2022 Fred V. Keenan Lifetime Achievement Award

A little more than a year ago, we took on a bold challenge to provide our members with a quarterly publication filled with strong, industry-relevant content from thought-leaders on a wide range of topics that you weren’t getting anyplace else.

The challenge to staff was to provide great topics, no fluff, no advertisements — a no-nonsense publication — and print and mail two copies per member, as well as email nearly 8,000 electronic versions. Oh, did I say no advertising revenue???

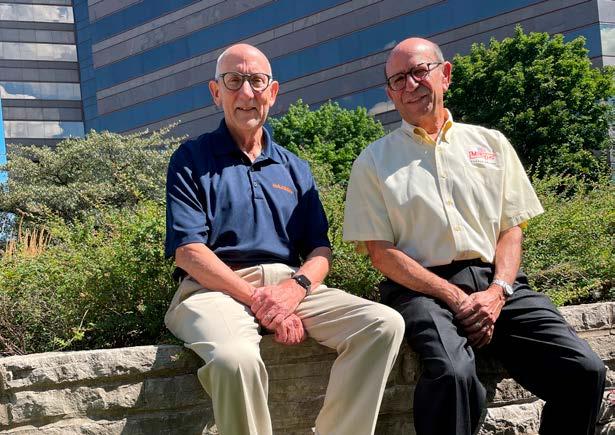

We have another exciting issue for you. In this issue, we highlight two industry icons as ASA prepares to present the prestigious Fred V. Keenan Lifetime Achievement Award to former ASA President Jeff New, chairman of Mid-City Supply in Elkhart, Indiana, and Gary Jones of Hajoca.

ASA Vice President of Innovation Beth Ladd, the director of our D.NEXT innovation lab, highlights research on how distributors can enhance their customer connections with contractors in light of mega-box stores such as Home Depot aggressively attacking our markets.

Industry consulting veteran Randy McLaren walks us through how distributors can gain advantages from proper customer segmentation.

Tom Noon, from ASA business intelligence partner Industry Insights, provides some great takeaways from the 2022 ASA Operating Performance Report, while stressing the importance in distributors utilizing this valuable benchmarking tool that now is in its 40th year of publication.

Graham Walker of ATS Software walks us through how the melding of artificial intelligence and human experience can be a game-changer in the construction supply chain.

ASA Emerging Leaders Chairman Dan New (Mid-City Supply) stresses the vital importance of building professional networks, while ASA Vice President of Operations Mike Miazga takes us through the results of ASA’s first quarterly market conditions survey.

2022 has been a turbulent year, but while I have talked to many members over the past few months, I am excited to hear that our members are ending the year on a high note.

Our Emerging Leaders and Women in Industry groups enjoyed record turnout at their conferences, ASA University created an exciting manual to guide members in establishing quality employee training programs, Dr Chris Kuehl continues to deliver his weekly podcasts, monthly webinars and economic reports, keeping you ahead of what’s happening in the economy, and our advocacy team is delivering as we face attacks on our businesses. You can check out Dr. Kuehl’s fourth-quarter observations in this issue.

And we think that these quarterly ASA Review issues are yet another quality benefit of membership. We hope you continue to enjoy them. Drop us a note if you’d like to read about a specific topic.

Michael Adelizzi, CEO

To be honest, there seems to be a lot that would encourage a bad case of insomnia these days.

We are to the point that we want to shoot “black swans” on sight. We still have to contend with the pandemic damage and, of course, we have had the oil/gas crisis brought on by the Russian invasion and the sanctions.

The hot topics of late have been recession and inflation and, of course, these are intimately linked.The surge in inflation has been attributed primarily to the supply chain chaos that has altered demand and supply equations as well as the energy mess.

Please forgive what might seem like a college lecture from your Econ 101 class that you have spent decades trying to forget. The news has been chock full of discussion regarding the interest rates set by the Federal Reserve, and nearly every time I hear some media type holding forth on the subject, they seem to get almost everything wrong. So, here is my feeble attempt to put some of this stuff in context and to help people understand what this interest rate manipulation is supposed to accomplish.

The rate that the Federal Reserve manipulates is the Fed Funds Rate.This is the rate that banks charge each other for overnight loans. Everyday banks make loans they can’t necessarily cover with the cash they have on hand and they are required to have enough on hand to handle these loans. They then borrow from one another to keep that balance sheet intact. The fact is that Fed rates do NOT automatically result in changed prime rates or mortgage rates or credit card rates.

They DO serve as a benchmark and guide, and most banks and other lenders react to the Fed’s movement. It is important to note that banks and mortgage companies and credit card issuers do not have to alter anything. Some will react right away, some will wait and offer bargains for a while. It is up to them.

The logic behind hiking rates is simple enough. It is a tool to address inflation. The usual motivation for an inflation surge is when demand exceeds supply. The consumer pushes suppliers to produce and if the supplier can’t keep pace they seek to control that demand with higher prices. Hike interest rates and the consumer has less money (eventually) and that reduces demand.

“Right now, companies are reluctant to let people go because it has been so hard to find them in the first place.”

There is demand-pull inflation and that is where aggregate demand increases faster than aggregate demand. There is also cost-push inflation where the price of inputs increases due to shortages of some kind. We are quite obviously dealing with the latter. The demand has not really been that excessive — it has been a supply chain breakdown.

Adding to the costs of production are wage hikes. As the worker seeks to keep pace with higher prices they demand more money. If there are not many jobs available, the workers have little leverage and are not succesful in demanding more. We have been in a labor shortage predicament for years and the latest data shows there are still 11 million jobs on offer for less than 6 million people ostensibly looking for work. Thus, the worker has all the leverage they need to demand higher and higher wages. The increase in wages thus far has been in excess of 5.5% and in many industries it has been more than that. This is still not keeping pace with inflation, however, and that means that higher demand levels are likely.

The hiking of interest rates works when one is dealing with demand-pull inflation as the more expensive money limits consumer demand. It is not very effective against costpush. This is what the central banks have been trying to communicate for years. The drivers of inflation have been a supply chain breakdown and the surge in energy costs due the sanctions imposed on the world’s second-largest oil producer (Russia).

Hiking rates is about all the central banks can do to tame inflation, but they admit it will only be partly successful. What will make them start slowing these rate hikes or even reversing them? It will come down to employment. The central banks have a dual mandate — control inflation and promote full employment through economic growth.

When the jobless rate begins to climb seriously the rate hikes will cease. This will mean unemployment rates north of 5.0% or 6.0%. It will mean a reduction in the “quit rate.”

Right now the number of quits is as high as it has been in decades as people assume they can find a job. When that is no longer the case the need to hike rates will fade. Given the most recent employment data there is no sense that the Fed will need to slow down the interest rate hikes, but that situation can change fast if the layoffs start to expand. Right now, companies are reluctant to let people go because it has been so hard to find them in the first place.

So, what about the energy situation as this has been the other prime driver for inflation? At the time of this writing, in the span of a few weeks the per-barrel price for oil has declined (falling to less than $80). There has been no sudden hint of a solution to the Ukraine mess or sudden discovery of additional oil reserves.

