2024 Fred V. Keenan Lifetime Achievement Award

ASA

2024 Fred V. Keenan Lifetime Achievement Award

ASA

I hear way too often from prospective members that “I don’t see value in ASA,” even though we have unequalled programs in business intelligence, led by our chief economist Dr. Chris Kuehl, our Operating Performance Report (now in its fourth decade of publication), plus valuable employee compensation and market reports.

There’s much more: Our nearly 200 courses that make up ASA University, our energetic EMERGE (Emerging Leaders) and ELEVATE (Women in Industry) conferences, our quarterly CONNECT online peer-to-peer best practices sessions, plus our robust advocacy efforts that protect our industry from unfair legislative, regulatory and code disruption.

When I hear that someone doesn’t see value, my mind wanders to what they can possibly mean. They don’t see value?

The value of all our programs and services is just the icing on top of the real value of ASA. That value is the banding together of more than 600 leading industry firms that provide more than 250 volunteers working on our 30 committees, councils task groups and boards, creating a powerful voice for our industry.

I tell every member that joins ASA to simply support the future of our industry. Our members rarely take, but instead give to growing our industry and ensuring we have a strong industry for the next generation, which is coming faster than we think. Those that look at ASA to see what they can get are looking at us wrong.

ASA has no industry competitors. We are the only true national trade association working on everyone’s behalf. While members may have competitors, when they belong to ASA, they leave that divisiveness behind and choose to work together for a stronger industry. Thank you for supporting ASA.

ASA Review has become a highly valuable source of great content for our members to gain some insight and clarity with what’s happening and how members can make sound business decisions that will improve the profitability and success of their businesses. In this Q4 edition of ASA Review, you will read about the new product data standard that ASA will launch at NETWORK in Chicago this month. This new standard will begin to simplify how data is shared between manufacturers and distributors, saving valuable time and money.

Once again, ASA recognizes two very distinguished individuals with the presentation of the 2024 Fred V. Keenan Lifetime Achievement Award. The Collins Companies’ Brian Touhey and Kohler’s Jim Lewis will be recognized for their long history of serving the industry at the association’s annual member lunch during NETWORK in Chicago.

Last year we surveyed 30,000 contractors in offering the Voice of the Contractor report that highlighted how contractors look at distributor service, what they see happening in the market and how they are positioning their companies and partners to win the future. In this issue, we reveal some of the results after surveying builders in all markets to get a glimpse as to what they see happening in construction and when markets might be making a rebound — the Voice of the Builder.

Also in this issue, Dr. Kuehl will provide his 2025 forecast and what distributors and manufacturers should be looking at to position their companies for a successful 2025.

We hope you have found these issues to be valuable. Thank you for being a member and supporting our mission.

Mike Adelizzi CEO

Simplify your sales, from client mgmt to order processing. Centralize your data, improve efficiency, & make better decisions with Distifabric.

it in

Want to receive a printed version of ASA Review? Contact ASA’s Mike Miazga at mmiazga@asa.net.

By Mike Miazga, Vice President Sales-Operations mmiazga@asa.net

The topic of cybersecurity was front and center during an informative panel discussion at ASA’s inaugural Innovation Summit recently held at the Westin O’Hare in Rosemont, Illinois.

ASA-member distributors, suppliers, reps and service providers heard from Winsupply’s Senior VP of IT Chris Schrameck, Texas Plumbing Supply Vice President Jeremy Fuller, NIBCO Information Security Supervisor Travis Slone and Coburn Supply Executive Vice President Michael Maloney on a host of cybersecurity issues during a 90-minute panel session moderated by Distribution Strategy Group’s Ian Heller

Panelists talked about real-world cybersecurity issues such as ransomware, phishing and email spamming, as well as ways to help protect industry companies from these increasing cyber threats.

Heller shared some staggering cyber-attack statistics, including 46% of cyber breaches impact businesses with fewer than 1,000 employees, while 61% of small businesses were the target of cyberattacks in the last three years. The numbers don’t stop there: Heller explained 82% of ransomware attacks in 2021 were against companies with fewer than 1,000 employees and 37% of companies hit by ransomware had fewer than 100 employees. Also, small businesses receive the highest rate of targeted, malicious emails at one in 323.

The ASA Innovation Summit packed education, best practices sharing and networking into a day-and-a-half program. Keynote speaker Jeremy Gutsche talked about tactics for disruptive thinking, and also conducted a scenario thinking workshop.

Other speakers included Breakthrough Innovation Advisors Managing Director Bruce Vojak, who talked about the value of innovation, specifically identifying strategic options being pursued to maturity, evaluating capabilities to renew a business and determining whether/to what extent to pursue innovation.

The FutureWork Institute President and CEO Margaret Regan took attendees on a visual journey into the digital future to experience how technology will change distribution, logistics and the world over the next 10 years.

Attendees were able to interact and network throughout the conference with Innovation Summit sponsors ATS Software, Blue Ridge, Canals AI, Inriver, Repfabric, Sparx IQ, Trimble and Xngage.

Small businesses receive the highest rate of targeted, malicious emails at 1 in 323.

By Brooks Hamilton

Artificial Intelligence (AI) is no longer just a buzzword — it’s a transformative tool reshaping industries across the economy.

For wholesale distribution executives, the question is how to implement this tool effectively to enhance operations, boost customer satisfaction, and drive sustainable growth.

Let’s look at some practical steps to integrate AI without overhauling your entire operation or disrupting the valuable relationships you’ve built. Consider this example:

A mid-sized supply company grappled with the following: an accelerating number of orders, keeping the workforce at current levels, reducing errors and training new staff.

Solution: The distributor partnered with an AI software provider that creates new quote drafts based on emailed requests. Once a draft quote is created, a customer service rep (CSR) examines it within the quote review screen and adjusts if needed. Then the quote details are automatically uploaded into the ERP application.

The results were substantial and rapid:

Order creation time decreased by 90%.

Order discrepancies requiring rewording dropped by 35%.

Anecdotal evidence suggests an increased win rate due to faster response time and low error / rework rate. Sometimes, just being first wins.

The company recently expanded the solution to generate quotes from phone calls and images. So, how can you determine where to invest your resources for a return like this? Start small and build.

Distributors need to build organizational capabilities in AI that will, over time, yield significant competitive advantage. AI is foundational to many other capabilities. Since there is no single AI solution that does everything, deciding where to build AI capabilities is a big question.

Consider this in National Football League terms: Each team is limited by the salary cap. It is up to the front office to determine where to spend those limited resources. Ideally, those great, new players fit within a strategy to propel the team into the playoffs.

Draft season is upon us.

This time, we’ll start with levels 1 and 2 and come back in the first issue ASA Review of 2025 with the more advanced levels 3 and 4.

