Introduction to Urban Data and Informatics | Fall 2023

New York City is currently experiencing significant changes in the short-term rental landscape. It is one of the most touristy cities in the world, attracting visitors with its museums, entertainment, restaurants and commerce.

In 2022, the city welcomed 56.7 million visitors, and the forecast for 2023 projects an increase to 63.3 million visitors. The tourism industry accounts for approximately 7% of the private sector employment and indirectly supported 376,800 jobs in 2019. Additionally, the hotel and accommodation sector provided 52,000 jobs and around $3.6 billion in wages in 2019, representing 18.4% of employment.

Nevertheless, the current housing shortage crisis has prompted the city to develop new policies to address the 340,00 housing shortage, with a particular focus on affordable housing. In this regard, the current administration ectacted Local Law 18, known as the Short-Term Rental registration Law, on January 9th, 2022, which stated its enforcement in September 2023.

New York City’s Short-Term Rental Registration Law is part of the New York City Administrative Code, under Chapters 31 and 32 of Title 26 (“Housing and Buildings”). The Law was created through the passage of Local Law 18 of 22.

The law mandates that short-term rental hosts register with the Mayor's Office of Special Enforcement (OSE) and prohibits booking service platforms (such as Airbnb, VRBO, Booking.com, and others) from processing transactions for unregistered short-term rentals. It is important to note that short-term rentals are defined as stays lasting 30 days or less.

The Short-Term Rental Registration Law also requires OSE to maintain a Prohibited Buildings list. Which includes buildings where short-term rentals are prohibited, either by law such as NYCHA or rent-regulated buildings, or lease and occupancy agreements.

The Short-Term Rental Registration Law in not allowed for:

• New York City Housing Authority (NYCH�) apartments

• Rent-controlled apartments

• Rent-stabilized apartments

• Single-Room Occupancy (SRO) units

These scenarios significantly impact the tourism industry in the city, particularly the hotels and accommodation sectors. As a result, this research project aims to explore and understand how the policy frameworks for short-term rentals affect the city’s landscape by examining data from before the law was enacted in 2022 and after it was implemented in 2023.

January 2022

February 2023

September 2023

Adoption of

Publication

Initial Phase of

What is the statistical correlation between tourism attractions, neighborhood median income, and short term rental supplies in New York City and how do these factors impact the short-term rental market in different boroughs of the city?

How does the enactment of Short-Term Rental Registration Law is changing the landscape of short term rental supply?

Short-term rentals are located in higher median income neighborhoods

Short-term rentals are located nearby tourism attractions

With the enactment of regulations on short term rentals in NYC, the supply of short term rentals will significantly decreased and nightly price between renting Airbnb and a hotel room will even out