This is a consumption issue as the expectation is that recession will cool demand for fuel. There will be less freight moving, fewer people flying, more people reducing their commute as they may have lost their jobs.

The challenge right now is that very little of this has been manifesting yet. The freight sector is still suffering from lack of capacity, the airlines are packed, jobless rates are down and consumers are spending. The sense is that oil prices may bounce back up again unless and until there is a real reduction in activity — maybe back to the $100 level.

Dr. Chris Kuehl is ASA’s chief economist and managing director of Armada Corporate Intelligence.

Three Fridays a month, ASA Chief Economist Dr. Chris Kuehl drops a 5-10-minute quick-hit economic update podcast for ASA members.

“Keeping it Real With Dr. Kuehl” addresses a specific topic of great interest to ASA members doing business in the PHCP-PVF supply chain. Have a topic or question for Dr. Kuehl? Email it to ASA’s Bri Baresel at bbaresel@asa.net

April 11-13, 2023 Charleston,

May 10-12, 2023 Savannah, GA

Mid-City Supply Chairman Jeff New and Hajoca Eastern Division Pricing and Vendor Relations Manager Gary Jones were exposed to what giving back to the industry means at young ages.

New, who was ASA’s president in 2008, started working at the Elkhart, Indiana-headquartered nine-location distributor at age 10, sweeping floors and filling orders at his father, Sam’s, company.

His first exposure to the American Supply Association came at an ASA convention in the late 1970s. “I was impressed with everything,” he says. “I attended conventions fairly regularly thereafter.”

New was really bit by the ASA bug when he attended an Emerging Leaders (called Young Executives at the time) conference in Colorado in the mid-1980s.

“It was there that I formed friendships with industry peers I still maintain today,” he says. “I joined the board of CWA/ NCWA in 1990 and started attending ASA board meetings as I went up the ladder in the regional leadership. At that point, I was hooked. I knew ASA was important to our industry, to my company and to myself. At those meetings, I realized I was surrounded by people smarter than me. I asked a lot of questions and learned a lot.”

Jones has a similar story, with Eastern Pennsylvania Supply’s Guthrie and Jack Conyngham egging him on to get involved with the industry’s national trade association.

“Guthrie and Jack were stewards of the industry even before ASA was formed,” he says. “They allowed me to attend early in my career, but strongly urged me to get involved on the regional and national level and to make a difference. As I transitioned to Hajoca (Hajoca acquired Eastern Penn

in 2017) under the leadership of Rick Fantham (Hajoca president and CEO) and Jock Castoldi (Hajoca division manager), the emphasis was even stronger.”

And both New and Jones have made a difference and then some with their long-time support of the PHCP-PVF industry and the American Supply Association through many key volunteer efforts. Thus, it’s no shock both were unanimously approved as the recipients of the 2022 Fred V. Keenan Lifetime Achievement Award. They will be honored at the ASA member lunch at NETWORK2022 in Chicago, Nov. 10.

New has been a longtime supporter of ASA’s government affairs efforts, serving as chair of the ASA Government Affairs Committee for 11 years and is now the chair of ASA’s new Advocacy Strategic Council. New also has been heavily involved over the years with ASA’s Political Action Committee. “Jeff has been an inspiration to ASA,” Consolidated Supply President Karla Neupert Hockley said in New’s award video. “His leadership and dedication are remarkable to the buying groups, to the chairs of ASA, as our ASA president and his involvement with government affairs. It’s a privilege for Consolidated Supply and Mid-City Supply to have a multigenerational friendship with the News and the Neuperts. It’s a wonderful achievement that Jeff is so deserving of. I know Karl (Neupert; Karla’s late father and a fellow Keenan Award recipient) would be very proud as well. Thank-you for your dedication and commitment to the industry, and most of all, thank-you for your friendship. You are positive. You are an inspiration and you have made this a better industry.”

Jones is proud to have been part of the inaugural roster of volunteers to serve on what is now known as the ASA Plumbing Division Advisory Group some 10 years ago. Jones also enjoyed a stint as that group’s chairman, which afforded him a seat on the ASA Board of Directors. Jones remains active with that important advisory group today.

New, pictured with his son, Dan (right) and Indiana Senator Todd Young, is heavily involved in ASA’s advocacy efforts. New is the current chair of ASA’s new Advocacy Strategic Council. Photo courtesy of Jeff New.

The Keenan Award is presented to individuals with a long history of service and dedication to the PHCP-PVF industry. To be considered, individuals must have exhibited strong influence on the current status of the industry, project a positive industry image, be responsible for positively affecting the industry in general, and have provided a history of dedicated service to the American Supply Association.

“My father taught me the need to give back to the industry that allowed you to be successful,” says New, whose sons, Dan and Jordan, are now co-presidents of Mid-City Supply, representing the third generation of family ownership. “I definitely got a huge return on my investment.”

New was president of ASA at a time when the association was at a crossroads of relevancy in the PHCP-PVF supply chain.

“As I was going through the chairs, it became apparent to the leadership that ASA was in need of a ‘refresh,’” he explains. “The hiring of Mike Adelizzi (current ASA CEO) gave us the needed spark to regain our importance to the industry. That, along with the creation and funding of the Karl E. Neupert Endowment Fund (ASA Education Foundation) and the development of a strong government affairs program have had the greatest impact on our industry.”

“The greatest benefits are always the relationships over the past 46 years,” he says. “They are irreplaceable. As difficult as it is, our personal and company goals should always take a back seat to the industry goals. Unless you put the industry goals first, you will never get the true value or meaning of ASA.”

“Gary is a super example of nice people finishing first, just like Fred Keenan himself,” Fantham said in a video congratulating Jones on the award. “The four qualities I admire about you the most — one your passion and pride for ASA. You are always a world-class ambassador. Two, your high expectations

New (an Indiana University grad) and Jones (Penn State graduate) both have served in a variety of key ASA volunteer roles over the years. “I definitely got a huge return on my investment,” New says of his involvement in ASA. Photo by Mike Miazga/ASA.

and functional competence. You always do your homework. Three, your servant leadership. You get so much joy winning through others; and four, your kindness and caring for all. You make each person feel special, including me. It has been my absolute privilege to have grown from colleague to friend since you joined the Hajoca team. Thank-you for being you.”

“You have always been a mentor to so many of us,” InSinkErator Director of Wholesale Sales Rebecca Falish said in her video tribute to Jones. “You always challenged us, always the wisest in the room. You always asked the right questions until you got the right answer, and for that I learned a lot and for that we are all thankful.”

Jones says if given the chance to speak to ASA membership he would address the emerging leaders and key decision-makers at ASA-member companies.

“To be given this award for doing what I have loved for 46 years is an honor beyond belief.”

Both New and Jones are humbled by the Keenan honor. “I am not naïve to believe there are many more deserving of this honor than I am,” Jones says. “To be recognized along with Jeff New and what he continues to contribute to ASA is truly humbling.” Photo by Mike Miazga/ASA.