Level 1: Get your hands dirty with a powerful device

Purpose: Familiarize yourself with easy-to-use and versatile applications.

Investment: Free to $30 / month / user

Tools: ChatGPT, Claude or Gemini (Professional plans recommended at $20-$30/month.)

Tips: Think of these applications as smart and well-informed interns in their first week. These applications work best with context and direction, just as a new employee would. Request that it ask clarifying questions. “Before responding, what clarifying questions do you have?”

Practical use cases and prompt

Email drafting: Craft thoughtful communications that maintain strong relationships. It drafts; you add that personal touch. Prompt: “Compose a professional response to a supplier’s delayed shipment, emphasizing our need for timely deliveries and proposing a solution.”

Meeting preparation: Organize effective meetings that drive action. Prompt: “Create an agenda for a team meeting to discuss how to categorize distressed inventory, include key discussion points.”

Policy manual creation: Efficiently develop comprehensive documents. Prompt: “Outline key sections for updating our employee handbook to include remote work policies and AI tool usage guidelines.”

Action step: Choose one of these prompts and test it this week.

2: Make

Purpose: As you become comfortable with AI, consider purpose-built AI tools to enhance your daily workflow. Move from occasional use of a chatbot (ChatGPT, etc.) to tools used regularly to reduce your daily load.

Investment: $15 to $30 / month / user

Tools: SuperHuman, Spark, Microsoft Office Copilots, Microsoft Teams, Otter.ai, Google Docs.

Tips: “AI auto-complete” and “AI-assisted drafting” are basic features for these applications. When selecting a tool, envision how you will use the outputs of these in your downstream tasks. For example, monthly departmental status meeting notes captured via Otter.ai are summarized in a draft created by MSFT Copilot for a quarterly board meeting.

Tools and Benefits:

Email management with SuperHuman or Spark. AIpowered sorting, prioritization, and quick replies. Focus on critical communications.

Meeting summarization with Microsoft Teams or Otter.ai. Automated transcriptions and summaries of meetings. Focus on discussions without worrying about notetaking and have summaries available for future tasks.

Document creation with Microsoft 365 Copilot or Google Workspace AI tools. Create reports, proposals and presentations more efficiently with AI content suggestions and formatting assistance within familiar office applications.

Action step: Implement one of these tools into your daily routine.

“AI Is no longer a buzzword. It’s a transformative tool reshaping industries across the economy.”

Your AI adoption roadmap

Start small. Test an AI prompt this week and then integrate a personal AI tool the next week.

By following this guide and leveraging expert support, you’re not just adopting new tools — you’ll strategically position your distribution business for sustained success.

Next time: We’ll dive into Level 3 (making work easier for each department) and Level 4 (additional possibilities and gradual expansion).

Brooks Hamilton is the founder of AI Strategy Advisors, a consultancy specializing in crafting AI strategies for companies of all sizes, including family-owned businesses. Reach him at brooks. hamilton@strategyadvisors.ai.

Visit ASA’s Industry Calendar for a comprehensive log of all PHCP-PVF-related conferences, buying group meetings and trade shows for the next few years. Go to ASA.net, hit the “Meetings and Events” tab and then “Industry Calendar.”

By Beth Ladd, Vice President of Innovation, bladd@asa.net

Last year, ASA’s Executive Committee engaged in a discussion of the ongoing challenges with obtaining, preparing and ingesting manufacturers’ data for use in wholesaler/distributor ERP and PIM software.

Four years after the start of the pandemic that brought global supply chain disruption, distribution is experiencing a dramatic increase in the demand for and use of data to plan, operate and manage the business of buying and selling products. Coupled with recent disruptive plays by big box and digital-first competitors, investment in data and digital transformation is a cost of competing the industry can no longer delay.

At NETWORK2024 in Chicago this month, ASA will release Version 1 of its industry product data standard and ask for constructive comment and reaction from ASA members. The goal was to work through as many of the product data standard columns in the first pass spreadsheet prior to NETWORK. The Product Data Standards Committee anticipates continuing to work through additional columns while the draft is out for comment.

“As an online distributor of PHCP and HVAC products, we are committed to providing our customers with clear and precise information,” says Laura McDermott , digital content strategy manager at Madison, Wisconsin-based First Supply. “We rely on manufacturers to provide relevant product details and digital assets. When manufacturers supply web-ready data in a standardized format, it not only reduces confusion, but also enhances the presentation of their products, effectively boosting their brand’s marketing efforts.”

Thus, investing effort in data sharing practices, increasing the level of data literacy, and building a trusted network of stakeholders

and data stewards invested in the use of product data and its governance is an essential initiative for ASA members.

“By having a standardized robust data recommendation, manufacturers don’t have to provide every wholesaler with a custom template.” — PJ O’Neill, Coburn Supply

ASA kicked off its first nationwide data governance effort in the fall of 2023. For the last 12 months, representatives directly involved in the syndication, dissemination, ingestion and use of product data from more than 20 ASA member companies have been meeting bimonthly to contribute to establishing a standard for the sharing of product data between manufacturers and wholesaler/distributors.

Convened and facilitated by ASA’s Vice President of Innovation Beth Ladd, the cross-functional data standardization committee is building a shared understanding of the current needs, current challenges, and wants and uses of industry product data with an eye toward the future of data governance and collaboration.

The assembled stakeholders and data stewards are building a framework for ongoing data quality, a feedback loop for continuous improvement as well as shining a light on the integral role of data as strategic business asset.

Committee members have demonstrated commitment to increasing confidence in the use and sharing of quality data,

beginning with a strategy of improving the current processes.

“I’ve been working with manufacturers for more than 20 years, and I still find some manufacturers not having a clue as to where to start when asked to provide digital product data,” notes PJ O’Neill, director of product information at Coburn Supply in Beaumont, Texas. “By having a standardized robust data recommendation, manufacturers don’t have to provide every wholesaler with a custom template.”

The committee and working groups are learning to crawl before they walk following best practices toward a data-enabled culture and shared data governance within our industry.

A product data standards committee provides the following benefits:

Establish a network of product data stakeholders.

Establish, maintain and publish a manufacturer product data contacts directory (ASA Quick Links first release in July 2024; visit www.asa.net to access).

Establish and maintain distributor product data contact persons (2025).

Build a cross-functional, shared understanding of the use(s) of product data.

Build a conduit for ongoing communication, interpretation of data standards, acceptable use and “rules of engagement.”

Align with established best practices of data governance.

A consistent, clear, predictable product data standard could provide the following benefits:

Manage and potentially reduce resource hours necessary to create product data sets.

Decrease miscommunication and manufacturer support for provided data sets.

Reduce product data inconsistencies.

