ASA is the industry’s only national trade association driven by a strategic vision that was originally developed back in 2008 by a group of 65 visionary volunteers that looked far into the future to map out a plan that today has established ASA as the leader in codes, standards, legislative and regulatory action, providing industry data and benchmarks, training and education, as well as building a strong industry brand that’s enabling us to attract the next generation of labor to support our members.

Today, nearly 250 volunteers continue to work on our strategic plan, always pushing ASA to look into the future, keeping us focused on what’s next and how we should be positioned to help our members win the future. No other trade association engages so many opinionated members to create one voice and one future. Most importantly, it’s giving ASA the ability to deliver on the promise of our mission of being the Unified Voice That Drives the Success of the PHCP and PVF Supply Chain Industry.

Thanks to the hard work of our many engaged volunteers, ASA had another very successful year. In this issue of ASA Review, we look back at all the many activities that our strategic councils tackled this past year and the strong year of accomplishment our association achieved as we continue to expand the value of ASA to the industry and most importantly, to our members.

Also in this exciting issue, we report on NETWORK2024’s Great Ideas roundtable session as we look at a few of the more than 100 great ideas members identified to attack four critical topics covered during the session. Since we launched the Great Ideas format during NETWORK three years ago, we have delivered nearly 400 great ideas to many industry issues.

Keith Prather, managing partner from Armada Corporate Intelligence, gives us an economic outlook for 2025 and what members need to know to make sound business decisions as they navigate the new year. Brian Hopkins from the Distribution Strategy Group reviews the e-commerce survey their firm recently conducted. You’ll also find in this issue Part 2 of Brooks Hamilton’s series entitled “Taking AI to the next level for wholesalers of all sizes.”

Steve Edwards, ASA’s recruitment marketing director, takes a look at the benefits of participating in job fairs for members and their ability to attract quality team members. And Bri Baresel, ASA’s manager of data and market intelligence, discusses the results of our new Quarterly Market Survey.

As the industry’s only national association, it is our goal to provide you with critical information to help you and your teams embrace the changes that are disrupting your future. We are proud of this exciting quarterly publication as one tool that we offer to help you and your teams, and hope you are getting some actionable ideas from these insightful articles.

Thank you for being a member and supporting our mission.

Mike Adelizzi CEO

Simplify your sales, from client mgmt to order processing. Centralize your data, improve efficiency, & make better decisions with Distifabric.

Want to receive a printed version of

Contact ASA’s Mike

By Bri Baresel, Manager of Data and Market Intelligence bbaresel@asa.net

ASA’s Business Intelligence Unit continues to produce reports, surveys and other market/data content that members demand.

In the most recent ASA Quarterly Market Survey, member distributors were asked what questions they would like answers to from other ASA member distributors. ASA was inundated with questions from distributors and will present the new report in multiple installments.

Some questions from members include: How do distributors manage dead stock? How are distributors using AI to help their company? What is the most important factor in selecting a supplier’s products? What strategies do distributors use to build and sustain customer loyalty? What sales increases are distributors budgeting for 2025? What key indicators do distributors see for markets this year and questions about cyber security.

In terms of managing dead/damaged stock, ASA distributor members say there are a variety of strategies, often relying on e-commerce platforms and internal sales initiatives. eBay, Amazon and clearance sections on websites are also popular for moving unsold items, members noted.

Some also engage in sales contests, offer steep discounts or donate products. When damaged goods occur, distributors typically rely on insurance for reimbursement. One member noted they classify inventory as dead stock if it hasn’t sold within 12 to 24 months, while many use internal systems to track and act on this topic.

ASA distributors say they use various systems to streamline order processing and fulfillment, with many relying on ERP solutions such as Eclipse, QuickBooks and Epicor Prophet 21 among others.

Additionally, barcode scanners and wireless warehouses enhance inventory management and efficiency, members noted. Key operational metrics tracked on this front include line items per hour, order filling rates, ontime deliveries and warehouse accuracy.

When selecting suppliers, distributors prioritize product quality, market demand, and reliable support. Competitive pricing, brand recognition, and availability are also crucial factors.

When maintaining strong relationships with suppliers’ distributors, ASA members say there are key strategies that include regular open communication — often through in-person meetings or frequent sales calls.

Distributors emphasize honesty, transparency and mutual trust. Many engage in joint sales calls, promote supplier products and provide consistent feedback. Paying on time, being realistic about purchasing capabilities, and fostering long-term partnerships also help strengthen these vital connections.

Going into 2025, distributors wanted to know what they feel is a distributor’s biggest challenge/fear/concern for the new year to which ASA distributor members express several concerns, with key challenges including rising interest rates, fluctuating tariffs, and decreasing profit margins.

There’s also uncertainty around global issues and the impact of new competitors and industry consolidation. Other concerns involve adapting to market shifts, labor shortages, and maintaining a strong inside sales team to meet growing demands. Many distributors also worry about the housing market’s lack of velocity and the effect of HVAC heat pump incentives on their hydronic-focused businesses.

The overall economic climate remains a central concern for sustained growth.

To receive a copy the full report, email Bri Baresel at bbaresel@asa.net.

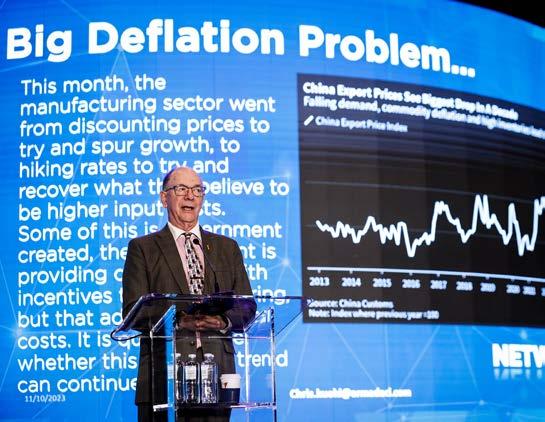

By Keith Prather, Managing Director Armada Corporate Intelligence

As we embark on a new year and a change in U.S. administrations, there are several key factors that ASA members will want to watch in the year ahead.