—Jeff New “The decision-makers have the ability to allow their associates to attend these meetings. It has never been more important to keep them in the industry as we see today with our labor situation. Don’t hide them from the beauty of our industry. I am proof that ever-lasting friendships and relationships are formed, and I have been allowed to be part of a great industry for the past 46 years. Allow others the same opportunity.”

“Emerging leaders in our industry have the opportunity to attend EMERGE (Emerging Leaders conference), ELEVATE (Women in Industry conference) and even NETWORK,” he explains. “I represent this group. No family affiliation, no vendor position that ASA was a requirement. I was someone who was allowed to attend and was encouraged to get involved and make a difference. Don’t stay in one group, but volunteer for other groups as well, if possible. There are many pillars now being formed that you would be able to assist in.

New has seen ASA take big steps forward over the last decade-plus. “ASA is in a good place right now,” he says. “Our membership has grown in numbers with more distributors, manufacturers and reps joining the ranks. Participation at conventions has been great. We have more programs for our membership than ever before and continue to look for more ways to be relevant. A component of our strategic plan in 2007 was to become a vital part of our industry. While that is always a moving target, I think we are achieving that goal.”

New and Jones join a select group of 12 other distinguished individuals who have received this award since its inception: Fred Keenan (for whom the award was named), Karl Neupert , Ed Felten , John McDonald , John Martin , Frank Finkel , Nick Giuffre , Morris Beschloss , Joel Becker , Dottie Ramsey , Joe Poehling and Joe Maiale The ASA Executive Committee accepted the unanimous recommendation of the Keenan Award Selection Committee to add New and Jones to this exclusive club. First Supply’s Poehling and Maiale (InSinkErator, retired) were honored last year at NETWORK2021 in Las Vegas.

Jones was an original volunteer leader on what today is known as ASA’s Plumbing Advisory Group and previously served as that group’s chairman. ASA file photo.

By Dan New, Chairman, Emerging Leaders Advisory Council

By Dan New, Chairman, Emerging Leaders Advisory Council

My first experience with ASA’s Emerging Leaders division was back in 2012 when it was still called Young Executives. I attended the Spring Forum conference in New Orleans and knew absolutely no one going in.

My dad, Jeff New, is very involved in ASA and was ASA president in 2008, so I had a little knowledge of ASA. What I didn’t know was just how valuable this group would become to me and my company.

At the top of the list when it comes to how impactful this group has been is the relationships I have developed with other distributors, manufacturers and reps. These relationships have led to many opportunities to improve our business.

There have been countless conversations with manufacturers that have led us to looking at new lines, bringing in new products or improving our partnerships with current vendors. Conversations on best practices with other distributors have led to improving our own operations. For example, a friend from another distributor reached out to me to talk about how we compensate a specific management position because he was going to be promoting someone soon and needed ideas on how to compensate them. Instead of paying a consultant, we reached out to other distributors when we had questions about our ERP system. There are many more examples of this over the past 10 years, and none of these interactions would have been possible without ASA’s Emerging Leaders group.

Since that New Orleans conference, I have attended every Emerging Leaders Spring Forum and have gained valuable knowledge at each one. In Charlotte in 2015 we heard Steve McClatchy talk about improving our performance by understanding how we make decisions. It was an eye-opening talk that gave us simple techniques to use to improve our performance that I still use today. In Cleveland in 2017 we heard Alex Goldfayn talk about his process of “Selling Boldly,”

and how doing simple actions can greatly increase sales, which ultimately led to us working with Alex directly in 2019 to develop a sales program for our company.

Do you have an eager young salesperson looking to take that next step, and you don’t know exactly how to provide it to him or her?

Do you have a new marketing manager who is eager to learn more about the industry and make connections with others to drive your marketing program?

Do you have a branch manager who has been with your company for a while, but is new to the position, and you’re looking for ways to help them improve?

How about a high achiever (or someone with potential to get there) who would benefit from some extra education and networking to help them see the bigger picture and get them to the next level?

If any of these situations, or ones like it, sound familiar to you, you’re not alone. Across our great industry we have incredible people who need that extra infusion of knowledge and networking building/expansion above and beyond what we can provide at our individual companies.

The Emerging Leaders division of ASA is here to help.

Emerging Leaders is an inclusive group for those in your organization who show potential to be more, and caters to individuals in all parts of your company. We have members in management, sales, marketing, HR, finance, operations and others. Anyone in your organization who is in the early part of their career or role will benefit from this group. We have members who are in their first year with their company and new to our industry, and others who are industry vets on their company’s executive team with more than a decade of experience. We have members in their mid-20s and their mid-40s.

Our mission is to help develop the up-and-coming leaders of our industry.

If you nodded your head along with anything you read here, if you want your people and your organization to improve, I urge you to join Emerging Leaders and have someone (or multiple people) in your organization come to our Spring Forum in Savannah, Georgia in May 2023.

Then make the commitment to come back in 2024, 2025 and beyond to build on that knowledge and further develop those relationships. My customers, associates and vendors are glad I did.

Dan New is co-president of Mid-City Supply in Elkhart, Indiana, and is the chairman of ASA’s Emerging Leaders Advisory Council.

While 2022 has been dominated by topics such as supply chain issues, possible recession and inflation, ASA distributors are plowing full steam ahead.

That diagnosis comes from the results of the recently released inaugural ASA Quarterly Market Survey. As background, prior the survey’s deployment, ASA’s Business Intelligence unit asked a group of association distributor members what questions and topics they would like asked in the survey.

Both multiple-choice and open-ended questions were asked, allowing respondents to further elaborate on their responses.

Full results of the survey were sent to ASA distributor members and can be found in the MyASA members-only portal at www.asa.net/myasa (log-in credentials required) or by emailing ASA Manager of Data and Market Intelligence Bri Baresel at bbaresel@asa.net

Questions in the survey ranged from standard sales and business-condition topics to more specific queries such as what companies are doing to help their employees combat inflation, vendor-managed inventory, incentives used for employee training, best practices being used to maintain current employees and resist resignations and what is the biggest unknown you would like to have data on, among others.

As chronicled in ASA’s monthly sales reports throughout this year, business conditions continue to be favorable. More than 90% of respondents to the survey report sales have increased over the past six months, while only 9.7% report a decline in sales.

One respondent cautioned that much of the uptick can be traced to price increases, while another distributor noted it was up in terms of dollars, but volume is closer to flat vs. the prior year. “Dollars more than units,” another distributor wrote. In terms of recession talk, just more than 58% of respondents say recent recession talk has minimally impacted their business, while 22.6% report it has somewhat had an impact, while nearly 13% say recession chatter has had no impact. “Prices are higher, but the amount of projects started does not seem to stop,” a respondent noted.

Distributors were asked if they pay more attention currently to week-over-week sales or gross-profit trends, and 74.2% of respondents say gross-profit trends hold more importance currently than week-over-week sales.

“Margin is one of the top-two importance factors of a successful business,” one respondent wrote. “We can control margin and expense, but sales are what they are at the current time.”

One distributor noted they watch both, as well as open orders.

of respondents are handling inflationary pressures by issuing salary increases to employees.

When posed the question if Home Depot or other big-box stores have had a greater impact on business since the start of the pandemic, 33% of distributor respondents responded either with “minimally” or “no impact” with 16.1% saying “greatly” and 19.3% responding “somewhat.”