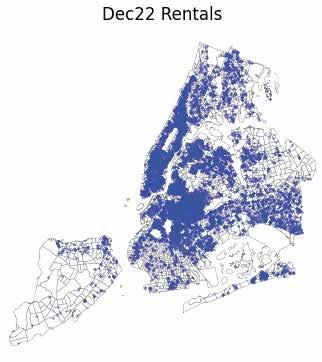

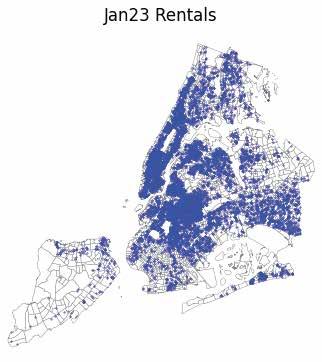

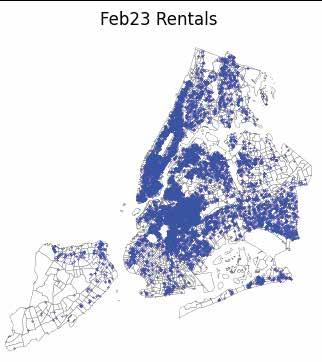

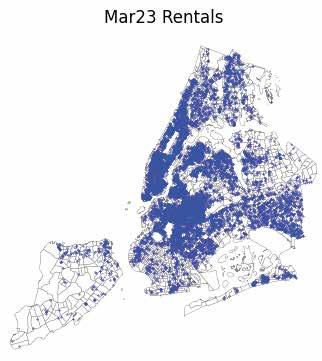

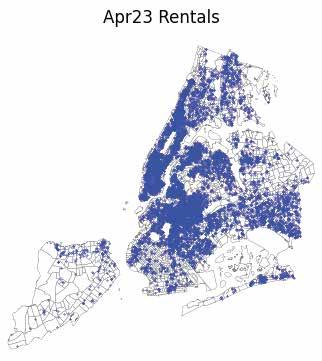

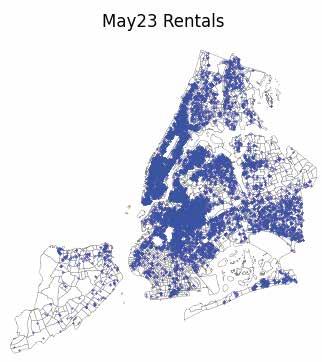

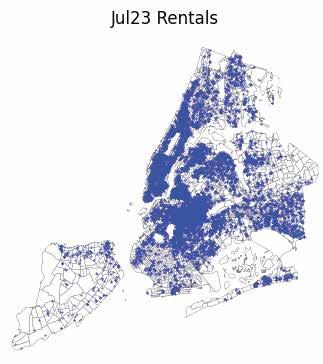

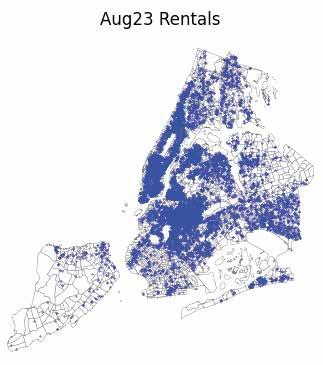

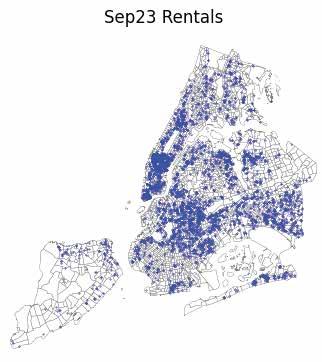

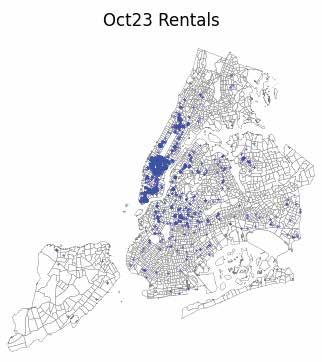

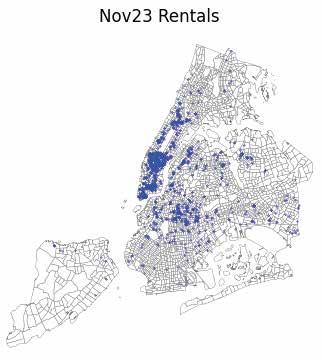

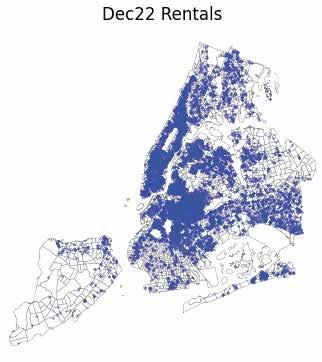

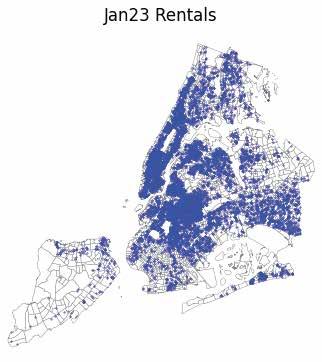

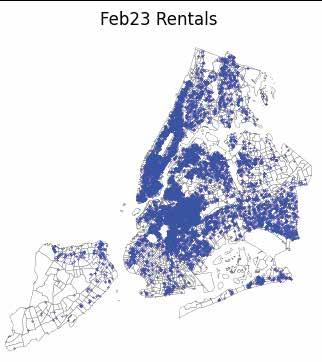

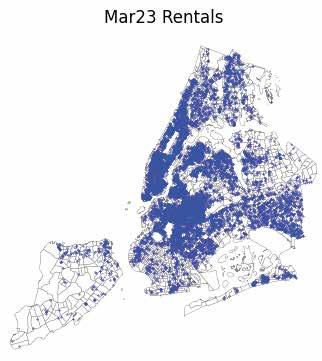

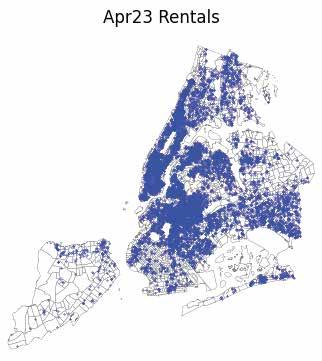

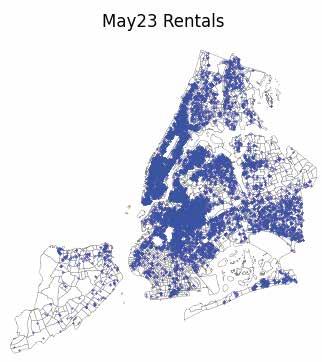

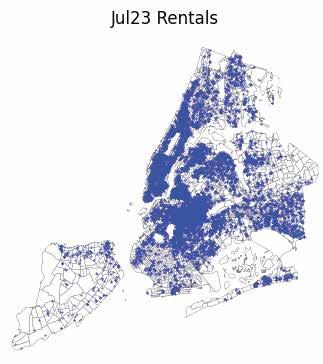

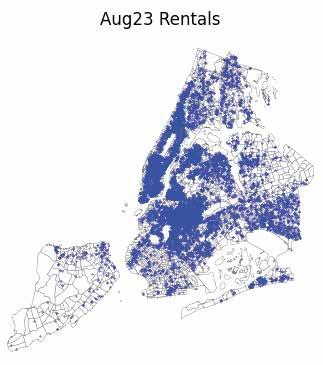

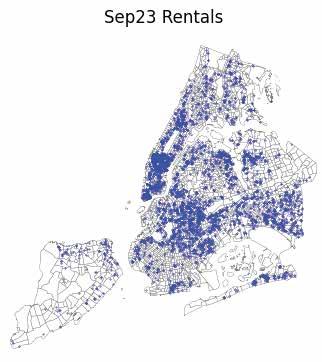

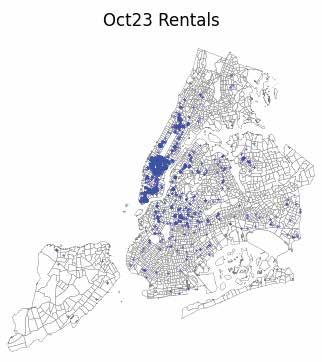