Minimize human error by reducing the need for manual manipulation of product data.

Reduce confusion and misunderstanding when interpreting product data sets for use by distributors.

Increase usability of digital data in distributor ERPs and PIMs, etc.

“This effort will help us to streamline the output/input between distributors and manufacturers,” says Lauren Bond, senior customer data analyst at Delta Faucet. “It will foster a network for sharing best practices and solutions which will ultimately enhance capabilities. Cleaner, better organized, data will boost consistency, efficiency, and drive growth as well as help enable better industry-wide data comprehension.”

By way of acknowledgement that manufacturer products/ SKUs number in the millions, the Product Data Standards Committee agreed to utilize a pragmatic approach to begin the standardization process. To begin, the group looked across spreadsheets of product data from several of the participating manufacturers.

From these data, an initial working spreadsheet was created containing more than 100 columns of product data attributes that are common between manufacturers and products. For example, attributes such as: UPC, Manufacturer Name, Brand, Color, Short Description, etc.

Each product data attribute is discussed in detail, collaborating to create a shared understanding of current usage, challenges, as well as seek potential alignment. Metadata such as a suggested field name, business definition, valid values, etc., are defined. Attributes are currently documented in the following format:

Column Definition

The twelve-digit Global Trade Item Number (GTIN12) also referred to as Universal Product Code (UPC). These numbers are encoded in the UPC-A barcode.

Column Length 12

Null

This column may not be null

Potential Software Type Destination ERP, PIM, DAM, eCommerce, webpages, catalogs

Potential Audience Consumer, tradesperson, showroom staff, counter staff

Valid Values

Notes

Suggested Business Logic

This column is expected to contain twelve numbers for use in point of sale. The first eleven digits contain your company prefix and the Item Reference. The last digit is a check digit.

Examples 034449946506

How can I access the current working standard?

The Version 1 working standard is housed on the website at asa.net under the “Industry Standards” dropdown at the top of the home page.

How do I provide comment on the working standard?

Comments/reactions to the standard can be sent to ASA Vice President of Innovation Beth Ladd at bladd@asa.net

Interested in learning more about the Product Data Standards initiative? Please reach out via info@asa.net for more information.

ASA’s Recruiters Toolbox, now housed on the ASA website at asa.net as a free member benefit, provides thousands of digital assets, webinars, templates, job descriptions and more for members’ unlimited use without separate login credentials.

By Taylor Albano and Steve Edwards, ASA Education Foundation

talbano@asa.net sedwards@asa.net

In late 2023, ASA conducted a national labor study to understand the current workforce dynamics of the PHCP/ PVF industry. The study’s results show that more than 31% of the industry’s workforce are over the age of 55 with almost 10% 65 years old or older.

When you consider there are about 373,000 employees among PHCP/PVF distributors, manufacturers and manufacturers’ reps, this means there are 116,000 employees who have reached or are close to reaching retirement. ASA members report they expect 27% of the workforce or about 101,000 people to retire in the next 10 years with 41,000 of those in the next five years.

These results underscore the importance of PROJECT TALENT, ASA’s strategic initiative to increase the number

of talented workers taking advantage of attractive career opportunities in the PHCP/PVF industry.

Throughout 2024, several PROJECT TALENT enhancements and updates have been made to not only further create awareness of the opportunities that exist within the industry, but with tools and resources to assist ASA members with their local recruitment.

Through comprehensive social media and email marketing campaigns during the first half of the year, more than 15,000 people visited supplyindustrycareers.com , a website designed to provide job seekers information about the industry. More than 1.1 million impressions were gained via Facebook and Instagram posts regarding industry employment during the first six months of 2024.

A new website feature that allows job seekers to find ASA members in the geography of their choice and easily see those that are currently hiring has also grown. Presently, there are 53 ASA member companies representing nearly 2,600 locations across the country indicating they are now hiring with direct links to their company’s website.

A reimagined Recruiter Toolbox was also launched in 2024. Now, part of the ASA.net website, the new Recruiter Toolbox, designed to supplement members’ own recruitment efforts, provides thousands of digital assets, webinars, templates, job descriptions and more for members’ unlimited use without separate login credentials.

The new Recruiter Toolbox was the topic of one of the PROJECT TALENT quarterly webinars which also included a panel discussion with industrial distribution students about their job search preferences, and detailed results from the association’s national labor study. Recordings of PROJECT TALENT webinars are available in the Recruiter Toolbox.

Plans are underway for further PROJECT TALENT enhancements, including tools to assist members participating in local job fairs or presentations.

As the pace of life quickens, training and development must continuously evolve to prepare for the change in learning styles, learner attention span, and information retention in a digital world. ASA University is committed to meeting learners where they’re at — whether that’s a few snatched minutes of time between customers, or an individual ready to commit to intensive study through ASA’s Master of Distribution Management Program.

In 2024, ASA University introduced Mini-Tracks for our members, which uniquely focus on the timely topics of the day — such as cybersecurity, AI, and managing remotely — and can be consumed in just under an hour. These bite-sized pieces of learning not only fit neatly into the dayto-day flow of work, but also provide impactful, actionable information in a short amount of time.

ASA University is also known for its industry-specific course offerings, which have educated thousands of members over the years. In 2024, efforts have started transforming the stellar content that ASA University has come to be known for into microlearning, offering a more modern format, improved

look and feel, and best of all, better design for knowledge retention (and the modern attention span!).

Using the input and feedback of the ASA-U Task Group, new features will be integrated into each course, including “application scenarios,” where learners are asked to apply the knowledge they learned — not just factual recall.

The core education that makes ASA University training best-in-class will remain — but in a new and improved experience. To add to the impact, each course will also include helpful takeaway documents — such as lesson summaries and cheat-sheets, as well as a “connect the dots to real life” scavenger-hunt activities, which asks students to make connections between what they’ve just learned, and the reality of their business. Live action video and engaging graphics also enhance the experience for learners, showing them how products work in action.

Keep an eye out for ASA University’s microlearning releases in early 2025 and beyond as its library of offerings gets the makeover of a lifetime.

ASA University announces the graduation of 11 Master of Distribution Management (MDM) students this fall. Beginning in October 2023, these industry professionals worked tirelessly to complete the program and earn their Certificate of Master of Distribution Management.

Congratulations to:

Adriana Quijano Rossy (CIB Corp.), Billy Lee (Lee Supply), Brian Glowacki (Mid-State Supply), Bryan Morales (CIB Corp.), Christopher Walther (Rubenstein Supply), Jonathan Curry (Schaefer Plumbing Supply), Jonathan Lopez Claudino (CIB Corp.), Mickey Brown (Schaefer Plumbing Supply), Patrick Maloney (Coburn Supply) Todd Yates (NH Yates), Tom Breidenstein (Schaefer Plumbing Supply).

