REVIEW

ASA leaders work to define the future and the association’s role in getting there

ASA President Patrick Maloney

Setting the stage for the next 5 years

For nearly 20 years, ASA has been driven by a long-term vision and strategic plan, created by members and staff that has guided the resurgence of our national association.

Today, ASA has become the unifying voice that is leading our industry in key strategic areas, from advocating for our industry for sound legislative and regulatory policy in Washington, California, or at the codes and standards level, providing critical data for members to make sound business decisions, building brand awareness of our industry for new career seekers that will fill our job openings, to how AI and innovation can be utilized by members to win success in the future.

In this exciting issue of ASA Review, we look at the work nearly 90 ASA volunteers put in at the annual ASA LEAD strategic planning retreat to map out the critical issues the association will tackle over the next five years as we continue to lead our members in a rapidly changing landscape brought on by disruption from AI and innovation.

As the industry’s association, it is our goal to provide you with critical information to help you and your teams embrace the changes that are disrupting your futures. Engaging the entire industry behind one united voice in the advocacy fight to protect our industry’s interests is one of our critical components of our strategic vision. To help in this vital area, ASA recently partnered with the AD buying group in Washington, D.C., to go up to Capitol Hill for meetingswith 80 different members of Congress to advocate for several key industry issues. Nearly 300 AD attendees were part of these meetings, all advocating for issues such as tax reform and sensible regulations. You can read more about this successful event in this issue.

Also in this issue, Graham Walker from ATS Software, outlines mastering metrics and creating a data-driven guide for distributors. We’ll also look at the results from the new ASA biannual Cross-Industry Compensation and Benefits Report, while our own Steve Edwards reports on the association’s second labor study and how the labor landscape has changed in our industry since that first study was conducted back in 2015, alerting us to the rapid decline in our industry’s labor force brought on by an aging workforce. And ASA Chief Economist Dr. Chris Kuehl tells us if there is going to be a shift in the economy heading into the summer months.

We continue to be proud of the awesome content being presented in each issue of ASA Review that provides you with the trends and challenges you need to be aware of, and how you and your teams can navigate your future.

We hope you enjoy this edition.

Mike Adelizzi CEO

As an ASA Association Partner: Repfabric is the exclusive association partner of ASA for CRM software, specifically designed for distributors/wholesalers, manufacturers, & manufacturer reps in the plumbing industry.

InSinkErator’s Rebecca Falish receives Alice A. Martin Woman of the Year Award

By Mike Adelizzi, CEO madelizzi@asa.net

During the recent ASA Women in Industry ELEVATE conference in Nasvhille (that set a new attendance mark with more than 425 attendees), it was announced InSinkErator Director of Wholesale Sales Rebecca Falish is the recipient of the 2024 Alice A. Martin Woman of the Year Award.

The award honors the legacy of the late Alice Martin of NIBCO. The award was created with the goal of recognizing women in the PHCP/PVF industry who have a record of significant accomplishment and embody the character of Martin; who exemplify traits of embracing education and encouraging inventive ideas; promoting/mentoring women within our industry; inspiring others through their work and example; participating in ASA Women in Industry Division activities; and being a bold leader that others emulate.

Falish embodies those qualities and more as a leader, a mentor and a champion for women, which has resonated throughout every discussion made about her. Falish is a former ASA Women in Industry Division chairwoman (and a founding member of the division), a former member of the ASA Executive Committee and Board of Directors, the ASA Vendor Member Division Advisory Council, chairwoman of the ASA’s Workforce Development Strategic Council and a member of the ASA Northeast Advisory Council (formerly WANE). Her service to the industry includes volunteer roles outside ASA, including PHCC.

“Rebecca has been such a great influence in my career,” 2024 ASA Women in Industry Division Advisory Council

Past Chairwoman Kala McDonald (The Collins Companies) said. “A few years back, she asked me to chair Women in Industry after her term and I was beyond intimidated. I do not like public speaking and I wasn’t sure I was up to the task, but she assured me I was. She gave me a pep talk and sold me on the concept, and then she said she would have my back and she did. Over the years, I have witnessed Rebecca mentor and elevate so many people, both men and women to get them to see their own potential. She is a true leader in this industry and a great example for all women going forward.”

Past recipients include: 2019: Ashley Martin (NIBCO), 2020: Katie Poehling Seymour (First Supply); 2021: Robyn Brookhart (Liberty Pumps); 2022: Suzanne Chreene (Delta Faucet); 2023: Karla Neupert Hockley (Consolidated Supply).

“I am so thrilled Rebecca is being honored with this award,” 2024 ASA Chairwoman and Women in Industry Division cofounder Katie Poehling Seymour (First Supply) said. “In the true spirit of Alice, Rebecca has been behind the scenes of the Women in Industry Division since its inception. Like Alice, she has simply done the work and made things happen for the organization without a lot of fanfare. She is a friend, a partner and has been a role model for my journey in this industry.”

Industry Calendar

To access the latest PCHP-PVF industry calendar of events, visit www.asa.net.

InSinkErator’s Rebecca Falish is the 2024 Alice A. Martin Woman of the Year Award recipient. Photo by Rob Zambrano /ASA

Mastering metrics: Part 1 A

data-driven guide for PHCP/PVF distributors.

By Graham Walker

The wholesale distribution of plumbing and HVAC products operates within a highly competitive marketplace. Distributors consistently battle against thin margins, evolving customer demands, and the ongoing complexities presented within the supply chain. Studies show that companies leveraging data analytics see a 5-6% increase in profitability, so let’s dive into the power of metrics and reveal how they can drive your success.

It may seem that KPIs are something you should be able to pick up off the shelf and use, like a piece of software or a template. The truth is KPIs are a detailed representation of your specific business and of your aspirations for your business.

Metrics empower decision-making. You can only manage what you can measure, so well-crafted metrics that provide insights into the elements of your objectives and strategies are essential to accomplishing your goals. Actionable metrics provide focus and drive improved outcomes. This article lays the foundation for building a thriving data-centric wholesale business while introducing strategies for leveraging emerging AI tools that extract greater value from the abundance of data now available.

