaker. Joke about the common fears of CRM systems — no, it’s not going to send

“As sales teams continue to evolve, the flexibility of CRM tools will only become more crucial.”

rogue emails to your clients or judge your coffee habits. Light-hearted, engaging training sessions can help ease the transition and foster a more positive view of the new tool.

Maintain your company’s edge

As sales teams continue to evolve, the flexibility of CRM tools will only become more crucial. Whether it’s integrating with AI tools for more intelligent data processing or using machine learning to predict customer behaviors, CRM tools must adapt or die.

Implementing a CRM system doesn’t have to be a drama-filled saga. With the right approach, a sprinkle of creativity, and a dash of humor, it can be a journey to a more organized, efficient, and successful sales process.

Here’s to the teams making it happen — may your sales soar and your CRM implementations be smooth!

Scott Stockham is the chief revenue officer at ASA Association Partner Repfabric, a CRM and sales data management platform for multi-line sales teams. Contact him at scott.stockham@repfabric.com or visit www.repfabric.com

With a management-directed team, the CRM tool becomes the central repository of sales data and insights that align with the business’s broader goals. Shutterstock Photos

The rise of the ‘toolbox generation’ creates opportunities for ASA members

ASA’s Project Talent provides tools and

resources to increase visibility of PHCP/PVF industry as a viable career path.

By Steve Edwards, Director of Recruitment Marketing, sedwards@asa.net

Recently, The Wall Street Journal published an article titled “How Gen Z is Becoming the Toolbelt Generation.”

The basis of the article is how Gen Z is positively responding to America’s need for tradespeople including plumbers, pipefitters and steamfitters.

Vocational-focused community college enrollment is at its highest level since it’s been tracked by the National Student Clearinghouse, and the number of students studying construction trades has risen nearly 25% in the past six years.

Both are positive signs Generation Z — ages 12 to 27 — is recognizing and acting upon the opportunities that

exist in the trades, including the entrepreneurial prospects and compensation closely aligned with careers requiring a college degree.

Payroll-services provider ADP reports the median pay for new construction hires has been rising and is currently at $48,089, compared to new professional services hires who earn a median salary of $39,520.

According to ADP, this is the fourth year that median annual pay for new construction hires has outpaced new hires in professional services and the information sector.

Other data painting an optimistic picture is in the past 10 years, the number of plumbers has increased from 553,000 to 635,000 and, with that growth, the median age of plumbers has decreased by 2% to 40.8 years of age, this according to the Bureau of Labor Statistics.

That’s great, but what about distributors, manufacturers and reps?

Most ASA members continue to struggle finding talent and often include this as one of their primary business challenges.

Through ASA’s Project Talent, members have access to tools and resources, and the association conducts ongoing social media and email marketing campaigns to increase the visibility of the PHCP and PVF industries as career paths.

However, these are simply air cover for the on-the-ground, local recruitment work of ASA distributors, manufacturers and independent reps.

Signs show Generation Z— ages 12 to 27— is recognizing and acting upon the opportunities that exist in the trades, including the entrepreneurial prospects and compensation closely aligned with careers requiring a college degree. Shutterstock Photo.

3. Local community colleges, trade schools and high schools

Given the increase in community college enrollment and interest in the trades, now is the time to create or improve relationships with local community colleges, trade schools and high schools.

Most offer job fairs and often look for class speakers and experts. You can find local community colleges with trade programs and local trade school programs by visiting www.aacc.nche.edu

4. Polish your candidate messaging

ASA recently conducted market research among job seekers to best understand what messaging about opportunities within the PHCP/PVF industry most resonates with them.

If talent acquisition remains difficult, are the necessary steps being taken to leverage the growing “Toolbelt Generation?”

1. Employer brand

In traditional corporate branding, an organization’s brand is the essence of the value it provides customers. Employer branding is the same concept, but the objective is to convey and influence a company’s reputation as an employer and its value to current and potential employees.