In 2024, ASA University has enrolled more than 40 students who will be eligible to graduate in 2025.

Taylor Albano is vice president of education and training. Steve Edwards is director of recruitment marketing.

of the PHCP-PVF industry’s workforce is over the age of 55 with almost ten percent 65 years of age or older.

Source: ASA Labor Study.

This year, ASA University has enrolled more than 40 students in its Master of Distribution Management program.

By Dr. Chris Kuehl, ASA Chief Economist

J.K. Galbraith was a noted economist from Canada and was famous for his pithy quotes. One, in particular, seems to sum it all up. “The sole purpose of economic forecasting is to make astrology look legitimate.”

It has been a rough year for those in the prognosticating business. There was an expectation of recession all last year with predictions of quarterly growth rates in decline. Instead, we saw rates at 2.1% for the first quarter, 2.1% again in the second quarter, 4.9% growth in the third quarter and in the fourth quarter the rate was 3.4%.

Some thought that long-expected downturn was starting to manifest in the first quarter of this year when the numbers fell to 1.6%, but in the second quarter there was a bounce back to 2.8% and right now the expectation for third quarter is close to 3%. No recession in sight and everyone at the Fed still talks about a soft landing. The economy is still being propelled by consumer spending (mostly by the upper-third of income earners), non-residential construction activity and the continued flow of government money.

Inflation chat

Inflation is measured a number of ways. The media likes to refer to the Consumer Price Index as it is current and released at the first of the month. The problem is the CPI is a bit speculative because it is based on assumptions. The Fed uses Personal Consumption Expenditures, what we actually bought, and what it actually cost. The problem is it takes about two months to collect that data and thus the PCE lags. The rate the Fed sees right now is 2.3% and that is very close to their goal of 2%. This is what allowed the drop in interest rates.

The initial trigger has been pulled. The Fed elected to go with a half-point cut rather than a quarter point. Now the question is what happens next. Does this cut become the first of many more? Most analysts are suggesting another quarter-point reduction will be seen in December and there will be more quarter-point cuts in 2025.

The goal for the Fed seems to be rates between 3% and 3.5%, but there is a lot of disagreement over how soon that would take place. Central banks have a mantra. They raise rates until they break something and then they lower rates to fix what they broke. All in the name of lowering the rate of inflation.

The same issues still affect manufacturing and little progress is expected in the coming year. The top of the list is still the worker shortage. By 2030 the entire Boomer generation will have reached the age of retirement. It is not that all of them will be leaving the labor force at once but most of those in manufacturing and construction are ready to quit by 65.

The measure of whether they broke anything is generally unemployment and quarterly growth. It can be argued that the Fed did not break anything with those rate hikes. There has been solid quarterly growth through 2023 and into 2024, and the jobless rate has been sitting at 4.3% (normal jobless rate is still thought to be 6%). The talk from the Fed is still all about the soft landing and the hawks on the Open Market committee still urge slow movement on rates.

The rate of joblessness remains well below average. It has been a long time since the unemployment rate has been at 6% but that is still considered the “normal” rate. The recent job numbers had been weak but they surged recently. The rate has moved from under 4% to around 4.3% but the movement that has the Fed worried is in U-6 as it has also moved up. It still remains lower than in past years but has been gaining, and every time that has occurred there has been some kind of economic retreat.

“The system of just-In-time is a shambles and most companies have returned to the practice of holding a lot of inventory.”

The latest data on industrial production has continued to trend in a positive direction. This has been fairly close to the long run average — only off by 0.9%. The bottom line is manufacturing has remained healthy as there appears to be continued demand for inventory build. There are a few motivations for expanded industrial activity and they are based on some trepidation regarding the future. There is the fear that government support through the Inflation Reduction Act might end in 2025. That also encouraged the manufacturers to act early and be ready for a possible retreat next year.

The level of workforce participation is as low as it has been since the 1970s. It stands at 61.6% and is still dropping. The issue for the industrial community is that there are few replacements for those that are leaving. The second issue is the supply chain as was discussed in detail above. The system of just-In-time is a shambles and most companies have returned to the practice of holding a lot of inventory. This is certainly making it possible to accommodate the needs of the customer, but inventory levels are high as compared to past years and that is expensive. It has also required the construction of a great deal more warehouse and storage space.

The third issue is related to the issue of inventory build — overall logistics has become more expensive and less reliable. The transportation sector has been overloaded by the expansion of online purchasing and most of the industry has been unprepared. The parcel companies like Fed-Ex, UPS and Amazon are booming but the traditional trucking industry has been negatively affected as there has been a decline in the kind of shipping that dominated before the boom in online.

The fourth issue revolves around trade. The pattern of the past was simple enough — produce or source in China and then deliver to U.S. users. As the U.S. has tried to protect its domestic producers and reduce the level of dependence on China, there has been a whole series of tariffs and restrictions put in place. That alters the patterns, and many seem to forget that a tariff is ultimately paid by the consumer of that product. Some in the U.S. can pass that cost on but many can’t.

The fifth issue is the same one facing business in general — what is the prospect for an interest rate cut and what happens with the coming election. There is potential for a radical shift in governmental priorities.

Register for Dr. Kuehl’s monthly free webinar at www.asa.net

His “Keeping it Real With Dr. Kuehl” economic update podcast is available on the ASA website and through usual popular podcast platforms.

More Dr. Kuehl

ASA Chief Economist Dr. Chris Kuehl conducts a free monthly live economic update webinar for ASA members and does three subject-specific podcasts each month. Visit www.asa.net for more details.

By Mike Miazga, Vice President Sales-Operations mmiazga@asa.net

Over the last four years, ASA has honored a bevy of deserving living legends with the Fred V. Keenan Lifetime Achievement Award.

While not a mandatory yearly award, members of the association’s Keenan Award nominating committee have recently bestowed the honor in successive years on such PHCP-PVF luminaries as Joe Poehling (First Supply), Joe Maiale (InSinkErator), Jeff New (Mid-City Supply), Gary Jones (Hajoca), and last year, Rob Grim (InSinkErator) and Don Maloney (Coburn Supply).

And now, two additional industry giants join this elite club of 18 honorees with The Collins Companies’ Brian Tuohey and Kohler’s Jim Lewis being named the recipients of the 2024 Fred V. Keenan Lifetime Achievement Award.

The ASA Executive Committee accepted the unanimous recommendation of the Keenan Award Selection Committee to add Tuohey and Lewis to this exclusive club. Tuohey and Lewis will be honored Nov. 14 at the InSinkErator Annual

Tuohey and Lewis share the unique distinction of coming off a 2023 year where both also earned ASA divisional top honors with Tuohey being named the recipient of the Industrial Piping Division Award of Excellence, while Lewis was the 2024 Plumbing Division Award of Excellence honoree.