Coming out of 2024, U.S. economic activity was good across most sectors with macroeconomic growth likely coming in at 2.7%. U.S. growth forecasts for 2025 range widely from 2.5% to 3%.

The incoming Trump administration will go in with a playbook of sorts. And like all strategies, may not “survive first contact” and could require some adjustments in the quarters ahead. The playbook is complex and requires the coordination of multiple facets of government as well as movement by private enterprise.

At its core, the strategy’s objective will be to 1) shift more of the economic growth engine to private enterprise and away from government spending because 2) the U.S. government must get spending under control. A runaway deficit and more than $1.4 trillion in annual interest payments alone is unsustainable. But while stimulating private investment and spending (and construction activity is a big driver of this), it must 3) try to keep inflation tame in the process.

1. From day one, the administration will likely use Executive Orders to start reducing operating overhead and remove red tape that currently could be hindering new project starts. This should help spur growth across energy production sectors (to the degree that new leases, pipelines, etc., don’t get caught up in legal logjams), non-residential construction activity, and should improve domestic manufacturing activity.

2. Early indications suggest that some incentives to immediately lure foreign investment into the U.S. will be a key focus for the administration. Softbank was one of the first to announce a $100 billion investment in the U.S.; most of this investment will help spur nonresidential construction and manufacturing.

3. The Depar tment of Government Efficiency (DOGE) has been met with mixed reviews on how effective it can actually be. It theoretically only has the power to make suggestions to Congress to trim spending and can certainly use the power of public exposure to affect voter sentiment on spending. Projects that already have federal appropriations allocated to them should continue through this next budget cycle, but they could come under fire in the 2026 fiscal year or beyond.

1. There are several factors that the new administration believes will help trim inflation. Although it uses the catchphrase “drill baby drill” to explain its inflation reduction strategy, in theory it is far more complex than that. Energy use (as a percentage of total operating costs) can vary from sector to sector. At a federal level, tax returns show that nearly 66% of companies claim 10% of their total costs are related to energy. Trimming costs across the board for energy can have a dramatic impact on corporate profits (and give them more operating leverage to reduce market prices). Lastly on this point, new industries such as data centers and anything driven by hi-tech have a much heavier energy consumption component. The administration fully understands that to keep the U.S. economy robust and support growth, it must improve electricity production.

a. The administration also knows that it would fall shor t of hitting electricity demand targets using just solar and wind power energy sources for growth.

b. Natural gas will be the likely shor t-term gap filler until more nuclear power or other sources can be developed (15-20-year horizon).

c. In southern regions where the solar maximum is present, solar projects are likely to continue to see strong investment, but they won’t be the sole source of electricity production.

2. The use of tarif fs is risky. First, it does push up inflation risk. In the first Trump term, tariffs were applied surgically with more than 10,000 exclusions being granted. The ultimate effect was it pushed inflation from 1.7% to 1.9% at the time (hardly noticeable except for those suppliers directly impacted). But it can also generate hundreds of billions in revenue to pay down the deficit.

3. Ending the Red Sea situation. An area that also will affect ASA members is the Trump administration potentially ending the Red Sea situation. Houthi Rebels started attacking commercial maritime vessels trying to transit the Red Sea and Suez Canal in the fall of 2023. Maritime shipping prices as a result are up between 100-200%. In addition, analysts believe that there is a $6 geopolitical cost premium per barrel on current oil prices. Reopening the Suez Canal would help push inflation down worldwide.

“The ripple effects for ASA members across this economic strategy could generally be very good.”

1. The Federal Reserve was expected to hit its target rate by the end of 2025, but concerns over inflation have pulled back that forecast. After trimming a full point in 2024, the Fed is now expected to only cut two more times in 2025 with a quarter-point cut each and then follow that with two more in 2026 to hit its target rate of @3%.

2. But mor tgage rates are tied more to the 10-year U.S. Treasury yield rate. Recently, bond yields have been higher than usual and that has pushed mortgage rates higher. Getting federal spending in line would lower yield rates.

The ripple effects for ASA members across this strategy could generally be very good. Some input pressure from higher tariffs will be a concern for some, unless they are surgically applied as was seen in the first Trump term.

But, if the playbook works, there should be improvements in household spending (for automotive and home improvement activity). Eventually, improving mortgage rates and a stable labor environment will lead to more residential construction activity. And based on the shift from government spending to private investment, expect an increase in nonresidential construction to continue (with some risk to those that are primarily focused on government spending projects). Infrastructure spending and other construction, defense manufacturing, and other tangible product types of funding should continue in the near term.

Keith Prather, MBA, is managing partner and co-founder of Armada Corporate Intelligence. Keith co-founded Armada with ASA Chief Economist Dr. Chris Kuehl in 2000. Contact Keith at kprather@armadaci.com.

By Mike Adelizzi, CEO, madelizzi@asa.net

In its fourth year, ASA’s Great Ideas roundtable event conducted each year at NETWORK has developed into a must-attend session.

Since its inception, more than 400 great ideas to many industry issues faced by members have been delivered. Here are just a few of the more than 100 great ideas offered this past November during NETWORK in Chicago.

The hiring process has been more aggressive with people being unpredictable in their want. Turnover is still a challenge. Benefit packages are becoming more competitive. Bonuses can keep good team members.

Use profit sharing to invest in their people and help with employee retention. Distributors are looking for other programs to keep employees from leaving for a small raise. Fewer outside sales and more inside. Trend is less face to face using Hub Spot, CRM and GOHO.