The goal of employer branding is to position a company as a fulfilling place to work for prospective employees. An employer brand can help attract the type of candidates a company desires and ideally positions it ahead of the competition. Companies that invest in employer branding are more likely to attract candidates who not only have the right skills and experience but fit best with a company’s culture and values. Employer branding also gives businesses the ability to compete for jobseekers on more than just compensation.

“Honing recruitment tools and finding new angles of opportunity will put companies in

the best position to identify and acquire talent.”

2. Online presence

A company’s online presence is paramount because eight of every 10 job searches begin online. Information about a company’s culture, employee testimonials, a straightforward application process are all table stakes in today’s recruitment environment.

Not only must a company’s careers website include these elements, but a firm’s social media presence should be consistent and include the same content.

ASA has created a checklist to assist members with ensuring their online presence is meeting the needs of job seekers. This checklist can be found in the ASA Recruiter Toolbox, located at www.asa.net, available only to members.

For students, be it high school, trade school, community college or university, messages that reinforce stability, growth and development, meaningful work, and opportunities for a wide range of skillsets are desired.

ASA members can find specific, ready-to-use messages to incorporate into local recruitment materials in the members-only ASA Recruiter Toolbox, available at www.asa.net, under “Recruitment Resources.”

These are just a few areas that deserve critical review and can deliver positive recruitment results. The current state of labor in the United States, including historically low unemployment rates, creates strong headwinds for ASA members.

However, honing recruitment tools and finding new angles of opportunity, such as the evolution of the “Toolbelt Generation” and the growing number of potential customers, will put companies in the best position to identify and acquire talent.

Project Talent is one of four mega goals included in the association’s strategic plan. This goal includes the objective of developing and implementing a program to attract and grow the number of talented workers taking advantage of fulfilling career opportunities in the PHCP/PVF Industry.

ASA recently held a panel discussion webinar with students and graduates from Texas A&M University’s Industrial Distribution program that allowed ASA members to hear directly from the students about their processes and preferences when considering career opportunities. Photo by Steve Edwards/ASA.

DISTRIBUTOR PROFITABILITY

How new sales tactics can provide critical new funding to ensure labor challenges melt away

Continued From Page 11

Cash flow and profits (NBC) are directly delivered by the spread between gross margin rate (GP%) and the expense rate (Exp %).

We use these metrics to do detailed customer segmentation, identifying accounts where:

Sales penetration activities will drive more cash flow;

Account protection and customer loyalty programs will retain high-efficiency accounts;

Where policy changes and revenue enhancement programs can generate new profits;

Where lean services can make them more profitable; and more.

How to fund higher wages

There are a number of well-known, widely applied sales activities, but a scattershot application is largely ineffectual or counter productive. (It’s not helpful to successfully acquire more moneylosing accounts, or reduce service levels on highly-profitable ones just because they have lower volumes, or to increase prices on low-margin accounts that are already profitable.)

To fund higher wage rates, we need new cash flow, and there are several highly reliable ways to get it.

Penetration selling: Identify HLAs (high-leverage accounts, blue blocks in the example on Page 11) as those with the highest revenue-to-profit conversion rates. An account that converts revenue at a 20% rate will deliver four times as much for each new sales dollar as another with a 5% rate. And since the truck is already going there, incremental sales don’t have all the incremental costs, raising the overall rate for everything sold to the account. Focus sales effort on finding more products that these accounts can buy.

Customer growth programs: HEAs (high-efficiency accounts, green blocks in the example on Page 11) can be profitable with reduced pricing in targeted cases. Help these accounts grow by assisting with special pricing on large bids. Knowing their expense rates ensures you price the special bids to be profitable. Growing their business grows your business and creates true loyalty. Create an organized program to facilitate this, and add new cash flow.