“Being chosen to receive the ASA Fred V. Keenan Lifetime Achievement Award is both a totally unexpected and very humbling honor,” said Tuohey, CEO of East Windsor, Connecticut-based PVF distributor The Collins Companies.

“Thank you to my mentors, my colleagues at Collins, and of course, my family, who has encouraged, taught and supported me through the last 40-plus years, which has allowed me to life a life that could only be described as the realization of the American Dream.”

Tuohey, a 40-plus-year veteran of The Collins Companies, purchased the company in 1998, and under his direction has grown it into one of the largest industrial distributors of engineered specialties, pipe, valves and fittings serving the Northeast with nine locations throughout New England and Upstate New York. The company boasts a more than 100year lineage.

In addition to being a long-time member and past chairman of ASA’s IPD Advisory Group, Tuohey also served as ASA president in 2018 (the 50th individual to hold the presidency) and is the first ASA past president to receive the IPD’s top honor.

“This award represents everything you are to this industry and to this company,” said Tuohey’s daughter, Kala McDonald, vice president of HR and finance at The Collins Companies and a past ASA Women in Industry Advisory Council chairwoman, in a video talking about her father receiving the award. “You are always the first to raise your hand, always the first to say yes and your door is always open to your people and the opportunities that arise. Your forward-thinking manner has driven your success. All these things being said, you make us proud every day with the way you lead with your heart and your values. We are so proud and so very lucky to have you as our mentor and our model for how to lead.”

“I can’t think of anybody more deserving,” Galloup Executive Vice President Mark Wassink said. “Thank you for your service. Every time you have served in whatever capacity that may be, you have made others around you and our industry better, and that is truly a special achievement. Thank you, most of all, for your friendship and your mentorship. You are a special man and a special friend.”

Lewis, Kohler’s vice president and general manager for Kohler Home Solutions, has been a longtime member of the ASA Plumbing Division Advisory Group and also served on the ASA Executive Committee and Board of Directors, as well as the

ASA Vendor Member Division Advisory Group and the Building One Future — VITALITY Strategic Action Team.

“Being honored with the Keenan Award is truly humbling,” Lewis said. “It makes me think of all the teachers and mentors I have had along the way that I still look up to that invested in me — many of these are wholesalers and I am truly grateful. I have been fortunate to work for one of the great companies in our industry for the last 34 years and it seems like a great adventure much more than a job. Being part of ASA is important to me to be able to participate in keeping the industry we love strong. Being a Keenan recipient is truly the honor of my career.”

In addition to his active participation at ASA, Lewis is also very active with PHCC and has served on the PHCC Board of Directors, the Joint Center for Housing Studies of Harvard University, Remodeling Futures Council (serving on its Steering Committee) and is a past board member of the Kohler School Foundation.

“I can’t think of many people in our industry more worthy of this honor than you,” said The Granite Group CEO Bill Condron (a former ASA president) in a video congratulating Lewis. “Obviously, you built an incredible career at Kohler, but in that career, you found the time to volunteer in so many different ways in our industry and our association. We are a better industry and a better association because of incredible leaders like you who bring their passion, commitment and creativity every day. We are better off for it and it’s why you are so worthy of this incredible honor.”

Hajoca President and CEO Rick Fantham, also a former ASA president, cited four qualities that highlight Lewis’ commitment to ASA.

“One, you lead by example on engagement,” he said. “Two, you ensure Kohler invests in quality events to enrich our meetings. Three, you bring balance and commonsense to productive debates on the board, and four, you are always an advocate for ASA.”

Hajoca’s Jonas Weiner added: “This recognition is a testament to your dedication for supporting our industry in so many ways. Personally, you have supported me and guided me and helped so many of us contribute to the success of our industry. I look forward to your continued leadership and am proud to call you my friend.”

In addition to the recent Keenan pairings of Tuohey-Lewis, Maloney-Grim, New-Jones and Poehling-Maiale, previous winners of the award include Fred Keenan (for whom the award was named), Karl Neupert, Ed Felten, John McDonald, John Martin, Frank Finkel, Nick Giuffre, Morris Beschloss, Joel Becker and Dottie Ramsey

By Stephen Rossi Vice President of Advocacy srossi@asa.net

With Congress back in session after Labor Day, ASA members had a great opportunity to lobby legislators and their staffs on Capitol Hill before their current break to get back on the campaign trail.

Participants were hosted to exceptional experiences over the two-day A.O. Smith ASA Legislative Fly-In, while putting leaders from the PHCP-PVF industry in touch with policymakers.

This was the second legislative fly-in coordinated by ASA in 2024, after AD and ASA collaborated on a Hill Day in conjunction with AD’s Spring Networks Meeting held in March.

The event kicked off with an issue briefing by ASA VP of Advocacy Steve Rossi, who provided participants with an overview of issues that would serve as the basis for member activity on Capitol Hill, along with the latest legislative developments in the House and Senate.

Being in Washington at such a critical time — with legislators trying to finalize much of their work before heading back to their respective states and districts to campaign — served to keep ASA’s legislative efforts top of mind.

After the briefing and a small reception, ASA members had dinner to discuss both the journey they were about to embark

upon, as well as to discuss industry challenges and what legislative solutions could be enacted.

At the dinner, ASA member attendees were joined by Indiana Congressman Rudy Yakym, who currently serves on the House budget and transportation & infrastructure committees. Rep. Yakym joined in the spirited discussion with ASA members to provide insights into current legislative efforts, a preview of which issues of importance will come up next year, and gained valuable feedback from ASA members on how various laws and regulations are affecting their businesses.

The next morning, after a hearty breakfast to fuel ASA members through the halls of Congress, each member received a U.S. Senate padfolio, stuffed with the issues they would be lobbying on, as well as a map of the Capitol to aid in their Hill travels.

In addition, Rossi provided a quick overview of the mobile app each attendee would be using to ease their movement through office buildings. The app provided background information on legislators and staff, as well as provided a medium for feedback and allowed members to provide a note of thanks after their appointments had concluded.

A quick picture on the east steps of the Capitol and they were off! While some headed to their meetings on the Senate side, others set off for the House, where several were treated to a personal tour of the Capitol by Congressman Yakym, who graciously escorted ASA members to the House gallery while he took votes, then continued the tour that culminated on the Speaker’s Balcony (which some argue has the best view of Washington) for a group photo with the congressman, before heading out to their next appointments.