Be aware of state-by-state changes in labor law requiring benefits for lesser hourly employees. Some health-care costs rising between 10-20%. Share with employees such as lowering 70% coverage to 60% with employees taking on 40%.

Need price increases because of employee costs, but contractors have pushed back — don’t see that as their problem like raw materials costs. Provide customers with greater detail on cost to serve.

Evaluate commission plans especially with inflation. Commission for inside sales.

Utilizing wireless warehouses and automation to reduce costs.

Using “in-house” app to drive sales vs. employee keying in orders.

Pay more attention to price overrides.

Distributors are watching contractors because many have not reflected inflation in their projects — cause for concern as they are running lean, putting pressure on receivables.

Use “price scraping” software to look at pricing with competitors (Home Depot, Lowes, Menards, etc.).

Using a third party for help with pricing schematics (Sparx IQ, Profit 2, etc.) — AI pricing tool.

Investing in technologies, such as using Blue Ridge Global supply chain software, to create on-time inventory.

Overall, the supply chain is strengthening with distributors wanting more data intelligence from manufacturers so they know how quick and how much they can get.

With the volatile demand over the last few years, most distributors are using historical % of total business using 2023 vs 2024 change, discounting COVID times. Some

contractors are providing forecasting, which helps. A lot of packing inventory in to keep customers happy.

Most distributors are using fill rates and turns to measure purchasing.

Price fluctuations on items such as PVF and steel are low, making distributors hesitant for big buys.

Lots of manual forecasting — need strong communication between manufacturers and distributors to make deliveries to contractors work. Maybe strengthening communication and trust can eliminate the psychology behind why wholesalers, customers and manufacturers keep over-stocking. Space is a problem for most distributors.

More manufacturers are leaning on reps to provide forecasting — some are asking for daily data.

Tools used:

No one yet is using AI to predict forecasting. However, Slim Stock is a software that uses AI to recommend inventory purchases rather than feedback from sales team. Distributors like Blue Ridge platform (6-12 months to implement). Linking the ERP tool to Power BI to manage spikes.

There is really no balance between purchasing and sales when predicting inventory levels. Sales wins all the time. However, some are requiring their purchasing team to do ride-alongs with the sales teams.

Distributors get feedback on stock levels from conversations with the branch managers, sales managers and sales teams. When evaluating a new line, distributors lean on the top sellers of the manufacturer.

Listening sessions with employees but then act so they know you are serious. If you have multiple locations, visit them often to listen. Show you’re interested and care.

Look at robotics as a way to help employees perform and not replace them. Invest in employees (even if they end up leaving). Provide a path for promotion through training. Can automation save labor? Yes, but a better way to look at it

is that automation can help firms gain more work with the existing labor.

Look to hire retiring plumbers to fill counter and other key roles. Recruit from competitors such as Home Depot and Lowes.

Instead of exit interviews, conduct “stay interviews.” Identify people you’d like to keep and have active conversations with them. Have leaders who are non-related to the specific department interview other department teams you’d like to keep. If you don’t have a mentorship program, create one.

Invest in a strong internship program. ASA can help here. Share success stories of longtime employees. Don’t focus your internships just on college. Look to attract high schools and trade schools — not everyone wants college. Great diamonds in the rough at the non-college levels.

Internships do cost money and staff time suck but they are great ways to identify rock stars for your company.

Need to institutionalize data. Get it out of the heads of older employees (such as customer history, space, kids’ hobbies, etc.) and into a database — this is becoming critical.

The Amazon effect will take over unless we all drive our reputation of being the expert. Sometimes, Amazon sells knockoffs. Need to watch for this and notify customers.

Quotations are another area where AI can be used. Quotes on jobs to customers and speed-to-quote is critical. We need accuracy and speed to be successful in the future.

Data and product accuracy on the correct information is on distributor websites. Customers want visibility of inventory and access to product through online platform.

Ability to order online after hours, which is becoming more prevalent, especially on larger projects. It’s a way to compete more effectively with Big Box stores.

Demand for personalization: Create small customer groups to build out personalization; Web analytics to track customer behaviors; Constant observation of customer movements.

Customers going more online for purchases such as faucets. Distributors need to be there —deepen eCommerce. We know more about the customer than Amazon, need to automate that knowledge/ out-service Amazon. AI quote generation and leverage AI to identify when customers will need an order.

Text ordering to help contractors, also text customers photos/ and photos of delivery to customers — apps exist to help.

Create the expectation that returns are easy like Amazon.

For a full copy of the report, contact ASA’s Mike Miazga at mmiazga@asa.net .

By Brian Hopkins, Distribution Strategy Group

Members of The American Supply Association are optimistic about eCommerce growth in 2024 as highlighted in the new 2024 State of eCommerce Study, conducted in collaboration with Distribution Strategy Group — a Colorado-based firm specializing in strategic guidance for distributors facing market disruption that provides insights consulting, and analytics to support their clients.

The survey spanned multiple sectors, including industrial, electrical, safety, HVACR, plumbing, building materials, chemical and plastics, oil and gas products, JanSan, hardware, and more. Respondents were an 85-15% split between distributors and manufacturers.

From DSG’s report, the plumbing distribution industry is going through big changes as it adopts more digital tools and platforms. According to the study, plumbing distributors are using online channels to improve their market presence while keeping their traditional strengths, such as good customer relationships and deep product knowledge. This shows

the industry’s ability to adapt to new customer needs in a competitive market, DSG notes.