Order efficiency improvements: All accounts generating above-average OpCash (gross profit) can have reduced manpower requirements and reduced cost envelopes with reductions in order frequency. For example, daily orders could be changed to Tuesday / Friday. Similarly, VMI (vendor managed inventory) programs can put an

inventory of low-value items on the customer’s floor, with periodic replenishment. These practices reduce manpower requirements and free up cash flow for wages.

Adjust cost structures: “Regular” accounts (those that represent annual gross profit dollar values below the company’s average) can generate more free cash-flow by eliminating certain costs and manpower. Ideally, they would not qualify for: trade credit (cash / check / credit card only); sales commissions; free delivery; free installation; etc.

Charge for services: Consider delivery as a product and sell it at a markup. Recognize both its cost and its value, and price accordingly. Even if you do not recover the entire cost of delivery, a small fee still contributes to new cash-flow. Apply the same logic to other value-added services you provide.

Rebates: Manufacturers drive their sales volumes and customer loyalty with rebate programs that add new money to your operations. Exploit this by actively working to shift sales into lines that have rebates available. Also work to increase the frequency of rebate payments — don’t wait for up to a year to get the rebates you’ve earned. Most suppliers have quarterly (and even monthly) cycles available, and this is one of areas where large players get an advantage over you.

Direct sales: Wherever possible, offload logistics costs and manpower to suppliers by arranging direct sales. You can offer slightly reduced pricing so you can win additional business, but be very careful distributors are prone to overestimating savings and then underpricing. Profit should increase on these sales.

Utilize analytics: Ensure you target initiatives where they’ll actually work and will drive the largest gains. Even very sensible ideas will not achieve anything in areas that are already optimized, or where the level of activity the initiative addresses is low. Worse still, applying these ideas blindly will most often hurt profits, so be sure you have the information to target the right areas.

Get immediate gains by going after the high-return areas, and monitor the results into the future to make sure the gains aren’t lost as new practices revert to prior methods.

In the current day, these ideas are already important for maintaining or restoring profitability. Going forward, they’re a requirement for long-term survival in the new labor environment.

Randy MacLean is the president of WayPoint Analytics. Contact him at rmaclean@waypointanalytics.com .

ARTIFICIAL INTELLIGENCE

Harnessing the power of AI in wholesale distribution Moving beyond the hype to real use cases.

By Graham Walker ATS Software

Artificial Intelligence is a frequent headline for tech-savvy industries, yet its use cases still need pioneers who will test, iterate and refine the power that generative AI can bring. To get a real impact from AI, let’s look at three main areas where AI could empower your distribution strategy:

Demand forecasting: AI excels at processing large volumes of historical sales data alongside external considerations such as seasonality, and even emerging market trends. Uploading a historical transaction dataset to a large language model (LLM) AI platform such as ChatGPT’s Advanced Data Analytics would allow you to “chat with your data” by asking the AI to review and recommend areas that it deems valuable so you can ask further questions about what the AI sees and get instantaneous answers and charts based on your questions.

Pricing strategies: AI can analyze quote data to uncover win/loss rates and what the trends are regarding the price and margins for each project by region, by building type, by category and by customer. This will help you understand project price sensitivity and assuming you capture the names of the subcontractors, the general contractors, the architect and the design engineer, you can start to see patterns that you could influence to win more business through price adjustments, relationship building and product education.

Anomaly detection: AI is perfectly suited to help find anomalies in your financial transactions to ensure you’re protected from fraud of any kind whether internal, external, large or small.

Crafting AI prompts

Here’s a practical approach to using LLMs to gain insights into metrics and objectives.

Harnessing LLM AI tools such as ChatGPT or Google Gemini hinges on the quality of your prompts and guidance. I recommend OpenAI’s Enterprise ChatGPT subscription as it is the only version that does not use your data to train the language model. In other words, the data you upload there doesn’t leave your control. Let’s use a few examples that relate to the discussion above:

Example 1: Identifying correlations that lead to high-margin business

Problem: You want to review quotes, order entry and revenue data to find correlations that lead to higher profit margins. You want to do more business with customers that show high profit margins, but you need to understand if there are more correlations to the margins than just the volume of business.