While at meetings with legislators and staff, ASA members sought to educate them on several issues of importance to our industry. These included:

Supporting current corporate tax laws, by opposing the repeal of the Tax Cuts and Jobs Act, and to support the maintenance of the 199A pass-through business

deduction, lower corporate rate, estate tax exemption, and full business expenses.

Supporting LIFO (Last In, First Out) Inventory Valuation

Support full repeal of the estate tax and protect step up basis: Asking members of Congress and senators to support the Death Tax Repeal Act (S. 1108/H.R. 7035)

Supporting the Healthy H2O Act as part of the current Farm Bill, which would provide direct assistance to rural communities, households, and nonprofits to test their drinking water and fund filtration technology to provide safer drinking water.

Supporting the Workforce Investment and Opportunity Act (WIOA) reauthorization, that passed out of the House with a bipartisan vote of 378-26 in April, but still needs to be passed in the Senate.

During lunch at the historic Capitol Hill Club, members were able to commiserate with industry allies such as Mark Valentini with Plumbing Heating Cooling Contractors (PHCC) National Association and Palmer Schoening of the Family Business Coalition, who provided additional insights on legislative and regulatory hurdles that the industry is facing during the current Congress and the next.

After lunch, members finished out their day with several appointments, before meeting for dinner that evening to compare notes and share their unique experiences.

“ASA members talked to their elected officials about supporting corporate tax laws by opposing the repeal of the Tax Cuts and Jobs Act.”

Together, members from 12 different states attended 31 meetings on Capitol Hill from across the country — giving them the opportunity to advocate for our industry and invite members of Congress and senators to visit their facilities to better understand the stature of the PHCP-PVF industry.

Our next opportunity to visit Capitol Hill will take place during NETWORK2025, being held next November in Washington, DC. In the meantime, if any members would like to visit their members of Congress, senators or their staffs — or invite them to visit their businesses — please contact ASA’s Rossi at srossi@asa.net

ASA members from 12 states attended 31 meetings on Capitol Hill during the recent ASA Legislative Fly-In.

By Mike Miazga, Vice President Sales-Operations mmiazga@asa.net

On the heels of the success of ASA’s 2023 Voice of the Contractor Survey, the association’s Business Intelligence Unit has been busy this summer and early fall on a new mission.

In partnership with Sarasota, Florida-based Farmington Consulting Group and owner TJ O’Connor, ASA will debut the results of the 2024 ASA Voice of the Builder Survey at NETWORK2024 in Chicago where O’Connor will give a live presentation on the findings.

The new survey queried builders across the country in the residential, multifamily, commercial and industrial sectors.

Business conditions

Preliminary findings (the survey was nearing its deadline for submissions at press time) show 61% of builders report demand for their services/work over the past 12 months has been steady or has increased, noting the high majority of builders are optimistic about the future.

Only 13% of builders expect demand for their services to decrease over the next 12 months, while 39% expect demand for their services to increase and 48% expect demand to remain steady over the next year.

Fifty-seven percent of builders state they have been installing more base products instead of premium products due to higher interest rates. Conversely, 41% of builders say high interest rates are having no effect on their builds.

Another intriguing question in the survey tackles property ownership. Seventy-four percent of builders own a majority of the properties they are building on, while 26% work for a larger entity, such as a developer.

89% of builders buy the majority of their decorative fixtures from wholesalers and 67% of the time the builders themselves are purchasing the decorative fixtures for their building projects.

An array of questions center around the innerworkings of builders. Ninety-eight percent of builders surveyed say they act as their own general contractor, while 49% have their own inhouse designer(s) and 39% say they use an external designer. Twelve percent of respondents do not utilize designers.

When it comes to working with wholesalers, 79% of builders only regularly do business with one or two plumbing distributors.

And when selecting a plumbing distributor to do business with the top five most important factors to builders include: product availability (No. 1), price (No. 2), relationships (No. 3), delivery capabilities (No. 4) and manufacturer brands represented (No. 5). E-commerce and online ordering capabilities ranked 11th.

Piggybacking on that online ordering topic, the average builder only places 11% of their total purchases with plumbing distributors online through their website and/or mobile app.

Just more than half of respondents say they are influenced by wholesaler incentive programs.

Only 28% of builders participate in builder-specific buying groups, such as Affiliated Buyers Group or CBUSA or HomeSphere where they earn rebates for purchases.

On a typical building project, 53% of the average builder’s budget goes toward material and 47% goes toward labor. The average builder states 56% of their builds are budget-minded, while 44% are designer-led.

Nearly 80% of builders are typically more interested in higher-efficiency products over builder-grade base products for their builds.

When selecting one brand of products over another, the top five most important factors to builders include: quality (No. 1), price (No. 2), availability/lead time (No. 3), style/ look/innovation (No. 4) and end-user preference (No. 5, i.e. homeowner, property manager).

In terms of rough plumbing materials, 81% of the time builders have their subcontractors purchase the rough plumbing materials for their building projects. At the same time, 91% of builders buy the majority of their rough plumbing materials from wholesale distributors.

PEX pipe is the No.1 preferred type of pipe builders prefer to install in their builds, while crimp PEX fittings are the No. 1 preferred type of fittings builders prefer to install. Just more than half of builders surveyed prefer to install fusion weld piping in their builds, while 48% prefer a grooved applications.

On the subject of water heaters, 64% of the time builders have their subcontractors purchase water heaters for their building projects. Just over half of builders prefer to install tankless units, while 39% prefer standard water heaters and only 6% prefer heat pump water heaters.

Half of builders surveyed hard spec a particular brand of water heaters in their builds, while an additional 31% say they hard multi-spec brands of water heaters.

“57% of builders stat they have been installing more base products instead of premium products due to higher interest rates.”

With decorative fixtures, 89% of builders buy the majority of their decorative fixtures from wholesalers and 67% of the time the builders themselves are purchasing the decorative fixtures for their building projects. Half of survey respondents hard spec a particular brand of faucets in their builds, while an additional 37% hard multi-spec brands of faucets. Half of survey respondents hard spec a particular brand of toilets in their builds, while an additional 35% of builders hard multi-spec brands of toilets.

The survey also gets into specific manufacturer brands in categories such as piping, water heaters and decorative fixtures.

If you helped ASA in any way with this survey, you will receive a complimentary copy for your firm. Otherwise, the survey will be available for $99 for members and $599 for non-ASA members by contacting ASA Manager of Data and Market Intelligence Bri Baresel at bbaresel@asa.net

61 80 11 56

61% of builders report demand for their services/work over the past 12 months has been steady or has increased.

Nearly 80% of builders are typically more interested in higher-efficiency products over builder-grade base products.

The average builder only places 11% of their total purchases with plumbing distributors online through their website and/or mobile app.

The average builder states 56% of their builds are budget-minded.