Through the end of 2024, 45% of plumbing distributors have taken on eCommerce, with 13.4% of their revenue coming from digital channels. The study states this is a strong sign of commitment to digital transformation.

eCommerce in the distribution industry has grown steadily: in 2022, it made up 9.9% of total revenue; in 2023, it grew to 10.5%; and in 2024, it reached 13.1%. The plumbing sector’s 13.4% digital revenue is ahead of many other industries, but there is still room for improvement, especially as larger distributors make a bigger percentage of their revenue from eCommerce than smaller ones, DSG reports.

This study divides distributors into four stages based on how much of their total revenue comes from ecommerce: Nascent (0–5%), development (5–10%), mature (10–20%) and leader (more than 20%). The study shows 35% of plumbing distributors were expected to be in the mature stage by the end of 2024, 24% are leaders, and 13% of distributors are getting more than 30% of their revenue from eCommerce.

These numbers show more plumbing distributors are using eCommerce to generate a significant part of their revenue, with room for more growth in the future.

The study also shows the plumbing industry has some different trends when it comes to eCommerce use. One major trend in this report is the use of mobile apps. Plumbing distributors rank third for the effectiveness of their mobile apps, compared to other industries. Contractors and customers say they appreciate the convenience of mobile apps, specifically for ordering on the go and handling repairs.

A second trend is a focus on customer experience (CX) — 66% of plumbing distributors say CX is their top priority.

The last trend in the plumbing sector is the focus on increasing transaction sizes. 33% of plumbing distributors prioritize bigger orders, which is much higher than the 9% seen in the broader distribution industry.

These three trends indicate plumbing distributors are balancing digital innovation with the practical needs of their customers, especially contractors who need technical expertise and quick service, DSG reports.

The report also shows there are several factors that influence eCommerce success for plumbing distributors. Plumbing products usually require detailed specifications and compatibility checks, which makes it important to have strong online platforms that can handle complex product information and custom pricing, DSG notes. Plumbing contractors say that when working in high-pressure environments they need quick access to inventory, realtime product availability updates, and the ability to place emergency orders.

Digital marketing tools, such as email campaigns and mobile app promotions, have been proven effective at driving traffic and sales. However, human interactions remain the essential drive, with field sales representatives and customer service teams still playing an important role in helping customers adopt digital tools.

In terms of operations, the DSG report states plumbing distributors focus on unique goals. One key priority is improving efficiency and inventory visibility. Many distributors are combining digital tools with their counter service operations, so customers can see real-time inventory availability and enjoy smoother order processing and returns. The report adds that plumbing distributors are less focused on integrating ERP (enterprise resource planning) systems than other sectors and, instead, are

prioritizing features such as mobile-friendly interfaces and real-time inventory updates.

Financially, 35% of plumbing distributors are focused on acquiring new customers, compared to only 4% in the broader market. This is a shift, since last year’s findings stated most distributors focus on expanding revenue from their existing customers. Additionally, 33% of plumbing distributors are focused on increasing transaction sizes, which is much higher than the industry average.

When it comes to investment satisfaction, 26% of plumbing distributors say they are highly satisfied with their eCommerce investments.

Looking ahead, the DSG study predicts eCommerce rates in the plumbing sector will grow faster than adoption rates. This means distributors will focus more on improving their existing eCommerce platforms rather than only increasing the number of distributors using digital tools.

According to DSG, the next phase of digital transformation in plumbing distribution will depend on the ability to integrate these strengths with advanced digital tools to create seamless, customer-friendly experiences for contractors and end-users alike.

To get a copy of these results, please email Bri Baresel (who contributed to this report) at bbaresel@asa.net

of plumbing distributors say customer experience (CX) is their top priority.

of plumbing distributors prioritize bigger orders, much higher than the 9% seen in the broader distribution industry.

By Brooks Hamilton

In the last issue of ASA Review in Q4 of 2024, we looked at practical steps to integrate AI without overhauling your entire operation or disrupting the valuable relationships you’ve built. We called these levels 1 and 2.

For wholesale distribution executives, the question is how to implement this tool effectively to enhance operations, boost customer satisfaction and drive sustainable growth.

Now, let’s ramp it up a notch and dive into levels 3 and 4 — making work easier for each department and additional possibilities and gradual expansion.

Level 3: Make work easier for each department

Purpose: Expand AI benefits to your team. Enable your team to cut down on time-consuming, low-value tasks.

Investment: Highly variable. Dependent upon the relevant department, scope and vendor.

Tools: WrangleWorks, MyDataFactory, Spellbook, Harvey, Docebo or TalentLMS.

Tips: There is a surprising amount of effort expended to work around the limitations of current systems.

Solutions and Benefits:

1. Product Matching with WrangleWorks or MyDataFactory. Streamlines RFP creation, cost updates and supply chain efficiency. Greatly reduce the amount of time and effort required to prepare RFQ responses. Faster responses and fewer mistakes lead to greater RFQ throughput and happier employees.

2. Contract Review with Spellbook or Harvey. Automates initial contract reviews, reducing legal expenses. Speeds up negotiations and lowers external legal costs by using it for a first pass at the documents. Always have it reviewed by appropriate legal representation.

3. Training and Development with Docebo or TalentLMS. Provides personalized learning paths for employees. Accelerates onboarding and enhances skill development.

Action Step: Identify one area where AI can significantly boost team productivity.

Bonus Level 3: Share your vision

Your workforce is aware of AI and is trying to develop a narrative as to how it will be used within your organization. Now is the time to talk to them because otherwise they will

weave their own narrative that fits their fears rather than your vision.

Job Security: AI handles routine tasks, allowing your team to focus on strategic initiatives that require human insight.

Complexity: Many AI tools are user-friendly and require minimal training. With professional guidance, implementation becomes even smoother.

Cultural Fit: Emphasize AI as a tool that complements your team’s expertise, aligning with your company’s values of hard work and integrity.

Action Step: Reflect on your core values and how those will be reflected in how you roll out AI within the organization.