“The big-box tends to push price increases through slower than the wholesale channel,” one distributor said.

Respondents noted PVC, fittings and water heater pricing are the most common pain points when it comes to losing business to big-box stores.

Following up on that question, 51.6% say they do not see a continued increase in big-box store market share in the industry with 48.4 saying they do see a continued increase in big-box store prevalence.

“The big-box stores created some pricing pressures with certain products,” one respondent said. “They are selling products for less than we can buy them.”

of respondents say they see a continued increase in big-box store market share in the industry.

As far as current inflation conditions, the response from ASA distributors was a positive one.

“It’s stabilizing overall,” one company wrote. “I expect price increases to return to a more normal cadence and see current prices as a new set of normal in terms of a baseline.”

“Some prices are going up, but my real concern is looming deflation, such as with water heaters,” another distributor wrote.

One key question posed to ASA distributors was how they are handling the inflationary pressures with employees? Almost 75% say they issued salary increases to help, while other remedies mentioned included bonuses and a one-time inflationary stipend check.

Distributors were asked how they are best managing vendor lead times as the supply chain heads toward better stability?

“We are trying to hedge and manage inventory and only buying what we need at this time,” one respondent wrote.

“Increasing the number of vendors used,” was another response.

“I was ordering more inventory than I normally would to mitigate stock outages, but with deflationary pressures mounting, I dare not do that,” one distributor explained.

“We have way too much inventory,” another distributor lamented. One distributor brought up the topic of freight with this

topic. “Lead times are much more reliable, however vendor minimums for free freight are increasing,” the distributor noted. “This has forced buyers to purchase less frequently.”

In terms of still problematic product categories, PVC pipe, flex duct and valves ranked at the top of list among survey respondents.

Looking at the next six months, nearly 60% of respondents say they expect sales to slightly grow, while a little more than 25% say they expect sales to slightly decline. The good news is only a little more than 3% say the expect a strong decline in sales over the next six months.

Fast-forwarding to 2023, more than 61% of respondents say they predict an economic decline, project delays/cancellations next year.

Digging a little deeper on that topic, more than 67% of respondents say if a decline/disruption in 2023 occurs, it will happen in the first six months of 2023, while just more than 32% say if there is a decline, it will happen in the backend of 2023.

If you have a question(s) you would like posed in the next quarterly market survey set to launch in January, 2023, email ASA Manager of Data and Market Intelligence Bri Baresel at bbaresel@asa.net

61A little more than 61% of survey respondents say they predict an economic decline, project delays/ cancellations, continued disruptions in 2023.

KEEPING MEMBERS INFORMED, ENGAGEDCommercial construction requires a high degree of human expertise that will never be replaced by machines. There are, however, a large number of low-value tasks that are primed for AI automation and efficiencies.

Highly skilled architects, engineers, quoters, manufacturers and wholesalers can greatly benefit from such automation. Freeing these professionals to operate only in their greatest strengths through collaborative intelligence will lead to dramatic efficiencies, an exponential surge in capacity, and soaring profitability, transforming the future of the construction value chain.

A study in the Harvard Business Review involving 1,500 companies found that the most significant performance improvements are achieved when humans and machines work together. Let’s explore how AI technology can complement human expertise to reduce time and costs, issuing in a new era of productivity, capacity and profitability.

At a high level there are three core elements that bring a construction project together:

1) The humans that design, engineer, price and construct the building.

2) The products that make up the building.

3) The computers and technology that help calculate, tabulate and communicate all the steps required to realize the project.

Before we explore how AI and humans can collaborate, we must acknowledge the superiority of human judgment. People will always have a superior innate ability to consider outside factors, making secondary decisions that will positively impact a project in ways that a machine simply cannot.

We can, however, easily program a remarkable degree of knowledge and technical experience through machine learning. Today, with the right algorithm, we can train AI with the equivalent of 50-plus years of human technical experience and logic in just a day or two.

Furthermore, AI can continuously learn and gain more expertise as additional input is given, empowering humans to make increasingly informed decisions with unprecedented speed and accuracy. This allows professionals at every point in the construction value chain to leverage the learnings from each project into greater efficiencies and profitability. It is this marriage of unique strengths that makes the collaborative intelligence of humans and AI the recipe for a revolutionary leap forward in productivity and achievement.

Let’s consider a specific example in the design, quoting and supply of the plumbing elements (Division 22) of a new construction project. There are three key participants involved:

1) The design team of architect and engineer.

2) The manufacturers of the products specified.

3) The pricing and supply chain, made up of manufacturers reps, wholesalers and contractors.

Today, there are many inefficiencies caused by the lack of data-rich specs and drawings. The detailed product information in the drawings — and the specifications produced by architects and engineers — is not currently accessible as data that can be read by a machine and imported into a pricing solution.

The absence of a universal manufacturer product database leads to many redundancies in the process of turning specifications into a quotation. As such, the process

currently relies heavily on human experience and judgment and is inordinately time consuming. A comprehensive, validated, multi-manufacturer database from which architects and engineers can specify, and rep firms and wholesalers can quickly price the project would completely eliminate these inefficiencies, increasing the productivity and profitability of everyone involved.

Once a project is issued for tender, pricing continues to rely on manual processes by highly experienced quoters who read, extract the products, reenter data into a pricing tool and issue numerous pricing requests. This process is duplicated dozens of times by various reps, manufacturers and wholesalers, all of whom are quoting the same project. These redundancies are unnecessary and add significant costs to the process.

Instead, imagine using AI to instantly do these initial steps one time and making that data available to all, so that

it eliminates the duplication of manual effort in reading drawings and specs and extracting the products specified.

Then, imagine that product data being sent to a pricing platform that produces a quotation that is queued up for review by the experienced human quoters. These professionals then make any necessary judgment calls and refinements to ensure the highest level of accuracy in the quote. Suddenly, they are completing their pricing tasks in a quarter of the time with an exponentially higher degree of accuracy. This is how collaborative intelligence can and will revolutionize productivity and profitability across the value chain process.

The future is collaborative Not all change is progress, but all progress requires change, and those who are willing to embrace AI-based advancements will be the first to realize the exceptional and transformative efficiencies to be found in collaborative intelligence.

AI is not displacing professionals, but rather empowering them to leverage their greatest strengths while nurturing the key relationships that lead to greater opportunities and long-term, sustainable profitability. This is why we see extraordinary confidence in the senior executives who recognize that the future of enabling greater human excellence and corporate success begins with investing in AI today.

AI is not displacing professionals, but rather empowering them to leverage their greatest strengths while nurturing the key relationships that lead to greater opportunities and long-term, sustainable profitability. Shutterstock Photo.

Graham Walker is vice president of sales and marketing at ATS Software. The ATS Spec Tool is a cloud-based specification information system that connects the design community with the leading building product manufacturers in the construction industry. Contact Graham at graham@atsspec.com.

Our industry needs talent at a time when a large segment of the labor pool is retiring, and more and more young jobseekers are looking for career opportunities in newer and more exciting industries.