Building a metrics-driven foundation

The why: Understanding the power of KPIs

An effective mix of KPIs should be both backward and forward-looking to provide meaningful guidance beyond simply measuring activities. Lagging KPIs yield critical insights from what occurred in the past while forward-looking objectives and results oriented KPIs (sometimes referred to as OKRs) drive behavior by measuring trends and progress. Both are needed to improve efficiency, increase profitability, boost customer satisfaction and safeguard competitiveness.

Wholesalers can quickly see areas where past processes or decisions succeeded, so these successes can be repeated, or they can easily spot areas where a focus and change are needed.

“A focus on measuring the right metrics and cascading them down to the entire team has allowed us to make improvements year-over-year due to the ability to see where gaps exist in productivity, customer loyalty, and bottom-line growth and take action to correct them,” says Mark Mininch, president of Marks Supply, a Marcone Company, with more than 60 years in plumbing and HVAC distribution in Toronto.

In addition to key financial metrics, Mininch breaks down his metrics in a way that follows the same path as the revenue in the company, starting with quoting to win new projects, purchasing to maintain proper inventory levels based on demand, fulfillment to measure the efficiency of orders and customer service and logistics to ensure optimization of cost and service. For this article, let’s reclassify these a little into similar but expanded categories of metrics, we’ll start in Part 1 here with senior management and sales and customer service metrics and then come back in a future issue with quoter and warehouse manager metrics.

(See details of how to set up the KPIs for these metrics on LinkedIn: www.linkedin.com/in/next-gen-ai)

“Win rate metrics are helpful when evaluating product pricing, the performance of specific sales channels or when developing effective promotional or joint-rebate strategies.”

1. Senior management metrics

a. Inventory accuracy and turns:

Consistent control of inventory is key. This metric provides a vital snapshot of supply chain efficiency and working capital needs. Accurate inventory and timely turns prevent potential revenue loss caused by expired, slow-moving or damaged products.

b. Fill rate and on-time delivery:

These metrics are essential for meeting customer needs. Distributors must understand fill rates and track how accurately and timely orders are delivered, as these are pivotal indicators of customer satisfaction and loyalty.

c. Customer acquisition cost (CAC) and lifetime value (LTV):

These metrics shed light on the overall return on investment of activities involved in attracting new customers. Wholesalers must consider if these acquisition costs make acquiring specific customer segments feasible and, ideally, identify the highest-value customers driving long-term profit.

d. Gross margin and profitability by product group:

A thorough analysis of the gross margin by product or product group offers a clear look at what product lines, suppliers, and even specific SKUs offer the greatest return. Knowing this data makes optimizing pricing or focusing sales and marketing decisions an informed process.

e. Operational costs and overhead:

These metrics measure overall business spending. An examination of overhead expenses and operating costs enables distributors to streamline their operations or

pinpoint areas needing specific attention to maintain or enhance profitability.

2. Sales and customer service metrics

a. Sales cycle length and win rate:

These metrics track sales effectiveness. Monitoring the speed at which sales move through the funnel identifies issues in the process and offers insights for further optimizations. Win rate metrics are helpful when evaluating product pricing, the performance of specific sales channels or when developing effective promotional or joint-rebate strategies. These measurements should be divided up by sales category (showroom, counter sales, commercial projects, etc.) and by region.

b. Fill rate and on-time delivery:

Consistent fulfillment expectations influence customer satisfaction, and sales and customer service teams are at the front line of dealing with issues when expectations are unmet. Providing customer service teams with visibility into these metrics empowers them to take a proactive role in ensuring orders are filled and shipped on time.

c. Customer satisfaction with project execution:

Projects may often be a one-time occurrence for the customer, so it’s essential to focus on the experience for every job from start to finish. This customer satisfaction metric directly evaluates how successfully distributors manage project deliveries — ensuring future opportunities come back.

Graham Walker is vice president of sales and marketing at ATS Software in Toronto, Ontario, Canada. ATS enhances the design development process by providing options to review manufacturers’ product details and build customized and accurate spec packages complete with images, written specs, BIM families, budget pricing and more. Contact him at graham@atssoftware.com .

A thorough analysis of the gross margin by product or product group offers a clear look at what product lines, suppliers, and even specific SKUs offer the greatest return. Shutterstock photos.

ASA labor study shows progress in some areas and continued challenges in others

By Steve Edwards, Director of Recruitment Marketing, sedwards@asa.net

Eight years after ASA conducted its first national labor study of the PHCP/PVF industry, the association has repeated its efforts to understand the current state of the industry’s workforce and what changes have occurred since the first study in 2015.

The 2015 study illustrated the aging workforce in the industry and the need to attract potential employees to make up for the large number of anticipated retirements. This resulted in the creation of ASA’s PROJECT TALENT platform, a strategic initiative to attract and grow the number of talented workers across the industry.

The latest study’s results show that more than 31% of the industry’s workforce is over the age of 55 with almost 10% 65 years old or older. This is compared to 2015 where 26% of the industry’s workforce was over the age of 55 and nearly 6% was 65 or older.

When you consider there are about 373,000 employees among PHCP/PVF distributors, manufacturers, and independent manufacturers reps, this means there are 116,000 employees who have reached or are close to reaching retirement. ASA members report they expect 27% of

the workforce or about 101,000 people to retire in the next 10 years with 41,000 of those in the next five years.

Furthermore, the number of employees between the ages of 19 and 24 has increased from 6% in 2015 to more than 10%

62% of ASA members report the number of women employed by their firms has increased since 2015. Slightly more than 1 in 5 PHCP/PVF industry workers are women. ASA’s Women in Industry ELEVATE national conference recently drew a record 425 attendees in Nashville. Photo by Jason Mallory/ASA.

now, signaling the industry is working to address the large number of expected retirements.

PHCP/PVF workforce becoming more diverse Evident by the growth of ASA’s Women in Industry division and the increase in women attending industry events, 62% of ASA members report the number women employed by their firms has increased since 2015, with 30% reporting it’s stayed about the same. Slightly more than 1 in 5 PHCP/PVF industry workers are women.

In addition to the growing population of women in the industry, similar increases are being seen in the number of Hispanic, African American, and Asian workers.

Full-time employees still dominate the industry

Despite the evolving makeup of the U.S. workforce, the study also shows that more than 90% of workers in the industry are employed full-time. This is consistent with the results from 2015.