Purpose: While immediate steps can yield quick wins, AI also opens doors to innovations. Using knowledge and perspective gained from prior phases, select more transformative and sophisticated projects that can drive significant ROI and competitive advantage.

Investment: Highly variable but typically requires medium to high investment levels for the software category. Dependent upon the use case, scope and vendor.

Tools: These vendors may use techniques from generative AI in conjunction with AI techniques from prior waves.

Pricing: Improve margin by optimizing pricing to best reflect willingness to pay and pass through cost changes.

Product Recommender for Sales: Increase sales velocity by providing guidance to every sales rep for every customer.

Advanced Customer Service: Implement AI chatbots for 24/7 support.

Supply Chain Optimization: Efficiently deploy cash and effectively position products by using AI for demand forecasting and logistics planning.

1. Start small. Test an AI prompt this week.

2. Personal productivity. Integrate a personal AI tool next week.

3. Team implementation. Launch a departmental AI pilot initiative.

4. Evaluate and adjust. Continuously monitor performance and make necessary adjustments.

By following this guide and leveraging expert support, you’re not just adopting new tools — you’ll strategically position your distribution business for sustained success.

Brooks Hamilton is the founder of AI Strategy Advisors, a consultancy specializing in crafting AI strategies for companies of all sizes, including family-owned businesses. Reach him at brooks.hamilton@strategyadvisors.ai.

A year of success in offering indispensable resources to help drive members’ success.

The American Supply Association continues to be an indispensable resource for PHCP-PVF member companies and their employees.

In 2024, the industry’s only national trade association once again helped its members continue to prosper in their businesses through its efforts on the education/training, workforce development, business intelligence, advocacy/ codes and standards, and networking fronts.

ASA continues to expand its membership, adding more than 40 new companies, including one again posting double-digit distributor additions.

At the annual LEAD Strategic Leadership Summit in February, nearly 100 volunteer leaders gathered to discuss strategic initiatives designed to address the most pressing challenges and opportunities facing the PHCP and PVF distribution industry. Attendees looked five to 10 years into the future and collectively discussed disruptors members would face and how they will impact future success and viability for businesses.

Nearly 300 leading wholesaler firms

$70-billion-plus in annual sales 4,400 branch locations

nearly 300 supplier, reps, master distributors and service providers

NETWORK continues to be the event CEOs attend to build their networks and find inspiration

ASA chief economist continues to play vital role in member decisions

According to the new ASA Member Satisfaction Survey, nearly 75 percent of respondents say they find ASA Chief Economist Dr. Chris Kuehl’s free monthly economic update webinar (now done with business partner Keith Prather) either important or very important among the many ASA member offerings.

distributor firms

Nearly $50 billion in industry sales

ASA provides members with insights not found in other publications

Now in its fourth year of publication, ASA Review continues to provide worthwhile, industry-beneficial articles from industry thought-leaders each quarter.

of ASA members believe that supporting an industry trade association is very valuable to their business. (Source: 2025 ASA Member Satisfaction Survey).

420 attendees make ASA’s ELEVATE unequaled in its value to women industry professionals

The ASA Women in Industry Division continues to explode in popularity. The 2024 ELEVATE event drew 420 attendees to the Grand Hyatt in Nashville, punctuating the group’s importance as the original best practices-networking group for women in the PHCP-PVF industry.

Well into it’s second decade of existence, the ASA Emerging Leaders Division also continues to gain major momentum. The 2024 EMERGE event at the Westin Copley Place in Boston drew nearly 260 attendees, bringing together high-ceiling, high-potential employees of ASA member companies for multiple days of best practices sharing, education and networking.

The inaugural ASA Central Summit in Kansas City featured more than 150 attendees, including those from 24 unique distributor firms, as well as suppliers, reps and other invited guests covering 13 Central states from Texas to Wisconsin and Colorado to Illinois. Attendees from the expanded ASA Central region heard seminars on topics such as leadership and the art of negotiating, as well as enjoyed a best practices roundtable session and a mid-year economic update.

ASA debuts mobile event app at NETWORK

ASA’s new mobile event app debuted at NETWORK2024 in Chicago. More than half the NETWORK registrants logged into the app at some point.

ASA Insights e-news delivers relevant

ASA Insights, the association’s weekly e-newsletter, continues to deliver relevant, impactful content to members 52 weeks a year.

Insights is sent to nearly 8,000 subscribers each week.

Insights enjoys a robust more than 50 percent open rate.

ASA website registers big gains in usage

ASA’s revamped website at asa.net has been a hit with members. In 2024, active users of the site were up 26% while new users were up more than 25%.

In 2024, ASA’s Advocacy office continued its important efforts in protecting the industry’s best interests at the federal and state legislative/regulatory levels, as well as in the codes and standards arena.

295

82 85

ASA engaged 295 members in 104 Congressional meetings over two days on Capitol Hill.

Political Action Committee (PAC) contributions increased 82% year over year.

ASA enjoyed an 85% success rate on codes and standards positions taken.

100 89

89% of ASA PAC-supported federal candidates won their races.

100% of ASA’s Executive Committee and 95% of the ASA Board of Directors contributed to the PAC.

ASA Innovation Summit provides critical insights for members

ASA’s first-ever Innovation Summit brought together 100 industry attendees for two days of education seminars on topics such as cybersecurity, disruptive thinking, innovation and the digital future.

ASA unifies the industry behind a new national product standard

At NETWORK in Chicago, ASA’s data task group, part of the association’s Embracing the Future strategic action council, debuted a new national standard to facilitate a faster and less customized way to obtain manufacturer product data for use by distributors in PIMs, ERPs and distributor e-commerce.

91%

of ASA members believe the association’s efforts to educate elected officials to support our industry is very valuable to their futures.