Association members need to ensure successorship of leadership and a pipeline of qualified candidates to fill jobs. The complexity and scope of this challenge is beyond the ability of any one company and requires a unified industry effort driven by the association and its member companies to attract a diverse group of candidates into the industry through a universal, positive and accurate narrative for the PHCP-PVF distribution industry.

The American Supply Association is proud to announce that Steve Edwards, former chief marketing officer for industry giant Winsupply, has joined the ASA team to lead Project Talent and the association’s effort toward promoting the industry brand and attracting career seekers to member companies.

During his 15 years at Winsupply, Edwards led a marketing team and brings with him an incredibly strong background to drive one

of the most critical issues facing every industry company.

Critical to this effort will be to continue to develop and expand a robust marketing and communication strategy to create awareness of the career opportunities within the PHCP/PVF industry, while working closely with a third-party advertising agency and volunteer committees; working closely with the Project Talent Task Group and other key volunteers to develop and implement impactful communications that engage ASA members in utilizing and supporting association recruitment tools; and curate high-value recruitment resources to support member efforts to attract and retain top talent; develop programs and services to support ASA members in their recruitment efforts; as well as expanding efforts to engage ASA members in the recruitment process, plus utilizing the developed tools to support these efforts.

For more information about all the career resources that ASA has available, contact Steve Edwards, sedwards@asa.net or 630-467-0000, extension 1220

ASA PAC continues to grow in significance Increased participation and reinvigorated fundraising efforts help provide support for elected officials who support the PHCP-PVF industry.

By Steve Rossi, Director of Government AffairsHaving emerged successfully from 2020 election cycle, ASA PAC has continued to grow over the last two years — both in fundraising and awareness.

Backing more than 25 federal candidates in 2020, ASA PAC saw a 92% success rate in helping candidates win seats in the House, as well as the Senate. Not content with resting on its laurels, the PAC has entered the 2022 midterms with increased vigor in a difficult political environment.

Since the last election, ASA PAC has significantly increased the number of member companies authorized to participate in political activity but has also reinvigorated its fundraising efforts. Authorized ASA members have been generous with both their time and financial support to help our industry have a voice in Washington and a seat at the table.

While the last election saw the White House change hands, Republicans picked up seats in the House —providing Speaker Nancy Pelosi (D-CA) the narrowest political majority in modern history. After a contentious election for the Senate and two runoffs in Georgia, the upper chamber was split evenly between both parties, the first time a 50-50 split had occurred since 2001.

Since the vice president also serves as the president of the Senate with the power to break tie votes, the 51-50 Democratic advantage gave Sen. Chuck Schumer (D-NY) leadership in the chamber.

Economic, political and social realities have provided one of the most unstable political environments ever. Between runaway inflation, increasing energy costs, supply chain issues, an unbalanced job market and a Supreme Court decision, voters have shifted back and forth on several issues over the last 10 months. Historically, the party out of the White House picks up seats during the midterm elections — sort of a “buyer’s remorse” for voters.

At the beginning of the year, Republicans appeared set for a major sweep of Congress, riding on the president’s approval numbers and shaky economic performance. In July, the Dobbs decision activated certain elements of the Democratic Party that had previously been disinterested in voting.

In addition, political polling has suffered some setbacks since the 2016 election. With less people having landlines (which was the traditional medium for polling), pollsters have had to mix things up by also incorporating mobile phones, SMS and online survey to gauge voter sentiment. However, as 2016 and 2020 polling showed, certain shifts in voting coalitions had been missed, as well as discovering the intentions of new voters. Even considering that, the polling methodologies have gone largely unchanged.

As a result, ASA PAC embarked on a high level of research to find the best mix of federal candidates to support in 2022. The candidates supported included a mix of new candidates, veteran office holders and those who have helped our industry through tough times by implementing commonsense public policy. By targeting candidates that possess these qualities, as of this writing, ASA PAC has supported 10 candidates in the Senate and 15 in the House to help support those who stand up for our industry.

Since 2020, ASA PAC has made great strides to build the organization’s reputation, influence and standing. That growth will continue into the 2024 presidential cycle, as more members participate, contribute and engage with their elected officials in Washington.

As part of that strategy, ASA will be holding a Legislative Fly-In in Washington, D.C. in spring 2023, providing individuals of ASA member companies the opportunity to meet with their elected officials on Capitol Hill. More details on the Fly-In will be released shortly.

If you are interested in participating, please contact Government Affairs Director Steve Rossi at srossi@asa. net for more information.

I think most executives can remember a carefully planned marketing or pricing initiative that didn’t really pan out.

Some years ago, we saw yet another example of this and decided to find out why so many projects weren’t paying off. The answer turned out to be the ineffectual customer segmentation models the programs were based on.

There had to be a better way — a methodology directly serving the very purpose of effective segmentation — so we engineered something much, much better. This has been a renaissance in the effectiveness of these programs and has had a real impact on the profit rates of many companies.

The need for differentiated service models Wise and effective use of company resources requires identification of customer segments which have similar needs and logistical requirements, presenting similar opportunities to produce high profit rates.

The first two of these elements demand thinking through and developing streamlined service models for each type of business or customer the company serves.

“Service Model” is the term for a particular set of processes and practices that encompass the way your company interacts with certain customer groups. It describes what you offer and how, what supporting services (such as trade credit and delivery) are included, the level of sales coverage, etc.

Differentiated service models for different sets of customer needs are an absolute requirement to improve your competitive position and drive profit growth.

Integrating the opportunity and efficiency components into your plans is where profit-value segmentation comes in.

Because no company has the bandwidth to develop individual service models for every customer, effective segmentation shares the invested time across many customers.

Segmentation is a management trick — it’s supposed to group customers with similar needs and logistics so your initiatives will be right for most or all of the customers in each segment. This increases efficiency because you need only develop a limited number of programs or policies, and a large number of customers can be affected.

Too often, segmentation efforts get mired in the surface attributes of the customers — things such as customer size, sector or zip code. This results in diverse populations within the segments, which is the opposite of the objective.

We found that, by far, the most effective segmentation looks at customer profit opportunity and customer relationship efficiency. In other words, identifying customers more- or less-likely to produce profit, and whether they actually do so. So, how is this done?

Profit-value segmentation delivers a reliable and effective way to properly segment customers, and to match the right mix of offerings and processes to each group.

Ineffective segmentation based on cosmetic or surface attributes such as company size, market and geography aren’t correlated to opportunity or efficiency and will create diverse populations within the segments. Programs targeted at the “average” needs of each group will be wrong for most of the segment population, causing programs to fail.

Segments developed with profit-value segmentation use profit opportunity and relationship efficiency to group customers. This value-based methodology groups customer with very diverse attributes into each group, and is a much more precise fit for tailored offerings and operations.

Groups with marginal profit opportunity can be made more profitable by creating more streamlined or no-frills service models, which will ameliorate losses and can change moneylosing small accounts into money makers.

Groups that are the actual core of the company’s profit generation get concierge service and a high-level treatment that brings resiliency to the relationship and makes it easier for the salesforce to get more of them.