This is notable given the growing number of people taking part in the gig economy made up of short-term employment, contractual jobs, and independent contractors. Gig economy workers have more than tripled since the 2015 study according to a study conducted by the University of Chicago.

“The study shows ASA members are expecting to need slightly less outside salespeople, but more counter salespeople.”

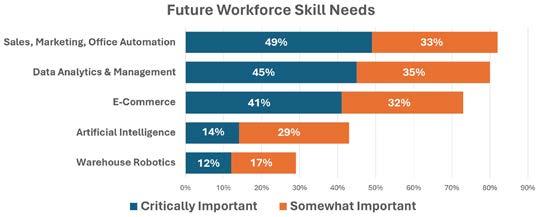

Future workforce skill needs

While the need for general administrative staff, drivers and warehouse workers dominates current and future needs, the study shows a small shift in the skills needed in the future.

The study shows ASA members are expecting to need slightly

less outside salespeople, but more counter salespeople and a consistent number of inside salespeople. This is consistent with data recently reported in ASA’s Voice of the Contractor study that illustrates the changes in contractor buying habits.

Additionally, ASA members are reporting a more significant need for customer service and technical support staff in the future.

The need for automation and better use of data Aligning with the future need for more technical support staff, ASA members reported the high degree of importance for sales, marketing and office automation, data analytics and management, and e-commerce skills moving forward.

Less important, but on the radar of members is how artificial intelligence (AI) and warehouse robotics will affect future staffing. These are often considered to be significant investments and tools for only larger companies. However, as these technologies progress and the understanding of how they can benefit companies becomes clearer, it’s expected more ASA members will begin embracing them.

This information and more details were recently the subject of a webinar for all ASA members. Also, a copy of a full written report of the study will be distributed to members.

About PROJECT TALENT

The PHCP/PVF national labor study supports the objective of ASA’s PROJECT TALENT to develop and implement a program to attract and grow the number of talented workers taking advantage of fulfilling career opportunities in the PHCP/ PVF industry. PROJECT TALENT is a part of ASA’s Employee Recruitment and Education goal, one of four mega goals included in the association’s strategic plan.

How can I get a copy of the study?

ASA members can get a copy of the new ASA national labor study by contacting Steve Edwards at sedwards@asa.net.

Has the economic picture shifted heading into the summer months?

By Chris Kuehl, ASA Chief Economist

Have I mentioned that the sole function of economic forecasting is to make astrology respectable? This was a rather famous and appropriate quote from John Kenneth Galbraith. It is not that we are really that bad at forecasting but one is only as good as the data, and when these numbers keep changing, it makes life interesting.

Lately there have been several of these significant and unexpected changes and suddenly the economic picture has shifted — in some positive ways and in some not so positive ways.

The most important of these changes has to do with interest rates and the potential for their decline later this year. Since the start of 2024, there have been assertions that the Fed Funds rate would start to come down from its current level of 5.5%.

The markets seemed to think this would happen by the second quarter despite the fact the Fed never suggested this decision would be made that soon. The assumption was changed, and predictions of a rate cut by the third or fourth quarter dominated. Now, that expectation has been altered by the latest data on inflation, job growth and overall economic progress.

Remember the mantra of the central bank — “We raise rates until we break something and then we lower rates to fix what we broke.” The pressing question is — has the Fed broken anything with these rate hikes? Looking at the data, it would be difficult to assert that they have. The unemployment rate fell back to 3.8% in the last Labor Department reading, and there was an additional 300,000 jobs added. At the same time, the inflation rate ticked back up to 3.5% (from 2.5%). The estimates for Q1 growth were originally less than 2% but is now at 2.4%. In other words, there is no pressing reason for the Fed to consider a rate cut, and now analysts are suggesting these reductions will not come until 2025.

The bond buyers have already signaled they think the European Central Bank will cut its rates before the Fed does. This basically means companies that have been counting on rate cuts may have to wait longer than expected. The Fed has not officially declared their intention but the hawks on the Open Market Committee are making their case.

Oil outlook

Change No. 2 involves the outlook for oil prices. It was just a few weeks ago that analysts were confidently asserting that per-barrel prices would stay in the $70 to $85 range “in perpetuity” based on the new technology deployed in oil production. It was now possible for producers to react almost instantly to changes in the spot price per barrel.

Shutterstock photos.

There was a little asterisk with that assertion — pending geopolitics. In the last few weeks prior to press time, that geopolitical concern has come front and center and prices have soared into the 90s again and analysts are now suggesting that $100 and above will be in the future. The bottom line is that oil is a globally priced commodity, and it doesn’t actually matter that the U.S. is North American independent as far as oil production goes.

The U.S. is hitting record levels of crude production (more than 13 million bpd) and consumes around 20 million bpd (that which we don’t produce we get mainly from Canada and Mexico). The fact is Iran and Israel are on a collision course and neither seems inclined to back off. Iran has now threatened to shut down the Straits of Hormuz as the Houthi rebels have shut down the Red Sea. If this takes place, there is no route for Saudi oil to reach the markets and no way for the production of the other Gulf oil states. That sends the price of oil into orbit and could well trigger attacks that escalate that war in a hurry.

How China factors into the economy

And that’s not all folks. There is yet another change that will prove economically disruptive. China is facing a serious deflation crisis, and this has combined with the collapse of the property market (as well as the overall stock market). China has not seen levels of foreign direct investment this low since the early 1990s. The upshot is China is in economic distress, and ordinarily that would trigger reductions in production and subsequent layoffs.

China is not about to risk large numbers of unemployed so these operations keep producing and that creates massive surplus. Given that China is still a command economy, that output keeps accumulating and China then dumps it on the global economy. That means a surge of Chinese goods priced lower than they have been in years. This will stall the reshoring effort in the U.S. and Europe. If one buys from China this is good news, but if one competes with China this is bad news, indeed. China had been trying to reduce dependence on exports but right now they need all the business they can get.

ASA economic update podcast

Dr. Kuehl’s “Keeping it Real with Dr. Kuehl” economic update podcast is produced three times a month, each time focusing on a specific economic topic. The podcast is available on the ASA website (www.asa.net) and on all popular podcasting platforms. To be added to the podcast mailing list, contact Bri Baresel at bbaresel@asa.net.