Following in the footsteps of the 2023 Voice of the Contractor Survey, ASA launched the 2024 Voice of the Builder Survey that gathered insights from builders across residential, commercial, industrial and institutional sectors. Builders were asked their thoughts on topics such as purchasing decisions, product choices and training, and their relationships with suppliers and wholesalers. Look for the Voice of the Engineer/Specifier report in late 2025.

Operating Performance Report continues to be the gold standard in distributor financial benchmarking

In 2024, nearly 120 ASA distributor firms provided data for the Operating Performance Report, a comprehensive financial and operating benchmarking survey.

For more than 40 years, the OPR has served as a cornerstone for operational benchmarking and decisionmaking in the distribution industry as ASA continues to deliver impactful resources for its members.

Revamped Materials Market Digest provides members with critical commodities data

The ASA Commodities Report underwent a supersized revamp and remerged in late 2024 as the new Materials Market Digest that provides comprehensive insights into qualified market data for a multitude of key materials, especially recent changes in pricing or priceinfluencing actions.

ASA now has 240 volunteer leaders from ASA-member companies spanning 25 total councils, committees and task groups.

live economic update webinars

than 40 economic podcasts published in 2024 Detailed economic/market reports each month 4 quarterly market surveys — questions ASA members want to know!

partnerships with IDEA and Distribution Strategy Group

ASA graduates first MDM class: Valuable program for Emerging Leaders

ASA University rolled out its reimagined Master of Distribution Management (MDM) program in 2024 to great success. Nearly 40 employees from 19 ASA-member companies (17 wholesalers, 1 supplier, 1 rep) enrolled in the MDM program last year with 10 graduating.

ASA University: The industry standard for employee training and education

In 2024, 172 unique courses were taken via ASA University

ASA University had 12,597 course registrations in 2024

146 custom training tracks were developed for members

Distributor members now have access to 217 supplier trainings from 29 vendors

Most popular course 2024: Intro to PVF

PROJECT TALENT drives jobseekers to ASA member company websites

ASA’s PROJECT TALENT careers recruitment platform continues to take a leadership position in the industry in helping member companies in their talent recruitment journeys via the SupplyIndustryCareers.com website.

In 2024, 3,000-plus job seekers linked directly to member websites from this page.

2,600 member locations are currently highlighted on the webpage as “Now Hiring.”

1,950

PROJECT Talent’s Recruiter Toolbox, loaded with critical marketing assets to help ASA members in their employee recruitment processes, had 1,950 member visits in 2024.

10

10 new member-exclusive resources were added to support members with job fairs/school visits. A total of 1,900plus assets in the Recruiter Toolbox are now available for members to download to help with recruitment efforts.

Most popular training track 2024: Branch Manager

177

Since switching to a self-directed quarterly meeting format, ASA’s CONNECT peer-topeer networking platform saw registrations spike from the low 40s to nearly 180 across 8 job-specific communities. The most popular communities in 2024 were HR, training and operations.

By Steve Edwards, Director of Recruitment Marketing sedwards@asa.net

As highlighted in 2024 ASA President Patrick Maloney’s address at NETWORK in Chicago, recruiting people to our industry requires diligent effort and a comprehensive recruitment strategy.

Maloney spoke about his recent visits to local colleges to speak about the industry and opportunities at his company, Coburn Supply Co., based out of Beaumont, Texas. He said that both schools and students were eager to hear from him, and this opportunity exists for all ASA members.

It may be surprising to hear about the emphasis on a faceto-face recruitment approach given the proliferation of online tools for both employers and prospective employees.

While digital methods such as websites, social media and search engine optimization remain critically important for both companies and job seekers, there are benefits of face-to-face interactions that cannot be matched online. This is particularly true given the current challenges of attracting and retaining top talent.

Here are examples of how job fairs should be included in a company’s recruitment strategy.

One of the advantages of attending job fairs is the direct access they provide to a diverse pool of candidates. Unlike online applications where recruiters sift through many resumes, job fairs allow companies to interact with individuals who have chosen to attend the event. These candidates are typically motivated, career-focused, and actively seeking opportunities, making them an ideal audience for recruiters.

Job fairs also often cater to specific industries or types of job seekers, such as recent graduates, professionals in tech, or veterans transitioning to civilian jobs. This targeted approach enables companies to focus their efforts on finding candidates who align with their hiring needs.

Meeting candidates in person allows recruiters to assess qualities such as communication skills, cultural fit or other traits that are difficult to evaluate through resumes or virtual interviews.

For candidates, job fairs provide a chance to ask questions, get a feel for a company’s culture, and make an impression on recruiters. These connections can help companies stand out from competitors and create a more memorable recruitment experience.

As we know, the PHCP/PVF industry suffers from lack of awareness or misperceptions among job seekers. Job fairs are an excellent opportunity for ASA members to enhance their employer brand. By participating in these events, businesses can showcase their values, mission and culture to a broader audience.

A well-organized booth or recruitment space, engaging materials and approachable representatives are all critical for a successful job fair. Even candidates who may not be immediately interested may remember the company positively and consider it in the future.

The hiring process can be time-consuming and expensive, especially when it involves advertising positions, screening resumes, and scheduling multiple interviews. Job fairs streamline this process by bringing candidates and recruiters together in one location, allowing for on-the-spot interviews and initial assessments. Some companies even extend job offers during the event, significantly reducing time-to-hire.

Job fairs provide networking opportunities beyond direct recruitment. Companies can connect with high school guidance counselors, trade school, community college and university career centers. These relationships can lead to future opportunities, such as internship programs or joint recruitment.

Job fairs can also connect companies with thought-leaders who can provide insights into job seekers, workforce challenges and recruitment strategies.