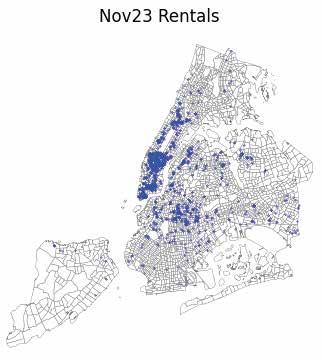

We developed a time series illustrating the distribution changes of Airbnb listings in New York City from December 2022 to November 2023.

Preliminary findings indicate a substantial decrease in the number of Airbnb listings in New York after the enforcement of Local Law 18 in September 2023.

The most notable change occurred between August and September 2023, with listings decreasing by more than half. This downward trend persisted until October 2023.

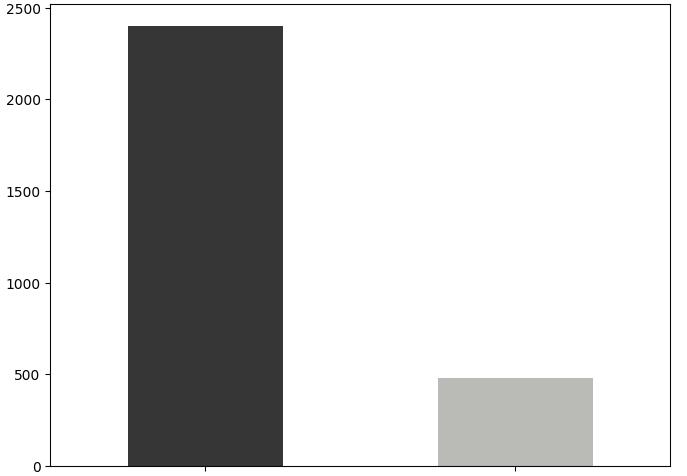

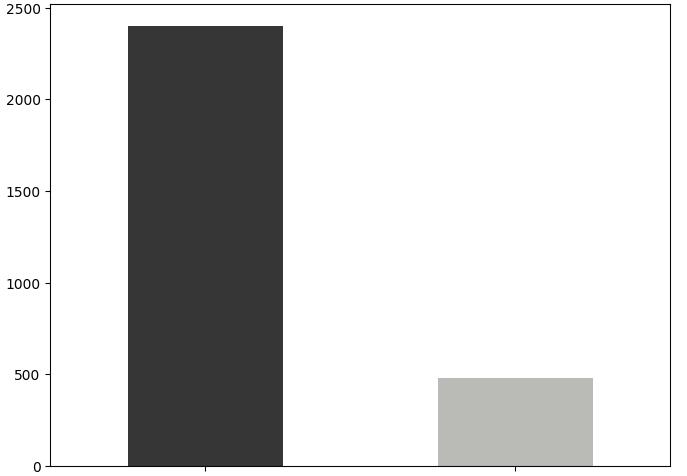

Examining the license types of listings, only Class "B" buildings are expected to possess exempt licenses. Class "B" encompasses hotels, lodging houses, rooming houses, boarding houses, boarding schools, furnished room houses, lodgings, club houses, and college and school dormitories.