Biannual compensation and benefits survey provides key roadmap for ASA member companies

By Greg Manns, Senior Vice President, Industry Insights

In today’s rapidly shifting business landscape, staying ahead means understanding the challenges and opportunities that define our industry.

With that being said, ASA once again teamed up with 12 other distribution-centric trade associations to produce the 2024 Cross-Industry Compensation and Benefits Survey where data was received from nearly 600 wholesalers (nearly 8,000 locations) doing business in industries such as PHCP-PVF, electrical, HVAC, jan-san, beer, industrial and more.

This invaluable resource delves deep into the dynamics shaping today’s workforce and operating strategies, offering ASA members insights to navigate the complexities of today’s market.

This year’s report features compensation data for more than 40 job-specific titles from the warehouse all the way to the president/CEO office, as well as data on benefits and other best practices related to this vital HR component.

“The ASA biannual compensation report is the Bible for compensation packages in the PHCP world,” says Jack Bell Jr., president of Louisville, Kentucky-based Masters’ Supply. “We utilize it in every department, including our executive team for compensation packages. We use it for new hires and for employees being promoted.”

William Dowding, business development manager at Salem, Massachusetts-based Salem Plumbing Supply, adds: “The reporting and survey results we get from ASA is the primary reason for our membership. In particular, the compensation report is of most importance to us. The recruiting and retaining of employees are a long and sometimes difficult process. This report allows us to understand where our comp program sits in relationship to the greater marketplace — and what we need to improve on. Without this information, we have less than a complete understanding. We share the pertinent results with different members of our organization, so they too understand. It’s a very important tool for us.”

The new 2024 ASA Cross-Industry Compensation and Benefits Survey features compensation data for more than 40 job-specific positions ranging from the warehouse to the C-suite. Shutterstock photos.

Top industry challenges: Navigating through uncertainty

The 2024 survey reveals a clear consensus among respondents — finding qualified employees remains the top challenge. However, in this inflationary buildup of the past few years, a clear pattern has emerged, highlighting a significant focus on cost and expense management, with 5 out of the top 7 issues centered around financial concerns, including healthcare costs, operating costs, and maintaining profit levels in a competitive pricing environment.

The turnover dilemma:

Seeking stability in shifting sands

A notable area of concern is the turnover rate in nonmanagement operations/warehouse positions, where more than a quarter of respondents report rates exceeding 30%. This trend underscores the critical importance of addressing turnover rates to minimize operational disruptions, especially given the average time to fill such positions exceeds 30 days.

“We like to benchmark ourselves and see how we compare to others in the industry,” says Isabela Montoya, human resources manager at Torrington, Connecticut-based Torrco.

Compensation trends: A strategic outlook

The landscape of base salary adjustments for 2024 suggests a cautious approach, with a slight downtrend compared to 2023. This aligns with a broader emphasis on cost management amidst economic softening, highlighting the need for strategic salary planning. The full report is a great resource for evaluating your compensation plans as it provides detailed compensation information for more than 40 positions across C-suite, G&A, sales and marketing, operations/warehouse, and IT.

“The survey helps us see where we need to improve and gives ideas on what we could be offering to become more competitive.”

—Angie Ritz, Lee Supply Corp.

“Why I do the report is to benchmark my pay rate and benefits against others to insure I am competitive in the job market,” says Kim Betts, CEO-owner of Westfield, Massachusettsbased Betts Plumbing and Heating Supply.

Filling the talent pool:

Innovative approaches to recruitment

Recruitment strategies have remained consistent, yet the emphasis on referrals and internal transfers/promotions has grown, reflecting their effectiveness. The financial incentive for successful referrals has notably increased, nearly doubling from 2022, illustrating a proactive approach to leveraging internal networks for talent acquisition.

Your strategic advantage awaits

The 2024 Cross-Industry Compensation & Benefits Survey offers more than just data; it provides a roadmap for ASA members to navigate the complexities of the current economic landscape. From detailed turnover rates and compensation trends to innovative recruitment strategies, this report is an essential tool for strategic planning and competitive positioning. We invite you to dive deeper into these insights and leverage the full report to propel your organization forward.

“We participate in the survey because we like to know where we fit in among other suppliers,” says Angie Ritz, human resources manager at Indianapolis-based Lee Supply Corp. “It helps us see where we need to improve and gives ideas on what we could be offering to become more competitive.”

Nate Chocolous, human resources manager at Lynchburg, Virginia-based NB Handy, adds: “We would like to use the survey as one of many checks and balances for establishing competitive pay structures, and we like that it directly relates to our industry.”

How can I get a copy of the report?

If you are an ASA member company that submitted data for the report, it will be delivered to your inbox free of charge as a thank-you for your participation.

If you did not submit your company’s data, but would still like a copy of the report, it can be purchased for $399. Send an email to ASA’s Bri Baresel at bbaresel@asa.net to order.

This report, produced by longtime ASA business intelligence partner Industry Insights, is appropriate for all ASA members, wholesalers, suppliers, reps, master distributors and service providers given the vast amount of best practices provided.

The new study reveals more than a quarter of survey respondents have turnover rates for non-management operations/warehouse positions exceeding 30%.

ASA volunteer leaders work to define the future and the association’s role in getting there

By Mike Adelizzi, CEO, madelizzi@asa.net

For nearly 20 years, ASA has been driven by a long-term vision and strategic plan, created by members and staff that has guided the resurgence of our national association.

Today, ASA has become the unifying voice leading the industry to an envisioned future of success — from advocating for our industry in Washington, California or at the codes and standards level, providing critical data for members to make sound business decisions, building brand awareness of our industry for new career seekers that will fill our job openings, to how AI and innovation can be utilized by members to win success in the future.

In an era marked by rapid technological advancements, shifting market dynamics, and increasing regulatory and environmental concerns, the American Supply Association stands at the forefront of transformative change. Earlier this year, nearly 90 volunteers from the ASA Board of Directors, strategic councils and special interest divisions, gathered at the LEAD2024 Strategic Leadership Summit to discuss strategic initiatives designed to address the most pressing challenges and opportunities facing the PHCP and PVF distribution industry.