AI prompt: “Act as a seasoned business analyst of a wholesale distribution company and analyze the attached project quotes, sales order and revenue data. Analyze profit margins by project to find correlations to things such as the

AI can help identify correlations that can lead to high margin business. Shutterstock Photos.

speed of project completion indicated by the time between the first and last order, or commonalities of who is involved in the project such as the engineer, general contractor and subcontractor. Look for other relationships that might seem to be influencing high-margin projects.”

Example 2: Identifying your most profitable segments

Problem: You want to rank your most profitable areas by customer, product, brand, category, and region and get ideas on how to double down on what works.

AI prompt: “Act as a financial analyst with experience in wholesale distribution of plumbing products. Please analyze the attached sales and cost data to identify key areas of profitability. Provide a prioritized list of the top three areas where I should double down my efforts to sell more and the bottom three areas where I should consider improving or eliminating my sales efforts. Ask me clarifying questions if you are not clear on any of the data points.”

Example 3: Inventory optimization and brand alignment percentage

Problem: I need to assess my inventory against market demand trends to look for things such as overstocked items, high turnover vs. low turnover products and trends in dominant brands that are being specified as the basis of design compared to what brands I have in inventory.

AI prompt: “Analyze the attached quote, order and warehouse shipping data to identify and mitigate risks related to inventory management, focusing on the following key areas:

Segment A: Overstock analysis: Identify items that are overstocked by comparing current inventory levels to historical sales data. Highlight products with the lowest turnover rates as potential overstock risks.

Segment B: Calculate and rank items by their turnover rate to identify high-performing products. Use the formula Turnover Rate = Sales Volume / Average Inventory for a specified period to assess efficiency in inventory management.

Segment C: Brand specification trends: Analyze the trends in brands that architects or engineers are specifying as the basis

of design in projects compared to the brands currently held in inventory. Identify mismatches where specified brands are underrepresented in the inventory, indicating potential missed sales opportunities. Let me know if I am missing data points required to perform these calculations and if there are other inventory optimization calculations that I may be missing.”

Important note: AI responses shouldn’t be followed blindly. It is essential to have subject-matter experts evaluate the outputs to ensure validity and refine further analyses based on findings. AI serves as a tool to generate new perspectives and identify patterns humans might miss due to sheer data volume.

“It is essential to have subject-matter experts evaluate AI outputs to ensure validity and refine further analyses based on findings.”

How to start using ChatGPT’s Advanced Data Analytics:

1. Get a team or enterprise subscription to ChatGPT

2. Prepare and organize data: Clean the data by removing inaccuracies and organizing it in a structured format in a spreadsheet or a database to allow for analysis. Finding a point of connection such as transaction number or UPC code is essential when you combine data from different sources, otherwise, you will need to create a unique identifier to complete the required data point connections and correlations.

3. Develop custom prompts: Create specific prompts for ChatGPT that align with your business goals. You can ask ChatGPT to help you write prompts to get you started.

4. Integrate ChatGPT with business systems: Find analysis tools that have ChatGPT built-in or find a no-code developer to help you write an automated workflow for AI analysis.

5. Test & iterate until you get the outputs you want: The most challenging part of deploying AI for data analytics is getting the data cleansed and formatted in a way that AI can read and understand it. Test and make changes to the data output and format to allow the AI to read and understand the data because once you have it formatted correctly, the insights AI can provide will be well worth the effort to clean the data in the first place.

Graham Walker is vice president of sales and marketing at ATS Software in Toronto, Ontario, Canada. Contact Graham at graham@atssoftware.com.

ASA Volunteer Leaders Wanted Interested in being an ASA member volunteer? Visit www.asa.net/About-ASA/ASA-Volunteer-Leaders to learn more.

AI excels at processing large volumes of historical sales data alongside external considerations such as seasonality, and even emerging market trends.