By Rebecca Fox, Blue Ridge Global

In the PHCP-PVF distribution industry, inventory management is a constant balancing act. Among the many challenges that distributors face, managing slow-moving and sporadically used items stands out as one of the most complex.

These items, while not in high demand, are still essential to the industry. Neglecting them can lead to lost sales and reduced customer satisfaction, while overstocking them ties up capital and leads to excess holding costs.

Effective demand planning for slow-moving inventory and sporadically used items is essential for ensuring availability while minimizing financial risk.

Slow-moving inventory refers to items that have a low turnover rate and are used less frequently. In the plumbing and PVF industry, these items might include specialized fittings, rare pipe sizes or niche valves that are only required for specific projects or maintenance jobs. While these products don’t move off the shelves quickly, they are critical to the success of contractors and end customers.

The core challenge with slow-moving inventory is balancing availability with cost. On one hand, customers expect distributors to have the products they need when they need them. On the other hand, holding onto excess inventory that isn’t selling can tie up valuable capital and increase warehouse costs.

In addition to slow-moving items, distributors also deal with items that have sporadic demand. These are products that may not be frequently purchased but experience sudden, unpredictable spikes in demand. This can be due to seasonal changes, large construction projects, or emergencies such as pipe bursts.

Sporadic usage patterns are difficult to forecast using traditional demand-planning methods, which often rely on historical data and consistent trends. While historical data and consistent trends work well for high-demand items, slowmoving and sporadic products often require more nuanced approaches. Since demand for these items is irregular and unpredictable, traditional forecasting methods may need to be supplemented with more specialized strategies or technology to ensure accurate inventory planning.

In order to effectively manage slow-moving and sporadically used items, accurate demand forecasting is essential. However, standard forecasting techniques that work well for fast-moving, high-demand products are often ineffective for these items. This is where more advanced strategies come into play, leveraging technology, data analytics and industryspecific knowledge to make better inventory decisions.

The first step in managing slow-moving and sporadic items

is to segment your inventory based on demand patterns. By categorizing products into groups such as high-volume, slow-moving and sporadic items, distributors can create customized forecasting models that reflect the unique characteristics of each category.

For slow-moving items, focus on maintaining just enough inventory to meet occasional demand without overstocking. For sporadic items, leverage safety stock to ensure availability during unexpected demand spikes, but avoid holding excessive quantities.

Historical data can be a double-edged sword when it comes to forecasting for slow-moving and sporadic items. While past sales data can provide insights into demand patterns, it’s important to account for external factors such as economic conditions, customer-specific needs and market trends.

In the plumbing and PVF industry, these factors can significantly impact demand for certain products. For example, a major infrastructure project might drive short-term demand for specific pipe sizes or valves, while regulatory changes could influence demand for environmentally friendly materials.

Advanced statistical forecasting models, such as Croston’s method, are designed to handle intermittent demand more effectively than traditional models such as moving averages. Croston’s method separates the estimation of the demand size and the time between demand events, making it particularly useful for forecasting sporadic and slow-moving items.

Implementing a forecasting solution that incorporates these advanced models can help plumbing and PVF distributors better predict demand for niche and sporadic products.

For slow-moving items, rather than overstocking individual branches, it can be more effective to centralize safety stock in a distribution center or hub. This approach allows for inventory to be transferred to branches on demand, reducing holding costs at the local level while still ensuring quick access to essential products when needed.

Additionally, utilizing demand exceptions and item alerts can help distributors closely monitor the performance of these items. By tracking changes in demand, distributors can rapidly adjust inventory levels, either replenishing stock or scaling back to avoid excess. This proactive approach ensures distributors can respond swiftly to fluctuations without compromising service levels or carrying unnecessary stock.

Demand forecasting technology uses frequently updated data to provide more accurate and responsive demand forecasts. In the plumbing and PVF industry, this can be especially useful for tracking market trends and responding to sudden shifts in demand for sporadic items.

For example, demand forecasting can alert distributors to a sudden increase in demand for specific valves or fittings due to a regional construction project, allowing them to adjust inventory levels accordingly. This approach helps distributors stay ahead of demand and reduces the risk of stockouts or excess inventory.

Safety stock plays a crucial role in managing sporadic and slow-moving items. While it’s important to have enough stock on hand to meet unexpected demand, carrying too much safety stock can lead to increased carrying costs and waste.

To optimize safety stock levels, distributors should analyze factors such as lead times, supplier reliability, and the variability of demand. By adjusting safety stock levels based on these factors, plumbing and PVF distributors can strike the right balance between availability and cost.

Finally, it’s important to regularly review the performance of slow-moving and sporadic inventory. By analyzing key metrics such as turnover rates, holding costs, and customer satisfaction, distributors can identify opportunities for improvement and adjust their demand planning strategies accordingly.

Inventory reviews should be an ongoing process, especially in an industry where demand can change quickly due to external factors such as construction cycles, market conditions and seasonal trends.

Effective demand planning for slow-moving and sporadic items in the plumbing and PVF distribution industry requires a combination of advanced forecasting techniques, collaboration with suppliers, and ongoing inventory optimization. By implementing these strategies, distributors can ensure product availability while minimizing costs, ultimately enhancing customer satisfaction and operational efficiency.

In a competitive industry, getting the balance right can be the key to long-term success.

Rebecca Fox is director of product marketing and strategy for ASA Silver Supplier Partner Blue Ridge, a global supply chain software company. Visit www. blueridgeglobal.com for more details.

How to get your profits back 7 tactics to align order value with logistics costs.

By Randy MacLean, WayPoint Analytics

When average order logistics costs exceed order value (gross profit), it will drain away profits already made on other (profitable) orders. In most companies, this is happening thousands of times each day, and it’s the principal cause of the profit erosion that’s prevalent in most distributors.

The real drivers of lost profits are rapidly escalating manpower costs (up 68% since 2006), and the end of historically low interest rates. These market changes are structural and permanent, so distributors need permanent changes to address them. Distributors are rethinking their pricing and service models, because too many orders no longer have enough value to cover their costs.

You can’t sell your way out of the problem, and simple acrossthe-board solutions won’t work, either.

Changes need to be tailored to very specific customer and product groups. Profit recovery can only happen when the tactics here are applied to very specific subsets of customers and products, otherwise they can harm sales and profits in other groups. This is why detailed analytics are necessary.

Simply said, you can’t apply most of these tactics without knowing which accounts to apply them to. You need detailed customer and product profitability data.

So, here are the specific tactics companies are using right now to get back to historic profit levels:

Get detailed customer profit analysis: Reports assess costs and profits for customers, products, sales territories, business segments and more. Multi-dimensional value and cost analysis can deliver advanced segmentation, identifying customer groups for specific actions.