We looked five to 10 years into the future and collectively discussed the disruptors that we would face and how they will impact our future success and viability as businesses. Most importantly, we strategized how ASA’s commitment to innovation, sustainability, and leadership could define our industry, association, and our members’ future success.

As leaders within ASA representing the plumbing heating, cooling, pipe and individual/mechanical pipe, valves and fittings distribution industry, we are at a pivotal juncture. The demographic shifts within our workforce and markets present both significant opportunities and challenges. Embracing these changes is not optional, but a strategic imperative for ensuring our continued relevance and success.

Earlier this year, volunteers from the ASA Board of Directors, strategic councils and special interest divisions, gathered to discuss strategic initiatives designed to address the most pressing challenges and opportunities facing the industry. Photos by Rob Zambrano/ASA.

Strategic imperatives and initiatives

Our strategic focus was guided by a comprehensive analysis of the industry landscape, identifying key areas where focused action can drive significant impact. These areas include shifting demographics, data privacy, environmental regulation, climate change, political engagement, labor market trends, e-commerce growth, technology adoption, and cybersecurity. During two days of strategy sessions and roundtable discussions, volunteers defined myriad initiatives that ASA will undertake over the next year or two that are not merely responses to these challenges but proactive efforts to reshape the industry and the association’s trajectory.

The overarching goal of these initiatives is twofold: to secure the association’s position as a leader in addressing global challenges and to ensure the long-term sustainability and profitability of our member companies.

By fostering a culture of innovation, enhancing our political and regulatory influence, attracting and developing talent, and embracing digital transformation, ASA will aim to not only navigate the complexities of the current landscape but also to define the standards of excellence for the future.

Central to the success of these initiatives is a commitment to collaboration — within our association, across the industry and beyond. The challenges we face are complex and multifaceted, requiring the collective effort, expertise, and resources of all stakeholders, as well as inviting leaders at all levels to engage with these initiatives, contribute their insights, and join us in driving meaningful change and speaking and acting with one voice.

The work ahead

ASA’s leadership presented the strategic initiatives coming out of LEAD over the next several months, and as the work from the conference is digested, streamlined, and reported, we are excited to continue our strategic journey that initially began in 2008 with a clearer vision of the future.

The journey ahead is challenging yet filled with opportunity. Together, with the support and engagement of our members and partners, we are poised to navigate this journey, transforming challenges into opportunities, and securing a prosperous future for our industry and our members.

The new goals and initiatives coming out of the LEAD summit will be incorporated with our existing strategic plan and shared with our strategic councils and task groups that will continue their work toward leading our industry to a successful future.

ATS Software’s John Gillespie, chairman of ASA’s Embracing the Future Strategic Action Council, makes a point.

Chris Reynolds, of Plumbers & Factory Supplies, presents his group’s thoughts during the LEAD2024 Strategic Leadership Summit.

ASA President Patrick Maloney (Coburn Supply) was among the nearly 90 ASA volunteer leaders who took part in the LEAD2024 Strategic Leadership Summit.

ASA leads AD members on Capitol Hill

By Steve Rossi ,Vice President of Advocacy, srossi@asa.net

In late March, ASA partnered with the AD buying and marketing group to bring nearly 300 of the group’s distributors and manufacturers attending AD’s Spring Network Meeting to lobby roughly 80 members of Congress in Washington, D.C., on critical issues facing the PHCP-PVF and HVAC industries.

One vital area of concern to the attendees was the extension of the Tax Cuts and Jobs Act (TCJA) which reduced the top corporate income tax rate from 35% to 21%. Its 199A small business deduction also cuts taxes for pass-through businesses. Under current law, the 20% tax deduction for qualified business income is set to expire in 2025.

Keeping lower taxable income rates to help corporate and passthrough businesses prosper is a priority for our industry. Many of our members are owners of multi-generational family businesses and the industry has seen consolidation in recent years due to the massive compliance costs imposed by the estate tax and difficulty passing operations to the next generation.

According to Rep. Rudy Yakym (IN-2), who addressed AD attendees, this year’s national election will be pivotal to extending the tax cuts set to expire at the end of 2025. He also discussed an effort to change the dialogue from the estate tax being a benefit for the rich, to an effort to protect local jobs, as family-owned businesses can transfer businesses and jobs to the next generation rather than selling to corporations and private equity that will strip down local businesses.

Regulatory reform was another area of concern on which attendees lobbied. In particular, the REINS Act — requiring

Congress to take an up or down vote and for the President to sign off on all new major rules before they can be enforced on the American people.

Major rules are those that have an annual economic impact of $100 million or more. According to George Washington University’s Regulatory Studies Center, in 2023, 80 major rules were finalized by the Executive Branch.

“While ASA engages full time in advancing the interests of our industry, bringing large groups of our members and prospective members, like the AD meeting in Washington, helps us move the needle,” ASA CEO Mike Adelizzi said. “We applaud AD’s willingness to hold its meeting in D.C. and help us educate Congress on industry issues and concerns.”

ASA partnered with AD to bring nearly 300 of its members to lobby roughly 80 members of Congress on critical issues facing the industry today. ASA Photos.

Damon (left) and Jason Lee of Oklahoma-based Lee Supply speak with a member of Oklahoma rep. Kevin Hern’s office staff.

ASA announces partnership with IDEA to help members advance in their digital journey

By Mike Miazga, Vice President Sales-Operations, mmiazga@asa.net

The American Supply Association recently announced a new partnership with technology solutions provider IDEA that will provide ASA member companies the opportunity to explore a variety of platforms to help them in their digital journey in an ever-changing technology landscape.

IDEA (www.idea4industry.com) was created for the industry, by the industry. Since the National Electrical Manufacturers Association (NEMA) and the National Association of Electrical Distributors (NAED) established IDEA in 1998, the company has been serving distributors and manufacturers with product data syndication and electronic data interchange (EDI) solutions.

IDEA’s mission is to assume a leadership position in facilitating the exchange of complete, high-quality, commercial-grade transactional and e-commerce content.

Through this partnership, ASA member companies can explore four different IDEA products: a comprehensive product relationship database, EDI solutions, flexible EDI integration and a central hub for order tracking, pricing and stock status.