Contrary to this expectation, we discovered that a majority of short-term Airbnbs are listed with exempt licenses, despite being private apartments. Furthermore, many of these listings are managed by property management companies that hold licenses for short-term rentals. Examples of one of these property management companies is RoomPicks.

Analizing

Exploring the Landscape of Short-Term Rentals in New York 1 Catharina Utami (cku2103) | Inneke Rachmawati (ir2453) Camila Botero (cb3785)

the City

Overview Research Questions

Methodology Findings Count of Exempt and non-Exempt Licenses of Airbnb Listings Nov 2023 Time Series Map Showing Airbnb Listings From December 2022 to November 2023 December 2022 January 2023 February 2023 March 2023 April 2023 May 2023 June 2023 July 2023 August 2023 September 2023 October 2023 November 2023 Number of Aibnb Listings with Minimum Nights Stay (3 Days)

Hypothesis

Local

Law 18

the Enforcement

of the Rules for the program

Booking ACS Census Tracts Points of Attraction Airbnb Scrape data with BeautifulSoup Filter short-term rentals with <3 days minimum stay Clean data with pandas Table Join Booking nightly price Half a mile buffer of tourism attractions Denstity map of Airbnb listings clipped by tourist attractions buffers Airbnb listings dataset Boxplot of price range Licence bar chart Mapping change distribution of Airbnb Count overlapping geometries Census tract with median income data Density map of Airbnb listings Half a mile buffer of median income census tracts Denstity map of Airbnb listings clipped by median income CT buffers 750 feet buffer of Airbnb listings Count Non-Exempt Licences: 480 Exempt Licences: 2,402 Number of Listings Months

Introduction to Urban Data and Informatics | Fall 2023

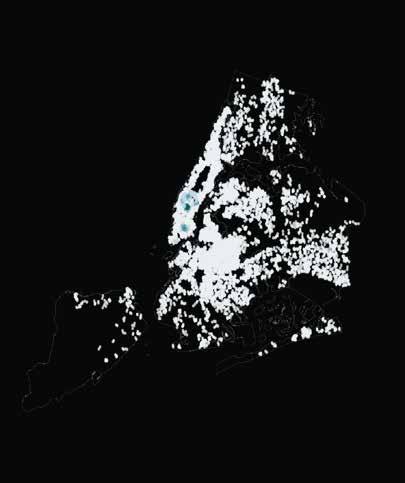

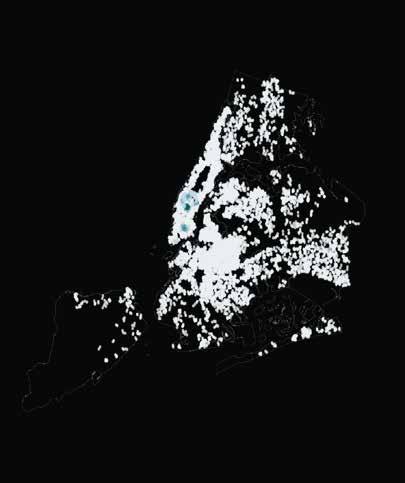

First, we generated a point density map using a 750-foot buffer radius (average block length in Manhattan). We subsequently assessed geometric overlaps to identify multiple listings within the same block and performed equal division.

The results indicated initial Airbnb density in Midtown, Lower Manhattan, and Prospect Heights. However, post-enforcement of Law 18, the remaining density is solely in Midtown, Manhattan.

Next, we established a half-mile buffer for high-income census tracts with incomes exceeding $186,000. We then created a clipped map to examine the relationship between Airbnb listing concentration and high median income census tracts, intending to use the city's points of attraction as centroids as the last part of the geospatial analysis.

