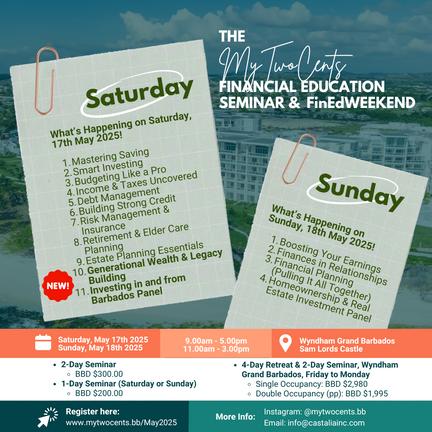

Financial Seminar PostEvent Report

Introduction

The September 2024 MyTwoCents Financial Education Seminar was a landmark event, attracting over 150 participants from a wide range of backgrounds and marking our largest gathering to date This overwhelming response has led us to expand to a new venue at the Wyndham Grand Barbados. This Post-Event Report captures our seminar’s key successes, including feedback from participants, our approach to measuring impact, and highlights from the day’s sessions.

Heartfelt Thank You to Our Sponsors

We sincerely thank our sponsors for their invaluable support, which has been essential to achieving our mission Your partnership has empowered our community with practical financial knowledge, driving high engagement with new accounts, investments, and services. We look forward to continuing this impactful journey with you as we expand MyTwoCents in 2025.

What’s Next

In this report, you’ll also find insights into our future plans, including new segments and the addition of the FinEdWeekend, designed to deepen engagement and broaden our reach in financial education. Thank you for being part of this journey toward financial empowerment in Barbados.

3,725

357 All Post Average

27k 57 34 Followers +10 4% 3-month Content

Reach per boosted posts Share Save

How did we measure success?

Success for our seminar was measured through a mix of participant feedback, engagement, and proactive actions:

Community Engagement: Over 180 attendees and invitees joined the MyTwoCents WhatsApp Community after the seminar, actively participating in weekly discussions across various groups.

Participant Feedback: We received exceptional feedback, with select highlights featured on page 6 of this report

Media Reach: The seminar’s visibility was amplified by radio segments on 94 7FM, HITZ, and SLAM 101 1FM, further broadening our reach.

Action by Attendees: Many attendees took immediate steps, applying insights gained during the seminar

Examples include utilizing SigniaGlobe Financial as a mutual fund broker, opening new investment accounts with Carilend, setting up service accounts with FLOW Barbados, and exploring products from COB.

Comprehensive Coverage & Immediate Sign-Ups: The seminar’s curriculum included Budgeting, Saving, Investing, Risk Management, Insurance, Debt Management, Credit Management, Retirement and Estate Planning, Boosting Your Earnings, Finances in Relationships, and a Homeownership & Real Estate Investment Panel This comprehensive approach led to immediate interest and sign-ups for insurance and credit union memberships related to the products highlighted.

These outcomes underscore the seminar’s success in sparking meaningful financial action and fostering ongoing empowerment among our attendees

Participant

Listen to what our participants had to say about their experience

Participant Reviews

“Nikita is very engaging, there wasn't a point in time that she was presenting that didn't have my attention. The audience engagement was also great It was amazing. I came wanting more knowledge and that was delivered I know things I didn't know that I didn't know. The opportunity to network was also great. I'm glad there's an opportunity for people to get so much financial knowledge in this format in Barbados ” - Configuration Analyst

“The best financial education I ever received” - Courtesy Clerk

“This event was well conceptualized and well delivered It gave specific and detailed content which you can actually apply and most of all the transparency and honesty of the facilitator made you feel confident that you were being given good advice ” - Teacher

“LOVED IT!”- Medical Doctor

“This was my first session and the entire evening was a wealth of information ”Technology Manager

Sponsor Reviews

Listen to what some of our sponsors had to say about their experience

Marcus Myers Marketing Manager

COB Credit Union

Lender Relations & Marketing Manager

Carilend Barbados

September 2024 Event

What's next