IDEA X-Check

IDEA X-Check, sponsored by NAED, features cross-references, product relationships, and keywords for more than 750,000 products from 835 different manufacturers (and counting). IDEA X-Check improves online shopping experiences by displaying information relating to accessories, upgrades, and parts associated with a given product. With 1-million-plus one-to-one cross references and more added daily, companies can keep buyers engaged on their site and compete against online giants, IDEA notes.

IDEA Exchange

IDEA Exchange is a complete EDI solution for manufacturers and distributors, powered by a worldclass VAN and an expert support team on call to solve technical problems or manage a company’s entire EDI operation.

“In our 20-plus years in EDI, we have encountered many complex challenges: companies demanding a fortune in implementation fees, EDI-trained staff retiring with no replacements and trading partner EDI requirements increasing in complexity,” IDEA says. “Our team takes a consultative approach to build, customize and support EDI services and solutions.”

IDEA Managed Services

IDEA Managed Services provides premium, managed EDI solutions for a company’s unique business. Features include EDI mapping/translation services; managed AS2/ FTP connections; Trading partner onboarding; and EDI professional services that leverage decades of IDEA EDI expertise and best practices.

IDEA OrdrTrak

OrdrTrak streamlines information exchange across the manufacturer, rep, distributor and contractor disciplines. With a unified platform and single login, OrdrTrak facilitates the efficient viewing and sharing of order status, product inventory details, product specifications and pricing information in order to minimize manual efforts, reduce response time lags and generate industry-wide cost savings.

Learn More

To learn more about the services IDEA is offering to ASA member companies, visit www.asa.net/industry-intelligence/ Service-Providers/IDEA and fill out the Request More Information box.

Planning on keeping your business? Estate-planning tips to effectively safeguard your company’s future.

By Brad Williams, Managing Director, The Beringer Group

When faced with the choice of selling or keeping your business and the final decision is to continue forward, here are five estate-planning tips to effectively safeguard your company’s future.

1. Start early

It’s never too early to start thinking about estate planning, especially for business owners with significant assets at stake.

Early planning not only allows you to leverage tax-saving strategies but also ensures you have plenty of time to make informed decisions regarding your estate. Additionally, early planning allows for the implementation of effective asset distribution strategies, ensuring a smooth transition of wealth to future generations.

By taking proactive steps, business owners can secure their legacy and provide financial security for their loved ones. If you’re planning to transfer the company to a member of your family, providing them additional time to pay off a loan will ease the financial strain on the individual and the business. For instance, opting for a 30-year mortgage instead of a 15-year mortgage offers greater flexibility and reduces immediate financial strain.

2. Consider business succession

As a business owner, it’s crucial to establish a clear plan for the future of your business in the event of your passing. This involves identifying a successor, implementing a buy-sell agreement or creating a trust to manage your business assets.

Regularly reviewing and updating your business’s succession plan is vital to ensure it adapts to changes in your circumstances or goals.

Consulting with a professional advisor can help simplify the complexities of business succession and enable you to make well-informed decisions for the future. Even though contemplating our mortality may be uncomfortable, every business owner needs a “hit by the bus plan.”

3. Review and update your plan regularly

Your estate plan requires ongoing attention, it is not a set-itand-forget-it document. Changes in your personal or financial situation, as well as changes in tax laws, can impact the effectiveness of your plan.

Regular review and updates are crucial to ensure your plan remains relevant to your needs. Consulting regularly with an experienced estate-planning attorney can help you navigate

Shutterstock Photo

any necessary adjustments and ensure your plan reflects your evolving circumstances. By proactively addressing any changes, you can maintain the utmost confidence in the continued protection of your assets and the realization of your wishes.

Understanding the valuation of your business is imperative of utilizing the minority valuation discount to reduce estate taxes.

4. Minimize estate taxes

Business owners need to be mindful of estate taxes, which can pose significant financial implications. Strategies such as gifting, establishing a trust, and utilizing life insurance can help minimize the tax burden on your estate.

Additionally, consulting with a qualified estate-planning attorney can provide valuable guidance in developing a comprehensive strategy tailored to your specific circumstances. By staying proactive and well-informed, business owners can protect their assets and ensure a smooth transition of wealth to future generations.

Starting from Jan. 1, 2026, the existing lifetime estate and gift tax exemption, which stands at $13.61 million per individual in 2024, will be cut in half and adjusted for inflation. It’s important to act before the exemption is reduced by 50%.

“Understanding the valuation of your business is imperative of utilizing the minority valuation discount to reduce estate taxes.”

5. Work with professionals

Estate planning is a complex and highly specialized area of law. It’s essential to work with professionals who have experience in estate planning for business owners, including attorneys, financial planners, and tax professionals.

These professionals can provide valuable insights and expertise to ensure your estate plan is tailored to the unique needs and goals of your business. By collaborating with them, you can navigate the intricate legal and financial aspects of estate planning more effectively.

There’s a legend about the famous artist Pablo Picasso that tells a story of a time a man interrupted Picasso during his dinner at a restaurant. The man, overwhelmed by seeing Picasso in person, couldn’t resist asking him for a sketch, anything really, he could take away from this moment.

The man offered to pay Picasso whatever he wanted for the ad hoc art. Picasso obliged, taking a pencil out of his jacket

pocket, and quickly sketching a goat. It took no more than a minute, but it was undoubtedly a Picasso.

Before handing it over to the man, Picasso demanded $100,000 for the sketch. The man was floored. “$100,000?! It took you 30 seconds to make it!”

Picasso put the sketch back in his pocket and replied, “You’re wrong, it took me 40 years.”

The benefit of working with professionals will help you execute your plan in a timely and effective manner.

Estate planning is a critical process for business owners who want to protect their assets and ensure the future of their business. By starting early, considering business succession, regularly reviewing and updating your plan, minimizing estate taxes, and working with professionals, you can create a plan that meets your unique needs and goals.

Additionally, effective estate planning can provide peace of mind by clearly outlining your wishes regarding the distribution of your assets and minimizing potential conflicts among your heirs.

It is a proactive approach that empowers business owners to maintain control over their legacy and secure a smooth transition for their business.