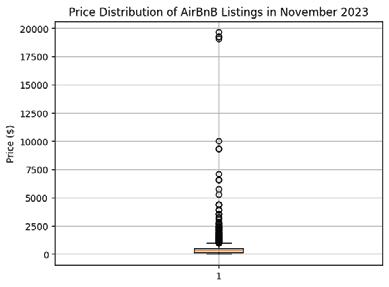

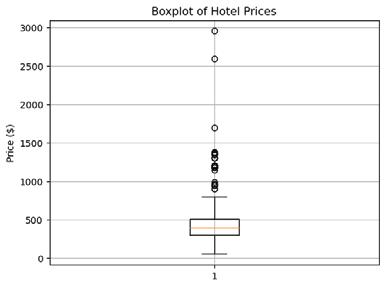

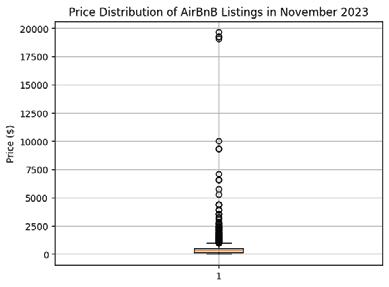

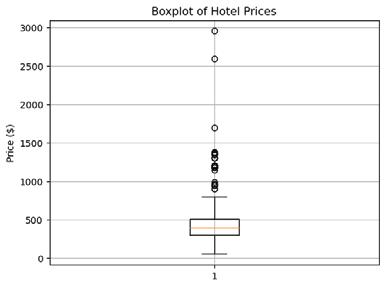

As of November 2023, Airbnb prices have nearly doubled, potentially attributed to a substantial reduction in available listings within the city.

The study identified a broader spectrum of prices for Airbnb, considering its ability to accommodate more guests compared to the standard hotel room designed for two occupants. Surprisingly, the median price of an Airbnb is lower than that of hotels, challenging our initial hypothesis that prices would equalize between hotel rooms and Airbnb accommodations.

Median price Airbnb Dicember 2022: $150

Median price Airbnb September 2023: $183

Median price Airbnb November 2023: $299

Median price hotels in Booking November 2023: $394

Limitations and Conclusions

Aibnb listings data was only available for a one year timeframe.

The concentration of points of attraction depends on the source. This can significantly impact the results of the maps and buffer analyses.

Hotel prices in platforms such as Booking.com fluctuates depending on weekdays, weekends and high season.

Booking.com could only be scrapped for present data.

1 2 3

In Manhattan, the areas with the highest number of Airbnb listings are located in proximity to high median-income census tracts and tourist attractions

In Brooklyn, the areas with high number of Airbnb listings are located outside the buffer of high median-income census tracts and tourist attractions

The Short-Term Rental Registration Law has significantly impacted the availability of Airbnb listings in New York and the prices have almost double.

Bouhaj, K. (2020). Exploring Airbnb data in Mexico City using geo-spatial analysis (Part One). From https://medium.com/@kenza-bouhaj/exploring-airbnb-data-in-mexico-city-using-geo-spatial-analysis-part-one-9a91f5d01893.

DiNapoli, T. P., Jain, R. (2021) The Tourism Industry in New York City: Reigniting the Return. From https://www.osc.state.ny.us/reports/osdc/tourism-industry-new-york-city.

New York City Department of Special Enforcement. Short-Term Rental Registration and Verification by Booking Services. https://www.nyc.gov/site/specialenforcement/registration-law/registration.page

Yustindra, F. (2020). Sectioning Airbnb Neighborhoods in Tokyo: Survey the Surroundings. From https://towardsdatascience.com/sectioning-airbnb-neighborhoods-in-tokyo-survey-the-surroundings-31edd55b37d9.

Zaveri, M. (2023). New York City’s Crackdown on Airbnb Is Starting. Here’s What to Expect. From https://www.nytimes.com/2023/09/05/nyregion/airbnb-regulations-nyc-housing.html.

Zaveri, M. (2023). New York City Has a Bold Plan to Fix Its Housing Crisis. Will It Work? From https://www.nytimes.com/2023/10/25/nyregion/nyc-housing-crisis-plan.html#:~:text=While%20an%20ambitious%20target%2C%20it,340%2C000%20homes%20as%20of%202021.

Analizing the City Exploring the Landscape of Short-Term Rentals in New York 2 Catharina Utami (cku2103) | Inneke Rachmawati (ir2453) Camila Botero (cb3785)

Findings

NYC Overlapped Point Density Map of Airbnb Listings - November 2023 NYC Aibnb Density Map with Buffers of Tourist Attraction | Nov 23 NYC Airbnb Density Map with Buffers of Tourist Attraction Clipped | Nov 23 Price Distribution of Airbnb and Booking Listings in November 2023 Airbnb Booking

NYC Aibnb Density Map with High Income Census Tract Buffer Nov 23 NYC Aibnb Density Map with High Income Census Tract Buffer Clipped | Nov 23 December 2022 November 2023 421 337 253 169 85 5 mi 5 mi 5 mi 5 mi 5 mi