Job fairs also can be a great source of market intelligence. By interacting with candidates and observing other companies, companies can gain greater insights into what job seekers are looking for in employers. This includes understanding salary expectations, preferred benefits, and desired workplace cultures. Another benefit is competitive intelligence. Companies can learn how others are positioning themselves, which can lead to refinement in a company’s recruitment approach.

Not all job fair attendees are ready to commit to a job immediately. Many, especially students or early-career professionals, attend these events to explore their options and learn about potential employers. By building relationships with these individuals early, companies can create a pipeline of future talent.

This proactive approach to recruitment ensures that when these candidates are ready to enter the workforce, they already have a positive association with the company.

Within the ASA Recruiter Toolbox, members have access to several tools to assist them with career fairs or presentation opportunities.

1. Find local job fairs, trade schools, community colleges or CDL training programs using this easy-to-use resource.

2. Research-tested talking points about opportunities in the industry that effectively resonate with students and recent graduates.

3. A pre-designed brochure that explains the PHCP/PVF industry with the ability to include the ASA member’s logo and contact information. Directions for a local printer are also included in the Toolbox.

4. A PowerPoint presentation about industry members can be used if speaking to groups of students or grads and the ability to customize using the member’s information.

5. Customizable templates for job fair standup banners to assist with industry and member branding.

To access the Recruiter Toolbox, go to ASA.net and click on Recruiter Toolbox under the Education menu. A valid ASA member login is required.

Project Talent is one of four mega goals included in the Association’s strategic plan. This goal includes the objective of developing and implementing a program to attract and grow the number of talented workers taking advantage of fulfilling career opportunities in the PHCP/PVF Industry.

Visit ASA’s Industry Calendar for a comprehensive log of all PHCP-PVF-related conferences, buying group meetings and trade shows for the next few years. Go to ASA.net, hit the “Meetings and Events” tab and then “Industry Calendar.”

Are distribution companies prepared for 2025? Master the basics before anything else.

By Chris Blaylock, WIPFLI

AI-powered warehouses. Automated efficiency. The distribution industry is imagining an ambitious 2025. But there’s a catch: The infrastructure in place can’t support the lofty dreams many in the industry are chasing.

The reality is that many distributors struggle to use their existing data, let alone manage the intricacies of artificial intelligence (AI). Despite this, they are desperately pursuing AI solutions without having fundamental plans in place for basics such as cybersecurity. It is crucial to take a step back from the hype and concentrate on core actions that can truly make a difference.

Jumping the gun with AI

AI is often seen as a means to revolutionize distribution, but what many fail to mention is that the companies achieving tangible success are not initially relying on AI. Instead, they are focusing on using the data they already have.

In 2025, the distributors who emerge as successful will not be those who simply purchase the most advanced AI tools, but rather those who prioritize organizing their data, comprehending their existing information and gradually addressing specific obstacles. This necessitates a collaborative effort involving various departments such as operations, IT and finance, as well as external allies, to establish effective key performance indicators (KPIs) and practical dashboards.

Consider the current state of warehouses: Instead of focusing on improving their fundamental data infrastructure, companies are putting significant resources into AI technology. This often leads to fragmented and unreliable data, making it difficult

to build accurate predictive models or implement automated decision-making. In this rush to adopt advanced analytics, companies often neglect mastering basic reporting and understanding their current processes.

The areas where automation is effective are not in eradicating employment opportunities, but in demonstrating the significant need for human workers in diverse positions. The automated warehouses that receive the most attention do not displace employees, but rather assign them to more critical responsibilities.

The “auto store” systems that are now emerging are prime examples. These automated storage systems are equipped with cutting-edge robotic systems that are responsible for retrieving products, effectively decreasing the physical workload on employees. Despite common belief, these systems are not causing job loss. Rather, they are allowing workers to devote their attention to more challenging tasks, such as problemsolving, providing customer service and strategic planning, which are not yet capable of being handled by machines.

A comprehensive talent strategy is necessary for all these requirements. In 2025, true innovators will not be wondering how to replace their workforce with automation; rather, they will be exploring ways to enhance the effectiveness of their human talent through automation. Prominent companies are placing emphasis on personalization by catering to the individual needs of each employee throughout their career journey. They also provide personalized development resources and opportunities for advancement. The culture of a company now plays a vital role in employee engagement

and retention, with top-performing organizations prioritizing recognition and establishing clear pathways for growth.

As the industry’s focus remains on AI, distribution businesses face more fundamental risks. Many companies operate with minimal safeguards and emergency strategies, essentially gambling on the stability of their entire value chain.

A survey by Deloitte reveals that a vast majority of companies, 91%, have encountered a cyber incident or breach in recent times.

Such attacks have the potential to completely disrupt the operations of a distribution business by hindering order processing, fulfillment and shipping. Despite this, many organizations still lack proper response protocols and designated team responsibilities in the event of a cyberattack. This will result in companies struggling to effectively handle the attacks and resorting to coordinating with external vendors, often leading to costly errors.

The susceptibility to risk also applies to the connections within the supply chain. The post-pandemic era has shown us that being flexible with suppliers is not the only aspect of supply chain adaptability — it also involves establishing strong, complex relationships that can endure unexpected events. However, many businesses continue to view supplier relationships as merely transactional instead of strategic partnerships.

In 2025, distributors that are successful will go beyond just diversifying their suppliers and instead focus on building strong resilience. This will involve establishing collaborative partnerships with their suppliers, even with competitors if needed, and keeping channels of communication open in preparation for any potential crises.

These enhanced collaborations also open doors for improved customer service. In the same way that we tailor employee encounters, customer engagements also require a comparable degree of personalization.

Top distributors are using their data to gain insights into customer profiles and proactively anticipate their needs. This could involve forecasting order trends, customizing communication methods or designing focused promotional strategies based on individual customer actions and preferences.