Next Issue

Selling your company? Tips from PHCP-PVF distributors that have done just that in recent years.

Starting Jan. 1, 2026, the existing lifetime estate and gift tax exemption, which stands at $13.61 million per individual in 2024, will be cut in half and adjusted for inflation.

Brad Williams is the managing director of The Beringer Group (www.theberingergroup.com), a privately held independent advisory firm specializing in areas such as succession planning, investment services and tax mitigation expertise. The Beringer Group has worked with substantial privately-held businesses and heads of affluent family enterprises since 1979.

By taking proactive steps, business owners can secure their legacy and provide financial security for their loved ones.

QUARTERLY MARKET SURVEY: REPS

ASA Quarterly Market Survey dives into reps’ relationships with wholesalers and suppliers

By Mike Miazga, Vice President Sales-Operations, mmiazga@asa.net

ASA’s first Quarterly Market Survey of 2024 examines independent manufacturers’ reps relationships with other parts of the PHCP-PVF supply chain, as well as overall business conditions in their space.

As is always the case with this survey, ASA member manufacturers’ reps posed questions they would like answered by other reps. Some of the questions were left open-ended to allow for rep elaboration, enhancing the value of the report.

In terms of rep firms’ vital statistics, 45% of rep firm respondents have been in business 41-60 years, while 36% have been in existence for 20-40 years. In terms of scope of business, 31.3% of respondents are focused mainly on residential, while 28.4% are commercial/industrial focused.

Nearly 60% of respondents said sales in 2023 were where they thought to be, while 31.3% said they were higher than expected.

Only 25% of responding rep firms say they plan to add a line or lines in 2024, but 84% of respondents say they plan on hiring more staff this year.

On the subject of expansion, 55.2% of survey participants say they have no plans to expand via acquisition or organically.

Looking at the sales process, 55% of customers say faceto-face customer time has stayed the same, while 20% said it was decreasing. When asked to spitball the breakdown of sales calls made, respondents say 47% on average are made to wholesalers, while 32% are made to contractors.

Reps also were asked what they consider the biggest challenges facing them today.

“Consolidation of wholesalers and manufacturers,” one noted. “More line conflicts are created.”

“Constantly working on staff retention and ensuring we find the balance between money and happiness for our team,” another wrote.

Other topics in the survey include the subject of remote workers, how reps are handling general email inboxes, complexity of sales transfer papers from major wholesalers, monthly factory reports, best practices when a customer or competitor poaches an employee and much more.

How do I get a copy of the report?

To receive a free copy of this Quarterly Market Survey and to be added to the mailing list to receive this report throughout the year, contact ASA’s Bri Baresel at bbaresel@asa.net.

Survey respondents say 74% of their business is commission vs. buy/sell.

The average ratio of outside to inside sales reps at a rep firm is 5 (outside) to 3 (inside).

of respondents expect 2024 sales to be up, while 43% say they are expecting a decline.

When asked the biggest challenges reps are facing today, many cited the labor pool and retaining top talent as chief concerns. Shutterstock photo.

ASA’s Women in Industry ELEVATE2024 conference draws more than 400 attendees

The American Supply Association’s Women in Industry division, now in its second decade of existence as the original best practices-networking group for women in the PHCP-PVF industry, recently drew more than 400 attendees to its ELEVATE2024 national conference in Nashville at the Grand Hyatt — establishing yet another all-time attendance mark for the event. Next year’s ELEVATE event will be held April 22-24 at the Miami Marriott Biscayne Bay.

Photos by Jason Mallory/ASA.

How high-profit companies exploit labor capacity to fund wage levels that attract and keep talent

By Randy MacLean, President, WayPoint Analytics, rmaclean@waypointanalytics.com

Recently, we’ve been looking carefully at the impact of labor scarcity and collaborating on how to use the shortage for a competitive advantage.

Ultimately, our clients are targeting areas where efficiency gains let them apply labor costs more favorably, and customer programs that generate new cash flow to fund market-leading wages.

Demographic shifts changing the game

The 2020s have presented historic challenges for the wholesale/distribution industry. The retrenchment we saw with COVID-19, the rapid and passing sales acceleration in its aftermath, and record inflation have whipsawed executives trying to be responsive to the market. The shift to “work at home,” and more customers insisting sales calls move to virtual is changing the landscape even more.

Now, we’re feeling shifts in the labor market reaching nearcrisis levels. This is being driven by demographics, and the numbers are sobering.

According to the U.S. Census Bureau and the Department of Labor Statistics, the pool of non-college people in the 20–35 age bracket has shrunk from 31 million in 2020 to just 25 million in 2022, a drop of 19.4%.

This cohort is the source of labor for distribution, construction, hospitality, clerical workers, and the military. In wholesale/distribution, competition for workers has driven wages from $20.04 in 2006 to $33.82 in 2023, up a whopping 68.8%. If companies can’t pay wages above the average, turnover is severe.

This has made labor availability and labor costs the determining factor for company success, and the first priority for senior executives. For distributors, this has had a double impact — not only are our own labor costs skyrocketing, but wage inflation in manufacturing has driven up purchase price of products.

Since margins have been static, rising labor has put an unprecedented squeeze on profits. Companies are now applying labor more wisely and developing additional cash flow to fund higher wage rates. It’s become too expensive to waste labor on orders and activities with insufficient value to cover labor costs, and good analytics are essential to knowing where, exactly, this is happening.

Managing labor costs

Simply put, with labor getting scare and expensive, it’s now a requirement to utilize it only where there’s sufficient profit available to justify it. It used to be labor was such a commodity, you just hired enough people to do the work. Now, you need to decide which work is valuable enough to assign labor to it. For the rest, you reduce the needed labor component, eliminate that business or subsidize it where it’s strategically necessary.

For most, this is a completely new way of thinking. But continuing as before is a road to failure. The challenge is: How do you decide? For this, you must have analytics.

Data analytics for labor

First, Gross profit (what we at WayPoint refer to as OpCash, or operating cash) represents profit opportunity in a sale or a customer account. If a sale has $100 of OpCash, you cannot make any more than $100 of profit, so your expenses need to be less than $100 and, practically, a lot less.