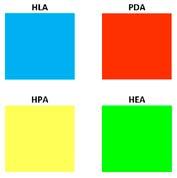

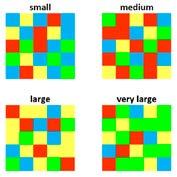

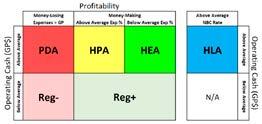

Profit-value segmentation uses customer profit potential and efficiency values to map them into a matrix, segregating them into groups where the two dimensions are similar within the group.

You’ll know the segmentation has failed when your dependent initiative requires course corrections and myriad exceptions.

Profit-value segmentation is based on the two critical dimensions and produces segments with customers very cleanly distributed into very actionable segments.

This creates six segments. The five segments on the left are exclusive of each other, where a customer can only exist in one. The sixth segment (on the right) is a second dimension that will contain customers already in one of the segments on the left.

In the world of LIPA (Line-Item Profit Analytics), our field of specialty, we have a vernacular so we can effectively communicate the values that really control profitability and growth. So, for clarity, a few definitions:

OpCash (operating cash) is usually called gross profit and represents the profit ceiling for a sale or account.

CTS (cost-to-serve) is the sum of operating costs associated with doing business with a customer, excluding the cost of the salesforce.

NBC (net before compensation) is the operating profit, before the costs of the salesforce are applied.

ROX (return on expenses) is the actual NBC return for dollars spent in operations and administration. You might think of this as ROI for expenditures.

“Reg-“ signifies

in

but don’t represent enough OpCash to have a large individual effect on profit performance. Shutterstock Photo.

With that out of the way, let’s look at the segments produced by the profit-value segmentation model.

HLA – High-leverage accounts: High-volume accounts with above-average NBC production rates. HLAs generate profits at a much higher rate than all other accounts, and are both the fastest path to increased profit, and the way to increase the company’s overall profit rate. Increasing the proportion of sales in these accounts is the only way to increase the company’s profit production rate. This is vital for company leaders to drive sustained profit and cash-flow gains. HLA accounts are the first part of your Platinum account group — the accounts you prioritize and protect.

HEA – High-efficiency accounts: High-volume accounts with below-average cost rates. HEAs convert large OpCash values into profit at a CTS well below their peers. They’re the best accounts for growth because adding accounts to this group grows OpCash and NBC faster than it grows expenses. This drives higher ROX values, and this segment is the second part of your Platinum account group.

HPA – High-potential accounts: Accounts with aboveaverage OpCash, but below-average profit performance. HPAs have the potential to be very large money-makers or very large money-losers. You can’t make or lose a lot of money on a small account. The initiatives you develop for this class of customers will streamline to operational costs for the group, and likely include incentive design to encourage large, less-frequent orders.

PDA – Profit-drain accounts: Accounts with above-average OpCash production, but also out-of-range expenses. They feature an inverted spread between margin and CTS% (CTS% is higher than margin, producing losses). PDAs are the accounts that need to be reformed or replaced, as they consume profits made elsewhere.

Reg+ – Money-making small accounts: Accounts in this group are profitable, but don’t represent enough OpCash to have a large individual effect on profit performance, but their usually large numbers can add up. There will also be accounts in this section that are on the fringe of being HLAs and can be moved into the category with some focus.

Reg- – Money-losing small accounts: Accounts in this group are unprofitable, but don’t represent enough OpCash to have a large individual effect on profit performance, but their usually large numbers can add up. Improved service models, customer incentives and policy changes can move the least-bad of these into the Reg+ category and encourage the worst to patronize your competitors where they’ll tie up resources and drain profits.

Profit-value segmentation is the core of developing the differentiated service models that most effectively match resources and activities to the right customers, streamlining your organization so it produces gains in profit and customer service, while eliminating wasteful activities and related costs.

This is so critical to success that it’s a core function here at WayPoint, and drives customer selection and service models in the companies that out-perform their industries.

Editor’s note: This article is adapted from a section in “Profit-Driven Analysis & Practices: The CEO’s Guide to Record Profits” by Randy MacLean.

Randy MacLean is the founder of WayPoint Analytics (www. WayPointAnalytics.net), the inventor of LIPA and best-selling author of a series of profit practices books. For more than a decade, he’s been analyzing company results, thinking about, writing about and advising on profit issues in distribution and manufacturing. Contact Randy at info@waypointanalytics.com or 480-426-9955.

Follow all the ASA happenings on the association's popular LinkedIn social media page @American Supply Association (ASA)

By Beth Ladd, Vice President of Innovation

By Beth Ladd, Vice President of Innovation

As B2B offerings become increasingly commoditized, it has become more important than in any previous time in history to have a clear picture of the value proposition of your distributorship.

The last 20 years — and in particular, the last two — have seen the slow but steady growth of industry behemoths that are driving commoditization of the PHCP-PVF industry. Compounding the pressures posed by this commoditization, the number of active contractors is likely to further decline in the near future.

By 2025, the youngest of the baby boomers will be 65 years old, and the “birth dearth” following the Great Recession will begin a reduction in the number of new high school graduates entering the workforce. Combine this shrinkage in your customer base and the increasing difficulty in differentiating your place in the industry, and one can see that this is a critical time for distributors to have a clear, strategic vision of the elements of value that attract, delight and retain their contractors and customers.

From the inception of ASA’s D.NEXT initiative, distributors have claimed there exists a unique value in the relationship that distributors have with their contractors. However, when asked to define or describe the components of this differentiating and valuable relationship, many are flummoxed.

We have attacked this question from multiple angles throughout our research for the industry, and we believe we have found the beginning of an answer.

We developed a pyramid diagram that depicts elements of a distributor’s relationship with their contractors. We took inspiration from research performed in 2018 by Bain Consulting and refined it specifically for our members. The concept is that of a hierarchical pyramid of value where each layer acts as the foundation and support for the higher levels of the pyramid. The lower layers are more quantitative and objective, and each subsequent layer becomes more subjective and qualitative as the value provided becomes less transactional and more experiential or personalized. For a copy of the diagram, email mmiazga@asa.net.

Our framework for distributors describes 23 distinct “elements of value.” They fall into five levels: Table Stakes, Functional Value, Ease of Doing Business, Relationship and Purpose.

The base of the pyramid contains elements of value that are the foundation of any business relationship: price, product availability and ethical business practices. These elements are the bare minimum for contractor customers to consider doing business with a supplier — they can almost be understood as needs rather than elements of value, unlike the other levels of the pyramid.

That said, you cannot compete exclusively on price and availability alone. Amazon and big-box stores will always win for the products they sell. If the decision of where to go for materials was dictated exclusively by price and availability, then distributors would have shaky ground to stand on. But there is more to business than price alone. One need only have sufficiently low pricing, sufficiently regular availability and sufficiently forthright business practices to remain in business.

Once this foundation is laid, research indicates additional resources invested in these elements will see diminishing returns compared to the higher levels of the pyramid.

The second level of elements of value represents things that provide quantitative value to the contractor, but how much value they provide and how they are seen by each contractor can be more subjective. The way we differentiate between functional value and table stakes is whether weakness in one area will bring business to a halt — a poor delivery network or lacking digitization can be frustrating, but unreasonable stock shortages are crippling.