Distributors should focus on three priorities:

1. Ensure accurate data: Before implementing AI, establish strong data management strategies. Understand your existing data and how to effectively use it. Begin with small projects to showcase value and then expand.

2. Prioritize synergy between humans and AI: Instead of viewing automation as a replacement for employees, create systems that enhance human abilities. Invest in training programs to assist workers in adapting to new roles.

3. Strengthen your fundamentals: Develop concrete response plans for cybersecurity incidents. Ensure all team members understand their responsibilities in maintaining operational continuity. Regularly test and update these plans based on real-life experiences.

One option is to constantly follow every new technological trend, but another option is to focus on creating strong foundations for sustainable innovation. The decision we make will ultimately determine if 2025 will be a year of significant advancements or simply more aimless digital developments.

Achieving success does not solely rely on possessing cuttingedge technology, rather, it lies in having a solid groundwork to use that technology efficiently. This entails beginning with the fundamentals: accurate data, well-defined procedures and skilled teams.

In the distribution landscape of 2025, the successful companies will not necessarily be the ones with the largest AI budgets or the highest number of robots. Rather, it will be those who focused on mastering the basics before anything else.

Chris Blaylock is an audit partner at WIPFLI, specializing in manufacturing and distribution. Contact Chris at cblaylock@wipfli.com.

By Veronica Pratt and Katherine Scheibert, Savings4Members

Member service programs, or MSPs, have become essential for independent businesses looking to stay competitive. While larger corporations benefit from better rates and resources, smaller businesses often face challenges in accessing affordable services. MSPs provide these businesses with valuable tools and services that help level the playing field, enabling them to operate more efficiently, cut costs, and secure reliable vendor relationships.

One of the most immediate and impactful benefits of MSPs for independent businesses is cost reduction. Operating costs for services such as shipping, fuel, office supplies, and other essential resources can be burdensome for smaller companies. By leveraging collective purchasing power, MSPs secure rates usually reserved for large corporations, helping smaller businesses save significantly. These savings aren’t just operational advantages — they create financial flexibility

and opportunities. With reduced expenses, independent businesses can invest in growth initiatives, such as expanding inventory, enhancing marketing efforts, or improving customer service, ultimately strengthening their competitive edge in an evolving market.

For example, many MSPs provide fuel savings through partnerships with leading suppliers, giving independent businesses access to discounted rates and efficient fuel management solutions. By lowering fuel costs, MSPs enable businesses to allocate savings toward optimizing transportation and logistics, improving overall operational efficiency.

MSPs provide valuable support by streamlining vendor management and reducing administrative problems. Managing multiple vendors can be complex and time-consuming for small businesses with limited staffing resources. MSPs simplify this process by consolidating vendor relationships, providing a single point of contact for various services, and offering administrative support. This frees up time for business owners to focus on delivering value to their customers.

Efficiency gains are also achieved through the optimization of supply chains. MSPs help reduce supply chain complexities that can overwhelm smaller teams by providing guidance on procurement, inventory management, and other critical operations. By eliminating unnecessary steps and minimizing delays, MSPs help independent businesses to operate more smoothly, ultimately enhancing productivity and allowing them to concentrate on core services and customer engagement.

Access to specialized expertise and resources Independent businesses often struggle to access expensive, specialized solutions due to budget constraints. MSPs connect these businesses with experts, resources, and training opportunities that can improve operations and keep them informed of best practices. MSPs often partner with industry leaders to provide training and tools that small teams might not otherwise afford. Programs in technology, compliance, and business management help independent businesses stay up to date with industry changes and operate more effectively.

Some MSPs provide access to valuable webinars, tools, and training programs that are typically out of reach for smaller businesses. These resources help small teams enhance their skills, stay informed about industry trends, and adopt best practices without the need for extensive in-house expertise. Through workshops on technology, compliance, and business management, MSPs empower independent businesses to grow sustainably and stay competitive. By offering these tailored learning opportunities, MSPs help small businesses position themselves for long-term success and resilience in a rapidly evolving market.

“Distributors of all sizes can increase their profits by taking advantage of the programs, and almost everyone can utilize at least a few of their programs that provide significant bottom-line savings.” -Jeff Braun, CEO of Cooperative

Finding reliable vendors can be challenging and risky for independent or small businesses, especially when it comes to quality and consistency. MSPs simplify this process by establishing partnerships with trusted vendors. This gives small businesses access to a preapproved network of suppliers, eliminating the need to vet them individually. This can reduce risks associated with unfamiliar vendors and provide independent businesses with peace of mind when it comes to quality and service reliability.

Through these partnerships, MSPs ensure that independent businesses can access dependable support when they need it. The consistency and reliability brought by MSPs mean that independent businesses aren’t left scrambling to find support during critical times. MSPs also provide businesses with valuable relationship-building opportunities, facilitating connections with reputable vendors and service providers who are committed to their success. This network can be a vital resource, offering stability and assurance for independent businesses as they navigate a competitive market.

As independent businesses continue to adapt and innovate, MSPs will play an ever-more important role in supporting their success. For any independent business owner looking to expand their reach, secure their operations, and grow sustainably, engaging with a reputable MSP can be a transformative decision.

Through this partnership, independent businesses can gain access to resources and opportunities that were once out of reach, creating a path toward a bright and prosperous future.

Savings4Members has been an ASA partner since 2019, providing substantial savings to PHCP-PVF wholesaler, supplier, rep and service provider members. Savings4Members works with dozens of purchasing cooperatives, buying groups and associations across many different industries to supply members with significant cost savings on services and products they use every day. With access to more than 20 categories of discounts and a team that handles the details, Savings4Members ensures members can easily access and maximize the benefits most valuable to them. Visit asa.savings4members.com to get started.