Second, the cost structure for each particular sale can vary widely. Profitability depends on myriad factors: how many items are on the order; how much product is sharing the cost of the delivery; what rebates apply; are commissions paid? Depending on these and many other elements, costs may exceed OpCash (sometimes far exceed OpCash), thus producing losses.

You’ll need to have a reasonably sophisticated cost and profit analysis system so you can target your efforts. Many

It’s become too expensive to waste labor on orders and activities with insufficient value to cover labor costs. Shutterstock photos.

companies use our system, where each cost is distributed to its related products and related customer accounts, and very precise profit numbers are known for every customer, product, territory, etc.

Using rule-of-thumb estimates (based on averages) won’t cut it. Like all such metrics, you miss the outliers at the top and bottom of the range — and these are the ones that matter. You need to identify customers and sales with superior profit rates because those will fund higher wages. Those with losses indicate target areas for manpower reduction and efficiency gains.

To assign labor wisely, knowing with certainty which accounts, products and situations to prioritize is as vital as knowing which to avoid. Detailed profit analysis (whether internally developed or from a professional system) provides the roadmap for action.

Improving labor productivity and efficiency

Targeting labor where it can drive the best return is important, but there’s no practical way you can make individual decisions on thousands of orders. That’s why order classification is so useful.

Classify orders into groups most likely to produce high profit rates (and those that almost guarantee losses) to guide your labor assignment. Identify areas where automation or new processes can turn money-losers into money-makers.

Innovating to move more product value for less manpower has a magnifying effect by making more of your order portfolio profitable. In turn, this makes all your accounts more profitable and shifts some from unprofitable to profitable. Just as important, it expands the addressable market of potentially profitable accounts, making sales efforts more productive.

Metrics for managing labor

Getting good metrics in place has been an important step for the companies that are knocking it out of the park. These are where we focus first:

OCR (OpCash Ratio) – OCR indicates the scale of the opportunity to make profits. [OpCash (or Gross Profit) ÷ Expenses]: OCR indicates how much product value is handled per dollar spent, and higher numbers represent the best profit opportunities. Focus on growing areas with high OCR and increase OCR by reducing the need for manpower in those areas.

ROX (Return on Expenditures) – ROX indicates the amount of profit returned per expense dollar. [Net Profit ÷ Expenses]: This is the end-result of operational activities, and accounts for how much cost is actually incurred. Implement this at the branch, warehouse and product category level to identify high and low points and prioritize those with the highest rates. Target low (below $1.00 returned per dollar spent) for labor cost reductions.

Productivity measures – These indicate the amount of potential value derived from any particular resource unit. [e.g., OpCash ÷ labor payroll]: These are the fundamental manageable metrics that drive operational efficiency. The base units can be headcount, manhours, payroll dollars, warehouse square foot, or any myriad others you may invent. You can make comparisons between operating units to find the leaders and laggards, or across time to see improvement or deterioration.

Using these metrics

The most capable systems calculate and display all of these measures across: locations; product lines; delivery methods; and much more. Managers can target time and attention where the stats lag, and also exploit high productivity areas to increase cash-flow.

You absolutely must have detailed cost analytics so the expenses associated with each order, customer, or product are known. Expense allocations are the determinative factor for profitability at every level of analysis. Whether you invest time and manpower to roll-your-own, or rent a highend system, you need accuracy so your initiatives won’t be misdirected.

Driving improvements

There are many actions that the market leaders have adopted. Here are a few you might consider:

Eliminating touches: Every time someone touches the product or service, it costs money (and consumes manpower). Branch replenishment from a distribution center is a model that is becoming increasingly difficult to keep profitable or competitive. Direct DC-to-customer deliveries eliminate touches and conserves manpower.

Centerville & Riverside are moving significantly less product value per delivery dollar and direct DC deliveries will boost profitability.

Corrugated and Packaging are earning only 30 & 32 cents per expense dollar, well below other categories. Reducing labor costs for handling these products will increase profits. MM NOTE:

Warehouse reorg: Analyzing where and why “walk time” occurs, and then organizing to reduce it can seriously impact labor requirements. When Items frequently sold together are proximate, more orders are picked with lower headcount. If your warehouse is organized by vendor or product category, you’re likely wasting manpower.

Zone picking: Where feasible, warehouse organization can match destination organization. If destinations have distinct product patterns (such as grocery store aisles or manufacturing plant campuses), having all the product used by each sub-destination together in the warehouse facilitates individual cartons for each sub-destination.

Pre-packing: Where feasible, items sold on their own and in significant volumes can be ordered “shipping-ready” from suppliers, needing only a shipping label applied, eliminating packaging cost and labor.

Value-add areas: Kitting, converting, or preparing inventory to make it more suitable for customer needs is a prevalent strategy. Organizing so these operations are proximate to the needed inventory reduces labor consumed moving input components.

Automation: It’s getting prohibitive to use people to move product within the warehouse. Elimination of “walk time” ranges from using simple conveyors up to robotic picking. Even small distributors are looking more like Amazon than the traditional rack rows and pushcarts of the past.

Third-party logistics: Off-loading warehousing and shipping to third-party logistics companies, particularly when reaching into smaller markets, can be very productive. 3PLs have greater efficiency and provide cost variability, avoiding unwelcome cost escalation from seasonality or other dynamics.

Self-service picking: Expanding the “will-call” area so customers can pick their own product, and making this strictly “cash-and-carry” (check or credit card only, with no shipping) is a very good manpower reduction strategy.

Funding manpower: The necessary first step is eliminating unnecessary activities, and monitoring using the productivity and efficiency metrics suggested above to drive and lock in gains. You’ll need good cost and profitability analytics for this.

The next step will come from the sales side, where customer selection is also driven by detailed profit analysis. A combination of working with customers whose business model naturally supports your efficiency initiatives, and using certain advanced techniques to exploit those that already provide profit rates two to five times the average will close the loop on addressing the labor crisis.

Work on the sales side will directly fund high wage rates out of sales gains instead of out of the company’s bottom line.

Next issue: How new sales tactics will provide critical new funding so you can pay so well that labor challenges melt away.

Randy MacLean is the president of WayPoint Analytics. Contact Randy at rmaclean@waypointanalytics.com.

Elimination of “walk time” ranges from using simple conveyors up to robotic picking.