Functional value is composed of seven elements: scalability, discounts, product quality, product problem resolution, transparency, delivery and digitization. We wish to clarify a few of these, as our usage of these terms is slightly unconventional.

Scalability does not refer to the scalability of the distributor, but rather the ability of the distributor to support the growth of contractor companies, in terms of both material and organizational demands.

Product quality refers to having products that are of a sufficient quality for the contractor’s or end customer’s purposes. This can, but does not necessarily, mean the highest possible quality.

Product problem resolution means dealing with all forms of postsales support — installation, warranty, exchanges, returns, etc.

Transparency refers to actively providing contractors with a clear view of the distributor’s ordering, processing, timelines

and capabilities. A key point is the actively in actively providing, even if the information is technically available, if it takes a great deal of effort for the contractor to access it, that information is of no more use than not being available at all.

We do not believe the elements found here have become commoditized in the same way that table stakes have, in part due to the more subjective nature of their impact on the contractor, but we are seeing the beginning of this process. In particular, the pandemic and the resultant significant investment in digitization by big-box stores has drastically accelerated the rate at which these elements are becoming non-negotiable to contractors.

On the graphic, there is a red line between the lower two levels and the upper three. This is to represent the division between what every supplier is capable of doing — and every supplier does, to some extent — and the things that big-box stores do not do.

The first two levels provide material benefits to your contractors and quantifiable benefits to a business. The three higher levels are more subjective, and at times can seem ephemeral. Although the first two layers are significant, we believe that a distributor only needs a solid-enough foundation to support their efforts in the higher layers. Once that foundation is secured, our research indicates you should focus the remainder of your time and energy on the highest three layers.

We believe the three higher levels represent an opportunity for distributors to differentiate themselves from competitors, personalize contractor experience and reveal competitive advantage. The higher levels do not necessarily provide obvious or immediate returns, and this means that efforts towards these elements may, at times, feel misplaced. It is not our intention to discount the time and investment that improving these elements will require, but we believe that an opportunity for truly cementing your relationship with your contractors lies in ease of doing business, relationship and purpose.

Lastly, there are two connected reasons to focus on these higher elements of value. The first is we do not currently see big-box stores focusing on these elements, meaning your efforts here may help you differentiate yourselves from the more commoditized giants. The second, and the more important reason, is we believe they likely never will. These national giants are under pressure to show consistent shortterm returns. Investments in their business are publicly scrutinized by shareholders. Most distributors have the blessing of not being forced to respond to shareholder pressures, and this gives you the freedom to invest in building long-term resilience over near-term returns.

The third level contains elements that make doing business with a supplier more personalized and pleasurable, things that improve the contractor experience in a way that is tangible and marketable but may be difficult to isolate.

Ease of doing business is composed of seven elements: time savings, organization, reduce hassles, flexibility, product knowledge, risk reduction and product mix.

Time savings is reducing contractors’ time spent during any stage of the purchasing journey. Examples include picking orders before contractors arrive and charging to a contractor’s account instead of paying at the counter.

Organization means providing services and resources to help contractors get both stock and business organized. This is helping the contractor organize, not organizing your own business.

Reduced hassles means reducing the friction that exists when purchasing supplies. Reducing hassles is about reducing the amount of effort contractors have to expend, while time savings is about reducing the amount of time spent.

Flexibility is being willing and able to deviate from written or established processes to accommodate different contractors’ needs, including providing extension of credit terms and support of custom projects with protracted timelines.

Product knowledge is providing technical details and getting product information from the manufacturer on the contractor’s behalf. This includes conducting research and acquiring information from manufacturers and their representatives.

Risk reduction means helping contractors reduce their business risk. This includes offering tool rental services to reduce financial risks by keeping funds available, avoid tool/ equipment storage costs and complete jobs efficiently.

Product mix refers to offering a wide variety of products, including convenience and expendable items, so that contractors don’t have to go to multiple locations to get everything they need.

We think of this layer as the elements that improve and strengthen the relationship between two businesses — the contractor’s and the distributor’s. This is the first layer that truly represents “relationship,” and this layer focuses on the business side of the relationship. It may be the case that this layer is more foundational than the fourth because a lack of a personal relationship is acceptable, so long as there are business reasons to stay with a distributor. On the other hand, a strong personal relationship that isn’t founded on good business principles will eventually lead to the contractor asking themselves hard questions.

This level contains the elements of value that build and maintain the personal, human relationship between the contractors and the employees of a distributor. Importantly, this is not the relationship between management and the contractors. These elements foster the development of interpersonal relationships between your employees and your contractors. These elements compel people to want to interact with the expectation of a better day. The fourth level is composed of five elements: cultural fit, expertise, commitment, fun and perks and education.

Cultural fit is all about providing contractors with a sense of community during the process of purchase, i.e., distributors and contractors share the same values and ways of doing business. Note that preferences for what this culture should look like will vary from person to person. The point of focusing on cultural fit is to make your contractors comfortable and welcome, to make them feel like they are on the same team as the distributor’s own staff.

Expertise means having staff that possesses practical or applied knowledge in the industry and using that knowledge to help their contractor customers. The way we differentiate technical knowledge in the third level from expertise here is that technical knowledge is book learning, whereas expertise is applied knowledge. It’s the difference between having the specs for a product memorized and understanding the difficulties that come with installing said product and knowing how to work with or around them. Expertise is particularly relevant for less experienced contractors who may need to rely

on the knowledge of the distributor’s staff for help.

Commitment means demonstrating commitment to the contractor’s own success. Employees should be given agency to demonstrate that customers’ problems are taken as their own problems. This means the distributor purposefully acknowledges that a contractor’s commitment to remain loyal to distributors comes with certain responsibilities, and the distributor needs to commit to the necessary work to maintain that loyalty.

Fun and perks is offering experiences and incentives for contractors to get involved with distributors’ business, including giving away snacks, drinks, merch, etc. This is both about improving the contractor’s lives on a day-by-day basis with the little things that show every customer matters, and the big events that reinforce a sense of community between the contractor’s and the distributor’s employees.

Education means offering training opportunities for ongoing education, new products and new technologies (occasionally in cooperation with manufacturers and their representatives). Making it easy for plumbers to learn new installation techniques, helping them keep their license through education credits, and even providing access to industry conferences all help to support your contractors’ livelihood and business success.

These elements help develop a sense of community between people, of belonging in the same tribe and having a bond with one another. They are all things that cannot be forced or they will feel fake; they are also extremely difficult to overtly measure without hindering their authenticity.

Broadly, efforts in these elements of value may consist of identification and reduction of organizational culture barriers and supporting the growth of your people. In particular, a significant place where culture is experienced is at the counter. This is a core interaction with contractors, a primary mode of business, and the place where two people can interact face-to-face most often. All these elements are applicable throughout the company, but their implementation is relevant and highly impactful at the counter.