Customer segments are further grouped by the cause of the dysfunction. (Low order value vs. high logistical costs; or high order frequency driving low order value, or a mismatched service model, or inappropriate pricing, etc.) Profit value for the various groups can then be managed using one or more of the following tactics.

Targeted price increase: Consider a price increase for groups of chronically money-losing customers. This can

help a larger portion of their orders cover their logistics costs and will reduce the losses from the group. Profitvalue segmentation is, by far, the most effective method for customer grouping, and identifying the “Reg-“ (small moneylosing customer) group for pricing action is one of the most effective mechanisms for recovering profits.

Small orders from money-losing small accounts typically consume about 35% of the profit made elsewhere, diverting millions away from the bottom line as the costs of these orders far exceed order value. In one recent case, the client was losing $4.4M per year in this group, and applied a 10% price increase for this segment, generating $1.4M in new profit. The orders were so small that the $4 or $7 increase in price was practically unnoticed.

Minimum order quantities: Set minimum order quantities (MoQs), or minimum order values, to ensure more orders contribute positively to the bottom line. This helps dilute the impact of fixed logistics costs per order. An analysis of actually-achieved profits for each SKU at each quantity level can be an eye-opener.

MOQ analysis is a regular activity in our large clients in low-margin sectors. Reviewing the low-value items in each product category and identifying the lowest quantity that can be profitable for each item can be one of the most effective ways to protect profits. In one recent example, the client was able to prevent more than $900K in losses on small orders by setting new minimum quantities on their lowest-value items.

This also can be implemented by sourcing low-value items in bundled quantities (6-packs or 10-packs) so gross profit is more likely to cover costs.

Stop breaking bulk packs: The savings in buying bulk packs is almost never as much as the extra manpower costs

needed to count and process random quantities of low-value items. Be sure you’ve got accurate and detailed analytics so you know where and when the practice is not a detractor from profits.

Actively manage delivery revenue: When “Free Delivery” is part of your business model, make sure there are parameters that prevent the practice from destroying your bottom line. What may have been a good idea at wage rates around $7 is unsustainable at $25+. Free delivery on the customer’s delivery day, or for orders more than $250 can be an avenue to continuing the practice.

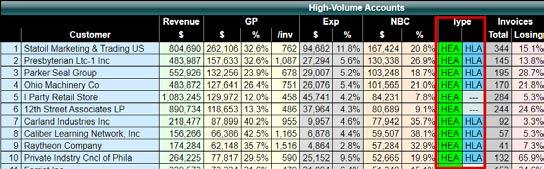

The red-tinted cells show where logistics (warehouse handling and delivery) costs exceed average order value. Identifying these accounts and changing the delivery model can generate big gains.

Restructure delivery schedules: Reduce delivery frequency, effectively combining orders and increasing average order value. For example, encourage order consolidation by offering your regular free or low-cost delivery only on specific days of the week. If your customers mainly operate on weekdays, you could offer free delivery only on Tuesdays and Thursdays. If they operate on weekends as well, you could offer it on Mondays, Wednesdays and Fridays. This approach not only lowers logistics costs by reducing the number of deliveries but also encourages customers to place larger, consolidated orders, thereby increasing the average order value.

Establish weekly delivery schedules: Another alternative is to establish weekly delivery schedules for your routes and offer customers free delivery on their designated delivery day, while charging for delivery on other days. This can streamline logistics operations and encourage customers to align their orders with the scheduled delivery days, consolidating orders and reducing costs.

Once again, detailed cost analysis can quantify the potential gains and identify the accounts to target.

Stop wasting manpower dollars in product movement: Reducing the number of locations where inventory exists can have a significant impact on long-term profitability. Each inventory location causes duplication of inventory and

duplication of personnel. The most profitable companies today have a focus on transitioning to DC-to-customer deliveries everywhere it’s possible. In one recent analysis, a client added more than 3% to their net profit rate by moving more than 1/3 of their deliveries to the DC-to-customer model.

OpCash ratios by branch shows values of product moved per expense dollar spent. Higher numbers show higher operating efficiency. Warehouse and delivery are highlighted.

Warehouse organization: Organize the warehouse to reduce walk time and increase efficiency. Use conveyors and robots to eliminate the manpower costs associated with moving products within the warehouse.

Product isolation and grouping: Revise product isolation within the warehouse so products most likely to be ordered together are stored together. This reduces picking time and handling costs.

Packing stations: Implement packing stations throughout the warehouse so products of different kinds or for different types of customers are co-located near their respective packing stations. This also reduces handling time and improves overall efficiency.

Think through service models for customer groups: Identify and plan out separate service models for different customer needs. For instance, counter sales can be organized with a self-serve component for customers that come in, allowing them to pick their own items from a limited selection of frequently purchased items. This model reduces the need for staff assistance and speeds up the purchasing process for customers, improving both efficiency and customer satisfaction.

Shift customers with high logistics costs to different service models that are more cost-effective. For example, transitioning some customers to self-service or lower-cost delivery options can help. Assess the feasibility of alternative service models such as click-and-collect or third-party delivery services to reduce direct logistics expenses.

Onsite delivery: Certain customers may need onsite delivery of products at jobsites. This model ensures timely delivery of necessary materials directly to the location where they are needed, reducing downtime and improving customer satisfaction.

Stocking inventory at customer sites: Another model might involve stocking inventory at a customer site, periodically counting what’s been consumed and billing the customer for those products. This ensures customers have immediate access to necessary items without frequent reordering and can streamline the billing process. In one instance, our client moved stocking inventory, processing equipment and personnel to the customer location. Not only was the customer delighted to have dedicated and immediate preparation of product but our client is now much more integrated in the customer’s success.

In each case, the objective is to consolidate more product value into individual deliveries, increasing the order value to logistics cost ratio for more of your sales.

Encourage customers to pick up orders themselves or set up regional distribution hubs that customers can access, reducing delivery distances and costs. By promoting selfpickup options, companies can significantly cut down on lastmile delivery expenses. Regional hubs can serve as strategic points for consolidating deliveries and providing convenient pickup locations for customers.

The objective is to provide a way to deliver products to customers with normally low order values in such a way that their participation in order entry, picking and transportation reduces costs so a viable order value need not be as high.

The value of these strategies is typically a profit increase of at least 5% of sales, so there’s millions available for companies that pursue them. The most surprising thing is that this is not new money. The gains all come from retaining more of the profits already earned on good sales, and simply not squandering those profits on money-losing activities.

Get started on this today, and your year-end will be much better than your current trajectory.

Randy MacLean, founder of WayPoint Analytics, has been delivering detailed cost and profit analyses to distributors and manufacturers for more than 15 years. Learn more at www.waypointanalytics.net.