This one contains a single element of value. All organizations exist to make peoples’ lives better, sometimes in major, transformational ways and oftentimes in smaller, subtle ways. This element shares recognition, inspiration, love of and hope for the future of the industry and the community of tradespersons. Purpose goes beyond providing products and

building relationships and extends to include strengthening the future of the contractor’s business, as well. Purpose will not necessarily provide a distributor recognition or differentiation, but it should provide clarity on how to help contractors succeed.

A distributor we interviewed described the potential for inventory management software integration with their contractors. The software would track inventory of pipes, valves and other supplies at the contractor’s shop. When the inventory fell below a predetermined threshold, an order would be transmitted to the distributor who would pick, pull and deliver replenishment stock directly to the contractor’s shop. Digitization of this business process offered near-term benefits: organized buying behavior, relieved contractors of manually counting inventory and supported having enough product inventory at the right time. However, in the long game, it supports a contractor’s strategy to grow and scale their business by creating inventory data to feed into reports that support monitoring, forecasting, job costing, quoting and fiscal discipline.

Partnering with your contractors at this level is certainly mutualistic and somewhat altruistic. It enables a distributor to discern where to increase or decrease their efforts and customize supporting services for each contractor customer. In this way, you become more than adjacent members in a value chain, you contribute “a how” to a contractor’s future and strengthen the community of trades as well as the industry overall.

The last two years have seen disorienting waves of business chaos as well as a volume of change equivalent to the preceding 10 years combined. More than ever, distributors should be asking themselves what relationship opportunities lie within their grasp. Chaos has reshuffled the deck and has dealt the savvy player an opportunity to push beyond the way it is being done toward the products, services and relationships of the way it will be done.

What elements of value resonate with the contractor customers of today and the upcoming Generation Z? How will your distributorship choose to incorporate elements of value into your operations in support of your community, contractors and customers?

Now is a pivotal time for distributors to get curious, innovate and engage in developing, communicating and operationalizing a clear vision of their elements of value.

Beth Ladd is vice president of innovation at ASA and runs the association’s D.NEXT innovation lab at Research Park on the campus of the University of Illinois in Champaign-Urbana. For more on D.NEXT and the innovation lab, contact Beth at bladd@asa.net

How will your distributorship choose to incorporate elements of value into your operations in support of your community, contractors and customers?

ASA OPR provides your key to better company financial performance Now in its fourth decade of publication, this industry gold-standard report provides benchmarking metrics in more than 70 categories.

By Tom NoonLet’s face it. New challenges always exist in the PHCP-PVF distribution industry.

While we all keep hoping business will continue to be as strong as that of the past 18 months (for most industry companies), the uneasiness of an impending recession, coupled with geopolitical pressures, is quite unsettling. Certainly, the recent slowdown of the housing market, as the Federal Reserve has raised interest rates to combat decades high inflation, further complicates future business decisions.

It is no wonder that unprecedented uncertainty exists.

Ironically, even with the pandemic, the supply shortages, and all the other recent challenges, industry wholesalers have continued to flourish. Based on the 2022 ASA Operating Performance Report (OPR) results, 2021 revenue growth of 20.7%, and bottom-line profit margins of 8.5% (before tax) are both the highest reported results in decades. Yet, whatever might be lurking for the next 12 months is unsettling, to say the least.

Over the 40-year history of the ASA OPR, many recessions have come and gone, followed by periods of prosperity. While the reasons for strong or poor performance have varied, and certainly swings in the economy are a major factor, one clear consistency exists among companies that are the most successful:

Their owners strive to seek and implement as much information about their business operations as possible. One

tremendous industry tool in this regard is the annual ASA Operating Performance Report

Someone once said, “What you don’t know about your business has as much or more impact on your company’s success as what you do know.” Or said differently, your company’s problems probably have more to do with your own lack of knowledge, innovation and implementation, than a recession could ever have.

Each year’s ASA OPR provides you with vital financial and operating performance benchmarks for gauging your own company’s strengths, weaknesses and improvement opportunities. Such information is nowhere else available.

In addition to receiving the nearly 100-page industry-wide report that tracks more than 70 critical financial metrics, an in-depth customized report shows your own firm’s confidential performance ratios alongside the aggregated results of comparable groups of your industry peers. The industry-wide report also contains analysis, historical trends, ratio definitions and all the data aggregations.

The OPR has been prepared in strictest confidence for the past 40 years by Industry Insights, ASA’s business intelligence

partner. The only thing ASA does is pay for this service — it never sees a single company’s results — ever. All you have to do is sit down and fill out the confidential OPR survey form and submit your information (in confidence) to Industry Insights.

The reports you will receive back, as well as the interactive capability of the ASA Business Intelligence Portal, could literally save your company thousands of dollars, and maybe even be the difference between surviving or failure.

For example, a consistent key to high profitability in the industry is effective personnel management. The most recent study finds that “payroll costs (including fringe benefits) as a percentage of sales” by industry segment to be:

14.5% for plumbing supply firms.

15.1% for PVF firms.

15.2% for plumbing supply & PVF combination firms.

13.8% for HVAC & other firms.

14.7% for all OPR participants in the aggregate.

If your company’s personnel costs are substantially higher than your industry peers, this may be a red flag of inefficiencies that are hurting profitability.

You may be asking yourself: I am not a financial expert and I simply do not have the time to pour through countless performance ratios, trying to understand what they mean.

You do not need to worry. The OPR study is designed so you do not have to be a financial expert and you do not need to spend much time in order to learn invaluable insights about your business that are not otherwise possible. Rather than writing a 20-page dissertation about the benefits of participating, here are 10 short reasons for doing so each year:

Your own company’s ratios are already calculated for you and shown alongside the most relevant peer group comparatives. So, once you participate, you never have to make any calculations.

In addition to the comparative performance ratios, you are also provided with an objective report card showing your own company’s potential strengths and weaknesses, and improvement suggestions.

Over time, you are provided trend graphs highlighting your own company’s historical performance (for key measures) vs. the trend performance of your industry peers.

The report provides vital information pertaining to profitability, productivity, sales performance, liquidity, operating expense control, cash management, inventory management, receivables management and other important information.

If you did not participate in the 2022 ASA Operating Performance Report and would like to purchase a copy of this benchmarking gold standard, contact ASA Data and Market Intelligence Manager Bri Baresel at bbaresel@asa.net.

The report is an invaluable tool for dealing with bankers and obtaining the most favorable loan terms.

The report provides invaluable information to help value how much your business is worth; plus, OPR survey participants can utilize ASA’s Business Valuation Appraisal service at a greatly reduced price.

The OPR is the only true benchmark available for the PHCP-PVF distribution industry.

Participation is easy. Fill out a short confidential questionnaire and submit it to Industry Insights through ASA’s Business Intelligence Portal.

The yearly OPR participation fee is insignificant relative to the improvement potential for your business.

The study is done in strictest confidence by Industry Insights, as has been the case for 40 years.

Can you really afford not to participate? The OPR is designed to serve as an easy-to-understand, actionable tool for industry firms to evaluate their own company’s operating results, in order to pinpoint strengths, weaknesses and improvement opportunities.

Tom Noon is principal at Industry Insights, ASA’s business intelligence partner. Contact Tom at tnoon@industryinsights.com or 380-233-9163